Shareholder Report

|

12 Months Ended |

|

Jul. 31, 2025

USD ($)

Holding

|

|---|

| Shareholder Report [Line Items] |

|

|

| Document Type |

N-CSR

|

|

| Amendment Flag |

false

|

|

| Registrant Name |

MFS SERIES TRUST X

|

|

| Entity Central Index Key |

0000783740

|

|

| Entity Investment Company Type |

N-1A

|

|

| Document Period End Date |

Jul. 31, 2025

|

|

| C000034483 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

MFS® Emerging MarketsDebt Fund

|

|

| Class Name |

Class R6

|

|

| Trading Symbol |

MEDHX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about MFS Emerging Markets Debt Fund for the period of August 1, 2024 to July 31, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the fund at funds.mfs.com. You can also request this information by contacting us at 1‑800‑225‑2606 or by sending an e-mail request to orderliterature@mfs.com.

|

|

| Additional Information Phone Number |

1‑800‑225‑2606

|

|

| Additional Information Email |

orderliterature@mfs.com

|

|

| Additional Information Website |

funds.mfs.com

|

|

| Expenses [Text Block] |

FUND EXPENSES

What were the fund costs for the last year?

| (based on a hypothetical $10,000 investment) |

|

|

| Class Name |

Costs of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment |

| R6 |

$74 |

0.71% |

|

|

| Expenses Paid, Amount |

$ 74

|

|

| Expense Ratio, Percent |

0.71%

|

|

| Factors Affecting Performance [Text Block] |

MANAGEMENT'S DISCUSSION OF FUND PERFORMANCE

-

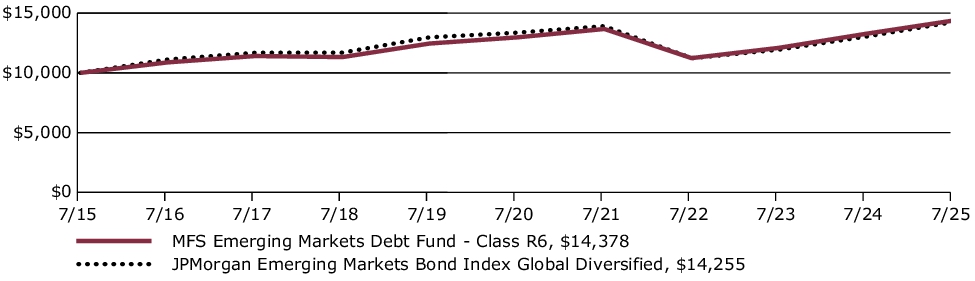

For the twelve months ended July 31, 2025, Class R6 shares of the MFS Emerging Markets Debt Fund (fund) provided a total return of 8.35%, at net asset value. This compares with a return of 9.32% for the fund’s benchmark, the JPMorgan Emerging Markets Bond Index Global Diversified.

-

Global equity markets reached record levels during the period withstanding considerable volatility amid tariffs, geopolitical conflict and high levels of uncertainty. In the US, a pro-growth tax and spending bill was signed into law while in Europe, renewed focus on defense and infrastructure spending brightened the outlook.

-

Market volatility rose toward the end of the period amid a volatile US policymaking environment as the Trump administration spent much of the April-July period finetuning its tariff strategy. Negotiations with China made progress with both sides easing export restrictions on strategic goods that cannot yet be produced domestically.

-

Moderating inflation pressures allowed many global central banks to ease monetary policy during the period. Amid a difficult policymaking environment and slower job growth, the Federal Reserve stayed on the sidelines, awaiting greater clarity on the impact of tariffs.

-

In fixed income markets, global bond yields initially declined but later rose to levels similar to the start of the reporting year. Credit spreads generally narrowed and stayed near historical lows, despite a brief widening in April and May due to tariff concerns. US bond market volatility, measured by the Merrill Lynch Option Volatility Estimate (MOVE) Index, ended near session lows after rising around the US election and trade war.

|

|

| Performance Past Does Not Indicate Future [Text] |

The fund’s past performance is not a good predictor of the fund’s future performance.

|

|

| Line Graph [Table Text Block] |

FUND PERFORMANCE

The fund’s past performance is not a good predictor of the fund’s future performance. The graph and table below do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The graph and table below assume reinvestment of dividends and capital gain distributions.

Growth of a Hypothetical $10,000 Investment

This graph shows the performance of a hypothetical $10,000 investment in Class R6 over a ten year period or since inception, if shorter, in comparison to a broad measure of market performance.

|

|

| Average Annual Return [Table Text Block] |

Average Annual Total Returns through 7/31/25

This table shows the average annual total returns of the class of shares noted for the periods shown, both with (if any) and without sales charges. It also shows the average annual total returns of a broad measure of market performance over the same periods.

| Share Class |

1-yr |

5-yr |

10-yr |

| R6 without sales charge |

8.35% |

2.09% |

3.70% |

| Comparative Benchmark(s) |

|

|

|

| JPMorgan Emerging Markets Bond Index Global Diversified ∆ |

9.32% |

1.31% |

3.61% |

|

∆

|

Source: FactSet Research Systems Inc.

|

|

|

| No Deduction of Taxes [Text Block] |

The graph and table below do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

|

|

| Updated Performance Information Location [Text Block] |

Visit mfs.com/perf/r6 for more recent performance information.

|

|

| Net Assets |

$ 7,388,571,766

|

|

| Holdings Count | Holding |

456

|

|

| Advisory Fees Paid, Amount |

$ 47,779,638

|

[1] |

| Investment Company Portfolio Turnover |

69.00%

|

|

| Additional Fund Statistics [Text Block] |

FUND STATISTICS AS OF 7/31/25

| Net Assets ($): |

7,388,571,766 |

|

Average Effective Maturity (yrs): |

9.6 |

| Total Number of Holdings: |

456 |

|

Average Effective Duration (yrs): |

6.2 |

| Total Management Fee ($)#: |

47,779,638 |

|

|

|

| Portfolio Turnover Rate (%): |

69 |

|

|

|

# Includes the effect of any management fee waivers, if applicable.

Where the fund holds derivatives, they are not included in the total number of portfolio holdings.

|

|

| Holdings [Text Block] |

PORTFOLIO COMPOSITION (BASED ON TOTAL INVESTMENTS AS OF 7/31/25)

Portfolio structure

| Fixed Income |

95.9% |

| Money Market Funds |

4.1% |

Issuer country weightings

| United States |

8.5% |

| Mexico |

5.5% |

| India |

4.6% |

| Chile |

3.8% |

| Romania |

3.7% |

| Turkey |

3.5% |

| Hungary |

3.2% |

| Saudi Arabia |

3.0% |

| United Arab Emirates |

2.8% |

| Other Countries |

61.4% |

Composition including fixed income credit quality

| AA |

2.4% |

| A |

11.0% |

| BBB |

28.3% |

| BB |

30.4% |

| B |

11.5% |

| CCC |

6.8% |

| C |

0.3% |

| D |

0.2% |

| U.S. Government |

4.3% |

| Not Rated |

0.7% |

| Money Market Funds |

4.1% |

Ratings are assigned using Moody’s, Fitch, and Standard & Poor’s and applying a hierarchy: If all 3 agencies rate a security, the middle rating is assigned; if 2 agencies rate a security, the lower rating is assigned. If none of the 3 agencies rate a security, we use DBRS Morningstar. If none of the 4 agencies rate a security, we use Kroll Bond Rating Agency. Ratings are shown in the S&P and Fitch scale (e.g., AAA). All ratings are subject to change.

|

|

| Credit Ratings Selection [Text Block] |

Ratings are assigned using Moody’s, Fitch, and Standard & Poor’s and applying a hierarchy: If all 3 agencies rate a security, the middle rating is assigned; if 2 agencies rate a security, the lower rating is assigned. If none of the 3 agencies rate a security, we use DBRS Morningstar. If none of the 4 agencies rate a security, we use Kroll Bond Rating Agency. Ratings are shown in the S&P and Fitch scale (e.g., AAA). All ratings are subject to change.

|

|

| C000074227 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

MFS® Emerging MarketsDebt Fund

|

|

| Class Name |

Class R4

|

|

| Trading Symbol |

MEDGX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about MFS Emerging Markets Debt Fund for the period of August 1, 2024 to July 31, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the fund at funds.mfs.com. You can also request this information by contacting us at 1‑800‑225‑2606 or by sending an e-mail request to orderliterature@mfs.com.

|

|

| Additional Information Phone Number |

1‑800‑225‑2606

|

|

| Additional Information Email |

orderliterature@mfs.com

|

|

| Additional Information Website |

funds.mfs.com

|

|

| Expenses [Text Block] |

FUND EXPENSES

What were the fund costs for the last year?

