Shareholder Report

|

12 Months Ended |

|

Jul. 31, 2025

USD ($)

$ / shares

|

|---|

| Shareholder Report [Line Items] |

|

|

| Document Type |

N-CSR

|

|

| Amendment Flag |

false

|

|

| Registrant Name |

Putnam

Investment Funds

|

|

| Entity Central Index Key |

0000932101

|

|

| Entity Investment Company Type |

N-1A

|

|

| Document Period End Date |

Jul. 31, 2025

|

|

| Class A |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Putnam

Large Cap Growth Fund

|

|

| Class Name |

Class

A

|

|

| Trading Symbol |

POGAX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This

annual

shareholder report

contains important information about Putnam

Large Cap Growth Fund for the period August

1, 2024, to July 31,

2025.

|

|

| Shareholder Report Annual or Semi-Annual |

annual

shareholder report

|

|

| Additional Information [Text Block] |

You

can find additional information about the Fund at https://www.franklintempleton.com/regulatory-fund-documents.

You can also request this information

by contacting us at (800)

225-1581.

|

|

| Material Fund Change Notice [Text Block] |

This report describes changes

to the Fund that occurred during the reporting period.

|

|

| Additional Information Phone Number |

(800)

225-1581

|

|

| Additional Information Website |

https://www.franklintempleton.com/regulatory-fund-documents

|

|

| Expenses [Text Block] |

WHAT

WERE THE FUND COSTS FOR THE LAST YEAR? (based

on a hypothetical $10,000 investment)

|

|

|

|

Class

Name |

Costs

of a $10,000 investment

|

Costs

paid as a percentage of a $10,000

investment*

|

|

Class

A |

$103

|

0.93%

|

|

[1] |

| Expenses Paid, Amount |

$ 103

|

|

| Expense Ratio, Percent |

0.93%

|

|

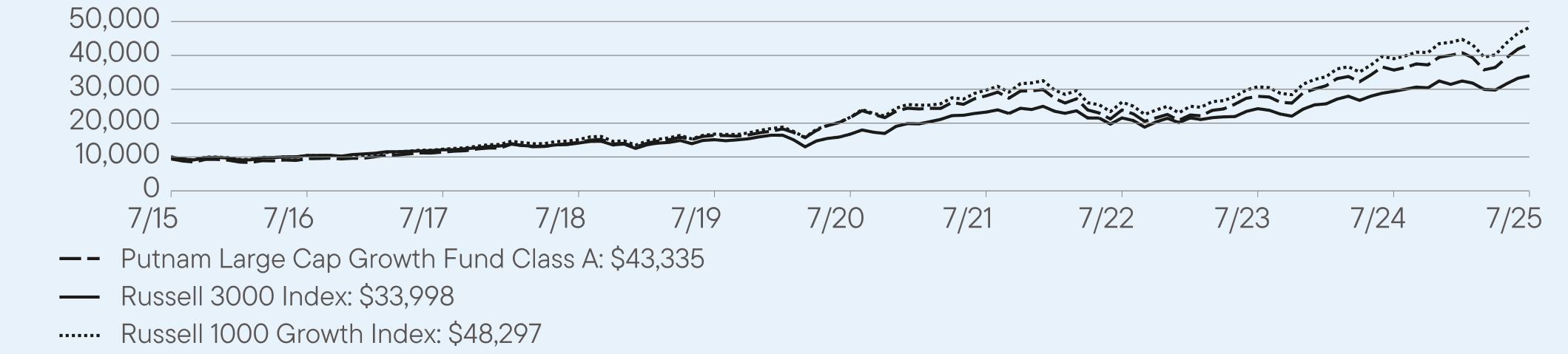

| Factors Affecting Performance [Text Block] |

HOW

DID THE FUND PERFORM LAST YEAR AND WHAT AFFECTED ITS PERFORMANCE?

For the twelve months ended July

31, 2025, Class A shares of

Putnam Large Cap Growth Fund returned 21.47%.

The Fund compares its performance

to the Russell 1000 Growth Index, which returned 23.75% for the same period.

PERFORMANCE

HIGHLIGHTS

|

|

|

Top

contributors to performance: |

|

↑

|

Overweight

position in Broadcom, a semiconductor and software company |

|

↑

|

Not

owning Merck, a pharmaceutical company |

|

↑

|

Overweight

position in Netflix |

|

|

|

Top

detractors from performance: |

|

↓

|

Underweight

exposure to Palantir Technologies |

|

↓

|

Overweight

position in Salesforce, a cloud-based software company |

|

↓

|

Out-of-benchmark

position in Canadian Pacific Kansas City Railway |

|

|

| Performance Past Does Not Indicate Future [Text] |

The

Fund’s past performance is not necessarily an indication of how the Fund will perform in the future.

|

|

| Line Graph [Table Text Block] |

|

|

| Average Annual Return [Table Text Block] |

AVERAGE

ANNUAL TOTAL RETURNS (%) Period

Ended July 31, 2025

|

|

|

|

|

|

1

Year |

5

Year |

10

Year |

|

Class

A |

21.47

|

14.86

|

16.48

|

|

Class

A (with sales charge) |

14.49

|

13.51

|

15.79

|

|

Russell

3000 Index |

15.68

|

15.19

|

13.02

|

|

Russell

1000 Growth Index |

23.75

|

17.27

|

17.06

|

|

|

| No Deduction of Taxes [Text Block] |

The

graph and table do not reflect

the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

|

|

| Material Change Date |

Aug. 01, 2024

|

|

| Updated Performance Information Location [Text Block] |

For current month-end performance,

please call Franklin Templeton at (800)

225-1581 or visit

https://www.franklintempleton.com/investments/options/mutual-funds.

