Exhibit 99.1

F-1

PRESTIGE

WEALTH INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

| March 31,

2025 | September 30,

2024 | |||||||

| (Unaudited) | ||||||||

| ASSETS | ||||||||

| Cash and cash equivalents | $ | $ | ||||||

| Accounts receivable | ||||||||

| Contract asset | ||||||||

| Note Receivables, net | ||||||||

| Amounts due from related parties, net | ||||||||

| Right-of-use assets | ||||||||

| Income tax receivables | ||||||||

| Prepaid deposit for acquisition | ||||||||

| Deposit for long term investment | ||||||||

| Prepaid expenses and other assets, net | ||||||||

| Goodwill | — | |||||||

| Intangible assets | ||||||||

| Total assets | $ | $ | ||||||

| LIABILITIES AND SHAREHOLDERS’ EQUITY | ||||||||

| Liabilities | ||||||||

| Tax payable | $ | $ | ||||||

| Lease liability | ||||||||

| Amounts due to related parties | ||||||||

| Deferred tax liabilities | ||||||||

| Deposits from private placement | ||||||||

| Other payables and accrued liabilities | ||||||||

| Total liabilities | $ | $ | ||||||

| Shareholders’ equity | ||||||||

| Ordinary share ($ | $ | $ | ||||||

| Additional paid in capital | ||||||||

| Subscription receivable | ( | ) | ||||||

| Accumulated deficit | ( | ) | ( | ) | ||||

| Accumulated other comprehensive income | ( | ) | ( | ) | ||||

| Total shareholders’ equity | $ | $ | ||||||

| Total liabilities and shareholders’ equity | $ | $ | ||||||

| * |

See notes to the consolidated financial statements

F-2

PRESTIGE

WEALTH INC.

CONDENSED CONSOLIDATED STATEMENTS OF INCOME AND COMPREHENSIVE INCOME

| For

the six months ended March 31, | ||||||||

| 2025 | 2024 | |||||||

| (Unaudited) | (Unaudited) | |||||||

| Net revenue | ||||||||

| Wealth management services | ||||||||

| Referral fees | $ | $ | ||||||

| Asset management services | ||||||||

| Advisory service fees | ||||||||

| Management fees | ||||||||

| Subtotal | ||||||||

| Total net revenue | ||||||||

| Gross Margin | ||||||||

| Operation cost and expenses | ||||||||

| Selling, general and administrative expenses | ||||||||

| Total operation cost and expenses | ||||||||

| Loss from operations | ( | ) | ( | ) | ||||

| Other income | ||||||||

| Loss before income taxes | ( | ) | ( | ) | ||||

| Income taxes benefits (expenses) | ( | ) | ||||||

| Net loss | $ | ( | ) | $ | ( | ) | ||

| Other comprehensive income | ||||||||

| Foreign currency translation adjustment | ||||||||

| Total comprehensive income | $ | ( | ) | $ | ( | ) | ||

| Loss per ordinary share | ||||||||

| Basic and diluted | $ | ( | ) | $ | ( | ) | ||

| Weighted average number of ordinary shares outstanding* | ||||||||

| Basic and diluted | ||||||||

| * |

See notes to the consolidated financial statements

F-3

PRESTIGE

WEALTH INC.

CONDENSED CONSOLIDATED STATEMENTS OF CHANGES IN SHAREHOLDERS’ EQUITY

| Ordinary Shares | Subscription | Additional paid | Retained | Accumulated other comprehensive | Total shareholders’ | |||||||||||||||||||||||

| Shares* | Amount | receivable | in capital | earnings | income (loss) | equity | ||||||||||||||||||||||

| Balance, September 30, 2023 | $ | $ | $ | $ | $ | ( | ) | $ | ||||||||||||||||||||

| Net loss | — | ( | ) | ( | ) | |||||||||||||||||||||||

| Foreign currency translation adjustment | — | |||||||||||||||||||||||||||

| Balance, March 31, 2024 (Unaudited) | $ | $ | $ | $ | $ | ( | ) | $ | ||||||||||||||||||||

| Balance, September 30, 2024 | $ | $ | $ | $ | ( | ) | $ | ( | ) | $ | ||||||||||||||||||

| Net loss | — | ( | ) | ( | ) | |||||||||||||||||||||||

| Issuance of common shares | ( | ) | ||||||||||||||||||||||||||

| Warrants issued | — | |||||||||||||||||||||||||||

| Warrants exercised | ( | ) | ( | ) | ||||||||||||||||||||||||

| Foreign currency translation adjustment | — | |||||||||||||||||||||||||||

| Balance, March 31, 2025 (Unaudited) | $ | $ | ( | ) | $ | $ | ( | ) | $ | ( | ) | $ | ||||||||||||||||

| * | The ordinary shares are presented on a retroactive basis to reflect the Company’s share subdivision on July 15, 2022. |

See notes to the consolidated financial statements

F-4

PRESTIGE

WEALTH INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

| For

six months ended March 31, | ||||||||

| 2025 | 2024 | |||||||

| (Unaudited) | (Unaudited) | |||||||

| Cash flows from operating activities | ||||||||

| Net loss | ( | ) | ( | ) | ||||

| Adjustments to reconcile net income to net cash provided by operating activities: | ||||||||

