This report describes changes to the Fund that occurred during the reporting period.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

Fund name | Costs of a $10,000

investment | Costs paid as a percentage of a

$10,000 investment |

|---|---|---|

iShares Core 30/70 Conservative Allocation ETF | $10Footnote Reference(a) | 0.10%Footnote Reference(a) |

| Footnote | Description |

Footnote(a) | Excludes fees and expenses incurred indirectly as a result of investments in underlying funds. |

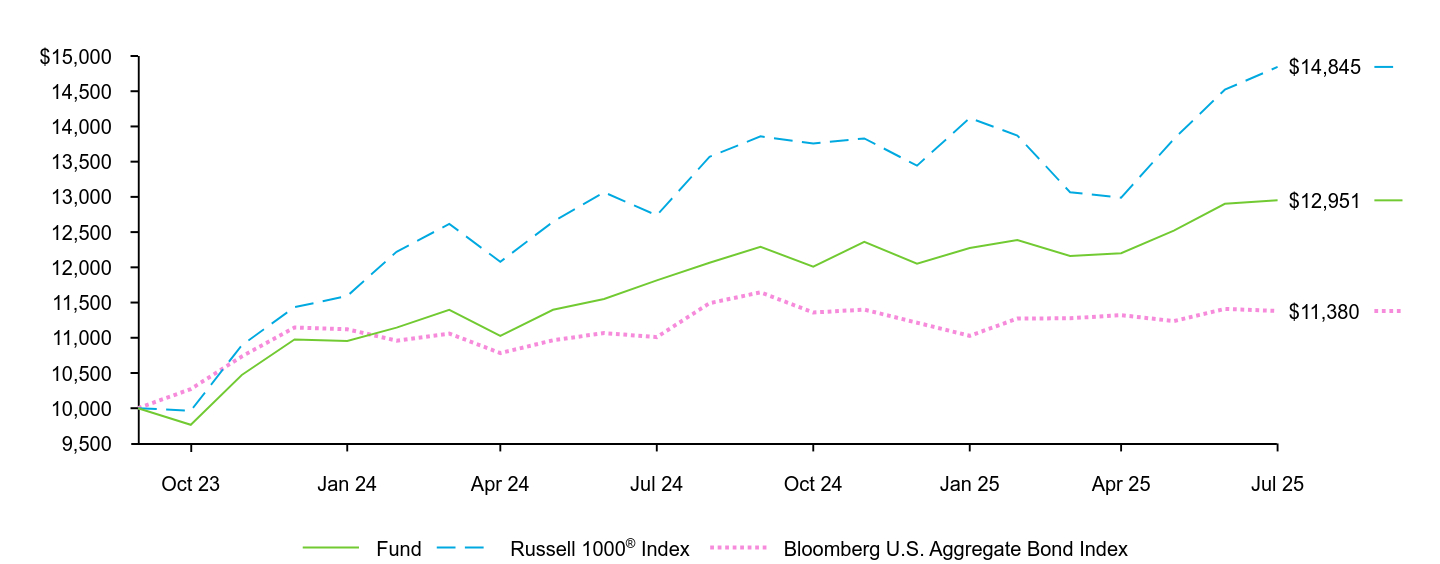

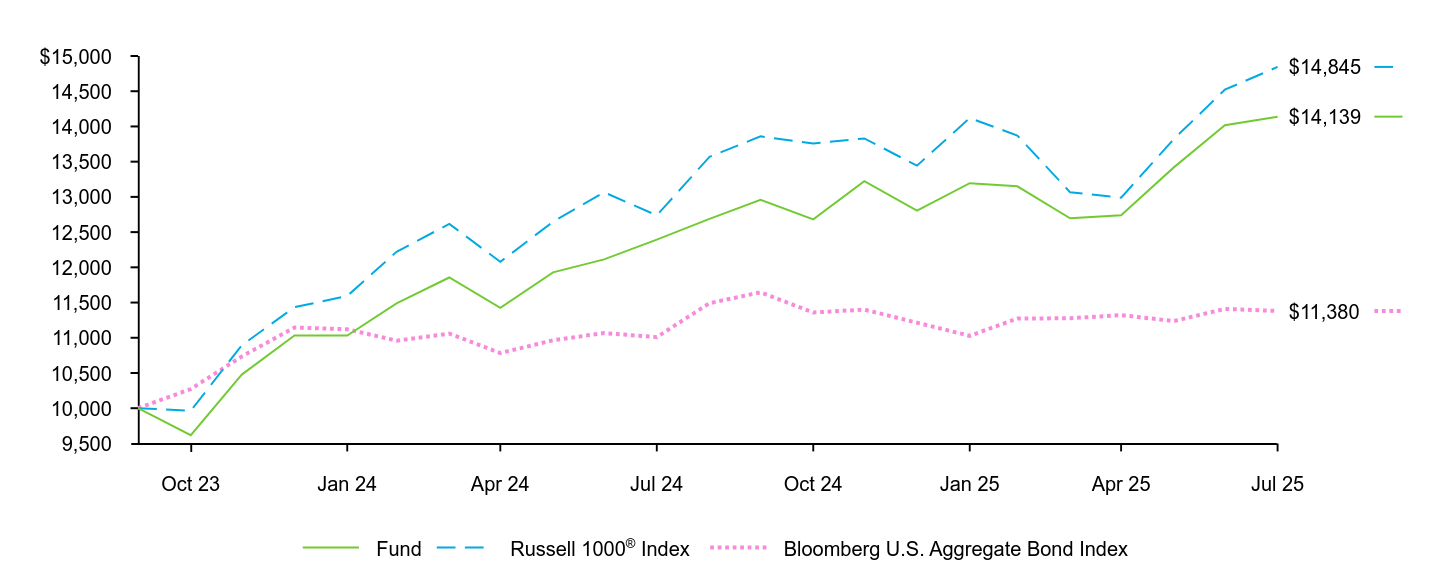

How did the Fund perform last year?

