MANAGEMENT INFORMATION CIRCULAR

(Containing information as at August 15, 2024 unless indicated otherwise)

This Management Information Circular (the "Circular") is furnished in connection with the solicitation of proxies by the management of BTQ Technologies Corp. (the "Company") for use at the annual general meeting (the "Meeting") of its shareholders to be held at the offices of Farris LLP, 25th floor, 700 West Georgia Street, British Columbia, V7Y 1B3 on September 18, 2024 at the time and place and for the purposes set forth in the accompanying notice of the Meeting.

In this Circular, references to "the Company", "we" and "our" refer to BTQ Technologies Corp., "common shares" means common shares without par value in the capital of the Company. "Beneficial Shareholders" means shareholders who do not hold common shares in their own name and "intermediaries" refers to brokers, investment firms, clearing houses and similar entities that own securities on behalf of Beneficial Shareholders.

GENERAL PROXY INFORMATION

Solicitation of Proxies

The solicitation of proxies will be primarily by mail, but proxies may be solicited personally or by telephone by directors, officers and regular employees of the Company. The Company will bear all costs of this solicitation. We have arranged for intermediaries to forward the meeting materials to beneficial owners of common shares held as of record by those intermediaries and we may reimburse the intermediaries for their reasonable fees and disbursements in that regard.

Appointment of Proxyholders

The individuals named in the accompanying form of proxy (the "Proxy") are officers and directors of the Company. If you are a shareholder entitled to vote at the Meeting, you have the right to appoint a person or company other than either of the persons designated in the Proxy, who need not be a shareholder, to attend and act for you on your behalf at the Meeting. You may do so either by inserting the name of that other person in the blank space provided in the Proxy or by completing and delivering another suitable form of proxy.

The only methods by which you may appoint a person as proxy are submitting a Proxy by mail, hand delivery or fax.

Voting by Proxyholder

The persons named in the Proxy will vote or withhold from voting the common shares represented thereby in accordance with your instructions on any ballot that may be called for. If you specify a choice with respect to any matter to be acted upon, your common shares will be voted accordingly. The Proxy confers discretionary authority on persons named therein with respect to:

(a) each matter or group of matters identified therein for which a choice is not specified, other than the appointment of an auditor and the election of directors,

(b) any amendment to or variation of any matter identified therein, and

(c) any other matter that properly comes before the Meeting.

In respect of a matter for which a choice is not specified in the Proxy, or where both choices have been specified, in favour or all matters described herein, the persons named in the Proxy will vote the common shares represented by the Proxy for the approval of such matter.

Notice and Access

The Company is not sending this Circular to registered or beneficial shareholders using "notice-and-access" as defined under National Instrument 54-101 ("NI 54-101").

2

Registered Shareholders

If you are a Registered Shareholder and wish to have your common shares voted at the Meeting, you will be required to submit your vote by proxy. Registered Shareholders electing to submit a proxy may do so by completing, dating and signing the Proxy and returning it to the Company's transfer agent, Computershare Trust Company of Canada ("Computershare"), in accordance with the instructions on the Proxy. Alternatively, Registered Shareholders may vote their common shares via the internet or by telephone as per the instructions provided on the Proxy.

In all cases you should ensure that the Proxy is received at least 48 hours (excluding Saturdays, Sundays and holidays) before the Meeting or the adjournment thereof at which the Proxy is to be used.

Registered Shareholders electing to submit a Proxy may do so by:

(a) Internet. Vote online at www.investorvote.com using the Proxy control number found in the enclosed Proxy.

(b) Telephone. Using a touch-tone phone to transmit voting choices to the toll-free number given in the Proxy. Registered Shareholders who choose this option must follow the instructions of the voice response system and refer to the enclosed Proxy for the toll-free number, the holder's account number and the Proxy Control Number.

(c) Mail. Completing, dating and signing the enclosed Proxy and returning it to Computershare, by fax within North America at 1-866-249-7775, or by mail or hand delivery at 8th Floor, 100 University Avenue, Toronto, Ontario, M5J 2Y1, Canada.

In all cases ensuring that the Proxy is received at least 48 hours (excluding Saturdays, Sundays and holidays) before the Meeting or the adjournment thereof at which the Proxy is to be used.

Should you wish to contact Computershare, please refer to the following:

General Shareholder Inquiries:

| By phone: | 1-800-564-6253 |

| By fax: | 1-888-453-0330 |

| By email: | service@computershare.com |

| By regular mail: | Computershare Trust Company of Canada |

| 100 University Avenue, 8th Floor | |

| Toronto, Ontario, M5J 2Y1 |

Beneficial Shareholders

The following information is of significant importance to shareholders who do not hold common shares in their own name. Beneficial Shareholders should note that the only proxies that can be recognized and acted upon at the Meeting are those deposited by Registered Shareholders (those whose names appear on the records of the Company as the registered holders of common shares).

These securityholder materials are being sent to both registered and non-registered owners of the securities of the Company. If you are a non-registered owner, and the Company or its agent has sent these materials directly to you, your name and address and information about your holdings of securities, have been obtained in accordance with applicable securities regulatory requirements from the intermediary holding on your behalf. By choosing to send these materials to you directly, the Company (and not the intermediary holding on your behalf) has assumed responsibility for (i) delivering these materials to you, and (ii) executing your proper voting instructions. Please return your voting instructions as specified in your request for voting instructions.

