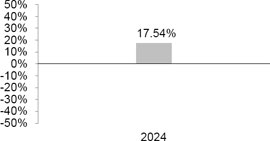

The bar chart and Average Annual Total Returns table illustrate the variability of the Fund’s returns which is some indication of the risks of investing in the Fund. The bar chart shows the performance of the Fund for each full calendar year since the Fund’s inception. The Average Annual Total Returns table shows how the Fund’s average annual returns compare with those of a broad measure of market performance over time. Remember, the Fund’s past performance, before and after taxes, is not necessarily an indication of how the Fund will perform in the future. Updated performance information will be available at no cost by www.futurefundetf.com or by calling 877-466-7090.

The calendar year-to-date return for the Fund’s shares as of June 30, 2025 was 10.01%

During the period shown in the bar chart, the best performance for a quarter was 11.24% (for the quarter ended March 31, 2024). The worst performance was (1.64)% (for the quarter ended September 30, 2024).

| One Year | Since Inception* | |

| Return Before Taxes | 17.54% | 11.85% |

| Return After Taxes on Distributions | 16.00% | 10.89% |

| Return After Taxes on Distributions and Sale of Fund Shares | 10.39% | 8.69% |

| S&P 500 Total Return Index | 25.02% | 22.83% |

| * | Future Fund Long Short ETF commenced operations on June 20, 2023. |

After-tax returns are based on the highest historical individual federal marginal income tax rates, and do not reflect the impact of state and local taxes; actual after-tax returns depend on an individual investor’s tax situation and may differ from those shown. If you own shares of the Fund in a tax-deferred account, such as an individual retirement account or a 401(k) plan, this information is not applicable to your investment. A higher after-tax return results when a capital loss occurs upon redemption and translates into an assumed tax deduction that benefits the shareholder.

S&P 500 Total Return Index is an unmanaged composite of 500 large capitalization companies. This index is widely used by professional investors as a performance benchmark for large-cap stocks. You cannot invest directly in an index and unmanaged index returns do not reflect any fees, expenses or sales charges.

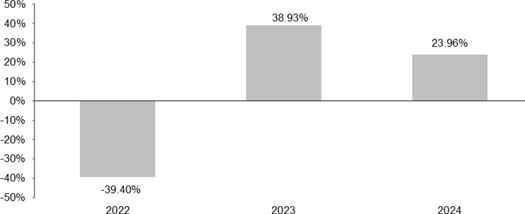

The bar chart and Average Annual Total Returns table illustrate the variability of the Fund’s returns which is some indication of the risks of investing in the Fund. The bar chart shows the performance of the Fund for each full calendar year since the Fund’s inception. The Average Annual Total Returns table shows how the Fund’s average annual returns compare with those of a broad measure of market performance over time. Remember, the Fund’s past performance, before and after taxes, is not necessarily an indication of how the Fund will perform in the future. Updated performance information will be available at no cost by www.futurefundetf.com or by calling 877-466-7090.

The calendar year-to-date return for the Fund’s shares as of June 30, 2025 was 9.31%.

During the period shown in the bar chart, the best performance for a quarter was 16.51% (for the quarter ended March 31, 2023). The worst performance was -26.69% (for the quarter ended June 30, 2022).

| One Year | Since Inception* | |

| Return Before Taxes | 23.96% | 0.43% |

| Return After Taxes on Distributions | 23.96% | 0.42% |

| Return After Taxes on Distributions and Sale of Fund Shares | 14.19% | 0.32% |

| MSCI All Country World Index (AWCI) | 18.01% | 6.52% |

| S&P 500 Total Return Index | 25.02% | 10.13% |

| Russell 3000 Growth Index | 31.57% | 37.78% |

| * | One Global ETF commenced operations on August 23, 2021. |

After-tax returns are based on the highest historical individual federal marginal income tax rates, and do not reflect the impact of state and local taxes; actual after-tax returns depend on an individual investor’s tax situation and may differ from those shown. If you own shares of the Fund in a tax-deferred account, such as an individual retirement account or a 401(k) plan, this information is not applicable to your investment. A higher after-tax return results when a capital loss occurs upon redemption and translates into an assumed tax deduction that benefits the shareholder.

Effective March 6, 2025, the Fund’s primary benchmark changed from the S&P 500 Total Return Index to the MSCI All Country World Index (AWCI). The S&P 500 Total Return Index will continue to be shown for a period of one year.

The MSCI AWCI is a global equity index that measures the equity performance in both developed and emerging markets. You cannot invest directly in an index and unmanaged index returns do not reflect any fees, expenses or sales charges.

S&P 500 Total Return Index is an unmanaged composite of 500 large capitalization companies. This index is widely used by professional investors as a performance benchmark for large-cap stocks. You cannot invest directly in an index and unmanaged index returns do not reflect any fees, expenses or sales charges.

The Russell 3000 Growth Index is a market capitalization-weighted index based on the Russell 3000 index. The Russell 3000 Growth Index includes companies that display signs of above-average growth. The index is used to provide a gauge of the performance of growth stocks in the United States.