What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

Fund name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|---|---|

iShares U.S. Consumer Focused ETF | $19 | 0.18% |

How did the Fund perform last year?

For the reporting period ended July 31, 2025, the Fund returned 13.78%.

For the same period, the S&P Total Market Index returned 15.73%.

What contributed to performance?

While U.S. consumer spending remained resilient during the reporting period, consumer patterns began to shift towards prioritizing essentials. The consumer discretionary sector was the largest contributor to the Fund’s return. Notably, a major e-commerce firm in the broadline retail segment saw significant gains due to its expansion into groceries and continued growth of its cloud computing business. Among specialty retail names, automotive retail companies benefited. An online used car platform was supported by an increased demand for used cars, while an auto parts and accessories specialist gained as consumers held onto older vehicles for longer. In the consumer staples sector, a focus on value and affordability helped two large discount retailers, as well as customer loyalty, lower pricing, investments in technology, and e-commerce strength.

What detracted from performance?

There were no meaningful detractors from the Fund’s performance during the reporting period.

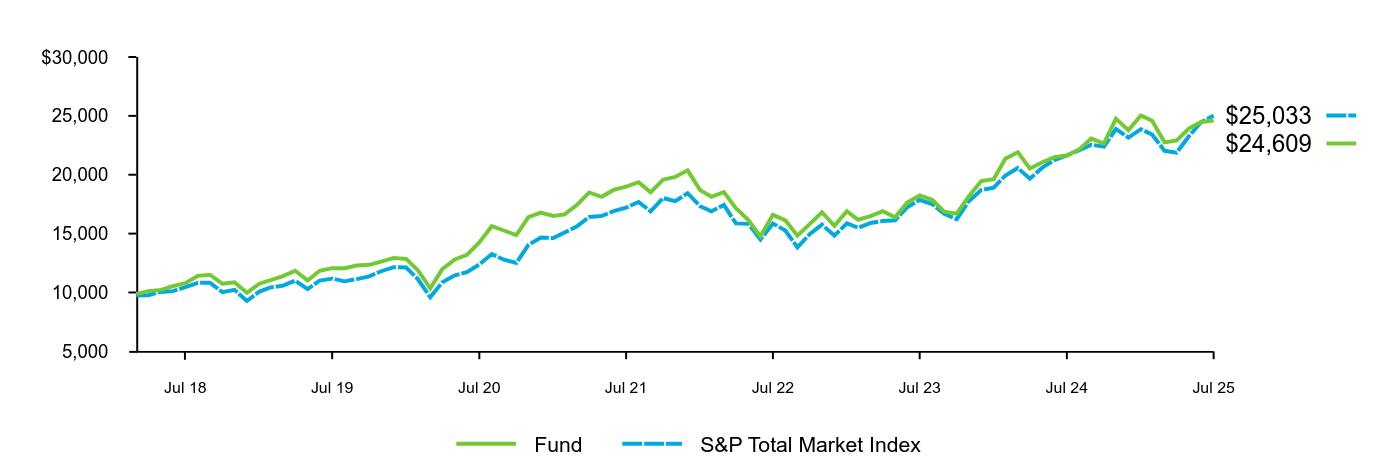

Fund performance

Cumulative performance: March 21, 2018 through July 31, 2025

Initial Investment of $10,000

Fund | S&P Total Market Index | |

|---|---|---|

Mar 18 | $9,884 | $9,736 |

Apr 18 | $10,112 | $9,770 |

May 18 | $10,216 | $10,046 |

Jun 18 | $10,538 | $10,113 |

Jul 18 | $10,796 | $10,451 |

Aug 18 | $11,415 | $10,814 |

Sep 18 | $11,506 | $10,832 |

Oct 18 | $10,743 | $10,029 |

Nov 18 | $10,864 | $10,230 |

Dec 18 | $9,978 | $9,276 |

Jan 19 | $10,747 | $10,075 |

Feb 19 | $11,043 | $10,429 |

Mar 19 | $11,391 | $10,579 |

Apr 19 | $11,848 | $11,000 |

May 19 | $11,024 | $10,290 |

Jun 19 | $11,845 | $11,011 |

Jul 19 | $12,062 | $11,173 |

Aug 19 | $12,058 | $10,947 |

Sep 19 | $12,285 | $11,136 |

Oct 19 | $12,350 | $11,373 |

