Shareholder Report

|

12 Months Ended |

|

Jul. 31, 2025

USD ($)

Holding

|

|---|

| Shareholder Report [Line Items] |

|

| Document Type |

N-CSR

|

| Amendment Flag |

false

|

| Registrant Name |

TARGET PORTFOLIO TRUST

|

| Entity Central Index Key |

0000890339

|

| Entity Investment Company Type |

N-1A

|

| Document Period End Date |

Jul. 31, 2025

|

| PGIM Quant Solutions Small-Cap Value Fund - Class A |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

PGIM Quant Solutions Small-Cap Value Fund

|

| Class Name |

Class A

|

| Trading Symbol |

TSVAX

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about the Class A shares of PGIM Quant Solutions Small-Cap Value Fund (the “Fund”) for the period of August 1, 2024 to July 31, 2025.

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at pgim.com/investments/mutual-funds/prospectuses-fact-sheets . You can also request this information by contacting us at (800) 225-1852 or (973) 367-3529 from outside the US.

|

| Additional Information Phone Number |

(800) 225-1852 or (973) 367-3529

|

| Additional Information Website |

pgim.com/investments/mutual-funds/prospectuses-fact-sheets

|

| Expenses [Text Block] |

WHAT WERE THE FUND COSTS FOR THE LAST YEAR? (Based on a hypothetical $10,000 investment)

|

|

Costs paid as a percentage |

PGIM Quant Solutions Small-Cap Value Fund—Class A |

|

|

|

| Expenses Paid, Amount |

$ 105

|

| Expense Ratio, Percent |

1.09%

|

| Factors Affecting Performance [Text Block] |

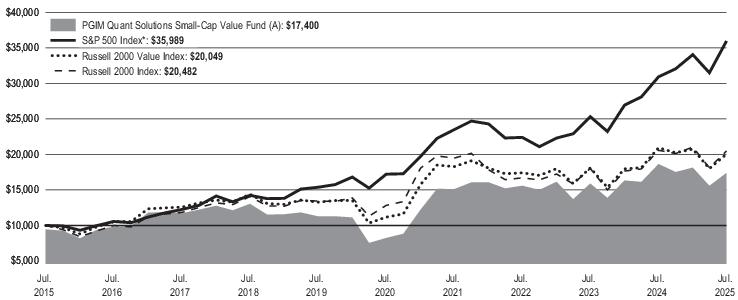

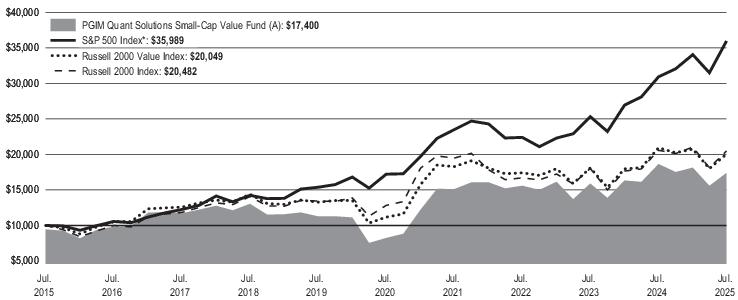

WHAT AFFECTED THE FUND’S PERFORMANCE DURING THE REPORTING PERIOD? ■ Market gains continued to be fueled by large-cap stocks, which outperformed small-cap names by over 17% during the reporting period. US small-cap stocks (as measured by the Russell 2000 Index) declined 0.55%, while large-cap stocks (as measured by the Russell 1000 Index) gained 16.54%. Additionally, growth stocks continued to outpace value stocks. Although this gap was most significant among large-caps, the Russell 2000 Value Index (-4.27%) trailed the Russell 2000 Growth Index (3.15%) by over 7%. ■ PGIM Quantitative Solutions’ focus on stocks with low valuations and attractive business prospects drove underperformance, as the Fund lagged the Russell 2000 Value Index in seven of the 11 economic sectors. ■ The most significant detractors relative to the Russell 2000 Value Index were positions across multiple industries in the materials, communication services, and information technology sectors. ■ The most substantial positive contributions came from financials, driven by PGIM Quantitative Solutions’ positioning among insurance and financial services companies. |

| Performance Past Does Not Indicate Future [Text] |

The Fund’s past performance is not a good predictor of the Fund’s future performance.

|

| Line Graph [Table Text Block] |

|

| Average Annual Return [Table Text Block] |

Average Annual Total Returns as of 7/31/2025 |

|

|

|

|

Class A with sales charges |

|

|

|

Class A without sales charges |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| *The Fund compares its performance against this broad-based index in response to regulatory requirements. |

| No Deduction of Taxes [Text Block] |

The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. |

| Updated Performance Information Location [Text Block] |

Visit pgim.com/investments/mutual-funds/prospectuses-fact-sheets or call (800) 225-1852 or (973) 367-3529 from outside the US for more recent performance data.

|

| Net Assets |

$ 349,939,143

|

| Holdings Count | Holding |

397

|

| Advisory Fees Paid, Amount |

$ 2,180,736

|

| Investment Company, Portfolio Turnover |

122.00%

|

| Additional Fund Statistics [Text Block] |

WHAT ARE SOME KEY FUND STATISTICS AS OF 7/31/2025?

|

|

|

|

Total advisory fees paid for the year |

|

Portfolio turnover rate for the year |

|

|

| Holdings [Text Block] |

WHAT ARE SOME CHARACTERISTICS OF THE FUND’S HOLDINGS AS OF 7/31/2025?

|

|

|

|

Affiliated Mutual Fund - Short-Term Investment (5.9% represents investments purchased with collateral from securities on loan) |

|

Oil, Gas & Consumable Fuels |

|

|

|

Electronic Equipment, Instruments & Components |

|

|

|

Commercial Services & Supplies |

|

Construction & Engineering |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Health Care Providers & Services |

|

Real Estate Management & Development |

|

|

|

|

|

|

|

|

|

|

|

Diversified Consumer Services |

|

|

|

Energy Equipment & Services |

|

|

|

|

|

|

|

|

|

Trading Companies & Distributors |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Textiles, Apparel & Luxury Goods |

|

Life Sciences Tools & Services |

|

|

|

Consumer Staples Distribution & Retail |

|

|

|

Semiconductors & Semiconductor Equipment |

|

|

|

Mortgage Real Estate Investment Trusts (REITs) |

|

Hotels, Restaurants & Leisure |

|

Unaffiliated Exchange-Traded Funds |

|

Health Care Equipment & Supplies |

|

|

|

|

|

Liabilities in excess of other assets |

|

|

|

|

Consists of Industries that each make up less than 0.5% of the Fund's net assets |

|

| PGIM Quant Solutions Small-Cap Value Fund - Class C |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

PGIM Quant Solutions Small-Cap Value Fund

|

| Class Name |

Class C

|

| Trading Symbol |

TRACX

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about the Class C shares of PGIM Quant Solutions Small-Cap Value Fund (the “Fund”) for the period of August 1, 2024 to July 31, 2025.

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at pgim.com/investments/mutual-funds/prospectuses-fact-sheets . You can also request this information by contacting us at (800) 225-1852 or (973) 367-3529 from outside the US.

|

| Material Fund Change Notice [Text Block] |

This report describes changes to the Fund that occurred during the reporting period.

|

| Additional Information Phone Number |

(800) 225-1852 or (973) 367-3529

|

| Additional Information Website |

pgim.com/investments/mutual-funds/prospectuses-fact-sheets

|

| Expenses [Text Block] |

WHAT WERE THE FUND COSTS FOR THE LAST YEAR? (Based on a hypothetical $10,000 investment)

|

|

Costs paid as a percentage |

PGIM Quant Solutions Small-Cap Value Fund—Class C |

|

|

|

| Expenses Paid, Amount |

$ 265

|

| Expense Ratio, Percent |

2.76%

|

| Factors Affecting Performance [Text Block] |

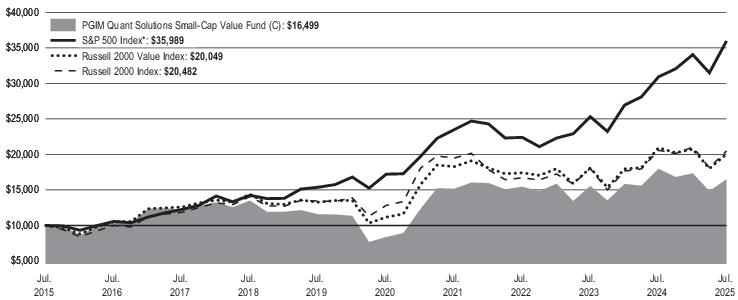

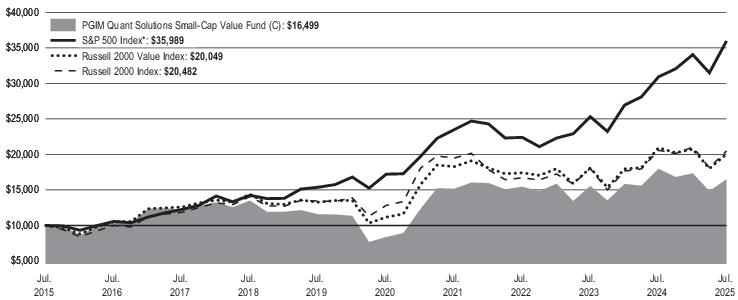

WHAT AFFECTED THE FUND’S PERFORMANCE DURING THE REPORTING PERIOD? ■ Market gains continued to be fueled by large-cap stocks, which outperformed small-cap names by over 17% during the reporting period. US small-cap stocks (as measured by the Russell 2000 Index) declined 0.55%, while large -cap stocks (as measured by the Russell 1000 Index) gained 16.54%. Additionally, growth stocks continued to outpace value stocks. Although this gap was most significant among large-caps, the Russell 2000 Value Index (-4.27%) trailed the Russell 2000 Growth Index (3.15%) by over 7%. ■ PGIM Quantitative Solutions’ focus on stocks with low valuations and attractive business prospects drove underperformance, as the Fund lagged the Russell 2000 Value Index in seven of the 11 economic sectors. ■ The most significant detractors relative to the Russell 2000 Value Index were positions across multiple industries in the materials, communication services, and information technology sectors. ■ The most substantial positive contributions came from financials, driven by PGIM Quantitative Solutions’ positioning among insurance and financial services companies. |

| Performance Past Does Not Indicate Future [Text] |

The Fund’s past performance is not a good predictor of the Fund’s future performance.

