|

Class Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment*

|

|

Class A

|

$100

|

0.96%

|

|

Top contributors to performance:

|

|

|

↑

|

Underweight to securities rated BB as they underperformed.

|

|

↑

|

Issuer selection within multiple sectors, including technology, transportation and energy.

|

|

↑

|

Opportunistic allocation to emerging markets.

|

|

Top detractors from performance:

|

|

|

↓

|

Industry allocation, driven mainly by an underweight to communications and an overweight to banking.

|

|

↓

|

Opportunistic allocation to investment-grade-rated securities.

|

|

↓

|

Issuer selection within multiple sectors, including communications and consumer cyclicals.

|

|

|

1 Year

|

5 Year

|

10 Year

|

|

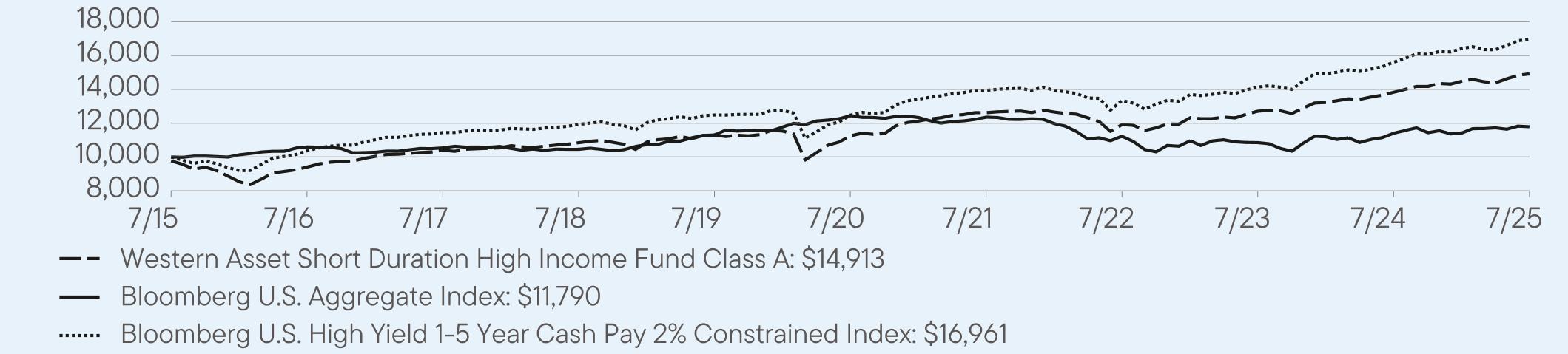

Class A

|

7.86

|

5.80

|

4.31

|

|

Class A (with sales charge)

|

5.44

|

5.34

|

4.08

|

|

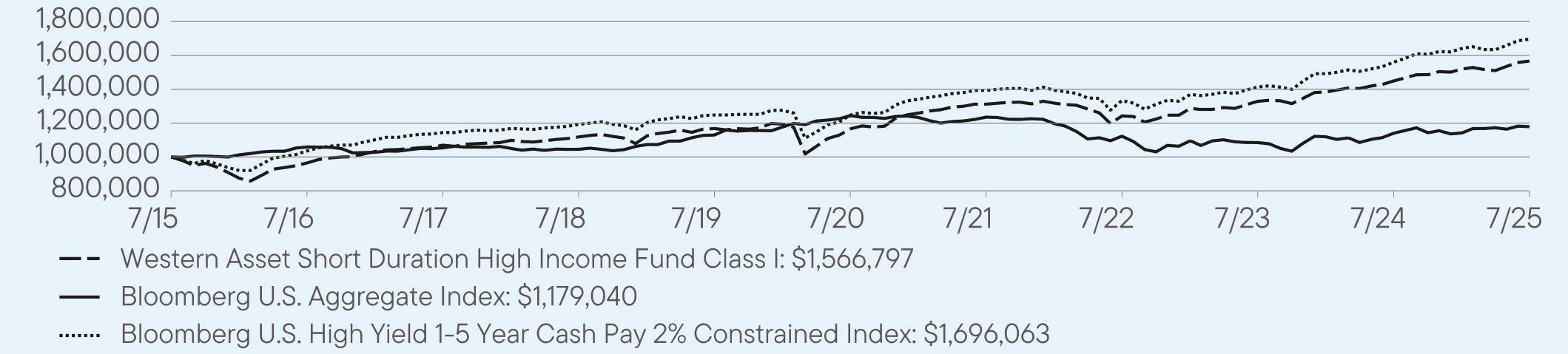

Bloomberg U.S. Aggregate Index

|

3.38

|

-1.07

|

1.66

|

|

Bloomberg U.S. High Yield 1-5 Year Cash Pay 2% Constrained Index

|

8.70

|

6.33

|

5.43

|

https://www.franklintempleton.com/investments/options/mutual-funds.

