Shareholder Report

|

6 Months Ended |

|

Jul. 31, 2025

USD ($)

Holding

|

|---|

| Shareholder Report [Line Items] |

|

|

| Document Type |

N-CSRS

|

|

| Amendment Flag |

false

|

|

| Registrant Name |

SEI DAILY INCOME TRUST

|

|

| Entity Central Index Key |

0000701939

|

|

| Entity Investment Company Type |

N-1A

|

|

| Document Period End Date |

Jul. 31, 2025

|

|

| C000018365 |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Government Fund

|

|

| Class Name |

Institutional Class Shares

|

|

| Trading Symbol |

SEOXX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about Institutional Class Shares of the Government Fund (the "Fund") for the period from February 1, 2025 to July 31, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

Semi-Annual Shareholder Report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at https://www.seic.com/mutual-fund-documentation/prospectuses-and-reports. You can also request this information by contacting us at 610-676-1000.

|

|

| Additional Information Phone Number |

610-676-1000

|

|

| Additional Information Website |

https://www.seic.com/mutual-fund-documentation/prospectuses-and-reports

|

|

| Expenses [Text Block] |

What were the Fund costs for the last six months?(based on a hypothetical $10,000 investment) Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

Government Fund, Institutional Class Shares | $11 | 0.21%Footnote Reference(1) |

|---|

| Footnote | Description | Footnote(1) | The expense ratio includes a proxy fee expense. Had this expense been excluded the ratio would have been 0.20%. |

|

|

| Expenses Paid, Amount |

$ 11

|

|

| Expense Ratio, Percent |

0.21%

|

[1] |

| AssetsNet |

$ 6,233,994,000

|

|

| Holdings Count | Holding |

116

|

|

| Advisory Fees Paid, Amount |

$ 2,178

|

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics as of July 31, 2025 | Total Net Assets (000's) | Number of Holdings | Total Advisory Fees Paid (000's) |

|---|

| $6,233,994 | 116 | $2,178 |

|---|

|

|

| Holdings [Text Block] |

Asset WeightingsFootnote Reference*Value | Value |

|---|

U.S. Government Agency Obligations | 18.1% | Repurchase Agreements | 28.2% | U.S. Treasury Obligations | 53.4% |

| Footnote | Description | Footnote* | Percentages are calculated based on total net assets. |

|

|

| Largest Holdings [Text Block] |

Holding Name | Coupon Rate | Maturity Date | Percentage of Total

Net Assets |

|---|

Natixis S.A. | 4.360%

| 08/01/25

| 3.4% | U.S. Treasury Bills | 4.291%

| 09/11/25

| 3.4% | U.S. Treasury Bills | 4.248%

| 08/19/25

| 3.3% | U.S. Treasury Bills | 4.244%

| 08/07/25

| 3.2% | Barclays Bank | 4.360%

| 08/01/25

| 3.2% | Mizuho Securities | 4.370%

| 08/01/25

| 3.2% | MUFG Securities Americas | 4.360%

| 08/01/25

| 3.2% | Citigroup Global Markets | 4.360%

| 08/01/25

| 3.1% | U.S. Treasury Bills | 4.258%

| 09/09/25

| 3.1% | BNP Paribas | 4.360%

| 08/01/25

| 2.8% |

|

|

| C000162326 |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Government Fund

|

|

| Class Name |

Admin Class Shares

|

|

| Trading Symbol |

GFAXX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about Admin Class Shares of the Government Fund (the "Fund") for the period from February 1, 2025 to July 31, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

Semi-Annual Shareholder Report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at https://www.seic.com/mutual-fund-documentation/prospectuses-and-reports. You can also request this information by contacting us at 610-676-1000.

|

|

| Additional Information Phone Number |

610-676-1000

|

|

| Additional Information Website |

https://www.seic.com/mutual-fund-documentation/prospectuses-and-reports

|

|

| Expenses [Text Block] |

What were the Fund costs for the last six months?(based on a hypothetical $10,000 investment) Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

Government Fund, Admin Class Shares | $19 | 0.37%Footnote Reference(1) |

|---|

| Footnote | Description | Footnote(1) | The expense ratio includes a proxy fee expense. Had this expense been excluded the ratio would have been 0.35%. |

|

|

| Expenses Paid, Amount |

$ 19

|

|

| Expense Ratio, Percent |

0.37%

|

[2] |

| AssetsNet |

$ 6,233,994,000

|

|

| Holdings Count | Holding |

116

|

|

| Advisory Fees Paid, Amount |

$ 2,178

|

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics as of July 31, 2025 | Total Net Assets (000's) | Number of Holdings | Total Advisory Fees Paid (000's) |

|---|

| $6,233,994 | 116 | $2,178 |

|---|

|

|

| Holdings [Text Block] |

Asset WeightingsFootnote Reference*Value | Value |

|---|

U.S. Government Agency Obligations | 18.1% | Repurchase Agreements | 28.2% | U.S. Treasury Obligations | 53.4% |

| Footnote | Description | Footnote* | Percentages are calculated based on total net assets. |

