TRIPLE NET SPACE LEASE

(SINGLE-TENANT)

between

3045 PARK PROPERTY LLC,

a California limited liability company,

as

LANDLORD

and

TRIPACTIONS, INC.,

a Delaware corporation,

as

TENANT

for

PREMISES

At

3045 Park Boulevard

PALO ALTO, CALIFORNIA

This Triple Net Space Lease (Single Tenant) (the “Lease”), dated as of the Effective Date first written in the Summary of Basic Lease Information set forth in Article I below (the “Summary”), is made by and between 3045 PARK PROPERTY LLC, a California limited liability company (“Landlord”), and TRIPACTIONS, INC., a Delaware corporation (“Tenant”).

ARTICLE I

SUMMARY OF BASIC LEASE INFORMATION

| | | | | | | | | | | | | | |

| | | | |

| TERMS OF LEASE | DESCRIPTION |

| Effective Date: | June 24, 2022 |

| | | | |

| Premises (Article II) | |

| | | | |

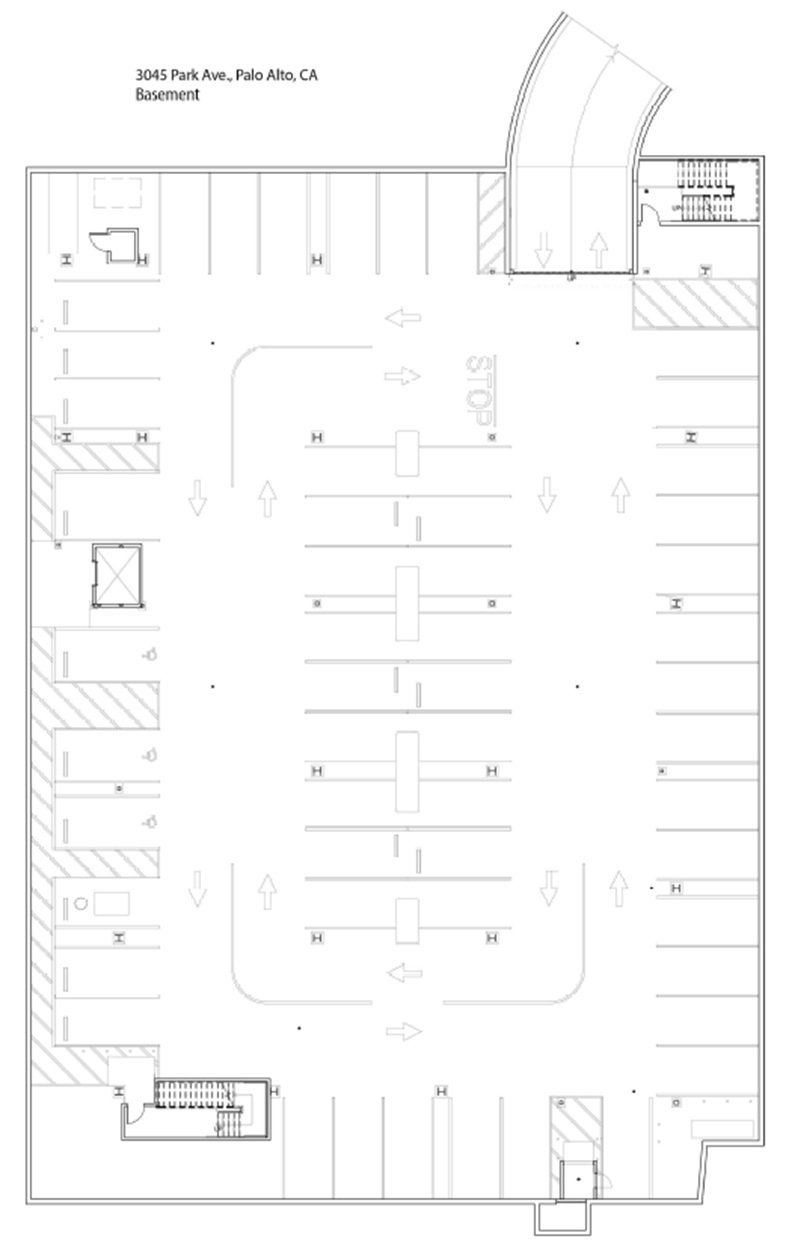

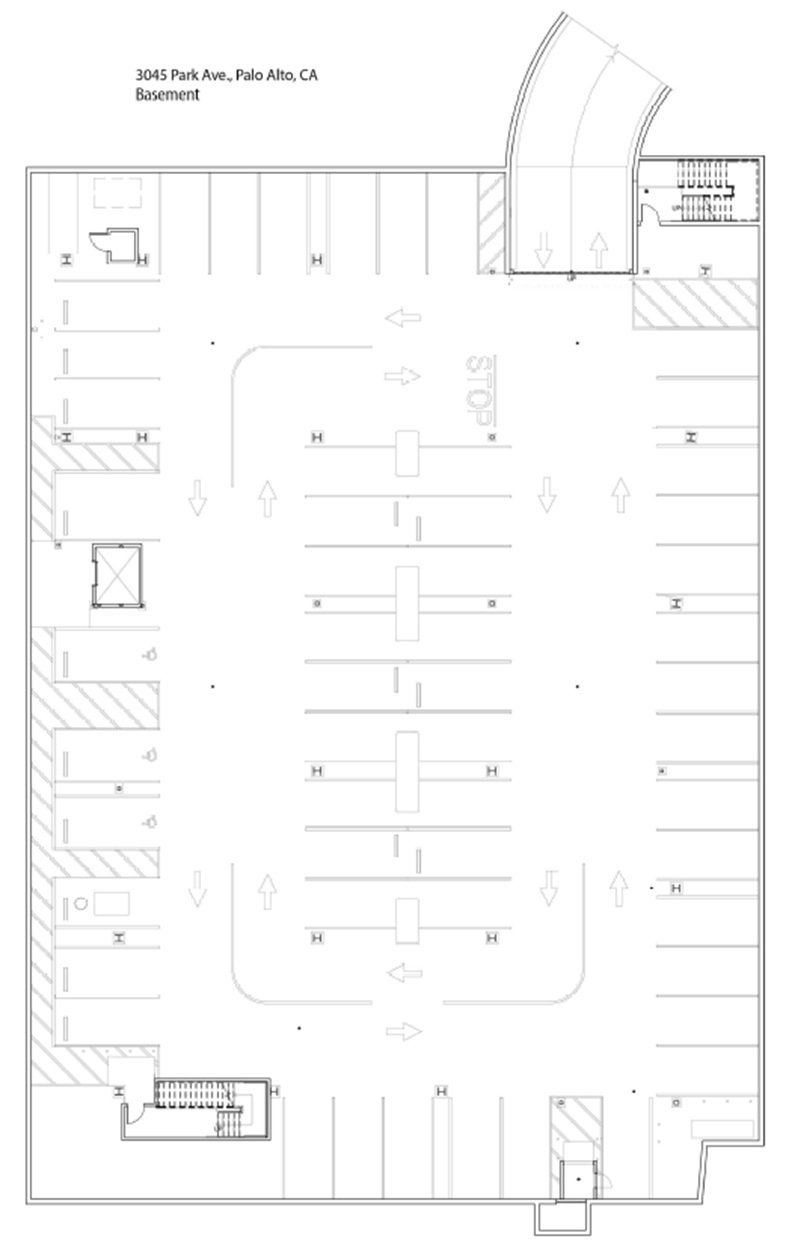

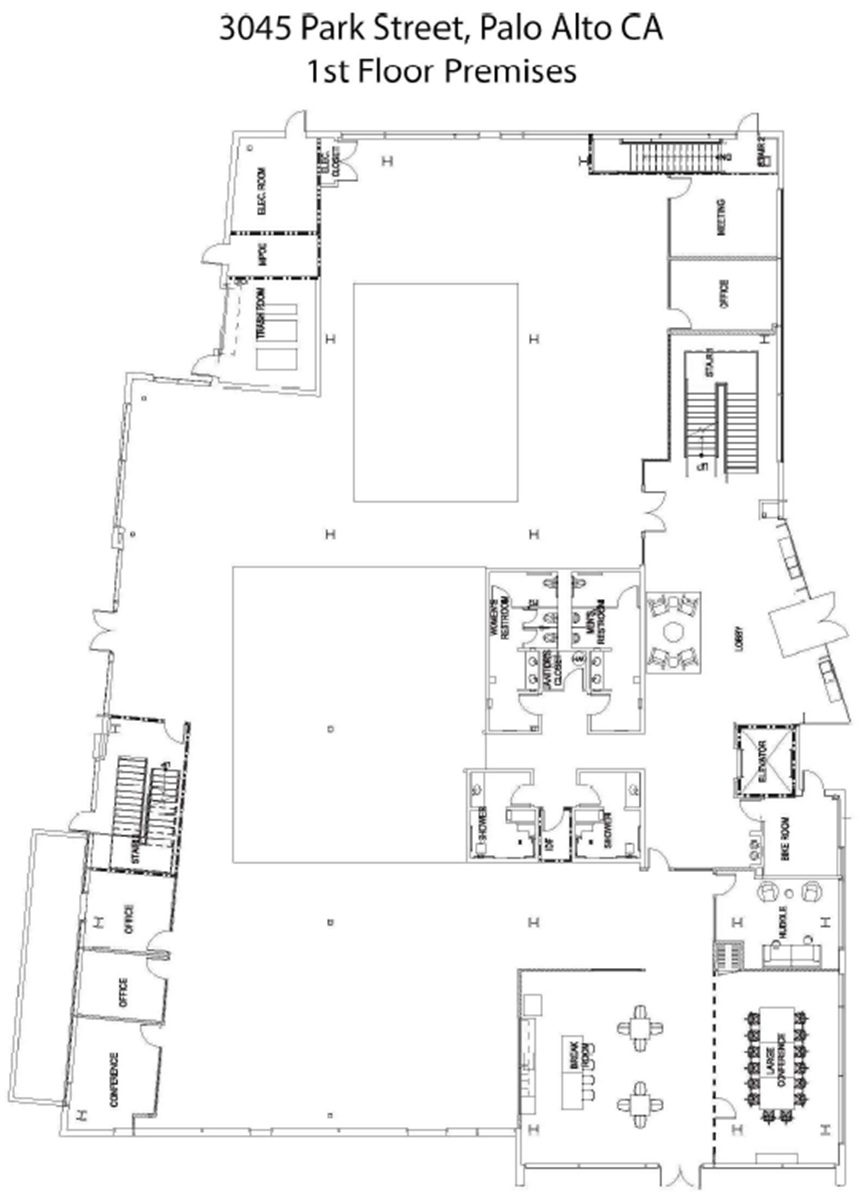

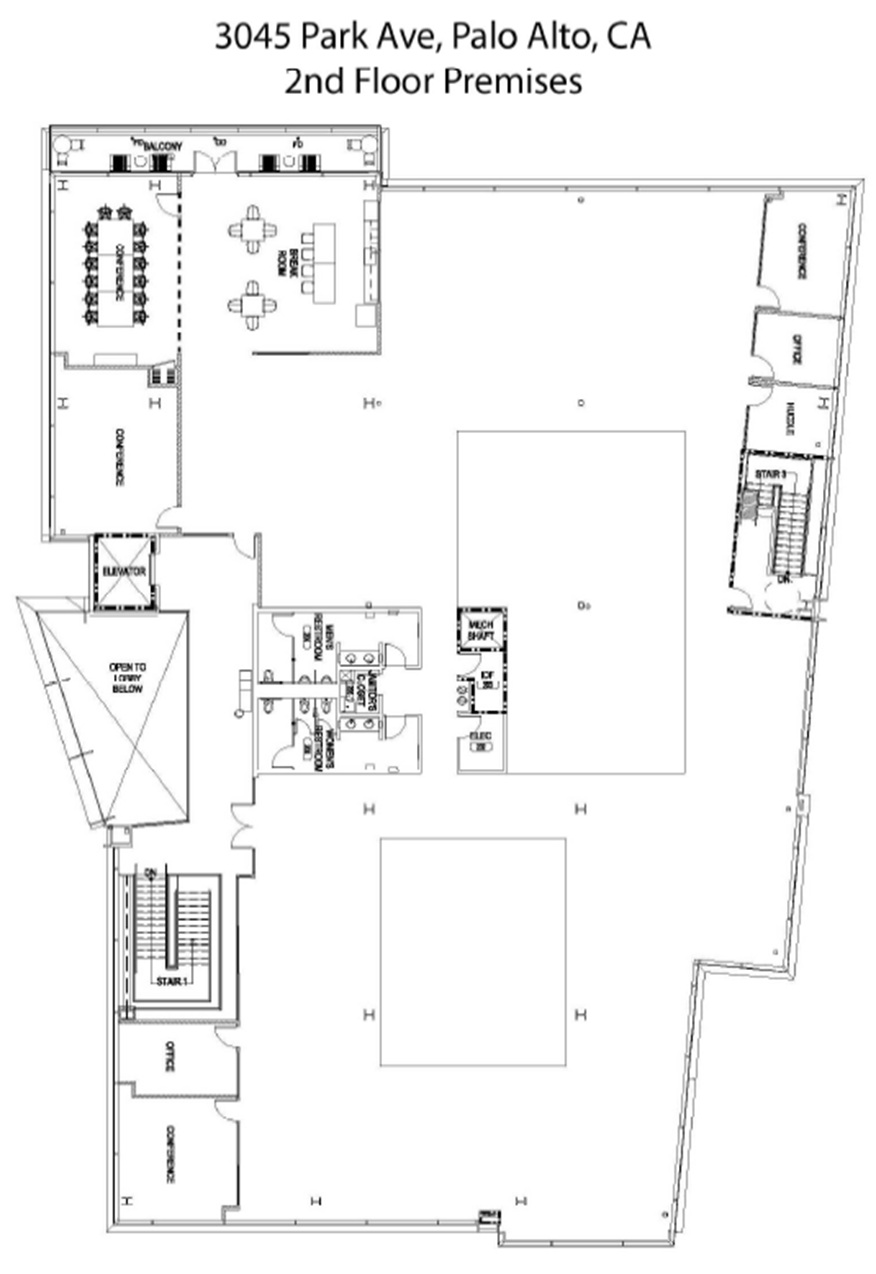

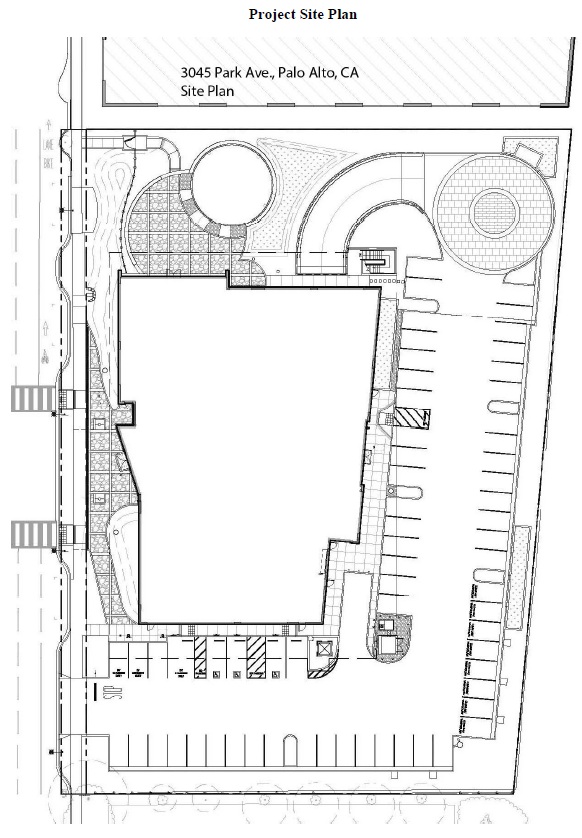

| Premises: | The entire two (2) story building located at 3045 Park Boulevard in Palo Alto, California containing an agreed upon 31,582 square feet of Rentable Area (as defined in Section 2.01 below) and shown on Exhibit A attached hereto. |