If common shares are listed in an account statement provided to a shareholder by a broker, then in almost all cases those common shares will not be registered in the shareholder's name on the records of the Company. Such common shares will more likely be registered under the names of the shareholder's broker or an agent of that broker. In the United States, the vast majority of such common shares are registered under the name of Cede & Co. as nominee for The Depository Trust Company (which acts as depositary for many U.S. brokerage firms and custodian banks), and in Canada, under the name of CDS & Co. (the registration name for The Canadian Depository for Securities Limited, which acts as nominee for many Canadian brokerage firms).

There are two kinds of beneficial owners - those who object to their name being made known to the issuers of securities which they own (called "OBOs" for "Objecting Beneficial Owners") and those who do not object to the issuers of the securities they own knowing who they are (called "NOBOs" for "Non-Objecting Beneficial Owners").

3

Pursuant to National Instrument 54-101 of the Canadian Securities Administrators, the Company is sending proxy- related materials directly to NOBOs, which materials will include a scannable Voting Instruction Form (a "VIF"). These VIFs are to be completed and returned to Computershare in the envelope provided or by facsimile. In addition, Computershare provides both telephone voting and Internet voting as described on the VIF itself which contain complete instructions. Computershare will tabulate the results of the VIFs received from NOBOs and will provide appropriate instructions at the Meeting with respect to the common shares represented by the VIFs they receive.

Management of the Company does not intend to pay for intermediaries to forward to OBOs under National Instrument 54-101 the proxy-related materials and Form 54-101F7 Request for Voting Instructions Made by Intermediary, and, in the case of an OBO, the OBO will not receive the materials unless the OBO's intermediary assumes the cost of delivery.

Every intermediary that mails proxy-related materials to Beneficial Shareholders has its own mailing procedures and provides its own return instructions to clients. Beneficial Shareholders should follow the instructions of their intermediary carefully to ensure that their common shares are voted at the Meeting.

Most brokers now delegate responsibility for obtaining instructions from clients to Broadridge Financial Solutions, Inc. ("Broadridge") in the United States and in Canada. Broadridge mails a voting instruction form (the "Broadridge VIF") which will be similar to the Proxy provided to Registered Shareholders by the Company. However, its purpose is limited to instructing the intermediary on how to vote on your behalf. The Broadridge VIF will appoint the same persons as the Company's Proxy to represent you at the Meeting. You have the right to appoint a person (who need not be a shareholder of the Company), other than the persons designated in the Broadridge VIF, to represent you at the Meeting. To exercise this right, you should insert the name of the desired representative in the blank space provided in the Broadridge VIF. The completed Broadridge VIF must then be returned to Broadridge by mail or facsimile or given to Broadridge by phone or over the internet, in accordance with Broadridge's instructions. Broadridge then tabulates the results of all instructions received and provides appropriate instructions respecting the voting of common shares to be represented at the Meeting. If you receive a Broadridge VIF, you cannot use it to vote common shares directly at the Meeting - the Broadridge VIF must be completed and returned to Broadridge, in accordance with its instructions, well in advance of the Meeting in order to have the common shares voted.

Although as a Beneficial Shareholder you may not be recognized directly at the Meeting for the purposes of voting common shares registered in the name of your broker, you, or a person designated by you, may attend at the Meeting as proxyholder for your broker and vote your common shares in that capacity. If you wish to attend the Meeting and indirectly vote your common shares as proxyholder for your broker, or have a person designated by you do so, you should enter your own name, or the name of the person you wish to designate, in the blank space on the voting instruction form provided to you and return the same to your broker in accordance with the instructions provided by such broker, well in advance of the Meeting.

Alternatively, you can request in writing that your broker send you a legal Proxy which would enable you, or a person designated by you, to attend at the Meeting and vote your common shares.

Revocation of Proxies

In addition to revocation in any other manner permitted by law, a Registered Shareholder who has given a Proxy may revoke it by:

(a) executing a Proxy bearing a later date or by executing a valid notice of revocation, either of the foregoing to be executed by the Registered Shareholder or the Registered Shareholder's authorized attorney in writing, or, if the shareholder is a corporation, under its corporate seal by an officer or attorney duly authorized, and by delivering the Proxy bearing a later date to Computershare at any time up to 10:00 a.m. (Vancouver time) on September 16, 2024 or, if the Meeting is adjourned, 10:00 a.m. (Vancouver time) on the second business day that precedes any reconvening thereof, or to the chairman of the Meeting on the day of the Meeting or any reconvening thereof, or in any other manner provided by law; or

(b) personally attending the Meeting and voting the Registered Shareholder's common shares.

A revocation of a Proxy will not affect a matter on which a vote is taken before the revocation.

INTEREST OF CERTAIN PERSONS OR COMPANIES IN MATTERS TO BE ACTED UPON

No director or executive officer of the Company, nor any person who has held such a position since the beginning of the last completed financial year end of the Company, nor any proposed nominee for election as a director of the Company, nor any associate or affiliate of the foregoing persons, has any substantial or material interest, direct or indirect, by way of beneficial ownership of securities or otherwise, in any matter to be acted on at the Meeting other than the election of directors, the appointment of the auditor and as set out herein.

4

VOTING SECURITIES AND PRINCIPAL HOLDERS OF VOTING SECURITIES

The board of directors (the "Board") of the Company has fixed August 13, 2024 as the record date (the "Record Date") for determination of persons entitled to receive notice of the Meeting. Only shareholders of record at the close of business on the Record Date who either attend the Meeting personally or complete, sign and deliver a form of Proxy in the manner and subject to the provisions described above will be entitled to vote or to have their common shares voted at the Meeting.

