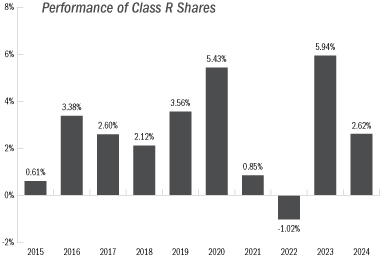

The following information provides some indication of the risks and variability of investing in the Fund by showing how the Fund's performance has varied from year to year and by showing how the Fund's average annual returns for the past one-, five-, ten-year and since inception periods compare with those of the Standard & Poor's 500® Index, ICE BofA U.S. 3-Month Treasury Bill Index and the Bloomberg U.S. Aggregate Bond Index.

The bar chart presents the calendar year total returns of the Fund's Class R Shares before taxes. Returns shown in the bar chart do not reflect sales charges applicable to other share classes, which would reduce performance results. The performance table reflects the performance of the Fund's Class R shares before and after taxes and the Fund's Class I, Class C and Class A shares before taxes. How the Fund has performed in the past (before and after taxes) is not necessarily an indication of how the Fund will perform in the future. Updated information on the Fund's performance can be obtained by visiting www.arbitragefunds.com.

|

|

Year-by-Year Annual Total Returns through December 31, 2024 – Class R Shares During the period shown in the bar chart, the highest return for a quarter was 3.66% during the quarter ended June 30, 2020 and the lowest return for a quarter was -2.90% during the quarter ended June 30, 2022. The year-to-date return of the Fund's Class R shares through June 30, 2025 is 3.88%. While the Class I, Class C, and Class A shares would have substantially similar annual returns to the Class R shares because the shares are invested in the same portfolio of securities, the performance of Class I, Class C, and Class A shares will differ from that shown since the Classes do not have the same expenses or inception dates. |

||||||

During the period shown in the bar chart, the highest return for a quarter was 3.66% during the quarter ended June 30, 2020 and the lowest return for a quarter was -2.90% during the quarter ended June 30, 2022.

The year-to-date return of the Fund's Class R shares through June 30, 2025 is 3.88%.

While the Class I, Class C, and Class A shares would have substantially similar annual returns to the Class R shares because the shares are invested in the same portfolio of securities, the performance of Class I, Class C, and Class A shares will differ from that shown since the Classes do not have the same expenses or inception dates.

The table below shows the Fund's average annual total returns for Class R shares, Class I shares, Class C shares, and Class A shares compared with those of the Standard & Poor's 500® Index, ICE BofA U.S. 3-Month Treasury Bill Index and the Bloomberg U.S. Aggregate Bond Index. The returns in the table below reflect the maximum applicable sales charges for the relevant share class. The table also presents the impact of taxes on the returns of the Fund's Class R shares. After-tax returns are shown for Class R shares only, and after-tax returns for Class I, Class C, and Class A shares will vary. After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns depend on an investor's tax situation and may differ from those shown, and after-tax returns shown are not relevant to investors who hold their Fund shares through tax-deferred arrangements, such as 401(k) plans or individual retirement accounts. Return after taxes on distributions measures the effect of taxable distributions, but assumes the underlying shares are held for the entire period. Return after taxes on distributions and sale of Fund shares shows the effect of both taxable distributions and any taxable gain or loss that would be realized if the underlying shares were purchased at the beginning and sold at the end of the period (for purposes of the calculation, it is assumed that income dividends and capital gain distributions are reinvested at net asset value and that the entire account is redeemed at the end of the period, including reinvested amounts).