|

| Line Graph [Table Text Block] |

|

| Average Annual Return [Table Text Block] |

Average Annual Total Returns as of 7/31/2025 |

|

|

|

|

Class C with sales charges |

|

|

|

Class C without sales charges |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| *The Fund compares its performance against this broad-based index in response to regulatory requirements. |

| No Deduction of Taxes [Text Block] |

The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. |

| Material Change Date |

Aug. 01, 2024

|

| Updated Performance Information Location [Text Block] |

Visit pgim.com/investments/mutual-funds/prospectuses-fact-sheets or call (800) 225-1852 or (973) 367-3529 from outside the US for more recent performance data.

|

| Net Assets |

$ 349,939,143

|

| Holdings Count | Holding |

397

|

| Advisory Fees Paid, Amount |

$ 2,180,736

|

| Investment Company, Portfolio Turnover |

122.00%

|

| Additional Fund Statistics [Text Block] |

WHAT ARE SOME KEY FUND STATISTICS AS OF 7/31/2025?

|

|

|

|

Total advisory fees paid for the year |

|

Portfolio turnover rate for the year |

|

|

| Holdings [Text Block] |

WHAT ARE SOME CHARACTERISTICS OF THE FUND’S HOLDINGS AS OF 7/31/2025?

|

|

|

|

Affiliated Mutual Fund - Short-Term Investment (5.9% represents investments purchased with collateral from securities on loan) |

|

Oil, Gas & Consumable Fuels |

|

|

|

Electronic Equipment, Instruments & Components |

|

|

|

Commercial Services & Supplies |

|

Construction & Engineering |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Health Care Providers & Services |

|

Real Estate Management & Development |

|

|

|

|

|

|

|

|

|

|

|

Diversified Consumer Services |

|

|

|

Energy Equipment & Services |

|

|

|

|

|

|

|

|

|

Trading Companies & Distributors |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Textiles, Apparel & Luxury Goods |

|

Life Sciences Tools & Services |

|

|

|

Consumer Staples Distribution & Retail |

|

|

|

Semiconductors & Semiconductor Equipment |

|

|

|

Mortgage Real Estate Investment Trusts (REITs) |

|

Hotels, Restaurants & Leisure |

|

Unaffiliated Exchange-Traded Funds |

|

Health Care Equipment & Supplies |

|

|

|

|

|

Liabilities in excess of other assets |

|

|

|

|

Consists of Industries that each make up less than 0.5% of the Fund's net assets |

|

| Material Fund Change [Text Block] |

WERE THERE ANY SIGNIFICANT CHANGES TO THE FUND THIS YEAR? The following is a summary of certain changes to the Fund since August 1, 2024: ■ For the year ended July 31, 2025, the Class C shares total annual Fund operating expenses after waivers and/or expense reimbursement increased from 2.49% in the year ended July 31, 2024 to 2.76% primarily due to a decrease in Fund's net assets. |

| Material Fund Change Risks Change [Text Block] |

WERE THERE ANY SIGNIFICANT CHANGES TO THE FUND THIS YEAR? The following is a summary of certain changes to the Fund since August 1, 2024: ■ For the year ended July 31, 2025, the Class C shares total annual Fund operating expenses after waivers and/or expense reimbursement increased from 2.49% in the year ended July 31, 2024 to 2.76% primarily due to a decrease in Fund's net assets. For more complete information, you should review the Fund’s next prospectus, which we expect to be available by September 29, 2025 at pgim.com/investments/mutual-funds/prospectuses-fact-sheets or by request at (800) 225-1852. |

| Updated Prospectus Phone Number |

(800) 225-1852

|

| Updated Prospectus Web Address |

pgim.com/investments/mutual-funds/prospectuses-fact-sheets

|

| PGIM Quant Solutions Small-Cap Value Fund - Class R |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

PGIM Quant Solutions Small-Cap Value Fund

|

| Class Name |

Class R

|

| Trading Symbol |

TSVRX

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about the Class R shares of PGIM Quant Solutions Small-Cap Value Fund (the “Fund”) for the period of August 1, 2024 to July 31, 2025.

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at pgim.com/investments/mutual-funds/prospectuses-fact-sheets . You can also request this information by contacting us at (800) 225-1852 or (973) 367-3529 from outside the US.

|

| Additional Information Phone Number |

(800) 225-1852 or (973) 367-3529

|

| Additional Information Website |

pgim.com/investments/mutual-funds/prospectuses-fact-sheets

|

| Expenses [Text Block] |

WHAT WERE THE FUND COSTS FOR THE LAST YEAR? (Based on a hypothetical $10,000 investment)

|

|

Costs paid as a percentage |

PGIM Quant Solutions Small-Cap Value Fund—Class R |

|

|

|

| Expenses Paid, Amount |

$ 127

|

| Expense Ratio, Percent |

1.32%

|

| Factors Affecting Performance [Text Block] |

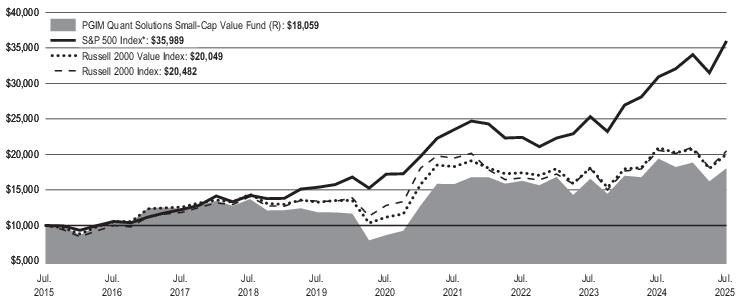

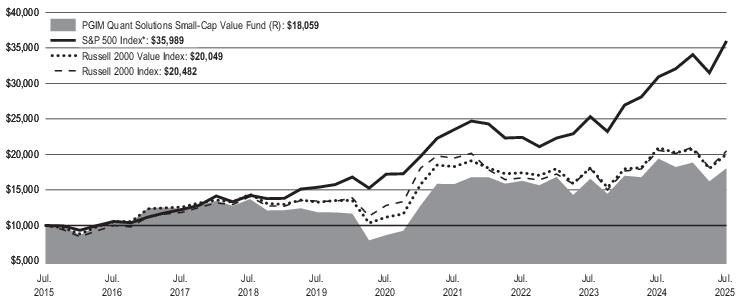

WHAT AFFECTED THE FUND’S PERFORMANCE DURING THE REPORTING PERIOD? ■ Market gains continued to be fueled by large-cap stocks, which outperformed small-cap names by over 17% during the reporting period. US small-cap stocks (as measured by the Russell 2000 Index) declined 0.55%, while large-cap stocks (as measured by the Russell 1000 Index) gained 16.54%. Additionally, growth stocks continued to outpace value stocks. Although this gap was most significant among large-caps, the Russell 2000 Value Index (-4.27%) trailed the Russell 2000 Growth Index (3.15%) by over 7%. ■ PGIM Quantitative Solutions’ focus on stocks with low valuations and attractive business prospects drove underperformance, as the Fund lagged the Russell 2000 Value Index in seven of the 11 economic sectors. ■ The most significant detractors relative to the Russell 2000 Value Index were positions across multiple industries in the materials, communication services, and information technology sectors. ■ The most substantial positive contributions came from financials, driven by PGIM Quantitative Solutions’ positioning among insurance and financial services companies. |

| Performance Past Does Not Indicate Future [Text] |

The Fund’s past performance is not a good predictor of the Fund’s future performance.

|

| Line Graph [Table Text Block] |

|

| Average Annual Return [Table Text Block] |

Average Annual Total Returns as of 7/31/2025 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| *The Fund compares its performance against this broad-based index in response to regulatory requirements. |

| No Deduction of Taxes [Text Block] |

The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. |

| Updated Performance Information Location [Text Block] |

Visit pgim.com/investments/mutual-funds/prospectuses-fact-sheets or call (800) 225-1852 or (973) 367-3529 from outside the US for more recent performance data.

|

| Net Assets |

$ 349,939,143

|

| Holdings Count | Holding |

397

|

| Advisory Fees Paid, Amount |

$ 2,180,736

|

| Investment Company, Portfolio Turnover |

122.00%

|

| Additional Fund Statistics [Text Block] |

WHAT ARE SOME KEY FUND STATISTICS AS OF 7/31/2025?

|

|

|

|

Total advisory fees paid for the year |

|

Portfolio turnover rate for the year |

|

|

| Holdings [Text Block] |

WHAT ARE SOME CHARACTERISTICS OF THE FUND’S HOLDINGS AS OF 7/31/2025?

|

|

|

|

Affiliated Mutual Fund - Short-Term Investment (5.9% represents investments purchased with collateral from securities on loan) |

|

Oil, Gas & Consumable Fuels |

|

|

|

Electronic Equipment, Instruments & Components |

|

|

|

Commercial Services & Supplies |

|

Construction & Engineering |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Health Care Providers & Services |

|

Real Estate Management & Development |

|

|

|

|

|

|

|

|

|

|

|

Diversified Consumer Services |

|

|

|

Energy Equipment & Services |

|

|

|

|

|

|

|

|

|

Trading Companies & Distributors |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Textiles, Apparel & Luxury Goods |

|

Life Sciences Tools & Services |

|

|

|

Consumer Staples Distribution & Retail |

|

|

|

Semiconductors & Semiconductor Equipment |

|

|

|

Mortgage Real Estate Investment Trusts (REITs) |

|

Hotels, Restaurants & Leisure |

|

Unaffiliated Exchange-Traded Funds |

|

Health Care Equipment & Supplies |

|

|

|

|

|

Liabilities in excess of other assets |

|

|

|

|

Consists of Industries that each make up less than 0.5% of the Fund's net assets |

|

| PGIM Quant Solutions Small-Cap Value Fund - Class Z |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

PGIM Quant Solutions Small-Cap Value Fund

|

| Class Name |

Class Z

|

| Trading Symbol |

TASVX

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about the Class Z shares of PGIM Quant Solutions Small-Cap Value Fund (the “Fund”) for the period of August 1, 2024 to July 31, 2025.