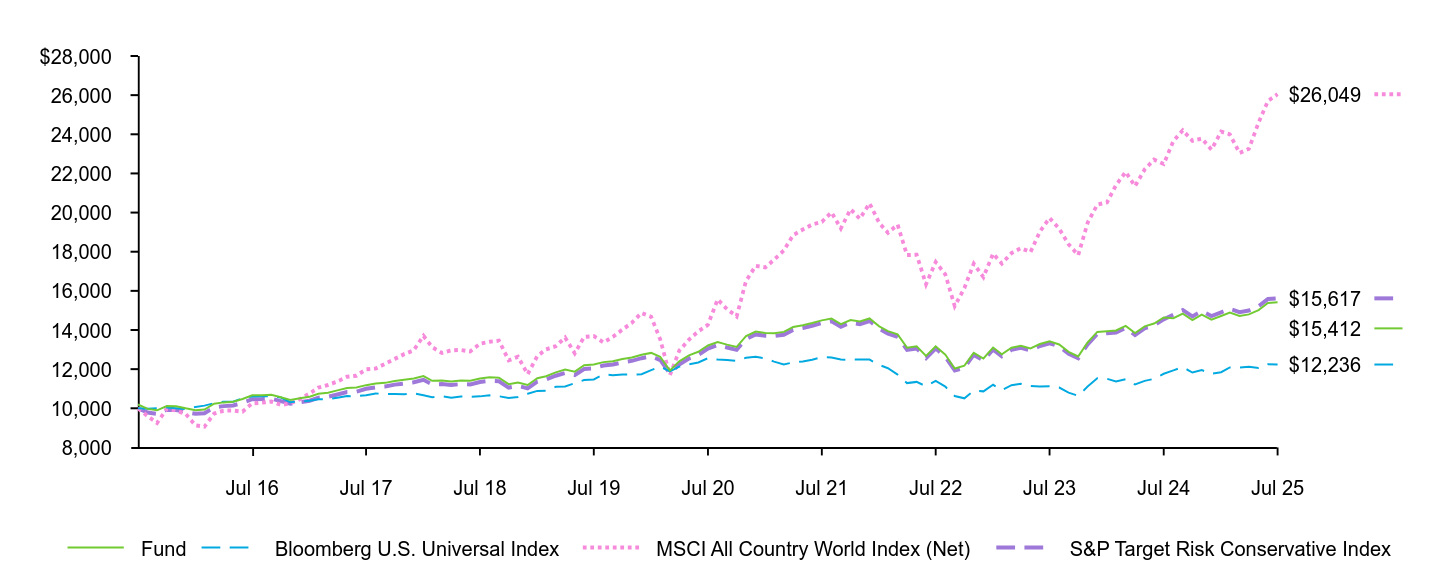

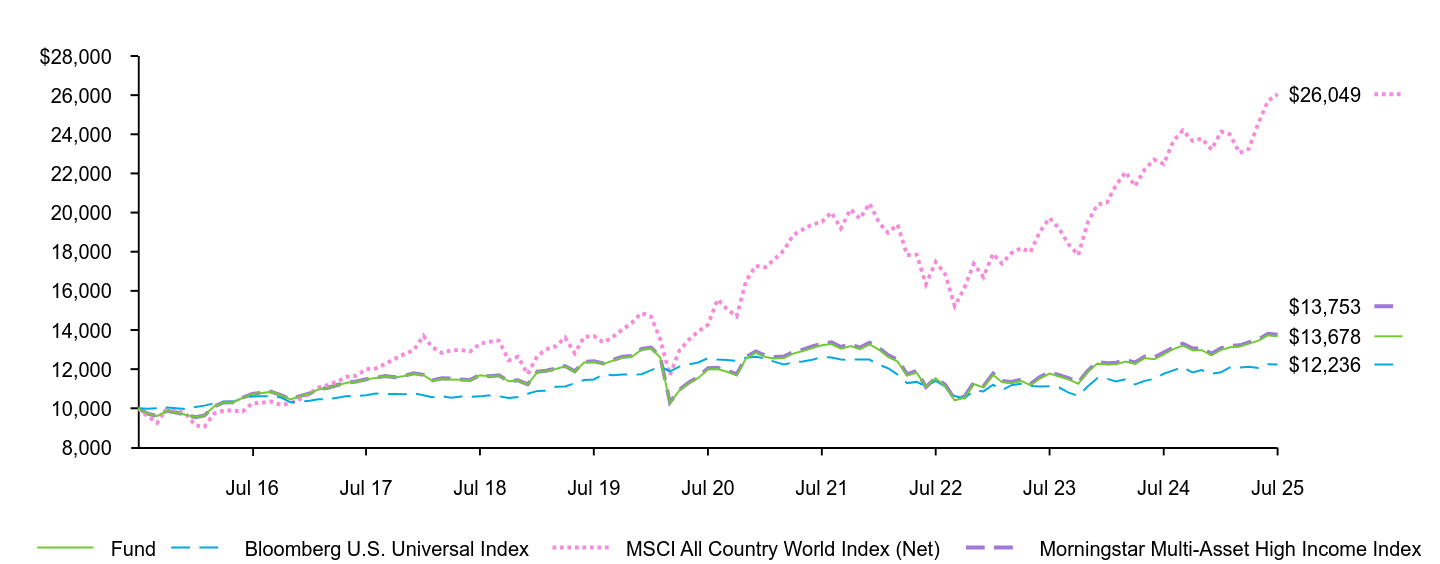

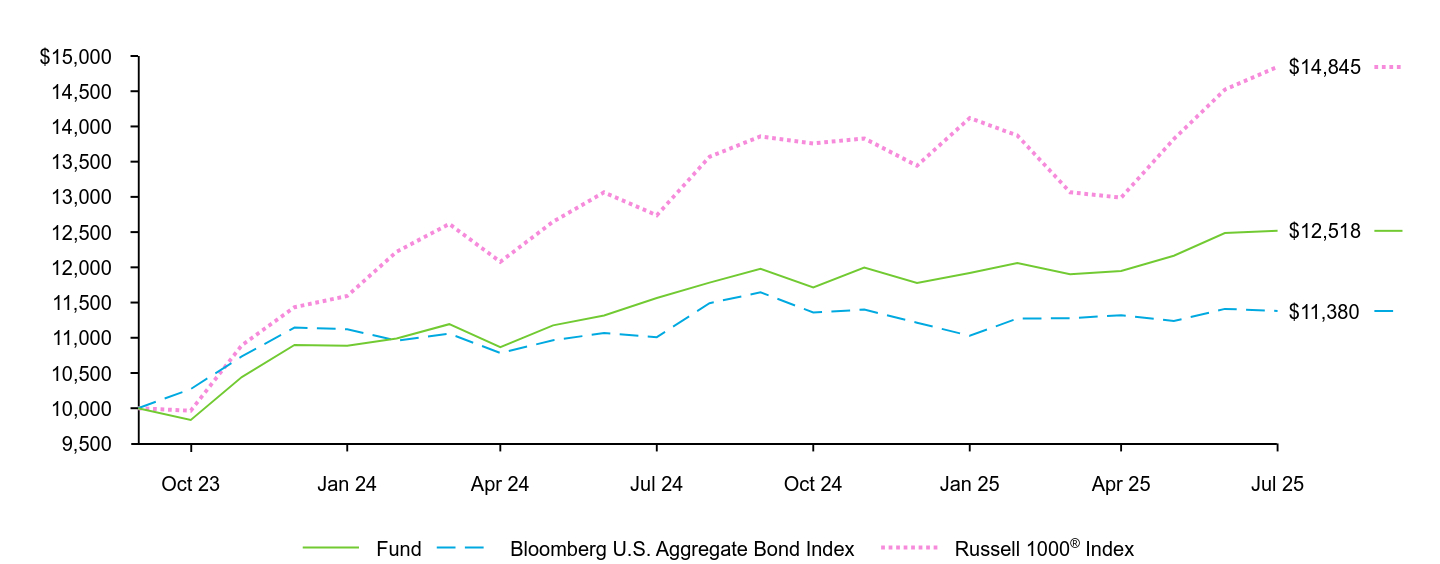

For the reporting period ended July 31, 2025, the Fund returned 7.29%.

For the same period, the Bloomberg U.S. Universal Index returned 4.00% and the MSCI All Country World Index (Net) returned 15.87%.

What contributed to performance?

U.S. large-capitalization equities were the largest contributor to the Fund’s return during the reporting period. In particular, semiconductor stocks gained amid continued demand for artificial intelligence (“AI”) and generative AI workloads in data centers, while systems software firms benefited from strong growth in their respective cloud businesses and increasing adoption of AI technologies. International developed stocks, particularly in Germany, gained amid optimism surrounding a historic fiscal stimulus plan targeting infrastructure and defense spending.

Within the bond allocation, longer-dated U.S. dollar-denominated bonds contributed.

What detracted from performance?

During the reporting period, there were no meaningful detractors from the Fund’s return.

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

Fund | Bloomberg U.S. Universal Index | MSCI All Country World Index (Net) | S&P Target Risk Conservative Index | |

