General Strategy Description. The Fund has adopted a policy pursuant to Rule 35d-1 under the 1940 Act to invest, under normal circumstances, at least 80% of its net assets (plus any borrowings for investment purposes) in investments that provide exposure to bitcoin. The Fund expects such investments to consist of options contracts, including FLexible EXchange® Options (“FLEX Options”), that reference one or more exchange-traded products that hold bitcoin directly (each a “Bitcoin ETP”) or the CBOE Bitcoin U.S. ETF Index (the “Bitcoin ETP Index” and together with the Bitcoin ETPs, the “Bitcoin Reference Asset”). FLEX Options are exchange-traded option contracts with uniquely customizable terms. Although guaranteed for settlement by the Options Clearing Corporation (the “OCC”), FLEX Options are still subject to counterparty risk with the OCC and may be less liquid than more traditional exchange-traded options. Bitcoin ETPs are exchange-traded investment products not registered under the Investment Company Act of 1940, as amended (the “1940 Act”), that seek to reflect the price of bitcoin, before fees and expenses, by purchasing and storing bitcoin in a digital vault and issuing exchange-listed shares that correspond to the price of bitcoin it holds. The Bitcoin ETP Index is a modified market capitalization-weighted index designed to reflect the price return performance of a basket of Bitcoin ETPs listed on U.S. Exchanges. The Bitcoin ETPs that the Fund may utilize as the Bitcoin Reference Asset include: iShares Bitcoin Trust ETF, Grayscale Bitcoin Trust, Fidelity Wise Origin Bitcoin Fund, Bitwise Bitcoin ETF Trust, ARK 21Shares Bitcoin ETF or the VanEck Bitcoin Trust. For the current Outcome Period, the Bitcoin Reference Asset is the Bitcoin ETP Index. Additional information regarding the Bitcoin ETPs and the Bitcoin ETP Index is available in “Additional Information Regarding the Fund’s Principal Investment Strategies.”

Due to the unique mechanics of the Fund’s strategy, the return an investor can expect to receive from an investment in the Fund has characteristics that are distinct from many other investment vehicles. It is important that an investor understand these characteristics before making an investment in the Fund. The Fund does not directly invest in bitcoin.

The Fund provides investment exposure to the price performance of bitcoin (i.e., “spot” bitcoin prices), as represented by the price of the Bitcoin Reference Asset (the “Bitcoin Price”) by investing in FLEX Options that reference the Bitcoin Reference Asset. The pre-determined outcomes sought by the Fund, which include the Floor and Participation Rate discussed below (the “Outcomes”), are based upon the Bitcoin Reference Asset, over an approximately three-month period (the “Outcome Period”). The current Outcome Period is from October 1, 2025 through December 31, 2025. Following the Outcome Period, each successive Outcome Period will begin on the day the prior Outcome Period concludes and will end three months thereafter. In addition to its investments in FLEX Options, the Fund also invests in U.S. Treasury Bills (“U.S. Treasuries”), that in combination with the Fund’s FLEX Options, produce the Fund’s Outcomes for an Outcome Period. See “Principal Investment Strategies—The Fund’s Investments” below for additional information.

Following the Outcome Period, each successive Outcome Period will begin on the day the prior Outcome Period concludes and will end three months thereafter. Upon conclusion of the Outcome Period, the Fund will receive the cash value of its investments held for the prior Outcome Period. It will then invest in a new series of FLEX Options and U.S. Treasuries with an expiration date or maturity date, respectively, in approximately three months and a new Outcome Period will begin.

The Outcomes may only be realized by investors who continuously hold Shares from the commencement of the Outcome Period until its conclusion. Investors who purchase Shares after the Outcome Period has begun or sell Shares prior to the Outcome Period’s conclusion may experience investment returns that are very different from those that the Fund seeks to provide. An investor that holds Shares through multiple Outcome Periods may fail to experience gains comparable to those of the Bitcoin Price over time because at the end of the Outcome Period a new Participation Rate will be established and any gains in the Bitcoin Price above the Participation Rate will be forfeited.