As at the Record Date, there were 124,203,879 common shares issued and outstanding, each carrying the right to one vote.

On a show of hands, every individual who is present and is entitled to vote as a shareholder or as a representative of one or more corporate shareholders will have one vote, and on a poll every shareholder present in person or represented by a Proxy and every person who is a representative of one or more corporate shareholders, will have one vote for each common share registered in that shareholder's name on the list of shareholders as at the Record Date, which is available for inspection during normal business hours at Computershare and will be available at the Meeting.

To the knowledge of the directors and executive officers of the Company, the only person that beneficially owns, directly or indirectly, or exercised control or direction over, common shares carrying 10% or more of the voting rights attached to all outstanding common shares of the Company as at the Record Date as follows:

| Name of Shareholder | Number of Shares Held | Percentage |

| Olivier Roussy Newton | 41,843,000 Shares | 33.69% |

VOTES NECESSARY TO PASS RESOLUTIONS

A simple majority of affirmative votes cast at the Meeting is required to pass the resolutions described herein. If there are more nominees for election as directors or appointment of the Company's auditor than there are vacancies to fill, those nominees receiving the greatest number of votes will be elected or appointed, as the case may be, until all such vacancies have been filled. If the number of nominees for election or appointment is equal to the number of vacancies to be filled, all such nominees will be declared elected or appointed by acclamation.

SETTING NUMBER OF DIRECTORS

The persons named in the enclosed Proxy intend to vote in favour of fixing the number of directors at five (5). The Board proposes that the number of directors be fixed at five (5). Shareholders will therefore be asked to approve an ordinary resolution that the number of directors elected be fixed at five (5).

ELECTION OF DIRECTORS

The term of office of each of the current directors expires at the conclusion of the Meeting. Unless the director's office is earlier vacated in accordance with the provisions of the Business Corporations Act (British Columbia), each director elected will hold office until the conclusion of the next annual general meeting of the Company, or if no director is then elected, until a successor is elected.

The following table sets out the names of management's nominees for election as a director (a "proposed director"), the province and country in which he is ordinarily resident, all major offices and positions with the Company and any of its significant affiliates each now holds, each nominee's principal occupation, business or employment for the five preceding years for new director nominees, the period of time during which each has been a director of the Company and the number of common shares of the Company beneficially owned by each, directly or indirectly, or over which each exercised control or direction, as at the Record Date.

5

| Name of Nominee, Province and Country of Ordinary Residence and Positions Held with the Company |

Occupation, Business or Employment(1) |

Director of the Company Since |

Common Shares Beneficially Owned or Controlled, or Directed, Directly or Indirectly(1) |

|

Olivier Roussy Newton Zug, Switzerland Director and CEO |

Entrepreneur; President of EV Technology Group; Founder of Latent Capital; Co- Founder of DEFI Technologies; former director of Hive Blockchain Technologies Ltd. | February 17, 2023 | 41,843,000 Shares |

|

Nicolas Roussy Newton Taipei City, Taiwan Director and COO |

Entrepreneur; Investor. | February 17, 2023 | Nil |

|

Michael Resendes(2) (3) British Columbia, Canada Director |

Accountant. | September 13, 2005 | 225,000 |

|

Johan Wattenstrom(2) (3) Zug, Switzerland Director |

Chief Executive Officer of Nortide Capital AG | February 17, 2023 | 400,000 |

| Kevin Mulhern(2) (3) Ontario, Canada Director |

Vice President of Business Operations of Broadridge; formerly CEO and Founder of AdvisorStream Ltd. | February 17, 2023 | 400,000 |

Notes:

(1) The information as to principal occupation, business or employment and common shares beneficially owned or controlled is not within the knowledge of the management of the Company and has been furnished by the respective nominees. Each nominee has held the same or a similar principal occupation with the organization indicated or a predecessor thereof for the last five years.

(2) Denotes a member of the audit committee of the Company.

None of the proposed directors of the Company is to be elected under any arrangement or understanding between the proposed director and any other person or company, except the directors and officers of the Company acting solely in such capacity.

CORPORATE CEASE TRADE ORDERS OR BANKRUPTCIES

The Company applied for a management cease trade order (an "MCTO") under National Policy 12-203 Management Cease Trade Orders ("NP 12-203") on March 18, 2024, due to the delayed filing of its consolidated financial statements for the year ended December 31, 2023. The MCTO was lifted after the filing of the Company's annual consolidated financial statements on June 4, 2024.

With the exception of the MCTO, as at the date of this Circular, and within the last 10 years before the date of this Circular, no proposed director (or any of their personal holding companies) of the Company was a director, CEO or CFO of any company (including the Company) that:

(a) was subject to a cease trade or similar order or an order denying the relevant company access to any exemptions under securities legislation, for more than 30 consecutive days while that person was acting in the capacity as director, CEO or CFO; or

(b) was the subject of a cease trade or similar order or an order that denied the issuer access to any exemption under securities legislation in each case for a period of 30 consecutive days, that was issued after the person ceased to be a director, CEO or CFO in the company and which resulted from an event that occurred while that person was acting in the capacity as director, CEO or CFO; or

(c) is as at the date of this Circular or has been within 10 years before the date of this Circular, a director or executive officer of any company, including the Company, that, while that person was acting in that capacity, or within a year of that person ceasing to act in that capacity, became bankrupt, made a proposal under any legislation relating to bankruptcy or insolvency or was subject to or instituted any proceedings, arrangement or compromise with creditors or had a receiver, receiver manager or trustee appointed to hold its assets; or

6

(d) has within the 10 years before the date of this Circular, become bankrupt, made a proposal under any legislation relating to bankruptcy or insolvency, or become subject to or instituted any proceedings, arrangements or compromise with creditors, or had a receiver, receiver manager as trustee appointed to hold the assets of that individual.

