DRAFT Fairness Opinion Presentation to the Special Committee Project Bruce July

3, 2025

DRAFT SECTION 1 2 Discussion Backdrop

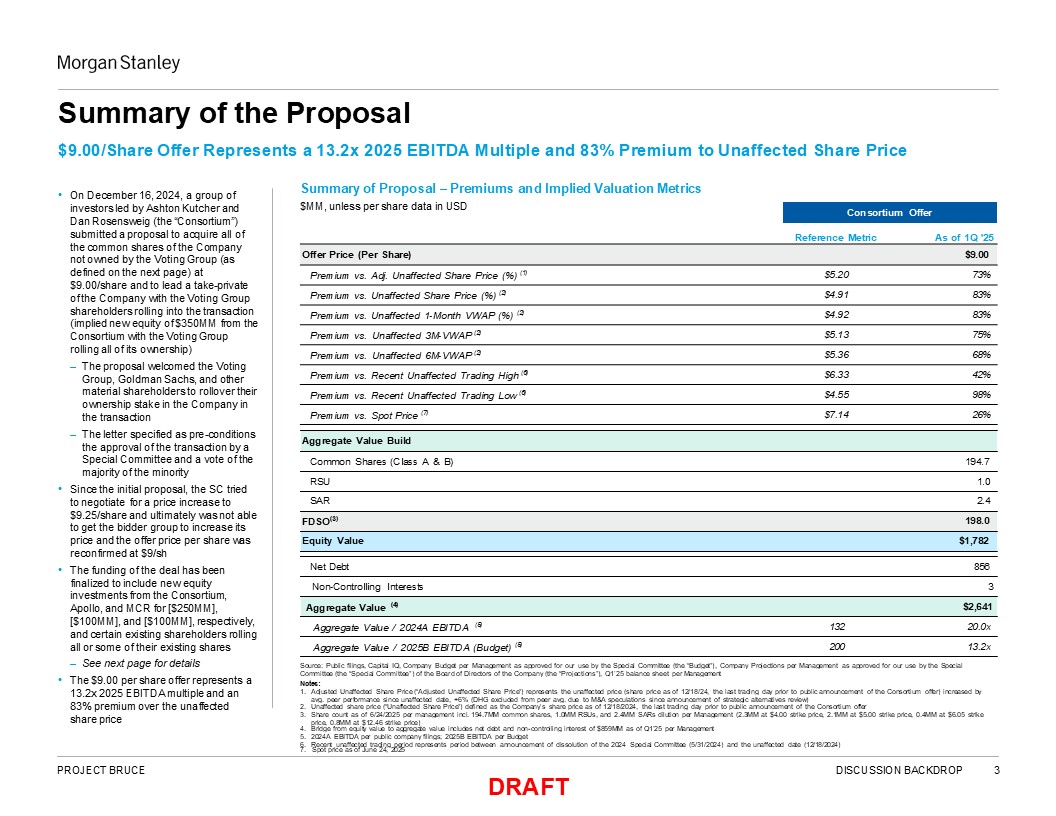

Consortium Offer Reference Metric As of 1Q '25 Offer Price (Per Share)

$9.00 Premium vs. Adj. Unaffected Share Price (%) (1) $5.20 73% Premium vs. Unaffected Share Price (%) (2) $4.91 83% Premium vs. Unaffected 1-Month VWAP (%) (2) $4.92 83% Premium vs. Unaffected 3M-VWAP (2) $5.13 75% Premium vs.

Unaffected 6M-VWAP (2) $5.36 68% Premium vs. Recent Unaffected Trading High (6) $6.33 42% Premium vs. Recent Unaffected Trading Low (6) $4.55 98% Premium vs. Spot Price (7) $7.14 26% Aggregate Value Build Common Shares (Class A

& B) 194.7 RSU 1.0 SAR 2.4 FDSO(3) 198.0 Equity Value $1,782 Net Debt 856 Non-Controlling Interests 3 Aggregate Value (4) $2,641 Aggregate Value / 2024A EBITDA (5) 132 20.0x Aggregate Value / 2025B EBITDA (Budget) (5) 200

13.2x Source: Public filings, Capital IQ, Company Budget per Management as approved for our use by the Special Committee (the “Budget”), Company Projections per Management as approved for our use by the Special Committee (the “Special

Committee”) of the Board of Directors of the Company (the “Projections”), Q1’25 balance sheet per Management Notes: Adjusted Unaffected Share Price (“Adjusted Unaffected Share Price”) represents the unaffected price (share price as of 12/18/

24, the last trading day prior to public announcement of the Consortium offer) increased by avg. peer performance since unaffected date, +6% (DHG excluded from peer avg. due to M&A speculations since announcement of strategic alternatives

review) Unaffected share price (“Unaffected Share Price”) defined as the Company’s share price as of 12/18/2024, the last trading day prior to public announcement of the Consortium offer Share count as of 6/24/2025 per management incl.

194.7MM common shares, 1.0MM RSUs, and 2.4MM SARs dilution per Management (2.3MM at $4.00 strike price, 2.1MM at $5.00 strike price, 0.4MM at $6.05 strike price, 0.8MM at $12.46 strike price) Bridge from equity value to aggregate value

includes net debt and non-controlling interest of $859MM as of Q1’25 per Management 2024A EBITDA per public company filings; 2025B EBITDA per Budget Recent unaffected trading period represents period between announcement of dissolution of the

2024 Special Committee (5/31/2024) and the unaffected date (12/18/2024) 7. Spot price as of June 24, 2025 PROJECT BRUCE DISCUSSION BACKDROP 3 DRAFT $9.00/Share Offer Represents a 13.2x 2025 EBITDA Multiple and 83% Premium to Unaffected

Share Price On December 16, 2024, a group of investors led by Ashton Kutcher and Dan Rosensweig (the “Consortium”) submitted a proposal to acquire all of the common shares of the Company not owned by the Voting Group (as defined on the next

page) at $9.00/share and to lead a take-private of the Company with the Voting Group shareholders rolling into the transaction (implied new equity of $350MM from the Consortium with the Voting Group rolling all of its ownership) The proposal

welcomed the Voting Group, Goldman Sachs, and other material shareholders to rollover their ownership stake in the Company in the transaction The letter specified as pre-conditions the approval of the transaction by a Special Committee and a

vote of the majority of the minority Since the initial proposal, the SC tried to negotiate for a price increase to $9.25/share and ultimately was not able to get the bidder group to increase its price and the offer price per share was

reconfirmed at $9/sh The funding of the deal has been finalized to include new equity investments from the Consortium, Apollo, and MCR for [$250MM], [$100MM], and [$100MM], respectively, and certain existing shareholders rolling all or some of

their existing shares See next page for details The $9.00 per share offer represents a 13.2x 2025 EBITDA multiple and an 83% premium over the unaffected share price Summary of Proposal – Premiums and Implied Valuation Metrics $MM, unless

per share data in USD Summary of the Proposal

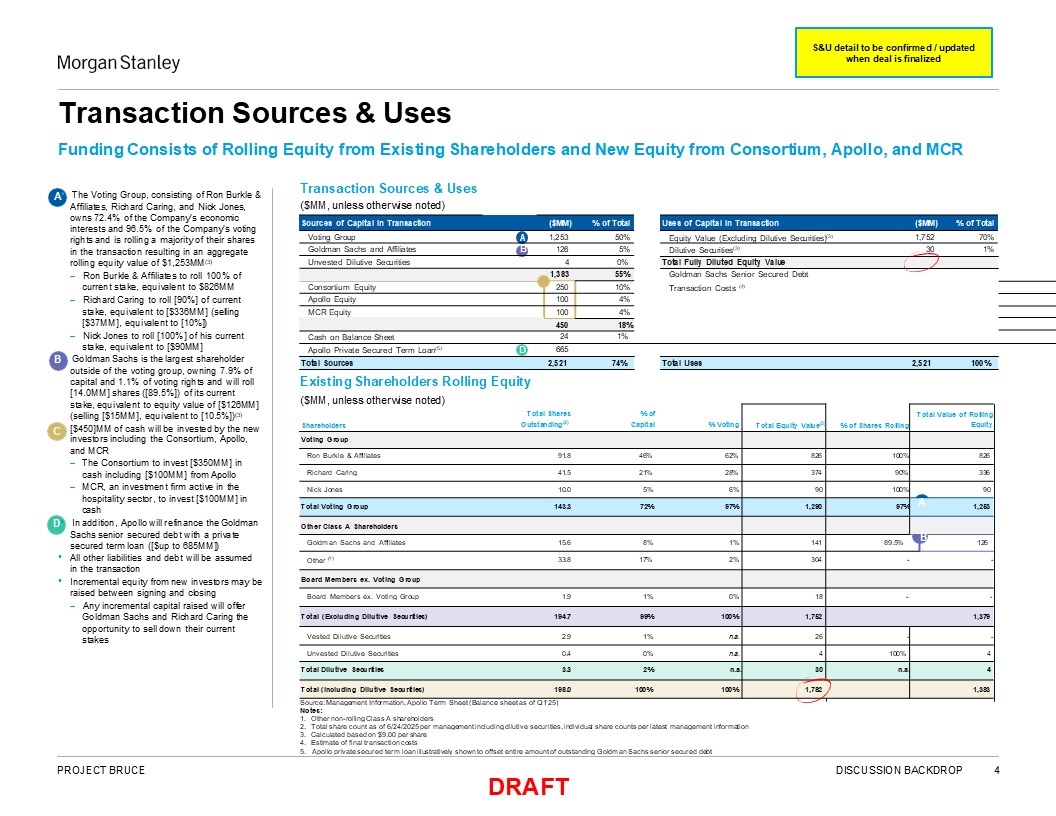

Rolling-Shareholders & Unvested Securities 1,383 55% Consortium

Equity 250 10% Apollo Equity 100 4% MCR Equity 100 4% Equity from New Investors 450 18% rolling equity value of $1,253MM(3) Unvested Dilutive Securities 4 0% Total Fully Diluted Equity Value 1,782 71% – Ron Burkle &

Affiliates to roll 100% of Goldman Sachs Senior Secured Debt 665 26% current stake, equivalent to $826MM Transaction Costs (4) 74 3% – Richard Caring to roll [90%] of current stake, equivalent to [$336MM] (selling [$37MM], equivalent

to [10%]) – Nick Jones to roll [100%] of his current Cash on Balance Sheet 24 1% Total Uses 2,521 100% investors including the Consortium, Apollo, and MCR The Consortium to invest [$350MM] in cash including [$100MM] from Apollo MCR, an

investment firm active in the hospitality sector, to invest [$100MM] in cash Transaction Sources & Uses Funding Consists of Rolling Equity from Existing Shareholders and New Equity from Consortium, Apollo, and MCR Existing Shareholders

Rolling Equity ($MM, unless otherwise noted) Transaction Sources & Uses Source: Management Information, Apollo Term Sheet (Balance sheet as of Q1’25) Notes: Other non-rolling Class A shareholders Total share count as of 6/24/2025 per

management including dilutive securities, individual share counts per latest management information Calculated based on $9.00 per share Estimate of final transaction costs Total Shares % of Shareholders Outstanding(2) Capital %

Voting Voting Group Total Equity Value(3) % of Shares Rolling Total Value of Rolling Equity Ron Burkle & Affiliates 91.8 46% 62% 826 100% 826 Richard Caring 41.5 21% 28% 374 90% 336 Nick

Jones 10.0 5% 6% 90 100% 90 Total Voting Group 143.3 72% 97% 1,290 97% A 1,253 Other Class A Shareholders Goldman Sachs and Affiliates 15.6 8% 1% 141 89.5% B 126 Other (1) 33.8 17% 2% 304 - - Board Members ex.

Voting Group Board Members ex. Voting Group 1.9 1% 0% 18 - - Total (Excluding Dilutive Securities) 194.7 99% 100% 1,752 1,379 Vested Dilutive Securities 2.9 1% n.a. 26 - - Unvested Dilutive

Securities 0.4 0% n.a. 4 100% 4 Total Dilutive Securities 3.3 2% n.a. 30 n.a. 4 Total (Including Dilutive Securities) 198.0 100% 100% 1,782 1,383 A• The Voting Group, consisting of Ron Burkle & Affiliates, Richard

Caring, and Nick Jones, owns 72.4% of the Company’s economic interests and 96.5% of the Company’s voting rights and is rolling a majority of their shares in the transaction resulting in an aggregate stake, equivalent to [$90MM] B• Goldman

Sachs is the largest shareholder outside of the voting group, owning 7.9% of capital and 1.1% of voting rights and will roll [14.0MM] shares ([89.5%]) of its current stake, equivalent to equity value of [$126MM] (selling [$15MM], equivalent to

[10.5%])(3) [$450]MM of cash will be invested by the new C ($MM, unless otherwise noted) Sources of Capital in Transaction ($MM) % of Total Uses of Capital in Transaction ($MM) % of Total Voting Group A 1,253 50% Equity Value

(Excluding Dilutive Securities)(3) 1,752 70% Goldman Sachs and Affiliates B 126 5% Dilutive Securities(3) 30 1% S&U detail to be confirmed / updated when deal is finalized D• In addition, Apollo will refinance the Goldman Sachs

senior secured debt with a private secured term loan ([$up to 685MM]) All other liabilities and debt will be assumed in the transaction Incremental equity from new investors may be raised between signing and closing – Any incremental capital

raised will offer Goldman Sachs and Richard Caring the opportunity to sell down their current stakes Apollo Private Secured Term Loan(5) D 665 Total Sources 2,521 74% 5. Apollo private secured term loan illustratively shown to offset entire

amount of outstanding Goldman Sachs senior secured debt PROJECT BRUCE DISCUSSION BACKDROP 4 DRAFT

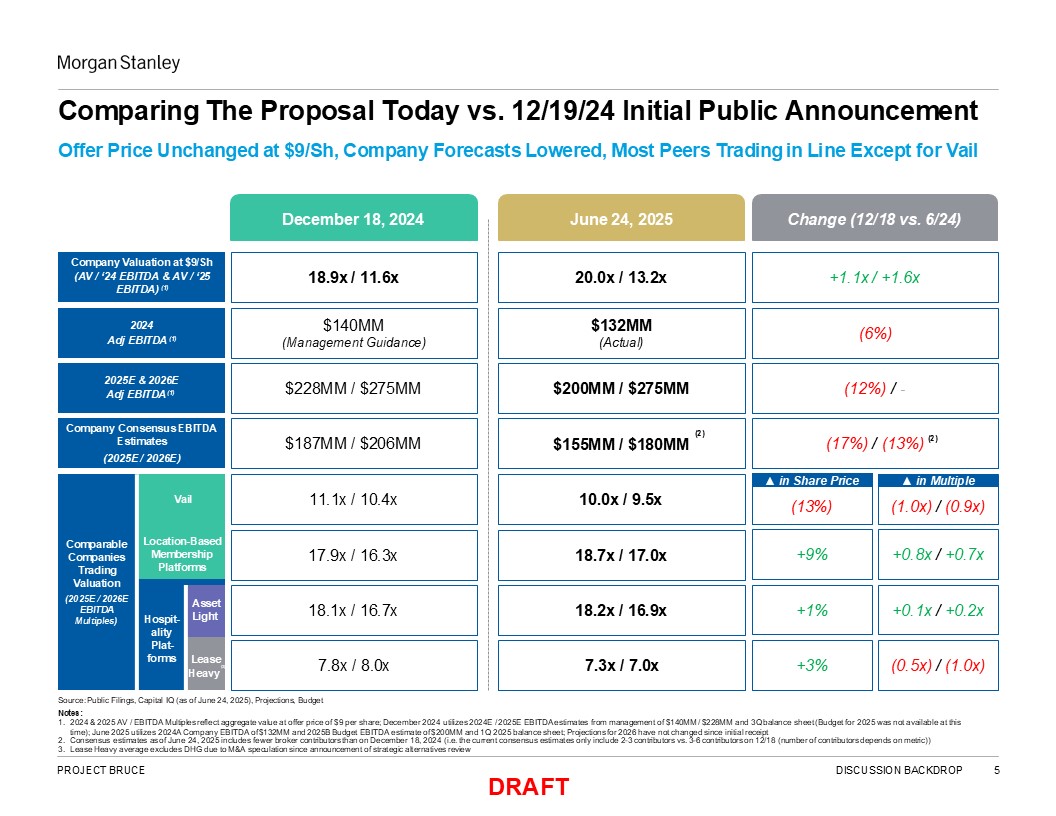

Comparing The Proposal Today vs. 12/19/24 Initial Public Announcement Source:

Public Filings, Capital IQ (as of June 24, 2025), Projections, Budget Notes: 2024 & 2025 AV / EBITDA Multiples reflect aggregate value at offer price of $9 per share; December 2024 utilizes 2024E / 2025E EBITDA estimates from management

of $140MM / $228MM and 3Q balance sheet (Budget for 2025 was not available at this time); June 2025 utilizes 2024A Company EBITDA of $132MM and 2025B Budget EBITDA estimate of $200MM and 1Q 2025 balance sheet; Projections for 2026 have not

changed since initial receipt Consensus estimates as of June 24, 2025 includes fewer broker contributors than on December 18, 2024 (i.e. the current consensus estimates only include 2-3 contributors vs. 3-6 contributors on 12/18 (number of

contributors depends on metric)) December 18, 2024 June 24, 2025 Change (12/18 vs. 6/24) Company Consensus EBITDA Estimates (2025E / 2026E) 2025E & 2026E Adj EBITDA (1) $187MM / $206MM 11.1x / 10.4x 17.9x / 16.3x 18.1x /

16.7x 7.8x / 8.0x $228MM / $275MM (2) $155MM / $180MM 10.0x / 9.5x 18.7x / 17.0x 18.2x / 16.9x 7.3x / 7.0x Vail Comparable Companies Trading Valuation Location-Based Membership Platforms (2025E / 2026E EBITDA Multiples) Hospit-

ality Plat- forms Asset Light Lease (3) Heavy s $200MM / $275MM (13%) ▲ in Share Price (1.0x) / (0.9x) ▲ in Multiple +9% +0.8x / +0.7x +1% +0.1x / +0.2x +3% (0.5x) / (1.0x) (12%) / - (17%) / (13%) (2) 3. Lease Heavy average

excludes DHG due to M&A speculation since announcement of strategic alternatives review PROJECT BRUCE DISCUSSION BACKDROP 5 DRAFT Offer Price Unchanged at $9/Sh, Company Forecasts Lowered, Most Peers Trading in Line Except for

Vail Company Valuation at $9/Sh (AV / ‘24 EBITDA & AV / ‘25 EBITDA) (1) 18.9x / 11.6x 20.0x / 13.2x +1.1x / +1.6x 2024 Adj EBITDA (1) $140MM (Management Guidance) $132MM (Actual) (6%)

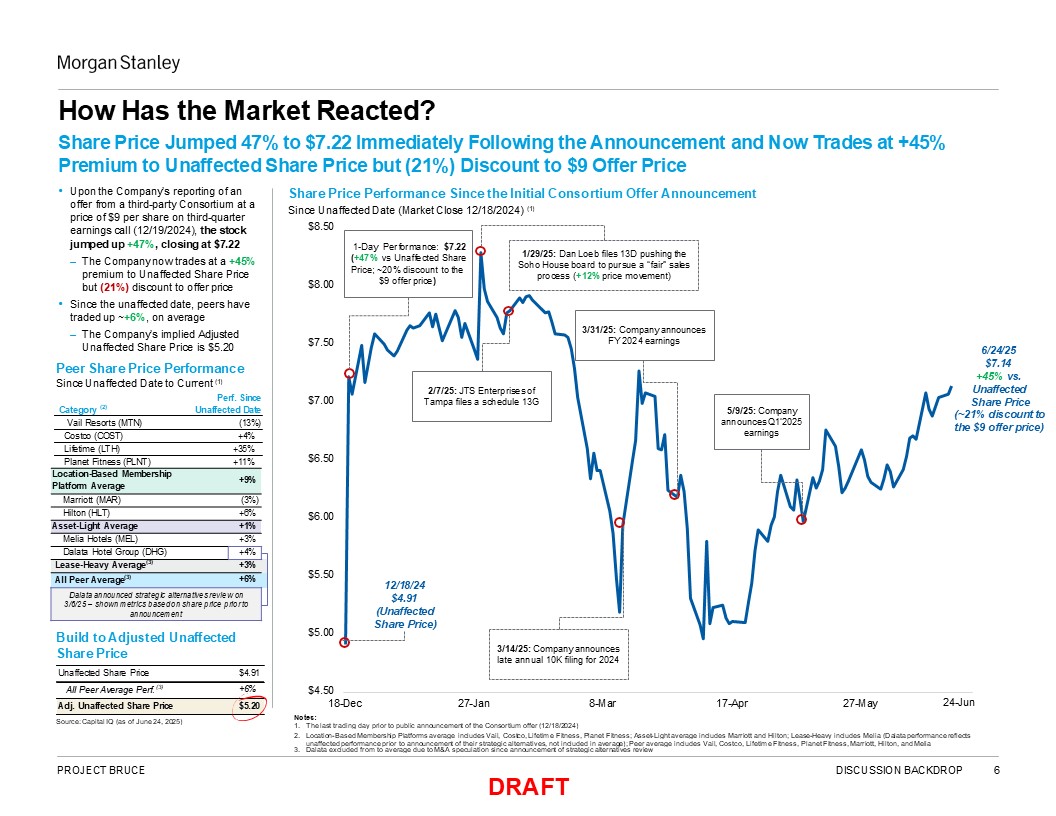

Unaffected Share Price $4.91 All Peer Average Perf. (3) +6% Adj. Unaffected

Share Price $5.20 $4.50 18-Dec 27-Jan 8-Mar 17-Apr 27-May $5.00 $5.50 $6.00 $6.50 $7.00 $7.50 $8.00 $8.50 Notes: The last trading day prior to public announcement of the Consortium offer (12/18/2024) Location-Based Membership

Platforms average includes Vail, Costco, Lifetime Fitness, Planet Fitness; Asset-Light average includes Marriott and Hilton; Lease-Heavy includes Melia (Dalata performance reflects unaffected performance prior to announcement of their strategic

alternatives, not included in average); Peer average includes Vail, Costco, Lifetime Fitness, Planet Fitness, Marriott, Hilton, and Melia How Has the Market Reacted? Share Price Performance Since the Initial Consortium Offer

Announcement Since Unaffected Date (Market Close 12/18/2024) (1) Source: Capital IQ (as of June 24, 2025) Upon the Company’s reporting of an offer from a third-party Consortium at a price of $9 per share on third-quarter earnings call

(12/19/2024), the stock jumped up +47%, closing at $7.22 The Company now trades at a +45% premium to Unaffected Share Price but (21%) discount to offer price Since the unaffected date, peers have traded up ~+6%, on average The Company’s

implied Adjusted Unaffected Share Price is $5.20 Peer Share Price Performance Since Unaffected Date to Current (1) Perf. Since Category (2) Unaffected Date Vail Resorts (MTN) (13%) Costco (COST) +4% Lifetime (LTH) +35% Planet Fitness

(PLNT) +11% 6/24/25 $7.14 +45% vs. Unaffected Share Price (~21% discount to the $9 offer price) 1-Day Performance: $7.22 (+47% vs Unaffected Share Price; ~20% discount to the $9 offer price) Share Price Jumped 47% to $7.22 Immediately

Following the Announcement and Now Trades at +45% Premium to Unaffected Share Price but (21%) Discount to $9 Offer Price 12/18/24 $4.91 (Unaffected Share Price) 1/29/25: Dan Loeb files 13D pushing the Soho House board to pursue a “fair”

sales process (+12% price movement) 2/7/25: JTS Enterprises of Tampa files a schedule 13G 3/14/25: Company announces late annual 10K filing for 2024 5/9/25: Company announces Q1’2025 earnings 3/31/25: Company announces FY 2024

earnings Build to Adjusted Unaffected Share Price 24-Jun Location-Based Membership Platform Average +9% Marriott (MAR) (3%) Hilton (HLT) +6% Asset-Light Average +1% Melia Hotels (MEL) +3% Dalata Hotel Group (DHG) +4% Lease-Heavy

Average(3) +3% All Peer Average(3) +6% Dalata announced strategic alternatives review on 3/6/25 – shown metrics based on share price prior to announcement 3. Dalata excluded from to average due to M&A speculation since announcement of

strategic alternatives review PROJECT BRUCE DISCUSSION BACKDROP 6 DRAFT

DRAFT SECTION 2 7 Valuation Perspectives

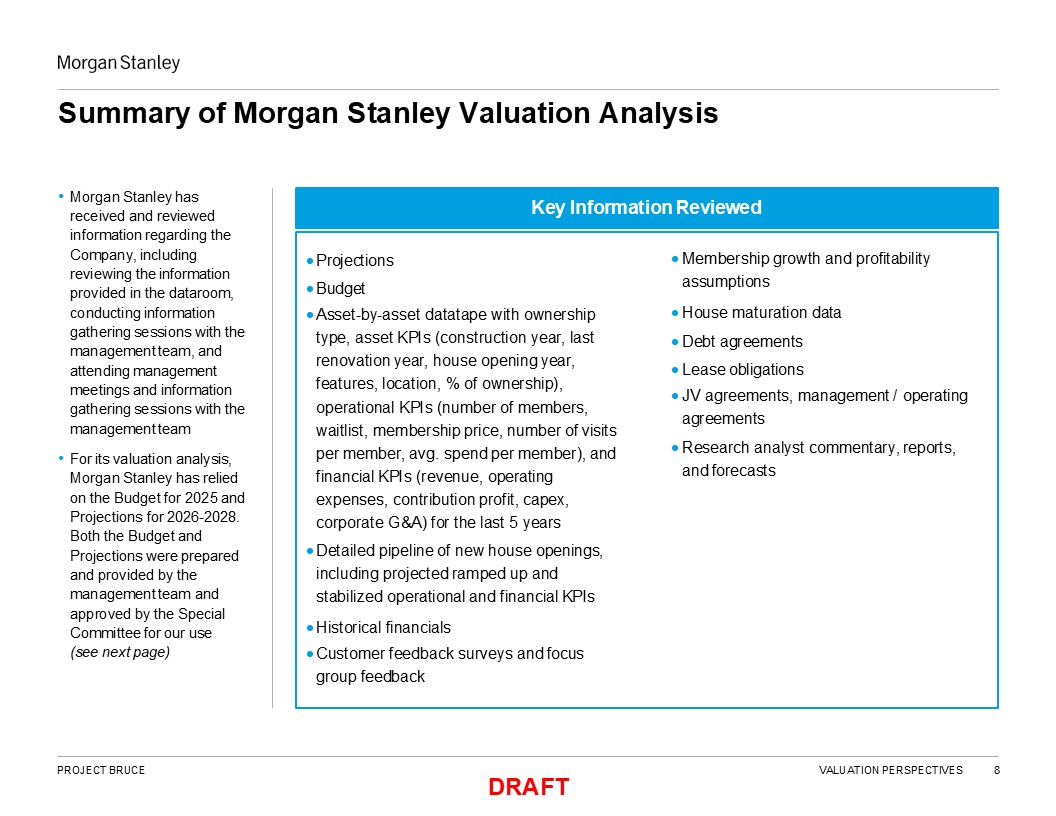

Summary of Morgan Stanley Valuation Analysis Morgan Stanley has received and

reviewed information regarding the Company, including reviewing the information provided in the dataroom, conducting information gathering sessions with the management team, and attending management meetings and information gathering sessions

with the management team For its valuation analysis, Morgan Stanley has relied on the Budget for 2025 and Projections for 2026-2028. Both the Budget and Projections were prepared and provided by the management team and approved by the Special

Committee for our use (see next page) Key Information Reviewed Projections Budget Asset-by-asset datatape with ownership type, asset KPIs (construction year, last renovation year, house opening year, features, location, % of ownership),

operational KPIs (number of members, waitlist, membership price, number of visits per member, avg. spend per member), and financial KPIs (revenue, operating expenses, contribution profit, capex, corporate G&A) for the last 5 years Detailed

pipeline of new house openings, including projected ramped up and stabilized operational and financial KPIs Historical financials Customer feedback surveys and focus group feedback PROJECT BRUCE VALUATION PERSPECTIVES 8 DRAFT Membership

growth and profitability assumptions House maturation data Debt agreements Lease obligations JV agreements, management / operating agreements Research analyst commentary, reports, and forecasts

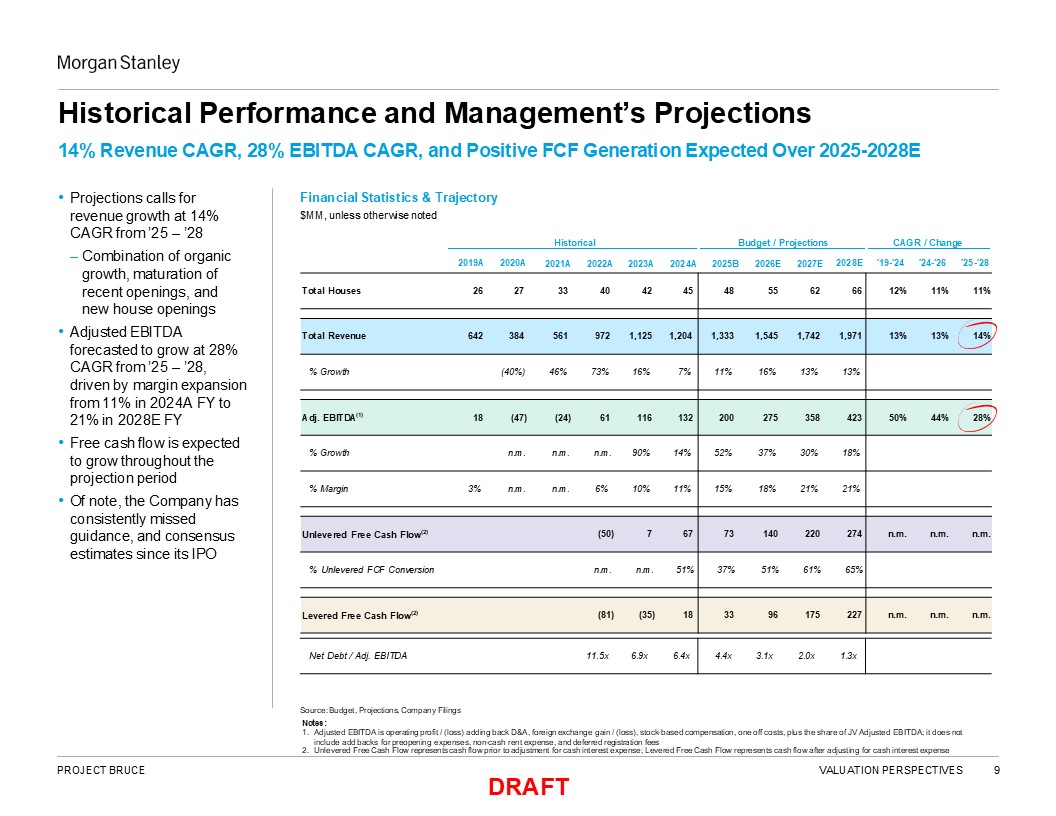

Total Houses 26 27 33 40 42 45 48 55 62 66 12% 11% 11% Total

Revenue 642 384 561 972 1,125 1,204 1,333 1,545 1,742 1,971 13% 13% 14% % Growth (40%) 46% 73% 16% 7% 11% 16% 13% 13% Adj. EBITDA(1) 18 (47) (24) 61 116 132 200 275 358 423 50% 44% 28% %

Growth n.m. n.m. n.m. 90% 14% 52% 37% 30% 18% % Margin 3% n.m. n.m. 6% 10% 11% 15% 18% 21% 21% Unlevered Free Cash Flow(2) (50) 7 67 73 140 220 274 n.m. n.m. n.m. % Unlevered FCF

Conversion n.m. n.m. 51% 37% 51% 61% 65% Levered Free Cash Flow(2) (81) (35) 18 33 96 175 227 n.m. n.m. n.m. CAGR / Change Historical Budget / Projections 2021A 2022A 2023A 2024A 2025B 2026E 2027E 2019A 2020A 2028E

'19-'24 '24-'26 '25-'28 Net Debt / Adj. EBITDA 11.5x 6.9x 6.4x 4.4x 3.1x 2.0x 1.3x Historical Performance and Management’s Projections 14% Revenue CAGR, 28% EBITDA CAGR, and Positive FCF Generation Expected Over

2025-2028E Projections calls for revenue growth at 14% CAGR from ’25 – ’28 – Combination of organic growth, maturation of recent openings, and new house openings Adjusted EBITDA forecasted to grow at 28% CAGR from ’25 – ’28, driven by

margin expansion from 11% in 2024A FY to 21% in 2028E FY Free cash flow is expected to grow throughout the projection period Of note, the Company has consistently missed guidance, and consensus estimates since its IPO Source: Budget,

Projections, Company Filings Notes: Adjusted EBITDA is operating profit / (loss) adding back D&A, foreign exchange gain / (loss), stock-based compensation, one off costs, plus the share of JV Adjusted EBITDA; it does not include add backs

for preopening expenses, non-cash rent expense, and deferred registration fees Unlevered Free Cash Flow represents cash flow prior to adjustment for cash interest expense; Levered Free Cash Flow represents cash flow after adjusting for cash

interest expense Financial Statistics & Trajectory $MM, unless otherwise noted PROJECT BRUCE VALUATION PERSPECTIVES 8 DRAFT