|

|

| Largest Holdings [Text Block] |

Holding Name | Coupon Rate | Maturity Date | Percentage of Total

Net Assets |

|---|

Natixis S.A. | 4.360%

| 08/01/25

| 3.4% | U.S. Treasury Bills | 4.291%

| 09/11/25

| 3.4% | U.S. Treasury Bills | 4.248%

| 08/19/25

| 3.3% | U.S. Treasury Bills | 4.244%

| 08/07/25

| 3.2% | Barclays Bank | 4.360%

| 08/01/25

| 3.2% | Mizuho Securities | 4.370%

| 08/01/25

| 3.2% | MUFG Securities Americas | 4.360%

| 08/01/25

| 3.2% | Citigroup Global Markets | 4.360%

| 08/01/25

| 3.1% | U.S. Treasury Bills | 4.258%

| 09/09/25

| 3.1% | BNP Paribas | 4.360%

| 08/01/25

| 2.8% |

|

|

| C000240469 |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Government Fund

|

|

| Class Name |

Wealth Class Shares

|

|

| Trading Symbol |

AABXX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about Wealth Class Shares of the Government Fund (the "Fund") for the period from February 1, 2025 to July 31, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

Semi-Annual Shareholder Report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at https://www.seic.com/mutual-fund-documentation/prospectuses-and-reports. You can also request this information by contacting us at 610-676-1000.

|

|

| Additional Information Phone Number |

610-676-1000

|

|

| Additional Information Website |

https://www.seic.com/mutual-fund-documentation/prospectuses-and-reports

|

|

| Expenses [Text Block] |

What were the Fund costs for the last six months?(based on a hypothetical $10,000 investment) Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

Government Fund, Wealth Class Shares | $19 | 0.37%Footnote Reference(1) |

|---|

| Footnote | Description | Footnote(1) | The expense ratio includes a proxy fee expense. Had this expense been excluded the ratio would have been 0.35%. |

|

|

| Expenses Paid, Amount |

$ 19

|

|

| Expense Ratio, Percent |

0.37%

|

[3] |

| AssetsNet |

$ 6,233,994,000

|

|

| Holdings Count | Holding |

116

|

|

| Advisory Fees Paid, Amount |

$ 2,178

|

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics as of July 31, 2025 | Total Net Assets (000's) | Number of Holdings | Total Advisory Fees Paid (000's) |

|---|

| $6,233,994 | 116 | $2,178 |

|---|

|

|

| Holdings [Text Block] |

Asset WeightingsFootnote Reference*Value | Value |

|---|

U.S. Government Agency Obligations | 18.1% | Repurchase Agreements | 28.2% | U.S. Treasury Obligations | 53.4% |

| Footnote | Description | Footnote* | Percentages are calculated based on total net assets. |

|

|

| Largest Holdings [Text Block] |

Holding Name | Coupon Rate | Maturity Date | Percentage of Total

Net Assets |

|---|

Natixis S.A. | 4.360%

| 08/01/25

| 3.4% | U.S. Treasury Bills | 4.291%

| 09/11/25

| 3.4% | U.S. Treasury Bills | 4.248%

| 08/19/25

| 3.3% | U.S. Treasury Bills | 4.244%

| 08/07/25

| 3.2% | Barclays Bank | 4.360%

| 08/01/25

| 3.2% | Mizuho Securities | 4.370%

| 08/01/25

| 3.2% | MUFG Securities Americas | 4.360%

| 08/01/25

| 3.2% | Citigroup Global Markets | 4.360%

| 08/01/25

| 3.1% | U.S. Treasury Bills | 4.258%

| 09/09/25

| 3.1% | BNP Paribas | 4.360%

| 08/01/25

| 2.8% |

|

|

| C000018374 |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Government II Fund

|

|

| Class Name |

Class F Shares

|

|

| Trading Symbol |

TCGXX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about Class F Shares of the Government II Fund (the "Fund") for the period from February 1, 2025 to July 31, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

Semi-Annual Shareholder Report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at https://www.seic.com/mutual-fund-documentation/prospectuses-and-reports. You can also request this information by contacting us at 610-676-1000.

|

|

| Additional Information Phone Number |

610-676-1000

|

|

| Additional Information Website |

https://www.seic.com/mutual-fund-documentation/prospectuses-and-reports

|

|

| Expenses [Text Block] |

What were the Fund costs for the last six months?(based on a hypothetical $10,000 investment) Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

Government II Fund, Class F Shares | $11 | 0.21%Footnote Reference(1) |

|---|

| Footnote | Description | Footnote(1) | The expense ratio includes a proxy fee expense. Had this expense been excluded the ratio would have been 0.20%. |

|

|

| Expenses Paid, Amount |

$ 11

|

|

| Expense Ratio, Percent |

0.21%

|

[4] |

| AssetsNet |

$ 1,473,396,000

|

|

| Holdings Count | Holding |

103

|

|

| Advisory Fees Paid, Amount |

$ 342

|

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics as of July 31, 2025 | Total Net Assets (000's) | Number of Holdings | Total Advisory Fees Paid (000's) |

|---|

| $1,473,396 | 103 | $342 |

|---|

|

|

| Holdings [Text Block] |

Asset WeightingsFootnote Reference*Value | Value |

|---|

U.S. Government Agency Obligations | 41.3% | U.S. Treasury Obligations | 60.0% |

| Footnote | Description | Footnote* | Percentages are calculated based on total net assets. |