The Fund’s strategy has been specifically designed to produce the Outcomes based upon the Bitcoin Price at the outset of the Outcome Period through its the conclusion, subject to the “Participation Rate” and “Floor” described herein. The Fund seeks to provide shareholders that hold Shares for the entire Outcome Period with a maximum loss experienced by the Bitcoin Price over the course of the Outcome Period of 20% (the “Floor”), before taking into account annual Fund management fees, shareholder transaction fees, brokerage commissions, taxes and any extraordinary expenses incurred by the Fund. The Floor is provided after taking into account interest income received via the U.S. Treasuries. The Fund’s shareholders will bear all Bitcoin Price losses on a one-to-one basis prior to the Floor. There is no guarantee that the Fund will be successful in providing the sought-after Floor. See “Principal Investment Strategies—Floor” herein for additional information regarding the Floor.

If the Bitcoin Price increases over the duration of the Outcome Period, the Fund seeks to provide investors that hold Shares for the entire Outcome Period with 71.00% of the increase in value experienced by the Bitcoin Price over the duration of the Outcome Period (the “Participation Rate”). As a result of the Participation Rate, while the Fund is not capped in the amount of upside performance it can experience, the Fund’s returns will underperform any positive returns in the Bitcoin Price. Since the Fund will not participate in the entirety of the gains experienced by the Bitcoin Price through the operation of the Participation Rate, the Fund will underperform any gains in the Bitcoin Price over the course of the Outcome Period and shareholders will forfeit any gains in the Bitcoin Price that exceed the Participation Rate. Any gains experienced by shareholders will be reduced by the Fund’s management fee for the Outcome Period, and further reduced by any shareholder transaction fees, brokerage commissions, taxes and any extraordinary expenses incurred by the Fund. Unlike other funds that employ a “defined outcome strategy,” the Fund does not limit returns investors may receive through the implementation of capped returns, or a “cap”. Rather, the Fund participates in a percentage of positive returns of the Bitcoin Price and such returns are limited by the Participation Rate. The Participation Rate is dependent upon market conditions at the time the Fund enters into its FLEX Options for the Outcome Period and is likely to rise or fall from one Outcome Period to the next. Accordingly, it is possible that the Participation Rate in a subsequent Outcome Period could be substantially lower or higher than the current Participation Rate.

As is discussed in further detail below, it is anticipated that during the Outcome Period the Fund’s NAV will not increase or decrease at the same rate as the Bitcoin Price. The Fund’s NAV is based upon the value of its portfolio, which includes the FLEX Options and U.S. Treasuries. Although the value of the Bitcoin Price is a significant component of the value of the Fund’s FLEX Options, the time remaining until those FLEX Options expire also affects their value. The Fund’s investment sub-adviser, Milliman Financial Risk Management LLC (“Milliman” or the “Sub-Adviser”),

generally anticipates that the Fund’s NAV will increase on days when the Bitcoin Price increases and will decrease on days when the Bitcoin Price decreases, but that the rate of such increase or decrease will be less than the Bitcoin Price.

