FILING PUBLIC UTILITY

System Energy Resources, Inc.

Rate Schedule FERC No. 2

| | |

PUBLIC UTILITIES RECEIVING SERVICE

UNDER RATE SCHEDULE |

Entergy Arkansas, LLC

Entergy Mississippi, LLC

Entergy New Orleans, LLC

SERVICE TO BE PROVIDED UNDER RATE SCHEDULE

Wholesale Sale of Electric Power

Unit Power Sales Agreement

THIS AGREEMENT, made, entered into, and effective as of this 10th day of June, 1982, as amended from time to time thereafter, and as revised to comply with Federal Energy Regulatory Commission (“FERC”) Opinion Nos. 446 and 446-A and FERC Order No.614, between and among Entergy Arkansas, LLC (“EAL”), Entergy Mississippi, LLC (“EML”), Entergy New Orleans, LLC (“ENOL”) and System Energy Resources, Inc. (“System Energy”).

WITNESSETH THAT:

WHEREAS, System Energy was incorporated on February 11, 1974 under the laws of the State of Arkansas to own certain future generating capacity for the then-existing Entergy System, of which EAL, Entergy Louisiana, LLC (“ELL”), EML and ENOL (“System Companies”) were members; and

WHEREAS, System Energy has accordingly undertaken the ownership and financing of an undivided interest in, and construction of, the Grand Gulf Generating Station, a one-unit, nuclear-fueled electric generating station on the east bank of the Mississippi River near Port Gibson, Mississippi (“Project”); and

WHEREAS, the System Companies own and operate electric generating, transmission and distribution facilities in Arkansas, Louisiana and Mississippi and generate, transmit and sell electric energy both at retail and wholesale in such states; and

WHEREAS, System Energy has agreed to sell to EAL, EML, and ENOL (“Purchasers”) specified percentages of all of the capacity and energy available to System Energy from the Project, and the System Companies have agreed to join with System Energy, before the date Unit I of the Project is placed in service, in executing an agreement which will set forth in detail the terms and conditions for the sale of such capacity and energy by System Energy to the System Companies; and

WHEREAS, Unit 1 was placed in commercial operation in July 1985; and

WHEREAS, as part of the SERI settlement filed at FERC on September 12, 2024 and approved by FERC on November 25, 2024 (the “Settlement”), 189 FERC ¶ 61,143, Entergy Louisiana, LLC (“ELL”), EAL, and EML agreed as Divestiture Settling Parties to amend this Unit Power Sales Agreement to remove ELL in its entirety and to increase EML’s entitlement to energy and capacity available to System Energy from the Project by 14%; and

WHEREAS, as part of the Settlement, the Divestiture Settling Parties also agreed to amend this Unit Power Sales Agreement to reduce EAL’s then-effective entitlement to Sysetm Energy’s capacity and energy from the Project by 2.43% (which represents the share that EAL sold at the time to ELL under separate life-of-unit designated purchase power agreements), and to increase EML’s specified entitlement by the same 2.43%; and

WHEREAS, EAL and EML desire to modify this Unit Power Sales Agreement to reflect prior life of unit designated purchase power agreements under which EAL sold a total of 6.95% of its entitlement to System Energy’s capacity and energy in order to reduce tariff administrative burdens;

NOW, THEREFORE, System Energy and the Purchasers mutually understand and agree as follows:

1.1 System Energy shall, subject to the terms and conditions of this Agreement, make available, or cause to be made available, to the Purchasers all of the capacity and energy which shall be available to System Energy at the Project, including test energy produced during the course of the construction and testing of Unit 1 of the Project (“Power”).

1.2 The Purchasers shall, subject to the terms and conditions of this Agreement, be entitled to receive all of the Power which shall be available to System Energy at the Project in accordance with their respective Entitlement Percentages. The Entitlement Percentages are as follows:

| | | | | |

| Entitlement Percentages |

| Unit No. 1 |

| EAL | 24.19% |

| ELL | 0% |

| EML | 56.38% |

| ENOL | 19.43% |

| 100% |

Under this Agreement, effective October 1, 2025, ELL is not a Purchaser.

1.3 Commencing with the earlier of (a) the date of commercial operation of the Unit or (b) December 31, 1984 and continuing monthly thereafter until this Agreement is terminated pursuant to the provisions of Section 9 hereof, in consideration of the right to receive its Entitlement Percentage of such Power from the unit, each Purchaser will pay System Energy an amount determined pursuant to the Monthly Grand Gulf Power Charge Formula, which is attached hereto as Appendix 1.

2. The performance of the obligations of System Energy hereunder shall be subject to the receipt and continued effectiveness of all authorizations of governmental regulatory authorities at the time necessary to permit System Energy to perform its duties and obligations hereunder, including the receipt and continued effectiveness of all authorizations by governmental regulatory authorities at the time necessary to permit the completion by System Energy of the construction of the Project, the operation of the Project, and for System Energy to make available to the Purchasers all of the Power available to System Energy at the Project. System Energy shall use its best efforts to secure and maintain all such authorizations by governmental regulatory authorities.

3. System Energy shall operate and maintain the Project in accordance with good utility practice. Outages for inspection, maintenance, refueling, repairs and replacements shall be scheduled in accordance with good utility practice and, insofar as practicable, shall be mutually agreed to by System Energy and the Purchasers.

4. Delivery of Power sold to the Purchasers pursuant to this Agreement shall occur at the Project’s step-up transformer and shall be made in the form of three-phase, sixty hertz alternating current at a nominal voltage of 500 kilovolts. System Energy will supply and maintain all necessary metering equipment for determining the quantity and conditions of delivery under this Agreement. System Energy will furnish to the Purchasers such summaries of meter reading and other metering information as may reasonably be requested.

5. Monthly bills shall be calculated in accordance with the provisions of the Monthly Grand Gulf Power Charge Formula, attached hereto as Appendix 1.

6. Nothing contained herein shall be construed as affecting in any way the right of System Energy to unilaterally make application to FERC for a change in the rates contained herein or any other term or condition of this Agreement under Section 205 of the Federal Power Act and pursuant to FERC Rules and Regulations promulgated thereunder.

7. No Purchaser shall be entitled to set off against any payment required to be made by it under this Agreement (a) any amounts owed by System Energy to any Purchaser or (b) the amount of any claim by any Purchaser against System Energy. The foregoing, however, shall not affect in any other way the rights and remedies of any Purchaser with respect to any such amounts owed to any Purchaser by System Energy or any such claim by any Purchaser against System Energy.

8. The invalidity and unenforceability of any provision of this Agreement shall not affect the remaining provisions hereof.

9. This Agreement shall continue until terminated by mutual agreement of all parties hereto.

10. This Agreement shall be binding upon the parties hereto and their successors and assigns, but no assignment hereof, or of any right to any funds due or to become due under this Agreement, shall in any event relieve either any Purchaser or System Energy of any of their respective obligations hereunder, or, in the case of the Purchasers, reduce to any extent their entitlement to receive all of the Power available to System Energy from time to time at the Project.

11. The agreements herein set forth have been made for the benefit of the Purchasers and System Energy and their respective successors and assigns and no other person shall acquire or have any right under or by virtue of this Agreement.

12. The Purchasers and System Energy may, subject to the provisions of this Agreement, enter into a further agreement or agreements between the Purchasers and System

Energy, setting forth detailed terms and provisions relating to the performance by the Purchasers and System Energy of their respective obligations under this Agreement. No agreement entered into under this Section 12 shall, however, alter to any substantive degree the obligations of any party to this Agreement in any manner inconsistent with any of the foregoing sections of this Agreement.