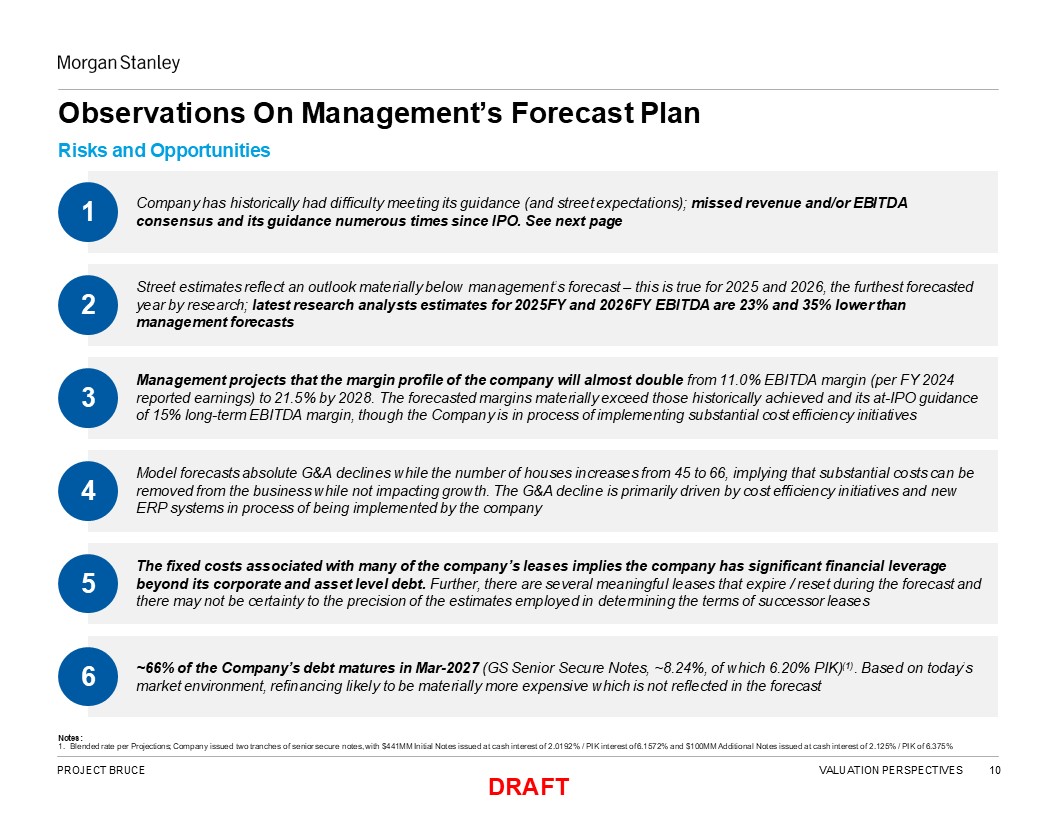

Observations On Management’s Forecast Plan Risks and Opportunities ~66% of the

Company’s debt matures in Mar-2027 (GS Senior Secure Notes, ~8.24%, of which 6.20% PIK)(1). Based on today’s market environment, refinancing likely to be materially more expensive which is not reflected in the forecast 6 Street estimates

reflect an outlook materially below management’s forecast – this is true for 2025 and 2026, the furthest forecasted year by research; latest research analysts estimates for 2025FY and 2026FY EBITDA are 23% and 35% lower than management

forecasts 2 The fixed costs associated with many of the company’s leases implies the company has significant financial leverage beyond its corporate and asset level debt. Further, there are several meaningful leases that expire / reset during

the forecast and there may not be certainty to the precision of the estimates employed in determining the terms of successor leases 5 Management projects that the margin profile of the company will almost double from 11.0% EBITDA margin (per

FY 2024 reported earnings) to 21.5% by 2028. The forecasted margins materially exceed those historically achieved and its at-IPO guidance of 15% long-term EBITDA margin, though the Company is in process of implementing substantial cost

efficiency initiatives 3 Company has historically had difficulty meeting its guidance (and street expectations); missed revenue and/or EBITDA consensus and its guidance numerous times since IPO. See next page 1 Model forecasts absolute

G&A declines while the number of houses increases from 45 to 66, implying that substantial costs can be removed from the business while not impacting growth. The G&A decline is primarily driven by cost efficiency initiatives and new ERP

systems in process of being implemented by the company 4 1. Blended rate per Projections; Company issued two tranches of senior secure notes, with $441MM Initial Notes issued at cash interest of 2.0192% / PIK interest of 6.1572% and $100MM

Additional Notes issued at cash interest of 2.125% / PIK of 6.375% PROJECT BRUCE VALUATION PERSPECTIVES 10 DRAFT Notes:

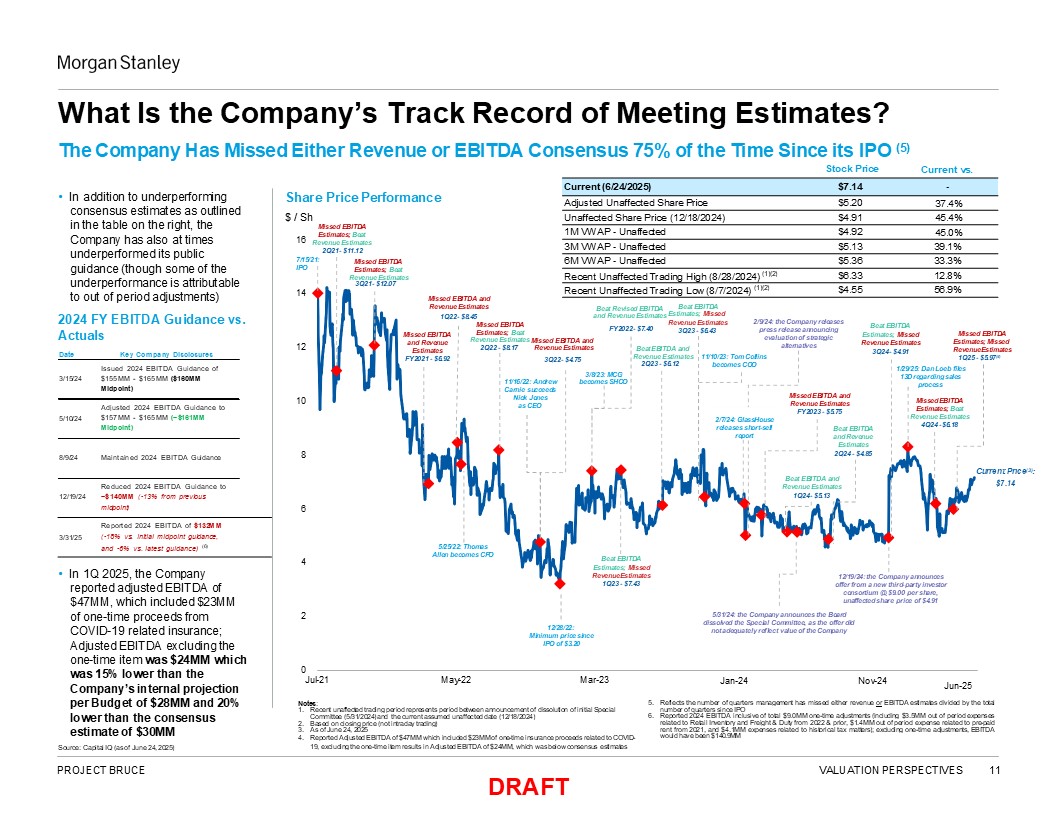

3/15/24 Issued 2024 EBITDA Guidance of $155MM - $165MM

($160MM Midpoint) 5/10/24 Adjusted 2024 EBITDA Guidance to $157MM - $165MM (~$161MM Midpoint) 8/9/24 Maintained 2024 EBITDA Guidance In addition to underperforming consensus estimates as outlined in the table on the right, the Company

has also at times underperformed its public guidance (though some of the underperformance is attributable to out of period adjustments) 2024 FY EBITDA Guidance vs. Actuals Date Key Company Disclosures Current (6/24/2025) $7.14 - Adjusted

Unaffected Share Price $5.20 37.4% Unaffected Share Price (12/18/2024) $4.91 45.4% 1M VWAP - Unaffected $4.92 45.0% 3M VWAP - Unaffected $5.13 39.1% 6M VWAP - Unaffected $5.36 33.3% Recent Unaffected Trading High (8/28/2024)

(1)(2) $6.33 12.8% Recent Unaffected Trading Low (8/7/2024) (1)(2) $4.55 56.9% Current vs. The Company Has Missed Either Revenue or EBITDA Consensus 75% of the Time Since its IPO (5) Stock Price In 1Q 2025, the Company reported

adjusted EBITDA of $47MM, which included $23MM of one-time proceeds from COVID-19 related insurance; Adjusted EBITDA excluding the one-time item was $24MM which was 15% lower than the Company’s internal projection per Budget of $28MM and 20%

lower than the consensus estimate of $30MM 0 Jul-21 May-22 Mar-23 Notes: Recent unaffected trading period represents period between announcement of dissolution of initial Special Committee (5/31/2024) and the current assumed unaffected date

(12/18/2024) Based on closing price (not intraday trading) As of June 24, 2025 Reported Adjusted EBITDA of $47MM which included $23MM of one-time insurance proceeds related to COVID- 2 4 8 10 12 14 16 Jan-24 Nov-24 What Is the

Company’s Track Record of Meeting Estimates? Current Price(3): $7.14 Source: Capital IQ (as of June 24, 2025) 19, excluding the one-time item results in Adjusted EBITDA of $24MM, which was below consensus estimates PROJECT BRUCE VALUATION

PERSPECTIVES 11 DRAFT Reflects the number of quarters management has missed either revenue or EBITDA estimates divided by the total number of quarters since IPO Reported 2024 EBITDA inclusive of total $9.0MM one-time adjustments (including

$3.5MM out of period expenses related to Retail Inventory and Freight & Duty from 2022 & prior, $1.4MM out of period expense related to pre-paid rent from 2021, and $4.1MM expenses related to historical tax matters); excluding one-time

adjustments, EBITDA would have been $140.9MM 7/15/21: IPO Missed EBITDA Estimates; Beat Revenue Estimates 3Q21 - $12.07 Missed EBITDA and Revenue Estimates FY2021 - $6.92 2Q22 - $8.17 Allen becomes CFO Beat EBITDA Estimates; Missed

Revenue Estimates 1Q23 - $7.43 Missed EBITDA and Revenue Estimates 1Q22 - $8.45 Missed EBITDA Estimates; Beat 11/16/22: Andrew Carnie succeeds Nick Jones as CEO Revenue Estimates Missed EBITDA and Beat EBITDA and FY2022 - $7.40 Beat

Revised EBITDA Revenue Estimates 3Q22 - $4.75 3/8/23: MCG becomes SHCO 2/9/24: the Company releases press release announcing evaluation of strategic alternatives Revenue Estimates 11/10/23: Tom Collins 2Q23 - $6.12 becomes COO 3Q23 -

$6.43 Beat EBITDA and Revenue Estimates Estimates; Missed Revenue Estimates Beat EBITDA Estimates; Missed Revenue Estimates 3Q24 - $4.91 Reduced 2024 EBITDA Guidance to Beat EBITDA and Revenue Estimates 12/19/24 ~$140MM (-13% from

previous 1Q24 - $5.13 midpoint) 6 Reported 2024 EBITDA of $132MM 3/31/25 (-18% vs. initial midpoint guidance, and -6% vs. latest guidance) (6) 5/25/22: Thomas Missed EBITDA and Revenue Estimates FY2023 - $5.75 12/19/24: the Company

announces offer from a new third-party investor consortium @ $9.00 per share, unaffected share price of $4.91 5/31/24: the Company announces the Board dissolved the Special Committee, as the offer did not adequately reflect value of the

Company 12/28/22: Minimum price since IPO of $3.20 1/29/25: Dan Loeb files 13D regarding sales process Jun-25 Missed EBITDA Estimates; Beat Revenue Estimates 4Q24 - $6.18 Missed EBITDA Estimates; Missed Revenue Estimates 1Q25 -

$5.97(4) Share Price Performance $ / Sh Missed EBITDA Estimates; Beat Revenue Estimates 2Q21 - $11.12 Beat EBITDA and Revenue Estimates 2Q24 - $4.85 2/7/24: GlassHouse releases short-sell report

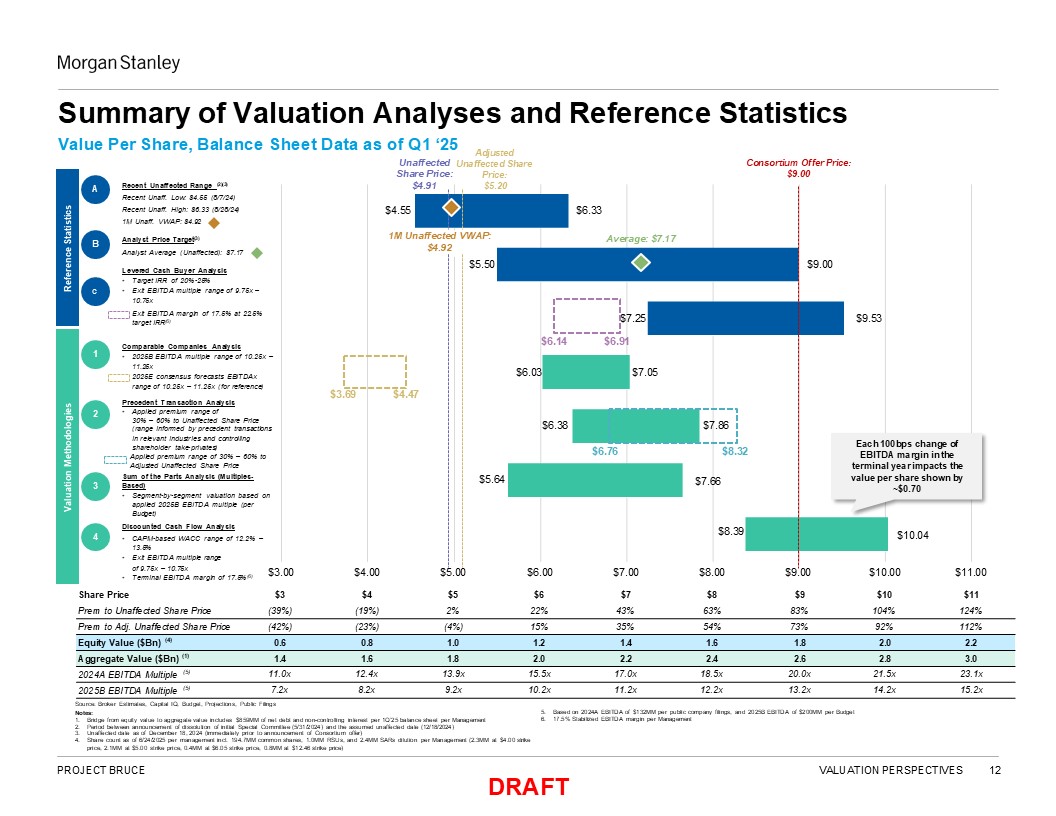

$8.39 $5.64 $6.38 $6.03 $7.25 $5.50 $4.55 $10.04 $7.66 $7.86 $7.05 $9.53 $9.00 $6.33 $3.00 $4.00 $5.00 $6.00 $7.00 $8.00 $9.00 $10.00 $11.00 Share

Price $3 $4 $5 $6 $7 $8 $9 $10 $11 Prem to Unaffected Share Price (39%) (19%) 2% 22% 43% 63% 83% 104% 124% Prem to Adj. Unaffected Share Price (42%) (23%) (4%) 15% 35% 54% 73% 92% 112% Equity Value ($Bn)

(4) 0.6 0.8 1.0 1.2 1.4 1.6 1.8 2.0 2.2 Aggregate Value ($Bn) (1) 1.4 1.6 1.8 2.0 2.2 2.4 2.6 2.8 3.0 2024A EBITDA Multiple (5) 11.0x 12.4x 13.9x 15.5x 17.0x 18.5x 20.0x 21.5x 23.1x 2025B EBITDA Multiple

(5) 7.2x 8.2x 9.2x 10.2x 11.2x 12.2x 13.2x 14.2x 15.2x Consortium Offer Price: $9.00 Recent Unaffected Range (2)(3) Recent Unaff. Low: $4.55 (8/7/24) Recent Unaff. High: $6.33 (8/28/24) 1M Unaff. VWAP: $4.92 A Based on 2024A