Class C shares automatically convert to Class A shares approximately eight years after purchase if the conversion is available through your financial intermediary. In the table below, the performance for Class C shares does not reflect the conversion of Class C shares to Class A shares after eight years.

|

ARBITRAGE FUND |

One Year |

Five Years |

Ten Years |

Since Inception* |

|||||||||||||||

|

Class R Return Before Taxes |

2.62 |

% |

2.73 |

% |

2.59 |

% |

3.70 |

% |

|||||||||||

|

Class R Return After Taxes on Distributions |

2.35 |

% |

1.75 |

% |

1.71 |

% |

2.78 |

% |

|||||||||||

|

Class R Return After Taxes on Distributions and Sale of Fund Shares |

1.68 |

% |

1.75 |

% |

1.68 |

% |

2.61 |

% |

|||||||||||

|

Class I Return Before Taxes |

2.95 |

% |

2.99 |

% |

2.84 |

% |

3.03 |

% |

|||||||||||

|

Class C Return Before Taxes |

0.92 |

% |

1.97 |

% |

1.82 |

% |

1.54 |

% |

|||||||||||

|

Class A Return Before Taxes |

-0.19 |

% |

2.22 |

% |

2.32 |

% |

2.24 |

% |

|||||||||||

|

Standard & Poor's 500® Index** |

25.02 |

% |

14.53 |

% |

13.10 |

% |

7.91 |

% |

|||||||||||

|

ICE BofA U.S. 3-Month Treasury Bill Index*** |

5.25 |

% |

2.46 |

% |

1.77 |

% |

1.80 |

% |

|||||||||||

|

Bloomberg U.S. Aggregate Bond Index**** |

1.25 |

% |

-0.33 |

% |

1.35 |

% |

3.79 |

% |

|||||||||||

* The inception date for Class R shares is September 18, 2000, the inception date for Class I shares is October 17, 2003, the inception date for Class C shares is June 1, 2012, and the inception date for the Class A shares is June 1, 2013. The "Since Inception" returns reflected for the Standard & Poor's 500® Index, the ICE BofA U.S. 3-Month Treasury Bill Index and the Bloomberg U.S. Aggregate Bond Index are based on the inception date for Class R shares.

** Due to new regulatory requirements, effective May 31, 2024, the Standard & Poor's 500® Index became the Fund's broad-based securities market index. The Standard & Poor's 500® Index serves as the Fund's regulatory index and provides a broad measure of market performance. The Standard and Poor's 500® Index, or simply the S&P 500, is a stock market index tracking the performance of 500 large companies listed on stock exchanges in the U.S.

*** The ICE BofA U.S. 3-Month Treasury Bill Index tracks the performance of the U.S. Treasury Bills publicly issued in the U.S. domestic market with a remaining term to final maturity of less than 3 months.

**** The Bloomberg U.S. Aggregate Bond Index is a market value-weighted index of investment grade fixed-rated debt issues, including government, corporate, asset-backed and mortgage-backed securities with a maturity of one year or more.

The indexes are calculated on a total-return basis, are unmanaged and are not available for direct investment. The indexes reflect no deduction for fees, expenses, or taxes. The indexes are not intended to, and do not, parallel the risk or investment style of the Fund's investment strategy.

In calculating the federal income taxes due on redemptions, capital gains taxes resulting from redemptions are subtracted from the redemption proceeds and the tax benefits from capital losses resulting from the redemptions are added to the redemption proceeds. Under certain circumstances, the addition of the tax benefits from capital losses resulting from redemptions may cause the Return After Taxes on Distributions and Sale of Fund Shares to be greater than the Return After Taxes on Distributions or even the Return Before Taxes.

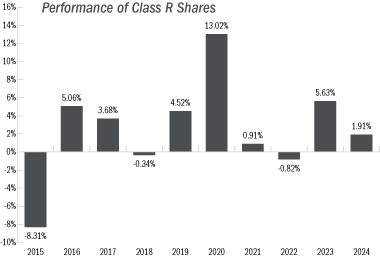

The following information provides some indication of the risks and variability of investing in the Fund by showing how the Fund's performance has varied from year to year and by showing how the Fund's average annual returns for the past one-, five-, ten-year and since inception periods compare with those of the Standard & Poor's 500® Index, ICE BofA U.S. 3-Month Treasury Bill Index and the Bloomberg U.S. Aggregate Bond Index.