13. Each of the Purchasers shall, at any time and from time to time, be entitled to assign all of its right, title and interest in and to all of the power to which any of them shall be entitled under this Agreement, but no Purchaser shall, by such assignment, be relieved of any of its obligations and duties under this Agreement except through the payment to System Energy, by or on behalf of such Purchaser, of the amount or amounts which such Purchaser shall be obligated to pay pursuant to the terms of this Agreement.

IN WITNESS WHEREOF, the parties hereto have caused this Agreement to be duly executed as of the day and year first above written

| | |

SYSTEM ENERGY RESOURCES, INC., formerly MIDDLE SOUTH ENERGY, INC.

By: /S/ F W. Lewis |

ENTERGY ARKANSAS, LLC, formerly

ARKANSAS POWER AND LIGHT COMPANY

By: /S/ Jerry Maulden |

ENTERGY LOUISIANA, LLC, formerly

LOUISIANA POWER AND LIGHT COMPANY

By: /S/ J. Wyatt |

ENTERGY MISSISSIPPI, LLC, formerly

MISSISSIPPI POWER AND LIGHT COMPANY

By: /S/ D. C. Lutkin |

ENTERGY NEW ORLEANS, LLC, formerly

NEW ORLEANS PUBLIC SERVICE INC.

By: /S/ James M. Cain |

| | |

SYSTEM ENERGY RESOURCES, INC.

MONTHLY GRAND GULF POWER CHARGE FORMULA |

1. GENERAL

This Grand Gulf Power Charge Formula (“PCF”) sets out the procedures that shall be used to determine the monthly amounts which System Energy Resources, Inc. (“SERI”) shall charge Entergy Arkansas, LLC (“EAL”); Entergy Mississippi, LLC (“EML”); and Entergy New Orleans, LLC (“ENOL”) (referred to hereafter, collectively, as “Purchasers”, or, individually, as “Purchaser”), for capacity and energy from the Grand Gulf Nuclear Station (“Grand Gulf”) pursuant to the Unit Power Sales Agreement (“UPSA”) between SERI and the Purchasers to which this document is attached as Appendix 1. The monthly charges for capacity (“Monthly Capacity Charges”) shall be determined in accordance with the provisions of Section 2 below. The monthly charges for fuel (“Monthly Fuel Charges”) shall be determined in accordance with the provisions of Section 3 below. The Monthly Capacity Charges and the Monthly Fuel Charges determined in accordance with the provisions of this PCF shall be billed to the Purchasers monthly in accordance with the provisions of Section 4 below.

2. MONTHLY CAPACITY CHARGE

The Monthly Capacity Charge to be billed to each of the Purchasers for any service month shall be determined by applying the Monthly Capacity Charge Formula set out in Attachment A to the applicable cost data.

3. MONTHLY FUEL CHARGE

The Monthly Fuel Charge to be billed to each of the Purchasers for any service month shall be determined by applying the Monthly Fuel Charge Formula set out in Attachment B to fuel cost data for the service month.

4. BILLING

On or before the fifth workday of each month SERI shall render a billing to each of the Purchasers reflecting the Purchaser’s Monthly Capacity Charge and Monthly Fuel Charge for the immediately preceding service month. In addition, any applicable and appropriate adjustments shall be reflected in each of the monthly billings. The monthly billings shall be payable in immediately available funds on or before the 15th day of such month. After the 15th day of such month, interest shall accrue on any balance due to SERI, or owed by SERI, at the rate required for refunds rendered pursuant to the requirements of Section 35.19.a of the Code of Federal Regulations. Entergy Services LLC, acting as agent for SERI and the Purchasers, may prepare the necessary billings to the Purchasers and arrange for payment in accordance with the above requirements.

5. EFFECTIVE DATE AND TERM

This PCF shall be effective for service rendered on and after December 12, 1995 and shall continue in effect until modified or terminated in accordance with the provisions of this PCF or applicable regulations or laws.

| | | | | | | | | | | |

SYSTEM ENERGY RESOURCES, INC.

MONTHLY CAPACITY CHARGE FORMULA

DETERMINATION OF MONTHLY CAPACITY CHARGES

MONTH, XXXX |

| LINE NO | DESCRIPTION | AMOUNT | REFERENCE/SOURCE |

| 1 | CAPACITY REVENUE REQUIREMENT | | Page 3, Line 1 |

| 2 | CREDIT, PER STIPULATION AND AGREEMENT IN DOCKET NO. FA89-28 | | SERI Rate Schedule FERC No. 6 |

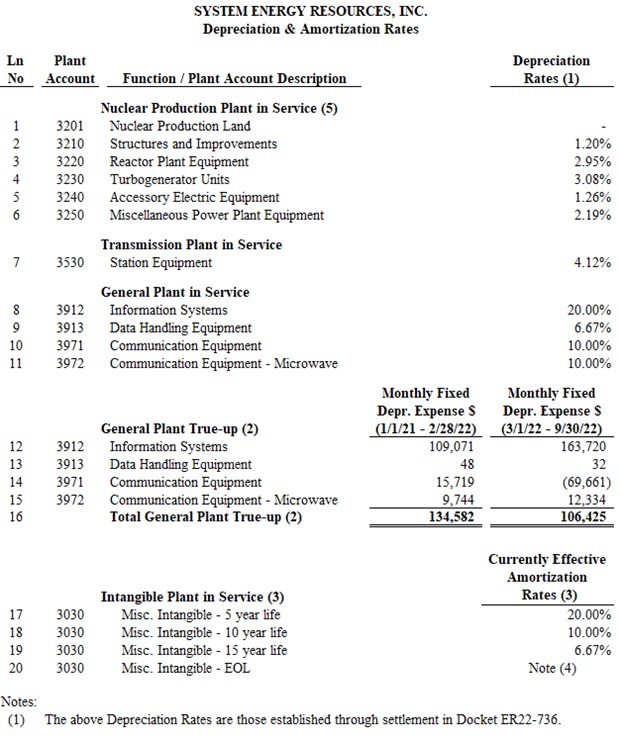

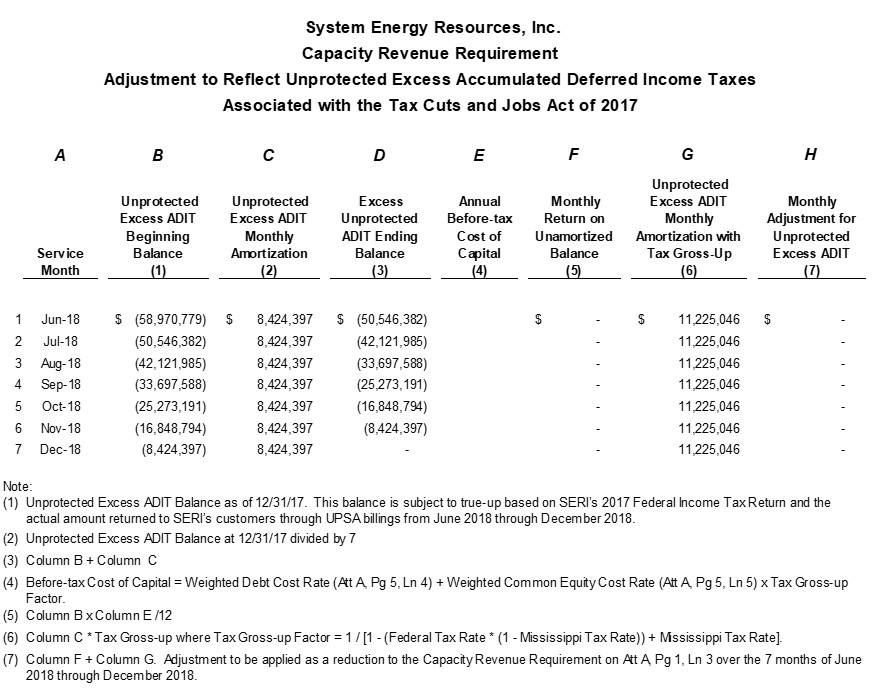

| 3 | ADJUSTMENT TO REFLECT UNPROTECTED EXCESS ADIT PER TAX CUTS AND JOBS ACT OF 2017 | | Attachment E |

4

5 | ONE-TIME CREDIT BASED ON IRS DETERMINATION OF THE FORMERLY UNCERTAIN 2015 COGS TAX POSITION (1) O&M EXPENSE TRUE-UP ADJUSTMENTS PURSUANT TO THE SEPTEMBER 2022 PARTIAL SETTLEMENT(3) | | Attachment G