None of the proposed directors (or any of their personal holding companies) has been subject to:

(1) any penalties or sanctions imposed by a court relating to securities legislation or by a securities regulatory authority or has entered into a settlement agreement with a securities regulatory authority; or

(2) any other penalties or sanctions imposed by a court or a regulatory body that would likely be considered important to a reasonable securityholder in deciding whether to vote for a proposed director

AUDIT COMMITTEE AND RELATIONSHIP WITH AUDITOR

The Audit Committee of the Board is responsible for monitoring the Company's systems and procedures for financial reporting and internal control, reviewing certain public disclosure documents and monitoring the performance and independence of the Company's external auditors. The committee is also responsible for reviewing the Company's annual audited financial statements, unaudited quarterly financial statements and management's discussion and analysis of financial results of operations for both annual and interim financial statements and review of related operations prior to their approval by the full Board.

The Company has filed an Annual Information Form (the "AIF") for the fiscal year ended December 31, 2023, on SEDAR+ at www.sedarplus.ca, which contains, among other things, all of the financial disclosure and also the Charter of the Company's Audit Committee as required under NI 52-110. In particular, the information that is required to be disclosed in Form 52-110F1 of NI 52-110 may be found under the heading "Audit Committee Disclosure" in the AIF.

The members of the Audit Committee are Michael Resendes, Kevin Mulhern, and Johan Wattenstrom. All members are not executive officers of the Company and, therefore, are independent members of the Audit Committee. All members are considered to be financially literate. A member of the audit committee is independent if the member has no direct or indirect material relationship with the Company. A material relationship means a relationship which could, in the view of the Company's Board, reasonably interfere with the exercise of a member's independent judgment. A member of the audit committee is considered financially literate if he or she has the ability to read and understand a set of financial statements that present a breadth and level of complexity of accounting issues that are generally comparable to the breadth and complexity of the issues that can reasonably be expected to be raised by the Company.

CORPORATE GOVERNANCE

General

Corporate governance refers to the policies and structure of the Board of a company whose members are elected by and are accountable to the shareholders of the company. Corporate governance encourages establishing a reasonable degree of independence of the Board from executive management and the adoption of policies to ensure the Board recognizes the principles of good management. The Board is committed to sound corporate governance practices as such practices are both in the interests of shareholders and help to contribute to effective and efficient decision-making.

Effective June 30, 2005, National Instrument 58-101 Disclosure of Corporate Governance Practices ("NI 58-101") and National Policy 58-201 Corporate Governance Guidelines ("NP 58-201") were adopted in each of the provinces and territories of Canada. NI 58-101 requires issuers to disclose the corporate governance practices that they have adopted. NP 58-201 provides guidance on corporate governance practices. This section sets out the Company's approach to corporate governance and addresses the Company's compliance with NI 58-101.

Board of Directors

Directors are considered to be independent if they have no direct or indirect material relationship with the Company. A "material relationship" is a relationship which could, in the view of the Company's Board, be reasonably expected to interfere with the exercise of a director's independent judgment.

7

The Company's Board facilitates its exercise of independent judgement in carrying out its responsibilities by carefully examining issues and consulting with outside counsel and other advisors in appropriate circumstances. The Company's Board requires management to provide complete and accurate information with respect to the Company's activities and to provide relevant information concerning the industry in which the Company operates in order to identify and manage risks. The Company's Board is responsible for monitoring the Company's officers, who in turn are responsible for the maintenance of internal controls and management information systems.

The current independent members of the Board are Michael Resendes, Johan Wattenstrom, and Kevin Mulhern. The non-independent members of the Board are Olivier Roussy Newton, CEO of the Company, and Nicolas Roussy Newton, COO of the Company.

Mandate

The Board of Directors is responsible for the stewardship and the general supervision of the management of the business of the Company and is to act in the best interests of the Company and its stakeholders. The Board will discharge its responsibilities directly and through its committees. In addition, the Board may from time to time, appoint such additional committees as it deems necessary and appropriate in order to discharge its duties.

Position Description

The Chairman of the Board is responsible for presiding at meetings of the Board and for annually proposing the leadership and membership of the Company's committees.

The Chairman of the Audit Committee is responsible for presiding at meetings of the Audit Committee and for investigating any complaints made against the Company through the whistleblower policy. Any responsibility which is not delegated to senior management or a Board committee remains with the full Board.

The CEO is responsible for the management of the resources and operations of a Company, making major corporate decisions, and acting as the main point of contact between the Board, employees, and the public. The CEO is also responsible for leading and developing key management personnel. There is no explicit written position description for the CEO at the point of this filings.

The COO oversees operations in the company's various offices in Canada, Taiwan, and Australia. The COO is also responsible for establishing general research direction and sourcing partnerships with potential customers and other research companies.

Directorships

In addition to his role at BTQ, Olivier Roussy Newton is serving as the executive chairman of Defi Technologies (CBOE CA: DEFI) (GR: R9B) (OTC: DEFTF), a financial technology company that converges traditional capital markets with the world of decentralized finance.

