Southwest Bancshares, Inc. the Bank Holding Company for: Announces the acquisition of October 1, 2025 Exhibit 99.1

Cautionary Note on Forward Looking Statements This presentation contains statements regarding the proposed transactions between (1) Prosperity Bancshares, Inc. (“Prosperity”) and Southwest Bancshares, Inc. (“Southwest”) and (2) Prosperity and American Bank Holding Corporation (“American”); future financial and operating results; benefits and synergies of the transactions; future opportunities for Prosperity; the issuances of common stock of Prosperity contemplated by the Agreement and Plan of Merger by and between Prosperity and Southwest (the “Prosperity/Southwest Merger Agreement”) and the Agreement and Plan of Merger by and between Prosperity and American (the “Prosperity/American Merger Agreement” and, together with the Prosperity/Southwest Merger Agreement, the “Merger Agreements”); in connection with the proposed transaction between Prosperity and Southwest, the expected filing by Prosperity with the Securities and Exchange Commission (the “SEC”) of a registration statement on Form S-4 (the “Prosperity/Southwest Registration Statement”) and a prospectus of Prosperity and a proxy statement of Southwest to be included therein (the “Prosperity/Southwest Proxy Statement/Prospectus”); in connection with the proposed transaction between Prosperity and American, a registration statement on Form S-4 (the “Prosperity/American Registration Statement” and, together with the Prosperity/Southwest Registration Statement, the “Registration Statements”) and a preliminary prospectus of Prosperity and a proxy statement of American included therein (the “Prosperity/American Proxy Statement/ Prospectus” and, together with the Southwest Proxy Statement/Prospectus, the “Proxy Statement/Prospectuses”), which registration statement was filed with the SEC on September 17, 2025 and amended on September 30, 2025; the expected timing of the closing of the proposed transactions; the ability of the parties to complete the proposed transactions considering the various closing conditions and any other statements about future expectations that constitute forward-looking statements within the meaning of the federal securities laws, including the meaning of the Private Securities Litigation Reform Act of 1995, as amended, Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended. From time to time, oral or written forward-looking statements may also be included in other information released to the public. Such forward-looking statements are typically, but not exclusively, identified by the use in the statements of words or phrases such as “aim,” “anticipate,” “believe,” “estimate,” “expect,” “goal,” “guidance,” “intend,” “is anticipated,” “is expected,” “is intended,” “objective,” “plan,” “projected,” “projection,” “will affect,” “will be,” “will continue,” “will decrease,” “will grow,” “will impact,” “will increase,” “will incur,” “will reduce,” “will remain,” “will result,” “would be,” variations of such words or phrases (including where the word “could,” “may,” or “would” is used rather than the word “will” in a phrase) and similar words and phrases indicating that the statement addresses some future result, occurrence, plan or objective. Forward-looking statements include all statements other than statements of historical fact, including forecasts or trends, and are based on current expectations, assumptions, estimates, and projections about Prosperity and its subsidiaries or related to the proposed transactions between (1) Prosperity and Southwest and (2) Prosperity and American and are subject to significant risks and uncertainties that could cause actual results to differ materially from the results expressed in such statements. These forward-looking statements may include information about Prosperity’s possible or assumed future economic performance or future results of operations, including future revenues, income, expenses, provision for loan losses, provision for taxes, effective tax rate, earnings per share and cash flows and Prosperity’s future capital expenditures and dividends, future financial condition and changes therein, including changes in Prosperity’s loan portfolio and allowance for loan losses, future capital structure or changes therein, as well as the plans and objectives of management for Prosperity’s future operations, future or proposed acquisitions, the future or expected effect of acquisitions on Prosperity’s operations, results of operations, financial condition, and future economic performance, statements about the anticipated benefits of each of the proposed transactions, and statements about the assumptions underlying any such statement. These forward looking statements are not guarantees of future performance and are based on expectations and assumptions Prosperity currently believes to be valid. Because forward-looking statements relate to future results and occurrences, many of which are outside of Prosperity’s control, they are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict. Many possible events or factors could adversely affect the future financial results and performance of Prosperity, Southwest or American or the combined company and could cause those results or performance to differ materially from those expressed in or implied by the forward-looking statements. Such risks and uncertainties include, among others: (1) the risk that the cost savings and synergies from the transactions may not be fully realized or may take longer than anticipated to be realized, (2) disruption to Prosperity’s, Southwest’s and American’s businesses as a result of the announcements and pendency of the transactions, (3) the risk that the integration of Southwest’s and/or American’s businesses and operations into Prosperity, will be materially delayed or will be more costly or difficult than expected, or that Prosperity is otherwise unable to successfully integrate Southwest’s and/or American’s business into its own, including as a result of unexpected factors or events, (4) the failure to obtain the necessary approval by the shareholders of Southwest and/or American, (5) the ability by each of Prosperity, Southwest and/or American to obtain required governmental approvals of the transactions on the timeline expected, or at all, and the risk that such approvals may result in the imposition of conditions that could adversely affect Prosperity after the closing of the transactions or adversely affect the expected benefits of the transactions, (6) reputational risk and the reaction of each company’s customers, suppliers, employees or other business partners to the transactions, (7) the failure of the closing conditions in the applicable Merger Agreements to be satisfied, or any unexpected delay in closing the transactions or the occurrence of any event, change or other circumstances that could give rise to the termination of the applicable Merger Agreements, (8) the dilution caused by the issuances of additional shares of Prosperity’s common stock in the transactions, (9) the possibility that the transactions may be more expensive to complete than anticipated, including as a result of unexpected factors or events, (10) the outcome of any legal or regulatory proceedings that may be currently pending or later instituted against Prosperity before or after any of the transactions, or against Southwest or American, (11) diversion of management’s attention from ongoing business operations and (12) general competitive, economic, political and market conditions and other factors that may affect future results of Prosperity, Southwest and American. Prosperity disclaims any obligation to update such factors or to publicly announce the results of any revisions to any of the forward-looking statements included herein to reflect future events or developments. These and various other factors are discussed in Prosperity’s Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, and Current Reports on Form 8-K, in each case filed with the SEC, and other reports and statements Prosperity has filed with the SEC. Copies of the SEC filings for Prosperity may be downloaded from the Internet at no charge from http://www.prosperitybankusa.com.

