Shareholder Report

|

12 Months Ended |

|

Jul. 31, 2025

USD ($)

Holding

|

|---|

| Shareholder Report [Line Items] |

|

| Document Type |

N-CSR

|

| Amendment Flag |

false

|

| Registrant Name |

Hartford Funds Exchange-Traded Trust

|

| Entity Central Index Key |

0001501825

|

| Entity Investment Company Type |

N-1A

|

| Document Period End Date |

Jul. 31, 2025

|

| C000189003 [Member] |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

Hartford Total Return Bond ETF

|

| Class Name |

Hartford Total Return Bond ETF

|

| Trading Symbol |

HTRB

|

| Security Exchange Name |

NYSEArca

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about the Hartford Total Return Bond ETF (the "Fund") for the period of August 1, 2024 to July 31, 2025.

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at hartfordfunds.com/reports-etf. You can also request this information by contacting us by calling 1‑800‑456‑7526.

|

| Additional Information Phone Number |

1‑800‑456‑7526

|

| Additional Information Website |

hartfordfunds.com/reports-etf

|

| Expenses [Text Block] |

What were the Fund costs for the last year? (Based on a hypothetical $10,000 investment)

| Fund Name |

Costs of a $10,000 investment |

Costs paid as a percentage

of a $10,000 investment |

| Hartford Total Return Bond ETF |

$29 |

0.29% |

|

| Expenses Paid, Amount |

$ 29

|

| Expense Ratio, Percent |

0.29%

|

| Factors Affecting Performance [Text Block] |

How did the Fund perform last year and what impacted its performance? Management's Discussion of Fund Performance United States (U.S.) fixed income sectors generated positive total returns during the trailing twelve-month period ended July 31, 2025, as measured by the Bloomberg U.S. Aggregate Bond Index. On an excess return basis, credit sectors produced positive returns over duration-equivalent government bonds as spreads compressed, with higher-yielding sectors generally performing best. Top Contributors to Performance -

The Fund’s allocation to Structured Finance sectors had a positive impact on results as spreads tightened. The Fund’s allocation to Non-Agency Residential Mortgage-Backed Securities (RMBS) benefited relative performance as supply shortages continued to support home prices, albeit at a slower pace. Exposure to other securitized sectors including Commercial Mortgage-Backed Securities (CMBS), Collateralized Loan Obligations (CLOs), and Asset-Backed Securities (ABS) contributed positively to relative performance on improved investor sentiment. Positioning within Agency Mortgage-Backed Security (MBS) also benefited results despite an increase in volatility. -

Out-of-benchmark exposure to High Yield aided results over the period, particularly Industrials. The Fund’s allocation to Emerging Market (EM) sovereign debt modestly benefited relative performance. Top Detractors to Performance -

Duration and yield curve positioning was the main detractor from relative performance following the increase in sovereign yields. -

The Fund’s underweight in Investment Grade Credit, particularly Industrials, detracted from relative performance. The Fund held tactical interest rate positions during the period, including interest rate futures and swaps; overall duration and yield curve positioning detracted from relative results. During the period, the Fund used currency forwards and options to implement non-US rate and currency positions which had a negligible impact on performance, in aggregate. Credit default swaps (CDX) were used to manage credit exposure and overall portfolio risk. EM credit default swap (CDX) positions had a neutral impact on performance during the period, and a small allocation to investment grade CDX also had a muted impact. The views expressed reflect the opinions of the Fund's sub-advisor, Wellington Management Company LLP, as of the date of this report and are subject to change based on what we consider to be changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

|

| Performance Past Does Not Indicate Future [Text] |

The Fund’s past performance is not a good predictor of the Fund’s future performance.

|

| Line Graph [Table Text Block] |

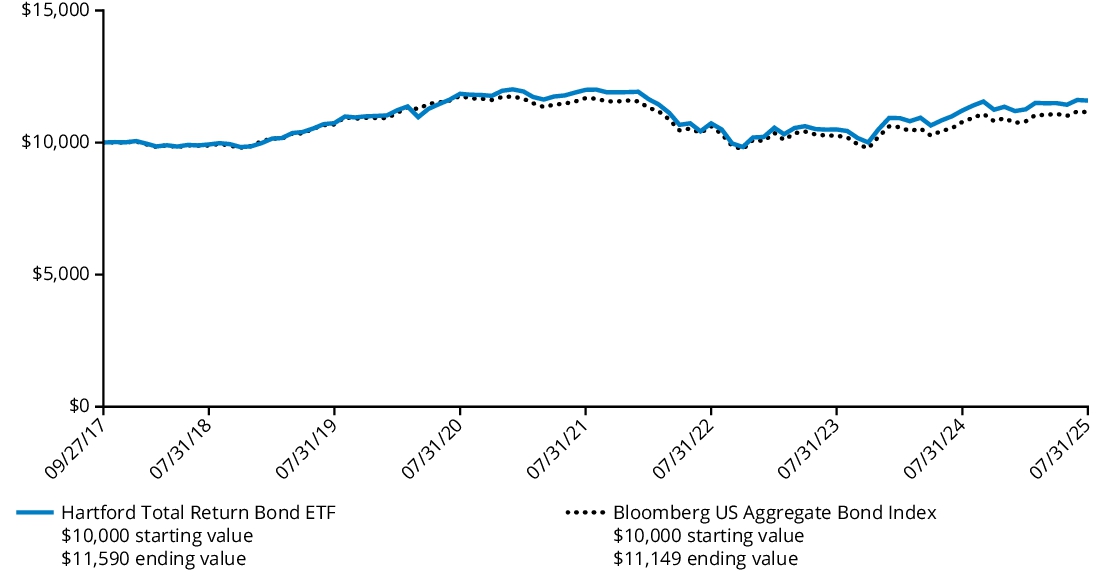

Comparison of Change in Value of $ 10,000 Investment The graph below represents the hypothetical growth of a $10,000 investment in the Fund and the comparative index. The Fund’s past performance is not a good predictor of the Fund’s future performance.

|

| Average Annual Return [Table Text Block] |

Average Annual Total Returns

For the Periods Ended July 31, 2025 |

1 Year |

5 Years |

Since Inception

(September 27, 2017) |

| Fund |

3.33% |

(0.43)% |

1.90% |

| Bloomberg US Aggregate Bond Index |

3.38% |

(1.07)% |

1.35% |

|

| Performance Inception Date |

Sep. 27, 2017

|

| No Deduction of Taxes [Text Block] |

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption or sale of Fund shares.

|

| Updated Performance Information Location [Text Block] |

Visit hartfordfunds.com for the most recent performance information.

|

| Net Assets |

$ 1,993,460,441

|

| Holdings Count | Holding |

1,558

|

| Advisory Fees Paid, Amount |

$ 5,611,114

|

| Investment Company Portfolio Turnover |

61.00%

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics as of

July 31, 2025

| Fund's net assets |

$1,993,460,441 |

| Total number of portfolio holdings |

1,558 |

| Total investment management fees paid |

$5,611,114 |

| Portfolio turnover rate (excludes to be announced (TBA) roll transactions) |

61% |

|

| Holdings [Text Block] |

Graphical Representation of Holdings as of July 31, 2025 The table below shows the investment makeup of the Fund, representing the percentage of net assets of the Fund. Composition by Security Type

| U.S. Government Agencies^ |

41.7 |

% |

| U.S. Government Securities |

31.6 |

% |

| Corporate Bonds |

22.8 |

% |

| Asset & Commercial Mortgage-Backed Securities |

18.3 |

% |

| Foreign Government Obligations |

2.1 |

% |

| Municipal Bonds |

0.3 |

% |

| Short-Term Investments |

0.5 |

% |

| Other Assets & Liabilities |

(17.3 |

)% |

| Total |

100.0 |

% |

| ^ |

All, or a portion of the securities categorized as U.S. Government Agencies, were agency mortgage-backed securities. |

|

| C000193047 [Member] |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

Hartford Municipal Opportunities ETF

|

| Class Name |

Hartford Municipal Opportunities ETF

|

| Trading Symbol |

HMOP

|

| Security Exchange Name |

NYSEArca

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about the Hartford Municipal Opportunities ETF (the "Fund") for the period of August 1, 2024 to July 31, 2025.