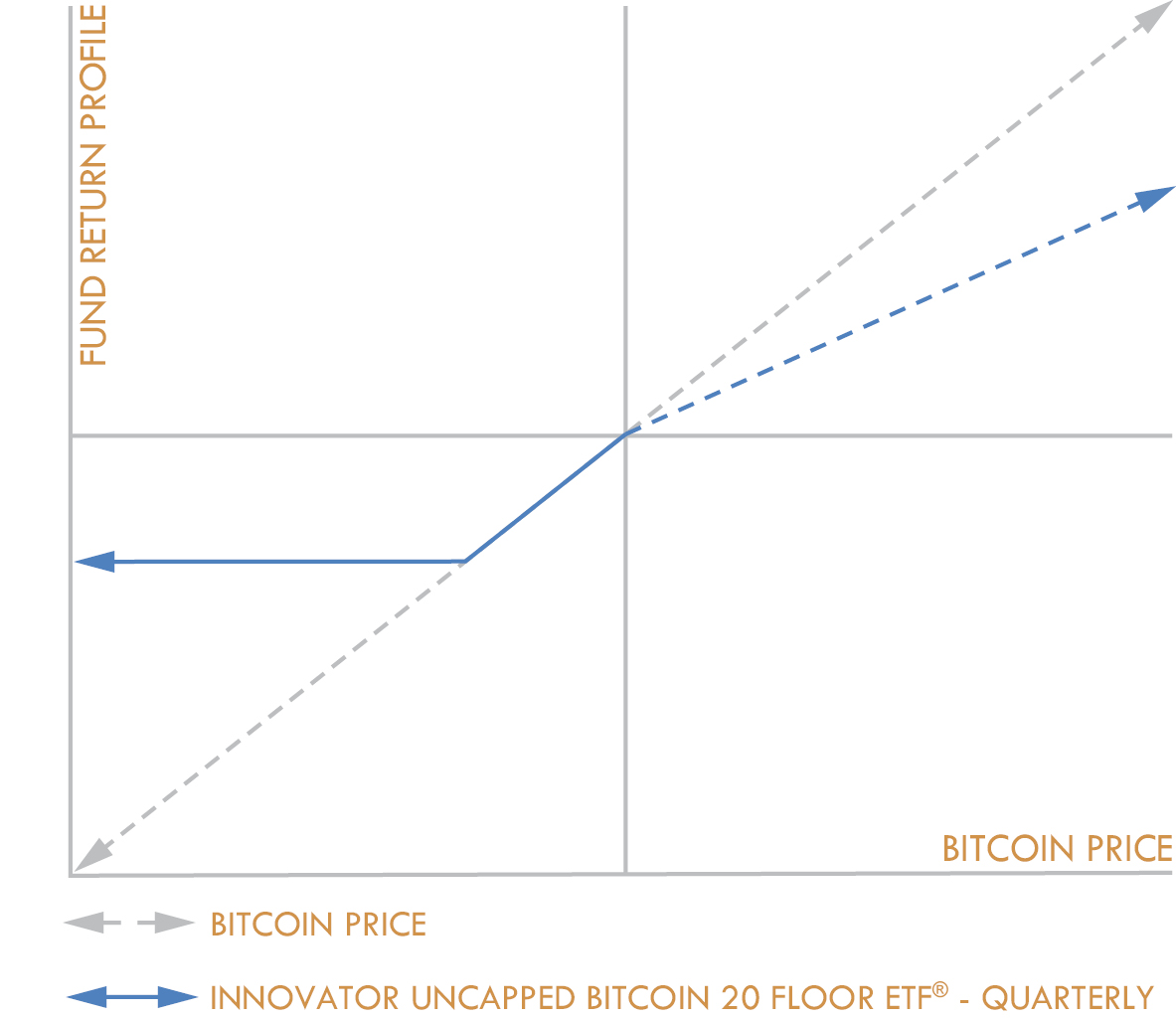

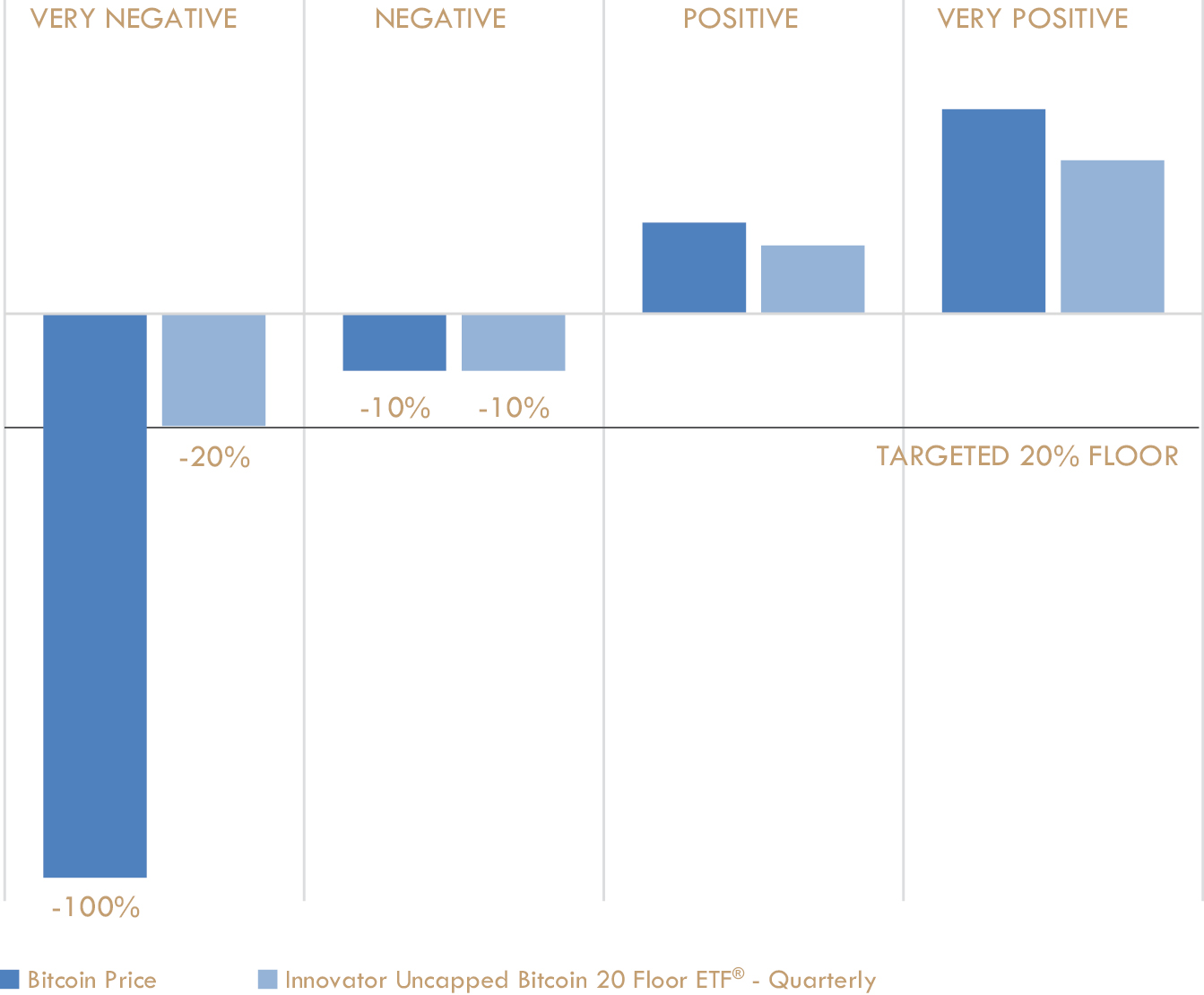

The Fund’s investment strategy seeks to provide a limit to the maximum loss of the Bitcoin Price experienced by the Fund over the course of the Outcome Period while simultaneously participating in a percentage of the returns of the Bitcoin Price (discussed in detail below). The two hypothetical graphical illustrations provided below are designed to illustrate the Outcomes that the Fund seeks to provide for investors who hold Shares for the entirety of the Outcome Period. There is no guarantee that the Fund will be successful in its attempt to provide the Outcomes for an Outcome Period. The returns that the Fund seeks to provide do not include the costs associated with purchasing Shares and certain expenses incurred by the Fund. The graphical illustrations below are for illustrative purposes and a potential Participation Rate and the impact on the returns of the Fund in comparison to the returns of the Bitcoin Price. If the Participation Rate is lower or higher than those shown for an Outcome Period, the positive returns experienced by investors, if any, will differ than those presented below. The Participation Rate is likely to change from one Outcome Period to the next and may be significantly higher or lower.

The following table contains hypothetical examples designed to illustrate the Outcomes the Fund seeks to provide over an Outcome Period, based upon the performance of the Bitcoin Price from -100% to 100%. The table is provided for illustrative purposes and does not provide every possible