| Deferred tax benefit | ( | ) | ( | ) | ||||

| Allowance for credit losses | ( | ) | ||||||

| Amortization of Right-of-use assets | ||||||||

| Interest on Lease liabilities | ||||||||

| Shares-based compensation | ||||||||

| Gain on termination of Right-of-use assets | ( | ) | ||||||

| Changes of Working Capital | ||||||||

| Accounts receivable | ( | ) | ||||||

| Contract assets | ||||||||

| Amounts due from related parties | ( | ) | ||||||

| Prepaid expenses and other assets | ( | ) | ||||||

| Income tax receivable | ( | ) | ( | ) | ||||

| Leases | ( | ) | ||||||

| Amounts due to related parties | ||||||||

| Income tax payable | ( | ) | ||||||

| Other payables and accrued liabilities | ||||||||

| Net cash used in operating activities | ( | ) | ( | ) | ||||

| Cash flows from investing activities: | ||||||||

| Loan to a third party | ( | ) | ( | ) | ||||

| Loan & interest repayment from a third party | ||||||||

| Deposit for long term investment | ( | ) | ||||||

| Net cash (used in) provided by investing activities | ( | ) | ||||||

| Cash flows from financing activities: | ||||||||

| Proceeds from private placement | ||||||||

| Net cash provided by financing activities | ||||||||

| Effect of exchange rate changes on cash and cash equivalents | ( | ) | ||||||

| Net change in cash and cash equivalents | ( | ) | ( | ) | ||||

| Cash and cash equivalents, beginning of the year | ||||||||

| Cash and cash equivalents, end of the year | $ | $ | ||||||

| Supplemental cash flow information | ||||||||

| Income tax paid | $ | $ | ( | ) | ||||

| Supplemental disclosure of non-cash operating activities | ||||||||

| Net off of amount due to/from RPT | $ | $ | ||||||

See notes to the consolidated financial statements

F-5

PRESTIGE

WEALTH INC.

NOTES TO UNAUDITED INTERIM CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

Note 1 ORGANIZATION

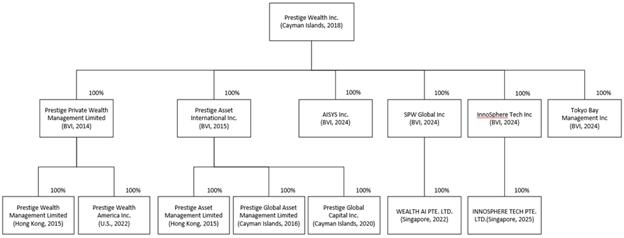

Prestige Wealth Inc. (“PWI”, or the “Company”) is a limited liability company established under the laws of the Cayman Islands on October 25, 2018. It is engaged in providing wealth management services and asset management services to high net worth and ultra-high net worth individuals and enterprises through its subsidiaries.

PRESTIGE

PRIVATE WEALTH MANAGEMENT LIMITED (“PPWM”), which was

Prestige Wealth Management Limited (“PWM”) is a wholly owned subsidiary of PPWM. It was established on January 26, 2015 in Hong Kong, and provides wealth management services to third parties.

PRESTIGE

ASSET INTERNATIONAL INC. (“PAI”) was incorporated in British Virgin Islands on December 4, 2015 and was

Prestige Asset Management Limited (“PAM”) is a wholly-owned subsidiary of PAI. It was established in accordance with laws and regulations of Hong Kong on December 14, 2015, and serves as investment advisor and provides investment advisory services to third parties with respect to identifying suitable target investment projects that fit the specific investment needs of investors.

Prestige Global Asset Management Limited (“PGAM”) is a wholly-owned subsidiary of PAI. It was established on June 8, 2016 under the laws of the Cayman Islands, and provides asset management services by managing various investment portfolios for high net worth and ultra-high net worth individuals and enterprises.

Prestige Global Capital Inc. (“PGCI) is a wholly-owned subsidiary of PAI. It was established on November 3, 2020 under the laws of the Cayman Islands, and provides asset management services by serving as a general partner of an Exempted Limited Partnership.

Prestige Wealth America Inc. (“PWAI”) is a wholly owned subsidiary of PPWM. It was established on February 15, 2022 in California, and provides wealth management services to third parties.

AISYS

Inc. (“AISYS”) was incorporated in the British Virgin Islands on May 10, 2024 and is

SPW Global Inc (“SPW”) was incorporated in the British Virgin Islands on March 11, 2024, which in turn wholly owns Wealth AI PTE LTD. (“Wealth AI”). On November 4, 2024, PWI completed its acquisition of all shares of SPW.

F-6

PRESTIGE

WEALTH INC.

NOTES TO UNAUDITED INTERIM CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

Note 1 ORGANIZATION (cont.)

Wealth AI PTE LTD. (“Wealth AI”) is a wholly-owned subsidiary of SPW. It was established May 20, 2022 in Singapore, and offers personalized, cost-effective wealth management solutions using artificial intelligence.

Tokyo Bay Management Inc. (“Tokyo Bay”) was incorporated in the British Virgin Islands on April 05, 2024, Tokyo Bay is a company based in Tokyo, Japan, providing wealth management services, family affairs services, lifestyle management services and related value-added services to high-net-worth clients in Japan. PWI completed its acquisitions of Tokyo Bay on December 16, 2024.

InnoSphere Tech Inc. (“InnoSphere Tech”) was incorporated in the British Virgin Islands on October 28, 2024, and it is a technology company that leverages its advantages in web scraping technology to collect data on finance, wealth management, and related industries according to international standards. PWI completed its acquisitions of InnoSphere Tech on December 16, 2024.

InnoSphere Tech Pte. LTD. (“InnoSphere Singapore”) is a wholly-owned subsidiary of InnoSphere Tech. It was established on February 20, 2025 in Singapore, and it focuses on developing platforms integrating AI based technology.

Group chart of the Company after reorganization is set out below:

F-7

PRESTIGE

WEALTH INC.

NOTES TO UNAUDITED INTERIM CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

Note 1 ORGANIZATION (cont.)

Details of the subsidiaries of the Company after reorganization are set out below:

| Name | Date of Incorporation | Place of incorporation | Percentage of effective ownership | Principal Activities | ||||

| Subsidiaries | ||||||||

| PPWM | ||||||||

| PWM | ||||||||

| PAI | ||||||||

| PAM | ||||||||

| PGAM | ||||||||

| PGCI | ||||||||

| PWAI | ||||||||

| AISYS | ||||||||

| SPW | ||||||||

| Wealth AI | ||||||||

| Tokyo Bay | ||||||||

| InnoSphere Tech | ||||||||

| InnoSphere Singapore |

Note 2 SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Basis of presentation and consolidation

The accompanying consolidated balance sheet as of September 30, 2024, which has been derived from audited financial statements, and the unaudited interim condensed consolidated financial statements as of March 31, 2025 and for the six months ended March 31, 2025 and 2024 have been prepared pursuant to the rules and regulations of the Securities and Exchange Commission (the “SEC”). Certain information and disclosures, which are normally included in financial statements prepared in accordance with United States generally accepted accounting principles, have been condensed or omitted pursuant to such rules and regulations. Management believes that the disclosures made are adequate to provide a fair presentation. The interim financial information should be read in conjunction with the financial statements and the notes for the fiscal years ended September 30, 2024 and 2023.