|

Total Net Assets

|

$495,519,602

|

|

Total Number of Portfolio Holdings*

|

345

|

|

Total Management Fee Paid

|

$2,708,482

|

|

Portfolio Turnover Rate

|

47%

|

|

Class Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment*

|

|

Class C

|

$173

|

1.67%

|

|

Top contributors to performance:

|

|

|

↑

|

Underweight to securities rated BB as they underperformed.

|

|

↑

|

Issuer selection within multiple sectors, including technology, transportation and energy.

|

|

↑

|

Opportunistic allocation to emerging markets.

|

|

Top detractors from performance:

|

|

|

↓

|

Industry allocation, driven mainly by an underweight to communications and an overweight to banking.

|

|

↓

|

Opportunistic allocation to investment-grade-rated securities.

|

|

↓

|

Issuer selection within multiple sectors, including communications and consumer cyclicals.

|

|

|

1 Year

|

5 Year

|

10 Year

|

|

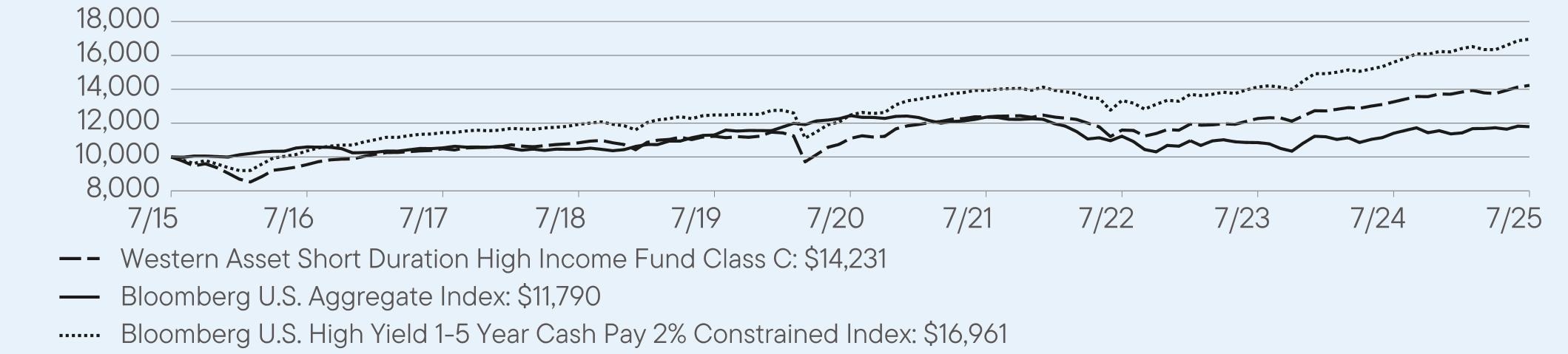

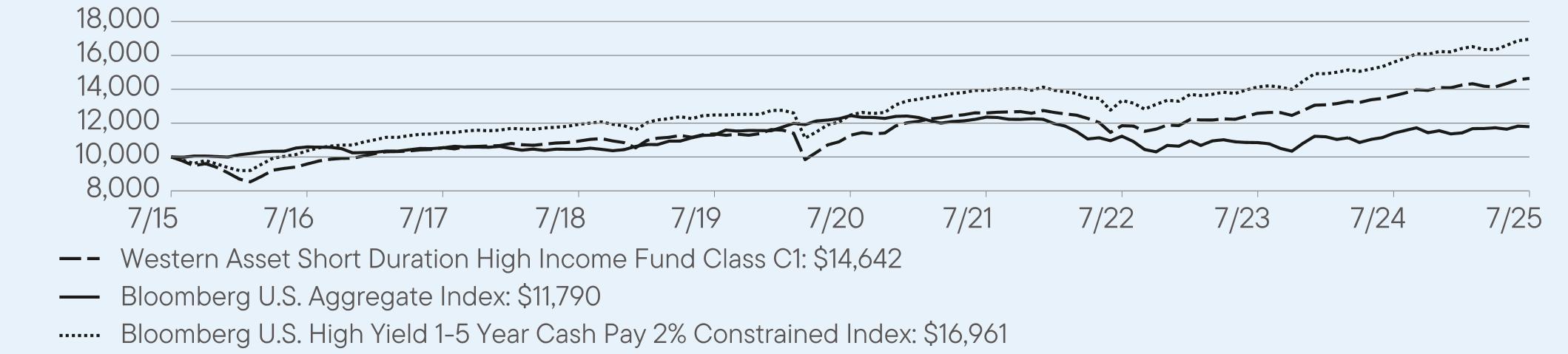

Class C

|

7.32

|

5.09

|

3.59

|

|

Class C (with sales charge)

|

6.32

|

5.09

|

3.59

|

|

Bloomberg U.S. Aggregate Index

|

3.38

|

-1.07

|

1.66

|

|

Bloomberg U.S. High Yield 1-5 Year Cash Pay 2% Constrained Index

|

8.70

|

6.33

|

5.43

|

https://www.franklintempleton.com/investments/options/mutual-funds.

|

Total Net Assets

|

$495,519,602

|

|

Total Number of Portfolio Holdings*

|

345

|

|

Total Management Fee Paid

|

$2,708,482

|

|

Portfolio Turnover Rate

|

47%

|

|

Class Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment*

|

|

Class C1

|

$155

|

1.49%

|

|

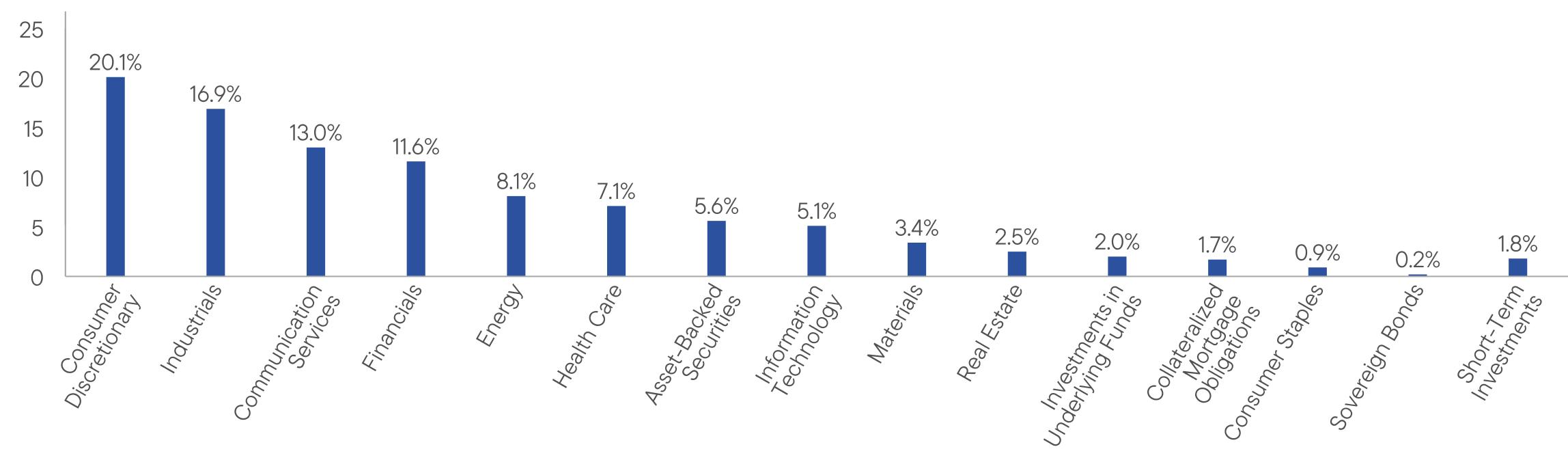

Top contributors to performance:

|

|

|

↑

|

Underweight to securities rated BB as they underperformed.