Supporting Workpapers |

| 6 | ADJUSTED CAPACITY REVENUE REQUIREMENT | | Line 1 — Line 2 — Line 3 – Line 4 – Line 5 |

| 7 | MONTHLY CAPACITY CHARGE FOR EAL (4) | | 24.19% * Line 6 |

| 8 | [RESERVED] | | |

| 9 | MONTHLY CAPACITY CHARGE FOR EML (2) | | 56.38% * Line 6 |

| 10 | MONTHLY CAPACITY CHARGE FOR ENOL (5) | | 19.43% * Line 6 |

NOTES:

(1) THE CREDIT IS EQUAL TO THE CUMULATIVE EFFECT ON THE REVENUE REQUIREMENT FROM JANUARY 1, 2016, THROUGH SEPTEMBER 30, 2020, INCLUSIVE OF INTEREST PER 18 C.F.R. § 35.19A THROUGH MARCH 15, 2021, ASSUMING THE AMOUNT OF THE 2015 COST OF GOODS SOLD TAX POSITION ACTUALLY ALLOWED BY THE IRS HAD BEEN TREATED AS CERTAIN WHEN ASSERTED.

(2) PURSUANT TO THE JUNE 2022 SETTLEMENT IN DOCKET NOS. EL17-41 ET AL., BEGINNING WITH BILLS FOR THE JULY SERVICE MONTHLY CAPACITY CHARGE FOR EML SHALL BE ADJUSTED TO REFLECT:

a. A COMMON EQUITY COST OF 9.65%; AND

b. A CAPITALIZATION RATIO THAT SHALL NOT EXCEED 52.0% COMMON EQUITY.

THESE ADJUSTMENTS SHALL HAVE NO EFFECT ON THE MONTHLY CAPACITY CHARGE FOR EAL OR ENOL. A WORKPAPER SUPPORTING THE TOTAL ADJUSTMENT AND FINAL EML MONTHLY CAPACITY CHARGES SHALL BE INCLUDED IN THE FILES PRODUCED ANNUALLY PURSUANT TO THE PROTOCOLS PROCESS.

(3) INCLUDE ON AN ANNUAL BASIS ADJUSTMENTS TO EXCLUDED EXPENSES DURING THE PRECEDING YEAR MADE PURSUANT TO THE SEPTEMBER 2022 SETTLEMENT IN DOCKET NO. EL20-72. AS PROVIDED IN ATTACHMENT A, PAGES 3 & 3.1, NOTE 3, ANY ADJUSTMENT ESTIMATED ON A MONTHLY BASIS BASED ON PRIOR YEAR’S DATA WILL BE REVIEWED AND TRUED UP ON AN ANNUAL BASIS.

(4) PURSUANT TO THE NOVEMBER 2023 SETTLEMENT IN DOCKET NOS. EL17-41 ET AL., BEGINNING WITH BILLS FOR NOVEMBER 2023 SERVICE, MONTHLY CAPACITY CHARGE FOR EAL SHALL BE ADJUSTED TO REFLECT:

Attachment A

Page 1.1 of 5

a. A COMMON EQUITY COST OF 9.65%; AND

b. A CAPITALIZATION RATIO THAT SHALL NOT EXCEED 52.0% COMMON EQUITY.

THESE ADJUSTMENTS SHALL HAVE NO EFFECT ON THE MONTHLY CAPACITY CHARGE FOR EML OR ENOL. A WORKPAPER SUPPORTING THE TOTAL ADJUSTMENT AND FINAL EAL MONTHLY CAPACITY CHARGES SHALL BE INCLUDED IN THE FILES PRODUCED ANNUALLY PURSUANT TO THE PROTOCOLS PROCESS.

(5) PURSUANT TO THE MAY 2024 SETTLEMENT IN DOCKET NOS. EL17-41 ET AL., BEGINNING WITH BILLS FOR JUNE 2024 SERVICE, MONTHLY CAPACITY CHARGE FOR ENOL SHALL BE ADJUSTED TO REFLECT:

a. A COMMON EQUITY COST OF 9.65%; AND

b. A CAPITALIZATION RATIO THAT SHALL NOT EXCEED 52.0% COMMON EQUITY.

THESE ADJUSTMENTS SHALL HAVE NO EFFECT ON THE MONTHLY CAPACITY CHARGE FOR EML OR EAL. A WORKPAPER SUPPORTING THE TOTAL ADJUSTMENT AND FINAL ENOL MONTHLY CAPACITY CHARGES SHALL BE INCLUDED IN THE FILES PRODUCED ANNUALLY PURSUANT TO THE PROTOCOLS PROCESS.

| | | | | | | | | | | |

SYSTEM ENERGY RESOURCES, INC.

MONTHLY CAPACITY CHARGE FORMULA

DEVELOPMENT OF RATE BASE (1)

MONTH, XXXX |

| LINE NO | DESCRIPTION | AMOUNT | REFERENCE/SOURCE |

| 1 | PLANT IN SERVICE | | FERC Accounts 101, 106 (2) |

| 2 | ACCUMULATED DEPRECIATION & AMORTIZATION | | FERC Accounts 108, 111 (3) |

| 3 | NET UTILITY PLANT | | Line 1 Plus Line 2 |

| 4 | NUCLEAR FUEL | | FERC Accounts 120.2-120.4 |

| 5 | AMORTIZATION OF NUCLEAR FUEL | | FERC Account 120.5 |

| 6 | MATERIALS & SUPPLIES | | FERC Accounts 154, 163 |

| 7 | PREPAYMENTS | | FERC Account 165 |

| 8 | DEFERRED REFUELING OUTAGE COSTS | | FERC Account 182.3 |

9 10 11 | ACCUMULATED DEFERRED INCOME TAXES PREPAID (ACCRUED) PENSION COSTS SALE-LEASEBACK RENTAL PAYMENTS COLLECTED IN ADVANCE OF PAYMENT TO OWNER-LESSORS | | FERC Accounts 190, 281, 282, 283 (4) FERC Accounts 182.38P& 253.012 (5) FERC Account 232 (6) |

| 12 | RATE BASE | | Sum of Lines 3 – 11 |

| | | |

| | | | | | | | |

| NOTES: |

| (1) | TO BE DETERMINED BASED ON DATA AS OF THE END OF THE MONTH IMMEDIATELY PRECEDING THE CURRENT SERVICE MONTH. |

| (2) | PRIOR TO INCLUDING CWIP, INCLUSIVE OF AFUDC, IN PLANT IN SERVICE AND RATE BASE, SERI WILL CALCULATE THE AFUDC RATE, EFFECTIVE JANUARY 1, 2023, CONSISTENT WITH THE METHODOLOGY APPROVED BY THE COMMISSION IN DOCKET NO. ER23-625-000. | |