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at hartfordfunds.com/reports-etf. You can also request this information by contacting us by calling 1‑800‑456‑7526.

|

| Material Fund Change Notice [Text Block] |

This report describes changes to the Fund that occurred during the reporting period.

|

| Additional Information Phone Number |

1‑800‑456‑7526

|

| Additional Information Website |

hartfordfunds.com/reports-etf

|

| Expenses [Text Block] |

What were the Fund costs for the last year? (Based on a hypothetical $10,000 investment)

| Fund Name |

Costs of a $10,000 investment |

Costs paid as a percentage

of a $10,000 investment |

| Hartford Municipal Opportunities ETF |

$29 |

0.29% |

|

| Expenses Paid, Amount |

$ 29

|

| Expense Ratio, Percent |

0.29%

|

| Factors Affecting Performance [Text Block] |

How did the Fund perform last year and what impacted its performance? Management's Discussion of Fund Performance United States (U.S.) fixed income sectors generated positive total returns during the trailing twelve-month period ended July 31, 2025, as measured by the Bloomberg U.S. Aggregate Bond Index. Credit sectors produced positive excess returns over duration-equivalent government bonds as spreads compressed, with higher-yielding sectors generally performing best, benefiting from their coupon advantage. Top Contributors to Performance -

Security selection within investment-grade revenue bonds contributed positively to performance, particularly in the Tax, Utilities, Education, and Transportation sectors. -

Our underweight allocation to general obligation revenue bonds also added to performance, especially within the Local GO (General Obligation) segment. Top Detractors to Performance -

The primary detractor from the Fund’s performance from a sector perspective was the out-of-benchmark sector allocation to high-yield revenue bonds, particularly within the Industrial Development and Resource Recovery sectors. -

Duration and yield curve positioning also detracted from performance, as the Fund was overweight the long end of the yield curve which sold off during the period. The views expressed reflect the opinions of the Fund's sub-advisor, Wellington Management Company LLP, as of the date of this report and are subject to change based on what we consider to be changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

|

| Performance Past Does Not Indicate Future [Text] |

The Fund’s past performance is not a good predictor of the Fund’s future performance.

|

| Line Graph [Table Text Block] |

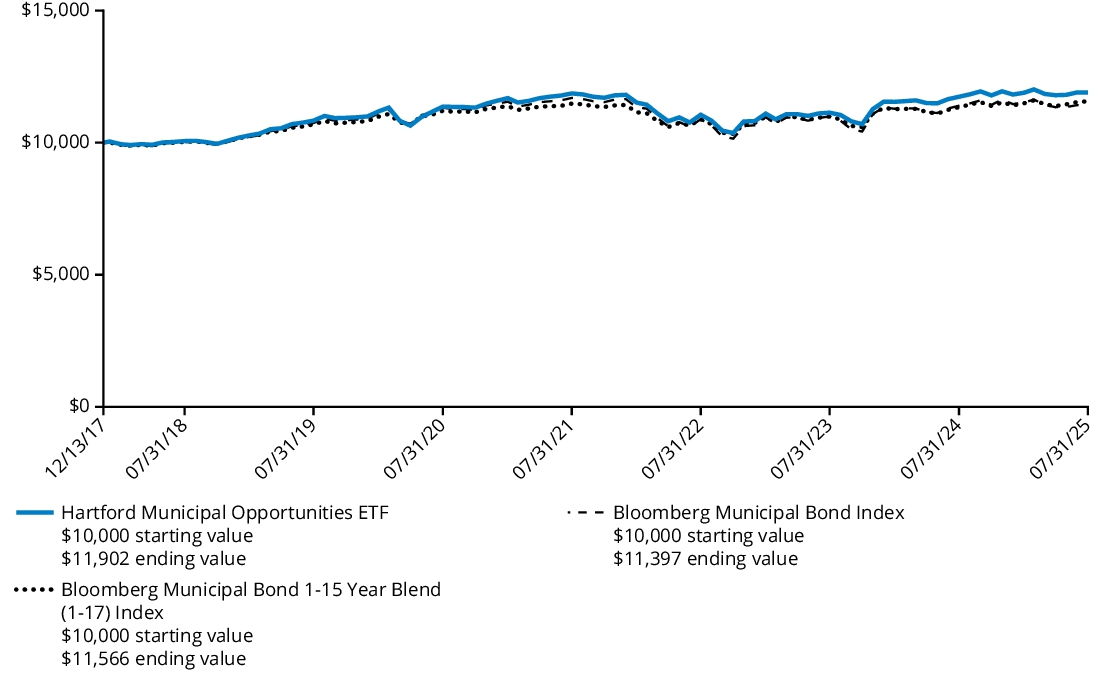

Comparison of Change in Value of $ 10,000 Investment The graph below represents the hypothetical growth of a $10,000 investment in the Fund and the comparative indices. The Fund’s past performance is not a good predictor of the Fund’s future performance.

|

| Average Annual Return [Table Text Block] |

Average Annual Total Returns

For the Periods Ended July 31, 2025 |

1 Year |

5 Years |

Since Inception

(December 13, 2017) |

| Fund |

1.41% |

0.93% |

2.31% |

| Bloomberg Municipal Bond 1-15 Year Blend (1-17) Index |

1.99% |

0.63% |

1.94% |

| Bloomberg Municipal Bond Index |

0.00% |

0.13% |

1.76% |

|

| Performance Inception Date |

Dec. 13, 2017

|

| No Deduction of Taxes [Text Block] |

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption or sale of Fund shares.

|

| Material Change Date |

Nov. 27, 2024

|

| Updated Performance Information Location [Text Block] |

Visit hartfordfunds.com for the most recent performance information.

|

| Net Assets |

$ 585,186,773

|

| Holdings Count | Holding |

572

|

| Advisory Fees Paid, Amount |

$ 1,466,867

|

| Investment Company Portfolio Turnover |

43.00%

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics as of

July 31, 2025

| Fund's net assets |

$585,186,773 |

| Total number of portfolio holdings (excluding derivatives, if any) |

572 |

| Total investment management fees paid |

$1,466,867 |

| Portfolio turnover rate |

43% |

|

| Holdings [Text Block] |

Graphical Representation of Holdings as of July 31, 2025 The table below shows the investment makeup of the Fund, representing the percentage of net assets of the Fund. Composition by Municipal Bonds

| Texas |

12.9 |

% |

| Illinois |

9.2 |

% |

| New York |

9.0 |

% |

| California |

6.3 |

% |

| Colorado |

3.8 |

% |

| Alabama |

3.7 |

% |

| Connecticut |

3.7 |

% |

| Wisconsin |

3.3 |

% |

| Pennsylvania |

3.1 |

% |

| Massachusetts |

3.0 |

% |

| Other* |

38.6 |

% |

| Short-Term Investments |

1.0 |

% |

| Other Assets & Liabilities |

2.4 |

% |

| Total |

100.0 |

% |

| * |

Ten largest state allocations are presented. Additional state allocations are found in Other along with U.S. Government Agencies. |

|

| Material Fund Change [Text Block] |

Material Fund Changes This is a summary of certain changes to the Fund since August 1, 2024. Effective as of November 27, 2024, the Fund’s investment strategy was revised to remove references to the sub-adviser’s consideration of ESG (environmental, social and governance) factors in making investment decisions for the Fund. In addition, ESG Integration Risk was removed from the Fund’s principal risks and designated instead as a secondary risk of the Fund. This summary provides an overview of certain changes to the Fund during the fiscal year ended July 31, 2025. For more complete information, you may review the Fund's prospectus dated November 27, 2024, which is currently available at hartfordfunds.com/reports-etf or upon request by calling 1-800-456-7526 or sending an e-mail to orders@mysummaryprospectus.com.

|

| Material Fund Change Strategies [Text Block] |

Effective as of November 27, 2024, the Fund’s investment strategy was revised to remove references to the sub-adviser’s consideration of ESG (environmental, social and governance) factors in making investment decisions for the Fund. In addition, ESG Integration Risk was removed from the Fund’s principal risks and designated instead as a secondary risk of the Fund. This summary provides an overview of certain changes to the Fund during the fiscal year ended July 31, 2025.

|

| Material Fund Change Risks Change [Text Block] |

In addition, ESG Integration Risk was removed from the Fund’s principal risks and designated instead as a secondary risk of the Fund. This summary provides an overview of certain changes to the Fund during the fiscal year ended July 31, 2025.

|

| Summary of Change Legend [Text Block] |

For more complete information, you may review the Fund's prospectus dated November 27, 2024, which is currently available at hartfordfunds.com/reports-etf or upon request by calling 1-800-456-7526 or sending an e-mail to orders@mysummaryprospectus.com.

|

| Updated Prospectus Phone Number |

1-800-456-7526

|

| Updated Prospectus Email Address |

orders@mysummaryprospectus.com

|

| Updated Prospectus Web Address |

hartfordfunds.com/reports-etf

|

| C000193049 [Member] |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

Hartford Schroders Tax-Aware Bond ETF

|

| Class Name |

Hartford Schroders Tax-Aware Bond ETF

|

| Trading Symbol |

HTAB

|

| Security Exchange Name |

NYSEArca

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about the Hartford Schroders Tax-Aware Bond ETF (the "Fund") for the period of August 1, 2024 to July 31, 2025.