Important data provider notices

and terms available at www.franklintempletondatasources.com.

|

|

| Net Assets |

$ 12,839,766,564

|

|

| Holdings Count | $ / shares |

48

|

[2] |

| Advisory Fees Paid, Amount |

$ 61,100,092

|

|

| Investment Company Portfolio Turnover |

34.00%

|

|

| Additional Fund Statistics [Text Block] |

KEY

FUND STATISTICS (as

of July 31, 2025)

|

|

|

Total

Net Assets |

$12,839,766,564

|

|

Total

Number of Portfolio Holdings*

|

48

|

|

Total

Management Fee Paid |

$61,100,092

|

|

Portfolio

Turnover Rate |

34%

|

|

[2] |

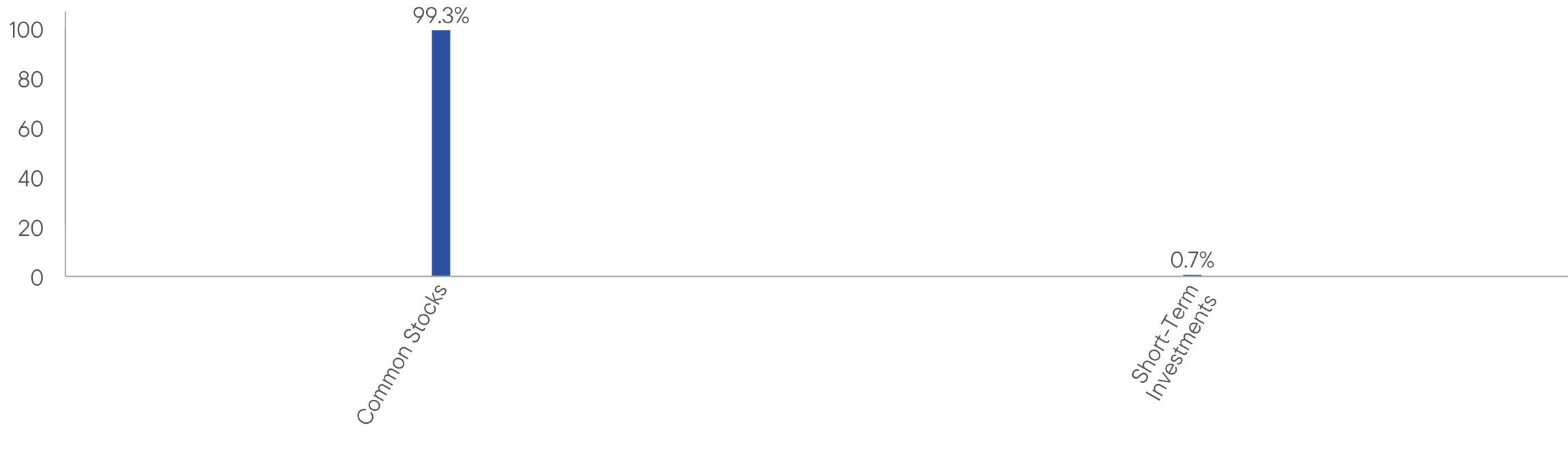

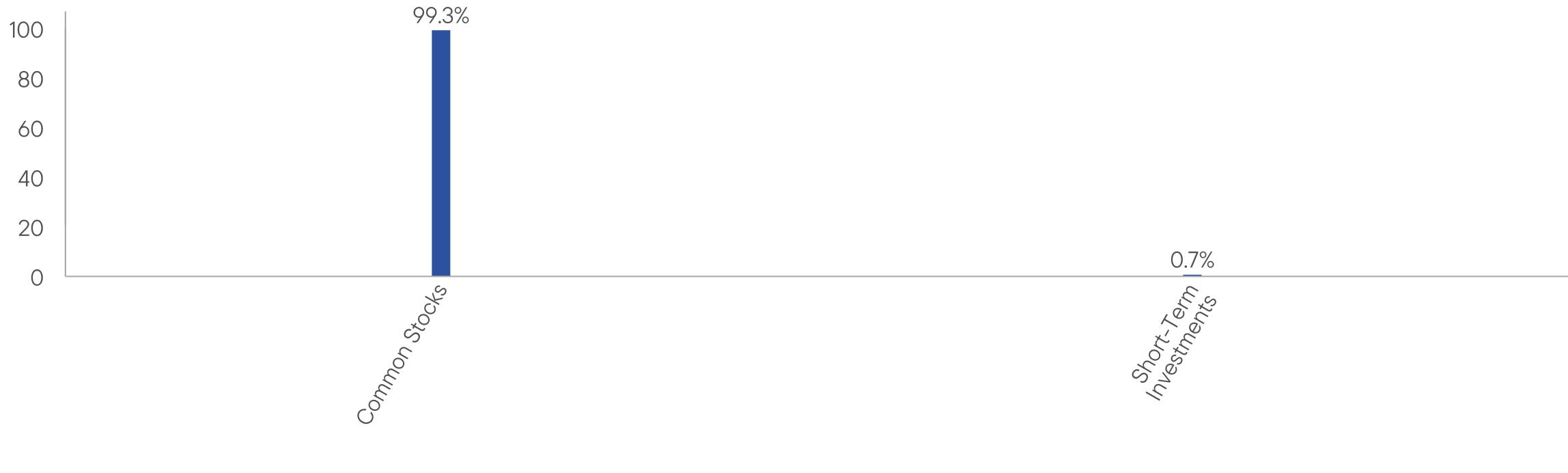

| Holdings [Text Block] |

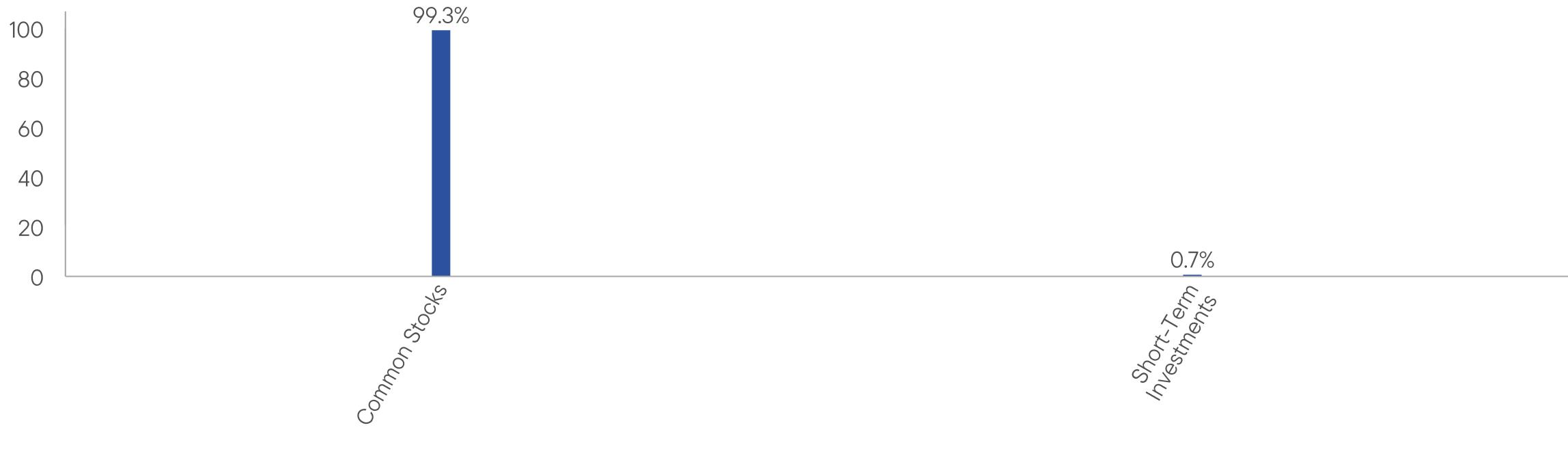

WHAT

DID THE FUND INVEST IN? (as

of July 31, 2025)

Portfolio Composition*

(% of Total Investments)

|

[3] |

| Material Fund Change [Text Block] |

HOW

HAS THE FUND CHANGED?