performance scenario for Shares over the course of an Outcome Period. There is no guarantee that the Fund will be successful in its attempt to provide the Outcomes for an Outcome Period. The table is not intended to predict or project the performance of the Bitcoin Price or the Fund. Fund shareholders should not take this information as an assurance of the expected performance of the Bitcoin Price or return on Shares. The actual overall performance of the Fund will vary with fluctuations in the value of the FLEX Options during the Outcome Period, among other factors. Please refer to the Fund’s website, www.innovatoretfs.com/qbf, which provides updated information relating to this table on a daily basis throughout the Outcome Period.

|

Bitcoin |

(100 |

)% |

(50 |

)% |

(25 |

)% |

(10 |

)% |

(5 |

)% |

0 |

% |

5 |

% |

10 |

% |

15 |

% |

20 |

% |

50 |

% |

100 |

% |

||||||||||||

|

Fund |

(20 |

)% |

(20 |

)% |

(20 |

)% |

(10 |

)% |

(5 |

)% |

0 |

% |

3.55 |

%* |

7.10 |

%* |

10.65 |

%* |

14.20 |

%* |

35.50 |

%* |

71.00 |

%* |

* The Participation Rate is set on the first day of the Outcome Period and is 71.00% of the returns of the Bitcoin Reference Asset, prior to taking into account any fees or expenses charged to shareholders, which will have the effect of lowering the returns experienced by shareholders. The Fund’s annual management fee, any shareholder transaction fees, brokerage commissions, taxes and any extraordinary expenses incurred by the Fund will also have the effect of reducing the Floor amounts for Fund shareholders.

