Exhibit 99.1

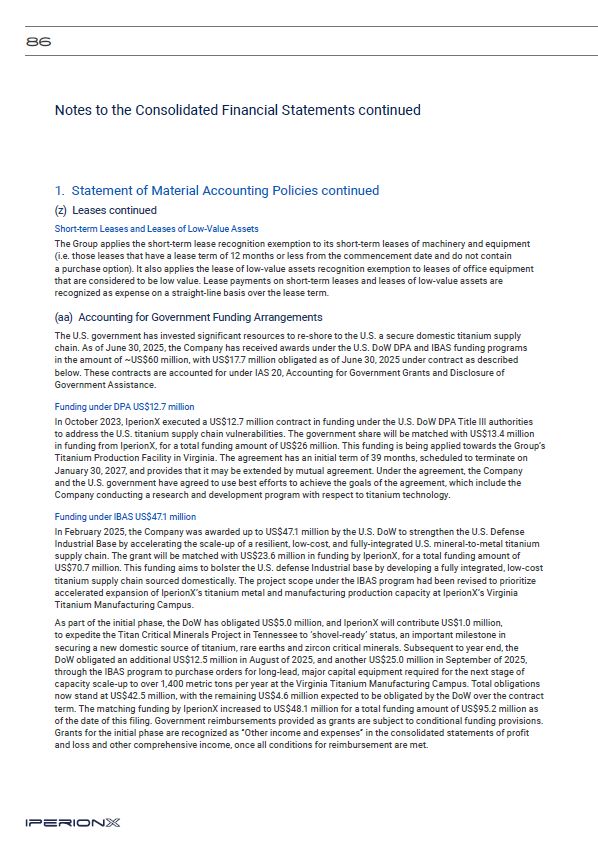

IperionX Limited ABN 84 618 935 372 Redefining titanium for the modern

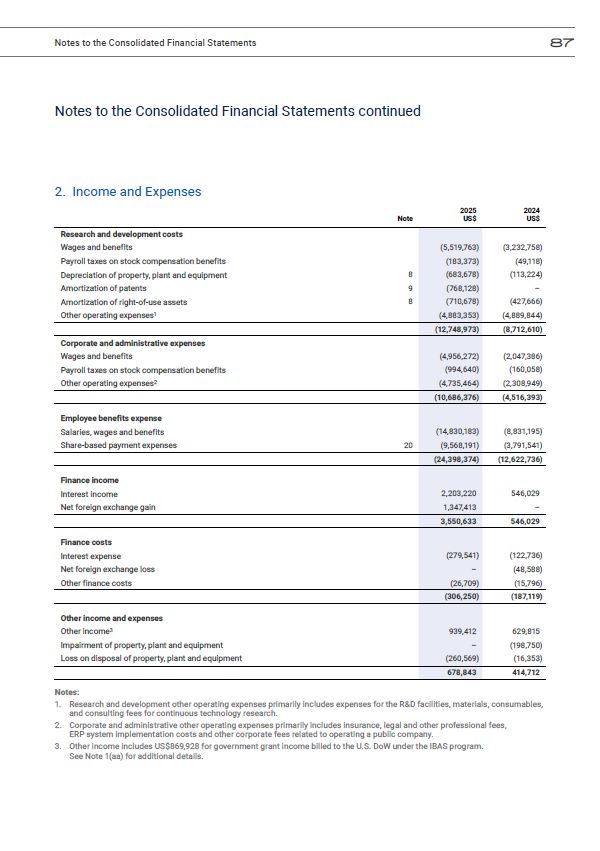

world Annual Report 2025

IperionX is a leading American titanium metal and critical materials

company. Letter to Shareholders FY25 Highlights 02 06 Overview 08 Titanium Products 12 Titanium Markets 14 IperionX’s Titanium Technologies Sustainability 16 22 Directors’ Report 26 71 Auditor’s Independence

Declaration Consolidated Statement of Profit or Consolidated Statement of Changes in Equity 74 Consolidated Statement of Cash Flows 75 Notes to the Consolidated Financial Statements 76 Consolidated Entity Disclosure

Statement 111 Directors’ Declaration 112 Independent Auditor’s Report 113 Mineral Resources Statement 118 Corporate Governance 119 ASX Additional Information 120 Loss and Other Comprehensive Income 72 Glossary of Terms and

Definitions 123 Consolidated Statement of Financial Position 73 Corporate Directory 125

IperionX is using patented metal technologies to produce high performance titanium

alloys, from titanium minerals or scrap titanium, at lower energy, cost and carbon emissions. Our Titan critical minerals project is the largest JORC‑compliant mineral resource of titanium, rare earth and zircon minerals sands in the

U.S. 01

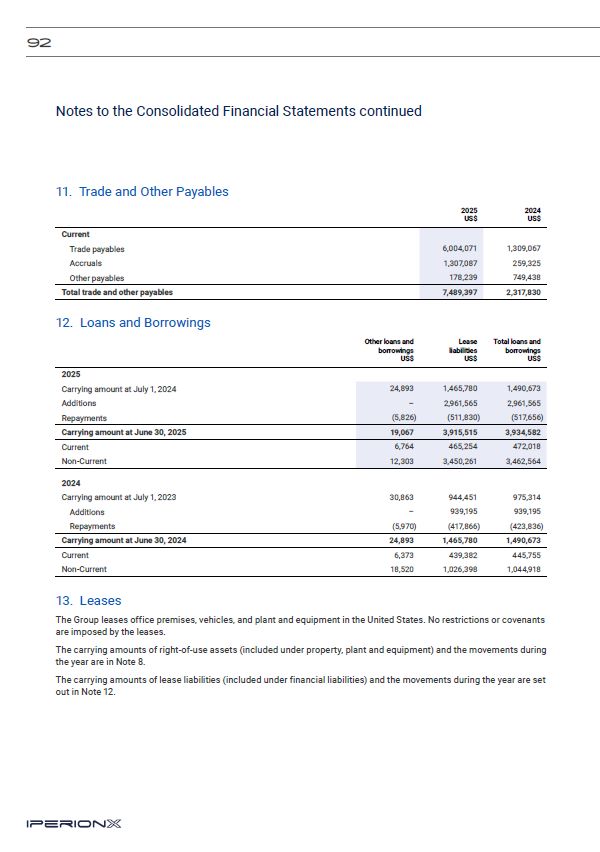

Taso Arima CEO & Managing Director Dear Fellow Shareholders, IperionX was

founded by a team with a powerful idea – make titanium affordable and sustainable – and this dedicated team are executing on this mission. In FY25 we decisively moved from development to production, commissioning our Virginia titanium

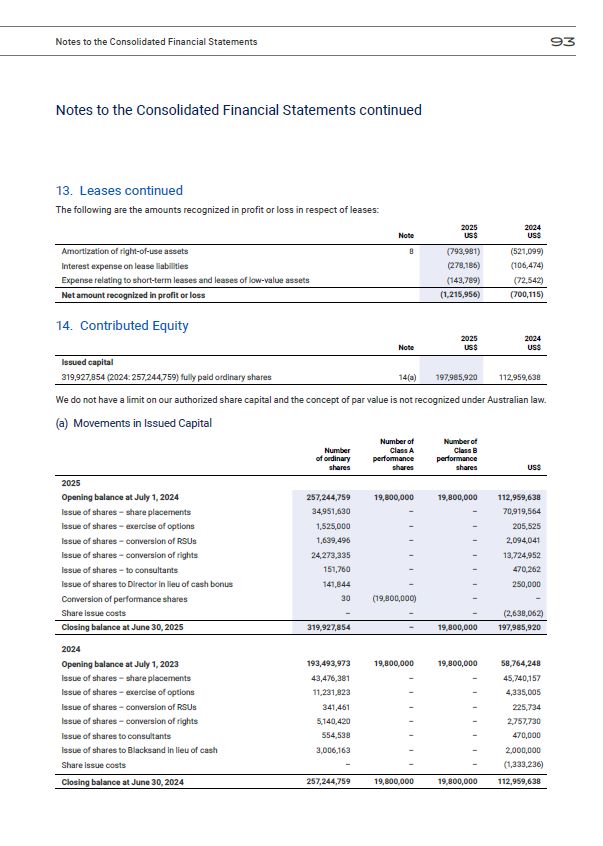

commercial‑scale operations, strengthening our U.S. funding base, and proving a faster, lower‑cost, more resilient A better way to make – and use – titanium For over 80 years, the Kroll titanium production process has constrained titanium to

high‑performance and high‑cost applications. Our patented HAMR™ and HSPT™ technologies invert that old model – producing high‑quality titanium powder directly from titanium scrap or mineral feedstocks, and then consolidating this powder into

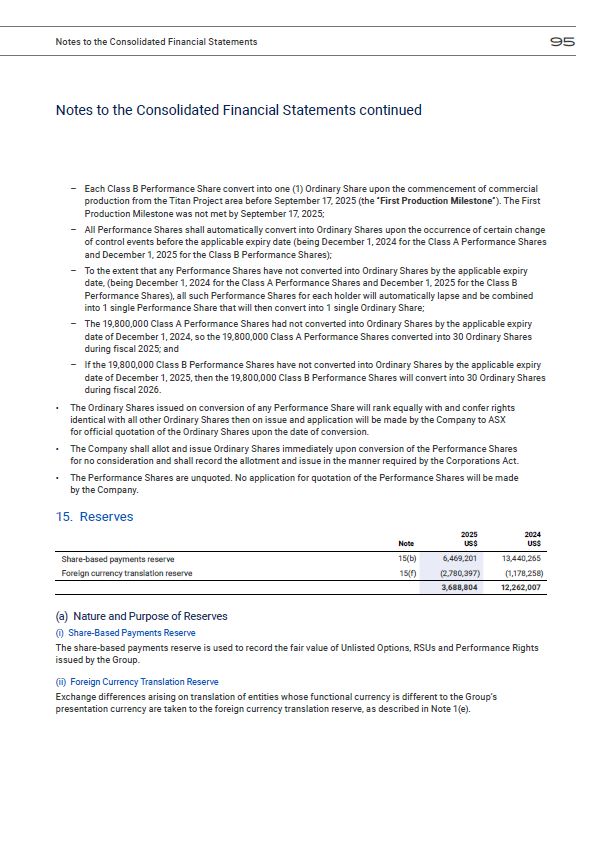

high‑performance near‑net‑shape, forged‑quality titanium parts with far higher yields, lower energy, and zero direct (Scope 1 and 2) emissions. In short: improved titanium production process, with fewer process steps, higher production

yields, and significantly lower costs. During the year we successfully commissioned titanium operations at our Virginia Titanium Manufacturing Campus. Innovative process improvements lifted our nameplate production capacity by 60% to ~200

tpa, without additional capex, and lowered our projected steady‑state unit costs to ~US$55/kg. We also defined the next step in our titanium scale‑up: a seven‑fold expansion to ~1,400 tpa by mid‑2027, supported by U.S. Government funding that

positions IperionX to the largest and lowest cost U.S. titanium powder producer, with targeted unit costs of ~US$29/kg at full scale. Funding to support U.S. defense industry priorities Our momentum to re‑shore a lower‑cost, high‑performance

U.S. titanium supply chain is accelerating. In FY25, IperionX was awarded up to US$47.1 million under the U.S. DoW IBAS program, including US$37.5 million obligated after year‑end for long‑lead equipment to accelerate our titanium production in

Virginia. We also secured an SBIR Phase III contract providing a US$99 million task‑order ceiling and received a US$1.3 million first order from the U.S. Army. Todd Hannigan Executive Chair Letter to Shareholders 02

Capital markets and shareholder support followed our technology lead and growing

momentum: we completed ~US$70 million equity placements to fund long‑lead items and fast‑track the titanium production expansion schedule. Commercial traction and a growing titanium product range Our titanium product roadmap targets

fasteners, brackets, gears and actuators, and electronics enclosures – these are high ‘buy‑to‑fly’ titanium parts where our near‑net‑shape technologies and economics could unlock +80% cost reductions versus legacy titanium manufacturing

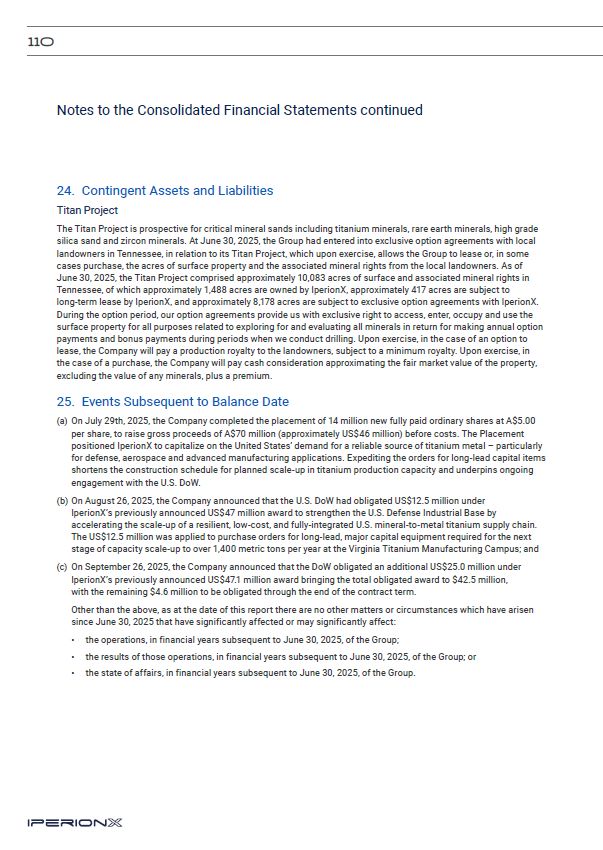

routes. Customer engagement accelerated over the year. We now count ~100 active potential customer programs and significantly progressed high‑potential commercial opportunities across the luxury, consumer electronics and defense sectors. We

signed a large supply contract with Ford for titanium powder and manufactured components. Safety, sustainability, and circular titanium supply chains Our Virginia Titanium Manufacturing Campus runs on 100% renewable power and our patented

HAMR™ process can use 100% titanium scrap – enabling closed‑loop titanium circularity at scale. We finished the year with zero lost-time injuries, producing 100% U.S.‑made recycled titanium powder with an estimated >90% lower footprint

versus conventional titanium powders, based on independent LCA studies. The Titan Critical Minerals Project: securing titanium mineral feedstocks and mineral‑to‑metal integration To underpin long‑term growth and security of domestic supply,

we advanced our leading Titan Project in Tennessee – one of the largest U.S. titanium, rare earth and zircon mineral sand resources – and commenced a U.S. Government‑funded Definitive Feasibility Study. Our proprietary Green Rutile™ and ARH™

process technologies can upgrade titanium minerals to +99% TiO₂ feedstock for our HAMR™ process, creating a fully‑integrated, American mineral‑to‑metal supply chain. ~$70m equity placements completed Letter to Shareholders 03

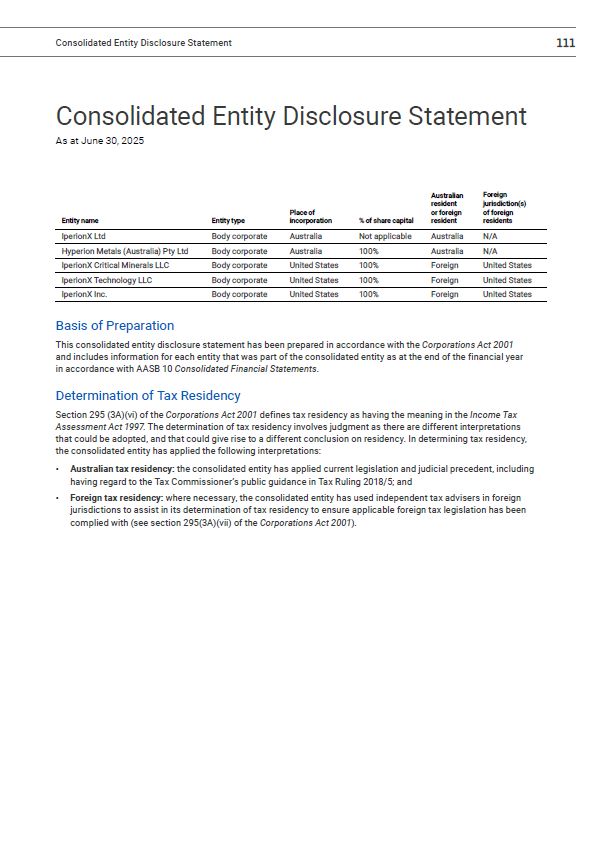

Results that compound FY25 was a year of execution and growing market

recognition. We commissioned, expanded capacity, improved our projected unit costs, grew our customer pipeline, and strengthened the balance sheet for accelerated titanium manufacturing growth. 2026 priorities: scale, customers, cash

generation Our priorities are clear: Ramping Virginia to industrial‑scale titanium output, while executing our U.S. Government funded seven‑fold expansion to ~1,400 tpa by mid‑2027; Scale customer contracts across defense, mobility,

electronics, and industrials – prioritizing high-margin, high‑yield, near‑net‑shape titanium components; and Keep lowering the cost curve: Scale resets the titanium cost curve – our patented titanium technologies scale efficiently, cutting

process steps, increasing manufacturing yields at lower energy and capital intensity. Leverage our structural cost advantage and push titanium toward value‑in‑use competitiveness with stainless steel and aluminum. Why this matters Steel had