|

|

| Largest Holdings [Text Block] |

Holding Name | Coupon Rate | Maturity Date | Percentage of Total

Net Assets |

|---|

FFCB | 0.040%

| 08/07/25

| 6.8% | U.S. Treasury Bills | 4.253%

| 09/04/25

| 5.7% | U.S. Treasury Bills | 4.227%

| 08/07/25

| 4.8% | U.S. Treasury Bills | 4.293%

| 08/14/25

| 4.8% | U.S. Treasury Bills | 4.273%

| 09/02/25

| 4.7% | FHLB, SOFRRATE + 0.005% | 4.345%

| 10/27/25

| 4.1% | U.S. Treasury Bills | 4.284%

| 08/12/25

| 3.6% | U.S. Treasury Notes, USBMMY3M + 0.205% | 4.414%

| 10/31/26

| 3.4% | FFCB | 0.000%

| 08/06/25

| 3.4% | FFCB | 1.021%

| 08/08/25

| 3.4% |

|

|

| C000018368 |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Treasury II Fund

|

|

| Class Name |

Class F Shares

|

|

| Trading Symbol |

SCPXX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about Class F Shares of the Treasury II Fund (the "Fund") for the period from February 1, 2025 to July 31, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

Semi-Annual Shareholder Report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at https://www.seic.com/mutual-fund-documentation/prospectuses-and-reports. You can also request this information by contacting us at 610-676-1000.

|

|

| Additional Information Phone Number |

610-676-1000

|

|

| Additional Information Website |

https://www.seic.com/mutual-fund-documentation/prospectuses-and-reports

|

|

| Expenses [Text Block] |

What were the Fund costs for the last six months?(based on a hypothetical $10,000 investment) Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

Treasury II Fund, Class F Shares | $11 | 0.21%Footnote Reference(1) |

|---|

| Footnote | Description | Footnote(1) | The expense ratio includes a proxy fee expense. Had this expense been excluded the ratio would have been 0.20%. |

|

|

| Expenses Paid, Amount |

$ 11

|

|

| Expense Ratio, Percent |

0.21%

|

[5] |

| AssetsNet |

$ 1,222,106,000

|

|

| Holdings Count | Holding |

55

|

|

| Advisory Fees Paid, Amount |

$ 281

|

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics as of July 31, 2025 | Total Net Assets (000's) | Number of Holdings | Total Advisory Fees Paid (000's) |

|---|

| $1,222,106 | 55 | $281 |

|---|

|

|

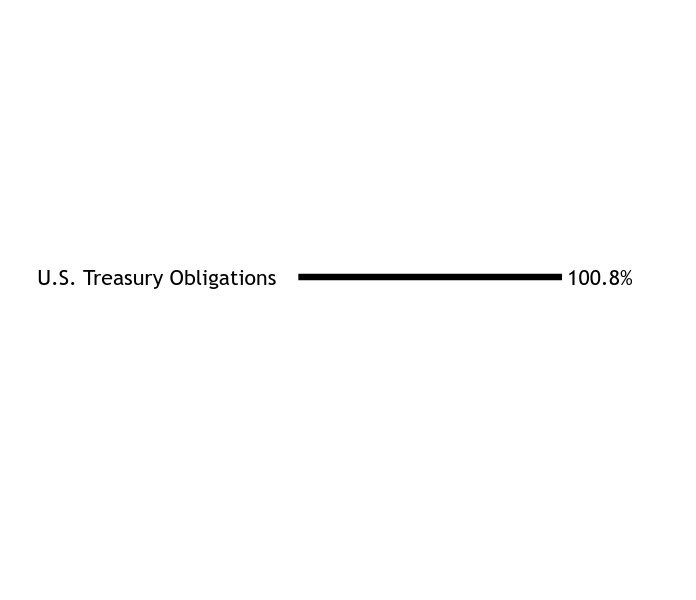

| Holdings [Text Block] |

Asset WeightingsFootnote Reference*Value | Value |

|---|

U.S. Treasury Obligations | 100.8% |

| Footnote | Description | Footnote* | Percentages are calculated based on total net assets. |

|

|

| Largest Holdings [Text Block] |

Holding Name | Coupon Rate | Maturity Date | Percentage of Total

Net Assets |

|---|

U.S. Treasury Bills | 4.268%

| 09/04/25

| 12.7% | U.S. Treasury Bills | 4.276%

| 08/28/25

| 10.2% | U.S. Treasury Bills | 4.289%

| 09/16/25

| 9.6% | U.S. Treasury Bills | 4.301%

| 09/02/25

| 5.7% | U.S. Treasury Bills | 4.286%

| 08/21/25

| 5.6% | U.S. Treasury Bill - When Issued | 4.279%

| 09/18/25

| 5.2% | U.S. Treasury Bills | 4.268%

| 08/26/25

| 4.4% | U.S. Treasury Notes, USBMMY3M + 0.098% | 4.307%

| 01/31/27

| 4.4% | U.S. Treasury Bills | 4.258%

| 09/09/25

| 3.8% | U.S. Treasury Bills | 4.290%

| 11/12/25

| 3.7% |

|

|

| C000022551 |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Ultra Short Duration Bond Fund

|

|

| Class Name |

Class F Shares

|

|

| Trading Symbol |

SECPX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about Class F Shares of the Ultra Short Duration Bond Fund (the "Fund") for the period from February 1, 2025 to July 31, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

Semi-Annual Shareholder Report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at https://www.seic.com/mutual-fund-documentation/prospectuses-and-reports. You can also request this information by contacting us at 610-676-1000.