|---|---|---|---|---|

Jul 15 | $10,193 | $10,000 | $10,000 | $10,000 |

Aug 15 | $9,970 | $9,971 | $9,597 | $9,780 |

Sep 15 | $9,896 | $10,009 | $9,249 | $9,711 |

Oct 15 | $10,119 | $10,042 | $9,974 | $9,928 |

Nov 15 | $10,107 | $10,005 | $9,890 | $9,917 |

Dec 15 | $9,999 | $9,955 | $9,711 | $9,812 |

Jan 16 | $9,904 | $10,065 | $9,124 | $9,720 |

Feb 16 | $9,934 | $10,136 | $9,061 | $9,746 |

Mar 16 | $10,233 | $10,261 | $9,732 | $10,043 |

Apr 16 | $10,302 | $10,331 | $9,876 | $10,111 |

May 16 | $10,340 | $10,339 | $9,889 | $10,145 |

Jun 16 | $10,475 | $10,520 | $9,828 | $10,281 |

Jul 16 | $10,667 | $10,607 | $10,253 | $10,468 |

Aug 16 | $10,669 | $10,619 | $10,288 | $10,473 |

Sep 16 | $10,694 | $10,621 | $10,348 | $10,496 |

Oct 16 | $10,560 | $10,551 | $10,171 | $10,365 |

Nov 16 | $10,421 | $10,314 | $10,248 | $10,231 |

Dec 16 | $10,513 | $10,344 | $10,469 | $10,311 |

Jan 17 | $10,590 | $10,381 | $10,754 | $10,388 |

Feb 17 | $10,742 | $10,461 | $11,056 | $10,538 |

Mar 17 | $10,796 | $10,457 | $11,192 | $10,592 |

Apr 17 | $10,915 | $10,544 | $11,367 | $10,708 |

May 17 | $11,041 | $10,625 | $11,615 | $10,829 |

Jun 17 | $11,058 | $10,616 | $11,664 | $10,846 |

Jul 17 | $11,183 | $10,669 | $11,990 | $10,996 |

Aug 17 | $11,261 | $10,761 | $12,035 | $11,072 |

Sep 17 | $11,299 | $10,723 | $12,268 | $11,113 |

Oct 17 | $11,394 | $10,736 | $12,523 | $11,209 |

Nov 17 | $11,454 | $10,720 | $12,764 | $11,258 |

Dec 17 | $11,523 | $10,767 | $12,970 | $11,328 |

Jan 18 | $11,650 | $10,664 | $13,701 | $11,456 |

Feb 18 | $11,404 | $10,563 | $13,123 | $11,214 |

Mar 18 | $11,425 | $10,616 | $12,829 | $11,236 |

Apr 18 | $11,375 | $10,545 | $12,961 | $11,190 |

May 18 | $11,421 | $10,603 | $12,978 | $11,238 |

Jun 18 | $11,404 | $10,587 | $12,909 | $11,220 |

Jul 18 | $11,524 | $10,609 | $13,297 | $11,343 |

Aug 18 | $11,587 | $10,662 | $13,400 | $11,404 |

Sep 18 | $11,564 | $10,616 | $13,457 | $11,381 |

Oct 18 | $11,235 | $10,527 | $12,450 | $11,058 |

Nov 18 | $11,322 | $10,574 | $12,633 | $11,147 |

Dec 18 | $11,191 | $10,740 | $11,744 | $11,020 |

Jan 19 | $11,540 | $10,888 | $12,671 | $11,365 |

Feb 19 | $11,641 | $10,900 | $13,008 | $11,469 |

Mar 19 | $11,837 | $11,097 | $13,173 | $11,663 |

Apr 19 | $11,976 | $11,112 | $13,617 | $11,800 |

May 19 | $11,870 | $11,283 | $12,808 | $11,699 |

Jun 19 | $12,203 | $11,442 | $13,649 | $12,007 |

Jul 19 | $12,235 | $11,476 | $13,689 | $12,043 |

Aug 19 | $12,359 | $11,736 | $13,364 | $12,189 |

Sep 19 | $12,405 | $11,685 | $13,647 | $12,235 |

Oct 19 | $12,521 | $11,723 | $14,024 | $12,351 |

Nov 19 | $12,595 | $11,720 | $14,368 | $12,424 |

Dec 19 | $12,731 | $11,738 | $14,872 | $12,561 |

Jan 20 | $12,830 | $11,948 | $14,673 | $12,658 |

Feb 20 | $12,625 | $12,127 | $13,514 | $12,460 |

Mar 20 | $11,932 | $11,891 | $11,691 | $11,778 |

Apr 20 | $12,403 | $12,129 | $12,944 | $12,242 |

May 20 | $12,704 | $12,242 | $13,503 | $12,543 |

Jun 20 | $12,887 | $12,344 | $13,933 | $12,725 |

Jul 20 | $13,211 | $12,561 | $14,268 | $13,052 |

Aug 20 | $13,386 | $12,489 | $15,565 | $13,233 |

Sep 20 | $13,253 | $12,466 | $15,063 | $13,104 |

Oct 20 | $13,133 | $12,422 | $14,696 | $12,987 |

Nov 20 | $13,687 | $12,584 | $16,509 | $13,538 |

Dec 20 | $13,923 | $12,627 | $17,278 | $13,775 |

Jan 21 | $13,851 | $12,548 | $17,197 | $13,707 |

Feb 21 | $13,834 | $12,386 | $17,593 | $13,690 |

Mar 21 | $13,903 | $12,242 | $18,060 | $13,760 |

Apr 21 | $14,151 | $12,345 | $18,846 | $14,008 |

May 21 | $14,240 | $12,392 | $19,130 | $14,100 |

Jun 21 | $14,357 | $12,482 | $19,392 | $14,217 |

Jul 21 | $14,493 | $12,607 | $19,525 | $14,356 |

Aug 21 | $14,583 | $12,599 | $20,014 | $14,447 |

Sep 21 | $14,301 | $12,491 | $19,188 | $14,169 |

Oct 21 | $14,510 | $12,481 | $20,168 | $14,379 |

Nov 21 | $14,431 | $12,496 | $19,684 | $14,301 |

Dec 21 | $14,591 | $12,488 | $20,472 | $14,462 |

Jan 22 | $14,189 | $12,214 | $19,470 | $14,065 |

Feb 22 | $13,943 | $12,048 | $18,967 | $13,820 |

Mar 22 | $13,775 | $11,724 | $19,379 | $13,655 |

Apr 22 | $13,099 | $11,287 | $17,827 | $12,985 |

May 22 | $13,167 | $11,349 | $17,847 | $13,054 |

Jun 22 | $12,673 | $11,122 | $16,337 | $12,563 |

Jul 22 | $13,166 | $11,402 | $17,477 | $13,054 |

Aug 22 | $12,736 | $11,105 | $16,833 | $12,627 |

Sep 22 | $12,033 | $10,627 | $15,222 | $11,930 |

Oct 22 | $12,180 | $10,510 | $16,141 | $12,076 |

Nov 22 | $12,836 | $10,902 | $17,392 | $12,729 |

Dec 22 | $12,544 | $10,865 | $16,703 | $12,440 |

Jan 23 | $13,106 | $11,202 | $17,903 | $12,999 |

Feb 23 | $12,756 | $10,927 | $17,393 | $12,652 |

Mar 23 | $13,092 | $11,183 | $17,930 | $12,987 |

Apr 23 | $13,200 | $11,252 | $18,183 | $13,094 |

May 23 | $13,059 | $11,135 | $17,985 | $12,956 |

Jun 23 | $13,285 | $11,118 | $19,027 | $13,182 |

Jul 23 | $13,427 | $11,129 | $19,724 | $13,323 |

Aug 23 | $13,263 | $11,062 | $19,173 | $13,161 |

Sep 23 | $12,883 | $10,798 | $18,380 | $12,783 |

Oct 23 | $12,649 | $10,636 | $17,827 | $12,552 |

Nov 23 | $13,361 | $11,114 | $19,473 | $13,260 |

Dec 23 | $13,903 | $11,536 | $20,407 | $13,800 |

Jan 24 | $13,939 | $11,508 | $20,519 | $13,836 |

Feb 24 | $13,975 | $11,370 | $21,401 | $13,874 |

Mar 24 | $14,211 | $11,482 | $22,075 | $14,109 |

Apr 24 | $13,840 | $11,214 | $21,345 | $13,742 |

May 24 | $14,186 | $11,400 | $22,207 | $14,086 |

Jun 24 | $14,330 | $11,504 | $22,702 | $14,231 |

Jul 24 | $14,642 | $11,765 | $22,481 | $14,542 |

Aug 24 | $14,604 | $11,938 | $23,658 | $14,785 |

Sep 24 | $14,833 | $12,102 | $24,205 | $15,019 |

Oct 24 | $14,510 | $11,827 | $23,666 | $14,693 |

Nov 24 | $14,791 | $11,952 | $23,785 | $14,979 |

Dec 24 | $14,525 | $11,771 | $23,218 | $14,710 |

Jan 25 | $14,713 | $11,842 | $24,137 | $14,901 |

Feb 25 | $14,890 | $12,087 | $23,998 | $15,082 |

Mar 25 | $14,722 | $12,084 | $23,048 | $14,913 |

Apr 25 | $14,799 | $12,127 | $23,258 | $14,992 |

May 25 | $15,017 | $12,065 | $24,592 | $15,215 |

Jun 25 | $15,379 | $12,253 | $25,699 | $15,582 |

Jul 25 | $15,412 | $12,236 | $26,049 | $15,617 |

........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 1 Year | 5 Years | 10 Years |

|---|---|---|---|

Fund NAV........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 7.29% | 3.52% | 4.42% |

Bloomberg U.S. Universal Index........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 4.00 | (0.52) | 2.04 |

MSCI All Country World Index (Net)........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 15.87 | 12.79 | 10.05 |

S&P Target Risk Conservative Index........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 7.39 | 3.65 | 4.56 |

Key Fund statistics

Net Assets........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | $629,172,274 |

|---|---|

Number of Portfolio Holdings........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 9 |

Net Investment Advisory Fees........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | $599,708 |

Portfolio Turnover Rate........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 3% |

Portfolio composition

All holdings

Asset class | Percent of Total InvestmentsFootnote Reference(a) |

|---|---|

Domestic Fixed Income........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 57.3% |

Domestic Equity........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 20.8 |

International Equity........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 11.8 |

International Fixed Income........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 10.1 |

Security | Percent of Total InvestmentsFootnote Reference(a) |

|---|---|

iShares Core Total USD Bond Market ETF........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 57.3% |

iShares Core S&P 500 ETF........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 19.2 |

iShares Core International Aggregate Bond ETF........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 10.1 |

iShares Core MSCI International Developed Markets ETF........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 8.4 |

iShares Core MSCI Emerging Markets ETF........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 3.4 |

iShares Core S&P Mid-Cap ETF........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 1.1 |

iShares Core S&P Small-Cap ETF........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 0.5 |

| Footnote | Description |

Footnote(a) | Excludes money market funds. |

This report describes changes to the Fund that occurred during the reporting period.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

Fund name | Costs of a $10,000

investment | Costs paid as a percentage of a

$10,000 investment |

|---|---|---|

iShares Core 40/60 Moderate Allocation ETF | $10Footnote Reference(a) | 0.10%Footnote Reference(a) |

| Footnote | Description |

Footnote(a) | Excludes fees and expenses incurred indirectly as a result of investments in underlying funds. |