|

|

↑

|

Issuer selection within multiple sectors, including technology, transportation and energy.

|

|

↑

|

Opportunistic allocation to emerging markets.

|

|

Top detractors from performance:

|

|

|

↓

|

Industry allocation, driven mainly by an underweight to communications and an overweight to banking.

|

|

↓

|

Opportunistic allocation to investment-grade-rated securities.

|

|

↓

|

Issuer selection within multiple sectors, including communications and consumer cyclicals.

|

|

|

1 Year

|

5 Year

|

10 Year

|

|

Class C1

|

7.50

|

5.35

|

3.89

|

|

Class C1 (with sales charge)

|

6.50

|

5.35

|

3.89

|

|

Bloomberg U.S. Aggregate Index

|

3.38

|

-1.07

|

1.66

|

|

Bloomberg U.S. High Yield 1-5 Year Cash Pay 2% Constrained Index

|

8.70

|

6.33

|

5.43

|

https://www.franklintempleton.com/investments/options/mutual-funds.

|

Total Net Assets

|

$495,519,602

|

|

Total Number of Portfolio Holdings*

|

345

|

|

Total Management Fee Paid

|

$2,708,482

|

|

Portfolio Turnover Rate

|

47%

|

|

Class Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment*

|

|

Class R

|

$145

|

1.40%

|

|

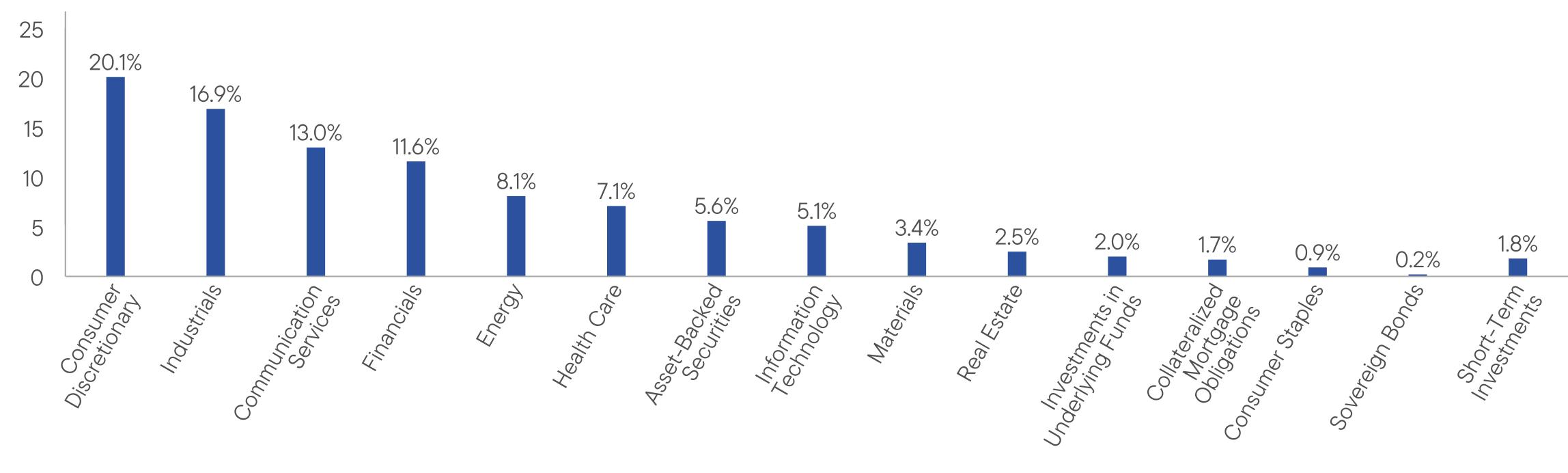

Top contributors to performance:

|

|

|

↑

|

Underweight to securities rated BB as they underperformed.

|

|

↑

|

Issuer selection within multiple sectors, including technology, transportation and energy.

|

|

↑

|

Opportunistic allocation to emerging markets.

|

|

Top detractors from performance:

|

|

|

↓

|

Industry allocation, driven mainly by an underweight to communications and an overweight to banking.

|

|

↓

|

Opportunistic allocation to investment-grade-rated securities.

|

|

↓

|

Issuer selection within multiple sectors, including communications and consumer cyclicals.

