| SEPTEMBER 19, 2025 BUSINESS UPDATE SUPPLEMENT: WOOLSEY SETTLEMENT AGREEMENT |

| Edison International | Woolsey Settlement Agreement 1 Statements contained in this presentation about future performance, including, without limitation, operating results, capital expenditures, rate base growth, dividend policy, financial outlook, and other statements that are not purely historical, are forward-looking statements. These forward-looking statements reflect our current expectations; however, such statements involve risks and uncertainties. Actual results could differ materially from current expectations. These forward-looking statements represent our expectations only as of the date of this presentation, and Edison International assumes no duty to update them to reflect new information, events or circumstances. Important factors that could cause different results include, but are not limited to the: • ability of SCE to recover its costs through regulated rates, timely or at all, including uninsured wildfire-related and debris flow-related costs (including amounts paid for self-insured retention and co-insurance, and amounts not recoverable from the Wildfire Insurance Fund), and costs incurred for wildfire restoration efforts and to mitigate the risk of utility equipment causing future wildfires; • the cybersecurity of Edison International's and SCE's critical information technology systems for grid control and business, employee and customer data, and the physical security of Edison International's and SCE's critical assets and personnel; • risks associated with the operation and maintenance of electrical facilities, including worker, contractor, and public safety issues, the risk of utility assets causing or contributing to wildfires, failure, availability, efficiency, and output of equipment and facilities, and availability and cost of spare parts; • impact of affordability of customer rates on SCE's ability to execute its strategy, including the impact of affordability on SCE’s ability to obtain regulatory approval of, or cost recovery for, operations and maintenance expenses, proposed capital investment projects, and increased costs due to supply chain constraints, tariffs, inflation and rising interest rates and the impact of legislative actions on affordability; • ability of SCE to update its grid infrastructure to maintain system integrity and reliability, and meet electrification needs; • ability of SCE to implement its operational and strategic plans, including its