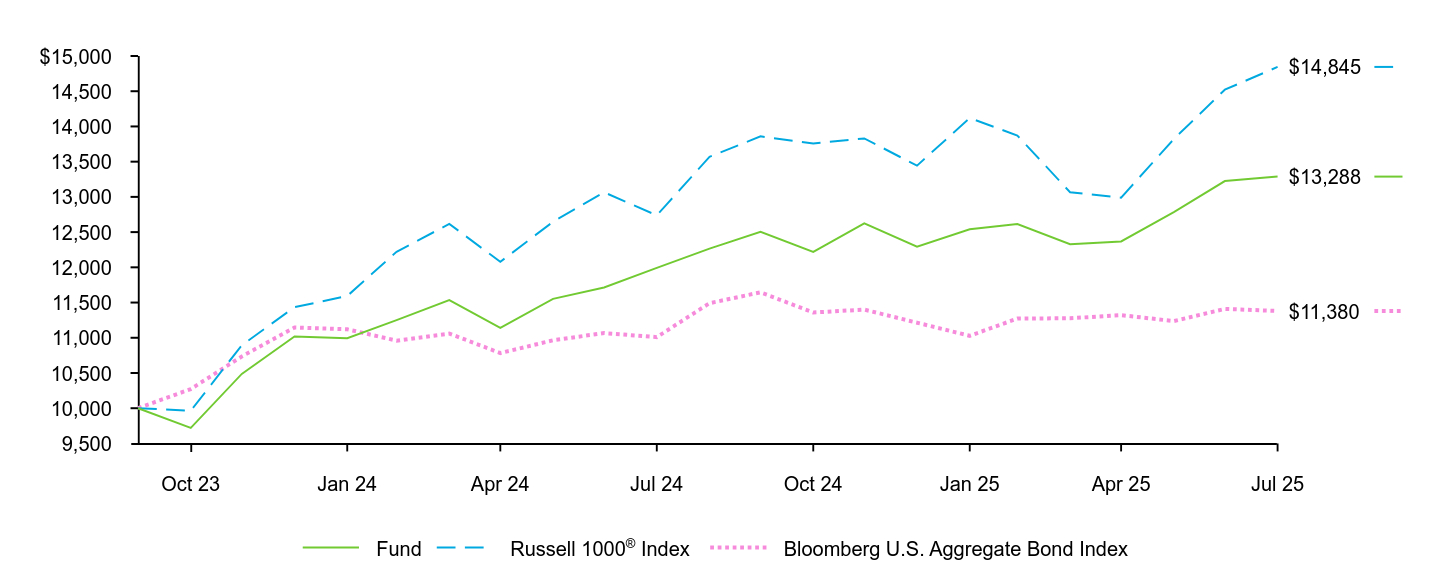

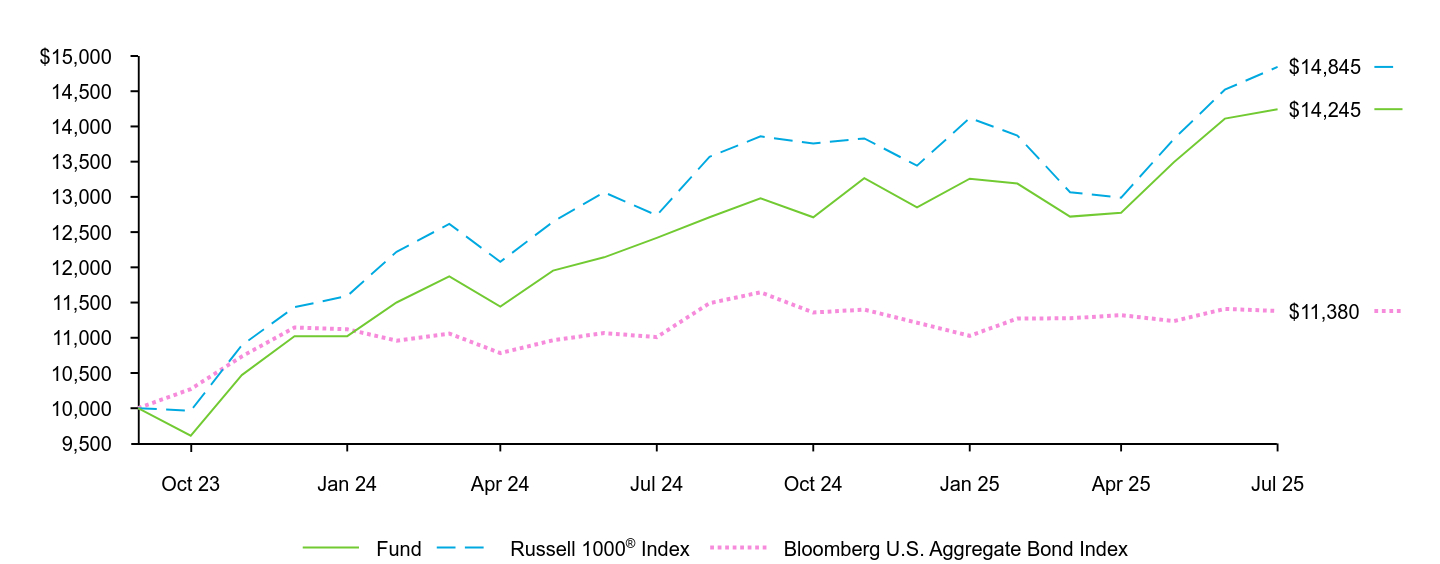

How did the Fund perform last year?

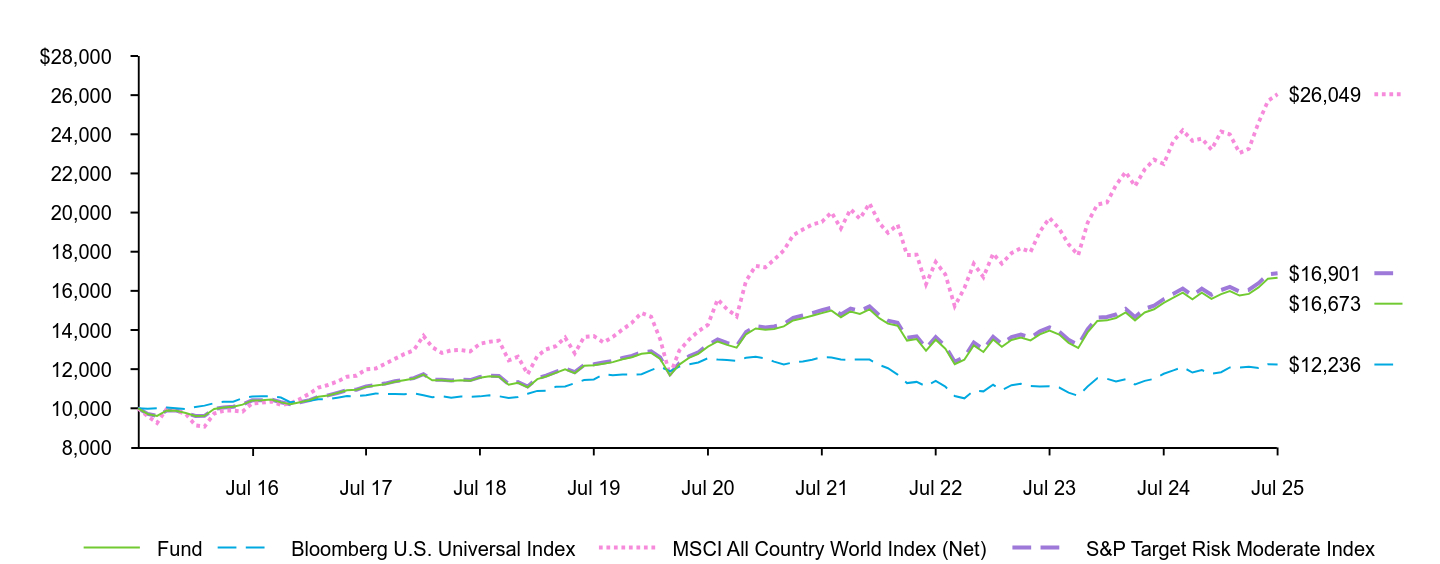

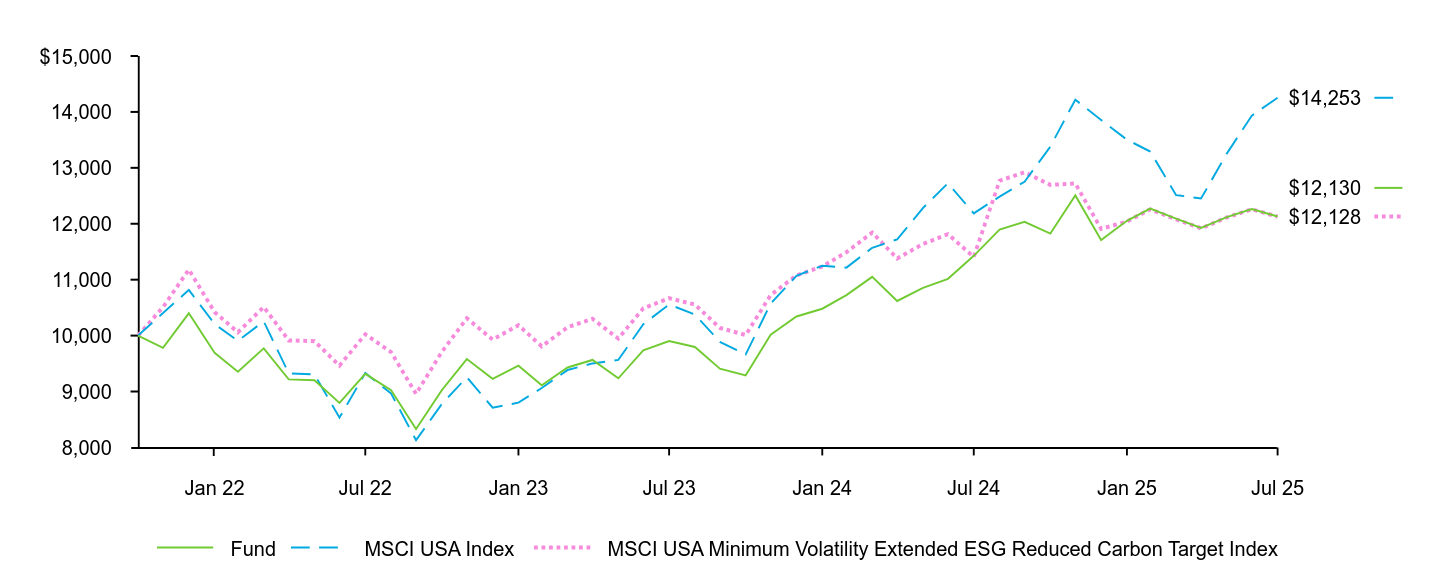

For the reporting period ended July 31, 2025, the Fund returned 8.38%.

For the same period, the Bloomberg U.S. Universal Index returned 4.00% and the MSCI All Country World Index (Net) returned 15.87%.

What contributed to performance?

U.S. large-capitalization equities were the largest contributor to the Fund’s return during the reporting period. In particular, semiconductor stocks gained amid continued demand for artificial intelligence (“AI”) and generative AI workloads in data centers, while systems software firms benefited from strong growth in their respective cloud businesses and increasing adoption of AI technologies. International developed stocks, particularly in Germany, gained amid optimism surrounding a historic fiscal stimulus plan targeting infrastructure and defense spending.

Within the bond allocation, longer-dated U.S. dollar-denominated bonds contributed.

What detracted from performance?

During the reporting period, there were no meaningful detractors from the Fund’s return.