EBITDA of $132MM per public company filings, and 2025B EBITDA of $200MM per Budget 17.5% Stabilized EBITDA margin per Management Source: Broker Estimates, Capital IQ, Budget, Projections, Public Filings Notes: Bridge from equity value to

aggregate value includes $859MM of net debt and non-controlling interest per 1Q’25 balance sheet per Management Period between announcement of dissolution of initial Special Committee (5/31/2024) and the assumed unaffected date

(12/18/2024) Unaffected date as of December 18, 2024 (immediately prior to announcement of Consortium offer) Share count as of 6/24/2025 per management incl. 194.7MM common shares, 1.0MM RSUs, and 2.4MM SARs dilution per Management (2.3MM at

$4.00 strike Summary of Valuation Analyses and Reference Statistics Value Per Share, Balance Sheet Data as of Q1 ‘25 Reference Statistics Valuation Methodologies of 9.75x – 10.75x Terminal EBITDA margin of 17.5%(6) 4 Average:

$7.17 2 3 Analyst Price Target(3) Analyst Average (Unaffected): $7.17 B Adjusted Price: $5.20 $6.91 $6.14 $4.47 $3.69 1 • • Levered Cash Buyer Analysis Target IRR of 20%-25% Exit EBITDA multiple range of 9.75x – 10.75x Exit

EBITDA margin of 17.5% at 22.5% target IRR(6) C Each 100bps change of EBITDA margin in the terminal year impacts the value per share shown by ~$0.70 Unaffected Unaffected Share Share Price: $4.91 1M Unaffected VWAP: $4.92 • Comparable

Companies Analysis 2025B EBITDA multiple range of 10.25x – 11.25x 2025E consensus forecasts EBITDAx range of 10.25x – 11.25x (for reference) Precedent Transaction Analysis Applied premium range of 30% – 60% to Unaffected Share

Price (range informed by precedent transactions in relevant industries and controlling shareholder take-privates) Applied premium range of 30% – 60% to Adjusted Unaffected Share Price Sum of the Parts Analysis (Multiples-

Based) Segment-by-segment valuation based on applied 2025B EBITDA multiple (per Budget) Discounted Cash Flow Analysis CAPM-based WACC range of 12.2% – 13.5% Exit EBITDA multiple range $8.32 price, 2.1MM at $5.00 strike price, 0.4MM at

$6.05 strike price, 0.8MM at $12.46 strike price) PROJECT BRUCE VALUATION PERSPECTIVES 12 DRAFT $6.76

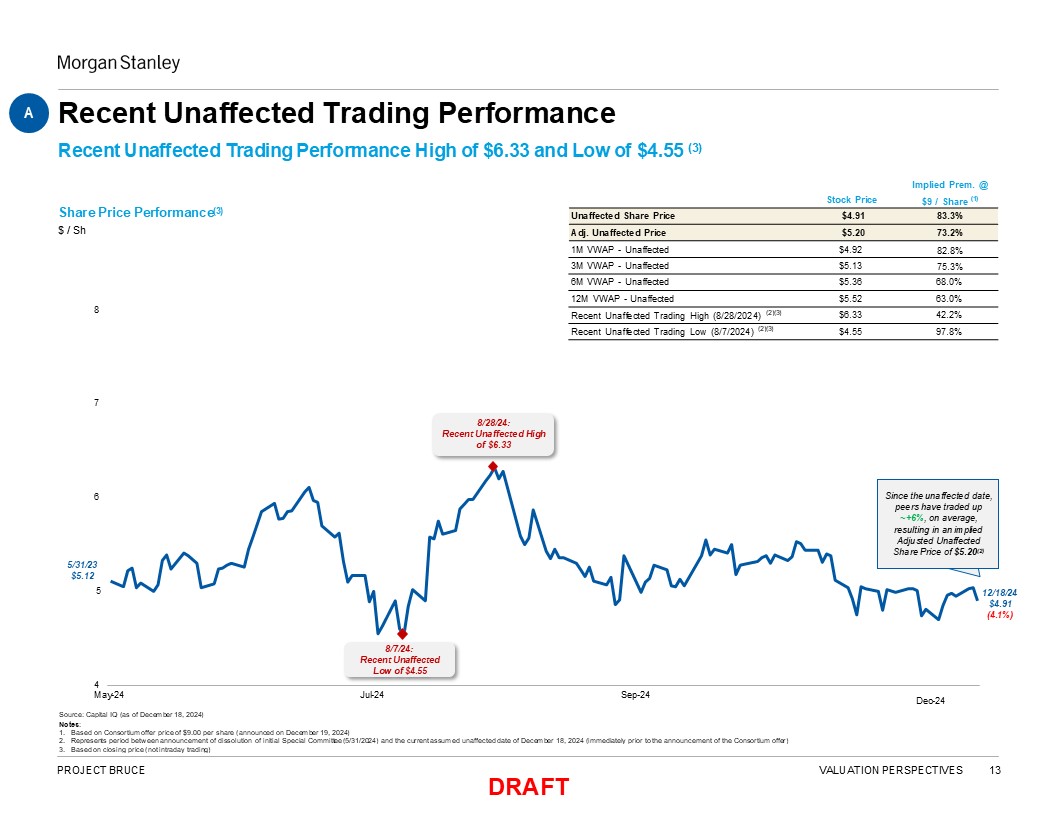

Implied Prem. @ $9 / Share (1) Unaffected Share Price $4.91 83.3% Adj.

Unaffected Price $5.20 73.2% Stock Price 1M VWAP - Unaffected $4.92 82.8% 3M VWAP - Unaffected $5.13 75.3% 6M VWAP - Unaffected $5.36 68.0% 12M VWAP - Unaffected $5.52 63.0% Recent Unaffected Trading High (8/28/2024)

(2)(3) $6.33 42.2% Recent Unaffected Trading Low (8/7/2024) (2)(3) $4.55 97.8% 5/31/23 $5.12 5 6 7 8 Nov-24 4 May-24 Jul-24 Sep-24 Source: Capital IQ (as of December 18, 2024) Notes: Based on Consortium offer price of $9.00 per

share (announced on December 19, 2024) Represents period between announcement of dissolution of initial Special Committee (5/31/2024) and the current assumed unaffected date of December 18, 2024 (immediately prior to the announcement of the

Consortium offer) Recent Unaffected Trading Performance Recent Unaffected Trading Performance High of $6.33 and Low of $4.55 (3) Share Price Performance(3) $ / Sh 12/18/24 $4.91 (4.1%) A Dec-24 8/7/24: Recent Unaffected Low of

$4.55 8/28/24: Recent Unaffected High of $6.33 Since the unaffected date, peers have traded up ~+6%, on average, resulting in an implied Adjusted Unaffected Share Price of $5.20(2) 3. Based on closing price (not intraday trading) PROJECT

BRUCE VALUATION PERSPECTIVES 13 DRAFT

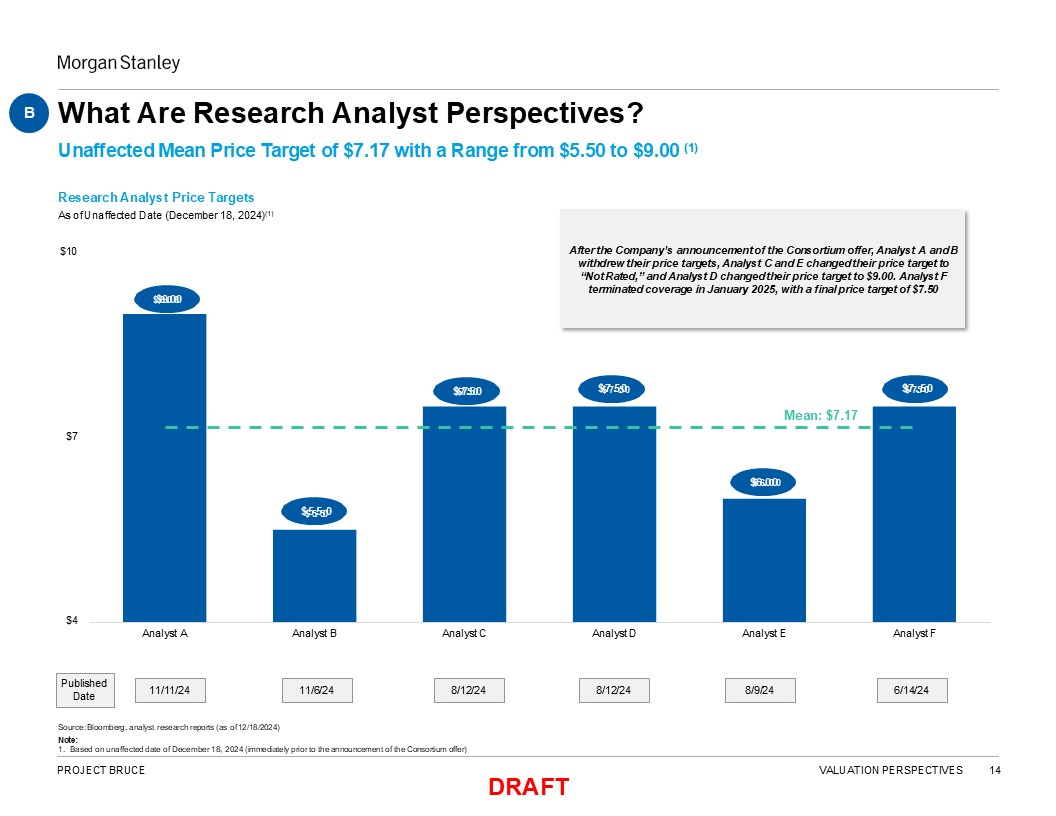

$4 $7 $10 Analyst A Analyst B Analyst C Analyst D Analyst E Analyst

F Research Analyst Price Targets As of Unaffected Date (December 18, 2024)(1) Unaffected Mean Price Target of $7.17 with a Range from $5.50 to $9.00 (1) 8/12/24 11/11/24 8/9/24 11/6/24 6/14/24 Published Date Mean:

$7.17 $$55..5500 8/12/24 What Are Research Analyst Perspectives? Source: Bloomberg, analyst research reports (as of 12/18/2024) Note: $$99..0000 $$77..5500 $$77.5.500 $$66..0000 $$77..5500 B After the Company’s announcement of the

Consortium offer, Analyst A and B withdrew their price targets, Analyst C and E changed their price target to “Not Rated,” and Analyst D changed their price target to $9.00. Analyst F terminated coverage in January 2025, with a final price

target of $7.50 1. Based on unaffected date of December 18, 2024 (immediately prior to the announcement of the Consortium offer) PROJECT BRUCE VALUATION PERSPECTIVES 14 DRAFT

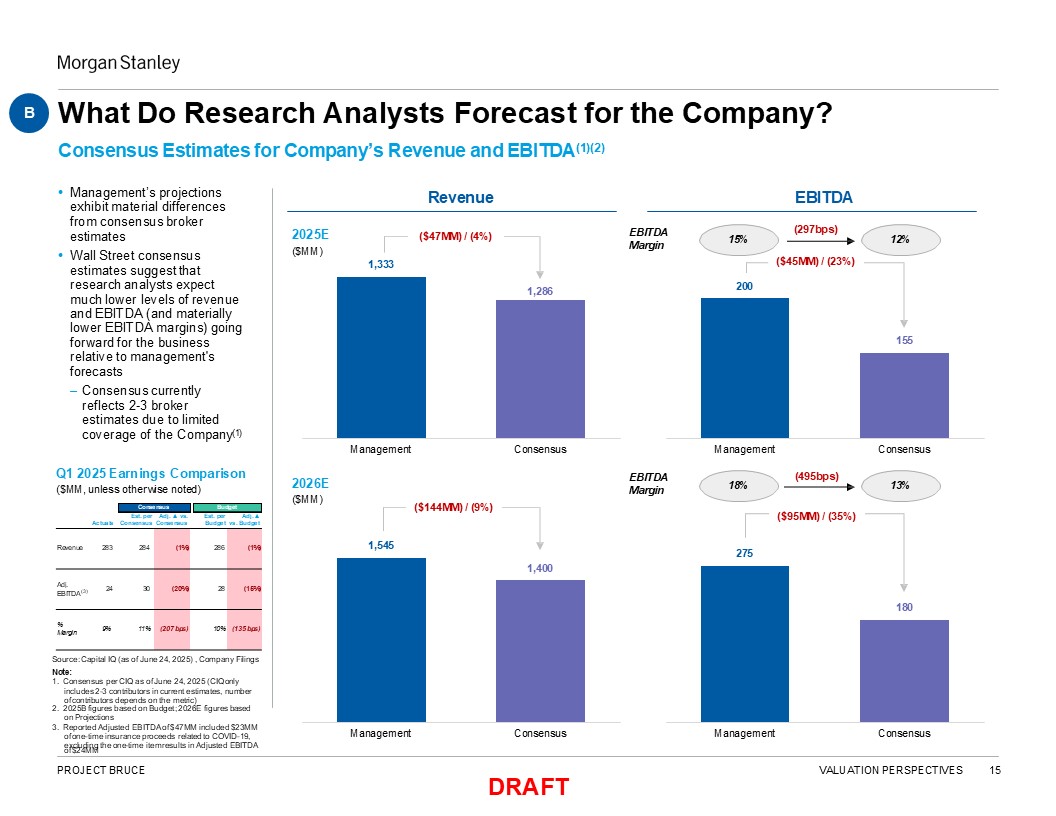

275 180 Management Consensus 1,333 1,286 Management Consensus 200 155 Management Consensus 1,545 1,400 Management Consensus Management’s

projections exhibit material differences from consensus broker estimates Wall Street consensus estimates suggest that research analysts expect much lower levels of revenue and EBITDA (and materially lower EBITDA margins) going forward for the

business relative to management's forecasts – Consensus currently reflects 2-3 broker estimates due to limited coverage of the Company(1) What Do Research Analysts Forecast for the Company? Consensus Estimates for Company’s Revenue and

EBITDA(1)(2) Source: Capital IQ (as of June 24, 2025) , Company Filings Note: Consensus per CIQ as of June 24, 2025 (CIQ only includes 2-3 contributors in current estimates, number of contributors depends on the metric) 2025B figures based

on Budget; 2026E figures based on Projections Reported Adjusted EBITDA of $47MM included $23MM of one-time insurance proceeds related to COVID-19, excluding the one-time item results in Adjusted EBITDA Q1 2025 Earnings Comparison ($MM,

unless otherwise noted) Consensus Budget Est. per Adj. ▲ vs. Est. per Adj. ▲ Actuals Consensus Consensus Budget vs. Budget Revenue 283 284 (1%) 286 (1%) Adj. EBITDA(3) 24 30 (20%) 28 (15%) % Margin 9% 11% (207 bps) 10% (135

bps) B 2025E ($MM) 2026E ($MM) 15% EBITDA Margin 12% 18% EBITDA Margin 13% Revenue EBITDA ($47MM) / (4%) ($45MM) / (23%) ($144MM) / (9%) ($95MM) / (35%) (297bps) (495bps) of $24MM PROJECT BRUCE VALUATION

PERSPECTIVES 15 DRAFT

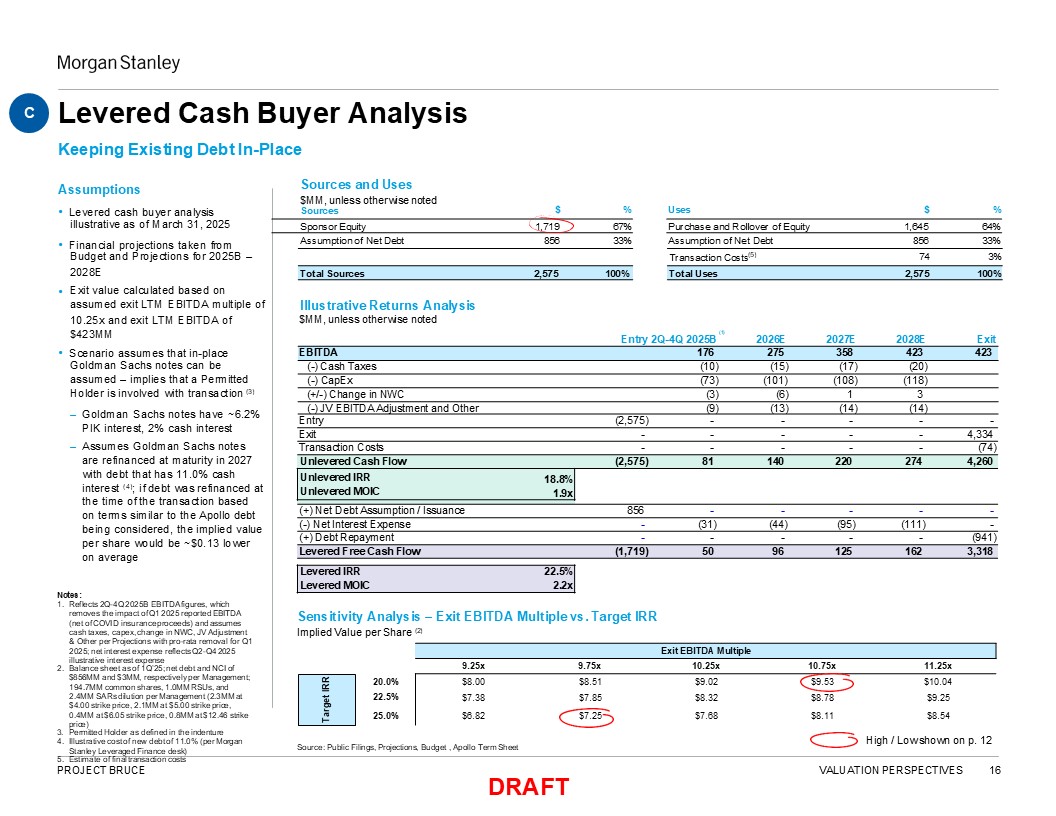

Exit EBITDA

Multiple 9.25x 9.75x 10.25x 10.75x 11.25x 20.0% 22.5% $8.00 $7.38 $8.51 $7.85 $9.02 $8.32 $9.53 $8.78 $10.04 $9.25 25.0% $6.82 $7.25 $7.68 $8.11 $8.54 Target

