Exhibit 99.3

Feldman Financial Advisors, Inc.

8804 Mirador Place

McLean, VA 22102

(202) 467-6862

Pioneer Federal Deer Lodge, Montana

Conversion Valuation Appraisal Report Valued as of September 2, 2025

Prepared By

Feldman Financial Advisors, Inc. McLean, Virginia |

Feldman Financial Advisors, Inc.

8804 Mirador Place

McLean, VA 22102

(202) 467-6862

September 2, 2025

Board of Directors

Pioneer Federal Savings and Loan Association

202 North Main Street

Deer Lodge, Montana 59722

Members of the Board of Directors:

At your request, we have completed and hereby provide an independent appraisal (the “Appraisal”) of the estimated pro forma market value of Pioneer Federal Savings and Loan Association (“Pioneer Federal” or the “Association”) as of September 2, 2025 in conjunction with Pioneer Federal’s conversion (the “Conversion”) from the mutual form of organization to the stock form of organization by means of a merger with and into a newly formed Montana state-chartered stock bank to be known as Pioneer State Bank (the “Bank”), issuance of all of the Bank’s capital stock to a newly formed stock holding company known as PSB Financial, Inc. (“PSB Financial”) and offering for sale of PSB Financial’s common stock to eligible depositors of the Association, the Association’s employee stock ownership plan, and certain members of the general public in the subscription and community offering (the “Stock Offering”).

The Conversion is being undertaken pursuant to a Plan of Conversion adopted by the Board of Directors of Pioneer Federal. The Appraisal is furnished pursuant to the filing by the Association and the Company of regulatory applications with respect to the Conversion and Stock Offering with the Montana Division of Banking and Financial Institutions (“MDOB”), the Federal Deposit Insurance Corporation (“FDIC”), the Board of Governors of the Federal Reserve System (“Federal Reserve Board”), and the Securities and Exchange Commission (“SEC”).

Feldman Financial Advisors, Inc. (“Feldman Financial”) is a financial consulting and advisory firm that specializes in valuations and analyses of business enterprises and securities in the thrift, banking, and insurance industries. The background of Feldman Financial is presented in Exhibit I. In preparing the Appraisal, we conducted an analysis of Pioneer Federal that included discussions with the Association’s management, the Association’s legal counsel, Godfrey & Kahn S.C., and the Association’s independent registered public accounting firm, Wipfli LLP.

In addition, where appropriate, we considered information based on other available published sources that we believe are reliable; however, we cannot guarantee the accuracy and completeness of such information. We also reviewed, among other factors, the economy in Pioneer Federal’s primary market area and compared the Association’s financial condition and operating performance with that of selected publicly traded thrift institutions. We reviewed conditions in the securities markets in general and in the market for thrift institution common stocks in particular.

Feldman Financial Advisors, Inc.

Board of Directors

Pioneer Federal Savings and Loan Association

September 2, 2025

Page Two

The Appraisal is based on Pioneer Federal’s representation that the information in the Conversion applications and additional evidence furnished to us by Pioneer Federal and its independent auditor are truthful, accurate, and complete. We did not independently verify the financial statements and other information provided by Pioneer Federal and its independent accounting firm, nor did we independently value the assets or liabilities of Pioneer Federal. The Appraisal considers Pioneer Federal only as a going concern and should not be considered as an indication of the liquidation value of Pioneer Federal.

Pursuant to the Plan of Conversion adopted and approved by Pioneer Federal’s Board of Directors, the Association will convert from the mutual to the stock form of organization and merge with and into the Bank. When the Conversion and Stock Offering are completed, all of the outstanding capital stock of the Bank will be owned by PSB Financial, and all of the common stock of PSB Financial will be owned by its stockholders.

The Bank will operate as a wholly-owned subsidiary of PSB Financial. The Bank will succeed to all of the rights, obligations, duties, and liabilities of Pioneer Federal, and all banking operations previously conducted by Pioneer Federal will be conducted through the Bank. The Bank will be subject to examination and regulation by the MDOB, as its chartering authority, and also subject to examination by the FDIC, its primary federal regulator and deposit insurer. PSB Financial will be a bank holding company subject to regulation and supervision by the Federal Reserve Board.

It is our opinion that, as of September 2, 2025, the estimated pro forma market value of Pioneer Federal was within a range (the “Valuation Range”) of $10,200,000 to $13,800,000 with a midpoint of $12,000,000. Pursuant to applicable appraisal guidelines, the Valuation Range was based upon a decrease of approximately 15% from the midpoint value to determine the minimum value and an increase of approximately 15% from the midpoint value to establish the maximum value. Assuming an additional increase of approximately 15% above the maximum value would result in an adjusted maximum of $15,870,000. Based on an initial offering price of $10.00 per share, the number of shares to be sold in the Stock Offering is as follows: 1,020,000 at the minimum, 1,200,000 at the midpoint, 1,380,000 at the maximum, and 1,587,000 at the adjusted maximum of the offering range.

Our Appraisal is not intended, and must not be construed, to be a recommendation of any kind as to the advisability of purchasing shares of common stock in the Stock Offering. Moreover, because the Appraisal is necessarily based upon estimates and projections of a number of matters, all of which are subject to change from time to time, no assurance can be given that persons who purchase shares of stock in the Stock Offering will thereafter be able to sell such shares at prices related to the foregoing estimate of the Association’s pro forma market value. Feldman Financial is not a seller of securities within the meaning of any federal or state securities laws, and any report prepared by Feldman Financial shall not be used as an offer or solicitation with respect to the purchase or sale of any securities.

Feldman Financial Advisors, Inc.

Board of Directors

Pioneer Federal Savings and Loan Association

September 2, 2025

Page Three

The Valuation Range reported herein will be updated as appropriate. These updates will consider, among other factors, any developments or changes in Pioneer Federal’s operating performance, financial condition, or management policies, and current conditions in the securities markets for thrift institution common stocks. Should any such new developments or changes be material, in our opinion, to the valuation of Pioneer Federal, appropriate adjustments to the estimated pro forma market value will be made. The reasons for any such adjustments will be explained in detail at that time.

| Respectfully submitted, | |

| Feldman Financial Advisors, Inc. | |

| |

| Trent R. Feldman | |

| President | |

| |

| Peter W. L. Williams | |

| Principal | |

Feldman Financial Advisors, Inc.

TABLE OF CONTENTS

| TAB | PAGE |

| INTRODUCTION | 1 |

| I. | Chapter One – Business of Pioneer Federal | ||

| General Overview | 3 | ||

| Financial Condition | 9 | ||

| Income and Expense Trends | 19 | ||

| Interest Rate Risk Management | 26 | ||

| Asset Quality | 30 | ||

| Office Facilities | 33 | ||

| Market Area | 34 | ||

| Summary Outlook | 42 | ||

| II. | Chapter Two – Comparisons with Publicly Traded Companies | ||

| General Overview | 43 | ||

| Selection Criteria | 44 | ||

| Recent Financial Comparisons | 48 | ||

| III. | Chapter Three – Market Value Adjustments | ||

| General Overview | 61 | ||

| Earnings Growth and Viability | 62 | ||

| Financial Condition | 63 | ||

| Market Area | 63 | ||

| Management | 65 | ||

| Dividend Payments | 66 | ||

| Liquidity of the Stock Issue | 66 | ||

| Subscription Interest | 67 | ||

| Recent Acquisition Activity | 69 | ||

| Stock Market Conditions and New Issue Discount | 69 | ||

| Adjustments Conclusion | 77 | ||

| Valuation Approach | 77 | ||

| Valuation Conclusion | 80 | ||

| IV. | Appendix -- Exhibits | |||

| I | Background of Feldman Financial Advisors,Inc. | I-1 | ||

| II-1 | Balance Sheets | II-1 | ||

| II-2 | Income Statements | II-2 | ||

| II-3 | Loan Portfolio Composition | II-3 | ||

| II-4 | Cash and Investments Composition | II-4 | ||

| II-5 | Deposit Accounts Composition | II-5 | ||

| III | Financial and Market Data for All Public Thrifts | III-1 | ||

| IV-1 | Pro Forma Assumptions for the Stock Offering | IV-1 | ||

| IV-2 | Pro Forma Conversion Valuation Range | IV-2 | ||

| IV-3 | Pro Forma Conversion Analysis at the Midpoint Value | IV-3 | ||

| IV-4 | Comparative Valuation Ratio Analysis | IV-4 | ||

i

Feldman Financial Advisors, Inc.