Nov 19 | $12,617 | $11,803 |

Dec 19 | $12,936 | $12,143 |

Jan 20 | $12,849 | $12,128 |

Feb 20 | $11,890 | $11,135 |

Mar 20 | $10,356 | $9,597 |

Apr 20 | $11,984 | $10,870 |

May 20 | $12,810 | $11,453 |

Jun 20 | $13,198 | $11,717 |

Jul 20 | $14,247 | $12,379 |

Aug 20 | $15,637 | $13,269 |

Sep 20 | $15,261 | $12,781 |

Oct 20 | $14,873 | $12,508 |

Nov 20 | $16,399 | $14,037 |

Dec 20 | $16,779 | $14,667 |

Jan 21 | $16,494 | $14,620 |

Feb 21 | $16,637 | $15,088 |

Mar 21 | $17,446 | $15,613 |

Apr 21 | $18,493 | $16,415 |

May 21 | $18,128 | $16,489 |

Jun 21 | $18,709 | $16,907 |

Jul 21 | $18,994 | $17,198 |

Aug 21 | $19,367 | $17,690 |

Sep 21 | $18,514 | $16,887 |

Oct 21 | $19,578 | $18,021 |

Nov 21 | $19,817 | $17,756 |

Dec 21 | $20,371 | $18,430 |

Jan 22 | $18,694 | $17,324 |

Feb 22 | $18,130 | $16,888 |

Mar 22 | $18,525 | $17,435 |

Apr 22 | $17,164 | $15,863 |

May 22 | $16,151 | $15,831 |

Jun 22 | $14,757 | $14,500 |

Jul 22 | $16,592 | $15,860 |

Aug 22 | $16,121 | $15,261 |

Sep 22 | $14,825 | $13,838 |

Oct 22 | $15,824 | $14,968 |

Nov 22 | $16,809 | $15,758 |

Dec 22 | $15,659 | $14,831 |

Jan 23 | $16,909 | $15,865 |

Feb 23 | $16,177 | $15,498 |

Mar 23 | $16,489 | $15,905 |

Apr 23 | $16,903 | $16,065 |

May 23 | $16,391 | $16,135 |

Jun 23 | $17,647 | $17,240 |

Jul 23 | $18,242 | $17,861 |

Aug 23 | $17,873 | $17,511 |

Sep 23 | $16,867 | $16,673 |

Oct 23 | $16,691 | $16,224 |

Nov 23 | $18,148 | $17,747 |

Dec 23 | $19,458 | $18,696 |

Jan 24 | $19,625 | $18,903 |

Feb 24 | $21,358 | $19,930 |

Mar 24 | $21,916 | $20,574 |

Apr 24 | $20,534 | $19,667 |

May 24 | $21,062 | $20,601 |

Jun 24 | $21,498 | $21,241 |

Jul 24 | $21,629 | $21,631 |

Aug 24 | $22,175 | $22,094 |

Sep 24 | $23,071 | $22,549 |

Oct 24 | $22,648 | $22,388 |

Nov 24 | $24,763 | $23,879 |

Dec 24 | $23,782 | $23,160 |

Jan 25 | $25,037 | $23,870 |

Feb 25 | $24,580 | $23,419 |

Mar 25 | $22,751 | $22,032 |

Apr 25 | $22,914 | $21,880 |

May 25 | $23,941 | $23,282 |

Jun 25 | $24,478 | $24,475 |

Jul 25 | $24,609 | $25,033 |

See “Average annual total returns” for additional information on fund performance.