| (based on a hypothetical $10,000 investment) |

|

|

| Class Name |

Costs of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment |

| R4 |

$85 |

0.82% |

|

|

| Expenses Paid, Amount |

$ 85

|

|

| Expense Ratio, Percent |

0.82%

|

|

| Factors Affecting Performance [Text Block] |

MANAGEMENT'S DISCUSSION OF FUND PERFORMANCE

-

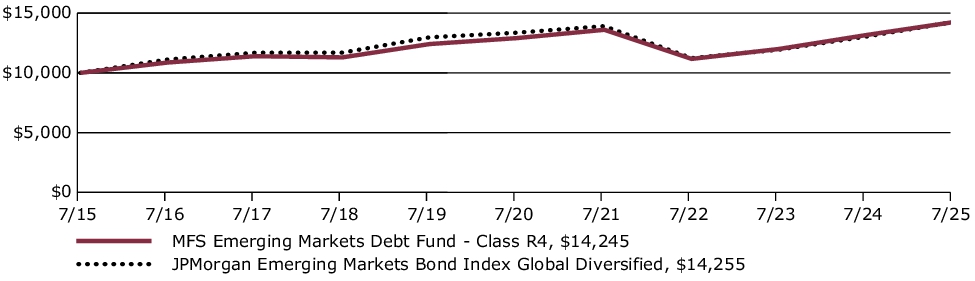

For the twelve months ended July 31, 2025, Class R4 shares of the MFS Emerging Markets Debt Fund (fund) provided a total return of 8.23%, at net asset value. This compares with a return of 9.32% for the fund’s benchmark, the JPMorgan Emerging Markets Bond Index Global Diversified.

-

Global equity markets reached record levels during the period withstanding considerable volatility amid tariffs, geopolitical conflict and high levels of uncertainty. In the US, a pro-growth tax and spending bill was signed into law while in Europe, renewed focus on defense and infrastructure spending brightened the outlook.

-

Market volatility rose toward the end of the period amid a volatile US policymaking environment as the Trump administration spent much of the April-July period finetuning its tariff strategy. Negotiations with China made progress with both sides easing export restrictions on strategic goods that cannot yet be produced domestically.

-

Moderating inflation pressures allowed many global central banks to ease monetary policy during the period. Amid a difficult policymaking environment and slower job growth, the Federal Reserve stayed on the sidelines, awaiting greater clarity on the impact of tariffs.

-

In fixed income markets, global bond yields initially declined but later rose to levels similar to the start of the reporting year. Credit spreads generally narrowed and stayed near historical lows, despite a brief widening in April and May due to tariff concerns. US bond market volatility, measured by the Merrill Lynch Option Volatility Estimate (MOVE) Index, ended near session lows after rising around the US election and trade war.

|

|

| Performance Past Does Not Indicate Future [Text] |

The fund’s past performance is not a good predictor of the fund’s future performance.

|

|

| Line Graph [Table Text Block] |

FUND PERFORMANCE

The fund’s past performance is not a good predictor of the fund’s future performance. The graph and table below do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The graph and table below assume reinvestment of dividends and capital gain distributions.

Growth of a Hypothetical $10,000 Investment

This graph shows the performance of a hypothetical $10,000 investment in Class R4 over a ten year period or since inception, if shorter, in comparison to a broad measure of market performance.

|

|

| Average Annual Return [Table Text Block] |

Average Annual Total Returns through 7/31/25

This table shows the average annual total returns of the class of shares noted for the periods shown, both with (if any) and without sales charges. It also shows the average annual total returns of a broad measure of market performance over the same periods.

| Share Class |

1-yr |

5-yr |

10-yr |

| R4 without sales charge |

8.23% |

1.99% |

3.60% |

| Comparative Benchmark(s) |

|

|

|

| JPMorgan Emerging Markets Bond Index Global Diversified ∆ |

9.32% |

1.31% |

3.61% |

|

∆

|

Source: FactSet Research Systems Inc.

|

|

|

| No Deduction of Taxes [Text Block] |

The graph and table below do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

|

|

| Updated Performance Information Location [Text Block] |

Visit mfs.com/perf/r4 for more recent performance information.

|

|

| Net Assets |

$ 7,388,571,766

|

|

| Holdings Count | Holding |

456

|

|

| Advisory Fees Paid, Amount |

$ 47,779,638

|

[2] |

| Investment Company Portfolio Turnover |

69.00%

|

|

| Additional Fund Statistics [Text Block] |

FUND STATISTICS AS OF 7/31/25

| Net Assets ($): |

7,388,571,766 |

|

Average Effective Maturity (yrs): |

9.6 |

| Total Number of Holdings: |

456 |

|

Average Effective Duration (yrs): |

6.2 |

| Total Management Fee ($)#: |

47,779,638 |

|

|

|

| Portfolio Turnover Rate (%): |

69 |

|

|

|

# Includes the effect of any management fee waivers, if applicable.

Where the fund holds derivatives, they are not included in the total number of portfolio holdings.

|

|

| Holdings [Text Block] |

PORTFOLIO COMPOSITION (BASED ON TOTAL INVESTMENTS AS OF 7/31/25)

Portfolio structure

| Fixed Income |

95.9% |

| Money Market Funds |

4.1% |

Issuer country weightings

| United States |

8.5% |

| Mexico |

5.5% |

| India |

4.6% |

| Chile |

3.8% |

| Romania |

3.7% |

| Turkey |

3.5% |

| Hungary |

3.2% |

| Saudi Arabia |

3.0% |

| United Arab Emirates |

2.8% |

| Other Countries |

61.4% |

Composition including fixed income credit quality

| AA |

2.4% |

| A |

11.0% |

| BBB |

28.3% |

| BB |

30.4% |

| B |

11.5% |

| CCC |

6.8% |

| C |

0.3% |

| D |

0.2% |

| U.S. Government |

4.3% |

| Not Rated |

0.7% |

| Money Market Funds |

4.1% |

Ratings are assigned using Moody’s, Fitch, and Standard & Poor’s and applying a hierarchy: If all 3 agencies rate a security, the middle rating is assigned; if 2 agencies rate a security, the lower rating is assigned. If none of the 3 agencies rate a security, we use DBRS Morningstar. If none of the 4 agencies rate a security, we use Kroll Bond Rating Agency. Ratings are shown in the S&P and Fitch scale (e.g., AAA). All ratings are subject to change.

|

|

| Credit Ratings Selection [Text Block] |

Ratings are assigned using Moody’s, Fitch, and Standard & Poor’s and applying a hierarchy: If all 3 agencies rate a security, the middle rating is assigned; if 2 agencies rate a security, the lower rating is assigned. If none of the 3 agencies rate a security, we use DBRS Morningstar. If none of the 4 agencies rate a security, we use Kroll Bond Rating Agency. Ratings are shown in the S&P and Fitch scale (e.g., AAA). All ratings are subject to change.

|

|

| C000074226 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

MFS® Emerging MarketsDebt Fund

|

|

| Class Name |

Class R3

|

|

| Trading Symbol |

MEDFX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about MFS Emerging Markets Debt Fund for the period of August 1, 2024 to July 31, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the fund at funds.mfs.com. You can also request this information by contacting us at 1‑800‑225‑2606 or by sending an e-mail request to orderliterature@mfs.com.

|

|

| Additional Information Phone Number |

1‑800‑225‑2606

|

|

| Additional Information Email |

orderliterature@mfs.com

|

|

| Additional Information Website |

funds.mfs.com

|

|

| Expenses [Text Block] |

FUND EXPENSES

What were the fund costs for the last year?

| (based on a hypothetical $10,000 investment) |

|

|

| Class Name |

Costs of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment |

| R3 |

$111 |

1.07% |

|

|

| Expenses Paid, Amount |

$ 111

|

|

| Expense Ratio, Percent |

1.07%

|

|

| Factors Affecting Performance [Text Block] |

MANAGEMENT'S DISCUSSION OF FUND PERFORMANCE

-

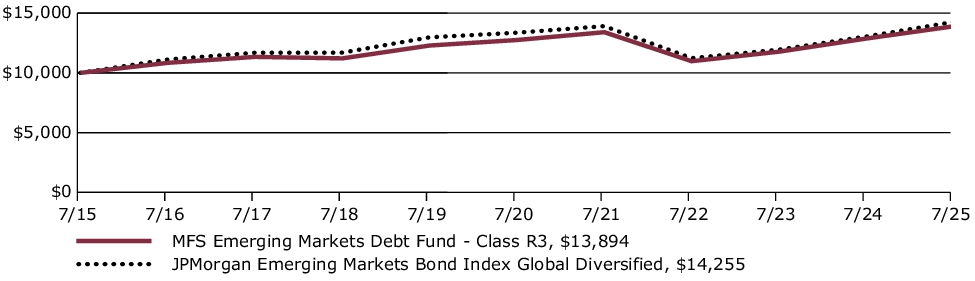

For the twelve months ended July 31, 2025, Class R3 shares of the MFS Emerging Markets Debt Fund (fund) provided a total return of 7.96%, at net asset value. This compares with a return of 9.32% for the fund’s benchmark, the JPMorgan Emerging Markets Bond Index Global Diversified.