| | | | |

| Building: | The entire two (2) story building located at 3045 Park Boulevard in Palo Alto, California containing an agreed upon 31,582 square feet of Rentable Area (as defined in Section 2.01 below) and shown on Exhibit A attached hereto. |

| | | | |

| Project: | The Project, once constructed, will consist of the Building and the related real property more particularly described in Exhibit A attached hereto. The Project also includes any current or future additional surface parking lots and above or below ground parking structures thereon or therein (collectively, the “Parking Facilities”). The Project is commonly referred to as “3045 Park Boulevard” and is depicted in Exhibit A. |

| | | | |

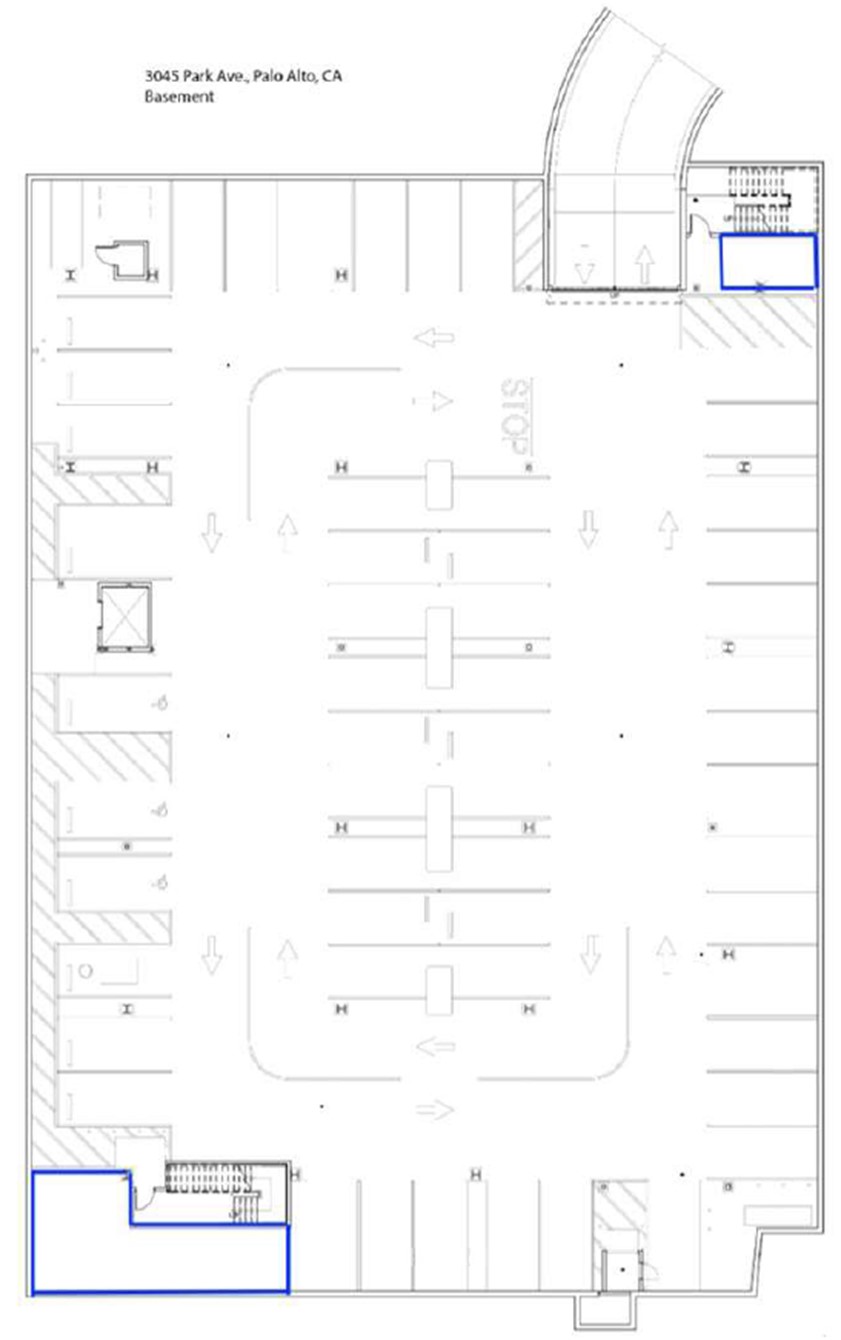

| Parking Spaces (Section 2.03): | All of the parking spaces at the Project and Parking Facilities, which includes, as of the Effective Date, 116 parking spaces (which is based on four (4) non- exclusive parking spaces per one thousand (1,000) square feet of gross measured areas as determined pursuant to the City of Palo Alto project approvals within the Premises), subject to the terms of Section 2.03 below. |