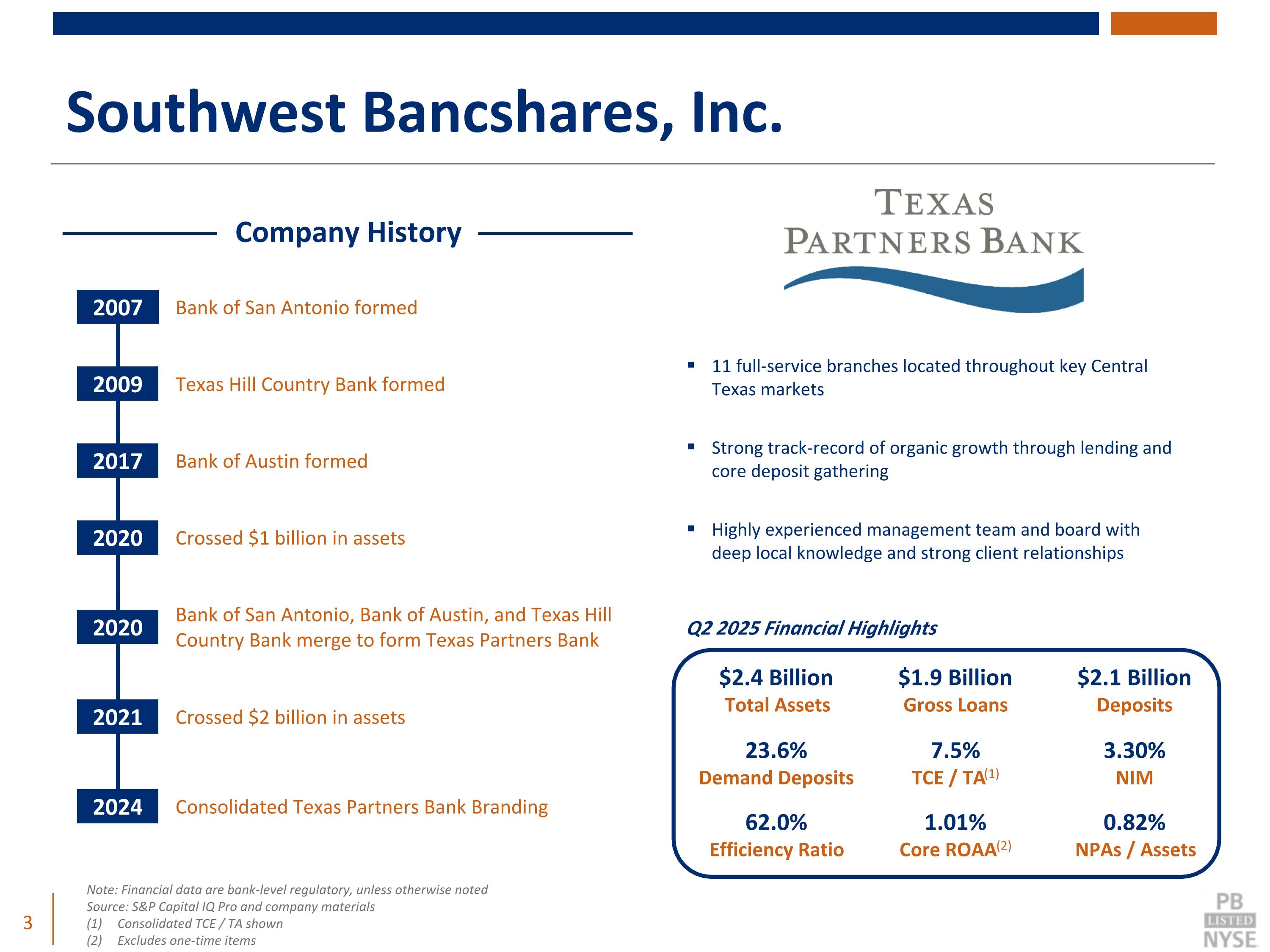

Southwest Bancshares, Inc. Company History 2007 Bank of San Antonio formed 2009 Texas Hill Country Bank formed 2017 Bank of Austin formed 2020 Crossed $1 billion in assets 2020 Bank of San Antonio, Bank of Austin, and Texas Hill Country Bank merge to form Texas Partners Bank 2021 Crossed $2 billion in assets $1.9 Billion Gross Loans $2.1 Billion Deposits 0.82% NPAs / Assets 23.6% Demand Deposits 7.5% TCE / TA(1) 3.30% NIM 62.0% Efficiency Ratio 1.01% Core ROAA(2) Note: Financial data are bank-level regulatory, unless otherwise noted Source: S&P Capital IQ Pro and company materials (1) Consolidated TCE / TA shown (2) Excludes one-time items Q2 2025 Financial Highlights 2024 Consolidated Texas Partners Bank Branding $2.4 Billion Total Assets 11 full-service branches located throughout key Central Texas markets Strong track-record of organic growth through lending and core deposit gathering Highly experienced management team and board with deep local knowledge and strong client relationships