Orientation and Continuing Education

When new directors are appointed, they receive an orientation, commensurate with their previous experience, on the Company's properties, business, technology and industry and on the responsibilities of directors.

Board meetings may also include presentations by the Company's management and employees to give the directors additional insight into the Company's business.

Ethical Business Conduct

The Board has found that the fiduciary duties placed on individual directors by the Company's governing corporate legislation and the common law and the restrictions placed by applicable corporate legislation on an individual directors' participation in decisions of the Board in which the director has an interest have been sufficient to ensure that the Board operates independently of management and in the best interests of the Company. Further, the Company's auditor has full and unrestricted access to the Audit Committee at all times to discuss the audit of the Company's financial statements and any related findings as to the integrity of the financial reporting process.

Nomination of Directors

The Board considers its size each year when it considers the number of directors to recommend to the shareholders for election at the annual meeting of shareholders, taking into account the number required to carry out the Board's duties effectively and to maintain a diversity of views and experience.

8

The Board does not have a nominating committee, and these functions are currently performed by the Board as a whole. However, if there is a change in the number of directors required by the Company, this policy will be reviewed.

Compensation

The Board as a whole determines compensation for the directors and the CEO.

Other Board Committees

The Board has no other committees other than the Audit Committee.

Majority Voting Policy

The Company has adopted a majority voting policy in director elections, which applies to any meeting of shareholders where an uncontested election of directors is held. Pursuant to this policy, any nominee who receives a greater number of votes "withheld" from his or her election than votes "for" such election will immediately tender his or her resignation to the Board. The independent directors of the Company (the "Committee") shall evaluate the best interests of the Company and its shareholders and shall recommend to the Board the action to be taken with respect to such tendered resignation, following which the Board shall consider the Committee's recommendation and make a determination. The Board shall accept the resignation absent exceptional circumstances. The above procedures shall be completed within ninety (90) days following the shareholder meeting.

In reaching its recommendation, the Committee shall consider all factors it deems relevant, including, without limitation, the effect of the exercise of cumulative voting in the election, if applicable, any stated reasons why shareholders "withheld" votes for the election from such director, the length of service and qualifications of the director whose resignation has been tendered, the director's contributions to the Company, the Company's corporate governance guidelines and whether any special interest groups conducted a campaign involving the election of directors to further the interests of such group, as opposed to the best interests of all shareholders.

In considering the Committee's recommendation, the Board will consider all of the factors considered by the Committee and such additional factors as it deems relevant.

Assessments

The Board monitors the adequacy of information given to directors, communication between the Board and management and the strategic direction and processes of the Board and committees.

STATEMENT OF EXECUTIVE COMPENSATION

Compensation Discussion and Analysis

Compensation, Philosophy and Objectives

The Company does not have a formal compensation program. The Board meets to discuss and determine management compensation, without reference to formal objectives, criteria or analysis. The general objectives of the Company's compensation strategy are to (a) compensate management in a manner that encourages and rewards a high level of performance and outstanding results with a view to increasing long-term shareholder value; (b) align management's interests with the long-term interests of shareholders; (c) provide a compensation package that is commensurate with other junior mineral exploration companies to enable the Company to attract and retain talent; and (d) ensure that the total compensation package is designed in a manner that takes into account the constraints that the Company is under by virtue of the fact that it is a junior mineral exploration company without a history of earnings.

The Board, as a whole, ensures that total compensation paid to all NEOs, as hereinafter defined, is fair and reasonable. The Board relies on the experience of its members as officers and directors with other junior mining companies in assessing compensation levels.

The Board has not conducted a formal evaluation of the implications of the risks associated with the Company's compensation policies. Risk management is a consideration of the Board when implementing its compensation policies and the Board do not believe that the Company's compensation policies result in unnecessary or inappropriate risk taking including risks that are likely to have a material adverse effect on the Company.

9

Analysis of Elements

Base salary is used to provide the NEOs a set amount of money during the year with the expectation that each NEO will perform his responsibilities to the best of his ability and in the best interests of the Company.

The Company considers the granting of incentive stock options to be a significant component of executive compensation as it allows the Company to reward each NEO's efforts to increase value for shareholders without requiring the Company to use cash from its treasury. Stock options are generally awarded to executive officers at the commencement of employment and periodically thereafter. The terms and conditions of the Company's stock option grants, including vesting provisions and exercise prices, are governed by the terms of the Company's stock option plan (the "Stock Option Plan").

Long Term Compensation and Option-Based Awards

The Company has no long-term incentive plans other than its Stock Option Plan. The Company's directors and officers and certain consultants are entitled to participate in the Stock Option Plan. The Stock Option Plan is designed to encourage share ownership and entrepreneurship on the part of the senior management and other employees. The Board believes that the Stock Option Plan aligns the interests of the NEO and the Board with shareholders by linking a component of executive compensation to the longer term performance of the Company's common shares.

Options are granted by the Board. In monitoring or adjusting the option allotments, the Board takes into account its own observations on individual performance (where possible) and its assessment of individual contribution to shareholder value, previous option grants and the objectives set for the NEOs and the Board. The scale of options is generally commensurate to the appropriate level of base compensation for each level of responsibility.