-

Global equity markets reached record levels during the period withstanding considerable volatility amid tariffs, geopolitical conflict and high levels of uncertainty. In the US, a pro-growth tax and spending bill was signed into law while in Europe, renewed focus on defense and infrastructure spending brightened the outlook.

-

Market volatility rose toward the end of the period amid a volatile US policymaking environment as the Trump administration spent much of the April-July period finetuning its tariff strategy. Negotiations with China made progress with both sides easing export restrictions on strategic goods that cannot yet be produced domestically.

-

Moderating inflation pressures allowed many global central banks to ease monetary policy during the period. Amid a difficult policymaking environment and slower job growth, the Federal Reserve stayed on the sidelines, awaiting greater clarity on the impact of tariffs.

-

In fixed income markets, global bond yields initially declined but later rose to levels similar to the start of the reporting year. Credit spreads generally narrowed and stayed near historical lows, despite a brief widening in April and May due to tariff concerns. US bond market volatility, measured by the Merrill Lynch Option Volatility Estimate (MOVE) Index, ended near session lows after rising around the US election and trade war.

|

|

| Performance Past Does Not Indicate Future [Text] |

The fund’s past performance is not a good predictor of the fund’s future performance.

|

|

| Line Graph [Table Text Block] |

FUND PERFORMANCE

The fund’s past performance is not a good predictor of the fund’s future performance. The graph and table below do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The graph and table below assume reinvestment of dividends and capital gain distributions.

Growth of a Hypothetical $10,000 Investment

This graph shows the performance of a hypothetical $10,000 investment in Class R3 over a ten year period or since inception, if shorter, in comparison to a broad measure of market performance.

|

|

| Average Annual Return [Table Text Block] |

Average Annual Total Returns through 7/31/25

This table shows the average annual total returns of the class of shares noted for the periods shown, both with (if any) and without sales charges. It also shows the average annual total returns of a broad measure of market performance over the same periods.

| Share Class |

1-yr |

5-yr |

10-yr |

| R3 without sales charge |

7.96% |

1.73% |

3.34% |

| Comparative Benchmark(s) |

|

|

|

| JPMorgan Emerging Markets Bond Index Global Diversified ∆ |

9.32% |

1.31% |

3.61% |

|

∆

|

Source: FactSet Research Systems Inc.

|

|

|

| No Deduction of Taxes [Text Block] |

The graph and table below do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

|

|

| Updated Performance Information Location [Text Block] |

Visit mfs.com/perf/r3 for more recent performance information.

|

|

| Net Assets |

$ 7,388,571,766

|

|

| Holdings Count | Holding |

456

|

|

| Advisory Fees Paid, Amount |

$ 47,779,638

|

[3] |

| Investment Company Portfolio Turnover |

69.00%

|

|

| Additional Fund Statistics [Text Block] |

FUND STATISTICS AS OF 7/31/25

| Net Assets ($): |

7,388,571,766 |

|

Average Effective Maturity (yrs): |

9.6 |

| Total Number of Holdings: |

456 |

|

Average Effective Duration (yrs): |

6.2 |

| Total Management Fee ($)#: |

47,779,638 |

|

|

|

| Portfolio Turnover Rate (%): |

69 |

|

|

|

# Includes the effect of any management fee waivers, if applicable.

Where the fund holds derivatives, they are not included in the total number of portfolio holdings.

|

|

| Holdings [Text Block] |

PORTFOLIO COMPOSITION (BASED ON TOTAL INVESTMENTS AS OF 7/31/25)

Portfolio structure

| Fixed Income |

95.9% |

| Money Market Funds |

4.1% |

Issuer country weightings

| United States |

8.5% |

| Mexico |

5.5% |

| India |

4.6% |

| Chile |

3.8% |

| Romania |

3.7% |

| Turkey |

3.5% |

| Hungary |

3.2% |

| Saudi Arabia |

3.0% |

| United Arab Emirates |

2.8% |

| Other Countries |

61.4% |

Composition including fixed income credit quality

| AA |

2.4% |

| A |

11.0% |

| BBB |

28.3% |

| BB |

30.4% |

| B |

11.5% |

| CCC |

6.8% |

| C |

0.3% |

| D |

0.2% |

| U.S. Government |

4.3% |

| Not Rated |

0.7% |

| Money Market Funds |

4.1% |

Ratings are assigned using Moody’s, Fitch, and Standard & Poor’s and applying a hierarchy: If all 3 agencies rate a security, the middle rating is assigned; if 2 agencies rate a security, the lower rating is assigned. If none of the 3 agencies rate a security, we use DBRS Morningstar. If none of the 4 agencies rate a security, we use Kroll Bond Rating Agency. Ratings are shown in the S&P and Fitch scale (e.g., AAA). All ratings are subject to change.

|

|

| Credit Ratings Selection [Text Block] |

Ratings are assigned using Moody’s, Fitch, and Standard & Poor’s and applying a hierarchy: If all 3 agencies rate a security, the middle rating is assigned; if 2 agencies rate a security, the lower rating is assigned. If none of the 3 agencies rate a security, we use DBRS Morningstar. If none of the 4 agencies rate a security, we use Kroll Bond Rating Agency. Ratings are shown in the S&P and Fitch scale (e.g., AAA). All ratings are subject to change.

|

|

| C000074225 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

MFS® Emerging MarketsDebt Fund

|

|

| Class Name |

Class R2

|

|

| Trading Symbol |

MEDEX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about MFS Emerging Markets Debt Fund for the period of August 1, 2024 to July 31, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the fund at funds.mfs.com. You can also request this information by contacting us at 1‑800‑225‑2606 or by sending an e-mail request to orderliterature@mfs.com.

|

|

| Additional Information Phone Number |

1‑800‑225‑2606

|

|

| Additional Information Email |

orderliterature@mfs.com

|

|

| Additional Information Website |

funds.mfs.com

|

|

| Expenses [Text Block] |

FUND EXPENSES

What were the fund costs for the last year?

| (based on a hypothetical $10,000 investment) |

|

|

| Class Name |

Costs of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment |

| R2 |

$137 |

1.32% |

|

|

| Expenses Paid, Amount |

$ 137

|

|

| Expense Ratio, Percent |

1.32%

|

|

| Factors Affecting Performance [Text Block] |

MANAGEMENT'S DISCUSSION OF FUND PERFORMANCE

-

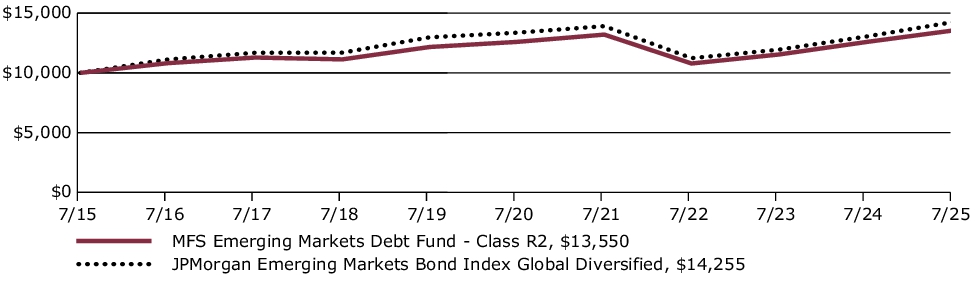

For the twelve months ended July 31, 2025, Class R2 shares of the MFS Emerging Markets Debt Fund (fund) provided a total return of 7.69%, at net asset value. This compares with a return of 9.32% for the fund’s benchmark, the JPMorgan Emerging Markets Bond Index Global Diversified.

-

Global equity markets reached record levels during the period withstanding considerable volatility amid tariffs, geopolitical conflict and high levels of uncertainty. In the US, a pro-growth tax and spending bill was signed into law while in Europe, renewed focus on defense and infrastructure spending brightened the outlook.