| | | | |

| Lease Term (Article III) | | | | |

| | | | |

| Commencement Date: | The later of (i) date upon which Landlord delivers the Premises to Tenant in the condition required by the Lease, including with all of the work (the “Landlord’s Work”) described in Schedule 1 attached hereto Substantially Complete and with the “Landlord’s FF&E” shown on Schedule 2 attached hereto removed from the Premises, subject to adjustment for Tenant Delays as is provided for in Schedule 1 to this Lease, and (ii) August 1, 2022. |

| | | | | | | | | | | | | | |

| | | | |

| TERMS OF LEASE | DESCRIPTION |

| | | | |

| Expiration Date: | The last day of the one hundred twentieth (120th) full month after the Commencement Date. |

| | | | |

| Option(s) to Extend: | Tenant is given two (2) options to extend the Lease Term (each, an “Option to Extend”) for a period of eighty-four (84) months each (each, an “Extended Term”) immediately following the date on which the initial Lease Term or the first Extended Term, as relevant, would otherwise expire. |

| Base Rent (Section 4.01): | Lease Months | Total SF | Rent psf/mo. | Monthly Rent |

| | | |

| 1 - 9 | 31,582 | $0.00 | $0.00 | |

| 10 - 12 | 31,582 | $8.75 | $276,342.50 | |

| 13 - 24 | 31,582 | $9.01 | $284,632.78 | |

| 25 - 36 | 31,582 | $9.28 | $293,171.76 | |

| 37 - 48 | 31,582 | $9.56 | $301,966.91 | |

| 49 - 60 | 31,582 | $9.85 | $311,025.92 | |

| 61 - 72 | 31,582 | $10.14 | $320,356.70 | |

| 73 - 84 | 31,582 | $10.45 | $329,967.40 | |

| 85 - 96 | 31,582 | $10.76 | $339,866.42 | |

| 97 - 108 | 31,582 | $11.08 | $350,062.41 | |

| 109 - 120 | 31,582 | $11.42 | $360,564.28 | |

| | | | |

| *Subject to the Base Rent Abatement Period provisions described in Section 4.02 below |

| | | | |

| Tenant’s Share (Section 4.05): | One Hundred percent (100%) |

| | | | |

| Security Deposit (Section 4.07): | Letter of Credit in the amount of Base Rent due hereunder for months ten (10) through eighteen (18) of the Lease Term (i.e., Two Million Five Hundred Thirty-Six Thousand Eight Hundred Twenty-Four and 18/100 Dollars ($2,536,824.18)) |

| | | | |

| Permitted Use (Article V): | General office, research and development of products, and other related uses allowed by Applicable Laws. |

| | | | |

| Broker (Section 17.23): | Landlord’s Broker: Newmark Cornish & Carey (Phil Mahoney and Howie Dallmar) Tenant’s Broker: T3 Advisors (David Bergeron and Bo McNally) |

| | | | |

| | | | |

ARTICLE II

PREMISES

Section 2.01 Demise of Premises

Landlord hereby leases to Tenant and Tenant leases from Landlord for the Lease Term (as defined in Section 3.01 below), at the rental, and upon all of the terms and conditions set forth herein, certain premises described in the Summary (the “Premises”), which Premises currently comprises all of that certain building described in the Summary (the “Building”) on real property situated at 3045 Park Boulevard in the City of Palo Alto, County of Santa Clara, State of California and commonly known as 3045 Park Boulevard. The parties hereto agree that the lease of the Premises is upon and subject to the terms, covenants and conditions herein set forth, and Tenant covenants as a material part of the consideration for this Lease, to keep and perform each and all of such terms, covenants and conditions by it to be kept and performed by Tenant and that this Lease is made upon the condition of such performance. The Premises are more particularly described and depicted herein in Exhibit A. Subject to the terms and conditions of this Lease, Landlord reserves the right to access and use the restrooms and janitor, telephone and electrical closets (as well as the space above any dropped ceilings) for cabling, wiring, pipes and other elements of the Building System (as defined in Section 6.01(a) below). The rentable square footage of the Premises and Building (the “Rentable Area”) has been determined and certified by Landlord’s architect by a method described as “dripline,” whereby the measurement encompasses the outermost perimeter of the constructed building, including every projection thereof and all area beneath each such projection, whether or not enclosed, with no deduction for any inward deviation of structure and with the measurement being made floor by floor, but beginning from the top of the Building. Subject to Applicable Laws (as defined in Section 5.02 below), emergencies and force majeure events, Landlord acknowledges and agrees that Tenant, its employees, agents, and invitees shall have access to the Premises and the Building twenty-four (24) hours a day, seven (7) days a week.

Section 2.02 Common Area

During the Lease Term, Tenant shall have the non-exclusive right to use the Common Area (as defined below). Landlord reserves the right, in its sole discretion, to modify the Common Area (including, without limitation, increasing or reducing the size thereof, adding or removing Project structures, facilities or other improvements, or changing the use, configuration and elements thereof), and to close or restrict access of certain areas from time to time for repair, maintenance or construction or to prevent a dedication thereof; provided that (i) Tenant nevertheless shall have direct access to the Premises (including access through the lobby of the Building and the elevators of the Building) and to Parking Facilities serving the Building, and (ii) any such modifications, when completed, shall not unreasonably interfere with or restrict Tenant’s access to or possession or use of the Premises or the visibility of Tenant’s Signage (as defined in Section 17.15(a) below). Landlord further reserves the right to establish, repeal and amend from time to time reasonable rules and regulations for the use of the Common Area and to grant easements or other rights to use the Common Area to others; provided, however, that (A) no amendment to the rules and regulations shall (I) unreasonably interfere with or restrict

Tenant’s access to or possession or use of the Premises, (II) be binding until Tenant has received at least ten (10) Business Days’ prior written notice of such rules and regulations, (III) apply retroactively, or (IV) materially increase Tenant’s obligations or materially decrease Tenant’s rights under the Lease; and (B) to the extent of any conflict between an express provision of this Lease (other than the attached Rules and Regulations) and such Common Area rules and regulations, this Lease shall control. The “Common Area” consists of all landscaping, sidewalks, walkways, driveways, curbs, Parking Facilities (including striping), roadways within the Project, sprinkler systems, lighting, surface water drainage systems, as well as additional or different facilities as Landlord may from time to time designate or install or make available for the use by Tenant in common with others.

Section 2.03 Parking

Throughout the Lease Term, Landlord shall provide Tenant with the number of parking spaces in the Parking Facilities set forth in the Summary applicable to such time period on an exclusive basis (“Tenant’s Parking Allocation”). Tenant’s Parking Allocation shall include a mixture of surface and underground parking. Landlord shall have no liability for the use of any such parking spaces by anyone (besides Landlord) other than Tenant or Tenant’s visitors. In the event Landlord is required by any law to limit or control parking at the Building or the Project, whether by validation of parking tickets or any other method of assessment, Tenant, at its cost, agrees to participate in such validation or assessment program under such reasonable rules and regulations as are from time to time established by Landlord. Tenant shall pay no monthly or “per space” fee for the Parking Facilities and except as otherwise expressly provided herein, all costs and expenses associated with Parking Facilities serving the Project shall be included in Operating Expenses. The Parking Facilities include six (6) parking stalls served by dual-head electric vehicle charging stations and appurtenances related thereto and twenty-nine (29) conduit-equipped only locations for future EV charging equipment (each, an “EV Charging Station”, and collectively, the “EV Charging Stations”). Tenant may, at Tenant’s sole expense, perform the installation of wiring and EV Charging Stations to cause certain other parking spaces within the Parking Facilities reasonably designated by Landlord to be ready for use by electric vehicles, and Tenant shall pay the actual cost charged by the applicable utility to power the EV Charging Stations installed by Tenant. Tenant shall be obligated to maintain and manage the use of any and all EV Charging Stations installed at the Project. Any parking spaces that incorporate EV Charging Stations for Tenant’s exclusive use shall be included within Tenant’s Parking Allocation and shall not result in any obligation of Landlord to provide any additional parking spaces to Tenant. Tenant shall have the exclusive use of all EV Charging Stations and parking spaces within the Parking Facilities at any time that Tenant is the sole tenant of the Project. Upon the expiration or earlier termination of this Lease, Tenant shall remove some or all of any EV Charging Stations installed by Tenant, as directed by Landlord, and return the relevant area to the condition in which it existed prior to installation of such EV Charging Station(s). Landlord acknowledges that Tenant may seek to institute additional commercially reasonable programs for the efficient use of Tenant’s Parking Allocation, including, but not limited to, the installation of signs or other identification of certain parking spaces as exclusive for certain staff or visitors (which shall be performed at Tenant’s sole expense) and valet parking and other alternative strategies for efficient parking (“Tenant’s Parking Programs”). Landlord agrees to cooperate

with Tenant in good faith to review and assist in the implementation of Tenant’s Parking Programs, so long as Tenant’s Parking Programs do not: (a) result in the violation of any Applicable Laws or Private Restrictions, (b) restrict the use of any areas designated for emergency access or fire safety corridors or other easements to third parties, (c) reduce the amount of parking available to tenants of the Project below the amount of parking spaces which are required by Applicable Laws for the lawful occupancy of the space then leased by such tenant, (d) result in any additional expense to Landlord, unless such expense is paid exclusively by Tenant, either directly to Landlord or as Operating Expenses, or (e) result in any additional liability whatsoever of Landlord to any third party which results solely from Landlord’s consent to or cooperation with Tenant’s Parking Program or Tenant’s implementation of Tenant’s Parking Program

ARTICLE III

TERM

Section 3.01 Lease Term

The term of this Lease (the “Lease Term”) shall commence on the Commencement Date set forth in the Summary, and shall expire, unless sooner terminated as provided for herein, on the Expiration Date set forth in the Summary (the “Expiration Date”), Within thirty (30) days following the Commencement Date, Landlord and Tenant shall execute and deliver a Memorandum of Commencement of Lease Term substantially in the form attached hereto as Exhibit B as a confirmation of the information set forth therein.

Section 3.02 Options to Extend

(a) Exercise.

The Options to Extend set forth in the Summary may be exercised by Tenant, if at all, only by delivery of irrevocable written notice (the “Option Notice”) to Landlord given not more than twelve (12) months nor less than nine (9) months prior to the end of the initial Lease Term or previous Extended Term, as applicable; provided, however, if, as of the date of delivery of the Option Notice or any day thereafter on or before the last day of the initial Lease Term or then-existing Extended Term, as applicable, Tenant (i) has received a written notice from Landlord that Tenant is in default under this Lease and such default remains uncured, (ii) has assigned this Lease to anyone other than an Affiliate (as defined in Section 11.02 below), (iii) is currently subletting more than fifty percent (50%) of the Premises to anyone other than an Affiliate, or (iv) has previously been delivered a notice of default under this Lease from Landlord that involves a monetary or a material non-monetary default three (3) or more times, then, at the sole option of Landlord, the Option Notice shall be totally ineffective, and this Lease shall expire on the last day of the initial Lease Term or then-existing Extended Term, if not sooner terminated. Furthermore, it is understood and agreed that the Options to Extend contemplated in this Section 3.02 are personal to the originally named Tenant and any Affiliate and are not transferable without the prior written consent of Landlord.