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at pgim.com/investments/mutual-funds/prospectuses-fact-sheets . You can also request this information by contacting us at (800) 225-1852 or (973) 367-3529 from outside the US.

|

| Additional Information Phone Number |

(800) 225-1852 or (973) 367-3529

|

| Additional Information Website |

pgim.com/investments/mutual-funds/prospectuses-fact-sheets

|

| Expenses [Text Block] |

WHAT WERE THE FUND COSTS FOR THE LAST YEAR? (Based on a hypothetical $10,000 investment)

|

|

Costs paid as a percentage |

PGIM Quant Solutions Small-Cap Value Fund—Class Z |

|

|

|

| Expenses Paid, Amount |

$ 77

|

| Expense Ratio, Percent |

0.80%

|

| Factors Affecting Performance [Text Block] |

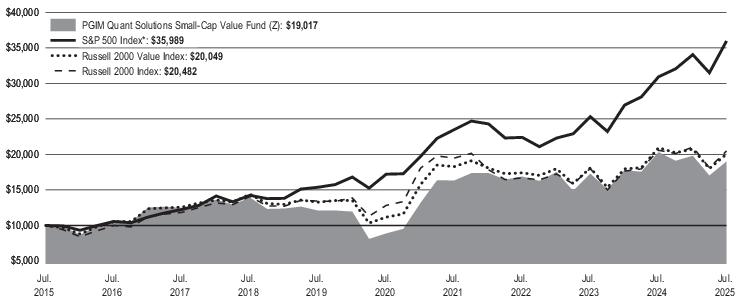

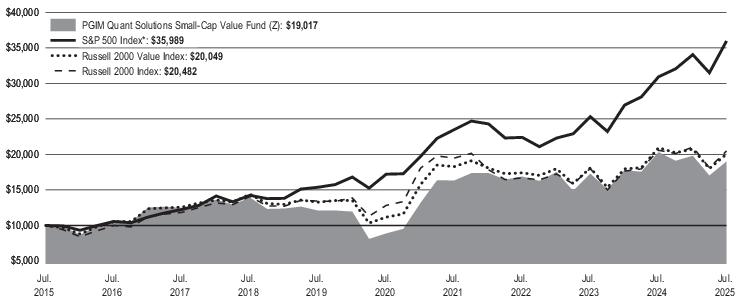

WHAT AFFECTED THE FUND’S PERFORMANCE DURING THE REPORTING PERIOD? ■ Market gains continued to be fueled by large-cap stocks, which outperformed small-cap names by over 17% during the reporting period. US small-cap stocks (as measured by the Russell 2000 Index) declined 0.55%, while large-cap stocks (as measured by the Russell 1000 Index) gained 16.54%. Additionally, growth stocks continued to outpace value stocks. Although this gap was most significant among large-caps, the Russell 2000 Value Index (-4.27%) trailed the Russell 2000 Growth Index (3.15%) by over 7%. ■ PGIM Quantitative Solutions’ focus on stocks with low valuations and attractive business prospects drove underperformance, as the Fund lagged the Russell 2000 Value Index in seven of the 11 economic sectors. ■ The most significant detractors relative to the Russell 2000 Value Index were positions across multiple industries in the materials, communication services, and information technology sectors. ■ The most substantial positive contributions came from financials, driven by PGIM Quantitative Solutions’ positioning among insurance and financial services companies. |

| Performance Past Does Not Indicate Future [Text] |

The Fund’s past performance is not a good predictor of the Fund’s future performance.

|

| Line Graph [Table Text Block] |

|

| Average Annual Return [Table Text Block] |

Average Annual Total Returns as of 7/31/2025 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| *The Fund compares its performance against this broad-based index in response to regulatory requirements. |

| No Deduction of Taxes [Text Block] |

The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. |

| Updated Performance Information Location [Text Block] |

Visit pgim.com/investments/mutual-funds/prospectuses-fact-sheets or call (800) 225-1852 or (973) 367-3529 from outside the US for more recent performance data.

|

| Net Assets |

$ 349,939,143

|

| Holdings Count | Holding |

397

|

| Advisory Fees Paid, Amount |

$ 2,180,736

|

| Investment Company, Portfolio Turnover |

122.00%

|

| Additional Fund Statistics [Text Block] |

WHAT ARE SOME K EY FUND STATISTICS AS OF 7/31/2025?

|

|

|

|

Total advisory fees paid for the year |

|

Portfolio turnover rate for the year |

|

|

| Holdings [Text Block] |

WHAT ARE SOME CHARACTERISTICS OF THE FUND’S HOLDINGS AS OF 7/31/2025?

|

|

|

|

Affiliated Mutual Fund - Short-Term Investment (5.9% represents investments purchased with collateral from securities on loan) |

|

Oil, Gas & Consumable Fuels |

|

|

|

Electronic Equipment, Instruments & Components |

|

|

|

Commercial Services & Supplies |

|

Construction & Engineering |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Health Care Providers & Services |

|

Real Estate Management & Development |

|

|

|

|

|

|

|

|

|

|

|

Diversified Consumer Services |

|

|

|

Energy Equipment & Services |

|

|

|

|

|

|

|

|

|

Trading Companies & Distributors |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Textiles, Apparel & Luxury Goods |

|

Life Sciences Tools & Services |

|

|

|

Consumer Staples Distribution & Retail |

|

|

|

Semiconductors & Semiconductor Equipment |

|

|

|

Mortgage Real Estate Investment Trusts (REITs) |

|

Hotels, Restaurants & Leisure |

|

Unaffiliated Exchange-Traded Funds |

|

Health Care Equipment & Supplies |

|

|

|

|

|

Liabilities in excess of other assets |

|

|

|

|

Consists of Industries that each make up less than 0.5% of the Fund's net assets |

|

| PGIM Quant Solutions Small-Cap Value Fund - Class R2 |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

PGIM Quant Solutions Small-Cap Value Fund

|

| Class Name |

Class R2

|

| Trading Symbol |

PSVDX

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about the Class R2 shares of PGIM Quant Solutions Small-Cap Value Fund (the “Fund”) for the period of August 1, 2024 to July 31, 2025.

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at pgim.com/investments/mutual-funds/prospectuses-fact-sheets . You can also request this information by contacting us at (800) 225-1852 or (973) 367-3529 from outside the US.

|

| Additional Information Phone Number |

(800) 225-1852 or (973) 367-3529

|

| Additional Information Website |

pgim.com/investments/mutual-funds/prospectuses-fact-sheets

|

| Expenses [Text Block] |

WHAT WERE THE FUND COSTS FOR THE LAST YEAR? (Based on a hypothetical $10,000 investment)

|

|

Costs paid as a percentage |

PGIM Quant Solutions Small-Cap Value Fund—Class R2 |

|

|

|

| Expenses Paid, Amount |

$ 110

|

| Expense Ratio, Percent |

1.14%

|

| Factors Affecting Performance [Text Block] |

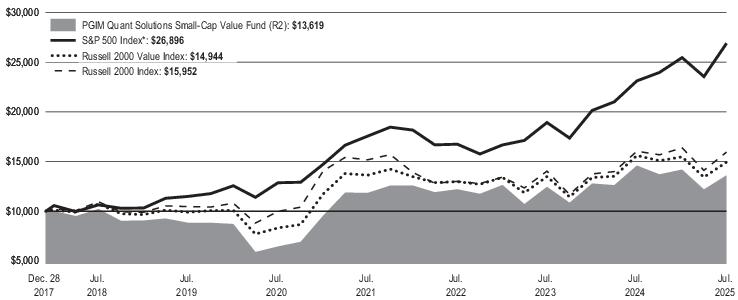

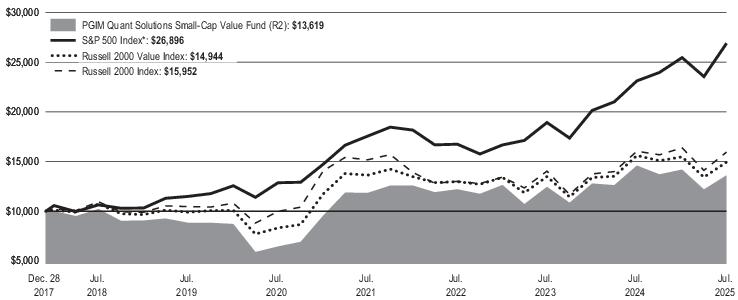

WHAT AFFECTED THE FUND’S PERFORMANCE DURING THE REPORTING PERIOD? ■ Market gains continued to be fueled by large-cap stocks, which outperformed small-cap names by over 17% during the reporting period. US small-cap stocks (as measured by the Russell 2000 Index) declined 0.55%, while large-cap stocks (as measured by the Russell 1000 Index) gained 16.54%. Additionally, growth stocks continued to outpace value stocks. Although this gap was most significant among large-caps, the Russell 2000 Value Index (-4.27%) trailed the Russell 2000 Growth Index (3.15%) by over 7%. ■ PGIM Quantitative Solutions’ focus on stocks with low valuations and attractive business prospects drove underperformance, as the Fund lagged the Russell 2000 Value Index in seven of the 11 economic sectors. ■ The most significant detractors relative to the Russell 2000 Value Index were positions across multiple industries in the materials, communication services, and information technology sectors. ■ The most substantial positive contributions came from financials, driven by PGIM Quantitative Solutions’ positioning among insurance and financial services companies. |

| Performance Past Does Not Indicate Future [Text] |

The Fund’s past performance is not a good predictor of the Fund’s future performance.