-

Market volatility rose toward the end of the period amid a volatile US policymaking environment as the Trump administration spent much of the April-July period finetuning its tariff strategy. Negotiations with China made progress with both sides easing export restrictions on strategic goods that cannot yet be produced domestically.

-

Moderating inflation pressures allowed many global central banks to ease monetary policy during the period. Amid a difficult policymaking environment and slower job growth, the Federal Reserve stayed on the sidelines, awaiting greater clarity on the impact of tariffs.

-

In fixed income markets, global bond yields initially declined but later rose to levels similar to the start of the reporting year. Credit spreads generally narrowed and stayed near historical lows, despite a brief widening in April and May due to tariff concerns. US bond market volatility, measured by the Merrill Lynch Option Volatility Estimate (MOVE) Index, ended near session lows after rising around the US election and trade war.

|

|

| Performance Past Does Not Indicate Future [Text] |

The fund’s past performance is not a good predictor of the fund’s future performance.

|

|

| Line Graph [Table Text Block] |

FUND PERFORMANCE

The fund’s past performance is not a good predictor of the fund’s future performance. The graph and table below do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The graph and table below assume reinvestment of dividends and capital gain distributions.

Growth of a Hypothetical $10,000 Investment

This graph shows the performance of a hypothetical $10,000 investment in Class R2 over a ten year period or since inception, if shorter, in comparison to a broad measure of market performance.

|

|

| Average Annual Return [Table Text Block] |

Average Annual Total Returns through 7/31/25

This table shows the average annual total returns of the class of shares noted for the periods shown, both with (if any) and without sales charges. It also shows the average annual total returns of a broad measure of market performance over the same periods.

| Share Class |

1-yr |

5-yr |

10-yr |

| R2 without sales charge |

7.69% |

1.48% |

3.08% |

| Comparative Benchmark(s) |

|

|

|

| JPMorgan Emerging Markets Bond Index Global Diversified ∆ |

9.32% |

1.31% |

3.61% |

|

∆

|

Source: FactSet Research Systems Inc.

|

|

|

| No Deduction of Taxes [Text Block] |

The graph and table below do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

|

|

| Updated Performance Information Location [Text Block] |

Visit mfs.com/perf/r2 for more recent performance information.

|

|

| Net Assets |

$ 7,388,571,766

|

|

| Holdings Count | Holding |

456

|

|

| Advisory Fees Paid, Amount |

$ 47,779,638

|

[4] |

| Investment Company Portfolio Turnover |

69.00%

|

|

| Additional Fund Statistics [Text Block] |

FUND STATISTICS AS OF 7/31/25

| Net Assets ($): |

7,388,571,766 |

|

Average Effective Maturity (yrs): |

9.6 |

| Total Number of Holdings: |

456 |

|

Average Effective Duration (yrs): |

6.2 |

| Total Management Fee ($)#: |

47,779,638 |

|

|

|

| Portfolio Turnover Rate (%): |

69 |

|

|

|

# Includes the effect of any management fee waivers, if applicable.

Where the fund holds derivatives, they are not included in the total number of portfolio holdings.

|

|

| Holdings [Text Block] |

PORTFOLIO COMPOSITION (BASED ON TOTAL INVESTMENTS AS OF 7/31/25)

Portfolio structure

| Fixed Income |

95.9% |

| Money Market Funds |

4.1% |

Issuer country weightings

| United States |

8.5% |

| Mexico |

5.5% |

| India |

4.6% |

| Chile |

3.8% |

| Romania |

3.7% |

| Turkey |

3.5% |

| Hungary |

3.2% |

| Saudi Arabia |

3.0% |

| United Arab Emirates |

2.8% |

| Other Countries |

61.4% |

Composition including fixed income credit quality

| AA |

2.4% |

| A |

11.0% |

| BBB |

28.3% |

| BB |

30.4% |

| B |

11.5% |

| CCC |

6.8% |

| C |

0.3% |

| D |

0.2% |

| U.S. Government |

4.3% |

| Not Rated |

0.7% |

| Money Market Funds |

4.1% |

Ratings are assigned using Moody’s, Fitch, and Standard & Poor’s and applying a hierarchy: If all 3 agencies rate a security, the middle rating is assigned; if 2 agencies rate a security, the lower rating is assigned. If none of the 3 agencies rate a security, we use DBRS Morningstar. If none of the 4 agencies rate a security, we use Kroll Bond Rating Agency. Ratings are shown in the S&P and Fitch scale (e.g., AAA). All ratings are subject to change.

|

|

| Credit Ratings Selection [Text Block] |

Ratings are assigned using Moody’s, Fitch, and Standard & Poor’s and applying a hierarchy: If all 3 agencies rate a security, the middle rating is assigned; if 2 agencies rate a security, the lower rating is assigned. If none of the 3 agencies rate a security, we use DBRS Morningstar. If none of the 4 agencies rate a security, we use Kroll Bond Rating Agency. Ratings are shown in the S&P and Fitch scale (e.g., AAA). All ratings are subject to change.

|

|

| C000074224 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

MFS® Emerging MarketsDebt Fund

|

|

| Class Name |

Class R1

|

|

| Trading Symbol |

MEDDX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about MFS Emerging Markets Debt Fund for the period of August 1, 2024 to July 31, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the fund at funds.mfs.com. You can also request this information by contacting us at 1‑800‑225‑2606 or by sending an e-mail request to orderliterature@mfs.com.

|

|

| Additional Information Phone Number |

1‑800‑225‑2606

|

|

| Additional Information Email |

orderliterature@mfs.com

|

|

| Additional Information Website |

funds.mfs.com

|

|

| Expenses [Text Block] |

FUND EXPENSES

What were the fund costs for the last year?

| (based on a hypothetical $10,000 investment) |

|

|

| Class Name |

Costs of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment |

| R1 |

$189 |

1.82% |

|

|

| Expenses Paid, Amount |

$ 189

|

|

| Expense Ratio, Percent |

1.82%

|

|

| Factors Affecting Performance [Text Block] |

MANAGEMENT'S DISCUSSION OF FUND PERFORMANCE

-

For the twelve months ended July 31, 2025, Class R1 shares of the MFS Emerging Markets Debt Fund (fund) provided a total return of 7.24%, at net asset value. This compares with a return of 9.32% for the fund’s benchmark, the JPMorgan Emerging Markets Bond Index Global Diversified.

-

Global equity markets reached record levels during the period withstanding considerable volatility amid tariffs, geopolitical conflict and high levels of uncertainty. In the US, a pro-growth tax and spending bill was signed into law while in Europe, renewed focus on defense and infrastructure spending brightened the outlook.

-

Market volatility rose toward the end of the period amid a volatile US policymaking environment as the Trump administration spent much of the April-July period finetuning its tariff strategy. Negotiations with China made progress with both sides easing export restrictions on strategic goods that cannot yet be produced domestically.

-

Moderating inflation pressures allowed many global central banks to ease monetary policy during the period. Amid a difficult policymaking environment and slower job growth, the Federal Reserve stayed on the sidelines, awaiting greater clarity on the impact of tariffs.

-

In fixed income markets, global bond yields initially declined but later rose to levels similar to the start of the reporting year. Credit spreads generally narrowed and stayed near historical lows, despite a brief widening in April and May due to tariff concerns. US bond market volatility, measured by the Merrill Lynch Option Volatility Estimate (MOVE) Index, ended near session lows after rising around the US election and trade war.

|

|

| Performance Past Does Not Indicate Future [Text] |

The fund’s past performance is not a good predictor of the fund’s future performance.

|

|

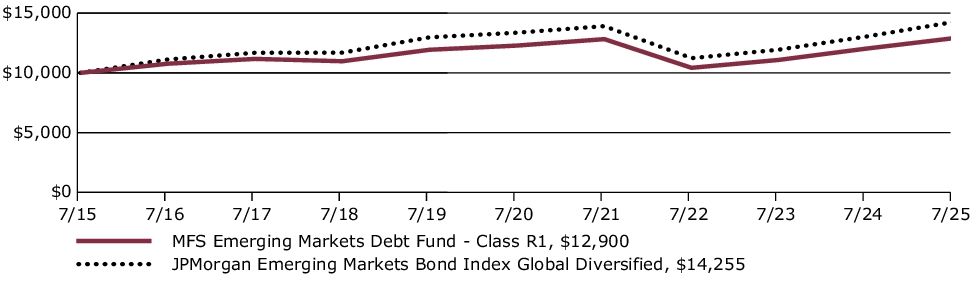

| Line Graph [Table Text Block] |

FUND PERFORMANCE

The fund’s past performance is not a good predictor of the fund’s future performance. The graph and table below do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The graph and table below assume reinvestment of dividends and capital gain distributions.

