Shareholder Report

|

12 Months Ended |

|

Jul. 31, 2025

USD ($)

Holding

|

|---|

| Shareholder Report [Line Items] |

|

| Document Type |

N-CSR

|

| Amendment Flag |

false

|

| Registrant Name |

The Tax-Exempt Bond Fund of America

|

| Entity Central Index Key |

0000050142

|

| Entity Investment Company Type |

N-1A

|

| Document Period End Date |

Jul. 31, 2025

|

| The Tax-Exempt Bond Fund of America® - Class A |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

The Tax-Exempt Bond Fund of America®

|

| Class Name |

Class A

|

| Trading Symbol |

AFTEX

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about The Tax-Exempt Bond Fund of America (the "fund") for the period from August 1, 2024 to July 31, 2025.

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the fund at capitalgroup.com/mutual-fund-literature-A (800) 421-4225 .

|

| Additional Information Phone Number |

(800) 421-4225

|

| Additional Information Website |

capitalgroup.com/mutual-fund-literature-A

|

| Expenses [Text Block] |

What were the fund costs for the last year? (based on a hypothetical $10,000 investment) Share class | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | | Class A | $ 53 | 0.53 % |

|

| Expenses Paid, Amount |

$ 53

|

| Expense Ratio, Percent |

0.53%

|

| Factors Affecting Performance [Text Block] |

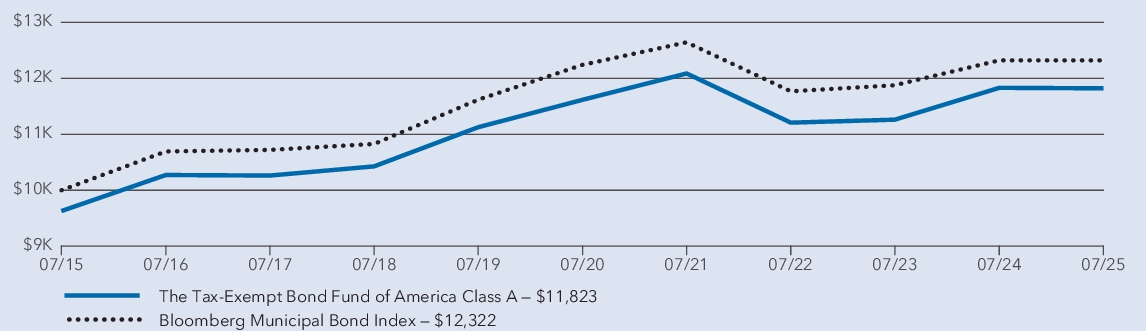

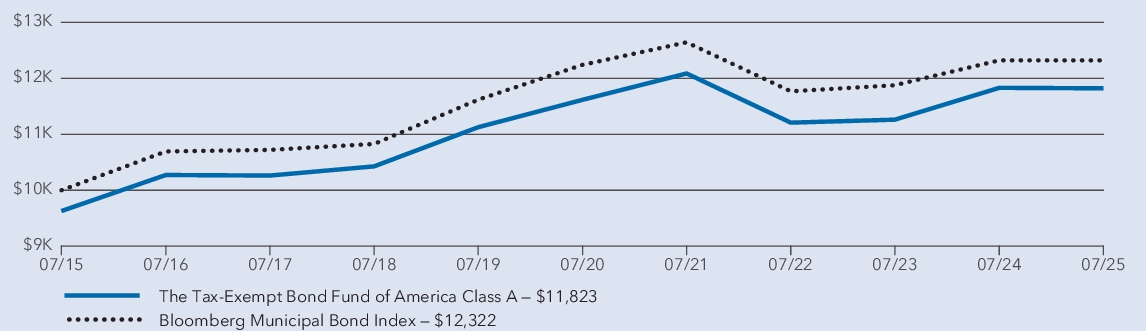

Management's discussion of fund performance The fund’s Class A shares lost 0.07% for the year ended July 31, 2025. That result compares with a 0.00% return for the Bloomberg Municipal Bond Index. For information on returns for additional periods, including the fund lifetime, please refer to capitalgroup.com/mutual-fund-returns-A . What factors influenced results During the fund’s fiscal year, municipal bond returns were essentially flat. Yields rose, ending the period near 15-year highs, which was in part driven by shifts in fiscal policy. The U.S. Federal Reserve reduced interest rates three times in 2024, prompting a decline in short-term yields as investors gravitated toward safer assets. Meanwhile, long-term yields moved higher, influenced by heightened market volatility and a strong wave of new municipal bond issuance. This dynamic led to a steepening of the municipal yield curve, with 10-year AAA yields outpacing two-year yields and enhancing the appeal of longer term maturities. Within the fund, a larger portion of investments than the index in housing and corporate bonds were particularly additive to results relative to the benchmark. Likewise, holdings in health care and cash and money market aided returns. Also, duration positioning and the fund’s exposure to derivatives further helped relative results. Holdings in general obligation, special tax and transportation sectors had a relative negative impact on returns. Likewise, curve positioning weighed on results.

|

| Performance Past Does Not Indicate Future [Text] |

The fund’s past performance is not a predictor of its future performance.

|

| Line Graph [Table Text Block] |

|

| Average Annual Return [Table Text Block] |

Average annual total returns | 1 year | 5 years | 10 years | | The Tax-Exempt Bond Fund of America — Class A (with sales charge) | (3.85 ) % | (0.42 ) % | 1.69 % | | The Tax-Exempt Bond Fund of America — Class A (without sales charge) | (0.07 ) % | 0.35 % | 2.07 % | | Bloomberg Municipal Bond Index | 0.00 % | 0.13 % | 2.11 % |