(b) Extended Term Rent.

In the event Tenant exercises an Option to Extend set forth herein, all the terms and conditions of this Lease shall continue to apply during such Extended Term, except that the Base Rent (as defined in Section 4.01 below) payable by Tenant during such Extended Term shall be equal to one hundred percent (100%) of Fair Market Rent (as defined below), as determined pursuant to Section 3.02(e) below. “Fair Market Rent” shall equal to the annual rent per rentable square foot (including Additional Rent and considering any “base year” or “expense stop” applicable thereto), including all escalations, at which tenants (pursuant to leases consummated within the twelve (12) month period preceding the first day of the relevant Extended Term) are leasing non-sublease, non-encumbered, non-equity space which is not significantly greater or smaller in size than the subject space, for a comparable lease term, in an arm’s length transaction, which comparable space is located in the “Comparable Buildings,” as that term is defined in this Section 3.02(b) below (transactions satisfying the foregoing criteria shall be known as the “Comparable Transactions”), taking into consideration the following concessions (the “Concessions”): (a) rental abatement concessions, if any, being granted such tenants in connection with such comparable space including without limitation, any free rent construction periods; (b) tenant improvements or allowances provided or to be provided for such comparable space, and taking into account the value, if any, of the existing improvements in the subject space, such value to be based upon the age, condition, design, quality of finishes and layout of the improvements and the extent to which the same can be utilized by a general office user other than Tenant; and (c) other reasonable monetary concessions being granted such tenants in connection with such comparable space; (d) the fact that Landlord is or is not required to pay a real estate brokerage commission in connection with Tenant’s exercise of its right to extend the Lease Term, or the fact that landlords are or are not paying real estate brokerage commissions in connection with such comparable space, and (e) any period of rental abatement, if any, granted to tenants in comparable transactions in connection with the design, permitting and construction of tenant improvements in such comparable spaces. The Fair Market Rent shall additionally include a determination as to whether, and if so to what extent, an adjustment (which could constitute an increase or decrease) to the Letter of Credit Security should be made for Tenant’s Rent obligations in connection with Tenant’s lease of the Premises during such Extended Term. Such determination shall be made by reviewing the extent of financial security then generally being imposed in Comparable Transactions from tenants of comparable financial condition and credit history to the then existing financial condition and credit history of Tenant (with appropriate adjustments to account for differences in the then-existing financial condition of Tenant and such other tenants). The Concessions (A) shall be reflected in the effective rental rate (which effective rental rate shall take into consideration the total dollar value of such Concessions as amortized on a straight-line basis over the applicable term of the Comparable Transaction (in which case such Concessions evidenced in the effective rental rate shall not be granted to Tenant)) payable by Tenant, or (B) at Landlord’s election, all such Concessions shall be granted to Tenant in kind. The term “Comparable Buildings” shall mean the Building and those other office buildings located near the Building and those other office buildings located in the greater Palo Alto ‒ Menlo Park office market.

(c) Determination of Fair Market Rent.

(i) Negotiation.

If Tenant timely and properly exercises an Option to Extend, then, within the first thirty (30) days following the date of delivery of the Option Notice (the “Negotiation Period”), the parties shall meet in good faith to negotiate the Base Rent for the Premises during the relevant Extended Term. If, during the Negotiation Period, the parties agree on the Base Rent for the Premises during the relevant Extended Term, then such agreed amount shall be the Base Rent payable by Tenant during the relevant Extended Term.

(ii) Arbitration.

In the event that the parties are unable to agree on the Base Rent for the Premises within the Negotiation Period, then within ten (10) days after the expiration of the Negotiation Period, each party shall separately designate to the other in writing and engage an appraiser to make this determination. Each appraiser designated shall be either a real estate broker or appraiser who shall have been active over the five (5) year period ending on the date of such appointment in the leasing or appraisal, as the case may be, of Comparable Buildings. The failure of either party to appoint an appraiser within the time allowed shall be deemed equivalent to appointing the appraiser appointed by the other party, who shall then determine the Fair Market Rent for the Premises for the relevant Extended Term. Within five (5) Business Days of their appointment, the two designated appraisers shall jointly designate a third similarly qualified appraiser. The third similarly qualified appraiser shall not have worked in any capacity for either party over the immediately preceding five (5) year period. Within thirty (30) days after their appointment, each of the two appraisers appointed by the parties shall submit to the third appraiser a sealed envelope containing such appointed appraiser’s good faith determination of the Fair Market Rent for the Premises for the relevant Extended Term; concurrently with such delivery, each such appraiser shall deliver a copy of his or her determination to the other appraiser. The third appraiser shall, within ten (10) days following receipt of such submissions, then determine which of the two appraisers’ determinations most closely reflects Fair Market Rent. The determination selected by the third appraiser shall be deemed to be the Fair Market Rent for the Premises during the relevant Extended Term. The third appraiser shall have no rights to adjust, amend or otherwise alter the determinations made by the appraisers selected by the parties, but must select one or the other of such appraisers’ submissions. The determination selected by the third appraiser’s determination shall be final and binding upon the parties. Said third appraiser shall, upon selecting the determination which most closely resembles Fair Market Rent, concurrently notify both parties hereto in writing. Each party shall be solely responsible to pay the fees and costs of the appraiser that it appointed and the parties shall share the fees and costs of the third appraiser equally. If the relevant Extended Term begins prior to the determination of Fair Market Rent, Tenant shall pay monthly installments of Base Rent equal to one hundred three percent (103%) of the monthly installment of Base Rent in effect for the last year of the initial Lease Term or then-existing Extended Term, as relevant. Once a determination is made, any over payment or under payment of Base Rent by Tenant shall be reimbursed as a credit against, or paid by adding to, the monthly installment of Base Rent next falling due.

ARTICLE IV

RENT; TRIPLE NET LEASE

Section 4.01 Base Rent

Commencing on the Commencement Date and continuing throughout the Lease Term (except as otherwise provided for in Sections 8.01(a), 10.01(b) and 13.02 and during the Base Rent Abatement Period described in Section 4.02 below), Tenant shall pay to Landlord, without prior notice or demand, base rent (“Base Rent”) as set forth in the Summary, which shall be payable in monthly installments, in advance, on or before the first day of each calendar month of the Lease Term. In the event that any month in the Lease Term begins on a day other than the first (1st) day of a month, the Base Rent and Additional Rent (as defined in Section 4.04 below) for such month shall be multiplied by a fraction, the numerator of which shall be the number of days in such month during the Lease Term and the denominator of which shall be number of days in such calendar month (e.g., if the Lease Term commences September 14, the fraction for such month shall be 17/30). Notwithstanding the foregoing, upon Tenant’s execution and delivery of this Lease to Landlord, Tenant shall pay to Landlord the Base Rent for the tenth (10th) month of the Lease Term (which is $276,342.50), together with Landlord’s estimate of Additional Rent due hereunder for the first (1st) month of the Lease Term (the “Initial Rent”).

Section 4.02 Base Rent Abatement Period

Notwithstanding anything herein to the contrary, Landlord and Tenant acknowledge and agree that Tenant shall not pay Base Rent hereunder during the first nine (9) months of the Lease Term (the “Base Rent Abatement Period”), as is shown in the “Base Rent” portion of the Summary; provided, however, that if at any time during the Lease Term Tenant is in default under the terms of this Lease (beyond any applicable notice and cure periods provided for herein), and, as a result thereof, Landlord terminates this Lease and seeks damages from Tenant pursuant to the terms of California Civil Code Section 1951.2 or as is otherwise permitted by law and the terms of this Lease, then Landlord may seek from Tenant, in addition to any other damages available to Landlord pursuant to this Lease, an amount equal to the Unamortized Base Rent Abatement Amount. As used herein, the term Unamortized Base Rent Abatement Amount shall be calculated by taking the total amount of the Base Rent that is excused hereunder during the Base Rent Abatement Period and amortizing such amount over the entire length of the Lease Term or the then-existing Extended Term, as relevant. The “Unamortized Base Rent Amount” shall mean the portion of such amortized amount attributable to the time period between the date of the default giving rise to such termination and the Expiration Date of the Lease or end of the then applicable Extended Term, as relevant.

Section 4.03 Payment of Rent

This Lease is what is commonly called an “Absolute Triple Net Lease,” it being understood that, except where and to the extent that Base Rent and/or Additional Rent is waived or abated by Landlord under the express terms of this Lease, Landlord shall receive the Base Rent set forth in Section 4.01 free and clear of, and in addition to, any and all expenses, costs, impositions, taxes, assessments, liens or charges payable by Tenant pursuant to this Lease.

Tenant shall pay all Rent in lawful money of the United States of America to Landlord at the notice address stated herein or to such other persons or at such other places as Landlord may designate in writing on or before the due date specified for same without prior demand, set-off or deduction of any nature whatsoever, except as provided in Sections 4.02, 8.01(a), 10.01(b) and 13.02 of this Lease. It is the intention of the parties hereto that this Lease shall not be terminable for any reason by Tenant and that Tenant shall in no event be entitled to any abatement of or reduction in Rent payable under this Lease, except as herein expressly provided, including in Section 4.02 above, Section 10.01(b) below, and Articles VIII and XIII concerning destruction and condemnation. Any present or future law to the contrary shall not alter this agreement of the parties.

Section 4.04 Additional Rent

In addition to the Base Rent referenced in Section 4.01 above, commencing on the Commencement Date and continuing throughout the Lease Term, except as waived or abated by Landlord under the express terms of this Lease, Tenant shall pay (i) Tenant’s Share of Operating Expenses (as defined in Section 4.05(a) below); (ii) Tenant’s Share of Insurance Expenses (as defined in Section 4.05(a) below); (iii) Tenant’s Share of Real Estate Taxes (as defined in Section 4.05(a) below); and (iv) a management fee (the “Management Fee”), payable on a monthly basis, in advance, at the same time and in the same manner applicable to monthly installments of Base Rent, in an amount equal to three percent (3%) of the then applicable monthly installment of Base Rent (for the purposes of this Section 4.04, the Base Rent due hereunder for each month during the Base Rent Abatement Period of the Lease Term shall be deemed to be Two Hundred Seventy- Six Thousand Three Hundred Forty-Two and 50/100 Dollars ($276,342.50) per month). All of the foregoing payments, together with any and all other amounts (other than Base Rent), whether or not contemplated, payable by Tenant pursuant to the terms of this Lease are referred to herein, collectively, as “Additional Rent,” and Base Rent and Additional Rent are referred to herein, collectively, as “Rent.”