Cayman Subsidiary. The Fund may invest in FLEX Options indirectly by investing a portion of its assets in a wholly-owned subsidiary of the Fund organized under the laws of the Cayman Islands (the “Subsidiary”), as determined necessary or advisable by the Fund. The Subsidiary and the Fund will have the same investment adviser, investment sub-adviser and investment objective.

The Subsidiary will also follow the same general investment policies and restrictions as the Fund. Except as noted herein, for purposes of this Prospectus, references to the Fund’s investment strategies and risks include those of the Subsidiary. The Fund complies with the provisions of the 1940 Act governing investment policies and capital structure and leverage on an aggregate basis with the Subsidiary. Furthermore, the Adviser, as the investment adviser to the Subsidiary, complies with the provisions of the 1940 Act relating to investment advisory contracts as it relates to its advisory agreement with the Subsidiary. The Subsidiary also complies with the provisions of the 1940 Act relating to affiliated transactions and custody. Because the Fund intends to qualify for treatment as a regulated investment company (“RIC”) under the Internal Revenue Code of 1986 (the “Code”), the size of the Fund’s investment in the Subsidiary will not exceed 25% of the Fund’s total assets at or around each quarter end of the Fund’s fiscal year. In order to continue to qualify as a RIC, the Fund will have to reduce its exposure to the Subsidiary on or around the end of each of the Fund’s fiscal quarter ends. At other times of the year, the Fund’s investments in the Subsidiary may significantly exceed 25% of the Fund’s total assets. The Subsidiary’s custodian is U.S. Bank, N.A.

The Fund’s Investments. The Fund holds directly and indirectly through the Subsidiary a portfolio composed of U.S. Treasuries and FLEX Options that reference the Bitcoin Reference Asset. The FLEX Options and U.S. Treasuries are each set to expire or mature, respectively, on the last day of the Outcome Period. A detailed explanation regarding the Fund’s investment portfolio can be found in “Additional Information Regarding the Fund’s Principal Investment Strategies.”

Use of FLEX Options. The Fund purchases and sells call FLEX Options to obtain its exposure to the Bitcoin Price. The customizable nature of the FLEX Options allows the Sub-Adviser to select the share price at which the Bitcoin ETPs will be exercised at the expiration of each option. This is commonly known as the “strike price.” At the commencement of the Outcome Period, the Sub-Adviser specifically selects the strike price for each FLEX Option such that when the FLEX Options are exercised on the final day of the Outcome Period, the Outcomes may be obtained, depending on the performance of the Bitcoin Price over the duration of the Outcome Period. The Fund utilizes European style option contracts, which are exercisable only on the expiration date of the option contract.

To achieve these returns, the Fund will purchase and sell a combination of call option contracts. A call option contract gives the buyer of the call option contract the right (but not the obligation) to buy, and the seller of the call option contract (i.e., the “writer”) the obligation to sell, a specified amount of an underlying reference asset at a pre-determined price. Each of the FLEX Options purchased and sold throughout the Outcome Period are expected to have the same or similar terms (i.e., strike price and expiration) as the corresponding FLEX Options purchased and sold on the first day of the Outcome Period.

U.S. Treasuries. In combination with the Fund’s FLEX Options, the U.S. Treasuries held by the Fund seek to provide the Floor. U.S. Treasury securities are government debt instruments issued by the United States Department of the Treasury that are backed by the full faith and credit of the United States Government. The U.S. Treasuries held by the Fund will have maturity dates that align with the conclusion of the Outcome Period and the Fund will enter into new U.S. Treasuries positions for each Outcome Period. There is no guarantee that the portion of the Fund’s portfolio consisting of U.S. Treasuries will retain sufficient value to provide the level

of sought-after protection provided by the Floor. The value of the U.S. Treasuries may increase (providing a higher protection level and therefore more protection to shareholders) or decrease (providing a lower protection level and therefore less protection to shareholders).