LIST OF TABLES

| TAB | PAGE |

| I. | Chapter One – Business of Pioneer Federal | |||

| Table 1 | Selected Financial Condition Data | 9 | ||

| Table 2 | Relative Balance Sheet Concentrations | 10 | ||

| Table 3 | Income Statement Summary | 20 | ||

| Table 4 | Income Statement Ratios | 21 | ||

| Table 5 | Yield and Cost Summary | 23 | ||

| Table 6 | Economic Value of Equity | 27 | ||

| Table 7 | Net Interest Income Sensitivity | 29 | ||

| Table 8 | Non-performing Asset Summary | 31 | ||

| Table 9 | Allowance for Credit Losses on Loans | 32 | ||

| Table 10 | Selected Demographic Data | 37 | ||

| Table 11 | Branch Office Deposit Data | 39 | ||

| Table 12 | Deposit Market Share in Powell County and Beaverhead County | 40 | ||

| II. | Chapter Two – Comparisons with Publicly Traded Companies | |||

| Table 13 | Comparative Group Operating Summary | 47 | ||

| Table 14 | Key Financial Comparisons | 49 | ||

| Table 15 | General Operating Characteristics | 56 | ||

| Table 16 | Summary Financial Performance Ratios | 57 | ||

| Table 17 | Income and Expense Analysis | 58 | ||

| Table 18 | Balance Sheet Composition | 59 | ||

| Table 19 | Growth Rates, Credit Risk, and Loan Composition | 60 | ||

| III. | Chapter Three – Market Value Adjustments | |||

| Table 20 | Comparative Market Area Data | 64 | ||

| Table 21 | Summary of Montana Bank and Thrift Acquisition Activity | 70 | ||

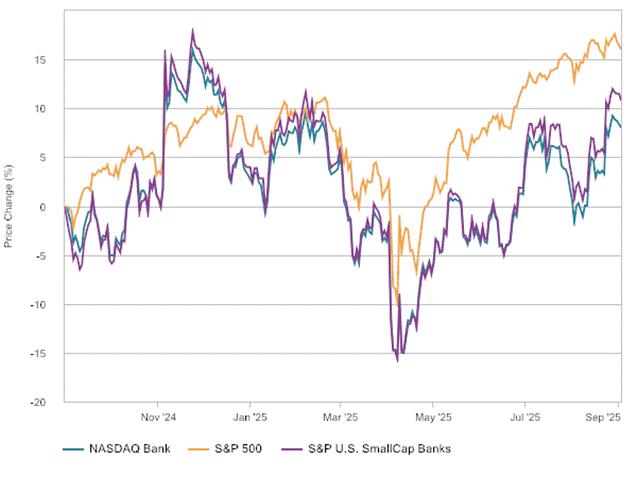

| Table 22 | Comparative One-Year Stock Market Index Performance | 71 | ||

| Table 23 | Comparative Three-Year Stock Market Index Performance | 72 | ||

| Table 24 | Summary of Standard Conversion Stock Offerings | 75 | ||

| Table 25 | Comparative Pro Forma Market Valuation Analysis | 82 | ||

ii

Feldman Financial Advisors, Inc.

INTRODUCTION

At your request, we have completed and hereby provide an independent appraisal (the “Appraisal”) of the estimated pro forma market value of Pioneer Federal Savings and Loan Association (“Pioneer Federal” or the “Association”) as of September 2, 2025 in conjunction with Pioneer Federal’s conversion (the “Conversion”) from the mutual form of organization to the stock form of organization by means of a merger with and into a newly formed Montana state-chartered stock bank to be known as Pioneer State Bank (the “Bank”), issuance of all of the Bank’s capital stock to a newly formed stock holding company known as PSB Financial, Inc. (“PSB Financial”) and offering for sale of PSB Financial’s common stock to eligible depositors of the Association, the Association’s employee stock ownership plan, and certain members of the general public in the subscription and community offering (the “Stock Offering”).

The Conversion is being undertaken pursuant to a Plan of Conversion adopted by the Board of Directors of Pioneer Federal. The Appraisal is furnished pursuant to the filing by the Association and the Company of regulatory applications with respect to the Conversion and Stock Offering with the Montana Division of Banking and Financial Institutions (“MDOB”), the Federal Deposit Insurance Corporation (“FDIC”), the Board of Governors of the Federal Reserve System (“Federal Reserve Board”), and the Securities and Exchange Commission (“SEC”).

Feldman Financial Advisors, Inc. (“Feldman Financial”) is a financial consulting and advisory firm that specializes in valuations and analyses of business enterprises and securities in the thrift, banking, and insurance industries. The background of Feldman Financial is presented in Exhibit I. In preparing the Appraisal, we conducted an analysis of Pioneer Federal that included discussions with the Association’s management, the Association’s legal counsel, Godfrey & Kahn S.C., and the Association’s independent registered public accounting firm, Elliott Davis, LLC.

1

Feldman Financial Advisors, Inc.

The Appraisal is based on the Association’s representation that the information in the Conversion applications and additional evidence furnished to us by the Association and its independent auditor are truthful, accurate, and complete. We did not independently verify the financial statements and other information provided by the Association and its independent accounting firm, nor did we independently value the assets or liabilities of the Association. The Appraisal considers the Association only as a going concern and should not be considered as an indication of the liquidation value of the Association.

Our Appraisal is not intended, and must not be construed, to be a recommendation of any kind as to the advisability of purchasing shares of common stock in the Stock Offering. Moreover, because the Appraisal is necessarily based upon estimates and projections of a number of matters, all of which are subject to change from time to time, no assurance can be given that persons who purchase shares of stock in the Stock Offering will thereafter be able to sell such shares at prices related to the foregoing estimate of the Association’s pro forma market value. Feldman Financial is not a seller of securities within the meaning of any federal or state securities laws, and any report prepared by Feldman Financial shall not be used as an offer or solicitation with respect to the purchase or sale of any securities.

The Valuation Range reported herein will be updated as appropriate. These updates will consider, among other factors, any developments or changes in the Association’s operating performance, financial condition, or management policies, and current conditions in the securities markets for thrift institution common stocks. Should any such new developments or changes be material, in our opinion, to the valuation of the Association, appropriate adjustments to the estimated pro forma market value will be made. The reasons for any such adjustments will be explained in detail at that time.

2

Feldman Financial Advisors, Inc.

I. Business of Pioneer Federal

General Overview

Pioneer Federal is a state-chartered mutual savings and loan association headquartered in Deer Lodge, Montana. Originally established in 1912, the Association conducts its operations from its main office in Deer Lodge, Montana, and a branch office in Dillon, Montana. The Association’s business consists primarily of accepting deposits from the general public and investing those deposits, together with funds generated from operations, in one- to four-family residential mortgage loans secured by properties located in its primary market area. To a significantly lesser extent, the Association also originates commercial real estate loans, construction and land development loans, commercial business loans, home equity loans and lines of credit, and automobile and other consumer loans. In addition, the Association offers electronic banking services including online banking, bill payment, automated teller machines (“ATMs”), debit cards, and mobile banking.

At June 30, 2025, Pioneer Federal had total assets of $113.3 million, total deposits of $85.8 million, net total loans of $85.1 million, and total equity of $18.4 million (measuring 16.27% of total assets). The Association reported net income of $224,000 for the year ended December 31, 2024 and net income of $126,000 for the six months ended June 30, 2025. The Association’s deposits are insured up to applicable limits by the FDIC. The Association is subject to examination and regulation by the MDOB, as its chartering authority, and also subject to examination by the FDIC, its primary federal regulator and deposit insurer. The Association is a member of the Federal Home Loan Bank (“FHLB”) of Des Moines. At June 30, 2025, the Association had 21 full-time employees.

3

Feldman Financial Advisors, Inc.

Since its inception, the Association has operated as a traditional savings institution focused primarily on serving the banking needs of customers in its primary market area of Powell and Beaverhead Counties in southwestern Montana, as well as contiguous counties and areas. The Association’s primary market area is predominantly rural with centralized town centers. Deer Lodge is the county seat of Powell County and had an estimated 2025 population of 3,097. Dillon is the county seat of Beaverhead County and had an estimated 2025 population of 4,196. Powell County had an estimated 2025 population of 7,229 and Beaverhead County had an estimated 2025 population of 10,136. In January 2024, Pioneer Federal relocated its main office in Deer Lodge from Milwaukee Avenue to a new state-of-the-art building on North Main Street. Both Deer Lodge and Dillon are close to the population hub of Butte, Montana, with Dillon located approximately 60 miles southwest of Butte and Deer Lodge located approximately 35 miles northwest of Butte.

The Association’s long operating history has provided it with a familiarity of its local communities and customer base. The Association believes that it has a strong community reputation as a residential mortgage lender, and its staff and management are easily accessible for customers. The Association continues to stress customer service and is community focused through its staff that is knowledgeable of the local customer base and very active in community endeavors. The Association relies on its experienced and committed staff to meet the needs of customers. The Association’s mission statement is:

Pioneer Federal Savings and Loan Association is dedicated to providing quality services and products to its customers all the while remaining financially strong and adding value to the quality of life in the communities it serves.

Over the past ten years, the Association has focused on conservative lending, controlled growth, and an emphasis on managing liquidity and maintaining solid capital levels. The Association’s total assets increased at a compound annual growth rate (“CAGR”) of 1.8% from $93.7 million at December 31, 2014 to $112.1 million at December 31, 2024. The Association’s total loans increased at a CAGR of 4.1% from $58.5 million at December 31, 2014 to $87.5 million at December 31, 2024. The Association’s ratio of total loans to total deposits expanded from 74.8% at year-end 2014 to 102.9% at year-end 2024. Over this same time period, the Association’s ratio of total equity to total assets increased moderately from 15.79% at year-end 2014 to 16.19% at year-end 2024. The Association was steadily profitable over the past ten years with earnings averaging 0.39% of average total assets.