| (3) | THE BALANCE FOR ACCUMULATED DEPRECIATION AND AMORTIZATION IS TO BE REDUCED BY ANY DECOMMISSIONING RESERVE AND RESERVE FOR DISPOSAL OF NUCLEAR FUEL INCLUDED IN FERC ACCOUNTS 108 AND 111 WHICH REPRESENT MONIES HELD BY THIRD PARTIES. |

| (4) | INCLUDING ADIT RESULTING FROM IRS RESOLUTION OF THE 2015 TAX POSITION TO INCLUDE THE DECOMMISSIONING LIABILITY IN COST OF GOODS SOLD. |

| (5) | PREPAID (ACCRUED) PENSION COSTS INCLUDES ACCOUNTS 253012 - PENSION LIABILITY - FUNDED STATUS, 18238P - REGULATORY ASSET FOR UNRECOGNIZED LOSSES AND POTENTIALLY ACCOUNT 254 - REGULATORY LIABILITY FOR UNRECOGNIZED GAINS. |

| (6) | PURSUANT TO THE SEPTEMBER 2022 SETTLEMENT IN DOCKET NO. EL20-72, BEGINNING WITH BILLS FOR THE OCTOBER 2022 SERVICE MONTH, THE BALANCE IN ACCOUNT 232 FOR THE MONTHLY SALE-LEASEBACK LEASE PAYMENTS COLLECTED IN ADVANCE OF PAYMENT BY SERI TO THE OWNER-LESSORS SHALL BE USED TO REDUCE RATE BASE. PURSUANT TO THE COMMISSION’S DECEMBER 23, 2022 ORDER IN DOCKET NO. EL18-152, SALE-LEASEBACK RENEWAL COSTS ARE EXCLUDED FROM RATES CHARGED TO EAL AND ENO, AND LINE NO. 11 WILL NO LONGER BE INCLUDED IN RATES CHARGED TO THOSE PURCHASERS. FOR THE REMAINING TERM OF THE SALE-LEASEBACK RENEWAL, RATES CHARGED TO EML WILL CONTINUE TO INCLUDE THE CREDIT DESCRIBED FOR LINE NO. 11. |

| | | | | | | | | | | |

SYSTEM ENERGY RESOURCES, INC.

MONTHLY CAPACITY CHARGE FORMULA

DEVELOPMENT OF CAPACITY REVENUE REQUIREMENT (1)

MONTH, XXXX |

| LINE NO | DESCRIPTION | AMOUNT | REFERENCE/SOURCE |

| | | |

| 1 | CAPACITY REVENUE REQUIREMENT | | Determined as described in Note 2 below. |

| 2 | OPERATION & MAINTENANCE EXPENSE (3) | | FERC Accounts 517, 519-525, 528-532, 556, 557, 560-573, 901-905, 920-931, 935 |

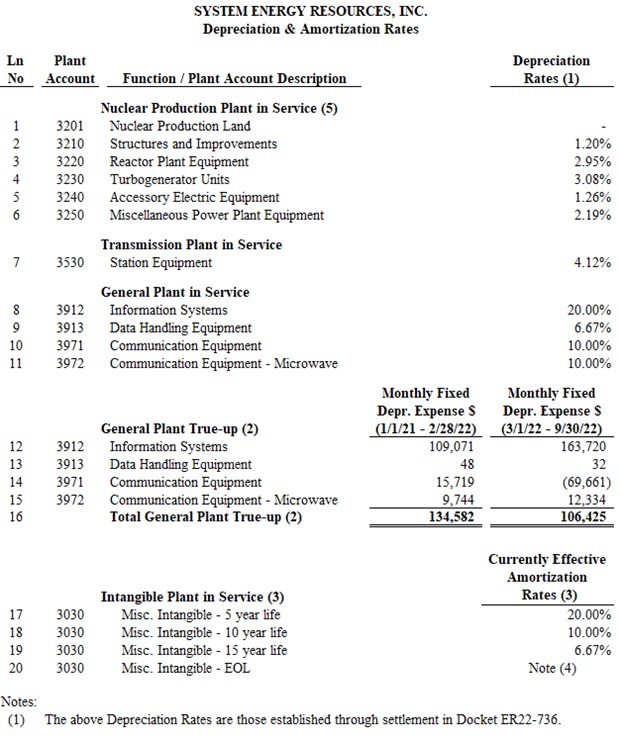

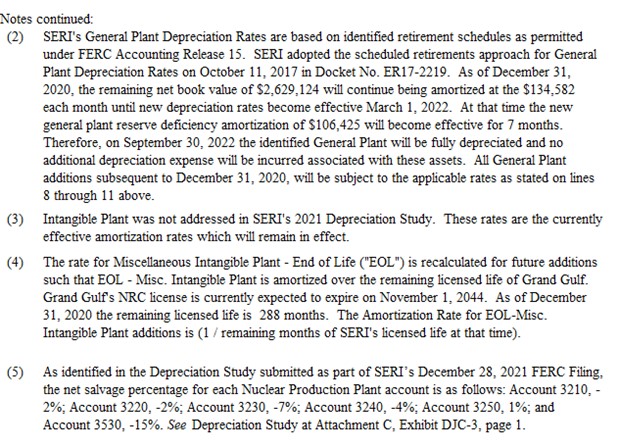

| 3 | DEPRECIATION EXPENSE | | FERC Account 403-Excluding Decommissioning Exp |

| 4 | DECOMMISSIONING EXPENSE (4) | | FERC Account 403-Decommissioning Expense |

| 5 | AMORTIZATION EXPENSE | | FERC Accounts 404, 407.3, 407.4 |

| 6 | TAXES OTHER THAN INCOME TAXES | | FERC Account 408.1 |

| 7 | CURRENT STATE INCOME TAX | | Page 4, Line 18 |

| 8 | CURRENT FEDERAL INCOME TAX | | Page 4, Line 25 |

| 9 | PROVISION FOR DEFERRED INCOME TAX-STATE | | State Portion of FERC Accounts 410.1, 411.1 (5) |

| 10 | PROVISION FOR DEFERRED INCOME TAX-FEDERAL | | Federal Portion of FERC Accounts 410.1, 411.1 (5) |

| 11 | INVESTMENT TAX CREDIT-NET | | FERC Account 411.4 |

| 12 | GAINS/LOSSES ON DISPOSITION OF UTILITY PLANT | | FERC Accounts 411.6, 411.7 |

| 13 | UTILITY OPERATING EXPENSES | | Sum of Lines 2 – 12 |

| | | |

| 14 | UTILITY OPERATING INCOME | | Line 1 minus Line 13 |

| 15 | VERIFICATION: | | |

| 16 | RATE BASE | | Page 1, Line 12 |

| 17 | RATE OF RETURN ON RATE BASE | | 12*(Line 14 / Line 16) (Must equal Line 18) |

| | | |

| 18 | COST OF CAPITAL | | Weighted Cost Rate from Page 5, Line 6 |

| | | | | |

| NOTES: |

| 1) | ALL EXPENSES ARE TO BE THOSE FOR THE CURRENT SERVICE MONTH. |

| |

| 2) | THE CAPACITY REVENUE REQUIREMENT FOR THE SERVICE MONTH IS THE VALUE THAT RESULTS IN A UTILITY OPERATING INCOME WHICH, WHEN DIVIDED BY THE RATE BASE (DETERMINED IN ACCORDANCE WITH PAGE 2) AND MULTIPLIED BY 12 PRODUCES A RATE OF RETURN ON RATE BASE EQUAL TO THE COST OF CAPITAL (DETERMINED IN ACCORDANCE WITH PAGE 5). PLEASE NOTE FOR EML, THE COST OF CAPITAL IS DETERMINED PURSUANT TO THE JUNE 2022 SETTLEMENT IN DOCKET NOS. EL17-41 ET AL., BEGINNING WITH BILLS FOR THE JULY 2022 SERVICE MONTH. SEE NOTE 10 ON ATTACHMENT A, PAGE 5. |

