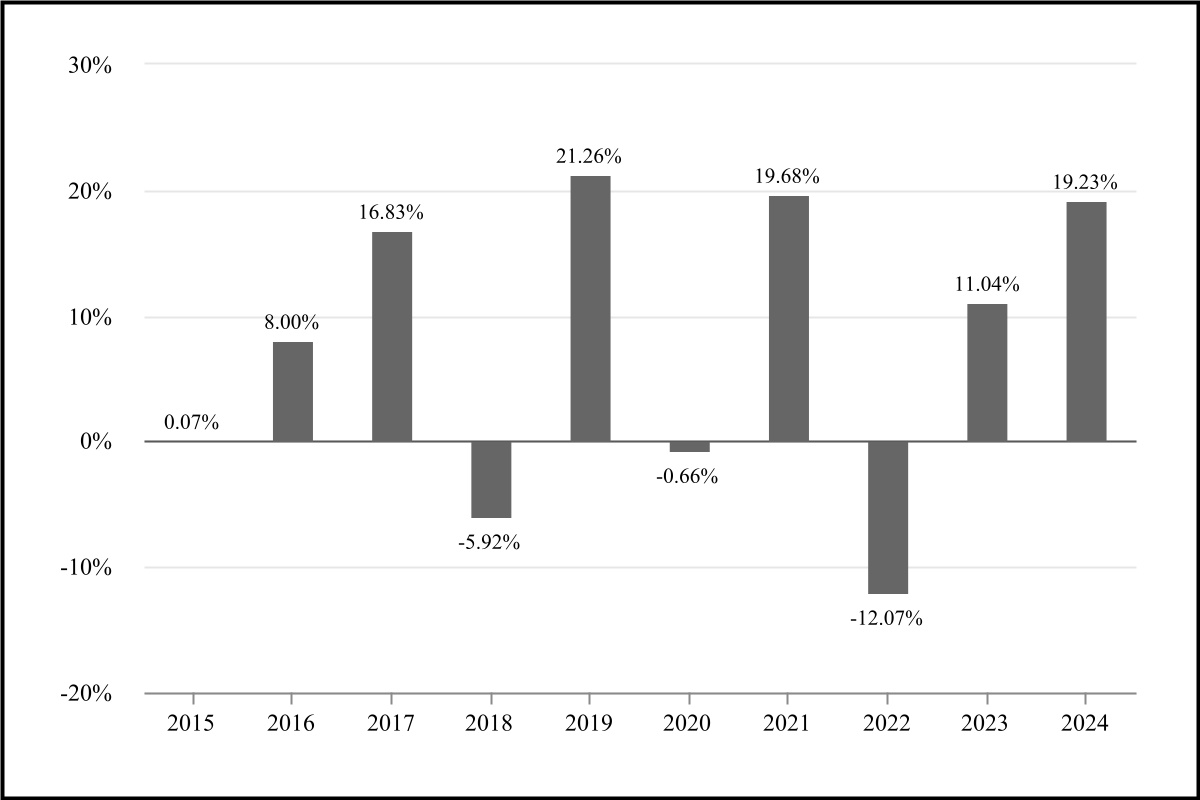

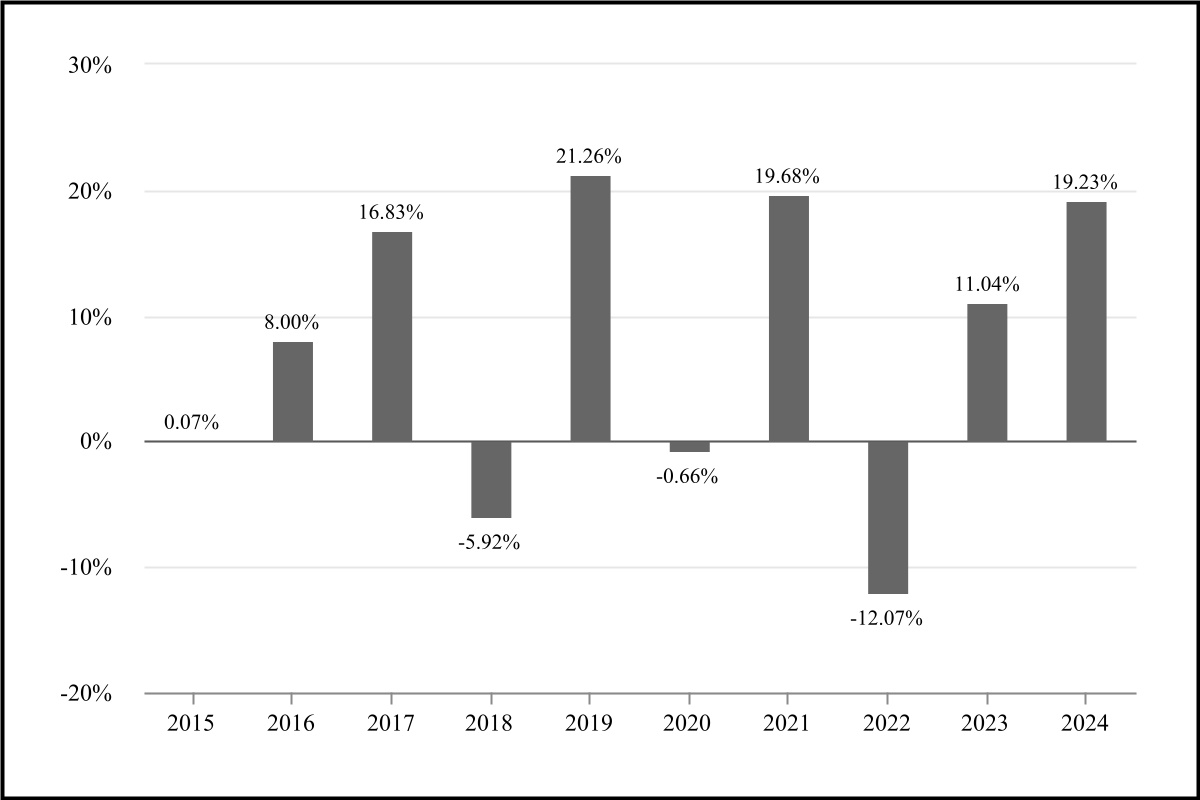

| Best Quarter: | 3/31/2019 | 9.07% | ||||||

| Worst Quarter: | 3/31/2020 | -21.52% | ||||||

Performance Management - Global X Funds - Global X S&P 500 Covered Call ETF |

Sep. 30, 2025 |

|||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Prospectus [Line Items] | ||||||||||||||||||||||||||||

| Bar Chart and Performance Table [Heading] | PERFORMANCE INFORMATION | |||||||||||||||||||||||||||

| Performance Narrative [Text Block] | The bar chart and table that follow show how the Fund performed on a calendar year basis and provide an indication of the risks of investing in the Fund by showing changes in the Fund's performance from year to year and by showing how the Fund's average annual returns for the indicated periods compare with the Fund's broad-based benchmark index, which reflects a broad measure of market performance, and the Underlying Index, which the Fund seeks to track. The Fund's past performance (before and after taxes) is not necessarily indicative of how the Fund will perform in the future. Updated performance information is available online at www.globalxetfs.com. The Fund operated as the Horizons S&P 500® Covered Call ETF (the "Predecessor Fund"), a series of Horizons ETF Trust I, prior to the Fund's acquisition of the assets and assumption of the liabilities of the Predecessor Fund on December 24, 2018 (the "Reorganization"). As a result of the Reorganization, the Fund assumed the performance and accounting history of the Predecessor Fund. Accordingly, performance figures for the Fund for periods prior to the date of the Reorganization represent the performance of the Predecessor Fund.

|

|||||||||||||||||||||||||||

| Performance Past Does Not Indicate Future [Text] | The Fund's past performance (before and after taxes) is not necessarily indicative of how the Fund will perform in the future. | |||||||||||||||||||||||||||