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

Fund | Bloomberg U.S. Universal Index | MSCI All Country World Index (Net) | S&P Target Risk Moderate Index | |

|---|---|---|---|---|

Jul 15 | $10,000 | $10,000 | $10,000 | $10,000 |

Aug 15 | $9,710 | $9,971 | $9,597 | $9,711 |

Sep 15 | $9,608 | $10,009 | $9,249 | $9,608 |

Oct 15 | $9,888 | $10,042 | $9,974 | $9,888 |

Nov 15 | $9,879 | $10,005 | $9,890 | $9,881 |

Dec 15 | $9,759 | $9,955 | $9,711 | $9,762 |

Jan 16 | $9,604 | $10,065 | $9,124 | $9,608 |

Feb 16 | $9,613 | $10,136 | $9,061 | $9,614 |

Mar 16 | $9,962 | $10,261 | $9,732 | $9,966 |

Apr 16 | $10,036 | $10,331 | $9,876 | $10,040 |

May 16 | $10,076 | $10,339 | $9,889 | $10,081 |

Jun 16 | $10,186 | $10,520 | $9,828 | $10,189 |

Jul 16 | $10,403 | $10,607 | $10,253 | $10,407 |

Aug 16 | $10,411 | $10,619 | $10,288 | $10,417 |

Sep 16 | $10,443 | $10,621 | $10,348 | $10,451 |

Oct 16 | $10,303 | $10,551 | $10,171 | $10,309 |

Nov 16 | $10,204 | $10,314 | $10,248 | $10,213 |

Dec 16 | $10,313 | $10,344 | $10,469 | $10,311 |

Jan 17 | $10,418 | $10,381 | $10,754 | $10,419 |

Feb 17 | $10,588 | $10,461 | $11,056 | $10,589 |

Mar 17 | $10,656 | $10,457 | $11,192 | $10,659 |

Apr 17 | $10,781 | $10,544 | $11,367 | $10,784 |

May 17 | $10,922 | $10,625 | $11,615 | $10,923 |

Jun 17 | $10,949 | $10,616 | $11,664 | $10,948 |

Jul 17 | $11,095 | $10,669 | $11,990 | $11,121 |

Aug 17 | $11,166 | $10,761 | $12,035 | $11,192 |

Sep 17 | $11,234 | $10,723 | $12,268 | $11,262 |

Oct 17 | $11,351 | $10,736 | $12,523 | $11,382 |

Nov 17 | $11,434 | $10,720 | $12,764 | $11,455 |

Dec 17 | $11,519 | $10,767 | $12,970 | $11,542 |

Jan 18 | $11,719 | $10,664 | $13,701 | $11,744 |

Feb 18 | $11,428 | $10,563 | $13,123 | $11,454 |

Mar 18 | $11,428 | $10,616 | $12,829 | $11,454 |

Apr 18 | $11,391 | $10,545 | $12,961 | $11,420 |

May 18 | $11,436 | $10,603 | $12,978 | $11,468 |

Jun 18 | $11,409 | $10,587 | $12,909 | $11,442 |

Jul 18 | $11,565 | $10,609 | $13,297 | $11,600 |

Aug 18 | $11,633 | $10,662 | $13,400 | $11,666 |

Sep 18 | $11,614 | $10,616 | $13,457 | $11,651 |

Oct 18 | $11,203 | $10,527 | $12,450 | $11,240 |

Nov 18 | $11,305 | $10,574 | $12,633 | $11,343 |

Dec 18 | $11,075 | $10,740 | $11,744 | $11,112 |

Jan 19 | $11,490 | $10,888 | $12,671 | $11,534 |

Feb 19 | $11,624 | $10,900 | $13,008 | $11,667 |

Mar 19 | $11,810 | $11,097 | $13,173 | $11,858 |

Apr 19 | $11,986 | $11,112 | $13,617 | $12,036 |

May 19 | $11,796 | $11,283 | $12,808 | $11,845 |

Jun 19 | $12,177 | $11,442 | $13,649 | $12,216 |

Jul 19 | $12,204 | $11,476 | $13,689 | $12,246 |

Aug 19 | $12,280 | $11,736 | $13,364 | $12,342 |

Sep 19 | $12,358 | $11,685 | $13,647 | $12,420 |

Oct 19 | $12,508 | $11,723 | $14,024 | $12,573 |

Nov 19 | $12,606 | $11,720 | $14,368 | $12,675 |

Dec 19 | $12,787 | $11,738 | $14,872 | $12,858 |

Jan 20 | $12,835 | $11,948 | $14,673 | $12,909 |

Feb 20 | $12,519 | $12,127 | $13,514 | $12,593 |

Mar 20 | $11,684 | $11,891 | $11,691 | $11,750 |

Apr 20 | $12,232 | $12,129 | $12,944 | $12,305 |

May 20 | $12,575 | $12,242 | $13,503 | $12,653 |

Jun 20 | $12,784 | $12,344 | $13,933 | $12,863 |

Jul 20 | $13,149 | $12,561 | $14,268 | $13,240 |

Aug 20 | $13,414 | $12,489 | $15,565 | $13,513 |

Sep 20 | $13,240 | $12,466 | $15,063 | $13,340 |

Oct 20 | $13,095 | $12,422 | $14,696 | $13,195 |

Nov 20 | $13,782 | $12,584 | $16,509 | $13,893 |

Dec 20 | $14,079 | $12,627 | $17,278 | $14,198 |

Jan 21 | $14,010 | $12,548 | $17,197 | $14,132 |

Feb 21 | $14,056 | $12,386 | $17,593 | $14,177 |

Mar 21 | $14,186 | $12,242 | $18,060 | $14,311 |

Apr 21 | $14,487 | $12,345 | $18,846 | $14,620 |

May 21 | $14,605 | $12,392 | $19,130 | $14,739 |

Jun 21 | $14,726 | $12,482 | $19,392 | $14,864 |

Jul 21 | $14,863 | $12,607 | $19,525 | $15,007 |

Aug 21 | $14,991 | $12,599 | $20,014 | $15,138 |

Sep 21 | $14,653 | $12,491 | $19,188 | $14,799 |

Oct 21 | $14,947 | $12,481 | $20,168 | $15,097 |

Nov 21 | $14,825 | $12,496 | $19,684 | $14,975 |

Dec 21 | $15,054 | $12,488 | $20,472 | $15,208 |

Jan 22 | $14,604 | $12,214 | $19,470 | $14,755 |

Feb 22 | $14,326 | $12,048 | $18,967 | $14,474 |

Mar 22 | $14,219 | $11,724 | $19,379 | $14,366 |

Apr 22 | $13,461 | $11,287 | $17,827 | $13,601 |

May 22 | $13,536 | $11,349 | $17,847 | $13,678 |

Jun 22 | $12,942 | $11,122 | $16,337 | $13,076 |

Jul 22 | $13,502 | $11,402 | $17,477 | $13,644 |

Aug 22 | $13,042 | $11,105 | $16,833 | $13,179 |

Sep 22 | $12,250 | $10,627 | $15,222 | $12,379 |

Oct 22 | $12,486 | $10,510 | $16,141 | $12,619 |

Nov 22 | $13,216 | $10,902 | $17,392 | $13,358 |

Dec 22 | $12,877 | $10,865 | $16,703 | $13,016 |

Jan 23 | $13,512 | $11,202 | $17,903 | $13,659 |

Feb 23 | $13,139 | $10,927 | $17,393 | $13,282 |

Mar 23 | $13,490 | $11,183 | $17,930 | $13,639 |

Apr 23 | $13,617 | $11,252 | $18,183 | $13,768 |

May 23 | $13,465 | $11,135 | $17,985 | $13,615 |

Jun 23 | $13,776 | $11,118 | $19,027 | $13,932 |

Jul 23 | $13,972 | $11,129 | $19,724 | $14,132 |

Aug 23 | $13,768 | $11,062 | $19,173 | $13,926 |

Sep 23 | $13,344 | $10,798 | $18,380 | $13,497 |

Oct 23 | $13,082 | $10,636 | $17,827 | $13,232 |

Nov 23 | $13,876 | $11,114 | $19,473 | $14,039 |

Dec 23 | $14,459 | $11,536 | $20,407 | $14,631 |

Jan 24 | $14,493 | $11,508 | $20,519 | $14,666 |

Feb 24 | $14,616 | $11,370 | $21,401 | $14,792 |

Mar 24 | $14,900 | $11,482 | $22,075 | $15,081 |

Apr 24 | $14,491 | $11,214 | $21,345 | $14,667 |

May 24 | $14,898 | $11,400 | $22,207 | $15,081 |

Jun 24 | $15,061 | $11,504 | $22,702 | $15,248 |

Jul 24 | $15,384 | $11,765 | $22,481 | $15,577 |

Aug 24 | $15,655 | $11,938 | $23,658 | $15,853 |

Sep 24 | $15,914 | $12,102 | $24,205 | $16,117 |

Oct 24 | $15,564 | $11,827 | $23,666 | $15,764 |

Nov 24 | $15,904 | $11,952 | $23,785 | $16,110 |

Dec 24 | $15,595 | $11,771 | $23,218 | $15,797 |

Jan 25 | $15,836 | $11,842 | $24,137 | $16,043 |

Feb 25 | $15,992 | $12,087 | $23,998 | $16,203 |

Mar 25 | $15,760 | $12,084 | $23,048 | $15,968 |

Apr 25 | $15,845 | $12,127 | $23,258 | $16,056 |

May 25 | $16,174 | $12,065 | $24,592 | $16,391 |

Jun 25 | $16,617 | $12,253 | $25,699 | $16,843 |

Jul 25 | $16,673 | $12,236 | $26,049 | $16,901 |

........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 1 Year | 5 Years | 10 Years |

|---|---|---|---|

Fund NAV........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 8.38% | 4.86% | 5.25% |

Bloomberg U.S. Universal Index........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 4.00 | (0.52) | 2.04 |

MSCI All Country World Index (Net)........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 15.87 | 12.79 | 10.05 |

S&P Target Risk Moderate Index........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 8.50 | 5.00 | 5.39 |

Key Fund statistics

Net Assets........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | $1,528,715,865 |

|---|---|

Number of Portfolio Holdings........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 9 |