The bar chart presents the calendar year total returns of the Fund's Class R Shares before taxes. Returns shown in the bar chart do not reflect sales charges applicable to other share classes, which would reduce performance results. The performance table reflects the performance of the Fund's Class R shares before and after taxes and the Fund's Class I and Class A shares before taxes. How the Fund has performed in the past (before and after taxes) is not necessarily an indication of how the Fund will perform in the future. Performance reflects fee waivers in effect. If fee waivers were not in place, the Fund's performance would be reduced. Updated information on the Fund's performance can be obtained by visiting www.arbitragefunds.com.

|

|

Year-by-Year Annual Total Returns through December 31, 2024 – Class R Shares During the period shown in the bar chart, the highest return for a quarter was 6.38% during the quarter ended June 30, 2020 and the lowest return for a quarter was -5.89% during the quarter ended September 30, 2015. The year-to-date return of the Fund's Class R shares through June 30, 2025 is 4.18%. While the Class I shares and Class A shares would have substantially similar annual returns to the Class R shares because the shares are invested in the same portfolio of securities, the performance of Class I and Class A shares will differ from that shown since the Classes do not have the same expenses or inception dates. |

||||||

During the period shown in the bar chart, the highest return for a quarter was 6.38% during the quarter ended June 30, 2020 and the lowest return for a quarter was -5.89% during the quarter ended September 30, 2015.

The year-to-date return of the Fund's Class R shares through June 30, 2025 is 4.18%.

While the Class I shares and Class A shares would have substantially similar annual returns to the Class R shares because the shares are invested in the same portfolio of securities, the performance of Class I and Class A shares will differ from that shown since the Classes do not have the same expenses or inception dates.

The table below shows the Fund's average annual total returns for Class R shares, Class I shares, and Class A shares compared with those of the Standard & Poor's 500® Index, ICE BofA U.S. 3-Month Treasury Bill Index and the Bloomberg U.S. Aggregate Bond Index. The returns in the table below reflect the maximum applicable sales charges for the relevant share class. The table also presents the impact of taxes on the returns of the Fund's Class R shares. After-tax returns are shown for Class R shares only, and after-tax returns for Class I and Class A shares will vary. After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns depend on an investor's tax situation and may differ from those shown, and after-tax returns shown are not relevant to investors who hold their Fund shares through tax-deferred arrangements, such as 401(k) plans or individual retirement accounts. Return after taxes on distributions measures the effect of taxable distributions, but assumes the underlying shares are held for the entire period. Return after taxes on distributions and sale of Fund shares shows the effect of both taxable distributions and any taxable gain or loss that would be realized if the underlying shares were purchased at the beginning and sold at the end of the period (for purposes of the calculation, it is assumed that income dividends and capital gain distributions are reinvested at net asset value and that the entire account is redeemed at the end of the period, including reinvested amounts).

|

WATER ISLAND EVENT-DRIVEN FUND |

One Year |

Five Years |

Ten Years |

Since Inception* |

|||||||||||||||

|

Class R Return Before Taxes |

1.91 |

% |

4.02 |

% |

2.39 |

% |

2.40 |

% |

|||||||||||

|

Class R Return After Taxes on Distributions |

1.91 |

% |

3.98 |

% |

2.20 |

% |

1.93 |

% |

|||||||||||

|

Class R Return After Taxes on Distributions and Sale of Fund Shares |

1.13 |

% |

3.10 |

% |

1.77 |

% |

1.67 |

% |

|||||||||||

|

Class I Return Before Taxes |

2.27 |

% |

4.31 |

% |

2.66 |

% |

2.66 |

% |

|||||||||||

|

Class A Return Before Taxes |

-1.35 |

% |

3.37 |

% |

2.07 |

% |

1.98 |

% |

|||||||||||

|

Standard & Poor's 500® Index** |

25.02 |

% |

14.53 |

% |

13.10 |

% |

14.35 |

% |

|||||||||||

|

ICE BofA U.S. 3-Month Treasury Bill Index*** |

5.25 |

% |

2.46 |

% |

1.77 |

% |

1.26 |

% |

|||||||||||

|

Bloomberg U.S. Aggregate Bond Index**** |

1.25 |

% |

-0.33 |

% |

1.35 |

% |

1.95 |

% |

|||||||||||

* The inception date for Class R shares and Class I shares is October 1, 2010 and the inception date for the Class A shares is June 1, 2013. The "Since Inception" returns reflected for the Standard & Poor's 500® Index, the ICE BofA U.S. 3-Month Treasury Bill Index and the Bloomberg U.S. Aggregate Bond Index are based on the inception date for Class R shares.