Effective November 1, 2024 (the

“Effective Date”), Putnam Investments Limited (“PIL”), a sub-advisor of the Fund prior to the Effective Date,

merged with and into Franklin Templeton Investment Management Limited (“FTIML”), a wholly-owned subsidiary of Franklin Resources,

Inc. (the “Merger”). As of the Effective Date, PIL investment professionals became employees of FTIML, and the sub-advisory

agreement between Putnam Investment Management, LLC (“Putnam Management”) and PIL with respect to the Fund was

terminated. In connection with the Merger, the Fund’s Trustees approved a new sub-advisory agreement between Putnam Management

and FTIML, pursuant to which FTIML became a sub-advisor of the Fund on the Effective Date.

Effective September 5, 2024 (the

“Conversion Date”), class B shares of the Fund acquired prior to the Conversion Date converted automatically

to class A shares.

This is a summary of certain

changes to the Fund since August

1, 2024. For

more complete information, you may review the Fund’s current

prospectus and any applicable supplements and the Fund’s next prospectus, which we expect to be available by December

1, 2025, at https://www.franklintempleton.com/regulatory-fund-documents

or upon request at (800)

225-1581 or

funddocuments@putnam.com.

|

|

| Updated Prospectus Phone Number |

(800)

225-1581

|

|

| Updated Prospectus Email Address |

funddocuments@putnam.com

|

|

| Updated Prospectus Web Address |

https://www.franklintempleton.com/regulatory-fund-documents

|

|

| Class C |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Putnam

Large Cap Growth Fund

|

|

| Class Name |

Class

C

|

|

| Trading Symbol |

POGCX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This

annual

shareholder report

contains important information about Putnam

Large Cap Growth Fund for the period August

1, 2024, to July 31,

2025.

|

|

| Shareholder Report Annual or Semi-Annual |

annual

shareholder report

|

|

| Additional Information [Text Block] |

You

can find additional information about the Fund at https://www.franklintempleton.com/regulatory-fund-documents.

You can also request this information

by contacting us at (800)

225-1581.

|

|

| Material Fund Change Notice [Text Block] |

This report describes changes

to the Fund that occurred during the reporting period.

|

|

| Additional Information Phone Number |

(800)

225-1581

|

|

| Additional Information Website |

https://www.franklintempleton.com/regulatory-fund-documents

|

|

| Expenses [Text Block] |

WHAT

WERE THE FUND COSTS FOR THE LAST YEAR? (based

on a hypothetical $10,000 investment)

|

|

|

|

Class

Name |

Costs

of a $10,000 investment

|

Costs

paid as a percentage of a $10,000

investment*

|

|

Class

C |

$186

|

1.69%

|

|

[4] |

| Expenses Paid, Amount |

$ 186

|

|

| Expense Ratio, Percent |

1.69%

|

|

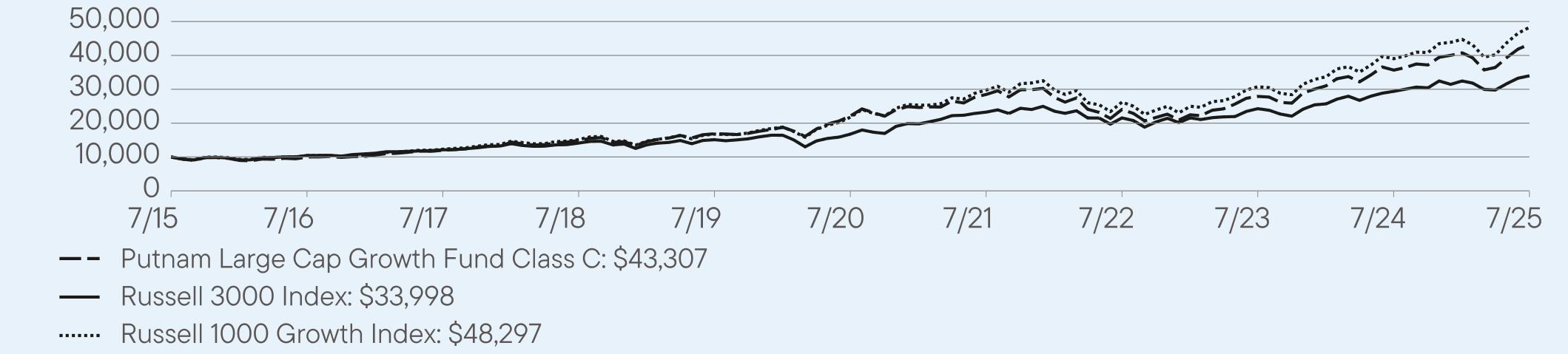

| Factors Affecting Performance [Text Block] |

HOW

DID THE FUND PERFORM LAST YEAR AND WHAT AFFECTED ITS PERFORMANCE?

For the twelve months ended July

31, 2025, Class C shares of

Putnam Large Cap Growth Fund returned 20.56%.

The Fund compares its performance

to the Russell 1000 Growth Index, which returned 23.75% for the same period.

PERFORMANCE

HIGHLIGHTS

|

|

|

Top

contributors to performance: |

|

↑

|

Overweight

position in Broadcom, a semiconductor and software company |

|

↑

|

Not

owning Merck, a pharmaceutical company |

|

↑

|

Overweight

position in Netflix |

|

|

|

Top

detractors from performance: |

|

↓

|

Underweight

exposure to Palantir Technologies |

|

↓

|

Overweight

position in Salesforce, a cloud-based software company |

|

↓

|

Out-of-benchmark

position in Canadian Pacific Kansas City Railway |

|

|

| Performance Past Does Not Indicate Future [Text] |

The

Fund’s past performance is not necessarily an indication of how the Fund will perform in the future.

|

|

| Line Graph [Table Text Block] |

|

|

| Average Annual Return [Table Text Block] |

AVERAGE

ANNUAL TOTAL RETURNS (%) Period

Ended July 31, 2025

|

|

|

|

|

|

1

Year |

5

Year |

10

Year |

|

Class

C |

20.56

|

14.00

|

15.79

|

|

Class

C (with sales charge) |

19.56

|

14.00

|

15.79

|

|

Russell

3000 Index |

15.68

|

15.19

|

13.02

|

|

Russell

1000 Growth Index |

23.75

|

17.27

|

17.06

|

|

|

| No Deduction of Taxes [Text Block] |

The

graph and table do not reflect

the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

|

|

| Material Change Date |

Aug. 01, 2024

|

|

| Updated Performance Information Location [Text Block] |

For current month-end performance,

please call Franklin Templeton at (800)

225-1581 or visit

https://www.franklintempleton.com/investments/options/mutual-funds.