Wildfire Mitigation Plan and capital investment program, including challenges related to project site identification, public opposition, environmental mitigation, construction, permitting, contractor performance, changes in the California Independent System Operator's (“CAISO”) transmission plans, and governmental approvals; • risks of regulatory or legislative restrictions that would limit SCE's ability to implement operational measures to mitigate wildfire risk, including Public Safety Power Shutoff (“PSPS”) and fast curve settings, when conditions warrant or would otherwise limit SCE's operational practices relative to wildfire risk mitigation; • ability of SCE to obtain safety certifications from the Office of Energy Infrastructure Safety of the California Natural Resources Agency (“OEIS“); • risk that California Assembly Bill 1054 (“AB 1054“) or other new California legislation does not effectively mitigate the significant exposure faced by California investor-owned utilities related to liability for damages arising from catastrophic wildfires where utility facilities are alleged to be a substantial cause, including the longevity of the Wildfire Insurance Fund and the California Public Utilities Commission (“CPUC”) interpretation of and actions under AB 1054, including its interpretation of the prudency standard clarified by AB 1054; • ability of Edison International and SCE to effectively attract, manage, develop and retain a skilled workforce, including its contract workers; • decisions and other actions by the CPUC, the Federal Energy Regulatory Commission, and the United States Nuclear Regulatory Commission, the California legislature and other governmental authorities, including decisions and actions related to nationwide or statewide crisis, approval of regulatory proceeding settlements, determinations of authorized rates of return or return on equity, the recoverability of wildfire-related and debris flow-related costs, issuance of SCE's wildfire safety certification, reforming wildfire-related liability protections available to California investor-owned utilities, wildfire mitigation efforts, approval and implementation of electrification programs, and delays in executive, regulatory and legislative actions; • governmental, statutory, regulatory, or administrative changes or initiatives affecting the electricity industry, including the market structure rules applicable to each market adopted by the North American Electric Reliability Corporation, CAISO, Western