Exhibit 99.2

Strategic transaction expected to catalyze returns from significant oil and gas resource

opportunity OxyChem Business Divestment Update OCTOBER 2, 2025

Cautionary statements Forward-Looking Statements This presentation contains

“forward-looking statements” within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995, including, but not limited to, statements about Occidental Petroleum Corporation’s (“Occidental” or

“Oxy”) expectations, beliefs, plans or forecasts, including the proposed sale of Occidental's chemical business to Berkshire Hathaway Inc. ("Berkshire") and the benefits of such sale. Forward-looking statements involve estimates,

expectations, projections, goals, forecasts, assumptions, risks and uncertainties. Actual outcomes or results may differ from anticipated results, sometimes materially. Factors that could cause results to differ from those projected or

assumed in any forward-looking statement include, but are not limited to: Occidental’s ability to consummate the proposed transaction with Berkshire (the “Transaction”); the possibility that any or all of the conditions to the Transaction may

not be satisfied or waived, including the failure to obtain the regulatory approvals required for the Transaction on the terms expected or on the anticipated schedule or at all; the occurrence of any event, change or other circumstance that

could give rise to the termination of the purchase agreement relating to the Transaction; the effect of the announcement or pendency of the Transaction on our ability to attract, motivate or retain key executives and employees, our ability to

maintain relationships with our customers, vendors, service providers and others with whom we do business, or our operating results and business generally; risks related to the Transaction diverting management’s attention from our ongoing

business operations; that the Transaction may not achieve some or all or any of the anticipated benefits or be completed in accordance with expected plans and timelines; general economic conditions, including slowdowns and recessions,

domestically or internationally; Occidental’s indebtedness and other payment obligations, including the need to generate sufficient cash flows to fund operations; Occidental’s ability to successfully monetize select assets and repay or

refinance debt and the impact of changes in Occidental’s credit ratings or future increases in interest rates; assumptions about energy markets; global and local commodity and commodity-futures pricing fluctuations and volatility; supply and

demand considerations for, and the prices of, Occidental’s products and services; actions by the Organization of the Petroleum Exporting Countries (OPEC) and non-OPEC oil producing countries; results from operations and competitive

conditions; future impairments of Occidental’s proved and unproved oil and gas properties or equity investments, or write-downs of productive assets, causing charges to earnings; unexpected changes in costs; government actions (including the

effects of announced or future tariff increases and other geopolitical, trade, tariff, fiscal and regulatory uncertainties), war (including the Russia-Ukraine war and conflicts in the Middle East) and political conditions and events;

inflation, its impact on markets and economic activity and related monetary policy actions by governments in response to inflation; availability of capital resources, levels of capital expenditures and contractual obligations; the regulatory

approval environment, including Occidental's ability to timely obtain or maintain permits or other government approvals, including those necessary for drilling and/or development projects; Occidental's ability to successfully complete, or any

material delay of, field developments, expansion projects, capital expenditures, efficiency projects, acquisitions or divestitures; risks associated with acquisitions, mergers and joint ventures, such as difficulties integrating businesses,

uncertainty associated with financial projections or projected synergies, restructuring, increased costs and adverse tax consequences; uncertainties and liabilities associated with acquired and divested properties and businesses;

uncertainties about the estimated quantities of oil, natural gas liquids (NGL) and natural gas reserves; lower-than-expected production from development projects or acquisitions; Occidental’s ability to realize the anticipated benefits from

prior or future streamlining actions to reduce fixed costs, simplify or improve processes and improve Occidental’s competitiveness; exploration, drilling and other operational risks; disruptions to, capacity constraints in, or other

limitations on the pipeline systems that deliver Occidental’s oil and natural gas and other processing and transportation considerations; volatility in the securities, capital or credit markets, including capital market disruptions and

instability of financial institutions; health, safety and environmental (HSE) risks, costs and liability under existing or future federal, regional, state, provincial, tribal, local and international HSE laws, regulations and litigation

(including related to climate change or remedial actions or assessments); legislative or regulatory changes, including changes relating to hydraulic fracturing or other oil and natural gas operations, retroactive royalty or production tax

regimes, and deep-water and onshore drilling and permitting regulations; Occidental’s ability to recognize intended benefits from its business strategies and initiatives, such as Occidental’s low-carbon ventures businesses or announced

greenhouse gas emissions reduction targets or net-zero goals; changes in government grant or loan programs; potential liability resulting from pending or future litigation, government investigations and other proceedings; disruption or

interruption of production or manufacturing or facility damage due to accidents, chemical releases, labor unrest, weather, power outages, natural disasters, cyber-attacks, terrorist acts or insurgent activity; the scope and duration of global

or regional health pandemics or epidemics and actions taken by government authorities and other third parties in connection therewith; the creditworthiness and performance of Occidental’s counterparties, including financial institutions,

operating partners and other parties; failure of risk management; Occidental’s ability to retain and hire key personnel; supply, transportation and labor constraints; reorganization or restructuring of Occidental’s operations; changes in

state, federal or international tax rates, deductions, incentives or credits; and actions by third parties that are beyond Occidental's control. Words such as “estimate,” “project,” “predict,” “will,” “would,” “should,” “could,” “may,”