4

Feldman Financial Advisors, Inc.

The Association’s current operating goal is to position the organization to succeed in an evolving and competitive financial services landscape and enhance its position as one of the leading community banking institutions in its market. The Association believes that it can provide long-term value to its customers, employees, future stockholders, and the communities it serves by executing a prudent business strategy that generates increasing profitability.

Pioneer Federal also believes there is a significant opportunity for a community-focused banking institution to continue to compete effectively in its primary market area and that the increased capital it will have after the completion of the Stock Offering will facilitate this objective. The core elements of the Association’s business strategy are outlined in more detail below:

| ● | Continue to focus on originating one- to four-family residential mortgage loans for retention in the Association’s loan portfolio. The Association is primarily a one- to four-family residential mortgage loan lender for borrowers in its primary market area. As of June 30, 2025, $73.2 million, or 84.5% of its total loan portfolio, consisted of residential first lien mortgage loans. The Association expects that residential mortgage lending will remain its primary lending activity. |

| ● | Modestly increase the relative volume of commercial loans, including real estate and non-real estate secured loans by expanding the Association’s commercial underwriting and administration staff. While Pioneer Federal plans to continue its historical focus on the origination of residential mortgage loans, the Association intends to prudently increase its originations of commercial real estate loans and commercial business loans to diversify its loan portfolio and increase yield, while seeking to manage credit and other risks related to commercial lending. At June 30, 2025, commercial real estate loans amounted to $4.4 million, or 5.1% of total loans, and commercial business loans amounted to $1.1 million, or 1.3% of total loans. |

5

Feldman Financial Advisors, Inc.

| ● | Maintain strong asset quality through conservative loan underwriting practices. The Association intends to maintain strong asset quality through conservative underwriting standards, active credit monitoring, well-defined policies and procedures, and employing experienced credit professionals. As of June 30, 2025, the Association’s non-performing assets measured 0.63% of total assets. |

| ● | Continue to grow low-cost “core” deposits. Core deposits include all deposits other than certificates of deposit. The Association plans to continue its efforts to increase its core deposits to provide additional fee income and a stable source of funds to support loan growth at costs consistent with improving its interest rate spread and net interest margin. Core deposits totaled $56.2 million, or 65.4% of total deposits, at June 30, 2025. Pioneer Federal believes that expansion of its commercial lending activity will enhance its ability to attract core deposits from commercial customers. |

| ● | Remain a community-oriented institution and continue to rely on high quality service to maintain and build a loyal customer base. The Association was established in 1912 and has been operating continuously in southwestern Montana since that time. Through the goodwill it has developed over years of providing timely and efficient banking services, the Association believes that it has been able to attract a loyal base of local customers on which it seeks to continue to build its banking business. |

| ● | Strengthen the Association’s digital-based banking capabilities. Pioneer Federal recognizes that customers can be expected to seek out banking institutions that offer a broad array of digital banking services. The Association plans to continue to implement plans to enhance its technology platform to remain an attractive option for current and potential customers, including converting to a new main data processing vendor as anticipated sometime in 2026. |

| ● | Grow organically and through opportunistic branching. The Association plans to grow its balance sheet organically on a managed basis. Moreover, the capital that the Association is raising through the Stock Offering will enable it to increase its lending and investment capacity. In addition to organic growth, the Association may also consider expansion opportunities in its market area or in contiguous markets. The capital raised from the Stock Offering would help fund any such opportunities that may arise. The Association is considering the addition of a branch office in western Montana in one or two years, but currently has no specific plans or intentions regarding any such expansion activities. |

6

Feldman Financial Advisors, Inc.

While its equity level is solid at 16.27% of total assets as of June 30, 2025, the Association believes it must raise additional capital in order to facilitate its growth objectives and loan generation activity, and provide a greater cushion in response to the risk profile associated with continued expansion and future economic conditions. As a stock organization upon completion of the Conversion, the Company and the Association will be organized in the ownership form used by commercial banks, most major businesses, and a large number of thrift institutions. The ability to raise new equity capital through the issuance and sale of capital stock will allow the Company and the Association the flexibility to increase its equity capital position more rapidly than by accumulating earnings.

The Association also believes that the ability to attract new capital will also help address the needs of the communities it serves and enhance its ability to expand or make acquisitions. After the Conversion, the Association will have an increased ability to merge with or acquire other financial institutions or business enterprises; however, there are no current arrangements, understandings, or agreements regarding any such acquisition opportunities. Finally, the Association expects to benefit from its employees and directors having stock ownership in its business, since that is viewed as an effective performance incentive and a means of attracting, retaining, and compensating employees and directors.

In summary, the Association’s primary reasons for implementing the Conversion and undertaking the Stock Offering are to:

| ● | Increase capital to support future growth and profitability.

|

|

| ● | Retain and attract qualified personnel by establishing stock-based benefit plans for management and employees.

|

|

|

● | Offer customers and employees an opportunity to acquire an equity interest in the Bank by purchasing shares of common stock of PSB Financial. |

7

Feldman Financial Advisors, Inc.

Moving forward, the Association’s strategic priorities have been identified and emphasized as described below:

| ● | Growth – grow lending and core deposits by gaining market share in the Association’s primary market area. |

| ● | Profitability – continue to improve the overall profitability of the Association through margin improvements, expanded services, and cost management. |

| ● | Service – continue efforts to improve the Association’s customer service and overall customer experience, including enhanced technology capabilities. |

| ● | Personnel – continue to augment the expertise, abilities, and productivity of the Association’s staff and the overall organizational management processes |

The remainder of Chapter I examines in more detail the trends addressed in this section, including the impact of changes in the Association’s economic and competitive environment, and recent strategic initiatives. The discussion is supplemented by the exhibits in the Appendix. Exhibit II-1 presents the Association’s balance sheets as of December 31, 2023 and 2024 and June 30, 2025. Exhibit II-2 summarizes the Association’s income statements for the years ended December 31, 2023 and 2024 and the six months ended June 30, 2024 and 2025.

8

Feldman Financial Advisors, Inc.

Financial Condition

Table 1 presents selected data concerning Pioneer Federal’s financial position as of December 31, 2023 and 2024 and June 30, 2025. Table 2 displays relative balance sheet concentrations as of similar period-end dates.

Table 1

Selected Financial Condition Data

As of December 31, 2023 and 2024 and June 30, 2025

(Dollars in Thousands)

| June 30, | December 31, | |||||||||||

| 2025 | 2024 | 2023 | ||||||||||

| Total assets | $ | 113,259 | $ | 112,109 | $ | 112,728 | ||||||

| Cash and cash equivalents | 9,199 | 6,433 | 10,193 | |||||||||

| Available-for-sale securities | 9,412 | 9,538 | 11,304 | |||||||||

| Held-to-maturity securities | 1,850 | 2,005 | 2,836 | |||||||||

| Other investments | 715 | 729 | 713 | |||||||||

| Total loans, net | 85,132 | 86,327 | 81,036 | |||||||||

| Cash value of life insurance | 754 | 744 | 764 | |||||||||

| Premises and equipment, net | 4,977 | 5,118 | 4,715 | |||||||||

| Total deposits | 85,842 | 85,090 | 86,071 | |||||||||

| Federal Home Loan Bank advances | 8,000 | 8,000 | 8,000 | |||||||||

| Total equity | 18,428 | 18,154 | 17,829 | |||||||||

Source: Pioneer Federal Savings and Loan Association, financial statements.

Asset Composition

The Association’s total assets amounted to $113.3 million at June 30, 2025, reflecting a 1.0% or $1.1 million increase from total assets of $112.1 million at December 31, 2024. In the prior year, the Association’s total assets decreased by 0.6% or $619,000 from $112.7 million at December 31, 2023 to $112.1 million at December 31, 2024. The recent increase in total assets was primarily due to an increase of $2.8 million in cash and cash equivalents, partially offset by a decrease of $1.2 million in net loans.

9

Feldman Financial Advisors, Inc.

Table 2

Relative Balance Sheet Concentrations

As of December 31, 2023 and 2024 and June 30, 2025

(Percent of Total Assets)

| June 30, | December 31, | |||||||||||

| 2025 | 2024 | 2023 | ||||||||||

| Cash and cash equivalents | 8.12 | % | 5.74 | % | 9.04 | % | ||||||

| Available-for-sale securities | 8.31 | 8.51 | 10.03 | |||||||||

| Held-to-maturity securities | 1.63 | 1.79 | 2.52 | |||||||||

| Other investments | 0.63 | 0.65 | 0.63 | |||||||||

| Total loans, net | 75.17 | 77.00 | 71.89 | |||||||||

| Cash value of life insurance | 0.67 | 0.66 | 0.68 | |||||||||

| Premises and equipment, net | 4.39 | 4.57 | 4.18 | |||||||||

| Other assets | 1.08 | 1.08 | 1.03 | |||||||||

| Total assets | 100.00 | % | 100.00 | % | 100.00 | % | ||||||

| Total deposits | 75.79 | % | 75.90 | % | 76.36 | % | ||||||

| Federal Home Loan Bank advances | 7.06 | 7.14 | 7.10 | |||||||||

| Other liabilities | 0.87 | 0.77 | 0.73 | |||||||||

| Total liabilities | 83.73 | 83.81 | 84.18 | |||||||||

| Total equity | 16.27 | 16.19 | 15.82 | |||||||||

| Total liabilities and equity | 100.00 | % | 100.00 | % | 100.00 | % | ||||||

Source: Pioneer Federal Savings and Loan Association, financial statements.

