NOTICE OF SPECIAL MEETING

AND

MANAGEMENT INFORMATION CIRCULAR

FOR THE

SPECIAL MEETING OF SECURITYHOLDERS

OF EMX ROYALTY CORPORATION

| Date: | November 4, 2025 |

| Time: | 10:00 A.M. (Vancouver time) |

| Where: | Suite 2200, RBC Place, 885 West Georgia Street |

| Vancouver, British Columbia V6C 3E8 |

|

YOUR VOTE IS IMPORTANT. PLEASE VOTE TODAY This document is important and requires your immediate attention. If you are in any doubt as to how to deal with this document, you should consult with your investment dealer, broker, lawyer or other professional advisor. This document does not constitute an offer or a solicitation to any person in any jurisdiction in which such offer or solicitation is unlawful. If you have any questions or require assistance, please contact EMX Royalty Corporation's proxy solicitation agent and shareholder communications advisor, Laurel Hill Advisory Group, at: Laurel Hill Advisory Group |

![]()

EMX ROYALTY CORPORATION

NOTICE OF SPECIAL MEETING OF SECURITYHOLDERS

| Date: | November 4, 2025 |

| Time: | 10:00 a.m. (Vancouver time) |

| Place: | Suite 2200, RBC Place, 885 West Georgia Street, Vancouver, British Columbia V6C 3E8 |

NOTICE IS HEREBY GIVEN that, pursuant to an order (the "Interim Order") of the Supreme Court of British Columbia (the "Court") dated September 29, 2025, a special meeting (the "Meeting") of the shareholders ("Shareholders") and optionholders who have been issued stock options (each, an "EMX Option") under the EMX Option Plan (as defined below) ("Optionholders", and together with Shareholders, the "Securityholders") of EMX Royalty Corporation ("EMX") will be held on November 4, 2025 beginning at 10:00 a.m. (Vancouver time) and located at the offices of Cassels Brock & Blackwell LLP at Suite 2200, RBC Place, 885 West Georgia Street, Vancouver, British Columbia V6C 3E8, for the following purposes:

(a) to consider and, if deemed advisable, to pass, with or without variation, a special resolution (the "Arrangement Resolution"), the full text of which is set forth in Appendix A to the accompanying management information circular of EMX dated September 29, 2025 (the "Circular"), to approve a plan of arrangement (the "Arrangement") under the provisions of Division 5 of Part 9 of the Business Corporations Act (British Columbia) ("BCBCA") involving EMX, Elemental Altus Royalties Corp. and 1554829 B.C. Ltd.; and

(b) to transact such further and other business as may properly be brought before the Meeting or any adjourned or postponed Meeting.

Specific details of the matters to be put before the Meeting are set forth in the accompanying Circular.

If the Arrangement Resolution is not approved by the Securityholders at the Meeting, the Arrangement will not be completed.

The board of directors of EMX (subject to two directors declaring an interest and abstaining from voting on the matter), after receiving the unanimous recommendation of a special committee comprised solely of independent directors of EMX, unanimously recommends that the Securityholders vote FOR the Arrangement Resolution.

In addition to in person attendance, the Meeting can also be accessed via live webcast at meetnow.global/M2JX4WC. Any Securityholder attending the Meeting via the live webcast will not be able to vote during the Meeting. Only Securityholders or their duly appointed proxyholders who are present in person at the Meeting are able to vote during the Meeting. Accordingly, in order that as many common shares of EMX (each, an "EMX Share") and EMX Options as possible are represented at the Meeting, Securityholders are encouraged to vote their EMX Shares and/or EMX Options via proxy prior to the proxy cut-off time as further described below. The accompanying Circular provides a summary of the information Securityholders will need to attend the Meeting.

The record date for the determination of Securityholders entitled to receive notice of and to vote at the Meeting is September 25, 2025 (the "Record Date"). Only Securityholders whose names have been entered in the register of Securityholders at the close of business on the Record Date will be entitled to receive notice of and to vote at the Meeting.

Each EMX Share entitled to be voted at the Meeting will entitle the holder thereof to one vote per EMX Share at the Meeting. Each EMX Option entitled to be voted at the Meeting will entitle the holder thereof to one vote per EMX Option at the Meeting. The Arrangement Resolution must be approved by (i) at least 66 2/3% of the votes cast by all Shareholders present in person or represented by proxy and entitled to vote at the Meeting; (ii) at least 66 2/3% of the votes cast by all Shareholders and Optionholders present in person or represented by proxy and entitled to vote at the Meeting, voting together as a single class; and (iii) a simple majority of the votes cast by Shareholders present in person or represented by proxy and entitled to vote at the Meeting, excluding votes cast by certain Shareholders required to be excluded under Multilateral Instrument 61-101 - Protection of Minority Security Holders in Special Transactions of the Canadian Securities Administrators.

- 2 -

A Securityholder may attend the Meeting in person or may be represented by proxy. Securityholders that are unable to attend the Meeting (or any adjournment or postponement thereof) in person are requested to date, sign and return the accompanying form of proxy or voting instruction form ("VIF"), as applicable, for use at the Meeting (or at any adjournment or postponement thereof), or alternatively, follow the instructions in such documents to vote electronically. Even if you plan to attend the Meeting in person, you may still vote in advance via proxy. In order to be acted upon at the Meeting, validly completed instruments of proxy must be received by Computershare Investor Services Inc., Attention: Proxy Department, by mail: 320 Bay Street, 14th Floor, Toronto, Ontario, M5H 4A6, or by facsimile: 1-866-249-7775 for toll free within North America or 1-416-263-9524 outside of North America, no later than 10:00 a.m. (Vancouver time) on October 31, 2025 or, if the Meeting is adjourned or postponed, no later than 48 hours (excluding weekends and holidays in the Province of British Columbia) prior to the time of the commencement of any adjournment or postponement of the Meeting. Notwithstanding the foregoing, the Chair of the Meeting has the discretion to accept proxies received after such deadline. The Chair of the Meeting is under no obligation to accept or reject any particular late proxy. The time limit for the deposit of proxies may be waived or extended by the Chair of the Meeting at their discretion, without notice. Registered Securityholders may use the internet (www.investorvote.com) or the telephone (1-866-732-8683) to transmit voting instructions on or before the date and time noted above and may also use the internet to appoint a proxyholder to attend and vote on behalf of such registered Securityholder, at the Meeting.

If you wish that a person other than the management nominees identified on the form of proxy or VIF attend and vote at the Meeting as your proxy and vote your EMX Shares and/or EMX Options, including if you are not a registered Shareholder and wish to appoint yourself as proxyholder to attend and vote at the Meeting, you MUST submit your form of proxy (or proxies) or VIF, as applicable, in accordance with the instructions set out in the Circular. If submitting a proxy or VIF appointing a person other than the management nominees identified, you must return your proxy or VIF in accordance with the instructions set out in the Circular by 10:00 a.m. (Vancouver time) on October 31, 2025 (or, if the Meeting is adjourned or postponed, by the time that is 48 hours prior to the adjourned or postponed Meeting, excluding Saturdays, Sundays and holidays). For information regarding voting or appointing a proxyholder by internet or voting online or by telephone, see the form of proxy and/or the section of the accompanying Circular entitled "Part VIII - General Proxy Matters".

Non-registered holders of EMX Shares who receive these materials through their broker, bank, trust company or other intermediary or nominee should follow the instructions provided by such broker, bank, trust company or other intermediary or nominee.

Securityholders who have questions about the information in the accompanying Circular or who need assistance with voting may contact EMX's proxy solicitation agent and securityholder communications advisor, Laurel Hill Advisory Group, by telephone at 1-877-452-7184 (toll free in North America) or 1-416-304-0211 (collect calls outside North America) or by email at assistance@laurelhill.com.

Pursuant to the Interim Order, registered Shareholders have a right to dissent in respect of the Arrangement Resolution. If the Arrangement Resolution is passed, a registered Shareholder that has duly and validly exercised their dissent rights in accordance with Sections 237 to 247 the BCBCA, as modified by the plan of arrangement, the Interim Order, and any other order of the Court, will be entitled to be paid an amount equal to the fair value of their EMX Shares as of the close of business on the business day before the Arrangement Resolution was approved. This dissent right and the dissent procedures are described in the accompanying Circular.

