Fund | Cost of $10,000 Investment | Costs paid as a percentage of a $10,000 investment |

| CGMM | $ 19* | 0.51 % † |

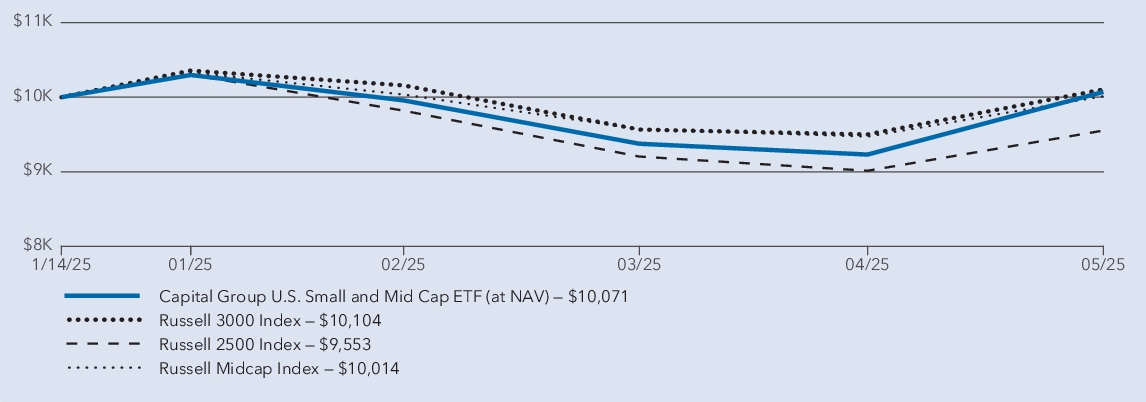

May 31, 2025. These results compare with a 4.47% loss for the Russell 2500 Index. For information on returns for additional periods, including the fund lifetime, please refer to

Since inception 1 | |

| Capital Group U.S. Small and Mid Cap ETF (at NAV) 2 | 0.71 % |

| Russell 3000 Index 3 | 1.04 % |

| Russell 2500 Index 3 | (4.47 ) % |

| Russell Midcap Index 3 | 0.14 % |

| Fund net assets (in thousands) | $ 247,965 |

| Total number of portfolio holdings | 84 |

| Total advisory fees paid (in thousands) | $ 211 |

| Portfolio turnover rate | 9 % |

| [1] | Based on operations for the period from January 14, 2025 to May 31, 2025. Expenses for the full year would be higher. |

| [2] | Annualized. |