This basis of accounting involves the application of accrual accounting and consequently, revenues and gains are recognized when earned, and expenses and losses are recognized when incurred. The Company’s financial statements are expressed in U.S. Dollars.

In the opinion of management, all adjustments (which include normal recurring adjustments) necessary to present a fair statement of the Company’s unaudited condensed consolidated financial position as of March 31, 2025, its consolidated results of operations and cash flows for the six months ended March 31, 2025 and 2024, as applicable, have been made. The interim results of operations are not necessarily indicative of the operating results for the full fiscal year or any future periods.

Use of estimates

The preparation of consolidated financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosures of contingent assets and liabilities as of the date of the financial statements and the reported amounts of revenues and expenses during the periods presented. Significant accounting estimates reflected in the Company’s consolidated financial statements include, but are not limited to, allowance for doubtful accounts, and the assessment of the valuation allowance on deferred tax assets. Actual results could differ from these estimates.

F-8

PRESTIGE

WEALTH INC.

NOTES TO UNAUDITED INTERIM CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

Note 2 SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (cont.)

Revenue recognition

The Group adopted ASC Topic 606 (“ASC 606”), Revenue from Contract with Customers, with effect from October 1, 2019, using the modified retrospective method applied to those contracts which were not completed as October 1, 2019.

Under Topic 606, the entity should recognize revenue to depict the transfer of promised goods or services to clients in an amount that reflects the consideration to which the entity expects to be entitled in exchange for those goods or services.

To achieve that core principle, an entity should apply the following steps:

Step 1: Identify the contract(s) with a customer.

Step 2: Identify the performance obligations in the contract.

Step 3: Determine the transaction price.

Step 4: Allocate the transaction price to the performance obligations in the contract.

Step 5: Recognize revenue when (or as) the entity satisfies a performance obligation.

Revenue recognition policies for each type of service are discussed as follows:

Advisory service fees

The Company acts as ongoing advisor to the client and provides a package of advisory services, including but not limited to, advising on global asset allocation, selecting and recommending suitable promotion or distribution channels for the issuance of the fund, coordinating daily operation and setting up meetings during post-establishment period, selecting and coordinating with lawyers for legal agreements and documents preparation, selecting qualified fund service providers, etc., as needed during the agreed-upon service period. Each contract of advisory service is accounted for as a single performance obligation which is satisfied over the service period. The Company allocates the transaction price to the single performance obligation based on a fixed annual fee and recognized revenue over the service period on a monthly basis.

Referral fees

The Company enters into contracts with brokers and refers high net worth or ultra-high net worth client who subscribe to wealth management products from the brokers, such referral service is regarded as the single performance obligation. The Company is then entitled to receive referral fees paid directly by the brokers; the referral fees are computed as a percentage of the premiums paid by the clients for purchase of the wealth management products distributed by the brokers.

When the client was referred to the broker, and relative wealth management products were successfully subscribed by the client, the performance obligation was satisfied. Revenue on first year premiums and if applicable, renewal premiums is recognized at the point in time when a client referred by the Company subscribes to wealth management products through the use of brokers the Company works with and such client has paid the requisite premiums and the applicable free look period has expired. Contract asset is recognized for the unbilled renewal referral fee as relevant service is provided, but payment contingent on the completion of the renewal. There is no significant financing component since the difference between the promised consideration and cash selling price of the service arises for reason other than the provision of finance to either the customer or the Company, and the difference between those amounts is proportional to the reason for the difference

F-9

PRESTIGE

WEALTH INC.

NOTES TO UNAUDITED INTERIM CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

Note 2 SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (cont.)

Management fees

The

Company is entitled to receive a management fee of one-twelfth of

The

Company is entitled to receive a management fee from either the discretionary account management or the fund the Company used to manage,

Prestige Capital Markets Fund I L.P., which is of

For the fund Prestige Capital Markets Fund I L.P., these customer contracts require the Company to provide fund management services, which represents a performance obligation that the Company satisfies over time. The management fee will be payable in US Dollars monthly in arrears as soon as the net asset value calculation was completed by the fund administrator and approved by the Company at the end of each month and recognized as revenue.

Disaggregation of revenue

The following table illustrates the disaggregation of revenue:

| For

the six months ended March 31, | ||||||||

| 2025 | 2024 | |||||||

| (Unaudited) | (Unaudited) | |||||||

| Revenue | ||||||||

| Referral fees | $ | $ | ||||||

| Advisory service fees | ||||||||

| Management fees | ||||||||

| Net Revenue | $ | $ | ||||||

| For

the six months ended March 31, | ||||||||

| 2025 | 2024 | |||||||

| (Unaudited) | (Unaudited) | |||||||

| Timing of Revenue Recognition | ||||||||

| Services transferred at a point in time | $ | $ | ||||||

| Services transferred over time | ||||||||

| $ | $ | |||||||

Contract assets

Contract assets represent the Company’s rights to consideration in exchange for services that the Company has transferred to the customer before payment is due. At the point of revenue recognition, the Company has completed all performance under the contract; however, their rights to consideration are conditional on the future renewal. As such, the Company records a corresponding contract assets for the renewal premiums allocated to referral services that have already been fulfilled the whole performance obligation. The Company only recognizes contract assets to the extent that the Company believes it is probable that it will collect substantially all of the consideration to which it will be entitled in exchange for the services transferred to the customer.

The contract assets will increase when the Company recognizes it and will decrease when the payment is due and be reclassified to a receivable.

F-10

PRESTIGE

WEALTH INC.

NOTES TO UNAUDITED INTERIM CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

Note 2 SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (cont.)

The contract assets will not be reclassified to a receivable given that the right to invoice and the payment due date is the same date. Per ASC 606-10-45-3, an entity shall assess a contract asset for impairment in accordance with Topic 310 on receivables. Per ASC 606-10-50-4a, impairment losses recognized on receivables or contract assets are disclosed separately from other impairment losses.