- 3 -

A registered Shareholder wishing to exercise rights of dissent with respect to the Arrangement must send to EMX a written objection to the Arrangement Resolution, which written objection must be sent to EMX (i) c/o Cassels Brock & Blackwell LLP, Suite 2200, RBC Place, 885 West Georgia Street, Vancouver, British Columbia V6C 3E8 (Attention: Jessica Lewis) and (ii) with a copy by email to jlewis@cassels.com, to be received by no later than 5:00 p.m. (Vancouver time) on October 31, 2025 or, in the case of any adjournment or postponement of the Meeting, by no later than 5:00 p.m. (Vancouver time) on the day that is two business days prior to the date of the adjourned or postponed Meeting, and must otherwise strictly comply with the dissent procedures set forth in Sections 237 to 247 of the BCBCA, as modified by the plan of arrangement, the Interim Order, and any other order of the Court.

Failure to strictly comply with the dissent procedures described in the Circular may result in the loss of any dissent rights. See the section entitled "Part I - The Arrangement - Right to Dissent" and Appendix L, "Section 237 through Section 247 of the Business Corporations Act (British Columbia)" in the accompanying Circular. Any Shareholder wishing to exercise Dissent Rights should seek independent legal advice.

The proxyholder has discretion under the accompanying form of proxy or VIF with respect to any amendments or variations of the matter of business to be acted on at the Meeting or any other matters properly brought before the Meeting or any adjournment or postponement thereof, in each instance, to the extent permitted by law, whether or not the amendment, variation or other matter that comes before the Meeting is routine or contested. As of the date hereof, management of EMX knows of no amendments, variations or other matters to come before the Meeting other than the matters set forth in this Notice of Special Meeting. Securityholders that are planning on returning the accompanying form of proxy or VIF are encouraged to review the accompanying Circular carefully before submitting their form of proxy or VIF.

- 4 -

| Registered Securityholders | Non-Registered Shareholders | ||

| EMX Shares and/or EMX Options held in own name and represented by a physical certificate or DRS. |

EMX Shares held with a broker, bank or other intermediary. |

||

|

Internet | www.investorvote.com | www.proxyvote.com |

|

Telephone | 1-866-732-8683 | Dial the applicable number listed on the voting instruction form. |

|

Return the proxy form in the enclosed postage paid envelope. | Return the voting instruction form in the enclosed postage paid envelope. |

Dated at Vancouver, British Columbia, the 29th day of September, 2025.

| ON BEHALF OF THE BOARD | |

| (signed) "Michael Winn" | |

| Michael Winn | |

| Executive Chairman and Director |

TABLE OF CONTENTS

- 2 -

- 3 -

![]()

EMX ROYALTY CORPORATION

LETTER TO SECURITYHOLDERS

September 29, 2025

Dear Fellow Securityholders:

You are invited to attend a special meeting (the "Meeting") of the shareholders ("Shareholders") and optionholders who have been issued stock options (each, an "EMX Option") under the EMX Option Plan (as defined below) ("Optionholders", and together with Shareholders, the "Securityholders") of EMX Royalty Corporation ("EMX") to be held on November 4, 2025 beginning at 10:00 a.m. (Vancouver time) and located at the offices of Cassels Brock & Blackwell LLP at Suite 2200, RBC Place, 885 West Georgia Street, Vancouver, British Columbia V6C 3E8. The Meeting can also be accessed via live webcast at meetnow.global/M2JX4WC. Any Securityholder attending the live webcast will not be able to vote during the Meeting. Only Securityholders or their duly appointed proxyholders who are present in person at the Meeting will be able to vote during the Meeting.

At the Meeting, you will be asked to consider and, if deemed advisable, to pass a special resolution to approve the proposed plan of arrangement (the "Arrangement") under the Business Corporations Act (British Columbia) involving EMX and Elemental Altus Royalties Corp. ("Elemental Altus") and 1554829 B.C. Ltd. ("Acquireco"). Please complete the enclosed form of proxy or voting instruction form ("VIF") and, in the case of a form of proxy, submit it to our transfer agent and registrar, Computershare Investor Services Inc. and, in the case of a VIF, submit it as instructed on such form or, alternatively, follow the instructions in such documents to vote electronically, as soon as possible but no later than 10:00 a.m. (Vancouver time) on October 31, 2025, or if the Meeting is adjourned or postponed, not later than 48 hours (excluding weekends and holidays in the Province of British Columbia) prior to the time of the commencement of any adjourned or postponed Meeting.

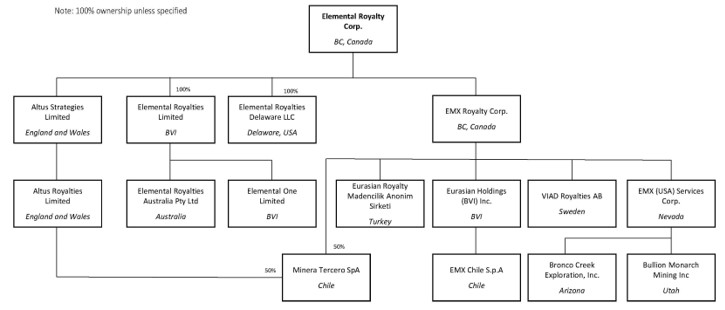

The Arrangement

On September 4, 2025, EMX, Elemental Altus and Acquireco entered into an arrangement agreement (the "Arrangement Agreement"). Pursuant to the Arrangement Agreement and the accompanying plan of arrangement (the "Plan of Arrangement"), Elemental Altus has agreed to, indirectly through an amalgamation of EMX with Acquireco, acquire all of the issued and outstanding common shares of EMX ("EMX Shares") for 0.2822 (the "Exchange Ratio") Elemental Altus common shares (each, an "Elemental Altus Share") for each EMX Share (the "Consideration"). Optionholders will receive replacement options of EMX ("Replacement Options"), with each Replacement Option being exercisable to purchase from Elemental Altus a number of Elemental Altus Shares equal to the number of EMX Shares subject to such EMX Option immediately prior to the effective time of the Arrangement multiplied by the Exchange Ratio (rounded down to the nearest whole number of Elemental Altus Shares) at an exercise price per Elemental Altus Share being the exercise price per EMX Share underlying such EMX Option immediately prior to the effective time of the Arrangement divided by the Exchange Ratio (rounded up to the nearest whole cent). Immediately following completion of the Arrangement and the concurrent Elemental Altus Financing (as defined below), subject to certain assumptions including that no additional EMX Shares are issued prior to the closing date of the Arrangement and that there are no Shareholders who exercise dissent rights, former Shareholders (including former holders of restricted share units of EMX) are anticipated to own approximately 49% of the outstanding shares of the combined company (the "Combined Company") and existing shareholders of Elemental Altus (the "Elemental Altus Shareholders") are anticipated to own approximately 51% of the outstanding shares of the Combined Company.

The Arrangement is currently anticipated to be completed in the fourth quarter of 2025. Registered Shareholders are concurrently being provided with a letter of transmittal explaining how to exchange their EMX Shares for Elemental Altus Shares. Shareholders whose EMX Shares are registered in the name of a broker, dealer, bank, trust company or other nominee must contact their nominee to deposit their EMX Shares under the Arrangement.

- 2 -

No action needs to be taken by the Optionholders to receive their Replacement Options.

Benefits to Securityholders

In reaching its conclusions and formulating its recommendation that Securityholders vote FOR the Arrangement Resolution (as defined below), the board of directors of EMX (the "Board") and a special committee comprised solely of independent directors of EMX (the "Special Committee") reviewed and considered a significant amount of information as well as a number of factors relating to the Arrangement, with the benefit of advice from their respective financial and legal advisors and input from EMX's senior management team, a summary of which is presented below. A more fulsome description of the information and factors considered by the Board and the Special Committee is located in the accompanying management information circular of EMX (the "Circular"):

Top Quality, Globally Diversified Portfolio The Combined Company will create a peer-leading revenue generating royalty company with combined revenue guidance of US$70 million in 2025 and analyst consensus revenue of US$80 million in 20261, underpinned by strong growth visibility. The Combined Company is expected to maintain a gold focused portfolio with projected adjusted revenue relating to a commodity split of 67% precious metals and 33% base metals on a latest quarter revenue basis, providing exposure to record gold prices. The Combined Company will also continue with a strengthened asset portfolio, anchored by four cornerstone royalties with world-class operators, as well as diversification through exposure to 16 paying royalties and 200 total royalties, providing a balanced foundation of immediate cash flow and long-term upside.