Section 4.05 Operating Expenses; Insurance Expenses; Real Estate Taxes

(a) Definitions

“Operating Expenses” shall mean all expenses, costs and amounts of every kind and nature (other than Insurance Expenses and Real Estate Taxes) which Landlord pays or accrues (whether obligated to do so or undertaken at Landlord’s discretion) during any calendar year during the Lease Term because of or in connection with the operation, management, maintenance, security, repair, replacement and restoration of (1) the Project and (2) the Building, or any portion thereof, including the Common Area, in accordance with sound real estate management accounting principles, consistently applied, it being agreed that Landlord’s recovery of Operating Expenses shall be without any component of profit or other mark-up to Landlord (except as expressly permitted in this Lease). For purposes of clarification, any given type of Operating Expense shall be included either as paid or as accrued during an Expense Year (but not both as paid and as accrued) and such manner of accounting as to such type of Operating Expense shall be maintained consistently throughout the Lease Term. Without limiting the

generality of the foregoing, Operating Expenses shall specifically include any and all of the following:

(i) With respect to the Project, any and all costs and expenses charged to Landlord as owner of the Project (or any portion thereof) pursuant to any covenants, conditions and restriction or similar governing document recorded against the property of which the Premises is a part as of the Effective Date for the operating, cleaning, lighting, maintaining, repairing and replacing all improvements and elements within the Common Area of the Project (including, without limitation, light poles and fixtures, storm and sanitary sewers, Parking Facilities, driveways and roads); and

(ii) With respect to the Building (or any portion thereof) or the Project to the extent such costs are incurred by Landlord and not otherwise included pursuant to item (i) above, all costs and expenses of cleaning, lighting, maintaining, repairing and replacing all improvements and elements (including, without limitation, light poles and fixtures, Parking Facilities, driveways and roads, storm and sanitary systems; costs of removal of trash, rubbish, garbage and other refuse; costs of painting of exterior and interior walls; costs of removal of graffiti; costs of maintaining landscaping; costs of providing security systems and personnel to the extent Landlord determines in its reasonable discretion to do so; fire protection and fire hydrant charges (including fire protection system signaling devices now or hereafter required, and the costs of maintaining of same); water and sewer charges; utility charges; license and permit fees necessary to operate and maintain the Building or the Project; costs of supplies, tools and materials used exclusively in the operation and maintenance of the Building or the Project and the Common Area; the cost (or the reasonable depreciation of the cost) of equipment used in the operation and maintenance of the Building or the Project and the Common Area (which shall be expensed or amortized, respectively, by Landlord over its useful life using commercial real estate management principles, consistently applied) and rent paid for leasing any such equipment; reasonable cost of on-site or off-site space for the storage of any and all items used in conjunction with the operation, management, maintenance and repair of the Project or Building or (including, without limitation, tools, machinery, records, decorations, tables, benches, supplies and meters); the cost of making all improvements which are intended to reduce Operating Expenses or to increase public safety as required by any Applicable Laws (but only to the extent of such savings over the Lease Term), or improvements which may be then required by governmental authority, laws, statutes, ordinances and/or regulations; the cost of all licenses, certificates, permits and inspections (other than inspections related to the inspection of the build-out of any space leased to tenants of the Project); the reasonable cost of contesting any governmental enactments which may affect Operating Expenses provided any reduction in Operating Expenses during the Lease Term shall be passed through to Tenant; reasonable costs incurred to comply with any transportation demand management program, any present or anticipated conservation program or any other required governmental program; payments under any easement, license, operating agreement, declaration, restrictive covenant, or instrument pertaining to the sharing of costs by the Building or the Project; costs, fees, charges or assessments imposed by, or resulting from any mandate imposed on Landlord by, any federal, state or local government for fire and police protection, trash removal, community services, or other services which do not constitute Real Estate Taxes hereunder; total compensation and

benefits (including premiums for workers’ compensation and other insurance, except to the extent such premiums are included in Insurance Expenses) paid to or on behalf of Landlord’s employees, agents, consultants and contractors below the grade of building manager, including, without limitation, full or part time on-site management or maintenance personnel.

(iii) Notwithstanding the foregoing, or any other provision in this Lease to the contrary, Operating Expenses shall exclude the following:

1. Attorneys’ fees, leasing commissions and other expenses incurred in connection with lease negotiations or disputes with Project tenants or prospective tenants;

2. Costs, including permit, license and inspection costs, and any allowances or other tenant improvement concessions, incurred or provided with respect to the design, construction and/or installation of tenant improvements made for other tenants in the Project or incurred in renovating or otherwise improving, decorating, painting or redecorating vacant space for tenants or other occupants of the Project;

3. Repairs or work paid from insurance, condemnation or warranty proceeds, or other costs for which Landlord is reimbursed by a third party or a tenant of the Project (other than by means of an Operating Expense reimbursement provision);

4. To the extent the Landlord’s Work or Common Area is not in compliance with Applicable Laws as of the date Landlord received a construction permit for the work in question, the costs of bringing the Landlord’s Work or Common Area into compliance with Applicable Laws as of the date such construction permit was received;

5. Penalties or other costs incurred due to a violation by Landlord, as determined by written admission, stipulation, final judgment or arbitration award, of any of the terms and conditions of this Lease or any other lease relating to the Project except to the extent such costs reflect costs that would have been incurred by Landlord absent such violation;

6. Overhead and profit paid to Landlord or its affiliated, subsidiaries or parent entities for goods and/or services in the Building or Project, to the extent the same exceeds the costs which would be incurred for the same if provided by unaffiliated third parties on a competitive basis;

7. The wages and benefits of any employee who does not devote substantially all of his or her employed time to the Building or Project unless such wages and benefits are prorated to reflect time spent on operating and managing the Building or Project; provided that in no event shall Operating Expenses include wages and/or benefits attributable to personnel above the level of portfolio property manager or chief engineer;

8. Costs reasonably attributable to any commercial concession in the Project that is not available to Tenant free of charge or on a subsidized basis;

9. Marketing, advertising and promotional expenditures;

10. Debt service, origination or prepayment fees and other costs associated with mortgages, or any ground lease rent;

11. Reserves of any kind;

12. Principal payments, late charges, penalties, liquidated damages, bad-debt expenses, interest, amortization or other payments on mortgages, or ground lease payments, if any;

13. Costs of correcting defects in the Building and the Common Area of the Project, or the equipment used therein and the replacement of defective equipment to the extent such costs are reimbursed by warranties of manufacturers, suppliers or contractors, or are otherwise borne by parties other than Landlord, except that conditions resulting from ordinary wear and tear will not be deemed defects for the purpose of this category;

14. Costs arising from Landlord’s charitable or political contributions;

15. Costs associated with the operation of the business of the partnership or entity which constitutes the Landlord, as the same are distinguished from the costs of the operation, management, repair, replacement and/or maintenance of the Premises, Building or Project, including costs of defending any lawsuits with any mortgagee (except as the actions of the Tenant may be in issue), costs of selling, syndicating, financing, mortgaging or hypothecating any of the Landlord’s interest in the Building or Project and costs incurred in disputes between Landlord and its employees, managers, or other tenants or occupants;

16. Costs incurred to remove, remedy, contain or treat any Hazardous Materials (as defined in Section 17.21(a) below), except to the extent that such costs arise in the ordinary course of ordinary maintenance of an office building campus or result from the acts or omissions of Tenant or any of Tenant’s Parties (as defined in Section 7.07 below); provided, however, that nothing herein shall be deemed to modify or lessen the obligations of Tenant pursuant to Section 17.21 of this Lease;

17. Rentals and other related expenses incurred in leasing HVAC systems, elevators or other equipment ordinarily considered to be capital improvements, except for: (i) expenses in connection with making repairs on or keeping Buildings Systems in operation while repairs are being made and (ii) costs of equipment not affixed to the Building that is used in providing janitorial or similar service;

18. Any costs recovered by Landlord to the extent such cost recovery allows Landlord to recover more than 100% of Operating Expenses, or which would duplicate or otherwise result in double reimbursement to Landlord for a single expenditure made by Landlord;

19. Costs for which any tenant directly contracts with local providers, costs for which Landlord is reimbursed by any tenant or occupant of the Project or by insurance by its carrier or any tenant’s carrier or by anyone else, and expenses in connection with services or other benefits not offered to Tenant or for which Tenant is charged directly but are provided to another tenant or occupant of the Project without a separate charge;

20. Depreciation of the Building or other improvements;

21. Damage and repairs necessitated by the negligence or willful misconduct of Landlord, Landlord’s employees, contractors, agents or invitees;

22. Insurance Expenses; and

23. Real Estate Taxes.

Notwithstanding the above or any provision to the contrary set forth in this Lease, if Tenant’s Share of the cost of any capital expenditure made by Landlord to the Project exceeds fifty cents ($0.50) per square foot of Rentable Area in the Premises (an “Amortized Capital Expense”) (which amount is subject to increase on each anniversary of the Rent Commencement Date by an amount equal to the then-annual increase in the Consumer Price Index published by the United States Department of Labor, Bureau of Labor Statistics, “All Items” for All Urban Consumers in the San Francisco, Oakland, San Jose metropolitan area (1982-1984 = 100) (the “CPI”)), then such cost, together with interest thereon at an interest rate equal to the Agreed Rate, shall be amortized over its useful life, and the amount includible in Operating Expenses for any month shall be limited to the monthly amortized cost thereof. Landlord may include the total amount of Tenant’s Share of any capital expenditure which is less than an Amortized Capital Expense in the Expense Year in which such capital expenditure is incurred. Notwithstanding the foregoing, for any capital expenditure which is intended to, and does in fact, reduce Operating Expenses, the recovery/payback period shall be reasonably determined by Landlord in accordance with generally accepted accounting practices and such annual amount included in Operating Expenses shall not exceed the amount of Operating Expenses reasonably anticipated to be saved in each calendar year throughout the Lease Term (as determined at the time Landlord elected to proceed with the capital improvement or acquisition of the capital equipment to reduce Operating Expenses).