* Investment results assume all distributions are reinvested and reflect applicable fees and expenses. When applicable, results reflect fee waivers and/or expense reimbursements, without which they would have been lower. † Results assume all distributions are reinvested. Any market index shown is unmanaged, and therefore, has no expenses. Investors cannot invest directly in an index. Source(s): Bloomberg Index Services Ltd. |

| No Deduction of Taxes [Text Block] |

The line chart and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

|

| Net Assets |

$ 22,866,000,000

|

| Holdings Count | Holding |

5,336

|

| Advisory Fees Paid, Amount |

$ 50,000,000

|

| Investment Company, Portfolio Turnover |

24.00%

|

| Additional Fund Statistics [Text Block] |

Key fund statistics | Fund net assets (in millions) | $ 22,866 | | Total number of portfolio holdings | 5,336 | | Total advisory fees paid (in millions) | $ 50 | | Portfolio turnover rate | 24 % |

|

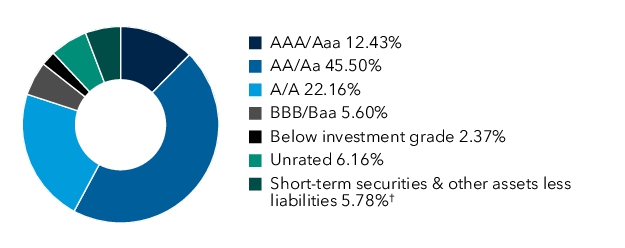

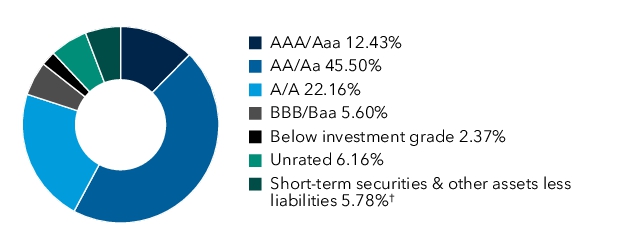

| Holdings [Text Block] |

Portfolio quality summary (percent of net assets) * Bond ratings, which typically range from AAA/Aaa (highest) to D (lowest), are assigned by credit rating agencies such as Standard & Poor’s, Moody’s and/or Fitch as an indication of an issuer’s creditworthiness. In assigning a credit rating to a security, the fund looks specifically to the ratings assigned to the issuer of the security by Standard & Poor’s, Moody’s and/or Fitch. If agency ratings differ, the security will be considered to have received the highest of those ratings, consistent with the fund’s investment policies. Securities in the “unrated“ category (above) have not been rated by a rating agency; however, the investment adviser performs its own credit analysis and assigns comparable ratings that are used for compliance with the fund’s investment policies. |

| The Tax-Exempt Bond Fund of America® - Class C |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

The Tax-Exempt Bond Fund of America®

|

| Class Name |

Class C

|

| Trading Symbol |

TEBCX

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about The Tax-Exempt Bond Fund of America (the "fund") for the period from August 1, 2024 to July 31, 2025.

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the fund at capitalgroup.com/mutual-fund-literature-C (800) 421-4225 .

|

| Additional Information Phone Number |

(800) 421-4225

|

| Additional Information Website |

capitalgroup.com/mutual-fund-literature-C

|

| Expenses [Text Block] |

What were the fund costs for the last year? (based on a hypothetical $10,000 investment) Share class | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | | Class C | $ 127 | 1.28 % |

|

| Expenses Paid, Amount |

$ 127

|

| Expense Ratio, Percent |

1.28%

|

| Factors Affecting Performance [Text Block] |

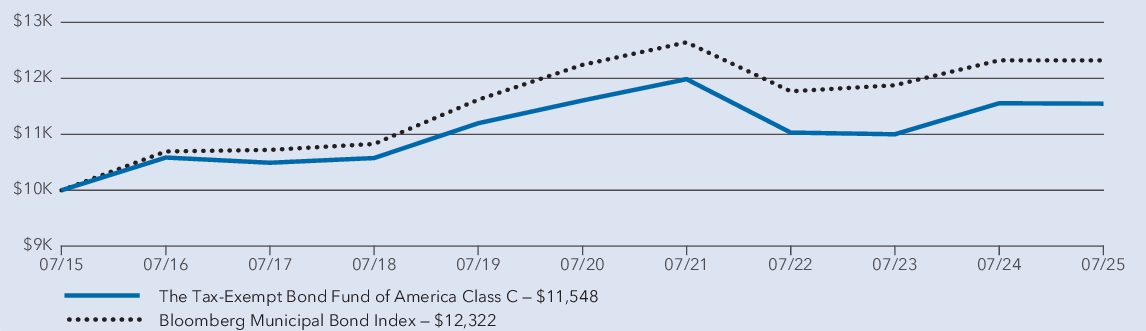

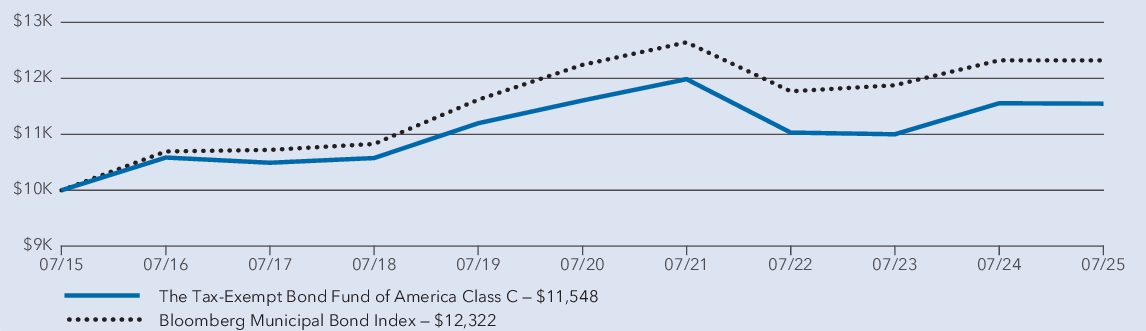

Management's discussion of fund performance The fund’s Class C shares lost 0.84% for the year ended July 31, 2025. That result compares with a 0.00% return for the Bloomberg Municipal Bond Index. For information on returns for additional periods, including the fund lifetime, please refer to capitalgroup.com/mutual-fund-returns-C . What factors influenced results During the fund’s fiscal year, municipal bond returns were essentially flat. Yields rose, ending the period near 15-year highs, which was in part driven by shifts in fiscal policy. The U.S. Federal Reserve reduced interest rates three times in 2024, prompting a decline in short-term yields as investors gravitated toward safer assets. Meanwhile, long-term yields moved higher, influenced by heightened market volatility and a strong wave of new municipal bond issuance. This dynamic led to a steepening of the municipal yield curve, with 10-year AAA yields outpacing two-year yields and enhancing the appeal of longer term maturities. Within the fund, a larger portion of investments than the index in housing and corporate bonds were particularly additive to results relative to the benchmark. Likewise, holdings in health care and cash and money market aided returns. Also, duration positioning and the fund’s exposure to derivatives further helped relative results. Holdings in general obligation, special tax and transportation sectors had a relative negative impact on returns. Likewise, curve positioning weighed on results.