Growth of a Hypothetical $10,000 Investment

This graph shows the performance of a hypothetical $10,000 investment in Class R1 over a ten year period or since inception, if shorter, in comparison to a broad measure of market performance.

|

|

| Average Annual Return [Table Text Block] |

Average Annual Total Returns through 7/31/25

This table shows the average annual total returns of the class of shares noted for the periods shown, both with (if any) and without sales charges. It also shows the average annual total returns of a broad measure of market performance over the same periods.

| Share Class |

1-yr |

5-yr |

10-yr |

| R1 without sales charge |

7.24% |

0.99% |

2.58% |

| Comparative Benchmark(s) |

|

|

|

| JPMorgan Emerging Markets Bond Index Global Diversified ∆ |

9.32% |

1.31% |

3.61% |

|

∆

|

Source: FactSet Research Systems Inc.

|

|

|

| No Deduction of Taxes [Text Block] |

The graph and table below do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

|

|

| Updated Performance Information Location [Text Block] |

Visit mfs.com/perf/r1 for more recent performance information.

|

|

| Net Assets |

$ 7,388,571,766

|

|

| Holdings Count | Holding |

456

|

|

| Advisory Fees Paid, Amount |

$ 47,779,638

|

[5] |

| Investment Company Portfolio Turnover |

69.00%

|

|

| Additional Fund Statistics [Text Block] |

FUND STATISTICS AS OF 7/31/25

| Net Assets ($): |

7,388,571,766 |

|

Average Effective Maturity (yrs): |

9.6 |

| Total Number of Holdings: |

456 |

|

Average Effective Duration (yrs): |

6.2 |

| Total Management Fee ($)#: |

47,779,638 |

|

|

|

| Portfolio Turnover Rate (%): |

69 |

|

|

|

# Includes the effect of any management fee waivers, if applicable.

Where the fund holds derivatives, they are not included in the total number of portfolio holdings.

|

|

| Holdings [Text Block] |

PORTFOLIO COMPOSITION (BASED ON TOTAL INVESTMENTS AS OF 7/31/25)

Portfolio structure

| Fixed Income |

95.9% |

| Money Market Funds |

4.1% |

Issuer country weightings

| United States |

8.5% |

| Mexico |

5.5% |

| India |

4.6% |

| Chile |

3.8% |

| Romania |

3.7% |

| Turkey |

3.5% |

| Hungary |

3.2% |

| Saudi Arabia |

3.0% |

| United Arab Emirates |

2.8% |

| Other Countries |

61.4% |

Composition including fixed income credit quality

| AA |

2.4% |

| A |

11.0% |

| BBB |

28.3% |

| BB |

30.4% |

| B |

11.5% |

| CCC |

6.8% |

| C |

0.3% |

| D |

0.2% |

| U.S. Government |

4.3% |

| Not Rated |

0.7% |

| Money Market Funds |

4.1% |

Ratings are assigned using Moody’s, Fitch, and Standard & Poor’s and applying a hierarchy: If all 3 agencies rate a security, the middle rating is assigned; if 2 agencies rate a security, the lower rating is assigned. If none of the 3 agencies rate a security, we use DBRS Morningstar. If none of the 4 agencies rate a security, we use Kroll Bond Rating Agency. Ratings are shown in the S&P and Fitch scale (e.g., AAA). All ratings are subject to change.

|

|

| Credit Ratings Selection [Text Block] |

Ratings are assigned using Moody’s, Fitch, and Standard & Poor’s and applying a hierarchy: If all 3 agencies rate a security, the middle rating is assigned; if 2 agencies rate a security, the lower rating is assigned. If none of the 3 agencies rate a security, we use DBRS Morningstar. If none of the 4 agencies rate a security, we use Kroll Bond Rating Agency. Ratings are shown in the S&P and Fitch scale (e.g., AAA). All ratings are subject to change.

|

|

| C000006903 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

MFS® Emerging MarketsDebt Fund

|

|

| Class Name |

Class I

|

|

| Trading Symbol |

MEDIX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about MFS Emerging Markets Debt Fund for the period of August 1, 2024 to July 31, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the fund at funds.mfs.com. You can also request this information by contacting us at 1‑800‑225‑2606 or by sending an e-mail request to orderliterature@mfs.com.

|

|

| Additional Information Phone Number |

1‑800‑225‑2606

|

|

| Additional Information Email |

orderliterature@mfs.com

|

|

| Additional Information Website |

funds.mfs.com

|

|

| Expenses [Text Block] |

FUND EXPENSES

What were the fund costs for the last year?

| (based on a hypothetical $10,000 investment) |

|

|

| Class Name |

Costs of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment |

| I |

$85 |

0.82% |

|

|

| Expenses Paid, Amount |

$ 85

|

|

| Expense Ratio, Percent |

0.82%

|

|

| Factors Affecting Performance [Text Block] |

MANAGEMENT'S DISCUSSION OF FUND PERFORMANCE

-

For the twelve months ended July 31, 2025, Class I shares of the MFS Emerging Markets Debt Fund (fund) provided a total return of 8.15%, at net asset value. This compares with a return of 9.32% for the fund’s benchmark, the JPMorgan Emerging Markets Bond Index Global Diversified.

-

Global equity markets reached record levels during the period withstanding considerable volatility amid tariffs, geopolitical conflict and high levels of uncertainty. In the US, a pro-growth tax and spending bill was signed into law while in Europe, renewed focus on defense and infrastructure spending brightened the outlook.

-

Market volatility rose toward the end of the period amid a volatile US policymaking environment as the Trump administration spent much of the April-July period finetuning its tariff strategy. Negotiations with China made progress with both sides easing export restrictions on strategic goods that cannot yet be produced domestically.

-

Moderating inflation pressures allowed many global central banks to ease monetary policy during the period. Amid a difficult policymaking environment and slower job growth, the Federal Reserve stayed on the sidelines, awaiting greater clarity on the impact of tariffs.

-

In fixed income markets, global bond yields initially declined but later rose to levels similar to the start of the reporting year. Credit spreads generally narrowed and stayed near historical lows, despite a brief widening in April and May due to tariff concerns. US bond market volatility, measured by the Merrill Lynch Option Volatility Estimate (MOVE) Index, ended near session lows after rising around the US election and trade war.

|

|

| Performance Past Does Not Indicate Future [Text] |

The fund’s past performance is not a good predictor of the fund’s future performance.

|

|

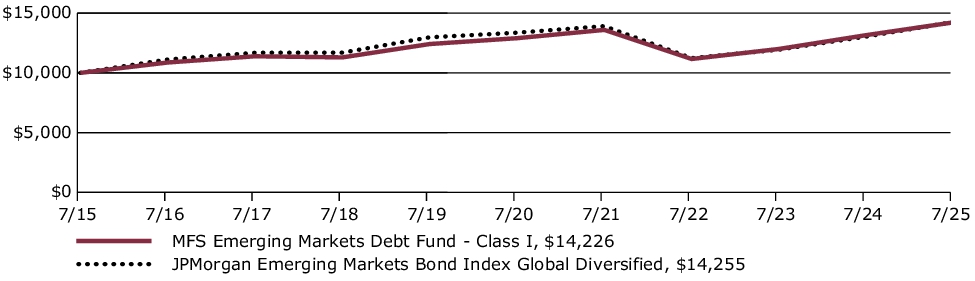

| Line Graph [Table Text Block] |

FUND PERFORMANCE

The fund’s past performance is not a good predictor of the fund’s future performance. The graph and table below do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The graph and table below assume reinvestment of dividends and capital gain distributions.