Contract assets are stated at the historical carrying amount net of write-offs and allowance for uncollectible accounts. The Company establishes an allowance for uncollectible accounts based on estimates, historical experience and other factors surrounding the credit risk of specific clients. Uncollectible accounts are written-off when a settlement is reached for an amount that is less than the outstanding historical balance or when the Company has determined the balance will not be collected.

Contract assets as of March 31, 2025 and September 30, 2024 are as follows:

| As of March 31, 2025 | As of September 30, 2024 | |||||||

| (Unaudited) | ||||||||

| Contract assets, net | $ | $ | ||||||

During

the year ended September 30, 2024, the Group recognized that the contract assets which derived from insurance commission, required a

full allowance due to the non-renewal of the insurance. As of September 30, 2024, the allowance for credit losses were $

The significant changes in the contract assets balances during the six months ended March 31, 2025 and the year ended September 30, 2024 are as follows:

| Contract assets | ||||

| USD | ||||

| Balance as of 9/30/2023 | ||||

| Net off amount of payment due | ( | ) | ||

| Provision of current expected credit losses | ( | ) | ||

| Exchange diff. | ||||

| Balance as of 9/30/2024 | ||||

| Net off amount of payment due | ( | ) | ||

| Exchange diff. | ( | ) | ||

| Balance as of 3/31/2025 (Unaudited) | ||||

F-11

PRESTIGE

WEALTH INC.

NOTES TO UNAUDITED INTERIM CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

Note 2 SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (cont.)

Business combinations

The Company accounts for its business combinations using the acquisition method of accounting in accordance with Accounting Standards Codification (“ASC”) 805 “Business Combinations.” The cost of an acquisition is measured as the aggregate of the acquisition date fair values of the assets transferred and liabilities incurred by the Company to the sellers and equity instruments issued. Transaction costs directly attributable to the acquisition are expensed as incurred. Identifiable assets and liabilities acquired or assumed are measured separately at their fair values as of the acquisition date, irrespective of the extent of any non-controlling interests. The excess of (i) the total costs of acquisition, fair value of the non-controlling interests and acquisition date fair value of any previously held equity interest in the acquiree over (ii) the fair value of the identifiable net assets of the acquiree is recorded as goodwill. If the cost of acquisition is less than the fair value of the net assets of the subsidiary acquired, the difference is recognized directly in the consolidated statements of comprehensive income. During the measurement period, which can be up to one year from the acquisition date, the Company may record adjustments to the assets acquired and liabilities assumed with the corresponding offset to goodwill. Upon the conclusion of the measurement period or final determination of the values of assets acquired or liabilities assumed, whichever comes first, any subsequent adjustments are recorded to the consolidated statements of comprehensive income.

In a business combination achieved in stages, the Company re-measures the previously held equity interest in the acquiree immediately before obtaining control at its acquisition-date fair value and the re-measurement gain or loss, if any, is recognized in the consolidated statements of comprehensive income.

When there is a change in ownership interests that results in a loss of control of a subsidiary, the Company deconsolidates the subsidiary from the date control is lost. Any retained non-controlling investment in the former subsidiary is measured at fair value and is included in the calculation of the gain or loss upon deconsolidation of the subsidiary.

Goodwill

Goodwill is initially measured at cost, being the excess of the aggregate of the consideration transferred, the amount recognized for non-controlling interests and any fair value of the Group’s previously held equity interests in the acquiree over the identifiable assets acquired and liabilities assumed. If the sum of this consideration and other items is lower than the fair value of the net assets acquired, the difference is, after reassessment, recognized in profit or loss as a gain on bargain purchase.

After initial recognition, goodwill is measured at cost less any accumulated impairment losses. Goodwill is tested for impairment annually or more frequently if events or changes in circumstances indicate that the carrying value may be impaired. For the purpose of impairment testing, goodwill acquired in a business combination is, from the acquisition date, allocated to each of the Group’s cash-generating units, or groups of cash-generating units, that are expected to benefit from the synergies of the combination, irrespective of whether other assets or liabilities of the Group are assigned to those units or groups of units.

Where goodwill has been allocated to a cash-generating unit (or group of cash-generating units) and part of the operation within that unit is disposed of, the goodwill associated with the operation disposed of is included in the carrying amount of the operation when determining the gain or loss on the disposal. Goodwill disposed of in these circumstances is measured based on the relative value of the operation disposed of and the portion of the cash-generating unit retained.

F-12

PRESTIGE

WEALTH INC.

NOTES TO UNAUDITED INTERIM CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

Note 2 SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (cont.)

Intangible assets (other than goodwill)

Intangible assets acquired separately are measured on initial recognition at cost. The cost of intangible assets acquired in a business combination is the fair value at the date of acquisition. The useful lives of intangible assets are assessed to be either finite or indefinite. Intangible assets with finite lives are subsequently amortized over the useful economic life and assessed for impairment whenever there is an indication that the intangible asset may be impaired. The amortization period and the amortization method for an intangible asset with a finite useful life are reviewed at least at each financial year end.

Intangible

assets are stated at cost less any impairment losses and are amortized on the straight-line basis over their estimated useful lives.

| Categories | Estimated useful lives | |

| Software | ||

| Patent | ||

| Trademark | ||

| Customer relationship | ||

| Non-patented technology |

The useful economic life for software is based on the anticipated number of years the software will retire due to significant upgrades to the software. The useful life of patent is estimated based on the shorter of legal registered period and the period over which the patent is expected to generate economic benefit. The useful life of trademarks is based on the estimated periods that the Group intends to derive future economic benefits from the use of the assets. Besides, The Group also takes into account factors including the duration of the patent and trademark, as well as the useful lives of similar assets in the marketplace. The customer relationship was acquired in a business combination recognized separately from goodwill and is initially recognized at its fair value at the acquisition date, which is regarded as their cost. Purchased non-patented technology is stated at cost less any impairment losses and amortized on the straight-line basis over its estimated useful lives of 10 years.