|

| Performance Past Does Not Indicate Future [Text] |

The fund’s past performance is not a predictor of its future performance.

|

| Line Graph [Table Text Block] |

|

| Average Annual Return [Table Text Block] |

Average annual total returns | 1 year | 5 years | 10 years | | The Tax-Exempt Bond Fund of America — Class C (with sales charge) | (1.81 ) % | (0.41 ) % | 1.45 % | | The Tax-Exempt Bond Fund of America — Class C (without sales charge) | (0.84 ) % | (0.41 ) % | 1.45 % | | Bloomberg Municipal Bond Index | 0.00 % | 0.13 % | 2.11 % |

* Investment results assume all distributions are reinvested and reflect applicable fees and expenses. When applicable, results reflect fee waivers and/or expense reimbursements, without which they would have been lower. † Results assume all distributions are reinvested. Any market index shown is unmanaged, and therefore, has no expenses. Investors cannot invest directly in an index. Source(s): Bloomberg Index Services Ltd. |

| No Deduction of Taxes [Text Block] |

The line chart and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

|

| Net Assets |

$ 22,866,000,000

|

| Holdings Count | Holding |

5,336

|

| Advisory Fees Paid, Amount |

$ 50,000,000

|

| Investment Company, Portfolio Turnover |

24.00%

|

| Additional Fund Statistics [Text Block] |

Key fund statistics | Fund net assets (in millions) | $ 22,866 | | Total number of portfolio holdings | 5,336 | | Total advisory fees paid (in millions) | $ 50 | | Portfolio turnover rate | 24 % |

|

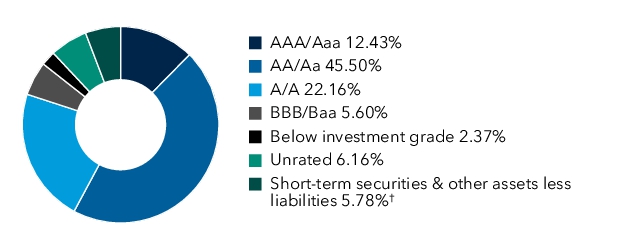

| Holdings [Text Block] |

Portfolio quality summary (percent of net assets) * Bond ratings, which typically range from AAA/Aaa (highest) to D (lowest), are assigned by credit rating agencies such as Standard & Poor’s, Moody’s and/or Fitch as an indication of an issuer’s creditworthiness. In assigning a credit rating to a security, the fund looks specifically to the ratings assigned to the issuer of the security by Standard & Poor’s, Moody’s and/or Fitch. If agency ratings differ, the security will be considered to have received the highest of those ratings, consistent with the fund’s investment policies. Securities in the “unrated“ category (above) have not been rated by a rating agency; however, the investment adviser performs its own credit analysis and assigns comparable ratings that are used for compliance with the fund’s investment policies. |

| The Tax-Exempt Bond Fund of America® - Class T |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

The Tax-Exempt Bond Fund of America®

|

| Class Name |

Class T

|

| Trading Symbol |

TLLLX

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about The Tax-Exempt Bond Fund of America (the "fund") for the period from August 1, 2024 to July 31, 2025.

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the fund at capitalgroup.com/mutual-fund-literature (800) 421-4225 .

|

| Additional Information Phone Number |

(800) 421-4225

|

| Additional Information Website |

capitalgroup.com/mutual-fund-literature

|

| Expenses [Text Block] |

What were the fund costs for the last year? (b as ed on a hypothetical $10,000 investment) Share class | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | | Class T | $ 27 | 0.27 % |

|

| Expenses Paid, Amount |

$ 27

|

| Expense Ratio, Percent |

0.27%

|

| Factors Affecting Performance [Text Block] |

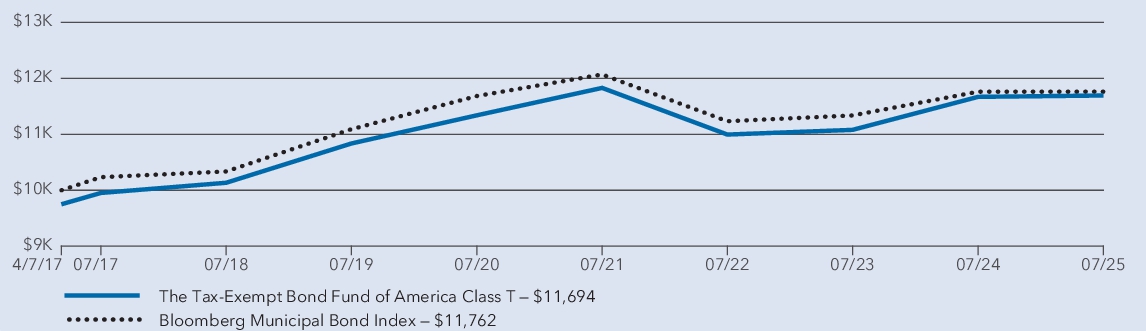

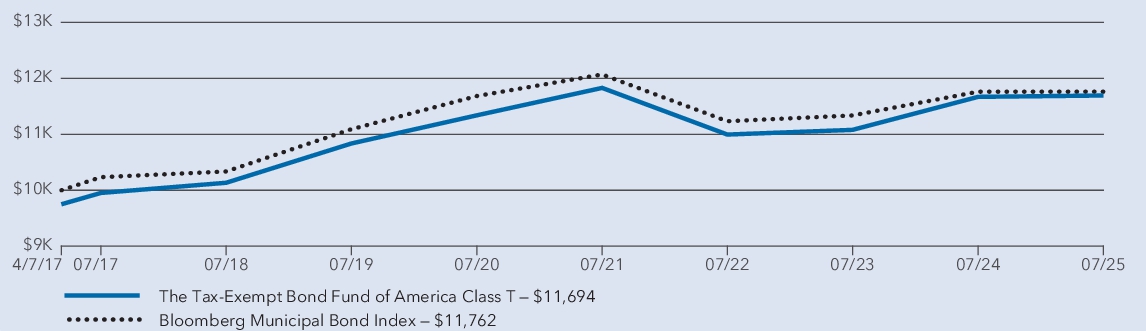

Management's discussion of fund performance The fund’s Class T shares gained 0.20% for the year ended July 31, 2025. That result compares with a 0.00% return for the Bloomberg Municipal Bond Index. What factors influenced results During the fund’s fiscal year, municipal bond returns were essentially flat. Yields rose, ending the period near 15-year highs, which was in part driven by shifts in fiscal policy. The U.S. Federal Reserve reduced interest rates three times in 2024, prompting a decline in short-term yields as investors gravitated toward safer assets. Meanwhile, long-term yields moved higher, influenced by heightened market volatility and a strong wave of new municipal bond issuance. This dynamic led to a steepening of the municipal yield curve, with 10-year AAA yields outpacing two-year yields and enhancing the appeal of longer term maturities. Within the fund, a larger portion of investments than the index in housing and corporate bonds were particularly additive to results relative to the benchmark. Likewise, holdings in health care and cash and money market aided returns. Also, duration positioning and the fund’s exposure to derivatives further helped relative results. Holdings in general obligation, special tax and transportation sectors had a relative negative impact on returns. Likewise, curve positioning weighed on results.