Meaningful Scale. The Combined Company results in a larger, well capitalized entity with a lower cost of capital, positioned to pursue further accretive royalty opportunities in the market. Graduating to become a mid-tier royalty company, with a materially higher combined revenue than the junior royalty companies, will fill a gap in the market left by recent industry consolidation. Further, the combined trading liquidity and expected indexation demand is anticipated to help close the valuation gap with peers. The Combined Company has a definitive trajectory, including the pursuit of a listing on NASDAQ, or at the discretion of Elemental Altus, NYSE American prior to the closing of the Arrangement.

Future Growth. The Combined Company is expected to benefit from complementary management expertise, uniting Elemental Altus' proven track record of accretive royalty acquisitions with EMX's disciplined royalty generation and acquisition capabilities. Additionally, the royalty generation business presents a unique differentiator, offering low cost, organic growth.

Fairness Opinions. The Board received a fairness opinion from CIBC World Markets and the Special Committee received a fairness opinion from Haywood, each dated September 4, 2025, and each to the effect that, as of the date of such opinion, the Consideration to be received by the Shareholders pursuant to the Arrangement is fair, from a financial point of view, to the Shareholders, in each case based upon and subject to the respective assumptions, limitations, qualifications and other matters set forth in each such opinion, as more fully described in the section in the accompanying Circular entitled "Part I - The Arrangement - Opinions of Financial Advisors".

Support of Directors, Officers and Shareholders. The boards of directors of each of EMX and Elemental Altus (subject to abstentions where legally required) and the Special Committee have unanimously recommended support for the Arrangement. Additionally, the directors and senior officers and certain shareholders of each of EMX and Elemental Altus have entered into voting and support agreements pursuant to which they have agreed, among other things, to vote in favour of the Arrangement Resolution at the Meeting and in favour of the Elemental Altus Resolutions (as defined below) at the special meeting (the "Elemental Altus Meeting") of Elemental Altus Shareholders to be held on November 4, 2025, as applicable. Additionally, the Elemental Altus Financing (as defined below) emphasizes strong investor confidence (including Tether (as defined below)) in the strategy and long-term vision of the Combined Company, and will provide it significant financial capacity and facilitate the Combined Company being unlevered upon completion of the Arrangement.

1 Based on figures (i) with respect to EMX from National Bank Financial Inc. and as of August 12, 2025, and (ii) with respect to Elemental Altus from each of Raymond James Ltd. and National Bank Financial Inc. as of August 19, 2025 and from Canaccord Genuity Corp. as of May 26, 2025.

- 3 -

Negotiated Transaction. The Arrangement Agreement is the result of a comprehensive negotiation process with respect to the key elements of the Arrangement Agreement and Plan of Arrangement, which includes terms and conditions that are reasonable in the judgment of the Board and the Special Committee. The Arrangement provides for a 21.5% premium on the 20 day volume weighted average price to Shareholders and management of EMX who will be taking on management positions with the Combined Company including the CEO and CFO roles.

Other Factors. The Board and the Special Committee also carefully considered the Arrangement with reference to current economics, industry and market trends affecting each of EMX and Elemental Altus in the royalty, metals and mining industry, business, operations, properties, assets, financial condition, risks, operating results and prospects of each of EMX and Elemental Altus, taking into account the results of EMX's due diligence review of Elemental Altus and its royalty interests.

We believe that the business combination with Elemental Altus brings with it an exciting future for EMX and our Securityholders. For additional information with respect to these and other reasons for the Arrangement, see the section in the accompanying Circular entitled "Part I - The Arrangement - Reasons for Recommendation of the Board".

Your vote is important. Whether or not you plan to attend the Meeting in person, we encourage you to vote promptly.

Regardless of whether Securityholders are attending the Meeting in person, Securityholders are encouraged to promptly submit the enclosed proxy form, or VIF, as applicable. Securityholders may vote online, by telephone or by mail. Proxies to be used at the Meeting, must be received by EMX's transfer agent, Computershare Investor Services Inc. by no later than 10:00 a.m. (Vancouver time) on October 31, 2025 (or, if the Meeting is adjourned or postponed, by the time that is 48 hours prior to the commencement of the adjourned or postponed Meeting, excluding Saturdays, Sundays and holidays). See the section in the accompanying Circular entitled "Part VIII - General Proxy Matters".

Securityholders that have questions or require further assistance, please contact EMX's proxy solicitation agent and securityholder communications advisor, Laurel Hill Advisory Group, by: (i) telephone, toll-free for Securityholders in North America at 1-877-452-7184, or collect call for Securityholders outside of North America at 416-304-0211; or (ii) e-mail to assistance@laurelhill.com. See the back page of this Circular for other methods of contacting EMX's proxy solicitation agent and securityholder communications advisor.

Required Approval

In order to become effective, the resolution approving the Arrangement (the "Arrangement Resolution"), the full text of which is set out in Appendix A to the accompanying Circular, must be approved by (i) at least 66 2/3% of the votes cast by all Shareholders present in person or represented by proxy and entitled to vote at the Meeting; (ii) at least 66 2/3% of the votes cast by all Shareholders and Optionholders present in person or represented by proxy and entitled to vote at the Meeting, voting together as a single class; and (iii) a simple majority of the votes cast by Shareholders present in person or represented by proxy and entitled to vote at the Meeting, excluding votes cast by certain Shareholders required to be excluded under Multilateral Instrument 61-101 - Protection of Minority Security Holders in Special Transactions of the Canadian Securities Administrators ("MI 61-101"). See the section in the accompanying Circular entitled "Part I - The Arrangement - Securities Law Matters - Canada". Completion of the Arrangement is subject to, among other things, the approval of the Arrangement Resolution by the Securityholders, the receipt of the Elemental Altus Shareholder Approval (as defined below), the approval of the Supreme Court of British Columbia, the satisfaction of the conditions precedent to the completion of the Elemental Altus Financing, the approval of the TSX Venture Exchange ("TSX-V") for the Arrangement, and the conditional approval or authorization for listing of the Elemental Altus Shares to be issued as the Consideration (and upon exercise of the Replacement Options and adjusted EMX Warrants) on the TSX-V and a U.S. stock exchange. The Arrangement will not proceed if any of such approvals are not obtained subject to limited exceptions in certain instances.

- 4 -

At the Elemental Altus Meeting, the Elemental Altus Shareholders will be asked to consider resolutions approving (a) a non-brokered private placement (the "Elemental Altus Financing") of 7,502,502 Elemental Altus Shares at a price of C$18.38 (or US$13.33) to raise gross proceeds of approximately US$100,000,000 (the "Elemental Altus Financing Resolution"), pursuant to the requirements of MI 61-101; (b) Tether Investments, S.A. de C.V. ("Tether") as a "Control Person" of Elemental Altus pursuant to TSX-V policies (the "Elemental Altus Control Person Resolution"); (c) the change of Elemental Altus' name to "Elemental Royalty Corp." (the "Elemental Altus Name Change Resolution", and collectively, the "Elemental Altus Resolutions"), and/or such other approvals, including disinterested or minority approvals, in each case as may be required by the TSX-V and/or applicable Securities Laws, in connection with the transactions contemplated by the Arrangement Agreement. The "Elemental Altus Shareholder Approval" means the approval of the Elemental Altus Resolutions (other than the Elemental Altus Name Change Resolution) at the Elemental Altus Meeting, which must be approved by at least (a) a simple majority of votes cast on the Elemental Altus Financing Resolution, excluding for this purpose votes cast by certain Elemental Altus Shareholders required to be excluded under MI 61-101, including without limitation, votes cast by Tether; and (b) a simple majority votes cast on the Elemental Altus Control Person Resolution, excluding for this purpose votes cast by Tether and its associates and affiliates.

Support Agreements

All senior officers and directors of EMX, along with certain Shareholders, who collectively hold approximately 22.62% of the outstanding EMX Shares and approximately 61.99% of the outstanding EMX Options, each as of the Record Date, have entered into voting and support agreements with Elemental Altus, pursuant to which they have agreed, among other things, to vote their EMX Shares and/or EMX Options in favour of the Arrangement Resolution.