Attachment A

Page 3.1 of 5

| | | | | |

| |

| 3) | EXCLUSIVE OF FUEL EXPENSE IN FERC ACCOUNT 518. IN ADDITION, PURSUANT TO THE SEPTEMBER 2022 SETTLEMENT IN DOCKET NO. EL20-72, BEGINNING WITH BILLS FOR THE OCTOBER 2022 SERVICE MONTH: (A) INCLUSION OF AIRCRAFT COSTS THAT ARE OR SHOULD PROPERLY BE RECORDED IN ACCOUNTS 517, 519-525, 528-532, 556, 557, 560-573, 901-905, 920-931, 935 SHALL BE LIMITED TO COSTS ALLOCATED TO SERI VIA DIRECT ASSIGNMENT PROJECT CODE AND COSTS ALLOCATED VIA NUCLEAR-BASED PROJECT CODE; SHALL EXCLUDE COST CODES FOR UNREGULATED NUCLEAR PLANTS; AND SHALL BE SUBJECT TO A CAP OF NO MORE THAN $1,500 PER PERSON PER FLIGHT (APPLIED PRIOR TO THE ALLOCATION OF THE FLIGHT’S COST ACROSS BUSINESS UNITS); (B) ANNUAL INCENTIVE PLAN EXPENSES THAT ARE OR SHOULD PROPERLY BE RECORDED IN ACCOUNT 920 AND ANY NUCLEAR OPERATING AND MAINTENANCE EXPENSE ACCOUNT (ACCOUNTS 517-525, 528-532) SHALL BE REDUCED TO EXCLUDE THE PORTION OF ANNUAL INCENTIVE PLAN EXPENSES AWARDED BASED ON FINANCIAL GOALS AND ALLOCATED TO SERI; (C) LONG TERM INCENTIVE PLAN EXPENSES THAT ARE OR SHOULD PROPERLY BE RECORDED IN ACCOUNT 920 AND ANY NUCLEAR OPERATING AND MAINTENANCE EXPENSE ACCOUNT (ACCOUNTS 517-525, 528-532) SHALL BE REDUCED TO EXCLUDE EXPENSES FOR STOCK OPTIONS, RESTRICTED STOCK AWARDS, AND PERFORMANCE UNIT AWARDS FOR MANAGEMENT LEVEL 1 THROUGH 4 EMPLOYEES; (D) INCLUSION OF ADVERTISING EXPENSES RECORDED IN ACCOUNT 930.1 SHALL BE LIMITED TO EXPENSES FOR SAFETY-BASED ADVERTISING. MONTHLY ESTIMATES OF EXCLUSIONS FOR THESE ISSUES SHALL BE INCLUDED BASED ON THE PRIOR SERVICE YEAR’S DATA AND SHALL BE TRUED UP NO LATER THAN MARCH 31 OF THE YEAR FOLLOWING THE SERVICE YEAR. SUPPORTING WORKPAPERS FOR THE ADJUSTMENT(S) WILL BE PROVIDED PURSUANT TO SECTION II.B.6(C) OF THE ANNUAL FORMULA RATE PROTOCOLS. PURSUANT TO THE COMMISSION’S DECEMBER 23, 2022 ORDER IN DOCKET NO. EL18-152, SALE-LEASEBACK RENEWAL COSTS (RECORDED IN ACCOUNT 931) ARE EXCLUDED FROM RATES CHARGED TO EAL AND ENO; HOWEVER, RATES CHARGED TO EML WILL CONTINUE TO INCLUDE 33% OF SERI’S SALE-LEASEBACK RENEWAL RENTAL COSTS FOR THE REMAINING TERM OF THE SALE-LEASEBACK RENEWAL. |

| |

| 4) | SHOULD THE FERC APPROVE A CHANGE IN SYSTEM ENERGY’S SCHEDULE OF ANNUAL DECOMMISSIONING EXPENSES DURING THE SERVICE MONTH, THE MONTHLY LEVEL IN EFFECT AS OF THE END OF THE MONTH SHALL BE UTILIZED. OTHERWISE, THE AMOUNT CHARGED TO FERC ACCOUNT 403 FOR THE SERVICE MONTH SHALL BE UTILIZED, AS SHOWN ON ATTACHMENT C. |

| |

| 5) | RESTRICTED TO THOSE ITEMS FOR WHICH CORRESPONDING TIMING DIFFERENCES ARE INCLUDED IN THE ADJUSTMENTS TO NET INCOME BEFORE INCOME TAX (SEE PAGE 4, LINE 10). |

| | | | | | | | | | | |

SYSTEM ENERGY RESOURCES, INC.

MONTHLY CAPACITY CHARGE FORMULA

DEVELOPMENT OF CURRENT INCOME TAX EXPENSE

MONTH, XXXX |

| LINE NO | DESCRIPTION | AMOUNT | REFERENCE/SOURCE |

| | | |

| 1 | CAPACITY REVENUE REQUIREMENT | | Page 3, Line 1 |

| 2 | OPERATION 8, MAINTENANCE EXPENSE | | Page 3, Line 2 |

| 3 | DEPRECIATION EXPENSE | | Page 3, Line 3 |

| 4 | DECOMMISSIONING EXPENSE | | Page 3, Line 4 |

| 5 | AMORTIZATION EXPENSE | | Page 3, Line 5 |

| 6 | TAXES OTHER THAN INCOME | | Page 3, Line 6 |

| 7 | NET INCOME BEFORE INCOME TAXES | | Line 1 - (Sum of Lines 2-6) |

| 8 | ADJUSTMENTS TO NET INCOME BEFORE INCOME TAX: | | |

| 9 | INTEREST SYNCHRONIZATION | | Rate Base (Page 1, Line 12) * (-1) * Total Debt Rate (Page 5, Line 4)/12 |

| 10 | OTHER ADJUSTMENTS | | See Note 1 |

| 11 | TOTAL ADJUSTMENTS | | Line 9 plus Line 10 |

| 12 | TAXABLE INCOME | | Line 7 plus Line 11 |

| COMPUTATION OF STATE INCOME TAX | | |

| 13 | STATE TAXABLE INCOME BEFORE ADJUSTMENTS | | Line 12 |

| 14 | NET ADJUSTMENT TO STATE TAXABLE INCOME | | See Note 1 |

| 15 | STATE TAXABLE INCOME | | Line 13 plus Line 14 |

| 16 | STATE INCOME TAX BEFORE ADJUSTMENTS | | Line 15 * Mississippi State Tax Rate (2) |

| 17 | ADJUSTMENTS TO STATE TAX | | See Note 1 |

| 18 | CURRENT STATE INCOME TAX | | Sum of Lines 16 - 17 |

| | | |

| COMPUTATION OF FEDERAL INCOME TAX | | |

| 19 | FEDERAL TAXABLE INCOME BEFORE ADJUSTMENTS | | Line 12 |

| 20 | CURRENT STATE INCOME TAX DEDUCTION | | Line 18 (Shown as deduction) |

| 21 | OTHER ADJUSTMENTS TO FEDERAL TAXABLE INCOME | | See Note 1 |

| 22 | FEDERAL TAXABLE INCOME | | Sum of Lines 19-21 |

| 23 | FEDERAL INCOME TAX BEFORE ADJUSTMENTS | | Line 22 * Federal Tax Rate (2) |