Important data provider notices

and terms available at www.franklintempletondatasources.com.

|

|

| Net Assets |

$ 12,839,766,564

|

|

| Holdings Count | $ / shares |

48

|

[5] |

| Advisory Fees Paid, Amount |

$ 61,100,092

|

|

| Investment Company Portfolio Turnover |

34.00%

|

|

| Additional Fund Statistics [Text Block] |

KEY

FUND STATISTICS (as

of July 31, 2025)

|

|

|

Total

Net Assets |

$12,839,766,564

|

|

Total

Number of Portfolio Holdings*

|

48

|

|

Total

Management Fee Paid |

$61,100,092

|

|

Portfolio

Turnover Rate |

34%

|

|

[5] |

| Holdings [Text Block] |

WHAT

DID THE FUND INVEST IN? (as

of July 31, 2025)

Portfolio Composition*

(% of Total Investments)

|

[6] |

| Material Fund Change [Text Block] |

HOW

HAS THE FUND CHANGED?

Effective November 1, 2024 (the

“Effective Date”), Putnam Investments Limited (“PIL”), a sub-advisor of the Fund prior to the Effective Date,

merged with and into Franklin Templeton Investment Management Limited (“FTIML”), a wholly-owned subsidiary of Franklin Resources,

Inc. (the “Merger”). As of the Effective Date, PIL investment professionals became employees of FTIML, and the sub-advisory

agreement between Putnam Investment Management, LLC (“Putnam Management”) and PIL with respect to the Fund was

terminated. In connection with the Merger, the Fund’s Trustees approved a new sub-advisory agreement between Putnam Management

and FTIML, pursuant to which FTIML became a sub-advisor of the Fund on the Effective Date.

This is a summary of certain

changes to the Fund since August

1, 2024. For

more complete information, you may review the Fund’s current

prospectus and any applicable supplements and the Fund’s next prospectus, which we expect to be available by December

1, 2025, at https://www.franklintempleton.com/regulatory-fund-documents

or upon request at (800)

225-1581 or

funddocuments@putnam.com.

|

|

| Updated Prospectus Phone Number |

(800)

225-1581

|

|

| Updated Prospectus Email Address |

funddocuments@putnam.com

|

|

| Updated Prospectus Web Address |

https://www.franklintempleton.com/regulatory-fund-documents

|

|

| Class R |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Putnam

Large Cap Growth Fund

|

|

| Class Name |

Class

R

|

|

| Trading Symbol |

PGORX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This

annual

shareholder report

contains important information about Putnam

Large Cap Growth Fund for the period August

1, 2024, to July 31,

2025.

|

|

| Shareholder Report Annual or Semi-Annual |

annual

shareholder report

|

|

| Additional Information [Text Block] |

You

can find additional information about the Fund at https://www.franklintempleton.com/regulatory-fund-documents.

You can also request this information

by contacting us at (800)

225-1581.

|

|

| Material Fund Change Notice [Text Block] |

This report describes changes

to the Fund that occurred during the reporting period.

|

|

| Additional Information Phone Number |

(800)

225-1581

|

|

| Additional Information Website |

https://www.franklintempleton.com/regulatory-fund-documents

|

|

| Expenses [Text Block] |

WHAT

WERE THE FUND COSTS FOR THE LAST YEAR? (based

on a hypothetical $10,000 investment)

|

|

|

|

Class

Name |

Costs

of a $10,000 investment

|

Costs

paid as a percentage of a $10,000

investment*

|

|

Class

R |

$132

|

1.19%

|

|

[7] |

| Expenses Paid, Amount |

$ 132

|

|

| Expense Ratio, Percent |

1.19%

|

|

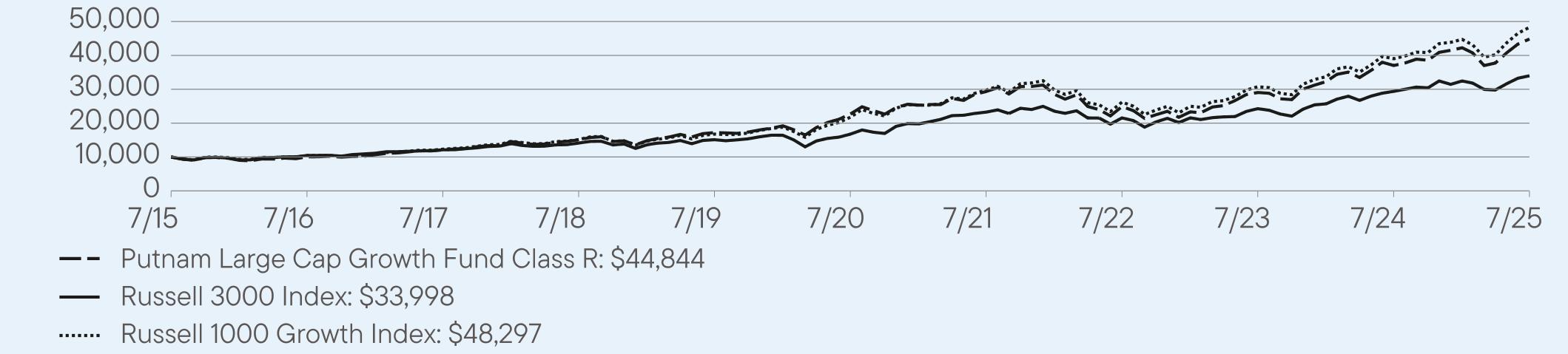

| Factors Affecting Performance [Text Block] |

HOW

DID THE FUND PERFORM LAST YEAR AND WHAT AFFECTED ITS PERFORMANCE?

For the twelve months ended July

31, 2025, Class R shares of

Putnam Large Cap Growth Fund returned 21.15%.

The Fund compares its performance

to the Russell 1000 Growth Index, which returned 23.75% for the same period.