The Outcome Period. The Outcomes sought by the Fund are based upon the Fund’s NAV at the outset of the Outcome Period. The Outcome Period begins on the day the FLEX Options and U.S. Treasuries are entered into and ends approximately three months later on the day the FLEX Options expire and U.S. Treasuries mature. Each FLEX Option’s value is ultimately derived from the performance of the Bitcoin Price during that time. Because the terms of the FLEX Options do not change, the Participation Rate and the Floor both relate to the Fund’s NAV on the first day of the Outcome Period. A shareholder that purchases Shares after the commencement of the Outcome Period will likely have purchased Shares at a different NAV than the NAV on the first day of the Outcome Period (i.e., the NAV upon which the Outcomes are based) and therefore may experience Outcomes that are very different from those sought by the Fund. Since the FLEX Options are exercisable only on the final day of the Outcome Period, a shareholder that sells Shares prior to the end of the Outcome Period may also experience investment outcomes very different from those sought by the Fund. To achieve the Outcomes sought by the Fund for the Outcome Period, an investor must hold Shares at the time that the Fund enters into the FLEX Options and continue to hold those Shares until the day the FLEX Options expire. Additionally, an investor that holds Shares through multiple Outcome Periods may fail to experience gains comparable to the Bitcoin Price over time because at the end of the Outcome Period a new Participation Rate will be established and any Bitcoin Price gains that exceed the Participation Rate will be forfeited. There is no guarantee that the Fund will be successful in its attempt to provide the Outcomes.

The Fund’s assets will be principally composed of FLEX Options, the value of which is derived from the performance of the underlying reference asset, the Bitcoin Reference Asset, and U.S. Treasuries. However, because a component of an option’s value is the number of days remaining until its expiration, during the Outcome Period, the Fund’s NAV will not directly correlate on a day-to-day basis with the returns experienced by the Bitcoin Price. The Sub-Adviser generally anticipates that the Fund’s NAV will increase on days when the Bitcoin Price increases and will decrease on days when the Bitcoin Price decreases, but that the rate of such increase or decrease will be less than that experienced by the Underlying ETF. Similarly, the amount of time remaining until the end of the Outcome Period also affects the impact of the Floor on the Fund’s NAV, which may not be in full effect prior to the end of the Outcome Period. The Fund’s strategy is designed to produce the Outcomes upon the expiration of the FLEX Options and maturity of the U.S. Treasuries on the last day of the Outcome Period and it should not be expected that the Outcomes will be provided at any point prior to that time. Taken together, this means that at the midpoint of the Outcome Period, if the Bitcoin Price has decreased by 20%, the Fund’s NAV can be expected to have decreased in value (because the Floor is not yet in full effect), but by less than 20% (because the Fund’s NAV will not correlate one-to-one with the Bitcoin Price and the Fund’s NAV tends not to participate fully in either Bitcoin Price gains or losses).

An investor that holds Shares through multiple Outcome Periods may fail to experience gains comparable to those of the Bitcoin Price over time because at the end of the Outcome Period a new Participation Rate will be established and any increases in the Bitcoin Price that exceed the Participation Rate will be forfeited. Similarly, an investor that holds Shares through multiple

Outcome Periods will be unable to recapture losses from prior Outcome Periods because at the end of each Outcome Period, a new Floor will be established based on the then-current price of the Bitcoin Reference Asset and any losses experienced during the prior Outcome Period will be locked-in. Moreover, the annual imposition of a new Participation Rate on future gains may make it difficult to recoup any losses from the prior Outcome Periods such that, over multiple Outcome Periods, the Fund may have losses that exceed those of the Bitcoin Reference Asset.

Participation Rate. The potential upside return that an investor can receive from an investment in Shares over the Outcome Period is subject to the Participation Rate. The Participation Rate represents the percentage of Bitcoin Price gains that the Fund experiences over the duration of the Outcome Period. Therefore, even though the Fund’s returns are based upon the performance of the Bitcoin Price, any gains that exceed the Participation Rate will not be experienced by the Fund. The Participation Rate is determined on the first day of the Outcome Period and is 71.00% of gains experienced by the Bitcoin Price over the duration of the Outcome Period. The Fund’s annual management fee, as well as any shareholder transaction fees, brokerage commissions, taxes and any extraordinary expenses incurred by the Fund, will lessen the returns experienced by shareholders. For the purpose of this prospectus, “extraordinary expenses” are non-recurring expenses that may incurred by the Fund outside of the ordinary course of its business, including, without limitation, costs incurred in connection with any claim, litigation, arbitration, mediation, government investigation or similar proceedings, indemnification expenses and expenses in connection with holding and/or soliciting proxies for a meeting of Fund shareholders. The Participation Rate is also set forth on the Fund’s website at www.innovatoretfs.com/qbf.