Warrants

Warrants issued by the Group are classified as equity instruments. The proceeds received, or the fair value of the warrants issued as part of a business combination or other equity financing, is recorded within additional paid-in capital upon issuance. Subsequent transactions, including the exercise or expiration of these warrants, are treated as reclassifications between equity accounts and do not result in the recognition of gain or loss in the consolidated statements of operations.

Impairment of long-lived assets

The Company evaluates its long-lived assets, including right-of-use assets, for impairment whenever events or changes in circumstances indicate that the carrying amount of an asset may not be recoverable in accordance with ASC subtopic 360-10, Property, Plant and Equipment: Overall (“ASC 360-10”). When these events occur, the Group assesses the recoverability of the long-lived assets by comparing the carrying amount of the assets to future undiscounted net cash flow expected to result from the use of the assets and their eventual disposition. If the sum of the expected undiscounted cash flow is less than the carrying amount of the assets, the Group will recognize an impairment loss equal to the excess of the carrying amount over the fair value of the assets. Impairment of long-lived assets were and as of March 31, 2025 and September 30, 2024, respectively.

F-13

PRESTIGE

WEALTH INC.

NOTES TO UNAUDITED INTERIM CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

Note 2 SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (cont.)

Subscription receivable

As of March 31, 2025, subscriptions receivable represented the commitment from an investor to purchase capital stock of the Group. Since the shares had already been issued, and the amount was not yet received by the Group, this item was recorded as subscriptions receivable on the equity section of the Group’s balance sheet as of March 31, 2025.

Segment Reporting

In accordance with ASC 280, Segment Reporting, an operating segment is identified as a component of an enterprise of which separate financial information and operating results are available and regularly reviewed by the Company’s chief operating decision maker (“CODM”). The Company has one operating and reportable segment with one business activity – earning referral fee from brokers. The Company’s CODM is its Chief Executive Officer. The Company’s CODM reviews financial information presented on a consolidated basis. The CODM uses the consolidated income or loss from operations and net income (loss) to evaluate financial performance, make decisions and allocate resources. The CODM also reviews the functional expenses such as selling and marketing expenses, research and development expenses and general and administrative expenses at the consolidated level to manage the Company’s operations. The CODM does not use asset or liability information in assessing the Company’s operating segment.

Recently Issued Accounting Standards adopted by the Company

The ASU 2023-07: Segment Reporting (Topic 280): Improvements to Reportable Segment Disclosures provides improvements to reportable segment disclosure requirements, primarily through enhanced disclosures about significant segment expenses. In addition, the amendments enhance interim disclosure requirements, clarify circumstances in which an entity can disclose multiple measures of segment profit or loss, provide new segment disclosure requirements for entities with a single reportable segment and contain other disclosure requirements. The ASU is effective for fiscal years beginning after December 15, 2023, and interim periods in fiscal years beginning after December 15, 2024. The ASU should be adopted retrospectively to all periods presented in the financial statements unless it is impracticable to do so. The Company adopted this guidance during the period ended March 31, 2025. The impact of the adoption of this guidance was not material to our financial position or results of operations, as the requirements impact only segment reporting disclosures in our notes to financial statements. See Segment Reporting above for further details.

Recently Issued Accounting Standards, not yet Adopted by the Company

The ASU 2025-01: Income Statement-Reporting Comprehensive Income-Expense Disaggregation Disclosures (Subtopic 220-40) issued in January 2025 clarified the effective date of ASU 2024-03 published on November 4, 2024. ASU 2024-03 expanded the disclosure of financial statements under ASC 220-40 and requires public business entities (“PBE”) to provide a disaggregated disclosure of certain expense captions into specified categories in disclosure within the footnote to the financial statements while it does not change the expense captions on the face of the income statement. In the footnote to the financial statements, PBEs are required to disaggregate, in a tabular presentation, each relevant expense caption on the face of the income statement that includes any of the following natural expenses: (1) purchases of inventory, (2) employee compensation, (3) depreciation, (4) intangible asset amortization, and (5) depreciation, depletion, and amortization (DD&A) recognized as part of oil and gas-producing activities or other types of depletion expenses. The tabular disclosure would also include certain other expenses, when applicable. This ASU will be effective for PBEs for annual reporting periods beginning after December 15, 2026, and interim reporting periods within annual reporting periods beginning after December 15, 2027. Early adoption is allowed. The Company is evaluating the impact of the adoption of this guidance in its consolidated financial statements.

The ASU 2023-09: Income Taxes (Topic 740): Improvements to Income Tax Disclosures enhances existing income tax disclosures primarily related to the rate reconciliation and income taxes paid information. With regard to the improvements to disclosures of rate reconciliation, a public business entity is required on an annual basis to (1) disclose specific categories in the rate reconciliation and (2) provide additional information for reconciling items that meet a quantitative threshold. Similarly, a public entity is required to provide the amount of income taxes paid (net of refunds received) disaggregated by (1) federal, state, and foreign taxes and by (2) individual jurisdictions in which income taxes paid (net of refunds received) is equal to or greater than 5 percent of total income taxes paid (net of refunds received). The ASU also includes certain other amendments to improve the effectiveness of income tax disclosures, for example, an entity is required to provide (1) pretax income (or loss) from continuing operations disaggregated between domestic and foreign, and (2) income tax expense (or benefit) from continuing operations disaggregated by federal, state, and foreign. ASU 2023-07: Segment Reporting (Topic 280): Improvements to Reportable Segment Disclosures. The ASU will be effective for annual periods beginning after December 15, 2024. Entities are required to apply the ASU on a prospective basis. The adoption of ASU 2023-09 is not expected to materially impact the Company’s consolidated balance sheets, statements of income and comprehensive income, cash flows or disclosures.

Other accounting standards that have been issued by FASB that do not require adoption until a future date are not expected to have a material impact on the consolidated financial statements upon adoption. The Company does not discuss recent standards that are not anticipated to have an impact on or are unrelated to its consolidated balance sheets, statements of income and comprehensive income, cash flows or disclosures.

F-14

PRESTIGE

WEALTH INC.

NOTES TO UNAUDITED INTERIM CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

Note 2 SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (cont.)

Recently issued ASUs by the FASB, except for the ones mentioned above, are not expected to have a significant impact on the Company’s consolidated results of operations or financial position.

