The following bar chart shows how the fund’s investment results have varied from year to year, and the following table shows how the fund’s average annual total returns for various periods compare with a broad measure of securities market results and, if applicable, other measures of market results that reflect the fund’s investment universe. This information provides some indication of the risks of investing in the fund. Past investment results (before and after taxes) are not predictive of future investment results. Updated information on the fund’s investment results can be obtained by visiting capitalgroup.com.

The following bar chart shows how the fund’s investment results have varied from year to year, and the following table shows how the fund’s average annual total returns for various periods compare with a broad measure of securities market results and, if applicable, other measures of market results that reflect the fund’s investment universe.

Highest/Lowest quarterly results during this period were:

Highest 3.64% (quarter ended December 31, 2023)

Lowest -2.79% (quarter ended March 31, 2022)

The fund's total return for the six months ended June 30, 2025, was 2.15%

| Average annual total returns For the periods ended December 31, 2024: | |||||

| Share class | Inception date | 1 year | 5 years | 10 years | Lifetime |

| F-2 − Before taxes | 8/12/2009 | 2.61% | 1.18% | 1.22% | 1.35 % |

| − After taxes on distributions | 2.61 | 1.14 | 1.19 | N/A | |

| − After taxes on distributions and sale of fund shares | 2.65 | 1.25 | 1.26 | N/A | |

| Share classes (before taxes) | Inception date | 1 year | 5 years | 10 years | Lifetime |

| A (with maximum sales charge) | 8/7/2009 | –0.03% | 0.55% | 0.88% | 1.11% |

| F-1 | 8/27/2009 | 2.29 | 0.87 | 0.92 | 1.08 |

| F-3 | 1/27/2017 | 2.68 | 1.25 | N/A | 1.50 |

| Indexes | 1 year | 5 years | 10 years | Lifetime (since Class F-2 inception) |

| Bloomberg Municipal Bond Index (reflects no deductions for sales charges, account fees, expenses or U.S. federal income taxes) | 1.05% | 0.99% | 2.25% | 3.39% |

| Bloomberg Municipal Short 1-5 Years Index (reflects no deductions for sales charges, account fees, expenses or U.S. federal income taxes) | 2.07 | 1.10 | 1.38 | 1.62 |

| Class F-2 annualized 30-day yield at July 31, 2025: 2.86% (For current yield information, please call American Funds Service Company at (800) 421-4225 or visit capitalgroup.com.) | ||||

After-tax returns are shown only for Class F-2 shares; after-tax returns for other share classes will vary. After-tax returns are calculated using the highest individual federal income tax rates in effect during each year of the periods shown and do not reflect the impact of state and local taxes. Your actual after-tax returns depend on your individual tax situation and likely will differ from the results shown above.

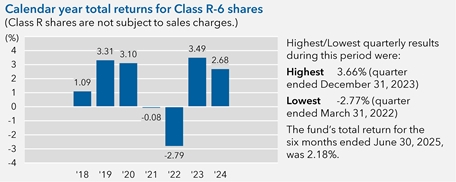

The following bar chart shows how investment results for the Class R-6 shares of the fund have varied from year to year, and the following table shows how the Class R-6 shares’ average annual total returns for various periods compare with a broad measure of securities market results and, if applicable, other measures of market results that reflect the fund’s investment universe. This information provides some indication of the risks of investing in the fund. Past investment results (before and after taxes) are not predictive of future investment results. Updated information on the fund’s investment results can be obtained by visiting capitalgroup.com.

The following bar chart shows how investment results for the Class R-6 shares of the fund have varied from year to year, and the following table shows how the Class R-6 shares’ average annual total returns for various periods compare with a broad measure of securities market results and, if applicable, other measures of market results that reflect the fund’s investment universe.

Highest/Lowest quarterly results during this period were:

Highest 3.66% (quarter ended December 31, 2023)

Lowest -2.77% (quarter ended March 31, 2022)

The fund's total return for the six months ended June 30, 2025, was 2.18%.

| Average annual total returns For the periods ended December 31, 2024: | |||||

| Share class | Inception date | 1 year | 5 year | Lifetime | |

| R-6 − Before taxes | 3/17/2017 | 2.68% | 1.25% | 1.49% | |

| − After taxes on distributions | 2.68 | 1.21 | 1.47 | ||

| − After taxes on distributions and sale of fund shares | 2.72 | 1.33 | 1.51 | ||

| Indexes | 1 year | 5 year | Lifetime (from Class R-6 inception) |

| Bloomberg Municipal Bond Index (reflects no deductions for sales charges, account fees, expenses or U.S. federal income taxes) | 1.05% | 0.99% | 2.34% |

| Bloomberg Municipal Short 1-5 Years Index (reflects no deductions for sales charges, account fees or U.S. federal income taxes) | 2.07 | 1.10 | 1.48 |

After-tax returns are calculated using the highest individual federal income tax rates in effect during each year of the periods shown and do not reflect the impact of state and local taxes. Your actual after-tax returns depend on your individual tax situation and likely will differ from the results shown above.