|

|

| Additional Information Phone Number |

610-676-1000

|

|

| Additional Information Website |

https://www.seic.com/mutual-fund-documentation/prospectuses-and-reports

|

|

| Expenses [Text Block] |

What were the Fund costs for the last six months?(based on a hypothetical $10,000 investment) Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

Ultra Short Duration Bond Fund, Class F Shares | $21 | 0.42%Footnote Reference(1) |

|---|

| Footnote | Description | Footnote(1) | The expense ratio includes a proxy fee expense. Had this expense been excluded the ratio would have been 0.38%. |

|

|

| Expenses Paid, Amount |

$ 21

|

|

| Expense Ratio, Percent |

0.42%

|

[6] |

| AssetsNet |

$ 199,553,000

|

|

| Holdings Count | Holding |

466

|

|

| Advisory Fees Paid, Amount |

$ 97

|

|

| InvestmentCompanyPortfolioTurnover |

45.00%

|

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics as of July 31, 2025 | Total Net Assets (000's) | Number of Holdings | Total Advisory Fees Paid (000's) | Portfolio Turnover Rate |

|---|

| $199,553 | 466 | $97 | 45% |

|---|

|

|

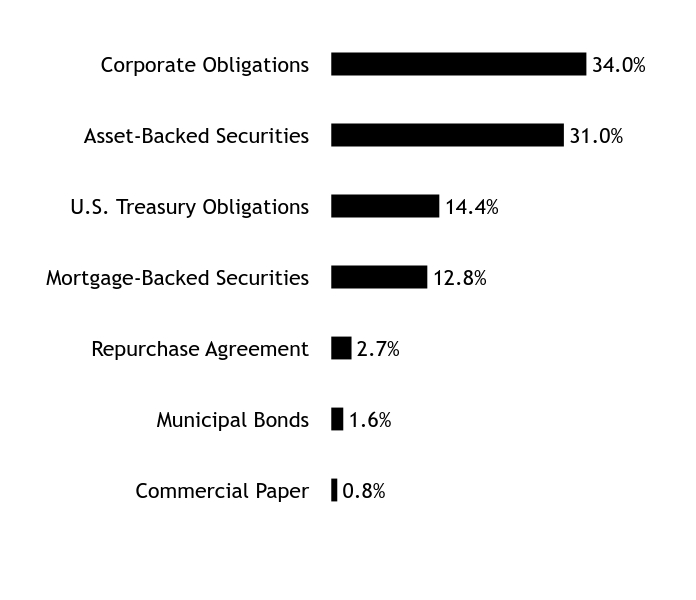

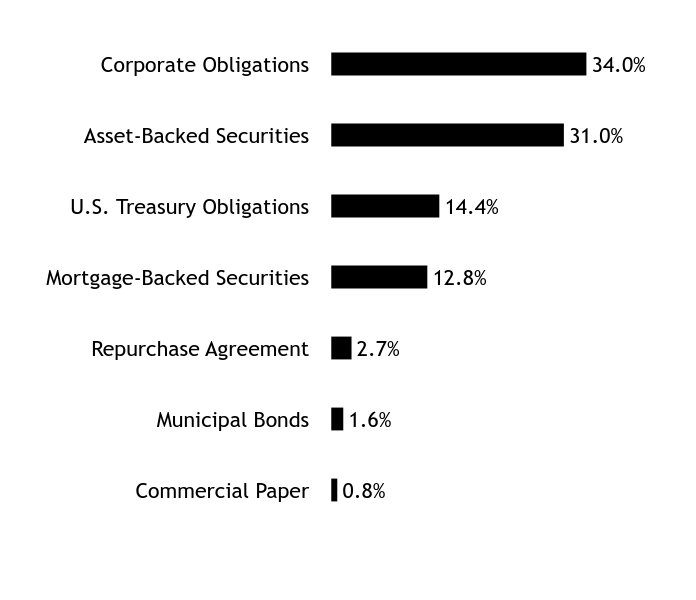

| Holdings [Text Block] |

Asset WeightingsFootnote Reference*Value | Value |

|---|

Commercial Paper | 0.8% | Municipal Bonds | 1.6% | Repurchase Agreement | 2.7% | Mortgage-Backed Securities | 12.8% | U.S. Treasury Obligations | 14.4% | Asset-Backed Securities | 31.0% | Corporate Obligations | 34.0% |

| Footnote | Description | Footnote* | Percentages are calculated based on total net assets. |

|

|

| Largest Holdings [Text Block] |

Holding Name | Coupon Rate | Maturity Date | Percentage of Total

Net AssetsFootnote Reference(A) |

|---|

U.S. Treasury Notes | 3.250%

| 06/30/27

| 3.7% | U.S. Treasury Notes | 1.625%

| 11/30/26

| 2.4% | U.S. Treasury Bill - When Issued | 4.227%

| 09/18/25

| 2.3% | U.S. Treasury Notes | 1.250%

| 12/31/26

| 2.1% | U.S. Treasury Notes | 2.500%

| 02/28/26

| 1.5% | U.S. Treasury Notes | 3.750%

| 08/31/26

| 1.0% | Truist Bank, SOFRRATE + 0.590% | 4.671%

| 05/20/27

| 0.9% | Golden Credit Card Trust, Ser 2021-1A, Cl A | 1.140%

| 08/15/28

| 0.8% | JPMorgan Chase, SOFRRATE + 0.765% | 1.470%

| 09/22/27

| 0.8% | Morgan Stanley, SOFRRATE + 0.858% | 1.512%

| 07/20/27

| 0.8% |

| Footnote | Description | Footnote(A) | Repurchase Agreements and Short-Term Investments are not shown in the top ten chart. |

|

|

| C000158211 |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Ultra Short Duration Bond Fund

|

|

| Class Name |

Class Y Shares

|

|

| Trading Symbol |

SECYX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about Class Y Shares of the Ultra Short Duration Bond Fund (the "Fund") for the period from February 1, 2025 to July 31, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