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at hartfordfunds.com/reports-etf. You can also request this information by contacting us by calling 1‑800‑456‑7526.

|

| Additional Information Phone Number |

1‑800‑456‑7526

|

| Additional Information Website |

hartfordfunds.com/reports-etf

|

| Expenses [Text Block] |

What were the Fund costs for the last year? (Based on a hypothetical $10,000 investment)

| Fund Name |

Costs of a $10,000 investment |

Costs paid as a percentage

of a $10,000 investment |

| Hartford Schroders Tax-Aware Bond ETF |

$39 |

0.39% |

|

| Expenses Paid, Amount |

$ 39

|

| Expense Ratio, Percent |

0.39%

|

| Factors Affecting Performance [Text Block] |

How did the Fund perform last year and what impacted its performance? Management's Discussion of Fund Performance United States (U.S.) fixed income sectors, as measured by the Bloomberg U.S. Aggregate Bond Index, generated positive total returns during the trailing twelve-month period ended July 31, 2025. Credit sectors produced positive excess returns over duration-equivalent government bonds as spreads compressed. Higher-yielding sectors generally performed better than other risk assets. Tax-Exempt Municipals were notable underperformers relative to Treasuries and other risk assets because of elevated yields and heavy supply. Top Contributors to Performance -

Sector selection due to the overweight to the Tax-Exempt Federal Agency and Tax-Exempt Other Revenue sectors was positive. Although it was a difficult year for Tax-Exempt Municipals, these sectors outperformed the broad municipal index which benefited the fund’s performance given the overweight exposure. -

Security selection within the Tax-Exempt Healthcare, Tax-Exempt General Obligation (GOs) and Tax-Exempt Utility sectors was a positive factor due to notable impacts from multiple issues and issuers. Top Detractors to Performance -

Duration impacts were notably negative due to the overweight allocation to long (i.e., 10 years and longer) maturity tax-exempt bonds. During the period, yields for Tax-Exempt Municipals rose which negatively impacted both absolute and relative performance. -

Tax-exempt new issuance over the period was extremely heavy as municipalities faced inflationary pressures to fund new projects and uncertain funding from the federal government. Many issuers with healthy balance sheets felt it was better to secure financing in calm markets rather than wait. The views expressed in this section reflect the opinions of the Fund's sub-adviser, Schroder Investment Management North America Ltd. as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

|

| Performance Past Does Not Indicate Future [Text] |

The Fund’s past performance is not a good predictor of the Fund’s future performance.

|

| Line Graph [Table Text Block] |

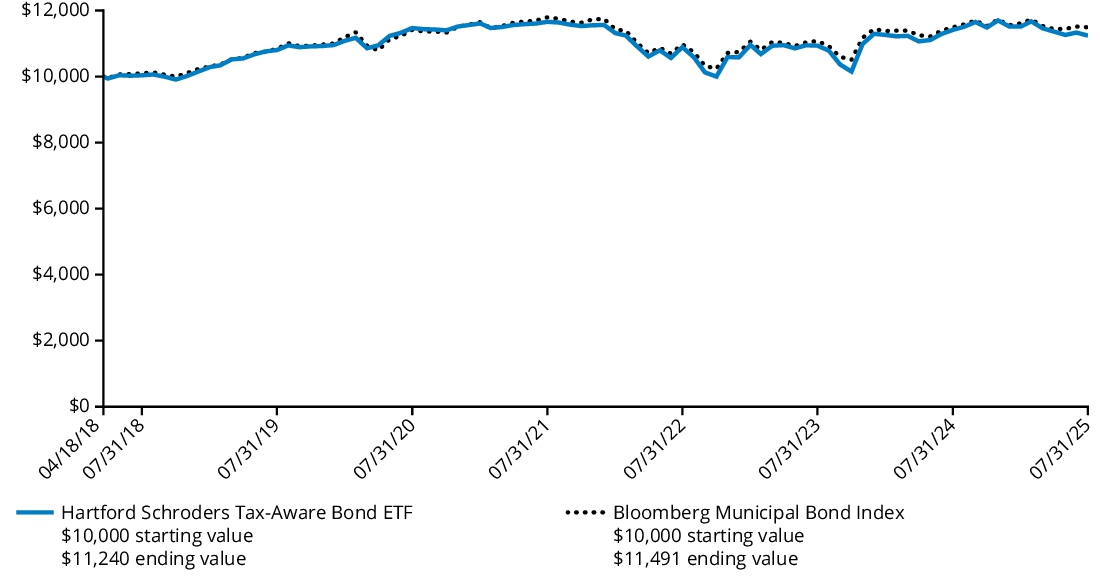

Comparison of Change in Value of $ 10,000 Investment The graph below represents the hypothetical growth of a $10,000 investment in the Fund and the comparative index. The Fund’s past performance is not a good predictor of the Fund’s future performance.

|

| Average Annual Return [Table Text Block] |

Average Annual Total Returns

For the Period Ended July 31, 2025 |

1 Year |

5 Years |

Since Inception

(April 18, 2018) |

| Fund |

(1.52)% |

(0.40)% |

1.62% |

| Bloomberg Municipal Bond Index |

0.00% |

0.13% |

1.92% |

|

| Performance Inception Date |

Apr. 18, 2018

|

| No Deduction of Taxes [Text Block] |

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption or sale of Fund shares.

|

| Updated Performance Information Location [Text Block] |

Visit hartfordfunds.com for the most recent performance information.

|

| Net Assets |

$ 388,171,058

|

| Holdings Count | Holding |

221

|

| Advisory Fees Paid, Amount |

$ 1,639,498

|

| Investment Company Portfolio Turnover |

66.00%

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics as of

July 31, 2025

| Fund's net assets |

$388,171,058 |

| Total number of portfolio holdings |

221 |

| Total investment management fees paid |

$1,639,498 |

| Portfolio turnover rate |

66% |

|

| Holdings [Text Block] |

Graphical Representation of Holdings as of July 31, 2025 The table below shows the investment makeup of the Fund, representing the percentage of net assets of the Fund. Composition by Security Type

| Municipal Bonds |

87.6 |

% |

| U.S. Government Agencies^ |

5.7 |

% |

| Short-Term Investments |

5.6 |

% |

| Other Assets & Liabilities |

1.1 |

% |

| Total |

100.0 |

% |

| ^ |

All, or a portion of the securities categorized as U.S. Government Agencies, were agency mortgage-backed securities. |

|

| C000200624 [Member] |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

Hartford AAA CLO ETF

|

| Class Name |

Hartford AAA CLO ETF

|

| Trading Symbol |

TRPA

|

| Security Exchange Name |

CboeBZX

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about the Hartford AAA CLO ETF (the "Fund") for the period of August 1, 2024 to July 31, 2025.