IRR 2026E 2027E 2028E Exit Entry (2,575) - - - - - Exit - - - - - 4,334 Transaction Costs - - - - - (74) Unlevered Cash Flow (2,575) 81 140 220 274 4,260 Unlevered IRR Unlevered MOIC 18.8% 1.9x (+) Net Debt

Assumption / Issuance 856 - - - - - (-) Net Interest Expense - (31) (44) (95) (111) - (+) Debt Repayment - - - - - (941) Levered Free Cash Flow (1,719) 50 96 125 162 3,318 Levered IRR Levered

MOIC 22.5% 2.2x Sensitivity Analysis – Exit EBITDA Multiple vs. Target IRR Implied Value per Share (2) Notes: Reflects 2Q-4Q 2025B EBITDA figures, which removes the impact of Q1 2025 reported EBITDA (net of COVID insurance proceeds) and

assumes cash taxes, capex, change in NWC, JV Adjustment & Other per Projections with pro-rata removal for Q1 2025; net interest expense reflects Q2-Q4 2025 illustrative interest expense Balance sheet as of 1Q’25; net debt and NCI

of $856MM and $3MM, respectively per Management; 194.7MM common shares, 1.0MM RSUs, and 2.4MM SARs dilution per Management (2.3MM at $4.00 strike price, 2.1MM at $5.00 strike price, 0.4MM at $6.05 strike price, 0.8MM at $12.46 strike

price) Permitted Holder as defined in the indenture Illustrative cost of new debt of 11.0% (per Morgan Stanley Leveraged Finance desk) Estimate of final transaction costs Levered Cash Buyer Analysis Keeping Existing Debt In-Place Sources

and Uses Assumptions Levered cash buyer analysis $MM, unless otherwise noted Sources $ % Uses $ % illustrative as of March 31, 2025 Sponsor Equity 1,719 67% Purchase and Rollover of Equity 1,645 64% Financial projections taken

from Assumption of Net Debt 856 33% Assumption of Net Debt 856 33% • $423MM Scenario assumes that in-place EBITDA 176 275 358 423 423 Goldman Sachs notes can be (-) Cash Taxes (10) (15) (17) (20) assumed – implies that a

Permitted (-) CapEx (73) (101) (108) (118) Holder is involved with transaction (3) (+/-) Change in NWC (3) (6) 1 3 (-) JV EBITDA Adjustment and Other (9) (13) (14) (14) Goldman Sachs notes have ~6.2% PIK interest, 2% cash

interest Assumes Goldman Sachs notes are refinanced at maturity in 2027 with debt that has 11.0% cash interest (4); if debt was refinanced at the time of the transaction based on terms similar to the Apollo debt being considered, the implied

value per share would be ~$0.13 lower on average Budget and Projections for 2025B – Transaction Costs(5) 74 3% 2028E Total Sources 2,575 100% Total Uses 2,575 100% Exit value calculated based on assumed exit LTM EBITDA multiple

of Illustrative Returns Analysis 10.25x and exit LTM EBITDA of $MM, unless otherwise noted (1) Entry 2Q-4Q 2025B C Source: Public Filings, Projections, Budget , Apollo Term Sheet High / Low shown on p. 12 PROJECT BRUCE VALUATION

PERSPECTIVES 16 DRAFT

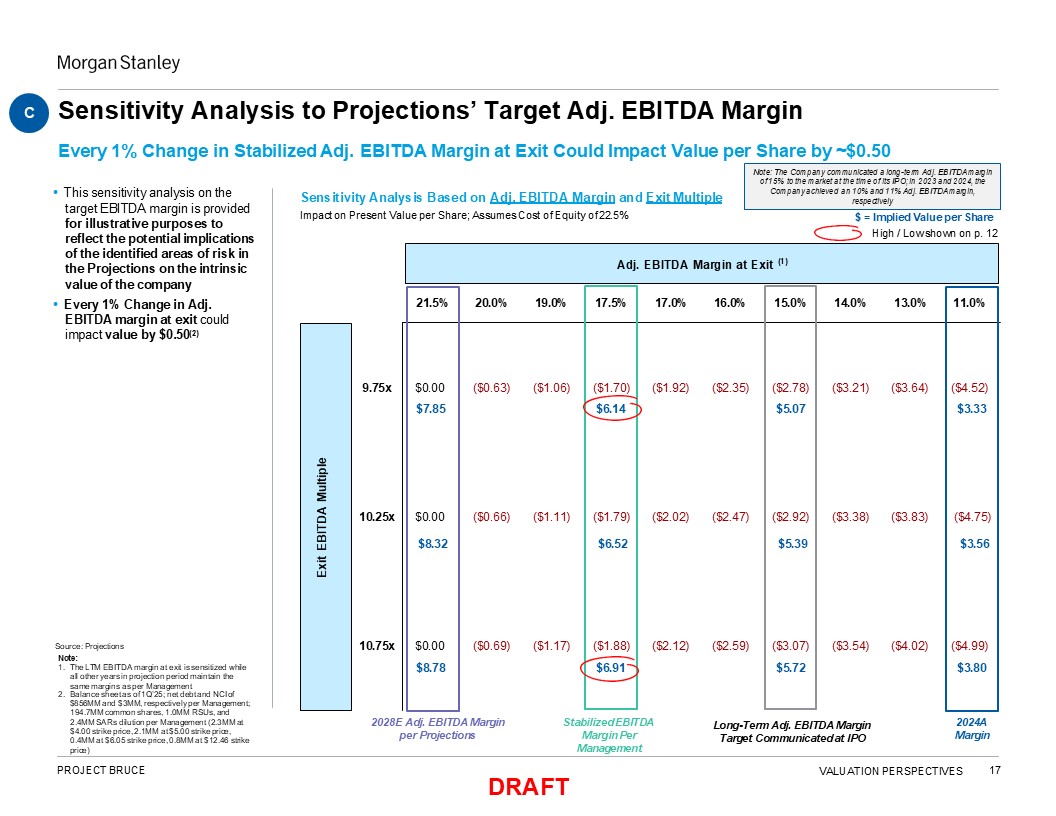

Adj. EBITDA Margin at Exit (1) 21.5% 20.0% 19.0% 17.5% 17.0% 16.0% 15.0% 14.0%

13.0% 11.0% 9.75x ($0.63) ($1.06) ($1.92) ($2.35) ($3.21) ($3.64) 10.25x ($0.66) ($1.11) ($1.79) ($2.02) ($2.47) ($3.38) ($3.83) 10.75x ($0.69) ($1.17) ($2.12) ($2.59) ($3.54) ($4.02) Exit EBITDA

Multiple $0.00 $7.85 $0.00 $8.32 $0.00 $8.78 ($3.07) $5.72 ($2.92) $5.39 ($2.78) $5.07 Sensitivity Analysis Based on Adj. EBITDA Margin and Exit Multiple Impact on Present Value per Share; Assumes Cost of Equity of 22.5% Source:

Projections Note: The LTM EBITDA margin at exit is sensitized while all other years in projection period maintain the same margins as per Management Balance sheet as of 1Q’25; net debt and NCI of $856MM and $3MM, respectively per

Management; 194.7MM common shares, 1.0MM RSUs, and 2.4MM SARs dilution per Management (2.3MM at $4.00 strike price, 2.1MM at $5.00 strike price, 0.4MM at $6.05 strike price, 0.8MM at $12.46 strike price) Every 1% Change in Stabilized Adj.

EBITDA Margin at Exit Could Impact Value per Share by ~$0.50 This sensitivity analysis on the target EBITDA margin is provided for illustrative purposes to reflect the potential implications of the identified areas of risk in the Projections

on the intrinsic value of the company Every 1% Change in Adj. EBITDA margin at exit could impact value by $0.50(2) Long-Term Adj. EBITDA Margin Target Communicated at IPO Note: The Company communicated a long-term Adj. EBITDA margin of 15%

to the market at the time of its IPO; in 2023 and 2024, the Company achieved an 10% and 11% Adj. EBITDA margin, respectively 2028E Adj. EBITDA Margin per Projections 2024A Margin C Sensitivity Analysis to Projections’ Target Adj. EBITDA

Margin ($1.88) $6.91 Stabilized EBITDA Margin Per Management $6.52 ($1.70) $6.14 ($4.99) $3.80 ($4.75) $3.56 ($4.52) $3.33 $ = Implied Value per Share High / Low shown on p. 12 PROJECT BRUCE VALUATION PERSPECTIVES 17 DRAFT

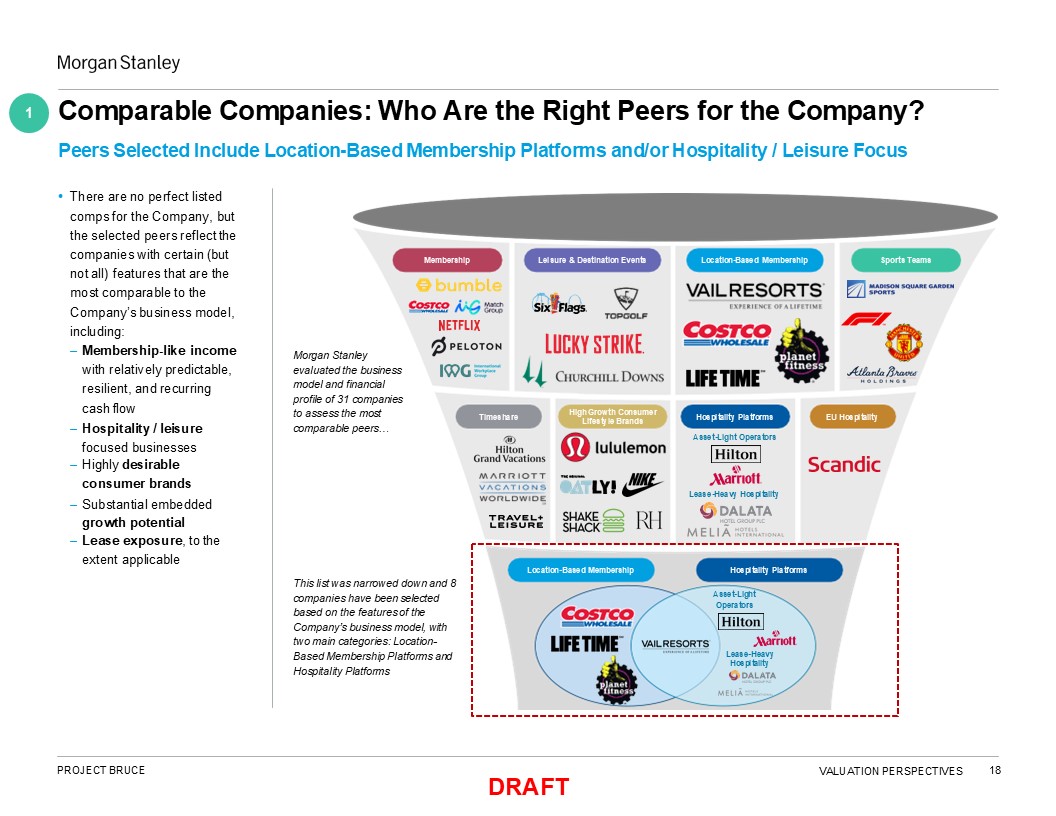

Comparable Companies: Who Are the Right Peers for the Company? Peers Selected

Include Location-Based Membership Platforms and/or Hospitality / Leisure Focus There are no perfect listed comps for the Company, but the selected peers reflect the companies with certain (but not all) features that are the most comparable to

the Company’s business model, including: Membership-like income with relatively predictable, resilient, and recurring cash flow Hospitality / leisure focused businesses Highly desirable consumer brands Substantial embedded growth

potential Lease exposure, to the extent applicable Morgan Stanley evaluated the business model and financial profile of 31 companies to assess the most comparable peers… This list was narrowed down and 8 companies have been selected based on

the features of the Company’s business model, with two main categories: Location- Based Membership Platforms and Hospitality Platforms Lease-Heavy Hospitality Location-Based Membership Hospitality Platforms Asset-Light

Operators Hospitality Platforms High Growth Consumer Lifestyle Brands EU Hospitality Timeshare Location-Based Membership Sports Teams Membership Leisure & Destination Events Asset-Light Operators Lease-Heavy

Hospitality 1 PROJECT BRUCE VALUATION PERSPECTIVES 17 DRAFT

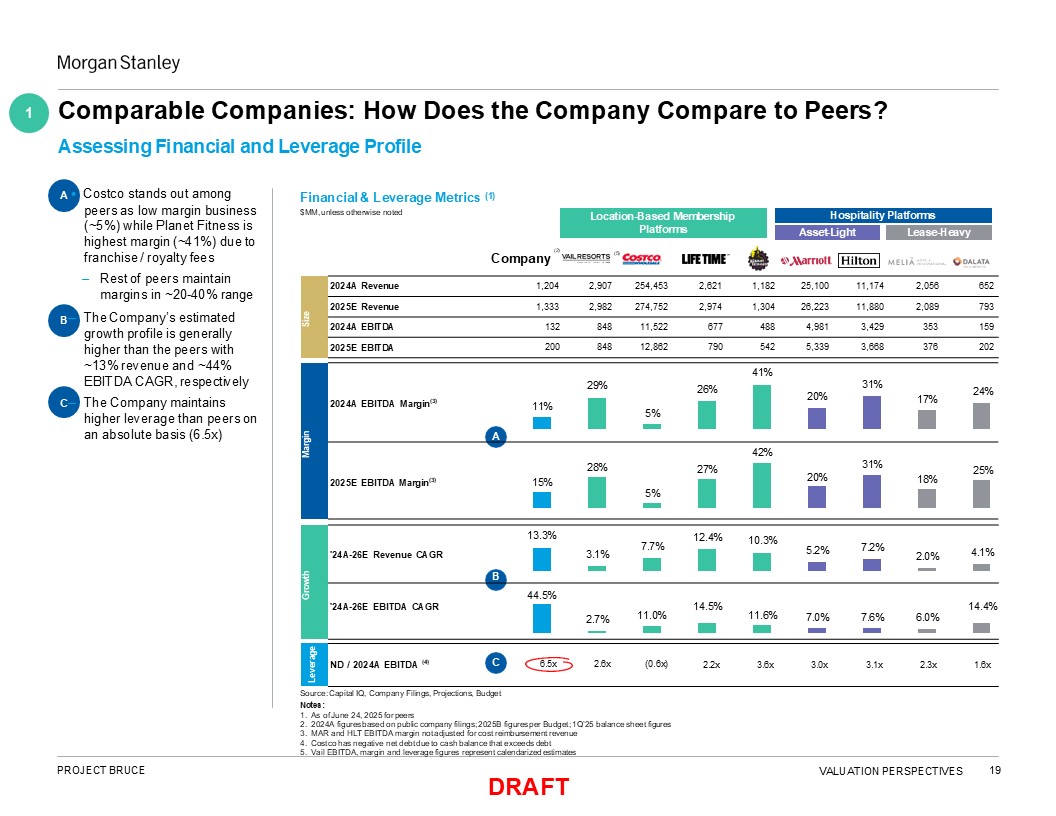

Size 2024A

Revenue 1,204 2,907 254,453 2,621 1,182 25,100 11,174 2,056 652 2025E Revenue 1,333 2,982 274,752 2,974 1,304 26,223 11,880 2,089 793 2024A EBITDA 132 848 11,522 677 488 4,981 3,429 353 159 2025E