Note 3 CONCENTRATIONS

Credit risk

Credit

risk is the risk that an issuer or counterparty will be unable or unwilling to meet a commitment (including the payment of amounts arising

from derivative contracts) in full when due, that the issuer or counterparty have entered into with the Company. Financial instruments

that potentially subject the Company to significant concentrations of credit risk consist primarily of cash. The bank accounts are not

insured by Federal Deposit Insurance Corporation (“FDIC”) insurance or other insurance. As of March 31, 2025 and September 30,

2024, $

Concentration risk

Concentration of customers

| For the six months ended March 31, | ||||||||||||||||

| Revenues | 2025 | % | 2024 | % | ||||||||||||

| (Unaudited) | (Unaudited) | |||||||||||||||

| Company A | ||||||||||||||||

| Company B | ||||||||||||||||

| Company N | ||||||||||||||||

| $ | $ | |||||||||||||||

F-15

PRESTIGE

WEALTH INC.

NOTES TO UNAUDITED INTERIM CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

Note 3 CONCENTRATIONS (cont.)

Accounts receivable | As

of March 31, 2025 | % | As

of September 30, 2024 | % | ||||||||||||

| (Unaudited) | (Unaudited) | |||||||||||||||

| Company H | ||||||||||||||||

| Company I | ||||||||||||||||

| $ | $ | |||||||||||||||

| * |

Note 4 BUSINESS COMBINATION

On

August 20, 2024, the Company entered into a definitive acquisition agreement, pursuant to which it would purchase all shares of SPW Global

Inc. (“SPW”), a company incorporated under the laws of the British Virgin Islands, which in turn wholly owns Wealth AI PTE

LTD. (“Wealth AI”). Wealth AI is a company based in Singapore that offers personalized, cost-effective wealth management

solutions using artificial intelligence. The total purchase price is US$

On

November 5, 2024, the Company entered into a definitive acquisition agreement, pursuant to which the Company will purchase all shares

of InnoSphere Tech Inc., a company incorporated under the laws of the British Virgin Islands. The total purchase price is US$

On

November 12, 2024, the Company entered into a definitive acquisition agreement pursuant to which PWM will purchase all shares of Tokyo

Bay, a company incorporated under the laws of the British Virgin Islands. The total purchase price is US$

Wealth AI |

Tokyo Bay | InnoSphere Tech | Total | |||||||||||||

| Net liabilities acquired (including cash of $ | $ | ( | ) | $ | $ | ( | ) | |||||||||

| Intangible assets(1) | ||||||||||||||||

| Goodwill | ||||||||||||||||

| Deferred tax liabilities(2) | ( | ) | ( | ) | ||||||||||||

| Total | $ | $ | $ | $ | ||||||||||||

| Total purchase price comprised of: | ||||||||||||||||

| – cash consideration | $ | $ | $ | $ | ||||||||||||

| – share-based consideration | ||||||||||||||||

| – warrants issued | ||||||||||||||||

| Total | $ | $ | $ | $ | ||||||||||||

| (1) |

| (2) |

The

transaction resulted in a purchase price allocation of $

F-16

PRESTIGE

WEALTH INC.

NOTES TO UNAUDITED INTERIM CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

Note 5 ACCOUNTS RECEIVABLE

Accounts receivable consist of the following natures:

| As

of March 31, 2025 | As

of September 30, 2024 | |||||||

| (Unaudited) | ||||||||

| Referral fees | $ | $ | ||||||

| Management fees | ||||||||

| Less: allowance for uncollectible receivables | ( | ) | ( | ) | ||||

| Total | $ | $ | ||||||

The aging of accounts receivable before allowance for uncollectible receivables is as follows:

| 0 – 90 days | 90 – 180 days | 180 days – 1 year | 1 year above | Total | ||||||||||||||||

| Referral fees | ||||||||||||||||||||

| Management fees | ||||||||||||||||||||

| Balance as of 9/30/2024 | $ | $ | $ | $ | $ | |||||||||||||||

| Referral fees | ||||||||||||||||||||

| Management fees | ||||||||||||||||||||

| Balance as of 3/31/2025 (Unaudited) | $ | $ | $ | $ | $ | |||||||||||||||

The movement of allowance is as follows:

| As

of March 31, 2025 | As

of September 30, 2024 | |||||||

| (Unaudited) | ||||||||

| Balance at beginning of the year | $ | $ | ||||||

| Current year reversal | ( | ) | ||||||

| Written-off as uncollectible | ( | ) | ||||||

| Changes due to foreign exchange | ||||||||

| Balance at end of the year | $ | $ | ||||||

The allowance for doubtful accounts is the Company’s best estimate of the amount of probable credit losses in the Company’s existing accounts receivable. The Company determines the allowance based on aging data, historical collection experience, customer specific facts, and existing economic conditions.

F-17

PRESTIGE

WEALTH INC.

NOTES TO UNAUDITED INTERIM CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

Note 6 PREPAID EXPENSES AND OTHER ASSETS

Prepaid expenses and other assets consist of the following items:

| As

of March 31, 2025 | As

of September 30, 2024 | |||||||

| (Unaudited) | ||||||||

| Fund advance payment(1) | $ | $ | ||||||

| Deposit for long term investment(2) | ||||||||

| Prepaid deposit for acquisition(3) | ||||||||

| Rental deposit | ||||||||

| Prepayment | ||||||||

| Amount due from Prestige Financial Holdings Group Limited (“PFHL”)(4) | ||||||||

| Others | ||||||||

| Less: allowance for uncollectible receivables | ( | ) | ( | ) | ||||

| Total | $ | $ | ||||||

| Prepaid deposit for acquisition | ||||||||

| Prepaid expenses and other assets | ||||||||

| Deposit for long term investments | ||||||||

| Total | $ | $ | ||||||

| (1) |

| (2) |

| (3) |

| (4) |

F-18

PRESTIGE

WEALTH INC.