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at hartfordfunds.com/reports-etf. You can also request this information by contacting us by calling 1‑800‑456‑7526.

|

| Material Fund Change Notice [Text Block] |

This report describes changes to the Fund that occurred during the reporting period.

|

| Additional Information Phone Number |

1‑800‑456‑7526

|

| Additional Information Website |

hartfordfunds.com/reports-etf

|

| Expenses [Text Block] |

What were the Fund costs for the last year? (Based on a hypothetical $10,000 investment)

| Fund Name |

Costs of a $10,000 investment |

Costs paid as a percentage

of a $10,000 investment |

| Hartford AAA CLO ETF |

$25 |

0.24% |

|

| Expenses Paid, Amount |

$ 25

|

| Expense Ratio, Percent |

0.24%

|

| Factors Affecting Performance [Text Block] |

How did the Fund perform last year and what impacted its performance? Management's Discussion of Fund Performance United States (U.S.) fixed income sectors generated positive total returns during the trailing twelve-month period ended July 31, 2025, as measured by the Bloomberg U.S. Aggregate Bond Index. Credit sectors produced positive excess returns over duration-equivalent government bonds as spreads compressed, with higher-yielding sectors generally performing best, benefiting from their coupon advantage. Top Contributors to Performance -

The portfolio’s credit quality positioning was the primary contributor to performance during the period. The fund has flexibility to invest up to 20% in AA or A-rated Collateralized Loan Obligations (CLOs) to enhance income and total return potential. The fund averaged an allocation of approximately 12% outside of AAA-rated CLOs during the period, which provided the portfolio with additional yield and return. Top Detractors to Performance The views expressed reflect the opinions of the Fund's sub-advisor, Wellington Management Company LLP, as of the date of this report and are subject to change based on what we consider to be changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

|

| Performance Past Does Not Indicate Future [Text] |

The Fund’s past performance is not a good predictor of the Fund’s future performance.

|

| Line Graph [Table Text Block] |

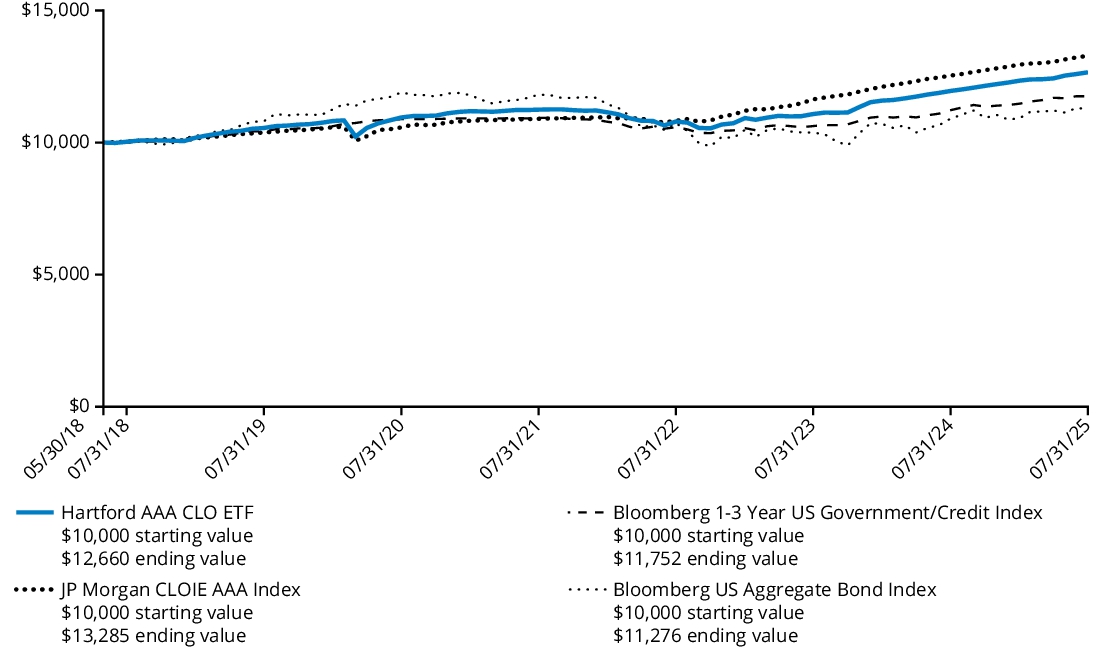

Comparison of Change in Value of $ 10,000 Investment The graph below represents the hypothetical growth of a $10,000 investment in the Fund and the comparative indices. The Fund’s past performance is not a good predictor of the Fund’s future performance.

|

| Average Annual Return [Table Text Block] |

Average Annual Total Returns

For the Periods Ended July 31, 2025 |

1 Year |

5 Years |

Since Inception

(May 30, 2018) |

| Fund |

5.90% |

2.94% |

3.34% |

| JP Morgan CLOIE AAA Index |

5.97% |

4.67% |

4.04% |

| Bloomberg 1-3 Year US Government/Credit Index |

4.68% |

1.54% |

2.25% |

| Bloomberg US Aggregate Bond Index |

3.38% |

(1.07)% |

1.63% |

|

| Performance Inception Date |

May 30, 2018

|

| No Deduction of Taxes [Text Block] |

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption or sale of Fund shares.

|

| Material Change Date |

Nov. 27, 2024

|

| Updated Performance Information Location [Text Block] |

Visit hartfordfunds.com for the most recent performance information.

|

| Net Assets |

$ 108,841,990

|

| Holdings Count | Holding |

123

|

| Advisory Fees Paid, Amount |

$ 231,366

|

| Investment Company Portfolio Turnover |

51.00%

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics as of

July 31, 2025

| Fund's net assets |

$108,841,990 |

| Total number of portfolio holdings (excluding derivatives, if any) |

123 |

| Total investment management fees paid |

$231,366 |

| Portfolio turnover rate |

51% |

|

| Holdings [Text Block] |

Graphical Representation of Holdings as of July 31, 2025 The table below shows the investment makeup of the Fund, representing the percentage of net assets of the Fund. Composition by Security Type

| Asset & Commercial Mortgage-Backed Securities |

99.3 |

% |

| Short-Term Investments |

0.7 |

% |

| Other Assets & Liabilities |

0.0 |

%† |

| Total |

100.0 |

% |

| † |

Percentage rounds to zero. |

|

| Material Fund Change [Text Block] |

Material Fund Changes This is a summary of certain changes to the Fund since August 1, 2024. Effective as of November 27, 2024, the Fund’s principal investment strategy was revised to remove the reference to investments in private placements and replace it with a reference to investments in restricted securities. In addition, “Mortgage-Related and Asset-Backed Securities Risk” was removed from the principal risks for the Fund. These changes result from the change in the Fund’s investment strategy that was completed in 2024. This summary provides an overview of certain changes to the Fund during the fiscal year ended July 31, 2025. For more complete information, you may review the Fund's prospectus dated November 27, 2024, which is currently available at hartfordfunds.com/reports-etf or upon request by calling 1-800-456-7526 or sending an e-mail to orders@mysummaryprospectus.com.

|

| Material Fund Change Strategies [Text Block] |

Effective as of November 27, 2024, the Fund’s principal investment strategy was revised to remove the reference to investments in private placements and replace it with a reference to investments in restricted securities. In addition, “Mortgage-Related and Asset-Backed Securities Risk” was removed from the principal risks for the Fund. These changes result from the change in the Fund’s investment strategy that was completed in 2024. This summary provides an overview of certain changes to the Fund during the fiscal year ended July 31, 2025.

|

| Material Fund Change Risks Change [Text Block] |

In addition, “Mortgage-Related and Asset-Backed Securities Risk” was removed from the principal risks for the Fund. These changes result from the change in the Fund’s investment strategy that was completed in 2024. This summary provides an overview of certain changes to the Fund during the fiscal year ended July 31, 2025.

|

| Summary of Change Legend [Text Block] |

For more complete information, you may review the Fund's prospectus dated November 27, 2024, which is currently available at hartfordfunds.com/reports-etf or upon request by calling 1-800-456-7526 or sending an e-mail to orders@mysummaryprospectus.com.

|

| Updated Prospectus Phone Number |

1-800-456-7526

|

| Updated Prospectus Email Address |

orders@mysummaryprospectus.com

|

| Updated Prospectus Web Address |

hartfordfunds.com/reports-etf

|

| C000217911 [Member] |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

Hartford Core Bond ETF

|

| Class Name |

Hartford Core Bond ETF

|

| Trading Symbol |

HCRB

|

| Security Exchange Name |

CboeBZX

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about the Hartford Core Bond ETF (the "Fund") for the period of August 1, 2024 to July 31, 2025.