Semi-Annual Shareholder Report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at https://www.seic.com/mutual-fund-documentation/prospectuses-and-reports. You can also request this information by contacting us at 610-676-1000.

|

|

| Additional Information Phone Number |

610-676-1000

|

|

| Additional Information Website |

https://www.seic.com/mutual-fund-documentation/prospectuses-and-reports

|

|

| Expenses [Text Block] |

What were the Fund costs for the last six months?(based on a hypothetical $10,000 investment) Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

Ultra Short Duration Bond Fund, Class Y Shares | $17 | 0.34%Footnote Reference(1) |

|---|

| Footnote | Description | Footnote(1) | The expense ratio includes a proxy fee expense. Had this expense been excluded the ratio would have been 0.30%. |

|

|

| Expenses Paid, Amount |

$ 17

|

|

| Expense Ratio, Percent |

0.34%

|

[7] |

| AssetsNet |

$ 199,553,000

|

|

| Holdings Count | Holding |

466

|

|

| Advisory Fees Paid, Amount |

$ 97

|

|

| InvestmentCompanyPortfolioTurnover |

45.00%

|

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics as of July 31, 2025 | Total Net Assets (000's) | Number of Holdings | Total Advisory Fees Paid (000's) | Portfolio Turnover Rate |

|---|

| $199,553 | 466 | $97 | 45% |

|---|

|

|

| Holdings [Text Block] |

Asset WeightingsFootnote Reference*Value | Value |

|---|

Commercial Paper | 0.8% | Municipal Bonds | 1.6% | Repurchase Agreement | 2.7% | Mortgage-Backed Securities | 12.8% | U.S. Treasury Obligations | 14.4% | Asset-Backed Securities | 31.0% | Corporate Obligations | 34.0% |

| Footnote | Description | Footnote* | Percentages are calculated based on total net assets. |

|

|

| Largest Holdings [Text Block] |

Holding Name | Coupon Rate | Maturity Date | Percentage of Total

Net AssetsFootnote Reference(A) |

|---|

U.S. Treasury Notes | 3.250%

| 06/30/27

| 3.7% | U.S. Treasury Notes | 1.625%

| 11/30/26

| 2.4% | U.S. Treasury Bill - When Issued | 4.227%

| 09/18/25

| 2.3% | U.S. Treasury Notes | 1.250%

| 12/31/26

| 2.1% | U.S. Treasury Notes | 2.500%

| 02/28/26

| 1.5% | U.S. Treasury Notes | 3.750%

| 08/31/26

| 1.0% | Truist Bank, SOFRRATE + 0.590% | 4.671%

| 05/20/27

| 0.9% | Golden Credit Card Trust, Ser 2021-1A, Cl A | 1.140%

| 08/15/28

| 0.8% | JPMorgan Chase, SOFRRATE + 0.765% | 1.470%

| 09/22/27

| 0.8% | Morgan Stanley, SOFRRATE + 0.858% | 1.512%

| 07/20/27

| 0.8% |

| Footnote | Description | Footnote(A) | Repurchase Agreements and Short-Term Investments are not shown in the top ten chart. |

|

|

| C000022552 |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Short-Duration Government Fund

|

|

| Class Name |

Class F Shares

|

|

| Trading Symbol |

TCSGX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about Class F Shares of the Short-Duration Government Fund (the "Fund") for the period from February 1, 2025 to July 31, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

Semi-Annual Shareholder Report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at https://www.seic.com/mutual-fund-documentation/prospectuses-and-reports. You can also request this information by contacting us at 610-676-1000.

|

|

| Additional Information Phone Number |

610-676-1000

|

|

| Additional Information Website |

https://www.seic.com/mutual-fund-documentation/prospectuses-and-reports

|

|

| Expenses [Text Block] |

What were the Fund costs for the last six months?(based on a hypothetical $10,000 investment) Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

Short-Duration Government Fund, Class F Shares | $24 | 0.48%Footnote Reference(1) |

|---|

| Footnote | Description | Footnote(1) | The expense ratio includes a proxy fee expense. Had this expense been excluded the ratio would have been 0.47%. |

|

|

| Expenses Paid, Amount |

$ 24

|

|

| Expense Ratio, Percent |

0.48%

|

[8] |

| AssetsNet |

$ 591,405,000

|

|

| Holdings Count | Holding |

401

|

|

| Advisory Fees Paid, Amount |

$ 286

|

|

| InvestmentCompanyPortfolioTurnover |

2.00%

|

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics as of July 31, 2025 | Total Net Assets (000's) | Number of Holdings | Total Advisory Fees Paid (000's) | Portfolio Turnover Rate |