Average annual total returns

Average Annual Total Returns | 1 Year | 5 Years | Since Fund

Inception |

|---|---|---|---|

Fund NAV........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 13.78% | 11.55% | 13.01% |

S&P Total Market Index........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 15.73 | 15.12 | 13.28 |

Key Fund statistics

Net Assets........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | $30,298,094 |

|---|---|

Number of Portfolio Holdings........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 189 |

Net Investment Advisory Fees........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | $52,906 |

Portfolio Turnover Rate........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 18% |

Industry allocation

Ten largest holdings

Industry | Percent of TotaI InvestmentsFootnote Reference(a) |

|---|---|

Specialty Retail........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 36.0% |

Consumer Staples Distribution & Retail........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 21.2 |

Hotels, Restaurants & Leisure........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 14.8 |

Broadline Retail........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 8.6 |

Textiles, Apparel & Luxury Goods........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 3.4 |

Financial Services........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 2.5 |

Commercial Services & Supplies........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 1.8 |

Ground Transportation........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 1.7 |

Software........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 1.6 |

Entertainment........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 1.5 |

OtherFootnote Reference(b)........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 6.9 |

Security | Percent of Total InvestmentsFootnote Reference(a) |

|---|---|

Home Depot, Inc. (The)........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 10.7% |

Walmart, Inc......................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................... | 8.6 |

Costco Wholesale Corp......................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................... | 8.0 |

Amazon.com, Inc......................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................... | 7.8 |

TJX Cos., Inc. (The)........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 5.2 |

Lowe's Cos., Inc......................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................... | 5.0 |

O'Reilly Automotive, Inc......................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................... | 3.3 |

Ross Stores, Inc......................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................... | 2.1 |

Chipotle Mexican Grill, Inc......................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................... | 2.1 |

Starbucks Corp......................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................... | 1.6 |

| Footnote | Description |

Footnote(a) | Excludes money market funds. |

Footnote(b) | Ten largest industries are presented. Additional industries are found in Other. |

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

Fund name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|---|---|

iShares U.S. Tech Independence Focused ETF | $21 | 0.18% |

How did the Fund perform last year?

For the reporting period ended July 31, 2025, the Fund returned 31.85%.

For the same period, the S&P Total Market Index returned 15.73%.

What contributed to performance?

Companies across the information technology sector contributed to the Fund’s return during the reporting period. Semiconductor stocks gained amid unprecedented demand for artificial intelligence (“AI”) and generative AI, data center expansions, and continued innovation in chips and network solutions. An application software company specializing in data analysis and artificial intelligence experienced robust growth across its government and commercial sectors. Meanwhile, systems software firms benefited from strong demand in cloud-delivered businesses, including cybersecurity, and increasing adoption of AI technologies. In the consumer discretionary sector, a major e-commerce firm in the broadline retail segment saw significant gains due to its expansion into groceries and continued growth of its cloud computing business.

What detracted from performance?

There were no meaningful detractors from the Fund’s return during the reporting period.