| 24 | ADJUSTMENTS TO FEDERAL TAX | | See Note 1 and Note 3 |

| 25 | CURRENT FEDERAL INCOME TAX | | Sum of Lines 23 - 24 |

| | | | | |

| NOTES: |

| 1) | ITEMS FROM MONTHLY TAX DETERMINATION THAT ARE APPROPRIATE FOR RATEMAKING PURPOSES. |

| 2) | RATE IN EFFECT AT THE END OF THE SERVICE MONTH. |

| 3) | INCLUDING A ONE-TIME CREDIT OF EXCESS DEFERRED FEDERAL INCOME TAXES RESULTING FROM IRS RESOLUTION OF THE 2015 TAX POSITION TO INCLUDE THE DECOMMISSIONING LIABILITY IN COST OF GOODS SOLD. |

| | | | | | | | | | | | | | | | | |

SYSTEM ENERGY RESOURCES, INC.

MONTHLY CAPACITY CHARGE FORMULA

DEVELOPMENT OF COST OF CAPITAL (1)

MONTH, XXXX |

| LINE NO | CAPITAL SOURCE | CAPITAL AMOUNT (2)(3) | CAPITALIZATION RATIO (4) | COST RATE | WEIGHTED

COST RATE (8) |

| 1 | DEBT | | | | |

| 2 | LONG TERM | FERC Accts 221, 224, 225, 226, 181, 189 | | (5) | | |

| 3 | SHORT TERM | | | (6) | | |

| 4 | TOTAL TERM | | | (7) | | |

| 5 | COMMON EQUITY | FERC Accts 201, 208, 216 | | (SEE NOTE 9) | |

| 6 | TOTAL | | | NA | |

| | | | | | | | |

| NOTES: |

| (1) | | TO BE DETERMINED BASED ON DATA AS OF THE END OF THE MONTH IMMEDIATELY PRECEDING THE CURRENT SERVICE MONTH. |

| (2) | | LONG TERM DEBT SHALL INCLUDE ALL ISSUES AND REFLECT THE PRINCIPAL AMOUNT. |

| (3) | | SHORT TERM DEBT SHALL INCLUDE ONLY THAT PORTION NOT REFLECTED IN THE CALCULATION OF SERI’S RATE FOR ALLOWANCE FOR FUNDS USED DURING CONSTRUCTION. |

| (4) | | APPLICABLE CAPITAL AMOUNT DIVIDED BY THE TOTAL CAPITAL AMOUNT. |

| (5) | | AVERAGE COST RATE FOR ALL OUTSTANDING ISSUES INCLUDING APPLICABLE AMORTIZATION OF DEBT DISCOUNT, PREMIUM, AND EXPENSE TOGETHER WITH AMORTIZATION OF LOSS OR GAIN ON REACQUIRED DEBT. |

| (6) | | THE AVERAGE COST RATE FOR ELIGIBLE SHORT TERM DEBT. |

| (7) | | WEIGHTED AVERAGE COST RATE FOR LONG TERM DEBT AND SHORT TERM DEBT. |

| (8) | | CAPITALIZATION RATIO FOR THE APPLICABLE CAPITAL SOURCE MULTIPLIED BY THE CORRESPONDING COST RATE. |

| (9) | | THE COMMON EQUITY COST RATE SHALL BE AS FOLLOWS: |

| A. FOR SERVICE FROM DECEMBER 12, 1995 THROUGH JULY 30, 2000 THE RATE SHALL BE 10.58%. |

| B. FOR SERVICE AFTER JULY 30, 2000 THE RATE SHALL BE 10.94%. |

| |

| | |

| | | | | | | | | | | |

SYSTEM ENERGY RESOURCES, INC.

MONTHLY FUEL CHARGE FORMULA

MONTH, XXXX |

| LINE NO | DESCRIPTION | AMOUNT | REFERENCE/SOURCE |

| | | |

| 1 | FUEL EXPENSE FOR APPLICABLE SERVICE MONTH | | FERC Account 518 |

| 2 | MONTHLY FUEL CHARGE FOR EAL | | 24.19% * Line 1 |

| 3 | [RESERVED] | | |

| 4 | MONTHLY FUEL CHARGE FOR EML | | 56.38% * Line 1 |

| 5 | MONTHLY FUEL CHARGE FOR ENOL | | 19.43% * Line 1 |

| | | |

| | | | | | | | | | | | | | |

System Energy Resources, Inc. Grand Gulf Decommissioning Model Revenue Requirement Summary ($000) |

| | Revenue Requirement |

Line

No. | Year | Owned

Portion | Leased

Portion | Total |

| 1 | 1995 | | 6,813 | 1,208 | 8,021 |

| 2 | 1996 | | 11,195 | 1,997 | 13,192 |

| 3 | 1997 | | 11,195 | 1,997 | 13,192 |

| 4 | 1998 | | 11,195 | 1,997 | 13,192 |

| 5 | 1999 | | 11,195 | 1,997 | 13,192 |

| 6 | 2000 | | 11,195 | 1,997 | 13,192 |

| 7 | 2001 | | 13,624 | 2,431 | 16,055 |

| 8 | 2002 | | 13,624 | 2,431 | 16,055 |

| 9 | 2003 | | 13,624 | 2,431 | 16,055 |

| 10 | 2004 | | 13,624 | 2,431 | 16,055 |

| 11 | 2005 | | 13,624 | 2,431 | 16,055 |

| 12 | 2006 | | 16,590 | 2,960 | 19,550 |

| 13 | 2007 | | 16,590 | 2,960 | 19,550 |

| 14 | 2008 | | 16,590 | 2,960 | 19,550 |

| 15 | 2009 | | 16,590 | 2,960 | 19,550 |

| 16 | 2010 | | 16,590 | 2,960 | 19,550 |

| 17 | 2011 | | 20,184 | 3,601 | 23,785 |

| 18 | 2012 | | 20,184 | 3,601 | 23,785 |

| 19 | 2013 | | 20,184 | 3,601 | 23,785 |

| 20 | 2014 | | 20,184 | 3,601 | 23,785 |

| 21 | 2015 | | 20,184 | 2,101 | 22,285 |

| 22 | 2016 | | 24,550 | 0 | 24,550 |

| 23 | 2017 | | 18,412 | 0 | 18,412 |

| 24 | 2018 | | 0 | 0 | 0 |

| 25 | 2019 | | 0 | 0 | 0 |

| 26 | 2020 | | 0 | 0 | 0 |

| 27 | 2021 | | 0 | 0 | 0 |

| 28 | 2022 | | 0 | 0 | 0 |

| 29 | 2023 | | 0 | 0 | 0 |

| 30 | 2024 | | 0 | 0 | 0 |

| 31 | 2025 | | 0 | 0 | 0 |

| 32 | 2026 | | 0 | 0 | 0 |

| 33 | 2027 | | 0 | 0 | 0 |

| 34 | 2028 | | 0 | 0 | 0 |

| 35 | 2029 | | 0 | 0 | 0 |

| 36 | 2030 | | 0 | 0 | 0 |

| 37 | 2031 | | 0 | 0 | 0 |

| | | | | | | | | | | | | | |

System Energy Resources, Inc. Grand Gulf Decommissioning Model Revenue Requirement Summary ($000) |

| | Revenue Requirement |

Line

No. | Year | Owned

Portion | Leased

Portion | Total |

| 38 | 2032 | | 0 | 0 | 0 |

| 39 | 2033 | | 0 | 0 | 0 |

| 40 | 2034 | | 0 | 0 | 0 |

| 41 | 2035 | | 0 | 0 | 0 |

| 42 | 2036 | | 0 | 0 | 0 |

| 43 | 2037 | | 0 | 0 | 0 |

| 44 | 2038 | | 0 | 0 | 0 |

| 45 | 2039 | | 0 | 0 | 0 |

| 46 | 2040 | | 0 | 0 | 0 |

| 47 | 2041 | | 0 | 0 | 0 |

| 48 | 2042 | | 0 | 0 | 0 |

| 49 | 2043 | | 0 | 0 | 0 |

| 50 | 2044 | | 0 | 0 | 0 |

System Energy Resources, Inc.