Bessemer. Aluminum had Hall‑Héroult. Titanium’s constraint was never the metal – it was the high‑cost Kroll production process. With our patented HAMR™ and HSPT™ technologies deliver that moment: a titanium manufacturing platform with higher

yields, fewer process steps, lower energy intensity, and lower costs. As cost falls and productivity rises, titanium’s use‑cases expands – from aerospace and defense to EVs, electronics, robotics, marine, and beyond. This is how specialty

metals become mainstream. To our employees, thank you for the persistence and ingenuity that got us here safely. To our customers, partners, communities, and shareholders – thank you for your trust and alignment. We enter FY26 with momentum

and a disciplined plan to scale a leading American titanium platform – where our breakthrough technologies and team are the edge. With appreciation, Anastasios (Taso) Arima Chief Executive Officer and Managing Director Todd

Hannigan Executive Chair ~7x increase in targeted production by mid‑2027 04

Letter to Shareholders 05

2020-21 Company formation Acquisition of the Titan Critical Minerals

Project ASX listing Initial rights to the titanium technologies 2021-22 Technical validation of the titanium technologies Pilot facility operations, Utah Commencement of customer engagement Nasdaq listing 2022-23 Continued pilot

facility operations and first commercial contracts Virginia site selected for commercial scale up Patent portfolio growth U.S. Air Force titanium recycling challenge First UL validated 100% recycled titanium Production of titanium metal

from Tennessee minerals Titan Project Scoping Study 2023-24 R&D 100 award Expansion of customer base Development and commissioning of commercial operations First $12.7 million U.S. Department of War award Team and leadership

growth FY25 was a breakthrough year for IperionX, representing the inflection point between project development and commencement of commercial operations; re‑shoring a domestic U.S. titanium supply chain. FY25 Highlights 06

Ramp up of commercial operations in Virginia Complete acquisition of breakthrough

titanium technologies − Full acquisition of the intellectual property portfolio to secure the exclusive commercial rights to breakthrough titanium technologies. U.S. Government funding to secure titanium supply chain − Secured $47.1 million

in funding under the Department of War’s Industrial Base Analysis and Sustainment (IBAS) program to expedite the Titan Critical Minerals Project and facilitate vertical integration at the Titanium Manufacturing Campus. Receipt of $99 million

Small Business Innovation Research (SBIR) Phase III Indefinite Delivery, Indefinite Quantity Contract − SBIR Phase III contract enables IperionX to receive task order funding from U.S. Government, with task orders to focus on manufacturing

high‑performance titanium fasteners for U.S. DoW agencies. First Army task order under SBIR − Received the first task order, valued at $1.3 million, from the U.S. Army under the SBIR Phase III contract with the DoW. Accelerated expansion

of U.S. titanium production − U.S. DoW backed expansion by mid‑2027 has commenced, to become the largest volume and lowest cost U.S. producer of titanium. Commencement of Titan Project Definitive Feasibility Study − Definitive Feasibility

Study (DFS) is underway at the Titan Critical Minerals Project in Tennessee, a major step toward developing a fully integrated, mineral‑to‑metal U.S. titanium supply chain. $99m SBIR Phase III contract awarded 2024-25+ 07 FY25

Highlights

Overview IperionX is a leading American titanium metal and critical materials

company – using patented titanium technologies to produce high performance titanium alloys, from titanium minerals or scrap titanium, at lower energy, cost and carbon emissions. 10,000 tpa target production by 2030 IperionX’s award‑winning

patented technology portfolio enables high strength forged titanium alloy products at low cost, with class‑leading sustainability and superior process energy efficiencies when compared to current industry methods such as the Kroll

process. Using its technologies, IperionX has now transitioned to be a commercial producer of titanium metal products in the United States. IperionX produces low‑cost and high‑quality angular and spherical titanium powder, which is used to

produce near‑net‑shape and final titanium parts through powder metallurgy or additive manufacturing. These technologies provide IperionX with a sustainable competitive advantage and significant value uplift from upgrading raw titanium

materials through to finished high‑performance titanium products when compared to traditional titanium industry supply chains. Operations are underway to re‑shore a low cost, sustainable, U.S. titanium supply chain Titanium has superior

material properties that are prized across advanced industries, including high strength, light weight and corrosion resistance. However, the U.S. no longer produces any primary titanium metal (i.e. titanium sponge), including for defense, with

China and Russia controlling around 75% of global supply. IperionX is now actively re‑shoring a low‑cost, sustainable U.S. titanium supply chain, through the commercialization of its titanium technologies and its commercial operations in

Virginia. Commissioning of initial commercial operations is complete; an order of magnitude scale up is now underway IperionX has demonstrated commercial‑scale titanium production, with the commissioning and commencement of commercial

operations at the Titanium Manufacturing Campus in Virginia, United States, at a rate of 125 metric tons per year, and has detailed its plans to scale up to 1,400 metric tons per year in 2027. Global leadership in advanced manufacturing of

high‑performance titanium components IperionX is aiming for global leadership in advanced manufacturing of high‑performance titanium components of +10,000 tpa by 2030, and has developed a plan to scale titanium capacity in high‑performance

titanium components, targeting cost competitiveness with stainless steel and aluminum. 08

60% Increase in initial titanium powder capacity from 125 tpa to 200

tpa Commencement and scale up of commercial operations Commercial scalability validated by higher titanium production capacity and lower unit costs Titanium powder production commenced in 2024, and nameplate capacity has increased by 60%

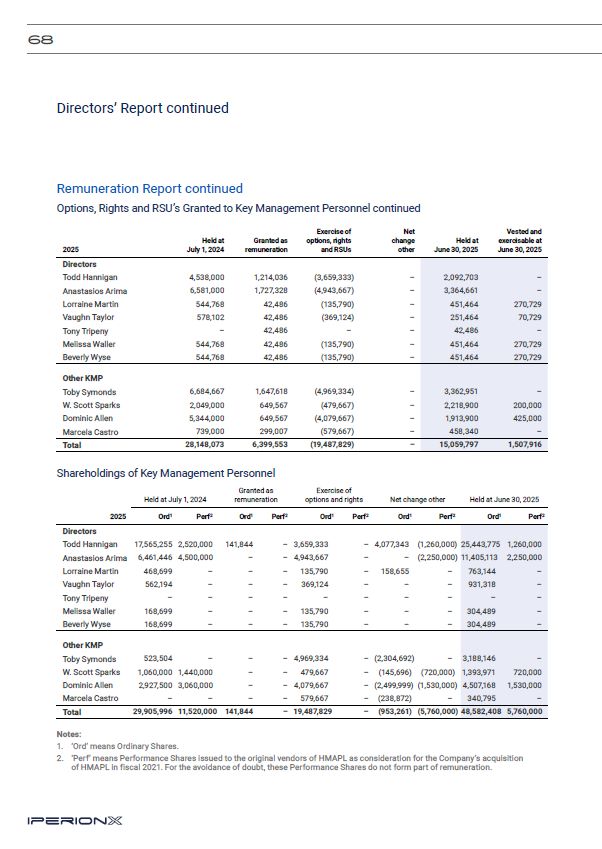

from 125 metric tons per year (tpa) to 200 tpa, driven by operational and technology process improvements with no additional capex. Projected titanium powder unit costs fall to ~US$55/kg at full utilization, from prior estimates of

US$75/kg. U.S. Department of War (DoW) backed expansion by mid‑2027 has commenced, to become the largest volume and lowest cost U.S. producer IperionX is accelerating a 7x expansion in titanium production capacity to 1,400 tpa, positioned to

be the largest volume and lowest‑cost American titanium powder producer, targeting titanium powder unit cost of ~US$29/kg at full utilization. The expansion has a low‑capital intensity, with capex of ~US$75 million, including contingency,

funded by U.S. DoW award of US$47.1 million, existing cash of US$54.8 million as of June 30, 2025, capital raise of US$46 million in July, 2025, and DoW SBIR Phase III task orders of US$99 million. Accelerated growth targets global market and

cost leadership in high‑performance titanium components IperionX is aiming for global leadership in advanced manufacturing of high‑performance titanium components of +10,000 tpa by 2030, and has developed a plan to scale titanium capacity in

high‑performance titanium components, targeting cost competitiveness with stainless steel and aluminum. Overview 09

$60m in funding and grants received to date through U.S. DoW programs Continued

U.S. Government funding to re‑shore a domestic titanium supply chain The U.S. government continues to support IperionX’s efforts to re‑shore a secure domestic titanium supply chain, building upon the initial US$12.7 million contract awarded to

IperionX in 2023. As of the date of this report, the Company has been awarded ~US$60 million in funding and grants through the U.S. DoW DPA Title III and IBAS programs. IperionX awarded $47.1 million by the U.S. DoW to secure U.S. titanium

supply chains In February 2025, IperionX was awarded a contract for up to US$47.1 million in funding by the U.S. DoW to strengthen the U.S. Defense Industrial Base by accelerating development of a resilient, low‑cost, and fully‑integrated

U.S. mineral‑to‑metal titanium supply chain. As part of the initial phase, the DoW obligated US$5 million through the Industrial Base Analysis and Sustainment program to expedite the Titan Critical Minerals Project in Tennessee to

‘shovel‑ready’ status. In August 2025, the U.S. DoW obligated a further US$12.5 million under the US$47.1 million award to be applied to purchase orders for long‑lead, major capital equipment required for the next stage of capacity scale‑up

to over ~ 1,400 metric tons per year at the Virginia Titanium Manufacturing Campus. Major incremental capacity categories include titanium deoxygenation, sintering and powder metallurgy consolidation systems; near‑net‑shape component

manufacturing and ancillary infrastructure upgrades. In September 2025, the Company announced that the DoW obligated an additional US$25.0 million to the previously announced US$47.1 million award. This US$25.0 million obligation, along with

the prior US$12.5 million and US$5.0 million, takes total obligations to US$42.5 million, with the remaining US$4.6 million expected to be obligated over the contract term. IperionX executed a U.S. DoW SBIR Phase III contract for up to US$99

million In June 2025, IperionX executed a Small Business Innovation Research (SBIR) Phase III contract with the U.S. DoW. Structured as an Indefinite Delivery, Indefinite Quantity contract in support of achieving “Low‑Cost Domestic Titanium

for Defense Applications” in the U.S., the contract establishes a funding mechanism through which qualifying U.S. Government agencies can place project‑specific task orders – collectively capped at US$99 million – for the supply of IperionX

titanium components and parts. 10

Zero direct carbon emissions Shortly after the SBIR Phase III contract

execution, IperionX received the first task order, valued at US$1.3 million, from the U.S. Army for the production and delivery of titanium parts for U.S. Army ground vehicle programs. Strategic advantages Fully integrated, lower‑cost and

sustainable solution via patented titanium technologies IperionX’s HAMR™ titanium production technology provides a lower‑energy, faster and lower temperature process to produce titanium, with energy consumption <50% vs. current industry,

and zero direct carbon emissions. The HSPT™ “forging” technology, is a non‑melt, advanced sintering technology that delivers forged quality titanium products. HAMR™ and HSPT™ can lower the cost, energy, and yield loss of producing titanium

products, and can produce titanium near‑net‑shape products at significantly higher yields and lower cost, unlocking a circular and zero direct carbon emission titanium supply chain. IperionX’s proprietary mineral upgrading technologies, Green

Rutile™ and ARH™, can add value to titanium minerals to produce low‑cost and high‑purity titanium feedstock for our HAMR™ titanium production facilities. The largest commercial producer of primary titanium metal in the U.S. IperionX’s

advanced HAMR™ furnace was successfully commissioned at the Titanium Manufacturing Campus in August 2024, marking the first titanium deoxygenation production run. IperionX successfully increased production by ~60 times from pilot scale to 125

metric tons per year, producing high performance titanium that exceeds industry quality standards, and has subsequently further increased capacity to 200 metric tons per year through operational improvements. Rapid expansion of operations,

supported by the U.S. Government The U.S. government is investing significant resources to re‑shore a secure domestic titanium supply chain that is currently dominated globally by China and Russia. IperionX is well positioned to benefit from

these resources to scale titanium production and manufacturing capacity. The US$47.1 million award in February of 2025 through the IBAS program builds upon the US$12.7 million in funding previously awarded under the DoW’s DPA Title III

Program, as well as up to US$99 million in contract awards under the SBIR Phase III program. The awards have allowed IperionX to commence scale up plans to 1,400 metric tons per year in 2027, aiming to be a leading U.S. titanium producer of

+10,000 metric tons per annum by 2030. Future integration using upgraded minerals from Titan Projects’ titanium mineral resources The fully permitted Titan Project in Tennessee is one of the largest titanium mineral resources in North

America, as well as a leading U.S. resource of zircon and rare earth critical minerals. The Titan Project, combined with our patented titanium mineral upgrading technologies, has the potential to deliver an innovative end‑to‑end solution

for a U.S. titanium supply chain, providing significant strategic value for defense and advanced manufacturing. IperionX is currently undertaking a definitive feasibility study on the Titan Project, funded by the DoW, and expected to be

complete in Q2 2026. Overview 11

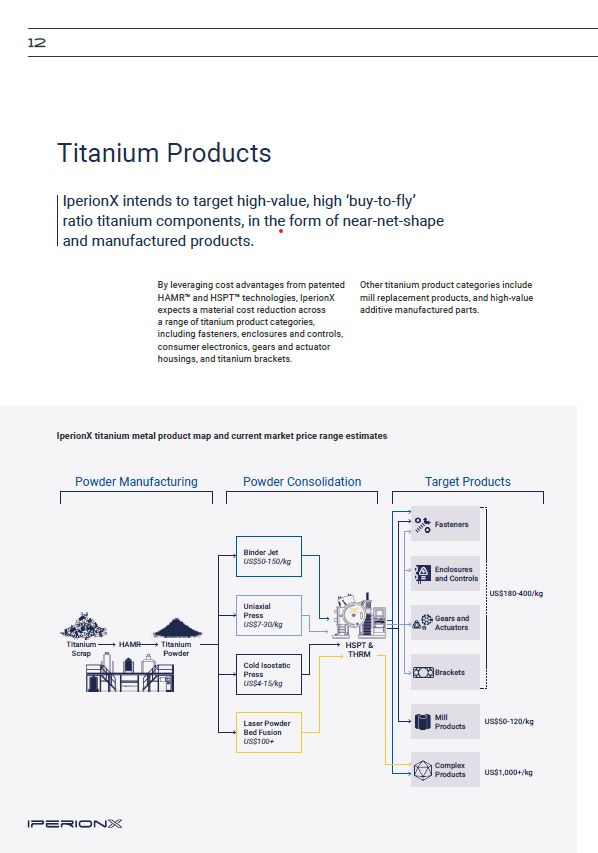

Titanium Products IperionX intends to target high‑value, high ‘buy‑to‑fly’ ratio

titanium components, in the form of near‑net‑shape and manufactured products. By leveraging cost advantages from patented HAMR™ and HSPT™ technologies, IperionX expects a material cost reduction across a range of titanium product categories,

including fasteners, enclosures and controls, consumer electronics, gears and actuator housings, and titanium brackets. Other titanium product categories include mill replacement products, and high‑value additive manufactured parts. IperionX

titanium metal product map and current market price range estimates US$180-400/kg US$50-120/kg US$1,000+/kg Powder Manufacturing Powder Consolidation Binder Jet US$50-150/kg Fasteners Enclosures and Controls Gears and

Actuators Brackets Mill Products Complex Products Titanium Scrap Titanium Powder HSPT & THRM HAMR Uniaxial Press US$7-30/kg Cold Isostatic Press US$4-15/kg Laser Powder Bed Fusion US$100+ Target Products 12

Titanium fasteners Fasteners — bolts, screws, nuts, washers, rivets — are

ubiquitous across major U.S. markets in automotive, construction, aerospace, marine, and industrial machinery. Titanium fasteners represent a large addressable market for IperionX. Leveraging our integrated patented technologies and

near‑net‑shape manufacturing, IperionX modelling indicates scope for product cost reductions of over 80%, and in some cases more than 90%, versus current market levels. The global titanium fastener market is ~US$4.3 billion1 annually, with the

global stainless steel fastener market ~US$15.2 billion2 annually. Lower‑cost titanium fasteners, priced competitively with stainless steel, could unlock accelerated substitution, volume growth and a larger addressable market. Enclosures and

controls (consumer electronics) The premium consumer electronics market is adopting titanium at scale, with leading global brands adding titanium to flagship devices. Over 1.2 billion3 mobile phones and 180 million3 smartwatches are sold

every year. IperionX offers a fully circular titanium supply chain that can convert consumer‑electronics titanium scrap into high‑quality titanium powder and titanium near‑net‑shape components, at lower energy, cost and environmental

footprint. Our first commercial project is already in progress to deliver into this market. Verified Market Research – Titanium Alloy Fasteners Market report. Verified Market Research – Stainless Steel Fasteners Market report. Statista –