EBITDA 200 848 12,862 790 542 5,339 3,668 376 202 2.2x 3.6x 3.0x 3.1x 2.3x 1.6x Leverage ND / 2024A EBITDA (4) C 6.5x 2.6x (0.6x) Source: Capital IQ, Company Filings, Projections, Budget Notes: As of June 24, 2025 for

peers 2024A figures based on public company filings; 2025B figures per Budget; 1Q’25 balance sheet figures MAR and HLT EBITDA margin not adjusted for cost reimbursement revenue Costco has negative net debt due to cash balance that exceeds

debt Vail EBITDA, margin and leverage figures represent calendarized estimates Financial & Leverage Metrics (1) $MM, unless otherwise noted Assessing Financial and Leverage Profile (2) Company Location-Based Membership

Platforms Hospitality Platforms Asset-Light Lease-Heavy Margin 2024A EBITDA Margin(3) A 11% 29% 5% 26% 41% 20% 31% 17% 24% 2025E EBITDA Margin(3) 15% 28% 5% 27% 42% 20% 31% 18% 25% Growth '24A-26E Revenue

CAGR B 13.3% 3.1% 7.7% 12.4% 10.3% 5.2% 7.2% 2.0% 4.1% 44.5% '24A-26E EBITDA CAGR 14.5% 14.4% 2.7% 11.0% 11.6% 7.0% 7.6% 6.0% A • Costco stands out among peers as low margin business (~5%) while Planet Fitness is highest

margin (~41%) due to franchise / royalty fees ‒ Rest of peers maintain margins in ~20-40% range B‒ The Company’s estimated growth profile is generally higher than the peers with ~13% revenue and ~44% EBITDA CAGR, respectively C‒ The Company

maintains higher leverage than peers on an absolute basis (6.5x) 1 Comparable Companies: How Does the Company Compare to Peers? (5) PROJECT BRUCE VALUATION PERSPECTIVES 17 DRAFT

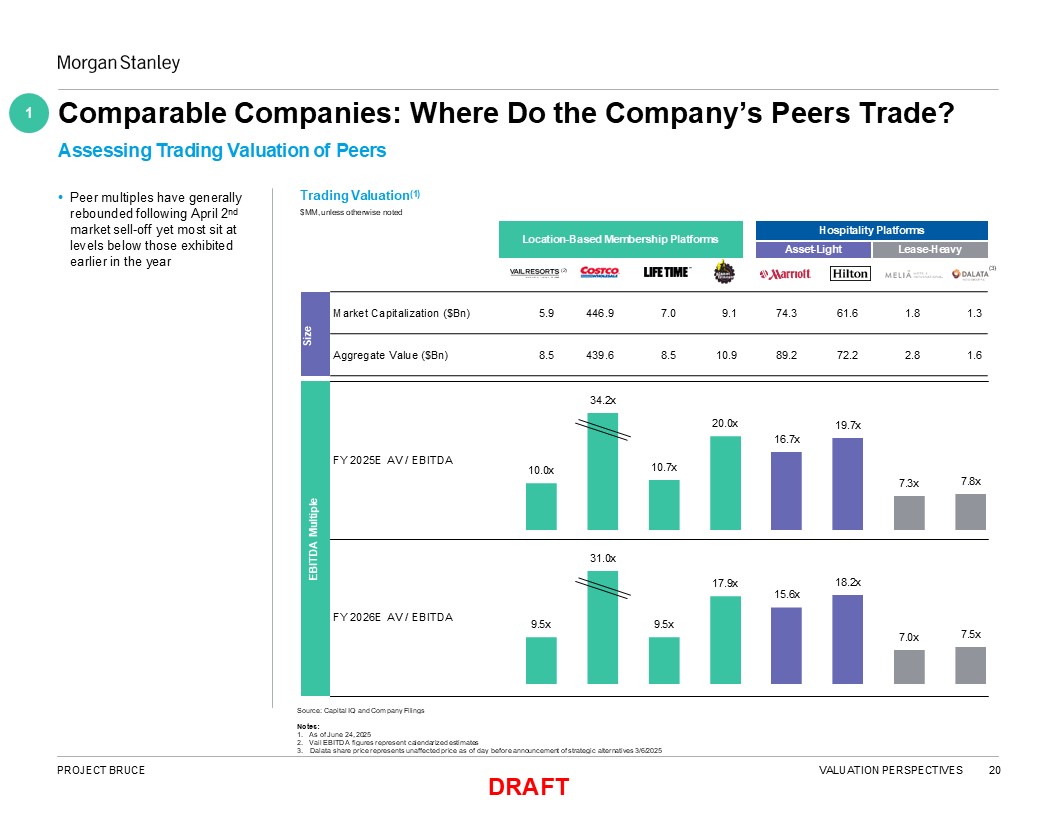

Size Market Capitalization

($Bn) 5.9 446.9 7.0 9.1 74.3 61.6 1.8 1.3 Aggregate Value ($Bn) 8.5 439.6 8.5 10.9 89.2 72.2 2.8 1.6 FY 2025E AV / EBITDA FY 2026E AV / EBITDA EBITDA

Multiple 10.0x 34.2x 10.7x 20.0x 16.7x 19.7x 7.3x 7.8x 9.5x 31.0x 9.5x 17.9x 15.6x 18.2x 7.0x 7.5x Trading Valuation(1) $MM, unless otherwise noted Source: Capital IQ and Company Filings Notes: As of June 24, 2025 Vail

EBITDA figures represent calendarized estimates Comparable Companies: Where Do the Company’s Peers Trade? Assessing Trading Valuation of Peers Peer multiples have generally rebounded following April 2nd market sell-off yet most sit at levels

below those exhibited earlier in the year Location-Based Membership Platforms Hospitality Platforms Asset-Light Lease-Heavy 1 3. Dalata share price represents unaffected price as of day before announcement of strategic alternatives

3/6/2025 PROJECT BRUCE VALUATION PERSPECTIVES 20 DRAFT (2) (3)

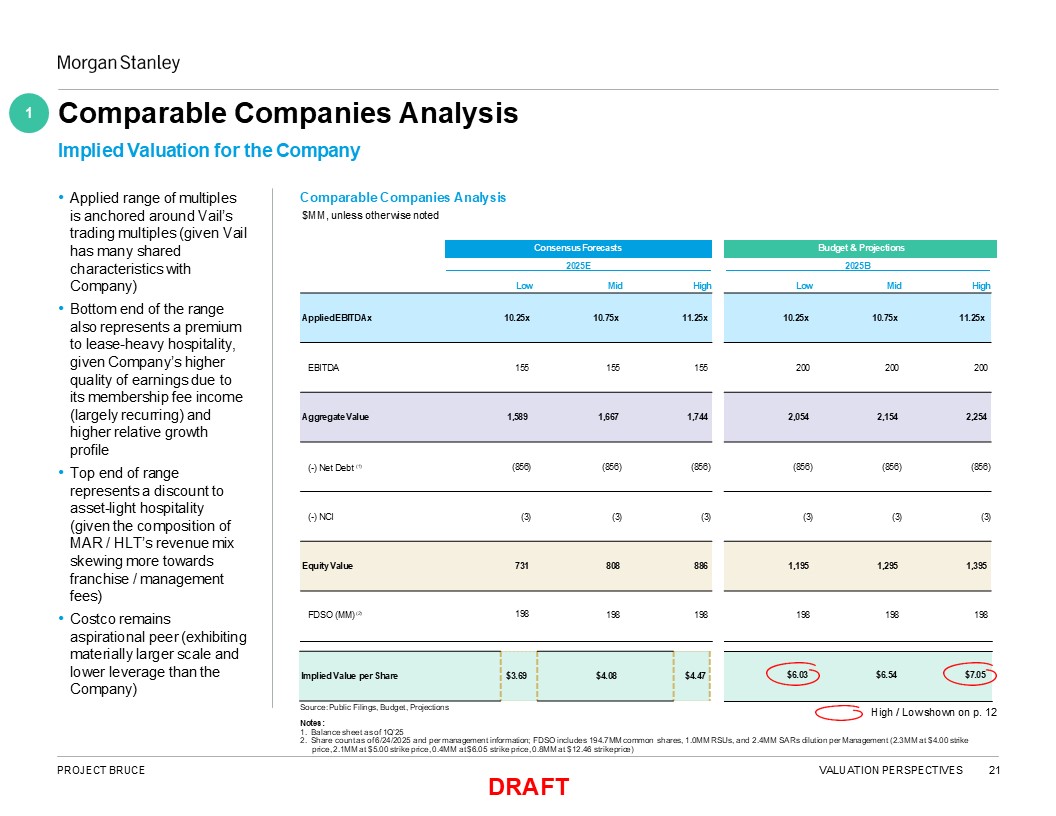

2025E 2025B Low Mid High Low Mid High Applied

EBITDAx 10.25x 10.75x 11.25x 10.25x 10.75x 11.25x EBITDA 155 155 155 200 200 200 Aggregate Value 1,589 1,667 1,744 2,054 2,154 2,254 (-) Net Debt (1) (856) (856) (856) (856) (856) (856) (-) NCI

(3) (3) (3) (3) (3) (3) Equity Value 731 808 886 1,195 1,295 1,395 FDSO (MM) (2) 198 198 198 198 198 198 Implied Value per Share $3.69 $4.08 $4.47 Consensus Forecasts Budget & Projections $6.03 $6.54 $7.05 Implied

Valuation for the Company Applied range of multiples is anchored around Vail’s trading multiples (given Vail has many shared characteristics with Company) Bottom end of the range also represents a premium to lease-heavy hospitality, given

Company’s higher quality of earnings due to its membership fee income (largely recurring) and higher relative growth profile Top end of range represents a discount to asset-light hospitality (given the composition of MAR / HLT’s revenue mix

skewing more towards franchise / management fees) Costco remains aspirational peer (exhibiting materially larger scale and lower leverage than the Company) Comparable Companies Analysis $MM, unless otherwise noted Comparable Companies

Analysis 1 Source: Public Filings, Budget, Projections Notes: 1. Balance sheet as of 1Q’25 2. Share count as of 6/24/2025 and per management information; FDSO includes 194.7MM common shares, 1.0MM RSUs, and 2.4MM SARs dilution per

Management (2.3MM at $4.00 strike High / Low shown on p. 12 price, 2.1MM at $5.00 strike price, 0.4MM at $6.05 strike price, 0.8MM at $12.46 strike price) PROJECT BRUCE VALUATION PERSPECTIVES 21 DRAFT

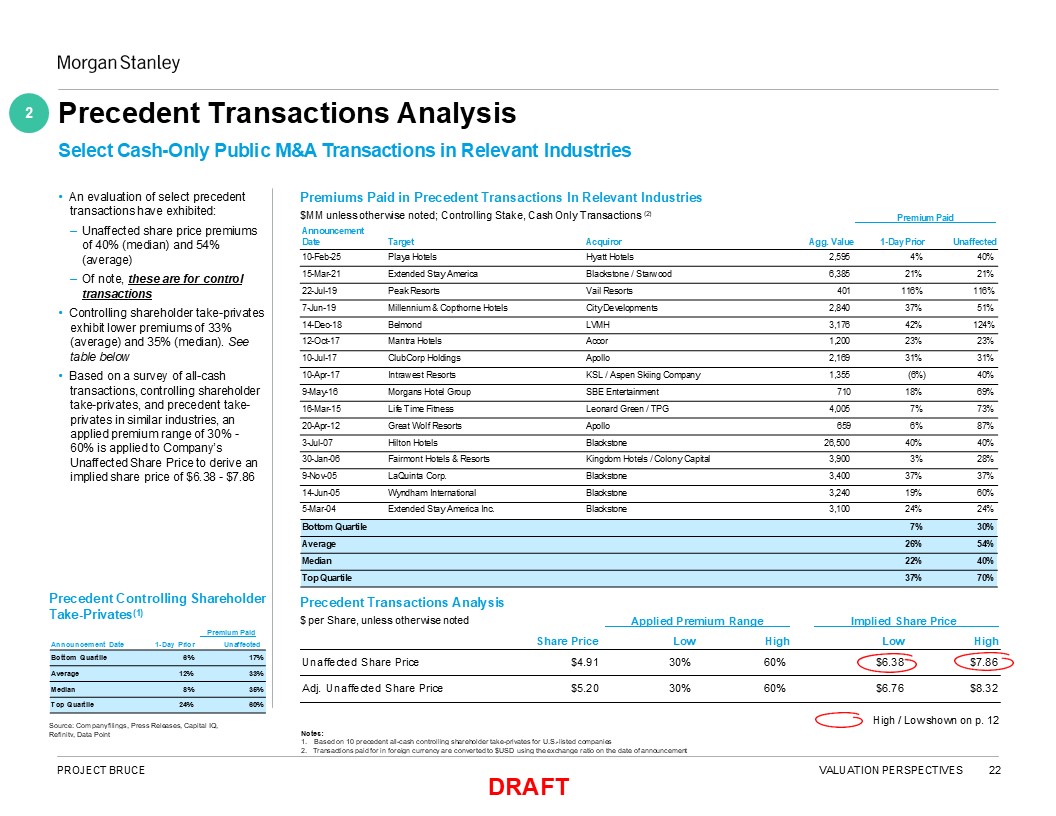

Share Price Unaffected Share Price $4.91 Applied Premium Range Low High 30%

60% 30% 60% Adj. Unaffected Share Price $5.20 Bottom Quartile 6% 17% Average 12% 33% Median 8% 35% Top Quartile 24% 60% Precedent Controlling Shareholder Take-Privates(1) Premium Paid Announcement Date 1-Day Prior

Unaffected Notes: 1. Based on 10 precedent all-cash controlling shareholder take-privates for U.S.-listed companies Precedent Transactions Analysis Select Cash-Only Public M&A Transactions in Relevant Industries An evaluation of select

precedent transactions have exhibited: Unaffected share price premiums of 40% (median) and 54% (average) Of note, these are for control transactions Controlling shareholder take-privates exhibit lower premiums of 33% (average) and 35%

(median). See table below Based on a survey of all-cash transactions, controlling shareholder take-privates, and precedent take- privates in similar industries, an applied premium range of 30% - 60% is applied to Company’s Unaffected Share

Price to derive an implied share price of $6.38 - $7.86 Premiums Paid in Precedent Transactions In Relevant Industries $MM unless otherwise noted; Controlling Stake, Cash Only Transactions (2) Announcement Source: Company filings, Press

Releases, Capital IQ, Refinitv, Data Point Precedent Transactions Analysis $ per Share, unless otherwise noted 2 Implied Share Price Low High $6.38 $7.86 $6.76 $8.32 High / Low shown on p. 12 2. Transactions paid for in foreign

currency are converted to $USD using the exchange ratio on the date of announcement PROJECT BRUCE VALUATION PERSPECTIVES 22 DRAFT Bottom Quartile 7% 30% Average 26% 54% Median 22% 40% Top Quartile 37% 70% Premium Paid

Date Target Acquiror Agg. Value 1-Day Prior Unaffected 10-Feb-25 Playa Hotels Hyatt Hotels 2,595 4% 40% 15-Mar-21 Extended Stay America Blackstone / Starwood 6,385 21% 21% 22-Jul-19 Peak Resorts Vail

Resorts 401 116% 116% 7-Jun-19 Millennium & Copthorne Hotels City Developments 2,840 37% 51% 14-Dec-18 Belmond LVMH 3,176 42% 124% 12-Oct-17 Mantra Hotels Accor 1,200 23% 23% 10-Jul-17 ClubCorp

Holdings Apollo 2,169 31% 31% 10-Apr-17 Intrawest Resorts KSL / Aspen Skiing Company 1,355 (6%) 40% 9-May-16 Morgans Hotel Group SBE Entertainment 710 18% 69% 16-Mar-15 Life Time Fitness Leonard Green /

TPG 4,005 7% 73% 20-Apr-12 Great Wolf Resorts Apollo 659 6% 87% 3-Jul-07 Hilton Hotels Blackstone 26,500 40% 40% 30-Jan-06 Fairmont Hotels & Resorts Kingdom Hotels / Colony Capital 3,900 3% 28% 9-Nov-05 LaQuinta

Corp. Blackstone 3,400 37% 37% 14-Jun-05 Wyndham International Blackstone 3,240 19% 60% 5-Mar-04 Extended Stay America Inc. Blackstone 3,100 24% 24%