|

| Line Graph [Table Text Block] |

|

| Average Annual Return [Table Text Block] |

Average Annual Total Returns as of 7/31/2025 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| *The Fund compares its performance against this broad-based index in response to regulatory requirements. |

| Performance Inception Date |

Dec. 28, 2017

|

| No Deduction of Taxes [Text Block] |

The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. |

| Updated Performance Information Location [Text Block] |

Visit pgim.com/investments/mutual-funds/prospectuses-fact-sheets or call (800) 225-1852 or (973) 367-3529 from outside the US for more recent performance data.

|

| Net Assets |

$ 349,939,143

|

| Holdings Count | Holding |

397

|

| Advisory Fees Paid, Amount |

$ 2,180,736

|

| Investment Company, Portfolio Turnover |

122.00%

|

| Additional Fund Statistics [Text Block] |

WHAT ARE SOME KEY FUND STATISTICS AS OF 7/31/2025?

|

|

|

|

Total advisory fees paid for the year |

|

Portfolio turnover rate for the year |

|

|

| Holdings [Text Block] |

WHAT ARE SOME CHARACTERISTICS OF THE FUND’S HOLDINGS AS OF 7/31/2025?

|

|

|

|

Affiliated Mutual Fund - Short-Term Investment (5.9% represents investments purchased with collateral from securities on loan) |

|

Oil, Gas & Consumable Fuels |

|

|

|

Electronic Equipment, Instruments & Components |

|

|

|

Commercial Services & Supplies |

|

Construction & Engineering |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Health Care Providers & Services |

|

Real Estate Management & Development |

|

|

|

|

|

|

|

|

|

|

|

Diversified Consumer Services |

|

|

|

Energy Equipment & Services |

|

|

|

|

|

|

|

|

|

Trading Companies & Distributors |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Textiles, Apparel & Luxury Goods |

|

Life Sciences Tools & Services |

|

|

|

Consumer Staples Distribution & Retail |

|

|

|

Semiconductors & Semiconductor Equipment |

|

|

|

Mortgage Real Estate Investment Trusts (REITs) |

|

Hotels, Restaurants & Leisure |

|

Unaffiliated Exchange-Traded Funds |

|

Health Care Equipment & Supplies |

|

|

|

|

|

Liabilities in excess of other assets |

|

|

|

|

Consists of Industries that each make up less than 0.5% of the Fund's net assets |

|

| PGIM Quant Solutions Small-Cap Value Fund - Class R4 |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

PGIM Quant Solutions Small-Cap Value Fund

|

| Class Name |

Class R4

|

| Trading Symbol |

PSVKX

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about the Class R4 shares of PGIM Quant Solutions Small-Cap Value Fund (the “Fund”) for the period of August 1, 2024 to July 31, 2025.

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at pgim.com/investments/mutual-funds/prospectuses-fact-sheets . You can also request this information by contacting us at (800) 225-1852 or (973) 367-3529 from outside the US.

|

| Additional Information Phone Number |

(800) 225-1852 or (973) 367-3529

|

| Additional Information Website |

pgim.com/investments/mutual-funds/prospectuses-fact-sheets

|

| Expenses [Text Block] |

WHAT WERE THE FUND COSTS FOR THE LAST YEAR? (Based on a hypothetical $10,000 investment)

|

|

Costs paid as a percentage |

PGIM Quant Solutions Small-Cap Value Fund—Class R4 |

|

|

|

| Expenses Paid, Amount |

$ 86

|

| Expense Ratio, Percent |

0.89%

|

| Factors Affecting Performance [Text Block] |

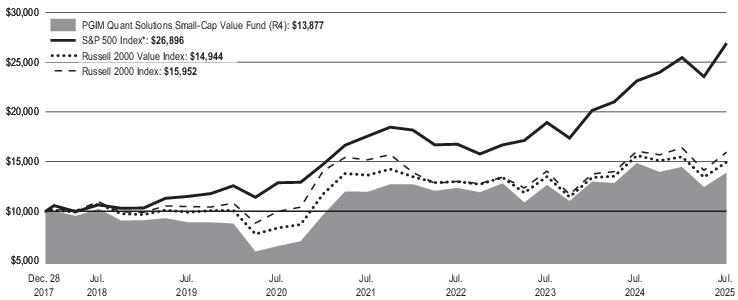

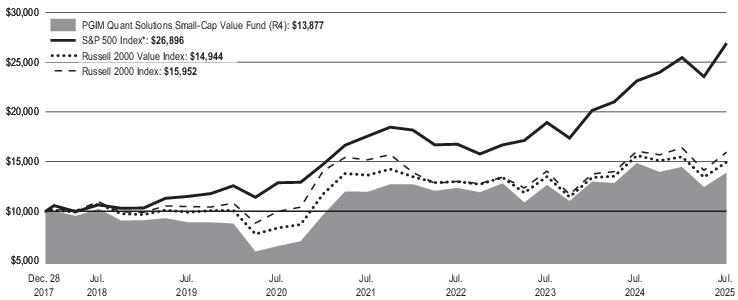

WHAT AFFECTED THE FUND’S PERFORMANCE DURING THE REPORTING PERIOD? ■ Market gains continued to be fueled by large-cap stocks, which outperformed small-cap names by over 17% during the reporting period. US small-cap stocks (as measured by the Russell 2000 Index) declined 0.55%, while large-cap stocks (as measured by the Russell 1000 Index) gained 16.54%. Additionally, growth stocks continued to outpace value stocks. Although this gap was most significant among large-caps, the Russell 2000 Value Index (-4.27%) trailed the Russell 2000 Growth Index (3.15%) by over 7%. ■ PGIM Quantitative Solutions’ focus on stocks with low valuations and attractive business prospects drove underperformance, as the Fund lagged the Russell 2000 Value Index in seven of the 11 economic sectors. ■ The most significant detractors relative to the Russell 2000 Value Index were positions across multiple industries in the materials, communication services, and information technology sectors. ■ The most substantial positive contributions came from financials, driven by PGIM Quantitative Solutions’ positioning among insurance and financial services companies. |

| Performance Past Does Not Indicate Future [Text] |

The Fund’s past performance is not a good predictor of the Fund’s future performance.

|

| Line Graph [Table Text Block] |

|

| Average Annual Return [Table Text Block] |

Average Annual Total Returns as of 7/31/2025 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| *The Fund compares its performance against this broad-based index in response to regulatory requirements. |

| Performance Inception Date |

Dec. 28, 2017

|

| No Deduction of Taxes [Text Block] |

The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. |

| Updated Performance Information Location [Text Block] |

Visit pgim.com/investments/mutual-funds/prospectuses-fact-sheets or call (800) 225-1852 or (973) 367-3529 from outside the US for more recent performance data.

|

| Net Assets |

$ 349,939,143

|

| Holdings Count | Holding |

397

|

| Advisory Fees Paid, Amount |

$ 2,180,736

|

| Investment Company, Portfolio Turnover |

122.00%

|

| Additional Fund Statistics [Text Block] |

WHAT ARE SOME KEY FUND STATISTICS AS OF 7/31/2025?

|

|

|

|

Total advisory fees paid for the year |

|

Portfolio turnover rate for the year |

|

|

| Holdings [Text Block] |

ARE SOME CHARACTERISTICS OF THE FUND’S HOLDINGS AS OF 7/31/2025?

|

|

|

|

Affiliated Mutual Fund - Short-Term Investment (5.9% represents investments purchased with collateral from securities on loan) |

|

Oil, Gas & Consumable Fuels |

|

|

|

Electronic Equipment, Instruments & Components |

|

|

|

Commercial Services & Supplies |

|

Construction & Engineering |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Health Care Providers & Services |

|

Real Estate Management & Development |

|

|

|

|

|

|

|

|

|

|

|

Diversified Consumer Services |

|

|

|

Energy Equipment & Services |

|

|

|

|

|

|

|

|

|

Trading Companies & Distributors |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Textiles, Apparel & Luxury Goods |

|

Life Sciences Tools & Services |

|

|

|

Consumer Staples Distribution & Retail |

|

|

|

Semiconductors & Semiconductor Equipment |

|

|

|

Mortgage Real Estate Investment Trusts (REITs) |

|

Hotels, Restaurants & Leisure |

|

Unaffiliated Exchange-Traded Funds |

|

Health Care Equipment & Supplies |

|

|

|

|

|

Liabilities in excess of other assets |

|

|

|

|

Consists of Industries that each make up less than 0.5% of the Fund's net assets |

|

| PGIM Quant Solutions Small-Cap Value Fund - Class R6 |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

PGIM Quant Solutions Small-Cap Value Fund

|

| Class Name |

Class R6

|

| Trading Symbol |

TSVQX

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about the Class R6 shares of PGIM Quant Solutions Small-Cap Value Fund (the “Fund”) for the period of August 1, 2024 to July 31, 2025.