Global smartphone/smartwatch sales to end users 2007‑2023. Goldman Sachs – The global market for humanoid robots could reach US$38 billion by 2035. Gears and actuators (humanoid robotics) The humanoid robotics market is forecast to expand

from under US$3 billion today to more than US$38 billion4 by 2035. Core to these systems are lightweight, strong, corrosion‑resistant gears and actuators — ideal for titanium and perfectly suited to our uniaxial press‑and‑sinter manufacturing

route, which mirrors traditional steel powder metallurgy gear production. Titanium brackets Titanium brackets are the natural complement to titanium fasteners across aerospace, marine, and construction — combining high strength, low

weight, and exceptional corrosion resistance. Mill products Although not central to our market product plan, IperionX’s powder metallurgy process can produce near‑final‑gauge titanium plate, sheet, and bar after sintering – bypassing large

portions of the titanium melt‑forge‑roll chain. Multiple industry partners are collaborating to quantify the cost and efficiency gains. High‑value additive manufactured parts For strategic programs and customers, we will manufacture

high‑value complex titanium parts via Laser Powder Bed Fusion (LPBF) and E‑Beam Powder Bed Fusion (EB‑PBF), smaller in output but with high‑value margins. As the expected lowest cost U.S. titanium‑powder producer, IperionX will strengthen the

additive manufacturing supply chain and deliver lower‑cost advanced manufactured titanium parts. 13 Titanium Products

Titanium Markets Automotive and transport Consumer electronics Aerospace and

defense Titanium and its alloys are used in high‑performance applications across a wide range of advanced industries. Titanium alloys are prized for their strength, lightweight, and high resistance to corrosion. 14

IperionX’s technologies produce lower‑cost and high‑quality titanium metal powder

that can be used to produce titanium semi‑finished stock products, near‑net forged titanium alloy shapes and high‑performance final titanium parts. A significant reduction in the end‑to‑end cost of manufacturing titanium parts has the

potential to increase the application of titanium to a wider range of markets. Energy Medical Luxury goods Industrial Titanium Markets 15

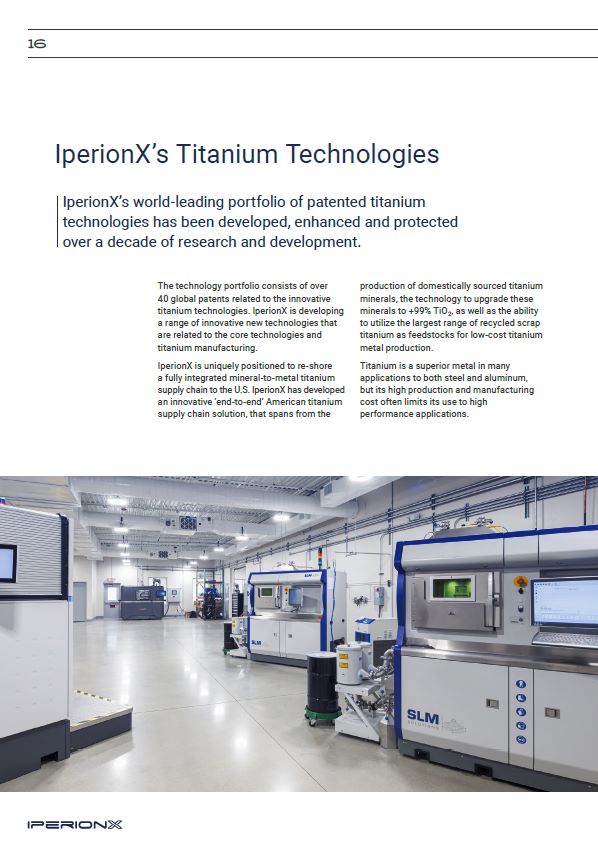

The technology portfolio consists of over 40 global patents related to the

innovative titanium technologies. IperionX is developing a range of innovative new technologies that are related to the core technologies and titanium manufacturing. IperionX is uniquely positioned to re‑shore a fully integrated

mineral‑to‑metal titanium supply chain to the U.S. IperionX has developed an innovative ‘end‑to‑end’ American titanium supply chain solution, that spans from the production of domestically sourced titanium minerals, the technology to upgrade

these minerals to +99% TiO2, as well as the ability to utilize the largest range of recycled scrap titanium as feedstocks for low‑cost titanium metal production. Titanium is a superior metal in many applications to both steel and aluminum, but

its high production and manufacturing cost often limits its use to high performance applications. IperionX’s Titanium Technologies IperionX’s world‑leading portfolio of patented titanium technologies has been developed, enhanced and protected

over a decade of research and development. 16

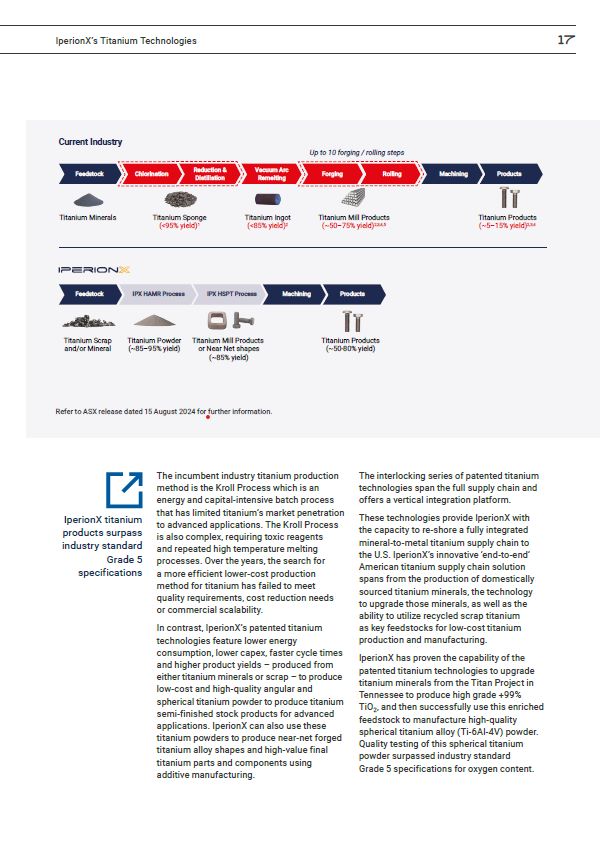

Vacuum Arc Remelting Chlorination Forging Rolling Products Machining Up to

10 forging / rolling steps Feedstock Reduction & Distillation Current Industry Products Feedstock IPX HAMR Process IPX HSPT Process Machining Titanium Minerals Titanium Sponge (<95% yield)1 Titanium Ingot (<85%

yield)2 Titanium Mill Products (~50–75% yield)2,3,4,5 Titanium Products (~5–15% yield)2,3,4 Titanium Scrap and/or Mineral Titanium Powder Titanium Mill Products (~85–95% yield) or Near Net shapes (~85% yield) Titanium Products (~50-80%

yield) IperionX titanium products surpass industry standard Grade 5 specifications Refer to ASX release dated 15 August 2024 for further information. The incumbent industry titanium production method is the Kroll Process which is an energy

and capital‑intensive batch process that has limited titanium’s market penetration to advanced applications. The Kroll Process is also complex, requiring toxic reagents and repeated high temperature melting processes. Over the years, the

search for a more efficient lower‑cost production method for titanium has failed to meet quality requirements, cost reduction needs or commercial scalability. In contrast, IperionX’s patented titanium technologies feature lower energy

consumption, lower capex, faster cycle times and higher product yields – produced from either titanium minerals or scrap – to produce low‑cost and high‑quality angular and spherical titanium powder to produce titanium semi‑finished stock

products for advanced applications. IperionX can also use these titanium powders to produce near‑net forged titanium alloy shapes and high‑value final titanium parts and components using additive manufacturing. The interlocking series of

patented titanium technologies span the full supply chain and offers a vertical integration platform. These technologies provide IperionX with the capacity to re‑shore a fully integrated mineral‑to‑metal titanium supply chain to the U.S.

IperionX’s innovative ‘end‑to‑end’ American titanium supply chain solution spans from the production of domestically sourced titanium minerals, the technology to upgrade those minerals, as well as the ability to utilize recycled scrap

titanium as key feedstocks for low‑cost titanium production and manufacturing. IperionX has proven the capability of the patented titanium technologies to upgrade titanium minerals from the Titan Project in Tennessee to produce high grade

+99% TiO2, and then successfully use this enriched feedstock to manufacture high‑quality spherical titanium alloy (Ti‑6Al‑4V) powder. Quality testing of this spherical titanium powder surpassed industry standard Grade 5 specifications for

oxygen content. IperionX’s Titanium Technologies 17

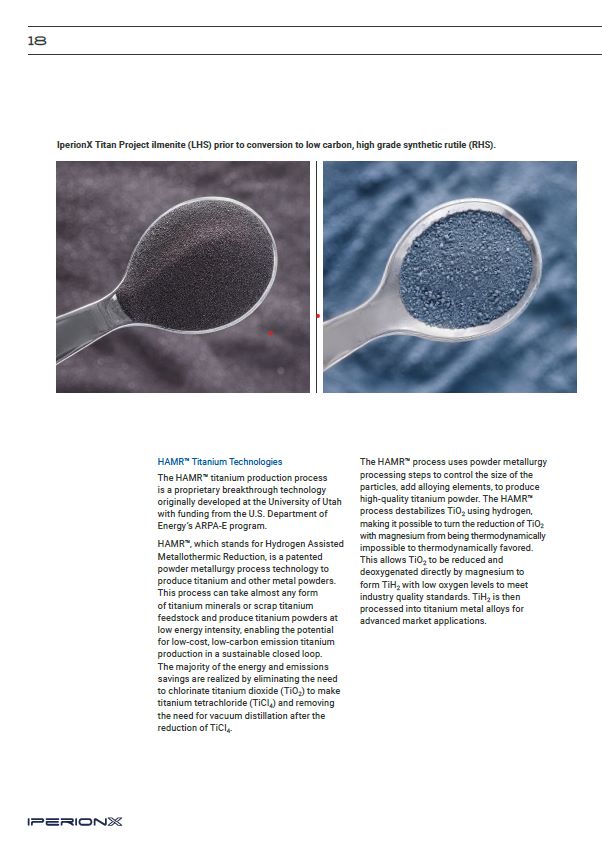

HAMR™ Titanium Technologies The HAMR™ titanium production process is a

proprietary breakthrough technology originally developed at the University of Utah with funding from the U.S. Department of Energy’s ARPA‑E program. HAMR™, which stands for Hydrogen Assisted Metallothermic Reduction, is a patented powder

metallurgy process technology to produce titanium and other metal powders. This process can take almost any form of titanium minerals or scrap titanium feedstock and produce titanium powders at low energy intensity, enabling the potential for

low‑cost, low‑carbon emission titanium production in a sustainable closed loop. The majority of the energy and emissions savings are realized by eliminating the need to chlorinate titanium dioxide (TiO2) to make titanium tetrachloride (TiCl4)

and removing the need for vacuum distillation after the reduction of TiCl4. The HAMR™ process uses powder metallurgy processing steps to control the size of the particles, add alloying elements, to produce high‑quality titanium powder. The

HAMR™ process destabilizes TiO2 using hydrogen, making it possible to turn the reduction of TiO2 with magnesium from being thermodynamically impossible to thermodynamically favored. This allows TiO2 to be reduced and deoxygenated directly by

magnesium to form TiH2 with low oxygen levels to meet industry quality standards. TiH2 is then processed into titanium metal alloys for advanced market applications. IperionX Titan Project ilmenite (LHS) prior to conversion to low carbon, high

grade synthetic rutile (RHS). 18

HSPT™ Titanium Forging Technologies The patented Hydrogen Sintering and Phase

Transformation (HSPT™) technology enables the low‑cost production of near‑net‑shape and additively manufactured titanium parts with similar properties to traditional forged or wrought parts. In traditional wrought manufacturing, multiple

energy intensive and expensive forging and machining steps are required to produce a titanium bar, plate, or sheet, and the subsequent machining required to make a part by subtractive manufacturing results in significant levels of scrap

generation. While powder metallurgy and additive manufacturing generate less waste and can be lower‑cost alternatives to traditional manufacturing, titanium parts manufactured by these alternative approaches typically have poor mechanical

properties and often rely on expensive post‑sintering thermal mechanical processing. In contrast, the patented HSPT™ ‘forging’ technology yields a wrought‑like ultrafine grain microstructure to produce titanium products with superior fatigue

properties versus traditional titanium powder metallurgy methods. IperionX uses its patented HAMR™ and HSPT™ technologies with powder metallurgy to manufacture high‑performance forged titanium products. By combining powder metallurgy or

additive manufacturing with the HSPT™ processing technology, IperionX produces near‑net‑shape titanium parts with an ultra‑fine‑grain microstructure. These parts have the potential to be produced at significantly lower cost and with greatly

reduced scrap generation, while achieving material performance properties similar to those produced by forging. IperionX’s Titanium Technologies 19

GSD™ Technologies The Granulation‑Sintering‑Deoxygenation (GSD™) process is a

patented thermochemical technology designed to produce spherical titanium powders for 3D printing and additive manufacturing. This innovative process significantly enhances production efficiency, increasing powder yield by up to 50%, while

delivering spherical titanium powders with low oxygen content, precise particle size control, and excellent flowability. In contrast, existing methods for producing spherical metal powders – such as gas atomization, plasma atomization, and the

plasma rotating electrode process – face significant limitations. While gas and plasma atomization can generate fine powders, their final product yield is low after size classification. A common challenge across all these methods is the low

production yield of fine powders, which is a key driver of the high cost of titanium powder in additive manufacturing. GSD™ technology addresses these limitations, offering a more efficient and cost‑effective solution for high‑quality titanium

powder production. The HAMR™ technologies offer the capability to directly manufacture advanced alloys from the oxides of alloying elements. These technologies enable the use of alloying elements like iron, niobium, zirconium, and molybdenum

etc. to create titanium alloys with enhanced strength, ductility, and fatigue performance. The HAMR™ technology offers advantages to manufacture advanced metal alloys that are difficult to produce at scale using traditional methods, such as

melt processes. Titan ilmenite (~60% TiO2) +99% TiO2 Ti‑6AI‑4V 20

Green Rutile™ and ARH™ Technologies IperionX’s proprietary mineral upgrading

technologies, Green Rutile™ and ARH™, can add value to titanium minerals to produce low‑cost and high‑purity titanium feedstock for use at HAMR titanium production facilities. The proprietary Green Rutile™ process upgrades lower grade titanium

minerals into higher‑grade synthetic rutile titanium product plus a co‑product of purified iron oxide powder that could be used for metal alloying or produced as a pre‑cursor for Lithium Iron Phosphate batteries. Most of global synthetic

rutile production is based upon the incumbent Becher Process, which consists of roasting lower‑grade ilmenite titanium minerals using coal as a reductant in a rotary kiln at temperatures of more than 1,100°C to convert the iron oxide in the

ilmenite to metallic iron, and then ‘rusting’ the kiln product in an aerated salt solution to remove most of the metallic iron. The Scope 1 and 2 emissions from the current production of synthetic rutile and titanium slag are significant,

estimated at approximately 3.3 tons and 2 tons of CO2 equivalent per ton of product. In contrast, IperionX’s Green Rutile™ process does not use coal as a reductant, and when combined with renewable or low‑carbon sourced electricity, has the

potential to result in high‑quality titanium product with low carbon emissions. IperionX is advancing plans to scale‑up the Green Rutile™ enrichment technology to upgrade lower grade ilmenite titanium minerals from the Titan Project into a

high‑quality synthetic rutile titanium product and iron oxide powder co‑product. IperionX’s patented Alkaline Roasting and Hydrolysis (ARH™) technology can further upgrade rutile titanium minerals, including Green Rutile™, to +99% titanium

dioxide (TiO2) feedstock so that it can be used as a high‑purity feedstock for the HAMR™ titanium production process. IperionX’s Titanium Technologies 21

Overview IperionX believes that a sustainable economy and the technologies of the

future will assist to drive increased demand for critical minerals and metals, including titanium. IperionX’s technologies bypass the high‑cost, high‑carbon Kroll Process and the energy intensive titanium melt processes and forging. IperionX’s

core patented technologies can provide a more sustainable and circular titanium metal supply chain compared to the current titanium supply chain. Sustainability Governance and Disclosures IperionX was founded with the mission to build an

end‑to‑end, low cost, and sustainable titanium supply chain in the United States. Sustainability is governed from the highest levels of IperionX’s management, with the Sustainability Sub‑Committee overseeing all related initiatives, including

the Annual Sustainability Report and annual sustainability goals. IperionX reports annually on its sustainability progress following Global Reporting Initiative, the Sustainability Accounting Standards Board, and the Task Force on

Climate‑related Financial Disclosures guidance. Sustainability IperionX’s core patented technologies can provide a more sustainable and circular titanium metal supply chain compared to the current titanium supply chain. 22

