The CCIX Board also considered a variety of uncertainties and risks and other potentially negative factors concerning the Transactions, including, but not limited to, the following:

Unaudited Prospective Unit Economics Information

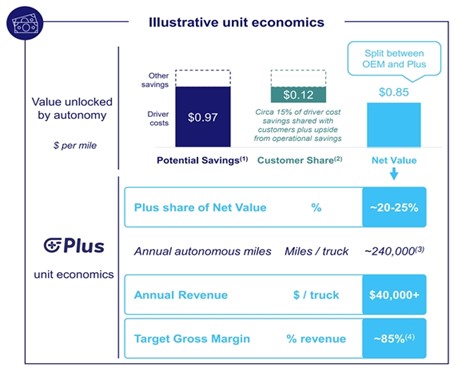

In connection with its consideration of the business combination, including the Transactions, PlusAI provided its internally-derived unit economic calculations (the “Unit Economics”) related to autonomous trucking deployments to (1) CCIX for use as a component of its overall evaluation of PlusAI (2) Ocean Tomo for use as a component of its fairness opinion as described further in the section entitled “Opinion of CCIX’s Financial Advisor,” and (3) to the PlusAI Board and its advisors in connection with its evaluation of the Transactions. The Unit Economics are being included in this proxy statement/prospectus because the Unit Economics were provided to the CCIX Board, Ocean Tomo and the PlusAI Board for their respective evaluations of the Transactions.

The Unit Economics are included in this proxy statement/prospectus solely to provide CCIX’s shareholders and PlusAI’s stockholders access to information made available in connection with the consideration by the CCIX Board and the PlusAI Board of the Transactions and Ocean Tomo’s fairness opinion. The Unit Economics should not be viewed as a projection or forecast of PlusAI’s overall financial performance. Furthermore, the Unit Economics do not take into account any circumstances or events occurring after the date on which such Unit Economics were prepared, which was May 27, 2025, and may differ, perhaps significantly, from similarly titled measures that may be presented in the future.

The Unit Economics were prepared in good faith by PlusAI’s management team and are based on its management’s reasonable estimates and assumptions with respect to the expected performance of its autonomous driving solutions, as applicable, at the time the Unit Economics were prepared and speak only as of that time. As such, the Unit Economics do not reflect any updates since the time such Unit Economics were delivered to the CCIX Board and Ocean Tomo in May 2025.

The Unit Economics reflect numerous estimates and assumptions with respect to matters specific to PlusAI’s business and general matters, including estimates and assumptions with respect to PlusAI’s business and the revenue models PlusAI expects to use in connection with the deployment its autonomous driving solutions, industry-wide business, economic, regulatory, market and financial conditions and other future events, all of which are difficult to predict and many of which are beyond PlusAI’s and CCIX’s control. Moreover, the Unit Economics are not subject to any escalation or discounting. The time at which the assumptions underlying the Unit Economics will be realized, if at all, is highly uncertain. As a result, there can be no assurance that the Unit Economics will be realized or that actual performance will yield similar results (i.e., not significantly higher or lower than those set forth in the Unit Economics).

Because the Unit Economics relate to estimates at scale, the timing of which is uncertain, such information by its nature becomes less predictive with the passage of time. These Unit Economics are subjective in many respects and thus are susceptible to multiple interpretations and periodic revisions based on actual experience and business developments. The Unit Economics have been prepared solely by PlusAI, have not been reviewed or verified by independent third parties. Some of PlusAI’s assumptions are estimates. These estimates are based on PlusAI’s management’s beliefs, estimates and assumptions and on information available to PlusAI’s management when the estimates were made. Although CCIX’s and PlusAI’s management teams believed that there was a reasonable basis for each of these estimates, CCIX and PlusAI caution you that these estimates are based on a combination of assumptions that may result in such estimates proving to be inaccurate. Information provided in the Unit Economics constitutes forward-looking statements that are inherently subject to significant uncertainties and contingencies, many of which are beyond PlusAI’s and CCIX’s control. The various risks and uncertainties include those set forth in the sections entitled “Risk Factors,” “PlusAI’s Management’s Discussion and Analysis of Financial Condition and Results of Operations” and “Cautionary Note Regarding Forward-Looking Statements.”