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at pgim.com/investments/mutual-funds/prospectuses-fact-sheets . You can also request this information by contacting us at (800) 225-1852 or (973) 367-3529 from outside the US.

|

| Additional Information Phone Number |

(800) 225-1852 or (973) 367-3529

|

| Additional Information Website |

pgim.com/investments/mutual-funds/prospectuses-fact-sheets

|

| Expenses [Text Block] |

WHAT WERE THE FUND COSTS FOR THE LAST YEAR? (Based on a hypothetical $10,000 investment)

|

|

Costs paid as a percentage |

PGIM Quant Solutions Small-Cap Value Fund—Class R6 |

|

|

|

| Expenses Paid, Amount |

$ 66

|

| Expense Ratio, Percent |

0.68%

|

| Factors Affecting Performance [Text Block] |

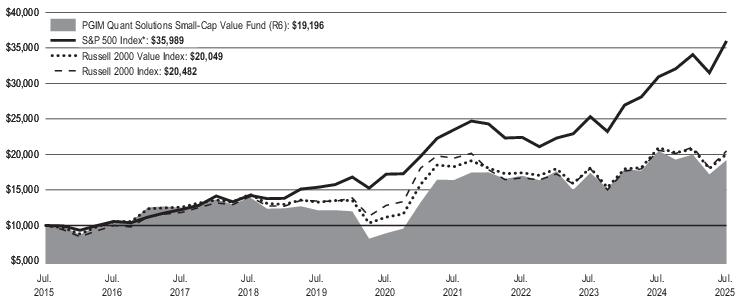

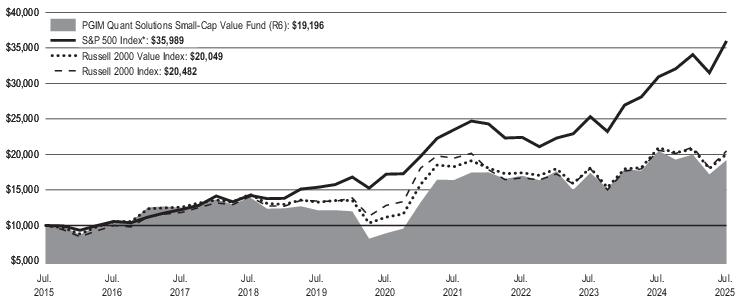

WHAT AFFECTED THE FUND’S PERFORMANCE DURING THE REPORTING PERIOD? ■ Market gains continued to be fueled by large-cap stocks, which outperformed small-cap names by over 17% during the reporting period. US small-cap stocks (as measured by the Russell 2000 Index) declined 0.55%, while large-cap stocks (as measured by the Russell 1000 Index) gained 16.54%. Additionally, growth stocks continued to outpace value stocks. Although this gap was most significant among large-caps, the Russell 2000 Value Index (-4.27%) trailed the Russell 2000 Growth Index (3.15%) by over 7%. ■ PGIM Quantitative Solutions’ focus on stocks with low valuations and attractive business prospects drove underperformance, as the Fund lagged the Russell 2000 Value Index in seven of the 11 economic sectors. ■ The most significant detractors relative to the Russell 2000 Value Index were positions across multiple industries in the materials, communication services, and information technology sectors. ■ The most substantial positive contributions came from financials, driven by PGIM Quantitative Solutions’ positioning among insurance and financial services companies. |

| Performance Past Does Not Indicate Future [Text] |

The Fund’s past performance is not a good predictor of the Fund’s future performance.

|

| Line Graph [Table Text Block] |

|

| Average Annual Return [Table Text Block] |

Average Annual Total Returns as of 7/31/2025 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| *The Fund compares its performance against this broad-based index in response to regulatory requirements. |

| No Deduction of Taxes [Text Block] |

The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. |

| Updated Performance Information Location [Text Block] |

Visit pgim.com/investments/mutual-funds/prospectuses-fact-sheets or call (800) 225-1852 or (973) 367-3529 from outside the US for more recent performance data.

|

| Net Assets |

$ 349,939,143

|

| Holdings Count | Holding |

397

|

| Advisory Fees Paid, Amount |

$ 2,180,736

|

| Investment Company, Portfolio Turnover |

122.00%

|

| Additional Fund Statistics [Text Block] |

WHAT ARE SOME KEY FUND STATISTICS AS OF 7/31/2025?

|

|

|

|

Total advisory fees paid for the year |

|

Portfolio turnover rate for the year |

|

|

| Holdings [Text Block] |

WHAT ARE SOME CHARACTERISTICS OF THE FUND’S HOLDINGS AS OF 7/31/2025?

|

|

|

|

Affiliated Mutual Fund - Short-Term Investment (5.9% represents investments purchased with collateral from securities on loan) |

|

Oil, Gas & Consumable Fuels |

|

|

|

Electronic Equipment, Instruments & Components |

|

|

|

Commercial Services & Supplies |

|

Construction & Engineering |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Health Care Providers & Services |

|

Real Estate Management & Development |

|

|

|

|

|

|

|

|

|

|

|

Diversified Consumer Services |

|

|

|

Energy Equipment & Services |

|

|

|

|

|

|

|

|

|

Trading Companies & Distributors |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Textiles, Apparel & Luxury Goods |

|

Life Sciences Tools & Services |

|

|

|

Consumer Staples Distribution & Retail |

|

|

|

Semiconductors & Semiconductor Equipment |

|

|

|

Mortgage Real Estate Investment Trusts (REITs) |

|

Hotels, Restaurants & Leisure |

|

Unaffiliated Exchange-Traded Funds |

|

Health Care Equipment & Supplies |

|

|

|

|

|

Liabilities in excess of other assets |

|

|

|

|

Consists of Industries that each make up less than 0.5% of the Fund's net assets |

|

| PGIM Core Bond Fund - Class A |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

PGIM Core Bond Fund

|

| Class Name |

Class A

|

| Trading Symbol |

TPCAX

|

| Annual or Semi-Annual Statement [Text Block] |

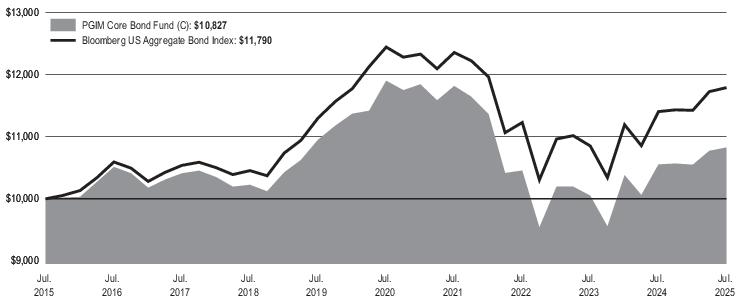

This annual shareholder report contains important information about the Class A shares of PGIM Core Bond Fund (the “Fund”) for the period of August 1, 2024 to July 31, 2025.

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at pgim.com/investments/mutual-funds/prospectuses-fact-sheets . You can also request this information by contacting us at (800) 225-1852 or (973) 367-3529 from outside the US.

|

| Material Fund Change Notice [Text Block] |

This report describes changes to the Fund that occurred during the reporting period. |

| Additional Information Phone Number |

(800) 225-1852 or (973) 367-3529

|

| Additional Information Website |

pgim.com/investments/mutual-funds/prospectuses-fact-sheets

|

| Expenses [Text Block] |

WHAT WERE THE FUND COSTS FOR THE LAST YEAR? (Based on a hypothetical $10,000 investment)

|

|

Costs paid as a percentage |

PGIM Core Bond Fund—Class A |

|

|

|

| Expenses Paid, Amount |

$ 66

|

| Expense Ratio, Percent |

0.65%

|

| Factors Affecting Performance [Text Block] |

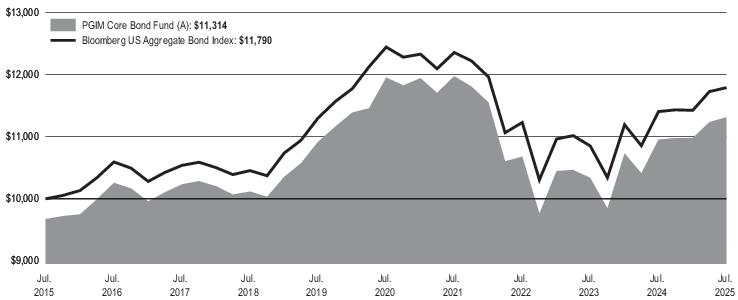

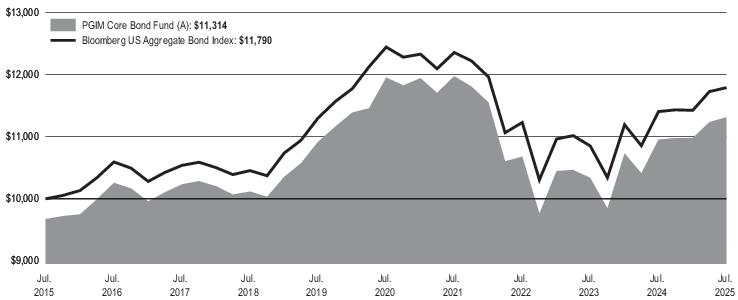

WHAT AFFECTED THE FUND’S PERFORMANCE DURING THE REPORTING PERIOD? ■ During the reporting period, credit spreads across a broad spectrum of fixed income asset classes generally tightened, recovering from the US administration’s announcement of reciprocal tariffs on April 2, 2025. The US Federal Reserve's easing cycle, which began with three rate cuts in the second half of 2024, was paused in the first half of 2025 amid increased uncertainty over the impact of US policy changes on the domestic labor market and inflation. Indeed, Core PCE came in higher than expected for the reporting period. In addition, revisions to the non-farm payroll report in July 2025 revealed a weaker labor market than previously indicated, causing investors to reprice their expectations for a September rate cut and a steepening of the US Treasury yield curve. (A yield curve is a line graph that illustrates the relationship between the yields and maturities of fixed income securities. It is created by plotting the yields of different maturities for the same type of bonds.) ■ The following strategies contributed most to the Fund’s performance during the reporting period: overweights relative to the Index in the AAA non-agency commercial mortgage-backed securities (CMBS), AAA collateralized loan obligations (CLO), and US investment-grade corporate sectors; security selection in AAA CLOs, AAA non-agency CMBS, US Treasuries, asset-backed securities (ABS), and US investment-grade corporates; credit positioning in banking, aerospace & defense, and technology. ■ The following strategies detracted from performance during the period: duration positioning and security selection in MBS. ■ The Fund uses derivatives to facilitate the implementation of the overall investment approach. During the reporting period, the Fund used swaps, options, and futures to help manage duration positioning and yield curve exposure. In aggregate, these positions detracted from performance. |

| Performance Past Does Not Indicate Future [Text] |

The Fund’s past performance is not a good predictor of the Fund’s future performance.

|

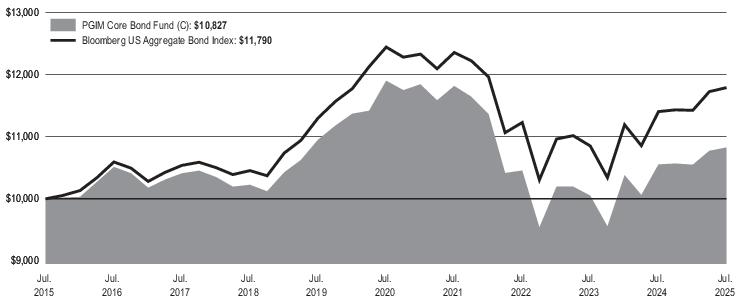

| Line Graph [Table Text Block] |

|

| Average Annual Return [Table Text Block] |

Average Annual Total Returns as of 7/31/2025 |

|

|

|

|

Class A with sales charges |

|

|

|

Class A without sales charges |

|

|

|

Bloomberg US Aggregate Bond Index |

|

|

|

|

| No Deduction of Taxes [Text Block] |

The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. |

| Material Change Date |

Aug. 01, 2024

|

| Updated Performance Information Location [Text Block] |

Visit pgim.com/investments/mutual-funds/prospectuses-fact-sheets or call (800) 225-1852 or (973) 367-3529 from outside the US for more recent performance data.

|

| Net Assets |

$ 2,252,570,714

|

| Holdings Count | Holding |

1,292

|

| Advisory Fees Paid, Amount |

$ 5,750,030

|

| Investment Company, Portfolio Turnover |

121.00%

|

| Additional Fund Statistics [Text Block] |

WHAT ARE SOME KEY FUND STATISTICS AS OF 7/31/2025?

|

|

|

|

Total advisory fees paid for the year |

|

Portfolio turnover rate for the year |

|

|

| Holdings [Text Block] |

WHAT ARE SOME CHARACTERISTICS OF THE FUND’S HOLDINGS AS OF 7/31/2025?