All senior officers and directors of Elemental Altus, along with certain Elemental Altus Shareholders, who collectively hold approximately 40% of the outstanding Elemental Altus Shares as of the Record Date, have also entered into voting and support agreements with EMX, pursuant to which they have agreed, among other things, to vote their Elemental Altus Shares in favour of the Elemental Altus Resolutions.

Board Recommendation

The Board received an opinion from CIBC World Markets Inc. and the Special Committee received an opinion from Haywood Securities Inc., each dated September 4, 2025 and each to the effect that, as of the date of such opinion, the Consideration to be received by the Shareholders pursuant to the Arrangement is fair, from a financial point of view, to the Shareholders, in each case based upon and subject to the respective assumptions, limitations, qualifications and other matters set forth in such opinion. The Board (subject to two directors declaring an interest and abstaining from voting on the matter), based on its considerations, investigations and deliberations of a number of factors, including (i) a thorough review of the Arrangement Agreement, (ii) consultation with representatives of EMX's management team, its financial and legal advisors, (iii) the fairness opinions of CIBC World Markets Inc. and Haywood Securities Inc., (iv) the unanimous recommendation of the Special Committee, (v) the reasons and risks relating to the Arrangement as further described in the accompanying Circular and (vi) other relevant matters, has unanimously determined that the Arrangement is in the best interests of EMX and unanimously recommends that the Securityholders vote FOR the Arrangement Resolution. See the section in the accompanying Circular entitled "Part I - The Arrangement - Recommendation of the Board".

The accompanying Circular contains a detailed description of the Arrangement, as well as detailed information regarding EMX and Elemental Altus and certain other information concerning the Combined Company following completion of the Arrangement. It also includes certain risk factors relating to completion of the Arrangement and the potential tax consequences to a Shareholder exchanging their EMX Shares for Elemental Altus Shares in connection with the Arrangement. Please give this material your careful consideration and, if you require assistance, consult your financial, tax or other professional advisors.

On behalf of the Board, I would like to express our gratitude for your ongoing support as we prepare to take part in this transformative transaction for EMX.

- 5 -

We look forward to seeing you at the Meeting.

Yours very truly,

|

(signed) "Michael Winn" |

|

|

Michael Winn |

|

|

Executive Chairman and Director |

- 6 -

| How to Vote in Advance of the Meeting | |||

| Registered Securityholders | Non-Registered Shareholders | ||

| EMX Shares and/or EMX Options held in own name and represented by a physical certificate or DRS. |

EMX Shares held with a broker, bank or other intermediary. |

||

|

Internet | www.investorvote.com | www.proxyvote.com |

|

Telephone | 1-866-732-8683 | Dial the applicable number listed on the voting instruction form. |

|

Return the proxy form in the enclosed postage paid envelope. | Return the voting instruction form in the enclosed postage paid envelope. | |

- 7 -

QUESTIONS AND ANSWERS RELATING TO THE MEETING AND ARRANGEMENT

The enclosed management information circular (the "Circular") is furnished in connection with the solicitation of proxies by or on behalf of management of EMX Royalty Corporation ("EMX") to be used at the special meeting (the "Meeting") of shareholders of EMX (the "Shareholders") and optionholders of EMX who have been issued stock options (each, an "EMX Option") under the EMX Option Plan (the "Optionholders", and together with the Shareholders, the "Securityholders") for the purposes indicated in the Notice of Special Meeting of Securityholders. The Meeting will be held on November 4, 2025 beginning at 10:00 a.m. (Vancouver time) and located at the offices of Cassels Brock & Blackwell LLP at Suite 2200, RBC Place, 885 West Georgia Street, Vancouver, British Columbia V6C 3E8. The Meeting can also be accessed via live webcast at meetnow.global/M2JX4WC. Any Securityholder attending the live webcast will not be able to vote during the Meeting. Only Securityholders or their duly appointed proxyholders who are present in person at the Meeting are able to vote during the Meeting. Capitalized terms used but not otherwise defined in this "Questions and Answers Relating to the Meeting and Arrangement" section have the meanings ascribed thereto under "Glossary of Terms" in the Circular.

It is expected that the solicitation of proxies by or on behalf of management of EMX will primarily be by mail and electronic means, but proxies may also be solicited by or on behalf of management of EMX by newspaper publication, in person or by telephone, facsimile or oral communication by directors, officers, employees or agents of EMX. EMX has also retained Laurel Hill Advisory Group as its proxy solicitation agent and securityholder communications advisor to assist it in connection with communications with Securityholders. Securityholders who have questions about the information in the Circular or who need assistance with voting may contact Laurel Hill Advisory Group by telephone at 1-877-452-7184 (toll free in North America) or 1-416-304-0211 (collect calls outside North America) or by email at assistance@laurelhill.com.

Custodians and fiduciaries will be supplied with proxy materials to forward to Non-Registered Shareholders and normal handling charges will be paid for such forwarding services. The Record Date to determine the Securityholders entitled to receive notice of and vote at the Meeting is September 25, 2025. Only Securityholders whose names have been entered in the applicable registers of Securityholders as of the close of business on the Record Date will be entitled to receive notice of and to vote at the Meeting.

Your vote is very important and you are encouraged to exercise your vote using any of the voting methods described below. Your completed form of proxy must be received by Computershare by no later than 10:00 a.m. (Vancouver time) on October 31, 2025, or if the Meeting is adjourned or postponed, no later than 48 hours (excluding weekends and holidays in the Province of British Columbia) prior to the time of the commencement of any adjourned or postponed Meeting. Notwithstanding the foregoing, the Chair of the Meeting has the discretion to accept proxies received after such deadline. The Chair of the Meeting is under no obligation to accept or reject any particular late proxy. The time limit for the deposit of proxies may be waived or extended by the Chair of the Meeting at their discretion, without notice.

The following are questions that you as a Securityholder may have regarding the proposed Arrangement to be considered at the Meeting. You are urged to carefully read the remainder of this Circular as the information in this section does not provide all of the information that might be important to you with respect to the Arrangement. Additional important information is also contained in the Appendices to, and the documents incorporated by reference into, this Circular.

Questions Relating to the Arrangement

Q. What is the proposed transaction?

A. On September 4, 2025, EMX, Elemental Altus and Acquireco entered into the Arrangement Agreement, whereby the Parties agreed to, among other things, effect a business combination pursuant to a court-approved arrangement under Division 5 of Part 9 of the BCBCA. Under the terms of the Arrangement, Shareholders will receive 0.2822 Elemental Altus Shares for each EMX Share. Optionholders will receive Replacement Options exercisable to purchase a number of Elemental Altus Shares equal to the number of EMX Shares subject to such EMX Option immediately prior to the Effective Time multiplied by the Exchange Ratio (rounded down to the nearest whole number of Elemental Altus Shares) at an exercise price per Elemental Altus Share being the exercise price per EMX Share underlying such EMX Option immediately prior to the Effective Time divided by the Exchange Ratio (rounded up to the nearest whole cent).

- 8 -

The Arrangement cannot proceed unless a number of conditions are satisfied, including approval of Arrangement Resolution by the Securityholders. See "Part II - The Arrangement Agreement".

Q. What is the Recommendation of the Board?

A. The Board (subject to two directors declaring an interest and abstaining from voting on the matter), based on, among a number of other factors, the fairness opinions of CIBC World Markets and Haywood (as discussed further in this Circular in the section "Part I - The Arrangement - Opinions of Financial Advisors"), and having received and reviewed the unanimous recommendation of the Special Committee, and other relevant matters, has unanimously determined that the Arrangement is in the best interests of EMX and unanimously recommends that the Securityholders vote FOR the Arrangement Resolution, the full text of which is set forth in Appendix A to this Circular, at the Meeting.

Q. Why is the Board making this recommendation?

A. In reaching its conclusions and formulating its recommendation, the Board and the Special Committee consulted with representatives of EMX's management team and their respective legal and financial advisors, and in the case of the Board, the Special Committee. The Board and the Special Committee also reviewed a significant amount of technical, financial and operational information relating to EMX and Elemental Altus and considered a number of factors and reasons, including those listed below.