Unlike other Funds that employ a “defined outcome strategy,” the Fund does not limit returns investors may receive through the implementation of a “cap”. Rather, the Fund participates in a percentage of positive returns of the Bitcoin Price and such returns are only limited by the Participation Rate. The Participation Rate is dependent upon market conditions at the time the Fund enters into its FLEX Options for the Outcome Period and is likely to change for each Outcome Period based upon prevailing market conditions at the beginning of the Outcome Period. The Participation Rate should be considered before investing in the Fund. There is no guarantee that the Fund will successfully achieve its investment objective.

The Participation Rate is a result of the design of the Fund’s principal investment strategy. In order to obtain upside exposure to the returns of the Bitcoin Price and provide the Floor, the Fund purchases U.S Treasuries and enters into a series of FLEX Options. The Fund purchases an in-the-money call FLEX Option to obtain the upside exposure to the Bitcoin Price, however, also sells an at-the-money call FLEX Option. The sold call FLEX Option will offset a portion of the gains the Fund, the extent of which is dependent upon the size of the sold call FLEX Options’ notional value versus that of the purchased call FLEX Options. Notional value is the total underlying amount of a derivatives trade and measures the economic exposure of a derivatives position. The notional exposure of the Fund’s purchased call FLEX Option will be 100% of the Fund’s portfolio. The notional exposure of the Fund’s sold call FLEX Option is expected to be less than such value, and the difference between the two produces the Participation Rate. The terms of the FLEX Options are determined based upon prevailing market conditions at the time the Fund enters into such FLEX Options, most notably current interest rate levels and volatility in the Bitcoin Price, among other reasons. Dependent upon market conditions at the onset of the Outcome Period when the Fund enters into its FLEX Options, the Participation Rate could be very low. Approximately

one week prior to the end of the Outcome Period, additional information about anticipated ranges for the Participation Rate for the next Outcome Period will be available on the Fund’s website, www.innovatoretfs.com/qbf, which also provides information relating to the Outcomes on a daily basis. See “Principal Investment Strategies—Fund Rebalance” below for additional information.

Floor. The Floor is only operative against Bitcoin Price losses exceeding 20% over the duration of the Outcome Period; however, there is no guarantee that the Fund will be successful in its attempt to provide the Floor. The Floor is a function of the Fund’s U.S Treasuries and the strike prices of the Fund’s FLEX Options. If the Bitcoin Reference Asset decreases by more than 20%, the FLEX Options will expire worthless and the Fund’s value will be comprised of the U.S. Treasuries, which are set at an amount that equals 80% of the Fund’s assets at the onset of the Outcome Period. The U.S. Treasuries are selected and weighted to specifically provide the 20% Floor by seeking to preserve the Fund’s capital in the event the FLEX Options expire worthless, such that in the event the Bitcoin Price declines by more than 20% (and therefore, the Fund’s FLEX Options expire worthless), the Fund will maintain its investment in the U.S. Treasuries, which will be equal to 80% of the Fund’s value at the commencement of the Outcome Period. The Floor is provided prior to taking into account annual Fund management fees equal to 0.79% of the Fund’s daily net assets, shareholder transaction fees, brokerage commissions, taxes and any extraordinary expenses incurred by the Fund. The Fund’s annual management fee, shareholder transaction fees, brokerage commissions, taxes and any extraordinary expenses incurred by the Fund will have the effect of extending the maximum losses incurred to the Floor for Fund shareholders. When the Fund’s annual management fee equal to 0.79% of the Fund’s daily net assets is taken into account for the Outcome Period, the net Floor for an Outcome Period is 20.20%. The Floor is provided after taking into account interest income received via the U.S. Treasuries, which will be distributed to shareholders periodically. If an investor is considering purchasing Shares during the Outcome Period, and the Fund has already increased in value, then a shareholder may experience losses that exceed 20% prior to gaining the protection offered by the Floor, which is not guaranteed. A shareholder that purchases Shares at the beginning of the Outcome Period may lose their entire investment. While the Fund seeks to limit losses experienced by the Bitcoin Price to 20% for shareholders who hold Shares for the entire Outcome Period, there is no guarantee it will successfully do so. Depending upon market conditions at the time of purchase, a shareholder that purchases Shares after the Outcome Period has begun may also lose their entire investment. An investment in the Fund is only appropriate for shareholders willing to bear those losses.