| Performance Information Illustrates Variability of Returns [Text] | The bar chart and table that follow show how the Fund performed on a calendar year basis and provide an indication of the risks of investing in the Fund by showing changes in the Fund's performance from year to year and by showing how the Fund's average annual returns for the indicated periods compare with the Fund's broad-based benchmark index, which reflects a broad measure of market performance, and the Underlying Index, which the Fund seeks to track. | |||||||||||||||||||||||||||

| Bar Chart [Heading] | Annual Total Returns (Years Ended December 31) | |||||||||||||||||||||||||||

| Bar Chart [Table] |

|

|||||||||||||||||||||||||||

| Bar Chart Closing [Text Block] |

|

|||||||||||||||||||||||||||

| Performance Table Heading | Average Annual Total Returns (for the Periods Ended December 31, 2024) | |||||||||||||||||||||||||||

| Performance Table Uses Highest Federal Rate | After-tax returns are calculated using the historical highest individual U.S. federal marginal income tax rates and do not reflect the impact of state and local taxes. | |||||||||||||||||||||||||||

| Performance Table Not Relevant to Tax Deferred | Your actual after-tax returns will depend on your specific tax situation and may differ from those shown above. After-tax returns are not relevant to investors who hold Shares of the Fund through tax-advantaged arrangements, such as 401(k) plans or individual retirement accounts (IRAs). | |||||||||||||||||||||||||||

| Index No Deduction for Fees, Expenses, or Taxes [Text] | (Index returns do not reflect deduction for fees, expenses, or taxes) | |||||||||||||||||||||||||||

| Performance Availability Website Address [Text] | www.globalxetfs.com | |||||||||||||||||||||||||||

| Global X S&P 500 Covered Call ETF Class | ||||||||||||||||||||||||||||

| Prospectus [Line Items] | ||||||||||||||||||||||||||||

| Highest Quarterly Return, Label [Optional Text] | Best Quarter: | |||||||||||||||||||||||||||

| Highest Quarterly Return | 9.07% | |||||||||||||||||||||||||||

| Highest Quarterly Return, Date | Mar. 31, 2019 | |||||||||||||||||||||||||||

| Lowest Quarterly Return, Label [Optional Text] | Worst Quarter: | |||||||||||||||||||||||||||

| Lowest Quarterly Return | (21.52%) | |||||||||||||||||||||||||||

| Lowest Quarterly Return, Date | Mar. 31, 2020 | |||||||||||||||||||||||||||