100% titanium scrap utilized Social Responsibility IperionX values its

employees and local communities in Virginia, Utah, Tennessee and North Carolina. Protecting the health and safety of all our stakeholders, including our employees, contractors, visitors, and communities, is a core value of IperionX and

fundamental to our future success. IperionX takes the responsibility of creating a safe workplace for employees seriously, ensuring compliance with applicable occupational and environmental health and safety laws and regulations governing our

operations. Sustainable Titanium Technologies IperionX can revolutionize the titanium industry by enabling a truly circular titanium supply chain. Our patented technologies can utilize 100% titanium scrap, including low‑quality (and

high‑oxygen) titanium scrap that other processes can’t recycle. Our resulting 100% recycled, high‑quality (and low‑oxygen) titanium powder and parts can be used for a wide variety of applications and industries. Once those products have come

to the end of their useful life, the technologies can be used to recycle the post‑consumer titanium again, enabling a true “closed‑loop” and low‑carbon titanium supply chain at scale. By diverting valuable titanium from downcycling – or from

yesterday’s waste stream – and upcycling it for new titanium products, we help meet today’s needs for sustainable, domestically sourced critical minerals and help our customers achieve their product circularity and sustainability goals. Low

Carbon Footprint IperionX’s sustainable and low‑carbon titanium powders are produced using 100% renewable energy, with zero associated Scope 1 and 2 carbon emissions. The low Scope 3 emissions associated with the titanium production process

are being actively managed and have the potential to be reduced via the procurement of low‑carbon process inputs. IperionX completed a comparative life cycle assessment (LCA) to demonstrate the low‑carbon offerings of its spherical titanium

powders compared to other conventionally produced metal powders for additive manufacturing. Results of the comparative LCA for climate change impacts indicate that 100% recycled spherical titanium powder to be produced at IperionX’s Titanium

Production Facility in Virginia has the potential for a life cycle carbon footprint as low as 7.8 kg of carbon dioxide equivalents (CO2e) per kg of powder. This finding represents over a 90% decrease in carbon footprint when compared to

conventional titanium powders produced using the plasma atomization process (estimated to be 88.8 kg CO2e per kg powder). Sustainability 23

Sustainable Mineral Development IperionX is committed to resource efficiency,

sustainable land management, and biodiversity at its Titan Project in Tennessee. The Titan Project aims to serve as a global model of sustainability and land stewardship throughout its lifecycle. Once operational, mineral extraction activities

at the Titan Project will be low impact, requiring no drilling or blasting. Completing the project in a phased approach with progressive reclamation will minimize our active operations to a small footprint at any given time. We are working

with the University of Tennessee Institute of Agriculture to research methods of restoring the land in ways that will improve soil fertility and benefit a biodiverse ecosystem. We are committed to having a net positive impact on the land in

all our operations. Environmental Regulation Our operations are subject to various environmental laws and regulations under the relevant government’s legislation. Full compliance with these laws and regulations is regarded as a minimum

standard for all operations to achieve. Instances of environmental non‑compliance by an operation are identified either by external compliance audits or inspections by relevant government authorities. There were no known breaches by IperionX

during the fiscal year ended June 30, 2025. 24

Financial Report Consolidated Statement of Profit or Loss and Other

Comprehensive Income 72 Consolidated Statement of Financial Position 73 Directors’ Report 26 Consolidated Entity Disclosure Statement 111 Auditor’s Independence Declaration 71 Directors’ Declaration 112 Independent Auditor’s

Report 113 Mineral Resources Statement 118 Corporate Governance 119 Consolidated Statement of Changes in Equity 74 ASX Additional Information 120 Consolidated Statement of Cash Flows 75 Glossary of Terms and Definitions 123 Notes

to the Consolidated Financial Statements 76 Corporate Directory 125 25

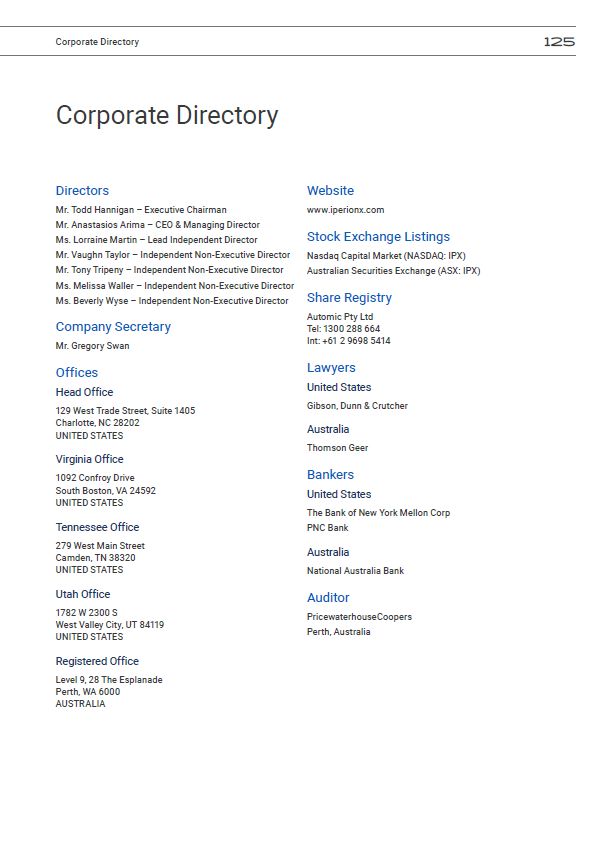

Directors’ Report The Directors of IperionX Limited present their report on the

consolidated entity consisting of IperionX Limited (“Company” or “IperionX”) and the entities it controlled at the end of, or during, the year ended June 30, 2025 (“Consolidated Entity” or “Group”). Directors The names and details of the

Company’s directors in office at any time during the financial year or since the end of the financial year are: Mr. Todd Hannigan Mr. Anastasios Arima Ms. Lorraine M. Martin Mr. Vaughn Taylor Ms. Melissa G. Waller Ms. Beverly M. Wyse Mr.

Tony Tripeny Executive Chairman Chief Executive Officer and Managing Director Lead Independent Director Independent Non-Executive Director Independent Non-Executive Director Independent Non-Executive Director Independent Non-Executive

Director (appointed March 17, 2025) Unless otherwise stated, Directors held their office from July 1, 2024 until the date of this report. Current Directors and Officers Mr. Todd Hannigan B.Eng (Hons), MBA Executive Chairman Mr. Hannigan was

appointed as Non-Executive Chairman of IperionX on February 1, 2021, and as Executive Chairman on May 24, 2021. Todd Hannigan has over 28 years of global experience in natural resources as company founder, chief executive officer, private

capital investor and non-executive director. Mr. Hannigan has worked internationally in the natural resources sector including for Piedmont Lithium Inc., Aston Resources, Hanson PLC and BHP Billiton. Mr. Hannigan holds a Bachelor of Engineering

(Mining) from The University of Queensland and an MBA from INSEAD. Other Current Public Directorships Executive Chairman Brazilian Rare Earths (January 2023 – present) Former Public Directorships During the Past Three Years None 26

Directors’ Report continued Mr. Anastasios (Taso) Arima BCom Chief Executive

Officer & Managing Director Mr. Arima is a founder of IperionX and was appointed as Executive Director on December 1, 2020, and as Managing Director and CEO of the Company on March 1, 2021. Anastasios (Taso) Arima has over 15 years of

experience in founding and developing critical material companies in North America. Mr. Arima was a founder and director of Piedmont Lithium and was instrumental in the development of the company. Mr. Arima attended the University of Western

Australia and earned a Bachelor of Commerce whilst studying for a Bachelor of Engineering. Other Current Public Directorships During the Past Three Years InVert Graphite Limited (formerly Dominion Minerals Limited) (November 2021 –

present) Former Public Directorships None Ms. Lorraine M. Martin B.A. (Computational Mathematics), M.Sc (Computer Science) Lead Independent Director President and CEO of the National Safety Council IperionX Director since September 13,

2021 Lorraine M. Martin is a director, President and CEO of the National Safety Council, serving in this position since June 2019. She is also co-founder and President of Pegasus Springs Foundation, a non-profit organization focused on

education and mentoring. Ms. Martin is the retired Executive Vice President and Deputy of Rotary and Mission Systems (“RMS”) for Lockheed Martin Corporation, a global aerospace, defense, security and advance technologies company. Prior to RMS,

Ms. Martin was Executive Vice President and General Manager for the F-35 Lightning II Program for Lockheed Martin Aeronautics Company. Her leadership of the F-35 program earned Pentagon recognition for reducing program costs while increasing

production and fielding more aircraft worldwide. She joined Lockheed Martin in 1988 and during her tenure, held a variety of high visibility leadership positions across the corporation. Prior to joining Lockheed Martin, she served as an

officer in the U.S. Air Force, holding various leadership positions for software intensive technology and development programs. She has a Master of Science degree in Computer Science from Boston University and a Bachelor of Arts degree in

Computational Mathematics from DePauw University. Other Current Public Directorships Kennametal Inc. (July 2018 – present) Former Public Directorships During the Past Three Years None IperionX Board Committees Lead Independent

Director Nominating and Governance Directors’ Report 27

Directors’ Report continued Current Directors and Officers continued Mr. Vaughn

Taylor BBus (Accounting), SAFin Independent Non-Executive Director Former Executive Director and Chief Investment Officer of AMB Capital Partners IperionX Director since March 3, 2021 Vaughn Taylor previously served as Executive Director and

Chief Investment Officer of AMB Capital Partners, (“AMB”) the global investment platform of the Bennett Family. Mr. Taylor was responsible for executing on the investment strategy, expanding the investment portfolio into international markets

and sourcing new investment opportunities. Mr. Taylor is an active global investor and is a board member of a number of listed and private market organizations both in Australia and the U.S. across a range of sectors. Mr. Taylor holds a

Bachelor of Business (Accounting) and a Master of Business (Real Estate) from RMIT University. Mr. Taylor also holds a Graduate Diploma in Applied Finance and Investment from Financial Services Professional Body, (“FINSIA”). Other Current

Public Directorships Alta Global Group Ltd (August 2021 – present) Former Public Directorships During the Past Three Years None IperionX Board Committees Audit Committee Compensation Committee (Chair) Ms. Melissa G. Waller B.A.

(Journalism and Mass Communications) Independent Non-Executive Director Former Deputy Treasurer and Chief of Staff for the North Carolina Department of State Treasury IperionX Director since September 13, 2021 Melissa G. Waller has over 30

years’ experience as a senior finance executive and is President for the AIF Institute, providing essential education, research and resources to investors and investment firms globally with over US$50 trillion assets under management. Ms.

Waller is the former Deputy Treasurer and Chief of Staff for the North Carolina Department of State Treasury, where she successfully oversaw Department strategic planning, operations, and public-policy implementation, along with a staff of

more than 400 employees, including the North Carolina Retirement Systems, the pension fund for the state and the tenth largest public pension fund in the United States, with assets in excess of US$90 billion. Ms. Waller has served as Chair of

the Department’s Corporate Governance Committee, as well as on the Council of Institutional Investors Board of Directors and the Governor’s Board of Innovation for the North Carolina University System. She currently serves as Executive Program

Director for the National Institute of Public Finance, as well as Director of Public and Private Partnerships for the Kenan Institute. Ms. Waller has a bachelor’s degree in journalism and mass communications from the University of North

Carolina. Other Current Public Directorships None Former Public Directorships During the Past Three Years None IperionX Board Committee Nominating and Governance Committee (Chair) Compensation Committee 28

Directors’ Report continued Ms. Beverly M. Wyse B.Sc. (Mechanical Engineering),

MBA Independent Non-Executive Director Former President of Shared Services, Boeing IperionX Director since September 13, 2021 Beverly M. Wyse worked for over 30 years at Boeing, most recently as President of Shared Services, a multi-billion

dollar operating group. In that role, she refocused and restructured the organization and also delivered improved efficiency and performance. Previously, she was Vice-President & General Manager of Boeing South Carolina, a major

manufacturing, assembly and delivery site for Boeing where she led the team through successful production rate increases, major improvements in workforce relations and significant reductions in operating costs. Throughout her extensive career

at Boeing, Ms. Wyse also successfully led the 737, 767 and 787 Charleston programs. Ms. Wyse holds an MBA and a B.Sc. in Mechanical Engineering from the University of Washington. Other Current Public Directorships None Former Public

Directorships During the Past Three Years Héroux-Devtek Inc. (February 2019 – February 2025) IperionX Board Committees Audit Committee Nominating and Governance Committee Compensation Committee Mr. Tony Tripeny BS (Economics) Independent

Non-Executive Director Former Executive Vice President and Chief Financial Officer of Corning Incorporated IperionX Director since March 17, 2025 Tony Tripeny brings over 40 years of financial and operational leadership in advanced

manufacturing, technology and materials science. Mr. Tripeny’s successful 36-year career at Corning Incorporated, a global innovator and leader in advanced materials science, included senior roles of Executive Vice President and Chief Financial

Officer, as well as Senior Vice President and Corporate Controller, until his retirement in 2022. Mr. Tripeny currently serves as a Director at Mesa Laboratories and Origin Materials. He holds an economics degree from the Wharton School of

Business at the University of Pennsylvania and is a member of both the Financial Executives Institute and the Institute of Management Accounting. Other Current Public Directorships Mesa Laboratories, Inc. (NASDAQ: MLAB) (2022 –

present) Origin Materials, Inc. (NASDAQ: ORGN) (May 2023 – present) Former Public Directorships During the Past Three Years None IperionX Board Committees Audit Committee (Chair) Nominating and Governance Committee Directors’ Report 29

Directors’ Report continued Principal Activities The principal activities of the

Group during the year consisted of the development of its titanium metal technologies and the development of its mineral properties in the United States. The Group is operating a U.S. based, integrated titanium business to support a range of

advanced industries, including consumer electronics, aerospace, defense, medical, bicycles, additive manufacturing and automotive. We expect to offer a range of titanium products and alloys for customers across these key industries. Our

portfolio of assets includes our operations at the Titanium Manufacturing Campus in Halifax County, Virginia; our Titan Project in Tennessee, which is in the exploration stage; and IPF R&D center in Salt Lake City, Utah, that together are

re-shoring a sustainable titanium supply chain in the U.S. During the 2025 fiscal year, IperionX exercised its exclusive option to acquire certain of the assets of Blacksand, and now owns patents to certain titanium and metal alloy production

technologies and holds exclusive global licenses over the Technologies, including hydrogen assisted metallothermic reduction, granulation sintering deoxygenation, low carbon titanium mineral enrichment, hydrogen sintering and phase

transformation, alkaline roast and hydrolysis, and other titanium alloying technologies. Operating and Financial Review Introduction IperionX has transitioned to become a leading sustainable producer of titanium products for a wide range of

industries. Titanium is prized for its high strength-to-weight ratio and its resistance to high temperatures and corrosion. Titanium is used in numerous advanced industries, including consumer electronics, aerospace, defense, industrial,

medical, bicycles, hydrogen and automotive. IperionX has developed commercial relationships with a range of customers across these sectors that desire high-performance titanium products via a more sustainable supply chain. IperionX aims to

sell titanium products directly to these customers. Our future products may include manufactured titanium components, titanium powders for additive manufacturing and powder metallurgy and traditional mill products. We offer a range of titanium

alloys, including aerospace grade titanium alloys and other high performance titanium alloys. Since the 1940’s, titanium has been commercially produced using the Kroll Process, which is a relatively energy and cost-intensive method that

produces high levels of greenhouse gas emissions. In contrast, IperionX controls the intellectual property rights to certain patented titanium and metal alloy production technologies which use less energy to produce high-performance titanium

products, at lower costs, with zero Scope 1 and 2 emissions, driven by the expected use of 100% renewable energy at our facilities (as reported in our recent life cycle assessment published in June 2024). Today the United States has no

commercial domestic primary titanium metal (titanium sponge) production capacity and the U.S. currently imports almost all of the titanium sponge required for its advanced industries. We are re-shoring titanium metal production, thereby

reducing America’s acute reliance on primary titanium imports and strengthening the domestic titanium supply chain. To achieve our goals, IperionX has two key value drivers: Titanium Metals: IperionX has successfully scaled and commissioned

its first commercial operations using the Technologies to produce high performance titanium alloys and products at lower costs, with zero Scope 1 and 2 emissions, from either scrap titanium or titanium minerals. IperionX is currently ramping up

production at its large-scale titanium production facility, in Virginia; and 30

Directors’ Report continued Critical Minerals: IperionX owns the Titan Project in

Tennessee, an exploration stage project, which is currently one of the largest titanium, zircon and rare earth mineral resources, reported in accordance with the JORC Code, in the U.S. At full production, we anticipate that the Titan Project

could produce approximately 100,000 tons per annum of titanium minerals that could potentially be used as a feedstock to produce 100% American-made titanium alloys. IperionX is currently undertaking a definitive feasibility study on the Titan

Project, funded by the U.S. DoW, and expected to be complete in Q2 2026. To meet the growing demand for sustainable and lower cost titanium products, IperionX is ramping up production at its titanium manufacturing facility in Virginia, with

first production of deoxygenated titanium achieved in August 2024, and full system commissioning completed in 2025. Technology and process improvements at the titanium manufacturing facility have already lifted nameplate titanium powder

capacity from 125 tpa to 200 tpa – and laid the groundwork for a seven-fold scale-up in titanium production to 1,400 tpa in 2027. IperionX is aiming for global leadership in advanced manufacturing of high-performance titanium components

of +10,000 tpa by 2030, and has developed a plan to scale titanium capacity in high-performance titanium components, targeting cost competitiveness with stainless steel and aluminum. To support the potential future growth in titanium

production, we also plan to develop the Titan Project in Tennessee to provide low-cost titanium mineral feedstock. In addition, we believe the Titan Project has the potential to be a sustainable, low-cost and globally significant producer of

titanium, rare earths and zircon minerals. These minerals are important for advanced U.S. industries including consumer electronics, aerospace, defense, medical, bicycles, additive manufacturing, hydrogen and automotive. Why