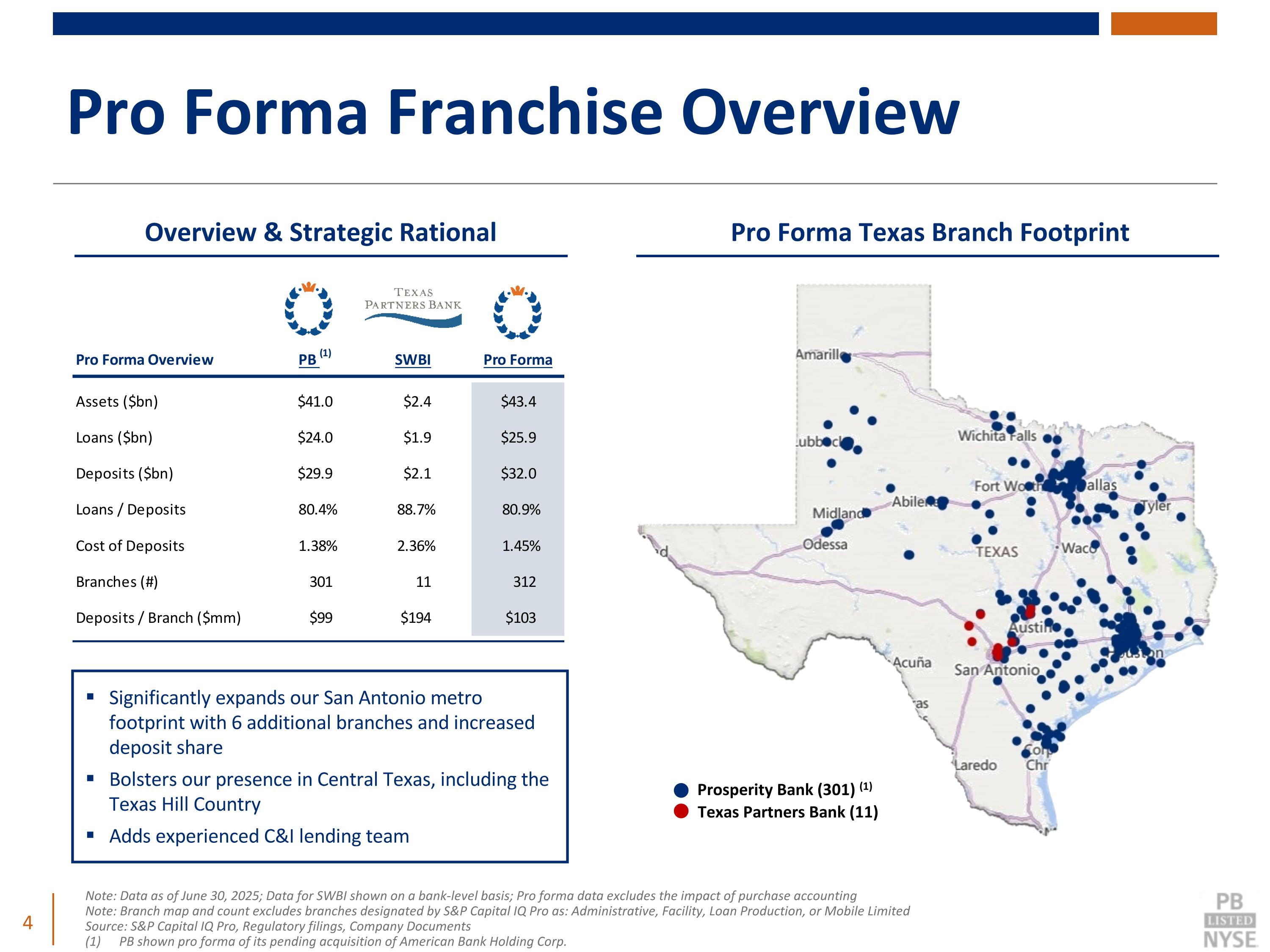

Significantly expands our San Antonio metro footprint with 6 additional branches and increased deposit share Bolsters our presence in Central Texas, including the Texas Hill Country Adds experienced C&I lending team Pro Forma Franchise Overview Note: Data as of June 30, 2025; Data for SWBI shown on a bank-level basis; Pro forma data excludes the impact of purchase accounting Note: Branch map and count excludes branches designated by S&P Capital IQ Pro as: Administrative, Facility, Loan Production, or Mobile Limited Source: S&P Capital IQ Pro, Regulatory filings, Company Documents (1) PB shown pro forma of its pending acquisition of American Bank Holding Corp. Texas Partners Bank (11) Prosperity Bank (301) (1) Pro Forma Texas Branch Footprint Overview & Strategic Rational