Growth of a Hypothetical $10,000 Investment

This graph shows the performance of a hypothetical $10,000 investment in Class I over a ten year period or since inception, if shorter, in comparison to a broad measure of market performance.

|

|

| Average Annual Return [Table Text Block] |

Average Annual Total Returns through 7/31/25

This table shows the average annual total returns of the class of shares noted for the periods shown, both with (if any) and without sales charges. It also shows the average annual total returns of a broad measure of market performance over the same periods.

| Share Class |

1-yr |

5-yr |

10-yr |

| I without sales charge |

8.15% |

1.98% |

3.59% |

| Comparative Benchmark(s) |

|

|

|

| JPMorgan Emerging Markets Bond Index Global Diversified ∆ |

9.32% |

1.31% |

3.61% |

|

∆

|

Source: FactSet Research Systems Inc.

|

|

|

| No Deduction of Taxes [Text Block] |

The graph and table below do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

|

|

| Updated Performance Information Location [Text Block] |

Visit mfs.com/perf/i for more recent performance information.

|

|

| Net Assets |

$ 7,388,571,766

|

|

| Holdings Count | Holding |

456

|

|

| Advisory Fees Paid, Amount |

$ 47,779,638

|

[6] |

| Investment Company Portfolio Turnover |

69.00%

|

|

| Additional Fund Statistics [Text Block] |

FUND STATISTICS AS OF 7/31/25

| Net Assets ($): |

7,388,571,766 |

|

Average Effective Maturity (yrs): |

9.6 |

| Total Number of Holdings: |

456 |

|

Average Effective Duration (yrs): |

6.2 |

| Total Management Fee ($)#: |

47,779,638 |

|

|

|

| Portfolio Turnover Rate (%): |

69 |

|

|

|

# Includes the effect of any management fee waivers, if applicable.

Where the fund holds derivatives, they are not included in the total number of portfolio holdings.

|

|

| Holdings [Text Block] |

PORTFOLIO COMPOSITION (BASED ON TOTAL INVESTMENTS AS OF 7/31/25)

Portfolio structure

| Fixed Income |

95.9% |

| Money Market Funds |

4.1% |

Issuer country weightings

| United States |

8.5% |

| Mexico |

5.5% |

| India |

4.6% |

| Chile |

3.8% |

| Romania |

3.7% |

| Turkey |

3.5% |

| Hungary |

3.2% |

| Saudi Arabia |

3.0% |

| United Arab Emirates |

2.8% |

| Other Countries |

61.4% |

Composition including fixed income credit quality

| AA |

2.4% |

| A |

11.0% |

| BBB |

28.3% |

| BB |

30.4% |

| B |

11.5% |

| CCC |

6.8% |

| C |

0.3% |

| D |

0.2% |

| U.S. Government |

4.3% |

| Not Rated |

0.7% |

| Money Market Funds |

4.1% |

Ratings are assigned using Moody’s, Fitch, and Standard & Poor’s and applying a hierarchy: If all 3 agencies rate a security, the middle rating is assigned; if 2 agencies rate a security, the lower rating is assigned. If none of the 3 agencies rate a security, we use DBRS Morningstar. If none of the 4 agencies rate a security, we use Kroll Bond Rating Agency. Ratings are shown in the S&P and Fitch scale (e.g., AAA). All ratings are subject to change.

|

|

| Credit Ratings Selection [Text Block] |

Ratings are assigned using Moody’s, Fitch, and Standard & Poor’s and applying a hierarchy: If all 3 agencies rate a security, the middle rating is assigned; if 2 agencies rate a security, the lower rating is assigned. If none of the 3 agencies rate a security, we use DBRS Morningstar. If none of the 4 agencies rate a security, we use Kroll Bond Rating Agency. Ratings are shown in the S&P and Fitch scale (e.g., AAA). All ratings are subject to change.

|

|

| C000006902 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

MFS® Emerging MarketsDebt Fund

|

|

| Class Name |

Class C

|

|

| Trading Symbol |

MEDCX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about MFS Emerging Markets Debt Fund for the period of August 1, 2024 to July 31, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the fund at funds.mfs.com. You can also request this information by contacting us at 1‑800‑225‑2606 or by sending an e-mail request to orderliterature@mfs.com.

|

|

| Additional Information Phone Number |

1‑800‑225‑2606

|

|

| Additional Information Email |

orderliterature@mfs.com

|

|

| Additional Information Website |

funds.mfs.com

|

|

| Expenses [Text Block] |

FUND EXPENSES

What were the fund costs for the last year?

| (based on a hypothetical $10,000 investment) |

|

|

| Class Name |

Costs of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment |

| C |

$189 |

1.82% |

|

|

| Expenses Paid, Amount |

$ 189

|

|

| Expense Ratio, Percent |

1.82%

|

|

| Factors Affecting Performance [Text Block] |

MANAGEMENT'S DISCUSSION OF FUND PERFORMANCE

-

For the twelve months ended July 31, 2025, Class C shares of the MFS Emerging Markets Debt Fund (fund) provided a total return of 7.16%, at net asset value. This compares with a return of 9.32% for the fund’s benchmark, the JPMorgan Emerging Markets Bond Index Global Diversified.

-

Global equity markets reached record levels during the period withstanding considerable volatility amid tariffs, geopolitical conflict and high levels of uncertainty. In the US, a pro-growth tax and spending bill was signed into law while in Europe, renewed focus on defense and infrastructure spending brightened the outlook.

-

Market volatility rose toward the end of the period amid a volatile US policymaking environment as the Trump administration spent much of the April-July period finetuning its tariff strategy. Negotiations with China made progress with both sides easing export restrictions on strategic goods that cannot yet be produced domestically.

-

Moderating inflation pressures allowed many global central banks to ease monetary policy during the period. Amid a difficult policymaking environment and slower job growth, the Federal Reserve stayed on the sidelines, awaiting greater clarity on the impact of tariffs.

-

In fixed income markets, global bond yields initially declined but later rose to levels similar to the start of the reporting year. Credit spreads generally narrowed and stayed near historical lows, despite a brief widening in April and May due to tariff concerns. US bond market volatility, measured by the Merrill Lynch Option Volatility Estimate (MOVE) Index, ended near session lows after rising around the US election and trade war.

|

|

| Performance Past Does Not Indicate Future [Text] |

The fund’s past performance is not a good predictor of the fund’s future performance.

|

|

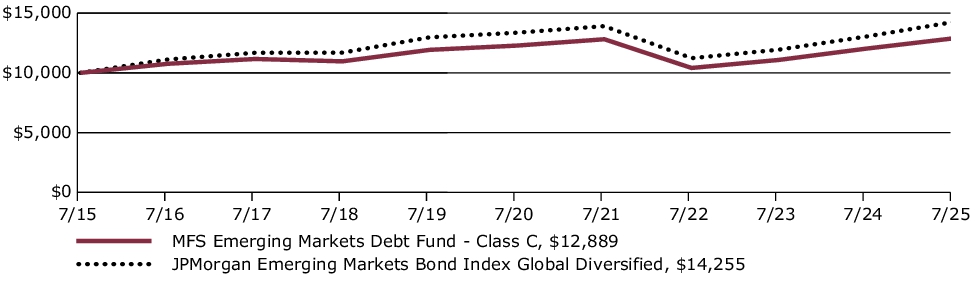

| Line Graph [Table Text Block] |

FUND PERFORMANCE

The fund’s past performance is not a good predictor of the fund’s future performance. The graph and table below do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The graph and table below assume reinvestment of dividends and capital gain distributions.

Growth of a Hypothetical $10,000 Investment

This graph shows the performance of a hypothetical $10,000 investment in Class C over a ten year period or since inception, if shorter, in comparison to a broad measure of market performance.

|

|

| Average Annual Return [Table Text Block] |

Average Annual Total Returns through 7/31/25

This table shows the average annual total returns of the class of shares noted for the periods shown, both with (if any) and without sales charges. It also shows the average annual total returns of a broad measure of market performance over the same periods.

| Share Class |

1-yr |

5-yr |

10-yr |

| C without sales charge |

7.16% |

0.97% |

2.57% |

| C with CDSC (1% for 12 months)× |

6.16% |

0.97% |

2.57% |

| Comparative Benchmark(s) |

|

|

|

| JPMorgan Emerging Markets Bond Index Global Diversified ∆ |

9.32% |

1.31% |

3.61% |

|

∆

|

Source: FactSet Research Systems Inc.

|

|

×

|

Assuming redemption at the end of the applicable period.

|

|

|

| No Deduction of Taxes [Text Block] |

The graph and table below do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

|

|

| Updated Performance Information Location [Text Block] |

Visit mfs.com/perf/c for more recent performance information.

|

|

| Net Assets |

$ 7,388,571,766

|

|

| Holdings Count | Holding |

456

|

|

| Advisory Fees Paid, Amount |

$ 47,779,638

|

[7] |

| Investment Company Portfolio Turnover |

69.00%

|

|

| Additional Fund Statistics [Text Block] |

FUND STATISTICS AS OF 7/31/25

| Net Assets ($): |

7,388,571,766 |

|

Average Effective Maturity (yrs): |

9.6 |

| Total Number of Holdings: |

456 |

|

Average Effective Duration (yrs): |

6.2 |

| Total Management Fee ($)#: |

47,779,638 |

|

|

|

| Portfolio Turnover Rate (%): |

69 |

|

|

|

# Includes the effect of any management fee waivers, if applicable.

Where the fund holds derivatives, they are not included in the total number of portfolio holdings.

|

|

| Holdings [Text Block] |

PORTFOLIO COMPOSITION (BASED ON TOTAL INVESTMENTS AS OF 7/31/25)