Bitcoin. Bitcoin is a digital asset that can be transferred among participants on the bitcoin peer-to-peer network (the “Bitcoin Network”) on a peer-to-peer basis via the Internet. Bitcoin can be transferred without the use of a central administrator or clearing agency, unlike other means of electronic payments. Because a central party is not necessary to administer bitcoin transactions or maintain the bitcoin ledger, the term decentralized is often used in descriptions of bitcoin.

Bitcoin is based on the decentralized, open-source protocol of a peer-to-peer electronic network. No single entity owns or operates the Bitcoin Network. Bitcoin is not issued by governments, banks or any other centralized authority. The infrastructure of the Bitcoin Network is collectively maintained on a distributed basis by the network’s participants, consisting of “miners,” who run special software to validate transactions, developers, who maintain and contribute updates to the bitcoin network’s source code, and users, who download and maintain on their individual computer a full or partial copy of the Bitcoin Blockchain (defined below) and related software.

Anyone can be a user, developer, or miner. The Bitcoin Network is accessed through software, and software governs the creation, movement, and ownership of bitcoin. The source code for the Bitcoin Network and related software protocol is open-source, and anyone can contribute to its development. The value of bitcoin is in part determined by the supply of, and demand for, bitcoin in the global markets for the trading of bitcoin, market expectations for the adoption of bitcoin as a decentralized store of value, the number of merchants and/or institutions that accept bitcoin as a form of payment, and the volume of peer-to-peer transactions, among other factors.

Bitcoin transaction and ownership records are reflected on the blockchain ledger for bitcoin (the “Bitcoin Blockchain”), which is a digital public record or ledger. Copies of this ledger are stored in a decentralized manner on the computers of each Bitcoin network node (a node is any user who maintains on their computer a full copy of all the bitcoin transaction records, the blockchain, as well as related software). Miners authenticate and bundle bitcoin transactions sequentially into files called “blocks”, which requires performing computational work to solve a cryptographic puzzle set by the Bitcoin Network’s software protocol. Because each solved block contains a reference to the previous block, they form a chronological “chain” back to the first bitcoin transaction. Copies of the Bitcoin Blockchain are stored in a decentralized manner on the computers of each individual Bitcoin Network full node, i.e., any user who chooses to maintain on their computer a full copy of the Bitcoin Blockchain as well as related software. Each bitcoin is associated with a set of unique cryptographic “keys”, in the form of a string of numbers and letters, which allow whoever is in possession of the private key to assign that bitcoin in a transfer that the Bitcoin network will recognize.

The Fund obtains its bitcoin exposure indirectly via FLEX Options. The Bitcoin Reference Asset is either one of the Bitcoin ETPs or the Bitcoin ETP Index. Additional information regarding the Bitcoin ETPs and the Bitcoin ETP Index is available in “Additional Information Regarding the Fund’s Principal Investment Strategies.”

Fund Rebalance. The Fund is a continuous investment vehicle. It does not terminate and distribute its assets at the conclusion of each Outcome Period. On the termination date of an Outcome Period, the Sub-Adviser will invest in a new set of FLEX Options and another Outcome Period will commence.

Approximately one week prior to the end of each Outcome Period, the Fund will file a prospectus supplement, which will alert existing shareholders that an Outcome Period is approaching its conclusion and disclose the anticipated ranges for the Participation Rate for the next Outcome Period. Following the close of business on the last day of the Outcome Period, the Fund will file a prospectus supplement that discloses the Fund’s final Participation Rate for the next Outcome Period. This information is available on the Fund’s website, www.innovatoretfs.com/qbf, which also provides information relating to the Outcomes on a daily basis.

The Fund’s website, www.innovatoretfs.com/qbf, provides information relating to the Outcomes on a daily basis. Important information relating to the Fund, including information relating to the Participation Rate, is communicated on the Fund’s website.

The Fund is classified as a “non-diversified company” under the 1940 Act. The Fund will not concentrate its investments in securities of issuers in any industry or group of industries as the term “concentrate” is used in the 1940 Act, except that the Fund may invest more than 25% of its total assets in investments that provide exposure to the Bitcoin Price.