|

| Performance Past Does Not Indicate Future [Text] |

The fund’s past performance is not a predictor of its future performance.

|

| Line Graph [Table Text Block] |

|

| Average Annual Return [Table Text Block] |

Average annual total returns | 1 year | 5 years | | | The Tax-Exempt Bond Fund of America — Class T (with sales charge) | (2.31 ) % | 0.10 % | 1.90 % | | The Tax-Exempt Bond Fund of America — Class T (without sales charge) | 0.20 % | 0.62 % | 2.21 % | | Bloomberg Municipal Bond Index | 0.00 % | 0.13 % | 1.97 % |

1 Class T shares were first offered on April 7, 2017. 2 Investment results assume all distributions are reinvested and reflect applicable fees and expenses. When applicable, results reflect fee waivers and/or expense reimbursements, without which they would have been lower. 3 Results assume all distributions are reinvested. Any market index shown is unmanaged, and therefore, has no expenses. Investors cannot invest directly in an index. Source(s): Bloomberg Index Services Ltd. |

| Performance Inception Date |

Apr. 07, 2017

|

| No Deduction of Taxes [Text Block] |

The line chart and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

|

| Net Assets |

$ 22,866,000,000

|

| Holdings Count | Holding |

5,336

|

| Advisory Fees Paid, Amount |

$ 50,000,000

|

| Investment Company, Portfolio Turnover |

24.00%

|

| Additional Fund Statistics [Text Block] |

Key fund statistics | Fund net assets (in millions) | $ 22,866 | | Total number of portfolio holdings | 5,336 | | Total advisory fees paid (in millions) | $ 50 | | Portfolio turnover rate | 24 % |

|

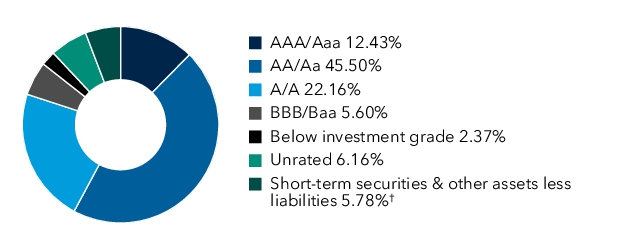

| Holdings [Text Block] |

Portfolio quality s um mary (percent of net assets) * Bond ratings, which typically range from AAA/Aaa (highest) to D (lowest), are assigned by credit rating agencies such as Standard & Poor’s, Moody’s and/or Fitch as an indication of an issuer’s creditworthiness. In assigning a credit rating to a security, the fund looks specifically to the ratings assigned to the issuer of the security by Standard & Poor’s, Moody’s and/or Fitch. If agency ratings differ, the security will be considered to have received the highest of those ratings, consistent with the fund’s investment policies. Securities in the “unrated“ category (above) have not been rated by a rating agency; however, the investment adviser performs its own credit analysis and assigns comparable ratings that are used for compliance with the fund’s investment policies. |

| The Tax-Exempt Bond Fund of America® - Class F-1 |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

The Tax-Exempt Bond Fund of America®

|

| Class Name |

Class F-1

|

| Trading Symbol |

AFTFX

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about The Tax-Exempt Bond Fund of America (the "fund") for the period from August 1, 2024 to July 31, 2025.

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the fund at capitalgroup.com/mutual-fund-literature-F1 (800) 421-4225 .

|

| Additional Information Phone Number |

(800) 421-4225

|

| Additional Information Website |

capitalgroup.com/mutual-fund-literature-F1

|

| Expenses [Text Block] |

What were the fund costs for the last year? (based on a hypothetical $10,000 investment) Share class | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | | Class F-1 | $ 61 | 0.61 % |