|---|

| $591,405 | 401 | $286 | 2% |

|---|

|

|

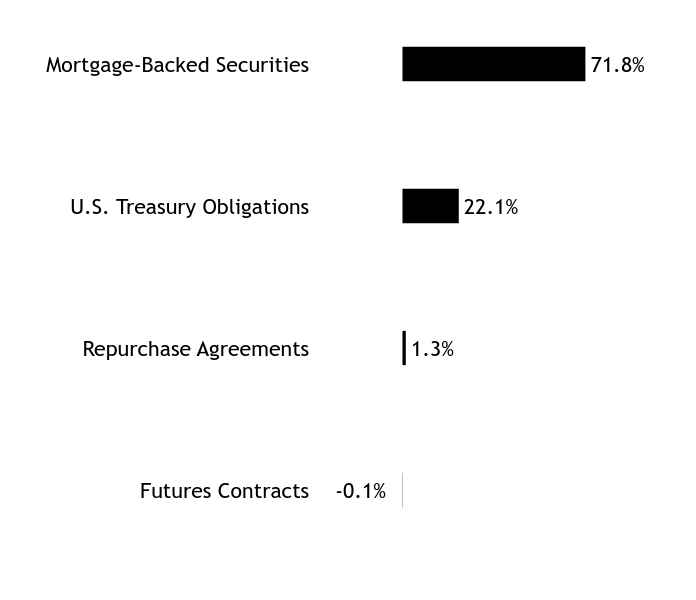

| Holdings [Text Block] |

Asset WeightingsFootnote Reference*Value | Value |

|---|

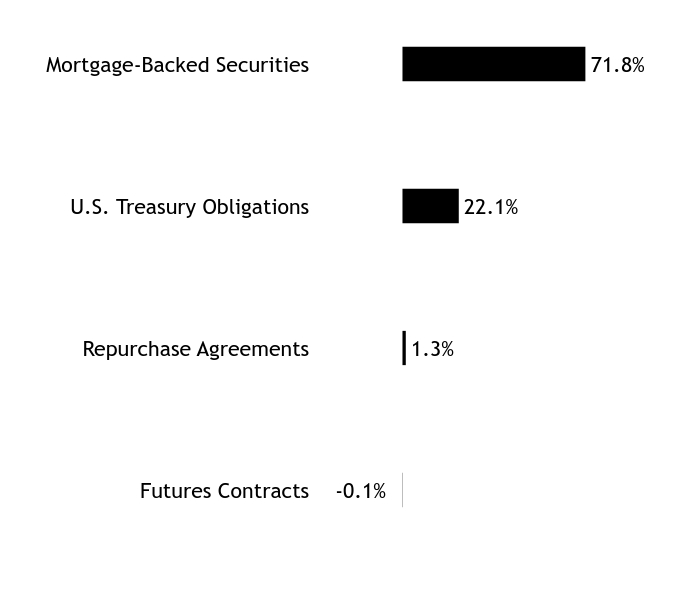

Futures Contracts | -0.1% | Repurchase Agreements | 1.3% | U.S. Treasury Obligations | 22.1% | Mortgage-Backed Securities | 71.8% |

| Footnote | Description | Footnote* | Percentages are calculated based on total net assets. |

|

|

| Largest Holdings [Text Block] |

Holding Name | Coupon Rate | Maturity Date | Percentage of Total

Net AssetsFootnote Reference(A) |

|---|

U.S. Treasury Notes | 1.125%

| 10/31/26

| 10.1% | U.S. Treasury Notes | 4.375%

| 12/15/26

| 8.1% | U.S. Treasury Notes | 3.750%

| 04/15/28

| 4.0% | FHLMC Multifamily Structured Pass-Through Certificates, Ser K516, Cl A2 | 5.477%

| 01/25/29

| 2.4% | FNMA REMIC, Ser 2024-41, Cl DA | 5.500%

| 12/25/51

| 1.7% | GNMA, Ser 2022-87, Cl CA | 2.500%

| 09/20/36

| 1.4% | FNMA REMIC, Ser 2013-121, Cl FA, SOFR30A + 0.514% | 4.865%

| 12/25/43

| 1.3% | FHLMC REMIC, Ser 2011-3930, Cl KE | 4.000%

| 09/15/41

| 1.2% | FHLMC REMIC, Ser 2025-5538, Cl AV | 5.000%

| 04/25/36

| 1.2% | FNMA REMIC, Ser 2018-55, Cl PA | 3.500%

| 01/25/47

| 1.2% |

| Footnote | Description | Footnote(A) | Repurchase Agreements are not shown in the top ten chart. |

|

|

| C000147419 |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Short-Duration Government Fund

|

|

| Class Name |

Class Y Shares

|

|

| Trading Symbol |

SDGFX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about Class Y Shares of the Short-Duration Government Fund (the "Fund") for the period from February 1, 2025 to July 31, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

Semi-Annual Shareholder Report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at https://www.seic.com/mutual-fund-documentation/prospectuses-and-reports. You can also request this information by contacting us at 610-676-1000.

|

|

| Additional Information Phone Number |

610-676-1000

|

|

| Additional Information Website |

https://www.seic.com/mutual-fund-documentation/prospectuses-and-reports

|

|

| Expenses [Text Block] |

What were the Fund costs for the last six months?(based on a hypothetical $10,000 investment) Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