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at hartfordfunds.com/reports-etf. You can also request this information by contacting us by calling 1‑800‑456‑7526.

|

| Additional Information Phone Number |

1‑800‑456‑7526

|

| Additional Information Website |

hartfordfunds.com/reports-etf

|

| Expenses [Text Block] |

What were the Fund costs for the last year? (Based on a hypothetical $10,000 investment)

| Fund Name |

Costs of a $10,000 investment |

Costs paid as a percentage

of a $10,000 investment |

| Hartford Core Bond ETF |

$30 |

0.29% |

|

| Expenses Paid, Amount |

$ 30

|

| Expense Ratio, Percent |

0.29%

|

| Factors Affecting Performance [Text Block] |

How did the Fund perform last year and what impacted its performance? Management's Discussion of Fund Performance United States (U.S.) fixed income sectors generated positive total returns during the trailing twelve-month period ended July 31, 2025, as measured by the Bloomberg U.S. Aggregate Bond Index. On an excess return basis, credit sectors produced positive returns over duration-equivalent government bonds as spreads compressed, with higher-yielding sectors generally performing best. Top Contributors to Performance -

The Fund’s allocation to Structured Finance sectors had a positive impact on results as spreads tightened. The Fund’s allocation to Non-Agency Residential Mortgage-Backed Securities (RMBS) contributed positively to relative performance as supply shortages continued to support home prices albeit at a slower pace. Exposure to other securitized sectors including Commercial Mortgage-Backed Securities (CMBS), Collateralized Loan Obligations (CLOs), and Asset-Backed Securities (ABS) contributed positively to relative performance on improved investor sentiment. -

The Fund’s security selection within Investment Grade Credit and an overweight to Utilities was beneficial for performance over the period. Top Detractors to Performance -

Duration and yield curve positioning was the main detractor from relative performance following the increase in sovereign yields. -

An allocation to Treasury Inflation-Protected Securities (TIPS) was a modest detractor from results. -

Within Investment Grade credit, an underweight to Industrials detracted from relative performance. The Fund held tactical interest rate positions during the period, including interest rate futures and swaps; overall duration and yield curve positioning detracted from relative results. Credit default swaps (CDX) were used to manage credit exposure and overall portfolio risk. Investment grade CDX positions had a muted impact on performance. The views expressed reflect the opinions of the Fund's sub-advisor, Wellington Management Company LLP, as of the date of this report and are subject to change based on what we consider to be changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

|

| Performance Past Does Not Indicate Future [Text] |

The Fund’s past performance is not a good predictor of the Fund’s future performance.

|

| Line Graph [Table Text Block] |

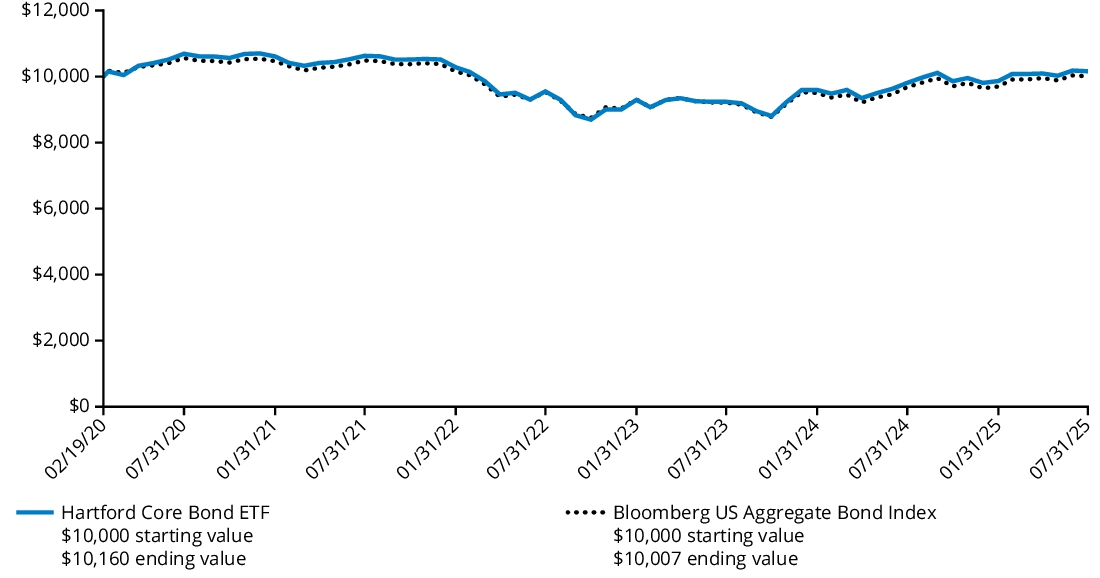

Comparison of Change in Value of $ 10,000 Investment The graph below represents the hypothetical growth of a $10,000 investment in the Fund and the comparative index. The Fund’s past performance is not a good predictor of the Fund’s future performance.

|

| Average Annual Return [Table Text Block] |

Average Annual Total Returns

For the Periods Ended July 31, 2025 |

1 Year |

5 Years |

Since Inception

(February 19, 2020) |

| Fund |

3.59% |

(1.01)% |

0.29% |

| Bloomberg US Aggregate Bond Index |

3.38% |

(1.07)% |

0.00% |

|

| Performance Inception Date |

Feb. 19, 2020

|

| No Deduction of Taxes [Text Block] |

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption or sale of Fund shares.

|

| Updated Performance Information Location [Text Block] |

Visit hartfordfunds.com for the most recent performance information.

|

| Net Assets |

$ 336,717,313

|

| Holdings Count | Holding |

881

|

| Advisory Fees Paid, Amount |

$ 849,710

|

| Investment Company Portfolio Turnover |

47.00%

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics as of

July 31, 2025

| Fund's net assets |

$336,717,313 |

| Total number of portfolio holdings |

881 |

| Total investment management fees paid |

$849,710 |

| Portfolio turnover rate (excludes to be announced (TBA) roll transactions) |

47% |

|

| Holdings [Text Block] |

Graphical Representation of Holdings as of July 31, 2025 The table below shows the investment makeup of the Fund, representing the percentage of net assets of the Fund. Composition by Security Type

| U.S. Government Securities |

40.1 |

% |

| U.S. Government Agencies^ |

31.4 |

% |

| Corporate Bonds |

23.0 |

% |

| Asset & Commercial Mortgage-Backed Securities |

17.8 |

% |

| Foreign Government Obligations |

1.5 |

% |

| Municipal Bonds |

0.2 |

% |

| Short-Term Investments |

0.4 |

% |

| Other Assets & Liabilities |

(14.4 |

)% |

| Total |

100.0 |

% |

| ^ |

All, or a portion of the securities categorized as U.S. Government Agencies, were agency mortgage-backed securities. |

|

| C000230284 [Member] |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

Hartford Strategic Income ETF(formerly, Hartford Sustainable Income ETF)

|

| Class Name |

Hartford Strategic Income ETF(formerly, Hartford Sustainable Income ETF)

|

| Trading Symbol |

HFSI

|

| Security Exchange Name |

CboeBZX

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about the Hartford Strategic Income ETF (the "Fund") for the period of August 1, 2024 to July 31, 2025.

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at hartfordfunds.com/reports-etf. You can also request this information by contacting us by calling 1‑800‑456‑7526.

|

| Additional Information Phone Number |

1‑800‑456‑7526

|

| Additional Information Website |

hartfordfunds.com/reports-etf

|

| Expenses [Text Block] |

What were the Fund costs for the last year? (Based on a hypothetical $10,000 investment)

| Fund Name |

Costs of a $10,000 investment |

Costs paid as a percentage

of a $10,000 investment |

| Hartford Strategic Income ETF |

$51 |

0.50% |

|

| Expenses Paid, Amount |

$ 51

|

| Expense Ratio, Percent |

0.50%

|

| Factors Affecting Performance [Text Block] |

How did the Fund perform last year and what impacted its performance? Management's Discussion of Fund Performance United States (U.S.) fixed income sectors generated positive total returns during the trailing twelve-month period ended July 31, 2025, as measured by the Bloomberg U.S. Aggregate Bond Index. On an excess return basis, credit sectors produced positive returns over duration-equivalent government bonds as spreads compressed, with higher-yielding sectors generally performing best. Top Contributors to Performance -

An allocation to High Yield was the top positive contributor to relative performance, led by Industrials and Financials, and an allocation to Bank Loans Industrial Issuers also aided relative results. The Fund’s allocation to convertible bonds focused on digitization and healthcare innovation themes also had a positive impact on relative performance. -

The Fund’s exposure to Emerging Market (EM) debt, both EM Corporate and to a lesser extent select EM Sovereign debt, contributed positively to relative performance amid spread narrowing. -