** Due to new regulatory requirements, effective May 31, 2024, the Standard & Poor's 500® Index became the Fund's broad-based securities market index. The Standard & Poor's 500® Index serves as the Fund's regulatory index and provides a broad measure of market performance. The Standard and Poor's 500® Index, or simply the S&P 500, is a stock market index tracking the performance of 500 large companies listed on stock exchanges in the U.S.

*** The ICE BofA U.S. 3-Month Treasury Bill Index tracks the performance of the U.S. Treasury Bills publicly issued in the U.S. domestic market with a remaining term to final maturity of less than 3 months.

**** The Bloomberg U.S. Aggregate Bond Index is a market value-weighted index of investment grade fixed-rated debt issues, including government, corporate, asset-backed and mortgage-backed securities with a maturity of one year or more.

The indexes are calculated on a total-return basis, are unmanaged and are not available for direct investment. The indexes reflect no deduction for fees, expenses, or taxes. The indexes are not intended to, and do not, parallel the risk or investment style of the Fund's investment strategy.

In calculating the federal income taxes due on redemptions, capital gains taxes resulting from redemptions are subtracted from the redemption proceeds and the tax benefits from capital losses resulting from the redemptions are added to the redemption proceeds. Under certain circumstances, the addition of the tax benefits from capital losses resulting from redemptions may cause the Return After Taxes on Distributions and Sale of Fund Shares to be greater than the Return After Taxes on Distributions or even the Return Before Taxes.

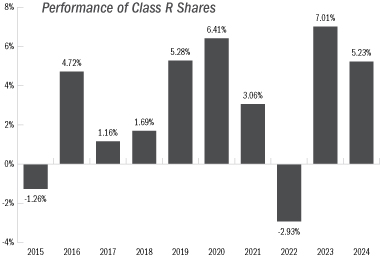

The following information provides some indication of the risks and variability of investing in the Fund by showing how the Fund's performance has varied from year to year and by showing how the Fund's average annual returns for the past one- and five-year and since inception periods compare with those of the Bloomberg U.S. Aggregate Bond Index and the ICE BofA U.S. 3-Month Treasury Bill Index.

The bar chart presents the calendar year total returns of the Fund's Class R Shares before taxes. Returns shown in the bar chart do not reflect sales charges applicable to other share classes, which would reduce performance results. The performance table reflects the performance of the Fund's Class R shares before and after taxes and the Fund's Class I and Class A shares before taxes. How the Fund has performed in the past (before and after taxes) is not necessarily an indication of how the Fund will perform in the future. Performance reflects fee waivers in effect. If fee waivers were not in place, the Fund's performance would be reduced. Updated information on the Fund's performance can be obtained by visiting www.arbitragefunds.com.

|

|

Year-by-Year Annual Total Returns through December 31, 2024 – Class R Shares During the period shown in the bar chart, the highest return for a quarter was 7.81% during the quarter ended June 30, 2020 and the lowest return for a quarter was -5.56% during the quarter ended March 31, 2020. The year-to-date return of the Fund's Class R shares through June 30, 2025 is 2.58%. While the Class I shares and Class A shares would have substantially similar annual returns to the Class R shares because the shares are invested in the same portfolio of securities, the performance of Class I and Class A shares will differ from that shown since the Classes do not have the same expenses or inception dates. |

||||||

During the period shown in the bar chart, the highest return for a quarter was 7.81% during the quarter ended June 30, 2020 and the lowest return for a quarter was -5.56% during the quarter ended March 31, 2020.

The year-to-date return of the Fund's Class R shares through June 30, 2025 is 2.58%.

While the Class I shares and Class A shares would have substantially similar annual returns to the Class R shares because the shares are invested in the same portfolio of securities, the performance of Class I and Class A shares will differ from that shown since the Classes do not have the same expenses or inception dates.