Electricity Coordinating Council, and similar regulatory bodies in adjoining regions, and changes in the United States' and California's environmental priorities that lessen the importance placed on greenhouse gas reduction and other climate related priorities; • potential for penalties or disallowances for non-compliance with applicable laws and regulations, including fines, penalties and disallowances related to wildfires where SCE's equipment is alleged to be associated with ignition; • extreme weather-related incidents (including events caused, or exacerbated, by climate change), such as wildfires, debris flows, flooding, droughts, high wind events and extreme heat events and other natural disasters (such as earthquakes), which could cause, among other things, worker and public safety issues, property damage, outages and other operational issues (such as issues due to damaged infrastructure), PSPS activations and unanticipated costs; • risks associated with the decommissioning of San Onofre, including those related to worker and public safety, public opposition, permitting, governmental approvals, on-site storage of spent nuclear fuel and other radioactive material, delays, contractual disputes, and cost overruns; • risks associated with cost allocation resulting in higher rates for utility bundled service customers because of possible customer bypass or departure for other electricity providers such as Community Choice Aggregators (“CCA,” which are cities, counties, and certain other public agencies with the authority to generate and/or purchase electricity for their local residents and businesses) and Electric Service Providers (entities that offer electric power and ancillary services to retail customers, other than electrical corporations (like SCE) and CCAs); • actions by credit rating agencies to downgrade Edison International or SCE’s credit ratings or to place those ratings on negative watch or negative outlook. Other important factors are discussed under the headings “Forward-Looking Statements”, “Risk Factors” and “Management’s Discussion and Analysis” in Edison International’s Form 10-K and other reports filed with the Securities and Exchange Commission, which are available on our website: www.edisoninvestor.com. These filings also provide additional information on historical and other factual data contained in this presentation. Forward-Looking Statements |