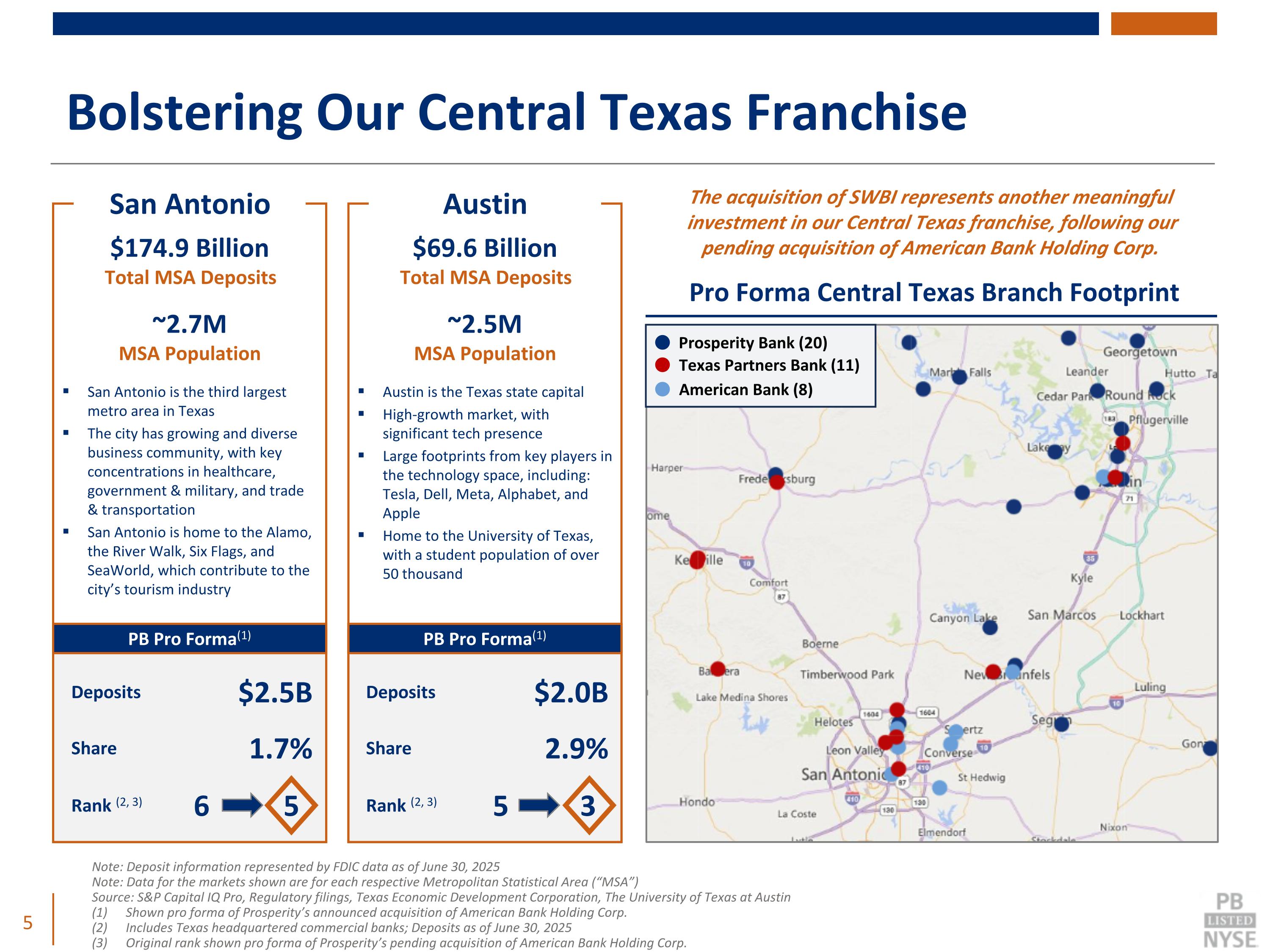

Bolstering Our Central Texas Franchise San Antonio $174.9 Billion Total MSA Deposits ~2.7M MSA Population San Antonio is the third largest metro area in Texas The city has growing and diverse business community, with key concentrations in healthcare, government & military, and trade & transportation San Antonio is home to the Alamo, the River Walk, Six Flags, and SeaWorld, which contribute to the city’s tourism industry Deposits Share Rank (2, 3) 6 5 $2.5B 1.7% PB Pro Forma(1) Austin $69.6 Billion Total MSA Deposits ~2.5M MSA Population Austin is the Texas state capital High-growth market, with significant tech presence Large footprints from key players in the technology space, including: Tesla, Dell, Meta, Alphabet, and Apple Home to the University of Texas, with a student population of over 50 thousand 5 3 $2.0B 2.9% PB Pro Forma(1) Note: Deposit information represented by FDIC data as of June 30, 2025 Note: Data for the markets shown are for each respective Metropolitan Statistical Area (“MSA”) Source: S&P Capital IQ Pro, Regulatory filings, Texas Economic Development Corporation, The University of Texas at Austin (1) Shown pro forma of Prosperity’s announced acquisition of American Bank Holding Corp. (2) Includes Texas headquartered commercial banks; Deposits as of June 30, 2025 (3) Original rank shown pro forma of Prosperity’s pending acquisition of American Bank Holding Corp. The acquisition of SWBI represents another meaningful investment in our Central Texas franchise, following our pending acquisition of American Bank Holding Corp. Pro Forma Central Texas Branch Footprint Deposits Share Rank (2, 3) Texas Partners Bank (11) Prosperity Bank (20) American Bank (8)