Net Investment Advisory Fees........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | $1,422,633 |

Portfolio Turnover Rate........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 5% |

Portfolio composition

All holdings

Asset class | Percent of Total InvestmentsFootnote Reference(a) |

|---|---|

Domestic Fixed Income........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 48.5% |

Domestic Equity........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 27.4 |

International Equity........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 15.6 |

International Fixed Income........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 8.5 |

Security | Percent of Total InvestmentsFootnote Reference(a) |

|---|---|

iShares Core Total USD Bond Market ETF........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 48.5% |

iShares Core S&P 500 ETF........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 25.4 |

iShares Core MSCI International Developed Markets ETF........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 11.1 |

iShares Core International Aggregate Bond ETF........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 8.5 |

iShares Core MSCI Emerging Markets ETF........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 4.5 |

iShares Core S&P Mid-Cap ETF........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 1.4 |

iShares Core S&P Small-Cap ETF........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 0.6 |

| Footnote | Description |

Footnote(a) | Excludes money market funds. |

This report describes changes to the Fund that occurred during the reporting period.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

Fund name | Costs of a $10,000

investment | Costs paid as a percentage of a

$10,000 investment |

|---|---|---|

iShares Core 60/40 Balanced Allocation ETF | $11Footnote Reference(a) | 0.10%Footnote Reference(a) |

| Footnote | Description |

Footnote(a) | Excludes fees and expenses incurred indirectly as a result of investments in underlying funds. |