Net total loans increased by $5.3 million or 6.5% from $81.0 million at year-end 2023 to $86.3 million at year-end 2024. The loan growth in 2024 was generated mainly from one- to four-family residential mortgage loans and commercial real estate loans. The decrease in net loans during the first half of 2025 reflected sluggish mortgage loan demand due to the appreciating market value of residential properties, which has continued to price out local market borrowers. As a result of the recent decrease in the Association’s loan portfolio, the percentage of net total loans decreased from 77.0% of total assets at December 31, 2024 to 75.2% of total assets at June 30, 2025 after increasing from 71.9% of total assets at December 31, 2023.

10

Feldman Financial Advisors, Inc.

Cash and cash equivalents increased by $2.8 million from $6.4 million at December 31, 2024 to $9.2 million at June 30, 2025. The recent increase in cash and cash equivalents was primarily attributable to an increase of deposits, along with paydowns of loan balances and investment securities. The aggregate amount of cash and investment securities increased by $2.5 million from $18.7 million, or 16.7% of total assets, at December 31, 2024 to $21.2 million, or 18.7% of total assets, at June 30, 2025.

The largest segment of the Association’s loan portfolio comprises residential real estate mortgage loans. As of June 30, 2025, one- to four-family residential mortgage loans accounted for $73.2 million or 84.5% of total loans as illustrated in Exhibit II-3. The Association’s loan portfolio also included commercial real estate loans ($4.4 million or 5.1% of total loans), home equity loans and lines of credit ($3.5 million or 4.1% of total loans), construction and land development loans ($3.0 million or 3.4% of total loans), other consumer loans ($1.3 million or 1.5% of total loans), and commercial business loans ($1.1 million or 1.3% of total loans).

The Association’s loan originations totaled $16.2 million for the year ended December 31, 2024 and $5.2 million for the six months ended June 30, 2025. Residential mortgage loans comprised the bulk of the origination volume during these periods, followed by construction loans and home equity lines of credit. Pioneer Federal periodically utilizes loan participations as a tool for serving the local communities and to diversify its loan portfolio. Loan participations also help the Association limit its lending risk by diversifying both geographical and collateral distribution. The Association maintains internal limits on the amount of a purchased loan participation in any one project and the aggregate exposure to loan participations in its loan portfolio.

Pioneer Federal’s one- to four-family residential mortgage loans are almost entirely fixed-rate loans. The Association’s residential mortgage loans originated in the primary market area are generally underwritten to Fannie Mae secondary market standards. Pioneer Federal generally charges a modest premium on the interest rate compared to market competitors as the Association’s loans are not sold into the secondary market, allowing direct contact with the borrower over the life of the loan. Terms on the Association’s residential mortgage loans vary with maturities of up to 30 years. Loan-to-value (“LTV”) ratios on residential mortgage loans are limited to 80% of the purchase price or appraised value, whichever is lower. Pioneer Federal does not offer or originate higher-risk loans such as subprime loans on one- to four-family residential properties.

11

Feldman Financial Advisors, Inc.

Pioneer Federal originates home equity lines of credit (“HELOCs”) and home equity loans, which are generally secured by first or second mortgages on owner-occupied residences. HELOCs have a 10-year revolving period with a 20-year amortization term, as the customer has the option to extend the 10-year revolving period when each 10-year period is coming due. HELOCs are fixed-rate for the first six months and then are indexed to the Wall Street Journal prime rate plus a 1.0% margin. A 0.125% rate reduction option is available for automatic payment and the same rate reduction is offered if the deposit account is maintained at Pioneer Federal. The LTV ratio for HELOCs and home equity loans is generally up to 80%, taking into account any superior mortgage on the collateral property. HELOCs are generally underwritten in the same manner as Pioneer Federal’s one- to four-family residential mortgage loans.

Commercial real estate loans and commercial business loans have not historically comprised a significant portion of Pioneer Federal’s total loan portfolio. While the Association expects that one- to four-family residential real estate lending will continue to be its primary emphasis of lending operations, Pioneer Federal intends to modestly increase its emphasis on commercial real estate loans and commercial business loans in an effort to increase the overall loan portfolio yield.

12

Feldman Financial Advisors, Inc.

Pioneer Federal’s commercial loan portfolio (including commercial real estate and commercial business loans) consists of approximately 20 loans with an aggregate principal balance of $5.6 million as of June 30, 2025. The Association has not historically originated in-house commercial loans and instead has purchased loan participations of commercial loans (real estate and non-real estate) through purchase relationships with two Montana-based financial institutions. The commercial loans in portfolio are secured by both owner-occupied and non-owner-occupied properties, as well as business-related assets with essentially all loans secured by property within Montana. The commercial real estate and non-real estate loans (participations) are generally fixed-rate for the first five years of the loan with an interest rate generally at the Wall Street Journal prime rate plus 1.0%. The interest rate adjusts every five years thereafter. Commercial real estate loans generally have terms up to 25 years. LTV ratios of commercial real estate loans are generally limited to 75% of the purchase price or appraised value, whichever is lower.

At June 30, 2025, Pioneer Federal’s largest purchased participation interest had an outstanding balance of $1.0 million, representing a 31% participation interest in a $3.95 million commercial real estate loan secured by a Powell County medical center. At June 30, 2025, the Association also had a line of credit participation purchased with a maximum credit of $1.75 million, representing 2.2% participation interest in an $81.5 million loan, secured by government-backed accounts receivable. As of June 30, 2025, the Association was not aware of any participation interests for which the loan is non-performing.

Pioneer Federal had $2.9 million in construction and land development loans as of June 30, 2025. The Association originates one-close construction/permanent loans, primarily to individuals for the construction of their primary residences and occasionally to contractors and builders of single-family homes. These loans combine the construction financing and the permanent mortgage into one closing, and after the construction period the loan converts to a permanent one-to four-family residential mortgage loan. Residential construction loans are underwritten to the same guidelines for permanent residential mortgage loans. Construction loans generally can be made with a maximum LTV ratio of 80% of the estimated appraised market value upon completion of the project. Pioneer Federal also originates a limited amount of land development loans to complement the construction lending activities, as such loans are generally secured by lots that will be used for residential development.

13

Feldman Financial Advisors, Inc.

The Association’s consumer loans totaled $1.3 million as of June 30, 2025. Pioneer Federal’s consumer loan portfolio generally consists of loans secured predominantly by automobiles and trucks (new and used). Consumer loans have fixed interest rates and terms of up to six years, with LTV ratios generally capped at 80% of the invoice price (for new vehicles) or 75% of the lesser of National Automobile Dealers Association trade-in value (for used vehicles) or purchase price.

Exhibit II-4 presents a summary of the Association’s portfolio of cash, short-term liquidity, and investment securities as of December 31, 2023 and 2024 and June 30, 2025. Consistent with its Investment Policy, the Association’s primary investment objectives are to (1) provide and maintain adequate liquidity and to meet any reasonable decline in deposits and any anticipated increase in the loan portfolio; (2) reduce interest rate risk and its impact on both earnings and the market value of the balance sheet; (3) maintain safety through a balance of high-quality, diversified investments with minimum risk characteristics; (4) provide collateral for pledging requirements; and (5) maximize returns consistent with the Association’s liquidity and safety requirements.

The Association’s Board of Directors is responsible for establishing appropriate risk limits and for reviewing and approving the Investment Policy at least annually. The Investment Committee, comprised of the Chief Executive Officer (“CEO”) and at least two appointed members of the Board of Directors, is responsible for developing, implementing, and approving investment strategies and monitoring investment activities. The CEO is responsible for proposing investment strategies and for executing, approved portfolio strategies. The Association’s current Investment Policy authorizes, with certain limitations, investments in U.S. Treasury and federal agency securities, mortgage-backed securities, collateralized mortgage obligations, corporate debt, commercial paper, state and municipal securities, mutual funds, federal funds, and interest-bearing deposits in other financial institutions, among other investments.

14

Feldman Financial Advisors, Inc.

As shown in Exhibit II-4, the Association’s aggregate cash and investments amounted to $21.2 million or 18.7% of total assets as of June 30, 2025. Cash and cash equivalents amounted to $9.2 million or 8.1% of the Association’s total assets as of June 30, 2025. Cash and cash equivalents increased decreased from $6.4 million or 5.7% of total assets as of year-end 2024 as the Association experienced excess liquidity due to sluggish residential mortgage demand and increased deposit flows.