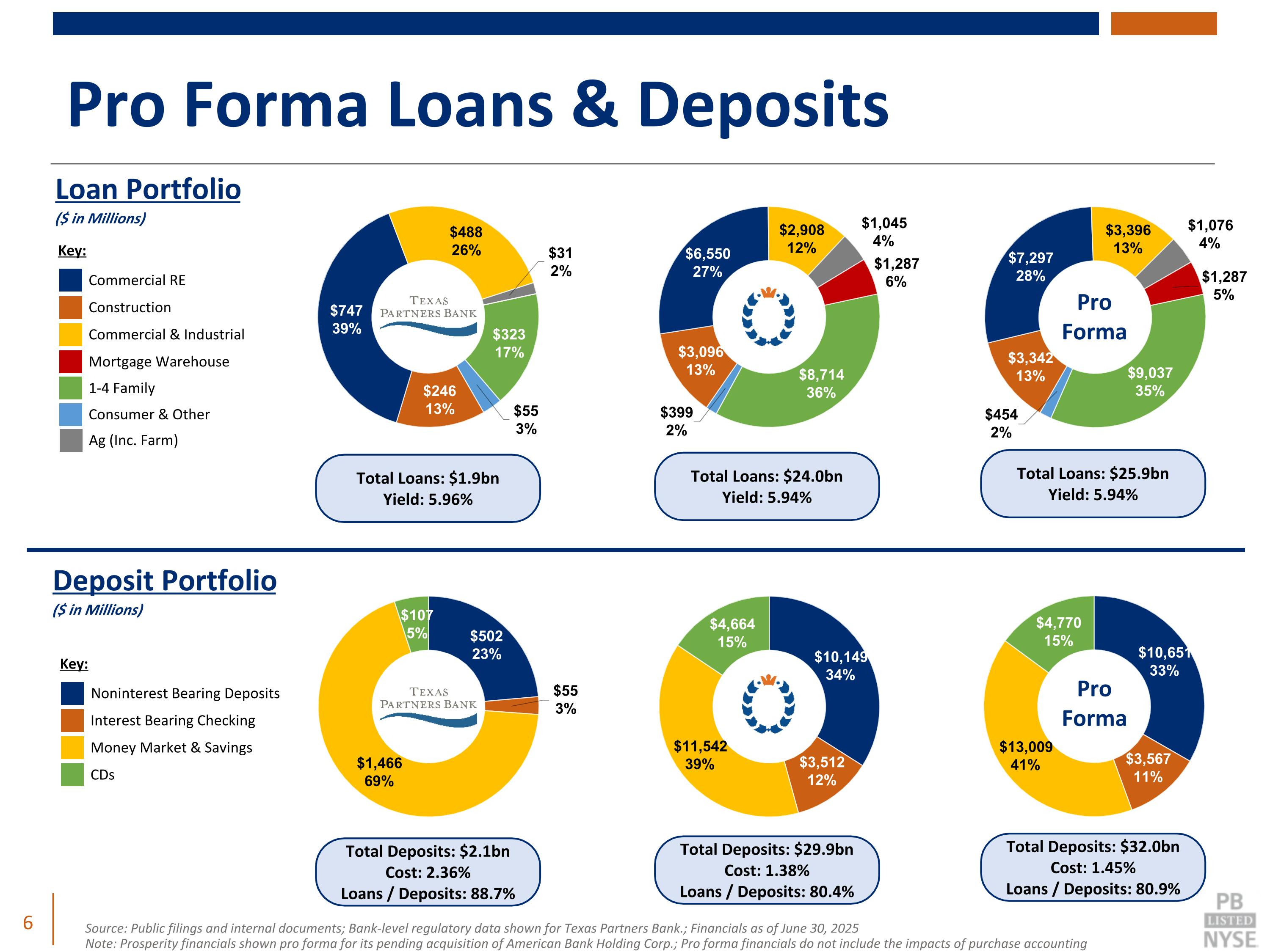

Pro Forma Loans & Deposits Source: Public filings and internal documents; Bank-level regulatory data shown for Texas Partners Bank.; Financials as of June 30, 2025 Note: Prosperity financials shown pro forma for its pending acquisition of American Bank Holding Corp.; Pro forma financials do not include the impacts of purchase accounting Pro Forma Commercial RE Construction Commercial & Industrial Mortgage Warehouse Key: Loan Portfolio ($ in Millions) 1-4 Family Consumer & Other Ag (Inc. Farm) Pro Forma Noninterest Bearing Deposits Interest Bearing Checking Money Market & Savings CDs Key: Total Loans: $1.9bn Yield: 5.96% Total Loans: $24.0bn Yield: 5.94% Total Loans: $25.9bn Yield: 5.94% Total Deposits: $2.1bn Cost: 2.36% Loans / Deposits: 88.7% Total Deposits: $29.9bn Cost: 1.38% Loans / Deposits: 80.4% Total Deposits: $32.0bn Cost: 1.45% Loans / Deposits: 80.9% Deposit Portfolio ($ in Millions)

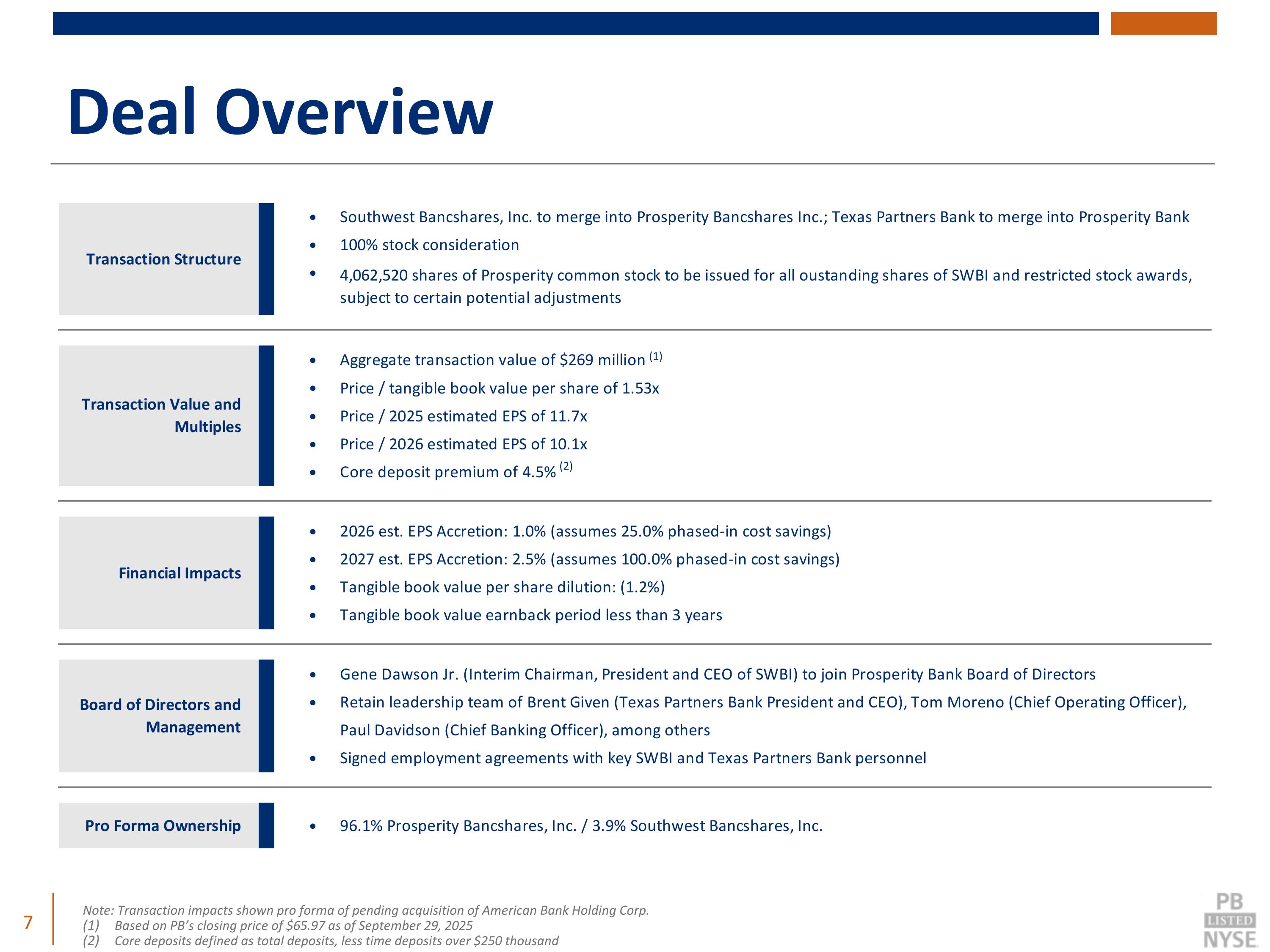

Deal Overview Note: Transaction impacts shown pro forma of pending acquisition of American Bank Holding Corp. Based on PB’s closing price of $65.97 as of September 29, 2025 Core deposits defined as total deposits, less time deposits over $250 thousand (1) (2)