The Fund’s allocation to Structured Finance sectors had a positive impact on results as spreads tightened. The Fund’s positioning within Non-Agency Residential Mortgage-Backed Securities (RMBS) benefited relative performance as supply shortages continued to support home prices, albeit at a slower pace. Exposure to other securitized sectors including Commercial Mortgage-Backed Securities (CMBS), Collateralized Loan Obligations (CLOs), and Asset-Backed Securities (ABS) contributed positively to relative performance on improved investor sentiment. Positioning within Agency Mortgage-Backed Security (MBS) Passthroughs also benefited results. -

The Fund implemented tactical duration and yield curve positioning relative to the benchmark which helped results over the period. Top Detractors to Performance -

The Fund’s positioning within Investment Grade Credit negatively affected relative performance. -

The Fund’s Developed Government Bond positioning hurt results overall following the increase in sovereign yields. The Fund implemented tactical interest rate positions during the period, which contributed positively to relative results. During the period, the Fund used futures and currency forwards to implement non-US rate and currency positions which detracted modestly from results in aggregate. The Fund also made use of interest rate swaps to manage interest rate risk and duration of the portfolio which had a small negative impact on results. Credit swaps (CDX and iTRAXX) were used to manage credit exposure and overall portfolio risk. EM Credit Default Swap (CDX) positions had a neutral impact on performance during the period, while high yield CDX contributed positively to results. The views expressed reflect the opinions of the Fund's sub-advisor, Wellington Management Company LLP, as of the date of this report and are subject to change based on what we consider to be changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

|

| Performance Past Does Not Indicate Future [Text] |

The Fund’s past performance is not a good predictor of the Fund’s future performance.

|

| Line Graph [Table Text Block] |

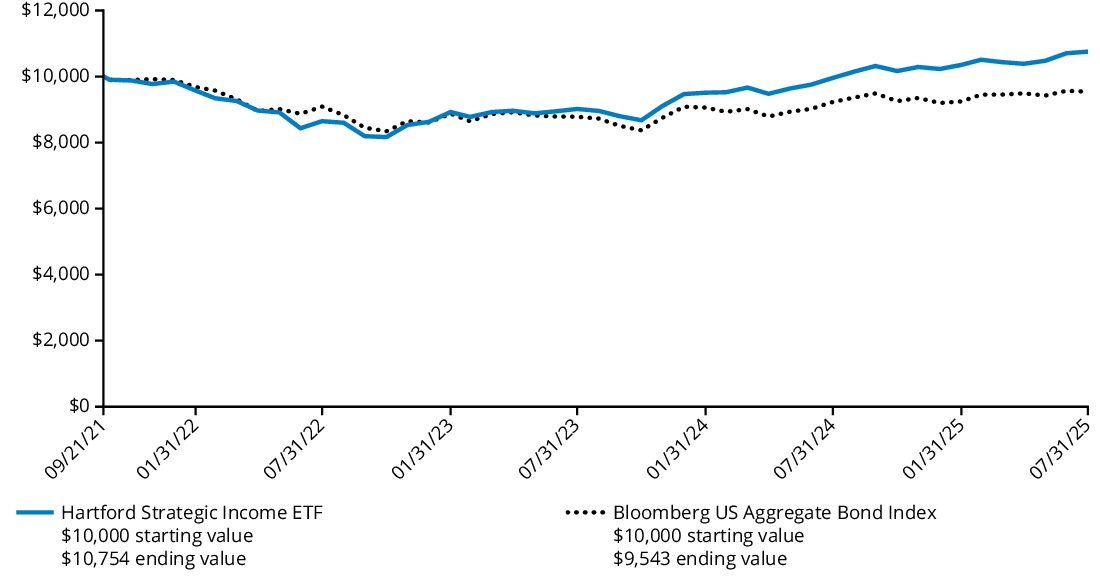

Comparison of Change in Value of $ 10,000 Investment The graph below represents the hypothetical growth of a $10,000 investment in the Fund and the comparative index. The Fund’s past performance is not a good predictor of the Fund’s future performance.

|

| Average Annual Return [Table Text Block] |

Average Annual Total Returns

For the Periods Ended July 31, 2025 |

1 Year |

Since Inception

(September 21, 2021) |

| Fund |

7.98% |

1.91% |

| Bloomberg US Aggregate Bond Index |

3.38% |

(1.21)% |

|

| Performance Inception Date |

Sep. 21, 2021

|

| No Deduction of Taxes [Text Block] |

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption or sale of Fund shares.

|

| Updated Performance Information Location [Text Block] |

Visit hartfordfunds.com for the most recent performance information.

|

| Net Assets |

$ 165,447,885

|

| Holdings Count | Holding |

776

|

| Advisory Fees Paid, Amount |

$ 460,848

|

| Investment Company Portfolio Turnover |

136.00%

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics as of

July 31, 2025

| Fund's net assets |

$165,447,885 |

| Total number of portfolio holdings |

776 |

| Total investment management fees paid |

$460,848 |

| Portfolio turnover rate (excludes to be announced (TBA) roll transactions) |

136% |

|

| Holdings [Text Block] |

Graphical Representation of Holdings as of July 31, 2025 The table below shows the investment makeup of the Fund, representing the percentage of net assets of the Fund. Composition by Security Type

| Corporate Bonds |

33.6 |

% |

| Asset & Commercial Mortgage-Backed Securities |

20.2 |

% |

| U.S. Government Securities |

18.4 |

% |

| Senior Floating Rate Interests |

10.1 |

% |

| U.S. Government Agencies^ |

9.9 |

% |

| Convertible Bonds |

7.2 |

% |

| Foreign Government Obligations |

5.6 |

% |

| Preferred Stocks |

1.0 |

% |

| Municipal Bonds |

0.2 |

% |

| Common Stocks |

0.0 |

%† |

| Warrants |

0.0 |

%† |

| Other Assets & Liabilities |

(6.2 |

)% |

| Total |

100.0 |

% |

| ^ |

All, or a portion of the securities categorized as U.S. Government Agencies, were agency mortgage-backed securities. |

| † |

Percentage rounds to zero. |

|

| C000230731 [Member] |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

Hartford Large Cap Growth ETF

|

| Class Name |

Hartford Large Cap Growth ETF

|

| Trading Symbol |

HFGO

|

| Security Exchange Name |

CboeBZX

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about the Hartford Large Cap Growth ETF (the "Fund") for the period of August 1, 2024 to July 31, 2025.

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at hartfordfunds.com/reports-etf. You can also request this information by contacting us by calling 1‑800‑456‑7526.

|

| Material Fund Change Notice [Text Block] |

This report describes changes to the Fund that occurred during the reporting period.

|

| Additional Information Phone Number |

1‑800‑456‑7526

|

| Additional Information Website |

hartfordfunds.com/reports-etf

|

| Expenses [Text Block] |

What were the Fund costs for the last year? (Based on a hypothetical $10,000 investment)

| Fund Name |

Costs of a $10,000 investment |

Costs paid as a percentage

of a $10,000 investment |

| Hartford Large Cap Growth ETF |

$67 |

0.59% |

|

| Expenses Paid, Amount |

$ 67

|

| Expense Ratio, Percent |

0.59%

|

| Factors Affecting Performance [Text Block] |

How did the Fund perform last year and what impacted its performance? Management's Discussion of Fund Performance United States (U.S.) equities, as measured by the Russell 1000 Growth Index, posted positive returns during the trailing twelve-month period ended July 31, 2025. Top Contributors to Performance -

Security selection was the primary driver of the Fund’s positive relative performance with strong selections in Industrials, Information Technology, and Health Care sectors. -

Sector allocation, a result of the Fund’s bottom-up stock selection process, also contributed to returns. The effect of allocation decisions was driven by the Fund’s overweight to Communication Services and underweight to Consumer Staples. -

The largest individual relative contributors during the period included overweight positions in Spotify Technology (Communication Services), Axon Enterprise (Industrials), and Broadcom (Information Technology). Top Detractors to Performance -

The largest individual relative detractors during the period included an underweight position in Tesla (Consumer Discretionary), not owning Palantir Technologies (Information Technology), and an overweight position in Uber Technologies (Industrials). The views expressed reflect the opinions of the Fund's sub-advisor, Wellington Management Company LLP, as of the date of this report and are subject to change based on what we consider to be changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

|

| Performance Past Does Not Indicate Future [Text] |

The Fund’s past performance is not a good predictor of the Fund’s future performance.