The Association’s available-for-sale securities portfolio, reported at fair value, totaled $9.4 million or 8.3% of total assets at June 30, 2025 and was composed of $5.5 million of mortgage-backed securities, $2.9 million of municipal and state obligations, and $1.0 million of U.S. Government and federal agency securities. The Association’s mortgage-backed securities are issued or guaranteed by U.S. Government-sponsored enterprises. The held-to-maturity securities portfolio, reported at amortized cost, totaled $1.8 million or 1.6% of total assets at June 30, 2025 and was composed of $975,000 of municipal and state obligations, $790,000 of mortgage-backed securities, and $84,000 of U.S. Government and federal agency securities. As of June 30, 2025, the Association had net unrealized losses of $575,000 in its available-for-sale securities portfolio $88,000 in its held-to-maturity securities portfolio. The Association also owned $427,000 of common stock in the FHLB of Des Moines and $287,000 in mutual funds as of June 30, 2025.

15

Feldman Financial Advisors, Inc.

Liability Composition

Deposits are the Association’s primary external source of funds for lending and investment purposes. Exhibit II-5 presents a summary of the Association’s deposit composition as of December 31, 2023 and 2024 and June 30, 2025. Total deposits amounted to $85.8 million or 75.8% of total assets and 90.5% of total liabilities at June 30, 2025. Total deposits increased by 0.9% or $752,000 from $85.1 million at December 31, 2024 to $85.8 million at June 30, 2025. Pioneer Federal offers checking accounts, savings accounts, tiered money market accounts, certificate of deposits accounts, and individual retirement account (“IRA”) certificates.

The Association’s total certificate accounts decreased by $3.0 million or 9.2% from $32.7 million or 38.4% of total deposits at year-end 2024 to $29.7 million or 34.6% of total deposits at June 30, 2025. The decline was partially due to the Association opting not to compete for higher-cost certificate accounts. Core deposits, defined as total deposits excluding certificate of deposit accounts, increased by $3.8 million or 7.2% from $52.4 million at year-end 2024 to $56.2 million at June 30, 2025. The ratio of core deposits to total deposits increased from 61.6% at December 31, 2024 to 65.4% at June 30, 2025, while the concentration of certificate deposits to total deposits decreased from 38.4% to 34.6% over the same time period.

The Association relies on customer service and longstanding relationships with customers in its primary market area to attract and retain deposits. Deposit account terms vary according to the minimum balance required, the time period that funds must remain on deposit, and the interest rate, among other factors. In determining the rates and terms of its deposit accounts, the Association considers the rates offered by competitors, liquidity needs, growth objectives, current operating strategies, and customer preferences and concerns. The Association has placed a concerted emphasis on attracting core deposit accounts, which tend to represent lower cost and more stable funding sources. For the six months ended June 30, 2025, the Association’s weighted average cost of core deposits was 0.37%, the weighted average cost of certificate accounts was 3.30%, and the overall weighted average cost of total deposits was 0.82%.

16

Feldman Financial Advisors, Inc.

As a member of the FHLB of Des Moines, the Association may obtain FHLB borrowings based upon the security of FHLB capital stock owned and certain of the Association’s residential real estate mortgage loans. Historically, the Association has not actively utilized FHLB borrowings as a source of funds. However, in September 2023, the Association obtained a $8.0 million FHLB advance that carries a fixed rate of 4.30% and matures in September 2028. The FHLB borrowing was used to support funding the construction of a new office facility in Deer Lodge and also for funding loan growth. At June 30, 2025, Pioneer Federal had additional borrowing capacity of $37.7 million from the FHLB of Des Moines. The Association also has a federal funds line of credit with its main correspondent institution. Federal funds purchased generally mature within one to four days from the transaction date. The Association had no federal funds purchased as of December 31, 2024 or June 30, 2025.

Equity Capital

The Association has historically maintained solid capital levels and its total equity amounted to $18.4 million or 16.27% of total assets at June 30, 2025. The ratio of total equity to assets increased from 16.19% at December 31, 2024 and 15.82% at December 31, 2023. Profitable operating results contributed to recent increases in the Association’s total equity. As of June 30, 2025, the Association’s total equity was composed of $18.7 million in retained earnings, offset by $305,000 in accumulated other comprehensive loss (“AOCL”). The Association’s AOCL reflects the after-tax effect of unrealized losses on available-for-sale securities. The Association’s AOCL improved by $100,000 for the year ended December 31, 2024 and $149,000 for the six months ended June 30, 2025. The recent decline in market interest rates had the effect of reducing the amount of net unrealized losses in the Association’s available-for-sale securities portfolio.

17

Feldman Financial Advisors, Inc.

Pioneer Federal’s capital level remains strong in comparison to minimum regulatory requirements. The Association has qualified for and elected to use the community bank leverage ratio (“CBLR”) framework for regulatory capital requirement purposes. An institution opting into the CBLR framework and meeting all requirements under the framework will be considered to have met the well-capitalized ratio requirements and is be required to report or calculate risk-based capital ratios. As of June 30, 2025, the required CBLR level was a tier 1 leverage capital ratio greater than or equal to 9.0%. The Association’s tier 1 leverage capital ratio increased from 16.45% at December 31, 2023 to 16.81% at December 31, 2024 and 17.00% at June 30, 2025. Based on the CBLR requirement, the Association was considered well capitalized for regulatory capital purposes as of June 30, 2025.

18

Feldman Financial Advisors, Inc.

Income and Expense Trends

Table 3 displays the main components of the Association’s earnings performance for the years ended December 31, 2023 and 2024 and the six months ended June 30, 2024 and 2025. Table 4 displays the Association’s principal income and expense ratios as a percent of average assets for the corresponding periods. Table 5 displays the Association’s weighted average yields on interest-earning assets and weighted average costs of interest-bearing liabilities.

Six Months Ended June 30, 2024 and 2025

Net income for the six months ended June 30, 2025 was $126,000, a decrease of $79,000 or 38.6%, compared to $205,000 for the six months ended June 30, 2024. The decrease was due to the combination of a non-recurring gain on the sale of the former Deer Lodge office location in 2024 of $311,000 along with an increase of $90,000 in professional fees incurred in 2025 in preparation for the Conversion. Pioneer Federal’s annualized return on average assets (“ROA”) measured 0.22% for the six months ended June 30, 2025, compared to 0.37% for the six months ended June 30, 2024.

The Association’s net interest income increased by $161,000 or 10.1% from $1.6 million for the six months ended June 30, 2024 to $1.7 million for the six months ended June 30, 2025. The net interest spread improved by 27 basis points from 2.63% in the first half of 2024 to 2.90% in the first half of 2025. The yield on interest-earning assets increased by 29 basis points from 4.63% to 4.92% over the comparative periods, while the cost of interest-bearing liabilities increased by only 2 basis points from 2.00% to 2.02%. Increases in the overall loan portfolio yield drove the improvements in the net interest spread. Relative to average assets, annualized net interest income increased from 2.81% to 3.10%.

19

Feldman Financial Advisors, Inc.

Table 3

Income Statement Summary

For the Years Ended December 31, 2023 and 2024

And the Six Months Ended June 30, 2024 and 2025

(Dollars in Thousands)

| Six Months Ended | Year Ended | |||||||||||||||

| June 30, | December 31, | |||||||||||||||

| 2025 | 2024 | 2024 | 2023 | |||||||||||||

| Total interest income | $ | 2,600 | $ | 2,436 | $ | 5,015 | $ | 4,381 | ||||||||

| Total interest expense | 867 | 864 | 1,823 | 1,088 | ||||||||||||

| Net interest income | 1,733 | 1,572 | 3,192 | 3,293 | ||||||||||||

| Provision for (recovery of) credit losses | (104 | ) | - | 28 | 35 | |||||||||||

| Net interest income after provision | 1,837 | 1,572 | 3,164 | 3,258 | ||||||||||||

| Total non-interest income | 128 | 414 | 495 | 268 | ||||||||||||

| Total non-interest expense | 1,831 | 1,722 | 3,362 | 3,136 | ||||||||||||

| Income before income taxes | 135 | 264 | 297 | 390 | ||||||||||||

| Income tax expense | 9 | 59 | 73 | 133 | ||||||||||||

| Net income | $ | 126 | $ | 205 | $ | 224 | $ | 257 | ||||||||

Source: Pioneer Federal Savings and Loan Association, financial statements.

Pioneer Federal recorded a $104,000 recovery on credit losses on loans for the six months ended June 30, 2025, compared to no provision or recovery for the six months ended June 30, 2024 As a result, the Association’s ratio of allowance for credit losses on loans to total loans decreased from 1.37% at December 31, 2024 to 1.27% at June 30, 2025. Non-performing assets decreased from $1.7 million or 1.53% of total assets at December 31, 2024 to $718,000 or 0.63% of total assets at June 30, 2025. Management’s determination of the adequacy of the allowance for credit losses was based, in part, on the low balances of non-accrual loans, delinquent loans, and net charge-offs in the first half of 2025 and prior periods.