|

| Expenses Paid, Amount |

$ 61

|

| Expense Ratio, Percent |

0.61%

|

| Factors Affecting Performance [Text Block] |

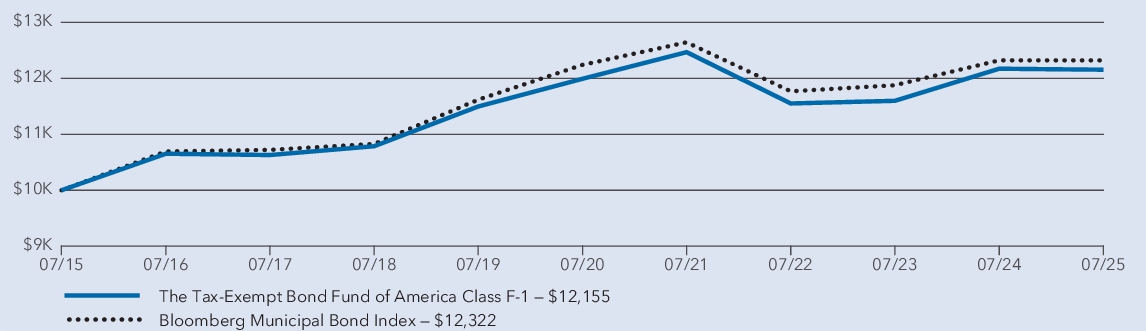

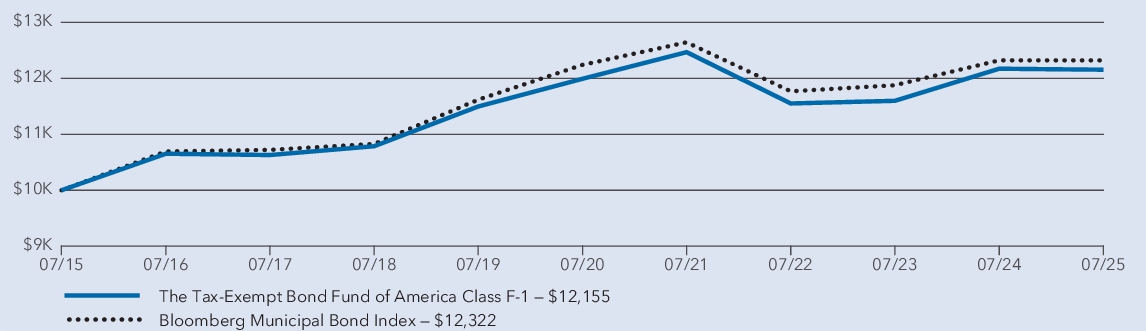

Management's discussion of fund performance The fund’s Class F-1 shares lost 0.15% for the year ended July 31, 2025. That result compares with a 0.00% return for the Bloomberg Municipal Bond Index. For information on returns for additional periods, including the fund lifetime, please refer to capitalgroup.com/mutual-fund-returns-F1 . What factors influenced results During the fund’s fiscal year, municipal bond returns were essentially flat. Yields rose, ending the period near 15-year highs, which was in part driven by shifts in fiscal policy. The U.S. Federal Reserve reduced interest rates three times in 2024, prompting a decline in short-term yields as investors gravitated toward safer assets. Meanwhile, long-term yields moved higher, influenced by heightened market volatility and a strong wave of new municipal bond issuance. This dynamic led to a steepening of the municipal yield curve, with 10-year AAA yields outpacing two-year yields and enhancing the appeal of longer term maturities. Within the fund, a larger portion of investments than the index in housing and corporate bonds were particularly additive to results relative to the benchmark. Likewise, holdings in health care and cash and money market aided returns. Also, duration positioning and the fund’s exposure to derivatives further helped relative results. Holdings in general obligation, special tax and transportation sectors had a relative negative impact on returns. Likewise, curve positioning weighed on results.

|

| Performance Past Does Not Indicate Future [Text] |

The fund’s past performance is not a predictor of its future performance.

|

| Line Graph [Table Text Block] |

|

| Average Annual Return [Table Text Block] |

Average annual total returns | 1 year | 5 years | 10 years | | The Tax-Exempt Bond Fund of America — Class F-1 | (0.15 ) % | 0.27 % | 1.97 % | | Bloomberg Municipal Bond Index | 0.00 % | 0.13 % | 2.11 % |

* Investment results assume all distributions are reinvested and reflect applicable fees and expenses. When applicable, results reflect fee waivers and/or expense reimbursements, without which they would have been lower. † Results assume all distributions are reinvested. Any market index shown is unmanaged, and therefore, has no expenses. Investors cannot invest directly in an index. Source(s): Bloomberg Index Services Ltd. |

| No Deduction of Taxes [Text Block] |

The line chart and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

|

| Net Assets |

$ 22,866,000,000

|

| Holdings Count | Holding |

5,336

|

| Advisory Fees Paid, Amount |

$ 50,000,000

|

| Investment Company, Portfolio Turnover |

24.00%

|

| Additional Fund Statistics [Text Block] |

| Fund net assets (in millions) | $ 22,866 | | Total number of portfolio holdings | 5,336 | | Total advisory fees paid (in millions) | $ 50 | | Portfolio turnover rate | 24 % |

|

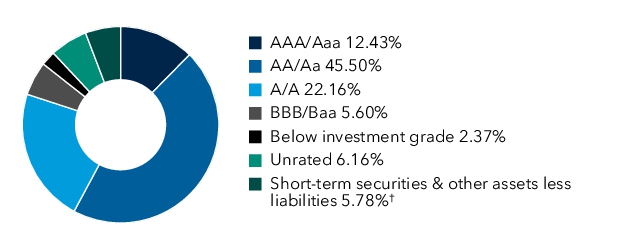

| Holdings [Text Block] |

Portfolio quality summary (percent of net assets) * Bond ratings, which typically range from AAA/Aaa (highest) to D (lowest), are assigned by credit rating agencies such as Standard & Poor’s, Moody’s and/or Fitch as an indication of an issuer’s creditworthiness. In assigning a credit rating to a security, the fund looks specifically to the ratings assigned to the issuer of the security by Standard & Poor’s, Moody’s and/or Fitch. If agency ratings differ, the security will be considered to have received the highest of those ratings, consistent with the fund’s investment policies. Securities in the “unrated“ category (above) have not been rated by a rating agency; however, the investment adviser performs its own credit analysis and assigns comparable ratings that are used for compliance with the fund’s investment policies. |

| The Tax-Exempt Bond Fund of America® - Class F-2 |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

The Tax-Exempt Bond Fund of America®

|

| Class Name |

Class F-2

|

| Trading Symbol |

TEAFX

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about The Tax-Exempt Bond Fund of America (the "fund") for the period from August 1, 2024 to July 31, 2025.

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the fund at capitalgroup.com/mutual-fund-literature-F2 (800) 421-4225 .

|

| Additional Information Phone Number |

(800) 421-4225

|

| Additional Information Website |

capitalgroup.com/mutual-fund-literature-F2

|

| Expenses [Text Block] |

What were the fund costs for the last year? (based on a hypothetical $10,000 investment) Share class | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | | Class F-2 | $ 36 | 0.36 % |