Titanium? Titanium is a strong, lightweight metal with important material properties for applications in consumer electronics, aerospace, defense, medical, bicycles, additive manufacturing, hydrogen and automotive. A range of titanium alloys

are recognized for high strength-to-weight ratio and excellent corrosion resistance that exceed many alloys of stainless steel and aluminum. However, titanium’s high production and manufacturing cost has historically been a key factor in

hindering its widespread application versus other structural metals such as stainless steel and aluminum. Currently, primary titanium metal is largely produced by the Kroll Process, invented in the 1940s. The Kroll Process works by reducing

titanium from titanium tetrachloride with magnesium in a capital and energy-intensive batch process. After primary titanium is produced with the Kroll Process, it must be melted, alloyed and remelted into ingots. The ingots are then

processed in a series of manufacturing steps to produce mill products, including consecutive rolling steps, extruding and forging. Mill products can be machined into parts using subtractive methods where large portions of the titanium metal are

machined away into scrap. Some mill products are drawn into wire and used in a gas atomization process to produce spherical titanium powders. The United States depends on imported titanium to support its defense and critical infrastructure

needs. In 2018, Russian and Chinese titanium sponge producers controlled 61% of the world’s titanium sponge production. By 2024, Russia and China’s control of global titanium sponge production had increased to approximately 75%. IperionX is

currently re-shoring an end-to-end titanium supply chain to the United States by vertically integrating the Technologies, and ultimately the Titan Project, to make sustainable, lower cost high-performance titanium. Directors’ Report 31

Directors’ Report continued Operating and Financial Review continued Our

Production Facilities Titanium Manufacturing Campus – Virginia IperionX’s Titanium Manufacturing Campus in Virginia comprises the Titanium Production Facility and the Advanced Manufacturing Center. Commissioning of the TPF is complete, which

is already producing high-quality and low-cost angular and spherical titanium powders. These titanium metal powders will be marketed to a wide range of customers for use in additive manufacturing and powder metallurgy. The high-quality

titanium powders are an important low-cost internal feedstock for the AMC, where they are utilized to manufacture a wide range of higher value titanium products such as semi-finished traditional mill products, near-net-shape forged titanium

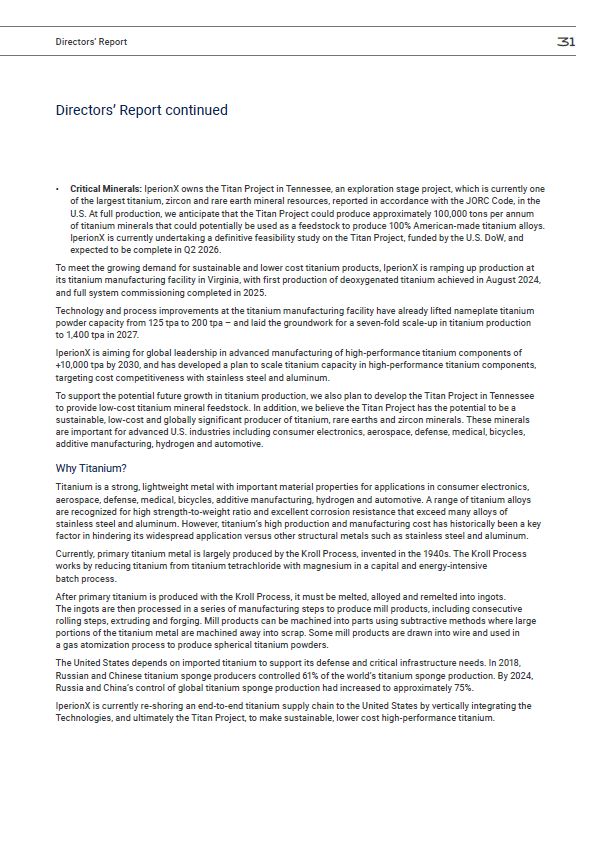

components and high-value titanium products using additive manufacturing. IperionX’s simple, low waste, vertically integrated solution: Current Industry Up to 10 forging / rolling steps Vacuum Arc

Remelting Chlorination Forging Rolling Products Machining Feedstock Reduction & Distillation Products Machining Feedstock IPX HAMR Process IPX HSPT Process Titanium Minerals Titanium Sponge (<95% yield)1 Titanium Ingot

(<85% yield)2 Titanium Mill Products (~50–75% yield)2,3,4,5 Titanium Products (~5–15% yield)2,3,4 Titanium Scrap and/or Mineral Titanium Powder Titanium Mill Products (~85–95% yield) or Near Net shapes (~85% yield) Titanium Products

(~50-80% yield) Refer to ASX release dated 15 August 2024 for further information. 32

Directors’ Report continued Titanium Production Facility – First Titanium

Deoxygenation Production Run Complete In August 2024, IperionX’s HAMR™ furnace successfully completed the first titanium deoxygenation production run at the TPF. The successful titanium deoxygenation production cycle was a significant

milestone in the development of HAMR™ technology that has the potential to revolutionize the titanium industry and demonstrates the commercial-scale capabilities of IperionX’s breakthrough titanium deoxygenation technologies. Produced entirely

from 100% scrap titanium (Ti-6Al-4V alloy, Grade 5 titanium), quality assessments confirmed a large reduction in oxygen levels from 3.42% to below 0.07%, far exceeding the ASTM standard requirement of 0.2% for Grade 5 titanium. In December

2024, IperionX completed the inaugural “end-to-end” commercial HAMR™ production cycle, efficiently deoxygenating high-oxygen titanium scrap and producing high-quality, low-oxygen titanium metal powder, and in September 2025, IperionX fully

commissioned all critical systems at its titanium production facility, demonstrating steady-state production of high-quality, low-cost titanium metal products directly from recycled titanium scrap, using IperionX’s proprietary HAMR™ and HSPT™

technologies. Technology and process improvements at the titanium manufacturing facility have already lifted nameplate titanium powder capacity from 125 tpa to 200 tpa – and laid the groundwork for a seven-fold scale-up in titanium production

to 1,400 tpa in 2027. IperionX is aiming for global leadership in advanced manufacturing of high-performance titanium components of +10,000 tpa by 2030, and has developed a plan to scale titanium capacity in high-performance titanium

components, targeting cost competitiveness with stainless steel and aluminum. Advanced Manufacturing Center – High-performance Titanium Product Manufacturing IperionX leverages its patented HAMR™ and HSPT™ technologies with powder metallurgy

to manufacture high-performance forged titanium products at its AMC, also located at the Titanium Manufacturing Campus in Virginia. The use of powder metallurgy has historically been limited in the titanium industry for two key

reasons: Titanium powder manufactured from high-cost titanium billets generates high yield losses for on-spec (low oxygen) titanium metal angular powders. This results in high-cost angular titanium powders, limiting their application for

traditional powder metallurgy production processes. Standard argon-vacuum sintering processes used to consolidate titanium powder can produce inferior microstructure, strength and fatigue properties compared to traditional forged titanium

products. IperionX’s patented HAMR™ titanium production technology can produce low-cost and high-quality titanium metal angular powders. Importantly, the proprietary HSPT™ ‘forging’ technology yields a wrought-like ultrafine grain

microstructure to produce titanium products with superior fatigue properties versus traditional titanium powder metallurgy methods. Capacity at the AMC will also be scaled in order to meet the scaled up titanium powder production of 1,400 tpa

in 2027. Directors’ Report 33

Directors’ Report continued Operating and Financial Review continued Our

Production Facilities continued Industrial Pilot Facility – Utah The IPF, located in Salt Lake City, Utah, has been producing titanium metal powder with the Technologies since 2019. IperionX has been producing angular and spherical titanium

metal powders in ~50-kilogram batches at the IPF for customers and advanced prototyping. Scrap titanium metal is the key titanium feedstock, with renewable power utilized to produce high-quality titanium powder. Production at the IPF has

demonstrated that the Technologies can reduce high oxygen content material to very low levels in titanium metal. With the commissioning of the large-scale manufacturing plant, this facility has been re-purposed as an R&D

facility. Re-shoring U.S. Critical Mineral Production with the Titan Critical Mineral Project IperionX plans to initially use 100% recycled titanium metal scrap as feedstock for the titanium powder and products produced at the Titanium

Manufacturing Campus. However, with high levels of forecast demand growth, IperionX intends to backwards integrate using upgraded titanium mineral feedstock from the Titan Project in Tennessee. The Titan Project has the potential to be a

long-term, low-cost and globally significant producer of titanium, rare earth and zircon critical minerals. These critical minerals are required for advanced U.S. industries, including consumer electronics, aerospace, defense, medical,

additive manufacturing, hydrogen and automotive. Future development of the Titan Project could provide a long-term source for low-cost upgraded titanium feedstocks that, combined with the Technologies, could help establish a fully integrated

U.S. titanium supply chain. Vertical integration of the Technologies along with a U.S. supply of critical minerals, including titanium, offers potential long-term competitive and strategic advantages. In February 2025, the DoW obligated US$5

million through the Industrial Base Analysis and Sustainment program to expedite the Titan Critical Minerals Project in Tennessee to ‘shovel-ready’ status through the completion of a Definitive Feasibility Study, due to be completed in Q2

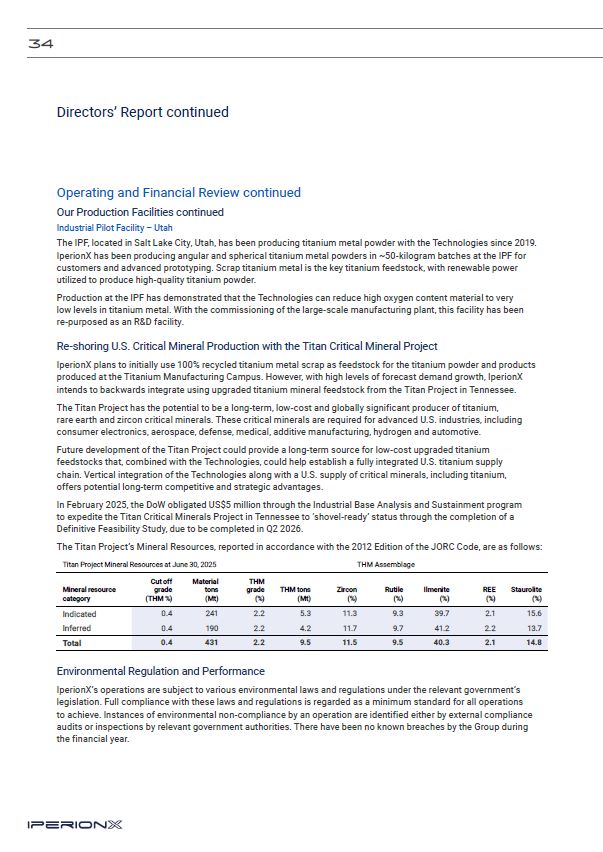

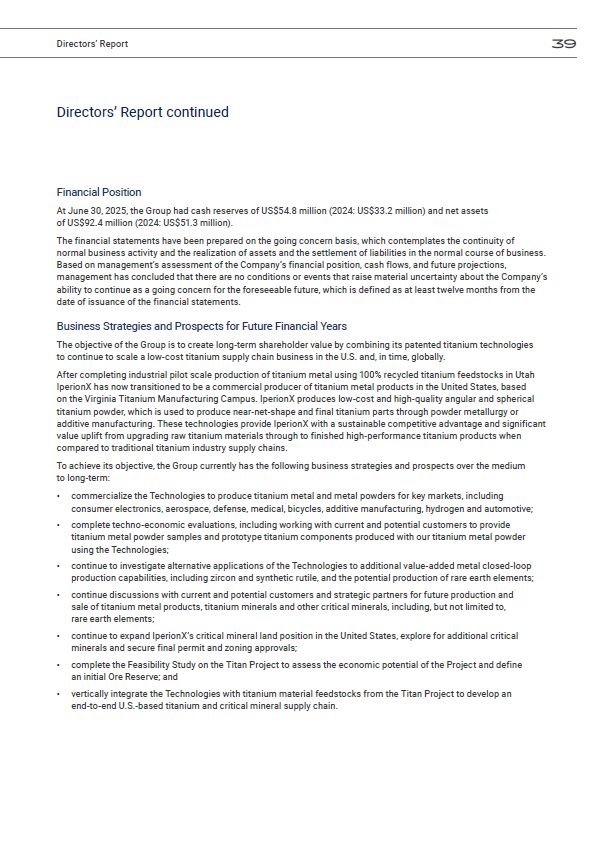

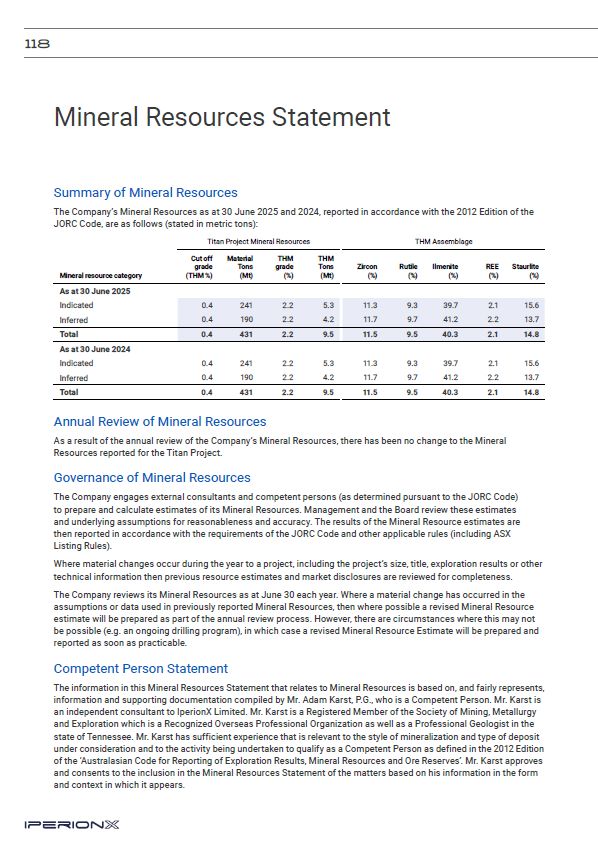

2026. The Titan Project’s Mineral Resources, reported in accordance with the 2012 Edition of the JORC Code, are as follows: Titan Project Mineral Resources at June 30, 2025 THM

Assemblage Indicated Inferred 0.4 0.4 241 190 2.2 2.2 5.3 4.2 11.3 11.7 9.3 9.7 39.7 41.2 2.1 2.2 15.6 13.7 Total 0.4 431 2.2 9.5 11.5 9.5 40.3 2.1 14.8 Mineral resource Cut off

grade Material tons THM grade THM tons Zircon Rutile Ilmenite REE Staurolite category (THM %) (Mt) (%) (Mt) (%) (%) (%) (%) (%) Environmental Regulation and Performance IperionX’s operations are subject to various

environmental laws and regulations under the relevant government’s legislation. Full compliance with these laws and regulations is regarded as a minimum standard for all operations to achieve. Instances of environmental non-compliance by an

operation are identified either by external compliance audits or inspections by relevant government authorities. There have been no known breaches by the Group during the financial year. 34

Directors’ Report continued Highlights Highlights during and subsequent to the

end of the financial year were as follows: U.S. Government funding to re-shore a domestic titanium supply chain IperionX awarded US$47.1 million by the U.S. DoW to secure U.S. titanium supply chains In February 2025, IperionX was awarded a

contract for up to US$47.1 million in funding by the U.S. DoW to strengthen the U.S. Defense Industrial Base by accelerating development of a resilient, low-cost, and fully-integrated U.S. mineral-to-metal titanium supply chain. As part of the

initial phase, the DoW obligated US$5 million through the Industrial Base Analysis and Sustainment program to expedite the Titan Critical Minerals Project in Tennessee to ‘shovel-ready’ status. In August 2025, the U.S. DoW obligated a further

US$12.5 million under the US$47.1 million award to be applied to purchase orders for long-lead, major capital equipment required for the next stage of capacity scale-up to over 1,400 metric tons per year at the Virginia Titanium Manufacturing

Campus. Major incremental capacity categories include titanium deoxygenation, sintering and powder metallurgy consolidation systems; near-net-shape component manufacturing and ancillary infrastructure upgrades. In September 2025, the Company

announced that the DoW obligated an additional US$25.0 million to the previously announced US$47.1 million award. This US$25.0 million obligation, along with the prior US$12.5 million and US$5.0 million, takes total obligations to US$42.5

million, with the remaining US$4.6 million expected to be obligated over the contract term. IperionX awarded U.S. DoW SBIR Phase III contract for up to US$99 million In June 2025, IperionX was awarded a SBIR Phase III contract by the U.S.