Short-Duration Government Fund, Class Y Shares | $17 | 0.34%Footnote Reference(1) |

|---|

| Footnote | Description | Footnote(1) | The expense ratio includes a proxy fee expense. Had this expense been excluded the ratio would have been 0.33%. |

|

|

| Expenses Paid, Amount |

$ 17

|

|

| Expense Ratio, Percent |

0.34%

|

[9] |

| AssetsNet |

$ 591,405,000

|

|

| Holdings Count | Holding |

401

|

|

| Advisory Fees Paid, Amount |

$ 286

|

|

| InvestmentCompanyPortfolioTurnover |

2.00%

|

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics as of July 31, 2025 | Total Net Assets (000's) | Number of Holdings | Total Advisory Fees Paid (000's) | Portfolio Turnover Rate |

|---|

| $591,405 | 401 | $286 | 2% |

|---|

|

|

| Holdings [Text Block] |

Asset WeightingsFootnote Reference*Value | Value |

|---|

Futures Contracts | -0.1% | Repurchase Agreements | 1.3% | U.S. Treasury Obligations | 22.1% | Mortgage-Backed Securities | 71.8% |

| Footnote | Description | Footnote* | Percentages are calculated based on total net assets. |

|

|

| Largest Holdings [Text Block] |

Holding Name | Coupon Rate | Maturity Date | Percentage of Total

Net AssetsFootnote Reference(A) |

|---|

U.S. Treasury Notes | 1.125%

| 10/31/26

| 10.1% | U.S. Treasury Notes | 4.375%

| 12/15/26

| 8.1% | U.S. Treasury Notes | 3.750%

| 04/15/28

| 4.0% | FHLMC Multifamily Structured Pass-Through Certificates, Ser K516, Cl A2 | 5.477%

| 01/25/29

| 2.4% | FNMA REMIC, Ser 2024-41, Cl DA | 5.500%

| 12/25/51

| 1.7% | GNMA, Ser 2022-87, Cl CA | 2.500%

| 09/20/36

| 1.4% | FNMA REMIC, Ser 2013-121, Cl FA, SOFR30A + 0.514% | 4.865%

| 12/25/43

| 1.3% | FHLMC REMIC, Ser 2011-3930, Cl KE | 4.000%

| 09/15/41

| 1.2% | FHLMC REMIC, Ser 2025-5538, Cl AV | 5.000%

| 04/25/36

| 1.2% | FNMA REMIC, Ser 2018-55, Cl PA | 3.500%

| 01/25/47

| 1.2% |

| Footnote | Description | Footnote(A) | Repurchase Agreements are not shown in the top ten chart. |

|

|

| C000022554 |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

GNMA Fund

|

|

| Class Name |

Class F Shares

|

|

| Trading Symbol |

SEGMX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about Class F Shares of the GNMA Fund (the "Fund") for the period from February 1, 2025 to July 31, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

Semi-Annual Shareholder Report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at https://www.seic.com/mutual-fund-documentation/prospectuses-and-reports. You can also request this information by contacting us at 610-676-1000.

|

|

| Additional Information Phone Number |

610-676-1000

|

|

| Additional Information Website |

https://www.seic.com/mutual-fund-documentation/prospectuses-and-reports

|

|

| Expenses [Text Block] |

What were the Fund costs for the last six months?(based on a hypothetical $10,000 investment) Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

GNMA Fund, Class F Shares | $33 | 0.66% |

|---|

|

|

| Expenses Paid, Amount |

$ 33

|

|

| Expense Ratio, Percent |

0.66%

|

|

| AssetsNet |

$ 13,969,000

|

|

| Holdings Count | Holding |

269

|

|

| Advisory Fees Paid, Amount |

$ 7

|

|

| InvestmentCompanyPortfolioTurnover |

51.00%

|

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics as of July 31, 2025 | Total Net Assets (000's) | Number of Holdings | Total Advisory Fees Paid (000's) | Portfolio Turnover Rate |

