| 1. | ORGANIZATION AND NATURE OF OPERATIONS |

Legend China Limited was incorporated in the Cayman Islands on April 13, 2016 with limited liability. Pursuant to a special resolution dated November 8, 2016, Legend China Limited changed its name to Legend China Ltd. Pursuant to a special resolution dated April 6, 2017, Legend China Ltd. changed its name to Lichen China Limited (“Lichen”). Pursuant to a special resolution dated February 10, 2025, Lichen China Limited changed its name to Lichen International Limited (“Lichen”).

Lichen is an investment holding company. Through its wholly owned subsidiaries, Lichen is principally engaged in the provision of: (i) financial and taxation solution services; (ii) education support services to partnered institutions; and (iii) software and maintenance services.

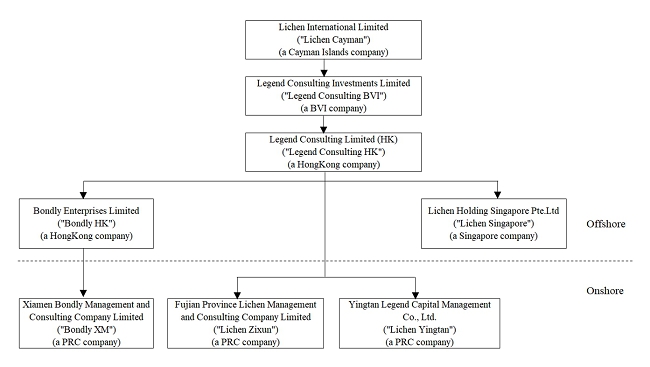

Lichen owns 100% interests in its subsidiaries. The following diagram illustrates the corporate structure of Lichen International Limited and its subsidiaries (collectively, the “Company”) as of June 30, 2025:

During the reporting periods, the Company has several subsidiaries in PRC. Details of the Company and its operating subsidiaries are set out below:

| Name of subsidiaries | Place of | Date of | Percentage | Principal activities | |||||

| Legend Consulting Investments Limited (“Legend Consulting BVI”) | The British Virgin Islands (“BVI”) | December 20, 2013 | 100 | % | Investment holding | ||||

| Legend Consulting Limited (“Legend Consulting HK”) | Hong Kong | January 8, 2014 | 100 | % | Investment holding | ||||

| Lichen Holding Singapore Pte. Ltd. (“Lichen Singapore”) | Singapore | December 28, 2023 | 100 | % | Provision of financial and taxation solution services, education support services and software and maintenance services | ||||

| Fujian Province Lichen Management and Consulting Company Limited (“Lichen Zixun”) | Fujian, the People’s Republic of China (“PRC”) | April 14, 2004 | 100 | % | Provision of financial and taxation solution services, education support services and software and maintenance services | ||||

| Bondly Enterprises Limited (“Bondly HK”) | Hong Kong | June 13, 2022 | 100 | % | Investment holding | ||||

| Xiamen Bondly Management and Consulting Company Limited (Bondly XM) | Fujian, the People’s Republic of China (“PRC”) | August 25, 2022 | 100 | % | Provision of financial and taxation solution services | ||||

| Yingtan Legend Capital Management Co., Ltd. (“Lichen Yingtan”) | Jiangxi, the People’s Republic of China (“PRC”) | November 27, 2023 | 100 | % | Investment |

Legend Consulting BVI is an investment holding company wholly owned by Lichen.

Legend Consulting HK is an investment holding company wholly owned by Legend Consulting BVI.

Lichen Zixun, which is wholly owned by Legend Consulting HK, is engaged in providing financial and taxation solution services and education support services.

Lichen Singapore, which is wholly owned and established by Legend Consulting HK on December 28, 2023, is engaged in providing financial and taxation solution services and education support services.

The acquisition of 60% of the equity interest in Bondly HK was completed on July 29, 2024 and the acquisition of remained 40% of the equity interest in Bondly HK was completed on February 26, 2025. Bondly HK is an investment holding company wholly owned by Legend Consulting HK.

Bondly XM, which is wholly owned and established by Bondly HK on August 25, 2022, is engaged in providing financial and taxation solution services.

Lichen Yingtan, which is wholly owned by Legend Consulting HK.

Reorganization and Share Issuance

On April 28, 2021, Lichen passed a resolution to increase the share capital. Pursuant to such resolution, the authorized share capital of Lichen was increased from HK$50,000 divided into 5,000,000 shares with a nominal or par value of HK$0.01 each (“HKD Shares”) to the aggregate of (i) HK$50,000 divided into 5,000,000 HKD Shares and (ii) US$50,000 divided into (a) 400,000,000 Class A Ordinary Shares with a nominal or par value of US$0.0001 each and (b) 100,000,000 Class B Ordinary Shares with a nominal or par value of US$0.0001 each. 5,400,000 Class A Ordinary Shares and 3,600,000 Class B Ordinary Shares (collectively, the “USD Shares”) were issued at the consideration of US$0.0001 per share. Upon the completion of the share issuance, all HKD Shares issued were repurchased by Lichen at the consideration HK$0.01 per share and cancelled immediately upon repurchase. Upon completion of the repurchase, the 5,000,000 unissued HKD Shares of the Company were cancelled resulting in the reduction of the authorized share capital of the Company to US$50,000 divided into (a) 400,000,000 Class A Ordinary Shares with a nominal or par value of US$0.0001 each and (b) 100,000,000 Class B Ordinary Shares with a nominal or par value of US$0.0001, each in accordance with section 13 of the Cayman Islands Companies Act. The issuance of 5,400,000 Class A Ordinary Shares and 3,600,000 Class B Ordinary Shares, the repurchase and the cancellation of HKD Shares were completed on April 28, 2021.

On December 15, 2021, Lichen executed a special resolution to change the par value of the ordinary shares from $0.0001 to $0.00004. Pursuant to such resolution, the authorized share capital of Lichen was US$50,000 divided into (a) 1,000,000,000 Class A Ordinary Shares with a nominal or par value of US$0.00004 each and (b) 250,000,000 Class B Ordinary Shares with a nominal or par value of US$0.00004, each in accordance with section 13 of the Cayman Islands Companies Act. The changes were completed on December 23, 2021. The change in capital structure is treated as being effective as of the beginning of the first period presented in the unaudited condensed consolidated financial statements.

The consideration paid by Lichen and its subsidiaries has been accounted for at historical cost and prepared on the basis as if the aforementioned transactions had become effective as of the beginning of the first period presented in the unaudited condensed consolidated financial statements. As all the entities involved in the process of the Reorganization are under common control before and after the Reorganization, the Reorganization is accounted for in a manner similar to a pooling-of-interest with the assets and liabilities of the parties to the Reorganization carried over at their historical amounts.

Initial Public Offering

On February 8, 2023, the Company closed its initial public offering of 4,000,000 Class A ordinary shares at a public offering price of $4.00 per Class A ordinary share for a total of $16,000,000 in gross proceeds. The Company raised total net proceeds of $14,098,140 after deducting underwriting discounts and commissions and offering expenses. In addition, the Company granted to its underwriters an option for a period of 45 days after the closing of the initial public offering to purchase up to an additional 600,000 Class A Ordinary Shares at the public offering price, less underwriting discounts.