20

Feldman Financial Advisors, Inc.

Table 4

Income Statement Ratios

For the Years Ended December 31, 2023 and 2024

And the Six Months Ended June 30, 2024 and 2025

(Percent of Average Assets)

| Six Months Ended | Year Ended | |||||||||||||||

| June 30, | December 31, | |||||||||||||||

| 2025(1) | 2024(1) | 2024 | 2023 | |||||||||||||

| Total interest income | 4.65 | % | 4.36 | 4.47 | % | 3.88 | % | |||||||||

| Total interest expense | 1.55 | 1.55 | 1.62 | 0.96 | ||||||||||||

| Net interest income | 3.10 | 2.81 | 2.84 | 2.92 | ||||||||||||

| Provision for (recovery of) credit losses | (0.19 | ) | 0.00 | 0.02 | 0.03 | |||||||||||

| Net interest income after provision | 3.29 | 2.81 | 2.82 | 2.89 | ||||||||||||

| Total non-interest income | 0.23 | 0.74 | 0.44 | 0.24 | ||||||||||||

| Total non-interest expense | 3.28 | 3.08 | 2.99 | 2.78 | ||||||||||||

| Income before income taxes | 0.24 | 0.47 | 0.26 | 0.35 | ||||||||||||

| Income tax expense | 0.02 | 0.10 | 0.07 | 0.12 | ||||||||||||

| Net income | 0.22 | 0.37 | 0.20 | 0.23 | ||||||||||||

(1) Annualized ratios for the period.

Source: Pioneer Federal Savings and Loan Association, financial data.

Non-interest income totaled $128,000 for the six months ended June 30, 2025, a decrease of $286,000 or 69.0% from $414,000 for the six months ended June 30, 2024. Excluding the gain on the sale of the former office location in the first half of 2024, non-interest income increased by $25,000 or 24.4% from $103,000 (or 0.18% annualized to average assets) to $128,000 (or 0.23% annualized to average assets) over the comparative periods. Interchange fees are the largest contributor of non-interest revenue and increased from $56,000 in the first half of 2024 to $87,000 in the first half of 2025. Service fees declined moderately from $36,000 in the first half of 2024 to $30,000 in the first half of 2025.

21

Feldman Financial Advisors, Inc.

The Association’s non-interest expense increased by $109,000 or 6.3% to $1.8 million for the six months ended June 30, 2025, compared to $1.7 million for the six months ended June 30, 2024. The increase in non-interest expense was due primarily to a $90,000 or 144.3% increase in professional fees and a $26,000 or 10.9% increase in occupancy costs. As previously noted, the increase in professional fees was mainly incurred in preparation for the Conversion. The increase in occupancy costs reflected the increased depreciation expense associated with the Association’s new office building in Deer Lodge. The ratio of annualized non-interest expense to average assets increased from 3.08% in the first half of 2024 to 3.15% in the first half of 2025.

Income tax expense declined from $60,000 for the six months ended June 30, 2024 to $9,000 for the six months ended June 30, 2025. The decrease was chiefly due to the decline in pre-tax income from $264,000 to $135,000 over the observed periods. The effective tax rate declined from 22.6% in the first half of 2024 to 6.6% in the first half of 2025.

Years Ended December 31, 2023 and 2024

Net income declined by $33,000 or 13.0% from $257,000 for the year ended December 31, 2023 to $224,000 for the year ended December 31, 2024. The Association’s ROA decreased from 0.23% for the year ended December 31, 2023 to 0.20% for the year ended December 31, 2024. The primary reasons for the decline in earnings were a $100,000 decrease in net interest income and a $226,000 increase in non-interest expense, offset partially by a $227,000 increase in non-interest income. The decrease in net interest income was largely attributable to a decrease in the Association’s net interest spread from 2.79% in 2023 to 2.65% in 2024. The increase in non-interest expense was attributable to an increase of $260,000 in occupancy costs related to the opening of the new office location in Deer Lodge. The increase in non-interest income primarily reflected the gain on the sale of the former office location in Deer Lodge.

22

Feldman Financial Advisors, Inc.

Table 5

Yield and Cost Summary

For the Years Ended December 31, 2023 and 2024

And the Six Months Ended June 30, 2024 and 2025

| Six Months Ended | Year Ended | |||||||||||||||

| June 30, | December 31, | |||||||||||||||

| 2025(1) | 2024(1) | 2024 | 2023 | |||||||||||||

| Weighted Average Yields | ||||||||||||||||

| Interest-bearing deposits | 2.95 | % | 5.64 | % | 5.32 | % | 2.47 | % | ||||||||

| Investment securities | 2.64 | 2.31 | 2.71 | 2.43 | ||||||||||||

| Loans | 5.37 | 4.95 | 5.01 | 4.55 | ||||||||||||

| Other investments | 9.37 | 8.88 | 9.11 | 1.80 | ||||||||||||

| Total interest-earning assets | 4.92 | 4.63 | 4.77 | 4.05 | ||||||||||||

| Weighted Average Costs | ||||||||||||||||

| Interest-bearing demand deposits | 0.20 | 0.20 | 0.21 | 0.20 | ||||||||||||

| Savings deposits | 2.06 | 1.10 | 1.12 | 0.84 | ||||||||||||

| Certificate of deposit accounts | 3.28 | 3.17 | 3.31 | 2.18 | ||||||||||||

| Total interest-bearing deposits | 1.78 | 1.76 | 1.89 | 1.23 | ||||||||||||

| Federal Home Loan Bank advances | 4.33 | 4.35 | 4.38 | 4.34 | ||||||||||||

| Total interest-bearing liabilities | 2.02 | 2.00 | 2.12 | 1.25 | ||||||||||||

| Net interest rate spread (2) | 2.90 | 2.63 | 2.65 | 2.79 | ||||||||||||

| Net interest margin (3) | 3.28 | 2.99 | 3.03 | 3.04 | ||||||||||||

| (1) | Annualized ratios. |

| (2) | Weighted average yield on interest-earning assets less the weighted average cost of interest-bearing liabilities. |

| (3) | Net interest income divided by average total interest-earning assets. |

Source: Pioneer Federal Savings and Loan Association, financial data.

Net interest income decreased by $100,000 or 3.0% to $3.2 million for the year ended December 31, 2024 compared to $3.3 million for the year ended December 31, 2023. The decrease reflects the decrease of 14 basis points in the net interest rate spread to 2.65% for the year ended December 31, 2024 from 2.79% for the year ended December 31, 2023, while average interest-earning assets decreased by $3.0 million or 2.8% on a year-to-year basis. The Association’s weighted average yield on interest-earning assets increased by 72 basis points from 4.05% in 2023 to 4.77% in 2024. In contrast, the weighted average cost of interest-bearing liabilities increased by 87 basis points from 1.25% in 2023 to 2.12% in 2024. Total interest income increased by $634,000 or 14.5% in 2024, while total interest expense increased by $734,000 or 67.4%. The increase in interest expense was impacted by a full year’s effect of the FHLB borrowing outstanding in 2024 and a broad increase in market interest rates on deposits.

23

Feldman Financial Advisors, Inc.

The aggregate provision for credit losses decreased from $35,000 in 2023 to $28,000 in 2024. The provision for losses on loans increased from $18,000 to $68,000, while the provision for losses on unfunded commitments decreased from $17,000 to a recovery of $40,000. Net loan charge-offs amounted to zero in 2023 and 2024. The allowance for credit losses on loans increased by $68,000 from $1.1 million (1.38% of total loans) at December 31, 2023 to $1.2 million (1.37% of total loans) at December 31, 2024. Non-performing loans increased from $597,000 as of December 31, 2023 to $1.7 million as of December 31, 2024. The increase was largely due to an increase of $582,000 in non-accrual residential mortgage loans.

Non-interest income totaled $495,000 for the year ended December 31, 2024, an increase of $227,000 or 84.6% from $268,000 for the year ended December 31, 2023. The increase was primarily due to a $311,000 gain on the sale of the former office in Deer Lodge following the opening of a new office location. Excluding the property sale gain, non-interest income decreased by $84,000 or 31.3% from $268,000 (or 0.25% of average assets) in 2023 to $184,000 (or 0.16% of average assets) in 2024. Interchange fees decreased by $11,000 or 7.4% from $138,000 in 2023 to $127,000 in 2024. The Association recorded a gain of $56,000 on the increase in the cash value of life insurance in 2023, but reported a decrease of $19,000 in 2024 due to the change in the cash value of life insurance.

24

Feldman Financial Advisors, Inc.

The Association’s non-interest expense increased by $226,000 or 7.2% to $3.4 million for the year ended December 31, 2024, compared to $3.1 million for the year ended December 31, 2023. The increase was due primarily to a $260,000 or 114.5% increase in occupancy costs as a result of the construction of a new office building in Deer Lodge. Salaries and employee benefits decreased by $19,000 or 1.2% and amounted to $1.6 million for the year ended December 31, 2024. The ratio of non-interest expense to average assets increased from 2.96% for the year ended December 31, 2023 to 3.00% for the year ended December 31, 2024.