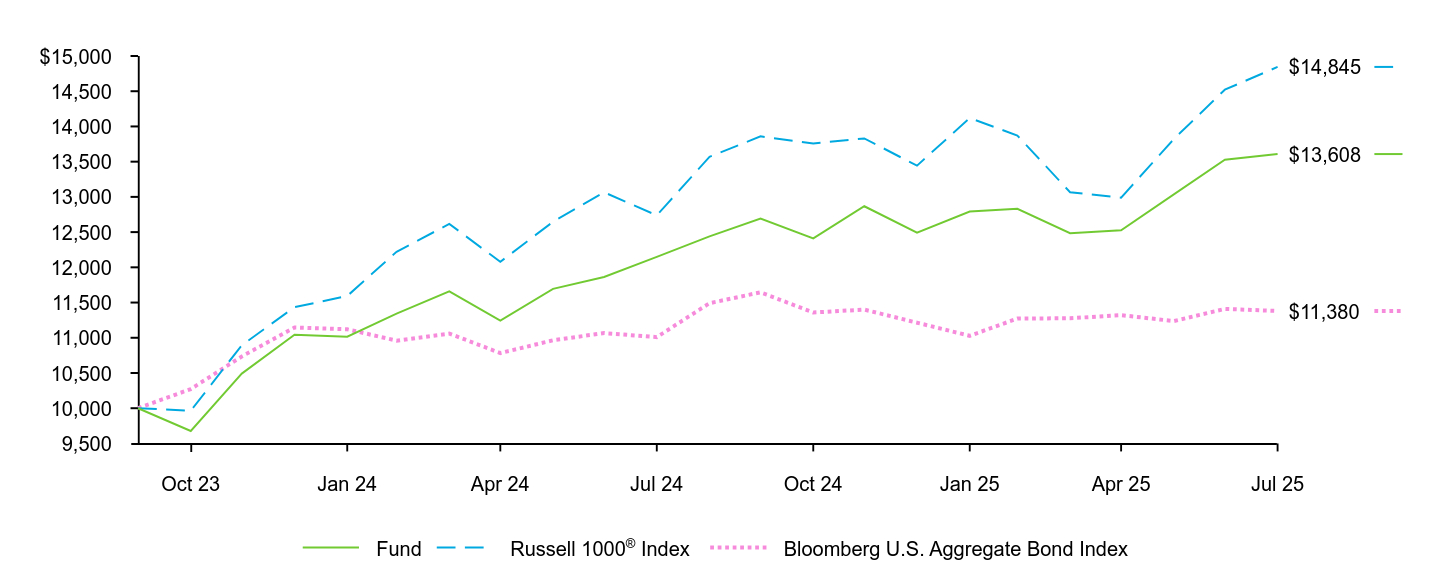

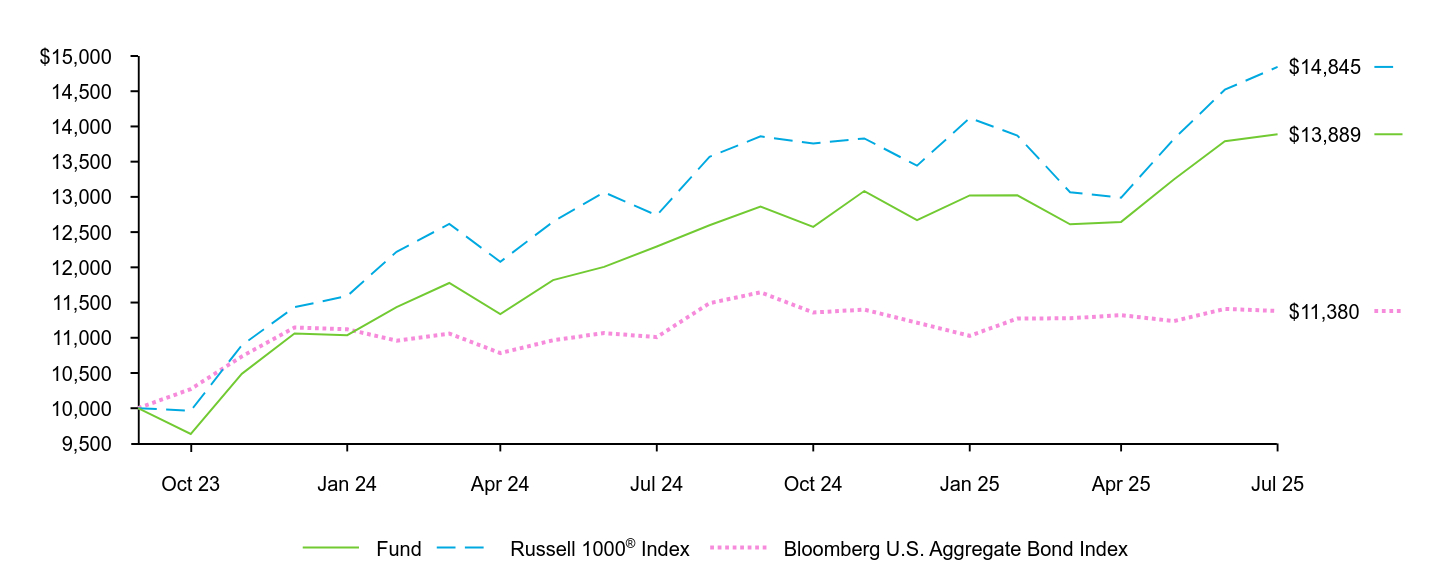

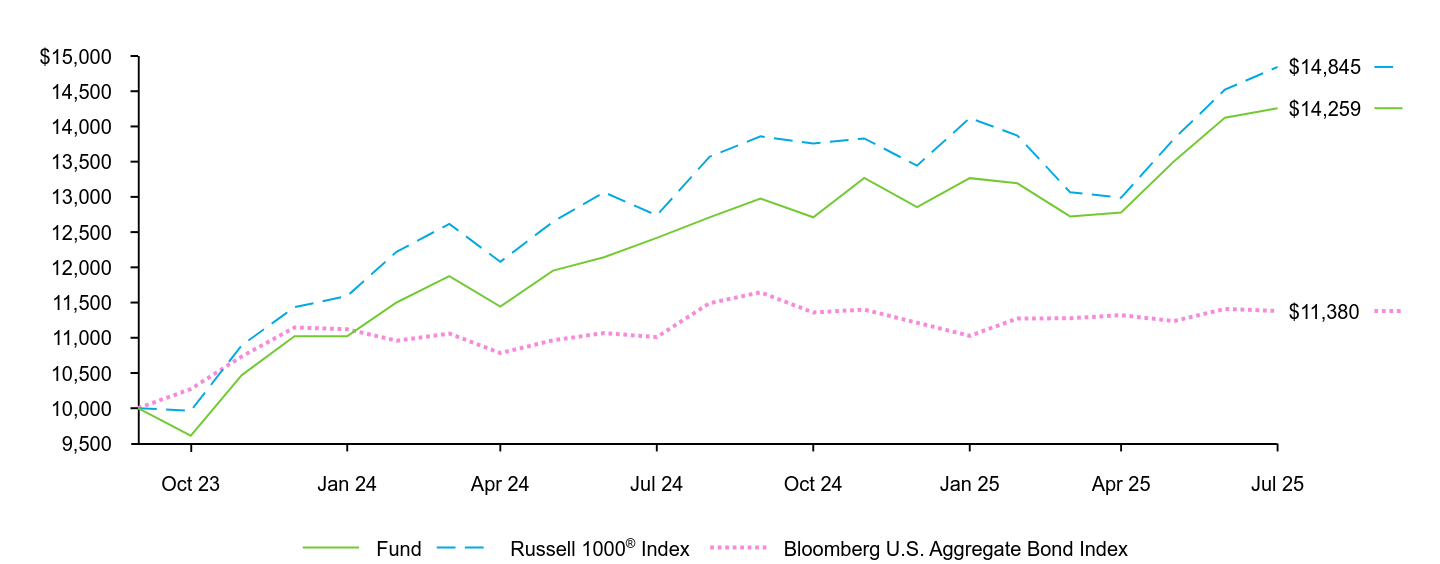

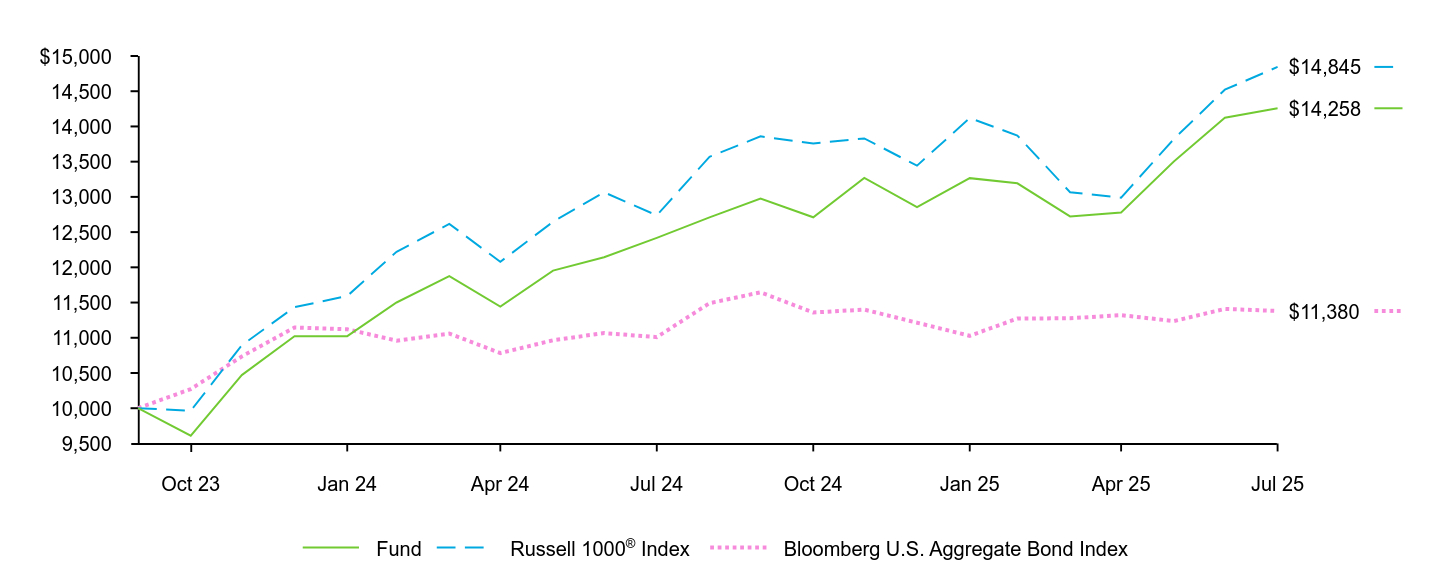

How did the Fund perform last year?

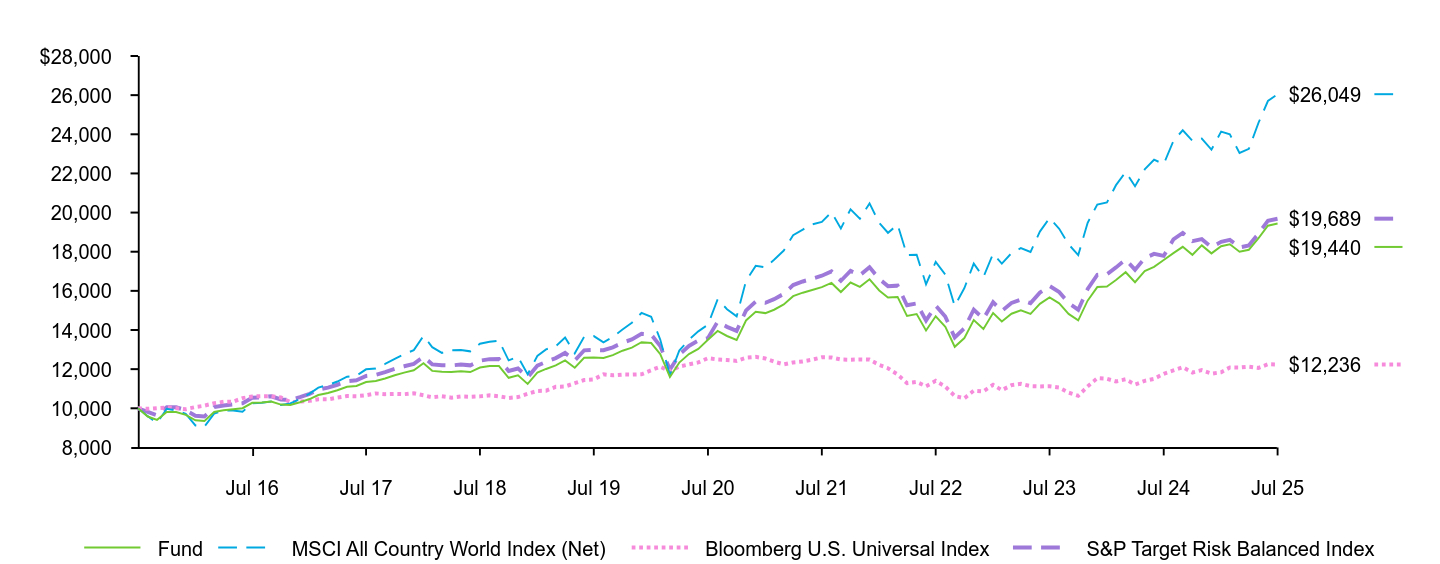

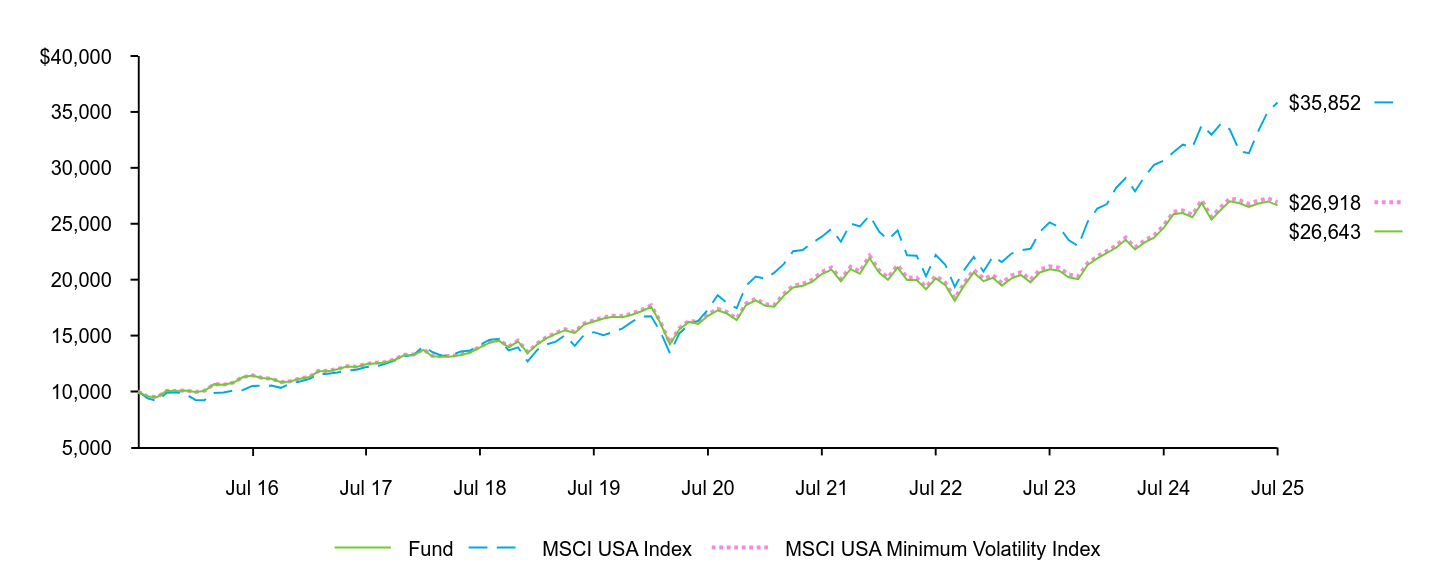

For the reporting period ended July 31, 2025, the Fund returned 10.58%.

For the same period, the MSCI All Country World Index (Net) returned 15.87% and the Bloomberg U.S. Universal Index returned 4.00%.

What contributed to performance?

U.S. large-capitalization equities were the largest contributor to the Fund’s return during the reporting period. In particular, semiconductor stocks gained amid continued demand for artificial intelligence (“AI”) and generative AI workloads in data centers, while systems software firms benefited from strong growth in their respective cloud businesses and increasing adoption of AI technologies. International developed stocks, particularly in Germany, gained amid optimism surrounding a historic fiscal stimulus plan targeting infrastructure and defense spending.

Within the bond allocation, longer-dated U.S. dollar-denominated bonds contributed.

What detracted from performance?

During the reporting period, there were no meaningful detractors from the Fund’s return.