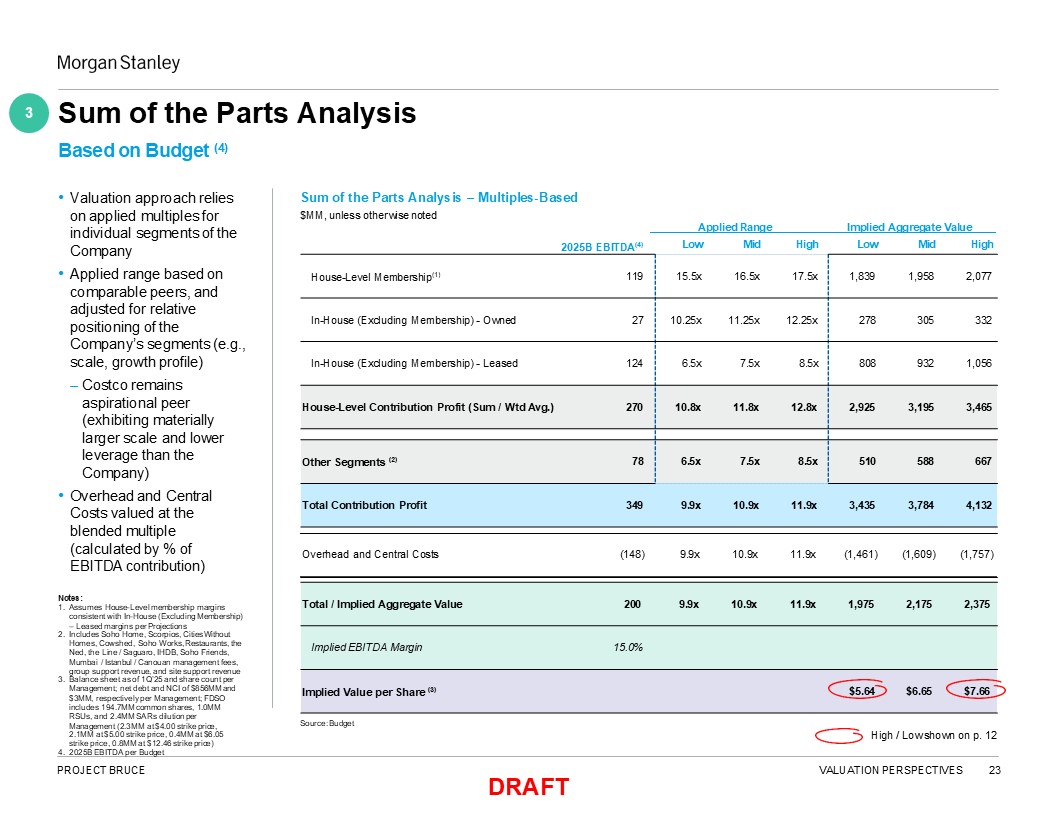

Total / Implied Aggregate Value 200 9.9x 10.9x 11.9x 1,975 2,175 2,375 Implied

EBITDA Margin 15.0% Implied Value per Share (3) $5.64 $6.65 $7.66 2025B EBITDA(4) Applied Range Implied Aggregate Value Low Mid High Low Mid High House-Level Membership(1) 119 15.5x 16.5x 17.5x 1,839 1,958 2,077 In-House

(Excluding Membership) - Owned 27 10.25x 11.25x 12.25x 278 305 332 In-House (Excluding Membership) - Leased 124 6.5x 7.5x 8.5x 808 932 1,056 House-Level Contribution Profit (Sum / Wtd

Avg.) 270 10.8x 11.8x 12.8x 2,925 3,195 3,465 Other Segments (2) 78 6.5x 7.5x 8.5x 510 588 667 Total Contribution Profit 349 9.9x 10.9x 11.9x 3,435 3,784 4,132 Overhead and Central

Costs (148) 9.9x 10.9x 11.9x (1,461) (1,609) (1,757) Sum of the Parts Analysis Based on Budget (4) Valuation approach relies on applied multiples for individual segments of the Company Applied range based on comparable peers, and

adjusted for relative positioning of the Company’s segments (e.g., scale, growth profile) – Costco remains aspirational peer (exhibiting materially larger scale and lower leverage than the Company) Overhead and Central Costs valued at the

blended multiple (calculated by % of EBITDA contribution) Sum of the Parts Analysis – Multiples-Based $MM, unless otherwise noted Source: Budget Notes: Assumes House-Level membership margins consistent with In-House (Excluding Membership)

– Leased margins per Projections Includes Soho Home, Scorpios, Cities Without Homes, Cowshed, Soho Works, Restaurants, the Ned, the Line / Saguaro, IHDB, Soho Friends, Mumbai / Istanbul / Canouan management fees, group support revenue, and

site support revenue Balance sheet as of 1Q’25 and share count per Management; net debt and NCI of $856MM and $3MM, respectively per Management; FDSO includes 194.7MM common shares, 1.0MM RSUs, and 2.4MM SARs dilution per Management (2.3MM

at $4.00 strike price, 2.1MM at $5.00 strike price, 0.4MM at $6.05 strike price, 0.8MM at $12.46 strike price) 4. 2025B EBITDA per Budget 3 High / Low shown on p. 12 PROJECT BRUCE VALUATION PERSPECTIVES 23 DRAFT

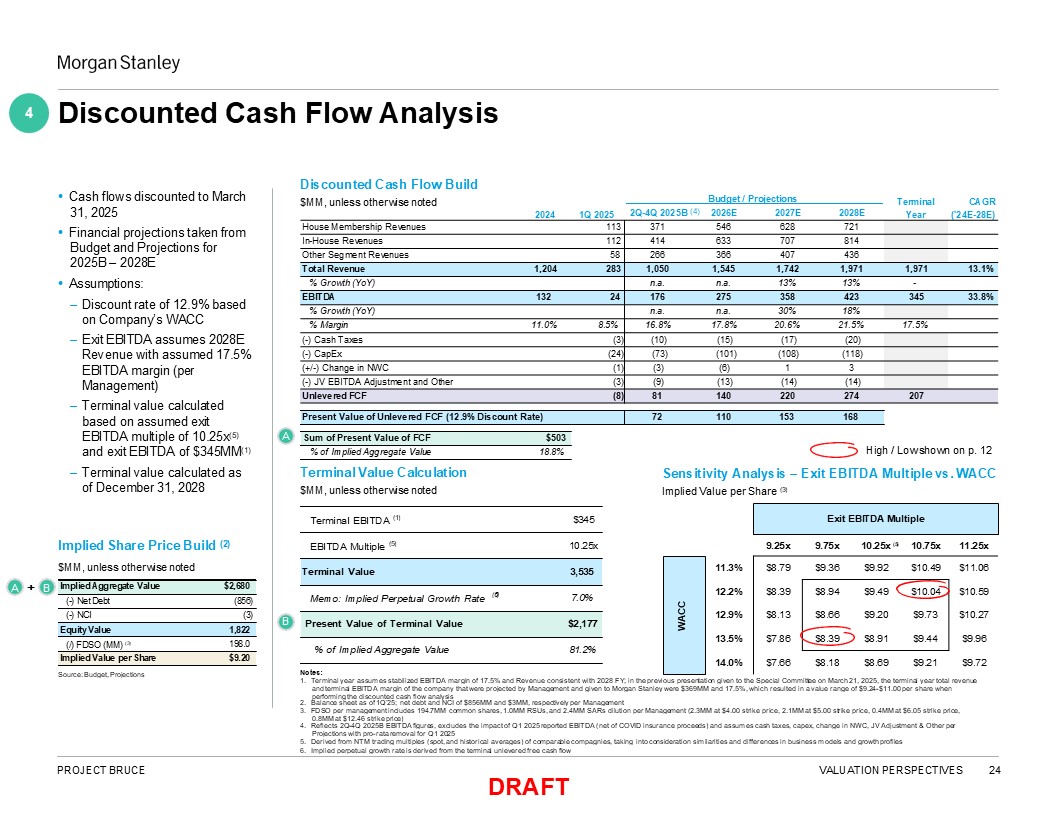

2024 1Q 2025 Terminal CAGR Year ('24E-28E) House Membership Revenues 113 371

546 628 721 In-House Revenues 112 414 633 707 814 Other Segment Revenues 58 266 366 407 436 Total Revenue 1,204 283 1,050 1,545 1,742 1,971 1,971 13.1% % Growth (YoY) n.a. n.a. 13% 13% - EBITDA 132 24 176

275 358 423 345 33.8% % Growth (YoY) n.a. n.a. 30% 18% % Margin 11.0% 8.5% 16.8% 17.8% 20.6% 21.5% 17.5% (-) Cash Taxes (3) (10) (15) (17) (20) (-) CapEx (24) (73) (101) (108) (118) (+/-) Change in NWC (1) (3)

(6) 1 3 (-) JV EBITDA Adjustment and Other (3) (9) (13) (14) (14) Unlevered FCF (8) 81 140 220 274 207 Budget / Projections 2Q-4Q 2025B (4) 2026E 2027E 2028E Present Value of Unlevered FCF (12.9% Discount Rate) Sum of Present

Value of FCF $503 % of Implied Aggregate Value 18.8% Terminal Value Calculation $MM, unless otherwise noted Terminal EBITDA (1) $345 EBITDA Multiple (5) 10.25x Terminal Value 3,535 (6) Memo: Implied Perpetual Growth Rate 7.0% Present

Value of Terminal Value $2,177 % of Implied Aggregate Value 81.2% Implied Aggregate Value $2,680 (-) Net Debt (856) (-) NCI (3) Equity Value 1,822 (/) FDSO (MM) (3) 198.0 Implied Value per Share $9.20 Exit EBITDA

Multiple 9.25x 9.75x 10.25x

(5) 10.75x 11.25x 11.3% $8.79 $9.36 $9.92 $10.49 $11.06 12.2% $8.39 $8.94 $9.49 $10.04 $10.59 12.9% $8.13 $8.66 $9.20 $9.73 $10.27 13.5% $7.86 $8.39 $8.91 $9.44 $9.96 14.0% $7.66 $8.18 $8.69 $9.21 $9.72 WACC Source:

Budget, Projections Discounted Cash Flow Analysis Cash flows discounted to March 31, 2025 Financial projections taken from Budget and Projections for 2025B – 2028E Assumptions: Discount rate of 12.9% based on Company’s WACC Exit EBITDA

assumes 2028E Revenue with assumed 17.5% EBITDA margin (per Management) Terminal value calculated based on assumed exit EBITDA multiple of 10.25x(5) and exit EBITDA of $345MM(1) Terminal value calculated as of December 31, 2028 Discounted

Cash Flow Build $MM, unless otherwise noted Notes: Terminal year assumes stabilized EBITDA margin of 17.5% and Revenue consistent with 2028 FY; in the previous presentation given to the Special Committee on March 21, 2025, the terminal year

total revenue and terminal EBITDA margin of the company that were projected by Management and given to Morgan Stanley were $369MM and 17.5%, which resulted in a value range of $9.24-$11.00 per share when performing the discounted cash flow

analysis Balance sheet as of 1Q’25; net debt and NCI of $856MM and $3MM, respectively per Management FDSO per management includes 194.7MM common shares, 1.0MM RSUs, and 2.4MM SARs dilution per Management (2.3MM at $4.00 strike price, 2.1MM at

$5.00 strike price, 0.4MM at $6.05 strike price, 0.8MM at $12.46 strike price) Reflects 2Q-4Q 2025B EBITDA figures, excludes the impact of Q1 2025 reported EBITDA (net of COVID insurance proceeds) and assumes cash taxes, capex, change in NWC,

JV Adjustment & Other per Projections with pro-rata removal for Q1 2025 Derived from NTM trading multiples (spot, and historical averages) of comparable compagnies, taking into consideration similarities and differences in business models

and growth profiles A B A + B 4 Implied Share Price Build (2) $MM, unless otherwise noted 72 110 153 168 High / Low shown on p. 12 Sensitivity Analysis – Exit EBITDA Multiple vs. WACC Implied Value per Share (3) 6. Implied perpetual

growth rate is derived from the terminal unlevered free cash flow PROJECT BRUCE VALUATION PERSPECTIVES 24 DRAFT

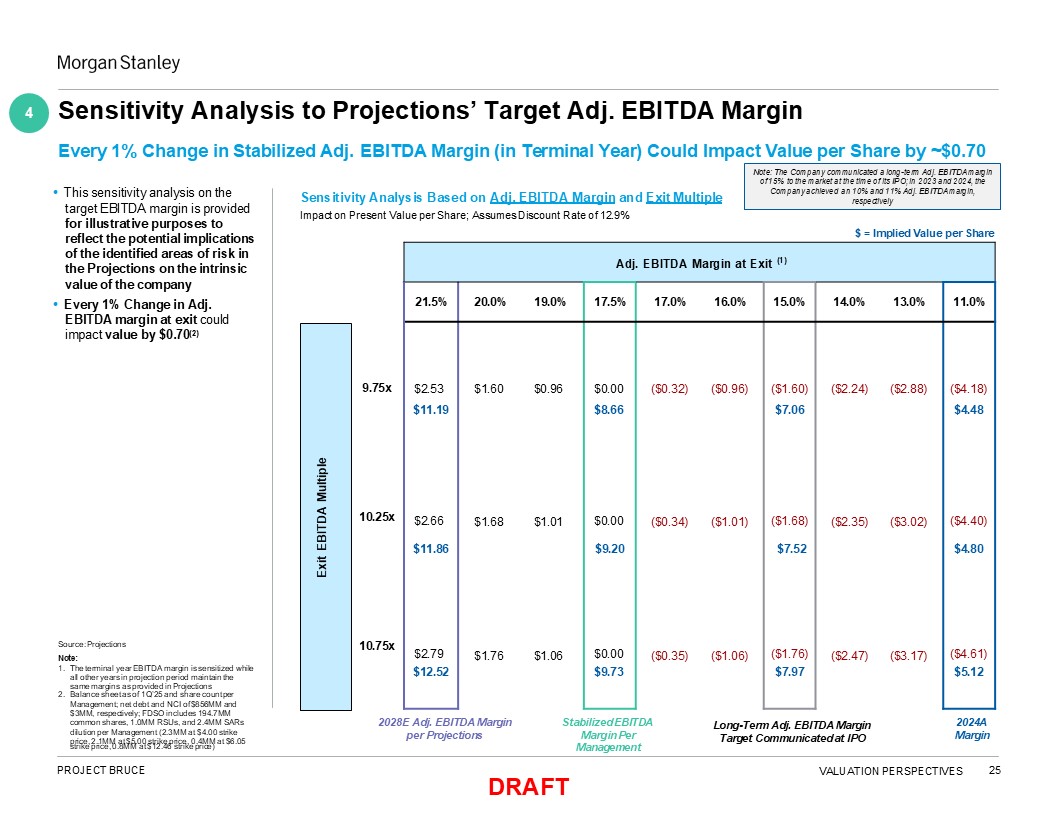

Adj. EBITDA Margin at Exit (1) 21.5% 20.0% 19.0% 17.5% 17.0%

16.0% 15.0% 14.0% 13.0% 11.0% $2.53 $11.19 $2.66 $11.86 $2.79 $12.52 $1.60 $0.96 $1.68 $1.01 $1.76 $1.06 $0.00 $8.66 $0.00 $9.20 $0.00 $9.73 ($0.32) ($0.96) ($0.34) ($1.01) ($0.35)

($1.06) ($1.60) $7.06 ($1.68) $7.52 ($1.76) $7.97 ($2.24) ($2.88) ($2.35) ($3.02) ($2.47) ($3.17) ($4.18) $4.48 ($4.40) $4.80 ($4.61) $5.12 9.75x 10.25x 10.75x Exit EBITDA Multiple Sensitivity Analysis Based on Adj. EBITDA

Margin and Exit Multiple Impact on Present Value per Share; Assumes Discount Rate of 12.9% Source: Projections Note: The terminal year EBITDA margin is sensitized while all other years in projection period maintain the same margins as

provided in Projections Balance sheet as of 1Q’25 and share count per Management; net debt and NCI of $856MM and $3MM, respectively; FDSO includes 194.7MM common shares, 1.0MM RSUs, and 2.4MM SARs dilution per Management (2.3MM at $4.00

strike price, 2.1MM at $5.00 strike price, 0.4MM at $6.05 Every 1% Change in Stabilized Adj. EBITDA Margin (in Terminal Year) Could Impact Value per Share by ~$0.70 This sensitivity analysis on the target EBITDA margin is provided for

illustrative purposes to reflect the potential implications of the identified areas of risk in the Projections on the intrinsic value of the company Every 1% Change in Adj. EBITDA margin at exit could impact value by $0.70(2) 2028E Adj.

EBITDA Margin per Projections 4 Sensitivity Analysis to Projections’ Target Adj. EBITDA Margin strike price, 0.8MM at $12.46 strike price) Management PROJECT BRUCE VALUATION PERSPECTIVES 25 DRAFT $ = Implied Value per Share Stabilized

EBITDA Margin Per 2024A Margin Note: The Company communicated a long-term Adj. EBITDA margin of 15% to the market at the time of its IPO; in 2023 and 2024, the Company achieved an 10% and 11% Adj. EBITDA margin, respectively Long-Term Adj.