In addition to determining the number of options to be granted pursuant to the methodology outlined above, the Board also makes the following determinations:

(a) parties who are entitled to participate in the Stock Option Plan;

(b) the exercise price for each stock option granted, subject to the provision that the exercise price cannot be lower than the prescribed discount permitted by the TSX Venture Exchange from the market price on the date of grant;

(c) the date on which each option is granted;

(d) the vesting period, if any, for each stock option;

(e) the other material terms and conditions of each stock option grant; and

(f) any re-pricing or amendment to a stock option grant.

The Board makes these determinations subject to and in accordance with the provisions of the Stock Option Plan. The Board reviews and approves grants of options on an annual basis and periodically during a financial year.

Use of Financial Instruments

The Company does not have a policy that would prohibit a NEO or director from purchasing financial instruments, including prepaid variable forward contracts, equity swaps, collars or units of exchange funds, that are designed to hedge or offset a decrease in market value of equity securities granted as compensation or held, directly or indirectly, by the NEO or director. However, management is not aware of any NEO or director purchasing such an instrument.

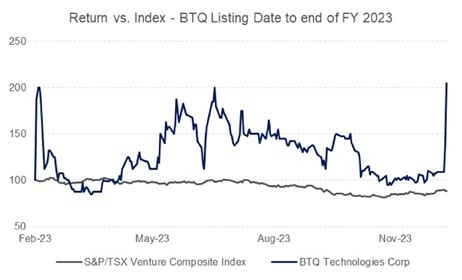

Performance Graph

This chart represents the illustrative value of a $100 investment in BTQ Technologies Corp. at the time of the company completing its RTO transaction vs. an investment in the S&P/TSX Venture Composite Index ("SPTSXVEN") for the same time period. The return on investment benchmark SPTSXVEN was chosen due to companies in said index having similar characteristics as BTQ (market capitalization, trading history, growth potential, etc.) but does not constitute a perfect comparable.

10

Summary Compensation Table

In this section, a "Named Executive Officer" ("NEO") includes (i) the CEO, (ii) the CFO, (iii) each of the three most highly compensated executive officers, other than the CEO and CFO, who were serving as executive officers as at the end of the most recently completed financial year of December 31, 2023, and whose total compensation was more than $150,000; and (iv) any additional individuals for whom disclosure would have been required except that the individual was not serving as an officer of the Company at the end of the most recently completed financial year.

The following table sets forth compensation paid to the Company's NEOs for the Company's three most recently completed financial years is as set out below:

11

| Name and principal position |

Year(1) | Salary ($) (a) |

Share- based awards ($)(2) (b) |

Option- based awards ($)(2) (c) |

Non-equity incentive plan compensation ($) |

Pension value ($) |

All other compensation ($) |

Total compensation ($)(2) |

|

| Annual incentive plans |

Long- term incentive plans |

||||||||

| Olivier Roussy Newton CEO |

2023 2022 2021 |

Nil Nil Nil |

Nil Nil Nil |

Nil Nil Nil |

Nil Nil Nil |

Nil Nil Nil |

Nil Nil Nil |

Nil Nil Nil |

Nil Nil Nil |

| Lonny Wong CFO |

2023 2022 2021 |

59,661(4) Nil Nil |

81,000(4) Nil Nil |

110,575(4) Nil Nil |

Nil Nil Nil |

Nil Nil Nil |

Nil Nil Nil |

Nil Nil Nil |

251,236(4) Nil Nil |

| Nicolas Roussy Newton COO |

2023 2022 2021 |

162,183 Nil Nil |

Nil Nil Nil |

196,843 Nil Nil |

Nil Nil Nil |

Nil Nil Nil |

Nil Nil Nil |

Nil Nil Nil |

359,026 Nil Nil |

| Peter Lavelle Chief Legal Officer |

2023 2022 2021 |

128,360 Nil Nil |

Nil Nil Nil |

157,474 Nil Nil |

Nil Nil Nil |

Nil Nil Nil |

Nil Nil Nil |

Nil Nil Nil |

285,834 Nil Nil |

| Po-Chun Kuo Chief Technology Officer |

2023 2022 2021 |

128,360 Nil Nil |

Nil Nil Nil |

157,474 Nil Nil |

Nil Nil Nil |

Nil Nil Nil |

Nil Nil Nil |

Nil Nil Nil |

285,834 Nil Nil |

| Ming-Yang Chih Chief Strategic Officer |

2023 2022 2021 |

97,163 Nil Nil |

Nil Nil Nil |

157,474 Nil Nil |

Nil Nil Nil |

Nil Nil Nil |

Nil Nil Nil |

86,275(5) Nil Nil |

340,912 Nil Nil |

Notes:

(1) 2023 and 2022 financial years ended January 31.

(2) Share-based awards comprise RSUs. Value represents the fair value of the entire award on the grant date which differs from the value reported in the Company's financial statements. For financial statement purposes, the accounting fair value amount is amortized over the service period to obtain the accounting compensation expense.

(3) The value ascribed to option grants represents non-cash consideration and has been estimated using the Black-Scholes option pricing model as at the date of grant as follows: February 17, 2023 - expected volatility - 216%, expected option life - 4.9 years, risk free-rate - 3.33%, dividend rate - 0%, May 18, 2023 - expected volatility - 219%, expected option life - 4.6 years, risk-free rate - 3.28%, dividen rate - 0%. The Company chose the Black-Scholes option pricing model given its prevalence of use in North America. The value represents the fair value of the entire award on the grant date which differs from the value reported in the Company's financial statements. For financial statement purposes, the accounting fair value amount is amortized over the service period to obtain the accounting compensation expense.