The following is a summary of the principal reasons for the unanimous determination of the Board (subject to two directors declaring an interest and abstaining from voting on the matter) and the Special Committee that the Arrangement is in the best interests of EMX and the unanimous recommendations of the Board and the Special Committee that Securityholders vote FOR the Arrangement Resolution.

Top Quality, Globally Diversified Portfolio The Combined Company will create a peer-leading revenue generating royalty company with combined revenue guidance of US$70 million in 2025 and analyst consensus revenue of US$80 million in 20262, underpinned by strong growth visibility. The Combined Company is expected to maintain a gold focused portfolio with projected adjusted revenue relating to a commodity split of 67% precious metals and 33% base metals on a latest quarter revenue basis, providing exposure to record gold prices. The Combined Company will also continue with a strengthened asset portfolio, anchored by four cornerstone royalties with world-class operators, as well as diversification through exposure to 16 paying royalties and 200 total royalties, providing a balanced foundation of immediate cash flow and long-term upside.

Meaningful Scale. The Combined Company results in a larger, well capitalized entity with a lower cost of capital, positioned to pursue further accretive royalty opportunities in the market. Graduating to become a mid-tier royalty company, with a materially higher combined revenue than the junior royalty companies, will fill a gap in the market left by recent industry consolidation. Further, the combined trading liquidity and expected indexation demand is anticipated to help close the valuation gap with peers. The Combined Company has a definitive trajectory, including the pursuit of a listing on NASDAQ, or at the discretion of Elemental Altus, NYSE American prior to the closing of the Arrangement.

Future Growth. The Combined Company is expected to benefit from complementary management expertise, uniting Elemental Altus' proven track record of accretive royalty acquisitions with EMX's disciplined royalty generation and acquisition capabilities. Additionally, the royalty generation business presents a unique differentiator, offering low cost, organic growth.

Fairness Opinions. The Board received a fairness opinion from CIBC World Markets and the Special Committee received a fairness opinion from Haywood, each dated September 4, 2025, and each to the effect that, as of the date of such opinion, the Consideration to be received by the Shareholders pursuant to the Arrangement is fair, from a financial point of view, to the Shareholders, in each case based upon and subject to the respective assumptions, limitations, qualifications and other matters set forth in each such opinion, as more fully described in the section in the accompanying Circular entitled "Part I - The Arrangement - Opinions of Financial Advisors".

2 Based on figures (i) with respect to EMX from National Bank Financial Inc. and as of August 12, 2025, and (ii) with respect to Elemental Altus from each of Raymond James Ltd. and National Bank Financial Inc. as of August 19, 2025 and from Canaccord Genuity Corp. as of May 26, 2025.

- 9 -

Support of Directors, Officers and Shareholders. The boards of directors of each of EMX and Elemental Altus (subject to abstentions where legally required) and the Special Committee have unanimously recommended support for the Arrangement. Additionally, the directors and senior officers and certain shareholders of each of EMX and Elemental Altus have entered into voting and support agreements pursuant to which they have agreed, among other things, to vote in favour of the Arrangement Resolution at the Meeting and in favour of the Elemental Altus Resolutions at the special meeting (the "Elemental Altus Meeting") of Elemental Altus Shareholders to be held on November 4, 2025, as applicable. Additionally, the Elemental Altus Financing emphasizes strong investor confidence (including Tether) in the strategy and long-term vision of the Combined Company, and will provide it significant financial capacity and facilitate the Combined Company being unlevered upon completion of the Arrangement.

Negotiated Transaction. The Arrangement Agreement is the result of a comprehensive negotiation process with respect to the key elements of the Arrangement Agreement and Plan of Arrangement, which includes terms and conditions that are reasonable in the judgment of the Board and the Special Committee. The Arrangement provides for a 21.5% premium on the 20 day volume weighted average price to Shareholders and management of EMX will be taking on management positions with the Combined Company including the CEO and CFO roles.

Other Factors. The Board and the Special Committee also carefully considered the Arrangement with reference to current economics, industry and market trends affecting each of EMX and Elemental Altus in the royalty, metals and mining industry, business, operations, properties, assets, financial condition, risks, operating results and prospects of each of EMX and Elemental Altus, taking into account the results of EMX's due diligence review of Elemental Altus and its royalty interests.

Based on these and other considerations, investigations and deliberations of a number of factors, including: (i) a thorough review of the Arrangement Agreement, (ii) consultation with representatives of EMX's management team, its financial and legal advisors, (iii) the CIBC World Markets Opinion and the Haywood Opinion (as discussed further in this Circular in the section "Part I - The Arrangement - Opinions of Financial Advisors"), (iv) the reasons described in this Circular under the heading "Part I - The Arrangement - Reasons for Recommendation of the Board" and the risks described in this Circular under the heading "Part III - Risk Factors" and (v) such other matters as it considered necessary and relevant, the Board (subject to two directors declaring an interest and abstaining from voting on the matter) and the Special Committee have each unanimously determined that the Arrangement is in the best interests of EMX and unanimously recommend that the Securityholders vote FOR the Arrangement Resolution, the full text of which is set forth in Appendix A to this Circular, at the Meeting.

Q. What percentage of the outstanding Elemental Altus Shares will former Shareholders of EMX and existing Elemental Altus Shareholders own, respectively, following completion of the Arrangement?

A. Upon completion of the Arrangement and the Concurrent Elemental Altus Financing, subject to certain assumptions including that no additional EMX Shares are issued prior to the Effective Time and that there are no Dissenting Shareholders, former Shareholders of EMX (including former holders of EMX RSUs) and existing Elemental Altus Shareholders are expected to own approximately 49% and 51% of the issued and outstanding Elemental Altus Shares, respectively, based on the number of securities of EMX and Elemental Altus issued and outstanding as of the date of this Circular.

Q. What is required for the Arrangement to become effective?

A. The obligations of EMX, Elemental Altus and Acquireco to consummate the Arrangement and the other transactions contemplated by the Arrangement Agreement are subject to the satisfaction or waiver of a number of conditions, including, among others, (i) approval of the Arrangement Resolution by the required vote of Securityholders at the Meeting in accordance with the Interim Order, (ii) the Elemental Altus Shareholder Approval by the required vote of Elemental Altus Shareholders at the Elemental Altus Meeting, (iii) the satisfaction of the conditions precedent to the completion of the Elemental Altus Financing, (iv) the conditional approval or authorization for listing of the Consideration Shares (and the Elemental Altus Shares issuable upon exercise of the Replacement Options and EMX Warrants) on the TSX-V and a U.S. Exchange, (v) the Final Order having been obtained from the Court in form and substance satisfactory to each of Elemental Altus and EMX, each acting reasonably, and not having been set aside or modified in a manner unacceptable to either EMX or Elemental Altus, each acting reasonably, on appeal or otherwise, (vi) the Key Regulatory Approvals and Key Third Party Consents shall have been obtained and shall not have been modified or withdrawn, (vii) no prohibition at Law existing, including a cease trade order, injunction or other prohibition or order at Law or under applicable legislation, against Elemental Altus or EMX which shall prevent the consummation of the Arrangement, and (viii) the distribution of the securities pursuant to the Arrangement shall be exempt from the prospectus and registration requirements of applicable Securities Laws either by virtue of exemptive relief from the securities regulatory authorities of each of the provinces and territories of Canada or by virtue of applicable exemptions under Securities Laws and shall not be subject to resale restrictions under applicable Securities Laws (other than as applicable to control persons or pursuant to Section 2.6 of NI 45-102). The Arrangement was also subject to the Consolidation being completed, which condition was satisfied on September 16, 2025.

- 10 -

Q. When is the Arrangement expected to be completed?

A. EMX currently anticipates that the Arrangement will be completed in the fourth quarter of 2025. However, completion of the Arrangement is subject to a number of conditions and it is possible that factors outside the control of EMX and/or Elemental Altus could result in the Arrangement being completed at a later time, or not at all (for a description of risks relating to the Arrangement, see the section of the Circular entitled "Part III - Risk Factors"). Subject to certain limitations, each Party may terminate the Arrangement Agreement if the Arrangement is not consummated by February 4, 2026, and in no event will completion of the Arrangement occur later than February 4, 2026, unless (i) extended by mutual agreement of the Parties or (ii) extended by any one Party for a period of not less than 30 days and not more than 90 days under certain conditions, in each case in accordance with the terms of the Arrangement Agreement.