NOTES TO UNAUDITED INTERIM CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

Note 7 OTHER PAYABLES AND ACCRUED LIABILITIES

Other payables and accrued liabilities consist of the following items:

| As

of March 31, 2025 | As

of September 30, 2024 | |||||||

| (Unaudited) | ||||||||

| Service fee payable | $ | $ | ||||||

| Accrued payroll | ||||||||

| Mandatory provident fund payable | ||||||||

| Dividend payable | ||||||||

| Deposits from private placement(1) | ||||||||

| Consideration payable(2) | ||||||||

| Others | ||||||||

| Total | $ | $ | ||||||

| (1) |

| (2) |

Note 8 WARRANT DERIVATIVE

On

June 24, 2024, the Company entered into a Business Development & Marketing Consulting Agreement with unrelated investor to provide

certain services to the Group in connection with business development, market expansion, sales channel establishment, marketing strategies,

and product planning in Japan. Under the Consulting Agreement, the Company agreed to pay $

On

July 1, 2024, the Company entered into a Software Technology Service Contract with unrelated investor to provide complete system customization,

development, testing, delivery, and operation and maintenance services to the Company. Under the Service Agreement, the Company agreed

to pay $

F-19

PRESTIGE

WEALTH INC.

NOTES TO UNAUDITED INTERIM CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

Note 8 WARRANT DERIVATIVE (cont.)

On

September 9, 2024, the Company entered into a Securities Purchase Agreement with certain accredited investors for a private placement

offering (“Private Placement”), pursuant to which the Company received gross proceeds of approximately $

On

November 5, 2024, the Company entered into a definitive acquisition agreement, pursuant to which the Company will purchase all shares

of InnoSphere Tech Inc., a company incorporated under the laws of the British Virgin Islands. The total purchase price is US$

On

November 12, 2024, the Company entered into a definitive acquisition agreement pursuant to which PWM will purchase all shares of Tokyo

Bay Management Inc. (“Tokyo Bay”), a company incorporated under the laws of the British Virgin Islands. The total purchase

price is US$

As

of March 31, 2025 and September 30, 2024, there were

Following is a summary of the warrant activity for the six months ended March 31, 2025, and for the years ended September 30, 2024 and 2023:

| Weighted | ||||||||||||

| Average | ||||||||||||

| Remaining | ||||||||||||

| Average | Contractual | |||||||||||

| Number of Warrants | Exercise Price | Term in Years | ||||||||||

| Outstanding at September 30, 2023 | $ | — | ||||||||||

| Granted | ||||||||||||

| Exercised | — | |||||||||||

| Surrendered | — | |||||||||||

| Expired | — | |||||||||||

| Outstanding at September 30, 2024 | ||||||||||||

| Granted | ||||||||||||

| Exercised | ( | ) | — | |||||||||

| Surrendered | — | |||||||||||

| Expired | — | |||||||||||

| Outstanding at March 31, 2025 | ||||||||||||

The fair value of the warrants was calculated using the Binomial Model with the following assumptions as follows:

| Oct 14, | Nov 5, | Nov 12, | ||||||||||

| Warrants | 2024 | 2024 | 2024 | |||||||||

| Market price per share (USD/share) | $ | $ | $ | |||||||||

| Exercise price (USD/share) | ||||||||||||

| Risk free rate | % | % | % | |||||||||

| Dividend yield | % | |||||||||||

| Expected term/Contractual life (years) | ||||||||||||

F-20

PRESTIGE

WEALTH INC.

NOTES TO UNAUDITED INTERIM CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

Note 9 TAXATION

The Company and its subsidiaries file tax returns separately.

1) Income tax

The Company is a Cayman Islands exempted company and currently conducts operations primarily through subsidiaries that are incorporated in the Cayman Islands, the British Virgin Islands and Hong Kong.

The Cayman Islands

The Company and PGAM are incorporated in the Cayman Islands and the Cayman Islands currently levy no taxes on individuals or corporations based upon profits, income, gains or appreciations and there is no taxation in the nature of inheritance tax or estate duty.

Pursuant to the Tax Concessions Act of the Cayman Islands, the Company has obtained an undertaking: (a) that no law which is enacted in the Cayman Islands imposing any tax to be levied on profits, income, gains or appreciation shall apply to the Company or its operations; and (b) that the aforesaid tax or any tax in the nature of estate duty or inheritance tax shall not be payable on the shares, debentures or other obligations of the Company.

The undertaking for the Company is for a period of twenty years from November 2, 2018.

There are no other taxes likely to be material to the Company levied by the Government of the Cayman Islands save certain stamp duties which may be applicable, from time to time, on certain instruments executed in or brought within the jurisdiction of the Cayman Islands.

The Cayman Islands are a party to a double tax treaty entered into with the United Kingdom in 2010 but are otherwise not a party to any other double tax treaties.

British Virgin Islands

PPWM and PAI are subsidiaries of the Company incorporated in the British Virgin Islands. There is no income or other tax in the British Virgin Islands imposed by withholding or otherwise on any payment to be made to or by the subsidiary incorporated in the British Virgin Islands.

California

PWAI

incorporated in California, the California currently levy

Singapore

Wealth AI is subsidiary of the Company incorporated in Singapore. There is no income or other tax in the Singapore imposed by withholding or otherwise on any payment to be made to or by the subsidiary incorporated in the Singapore.

Hong Kong

In

accordance with the relevant tax laws and regulations of Hong Kong, a company registered in Hong Kong is subject to income

taxes within Hong Kong at the applicable tax rate on taxable income. From year of assessment of 2018/2019 onwards, Hong Kong

profit tax rates are

F-21

PRESTIGE

WEALTH INC.

NOTES TO UNAUDITED INTERIM CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

Note 9 TAXATION (cont.)