DoW. Structured as an Indefinite Delivery, Indefinite Quantity contract in support of achieving “Low-Cost Domestic Titanium for Defense Applications” in the U.S., the contract establishes a funding mechanism through which qualifying U.S.

Government agencies can place project-specific task orders – collectively capped at US$99 million – for the supply of IperionX titanium components and parts. Shortly after the SBIR Phase III contract award, IperionX received the first task

order, valued at US$1.3 million, from the U.S. Army under the SBIR for the production and delivery of titanium parts for U.S. Army ground vehicle programs. Customer Engagements Partnership with Aperam to advance a circular titanium supply

chain In July 2024, IperionX and Aperam signed an agreement to apply IperionX’s fully circular and sustainable titanium supply chain solution to the consumer electronics sector, with IperionX to use its patented titanium technologies to

upcycle up to 12 metric tons of titanium scrap from the consumer electronics sector to manufacture a range of high-performance titanium products. IperionX executes sourcing contract with global automaker In September 2024, IperionX executed

a sourcing contract for the supply of manufactured metal components for Ford Motor Company. The term of the Contract runs for 45 months commencing in 2025, with IperionX contracted to supply titanium metal powder and manufacture components.

Total revenues from the contract are expected to be ~US$11 million. Directors’ Report 35

Directors’ Report continued Operating and Financial Review continued Highlights

continued Customer Engagements continued IperionX secures first U.S. army task order under US$99 million SBIR Phase III contract In June 2025, IperionX received the first task order, valued at US$1.3 million, from the U.S. Army under a SBIR

Phase III Indefinite Delivery Indefinite Quantity contract with the U.S. DoW. The task order facilitates the production and delivery of titanium parts for U.S. Army ground vehicle programs. The project was the first of further task orders

expected under the US$99 million SBIR Phase III contract, which enables any DoW and U.S. Government agency to support production capabilities to procure titanium parts and materials directly from IperionX. Other ongoing customer engagements

and developments Product development and qualification continues to build momentum across key customer sectors – defense, automotive and consumer electronics. There has been very strong customer engagement for high-performance titanium

components that suffer from historically low material yields (high scrap rates) – such as titanium fasteners, housings, and precision components. Titanium Manufacturing Campus Development Commissioning of the Titanium Manufacturing Campus in

Virginia In August 2024, IperionX commissioned the HAMR™ furnace and completed the first titanium deoxygenation production run at the Titanium Production Facility. The successful first titanium deoxygenation production cycle is a significant

milestone in the development of HAMR™ technology that has the potential to revolutionize the titanium industry and demonstrates the commercial-scale capabilities of IperionX’s breakthrough titanium deoxygenation technologies. In December 2024,

IperionX completed the inaugural “end-to-end” commercial HAMR™ production cycle, efficiently deoxygenating high-oxygen titanium scrap and producing high-quality, low-oxygen titanium metal powder. In September 2025, IperionX fully commissioned

all critical systems at its titanium production facility, demonstrating steady-state production of high-quality, low-cost titanium metal products directly from recycled titanium scrap, using IperionX’s proprietary HAMR™ and HSPT™ technologies.

Further, process improvements and optimization lifted nameplate titanium powder production capacity by 60% – from 125 tpa to 200 tpa – without additional capital spend. Higher throughput, lower reagent intensity and reduced production cycle

times are expected to cut operating costs down to ~US$55/kg. U.S. DoW backed expansion by mid-2027 has commenced, to become the largest and lowest cost U.S. producer In September 2025, IperionX announced that it was scaling titanium

production capacity to 1,400 tons per annum, with commissioning targeted for mid-2027 positioning IperionX to be the largest and lowest-cost North American titanium powder producer. The total expansion capital is ~US$75 million, including

~US$14 million in contingency, and is majority funded through the U.S. DoW IBAS award of US$42.1 million, along with IperionX’s balance sheet cash. Additional contract awards under the US$99 million SBIR Phase III program and access to Private

Activity Bonds enhance financial flexibility. The titanium production expansion to 1,400 tpa will support a more resilient, sustainable U.S. titanium supply chain, reducing reliance on foreign imports and enhancing national security for

advanced industries such as aerospace, defense, and electric vehicles. 36

Directors’ Report continued 2030 roadmap targets global leadership in

high-performance titanium components IperionX is aiming for global leadership in advanced manufacturing of high-performance titanium components of +10,000 tpa by 2030, and has developed a plan to scale titanium capacity in high-performance

titanium components, targeting cost competitiveness with stainless steel and aluminum. Titan Project Development Definitive Feasibility Study for Titan Project In April 2025, IperionX announced the commencement of a Definitive Feasibility

Study for its Titan Critical Minerals Project in Tennessee – the largest mineral resource (reported in accordance with the JORC Code) of titanium, rare earth, and zircon mineral sands in the United States. The DFS, expected to be completed in

Q2 2026, will define engineering, flowsheets, and infrastructure for long-term supply of titanium feedstock and heavy rare earths, including dysprosium and terbium – key elements for high-performance magnets and defense systems. This final

phase of feasibility is partly funded by an allocation from IperionX’s recent U.S. Government award of US$47.1 million, underscoring the strategic significance of the Titan Project in securing a fully integrated, U.S.-based ‘mineral-to-metal’

titanium supply chain. U.S. Government funding awarded to IperionX since January 2023 now totals over US$60 million. Strategic offtake partners – multiple partners, advanced due diligence Throughout the period, IperionX continued to receive

significant interest in the Titan Project’s valuable titanium, rare earth and zircon critical minerals. A major Japanese conglomerate completed bulk sample test work at the Titan Project to advance potential sales offtake and development

financing, with subsequent metallurgical test work taking place at an independent laboratory in Australia. A number of other Japanese parties have expressed interest in sales, marketing, and investment proposals focused on the offtake of

titanium and rare earth minerals from the Titan Project. Corporate In October 2024, IperionX completed a placement of 31.3 million new fully paid ordinary shares at an issue price of A$3.20 per share to raise A$100 million (approximately

US$67 million). Proceeds from the placement are being or were applied to Virginia Titanium Manufacturing Campus expansions (including studies, equipment and working capital), ongoing Virginia development and operations, acquisition of

intellectual property, and for general working capital and corporate purposes. Executive Chairman Mr. Todd Hannigan subscribed for 593,750 shares to raise A$1.9 million (approximately US$1.3 million). In November 2024, IperionX successfully

completed the acquisition of the intellectual property portfolio to secure the exclusive commercial rights to the breakthrough titanium technologies. The acquisition secured IperionX’s exclusive commercial rights to the patents and proprietary

technologies, including Green Rutile™, Alkaline Roasting Hydrolysis, Hydrogen Assisted Metallothermic Reduction and Hydrogen Sintering and Phase Transformation. In July 2025, IperionX completed a placement of 14 million new fully paid ordinary

shares at an issue price of A$5.00 per share to raise A$70 million (approximately US$46 million). The placement allows IperionX to order long-lead capital items and shorten the construction schedule for planned scale-up in titanium production.

Subject to shareholder approval, IperionX non-executive directors and executive directors subscribed for 433,230 shares under the placement to raise approximately A$2.2 million (approximately US$1.4 million). Directors’ Report 37

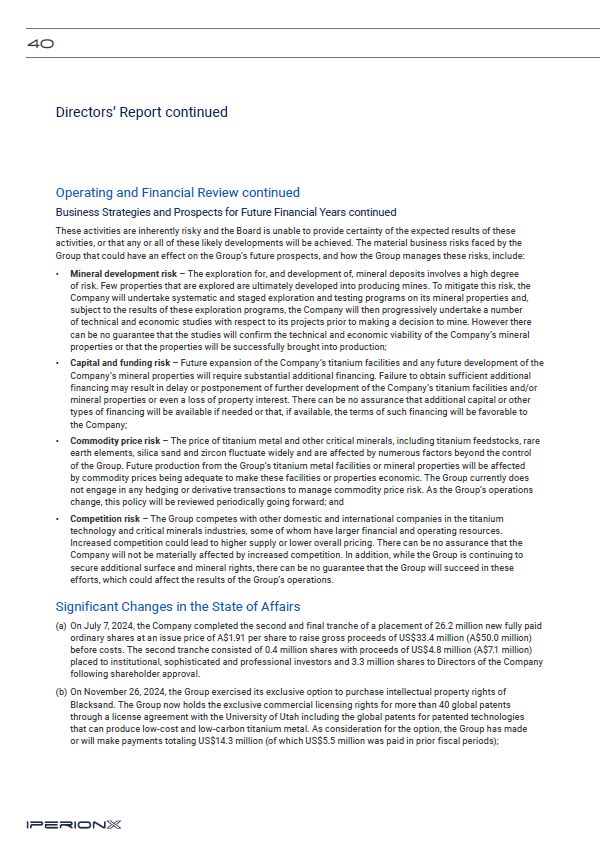

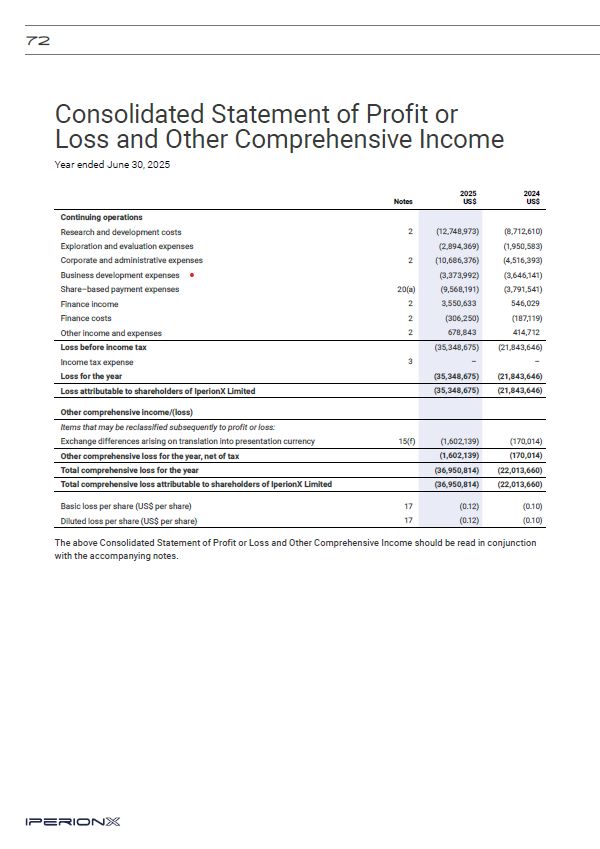

Directors’ Report continued Operating and Financial Review continued Results of

Operations The Group’s net loss after tax for the financial year ended June 30, 2025 was US$35.3 million (2024: US$21.8 million). This loss is largely attributable to: Research and development costs of US$12.7 million (2024: US$8.7 million)

which is attributable to the Group’s accounting policy of expensing R&D expenses incurred by the Group in connection with the R&D of the Group’s titanium processing technologies, including salaries and related personnel expenses,

subcontractor expenses, patent registration expenses, materials, and other related R&D expenses associated with processing operations at our IPF in Utah and Titanium Manufacturing Campus in Virginia; Exploration and evaluation expense of