Income tax expense decreased by $60,000 or 44.7% to $73,000 for the year ended December 31, 2024, compared to $133,000 for the year ended December 31, 2023. The decrease was due primarily to a $93,000 or 23.8% decrease in pre-tax income. The effective tax rates were 34.1% and 24.7% for the years ended December 31, 2023 and 2024.

25

Feldman Financial Advisors, Inc.

Interest Rate Risk Management

The Association seeks to reduce its earnings vulnerability and capital risk to changes in market interest rates by managing the mismatch between asset and liability maturities and interest rates. The Association’s Asset/Liability Committee (“ALCO”) focuses on ensuring a stable and steadily increasing flow of net interest income through managing the asset and liability mix of the balance sheet. The ALCO is expected to integrate the Association’s asset/liability management process into its operational decision making, including portfolio structure, investments, business planning, funding decisions, and pricing.

The Association attempts to manage the exposure of the net interest margin to unexpected changes due to interest rate fluctuations. The Association’s goal is not to eliminate interest rate risk, but to produce results that are consistent with the need for adequate liquidity, adequate capital, projected growth, acceptable risk, and appropriate profitability standards. The Association has interest rate risk guidelines that define the maximum potential reduction in net interest income and equity that the Association is prepared to accept. The Association has implemented various strategies to manage its interest rate risk. By enacting these strategies, the Association believes that it is better positioned to react to changes in market interest rates. These strategies include:

| · | Maintaining capital levels that exceed the thresholds for well-capitalized status under federal regulations. |

| · | Maintaining a high level of liquidity and investments. |

| · | Growing core deposit accounts that provide a stable, low-cost source of funds. |

| · | Managing the investment securities portfolio in a manner to reduce the average maturity and effective life of the portfolio. |

| · | Continuing to diversify the loan portfolio by adding more commercial real estate loans and commercial business loans, which typically have shorter maturities and/or balloon payments. |

26

Feldman Financial Advisors, Inc.

The Association monitors its interest rate sensitivity management through the use of models which generate estimates of the change in its net portfolio value of equity (economic value of equity or “EVE”) over a range of interest rate scenarios. EVE represents the market value of portfolio equity, which is different from book value, and is equal to the market value of assets minus the market value of liabilities (representing the difference between incoming and outgoing discounted cash flows of assets and liabilities) with adjustments made for off-balance sheet items. The EVE ratio, under any interest rate scenario, is defined as the EVE in that scenario divided by the market value of assets in the same scenario. Table 6 sets forth the Association’s EVE as of June 30, 2025 and reflects the changes to EVE as a result of the changes in interest rates as indicated.

Table 6

Economic Value of Equity

As of June 30, 2025

(Dollars in Thousands)

| Basis Point Change in Interest Rates (1) | Estimated EVE (2) ($000s) | Amount Change from Level ($000s) | Percent Change from Level | EVE Ratio (3) | Basis Point Change in EVE Ratio | |||||||||||||||

| + 300 b.p. | $ | 15,235 | $ | (3,116 | ) | (16.98 | )% | 13.47 | % | (276 | ) b.p. | |||||||||

| + 200 b.p. | 16,210 | (2,141 | ) | (11.67 | )% | 14.33 | % | (189 | ) b.p. | |||||||||||

| + 100 b.p. | 17,246 | (1,105 | ) | (6.02 | )% | 15.25 | % | (98 | ) b.p. | |||||||||||

| Level | 18,351 | -- | -- | 16.23 | % | -- | ||||||||||||||

| - 100 b.p. | 19,459 | 1,108 | 6.04 | % | 17.21 | % | 98 | b.p. | ||||||||||||

| - 200 b.p. | 20,649 | 2,298 | 12.52 | % | 18.26 | % | 203 | b.p. | ||||||||||||

| - 300 b.p. | 21,928 | 3,577 | 19.49 | % | 19.39 | % | 316 | b.p. | ||||||||||||

(1) Assumes an immediate uniform change in interest rates at all maturities.

(2) EVE is the discounted present value of expected cash flows from assets, liabilities, and off-balance sheet contracts.

(3) EVE ratio represents EVE divided by the present value of assets, which is calculated as the discounted value of incoming cash flows on interest-earning assets.

Source: Pioneer Federal Savings and Loan Association, financial data.

27

Feldman Financial Advisors, Inc.

Table 6 indicates that at June 30, 2025, in the event of an instantaneous 100 basis point increase in interest rates, the Association would experience a 6.0% decrease in EVE. In the event of an instantaneous 100 basis point decrease in interest rates, the Association would experience a 6.0% increase in EVE. In the event of an instantaneous 200 basis point increase in interest rates, the Association would experience an 11.7% decrease in EVE. In the event of an instantaneous 200 basis point decrease in interest rates, the Association would experience a 12.5% increase in EVE. Because of the Association’s relatively high concentration of fixed-rate loans, dramatic increases in the interest rate scenario produces broad declines in Pioneer Federal’s resulting EVE because assets decline in value significantly more than liabilities lose in value. The EVE simulations give no effect to any steps that the Association might take to counter the impact of such interest rate movement.

In addition to modeling changes in EVE, the Association also analyzes potential changes to net interest income for a 12-month period under rising and falling interest rate scenarios. The Association estimates its net interest income for a 12-month period, and then calculates what net interest income would be for the same period under the assumptions that the U.S. Treasury yield curve increases or decreases instantly by up to 300 basis points or decreases instantly by up to 300 basis points, in 100 point increments, with changes in interest rates representing immediate and permanent, parallel shifts in the yield curve.

Table 7 below sets forth, as of June 30, 2025, the calculation of the estimated changes in the Association’s net interest income resulting from the designated immediate changes in the U.S. Treasury yield curve. As shown in Table 7, an upward change of 100 basis points in market interest rates would decrease net interest income by $44,000 and an upward change of 200 basis points would decrease net interest income by $89,000. A downward upward change of 100 basis points in market interest rates would increase net interest income by $96,000 and an upward change of 200 basis points would increase net interest income by $184,000.

28

Feldman Financial Advisors, Inc.

Table 7

Net Interest Income Sensitivity

As of June 30, 2025

(Dollars in Thousands)

| Basis Point Change in Interest Rates (1) | Estimated Net Interest Income ($000s) | Change in Net Interest Income ($000s) | Percent Change from Level (%) | |||||||||

| + 300 b.p. | $ | 3,465 | $ | (135 | ) | (3.75 | )% | |||||

| + 200 b.p. | 3,511 | (89 | ) | (2.47 | )% | |||||||

| + 100 b.p. | 3,556 | (44 | ) | (1.22 | )% | |||||||

| Level | 3,600 | -- | -- | |||||||||

| - 100 b.p. | 3,696 | 96 | 2.67 | % | ||||||||

| - 200 b.p. | 3,784 | 184 | 5.11 | % | ||||||||

| - 200 b.p. | 3,861 | 261 | 7.25 | % | ||||||||

(1) Assumes an immediate uniform change in interest rates at all maturities.

Source: Pioneer Federal Savings and Loan Association, financial data.

29

Feldman Financial Advisors, Inc.

Asset Quality

Table 8 summarizes the Association’s total non-performing assets as of December 31, 2023 and 2024 and June 30, 2025. Historically, the Association has a solid record of reporting satisfactory asset quality. Pioneer Federal’s emphasis on residential mortgage lending in its primary market area has contributed to the consistently low level of loan delinquencies and charge-offs. Non-accrual loans increased from zero at December 31, 2023 to $585,000 at December 31, 2024, and subsequently declined to $111,000 at June 30, 2025. Relative to total loans, non-accrual loans declined from 0.67% at December 31, 2024 to 0.13% at June 30, 2025. The increase of non-accrual loans was chiefly due to an increase in non-accrual residential mortgage loans to $582,000, which declined to $108,000 as of June 30, 2025. The Association had no foreclosed assets or troubled debt restructurings as of December 31, 2023 and 2024 and June 30, 2025. The Association’s ratio of non-performing assets to total assets increased from 0.53% at December 31, 2023 to 1.53% at December 31, 2024 before declining to 0.63% at June 30, 2025.

Table 9 summarizes Pioneer Federal’s allowance for credit losses on loans (“ACL”) as of and for the years ended December 31, 2023 and 2024 and the six months ended June 30, 2025. Effective January 1, 2023, the Association began to use a current expected credit loss (“CECL”) model to estimate the ACL. The ACL decreased from $1.2 million at December 31, 2024 to $1.1 million at June 30, 2025 following the recording of a $104,000 recovery on the ACL during the first half of 2025. Net charge-offs amounted to $5,000 or 0.01% of average loans in the first half of 2025. As a result, the ratio of the ACL to total loans decreased from 1.37% at December 31, 2024 to 1.27% at June 30, 2025. The ratio of the ACL to total non-performing loans increased from 70.4% at December 31, 2024 to 153.1% at June 30, 2025, mainly due to the decline in non-performing loans from $1.7 million at December 31, 2024 to $718,000 at June 30, 2025.

| 30 |

Feldman Financial Advisors, Inc.