|

|

|

1 Year

|

5 Year

|

10 Year

|

|

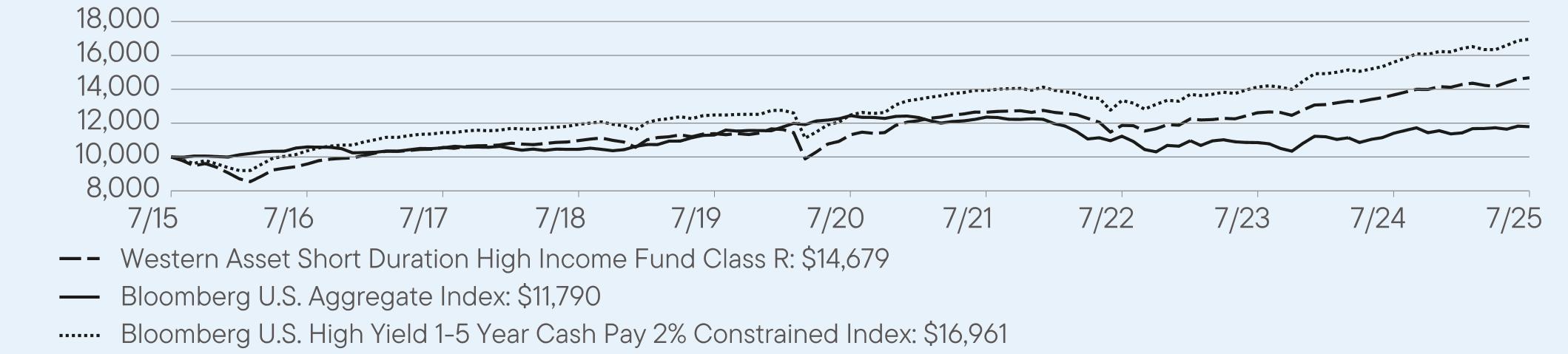

Class R

|

7.40

|

5.35

|

3.91

|

|

Bloomberg U.S. Aggregate Index

|

3.38

|

-1.07

|

1.66

|

|

Bloomberg U.S. High Yield 1-5 Year Cash Pay 2% Constrained Index

|

8.70

|

6.33

|

5.43

|

https://www.franklintempleton.com/investments/options/mutual-funds.

|

Total Net Assets

|

$495,519,602

|

|

Total Number of Portfolio Holdings*

|

345

|

|

Total Management Fee Paid

|

$2,708,482

|

|

Portfolio Turnover Rate

|

47%

|

|

Class Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment*

|

|

Class I

|

$75

|

0.72%

|

|

Top contributors to performance:

|

|

|

↑

|

Underweight to securities rated BB as they underperformed.

|

|

↑

|

Issuer selection within multiple sectors, including technology, transportation and energy.

|

|

↑

|

Opportunistic allocation to emerging markets.

|

|

Top detractors from performance:

|

|

|

↓

|

Industry allocation, driven mainly by an underweight to communications and an overweight to banking.

|

|

↓

|

Opportunistic allocation to investment-grade-rated securities.

|

|

↓

|

Issuer selection within multiple sectors, including communications and consumer cyclicals.

|

|

|

1 Year

|

5 Year

|

10 Year

|

|

Class I

|

8.11

|

6.08

|

4.59

|

|

Bloomberg U.S. Aggregate Index

|

3.38

|

-1.07

|

1.66

|

|

Bloomberg U.S. High Yield 1-5 Year Cash Pay 2% Constrained Index

|

8.70

|

6.33

|

5.43

|

https://www.franklintempleton.com/investments/options/mutual-funds.

|

Total Net Assets

|

$495,519,602

|

|

Total Number of Portfolio Holdings*

|

345

|

|

Total Management Fee Paid

|

$2,708,482

|

|

Portfolio Turnover Rate

|

47%

|

| [1] |

|

||

| [2] |

|

||

| [3] |

|

||

| [4] |

|

||

| [5] |

|

||

| [6] |

|

||

| [7] |

|

||

| [8] |

|

||

| [9] |

|

||

| [10] |

|

||

| [11] |

|

||

| [12] |

|

||

| [13] |

|

||

| [14] |

|

||

| [15] |

|