Portfolio structure

| Fixed Income |

95.9% |

| Money Market Funds |

4.1% |

Issuer country weightings

| United States |

8.5% |

| Mexico |

5.5% |

| India |

4.6% |

| Chile |

3.8% |

| Romania |

3.7% |

| Turkey |

3.5% |

| Hungary |

3.2% |

| Saudi Arabia |

3.0% |

| United Arab Emirates |

2.8% |

| Other Countries |

61.4% |

Composition including fixed income credit quality

| AA |

2.4% |

| A |

11.0% |

| BBB |

28.3% |

| BB |

30.4% |

| B |

11.5% |

| CCC |

6.8% |

| C |

0.3% |

| D |

0.2% |

| U.S. Government |

4.3% |

| Not Rated |

0.7% |

| Money Market Funds |

4.1% |

Ratings are assigned using Moody’s, Fitch, and Standard & Poor’s and applying a hierarchy: If all 3 agencies rate a security, the middle rating is assigned; if 2 agencies rate a security, the lower rating is assigned. If none of the 3 agencies rate a security, we use DBRS Morningstar. If none of the 4 agencies rate a security, we use Kroll Bond Rating Agency. Ratings are shown in the S&P and Fitch scale (e.g., AAA). All ratings are subject to change.

|

|

| Credit Ratings Selection [Text Block] |

Ratings are assigned using Moody’s, Fitch, and Standard & Poor’s and applying a hierarchy: If all 3 agencies rate a security, the middle rating is assigned; if 2 agencies rate a security, the lower rating is assigned. If none of the 3 agencies rate a security, we use DBRS Morningstar. If none of the 4 agencies rate a security, we use Kroll Bond Rating Agency. Ratings are shown in the S&P and Fitch scale (e.g., AAA). All ratings are subject to change.

|

|

| C000006901 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

MFS® Emerging MarketsDebt Fund

|

|

| Class Name |

Class B

|

|

| Trading Symbol |

MEDBX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about MFS Emerging Markets Debt Fund for the period of August 1, 2024 to July 31, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the fund at funds.mfs.com. You can also request this information by contacting us at 1‑800‑225‑2606 or by sending an e-mail request to orderliterature@mfs.com.

|

|

| Additional Information Phone Number |

1‑800‑225‑2606

|

|

| Additional Information Email |

orderliterature@mfs.com

|

|

| Additional Information Website |

funds.mfs.com

|

|

| Expenses [Text Block] |

FUND EXPENSES

What were the fund costs for the last year?

| (based on a hypothetical $10,000 investment) |

|

|

| Class Name |

Costs of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment |

| B |

$189 |

1.82% |

|

|

| Expenses Paid, Amount |

$ 189

|

|

| Expense Ratio, Percent |

1.82%

|

|

| Factors Affecting Performance [Text Block] |

MANAGEMENT'S DISCUSSION OF FUND PERFORMANCE

-

For the twelve months ended July 31, 2025, Class B shares of the MFS Emerging Markets Debt Fund (fund) provided a total return of 7.15%, at net asset value. This compares with a return of 9.32% for the fund’s benchmark, the JPMorgan Emerging Markets Bond Index Global Diversified.

-

Global equity markets reached record levels during the period withstanding considerable volatility amid tariffs, geopolitical conflict and high levels of uncertainty. In the US, a pro-growth tax and spending bill was signed into law while in Europe, renewed focus on defense and infrastructure spending brightened the outlook.

-

Market volatility rose toward the end of the period amid a volatile US policymaking environment as the Trump administration spent much of the April-July period finetuning its tariff strategy. Negotiations with China made progress with both sides easing export restrictions on strategic goods that cannot yet be produced domestically.

-

Moderating inflation pressures allowed many global central banks to ease monetary policy during the period. Amid a difficult policymaking environment and slower job growth, the Federal Reserve stayed on the sidelines, awaiting greater clarity on the impact of tariffs.

-

In fixed income markets, global bond yields initially declined but later rose to levels similar to the start of the reporting year. Credit spreads generally narrowed and stayed near historical lows, despite a brief widening in April and May due to tariff concerns. US bond market volatility, measured by the Merrill Lynch Option Volatility Estimate (MOVE) Index, ended near session lows after rising around the US election and trade war.

|

|

| Performance Past Does Not Indicate Future [Text] |

The fund’s past performance is not a good predictor of the fund’s future performance.

|

|

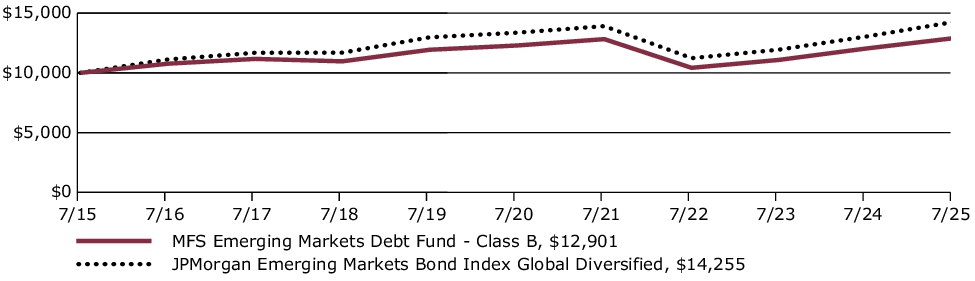

| Line Graph [Table Text Block] |

FUND PERFORMANCE

The fund’s past performance is not a good predictor of the fund’s future performance. The graph and table below do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The graph and table below assume reinvestment of dividends and capital gain distributions.

Growth of a Hypothetical $10,000 Investment

This graph shows the performance of a hypothetical $10,000 investment in Class B over a ten year period or since inception, if shorter, in comparison to a broad measure of market performance.

|

|

| Average Annual Return [Table Text Block] |

Average Annual Total Returns through 7/31/25

This table shows the average annual total returns of the class of shares noted for the periods shown, both with (if any) and without sales charges. It also shows the average annual total returns of a broad measure of market performance over the same periods.

| Share Class |

1-yr |

5-yr |

10-yr |

| B without sales charge |

7.15% |

0.97% |

2.58% |

| B with CDSC (declining over six years from 4% to 0%)× |

3.15% |

0.65% |

2.58% |

| Comparative Benchmark(s) |

|

|

|

| JPMorgan Emerging Markets Bond Index Global Diversified ∆ |

9.32% |

1.31% |

3.61% |

|

∆

|

Source: FactSet Research Systems Inc.

|

|

×

|

Assuming redemption at the end of the applicable period.

|

|

|

| No Deduction of Taxes [Text Block] |

The graph and table below do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

|

|

| Updated Performance Information Location [Text Block] |

Visit mfs.com/perf/b for more recent performance information.

|

|

| Net Assets |

$ 7,388,571,766

|

|

| Holdings Count | Holding |

456

|

|

| Advisory Fees Paid, Amount |

$ 47,779,638

|

[8] |

| Investment Company Portfolio Turnover |

69.00%

|

|

| Additional Fund Statistics [Text Block] |

FUND STATISTICS AS OF 7/31/25

| Net Assets ($): |

7,388,571,766 |

|

Average Effective Maturity (yrs): |

9.6 |

| Total Number of Holdings: |

456 |

|

Average Effective Duration (yrs): |

6.2 |

| Total Management Fee ($)#: |

47,779,638 |

|

|

|

| Portfolio Turnover Rate (%): |

69 |

|

|

|

# Includes the effect of any management fee waivers, if applicable.

Where the fund holds derivatives, they are not included in the total number of portfolio holdings.

|

|

| Holdings [Text Block] |

PORTFOLIO COMPOSITION (BASED ON TOTAL INVESTMENTS AS OF 7/31/25)

Portfolio structure

| Fixed Income |

95.9% |

| Money Market Funds |

4.1% |

Issuer country weightings

| United States |

8.5% |

| Mexico |

5.5% |

| India |

4.6% |

| Chile |

3.8% |

| Romania |

3.7% |

| Turkey |

3.5% |

| Hungary |

3.2% |

| Saudi Arabia |

3.0% |

| United Arab Emirates |

2.8% |

| Other Countries |

61.4% |

Composition including fixed income credit quality

| AA |

2.4% |

| A |

11.0% |

| BBB |

28.3% |

| BB |

30.4% |

| B |

11.5% |

| CCC |

6.8% |

| C |

0.3% |

| D |

0.2% |

| U.S. Government |

4.3% |

| Not Rated |

0.7% |

| Money Market Funds |

4.1% |

Ratings are assigned using Moody’s, Fitch, and Standard & Poor’s and applying a hierarchy: If all 3 agencies rate a security, the middle rating is assigned; if 2 agencies rate a security, the lower rating is assigned. If none of the 3 agencies rate a security, we use DBRS Morningstar. If none of the 4 agencies rate a security, we use Kroll Bond Rating Agency. Ratings are shown in the S&P and Fitch scale (e.g., AAA). All ratings are subject to change.