|

| Expenses Paid, Amount |

$ 36

|

| Expense Ratio, Percent |

0.36%

|

| Factors Affecting Performance [Text Block] |

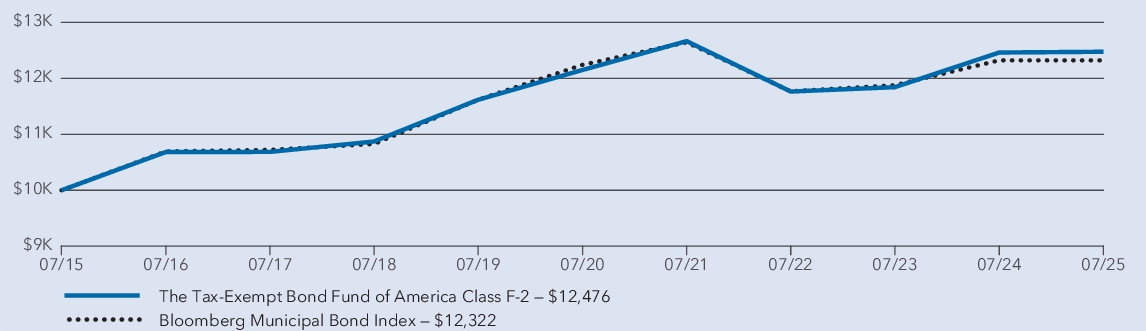

Management's discussion of fund performance The fund’s Class F-2 shares gained 0.11% for the year ended July 31, 2025. That result compares with a 0.00% return for the Bloomberg Municipal Bond Index. For information on returns for additional periods, including the fund lifetime, please refer to capitalgroup.com/mutual-fund-returns-F2 . What factors influenced results During the fund’s fiscal year, municipal bond returns were essentially flat. Yields rose, ending the period near 15-year highs, which was in part driven by shifts in fiscal policy. The U.S. Federal Reserve reduced interest rates three times in 2024, prompting a decline in short-term yields as investors gravitated toward safer assets. Meanwhile, long-term yields moved higher, influenced by heightened market volatility and a strong wave of new municipal bond issuance. This dynamic led to a steepening of the municipal yield curve, with 10-year AAA yields outpacing two-year yields and enhancing the appeal of longer term maturities. Within the fund, a larger portion of investments than the index in housing and corporate bonds were particularly additive to results relative to the benchmark. Likewise, holdings in health care and cash and money market aided returns. Also, duration positioning and the fund’s exposure to derivatives further helped relative results. Holdings in general obligation, special tax and transportation sectors had a relative negative impact on returns. Likewise, curve positioning weighed on results.

|

| Performance Past Does Not Indicate Future [Text] |

The fund’s past performance is not a predictor of its future performance.

|

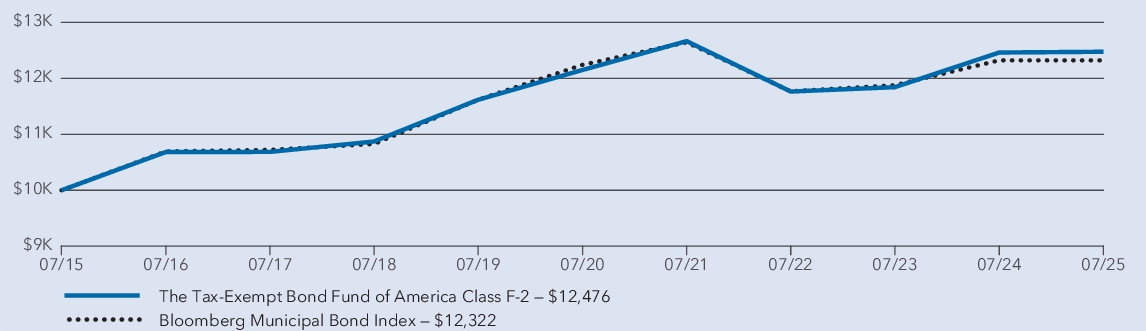

| Line Graph [Table Text Block] |

|

| Average Annual Return [Table Text Block] |

Average annual total returns | 1 year | 5 years | 10 years | | The Tax-Exempt Bond Fund of America — Class F-2 | 0.11 % | 0.53 % | 2.24 % | | Bloomberg Municipal Bond Index | 0.00 % | 0.13 % | 2.11 % |

* Investment results assume all distributions are reinvested and reflect applicable fees and expenses. When applicable, results reflect fee waivers and/or expense reimbursements, without which they would have been lower. † Results assume all distributions are reinvested. Any market index shown is unmanaged, and therefore, has no expenses. Investors cannot invest directly in an index. Source(s): Bloomberg Index Services Ltd. |

| No Deduction of Taxes [Text Block] |

The line chart and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

|

| Net Assets |

$ 22,866,000,000

|

| Holdings Count | Holding |

5,336

|

| Advisory Fees Paid, Amount |

$ 50,000,000

|

| Investment Company, Portfolio Turnover |

24.00%

|

| Additional Fund Statistics [Text Block] |

| Fund net assets (in millions) | $ 22,866 | | Total number of portfolio holdings | 5,336 | | Total advisory fees paid (in millions) | $ 50 | | Portfolio turnover rate | 24 % |

|

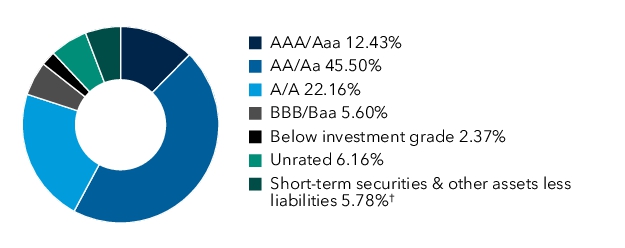

| Holdings [Text Block] |

Portfolio quality summary (percent of net assets) * Bond ratings, which typically range from AAA/Aaa (highest) to D (lowest), are assigned by credit rating agencies such as Standard & Poor’s, Moody’s and/or Fitch as an indication of an issuer’s creditworthiness. In assigning a credit rating to a security, the fund looks specifically to the ratings assigned to the issuer of the security by Standard & Poor’s, Moody’s and/or Fitch. If agency ratings differ, the security will be considered to have received the highest of those ratings, consistent with the fund’s investment policies. Securities in the “unrated“ category (above) have not been rated by a rating agency; however, the investment adviser performs its own credit analysis and assigns comparable ratings that are used for compliance with the fund’s investment policies. |

| The Tax-Exempt Bond Fund of America® - Class F-3 |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

The Tax-Exempt Bond Fund of America®

|

| Class Name |

Class F-3

|

| Trading Symbol |

TFEBX

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about The Tax-Exempt Bond Fund of America (the "fund") for the period from August 1, 2024 to July 31, 2025.