PERFORMANCE

HIGHLIGHTS

|

|

|

Top

contributors to performance: |

|

↑

|

Overweight

position in Broadcom, a semiconductor and software company |

|

↑

|

Not

owning Merck, a pharmaceutical company |

|

↑

|

Overweight

position in Netflix |

|

|

|

Top

detractors from performance: |

|

↓

|

Underweight

exposure to Palantir Technologies |

|

↓

|

Overweight

position in Salesforce, a cloud-based software company |

|

↓

|

Out-of-benchmark

position in Canadian Pacific Kansas City Railway |

|

|

| Performance Past Does Not Indicate Future [Text] |

The

Fund’s past performance is not necessarily an indication of how the Fund will perform in the future.

|

|

| Line Graph [Table Text Block] |

|

|

| Average Annual Return [Table Text Block] |

AVERAGE

ANNUAL TOTAL RETURNS (%) Period

Ended July 31, 2025

|

|

|

|

|

|

1

Year |

5

Year |

10

Year |

|

Class

R |

21.15

|

14.57

|

16.19

|

|

Russell

3000 Index |

15.68

|

15.19

|

13.02

|

|

Russell

1000 Growth Index |

23.75

|

17.27

|

17.06

|

|

|

| No Deduction of Taxes [Text Block] |

The

graph and table do not reflect

the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

|

|

| Material Change Date |

Aug. 01, 2024

|

|

| Updated Performance Information Location [Text Block] |

For current month-end performance,

please call Franklin Templeton at (800)

225-1581 or visit

https://www.franklintempleton.com/investments/options/mutual-funds.

Important data provider notices

and terms available at www.franklintempletondatasources.com.

|

|

| Net Assets |

$ 12,839,766,564

|

|

| Holdings Count | $ / shares |

48

|

[8] |

| Advisory Fees Paid, Amount |

$ 61,100,092

|

|

| Investment Company Portfolio Turnover |

34.00%

|

|

| Additional Fund Statistics [Text Block] |

KEY

FUND STATISTICS (as

of July 31, 2025)

|

|

|

Total

Net Assets |

$12,839,766,564

|

|

Total

Number of Portfolio Holdings*

|

48

|

|

Total

Management Fee Paid |

$61,100,092

|

|

Portfolio

Turnover Rate |

34%

|

|

[8] |

| Holdings [Text Block] |

WHAT

DID THE FUND INVEST IN? (as

of July 31, 2025)

Portfolio Composition*

(% of Total Investments)

|

[9] |

| Material Fund Change [Text Block] |

HOW

HAS THE FUND CHANGED?

Effective November 1, 2024 (the

“Effective Date”), Putnam Investments Limited (“PIL”), a sub-advisor of the Fund prior to the Effective Date,

merged with and into Franklin Templeton Investment Management Limited (“FTIML”), a wholly-owned subsidiary of Franklin Resources,

Inc. (the “Merger”). As of the Effective Date, PIL investment professionals became employees of FTIML, and the sub-advisory

agreement between Putnam Investment Management, LLC (“Putnam Management”) and PIL with respect to the Fund was

terminated. In connection with the Merger, the Fund’s Trustees approved a new sub-advisory agreement between Putnam Management

and FTIML, pursuant to which FTIML became a sub-advisor of the Fund on the Effective Date.

This is a summary of certain

changes to the Fund since August

1, 2024. For

more complete information, you may review the Fund’s current

prospectus and any applicable supplements and the Fund’s next prospectus, which we expect to be available by December

1, 2025, at https://www.franklintempleton.com/regulatory-fund-documents

or upon request at (800)

225-1581 or

funddocuments@putnam.com.

|

|

| Updated Prospectus Phone Number |

(800)

225-1581

|

|

| Updated Prospectus Email Address |

funddocuments@putnam.com

|

|

| Updated Prospectus Web Address |

https://www.franklintempleton.com/regulatory-fund-documents

|

|

| Class R5 |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Putnam

Large Cap Growth Fund

|

|

| Class Name |

Class

R5

|

|

| Trading Symbol |

PGODX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This

annual

shareholder report

contains important information about Putnam

Large Cap Growth Fund for the period August

1, 2024, to July 31,

2025.

|

|

| Shareholder Report Annual or Semi-Annual |

annual

shareholder report

|

|

| Additional Information [Text Block] |

You

can find additional information about the Fund at https://www.franklintempleton.com/regulatory-fund-documents.

You can also request this information

by contacting us at (800)

225-1581.

|

|

| Material Fund Change Notice [Text Block] |

This report describes changes

to the Fund that occurred during the reporting period.

|

|

| Additional Information Phone Number |

(800)

225-1581

|

|

| Additional Information Website |

https://www.franklintempleton.com/regulatory-fund-documents

|

|

| Expenses [Text Block] |

WHAT

WERE THE FUND COSTS FOR THE LAST YEAR? (based

on a hypothetical $10,000 investment)

|

|

|

|

Class

Name |

Costs

of a $10,000 investment

|

Costs

paid as a percentage of a $10,000

investment*

|

|

Class

R5 |

$78

|

0.70%

|

|

[10] |

| Expenses Paid, Amount |

$ 78

|

|

| Expense Ratio, Percent |

0.70%

|

|

| Factors Affecting Performance [Text Block] |

HOW

DID THE FUND PERFORM LAST YEAR AND WHAT AFFECTED ITS PERFORMANCE?

For the twelve months ended July

31, 2025, Class R5 shares of

Putnam Large Cap Growth Fund returned 21.75%.

The Fund compares its performance

to the Russell 1000 Growth Index, which returned 23.75% for the same period.

PERFORMANCE

HIGHLIGHTS

|

|

|

Top

contributors to performance: |

|

↑

|

Overweight

position in Broadcom, a semiconductor and software company |

|

↑

|

Not

owning Merck, a pharmaceutical company |

|

↑

|

Overweight

position in Netflix |

|

|

|

Top

detractors from performance: |

|

↓

|

Underweight

exposure to Palantir Technologies |

|

↓

|

Overweight

position in Salesforce, a cloud-based software company |

|

↓

|

Out-of-benchmark

position in Canadian Pacific Kansas City Railway |

|

|

| Performance Past Does Not Indicate Future [Text] |

The

Fund’s past performance is not necessarily an indication of how the Fund will perform in the future.

|

|

| Average Annual Return [Table Text Block] |

AVERAGE

ANNUAL TOTAL RETURNS (%) Period

Ended July 31, 2025

|

|

|

|

|

|

1

Year |

5

Year |

10

Year |

|

Class

R5 |

21.75

|

15.14

|

16.79

|

|

Russell

3000 Index |

15.68

|

15.19

|

13.02

|

|

Russell

1000 Growth Index |

23.75

|

17.27

|

17.06

|

|

|

| No Deduction of Taxes [Text Block] |

The

graph and table do not reflect

the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

|

|

| Material Change Date |

Aug. 01, 2024

|

|

| Updated Performance Information Location [Text Block] |

For current month-end performance,

please call Franklin Templeton at (800)

225-1581 or visit

https://www.franklintempleton.com/investments/options/mutual-funds.