Credit Quality expressed as a percentage of total investments as of 7/31/2025 (%) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Credit ratings reflect the highest rating assigned by a nationally recognized statistical rating organization (NRSRO) such as Moody’s Investors Service, Inc. (Moody’s), S&P Global Ratings (S&P), or Fitch Ratings, Inc. (Fitch). Credit ratings reflect the common nomenclature used by both S&P and Fitch. Where applicable, ratings are converted to the comparable S&P/Fitch rating tier nomenclature. The Not Rated category consists of securities that have not been rated by an NRSRO. Credit ratings are subject to change. Values may not sum to 100.0% due to rounding. |

| Credit Quality Explanation [Text Block] |

Credit ratings reflect the highest rating assigned by a nationally recognized statistical rating organization (NRSRO) such as Moody’s Investors Service, Inc. (Moody’s), S&P Global Ratings (S&P), or Fitch Ratings, Inc. (Fitch). Credit ratings reflect the common nomenclature used by both S&P and Fitch. Where applicable, ratings are converted to the comparable S&P/Fitch rating tier nomenclature. The Not Rated category consists of securities that have not been rated by an NRSRO. Credit ratings are subject to change. Values may not sum to 100.0% due to rounding.

|

| Material Fund Change [Text Block] |

WERE THERE ANY SIGNIFICANT CHANGES TO THE FUND THIS YEAR? The following is a summary of certain changes to the Fund since August 1, 2024: ■ Effective April 7, 2025, the Fund’s investment strategy was revised to clarify that the Fund may invest up to 5% of its investable assets in below investment-grade securities. At this time, the Fund's principal risk disclosure was revised to include “ Junk Bonds Risk ” as a principal risk of the Fund. For more complete information, you should review the Fund’s next prospectus, which we expect to be available by September 29, 2025 at pgim.com/investments/mutual-funds/prospectuses-fact-sheets or by request at (800) 225-1852. |

| Material Fund Change Risks Change [Text Block] |

WERE THERE ANY SIGNIFICANT CHANGES TO THE FUND THIS YEAR? The following is a summary of certain changes to the Fund since August 1, 2024: ■ Effective April 7, 2025, the Fund’s investment strategy was revised to clarify that the Fund may invest up to 5% of its investable assets in below investment-grade securities. At this time, the Fund's principal risk disclosure was revised to include “ Junk Bonds Risk ” as a principal risk of the Fund. For more complete information, you should review the Fund’s next prospectus, which we expect to be available by September 29, 2025 at pgim.com/investments/mutual-funds/prospectuses-fact-sheets or by request at (800) 225-1852. |

| Updated Prospectus Phone Number |

(800) 225-1852

|

| Updated Prospectus Web Address |

pgim.com/investments/mutual-funds/prospectuses-fact-sheets

|

| PGIM Core Bond Fund - Class C |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

PGIM Core Bond Fund

|

| Class Name |

Class C

|

| Trading Symbol |

TPCCX

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about the Class C shares of PGIM Core Bond Fund (the “Fund”) for the period of August 1, 2024 to July 31, 2025.

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at pgim.com/investments/mutual-funds/prospectuses-fact-sheets . You can also request this information by contacting us at (800) 225-1852 or (973) 367-3529 from outside the US.

|

| Material Fund Change Notice [Text Block] |

This report describes changes to the Fund that occurred during the reporting period. |

| Additional Information Phone Number |

(800) 225-1852 or (973) 367-3529

|

| Additional Information Website |

pgim.com/investments/mutual-funds/prospectuses-fact-sheets

|

| Expenses [Text Block] |

WHAT WERE THE FUND COSTS FOR THE LAST YEAR? (Based on a hypothetical $10,000 investment)

|

|

Costs paid as a percentage |

PGIM Core Bond Fund—Class C |

|

|

|

| Expenses Paid, Amount |

$ 147

|

| Expense Ratio, Percent |

1.45%

|

| Factors Affecting Performance [Text Block] |

WHAT AFFECTED THE FUND’S PERFORMANCE DURING THE REPORTING PERIOD? ■ During the reporting period, credit spreads across a broad spectrum of fixed income asset classes generally tightened, recovering from the US administration’s announcement of reciprocal tariffs on April 2, 2025. The US Federal Reserve's easing cycle, which began with three rate cuts in the second half of 2024, was paused in the first half of 2025 amid increased uncertainty over the impact of US policy changes on the domestic labor market and inflation. Indeed, Core PCE came in higher than expected for the reporting period. In addition, revisions to the non-farm payroll report in July 2025 revealed a weaker labor market than previously indicated, causing investors to reprice their expectations for a September rate cut and a steepening of the US Treasury yield curve. (A yield curve is a line graph that illustrates the relationship between the yields and maturities of fixed income securities. It is created by plotting the yields of different maturities for the same type of bonds.) ■ The following strategies contributed most to the Fund’s performance during the reporting period: overweights relative to the Index in the AAA non-agency commercial mortgage-backed securities (CMBS), AAA collateralized loan obligations (CLO), and US investment-grade corporate sectors; security selection in AAA CLOs, AAA non-agency CMBS, US Treasuries, asset-backed securities (ABS), and US investment-grade corporates; credit positioning in banking, aerospace & defense, and technology. ■ The following strategies detracted from performance during the period: duration positioning and security selection in MBS. ■ The Fund uses derivatives to facilitate the implementation of the overall investment approach. During the reporting period, the Fund used swaps, options, and futures to help manage duration positioning and yield curve exposure. In aggregate, these positions detracted from performance. |

| Performance Past Does Not Indicate Future [Text] |

The Fund’s past performance is not a good predictor of the Fund’s future performance.

|

| Line Graph [Table Text Block] |

|

| Average Annual Return [Table Text Block] |

Average Annual Total Returns as of 7/31/2025 |

|

|

|

|

Class C with sales charges |

|

|

|

Class C without sales charges |

|

|

|

Bloomberg US Aggregate Bond Index |

|

|

|

|

| No Deduction of Taxes [Text Block] |

The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. |

| Material Change Date |

Aug. 01, 2024

|

| Updated Performance Information Location [Text Block] |

Visit pgim.com/investments/mutual-funds/prospectuses-fact-sheets or call (800) 225-1852 or (973) 367-3529 from outside the US for more recent performance data.

|

| Net Assets |

$ 2,252,570,714

|

| Holdings Count | Holding |

1,292

|

| Advisory Fees Paid, Amount |

$ 5,750,030

|

| Investment Company, Portfolio Turnover |

121.00%

|

| Additional Fund Statistics [Text Block] |

WHAT ARE SOME KEY FUND STATISTICS AS OF 7/31/2025?

|

|

|

|

Total advisory fees paid for the year |

|

Portfolio turnover rate for the year |

|

|

| Holdings [Text Block] |

WHAT ARE SOME CHARACTERISTICS OF THE FUND’S HOLDINGS AS OF 7/31/2025?

Credit Quality expressed as a percentage of total investments as of 7/31/2025 (%) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Credit ratings reflect the highest rating assigned by a nationally recognized statistical rating organization (NRSRO) such as Moody’s Investors Service, Inc. (Moody’s), S&P Global Ratings (S&P), or Fitch Ratings, Inc. (Fitch). Credit ratings reflect the common nomenclature used by both S&P and Fitch. Where applicable, ratings are converted to the comparable S&P/Fitch rating tier nomenclature. The Not Rated category consists of securities that have not been rated by an NRSRO. Credit ratings are subject to change. Values may not sum to 100.0% due to rounding. |

| Credit Quality Explanation [Text Block] |

Credit ratings reflect the highest rating assigned by a nationally recognized statistical rating organization (NRSRO) such as Moody’s Investors Service, Inc. (Moody’s), S&P Global Ratings (S&P), or Fitch Ratings, Inc. (Fitch). Credit ratings reflect the common nomenclature used by both S&P and Fitch. Where applicable, ratings are converted to the comparable S&P/Fitch rating tier nomenclature. The Not Rated category consists of securities that have not been rated by an NRSRO. Credit ratings are subject to change. Values may not sum to 100.0% due to rounding.

