Pay vs Performance Disclosure - USD ($)

|

12 Months Ended |

May 31, 2025 |

May 31, 2024 |

May 31, 2023 |

May 31, 2022 |

May 31, 2021 |

| Pay vs Performance Disclosure |

|

|

|

|

|

| Pay vs Performance Disclosure, Table |

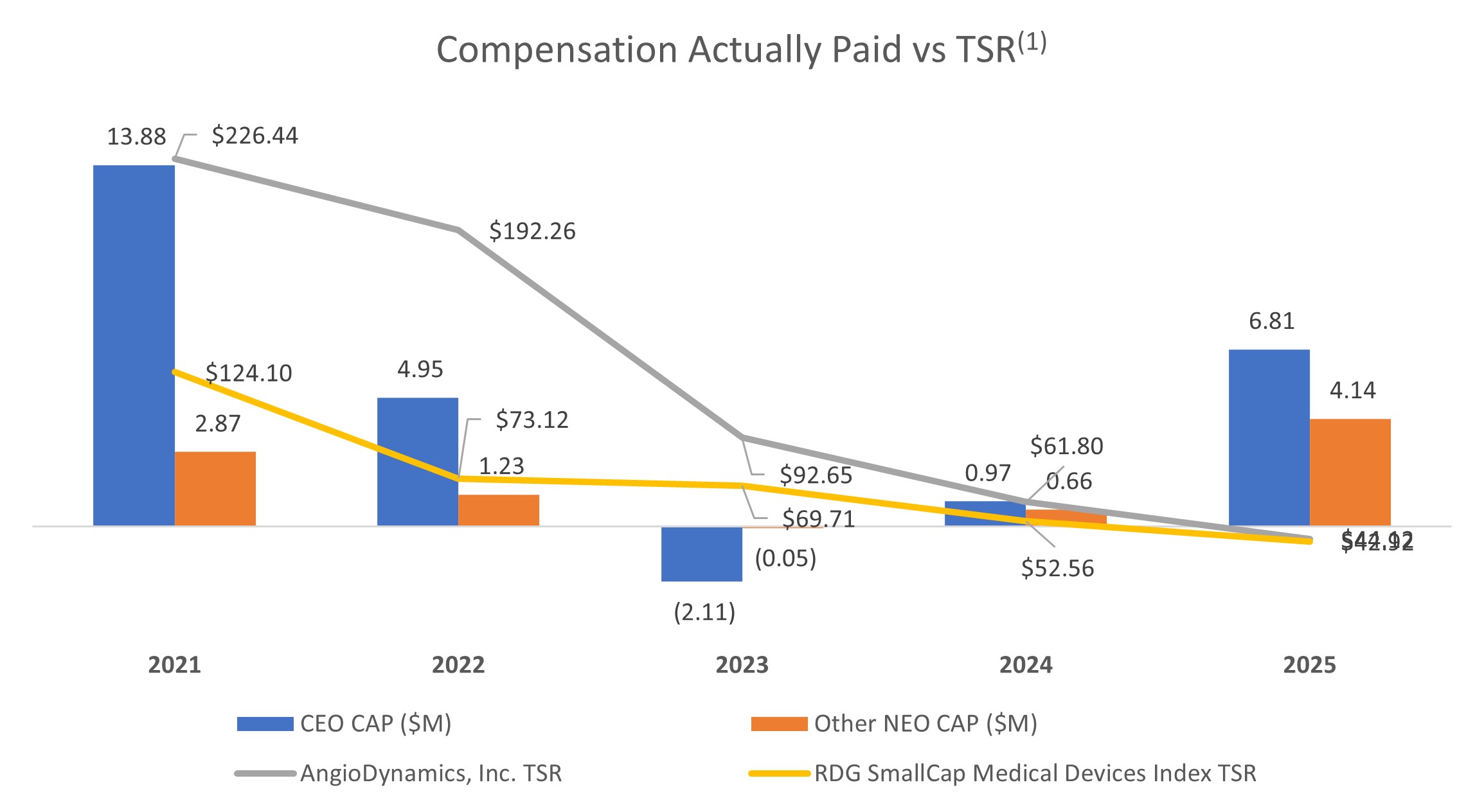

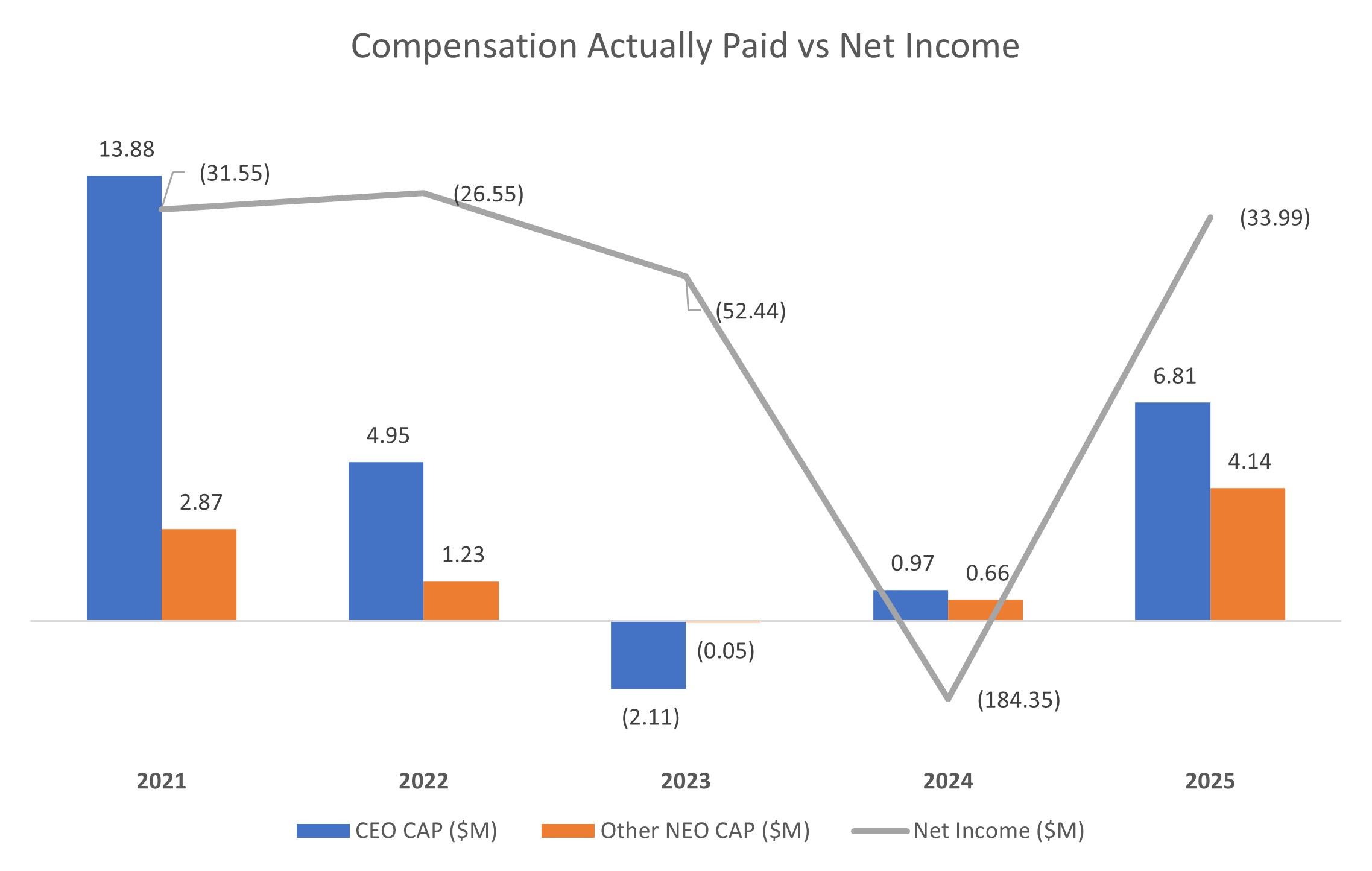

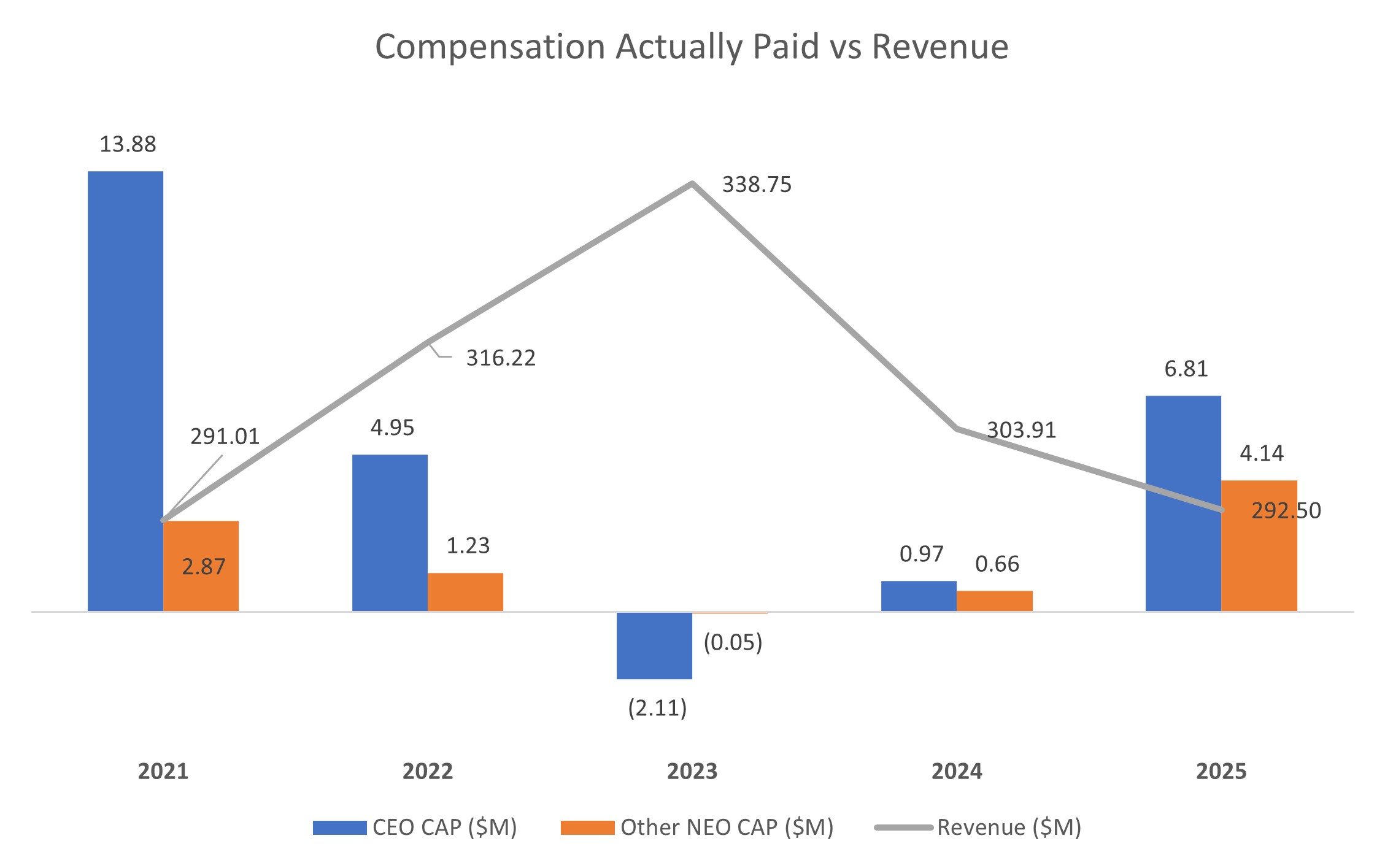

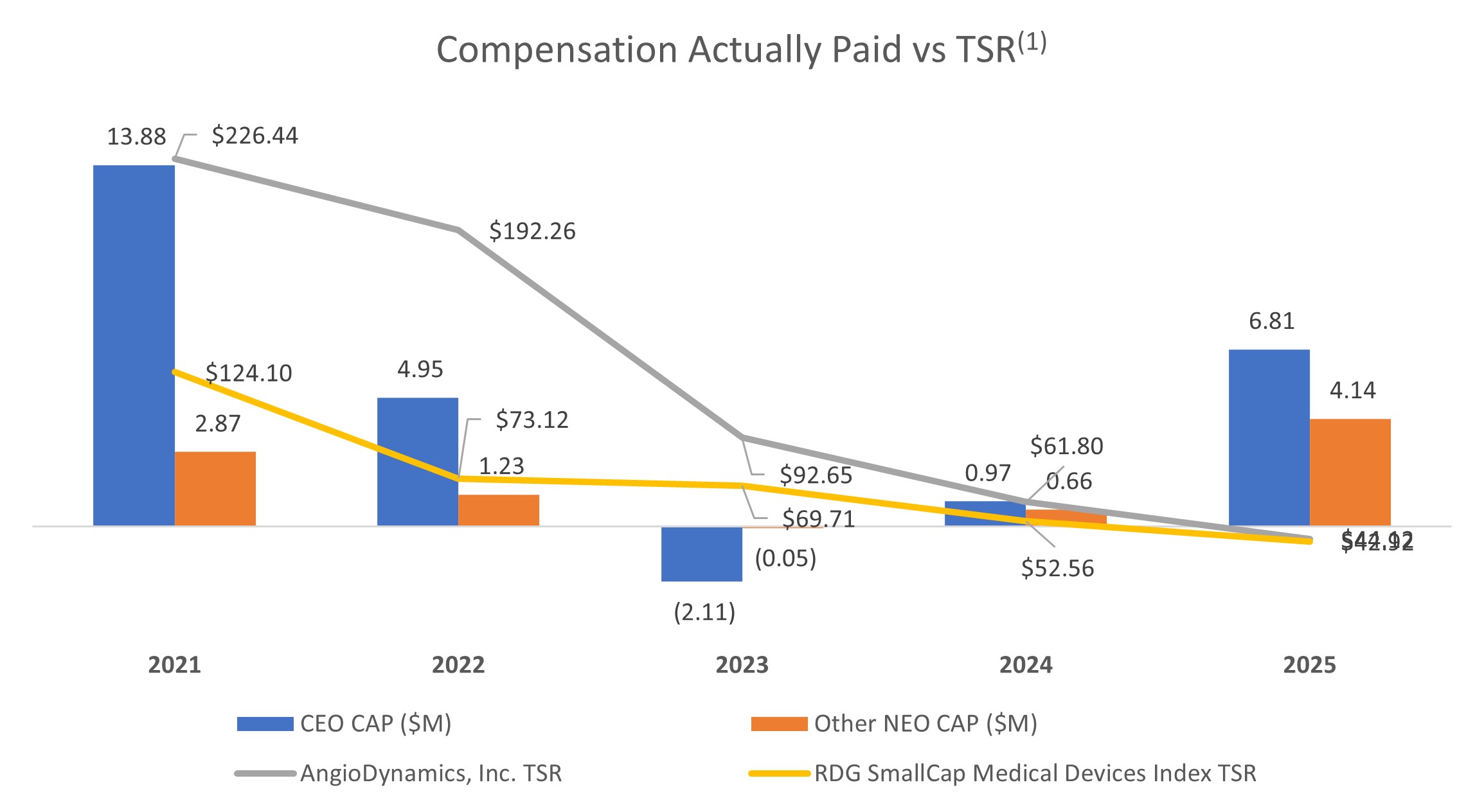

| | | | | | | | | | | | | | | | | | | | | | | | | | | | Fiscal Year | Summary Compensation Table Total for the CEO (1) | Compensation Actually Paid to the CEO (3)(4) | Average Summary Compensation Table Total for Non-CEO NEOs (2) | Average Compensation Actually Paid to the Non-CEO NEOs (3)(4) | Total Shareholder Return (5) | Peer Group Total Shareholder Return (5) | Net Income (loss) (in thousands) (6) | Revenue (in thousands) (7) | | 2025 | $ | 5,494,284 | | $ | 6,807,600 | | $ | 1,466,609 | | $ | 4,144,464 | | $ | 44.12 | | $ | 42.92 | | $ | (33,993) | | $ | 292,498 | | | 2024 | $ | 5,005,971 | | $ | 971,112 | | $ | 1,264,817 | | $ | 656,573 | | $ | 61.80 | | $ | 52.56 | | $ | (184,350) | | $ | 303,914 | | | 2023 | $ | 3,983,690 | | $ | (2,114,483) | | $ | 914,244 | | $ | (45,199) | | $ | 92.65 | | $ | 69.71 | | $ | (52,441) | | $ | 338,752 | | | 2022 | $ | 5,659,727 | | $ | 4,953,581 | | $ | 1,303,492 | | $ | 1,233,726 | | $ | 192.26 | | $ | 73.12 | | $ | (26,547) | | $ | 316,219 | | | 2021 | $ | 4,045,913 | | $ | 13,883,392 | | $ | 1,029,527 | | $ | 2,868,533 | | $ | 226.44 | | $ | 124.10 | | $ | (31,547) | | $ | 291,010 | |

|

|

|

|

|

| Company Selected Measure Name |

Revenue

|

|

|

|

|

| Named Executive Officers, Footnote |

Mr. Clemmer was the CEO for each of the fiscal years presented. Non-CEO NEOs for fiscal year 2025 were Messrs. Trowbridge, Weiss, and Nighan and Ms. Piccinini. Non-CEO NEOs for fiscal year 2024 were Messrs. Trowbridge, Nighan, and Campbell and Ms. Piccinini. Non-CEO NEOs for fiscal years 2023 and 2022 were Messrs. Trowbridge, Helsel, and Campbell and Ms. Piccinini. Non-CEO NEOs for fiscal year 2021 were Messrs. Trowbridge, Helsel, Campbell and Nighan.

|

|

|

|

|

| PEO Total Compensation Amount |

$ 5,494,284

|

$ 5,005,971

|

$ 3,983,690

|

$ 5,659,727

|

$ 4,045,913

|

| PEO Actually Paid Compensation Amount |

$ 6,807,600

|

971,112

|

(2,114,483)

|

4,953,581

|

13,883,392

|

| Adjustment To PEO Compensation, Footnote |

Subtractions from, and additions to, total compensation in the Summary Compensation Table ("SCT") by fiscal year to calculate Compensation Actually Paid ("CAP") are as follows: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | 2025 | | 2024 | | 2023 | | 2022 | | CEO | | Average of Non-CEO NEOs | | CEO | | Average of Non-CEO NEOs | | CEO | | Average of Non-CEO NEOs | | CEO | | Average of Non-CEO NEOs | | Total Compensation from SCT | $ | 5,494,284 | | | $ | 1,466,609 | | | $ | 5,005,971 | | | $ | 1,264,817 | | | $ | 3,983,690 | | | $ | 914,244 | | | $ | 5,659,727 | | | $ | 1,303,492 | | | Subtractions: | | | | | | | | | | | | | | | | | SCT Value of Stock and Option Awards | $ | (3,437,078) | | | $ | (734,299) | | | $ | (3,399,217) | | | $ | (592,487) | | | $ | (3,000,774) | | | $ | (454,289) | | | $ | (4,147,712) | | | $ | (687,958) | | | Adjustments: | | | | | | | | | | | | | | | | | Unvested value at year end of equity granted during the covered fiscal year | $ | 3,736,553 | | | $ | 3,217,933 | | | $ | 817,462 | | | $ | 226,197 | | | $ | 658,535 | | | $ | 99,697 | | | $ | 3,289,559 | | | $ | 518,057 | | | Change from prior year end in fair value of awards granted in any prior fiscal year that are outstanding and unvested at covered year end | $ | 1,263,456 | | | $ | 243,529 | | | $ | (313,264) | | | $ | (42,700) | | | $ | (3,867,465) | | | $ | (612,420) | | | $ | (1,051,502) | | | $ | (189,282) | | | Change as of the vesting date (from the end of the prior fiscal year) in fair value of awards granted in any prior fiscal years for which vesting conditions were satisfied at the end of or during the covered fiscal year | $ | (249,615) | | | $ | (49,308) | | | $ | (1,139,840) | | | $ | (199,254) | | | $ | 111,531 | | | $ | 7,569 | | | $ | 1,203,509 | | | $ | 289,417 | | | Compensation Actually Paid | $ | 6,807,600 | | | $ | 4,144,464 | | | $ | 971,112 | | | $ | 656,573 | | | $ | (2,114,483) | | | $ | (45,199) | | | $ | 4,953,581 | | | $ | 1,233,726 | |