“Insurance Expenses” shall mean all expenses, costs and amounts of every kind and nature which Landlord pays or accrues (whether obligated to do so or undertaken at Landlord’s discretion) during any calendar year during the Lease Term because of or with respect to insurance carried by Landlord in connection with the Building or the Project, pursuant to Sections 7.01 and 7.03 below.

“Real Estate Taxes” shall mean all federal, state, county, or local governmental or municipal taxes, fees, charges or other impositions of every kind and nature, whether general, special, ordinary or extraordinary (including, without limitation, real estate taxes, general and special assessments, transit taxes, business taxes, leasehold taxes or taxes based upon the receipt of rent, including gross receipts or sales taxes applicable to the receipt of rent, unless required to be paid by Tenant, personal property taxes imposed upon the fixtures, machinery, equipment, apparatus, systems and equipment, appurtenances, furniture and other personal property used in connection with the Project, or any portion thereof), which shall be paid or accrued during any calendar year (without regard to any different fiscal year used by such governmental or municipal authority) because of or in connection with the ownership, leasing and operation of the Project, or any portion thereof. Refunds of Real Estate Expenses shall be credited against Real Estate Expenses incurred during the Lease Term and refunded to Tenant regardless of when received. Notwithstanding anything to the contrary contained herein, “Real Estate Taxes” shall

not include: (i) any net income taxes and other taxes to the extent applicable to Landlord’s general or net income, franchise taxes, excess profits taxes, gift taxes, capital stock taxes, or any succession, estate or inheritance taxes of Landlord; or (ii) any penalties, interest, or other charges imposed as a result of Landlord’s late payment or non-payment of any Real Estate Taxes unless such failure is a direct result of Tenant’s failure to pay Real Estate Taxes to Landlord as and when due hereunder. Notwithstanding anything to the contrary set forth in this Lease, only Landlord may institute proceedings to reduce Real Estate Taxes and the filing of any such proceeding by Tenant without Landlord’s consent shall constitute a default by Tenant. Tenant may request from Landlord whether or not Landlord intends to file an appeal of any portion of Real Estate Taxes which are appealable by Landlord (the “Appealable Real Estate Taxes”) for any tax fiscal year. Landlord shall deliver written notice to Tenant within ten (10) days after such request indicating whether Landlord intends to file an appeal of Appealable Real Estate Taxes for such tax fiscal year. If Landlord indicates that Landlord will not file an appeal of such Real Estate Taxes, then Tenant may provide Landlord with written notice (“Appeals Notice”) at least thirty (30) days prior to the final date in which an appeal must be filed, requesting that Landlord file an appeal. Upon receipt of the Appeals Notice, Landlord shall promptly file such appeal and thereafter Landlord shall diligently prosecute such appeal to completion. Tenant may at any time in its sole discretion direct Landlord to terminate an appeal it previously elected pursuant to an Appeals Notice. In the event Tenant provides an Appeals Notice to Landlord and the resulting appeal reduces the Real Estate Taxes for the tax fiscal year in question as compared to the original bill received for such tax fiscal year and such reduction is greater than the costs for such appeal, then the costs for such appeal shall be included in Real Estate Taxes and passed through to the tenants of the Building. Alternatively, if the appeal does not result in a reduction of Real Estate Taxes for such tax fiscal year or if the reduction of Real Estate Taxes is less than the costs of the appeal, then Tenant shall reimburse Landlord, within thirty (30) days after written demand, for any and all costs reasonably incurred by Landlord which are not covered by the reduction in connection with such appeal. Tenant’s failure to timely deliver an Appeals Notice shall waive Tenant’s rights to request an appeal of the applicable Real Estate Taxes for such tax fiscal year. In addition, Tenant’s obligations to reimburse Landlord for the costs of the appeal pursuant to this Section 4.05(a) shall survive the expiration or earlier termination of this Lease in the event the appeal is not concluded until after the expiration or earlier termination of this Lease. Upon request, Landlord agrees to keep Tenant apprised of all tax protest filings and proceedings undertaken by Landlord to obtain a reduction or refund of Real Estate Taxes.

“Expense Year” shall mean each calendar year in which any portion of the Lease Term falls, through and including the calendar year in which the Lease Term expires, provided that Landlord, upon notice to Tenant, but not more than once during any twelve (12) month period, may change the Expense Year from time to time to any other twelve (12) consecutive month period, and, in the event of any such change, Tenant’s Share of Operating Expenses, Insurance Expenses and Real Property Taxes shall be equitably adjusted for any Expense Year involved in any such change.

(b) Tenant’s Share

For purposes hereof, “Tenant’s Share” shall mean the percentage derived by the quotient of the then-existing Rentable Area of the Premises divided by the Rentable Area of the Building. Landlord and Tenant acknowledge and agree that Tenant’s Share shall be the percentages set forth in the Summary. Notwithstanding the foregoing, Tenant’s Share shall be subject to increase or reduction, based upon any increase or reduction in the Rentable Area of the Building or the Premises.

(c) Payment

Commencing on the Commencement Date, and continuing through the Lease Term, Tenant shall pay, on the first day of each calendar month, monthly installments of Tenant’s Share of Operating Expenses, Tenant’s Share of Insurance Expenses and Tenant’s Share of Real Estate Taxes in amounts set forth in a written estimate by Landlord. Landlord shall have the right to revise its estimate from time to time (but not more than once during a particular calendar year) and, commencing with Tenant’s next installment of Base Rent due, Tenant thereafter shall pay such amounts set forth in such revised estimate (which may include an additional monthly amount based upon any shortfall in Landlord’s previous estimate). Landlord shall endeavor to furnish to Tenant a statement (hereinafter referred to as “Landlord’s Statement”), within one hundred twenty (120) days after the end of each calendar year, which shall set forth the actual amounts of Tenant’s Share of Operating Expenses, Tenant’s Share of Insurance Expenses and Tenant’s Share of Real Estate Taxes for such preceding calendar year. In the event that the actual amounts of Tenant’s Share of Operating Expenses, Tenant’s Share of Insurance Expenses and Tenant’s Share of Real Estate Taxes for such preceding calendar year exceed the estimated amounts paid by Tenant with respect to each of Tenant’s Share during such preceding calendar year, then Tenant shall pay to Landlord, as Additional Rent, the entire amount of such excess within thirty (30) days after receipt of Landlord’s Statement. In the event that the actual amounts of Tenant’s Share of Operating Expenses, Tenant’s Share of Insurance Expenses and Tenant’s Share of Real Estate Taxes for such preceding calendar year are less than the estimated amounts paid by Tenant with respect to each of Tenant’s Shares during such preceding calendar year, then Landlord shall apply such difference as a credit to Additional Rent next falling due (or if the Lease Term has expired or terminated and there remains no money due to Landlord, then Landlord shall remit to Tenant the amount of such excess within thirty (30) days of the expiration or earlier termination of the Lease, which obligation shall survive the expiration or earlier termination of the Lease Term). Tenant’s Share of Operating Expenses, Tenant’s Share of Insurance Expenses and Tenant’s Share of Real Estate Taxes for the ensuing estimation period shall be adjusted upward or downward based upon Landlord’s Statement. The provisions of this Section 4.05(c) shall survive the expiration or earlier termination of the Lease Term; provided, however, in no event shall Tenant be responsible for Tenant’s Share of Operating Expenses, Tenant’s Share of Insurance Expenses and/or Tenant’s Share of Real Estate Taxes attributable to any calendar year which are first billed to Tenant more than twelve (12) months after the expiration or earlier termination of the Lease Term.

Section 4.06 Tenant’s Right to Review Supporting Data

(a) Exercise of Right by Tenant

Provided Tenant has not received written notice of a Tenant default from Landlord under this Lease and such default has not yet been cured, and provided further that Tenant complies with the provisions of this Section 4.06, Tenant shall have the right to reasonably review supporting data for any portion of a Landlord’s Statement that Tenant claims is incorrect. In order for Tenant to exercise its right under this Section 4.06, Tenant shall, within one hundred eighty days (180) after any Landlord’s Statement is received, deliver a written notice (the “Audit Notice”) to Landlord specifying the portions of such Landlord’s Statement that are claimed to be incorrect, and Tenant shall simultaneously pay to Landlord all amounts due from Tenant to Landlord as specified in such Landlord’s Statement if such amounts have not previously been paid. Except as expressly set forth in Section 4.06(c) below, in no event shall Tenant be entitled to withhold, deduct, or offset any monetary obligation of Tenant to Landlord under this Lease, including, without limitation, Tenant’s obligation to make all Base Rent payments and all payments of Additional Rent pending the completion of, and regardless of the results of, any review under this Section 4.06. The right to review granted to Tenant under this Section 4.06 may only be exercised once for any Landlord’s Statement.

(b) Procedures for Review

Tenant agrees that any review of supporting data under this Section shall occur at such location at which Landlord’s records for the Building or the Project are then located; provided that such location shall be in and around the San Francisco Bay Area. Landlord shall provide access to its records within thirty (30) days after Tenant’s delivery of its Audit Notice, and any review and audit of the supporting data under this Section 4.06 shall occur at such location (in the San Francisco Bay Area) and at such time during Landlord’s normal business hours on such days (“Access Days”) during the thirty (30) day period after Tenant’s delivery of its Audit Notice as Landlord shall reasonably designate (the “Review Period”). Except as expressly provided herein, any review to be conducted by Tenant under this Section 4.06 shall be at the sole expense of Tenant and shall be conducted by a firm of certified public accountants of national or regional standing, on a non-contingency fee basis. Tenant acknowledges and agrees that any supporting data reviewed under this Section 4.06 shall constitute confidential information of Landlord, which shall not be disclosed to anyone other than the accountants performing the review and the management of Tenant who receive the results of the review. Except (i) to the extent required by law, (ii) in connection with any legal proceeding concerning this Lease, or (iii) to the extent such information or results are otherwise publicly available, the disclosure of such information or results of the review to any other person, whether or not caused by the conduct of Tenant, shall constitute a material breach of this Lease. Tenant shall deliver the results of its audit and review (“Audit Report”) to Landlord within the thirty (30) day period after the last Access Day designated by Landlord. If the amount Tenant paid has been overstated by more than five percent (5%) of the amount set forth in Landlord’s Statement during any calendar year, then Landlord shall reimburse Tenant for the costs incurred by Tenant in preparing such Audit Report. In the event that such results show that Tenant has

underpaid its obligations for a preceding period, the amount of such underpayment shall be paid by Tenant to Landlord with the next succeeding installment obligation of Additional Rent or, if the Lease has terminated or expired, in cash within thirty (30) days after the determination of underpayment is delivered to Tenant. In addition, if the amount Tenant paid has been understated by more than five percent (5%) of the amount set forth in Landlord’s Statement during any calendar year, then Tenant shall reimburse Landlord for the costs incurred by Landlord in responding to such Audit Report. Except as set forth above, each party shall pay all the costs, and expenses of its chosen accounting firm and one half of the costs and expenses of the independent accountant, if any.