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

Fund | MSCI All Country World Index (Net) | Bloomberg U.S. Universal Index | S&P Target Risk Balanced Index | |

|---|---|---|---|---|

Jul 15 | $10,000 | $10,000 | $10,000 | $10,000 |

Aug 15 | $9,578 | $9,597 | $9,971 | $9,815 |

Sep 15 | $9,408 | $9,249 | $10,009 | $9,640 |

Oct 15 | $9,808 | $9,974 | $10,042 | $10,052 |

Nov 15 | $9,808 | $9,890 | $10,005 | $10,053 |

Dec 15 | $9,662 | $9,711 | $9,955 | $9,904 |

Jan 16 | $9,383 | $9,124 | $10,065 | $9,620 |

Feb 16 | $9,351 | $9,061 | $10,136 | $9,585 |

Mar 16 | $9,809 | $9,732 | $10,261 | $10,059 |

Apr 16 | $9,894 | $9,876 | $10,331 | $10,147 |

May 16 | $9,947 | $9,889 | $10,339 | $10,199 |

Jun 16 | $10,002 | $9,828 | $10,520 | $10,257 |

Jul 16 | $10,280 | $10,253 | $10,607 | $10,541 |

Aug 16 | $10,297 | $10,288 | $10,619 | $10,560 |

Sep 16 | $10,350 | $10,348 | $10,621 | $10,616 |

Oct 16 | $10,189 | $10,171 | $10,551 | $10,451 |

Nov 16 | $10,166 | $10,248 | $10,314 | $10,428 |

Dec 16 | $10,306 | $10,469 | $10,344 | $10,567 |

Jan 17 | $10,471 | $10,754 | $10,381 | $10,737 |

Feb 17 | $10,680 | $11,056 | $10,461 | $10,952 |

Mar 17 | $10,779 | $11,192 | $10,457 | $11,055 |

Apr 17 | $10,923 | $11,367 | $10,544 | $11,204 |

May 17 | $11,097 | $11,615 | $10,625 | $11,381 |

Jun 17 | $11,140 | $11,664 | $10,616 | $11,427 |

Jul 17 | $11,341 | $11,990 | $10,669 | $11,651 |

Aug 17 | $11,395 | $12,035 | $10,761 | $11,711 |

Sep 17 | $11,526 | $12,268 | $10,723 | $11,846 |

Oct 17 | $11,689 | $12,523 | $10,736 | $12,016 |

Nov 17 | $11,823 | $12,764 | $10,720 | $12,145 |

Dec 17 | $11,942 | $12,970 | $10,767 | $12,272 |

Jan 18 | $12,299 | $13,701 | $10,664 | $12,640 |

Feb 18 | $11,911 | $13,123 | $10,563 | $12,244 |

Mar 18 | $11,863 | $12,829 | $10,616 | $12,198 |

Apr 18 | $11,850 | $12,961 | $10,545 | $12,187 |

May 18 | $11,898 | $12,978 | $10,603 | $12,237 |

Jun 18 | $11,852 | $12,909 | $10,587 | $12,194 |

Jul 18 | $12,082 | $13,297 | $10,609 | $12,432 |

Aug 18 | $12,157 | $13,400 | $10,662 | $12,511 |

Sep 18 | $12,160 | $13,457 | $10,616 | $12,517 |

Oct 18 | $11,558 | $12,450 | $10,527 | $11,905 |

Nov 18 | $11,688 | $12,633 | $10,574 | $12,036 |

Dec 18 | $11,245 | $11,744 | $10,740 | $11,582 |

Jan 19 | $11,821 | $12,671 | $10,888 | $12,174 |

Feb 19 | $12,011 | $13,008 | $10,900 | $12,373 |

Mar 19 | $12,194 | $13,173 | $11,097 | $12,563 |

Apr 19 | $12,451 | $13,617 | $11,112 | $12,831 |

May 19 | $12,071 | $12,808 | $11,283 | $12,441 |

Jun 19 | $12,583 | $13,649 | $11,442 | $12,960 |

Jul 19 | $12,594 | $13,689 | $11,476 | $12,979 |

Aug 19 | $12,572 | $13,364 | $11,736 | $12,965 |

Sep 19 | $12,715 | $13,647 | $11,685 | $13,116 |

Oct 19 | $12,943 | $14,024 | $11,723 | $13,351 |

Nov 19 | $13,102 | $14,368 | $11,720 | $13,517 |

Dec 19 | $13,378 | $14,872 | $11,738 | $13,804 |

Jan 20 | $13,333 | $14,673 | $11,948 | $13,769 |

Feb 20 | $12,767 | $13,514 | $12,127 | $13,180 |

Mar 20 | $11,597 | $11,691 | $11,891 | $11,974 |

Apr 20 | $12,336 | $12,944 | $12,129 | $12,734 |

May 20 | $12,772 | $13,503 | $12,242 | $13,189 |

Jun 20 | $13,034 | $13,933 | $12,344 | $13,466 |

Jul 20 | $13,501 | $14,268 | $12,561 | $13,587 |

Aug 20 | $13,954 | $15,565 | $12,489 | $14,426 |

Sep 20 | $13,693 | $15,063 | $12,466 | $14,160 |

Oct 20 | $13,493 | $14,696 | $12,422 | $13,954 |

Nov 20 | $14,489 | $16,509 | $12,584 | $14,996 |

Dec 20 | $14,929 | $17,278 | $12,627 | $15,453 |

Jan 21 | $14,863 | $17,197 | $12,548 | $15,390 |

Feb 21 | $15,037 | $17,593 | $12,386 | $15,573 |

Mar 21 | $15,303 | $18,060 | $12,242 | $15,848 |

Apr 21 | $15,731 | $18,846 | $12,345 | $16,294 |

May 21 | $15,908 | $19,130 | $12,392 | $16,479 |

Jun 21 | $16,046 | $19,392 | $12,482 | $16,619 |

Jul 21 | $16,191 | $19,525 | $12,607 | $16,773 |

Aug 21 | $16,407 | $20,014 | $12,599 | $16,999 |

Sep 21 | $15,937 | $19,188 | $12,491 | $16,513 |

Oct 21 | $16,425 | $20,168 | $12,481 | $17,021 |

Nov 21 | $16,202 | $19,684 | $12,496 | $16,796 |

Dec 21 | $16,592 | $20,472 | $12,488 | $17,205 |

Jan 22 | $16,019 | $19,470 | $12,214 | $16,610 |

Feb 22 | $15,663 | $18,967 | $12,048 | $16,241 |

Mar 22 | $15,688 | $19,379 | $11,724 | $16,266 |

Apr 22 | $14,719 | $17,827 | $11,287 | $15,261 |

May 22 | $14,814 | $17,847 | $11,349 | $15,359 |

Jun 22 | $13,974 | $16,337 | $11,122 | $14,485 |

Jul 22 | $14,704 | $17,477 | $11,402 | $15,242 |

Aug 22 | $14,159 | $16,833 | $11,105 | $14,677 |

Sep 22 | $13,142 | $15,222 | $10,627 | $13,623 |

Oct 22 | $13,590 | $16,141 | $10,510 | $14,089 |

Nov 22 | $14,506 | $17,392 | $10,902 | $15,039 |

Dec 22 | $14,053 | $16,703 | $10,865 | $14,572 |

Jan 23 | $14,870 | $17,903 | $11,202 | $15,421 |

Feb 23 | $14,435 | $17,393 | $10,927 | $14,971 |

Mar 23 | $14,831 | $17,930 | $11,183 | $15,382 |

Apr 23 | $15,004 | $18,183 | $11,252 | $15,560 |

May 23 | $14,821 | $17,985 | $11,135 | $15,372 |

Jun 23 | $15,335 | $19,027 | $11,118 | $15,909 |

Jul 23 | $15,662 | $19,724 | $11,129 | $16,250 |

Aug 23 | $15,359 | $19,173 | $11,062 | $15,936 |

Sep 23 | $14,823 | $18,380 | $10,798 | $15,380 |

Oct 23 | $14,489 | $17,827 | $10,636 | $15,035 |

Nov 23 | $15,499 | $19,473 | $11,114 | $16,089 |

Dec 23 | $16,195 | $20,407 | $11,536 | $16,816 |

Jan 24 | $16,224 | $20,519 | $11,508 | $16,848 |

Feb 24 | $16,552 | $21,401 | $11,370 | $17,193 |

Mar 24 | $16,955 | $22,075 | $11,482 | $17,609 |

Apr 24 | $16,443 | $21,345 | $11,214 | $17,079 |

May 24 | $17,009 | $22,207 | $11,400 | $17,667 |

Jun 24 | $17,222 | $22,702 | $11,504 | $17,893 |

Jul 24 | $17,579 | $22,481 | $11,765 | $17,787 |

Aug 24 | $17,926 | $23,658 | $11,938 | $18,628 |

Sep 24 | $18,252 | $24,205 | $12,102 | $18,964 |

Oct 24 | $17,842 | $23,666 | $11,827 | $18,539 |

Nov 24 | $18,323 | $23,785 | $11,952 | $18,647 |

Dec 24 | $17,914 | $23,218 | $11,771 | $18,232 |

Jan 25 | $18,282 | $24,137 | $11,842 | $18,506 |

Feb 25 | $18,383 | $23,998 | $12,087 | $18,610 |

Mar 25 | $18,000 | $23,048 | $12,084 | $18,219 |

Apr 25 | $18,102 | $23,258 | $12,127 | $18,324 |

May 25 | $18,693 | $24,592 | $12,065 | $18,929 |

Jun 25 | $19,330 | $25,699 | $12,253 | $19,576 |

Jul 25 | $19,440 | $26,049 | $12,236 | $19,689 |

........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 1 Year | 5 Years | 10 Years |

|---|---|---|---|

Fund NAV........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 10.58% | 7.56% | 6.87% |

MSCI All Country World Index (Net)........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 15.87 | 12.79 | 10.05 |

Bloomberg U.S. Universal Index........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 4.00 | (0.52) | 2.04 |

S&P Target Risk Balanced Index........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 10.69 | 7.70 | 7.01 |

Key Fund statistics

Net Assets........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | $2,573,687,554 |

|---|---|

Number of Portfolio Holdings........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 9 |

Net Investment Advisory Fees........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | $2,323,358 |

Portfolio Turnover Rate........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 5% |

Portfolio composition

All holdings

Asset class | Percent of Total InvestmentsFootnote Reference(a) |

|---|---|

Domestic Equity........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 40.1% |