Shareholder Report

|

12 Months Ended |

|

Jul. 31, 2025

USD ($)

Holding

|

|---|

| Shareholder Report [Line Items] |

|

| Document Type |

N-CSR

|

| Amendment Flag |

false

|

| Registrant Name |

Eubel Brady & Suttman Mutual Fund Trust

|

| Entity Central Index Key |

0001606378

|

| Entity Investment Company Type |

N-1A

|

| Document Period End Date |

Jul. 31, 2025

|

| C000143294 |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

Eubel Brady & Suttman Income and Appreciation Fund

|

| Trading Symbol |

EBSZX

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about Eubel Brady & Suttman Income and Appreciation Fund (the "Fund") for the period of August 1, 2024 to July 31, 2025.

|

| Shareholder Report Annual or Semi-Annual |

Annual Shareholder Report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at https://funddocs.filepoint.com/ebs/. You can also request this information by contacting us at (800) 391-1223.

|

| Additional Information Phone Number |

(800) 391-1223

|

| Additional Information Website |

<span style="font-weight: 700; box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 10.6667px; grid-area: auto; line-height: 16px; margin: 0px; overflow: visible; text-align: left; text-align-last: auto; white-space-collapse: preserve-breaks;"> https://funddocs.filepoint.com/ebs/</span>

|

| Expenses [Text Block] |

What were the Fund’s annualized costs for the last year?(based on a hypothetical $10,000 investment) Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

Eubel Brady & Suttman Income and Appreciation Fund | $23 | 0.22% |

|---|

|

| Expenses Paid, Amount |

$ 23

|

| Expense Ratio, Percent |

0.22%

|

| Performance Past Does Not Indicate Future [Text] |

The Fund's past performance is not a good predictor of how the Fund will perform in the future.

|

| Line Graph [Table Text Block] |

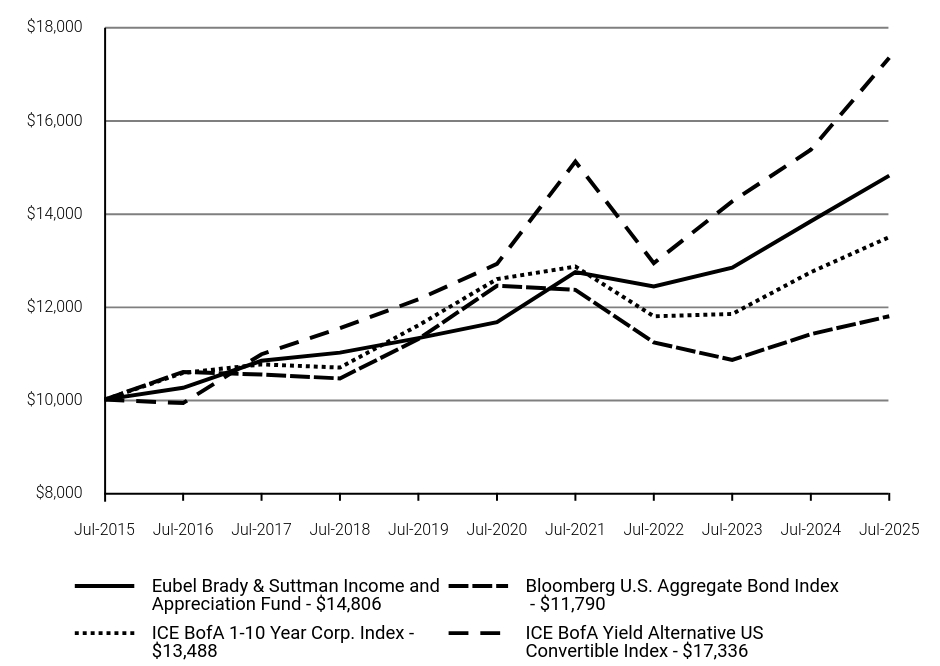

| Eubel Brady & Suttman Income and Appreciation Fund | Bloomberg U.S. Aggregate Bond Index | ICE BofA 1-10 Year Corp. Index | ICE BofA Yield Alternative US Convertible Index |