(c) Resolution of Disputes Regarding Operating Expenses, Insurance Expenses and Real Estate Taxes

Any errors disclosed by the Audit Report under this Section shall be promptly corrected (in which case Landlord will provide a revised Landlord’s Statement to reflect the results of the Audit Report within fifteen (15) days after receipt of Tenant’s Audit Report), provided that Landlord at its sole cost shall have the right to cause another review of the supporting data to be made by a firm of certified public accountants of national or regional standing, on a non- contingency fee basis by notice (“Notice of Final Accounting Review”) given to Tenant within such 15-day period, and with Landlord’s audit completed within 60 days after receipt of the Audit Report. In the event of a disagreement between the two accounting firms, the two accounting firms shall promptly agree on a third independent accountant who shall decide each item of disagreement and whose decision shall be deemed to be correct, final and binding on both Landlord and Tenant (“Final Accounting”). If the two accounting firms fail to select the independent accountant within thirty (30) days after Landlord’s accounting firm completes its review, Landlord or Tenant may apply to the presiding judge of the Superior Court to appoint such independent accountant. If the audit and review process described above results in a determination that Tenant has overpaid obligations for a preceding period, the amount of such overpayment plus interest at the Agreed Rate (as defined in Section 17.02 below) shall be credited against Tenant’s subsequent installment obligations to pay its share of rent or, if the Lease has terminated or expired, paid in cash to Tenant within thirty (30) days after the determination of overpayment is delivered to Landlord. In the event that such results show that Tenant has underpaid its obligations for a preceding period, the amount of such underpayment shall be paid by Tenant to Landlord with the next succeeding installment obligation of Additional Rent or, if the Lease has terminated or expired, in cash within thirty (30) days after the determination of underpayment is delivered to Tenant. Each party shall pay all the costs, and expenses of its chosen accounting firm and one half of the costs and expenses of the independent accountant, if any; provided, however, if the Final Accounting shows that Landlord’s calculation of Operating Expenses, Insurance Expenses and/or Real Estate Taxes in Landlord’s Statement being audited were overstated by more than three percent (3%), then Landlord shall pay the costs and expenses of the audit and review for the Final Accounting and Tenant’s audit. If the Final Accounting shows that Landlord’s calculation of Operating Expenses, Insurance Expenses and/or Real Estate Taxes in Landlord’s Statement being audited were understated by more than three percent (3%), then Tenant shall pay the costs and expenses of the audit and review for the Final Accounting and Landlord’s audit. The payment by Tenant of any amounts pursuant to this

Article IV shall not preclude Tenant from questioning, during the Review Period, the correctness of the particular Landlord’s Statement in question provided by Landlord.

(d) Effect of Tenant’s Default

In the event that Landlord provides Tenant with written notice that Tenant is in default of its obligations under this Lease at any time during the pendency of a review of records under this Section 4.06, said right to review shall immediately cease until such default is cured by Tenant.

Section 4.07 Letter of Credit Security

(a) Deposit of Letter of Credit Security

Tenant shall deposit with Landlord, within ten (10) business days after the full execution and delivery of this Lease to both parties, an unconditional, irrevocable letter of credit (“Letter of Credit”) on a form acceptable to Landlord and, if required, Landlord’s Lender(s), and in favor of Beneficiary, as defined below, in an amount equal to the amount of Base Rent due hereunder for months ten (10) through eighteen (18) of the Lease Term (i.e., Two Million Five Hundred Thirty-Six Thousand Eight Hundred Twenty-Four and 18/100 Dollars ($2,536,824.18) (the “Letter of Credit Security”)). “Beneficiary,” as used herein refers to either: (x) Landlord as beneficiary, or (y) if required by Landlord’s Lender(s), Landlord and Landlord’s Lender(s) as co-beneficiaries under the Letter of Credit Security. The Letter of Credit Security shall: (i) be issued by Wells Fargo Bank N.A. or any other commercial money center bank reasonably satisfactory to Landlord with retail branches in San Francisco, California (the “Issuer”); (ii) be a standby, at-sight, irrevocable letter of credit; (iii) be payable to Beneficiary; (iv) permit multiple, partial draws; (v) provide that any draw on the Letter of Credit Security shall be made upon receipt by the Issuer of a sight draft accompanied by a letter from Landlord stating that Landlord is entitled to draw on the Letter of Credit Security in the amount of such draw pursuant to the provisions of this Lease; (vi) provide for automatic annual extensions, without amendment (so-called “evergreen” provision) with a final expiry date no sooner than ninety (90) days after the end of the Lease Term; (vii) provide that is governed by the Uniform Customs and Practice for Documentary Credits (2007 revisions) International Chamber of Commerce Publication 600; and (viii) be cancelable if, and only if, Issuer delivers to Beneficiary no less than thirty (30) days advance written notice of Issuer’s intent to cancel. Tenant shall pay all costs, expenses, points and/or fees incurred by Tenant in obtaining the Letter of Credit Security. Landlord hereby approves Silicon Valley Bank as an Issuer of the Letter of Credit Security.

(b) Landlord’s Right to Draw on Letter of Credit Security

The Letter of Credit Security shall be held by Landlord as security for the performance of all of Tenant’s obligations pursuant to this Lease. Landlord shall have the immediate right to draw upon the Letter of Credit Security, in whole or in part and without prior notice to Tenant, other than as required under this Lease, at any time and from time to time: (1) if a default occurs under this Lease (beyond any applicable notice and cure period), or (2) Tenant

either files a voluntary bankruptcy petition or an involuntary bankruptcy petition is filed against Tenant by an entity or entities other than Landlord, under 11 U.S.C. § 101 et seq., or Tenant executes an assignment for the benefit of creditors. No condition or term of this Lease shall be deemed to render the Letter of Credit Security conditional, thereby justifying the Issuer of the Letter of Credit Security in failing to honor a drawing upon such Letter of Credit Security in a timely manner. The Letter of Credit Security and its proceeds shall constitute Landlord’s sole and separate property (and not Tenant’s property or, in the event of a bankruptcy filing by or against Tenant, property of Tenant’s bankruptcy estate) and Landlord may immediately upon any draw (and without notice to Tenant) apply or offset the proceeds of the Letter of Credit Security against: (A) any amounts payable by Tenant under the Lease that are not paid when due, after the expiration of any applicable notice and cure period; (B) all losses and damages that Landlord has suffered or may reasonably estimate that it may suffer as a result of any default (after the expiration of any applicable notice and cure period, unless Landlord is stayed by operation of law from giving such notice and cure period) by Tenant under this Lease, including any damages arising under Section 1951.2 of the California Civil Code for rent due following termination of this Lease; (C) any costs incurred by Landlord in connection with Tenant’s default (after expiration of any applicable notice and cure period, unless Landlord is stayed by operation of law from giving such notice and cure period) under this Lease (including reasonable attorney’s fees); and (D) any other amount that Landlord may spend or become obligated to spend by reason of Tenant’s default under this Lease beyond any applicable notice and cure periods but in no event in excess of amounts to which the Landlord would be entitled under the law. If any portion of the Letter of Credit Security is so drawn upon or applied, Tenant shall, within five (5) Business Days after written demand therefor, deposit cash or an additional letter of credit with Issuer in an amount sufficient to restore the Letter of Credit Security to its original amount; Tenant’s failure to do so shall be a default by Tenant. It is expressly understood that Landlord shall be relying on Issuer rather than Tenant for the timely payment of proceeds under the Letter of Credit Security and the rights of Landlord pursuant to this Section are in addition to any rights which Landlord may have against Tenant pursuant to Article XII below. Landlord shall not be required to keep the proceeds from the Letter of Credit Security separate from Landlord’s general funds or be deemed a trustee of same.

(c) Replacement Letter of Credit Security

If, for any reason whatsoever, the Letter of Credit Security becomes subject to cancellation or expiration during the Lease Term, within thirty (30) days prior to expiration of the Letter of Credit Security, Tenant shall cause the Issuer or another bank satisfying the conditions of Section 4.07(a) above to issue and deliver to Landlord a Letter of Credit Security to replace the expiring Letter of Credit Security (the “Replacement Letter of Credit Security”). The Replacement Letter of Credit Security shall be in the same amount as the original Letter of Credit Security and shall be on the terms and conditions set forth in Sections 4.07(a), (i) through (viii) above. Failure of Tenant to cause the Replacement Letter of Credit Security to be issued thirty (30) days prior to the then pending expiration or cancellation shall entitle Landlord to fully draw down on the existing Letter of Credit Security and, at Landlord’s election, shall be an Event of Default under this Lease without any relevant notice and cure period.

(d) Transfer of Beneficiary

During the Lease Term Landlord may transfer its interest in the Lease or Landlord’s Lender may change. Landlord may request a change to Beneficiary under the Letter of Credit Security to the successor of Landlord and/or Landlord’s Lender (the “Transferee”). Tenant agrees to cooperate and to cause Issuer, at Landlord’s cost, to timely issue a new Letter of Credit Security on the same terms and conditions as the original Letter of Credit Security, except that the new Letter of Credit Security shall be payable to the Transferee. Landlord shall surrender the existing Letter of Credit Security to Tenant simultaneously with Tenant’s delivery of the new Letter of Credit Security to Transferee.