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the fund at capitalgroup.com/mutual-fund-literature-F3 (800) 421-4225 .

|

| Additional Information Phone Number |

(800) 421-4225

|

| Additional Information Website |

capitalgroup.com/mutual-fund-literature-F3

|

| Expenses [Text Block] |

What were the fund costs for the last year? (based on a hypothetical $10,000 investment) Share class | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | | Class F-3 | $ 25 | 0.25 % |

|

| Expenses Paid, Amount |

$ 25

|

| Expense Ratio, Percent |

0.25%

|

| Factors Affecting Performance [Text Block] |

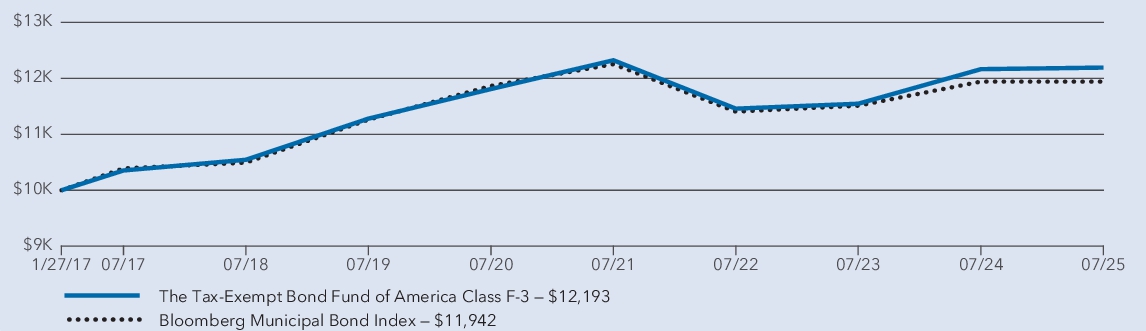

Management's discussion of fund performance The fund’s Class F-3 shares gained 0.22% for the year ended July 31, 2025. That result compares with a 0.00% return for the Bloomberg Municipal Bond Index. For information on returns for additional periods, including the fund lifetime, please refer to capitalgroup.com/mutual-fund-returns-F3 . What factors influenced results During the fund’s fiscal year, municipal bond returns were essentially flat. Yields rose, ending the period near 15-year highs, which was in part driven by shifts in fiscal policy. The U.S. Federal Reserve reduced interest rates three times in 2024, prompting a decline in short-term yields as investors gravitated toward safer assets. Meanwhile, long-term yields moved higher, influenced by heightened market volatility and a strong wave of new municipal bond issuance. This dynamic led to a steepening of the municipal yield curve, with 10-year AAA yields outpacing two-year yields and enhancing the appeal of longer term maturities. Within the fund, a larger portion of investments than the index in housing and corporate bonds were particularly additive to results relative to the benchmark. Likewise, holdings in health care and cash and money market aided returns. Also, duration positioning and the fund’s exposure to derivatives further helped relative results. Holdings in general obligation, special tax and transportation sectors had a relative negative impact on returns. Likewise, curve positioning weighed on results.

|

| Performance Past Does Not Indicate Future [Text] |

The fund’s past performance is not a predictor of its future performance.

|

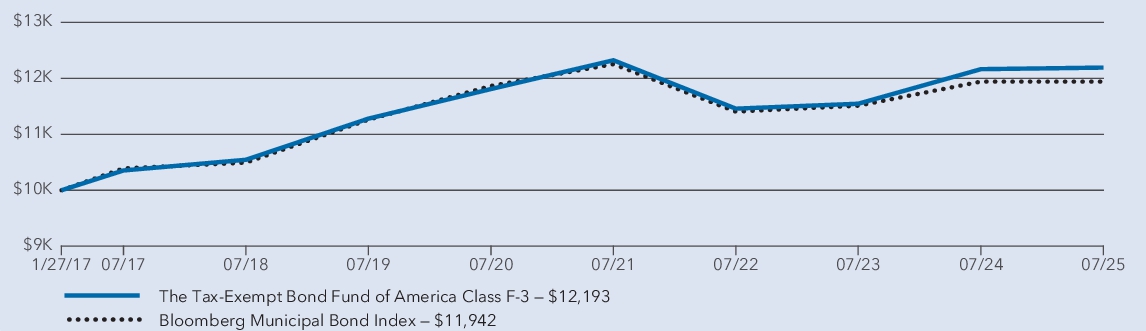

| Line Graph [Table Text Block] |

|

| Average Annual Return [Table Text Block] |

Average annual total returns | 1 year | 5 years | | | The Tax-Exempt Bond Fund of America — Class F-3 | 0.22 % | 0.64 % | 2.36 % | | Bloomberg Municipal Bond Index | 0.00 % | 0.13 % | 2.11 % |

1 Class F-3 shares were first offered on January 27, 2017. 2 Investment results assume all distributions are reinvested and reflect applicable fees and expenses. When applicable, results reflect fee waivers and/or expense reimbursements, without which they would have been lower. 3 Results assume all distributions are reinvested. Any market index shown is unmanaged, and therefore, has no expenses. Investors cannot invest directly in an index. Source(s): Bloomberg Index Services Ltd. |

| Performance Inception Date |

Jan. 27, 2017

|

| No Deduction of Taxes [Text Block] |

The line chart and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

|

| Net Assets |

$ 22,866,000,000

|

| Holdings Count | Holding |

5,336

|

| Advisory Fees Paid, Amount |

$ 50,000,000

|

| Investment Company, Portfolio Turnover |

24.00%

|

| Additional Fund Statistics [Text Block] |

| Fund net assets (in millions) | $ 22,866 | | Total number of portfolio holdings | 5,336 | | Total advisory fees paid (in millions) | $ 50 | | Portfolio turnover rate | 24 % |

|

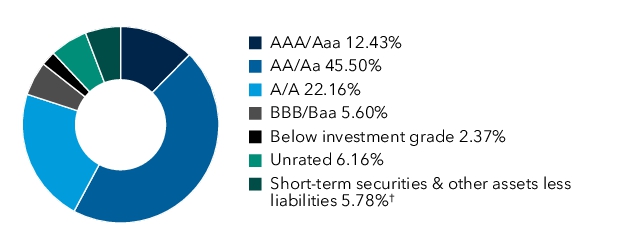

| Holdings [Text Block] |

Portfolio quality summary (percent of net assets) * Bond ratings, which typically range from AAA/Aaa (highest) to D (lowest), are assigned by credit rating agencies such as Standard & Poor’s, Moody’s and/or Fitch as an indication of an issuer’s creditworthiness. In assigning a credit rating to a security, the fund looks specifically to the ratings assigned to the issuer of the security by Standard & Poor’s, Moody’s and/or Fitch. If agency ratings differ, the security will be considered to have received the highest of those ratings, consistent with the fund’s investment policies. Securities in the “unrated“ category (above) have not been rated by a rating agency; however, the investment adviser performs its own credit analysis and assigns comparable ratings that are used for compliance with the fund’s investment policies. |

| The Tax-Exempt Bond Fund of America® - Class R-6 |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

The Tax-Exempt Bond Fund of America®

|

| Class Name |

Class R-6

|

| No Trading Symbol Flag |

true

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about The Tax-Exempt Bond Fund of America (the "fund") for the period from August 1, 2024 to July 31, 2025.