|

| Line Graph [Table Text Block] |

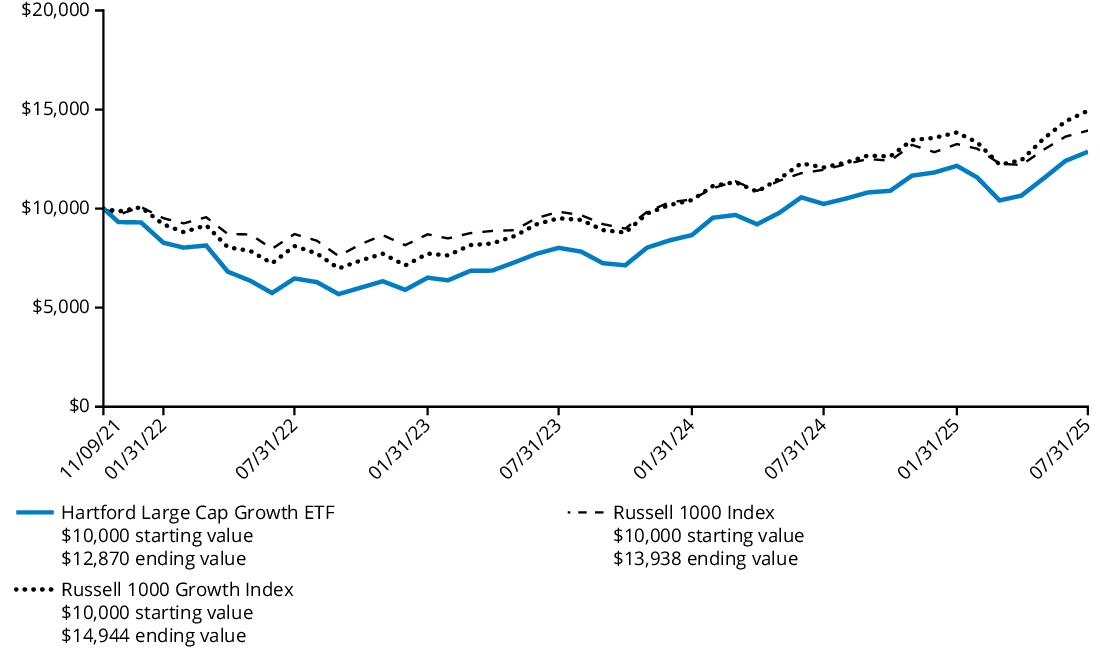

Comparison of Change in Value of $ 10,000 Investment The graph below represents the hypothetical growth of a $10,000 investment in the Fund and the comparative indices. The Fund’s past performance is not a good predictor of the Fund’s future performance.

|

| Average Annual Return [Table Text Block] |

Average Annual Total Returns

For the Periods Ended July 31, 2025 |

1 Year |

Since Inception

(November 09, 2021) |

| Fund |

25.75% |

7.00% |

| Russell 1000 Growth Index |

23.75% |

11.24% |

| Russell 1000 Index |

16.54% |

9.23% |

|

| Performance Inception Date |

Nov. 09, 2021

|

| No Deduction of Taxes [Text Block] |

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption or sale of Fund shares.

|

| Material Change Date |

Nov. 27, 2024

|

| Updated Performance Information Location [Text Block] |

Visit hartfordfunds.com for the most recent performance information.

|

| Net Assets |

$ 160,204,598

|

| Holdings Count | Holding |

51

|

| Advisory Fees Paid, Amount |

$ 794,307

|

| Investment Company Portfolio Turnover |

68.00%

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics as of

July 31, 2025

| Fund's net assets |

$160,204,598 |

| Total number of portfolio holdings (excluding derivatives, if any) |

51 |

| Total investment management fees paid |

$794,307 |

| Portfolio turnover rate |

68% |

|

| Holdings [Text Block] |

Graphical Representation of Holdings as of July 31, 2025 The table below shows the investment makeup of the Fund, representing the percentage of net assets of the Fund. Composition by Sector *

| Information Technology |

47.6 |

% |

| Communication Services |

18.6 |

% |

| Consumer Discretionary |

12.2 |

% |

| Health Care |

8.3 |

% |

| Financials |

5.4 |

% |

| Industrials |

2.8 |

% |

| Real Estate |

1.8 |

% |

| Utilities |

0.9 |

% |

| Energy |

0.8 |

% |

| Consumer Staples |

0.4 |

% |

| Short-Term Investments |

0.3 |

% |

| Other Assets & Liabilities |

0.9 |

% |

| Total |

100.0 |

% |

| * |

For Fund compliance purposes, the Fund may not use the same classification system. These classifications are used for financial reporting purposes. |

|

| Material Fund Change [Text Block] |

Material Fund Changes This is a summary of certain changes to the Fund since August 1, 2024. Effective as of November 27, 2024, the Fund’s principal investment strategy was revised to remove the reference to investments in American Depositary Receipts and add a reference to investments in the communications services sector. In addition, the following risks were removed from the principal risks of the Fund and designated instead as secondary risks: Depositary Receipts Risk, Foreign Investments Risk and Cash Transactions Risk. Active Trading Risk was removed from the Fund’s principal risks and from the Prospectus. These changes result from the Fund’s conversion from a semi-transparent ETF to a fully transparent ETF subject to Rule 6c-11 under the Investment Company Act of 1940, as amended, that was completed during 2024. This summary provides an overview of certain changes to the Fund during the fiscal year ended July 31, 2025. For more complete information, you may review the Fund's prospectus dated November 27, 2024, which is currently available at hartfordfunds.com/reports-etf or upon request by calling 1-800-456-7526 or sending an e-mail to orders@mysummaryprospectus.com.

|

| Material Fund Change Strategies [Text Block] |

Effective as of November 27, 2024, the Fund’s principal investment strategy was revised to remove the reference to investments in American Depositary Receipts and add a reference to investments in the communications services sector. In addition, the following risks were removed from the principal risks of the Fund and designated instead as secondary risks: Depositary Receipts Risk, Foreign Investments Risk and Cash Transactions Risk. Active Trading Risk was removed from the Fund’s principal risks and from the Prospectus. These changes result from the Fund’s conversion from a semi-transparent ETF to a fully transparent ETF subject to Rule 6c-11 under the Investment Company Act of 1940, as amended, that was completed during 2024. This summary provides an overview of certain changes to the Fund during the fiscal year ended July 31, 2025.

|

| Material Fund Change Risks Change [Text Block] |

In addition, the following risks were removed from the principal risks of the Fund and designated instead as secondary risks: Depositary Receipts Risk, Foreign Investments Risk and Cash Transactions Risk. Active Trading Risk was removed from the Fund’s principal risks and from the Prospectus. These changes result from the Fund’s conversion from a semi-transparent ETF to a fully transparent ETF subject to Rule 6c-11 under the Investment Company Act of 1940, as amended, that was completed during 2024. This summary provides an overview of certain changes to the Fund during the fiscal year ended July 31, 2025.

|

| Summary of Change Legend [Text Block] |

For more complete information, you may review the Fund's prospectus dated November 27, 2024, which is currently available at hartfordfunds.com/reports-etf or upon request by calling 1-800-456-7526 or sending an e-mail to orders@mysummaryprospectus.com.

|

| Updated Prospectus Phone Number |

1-800-456-7526

|

| Updated Prospectus Email Address |

orders@mysummaryprospectus.com

|

| Updated Prospectus Web Address |

hartfordfunds.com/reports-etf

|

| C000244148 [Member] |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

Hartford Quality Value ETF

|

| Class Name |

Hartford Quality Value ETF

|

| Trading Symbol |

QUVU

|

| Security Exchange Name |

CboeBZX

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about the Hartford Quality Value ETF (the "Fund") for the period of August 1, 2024 to July 31, 2025.