Important data provider notices

and terms available at www.franklintempletondatasources.com.

|

|

| Net Assets |

$ 12,839,766,564

|

|

| Holdings Count | $ / shares |

48

|

[11] |

| Advisory Fees Paid, Amount |

$ 61,100,092

|

|

| Investment Company Portfolio Turnover |

34.00%

|

|

| Additional Fund Statistics [Text Block] |

KEY

FUND STATISTICS (as

of July 31, 2025)

|

|

|

Total

Net Assets |

$12,839,766,564

|

|

Total

Number of Portfolio Holdings*

|

48

|

|

Total

Management Fee Paid |

$61,100,092

|

|

Portfolio

Turnover Rate |

34%

|

|

[11] |

| Holdings [Text Block] |

WHAT

DID THE FUND INVEST IN? (as

of July 31, 2025)

Portfolio Composition*

(% of Total Investments)

|

[12] |

| Material Fund Change [Text Block] |

HOW

HAS THE FUND CHANGED?

Effective November 1, 2024 (the

“Effective Date”), Putnam Investments Limited (“PIL”), a sub-advisor of the Fund prior to the Effective Date,

merged with and into Franklin Templeton Investment Management Limited (“FTIML”), a wholly-owned subsidiary of Franklin Resources,

Inc. (the “Merger”). As of the Effective Date, PIL investment professionals became employees of FTIML, and the sub-advisory

agreement between Putnam Investment Management, LLC (“Putnam Management”) and PIL with respect to the Fund was

terminated. In connection with the Merger, the Fund’s Trustees approved a new sub-advisory agreement between Putnam Management

and FTIML, pursuant to which FTIML became a sub-advisor of the Fund on the Effective Date.

This is a summary of certain

changes to the Fund since August

1, 2024. For

more complete information, you may review the Fund’s current

prospectus and any applicable supplements and the Fund’s next prospectus, which we expect to be available by December

1, 2025, at https://www.franklintempleton.com/regulatory-fund-documents

or upon request at (800)

225-1581 or

funddocuments@putnam.com.

|

|

| Updated Prospectus Phone Number |

(800)

225-1581

|

|

| Updated Prospectus Email Address |

funddocuments@putnam.com

|

|

| Updated Prospectus Web Address |

https://www.franklintempleton.com/regulatory-fund-documents

|

|

| Class R6 |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Putnam

Large Cap Growth Fund

|

|

| Class Name |

Class

R6

|

|

| Trading Symbol |

PGOEX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This

annual

shareholder report

contains important information about Putnam

Large Cap Growth Fund for the period August

1, 2024, to July 31,

2025.

|

|

| Shareholder Report Annual or Semi-Annual |

annual

shareholder report

|

|

| Additional Information [Text Block] |

You

can find additional information about the Fund at https://www.franklintempleton.com/regulatory-fund-documents.

You can also request this information

by contacting us at (800)

225-1581.

|

|

| Material Fund Change Notice [Text Block] |

This report describes changes

to the Fund that occurred during the reporting period.

|

|

| Additional Information Phone Number |

(800)

225-1581

|

|

| Additional Information Website |

https://www.franklintempleton.com/regulatory-fund-documents

|

|

| Expenses [Text Block] |

WHAT

WERE THE FUND COSTS FOR THE LAST YEAR? (based

on a hypothetical $10,000 investment)

|

|

|

|

Class

Name |

Costs

of a $10,000 investment

|

Costs

paid as a percentage of a $10,000

investment*

|

|

Class

R6 |

$67

|

0.60%

|

|

[13] |

| Expenses Paid, Amount |

$ 67

|

|

| Expense Ratio, Percent |

0.60%

|

|

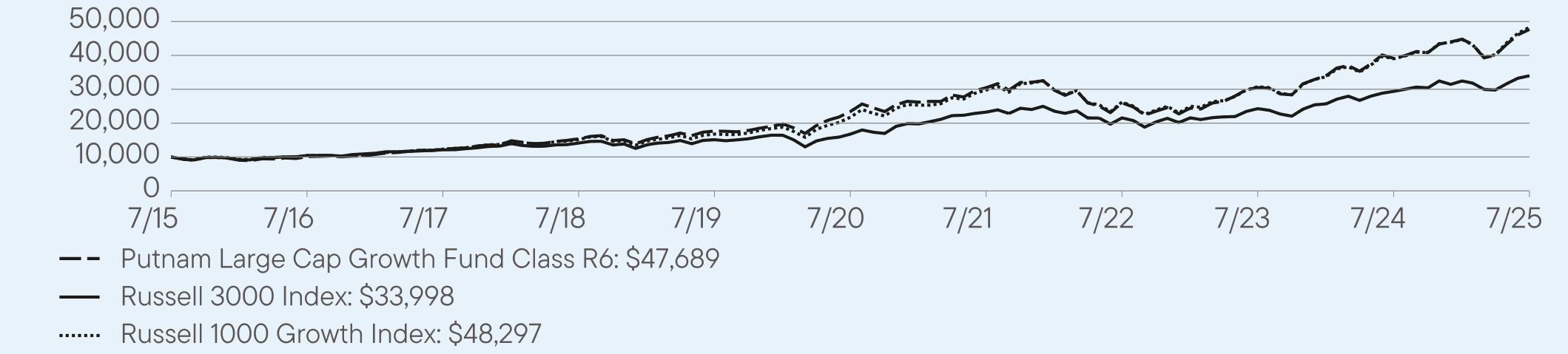

| Factors Affecting Performance [Text Block] |

HOW

DID THE FUND PERFORM LAST YEAR AND WHAT AFFECTED ITS PERFORMANCE?

For the twelve months ended July

31, 2025, Class R6 shares of

Putnam Large Cap Growth Fund returned 21.88%.

The Fund compares its performance

to the Russell 1000 Growth Index, which returned 23.75% for the same period.