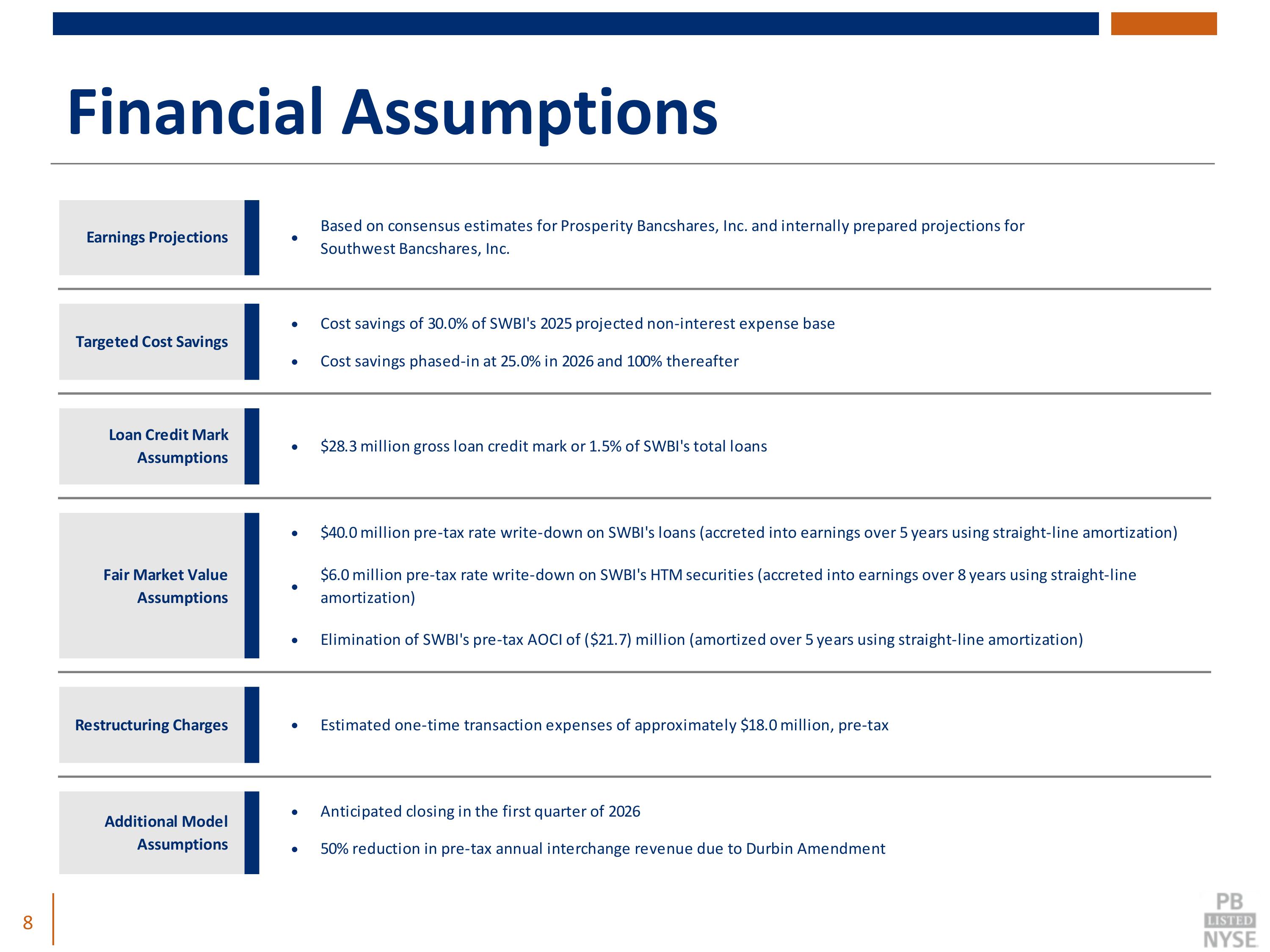

Financial Assumptions

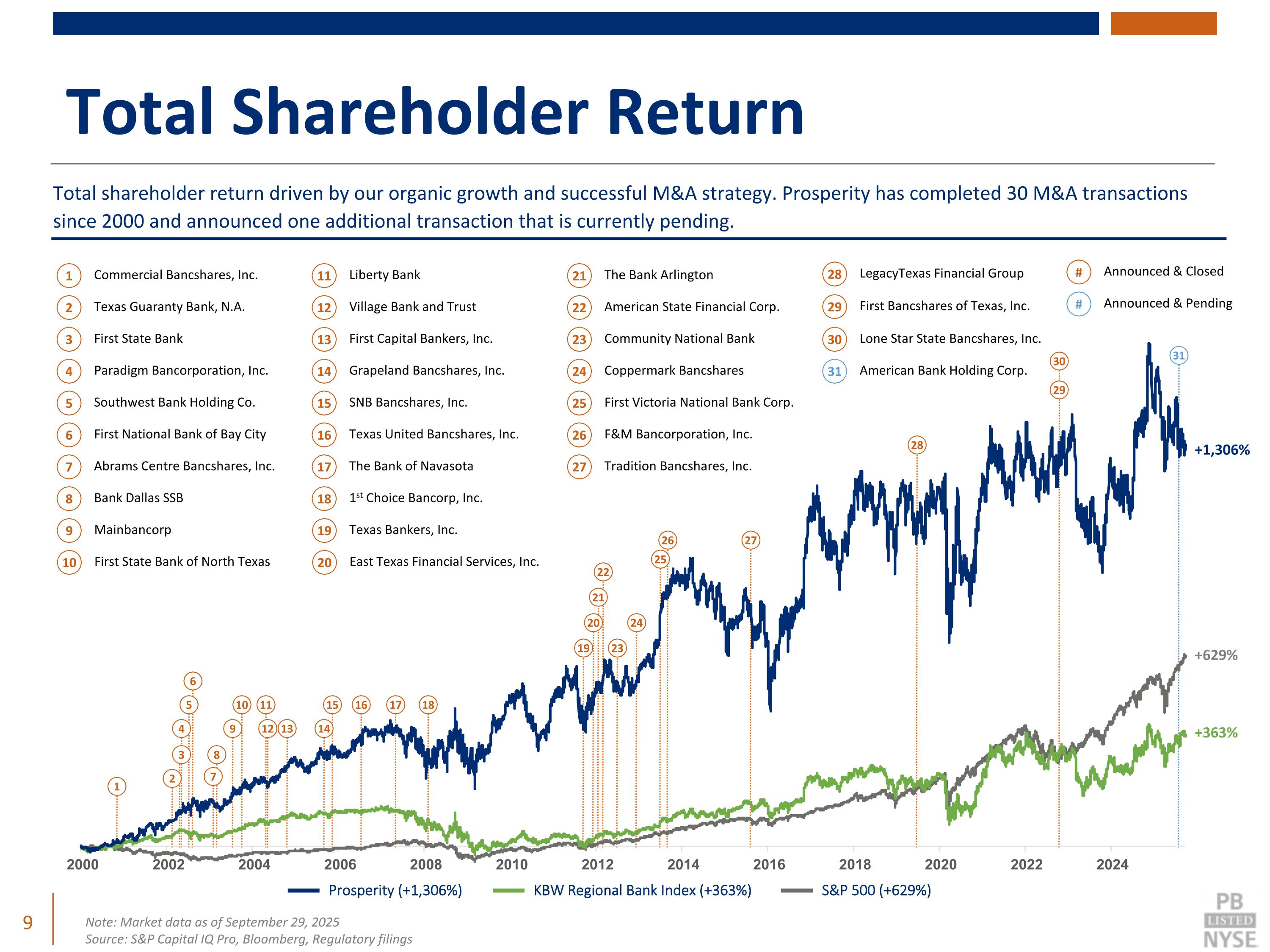

28 27 24 23 22 21 18 17 16 15 14 13 19 8 6 5 4 3 Total Shareholder Return Note: Market data as of September 29, 2025 Source: S&P Capital IQ Pro, Bloomberg, Regulatory filings Total shareholder return driven by our organic growth and successful M&A strategy. Prosperity has completed 30 M&A transactions since 2000 and announced one additional transaction that is currently pending. +1,306% +363% +629% Prosperity (+1,306%) KBW Regional Bank Index (+363%) S&P 500 (+629%) 30 29 1 Commercial Bancshares, Inc. 11 Liberty Bank 21 The Bank Arlington 29 First Bancshares of Texas, Inc. 2 Texas Guaranty Bank, N.A. 12 Village Bank and Trust 22 American State Financial Corp. 30 Lone Star State Bancshares, Inc. 3 First State Bank 13 First Capital Bankers, Inc. 23 Community National Bank 4 Paradigm Bancorporation, Inc. 14 Grapeland Bancshares, Inc. 24 Coppermark Bancshares 5 Southwest Bank Holding Co. 15 SNB Bancshares, Inc. 25 First Victoria National Bank Corp. 6 First National Bank of Bay City 16 Texas United Bancshares, Inc. 26 F&M Bancorporation, Inc. 7 Abrams Centre Bancshares, Inc. 17 The Bank of Navasota 27 Tradition Bancshares, Inc. 8 Bank Dallas SSB 18 1st Choice Bancorp, Inc. 28 LegacyTexas Financial Group 9 Mainbancorp 19 Texas Bankers, Inc. 10 First State Bank of North Texas 20 East Texas Financial Services, Inc. 1 2 7 9 10 11 20 26 25 12 31 American Bank Holding Corp. 31 # Announced & Closed # Announced & Pending

Prosperity is Doing Things Right Prosperity has been ranked as one of Forbes America’s Best Banks since the list’s inception in 2010, and was ranked in the Top 10 for 14 consecutive years Prosperity was named the “Best Overall Bank in Texas” by Money for 2024-2025 Prosperity was ranked among “America’s Best Regional Banks” by Newsweek in 2025 Source: www.Forbes.com, www.Money.com, www.Newsweek.com