|

|

|

|

|

| Non-PEO NEO Average Total Compensation Amount |

$ 1,466,609

|

1,264,817

|

914,244

|

1,303,492

|

1,029,527

|

| Non-PEO NEO Average Compensation Actually Paid Amount |

$ 4,144,464

|

656,573

|

(45,199)

|

1,233,726

|

2,868,533

|

| Adjustment to Non-PEO NEO Compensation Footnote |

Subtractions from, and additions to, total compensation in the Summary Compensation Table ("SCT") by fiscal year to calculate Compensation Actually Paid ("CAP") are as follows: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | 2025 | | 2024 | | 2023 | | 2022 | | CEO | | Average of Non-CEO NEOs | | CEO | | Average of Non-CEO NEOs | | CEO | | Average of Non-CEO NEOs | | CEO | | Average of Non-CEO NEOs | | Total Compensation from SCT | $ | 5,494,284 | | | $ | 1,466,609 | | | $ | 5,005,971 | | | $ | 1,264,817 | | | $ | 3,983,690 | | | $ | 914,244 | | | $ | 5,659,727 | | | $ | 1,303,492 | | | Subtractions: | | | | | | | | | | | | | | | | | SCT Value of Stock and Option Awards | $ | (3,437,078) | | | $ | (734,299) | | | $ | (3,399,217) | | | $ | (592,487) | | | $ | (3,000,774) | | | $ | (454,289) | | | $ | (4,147,712) | | | $ | (687,958) | | | Adjustments: | | | | | | | | | | | | | | | | | Unvested value at year end of equity granted during the covered fiscal year | $ | 3,736,553 | | | $ | 3,217,933 | | | $ | 817,462 | | | $ | 226,197 | | | $ | 658,535 | | | $ | 99,697 | | | $ | 3,289,559 | | | $ | 518,057 | | | Change from prior year end in fair value of awards granted in any prior fiscal year that are outstanding and unvested at covered year end | $ | 1,263,456 | | | $ | 243,529 | | | $ | (313,264) | | | $ | (42,700) | | | $ | (3,867,465) | | | $ | (612,420) | | | $ | (1,051,502) | | | $ | (189,282) | | | Change as of the vesting date (from the end of the prior fiscal year) in fair value of awards granted in any prior fiscal years for which vesting conditions were satisfied at the end of or during the covered fiscal year | $ | (249,615) | | | $ | (49,308) | | | $ | (1,139,840) | | | $ | (199,254) | | | $ | 111,531 | | | $ | 7,569 | | | $ | 1,203,509 | | | $ | 289,417 | | | Compensation Actually Paid | $ | 6,807,600 | | | $ | 4,144,464 | | | $ | 971,112 | | | $ | 656,573 | | | $ | (2,114,483) | | | $ | (45,199) | | | $ | 4,953,581 | | | $ | 1,233,726 | |

|

|

|

|

|

| Compensation Actually Paid vs. Total Shareholder Return |

| | | | | | | (1) | TSR represents the value of a $100 investment in common stock, assuming reinvestment of dividends, as measured at each fiscal year end. |

|

|

|

|

|

| Compensation Actually Paid vs. Net Income |

|

|

|

|

|

| Compensation Actually Paid vs. Company Selected Measure |

|

|

|

|

|

| Total Shareholder Return Vs Peer Group |

| | | | | | | (1) | TSR represents the value of a $100 investment in common stock, assuming reinvestment of dividends, as measured at each fiscal year end. |

|

|

|

|

|

| Tabular List, Table |

Relative TSR values versus the RDG SmallCap Medical Devices Index; •EBITDA and EPS; and •The Company Selected Measure is Revenue.