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at hartfordfunds.com/reports-etf. You can also request this information by contacting us by calling 1‑800‑456‑7526.

|

| Material Fund Change Notice [Text Block] |

This report describes changes to the Fund that occurred during the reporting period.

|

| Additional Information Phone Number |

1‑800‑456‑7526

|

| Additional Information Website |

hartfordfunds.com/reports-etf

|

| Expenses [Text Block] |

What were the Fund costs for the last year? (Based on a hypothetical $10,000 investment)

| Fund Name |

Costs of a $10,000 investment |

Costs paid as a percentage

of a $10,000 investment |

| Hartford Quality Value ETF |

$46 |

0.45% |

|

| Expenses Paid, Amount |

$ 46

|

| Expense Ratio, Percent |

0.45%

|

| Factors Affecting Performance [Text Block] |

How did the Fund perform last year and what impacted its performance? Management's Discussion of Fund Performance United States (U.S.) value equities, as measured by the Russell 1000 Value Index, rose over the trailing twelve-month period ending July 31, 2025, supported by strong corporate earnings, resilient consumer spending, and a rebound in technology stocks, despite interspersed periods of heightened volatility from trade tensions and inflation concerns. Top Contributors to Performance -

Security selection within the Energy and Financials sectors contributed positively to relative performance. -

Overweight allocations to Consumer Staples, Utilities, and Communication Services also contributed positively to relative performance. -

Top individual contributors over the period were overweight positions in Philip Morris International (Consumer Staples), Morgan Stanley (Financials), and a non-benchmark allocation to Broadcom (Information Technology). Top Detractors to Performance -

Security selection was the primary relative detractor during the period, driven by weak selection within the Industrials, Healthcare, and Materials sectors. -

Sector allocation, a result of the Fund’s bottom-up stock selection process, was also a modest relative detractor during the period due to the Fund’s underweight allocation to Industrials and overweight allocation to the Healthcare and Energy sectors. -

The largest individual detractors over the period were overweight positions in UnitedHealth Group (Healthcare), Elevance Health (Healthcare), and Merck (Healthcare). The views expressed reflect the opinions of the Fund's sub-advisor, Wellington Management Company LLP, as of the date of this report and are subject to change based on what we consider to be changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

|

| Performance Past Does Not Indicate Future [Text] |

The Fund’s past performance is not a good predictor of the Fund’s future performance.

|

| Line Graph [Table Text Block] |

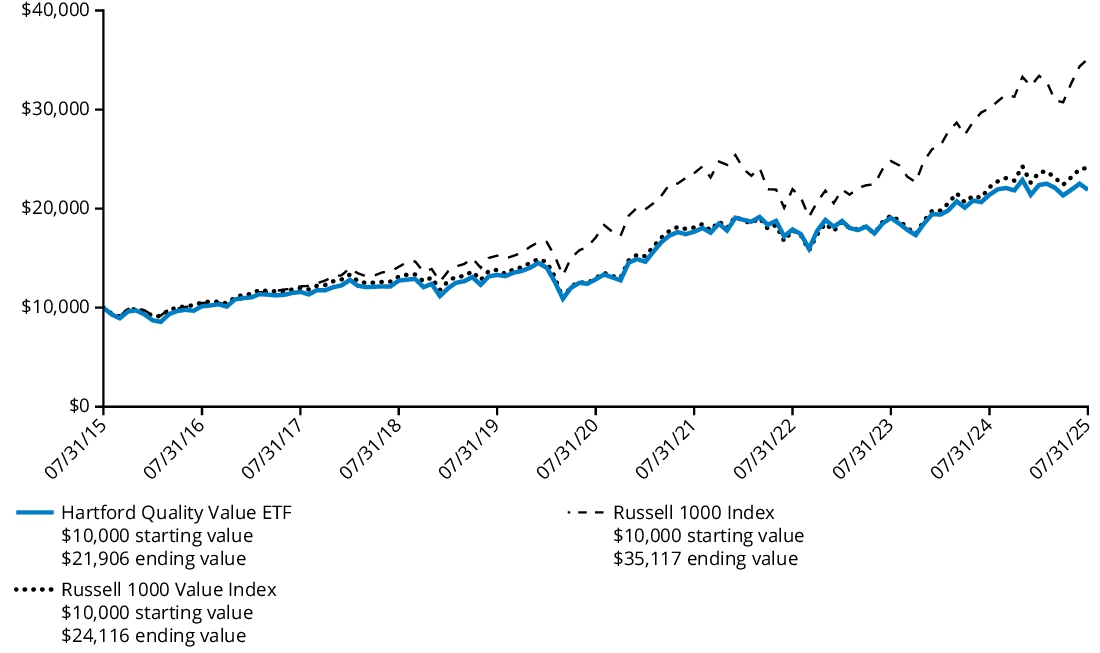

Comparison of Change in Value of $ 10,000 Investment The graph below represents the hypothetical growth of a $10,000 investment in the Fund and the comparative indices. The Fund’s past performance is not a good predictor of the Fund’s future performance.

|

| Average Annual Return [Table Text Block] |

Average Annual Total Returns

For the Periods Ended July 31, 2025 |

1 Year |

5 Years |

10 Years |

| Fund |

2.34% |

11.23% |

8.16% |

| Russell 1000 Value Index |

8.79% |

13.18% |

9.20% |

| Russell 1000 Index |

16.54% |

15.49% |

13.38% |

|

| No Deduction of Taxes [Text Block] |

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption or sale of Fund shares.

|

| Material Change Date |

Nov. 27, 2024

|

| Updated Performance Information Location [Text Block] |

Visit hartfordfunds.com for the most recent performance information.

|

| Net Assets |

$ 172,620,542

|

| Holdings Count | Holding |

65

|

| Advisory Fees Paid, Amount |

$ 790,895

|

| Investment Company Portfolio Turnover |

31.00%

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics as of

July 31, 2025

| Fund's net assets |

$172,620,542 |

| Total number of portfolio holdings (excluding derivatives, if any) |

65 |

| Total investment management fees paid |

$790,895 |

| Portfolio turnover rate |

31% |

|

| Holdings [Text Block] |

Graphical Representation of Holdings as of July 31, 2025 The table below shows the investment makeup of the Fund, representing the percentage of net assets of the Fund. Composition by Sector *

| Financials |

23.8 |

% |

| Industrials |

12.7 |

% |

| Health Care |

12.4 |

% |

| Information Technology |

10.6 |

% |

| Communication Services |

7.0 |

% |

| Utilities |

7.0 |

% |

| Energy |

6.8 |

% |

| Consumer Staples |

5.9 |

% |

| Consumer Discretionary |

5.0 |

% |

| Real Estate |

4.3 |

% |

| Materials |

3.1 |

% |

| Short-Term Investments |

0.1 |

% |

| Other Assets & Liabilities |

1.3 |

% |

| Total |

100.0 |

% |

| * |

For Fund compliance purposes, the Fund may not use the same classification system. These classifications are used for financial reporting purposes. |

|

| Material Fund Change [Text Block] |

Material Fund Changes This is a summary of certain changes to the Fund since August 1, 2024. Effective as of November 27, 2024, the Fund’s investment strategy was revised to remove references to the sub-adviser’s consideration of ESG (environmental, social and governance) factors in making investment decisions for the Fund. In addition, ESG Integration Risk was removed from the Fund’s principal risks and designated instead as a secondary risk of the Fund. This summary provides an overview of certain changes to the Fund during the fiscal year ended July 31, 2025. For more complete information, you may review the Fund's prospectus dated November 27, 2024, which is currently available at hartfordfunds.com/reports-etf or upon request by calling 1-800-456-7526 or sending an e-mail to orders@mysummaryprospectus.com.

|

| Material Fund Change Strategies [Text Block] |

Effective as of November 27, 2024, the Fund’s investment strategy was revised to remove references to the sub-adviser’s consideration of ESG (environmental, social and governance) factors in making investment decisions for the Fund. In addition, ESG Integration Risk was removed from the Fund’s principal risks and designated instead as a secondary risk of the Fund. This summary provides an overview of certain changes to the Fund during the fiscal year ended July 31, 2025.

|

| Material Fund Change Risks Change [Text Block] |

In addition, ESG Integration Risk was removed from the Fund’s principal risks and designated instead as a secondary risk of the Fund. This summary provides an overview of certain changes to the Fund during the fiscal year ended July 31, 2025.

|

| Summary of Change Legend [Text Block] |

For more complete information, you may review the Fund's prospectus dated November 27, 2024, which is currently available at hartfordfunds.com/reports-etf or upon request by calling 1-800-456-7526 or sending an e-mail to orders@mysummaryprospectus.com.

|

| Updated Prospectus Phone Number |

1-800-456-7526

|

| Updated Prospectus Email Address |

orders@mysummaryprospectus.com

|

| Updated Prospectus Web Address |

hartfordfunds.com/reports-etf

|