Table 8

Non-performing Assets Summary

As of December 31, 2023 and 2024 and June 30, 2025

(Dollars in Thousands)

| June 30, | December 31, | |||||||||||

| 2025 | 2024 | 2023 | ||||||||||

| Non-accrual Loans | ||||||||||||

| Residential first lien mortgage loans | $ | 108 | $ | 582 | $ | - | ||||||

| Consumer loans | 3 | 3 | - | |||||||||

| Total non-accrual loans | 111 | 585 | - | |||||||||

| Accruing loans past due 30-89 days | 147 | 862 | 597 | |||||||||

| Accruing loans past due 90 days or more | 460 | 270 | - | |||||||||

| Total non-performing loans | $ | 718 | $ | 1,717 | $ | 597 | ||||||

| Real estate owned | - | - | - | |||||||||

| Total non-performing assets | $ | 718 | $ | 1,717 | $ | 597 | ||||||

| Total non-accrual loans to total loans | 0.13 | % | 0.67 | % | 0.00 | % | ||||||

| Total non-performing loans to total loans | 0.83 | % | 1.95 | % | 0.72 | % | ||||||

| Total non-performing assets to total assets | 0.63 | % | 1.53 | % | 0.53 | % | ||||||

Source: Pioneer Federal Savings and Loan Association, financial data.

| 31 |

Feldman Financial Advisors, Inc.

Table 9

Allowance for Credit Losses on Loans

As of or For the Years Ended December 31, 2023 and 2024

And the Six Months Ended June 30, 2025

(Dollars in Thousands)

| At or For the | ||||||||||||

| Six Months | At or For the | |||||||||||

| Ended | Year Ended | |||||||||||

| June 30, | December 31, | |||||||||||

| 2025 | 2024 | 2023 | ||||||||||

| Allowance at beginning of period | $ | 1,208 | $ | 1,141 | $ | 1,180 | ||||||

| Impact of adoption of CECL accounting standard | - | - | (57 | ) | ||||||||

| Provision for (recovery of) credit losses on loans | (104 | ) | 68 | 18 | ||||||||

| Charge-offs: | ||||||||||||

| Residential loans | - | - | - | |||||||||

| Commercial loans | - | - | - | |||||||||

| Consumer loans | (5 | ) | - | (1 | ) | |||||||

| Total charge-offs | (5 | ) | - | (1 | ) | |||||||

| Recoveries: | ||||||||||||

| Residential loans | - | - | - | |||||||||

| Commercial loans | - | - | - | |||||||||

| Consumer loans | - | - | 1 | |||||||||

| Total recoveries | - | - | 1 | |||||||||

| Net charge-offs | (5 | ) | - | - | ||||||||

| Allowance at end of period | $ | 1,099 | $ | 1,208 | $ | 1,141 | ||||||

| Allowance to non-performing loans | 153.06 | % | 70.37 | % | 191.06 | % | ||||||

| Allowance to gross total loans | 1.27 | % | 1.37 | % | 1.38 | % | ||||||

| Net charge-offs to average loans | 0.01 | % | 0.00 | % | 0.00 | % | ||||||

Source: Pioneer Federal Savings and Loan Association, financial data.

| 32 |

Feldman Financial Advisors, Inc.

Office Facilities

Pioneer Federal conducts business from its main office (approximately 6,500 square feet) located at 202 North Main Street in Deer Lodge, Montana, and a branch office (approximately 11,500 square feet) located at 32 North Washington Street in Dillon, Montana. Both of the Association’s offices are full-service facilities and offer a full range of consumer banking products. The Deer Lodge office was opened in January 2024 following the construction of a new state-of-the-art building. The former Milwaukee Avenue office in Deer Lodge was relocated to the new North Main Street office location. The offices in Deer Lodge and Dillon are owned by Pioneer Federal and utilized by the Association as the sole occupant. Both offices feature ATMs and drive-up access.

The net book value of the Association’s premises and equipment totaled $5.0 million (net of accumulated depreciation of $1.7 million) at June 30, 2025. Because of the construction of the new office, the Association’s net premises and equipment increased from $759,000 or 0.7% of total assets at December 31, 2021 to $5.0 million or 4.4% of total assets at June 30, 2025. The Association believes that its current facilities are adequate to meet its present and foreseeable needs, subject to possible future expansion. The Association presently has no specific plans regarding the establishment of new branch offices or loan production offices.

| 33 |

Feldman Financial Advisors, Inc.

Market Area

Overview of Market Area

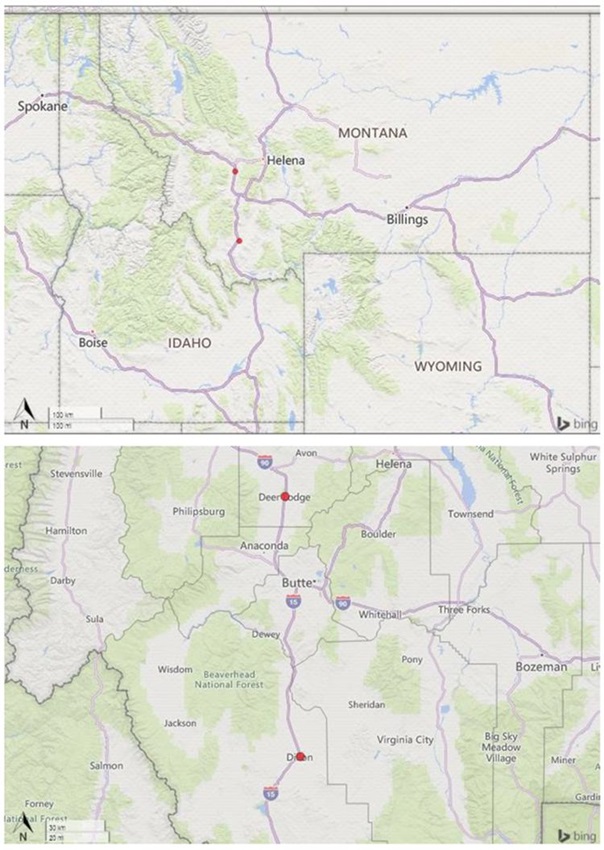

Pioneer Federal operates its main office in Deer Lodge, Montana, which is located in Powell County, and a branch office in Dillon, Montana, which is located in Beaverhead County. The city of Deer Lodge had an estimated 2025 population of 3,097 and is the county seat of Powell County. Pioneer Federal relocated its main office in Deer Lodge from Milwaukee Avenue to a new office building on North Main Street in January 2024. The city of Dillon had an estimated 2025 population of 4,196 and is the county seat of Beaverhead County. Dillon is located approximately 90 miles south of Deer Lodge. Powell County had an estimated 2025 population of 7,229. Beaverhead County had an estimated 2025 population of 10,136. Pioneer Federal’s office network is presented in the maps on the following page.

The economy in Powell County is geared to agriculture, other natural resources, government, and health care. Many of the large and small ranches in Powell County are owned by fourth and fifth generation residents. Sun Mountain Lumber Company is the area’s largest private employer and provides work for both loggers and mill employees. The Montana State Prison and Montana State Hospital are major employers in the local area. The Grant-Kohrs Ranch National Historic Site is also located in Deer Lodge and offers historic ranch house tours, living history demonstrations, and nearly ten miles of ranch roads and trails to hike on a 1,600 acre working cattle ranch. Beaverhead County is the largest county by area in Montana and one of the largest cattle and hay producing regions in the state. The major employers in Beaverhead County include Barrett Hospital and HealthCare, Beaverhead County, and High Divide Minerals (talc mining and processing company). The University of Montana Western is a public college located in Dillon and has a total undergraduate enrollment of approximately 1,200 students.

| 34 |

Feldman Financial Advisors, Inc.

● Pioneer Federal Savings and Loan Association - full-service offices

| 35 |

Feldman Financial Advisors, Inc.

Table 10 provides selected demographic data for the United States, the state of Montana, Powell County, and Beaverhead County. The two-county market area is sparsely populated and predominantly rural with the economic centers located in small towns in both counties. Powell County’s population is projected to increase by 3.6% over the next five years to 7,486 in 2030, while Beaverhead County’s population is projected to increase by 6.3% to 10,777 in 2030. The median ages in Powell County and Beaverhead County were 45.0 years and 43.1 years, respectively, above the state and national median ages of 41.0 years and 39.7, years, respectively. The estimated 2025 median household income of Powell County was $64,818, below the state and national levels of $72,066 and $78,770, respectively. The estimated 2025 median household income for Beaverhead County was $63,124.

The median housing values in Powell County and Beaverhead County ware $333,763 and $385,610, respectively, below the state median of $440,442. The median monthly gross rents ranged from $673 in Powell County to $855 in Beaverhead County, compared to the state and national medians of $1,013 and $1,298. Over the next five years, housing units are projected to increase by 3.4% in Powell County and 2.8% in Beaverhead County, compared to 4.2% for the overall state of Montana.