Q. What are the Canadian federal income tax consequences of the Arrangement to the Shareholders?

A. For a summary of certain of the material Canadian federal income tax consequences of the Arrangement applicable to Shareholders, see "Part IV - Certain Canadian Federal Income Tax Considerations". Such summary is not intended to be legal or tax advice. Shareholders should consult their own tax advisors as to the tax consequences of the Arrangement to them with respect to their particular circumstances.

Q. What are the United States federal income tax consequences of the Arrangement?

A. For a summary of certain United States federal income tax consequences of the Arrangement applicable to Shareholders, see "Part V - Certain United States Federal Income Tax Considerations". Shareholders should consult their tax advisors regarding the United States federal tax consequences of the Arrangement.

Q. Are there any risks I should consider in connection with the Arrangement?

A. Securityholders should consider a number of risk factors relating to the Arrangement and EMX in evaluating whether to approve the Arrangement Resolution. In addition to the risk factors described under the heading "Risk and Uncertainties" in the EMX AIF and under the heading "Risk Factors" in the Elemental Altus AIF, which risk factors are specifically incorporated by reference into this Circular, and the risk factors described under Appendix I, "Information Concerning EMX" appended to this Circular and under Appendix J, "Information Concerning Elemental Altus" appended to this Circular, the following is a list of certain additional and supplemental risk factors which Securityholders should carefully consider before making a decision regarding approving the Arrangement Resolution:

the Arrangement is subject to satisfaction or waiver of various conditions, and there is no certainty that all conditions will be satisfied or waived;

Shareholders will receive a fixed number of Elemental Altus Shares and the market value of Elemental Altus Shares may fluctuate prior to and following completion of the Arrangement;

- 11 -

the Arrangement Agreement may be terminated in certain circumstances;

while the Arrangement is pending, EMX is restricted from pursuing alternatives to the Arrangement and taking other certain actions;

EMX could be required to pay Elemental Altus a termination fee of approximately C$15.75 million in specified circumstances;

EMX will incur costs even if the Arrangement is not completed and EMX may have to pay various expenses incurred in connection with the Arrangement, including up to C$2 million as an expense reimbursement to Elemental Altus if the Arrangement Agreement is terminated in certain circumstances;

if the Arrangement is not consummated by the Outside Date, either EMX or Elemental Altus may elect not to proceed with the Arrangement;

EMX and Elemental Altus may become the targets of legal claims, securities class actions, derivative lawsuits and other claims, and any such claims may delay or prevent the Arrangement from being completed;

uncertainty surrounding the Arrangement could adversely affect EMX's or Elemental Altus' retention of personnel and business relationships and could negatively impact future business and operations;

the pending Arrangement may divert the attention of EMX's and Elemental Altus' management;

Dissent Rights may result in payments that impair EMX's financial resources or result in Elemental Altus electing not to complete the Arrangement;

EMX directors and officers may have interests in the Arrangement different from the interests of Securityholders following completion of the Arrangement;

Tax consequences of the Arrangement may differ from anticipated treatment, including that if the Arrangement does not qualify as a tax-deferred Reorganization, some Shareholders may be required to pay substantial U.S. federal income taxes;

the issuance of a significant number of Elemental Altus Shares and a resulting "market overhang" could adversely affect the market price of the Elemental Altus Shares after completion of the Arrangement;

EMX has not verified the reliability of the information regarding Elemental Altus included in, or which may have been omitted from this Circular;

there are risks related to the integration of EMX's and Elemental Altus' existing businesses;

the relative trading price of the EMX Shares and Elemental Altus Shares prior to the Effective Time and the trading price of the Elemental Altus Shares following the Effective Time may be volatile;

following completion of the Arrangement, the Combined Company may issue additional equity securities or incur additional debt;

failure by Elemental Altus and/or EMX to comply with applicable Laws prior to the Arrangement could subject the Combined Company to penalties and other adverse consequences following completion of the Arrangement; and

- 12 -

Q. What will happen to EMX if the Arrangement is completed?

A. If the Arrangement is completed, Elemental Altus will acquire, indirectly through an amalgamation of EMX with Acquireco, all of the EMX Shares and Amalco will become a wholly-owned subsidiary of Elemental Altus. Elemental Altus intends to have the EMX Shares delisted from the TSX-V and the NYSE American as promptly as possible following the Effective Date. In addition, subject to applicable Laws, Elemental Altus will apply to have EMX cease to be a reporting issuer in all jurisdictions in which it is a reporting issuer and thus will terminate EMX's public company reporting obligations in Canada following completion of the Arrangement.

Q. What will happen if the Arrangement Resolution is not approved or the Arrangement is not completed for any reason?

A. If the Arrangement Resolution is not approved or the Arrangement is not completed for any reason, the Arrangement Agreement may be terminated and EMX will continue to operate independently. In certain circumstances, EMX or Elemental Altus will be required to pay to the other the Termination Fee in connection with such termination. In certain other circumstances in which the Arrangement Agreement is terminated, either Elemental Altus or EMX may be required to pay to the other an expense reimbursement in an amount equal to C$2 million or a termination fee of approximately C$15.75 million. If, for any reason, the Arrangement is not completed or its completion is materially delayed and/or the Arrangement Agreement is terminated, the market price of the EMX Shares may be materially adversely affected and EMX's business, financial condition or results of operations could also be subject to various material adverse consequences, including that EMX would remain liable for costs relating to the Arrangement.

Q. Why am I being asked to approve the Arrangement?

A. Pursuant to the Interim Order and the BCBCA, in order to proceed with the Arrangement, EMX is required to obtain the approval of its Securityholders by special resolution passed by (i) at least 66 2/3% of the votes cast by all Shareholders present in person or represented by proxy and entitled to vote at the Meeting; (ii) at least 66 2/3% of the votes cast by all Shareholders and Optionholders present in person or represented by proxy and entitled to vote at the Meeting, voting together as a single class; and (iii) a simple majority of the votes cast by Shareholders present in person or represented by proxy and entitled to vote at the Meeting, excluding votes cast by certain Shareholders required to be excluded under MI 61-101. If the requisite approval of the Securityholders for the Arrangement Resolution is not obtained, the Arrangement will not be completed.

Q Should I send in my proxy now?

A: Yes. Once you have carefully read and considered the information in this Circular, you should complete and submit the enclosed form of proxy or VIF. You are encouraged to vote well in advance of the proxy cut-off time at 10:00 a.m. (Vancouver time) on October 31, 2025 to ensure your EMX Shares and/or EMX Options are voted at the Meeting. If the Meeting is adjourned or postponed, your proxy must be received not less than 48 hours (excluding Saturdays, Sundays and holidays recognized in the province of British Columbia) prior to the time of the commencement of the reconvened Meeting. Late proxies may be accepted or rejected by the Chair of the Meeting in their discretion. Notwithstanding the foregoing, the Chair of the Meeting has the discretion to accept proxies received after such deadline. The Chair of the Meeting is under no obligation to accept or reject any particular late proxy. The time limit for the deposit of proxies may be waived or extended by the Chair of the Meeting at their discretion, without notice.

Q. Are Shareholders entitled to Dissent Rights?

A. Yes. Pursuant to the Interim Order, Registered Shareholders have Dissent Rights in respect of the Arrangement Resolution. If the Arrangement Resolution is passed, a Registered Shareholder that has duly and validly exercised their Dissent Rights in accordance with the provisions of Sections 237 to 247 of the BCBCA, as modified by the Plan of Arrangement, the Interim Order, and any other order of the Court, will be entitled to be paid an amount equal to the fair value of their EMX Shares as of the close of business on the business day before the Arrangement Resolution was approved. Dissent Rights and the dissent procedures are described in the accompanying Circular.

- 13 -

A Registered Shareholder wishing to exercise rights of dissent with respect to the Arrangement must send to EMX a written objection to the Arrangement Resolution, which written objection must be sent to EMX (i) c/o Cassels Brock & Blackwell LLP, Suite 2200, RBC Place, 885 West Georgia Street, Vancouver, British Columbia V6C 3E8 (Attention: Jessica Lewis) and (ii) with a copy by email to jlewis@cassels.com, to be received by no later 5:00 p.m. (Vancouver time) on October 31, 2025 or, in the case of any adjournment or postponement of the Meeting, by no later than 5:00 p.m. (Vancouver time) on the day that is two business days prior to the new date of the Meeting, and must otherwise strictly comply with the dissent procedures set forth in Sections 237 to 247 of the BCBCA, as modified by the Plan of Arrangement, the Interim Order, and any other order of the Court.