EBITDA Margin Target Communicated at IPO

DRAFT APPENDIX 26 Supplemental Materials

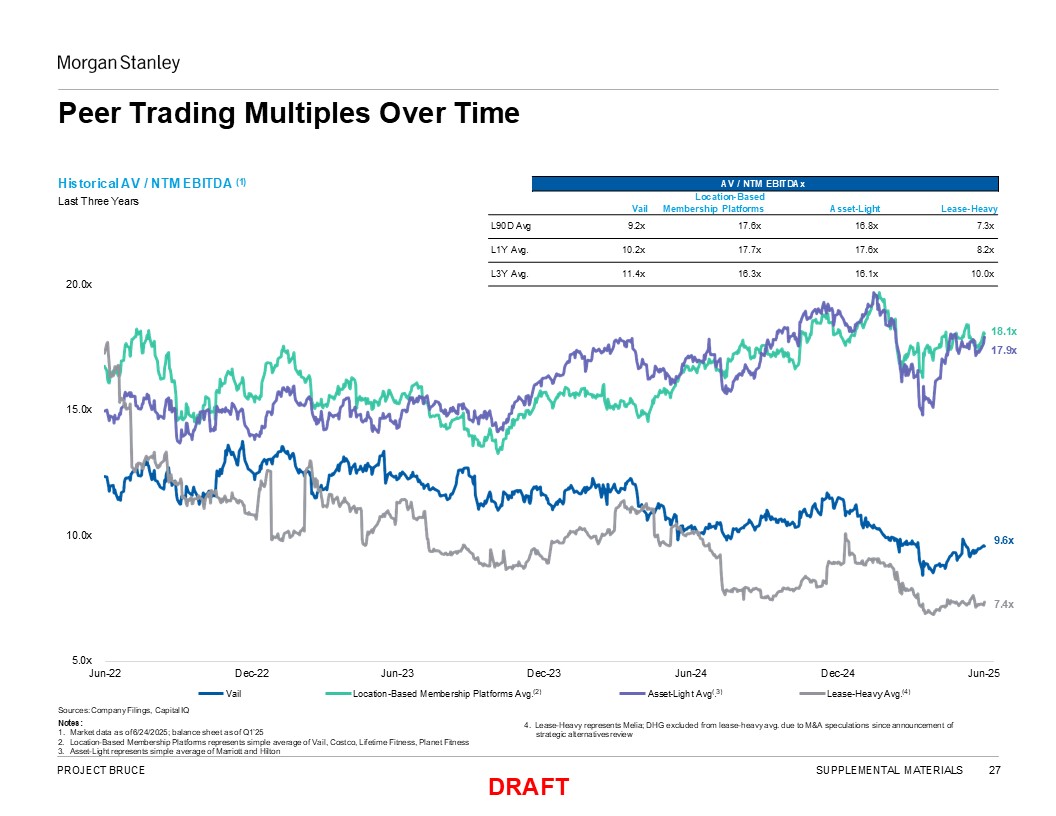

AV / NTM EBITDAx Vail Location-Based Membership

Platforms Asset-Light Lease-Heavy L90D Avg 9.2x 17.6x 16.8x 7.3x L1Y Avg. 10.2x 17.7x 17.6x 8.2x L3Y Avg. 11.4x 16.3x 16.1x 10.0x 5.0x 10.0x 15.0x 20.0x Jun-22 Dec-22 Vail Jun-25 Jun-23 Dec-23 Location-Based

Membership Platforms Avg.(2) Jun-24 Asset-Light Avg(.3) Dec-24 Lease-Heavy Avg.(4) PROJECT BRUCE SUPPLEMENTAL MATERIALS 27 DRAFT Peer Trading Multiples Over Time Historical AV / NTM EBITDA (1) Last Three Years Sources: Company

Filings, Capital IQ Notes: Market data as of 6/24/2025; balance sheet as of Q1’25 Location-Based Membership Platforms represents simple average of Vail, Costco, Lifetime Fitness, Planet Fitness Asset-Light represents simple average of

Marriott and Hilton 4. Lease-Heavy represents Melia; DHG excluded from lease-heavy avg. due to M&A speculations since announcement of strategic alternatives review 7.4x 9.6x 18.1x 17.9x

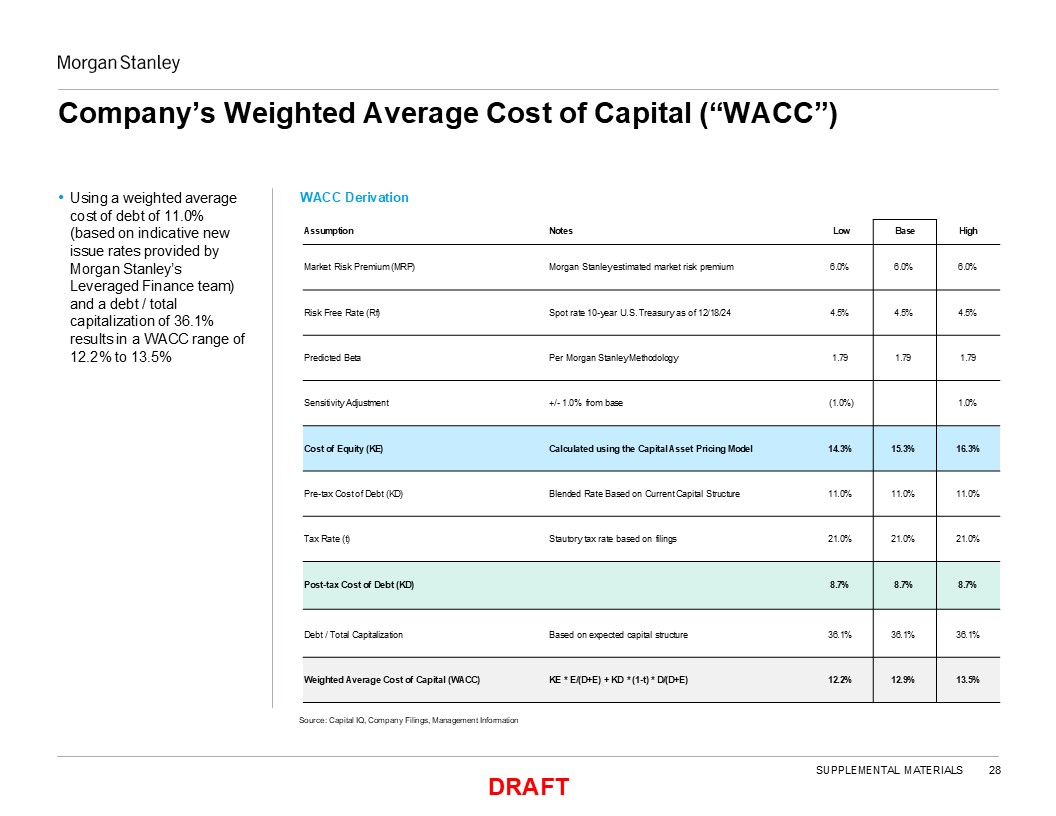

PROJECT BRUCE DRAFT Assumption Notes Low Base High Market Risk Premium

(MRP) Morgan Stanley estimated market risk premium 6.0% 6.0% 6.0% Risk Free Rate (Rf) Spot rate 10-year U.S. Treasury as of 12/18/24 4.5% 4.5% 4.5% Predicted Beta Per Morgan Stanley Methodology 1.79 1.79 1.79 Sensitivity

Adjustment +/- 1.0% from base (1.0%) 1.0% Cost of Equity (KE) Calculated using the Capital Asset Pricing Model 14.3% 15.3% 16.3% Pre-tax Cost of Debt (KD) Blended Rate Based on Current Capital Structure 11.0% 11.0% 11.0% Tax Rate

(t) Stautory tax rate based on filings 21.0% 21.0% 21.0% Post-tax Cost of Debt (KD) 8.7% 8.7% 8.7% Debt / Total Capitalization Based on expected capital structure 36.1% 36.1% 36.1% Weighted Average Cost of Capital (WACC) KE *

E/(D+E) + KD * (1-t) * D/(D+E) 12.2% 12.9% 13.5% SUPPLEMENTAL MATERIALS 28 Company’s Weighted Average Cost of Capital (“WACC”) WACC Derivation Using a weighted average cost of debt of 11.0% (based on indicative new issue rates provided

by Morgan Stanley’s Leveraged Finance team) and a debt / total capitalization of 36.1% results in a WACC range of 12.2% to 13.5% Source: Capital IQ, Company Filings, Management Information

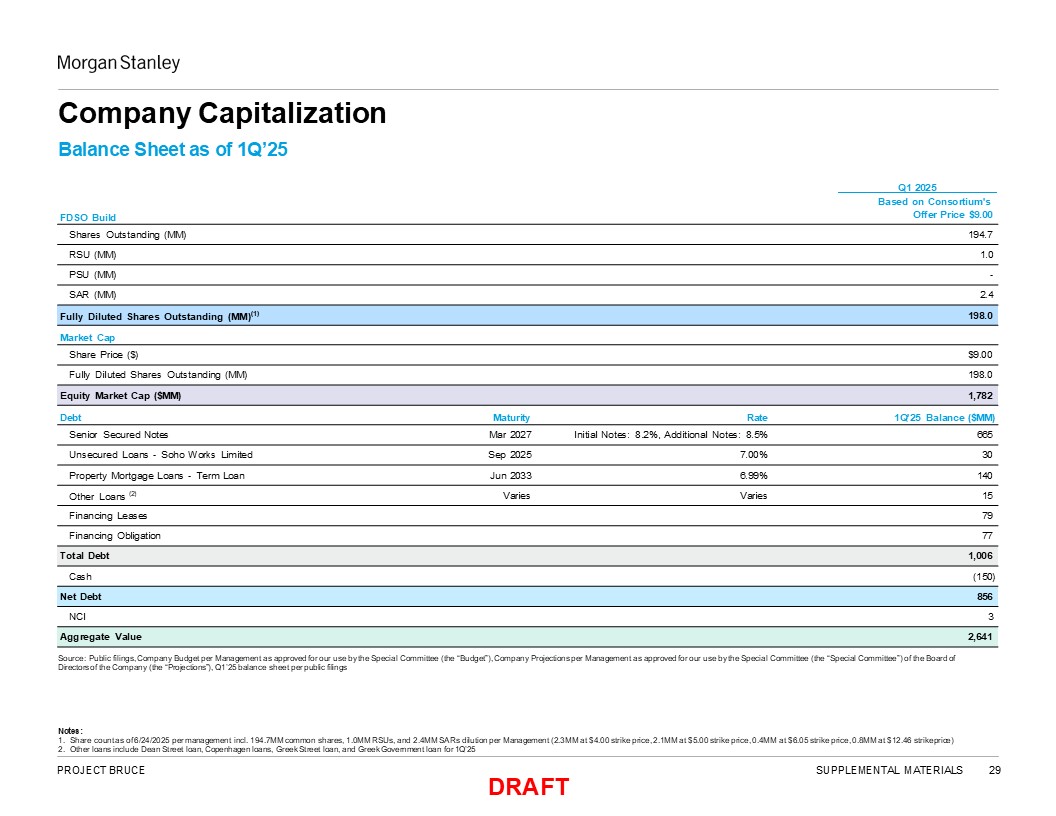

DRAFT PROJECT BRUCE SUPPLEMENTAL MATERIALS Balance Sheet as of 1Q’25 Q1 2025

FDSO Build Based on Consortium's Offer Price $9.00 Shares Outstanding (MM) 194.7 RSU (MM) 1.0 PSU (MM) - SAR (MM) 2.4 Fully Diluted Shares Outstanding (MM)(1) 198.0 Market Cap Share Price ($) $9.00 Fully Diluted Shares

Outstanding (MM) 198.0 Equity Market Cap ($MM) 1,782 Debt Maturity Rate 1Q'25 Balance ($MM) Senior Secured Notes Mar 2027 Initial Notes: 8.2%, Additional Notes: 8.5% 665 Unsecured Loans - Soho Works Limited Sep

2025 7.00% 30 Property Mortgage Loans - Term Loan Jun 2033 6.99% 140 Other Loans (2) Varies Varies 15 Financing Leases 79 Financing Obligation 77 Total Debt 1,006 Cash (150) Net Debt 856 NCI 3 Aggregate

Value 2,641 29 Notes: Share count as of 6/24/2025 per management incl. 194.7MM common shares, 1.0MM RSUs, and 2.4MM SARs dilution per Management (2.3MM at $4.00 strike price, 2.1MM at $5.00 strike price, 0.4MM at $6.05 strike price, 0.8MM

at $12.46 strike price) Other loans include Dean Street loan, Copenhagen loans, Greek Street loan, and Greek Government loan for 1Q’25 Company Capitalization Source: Public filings, Company Budget per Management as approved for our use by

the Special Committee (the “Budget”), Company Projections per Management as approved for our use by the Special Committee (the “Special Committee”) of the Board of Directors of the Company (the “Projections”), Q1’25 balance sheet per public

filings

PROJECT BRUCE DRAFT Legal Disclaimer © Morgan Stanley and/or certain of its

affiliates. All rights reserved. We have prepared this document solely for informational purposes. You should not definitively rely upon it or use it to form the definitive basis for any decision, contract, commitment or action whatsoever,

with respect to any proposed transaction or otherwise. You and your directors, officers, employees, agents and affiliates must hold this document and any oral information provided in connection with this document in strict confidence and may

not communicate, reproduce, distribute or disclose it to any other person, or refer to it publicly, in whole or in part at any time except with our prior written consent. If you are not the intended recipient of this document, please delete and

destroy all copies immediately. We have prepared this document and the analyses contained in it based, in part, on certain assumptions and information obtained by us from the recipient, its directors, officers, employees, agents, affiliates

and/or from other sources. Our use of such assumptions and information does not imply that we have independently verified or necessarily agree with any of such assumptions or information, and we have assumed and relied upon the accuracy and

completeness of such assumptions and information for purposes of this document. Neither we nor any of our affiliates, or our or their respective officers, employees or agents, make any representation or warranty, express or implied, in relation

to the accuracy or completeness of the information contained in this document or any oral information provided in connection herewith, or any data it generates and accept no responsibility, obligation or liability (whether direct or indirect,

in contract, tort or otherwise) in relation to any of such information. We and our affiliates and our and their respective officers, employees and agents expressly disclaim any and all liability which may be based on this document and any

errors therein or omissions therefrom. Neither we nor any of our affiliates, or our or their respective officers, employees or agents, make any representation or warranty, express or implied, that any transaction has been or may be effected on

the terms or in the manner stated in this document, or as to the achievement or reasonableness of future projections, management targets, estimates, prospects or returns, if any. Any views or terms contained herein are preliminary only, and are

based on financial, economic, market and other conditions prevailing as of the date of this document and are therefore subject to change. We undertake no obligation or responsibility to update any of the information contained in this document.

Past performance does not guarantee or predict future performance. This document and the information contained herein do not constitute an offer to sell or the solicitation of an offer to buy any security, commodity or instrument or related

derivative, nor do they constitute an offer or commitment to lend, syndicate or arrange a financing, underwrite or purchase or act as an agent or advisor or in any other capacity with respect to any transaction, or commit capital, or to

participate in any trading strategies, and do not constitute legal, regulatory, accounting or tax advice to the recipient. We recommend that the recipient seek independent third party legal, regulatory, accounting and tax advice regarding the

contents of this document. This document does not constitute and should not be considered as any form of financial opinion or recommendation by us or any of our affiliates. This document is not a research report and was not prepared by the

research department of Morgan Stanley or any of its affiliates. Notwithstanding anything herein to the contrary, each recipient hereof (and their employees, representatives, and other agents) may disclose to any and all persons, without

limitation of any kind from the commencement of discussions, the U.S. federal and state income tax treatment and tax structure of the proposed transaction and all materials of any kind (including opinions or other tax analyses) that are

provided relating to the tax treatment and tax structure. For this purpose, "tax structure" is limited to facts relevant to the U.S. federal and state income tax treatment of the proposed transaction and does not include information relating to

the identity of the parties, their affiliates, agents or advisors. This document is provided by Morgan Stanley & Co. LLC and/or certain of its affiliates or other applicable entities, which may include Morgan Stanley Realty Incorporated,

Morgan Stanley Senior Funding, Inc., Morgan Stanley Bank, N.A., Morgan Stanley & Co. International plc, Morgan Stanley Securities Limited, Morgan Stanley Bank AG, Morgan Stanley MUFG Securities Co., Ltd., Mitsubishi UFJ Morgan Stanley

Securities Co., Ltd., Morgan Stanley Asia Limited, Morgan Stanley Australia Securities Limited, Morgan Stanley Australia Limited, Morgan Stanley Asia (Singapore) Pte., Morgan Stanley Services Limited, Morgan Stanley & Co. International plc

Seoul Branch and/or Morgan Stanley Canada Limited. Unless governing law permits otherwise, you must contact an authorized Morgan Stanley entity in your jurisdiction regarding this document or any of the information contained herein. 30