The table below shows the Fund's average annual total returns for Class R shares, Class I shares, and Class A shares compared with those of the Bloomberg U.S. Aggregate Bond Index and the ICE BofA U.S. 3-Month Treasury Bill Index. The returns in the table below reflect the maximum applicable sales charges for the relevant share class. The table also presents the impact of taxes on the returns of the Fund's Class R shares. After-tax returns are shown for Class R shares only, and after-tax returns for Class I and Class A shares will vary. After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns depend on an investor's tax situation and may differ from those shown, and after-tax returns shown are not relevant to investors who hold their Fund shares through tax-deferred arrangements, such as 401(k) plans or individual retirement accounts. Return after taxes on distributions measures the effect of taxable distributions, but assumes the underlying shares are held for the entire period. Return after taxes on distributions and sale of Fund shares shows the effect of both taxable distributions and any taxable gain or loss that would be realized if the underlying shares were purchased at the beginning and sold at the end of the period (for purposes of the calculation, it is assumed that income dividends and capital gain distributions are reinvested at net asset value and that the entire account is redeemed at the end of the period, including reinvested amounts).

|

WATER ISLAND CREDIT OPPORTUNITIES FUND |

One Year |

Five Years |

Ten Years |

Since Inception* |

|||||||||||||||

|

Class R Return Before Taxes |

5.23 |

% |

3.69 |

% |

2.99 |

% |

2.96 |

% |

|||||||||||

|

Class R Return After Taxes on Distributions |

3.32 |

% |

2.23 |

% |

1.70 |

% |

1.65 |

% |

|||||||||||

|

Class R Return After Taxes on Distributions and Sale of Fund Shares |

3.07 |

% |

2.20 |

% |

1.72 |

% |

1.68 |

% |

|||||||||||

|

Class I Return Before Taxes |

5.50 |

% |

3.96 |

% |

3.26 |

% |

3.21 |

% |

|||||||||||

|

Class A Return Before Taxes |

1.77 |

% |

3.03 |

% |

2.65 |

% |

2.63 |

% |

|||||||||||

|

Bloomberg U.S. Aggregate Bond Index** |

1.25 |

% |

-0.33 |

% |

1.35 |

% |

1.43 |

% |

|||||||||||

|

ICE BofA U.S. 3-Month Treasury Bill Index*** |

5.25 |

% |

2.46 |

% |

1.77 |

% |

1.45 |

% |

|||||||||||

* The inception date for Class R shares and Class I shares is October 1, 2012. The inception date for the Class A shares is June 1, 2013. The "Since Inception" returns reflected for the Bloomberg U.S. Aggregate Bond Index and the ICE BofA U.S. 3-Month Treasury Bill Index are based on the inception date for Class R and Class I shares.

** Due to new regulatory requirements, effective May 31, 2024, the Bloomberg U.S. Aggregate Bond Index became the Fund's broad-based securities market index. The Bloomberg U.S. Aggregate Bond Index serves as the Fund's regulatory index and provides a broad measure of market performance. The Bloomberg U.S. Aggregate Bond Index is a market value-weighted index of investment grade fixed-rated debt issues, including government, corporate, asset-backed and mortgage-backed securities with a maturity of one year or more.

*** The ICE BofA U.S. 3-Month Treasury Bill Index is the Fund's additional index. The ICE BofA U.S. 3-Month Treasury Bill Index tracks the performance of the U.S. Treasury Bills publicly issued in the U.S. domestic market with a remaining term to final maturity of less than 3 months.

The indexes are calculated on a total-return basis, are unmanaged and are not available for direct investment. The indexes reflect no deduction for fees, expenses, or taxes. The indexes are not intended to, and do not, parallel the risk or investment style of the Fund's investment strategy.

In calculating the federal income taxes due on redemptions, capital gains taxes resulting from redemptions are subtracted from the redemption proceeds and the tax benefits from capital losses resulting from the redemptions are added to the redemption proceeds. Under certain circumstances, the addition of the tax benefits from capital losses resulting from redemptions may cause the Return After Taxes on Distributions and Sale of Fund Shares to be greater than the Return After Taxes on Distributions or even the Return Before Taxes.