Failure to strictly comply with the dissent procedures described in the Circular may result in the loss of any Dissent Rights. See the section entitled "Part I -The Arrangement - Right to Dissent" and Appendix L, "Section 237 through Section 247 of the Business Corporations Act (British Columbia)" in the accompanying Circular. Any Shareholder wishing to exercise Dissent Rights should seek independent legal advice.

Non-Registered Shareholders who wish to dissent should be aware that only Registered Shareholders are entitled to Dissent Rights. Accordingly, Non-Registered Shareholders desiring to dissent must make arrangements for the EMX Shares beneficially owned by such Non-Registered Shareholders to be registered in the Non-Registered Shareholder's name prior to the time the written objection to the Arrangement Resolution is required to be received by EMX or, alternatively, make arrangements for the registered holder of such EMX Shares to dissent on the Non-Registered Shareholder's behalf.

Q. Are Optionholders entitled to Dissent Rights?

A. No. Optionholders are not entitled to any rights of dissent in respect of the Arrangement.

General Questions Relating to the Meeting

Q. When and where is the Meeting?

A. The Meeting will be held in person as follows:

| Date: | November 4, 2025 |

| Time: | 10:00 a.m. (Vancouver time) |

| Place: | Suite 2200, RBC Place, 885 West Georgia Street, Vancouver, British Columbia V6C 3E8 |

The Meeting can also be accessed via live webcast at meetnow.global/M2JX4WC. Any Securityholder attending the live webcast will not be able to vote during the Meeting. Only Securityholders or their duly appointed proxyholders who are present in person at the Meeting are able to vote during the Meeting.

See the accompanying Circular which provides a summary of the information Securityholders will need who plan to attend the Meeting or access the live webcast.

Q. Am I entitled to vote?

A. You are entitled to vote if you were a holder of EMX Shares and/or EMX Options as of the close of business on September 25, 2025, the Record Date. Shareholders will be entitled to one vote for each EMX Share held, and Optionholders will be entitled to one vote for each EMX Option held, in each case as of the Record Date.

- 14 -

Q. What am I voting on?

A. At the Meeting, you will be voting on the Arrangement Resolution to approve a proposed Plan of Arrangement under the BCBCA involving EMX, Elemental Altus and Acquireco pursuant to which Elemental Altus will, among other things, acquire, indirectly through an amalgamation of EMX with Acquireco, all of the issued and outstanding EMX Shares in exchange for the Consideration. If the Arrangement Resolution is not approved by the Securityholders at the Meeting, the Arrangement will not be completed.

Q. What if amendments are made to this matter or if other matters of business are brought before the Meeting?

A. If you attend the Meeting in person and are eligible to vote, you may vote on such matters as you choose. If you have completed and returned the accompanying form of proxy, the persons named in the form of proxy will vote or withhold from voting the EMX Shares or EMX Options represented thereby in accordance with your instructions on any ballot that may be called for, and the persons named in the form of proxy will also have discretionary authority with respect to amendments or variations to the matters identified in the Notice of Special Meeting of Securityholders and to other matters that may properly come before the Meeting. As of the date of the Circular, EMX management knows of no such amendment, variation or other matter expected to come before the Meeting. If any other matters properly come before the Meeting, the persons named in the form of proxy will vote on them in accordance with their best judgment.

Q. Who is soliciting my proxy?

A. The management of EMX is soliciting your proxy and has engaged Laurel Hill Advisory Group to act as the proxy solicitation agent and securityholder communications advisor with respect to the matters to be considered at the Meeting. All costs of the solicitation of proxies for the Meeting will be borne by EMX.

It is expected that the solicitation of proxies by or on behalf of management of EMX will primarily be by mail and electronic means, but proxies may also be solicited by or on behalf of management of EMX by newspaper publication, in person or by telephone, facsimile or oral communication by directors, officers, employees or agents of EMX.

Securityholders who have questions about the information in this Circular or who need assistance with voting may contact Laurel Hill Advisory Group by telephone at 1-877-452-7184 (toll free in North America) or 1-416-304-0211 (collect calls outside North America) or by email at assistance@laurelhill.com.

Q. How can I vote?

A. If you are eligible to vote and your EMX Shares and/or EMX Options are registered in your name, you can vote your EMX Shares and/or EMX Options: (i) in person at the Meeting; (ii) by voting using the internet at www.investorvote.com; or (iii) by signing and returning your form of proxy in the prepaid envelope provided or by appointing a proxyholder using the internet at www.investorvote.com; or (iv) by calling 1-866-732-VOTE (8683).

If your EMX Shares are not registered in your name but are held by a nominee, please see below with respect to non-registered holders of EMX Shares.

Q. How can a non-registered holder of EMX Shares vote?

A. If your EMX Shares are not registered in your name, but are held in the name of an Intermediary (usually a bank, trust company, securities broker or other financial institution), your Intermediary is required to seek your instructions as to how to vote your EMX Shares. Your Intermediary will have provided you with a package of information, including these meeting materials and either a form of proxy or a VIF. Carefully follow the instructions accompanying the form of proxy or VIF. EMX Shares held by Intermediaries can only be voted (for or against resolutions) upon the instructions of the Non-Registered Shareholder. Without specific instructions, the Intermediary is prohibited from voting EMX Shares for their clients.

Additionally, EMX may use the Broadridge QuickVoteTM service to assist Shareholders with voting their EMX Shares. Certain Non-Registered Shareholders who have not objected to EMX knowing who they are (NOBOs) may be contacted by Laurel Hill Advisory Group, EMX's proxy solicitation agent and securityholder communications advisor, to conveniently obtain a vote directly over the telephone. Broadridge then tabulates the results of all instructions received and provides the appropriate instructions with respect to the EMX Shares to be represented at the Meeting.

- 15 -

Q. How can a non-registered holder of EMX Shares vote in person at the Meeting?

A. Only Registered Shareholders and Optionholders of record as at the close of business on the Record Date or their proxyholders are entitled to vote at the Meeting. If you are a Non-Registered Shareholder as at the close of business on the Record Date and you wish to vote at the Meeting, insert your name in the space provided on the form of proxy or VIF sent to you by your Intermediary. In doing so you are instructing your Intermediary to appoint you as a proxyholder. Complete the form by following the return instructions provided by your Intermediary. If you are a Registered Shareholder or Optionholder or a duly appointed proxyholder and are attending the Meeting in person, you should report to a representative of Computershare upon arrival at the Meeting.

Q. Who votes my EMX Shares and/or EMX Options and how will they be voted if I return a form of proxy?

A. By properly completing and returning the enclosed form of proxy, you are authorizing the persons named in the form of proxy to attend the Meeting on your behalf and to vote your securities in accordance with your instructions (or, where no instructions are provided, in accordance with the recommendations of management indicated on the form of proxy and in their discretion in respect of any other matters). You can use the enclosed form of proxy, or any other proper form of proxy permitted by Law, to appoint your proxyholder.

The EMX Shares and/or EMX Options represented by your proxy must be voted according to your instructions in the proxy. If you properly complete and return your proxy but do not specify how you wish the votes be cast, your proxyholder will vote your EMX Shares and/or EMX Options in their discretion. Unless you provide contrary instructions, EMX Shares and/or EMX Options represented by proxies received by management will be voted FOR the Arrangement Resolution.

Q. Can I appoint someone other than the individuals named in the enclosed form of proxy to vote my EMX Shares and/or EMX Options?

A. Yes, you have the right to appoint the person of your choice, who does not need to be a Securityholder, to attend and act on your behalf at the Meeting. If you wish to appoint a person other than the names that appear on the form of proxy, then strike out those printed names appearing on the form of proxy and insert the name of your chosen proxyholder in the space provided or submit another appropriate form of proxy permitted by Law, and in either case, send or deliver the completed proxy to the offices of Computershare, Attention: Proxy Department, by mail: 320 Bay Street, 14th Floor, Toronto, Ontario, M5H 4A6, or by facsimile: 1-866-249-7775 for Toll Free within North America or 1-416-263-9524 outside of North America, no later than 10:00 a.m. (Vancouver time) on October 31, 2025 or, if the Meeting is adjourned or postponed, no later than 48 hours (excluding weekends and holidays in the Province of British Columbia) prior to the time of the commencement of any adjourned or postponed Meeting, before the above-mentioned deadline. You can also appoint the person of your choice via the internet by following the instructions at www.investorvote.com. Your proxyholder must be present in person at the Meeting in order for your shares to be voted.