| Edison International | Woolsey Settlement Agreement 2 SCE and intervenors reach settlement agreement for Woolsey, which would authorize 35% cost recovery1 On September 19, 2025, SCE, Cal Advocates, EPUC, and SBUA filed a motion for approval of settlement agreement to recover ~$2.0 billion of ~$5.6 billion of losses1 Marks significant milestone and one step closer toward fully resolving 2017/2018 Wildfire/Mudslide Events Result of constructive negotiations and benefits financial strength of the utility and reduces costs for customers, supporting long-term affordability Helps reduce excess financing costs to customers Improves credit metrics (~90bps FFO-to-Debt benefit) Annualized interest expense benefit of ~18¢/share Combined with the previously-approved settlement for TKM cost recovery, would result in recovery of 43%, or ~$3.6 billion, of 2017/2018 Wildfire/Mudslide Events costs above insurance and FERC recoveries 1. Subject to CPUC approval. Amounts refer to WEMA costs (claims and associated financing and legal expenses). Proposed settlement would authorize recovery of 35% of WEMA costs and 85% of CEMA costs |

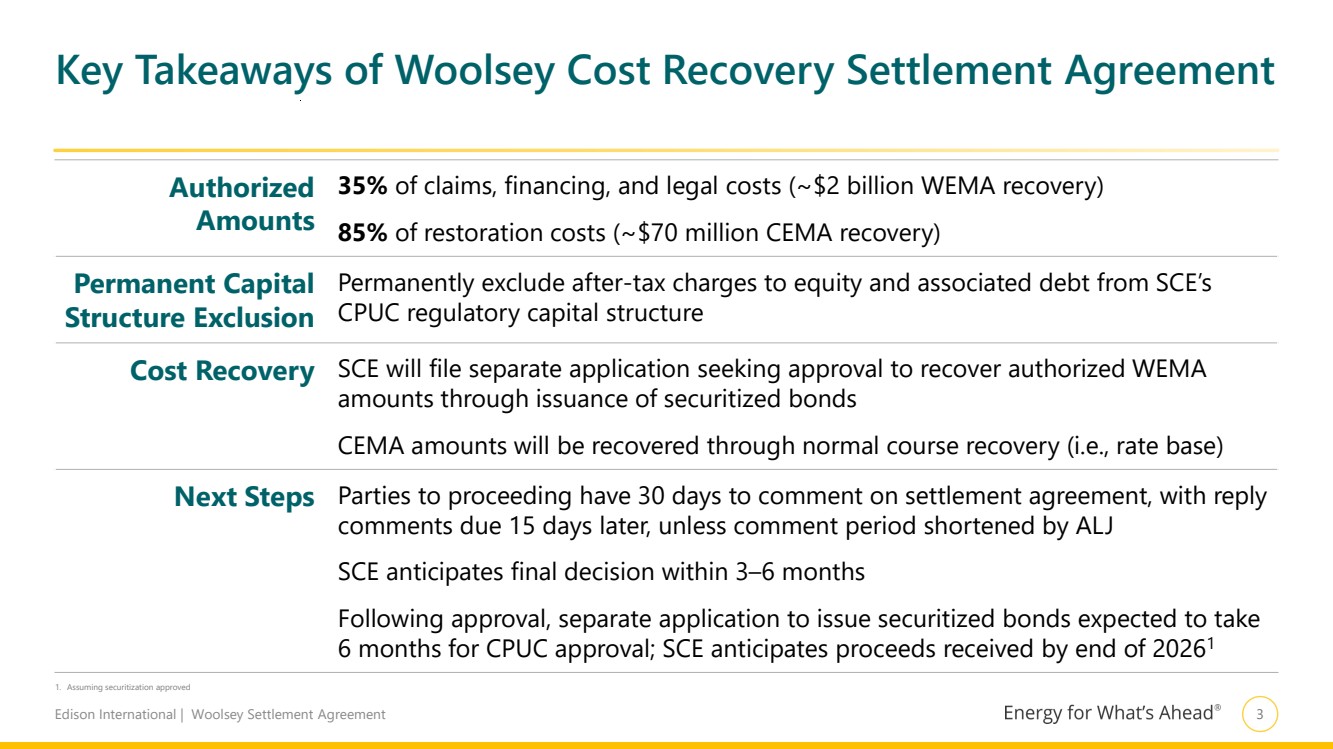

| Edison International | Woolsey Settlement Agreement 3 Key Takeaways of Woolsey Cost Recovery Settlement Agreement Authorized Amounts 35% of claims, financing, and legal costs (~$2 billion WEMA recovery) 85% of restoration costs (~$70 million CEMA recovery) Permanent Capital Structure Exclusion Permanently exclude after-tax charges to equity and associated debt from SCE’s CPUC regulatory capital structure Cost Recovery SCE will file separate application seeking approval to recover authorized WEMA amounts through issuance of securitized bonds CEMA amounts will be recovered through normal course recovery (i.e., rate base) Next Steps Parties to proceeding have 30 days to comment on settlement agreement, with reply comments due 15 days later, unless comment period shortened by ALJ SCE anticipates final decision within 3–6 months Following approval, separate application to issue securitized bonds expected to take 6 months for CPUC approval; SCE anticipates proceeds received by end of 20261 1. Assuming securitization approved |

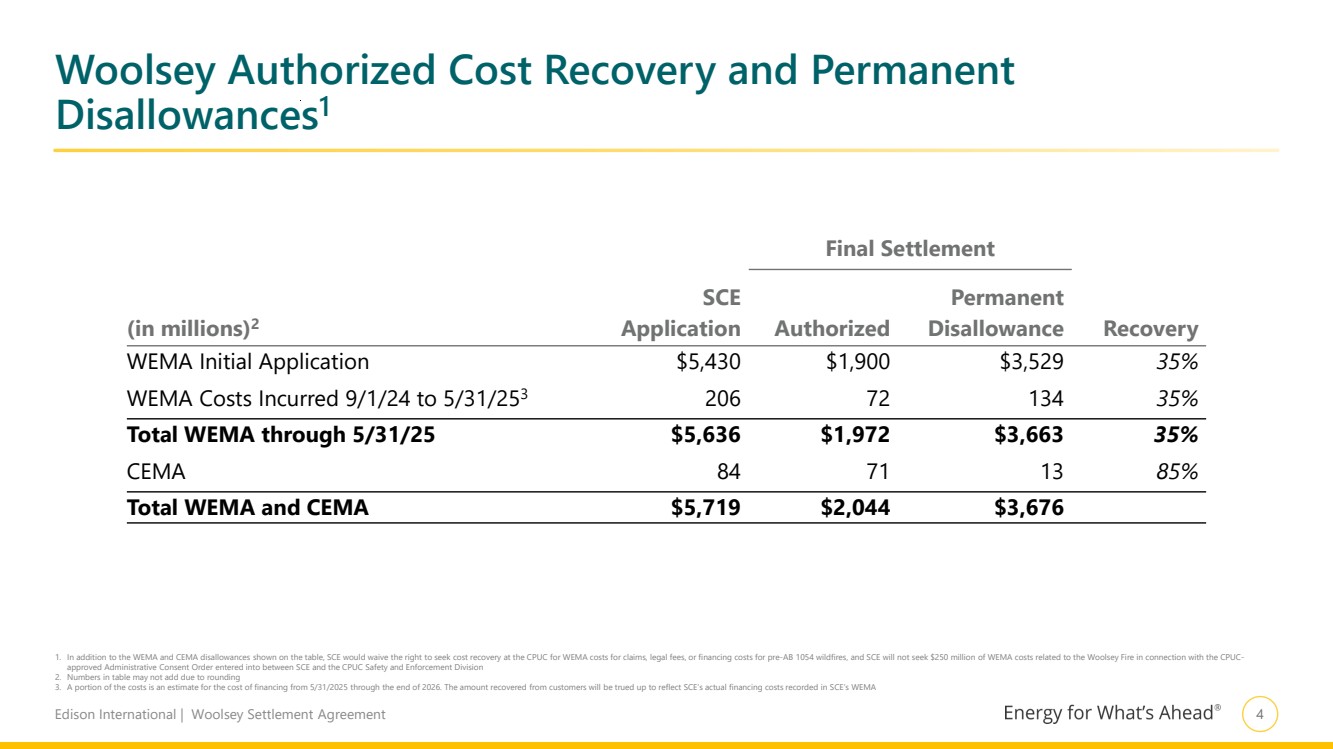