PERFORMANCE

HIGHLIGHTS

|

|

|

Top

contributors to performance: |

|

↑

|

Overweight

position in Broadcom, a semiconductor and software company |

|

↑

|

Not

owning Merck, a pharmaceutical company |

|

↑

|

Overweight

position in Netflix |

|

|

|

Top

detractors from performance: |

|

↓

|

Underweight

exposure to Palantir Technologies |

|

↓

|

Overweight

position in Salesforce, a cloud-based software company |

|

↓

|

Out-of-benchmark

position in Canadian Pacific Kansas City Railway |

|

|

| Performance Past Does Not Indicate Future [Text] |

The

Fund’s past performance is not necessarily an indication of how the Fund will perform in the future.

|

|

| Line Graph [Table Text Block] |

|

|

| Average Annual Return [Table Text Block] |

AVERAGE

ANNUAL TOTAL RETURNS (%) Period

Ended July 31, 2025

|

|

|

|

|

|

1

Year |

5

Year |

10

Year |

|

Class

R6 |

21.88

|

15.25

|

16.91

|

|

Russell

3000 Index |

15.68

|

15.19

|

13.02

|

|

Russell

1000 Growth Index |

23.75

|

17.27

|

17.06

|

|

|

| No Deduction of Taxes [Text Block] |

The

graph and table do not reflect

the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

|

|

| Material Change Date |

Aug. 01, 2024

|

|

| Updated Performance Information Location [Text Block] |

For current month-end performance,

please call Franklin Templeton at (800)

225-1581 or visit

https://www.franklintempleton.com/investments/options/mutual-funds.

Important data provider notices

and terms available at www.franklintempletondatasources.com.

|

|

| Net Assets |

$ 12,839,766,564

|

|

| Holdings Count | $ / shares |

48

|

[14] |

| Advisory Fees Paid, Amount |

$ 61,100,092

|

|

| Investment Company Portfolio Turnover |

34.00%

|

|

| Additional Fund Statistics [Text Block] |

KEY

FUND STATISTICS (as

of July 31, 2025)

|

|

|

Total

Net Assets |

$12,839,766,564

|

|

Total

Number of Portfolio Holdings*

|

48

|

|

Total

Management Fee Paid |

$61,100,092

|

|

Portfolio

Turnover Rate |

34%

|

|

[14] |

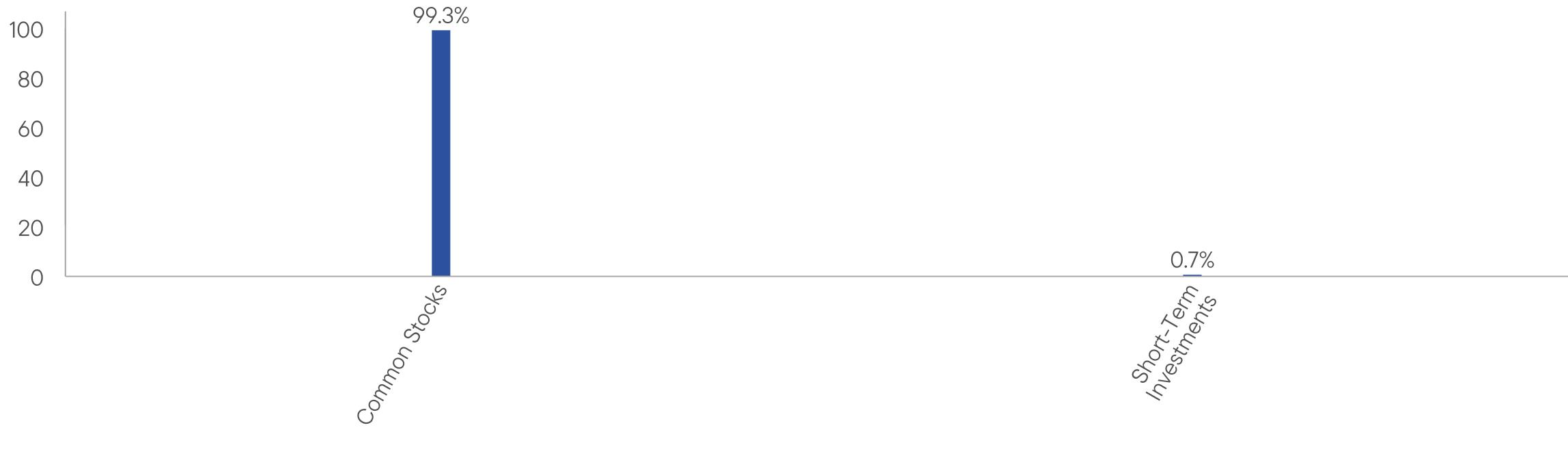

| Holdings [Text Block] |

WHAT

DID THE FUND INVEST IN? (as

of July 31, 2025)

Portfolio Composition*

(% of Total Investments)

|

[15] |

| Material Fund Change [Text Block] |

HOW

HAS THE FUND CHANGED?

Effective November 1, 2024 (the

“Effective Date”), Putnam Investments Limited (“PIL”), a sub-advisor of the Fund prior to the Effective Date,

merged with and into Franklin Templeton Investment Management Limited (“FTIML”), a wholly-owned subsidiary of Franklin Resources,

Inc. (the “Merger”). As of the Effective Date, PIL investment professionals became employees of FTIML, and the sub-advisory

agreement between Putnam Investment Management, LLC (“Putnam Management”) and PIL with respect to the Fund was

terminated. In connection with the Merger, the Fund’s Trustees approved a new sub-advisory agreement between Putnam Management

and FTIML, pursuant to which FTIML became a sub-advisor of the Fund on the Effective Date.

This is a summary of certain

changes to the Fund since August

1, 2024. For

more complete information, you may review the Fund’s current

prospectus and any applicable supplements and the Fund’s next prospectus, which we expect to be available by December

1, 2025, at https://www.franklintempleton.com/regulatory-fund-documents

or upon request at (800)

225-1581 or

funddocuments@putnam.com.

|

|

| Updated Prospectus Phone Number |

(800)

225-1581

|

|

| Updated Prospectus Email Address |

funddocuments@putnam.com

|

|

| Updated Prospectus Web Address |

https://www.franklintempleton.com/regulatory-fund-documents

|

|

| Class Y |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Putnam

Large Cap Growth Fund

|

|

| Class Name |

Class

Y

|

|

| Trading Symbol |

PGOYX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This

annual

shareholder report

contains important information about Putnam

Large Cap Growth Fund for the period August

1, 2024, to July 31,

2025.

|

|

| Shareholder Report Annual or Semi-Annual |

annual

shareholder report

|

|

| Additional Information [Text Block] |

You

can find additional information about the Fund at https://www.franklintempleton.com/regulatory-fund-documents.