|---|

| $13,969 | 269 | $7 | 51% |

|---|

|

|

| Holdings [Text Block] |

Sector WeightingsFootnote Reference*Value | Value |

|---|

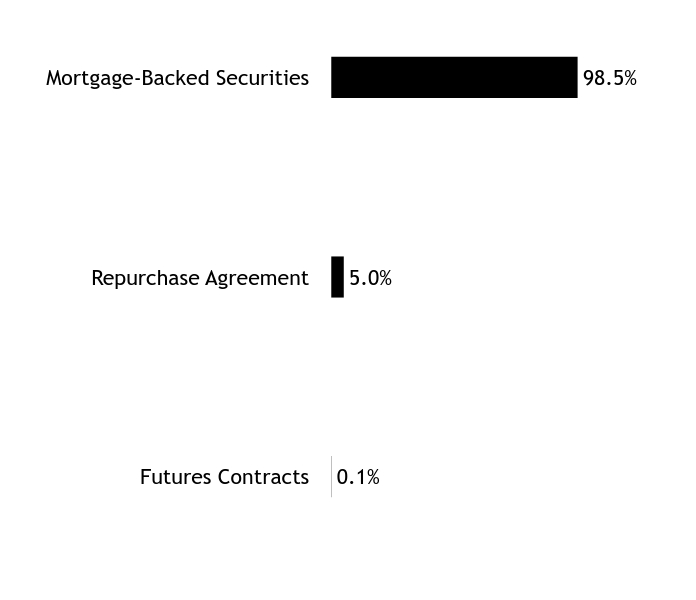

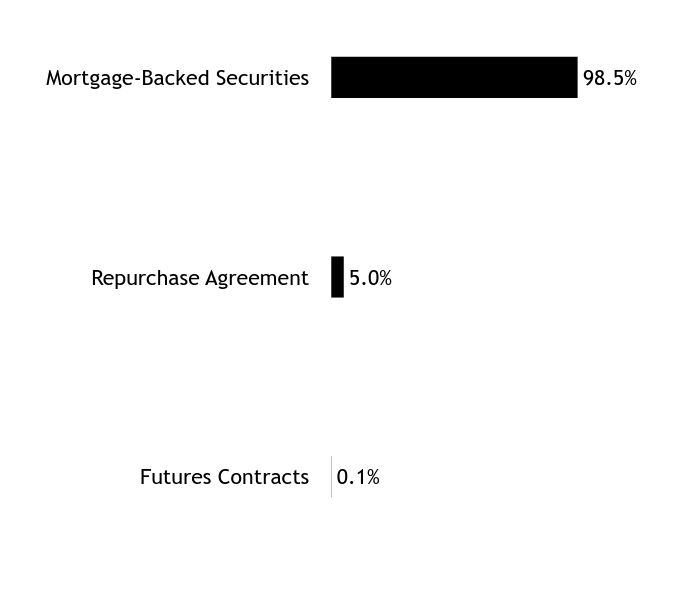

Futures Contracts | 0.1% | Repurchase Agreement | 5.0% | Mortgage-Backed Securities | 98.5% |

| Footnote | Description | Footnote* | Percentages are calculated based on total net assets. |

|

|

| Largest Holdings [Text Block] |

Holding Name | Coupon Rate | Maturity Date | Percentage of Total

Net AssetsFootnote Reference(A) |

|---|

GNMA | 2.500%

| 08/15/55

| 7.9% | GNMA | 2.000%

| 12/20/50

| 7.0% | GNMA | 2.000%

| 08/20/50

| 5.1% | GNMA | 2.500%

| 08/20/50

| 4.6% | GNMA | 3.500%

| 07/20/47

| 4.4% | GNMA | 4.000%

| 09/20/42

| 3.8% | GNMA | 3.000%

| 12/20/50

| 3.7% | GNMA | 3.500%

| 06/20/47

| 2.9% | GNMA | 4.500%

| 01/20/46

| 2.5% | GNMA, Ser 2016-136, Cl PJ | 3.500%

| 01/20/46

| 2.1% |

| Footnote | Description | Footnote(A) | Repurchase Agreements are not shown in the top ten chart. |

|

|

| C000147421 |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

GNMA Fund

|

|

| Class Name |

Class Y Shares

|

|

| Trading Symbol |

SGMYX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about Class Y Shares of the GNMA Fund (the "Fund") for the period from February 1, 2025 to July 31, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

Semi-Annual Shareholder Report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at https://www.seic.com/mutual-fund-documentation/prospectuses-and-reports. You can also request this information by contacting us at 610-676-1000.

|

|

| Additional Information Phone Number |

610-676-1000

|

|

| Additional Information Website |

https://www.seic.com/mutual-fund-documentation/prospectuses-and-reports

|

|

| Expenses [Text Block] |

What were the Fund costs for the last six months?(based on a hypothetical $10,000 investment) Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

GNMA Fund, Class Y Shares | $20 | 0.40% |

|---|

|

|

| Expenses Paid, Amount |

$ 20

|

|

| Expense Ratio, Percent |

0.40%

|

|

| AssetsNet |

$ 13,969,000

|

|

| Holdings Count | Holding |

269

|

|

| Advisory Fees Paid, Amount |

$ 7

|

|

| InvestmentCompanyPortfolioTurnover |

51.00%

|

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics as of July 31, 2025 | Total Net Assets (000's) | Number of Holdings | Total Advisory Fees Paid (000's) | Portfolio Turnover Rate |

|---|

| $13,969 | 269 | $7 | 51% |

|---|

|

|

| Holdings [Text Block] |

Sector WeightingsFootnote Reference*Value | Value |

|---|

Futures Contracts | 0.1% | Repurchase Agreement | 5.0% | Mortgage-Backed Securities | 98.5% |

| Footnote | Description | Footnote* | Percentages are calculated based on total net assets. |

|

|

| Largest Holdings [Text Block] |

Holding Name | Coupon Rate | Maturity Date | Percentage of Total

Net AssetsFootnote Reference(A) |

|---|

GNMA | 2.500%

| 08/15/55

| 7.9% | GNMA | 2.000%

| 12/20/50

| 7.0% | GNMA | 2.000%

| 08/20/50

| 5.1% | GNMA | 2.500%

| 08/20/50

| 4.6% | GNMA | 3.500%

| 07/20/47

| 4.4% | GNMA | 4.000%

| 09/20/42

| 3.8% | GNMA | 3.000%

| 12/20/50

| 3.7% | GNMA | 3.500%

| 06/20/47

| 2.9% | GNMA | 4.500%

| 01/20/46

| 2.5% | GNMA, Ser 2016-136, Cl PJ | 3.500%

| 01/20/46

| 2.1% |

| Footnote | Description | Footnote(A) | Repurchase Agreements are not shown in the top ten chart. |

|

|

|

|