| Edison International | Woolsey Settlement Agreement 4 Woolsey Authorized Cost Recovery and Permanent Disallowances1 Final Settlement (in millions)2 SCE Application Authorized Permanent Disallowance Recovery WEMA Initial Application $5,430 $1,900 $3,529 35% WEMA Costs Incurred 9/1/24 to 5/31/253 206 72 134 35% Total WEMA through 5/31/25 $5,636 $1,972 $3,663 35% CEMA 84 71 13 85% Total WEMA and CEMA $5,719 $2,044 $3,676 1. In addition to the WEMA and CEMA disallowances shown on the table, SCE would waive the right to seek cost recovery at the CPUC for WEMA costs for claims, legal fees, or financing costs for pre-AB 1054 wildfires, and SCE will not seek $250 million of WEMA costs related to the Woolsey Fire in connection with the CPUC-approved Administrative Consent Order entered into between SCE and the CPUC Safety and Enforcement Division 2. Numbers in table may not add due to rounding 3. A portion of the costs is an estimate for the cost of financing from 5/31/2025 through the end of 2026. The amount recovered from customers will be trued up to reflect SCE’s actual financing costs recorded in SCE’s WEMA |

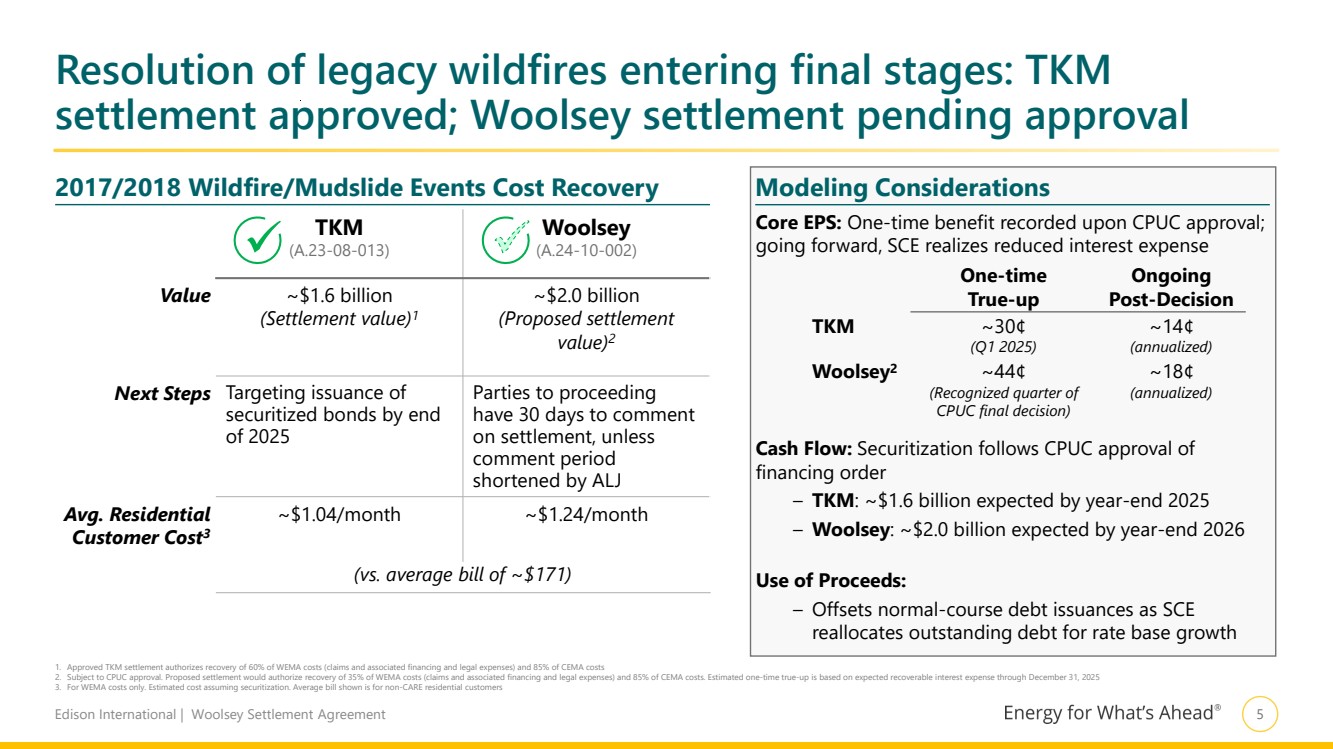

| Edison International | Woolsey Settlement Agreement 5 Resolution of legacy wildfires entering final stages: TKM settlement approved; Woolsey settlement pending approval TKM (A.23-08-013) Woolsey (A.24-10-002) Value ~$1.6 billion (Settlement value)1 ~$2.0 billion (Proposed settlement value)2 Next Steps Targeting issuance of securitized bonds by end of 2025 Parties to proceeding have 30 days to comment on settlement, unless comment period shortened by ALJ Avg. Residential Customer Cost3 ~$1.04/month ~$1.24/month (vs. average bill of ~$171) 2017/2018 Wildfire/Mudslide Events Cost Recovery Modeling Considerations 1. Approved TKM settlement authorizes recovery of 60% of WEMA costs (claims and associated financing and legal expenses) and 85% of CEMA costs 2. Subject to CPUC approval. Proposed settlement would authorize recovery of 35% of WEMA costs (claims and associated financing and legal expenses) and 85% of CEMA costs. Estimated one-time true-up is based on expected recoverable interest expense through December 31, 2025 3. For WEMA costs only. Estimated cost assuming securitization. Average bill shown is for non-CARE residential customers Core EPS: One-time benefit recorded upon CPUC approval; going forward, SCE realizes reduced interest expense Cash Flow: Securitization follows CPUC approval of financing order – TKM: ~$1.6 billion expected by year-end 2025 – Woolsey: ~$2.0 billion expected by year-end 2026 Use of Proceeds: – Offsets normal-course debt issuances as SCE reallocates outstanding debt for rate base growth ✓ ✓ One-time True-up Ongoing Post-Decision TKM ~30¢ (Q1 2025) ~14¢ (annualized) Woolsey2 ~44¢ (Recognized quarter of CPUC final decision) ~18¢ (annualized) |