You can also request this information

by contacting us at (800)

225-1581.

|

|

| Material Fund Change Notice [Text Block] |

This report describes changes

to the Fund that occurred during the reporting period.

|

|

| Additional Information Phone Number |

(800)

225-1581

|

|

| Additional Information Website |

https://www.franklintempleton.com/regulatory-fund-documents

|

|

| Expenses [Text Block] |

WHAT

WERE THE FUND COSTS FOR THE LAST YEAR? (based

on a hypothetical $10,000 investment)

|

|

|

|

Class

Name |

Costs

of a $10,000 investment

|

Costs

paid as a percentage of a $10,000

investment*

|

|

Class

Y |

$75

|

0.68%

|

|

[16] |

| Expenses Paid, Amount |

$ 75

|

|

| Expense Ratio, Percent |

0.68%

|

|

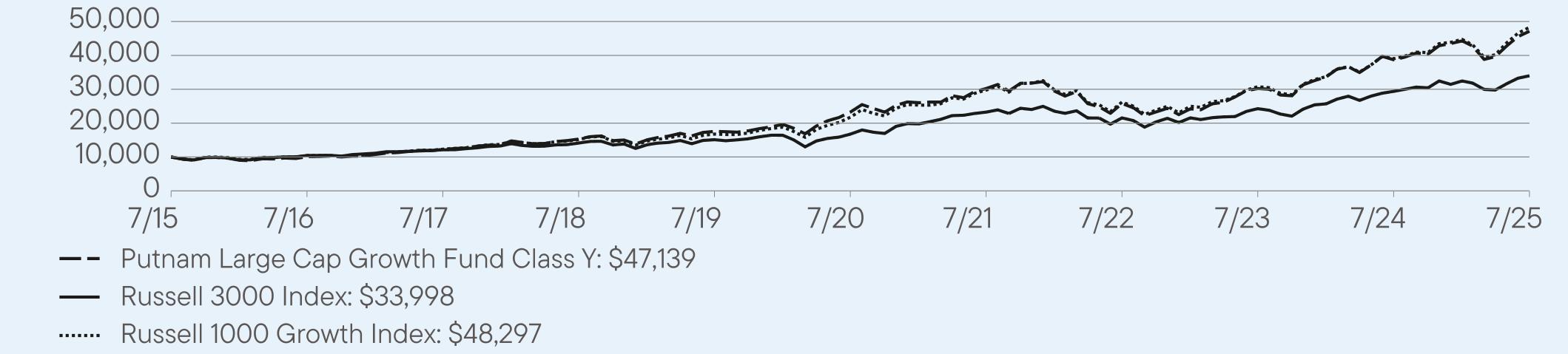

| Factors Affecting Performance [Text Block] |

HOW

DID THE FUND PERFORM LAST YEAR AND WHAT AFFECTED ITS PERFORMANCE?

For the twelve months ended July

31, 2025, Class Y shares of

Putnam Large Cap Growth Fund returned 21.77%.

The Fund compares its performance

to the Russell 1000 Growth Index, which returned 23.75% for the same period.

PERFORMANCE

HIGHLIGHTS

|

|

|

Top

contributors to performance: |

|

↑

|

Overweight

position in Broadcom, a semiconductor and software company |

|

↑

|

Not

owning Merck, a pharmaceutical company |

|

↑

|

Overweight

position in Netflix |

|

|

|

Top

detractors from performance: |

|

↓

|

Underweight

exposure to Palantir Technologies |

|

↓

|

Overweight

position in Salesforce, a cloud-based software company |

|

↓

|

Out-of-benchmark

position in Canadian Pacific Kansas City Railway |

|

|

| Performance Past Does Not Indicate Future [Text] |

The

Fund’s past performance is not necessarily an indication of how the Fund will perform in the future.

|

|

| Line Graph [Table Text Block] |

|

|

| Average Annual Return [Table Text Block] |

AVERAGE

ANNUAL TOTAL RETURNS (%) Period

Ended July 31, 2025

|

|

|

|

|

|

1

Year |

5

Year |

10

Year |

|

Class

Y |

21.77

|

15.15

|

16.77

|

|

Russell

3000 Index |

15.68

|

15.19

|

13.02

|

|

Russell

1000 Growth Index |

23.75

|

17.27

|

17.06

|

|

|

| No Deduction of Taxes [Text Block] |

The

graph and table do not reflect

the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

|

|

| Material Change Date |

Aug. 01, 2024

|

|

| Updated Performance Information Location [Text Block] |

For current month-end performance,

please call Franklin Templeton at (800)

225-1581 or visit

https://www.franklintempleton.com/investments/options/mutual-funds.

Important data provider notices

and terms available at www.franklintempletondatasources.com.

|

|

| Net Assets |

$ 12,839,766,564

|

|

| Holdings Count | $ / shares |

48

|

[17] |

| Advisory Fees Paid, Amount |

$ 61,100,092

|

|

| Investment Company Portfolio Turnover |

34.00%

|

|

| Additional Fund Statistics [Text Block] |

KEY

FUND STATISTICS (as

of July 31, 2025)

|

|

|

Total

Net Assets |

$12,839,766,564

|

|

Total

Number of Portfolio Holdings*

|

48

|

|

Total

Management Fee Paid |

$61,100,092

|

|

Portfolio

Turnover Rate |

34%

|

|

[17] |

| Holdings [Text Block] |

WHAT

DID THE FUND INVEST IN? (as

of July 31, 2025)

Portfolio Composition*

(% of Total Investments)

|

[18] |

| Material Fund Change [Text Block] |

HOW

HAS THE FUND CHANGED?

Effective November 1, 2024 (the

“Effective Date”), Putnam Investments Limited (“PIL”), a sub-advisor of the Fund prior to the Effective Date,

merged with and into Franklin Templeton Investment Management Limited (“FTIML”), a wholly-owned subsidiary of Franklin Resources,

Inc. (the “Merger”). As of the Effective Date, PIL investment professionals became employees of FTIML, and the sub-advisory

agreement between Putnam Investment Management, LLC (“Putnam Management”) and PIL with respect to the Fund was

terminated. In connection with the Merger, the Fund’s Trustees approved a new sub-advisory agreement between Putnam Management

and FTIML, pursuant to which FTIML became a sub-advisor of the Fund on the Effective Date.

This is a summary of certain

changes to the Fund since August

1, 2024. For

more complete information, you may review the Fund’s current

prospectus and any applicable supplements and the Fund’s next prospectus, which we expect to be available by December

1, 2025, at https://www.franklintempleton.com/regulatory-fund-documents

or upon request at (800)

225-1581 or

funddocuments@putnam.com.

|

|

| Updated Prospectus Phone Number |

(800)

225-1581

|

|

| Updated Prospectus Email Address |

funddocuments@putnam.com

|

|

| Updated Prospectus Web Address |

https://www.franklintempleton.com/regulatory-fund-documents

|

|

|

|