It is important to ensure that any other person you appoint as a proxyholder is attending the Meeting and is aware that their appointment to vote your EMX Shares and/or EMX Options has been made.

Q. What if my EMX Shares are registered in more than one name or in the name of a corporation?

A. If your EMX Shares are registered in more than one name, all registered persons must sign the form of proxy. If your EMX Shares are registered in a corporation's name or any name other than your own, then you must provide documents proving your authorization to sign the form of proxy for that company or name. For any questions about the proper supporting documents, contact Laurel Hill Advisory Group before submitting your form of proxy.

Q. Can I revoke a proxy or voting instruction?

A. Yes. If you are a Registered Securityholder and have returned a form of proxy, you may revoke it by:

- 16 -

completing and signing a proxy bearing a later date, and delivering it to Computershare any time up to 48 hours (excluding weekends and holidays in the Province of British Columbia) prior to the time of the Meeting, or 48 hours (excluding weekends and holidays in the Province of British Columbia) preceding the time to which the Meeting was adjourned or postponed; or

delivering a written statement, signed by you or your authorized attorney: (i) to Computershare any time up to 48 hours (excluding weekends and holidays in the Province of British Columbia) prior to the time of the Meeting, or 48 hours (excluding weekends and holidays in the Province of British Columbia) preceding the time to which the Meeting was adjourned or postponed; (ii) to the Chair of the Meeting prior to the start of such Meeting; or (iii) in any other manner permitted by Law.

If you are a Non-Registered Shareholder who has voted by proxy through your Intermediary and would like to change or revoke your vote, contact your Intermediary to discuss whether this is possible and what procedures you need to follow. The change or revocation of voting instructions by a Non-Registered Shareholder can take several days or longer to complete and, accordingly, any such action should be completed well in advance of the deadline given in the proxy or VIF by the Intermediary or its service company to ensure the change or revocation is effective.

Q. How do I receive DRS Advice(s) or certificate(s) representing Elemental Altus Shares in exchange for my EMX Share certificates or DRS Advices?

A. Registered Shareholders are concurrently being provided with a Letter of Transmittal that must be completed and sent with the certificate(s) or DRS Advice(s) representing your EMX Shares to Computershare, the Depositary for the Arrangement, at the office set forth in such Letter of Transmittal. You will receive DRS Advice(s) or certificate(s) representing Elemental Altus Shares for any EMX Shares that are deposited under the Arrangement as soon as practicable following completion of the Arrangement, provided that you have sent all of the necessary documentation to the Depositary prior to the Effective Date. If you are a Non-Registered Shareholder, contact your Intermediary for further instructions.

Q. How do I receive my Replacement Options in exchange for my EMX Options?

A. Optionholders do not need to take any actions to receive their Replacement Options. Notices of adjustment in respect of Replacement Options will be delivered to the Optionholders as soon as practicable following the completion of the Arrangement.

Q. What do I need to do now?

A. Carefully read and consider the information contained in, and incorporated by reference into, the Circular. You are required to make an important decision regarding your investment. If you have any questions about deciding how to vote, you should contact your own legal, tax, financial or other professional advisor. Your vote is important and you are encouraged to vote well in advance of the proxy cut-off time at 10:00 a.m. (Vancouver time) on October 31, 2025 to ensure your EMX Shares and/or EMX Options are voted at the Meeting.

Q. What if I have other questions?

A. Securityholders that have questions regarding the Meeting, this Circular or the matters described herein or require further assistance are encouraged to contact EMX's proxy solicitation agent and securityholder communications advisor, Laurel Hill Advisory Group, by: (i) telephone, toll-free for Shareholders in North America at 1-877-452-7184, or collect call for Securityholders outside of North America at 1-416-304-0211; or (ii) e-mail to assistance@laurelhill.com.

- 17 -

GLOSSARY OF TERMS

The following is a glossary of certain terms used in this Circular, including in the section entitled "Summary Information".

"Acceptable Confidentiality Agreement" means a confidentiality and standstill agreement between a Solicited Party and a person other than the other Party or any of its affiliates that (a) contains confidentiality and standstill terms that are no less favourable, individually and in the aggregate, than those contained in the applicable Confidentiality Agreement, provided that, notwithstanding the foregoing, such agreement may permit such person to submit a subsequent Acquisition Proposal on a confidential basis to the Solicited Party's board of directors provided that any such subsequent Acquisition Proposal did not result from a breach of the non-solicitation provisions of the Arrangement Agreement by the Solicited Party or any of its affiliates, (b) contains other customary terms that are no less favorable individually and in the aggregate to the Solicited Party (in its capacity as disclosing party under the applicable Confidentiality Agreement) than those contained in the applicable Confidentiality Agreement, and (c) allows and does not restrict or prohibit the Solicited Party from disclosing to the other Party such agreement or information relating to such agreement or the negotiations with or information furnished to such person and which does not otherwise conflict with, or restrict the Solicited Party from complying with, any of the terms of the Arrangement Agreement.

"Acquireco" means 1554829 B.C. Ltd. a corporation existing under the laws of the Province of British Columbia and a direct wholly-owned subsidiary of Elemental Altus;

"Acquireco Share" means a common share in the capital of Acquireco;

"Acquisition Proposal" means, other than the transactions contemplated by the Arrangement Agreement and other than any transaction involving only a Party and/or one or more of its wholly-owned subsidiaries or between one or more of such Party's wholly-owned subsidiaries, any offer, proposal, expression of interest or inquiry from any person or group of persons acting jointly or in concert (as such term is defined in NI 62-104) received by a Party or by a Representative of a Party (other than from the other Party or one or more of its affiliates), whether or not in writing and whether or not delivered to the shareholders of such Party, after the date of the Arrangement Agreement relating to:

(a) any direct or indirect acquisition, sale or disposition (or any joint venture, strategic relationship, lease, license, long-term supply agreement or other arrangement having the same economic effect as an acquisition, sale or disposition), in a single transaction or series of related transactions, of: (i) any assets of that Party and/or one or more of its subsidiaries that, individually or in the aggregate, constitute 20% or more of the consolidated assets of that Party and its subsidiaries, taken as a whole, or which contribute 20% or more of the consolidated revenue of a Party and its subsidiaries, taken as a whole (or any lease, long-term supply or off-take agreement, hedging arrangement or other transaction having the same economic effect as a sale of such assets) (in each case, determined from the most recent publicly available consolidated financial statements of that Party), or (ii) 20% or more of the issued and outstanding voting or equity securities of that Party or any one or more of its subsidiaries that, individually or in the aggregate, contribute 20% or more of the consolidated revenues or constitute 20% or more of the consolidated assets of that Party and its subsidiaries, taken as a whole (in each case, determined from the most recent publicly available consolidated financial statements of that Party);

(b) any direct or indirect take-over bid, tender offer or exchange offer that, if consummated, would result in such person or group of persons beneficially owning 20% or more of the issued and outstanding voting or equity securities of any class of voting or equity securities (and/or securities convertible into, or exchangeable or exercisable for, voting or equity securities) of that Party or its subsidiaries;

(c) any plan of arrangement, scheme of arrangement, merger, amalgamation, consolidation, share exchange, business combination, reorganization, recapitalization, liquidation, dissolution or other similar transaction involving that Party or any of its subsidiaries whose assets or revenues, individually or in the aggregate, constitute 20% or more of the consolidated assets or contribute 20% or more of the consolidated revenue, as applicable, of that Party and its subsidiaries, taken as a whole (in each case, determined from the most recent publicly available consolidated financial statements of that Party); or

- 18 -

(d) any other similar transaction or series of transactions involving the Party or any of its subsidiaries, and, in all cases, whether in a single transaction or in a series of related transactions;

"affiliate" except where otherwise indicated, has the meaning ascribed to such term in NI 45-106;