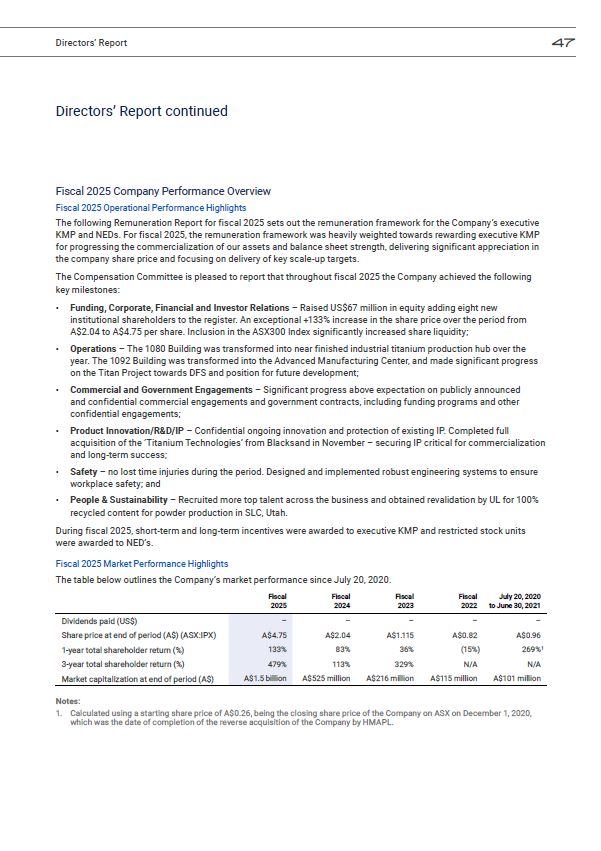

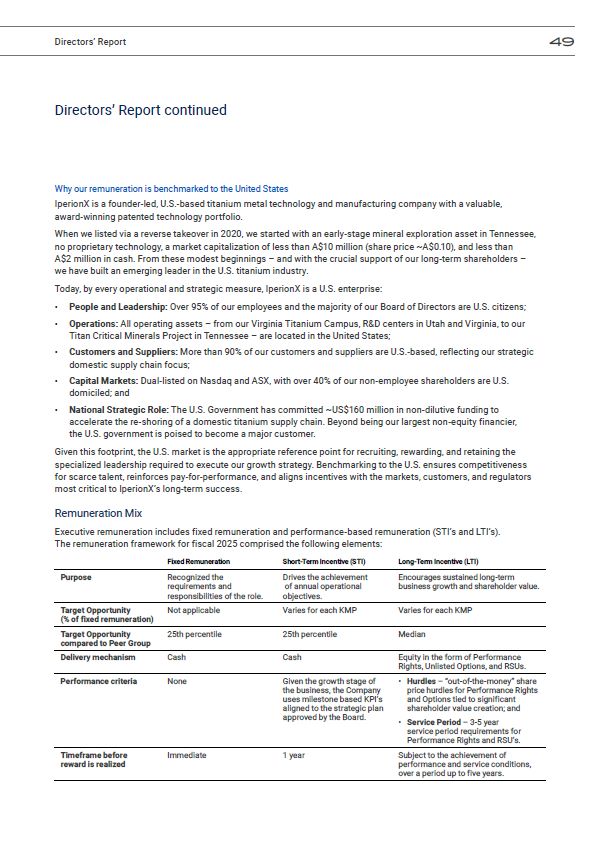

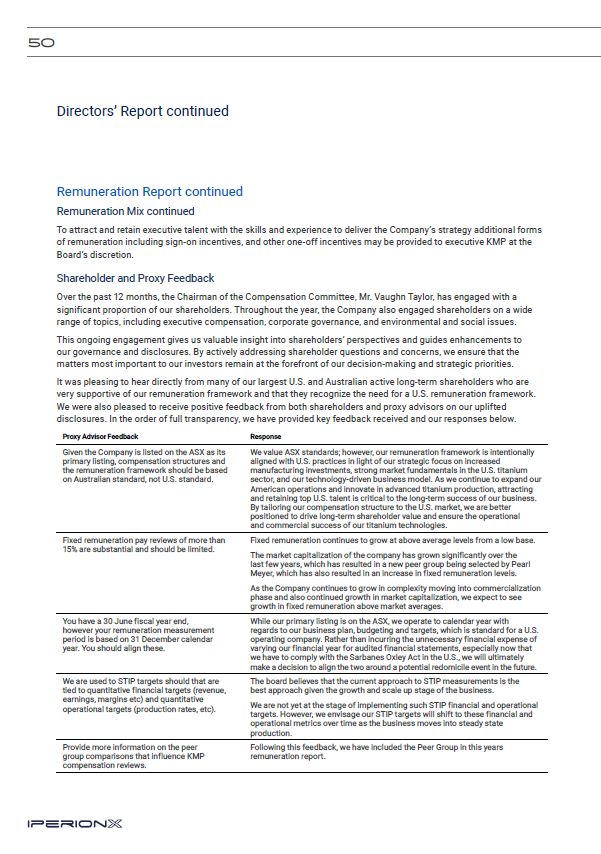

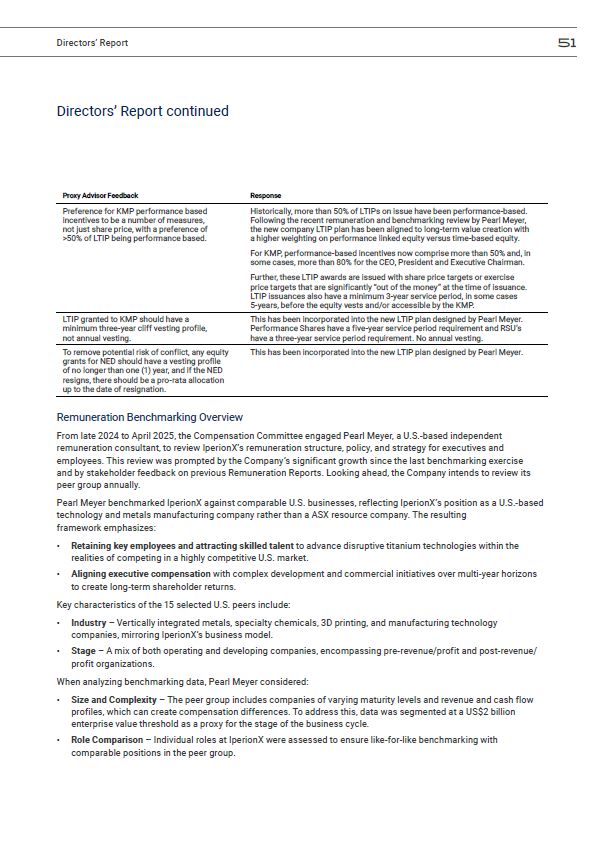

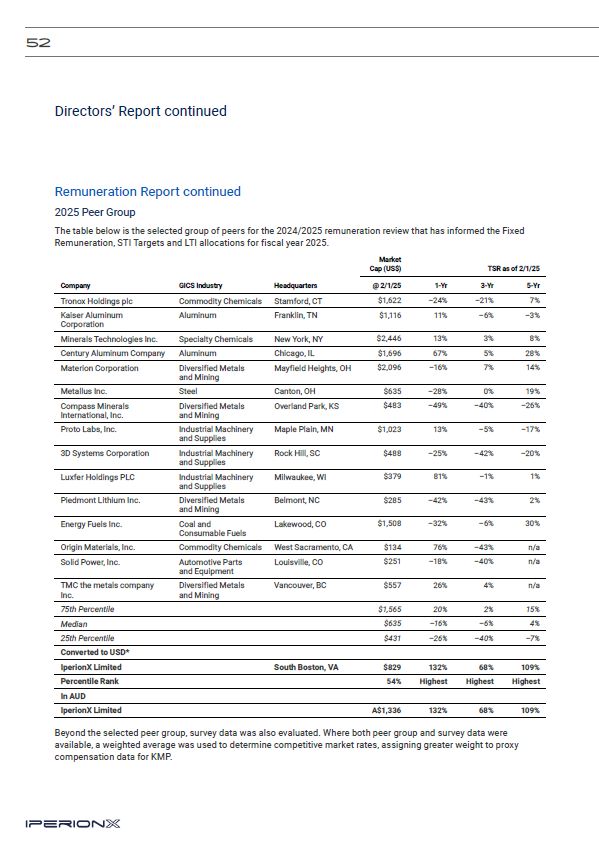

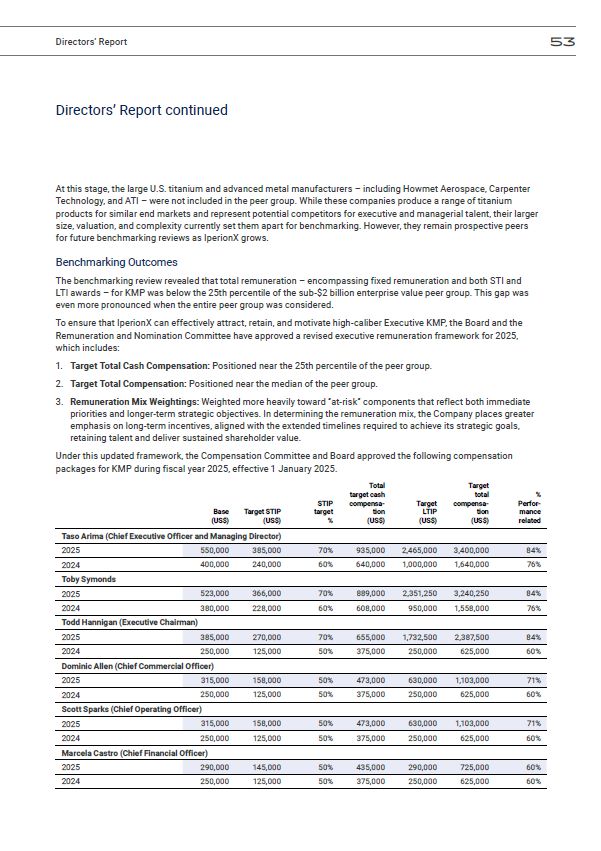

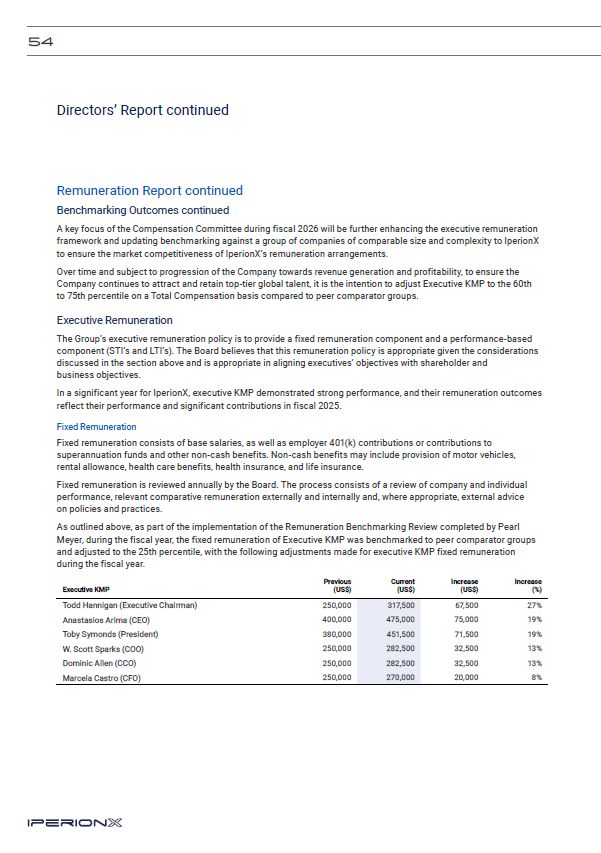

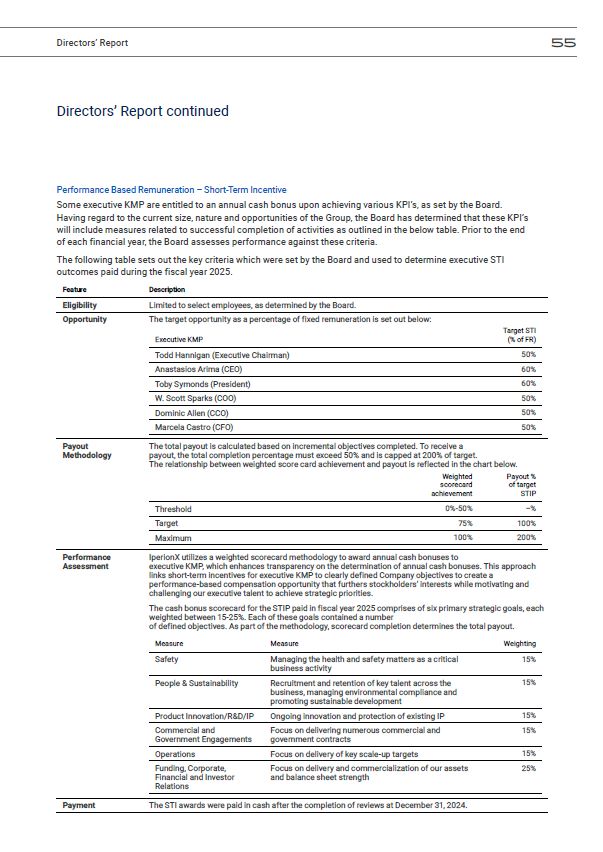

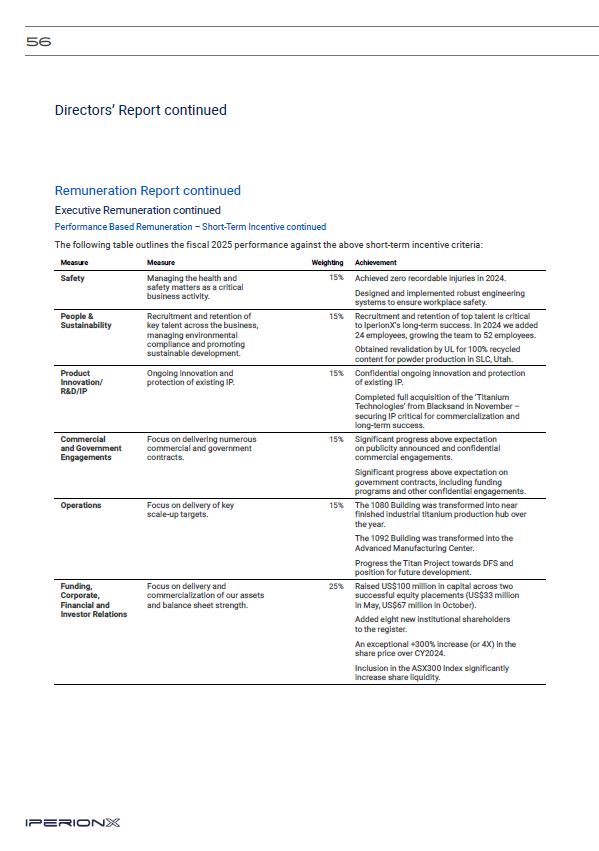

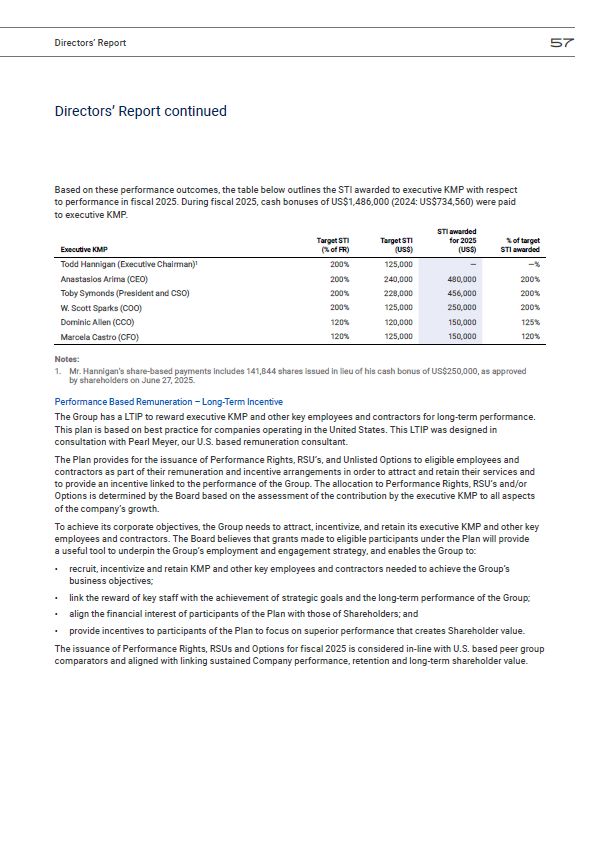

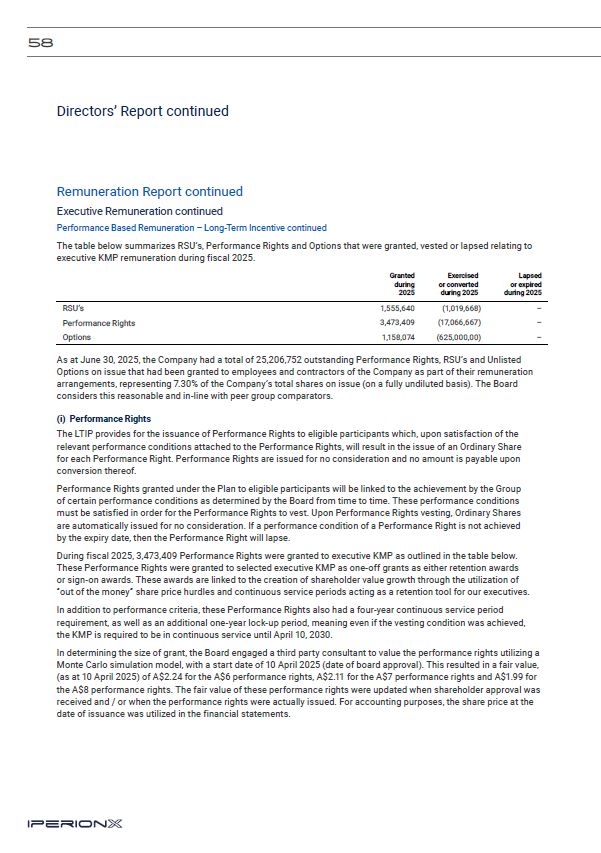

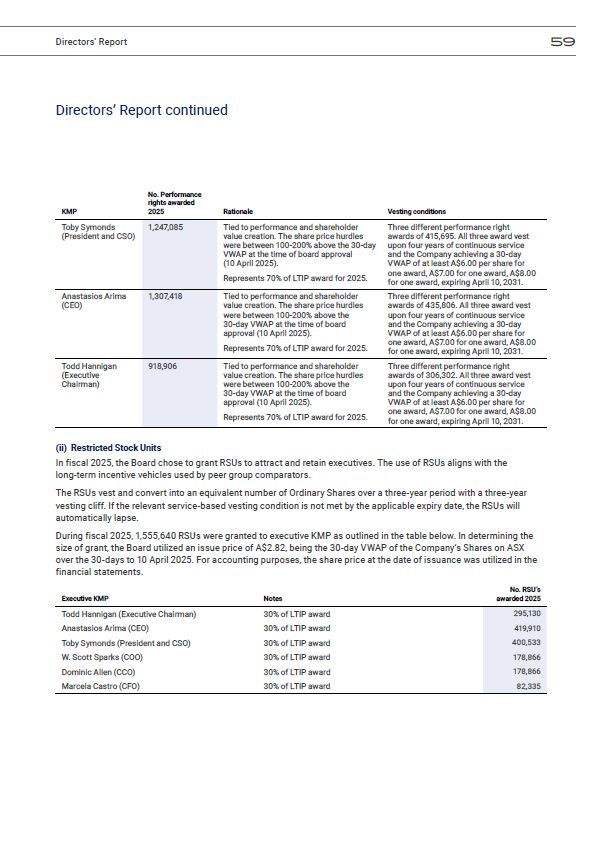

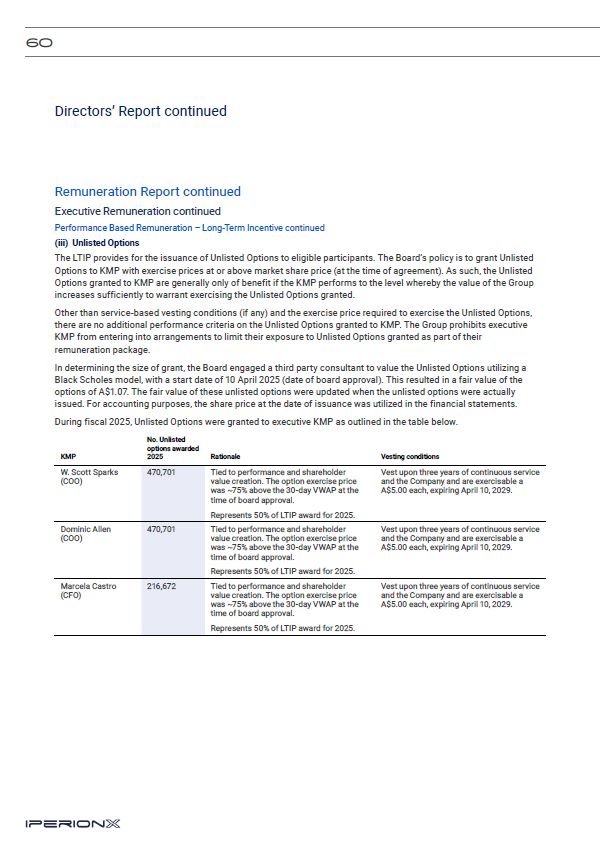

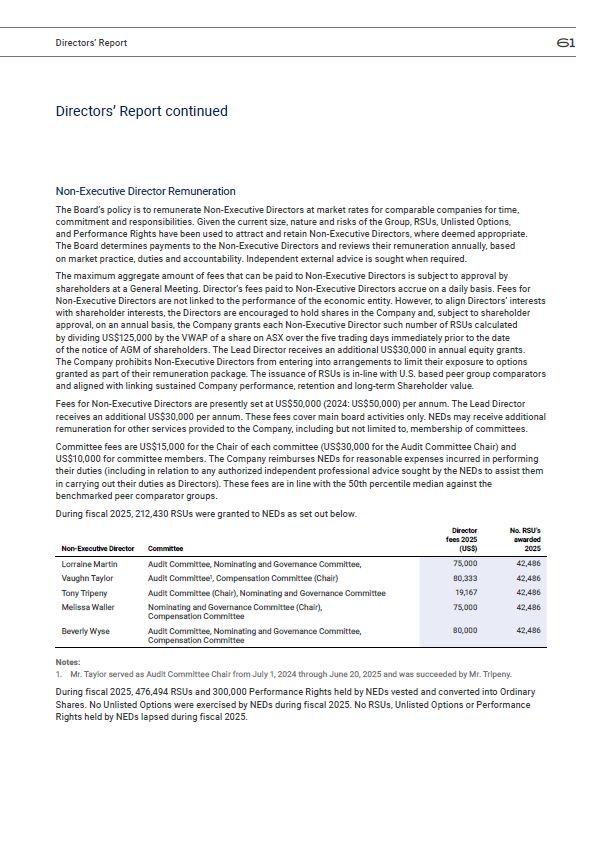

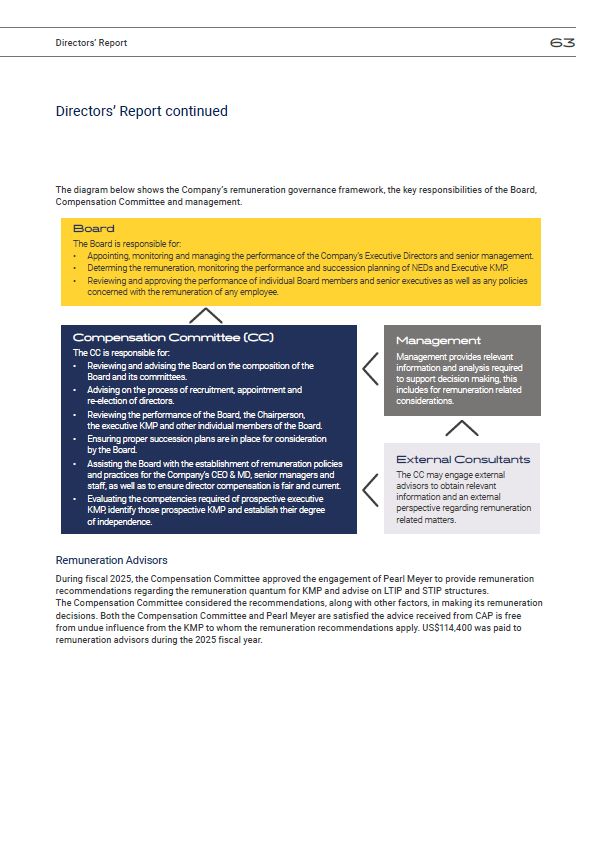