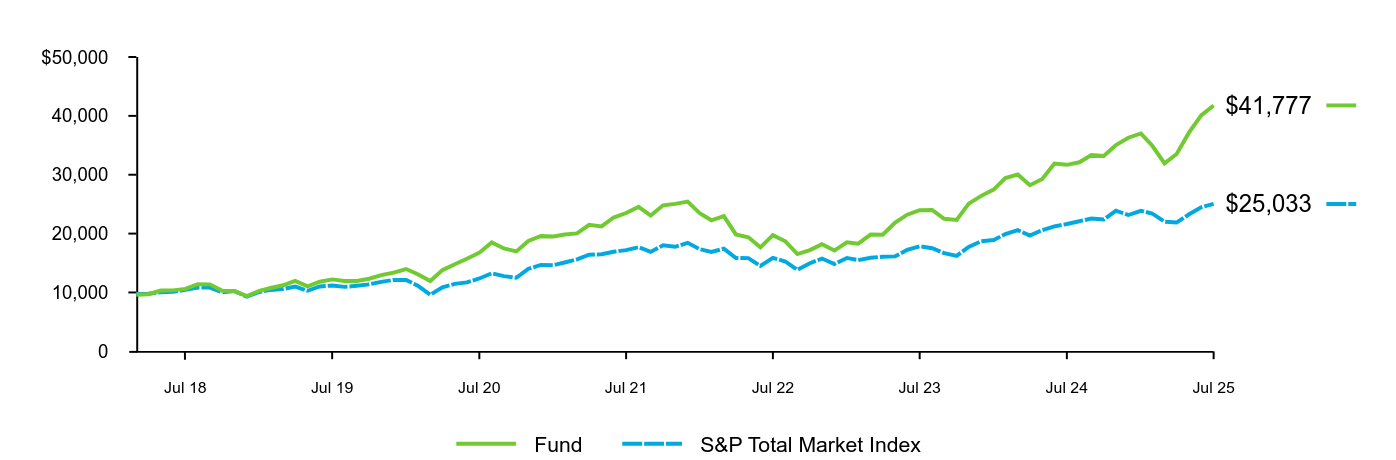

Fund performance

Cumulative performance: March 21, 2018 through July 31, 2025

Initial Investment of $10,000

Fund | S&P Total Market Index | |

|---|---|---|

Mar 18 | $9,598 | $9,736 |

Apr 18 | $9,699 | $9,770 |

May 18 | $10,321 | $10,046 |

Jun 18 | $10,351 | $10,113 |

Jul 18 | $10,600 | $10,451 |

Aug 18 | $11,418 | $10,814 |

Sep 18 | $11,379 | $10,832 |

Oct 18 | $10,277 | $10,029 |

Nov 18 | $10,237 | $10,230 |

Dec 18 | $9,396 | $9,276 |

Jan 19 | $10,283 | $10,075 |

Feb 19 | $10,762 | $10,429 |

Mar 19 | $11,222 | $10,579 |

Apr 19 | $11,951 | $11,000 |

May 19 | $11,042 | $10,290 |

Jun 19 | $11,828 | $11,011 |

Jul 19 | $12,219 | $11,173 |

Aug 19 | $11,942 | $10,947 |

Sep 19 | $11,959 | $11,136 |

Oct 19 | $12,331 | $11,373 |

Nov 19 | $12,949 | $11,803 |

Dec 19 | $13,378 | $12,143 |

Jan 20 | $13,985 | $12,128 |

Feb 20 | $13,079 | $11,135 |

Mar 20 | $11,949 | $9,597 |

Apr 20 | $13,796 | $10,870 |

May 20 | $14,782 | $11,453 |

Jun 20 | $15,717 | $11,717 |

Jul 20 | $16,759 | $12,379 |

Aug 20 | $18,509 | $13,269 |

Sep 20 | $17,484 | $12,781 |

Oct 20 | $16,977 | $12,508 |

Nov 20 | $18,758 | $14,037 |

Dec 20 | $19,606 | $14,667 |

Jan 21 | $19,503 | $14,620 |

Feb 21 | $19,849 | $15,088 |

Mar 21 | $20,044 | $15,613 |

Apr 21 | $21,498 | $16,415 |

May 21 | $21,234 | $16,489 |

Jun 21 | $22,729 | $16,907 |

Jul 21 | $23,503 | $17,198 |

Aug 21 | $24,541 | $17,690 |

Sep 21 | $23,063 | $16,887 |

Oct 21 | $24,802 | $18,021 |

Nov 21 | $25,042 | $17,756 |

Dec 21 | $25,444 | $18,430 |

Jan 22 | $23,406 | $17,324 |

Feb 22 | $22,268 | $16,888 |

Mar 22 | $22,963 | $17,435 |

Apr 22 | $19,863 | $15,863 |

May 22 | $19,365 | $15,831 |

Jun 22 | $17,673 | $14,500 |

Jul 22 | $19,739 | $15,860 |

Aug 22 | $18,686 | $15,261 |

Sep 22 | $16,522 | $13,838 |

Oct 22 | $17,194 | $14,968 |

Nov 22 | $18,198 | $15,758 |

Dec 22 | $17,122 | $14,831 |

Jan 23 | $18,523 | $15,865 |

Feb 23 | $18,302 | $15,498 |

Mar 23 | $19,831 | $15,905 |

Apr 23 | $19,806 | $16,065 |

May 23 | $21,876 | $16,135 |

Jun 23 | $23,214 | $17,240 |

Jul 23 | $23,964 | $17,861 |

Aug 23 | $24,019 | $17,511 |

Sep 23 | $22,509 | $16,673 |

Oct 23 | $22,314 | $16,224 |

Nov 23 | $25,093 | $17,747 |

Dec 23 | $26,411 | $18,696 |

Jan 24 | $27,471 | $18,903 |

Feb 24 | $29,432 | $19,930 |

Mar 24 | $30,041 | $20,574 |

Apr 24 | $28,216 | $19,667 |

May 24 | $29,293 | $20,601 |

Jun 24 | $31,901 | $21,241 |

Jul 24 | $31,686 | $21,631 |

Aug 24 | $32,116 | $22,094 |

Sep 24 | $33,342 | $22,549 |

Oct 24 | $33,172 | $22,388 |

Nov 24 | $35,028 | $23,879 |

Dec 24 | $36,290 | $23,160 |

Jan 25 | $37,003 | $23,870 |

Feb 25 | $34,964 | $23,419 |

Mar 25 | $31,938 | $22,032 |

Apr 25 | $33,536 | $21,880 |

May 25 | $37,190 | $23,282 |

Jun 25 | $40,075 | $24,475 |

Jul 25 | $41,777 | $25,033 |

See “Average annual total returns” for additional information on fund performance.

Average annual total returns

Average Annual Total Returns | 1 Year | 5 Years | Since Fund

Inception |

|---|---|---|---|