(e) Return of the Letter of Credit Security

The Letter of Credit Security or any balance thereof shall be returned (without interest) to Tenant (or, at Tenant’s option, to the last assignee of Tenant’s interests hereunder) within thirty (30) days after the expiration or earlier termination of the Lease and after Tenant has vacated the Premises and surrendered possession; provided that if prior to the Expiration Date a voluntary bankruptcy provision is filed by Tenant, or an involuntary bankruptcy is filed against Tenant by any of Tenant’s creditors other than Landlord, under 11 U.S.C. § 101 et seq., or Tenant executes an assignment for the benefit of creditors, then Landlord shall not be obligated to return the Letter of Credit Security or any proceeds of the Letter of Credit Security until all statutes of limitations for any preference avoidance statutes applicable to such bankruptcy or assignment for the benefit of creditors have elapsed or the bankruptcy court or assignee, whichever is applicable, has executed a binding release releasing Landlord of any and all liability for the preferential transfers relating to payments made under this Lease, and Landlord may retain and offset against any remaining Letter of Credit Security proceeds the full amount Landlord is required to pay to any third party on account of preferential transfers relating to this Lease. Landlord agrees it will cooperate in providing Issuer with a letter of cancellation or such other reasonable documentation as Issuer requests to effect the return and extinguishment of the credit issued under the Letter of Credit Security.

(f) Acknowledgment of Parties

Landlord and Tenant (a) acknowledge and agree that in no event or circumstance shall the Letter of Credit Security or any renewal thereof or substitute therefor or any proceeds thereof be deemed to be or treated as a “security deposit” under any law applicable to security deposits in the commercial context, including, but not limited to Section 1950.7 of the California Civil Code, as such Section now exists or as it may be hereafter amended or succeeded (the “Security Deposit Laws”), (b) acknowledge and agree that the Letter of Credit Security (including any renewal thereof or substitute therefor or any proceeds thereof) is not intended to serve as a security deposit, and the Security Deposit Laws shall have no applicability or relevancy thereto, and (c) waive any and all rights, duties and obligations that any such party may now, or in the future will, have relating to or arising from the Security Deposit Laws. Tenant hereby waives the provisions of Section 1950.7 of the California Civil Code and all other provisions of law, now or hereafter in effect, which (i) establish the time frame by which a Landlord must refund a security deposit under a lease, and/or (ii) provide that a Landlord may

claim from a security deposit only those sums reasonably necessary to remedy defaults in the payment of rent, to repair damage caused by a Tenant or to clean the Premises, it being agreed that Landlord may, in addition, claim those sums specified in this Section 4.07 and/or those sums reasonably necessary to compensate Landlord for any loss or damage caused by Tenant’s breach of this Lease, including any damages Landlord suffers following termination of this Lease.

ARTICLE V

USE

Section 5.01 Permitted Use and Limitations on Use

Tenant shall use and occupy the Premises only for the permitted use set forth in the Summary (the “Permitted Use”) and for no other use or purpose whatsoever. Tenant shall not use, suffer or permit the use of the Premises by any Tenant Party (as defined in Section 7.07 below) in any manner that would constitute waste, nuisance or unlawful acts. Tenant shall not do anything in or about the Premises which would (a) cause structural injury to the Building or the Premises, or (b) cause damage to any part of the Building or the Premises. Tenant shall not operate any equipment within the Building or the Premises which would (i) materially damage the Building or the Common Area, (ii) overload existing mechanical, electrical or other systems or equipment servicing the Building, (iii) impair the efficient operation of the sprinkler system or the heating, ventilating or air conditioning equipment within or servicing the Building, (iv) overload or damage or corrode the sanitary sewer system, or (v) damage the Common Area or any other part of the Project. Tenant shall not attach, hang or suspend anything from the ceiling, roof, walls or columns of the Building or set any load on the floor in excess of the load limits for which such items are designed nor operate hard wheel forklifts within the Premises. Any dust, fumes, or waste products generated by Tenant’s use of the Premises shall be contained and disposed so that they do not (A) create an unreasonable fire or health hazard, (B) damage the Premises, or (C) result in the violation of any Applicable Law. Except as approved by Landlord, Tenant shall not change the exterior of the Building, or the area outside of the Premises, or install any equipment or antennas on or make any penetrations of the exterior or roof of the Building, except as specifically provided herein. Tenant shall not conduct on any portion of the Premises any sale of any kind (but nothing herein is meant to prohibit sales and marketing activities of Tenant’s products and services in the normal course of business consistent with the Permitted Use), including any public or private auction, fire sale, going-out-of-business sale, distress sale or other liquidation sale, and any such sale shall be an immediate Event of Default hereunder without the benefit of a notice and cure period from Landlord, notwithstanding anything to the contrary in this Lease. No materials, supplies, tanks or containers, equipment, finished products or semi-finished products, raw materials, inoperable vehicles or articles of any nature shall be stored upon or permitted to remain within the outside areas of the Premises, except as Alterations subject to the terms of Section 6.03 of this Lease, and in fully fenced and screened areas outside the Building, including but not limited to the areas shown on Schedule 4 attached hereto, which have been designed for such purpose and have been approved in writing by Landlord for such use by Tenant and for which Tenant has obtained all appropriate permits from governmental agencies having jurisdiction over such articles. Notwithstanding anything herein to the contrary, Tenant may install Tenant’s networking equipment in the MPOE as an Alteration subject to the

terms of Section 6.03 of this Lease, so long as such installation and related use is otherwise in compliance with the terms of this Lease.

Section 5.02 Compliance with Laws

Throughout the Lease Term, Tenant shall comply with all applicable laws, statutes, codes, rules, regulations and ordinances including, without limitation, the Americans With Disabilities Act (collectively, the “Applicable Laws”) and covenants and private restrictions recorded and applicable to the Premises promulgated now or in the future regarding the physical condition of the Premises. Without limiting the foregoing, Tenant acknowledges that the Project shall incorporate internal window shades on the first and second floors of the west elevation of the Building that screen from view light and glare to the residential users adjacent to the Project. Tenant shall ensure that such window shades are automatically-timed to unfurl no later than 6:00 PM each day and shall remain drawn until at least 6:00 AM the following day. [NTD: The window shades are automatically timed to meet this schedule. They are a requirement of the City’s conditions of approval for the Project.] By executing this Lease, Tenant acknowledges that it has reviewed and satisfied itself as to its compliance, or intended compliance with the applicable zoning and permit requirements, hazardous materials and waste requirements, and all other Applicable Laws relevant to the uses stated in Section 5.01 above or the occupancy of the Premises.

Section 5.03 Delivery of Premises

(a) Early Entry

Notwithstanding anything herein to the contrary, as of the Delivery Date (as defined below), Tenant and Tenant’s invitees may enter the Premises, at Tenant’s sole risk, for the sole purpose of installation of furniture, fixtures, equipment, trade fixtures, data and telecommunications wiring and equipment and other business related equipment (collectively, the “FF&E”) and the installation of other improvements necessary or desirable for Tenant’s occupancy of the Premises. Tenant’s occupancy of the Premises prior to the Commencement Date shall be solely for the purpose of installing the FF&E and the installation of other improvements necessary or desirable for Tenant’s occupancy of the Premises (and not for the conduct of Tenant’s business) and shall be on all of the terms and conditions of this Lease as though the Lease Term had commenced on the Delivery Date, except the obligation to pay Base Rent, Operating Expenses, Insurance Expenses and Real Estate Taxes. The “Delivery Date” shall mean that date on which all of the following have occurred: (a) this Lease is fully executed and delivered by Landlord and Tenant; and (b) Tenant has delivered to Landlord (i) the Initial Rent, (ii) the Letter of Credit Security, and (iii) evidence of the insurance described in Article VII below. Tenant’s and Tenant’s Parties’ continued right to enter the Premises prior to the Commencement Date shall be conditioned upon such access not interfering with Landlord’s Work. Tenant shall ensure that any entry by Tenant or its invitees does not interfere with the construction or completion of any work to be performed by Landlord hereunder.

(b) Condition of Premises

Landlord shall deliver the Premises to Tenant broom clean, vacant, with Landlord’s Work Substantially Complete. As used in this Lease, “Substantially Complete” means that Landlord’s Work has been completed in pursuant to plans reasonably approved by both Landlord and Tenant, and the relevant agencies have signed off on all construction permits necessary for the Landlord’s Work. Tenant acknowledges and agrees that any certificate of permit for occupancy necessary from the City of Palo Alto for Tenant’s use of the Premises shall be the sole responsibility of Tenant, at Tenant’s expense, and shall not be conditioned to Substantial Completion of the Landlord’s Work or the Commencement Date of this Lease. Subject to the terms of this Lease and Landlord’s obligation to perform the Landlord’s Work and Landlord’s obligation, at Landlord’s sole expense, to install non-mechanized window shades on the remaining exterior windows of the Building (excepting the lobby) as soon as is practical, Tenant hereby accepts the Premises in their condition existing as of the Commencement Date, “AS-IS” and “WITH ALL FAULTS” subject to all Applicable Laws, including, but not limited to any applicable zoning, municipal, county and state laws, ordinances and regulations governing and regulating the use and condition of the Premises, and any private restrictions or covenants or restrictions, liens, encumbrances and title exceptions of record, and accepts this Lease subject thereto and to all matters disclosed thereby and by any exhibits attached hereto; provided, however, that Landlord represents and warrants to Tenant that on the Commencement Date: (i) the Premises shall be in compliance with all Applicable Laws in effect as of the date that Landlord received a construction permit for the performance of the construction of the relevant improvements in the Premises, and (ii) all sewer, plumbing, utility, mechanical, sanitary, storm drainage systems, communication systems, electrical, lighting, heating, ventilation, cooling, and other systems of the Building up to the point of connection to the Building (the “Building Systems”) shall be in good working order and condition (collectively, the “Landlord Premises Warranty”). In the event that it is determined, and Tenant notifies Landlord in writing within nine (9) months after the Commencement Date, that Landlord’s Premises Warranty is untrue, and such failure was not caused by Tenant or any Alterations made by or on behalf of Tenant, then it shall be the obligation of Landlord, and the sole right and remedy of Tenant, after receipt of written notice from Tenant setting forth with reasonable specificity the nature of the failure of the Landlord’s Premises Warranty to be untrue, to promptly, within a reasonable time and at Landlord’s sole cost, correct such failure or defect. Tenant’s failure to give such written notice to Landlord within nine (9) months after the Commencement Date shall constitute a conclusive presumption that Landlord’s Premises Warranty is true and correct, and any required correction, maintenance and repair after that date shall be performed by the party responsible for such repair pursuant to the terms of this Lease. Except as specifically set forth in this Lease, Landlord shall not be obligated to provide or pay for any improvement work or services related to the improvement of the Premises. Tenant acknowledges that neither Landlord nor any agent of Landlord has made any representation or warranty as to the present or future suitability of the Premises for the conduct of Tenant’s business. Neither party has been induced to enter into this Lease by, nor is either party is relying on, any representation or warranty outside those expressly set forth in this Lease.

(c) Inspection by a CASp in Accordance with Civil Code Section 1938