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the fund at capitalgroup.com/mutual-fund-literature-R6 (800) 421-4225 .

|

| Additional Information Phone Number |

(800) 421-4225

|

| Additional Information Website |

capitalgroup.com/mutual-fund-literature-R6

|

| Expenses [Text Block] |

What were the fund costs for the last year? (based on a hypothetical $10,000 investment) Share class | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | | Class R-6 | $ 26 | 0.26 % |

|

| Expenses Paid, Amount |

$ 26

|

| Expense Ratio, Percent |

0.26%

|

| Factors Affecting Performance [Text Block] |

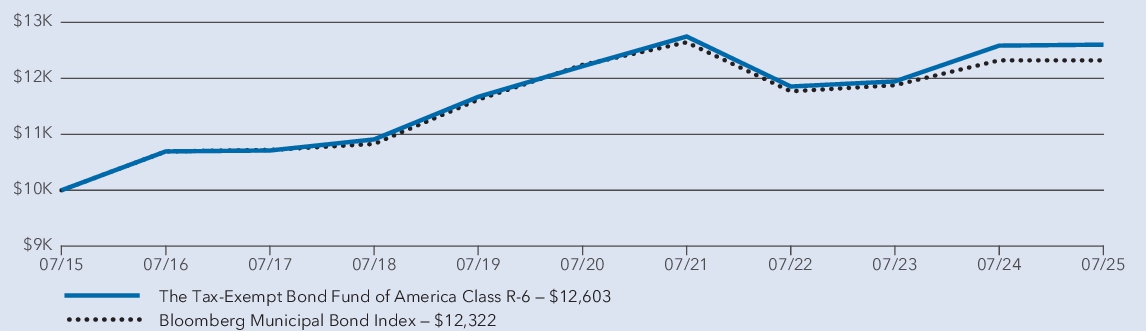

Management's discussion of fund performance The fund’s Class R-6 shares gained 0.14% for the year ended July 31, 2025. That result compares with a 0.00% return for the Bloomberg Municipal Bond Index. For information on returns for additional periods, including the fund lifetime, please refer to capitalgroup.com/mutual-fund-returns-R6 . What factors influenced results During the fund’s fiscal year, municipal bond returns were essentially flat. Yields rose, ending the period near 15-year highs, which was in part driven by shifts in fiscal policy. The U.S. Federal Reserve reduced interest rates three times in 2024, prompting a decline in short-term yields as investors gravitated toward safer assets. Meanwhile, long-term yields moved higher, influenced by heightened market volatility and a strong wave of new municipal bond issuance. This dynamic led to a steepening of the municipal yield curve, with 10-year AAA yields outpacing two-year yields and enhancing the appeal of longer term maturities. Within the fund, a larger portion of investments than the index in housing and corporate bonds were particularly additive to results relative to the benchmark. Likewise, holdings in health care and cash and money market aided returns. Also, duration positioning and the fund’s exposure to derivatives further helped relative results. Holdings in general obligation, special tax and transportation sectors had a relative negative impact on returns. Likewise, curve positioning weighed on results.

|

| Performance Past Does Not Indicate Future [Text] |

The fund’s past performance is not a predictor of its future performance.

|

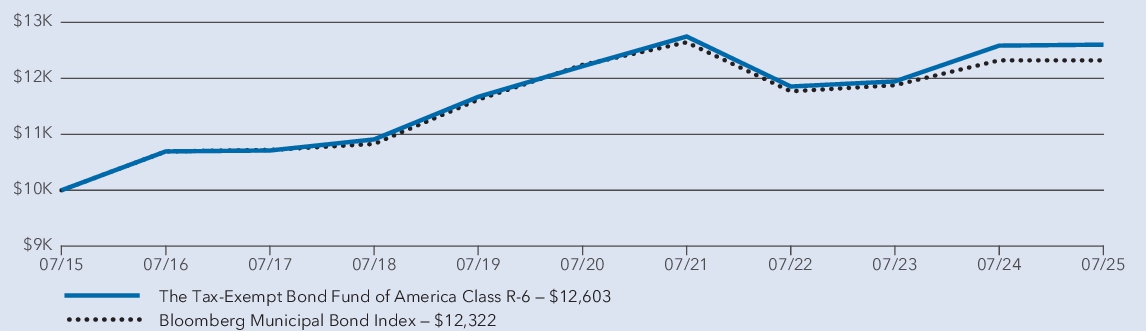

| Line Graph [Table Text Block] |

|

| Average Annual Return [Table Text Block] |

Average annual total returns | 1 year | 5 years | 10 years | | The Tax-Exempt Bond Fund of America — Class R-6 | 0.14 % | 0.62 % | 2.34 % | | Bloomberg Municipal Bond Index | 0.00 % | 0.13 % | 2.11 % |

* Investment results assume all distributions are reinvested and reflect applicable fees and expenses. When applicable, results reflect fee waivers and/or expense reimbursements, without which they would have been lower. † Results assume all distributions are reinvested. Any market index shown is unmanaged, and therefore, has no expenses. Investors cannot invest directly in an index. Source(s): Bloomberg Index Services Ltd. |

| No Deduction of Taxes [Text Block] |

The line chart and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

|

| Net Assets |

$ 22,866,000,000

|

| Holdings Count | Holding |

5,336

|

| Advisory Fees Paid, Amount |

$ 50,000,000

|

| Investment Company, Portfolio Turnover |

24.00%

|

| Additional Fund Statistics [Text Block] |

| Fund net assets (in millions) | $ 22,866 | | Total number of portfolio holdings | 5,336 | | Total advisory fees paid (in millions) | $ 50 | | Portfolio turnover rate | 24 % |

|

| Holdings [Text Block] |

Portfolio quality summary (percent of net assets) * Bond ratings, which typically range from AAA/Aaa (highest) to D (lowest), are assigned by credit rating agencies such as Standard & Poor’s, Moody’s and/or Fitch as an indication of an issuer’s creditworthiness. In assigning a credit rating to a security, the fund looks specifically to the ratings assigned to the issuer of the security by Standard & Poor’s, Moody’s and/or Fitch. If agency ratings differ, the security will be considered to have received the highest of those ratings, consistent with the fund’s investment policies. Securities in the “unrated“ category (above) have not been rated by a rating agency; however, the investment adviser performs its own credit analysis and assigns comparable ratings that are used for compliance with the fund’s investment policies. |