One-Time Credit (1)

Payable in the February 2021 Service Month Billing

FERC Interest Through March 15, 2021

| | | | | | | | |

Description |

| Amount |

|

|

|

Revenue Requirement Principal Amount |

| $22,195,965 |

|

|

|

FERC Interest |

| 3,049,923 |

|

|

|

Total One-Time Credit (2) |

| $25,245,888 |

Notes:

(1) The credit is equal to the cumulative effect on the revenue requirement from January 1, 2016, through September 30, 2020, inclusive of interest per 18 C.F.R. § 35.19a through March 15, 2021, assuming the amount of the 2015 Cost of Goods Sold Tax Position actually allowed by the IRS had been treated as certain when asserted.

(2) The Total One-Time Credit is included on Attachment A, Page 1, Line 4.

Formula Rate Protocols

Section I. Applicability

The following Information Exchange and Challenge Procedures shall apply to the SERI

UPSA.

Section II. Copies of UPSA Bills

A. SERI will provide Grand Gulf monthly bills for each calendar year beginning with calendar year 2019, together with information and workpapers that show how the bills were determined, to the designated representatives of the APSC, CNO, and MPSC (“Interested Parties”) not later than March 31 of the following year (“Annual Bills”). The bills and workpapers will be provided for all formula rate inputs such that customers can determine which Uniform System of Accounts are included and excluded from recovery through the UPSA, in native format with working formulas intact. These workpapers will identify which SERI trial balance accounts and/or sub-accounts are being excluded from the formula rate input amounts, when the amount reported in SERI’s Form No. 1 differs in any respect from the amount to be collected from customers. The UPSA workpapers will be in a format similar to the supporting workpapers (designated as a WP) included in each Entergy Operating Company’s MISO Attachment O transmission formula rate. SERI will also make the bills and workpapers available for public viewing by posting such information to the Entergy website not later than March 31. Annually, SERI will also report in its FERC Form No. 1 on schedule page 106b “Information on Formula Rates Formula Rate Variances” or on the applicable FERC Form No. 1 schedule page, detailed information regarding which SERI trial balance accounts and/or sub-accounts and the related account/sub-

account balances that have been excluded from the UPSA formula rate inputs and differ from the amounts reported in SERI’s FERC Form No. 1.

B. The Annual Bills provided by SERI will:

1. Include a workable data-populated formula and underlying workpapers in native format with all formulas and links intact.

2. Provide the formula rate calculations and all inputs thereto, as well as supporting documentation and workpapers for data that are used in the formula rate.

3. Provide sufficient information to enable Interested Parties to replicate the calculation of the formula.

4. With respect to any change in accounting that affects inputs to the formula rate or the resulting charges billed under the formula rate (“Accounting Change”), identify and explain any Accounting Changes, including

a. The initial implementation of an accounting standard or policy;

b. the initial implementation of accounting practices for unusual or unconventional items where FERC has not provided specific accounting direction;

c. correction of errors and prior period adjustments that impact the revenue requirement;

d. the implementation of new estimation methods or policies that change prior estimates; and

e. changes to income tax elections.

5. SERI must identify all items included in the Annual Bills at an amount other than on a historical cost basis (e.g., fair value adjustments).

6. On or before June 15 of each year, SERI shall provide the interested parties with the following:

a. The underlying data and calculations, with an accompanying narrative, reconciling any differences between the inputs shown on the monthly UPSA bills for the prior calendar year and the corresponding accounts on SERI's FERC Form No. 1.

b. The Annual Prepaid (Accrued) Pension Cost Workpaper (Pension Cost WP) detailing the determination of Prepaid (Accrued) Pension Cost in support of Attachment A, Page 2, Line 10 as of December 31 of the prior calendar year.

c. The O&M Expense True-Up Workpapers detailing the annual true-up of excluded expenses in support of Attachment A, Page 1, Line 5. With respect to the adjustments for executive annual incentive plan expenses, these workpapers shall include the table depicting the percentage of annual incentive plan expenses that are awarded to Entergy Services, LLC employees, based on financial-metrics for the prior service year; this percentage shall be used to calculate the exclusion of such costs that are billed to SERI.

7. On or before May 1 of each year, SERI shall make an Informational Filing with FERC providing the details of the year-end, actuarially determined Prepaid (Accrued) Pension Cost as of December 31 of the preceding calendar year.

C. SERI shall hold an open meeting among Interested Parties (“Annual Meeting”) between the date SERI provides the Annual Bills and a date that is no later than July 1. No less than seven (7) days prior to such Annual Meeting, SERI shall provide notice to the Interested Parties of the time, date, and location of the Annual Meeting. The Annual Meeting shall (i) permit SERI to explain and clarify its Annual Bills and (ii) provide Interested Parties an opportunity to seek information and clarifications from SERI about the Annual Bills.

Section III. Information Exchange Procedures

Each set of Annual Bills shall be subject to the following information exchange procedures (“Information Exchange Procedures”):

A. Interested Parties shall have until October 1 (unless such period is extended with the written consent of SERI or by FERC) to serve reasonable information and document requests on SERI (“Information Exchange Period”). If October 1 falls on a weekend or a holiday recognized by FERC, the deadline for submitting all information and document requests shall be extended to the next business day. Such information and document requests shall be limited to what is necessary to determine:

(1) the extent or effect of an Accounting Change;

(2) whether the Annual Bills fail to include data properly recorded in accordance with these protocols;

(3) the proper application of the UPSA formula and procedures in these protocols;

(4) the accuracy of data and consistency with the UPSA formula of the charges shown in the Annual Bills;

(5) the prudence of actual costs and expenditures;

(6) the effect of any change to the underlying Uniform System of Accounts or FERC Form No. 1;

(7) the addition to or deletion from any account/subaccount or detailed input in a workpaper due to an Accounting Change or such other changes implemented during the previous calendar year; or

(8) any other information that may reasonably have substantive effect on the calculation of the charges pursuant to the UPSA formula.

The information and document requests shall not otherwise be directed to ascertaining whether the formula rate is just and reasonable.

B. SERI shall make a good faith effort to respond to information and document requests pertaining to the Annual Bills within fifteen (15) business days of receipt of such requests. SERI shall respond to all information and document requests by no later than October 31, unless the Information Exchange Period is extended by SERI or FERC.

C. SERI shall not claim that responses to information and document requests provided pursuant to these protocols are subject to any settlement privilege in any subsequent FERC proceeding addressing the UPSA.