|

| Material Fund Change [Text Block] |

WERE THERE ANY SIGNIFICANT CHANGES TO THE FUND THIS YEAR? The following is a summary of certain changes to the Fund since August 1, 2024: ■ Effective April 7, 2025, the Fund’s investment strategy was revised to clarify that the Fund may invest up to 5% of its investable assets in below investment-grade securities. At this time, the Fund's principal risk disclosure was revised to include “ Junk Bonds Risk ” as a principal risk of the Fund. For more complete information, you should review the Fund’s next prospectus, which we expect to be available by September 29, 2025 at pgim.com/investments/mutual-funds/prospectuses-fact-sheets or by request at (800) 225-1852. |

| Material Fund Change Risks Change [Text Block] |

WERE THERE ANY SIGNIFICANT CHANGES TO THE FUND THIS YEAR? The following is a summary of certain changes to the Fund since August 1, 2024: ■ Effective April 7, 2025, the Fund’s investment strategy was revised to clarify that the Fund may invest up to 5% of its investable assets in below investment-grade securities. At this time, the Fund's principal risk disclosure was revised to include “ Junk Bonds Risk ” as a principal risk of the Fund. For more complete information, you should review the Fund’s next prospectus, which we expect to be available by September 29, 2025 at pgim.com/investments/mutual-funds/prospectuses-fact-sheets or by request at (800) 225-1852. |

| Updated Prospectus Phone Number |

(800) 225-1852

|

| Updated Prospectus Web Address |

pgim.com/investments/mutual-funds/prospectuses-fact-sheets

|

| PGIM Core Bond Fund - Class R |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

PGIM Core Bond Fund

|

| Class Name |

Class R

|

| Trading Symbol |

TPCRX

|

| Annual or Semi-Annual Statement [Text Block] |

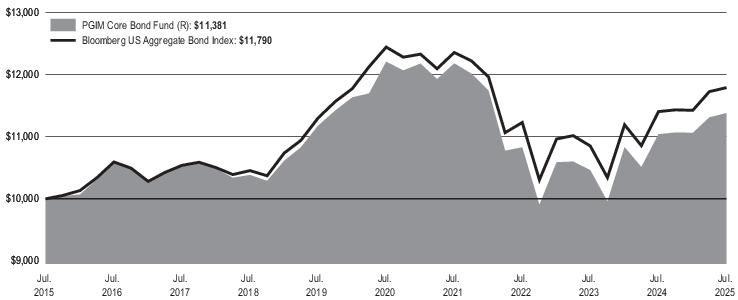

This annual shareholder report contains important information about the Class R shares of PGIM Core Bond Fund (the “Fund”) for the period of August 1, 2024 to July 31, 2025.

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at pgim.com/investments/mutual-funds/prospectuses-fact-sheets . You can also request this information by contacting us at (800) 225-1852 or (973) 367-3529 from outside the US.

|

| Material Fund Change Notice [Text Block] |

This report describes changes to the Fund that occurred during the reporting period. |

| Additional Information Phone Number |

(800) 225-1852 or (973) 367-3529

|

| Additional Information Website |

pgim.com/investments/mutual-funds/prospectuses-fact-sheets

|

| Expenses [Text Block] |

WHAT WERE THE FUND COSTS FOR THE LAST YEAR? (Based on a hypothetical $10,000 investment)

|

|

Costs paid as a percentage |

PGIM Core Bond Fund—Class R |

|

|

|

| Expenses Paid, Amount |

$ 96

|

| Expense Ratio, Percent |

0.95%

|

| Factors Affecting Performance [Text Block] |

WHAT AFFECTED THE FUND’S PERFORMANCE DURING THE REPORTING PERIOD? ■ During the reporting period, credit spreads across a broad spectrum of fixed income asset classes generally tightened, recovering from the US administration’s announcement of reciprocal tariffs on April 2, 2025. The US Federal Reserve's easing cycle, which began with three rate cuts in the second half of 2024, was paused in the first half of 2025 amid increased uncertainty over the impact of US policy changes on the domestic labor market and inflation. Indeed, Core PCE came in higher than expected for the reporting period. In addition, revisions to the non-farm payroll report in July 2025 revealed a weaker labor market than previously indicated, causing investors to reprice their expectations for a September rate cut and a steepening of the US Treasury yield curve. (A yield curve is a line graph that illustrates the relationship between the yields and maturities of fixed income securities. It is created by plotting the yields of different maturities for the same type of bonds.) ■ The following strategies contributed most to the Fund’s performance during the reporting period: overweights relative to the Index in the AAA non-agency commercial mortgage-backed securities (CMBS), AAA collateralized loan obligations (CLO), and US investment-grade corporate sectors; security selection in AAA CLOs, AAA non-agency CMBS, US Treasuries, asset-backed securities (ABS), and US investment-grade corporates; credit positioning in banking, aerospace & defense, and technology. ■ The following strategies detracted from performance during the period: duration positioning and security selection in MBS. ■ The Fund uses derivatives to facilitate the implementation of the overall investment approach. During the reporting period, the Fund used swaps, options, and futures to help manage duration positioning and yield curve exposure. In aggregate, these positions detracted from performance. |

| Performance Past Does Not Indicate Future [Text] |

The Fund’s past performance is not a good predictor of the Fund’s future performance.

|

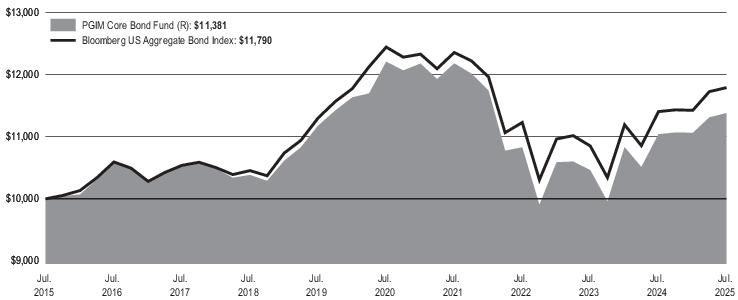

| Line Graph [Table Text Block] |

|

| Average Annual Return [Table Text Block] |

Average Annual Total Returns as of 7/31/2025 |

|

|

|

|

|

|

|

|

Bloomberg US Aggregate Bond Index |

|

|

|

|

| No Deduction of Taxes [Text Block] |

The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. |

| Material Change Date |

Aug. 01, 2024

|

| Updated Performance Information Location [Text Block] |

Visit pgim.com/investments/mutual-funds/prospectuses-fact-sheets or call (800) 225-1852 or (973) 367-3529 from outside the US for more recent performance data.

|

| Net Assets |

$ 2,252,570,714

|

| Holdings Count | Holding |

1,292

|

| Advisory Fees Paid, Amount |

$ 5,750,030

|

| Investment Company, Portfolio Turnover |

121.00%

|

| Additional Fund Statistics [Text Block] |

WHAT ARE SOME KEY FUND STATISTICS AS OF 7/31/2025?

|

|

|

|

Total advisory fees paid for the year |

|

Portfolio turnover rate for the year |

|

|

| Holdings [Text Block] |

WHAT ARE SOME CHARACTERISTICS OF THE FUND’S HOLDINGS AS OF 7/31/2025?

Credit Quality expressed as a percentage of total investments as of 7/31/2025 (%) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Credit ratings reflect the highest rating assigned by a nationally recognized statistical rating organization (NRSRO) such as Moody’s Investors Service, Inc. (Moody’s), S&P Global Ratings (S&P), or Fitch Ratings, Inc. (Fitch). Credit ratings reflect the common nomenclature used by both S&P and Fitch. Where applicable, ratings are converted to the comparable S&P/Fitch rating tier nomenclature. The Not Rated category consists of securities that have not been rated by an NRSRO. Credit ratings are subject to change. Values may not sum to 100.0% due to rounding. |

| Credit Quality Explanation [Text Block] |

Credit ratings reflect the highest rating assigned by a nationally recognized statistical rating organization (NRSRO) such as Moody’s Investors Service, Inc. (Moody’s), S&P Global Ratings (S&P), or Fitch Ratings, Inc. (Fitch). Credit ratings reflect the common nomenclature used by both S&P and Fitch. Where applicable, ratings are converted to the comparable S&P/Fitch rating tier nomenclature. The Not Rated category consists of securities that have not been rated by an NRSRO. Credit ratings are subject to change. Values may not sum to 100.0% due to rounding.

|

| Material Fund Change [Text Block] |

WERE THERE ANY SIGNIFICANT CHANGES TO THE FUND THIS YEAR? The following is a summary of certain changes to the Fund since August 1, 2024: ■ Effective April 7, 2025, the Fund’s investment strategy was revised to clarify that the Fund may invest up to 5% of its investable assets in below investment-grade securities. At this time, the Fund's principal risk disclosure was revised to include “ Junk Bonds Risk ” as a principal risk of the Fund. For more complete information, you should review the Fund’s next prospectus, which we expect to be available by September 29, 2025 at pgim.com/investments/mutual-funds/prospectuses-fact-sheets or by request at (800) 225-1852. |

| Material Fund Change Risks Change [Text Block] |

WERE THERE ANY SIGNIFICANT CHANGES TO THE FUND THIS YEAR? The following is a summary of certain changes to the Fund since August 1, 2024: ■ Effective April 7, 2025, the Fund’s investment strategy was revised to clarify that the Fund may invest up to 5% of its investable assets in below investment-grade securities. At this time, the Fund's principal risk disclosure was revised to include “ Junk Bonds Risk ” as a principal risk of the Fund. For more complete information, you should review the Fund’s next prospectus, which we expect to be available by September 29, 2025 at pgim.com/investments/mutual-funds/prospectuses-fact-sheets or by request at (800) 225-1852. |

| Updated Prospectus Phone Number |

(800) 225-1852

|

| Updated Prospectus Web Address |

pgim.com/investments/mutual-funds/prospectuses-fact-sheets

|

| PGIM Core Bond Fund - Class Z |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

PGIM Core Bond Fund

|

| Class Name |

Class Z

|

| Trading Symbol |

TAIBX

|

| Annual or Semi-Annual Statement [Text Block] |

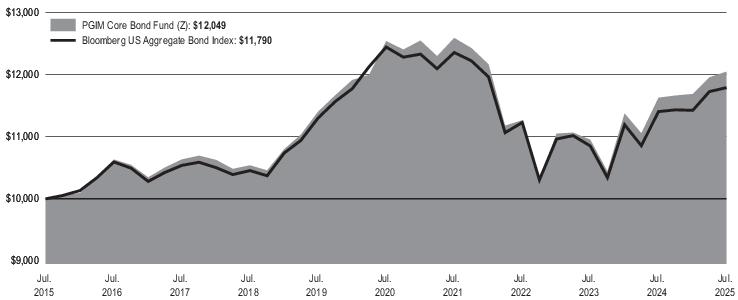

This annual shareholder report contains important information about the Class Z shares of PGIM Core Bond Fund (the “Fund”) for the period of August 1, 2024 to July 31, 2025.