Fund NAV........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 31.85% | 20.04% | 21.43% |

S&P Total Market Index........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 15.73 | 15.12 | 13.28 |

Key Fund statistics

Net Assets........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | $754,108,286 |

|---|---|

Number of Portfolio Holdings........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 103 |

Net Investment Advisory Fees........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | $780,463 |

Portfolio Turnover Rate........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 43% |

Industry allocation

Ten largest holdings

Industry | Percent of TotaI InvestmentsFootnote Reference(a) |

|---|---|

Software........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 34.9% |

Semiconductors & Semiconductor Equipment........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 23.6 |

Broadline Retail........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 7.6 |

IT Services........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 6.9 |

Interactive Media & Services........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 5.8 |

Capital Markets........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 5.0 |

Communications Equipment........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 3.9 |

Technology Hardware, Storage & Peripherals........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 2.9 |

Electronic Equipment, Instruments & Components........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 1.9 |

Aerospace & Defense........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 1.8 |

OtherFootnote Reference(b)........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 5.7 |

Security | Percent of Total InvestmentsFootnote Reference(a) |

|---|---|

Broadcom, Inc......................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................... | 11.5% |

Palantir Technologies, Inc., Class A........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 10.4 |

NVIDIA Corp......................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................... | 9.0 |

Amazon.com, Inc......................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................... | 7.6 |

Microsoft Corp......................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................... | 6.9 |

Salesforce, Inc......................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................... | 4.2 |

Oracle Corp......................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................... | 4.0 |

Meta Platforms, Inc., Class A........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 2.8 |

Apple, Inc......................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................... | 2.5 |

Accenture plc, Class A........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 2.3 |

| Footnote | Description |

Footnote(a) | Excludes money market funds. |

Footnote(b) | Ten largest industries are presented. Additional industries are found in Other. |