Section IV. Challenge Procedures

A. Interested Parties shall have until November 21 (unless such period is extended with the written consent of SERI or by FERC order) to review the inputs, supporting explanations, allocations, and calculations and to notify SERI in writing, which may be made electronically, of any specific Informal Challenges. The period of time from

receipt of copies of the Annual Bills on March 31 until November 21 shall be referred to as the Review Period. If November 21 falls on a weekend or a holiday recognized by FERC, the deadline for submitting all Informal Challenges shall be extended to the next business day. Failure to pursue an issue through an Informal Challenge or to lodge a Formal Challenge regarding any issue with the current set of Annual Bills shall bar pursuit of such issue in a Challenge Procedure as set forth in these protocols with respect to that Annual Bill cycle, but shall not bar pursuit of such issue or the lodging of a Formal Challenge as to such issue as it relates to subsequent Annual Bills.

B. A party submitting an Informal Challenge to SERI must specify the inputs, supporting explanations, allocations, calculations, or other information to which it objects, and provide an appropriate explanation and documents to support its challenge. SERI shall make a good faith effort to respond to any Informal Challenge within twenty (20) business days of notification of such challenge. SERI shall appoint a senior representative to work with the party that submitted the Informal Challenge (or its representative) toward a resolution of the challenge. If SERI disagrees with such challenge, SERI will provide the Interested Party(ies) with an explanation supporting the inputs, supporting explanations, allocations, calculations, or other information. No Informal Challenge may be submitted after November 21, and SERI must respond to all Informal Challenges by no later than December 21, unless the Review Period is extended by SERI or FERC.

C. Formal Challenges shall be filed pursuant to these protocols and shall satisfy all of the following requirements.

(1) A Formal Challenge shall:

(a) Clearly identify the action or inaction which is alleged to violate the filed UPSA formula or protocols;

(b) Explain how the action or inaction violates the filed UPSA formula or protocols;

(c) Set forth the business, commercial, economic, or other issues presented by

the action or inaction as such relate to or affect the party filing the Formal Challenge, including:

(i) The extent or effect of an Accounting Change;

(ii) Whether the Annual Bills fail to include data properly recorded in accordance with these protocols;

(iii) The proper application of the UPSA formula and procedures in these protocols;

(iv) The accuracy of data and consistency with the UPSA formula of the charges shown in the Annual Bills;

(v) The prudence of actual costs and expenditures;

(vi) The effect of any change to the underlying Uniform System of Accounts; or

(vii) Any other information that may reasonably have substantive effect on the calculation of the charge pursuant to the formula.

(d) Make a good faith effort to quantify the financial impact or burden (if any) created for the party filing the Formal Challenge as a result of the action or inaction;

(e) State whether the issues presented are pending in an existing Commission proceeding or a proceeding in any other forum in which the filing party is a party, and if so, provide an explanation why timely resolution cannot be achieved in that forum;

(f) State the specific relief or remedy requested, including any request for stay or extension of time, and the basis for that relief;

(g) Include all documents that support the facts in the Formal Challenge in possession of, or otherwise attainable by, the filing party, including, but not limited to, contracts and affidavits; and

(h) State whether the filing party utilized the Informal Challenge procedures described in these protocols to dispute the action or inaction raised by the Formal Challenge, and, if not, describe why not.

(2) Service. Any person filing a Formal Challenge must serve a copy of the Formal Challenge on SERI. Service to SERI must be simultaneous with filing at the Commission. Simultaneous service can be accomplished by electronic mail in accordance with § 385.2010(f)(3), facsimile, express delivery, or messenger. The party filing the Formal Challenge shall serve the individual listed as the contact person for SERI and Entergy Services, LLC listed on the FERC website.

D. Informal and Formal Challenges shall be limited to all issues that may be necessary to determine: (1) the extent or effect of an Accounting Change; (2) whether the Annual Bills fail to include data properly recorded in accordance with these protocols; (3) the proper application of the UPSA formula and procedures in these protocols; (4) the

accuracy of data and consistency with the UPSA formula of the charges shown in the Annual Bills;

(5) the prudence of actual costs and expenditures; (6) the effect of any change to the underlying Uniform System of Accounts; or (7) any other information that may reasonably have substantive effect on the calculation of the charge pursuant to the UPSA formula.

E. Any changes or adjustments to the Annual Bills resulting from the Information Exchange and Informal Challenge processes that are agreed to by SERI will be reported in the

Informational Filing described in Section VI of these protocols.

F. An Interested Party shall have until February 28 following the Review Period (unless such date is extended with the written consent of SERI to continue efforts to resolve the Informal Challenge) to make a Formal Challenge with FERC, which shall be served on SERI. Failure to pursue an issue through an Informal Challenge regarding any issue as to a given set of Annual Bills shall bar a Formal Challenge on such issue with respect to that Annual Bill cycle, but shall not bar pursuit of such issue or the lodging of a Formal Challenge as to such issue as it relates to subsequent Annual Bills. SERI shall respond to the Formal Challenge by the deadline established by FERC. A party may not pursue a Formal Challenge if that party did not submit an Informal Challenge on any issue during the applicable Review Period.

G. In any proceeding initiated by FERC concerning the Annual Bills or in response to a Formal Challenge, SERI shall bear the burden, consistent with section 205 of the Federal Power Act, of proving that it has correctly applied the terms of the formula rate

consistent with these protocols, and that it followed the applicable requirements and procedures in the UPSA. Nothing herein is intended to alter the burdens applied by FERC with respect to prudence challenges.

H. Except as specifically provided herein, nothing herein shall be deemed to limit in any way the right of SERI to file unilaterally, pursuant to Federal Power Act section 205 and the regulations thereunder, to change the formula rate or any of its inputs (including, but not limited to, rate of return), or the right of any other party to request such changes pursuant to section 206 of the Federal Power Act and the regulations thereunder.

I. No party shall seek to modify the formula rate under the Challenge Procedures set forth in these protocols and the Annual Bills shall not be subject to challenge by anyone for the purpose of modifying the UPSA formula. Any modifications to the UPSA formula will require, as applicable, a Federal Power Act section 205 or section 206 filing.

J. Any Interested Party seeking changes to the application of the UPSA formula due to a change in the Uniform System of Accounts shall first raise the matter with SERI before pursuing a Formal Challenge.

Section V. Changes to Annual Bills

Any changes to the data inputs, or as the result of any FERC proceeding to consider the Annual Bills, or as a result of the procedures set forth herein, shall be incorporated into the formula rate calculations on a going forward basis beginning with the UPSA bill that immediately follows the resolution of all challenges in an Annual Bill cycle. In addition, SERI will calculate refunds/surcharges for any changes or adjustments to the Annual Bills resulting from the Information Exchange and Informal Challenge processes that are agreed to by SERI

for all prior months where the improper amounts were included in the UPSA bill, beginning with the first monthly bill that the improper amount was improperly included in the preceding calendar year. The refunds/surcharges will be included as a one-time adjustment on the UPSA bill immediately following the resolution of all challenges in an Annual Bill cycle. Interest on any refund or surcharge shall be calculated in accordance with 18 C.F.R. § 35.19a.

Section VI. Informational Filing

A. By January 31 of each year, SERI shall submit to FERC an informational filing (“Informational Filing”). The Informational Filing must describe any corrections or adjustments made during the previous calendar year and must describe all aspects of the UPSA formula or its inputs that are the subject of an ongoing dispute under the Informal or Formal Challenge procedures. SERI will also describe any refunds to be made pursuant to Section V above.

B. Any challenges to the implementation of the UPSA formula must be made through the Challenge Procedures described in these protocols or in a separate complaint proceeding and not in response to the Informational Filing.

Section VII. Reservation of Rights

Nothing herein is intended to limit a party's right to file a complaint under Section 206 of the Federal Power Act, or a party's right to oppose such complaint on any grounds.