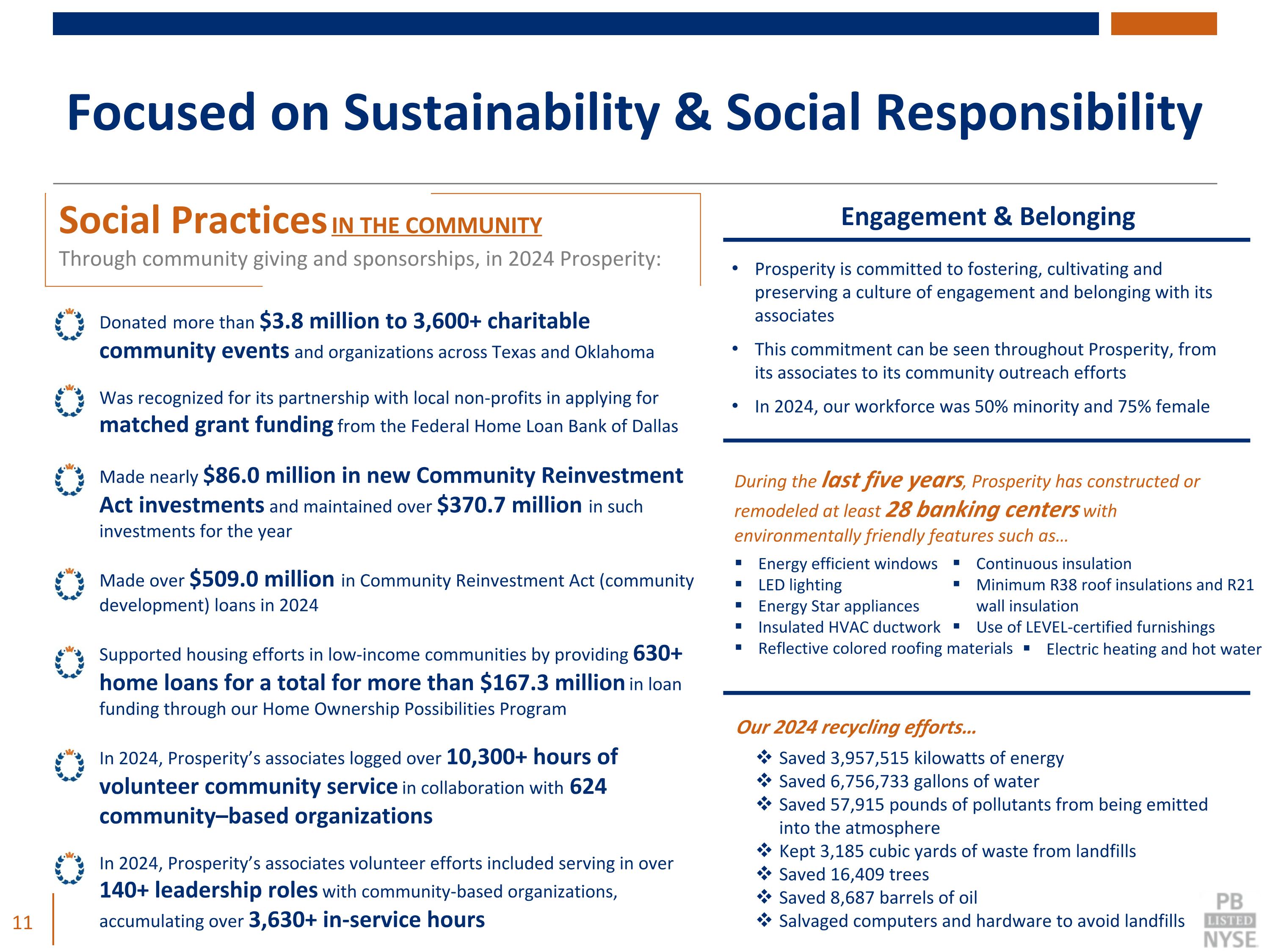

During the last five years, Prosperity has constructed or remodeled at least 28 banking centers with environmentally friendly features such as… Prosperity is committed to fostering, cultivating and preserving a culture of engagement and belonging with its associates This commitment can be seen throughout Prosperity, from its associates to its community outreach efforts In 2024, our workforce was 50% minority and 75% female Energy efficient windows LED lighting Energy Star appliances Insulated HVAC ductwork Reflective colored roofing materials Focused on Sustainability & Social Responsibility Engagement & Belonging Donated more than $3.8 million to 3,600+ charitable community events and organizations across Texas and Oklahoma Was recognized for its partnership with local non-profits in applying for matched grant funding from the Federal Home Loan Bank of Dallas Made nearly $86.0 million in new Community Reinvestment Act investments and maintained over $370.7 million in such investments for the year Made over $509.0 million in Community Reinvestment Act (community development) loans in 2024 Supported housing efforts in low-income communities by providing 630+ home loans for a total for more than $167.3 million in loan funding through our Home Ownership Possibilities Program In 2024, Prosperity’s associates logged over 10,300+ hours of volunteer community service in collaboration with 624 community–based organizations In 2024, Prosperity’s associates volunteer efforts included serving in over 140+ leadership roles with community-based organizations, accumulating over 3,630+ in-service hours 11 Our 2024 recycling efforts… Saved 3,957,515 kilowatts of energy Saved 6,756,733 gallons of water Saved 57,915 pounds of pollutants from being emitted into the atmosphere Kept 3,185 cubic yards of waste from landfills Saved 16,409 trees Saved 8,687 barrels of oil Salvaged computers and hardware to avoid landfills Continuous insulation Minimum R38 roof insulations and R21 wall insulation Use of LEVEL-certified furnishings Electric heating and hot water Social Practices IN THE COMMUNITY Through community giving and sponsorships, in 2024 Prosperity:

Important Information Additional Information about the Transaction and Where to Find It Prosperity intends to file with the SEC the Prosperity/Southwest Registration Statement on Form S-4 to register the shares of Prosperity common stock to be issued to the shareholders of Southwest in connection with Prosperity’s and Southwest’s proposed transaction. The Prosperity/Southwest Registration Statement will include the Prosperity/Southwest Proxy Statement/Prospectus which will be sent to the shareholders of Southwest in connection with the proposed transaction. This communication is not a substitute for the Prosperity/Southwest Proxy Statement/Prospectus or any other document which Prosperity may file with the SEC. In connection with Prosperity’s and American’s proposed transaction, Prosperity has filed with the SEC on September 17, 2025 the Prosperity/American Registration Statement on Form S-4, as amended on September 30, 2025 (the “Amended Prosperity/American Registration Statement”) (which Amended Prosperity/American Registration Statement was declared effective by the SEC on September 30, 2025), to register the shares of Prosperity common stock to be issued to the shareholders of American in connection with Prosperity’s and American’s proposed transaction. The Prosperity/American Proxy Statement/Prospectus will be delivered to shareholders of American. Prosperity may also file other documents with the SEC regarding the proposed transaction. This communication is not a substitute for the Prosperity/American Proxy Statement/Prospectus or Amended Prosperity/American Registration Statement or any other document which Prosperity may file with the SEC. INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE APPLICABLE REGISTRATION STATEMENT ON FORM S-4, THE APPLICABLE PROXY STATEMENT/PROSPECTUS INCLUDED WITHIN THE APPLICABLE REGISTRATION STATEMENT ON FORM S-4 AND ANY OTHER RELEVANT DOCUMENTS TO BE FILED WITH THE SEC IN CONNECTION WITH THE PROPOSED TRANSACTIONS OR INCORPORATED BY REFERENCE INTO THE APPLICABLE PROXY/STATEMENT PROSPECTUS, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THESE DOCUMENTS, CAREFULLY AND IN THEIR ENTIRETY, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT PROSPERITY, SOUTHWEST, AMERICAN AND THE APPLICABLE PROPOSED TRANSACTIONS. Investors and security holders may obtain free copies of these documents through the website maintained by the SEC at http://www.sec.gov. You will also be able to obtain these documents, free of charge, from Prosperity at http://www.prosperitybankusa.com. Copies of the Prosperity/American Proxy Statement/Prospectus (and the Prosperity/Southwest Proxy Statement/Prospectus, when it becomes available) can also be obtained, free of charge, by directing a request by telephone or mail to Prosperity Bancshares, Inc., Prosperity Bank Plaza, 4295 San Felipe, Houston, Texas 77027 Attn: Investor Relations, (281) 269-7199, or with respect to the Prosperity/American Proxy Statement/Prospectus, to American Bank Holding Corporation, 800 North Shoreline Boulevard, Corpus Christi, Texas 78401, Attn: Stephen Raffaele, (512) 306-5550 or, with respect to the Prosperity/Southwest Proxy Statement/Prospectus, Southwest Bancshares, Inc., 1900 NW Loop 410, San Antonio, Texas 78213, Attention: Investor Relations, (210) 807-5511, as applicable. No Offer or Solicitation This communication is for informational purposes only and is not intended to and does not constitute an offer to subscribe for, buy or sell, or the solicitation of an offer to subscribe for, buy or sell, or an invitation to subscribe for, buy or sell any securities or a solicitation of any vote or approval in any jurisdiction, nor shall there be any sale, issuance or transfer of securities in any jurisdiction in which such offer, invitation, sale or solicitation would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act, and otherwise in accordance with applicable law.

Greet The Customer With A Smile Address Our Customer By Name Try to Say Yes Instead of No Thank the Customer for Banking With Us