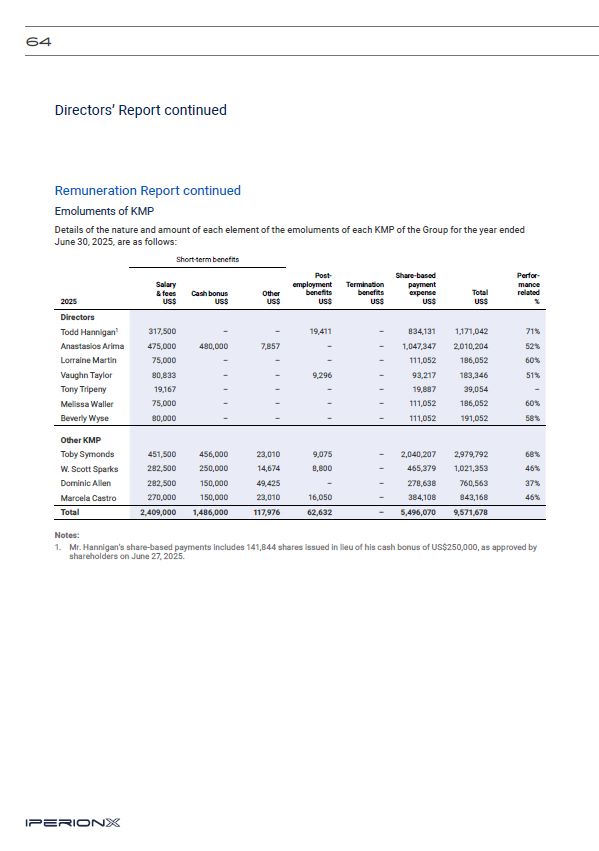

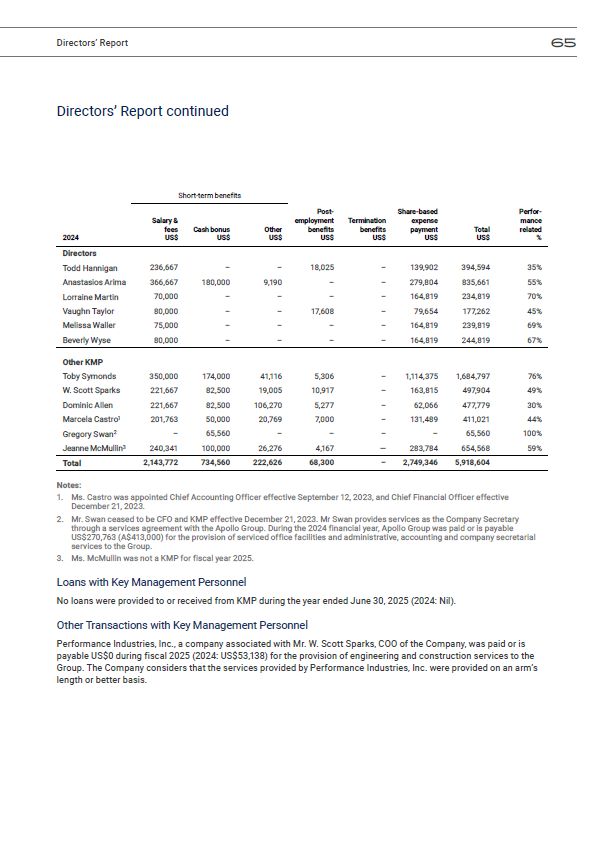

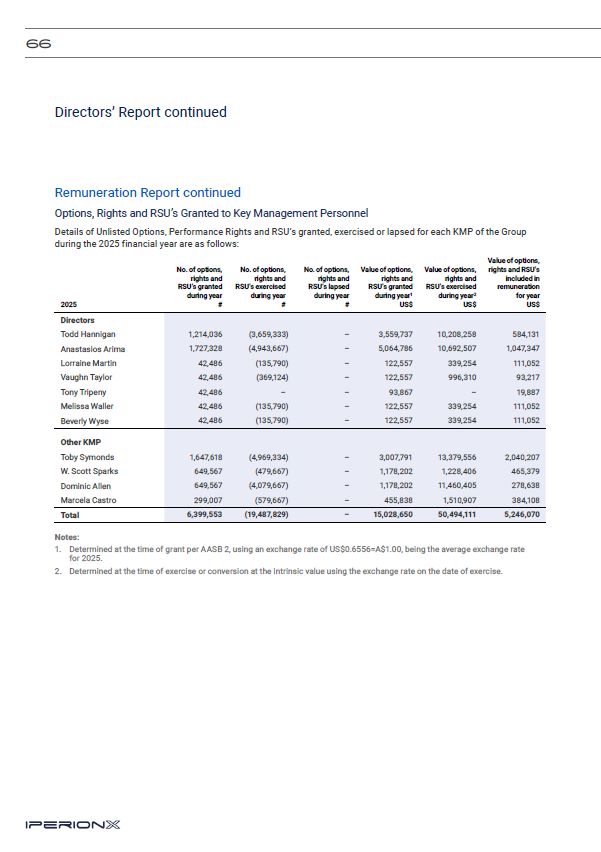

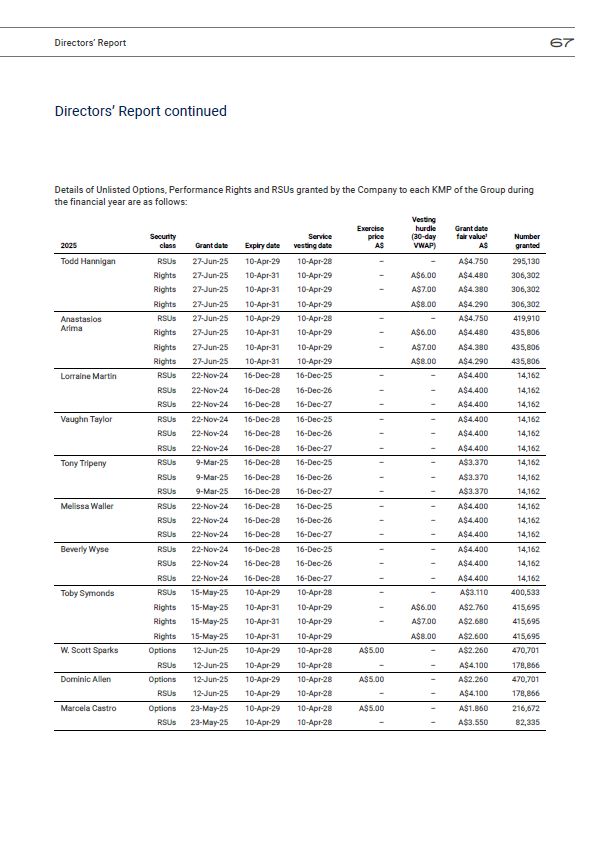

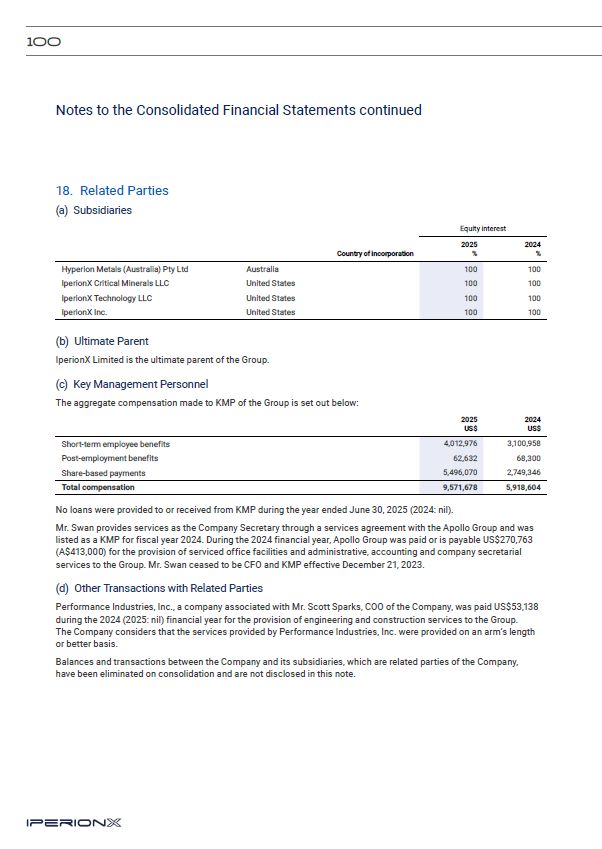

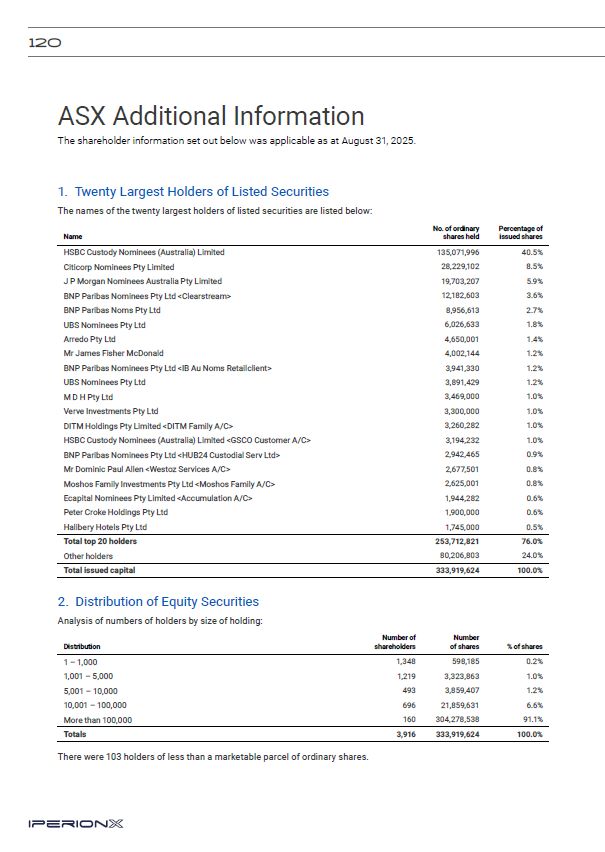

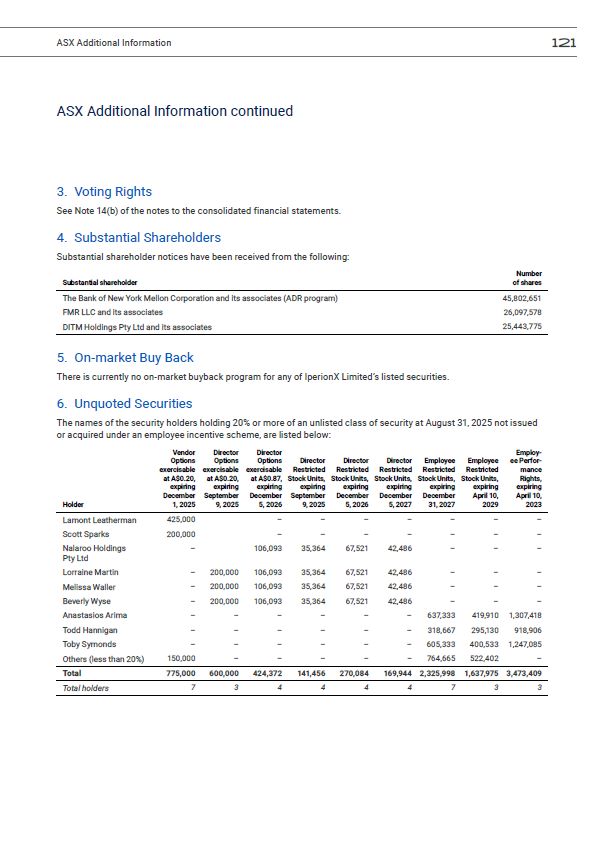

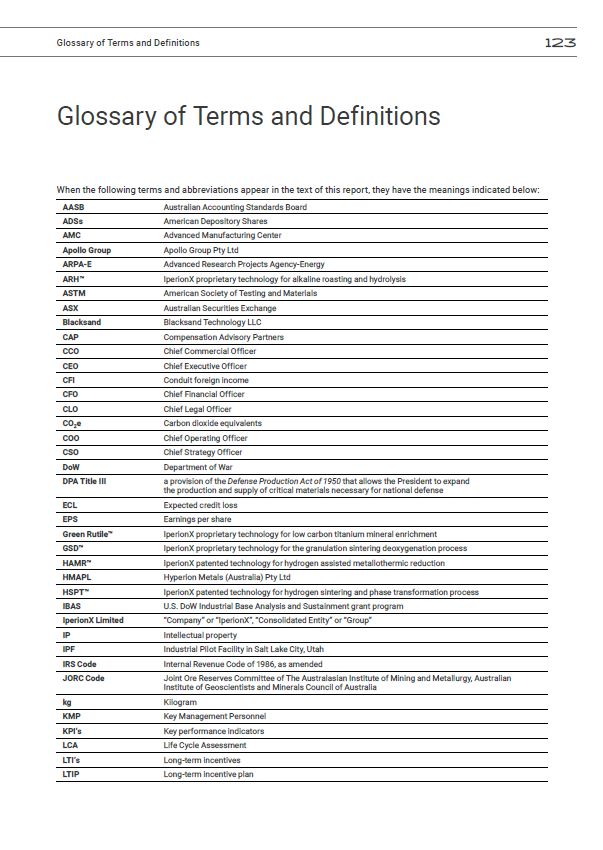

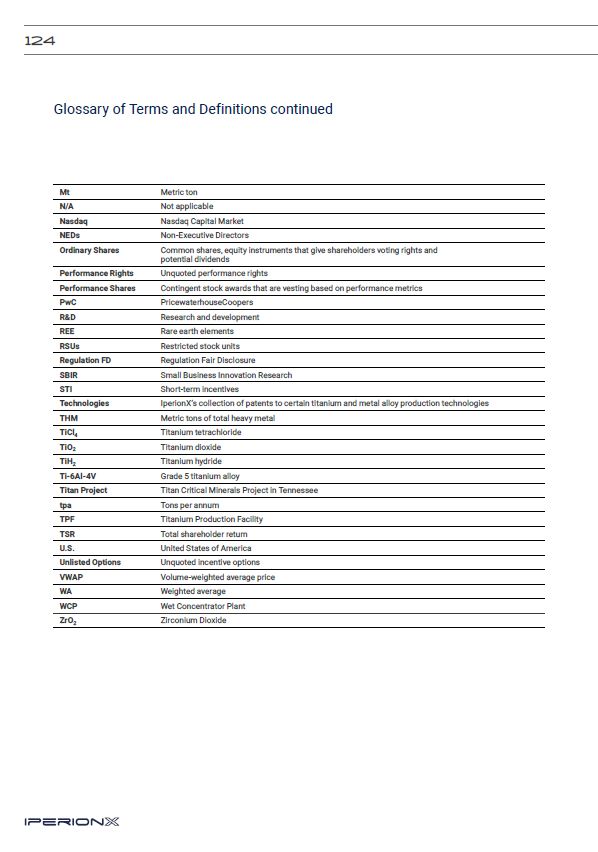

US$2.9 million (2024: US$2.0 million) which is attributable to the Group’s accounting policy of expensing exploration and evaluation expenditure (other than expenditures incurred in the acquisition of the rights to explore, including option