“might,” “anticipate,” “plan,” “intend,” “believe,” "think," "envision," “expect,” “aim,” “goal,” “target,” “objective,” “commit,” “advance,” “guidance,” “priority,” “focus,” “assumption,” “likely” or similar expressions that convey the

prospective nature of events or outcomes generally indicate forward-looking statements. You should not place undue reliance on these forward-looking statements, which speak only as of the date of this presentation unless an earlier date is

specified. Unless legally required, Occidental does not undertake any obligation to update, modify or withdraw any forward-looking statement as a result of new information, future events or otherwise. Other factors that could cause actual

results to differ from those described in any forward-looking statement appear in Part I, Item 1A “Risk Factors” of Occidental’s Annual Report on Form 10-K for the year ended December 31, 2024 (“2024 Form 10-K”) and in Occidental’s other

filings with the U.S. Securities and Exchange Commission. 2

3 Strategic move to accelerate opportunities in core business and integrated

technologies Immediate debt repayment of ~$6.5 B, with remaining ~$1.5 B after tax proceeds to go to balance sheet Expect to realize >$350 MM of annual interest expense savings Improves credit metrics and enhances financial flexibility

Strengthens financial position Unlocks resource potential and business value Reallocate capital to high-return oil and gas projects Enables acceleration and significant organic expansion of low-cost resource development Progresses

advanced recovery and integrated technologies 3 Broadens return of capital to shareholders Achieves <$15 B debt target, accelerating shareholder returns Opportunistic, multi-year share repurchase program and further net debt

reduction 1 Subject to customary purchase price adjustments Selling Occidental Chemical Corp. to Berkshire Hathaway for cash consideration of Transaction expected to close in fourth quarter 2025, subject to regulatory approvals and other

customary closing conditions $9.7 B 1

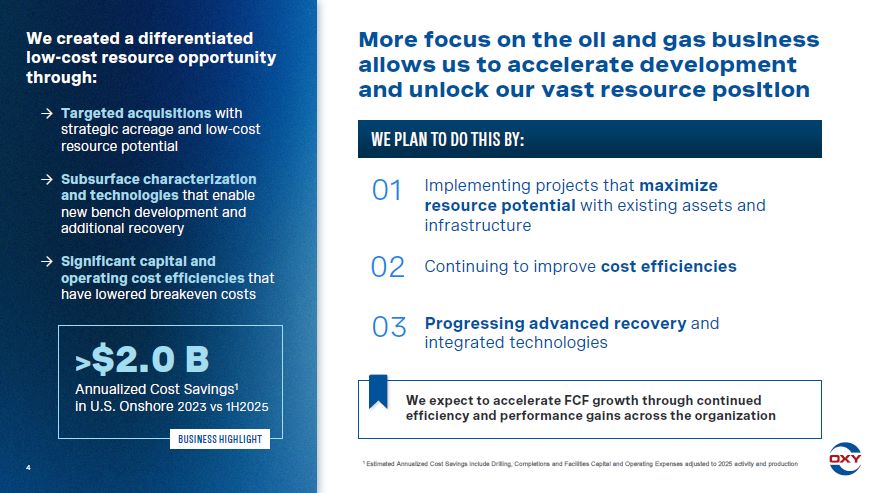

More focus on the oil and gas business allows us to accelerate development and unlock

our vast resource position 4 We expect to accelerate FCF growth through continued efficiency and performance gains across the organization WE PLAN TO DO THIS BY: Targeted acquisitions with strategic acreage and low-cost resource

potential Subsurface characterization and technologies that enable new bench development and additional recovery Significant capital and operating cost efficiencies that have lowered breakeven costs We created a differentiated low-cost

resource opportunity through: 4 >$2.0 B Annualized Cost Savings1 in U.S. Onshore 2023 vs 1H2025 01 02 03 Implementing projects that maximize resource potential with existing assets and infrastructure Continuing to improve cost

efficiencies Progressing advanced recovery and integrated technologies BUSINESS HIGHLIGHT 1 Estimated Annualized Cost Savings include Drilling, Completions and Facilities Capital and Operating Expenses adjusted to 2025 activity and

production

Unique opportunities to unlock resources across our portfolio 5 Developing secondary

recovery opportunities with exploration upside Advancing Gulf of America water flood projects Opportunistic explorationof Gulf of America and international areas of operation Expanding conventional and unconventional EOR Moving

unconventional EOR from demonstration to commercial scale Engineering a suite of workflows and technologies to improve recovery across global operations Expanding and adding low-cost resources Delaware Basin: New bench development with

existing infrastructure Midland Basin: New Barnett expansion with leading well performance and ultra-low development cost due to existing position Powder River Basin and Central Basin Platform: Creating opportunities in existing operating

areas through superior subsurface characterization PROGRESS ADVANCED RECOVERY TECHNOLOGIES ACCELERATE U.S. ONSHORE UNCONVENTIONAL VALUE Progressing integrated technologies in CO2, Power and Midstream to enable differentiated resource

recovery and value STRENGTHEN GLOBAL CONVENTIONAL PORTFOLIO

Transaction advances return of capital program 6 Sustainable and growing

dividend Immediate debt repayment of ~$6.5 B Achieves post-CrownRock debt target of <$15 B Opportunistic multi-year share repurchase program Preferred equity redemption expected to commence in August 2029 Likely preceded by cash build

on balance sheet Expect to retire remaining debt at maturity 01 02 03 04 05 ENABLING Enhanced shareholder returns Enterprise value rebalancing Strategy to maintain spend flexibility based on market conditions

“This transaction strengthens our financial position and catalyzes a significant

resource opportunity we’ve been building in our oil and gas business for the last decade. I’m incredibly proud of the impressive work the team has done to create this strategic opportunity that will unlock 20+ years of low-cost resource

runway and deliver meaningful near and long-term value.” VICKI HOLLUBPresident & CEO