|---|

Jul-2015 | $10,000 | $10,000 | $10,000 | $10,000 |

|---|

Jul-2016 | $10,255 | $10,594 | $10,574 | $9,926 |

|---|

Jul-2017 | $10,834 | $10,539 | $10,756 | $10,975 |

|---|

Jul-2018 | $11,009 | $10,455 | $10,688 | $11,534 |

|---|

Jul-2019 | $11,319 | $11,299 | $11,594 | $12,151 |

|---|

Jul-2020 | $11,663 | $12,443 | $12,586 | $12,912 |

|---|

Jul-2021 | $12,735 | $12,356 | $12,856 | $15,107 |

|---|

Jul-2022 | $12,430 | $11,229 | $11,788 | $12,929 |

|---|

Jul-2023 | $12,832 | $10,851 | $11,838 | $14,253 |

|---|

Jul-2024 | $13,826 | $11,405 | $12,735 | $15,361 |

|---|

Jul-2025 | $14,806 | $11,790 | $13,488 | $17,336 |

|---|

|

| Average Annual Return [Table Text Block] |

Average Annual Total Returns | 1 Year | 5 Years | 10 Years |

|---|

Eubel Brady & Suttman Income and Appreciation Fund | 7.09% | 4.89% | 4.00% |

|---|

Bloomberg U.S. Aggregate Bond Index | 3.38% | -1.07% | 1.66% |

|---|

ICE BofA 1-10 Year Corp. Index | 5.91% | 1.39% | 3.04% |

|---|

ICE BofA Yield Alternative US Convertible Index | 12.85% | 6.07% | 5.66% |

|---|

|

| No Deduction of Taxes [Text Block] |

The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

|

| AssetsNet |

$ 146,505,121

|

| Holdings Count | Holding |

35

|

| Advisory Fees Paid, Amount |

$ 0

|

| InvestmentCompanyPortfolioTurnover |

20.00%

|

| Additional Fund Statistics [Text Block] |

- Net Assets$146,505,121

- Number of Portfolio Holdings35

- Advisory Fee $0

- Portfolio Turnover20%

|

| Holdings [Text Block] |

Sector Weighting (% of net assets)Value | Value |

|---|

Other Assets in Excess of Liabilities | 0.5% | Materials | 3.4% | Energy | 3.4% | Consumer Staples | 4.7% | Industrials | 7.7% | Communications | 7.9% | Money Market | 16.2% | Technology | 16.4% | Financials | 19.1% | Consumer Discretionary | 20.7% |

Top 10 Holdings (% of net assets)Holding Name | % of Net Assets |

|---|

Patrick Industries, Inc., 1.750%, due 12/01/28 | 4.2% |

|---|

Lyft, Inc., 0.625%, due 03/01/29 | 4.2% |

|---|

Airbnb, Inc., 0.000%, due 03/15/26 | 4.0% |

|---|

TripAdvisor, Inc., 0.250%, due 04/01/26 | 3.9% |

|---|

Micron Technology, Inc., 6.750%, due 11/01/29 | 3.7% |

|---|

Winnebago Industries, Inc., 3.250%, due 01/15/30 | 3.5% |

|---|

Garrett Motion Holdings, 7.750%, due 05/31/32 144A | 3.5% |

|---|

Bentley Systems, Inc., 0.125%, due 01/15/26 | 3.5% |

|---|

JBT Marel Corporation, 0.250%, due 05/15/26 | 3.5% |

|---|

CNX Resources Corporation, 6.000%, due 01/15/29 144A | 3.4% |

|---|

Asset Weighting (% of total investments)Value | Value |

|---|

Bank Debt | 1.4% | Common Stocks | 3.8% | Convertible Bonds | 46.7% | Corporate Bonds | 31.8% | Money Market Funds | 16.3% |

|

| Material Fund Change [Text Block] |

No material changes occurred during the year ended July 31, 2025. |

| C000143295 |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

Eubel Brady & Suttman Income Fund

|

| Trading Symbol |

EBSFX

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about Eubel Brady & Suttman Income Fund (the "Fund") for the period of August 1, 2024 to July 31, 2025.

|

| Shareholder Report Annual or Semi-Annual |

Annual Shareholder Report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at https://funddocs.filepoint.com/ebs/. You can also request this information by contacting us at (800) 391-1223.

|

| Additional Information Phone Number |

(800) 391-1223

|

| Additional Information Website |

<span style="font-weight: 700; box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 10.6667px; grid-area: auto; line-height: 16px; margin: 0px; overflow: visible; text-align: left; text-align-last: auto; white-space-collapse: preserve-breaks;"> https://funddocs.filepoint.com/ebs/</span>

|

| Expenses [Text Block] |

What were the Fund’s annualized costs for the last year?(based on a hypothetical $10,000 investment) Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

Eubel Brady & Suttman Income Fund | $18 | 0.17% |

|---|

|

| Expenses Paid, Amount |

$ 18

|

| Expense Ratio, Percent |

0.17%

|

| Performance Past Does Not Indicate Future [Text] |

The Fund's past performance is not a good predictor of how the Fund will perform in the future.