PPWM

is subject to Hong Kong profit tax with statutory tax rate of

The components of the income taxes provision are:

| For

six months ended March 31, | ||||||||

| 2025 | 2024 | |||||||

| (Unaudited) | (Unaudited) | |||||||

| Current | $ | $ | ||||||

| Deferred | ( | ) | ||||||

| Total income taxes (benefits) provision | $ | ( | ) | $ | ||||

Significant components of deferred tax assets were as follows:

| As

of March 31, 2025 | As

of September 30, 2024 | |||||||

| (Unaudited) | ||||||||

| Deferred tax assets | $ | $ | ||||||

| Current period addition(1) | ||||||||

| Current period reversal(1) | ||||||||

| Exchange rate effect | ||||||||

| Gross deferred tax assets | $ | $ | ||||||

| Less: valuation allowance | ( | ) | ||||||

| Total deferred tax assets | ||||||||

| (1) |

Significant components of deferred tax liabilities were as follows:

| As

of March 31, 2025 | As

of September 30, 2024 | |||||||

| (Unaudited) | ||||||||

| Deferred tax liabilities(1) | $ | $ | ||||||

| Current period addition(1 | ||||||||

| Current period reversal(2) | ( | ) | ( | ) | ||||

| Exchange rate effect | ( | ) | ||||||

| Deferred tax liabilities, net | $ | $ | ||||||

| (1) |

| (2) |

F-22

PRESTIGE

WEALTH INC.

NOTES TO UNAUDITED INTERIM CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

Note 9 TAXATION (cont.)

Income before income taxes is attributable to the following tax jurisdictions:

| For

six months ended March 31, | ||||||||

| 2025 | 2024 | |||||||

| (Unaudited) | (Unaudited) | |||||||

| Hong Kong | $ | ( | ) | $ | ||||

| Cayman | ( | ) | ( | ) | ||||

| Singapore | ( | ) | ||||||

| Loss before income taxes | $ | ( | ) | $ | ( | ) | ||

Reconciliation between the Hong Kong statutory tax rate to income before income taxes and the actual provision for income taxes is as follows:

| For

six months ended March 31, | ||||||||

| 2025 | 2024 | |||||||

| (Unaudited) | (Unaudited) | |||||||

| Loss before income taxes expenses | $ | ( | ) | $ | ( | ) | ||

| Income tax statutory rate | % | % | ||||||

| Income tax (benefit) expense at statutory tax rate | ( | ) | ( | ) | ||||

| Reconciling items: | ||||||||

| Effect of tax-exempt for subsidiaries incorporated in Cayman Islands and Singapore | ||||||||

| Effect of valuation allowance on deferred tax assets | ||||||||

| Effect of different tax rates for the first HK$ | ( | ) | ||||||

| Effect of non-deductible item | ( | ) | ||||||

| Income taxes (benefit) expense | ( | ) | ||||||

| Effective income tax rate | % | % | ||||||

| (1) |

F-23

PRESTIGE

WEALTH INC.

NOTES TO UNAUDITED INTERIM CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

Note 10 RELATED PARTIES BALANCES AND TRANSACTIONS

The following is a list of related parties which the Company has transactions with:

| (a) | Mr. Chi Tak Sze, the controlling shareholder and |

| (b) | Prestige Financial Holdings Group Limited, a holding company controlled by Mr. Chi Tak Sze as of September 30, 2024. Prestige Financial Holdings Group Limited had been undergoing a court winding up process since December 2, 2024, and is no longer controlled by Mr. Chi Tak Sze. |

| (c) | Prestige Securities Limited, an entity under the control of Prestige Financial Holdings Group Limited |

| (d) | Mr. Hongtao Shi resigned his position of Chief Executive Officer and Chairperson of the Board of the Company on December 19, 2024 and January 6, 2025 respectively. |

| (e) | Mr. Ngat Wong resigned his position of Chief Financial Officer and Chief Operational Officer of the Company on February 27, 2025 and April 10, 2025 respectively. |

Amounts due from related parties

The balances of amount due from related parties were as followings:

| As

of March 31, 2025 | As

of September 30, 2024 | |||||||

| (Unaudited) | ||||||||

| Prestige Financial Holdings Group Limited (“PFHL”)(1) | ||||||||

| Prestige Securities Limited (“PSL”) (2) | ||||||||

| Less: Provision of current expected credit losses | ( | ) | ||||||

| Total | $ | $ | ||||||

F-24

PRESTIGE

WEALTH INC.

NOTES TO UNAUDITED INTERIM CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

Note 10 RELATED PARTIES BALANCES AND TRANSACTIONS (cont.)

The balances of amount due to related parties were as followings:

| As

of March 31, 2025 | As

of September 30, 2024 | |||||||

| (Unaudited) | ||||||||

| Hongtao Shi (3) | ||||||||

| Ngat Wong (4) | ||||||||

| Total | $ | $ | ||||||

| (1) |

| (2) |

| (3) |

| (4) |

Related party transactions

Following is the related party transactions for the six months ended March 31, 2025 and 2024:

| For

six months ended March 31, | ||||||||

| 2025 | 2024 | |||||||

| (Unaudited) | (Unaudited) | |||||||

| Rental income incurred by renting to Prestige Securities Limited | $ | $ | ( | ) | ||||

F-25

PRESTIGE

WEALTH INC.

NOTES TO UNAUDITED INTERIM CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

Note 11 SEGMENT REPORTING

Note 12 SUBSEQUENT EVENT

On

April 23, 2025, the Company entered into an Amended and Restated Securities Purchase Agreement (the “Amended and Restated Agreement”)

with certain accredited investors for a private placement offering, which amended and restated a Securities Purchase Agreement dated

as of March 7, 2025. Pursuant to the terms of the Amended and Restated Agreement, the Company agreed to sell, and the investors agreed

to purchase, (i)

On

April 25, 2025, the Company entered into a Project Outsourcing Agreement (the “Agreement”) with (i) InnoSphere Tech Inc.

(“InnoSphere Tech”), a wholly-owned subsidiary of the Company, and (ii) certain service providers (“Party B”).

Pursuant to the Agreement, Party B will provide services for the construction of MGAI Privatization Large Model System to InnoSphere

Tech. In consideration of the services, the Company will issue to Party B (or its designees)

On June 25, 2025, the Company entered into a definitive share purchase agreement pursuant to which the Company agreed to sell all of the issued and outstanding shares of Prestige Assets International Inc. (“PAII”), a wholly owned subsidiary incorporated in the British Virgin Islands, and three subsidiaries of PAII, namely Prestige Asset Management Limited, Prestige Global Asset Management Limited and Prestige Global Capital Inc., operating asset management business, to a third party. The transaction closed on the same day.

Other than the subsequent event described above, the Company has not identified any events with a material financial impact on the Company’s condensed consolidated financial statements.

F-26