(4) Amount paid/awarded to Saturna Group Chartered Professional Accountants LLP where Lonny Wong is a partner.

(5) Amount paid to Chelpis Quantum Tech Co., a company owed by Ming-Yang Chih.

INCENTIVE PLAN AWARDS

Outstanding Share and Option-based Awards

The Company has a formal Stock Option Plan, previously approved by the shareholders of the Company. As of the December 31, 2023, the following share-based and option-based awards were outstanding for each of the NEOs:

12

| Option-based Awards | Share-based Awards | ||||||

| Name | Number of securities underlying unexercised options (#) |

Option exercise price ($) |

Option expiration date (c) |

Value of unexercised in-the-money options ($) (1)(2) |

Number of shares or units of shares that have not vested (#) |

Market or payout value of share-based awards that have not vested ($) (3) |

Market or payout value of vested share-based awards not paid out or distributed ($) |

| Olivier Roussy Newton CEO |

Nil | Nil | Nil | Nil | Nil | Nil | Nil |

| Lonny Wong CFO |

250,000 | 0.45 | January 1, 2028 | 92,500 | 135,000 | 60,750 | Nil |

| Nicolas Roussy Newton COO |

500,000 | 0.40 | January 1, 2028 | 210,000 | Nil | Nil | Nil |

| Peter Lavelle Chief Legal Officer |

400,000 | 0.40 | January 1, 2028 | 168,000 | Nil | Nil | Nil |

| Po-Chun Kuo Chief Technology Officer |

400,000 | 0.40 | January 1, 2028 | 168,000 | Nil | Nil | Nil |

| Ming-Yang Chih Chief Strategic Officer |

400,000 | 0.40 | January 1, 2028 | 168,000 | Nil | Nil | Nil |

Notes:

(1) Based on the closing market price of $0.82 on December 29, 2023 and subtracting the exercise price of the options.

(2) These options have not been, and may never be, exercised, and actual gains, if any, on exercise will depend on the value of the common shares on the date of exercise.

(3) Share-based awards comprise of RSUs. Value is based on the fair value of the award on the grant date.

Incentive Plan Awards - Value Vested or Earned during the Most Recently Completed Financial Year

The following table sets forth details of the value of incentive plan awards that vested or were earned during the most recently completed financial year ended December 31, 2023:

| Name | Option-based awards- Value vested during the year ($) (a) |

Share-based awards - Value vested during the year ($) (b) |

Non-equity incentive plan compensation - Value earned during the year ($) |

| Olivier Roussy Newton CEO |

Nil | Nil | Nil |

| Lonny Wong CFO |

Nil | 20,250 | Nil |

| Nicolas Roussy Newton COO |

Nil | Nil | Nil |

| Peter Lavelle Chief Legal Officer |

Nil | Nil | Nil |

| Po-Chun Kuo Chief Technology Officer |

Nil | Nil | Nil |

| Ming-Yang Chih Chief Strategic Officer |

Nil | Nil | Nil |

Pension Plans

The Company does not provide retirement benefits for directors or executive officers.

Termination of Employment, Changes in Responsibility and Employment Contracts

There are no employment contracts between the Company and the NEOs, except as referred to under the heading "Management Contracts" below.

13

The Company has no plans or arrangements in respect to compensation to its executive officers which would result from the resignation, retirement or any other termination of the executive officers' employment with the Company or from a change of control of the Company or a change in the executive officers' responsibilities following a change in control, where in respect of an executive officer the value of such compensation exceeds $100,000.

Compensation of Directors

The Company does not pay cash fees to any of its directors. The Company compensates its directors through option grants. NEOs do not receive additional compensation for serving as directors.

Director Compensation Table

The following table provides information regarding compensation paid to the non-NEO directors of the Company for the most recently completed financial year.

| Name | Fees earned ($) |

Share based awards ($) |

Option based awards ($) (1) |

Non-equity incentive plan compensation ($) |

Pension value ($) |

All other compensation ($) |

Total ($) |

| Kevin Mulhern | Nil | Nil | 90,589 | Nil | Nil | Nil | 90.589 |

| Johan Wattenstrom |

Nil | Nil | 90,589 | Nil | Nil | Nil | 90.589 |

| Michael Resendes |

Nil | Nil | Nil | Nil | Nil | Nil | Nil |

(1) The value ascribed to option grants represents non-cash consideration and has been estimated using the Black-Scholes option pricing model as at the date of grant as follows: February 17, 2023 - expected volatility - 166%, expected option life - 1.9 years, risk free-rate - 4.15%, dividend rate - 0%, The Company chose the Black-Scholes option pricing model given its prevalence of use in North America. The value represents the fair value of the entire award on the grant date which differs from the value reported in the Company's financial statements. For financial statement purposes, the accounting fair value amount is amortized over the service period to obtain the accounting compensation expense.

INCENTIVE PLAN AWARDS

Outstanding Share and Option-based Awards

The Company has a formal Stock Option Plan, previously approved by the shareholders of the Company. As of the December 31, 2023, the following share-based and option-based awards were outstanding stock options for each of the non-NEO directors of the Company:

| Option-based Awards | Share-based Awards | ||||||

| Name | Number of securities underlying unexercised options (#) |

Option exercise price ($) |

Option expiration date (c) |

Value of unexercised in-the-money options ($) (1)(2) |

Number of shares or units of shares that have not vested (#) |

Market or payout value of share-based awards that have not vested ($) |

Market or payout value of vested share-based awards not paid out or distributed ($) |

| Kevin Mulhern | 300,000 | 0.40 | January 1, 2025 | 126,000 | Nil | Nil | Nil |

| Johan Wattenstrom |

300,000 | 0.40 | January 1, 2025 | 126,000 | Nil | Nil | Nil |

| Michael Resendes |

20,000 | 0.50 | March 5, 2025 | 6,400 | Nil | Nil | Nil |

Notes:

(1) Based on the closing market price of $0.82 on December 29, 2023 and subtracting the exercise price of the options.