|

|

|

|

|

| Total Shareholder Return Amount |

$ 44.12

|

61.80

|

92.65

|

192.26

|

226.44

|

| Peer Group Total Shareholder Return Amount |

42.92

|

52.56

|

69.71

|

73.12

|

124.10

|

| Net Income (Loss) |

$ (33,993,000)

|

$ (184,350,000)

|

$ (52,441,000)

|

$ (26,547,000)

|

$ (31,547,000)

|

| Company Selected Measure Amount |

292,498,000

|

303,914,000

|

338,752,000

|

316,219,000

|

291,010,000

|

| PEO Name |

Mr. Clemmer

|

|

|

|

|

| Additional 402(v) Disclosure |

The fair value of each equity award was re-measured on each vesting date and/or year end, as applicable, in accordance with Accounting Standards Codification (ASC) Topic 718. The assumptions used in the valuation of each type of award are summarized below: •Restricted stock units: The fair value of restricted stock units was based on the Company's closing stock price on each measurement date. •Non-qualified stock options: The fair value of non-qualified stock options was determined using a Black-Scholes option pricing model. •Performance unit awards: Performance unit awards are subject to vesting based on the Company's level of attainment of performance targets, as well as a TSR modifier at the end of each performance period that can adjust the aggregate number of shares eligible to vest at the end of the three-year performance period. The fair value for performance unit awards was determined using a Monte Carlo simulation. Total shareholder return (TSR) is determined based on the value of an initial fixed investment of $100 in common stock on May 31, 2020, assuming the reinvestment of the dividends. The TSR peer group comprises the RDG SmallCap Medical Devices Index.Reflects the dollar amount of net income reported in our audited financial statements for the applicable fiscal year. GAAP Revenue equals Net Revenue, so no reconciliations are required for fiscal years 2025, 2024, 2023, 2022 or 2021. See our 2025 Annual Report on Form 10-K for the year ended May 31, 2025.

|

|

|

|

|

| Measure:: 1 |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Name |

Revenue

|

|

|

|

|

| Measure:: 2 |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Name |

Relative TSR values versus the RDG SmallCap Medical Devices Index

|

|

|

|

|

| Measure:: 3 |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Name |

EBITDA

|

|

|

|

|

| Measure:: 4 |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Name |

EPS

|

|

|

|

|

| PEO | Aggregate Grant Date Fair Value of Equity Award Amounts Reported in Summary Compensation Table |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Adjustment to Compensation, Amount |

$ (3,437,078)

|

$ (3,399,217)

|

$ (3,000,774)

|

$ (4,147,712)

|

$ (2,137,451)

|

| PEO | Year-end Fair Value of Equity Awards Granted in Covered Year that are Outstanding and Unvested |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Adjustment to Compensation, Amount |

3,736,553

|

817,462

|

658,535

|

3,289,559

|

9,414,998

|

| PEO | Year-over-Year Change in Fair Value of Equity Awards Granted in Prior Years That are Outstanding and Unvested |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Adjustment to Compensation, Amount |

1,263,456

|

(313,264)

|

(3,867,465)

|

(1,051,502)

|

2,574,779

|

| PEO | Change in Fair Value as of Vesting Date of Prior Year Equity Awards Vested in Covered Year |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Adjustment to Compensation, Amount |

(249,615)

|

(1,139,840)

|

111,531

|

1,203,509

|

(14,847)

|

| Non-PEO NEO | Aggregate Grant Date Fair Value of Equity Award Amounts Reported in Summary Compensation Table |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Adjustment to Compensation, Amount |

(734,299)

|

(592,487)

|

(454,289)

|

(687,958)

|

(357,244)

|

| Non-PEO NEO | Year-end Fair Value of Equity Awards Granted in Covered Year that are Outstanding and Unvested |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Adjustment to Compensation, Amount |

3,217,933

|

226,197

|

99,697

|

518,057

|

1,573,581

|

| Non-PEO NEO | Year-over-Year Change in Fair Value of Equity Awards Granted in Prior Years That are Outstanding and Unvested |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Adjustment to Compensation, Amount |

243,529

|

(42,700)

|

(612,420)

|

(189,282)

|

561,569

|

| Non-PEO NEO | Change in Fair Value as of Vesting Date of Prior Year Equity Awards Vested in Covered Year |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Adjustment to Compensation, Amount |

$ (49,308)

|

$ (199,254)

|

$ 7,569

|

$ 289,417

|

$ 61,100

|