|

| Line Graph [Table Text Block] |

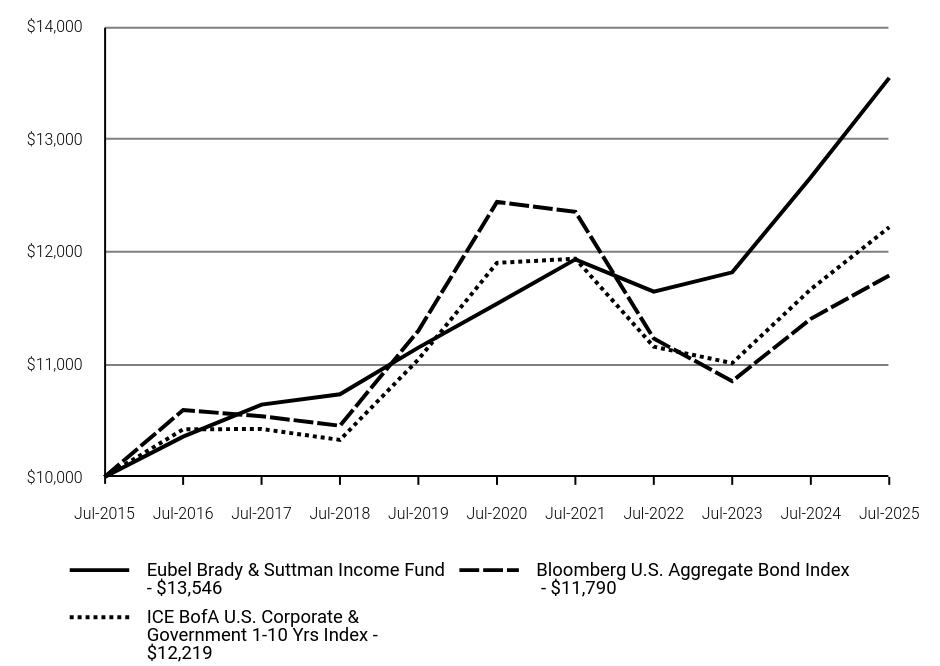

| Eubel Brady & Suttman Income Fund | Bloomberg U.S. Aggregate Bond Index | ICE BofA U.S. Corporate & Government 1-10 Yrs Index |

|---|

Jul-2015 | $10,000 | $10,000 | $10,000 |

|---|

Jul-2016 | $10,358 | $10,594 | $10,423 |

|---|

Jul-2017 | $10,643 | $10,539 | $10,426 |

|---|

Jul-2018 | $10,734 | $10,455 | $10,329 |

|---|

Jul-2019 | $11,149 | $11,299 | $11,044 |

|---|

Jul-2020 | $11,538 | $12,443 | $11,902 |

|---|

Jul-2021 | $11,933 | $12,356 | $11,939 |

|---|

Jul-2022 | $11,647 | $11,229 | $11,157 |

|---|

Jul-2023 | $11,818 | $10,851 | $11,011 |

|---|

Jul-2024 | $12,663 | $11,405 | $11,668 |

|---|

Jul-2025 | $13,546 | $11,790 | $12,219 |

|---|

|

| Average Annual Return [Table Text Block] |

Average Annual Total Returns | 1 Year | 5 Years | 10 Years |

|---|

Eubel Brady & Suttman Income Fund | 6.97% | 3.26% | 3.08% |

|---|

Bloomberg U.S. Aggregate Bond Index | 3.38% | -1.07% | 1.66% |

|---|

ICE BofA U.S. Corporate & Government 1-10 Yrs Index | 4.73% | 0.53% | 2.02% |

|---|

|

| No Deduction of Taxes [Text Block] |

The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

|

| AssetsNet |

$ 412,395,649

|

| Holdings Count | Holding |

54

|

| Advisory Fees Paid, Amount |

$ 0

|

| InvestmentCompanyPortfolioTurnover |

38.00%

|

| Additional Fund Statistics [Text Block] |

- Net Assets$412,395,649

- Number of Portfolio Holdings54

- Advisory Fee $0

- Portfolio Turnover38%

|

| Holdings [Text Block] |

Sector Weighting (% of net assets)Value | Value |

|---|

Other Assets in Excess of Liabilities | 1.0% | Communications | 1.4% | U.S. Government & Agencies | 3.5% | Consumer Staples | 4.2% | Materials | 5.5% | Technology | 6.2% | Health Care | 7.1% | Money Market | 9.8% | Consumer Discretionary | 10.8% | Industrials | 13.6% | U.S. Treasury Obligations | 14.0% | Financials | 22.9% |

Top 10 Holdings (% of net assets)Holding Name | % of Net Assets |

|---|

U.S. Treasury Notes, 4.375%, due 12/31/29 | 3.1% |

|---|

Timken Company (The), 4.500%, due 12/15/28 | 3.0% |

|---|

U.S. Treasury Notes, 4.625%, due 04/30/29 | 3.0% |

|---|

U.S. Treasury Notes, 4.500%, due 05/15/27 | 2.9% |

|---|

Mohawk Industries, Inc., 5.850%, due 09/18/28 | 2.8% |

|---|

Penske Truck Leasing Company, L.P., 5.700%, due 02/01/28 144A | 2.7% |

|---|

LKQ Corporation, 5.750%, due 06/15/28 | 2.7% |

|---|

HEICO Corporation, 5.250%, due 08/01/28 | 2.7% |

|---|

Bank OZK, 2.750%, due 10/01/31 | 2.6% |

|---|

U.S. Treasury Notes, 4.250%, due 01/15/28 | 2.6% |

|---|

Asset Weighting (% of total investments)Value | Value |

|---|

Bank Debt | 1.3% | Common Stocks | 1.7% | Corporate Bonds | 69.4% | Money Market Funds | 9.9% | U.S. Government & Agencies | 3.5% | U.S. Treasury Obligations | 14.2% |

|

| Material Fund Change [Text Block] |

No material changes occurred during the year ended July 31, 2025. |