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at pgim.com/investments/mutual-funds/prospectuses-fact-sheets . You can also request this information by contacting us at (800) 225-1852 or (973) 367-3529 from outside the US.

|

| Material Fund Change Notice [Text Block] |

This report describes changes to the Fund that occurred during the reporting period. |

| Additional Information Phone Number |

(800) 225-1852 or (973) 367-3529

|

| Additional Information Website |

pgim.com/investments/mutual-funds/prospectuses-fact-sheets

|

| Expenses [Text Block] |

WHAT WERE THE FUND COSTS FOR THE LAST YEAR? (Based on a hypothetical $10,000 investment)

|

|

Costs paid as a percentage |

PGIM Core Bond Fund—Class Z |

|

|

|

| Expenses Paid, Amount |

$ 34

|

| Expense Ratio, Percent |

0.33%

|

| Factors Affecting Performance [Text Block] |

WHAT AFFECTED THE FUND’S PERFORMANCE DURING THE REPORTING PERIOD? ■ During the reporting period, credit spreads across a broad spectrum of fixed income asset classes generally tightened, recovering from the US administration’s announcement of reciprocal tariffs on April 2, 2025. The US Federal Reserve's easing cycle, which began with three rate cuts in the second half of 2024, was paused in the first half of 2025 amid increased uncertainty over the impact of US policy changes on the domestic labor market and inflation. Indeed, Core PCE came in higher than expected for the reporting period. In addition, revisions to the non-farm payroll report in July 2025 revealed a weaker labor market than previously indicated, causing investors to reprice their expectations for a September rate cut and a steepening of the US Treasury yield curve. (A yield curve is a line graph that illustrates the relationship between the yields and maturities of fixed income securities. It is created by plotting the yields of different maturities for the same type of bonds.) ■ The following strategies contributed most to the Fund’s performance during the reporting period: overweights relative to the Index in the AAA non-agency commercial mortgage-backed securities (CMBS), AAA collateralized loan obligations (CLO), and US investment-grade corporate sectors; security selection in AAA CLOs, AAA non-agency CMBS, US Treasuries, asset-backed securities (ABS), and US investment-grade corporates; credit positioning in banking, aerospace & defense, and technology. ■ The following strategies detracted from performance during the period: duration positioning and security selection in MBS. ■ The Fund uses derivatives to facilitate the implementation of the overall investment approach. During the reporting period, the Fund used swaps, options, and futures to help manage duration positioning and yield curve exposure. In aggregate, these positions detracted from performance. |

| Performance Past Does Not Indicate Future [Text] |

The Fund’s past performance is not a good predictor of the Fund’s future performance.

|

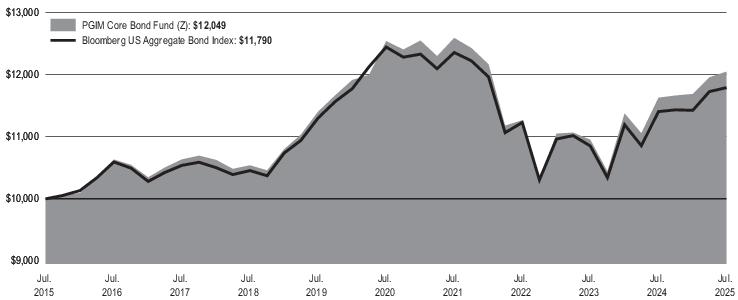

| Line Graph [Table Text Block] |

|

| Average Annual Return [Table Text Block] |

Average Annual Total Returns as of 7/31/2025 |

|

|

|

|

|

|

|

|

Bloomberg US Aggregate Bond Index |

|

|

|

|

| No Deduction of Taxes [Text Block] |

The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. |

| Material Change Date |

Aug. 01, 2024

|

| Updated Performance Information Location [Text Block] |

Visit pgim.com/investments/mutual-funds/prospectuses-fact-sheets or call (800) 225-1852 or (973) 367-3529 from outside the US for more recent performance data.

|

| Net Assets |

$ 2,252,570,714

|

| Holdings Count | Holding |

1,292

|

| Advisory Fees Paid, Amount |

$ 5,750,030

|

| Investment Company, Portfolio Turnover |

121.00%

|

| Additional Fund Statistics [Text Block] |

WHAT ARE SOME KEY FUND STATISTICS AS OF 7/31/2025?

|

|

|

|

Total advisory fees paid for the year |

|

Portfolio turnover rate for the year |

|

|

| Holdings [Text Block] |

WHAT ARE SOME CHARACTERISTICS OF THE FUND’S HOLDINGS AS OF 7/31/2025?

Credit Quality expressed as a percentage of total investments as of 7/31/2025 (%) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Credit ratings reflect the highest rating assigned by a nationally recognized statistical rating organization (NRSRO) such as Moody’s Investors Service, Inc. (Moody’s), S&P Global Ratings (S&P), or Fitch Ratings, Inc. (Fitch). Credit ratings reflect the common nomenclature used by both S&P and Fitch. Where applicable, ratings are converted to the comparable S&P/Fitch rating tier nomenclature. The Not Rated category consists of securities that have not been rated by an NRSRO. Credit ratings are subject to change. Values may not sum to 100.0% due to rounding. |

| Credit Quality Explanation [Text Block] |

Credit ratings reflect the highest rating assigned by a nationally recognized statistical rating organization (NRSRO) such as Moody’s Investors Service, Inc. (Moody’s), S&P Global Ratings (S&P), or Fitch Ratings, Inc. (Fitch). Credit ratings reflect the common nomenclature used by both S&P and Fitch. Where applicable, ratings are converted to the comparable S&P/Fitch rating tier nomenclature. The Not Rated category consists of securities that have not been rated by an NRSRO. Credit ratings are subject to change. Values may not sum to 100.0% due to rounding.

|

| Material Fund Change [Text Block] |

WERE THERE ANY SIGNIFICANT CHANGES TO THE FUND THIS YEAR? The following is a summary of certain changes to the Fund since August 1, 2024: ■ Effective April 7, 2025, the Fund’s investment strategy was revised to clarify that the Fund may invest up to 5% of its investable assets in below investment-grade securities. At this time, the Fund's principal risk disclosure was revised to include “ Junk Bonds Risk ” as a principal risk of the Fund. For more complete information, you should review the Fund’s next prospectus, which we expect to be available by September 29, 2025 at pgim.com/investments/mutual-funds/prospectuses-fact-sheets or by request at (800) 225-1852. |

| Material Fund Change Risks Change [Text Block] |

WERE THERE ANY SIGNIFICANT CHANGES TO THE FUND THIS YEAR? The following is a summary of certain changes to the Fund since August 1, 2024: ■ Effective April 7, 2025, the Fund’s investment strategy was revised to clarify that the Fund may invest up to 5% of its investable assets in below investment-grade securities. At this time, the Fund's principal risk disclosure was revised to include “ Junk Bonds Risk ” as a principal risk of the Fund. For more complete information, you should review the Fund’s next prospectus, which we expect to be available by September 29, 2025 at pgim.com/investments/mutual-funds/prospectuses-fact-sheets or by request at (800) 225-1852. |

| Updated Prospectus Phone Number |

(800) 225-1852

|

| Updated Prospectus Web Address |

pgim.com/investments/mutual-funds/prospectuses-fact-sheets

|

| PGIM Core Bond Fund - Class R6 |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

PGIM Core Bond Fund

|

| Class Name |

Class R6

|

| Trading Symbol |

TPCQX

|

| Annual or Semi-Annual Statement [Text Block] |

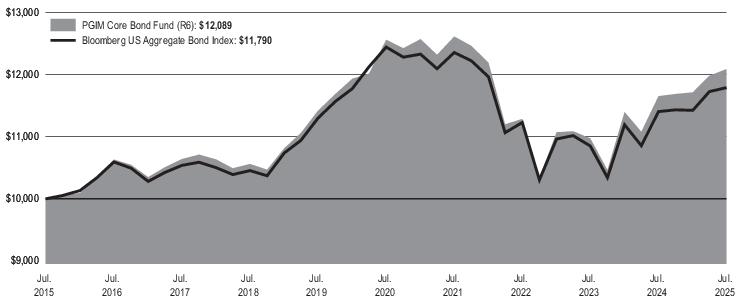

This annual shareholder report contains important information about the Class R6 shares of PGIM Core Bond Fund (the “Fund”) for the period of August 1, 2024 to July 31, 2025.

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at pgim.com/investments/mutual-funds/prospectuses-fact-sheets . You can also request this information by contacting us at (800) 225-1852 or (973) 367-3529 from outside the US.

|

| Material Fund Change Notice [Text Block] |

This report describes changes to the Fund that occurred during the reporting period. |

| Additional Information Phone Number |

(800) 225-1852 or (973) 367-3529

|

| Additional Information Website |

pgim.com/investments/mutual-funds/prospectuses-fact-sheets

|

| Expenses [Text Block] |

WHAT WERE THE FUND COSTS FOR THE LAST YEAR? (Based on a hypothetical $10,000 investment)

|

|

Costs paid as a percentage |

PGIM Core Bond Fund—Class R6 |

|

|

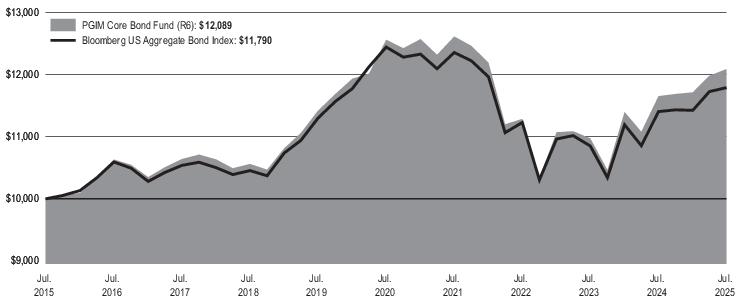

|