|

|

| Credit Ratings Selection [Text Block] |

Ratings are assigned using Moody’s, Fitch, and Standard & Poor’s and applying a hierarchy: If all 3 agencies rate a security, the middle rating is assigned; if 2 agencies rate a security, the lower rating is assigned. If none of the 3 agencies rate a security, we use DBRS Morningstar. If none of the 4 agencies rate a security, we use Kroll Bond Rating Agency. Ratings are shown in the S&P and Fitch scale (e.g., AAA). All ratings are subject to change.

|

|

| C000006900 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

MFS® Emerging MarketsDebt Fund

|

|

| Class Name |

Class A

|

|

| Trading Symbol |

MEDAX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about MFS Emerging Markets Debt Fund for the period of August 1, 2024 to July 31, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the fund at funds.mfs.com. You can also request this information by contacting us at 1‑800‑225‑2606 or by sending an e-mail request to orderliterature@mfs.com.

|

|

| Additional Information Phone Number |

1‑800‑225‑2606

|

|

| Additional Information Email |

orderliterature@mfs.com

|

|

| Additional Information Website |

funds.mfs.com

|

|

| Expenses [Text Block] |

FUND EXPENSES

What were the fund costs for the last year?

| (based on a hypothetical $10,000 investment) |

|

|

| Class Name |

Costs of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment |

| A |

$111 |

1.07% |

|

|

| Expenses Paid, Amount |

$ 111

|

|

| Expense Ratio, Percent |

1.07%

|

|

| Factors Affecting Performance [Text Block] |

MANAGEMENT'S DISCUSSION OF FUND PERFORMANCE

-

For the twelve months ended July 31, 2025, Class A shares of the MFS Emerging Markets Debt Fund (fund) provided a total return of 7.96%, at net asset value. This compares with a return of 9.32% for the fund’s benchmark, the JPMorgan Emerging Markets Bond Index Global Diversified.

-

Global equity markets reached record levels during the period withstanding considerable volatility amid tariffs, geopolitical conflict and high levels of uncertainty. In the US, a pro-growth tax and spending bill was signed into law while in Europe, renewed focus on defense and infrastructure spending brightened the outlook.

-

Market volatility rose toward the end of the period amid a volatile US policymaking environment as the Trump administration spent much of the April-July period finetuning its tariff strategy. Negotiations with China made progress with both sides easing export restrictions on strategic goods that cannot yet be produced domestically.

-

Moderating inflation pressures allowed many global central banks to ease monetary policy during the period. Amid a difficult policymaking environment and slower job growth, the Federal Reserve stayed on the sidelines, awaiting greater clarity on the impact of tariffs.

-

In fixed income markets, global bond yields initially declined but later rose to levels similar to the start of the reporting year. Credit spreads generally narrowed and stayed near historical lows, despite a brief widening in April and May due to tariff concerns. US bond market volatility, measured by the Merrill Lynch Option Volatility Estimate (MOVE) Index, ended near session lows after rising around the US election and trade war.

|

|

| Performance Past Does Not Indicate Future [Text] |

The fund’s past performance is not a good predictor of the fund’s future performance.

|

|

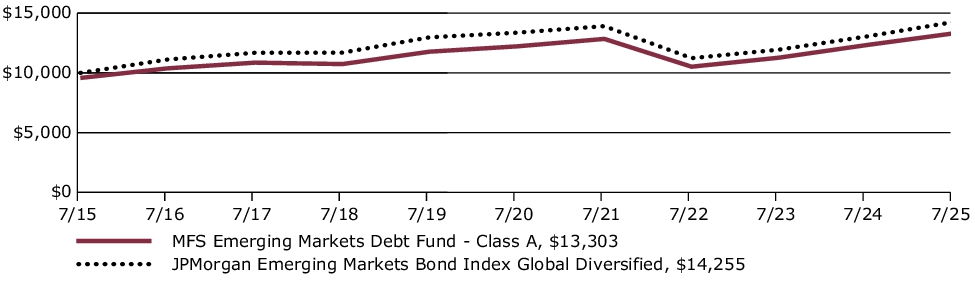

| Line Graph [Table Text Block] |

FUND PERFORMANCE

The fund’s past performance is not a good predictor of the fund’s future performance. The graph and table below do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The graph and table below assume reinvestment of dividends and capital gain distributions.

Growth of a Hypothetical $10,000 Investment

This graph shows the performance of a hypothetical $10,000 investment in Class A over a ten year period or since inception, if shorter, in comparison to a broad measure of market performance. This graph includes the deduction of the maximum applicable sales charge.

|

|

| Average Annual Return [Table Text Block] |

Average Annual Total Returns through 7/31/25

This table shows the average annual total returns of the class of shares noted for the periods shown, both with (if any) and without sales charges. It also shows the average annual total returns of a broad measure of market performance over the same periods.

| Share Class |

1-yr |

5-yr |

10-yr |

| A without sales charge |

7.96% |

1.72% |

3.34% |

| A with initial sales charge (4.25%) |

3.38% |

0.84% |

2.90% |

| Comparative Benchmark(s) |

|

|

|

| JPMorgan Emerging Markets Bond Index Global Diversified ∆ |

9.32% |

1.31% |

3.61% |

|

∆

|

Source: FactSet Research Systems Inc.

|

|

|

| No Deduction of Taxes [Text Block] |

The graph and table below do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

|

|

| Updated Performance Information Location [Text Block] |

Visit mfs.com/perf/a for more recent performance information.

|

|

| Net Assets |

$ 7,388,571,766

|

|

| Holdings Count | Holding |

456

|

|

| Advisory Fees Paid, Amount |

$ 47,779,638

|

[9] |

| Investment Company Portfolio Turnover |

69.00%

|

|

| Additional Fund Statistics [Text Block] |

FUND STATISTICS AS OF 7/31/25

| Net Assets ($): |

7,388,571,766 |

|

Average Effective Maturity (yrs): |

9.6 |

| Total Number of Holdings: |

456 |

|

Average Effective Duration (yrs): |

6.2 |

| Total Management Fee ($)#: |

47,779,638 |

|

|

|

| Portfolio Turnover Rate (%): |

69 |

|

|

|

# Includes the effect of any management fee waivers, if applicable.

Where the fund holds derivatives, they are not included in the total number of portfolio holdings.

|

|

| Holdings [Text Block] |

PORTFOLIO COMPOSITION (BASED ON TOTAL INVESTMENTS AS OF 7/31/25)

Portfolio structure

| Fixed Income |

95.9% |

| Money Market Funds |

4.1% |

Issuer country weightings

| United States |

8.5% |

| Mexico |

5.5% |

| India |

4.6% |

| Chile |

3.8% |

| Romania |

3.7% |

| Turkey |

3.5% |

| Hungary |

3.2% |

| Saudi Arabia |

3.0% |

| United Arab Emirates |

2.8% |

| Other Countries |

61.4% |

Composition including fixed income credit quality

| AA |

2.4% |

| A |

11.0% |

| BBB |

28.3% |

| BB |

30.4% |

| B |

11.5% |

| CCC |

6.8% |

| C |

0.3% |

| D |

0.2% |

| U.S. Government |

4.3% |

| Not Rated |

0.7% |

| Money Market Funds |

4.1% |

Ratings are assigned using Moody’s, Fitch, and Standard & Poor’s and applying a hierarchy: If all 3 agencies rate a security, the middle rating is assigned; if 2 agencies rate a security, the lower rating is assigned. If none of the 3 agencies rate a security, we use DBRS Morningstar. If none of the 4 agencies rate a security, we use Kroll Bond Rating Agency. Ratings are shown in the S&P and Fitch scale (e.g., AAA). All ratings are subject to change.

|

|

| Credit Ratings Selection [Text Block] |

Ratings are assigned using Moody’s, Fitch, and Standard & Poor’s and applying a hierarchy: If all 3 agencies rate a security, the middle rating is assigned; if 2 agencies rate a security, the lower rating is assigned. If none of the 3 agencies rate a security, we use DBRS Morningstar. If none of the 4 agencies rate a security, we use Kroll Bond Rating Agency. Ratings are shown in the S&P and Fitch scale (e.g., AAA). All ratings are subject to change.

|

|

|

|