14

(2) These options have not been, and may never be, exercised, and actual gains, if any, on exercise will depend on the value of the common shares on the date of exercise.

Incentive Plan Awards Options - Value Vested or Earned during the Most Recently Completed Financial Year

The following table sets forth details of the value of incentive plan awards that vested or were earned during the most recently completed financial year ended December 31, 2023 for each of the non-NEO directors of the Company::

| Name | Option-based awards- Value vested during the year ($) (a) |

Share-based awards - Value vested during the year ($) (b) |

Non-equity incentive plan compensation - Value earned during the year ($) |

| Kevin Mulhern | Nil | Nil | Nil |

| Johan Wattenstrom | Nil | Nil | Nil |

| Michael Resendes | Nil | Nil | Nil |

SECURITIES AUTHORIZED FOR ISSUANCE UNDER EQUITY COMPENSATION PLANS

For the financial year ended December 31, 2023, the only equity compensation plan which the Company had in place was the Stock Option Plan which was previously approved by the Board and the shareholders of the Company. The Stock Option Plan was established to provide incentive to qualified parties to increase their proprietary interest in the Company and thereby encourage their continuing association with the Company. The Stock Option Plan is administered by the Board. The Stock Option Plan provides that options will be issued to directors, officers, employees or consultants of the Company or a subsidiary of the Company. The Stock Option Plan provides that the number of common shares issuable under the Stock Option Plan, together with all of the Company's other previously established or proposed share compensation arrangements, may not exceed 10% of the total number of issued and outstanding common shares. All options expire on a date not later than five years after the date of grant of such option.

The following table sets out equity compensation plan information as at the end of the year ended.

| Plan Category | Number of securities to be issued upon exercise of outstanding options, warrants and rights |

Weighted-average exercise price of outstanding options, warrants and rights |

Number of securities remaining available for future issuance under equity compensation plans (excluding securities reflected in column (a)) |

| Equity compensation plans approved by securityholders - |

7,770,000 | $0.41 | 4,650,388 |

| Equity compensation plans not approved by securityholders |

Nil | Nil | Nil |

| TOTAL: | 7,770,000 | $0.41 | 4,650,388 |

INDEBTEDNESS OF DIRECTORS AND EXECUTIVE OFFICERS

At no time during the Company's last completed financial year or as of the Record Date, was any director, executive officer, employee, proposed management nominee for election as a director of the Company nor any associate of any such director, executive officer, or proposed management nominee of the Company or any former director, executive officer or employee of the Company or any of its subsidiaries indebted to the Company or any of its subsidiaries or indebted to another entity where such indebtedness was the subject of a guarantee, support agreement, letter of credit or other similar arrangement or understanding provided by the Company or any of its subsidiaries.

INTEREST OF INFORMED PERSONS IN MATERIAL TRANSACTIONS

To the knowledge of management of the Company, no informed person (a director, officer or holder of 10% or more of the common shares) or nominee for election as a director of the Company or any associate or affiliate of any informed person or proposed director had any interest in any transaction which has materially affected or would materially affect the Company or any of its subsidiaries since January 1, 2025 (being the commencement of the Company's last completed financial year), or has any interest in any material transaction in the current year other than as set out herein.

15

MANAGEMENT CONTRACTS

There are no management functions of the Company, which are to any substantial degree performed by a person or company other than the directors or executive officers of the Company.

APPOINTMENT OF AUDITOR

The Board proposes to appoint BDO Canada LLP, Chartered Professional Accountants, of Vancouver, British Columbia as the auditor of the Company. Unless otherwise instructed, the proxies given pursuant to this solicitation will be voted for the appointment of BDO Canada LLP, Chartered Professional Accountants, as the auditor of the Company to hold office until the close of the next annual general meeting of the Company. BDO Canada LLP, Chartered Professional Accountants has been the auditor of the Company since May 17, 2023. It is proposed that the remuneration to be paid to the auditor of the Company be fixed by the Board.

Management recommends and, unless otherwise directed, the persons named in the enclosed Proxy intend to vote FOR such resolution:

"UPON MOTION DULY MADE, IT WAS RESOLVED AS AN ORDINARY RESOLUTION THAT:

1. BDO Canada LLP, Chartered Professional Accountants, is hereby appointed as the auditor of the Company until the next annual general meeting of the Company.

2. Any one or more of the directors and officers of the Company be authorized to perform all such acts, deeds and things and execute, under seal of the Company or otherwise, all such documents as may be required to give effect to these resolutions."

ADDITIONAL INFORMATION

The audited consolidated financial statements of the Company for the year ended December 31, 2023, and the related management's discussion and analysis (the "Financial Materials") are available on SEDAR+ at www.sedarplus.ca and will be placed before the Meeting.

Shareholders may request copies of the Financial Materials without charge from the Company by telephone: (778) 373-5499.

OTHER MATTERS

The Board is not aware of any other matters which it anticipates will come before the Meeting as of the date of this Circular.