The Unit Economics were prepared solely for internal use and not with a view toward public disclosure or toward complying with GAAP or any guidelines established by the American Institute of Certified Public Accountants. The Unit Economics included in this proxy statement/prospectus have been prepared by, and are the responsibility of, PlusAI’s management. Neither Ocean Tomo, nor the independent registered public accounting firms of PlusAI or CCIX, nor any other registered public accounting firms, have compiled, examined or performed any procedures with respect to the Unit Economics contained in the proxy statement/prospectus, nor have they expressed any opinion or any other form of assurance on such information or their accuracy or achievability, and the independent registered public accounting firms of PlusAI and CCIX assume no responsibility for, and disclaim any involvement with, the Unit Economics. Further, to that end, the reports of Deloitte & Touche LLP and BPM LLP included in the financial statements in this proxy statement/prospectus relate to the historical consolidated financial statements of PlusAI. They do not extend to the Unit Economics and should not be read to do so.

Nonetheless, a summary of the Unit Economics is provided in this proxy statement/prospectus because the Unit Economics were made available to the CCIX Board and Ocean Tomo for use as a component of its fairness opinion as described further in the section entitled “Opinion of Churchill Capital’s Financial Advisor.” The inclusion of the Unit Economics in this proxy statement/prospectus should not be regarded as an indication that CCIX, the CCIX Board, PlusAI, the PlusAI Board, Ocean Tomo or their respective affiliates, advisors or other representatives considered, or now considers, such Unit Economics necessarily to be predictive of actual future results or to support

or fail to support your decision whether to vote for or against the business combination proposal. For more information, see the risk factor in the section entitled “Risk Factors — Risks Related to PlusAI — Risks Related to Our Business Operations — Forward-looking estimates and predictions as to the future deployment of our technology, and the associated adoption curve are subject to significant uncertainty and are based on assumptions and estimates that may prove inaccurate.” No person has made or makes any representation or warranty to any Churchill CCIX shareholder regarding the information included in the Unit Economics. The Unit Economics are not fact and are not necessarily indicative of future results. Readers of this proxy statement/prospectus are cautioned not to place undue reliance on this information.

The Unit Economics are not included in this proxy statement/prospectus to induce any CCIX shareholders to vote in favor of any of the proposals at the special meeting.

CCIX urges you to review the financial statements of PlusAI included in this proxy statement/prospectus, as well as the financial information in the section of this proxy statement/prospectus entitled “Unaudited Pro Forma Condensed Combined Financial Information” and to not rely on any single financial measure.

PlusAI uses certain financial measures in its Unit Economics that are not prepared in accordance with GAAP as supplemental measures to evaluate operational performance. There are limitations associated with the use of non-GAAP financial measures, and the metrics set forth in the Unit Economics should not be considered as a substitute for or in isolation from our financial statements prepared in accordance with GAAP. Non-GAAP financial measures are not prepared in accordance with GAAP, are not reported by all of PlusAI’s competitors and may not be directly comparable to similarly titled measures of PlusAI’s competitors. Non-GAAP financial measures should not be considered in isolation from, or as a substitute for, financial information presented in accordance with GAAP. Financial measures included in the Unit Economics provided to a board of directors or financial advisor in connection with a business combination transaction are excluded from the definition of “non-GAAP financial measures” under the rules of the SEC, and therefore the Unit Economics are not subject to SEC rules regarding disclosures of non-GAAP financial measures, which would otherwise require a reconciliation of a non-GAAP financial measure to a GAAP financial measure. Accordingly, no reconciliation of the financial measures included in the Unit Economics was prepared, and therefore none have been provided in this proxy statement/prospectus. The definitions of the non-GAAP measures included in the Unit Economics may not align with those underlying the non-GAAP measures presented in the section entitled “PlusAI’s Management’s Discussion and Analysis of Financial Condition and Results of Operations.” Further, other companies, including companies in our industry, may calculate these metrics differently or not at all, which reduces their usefulness as comparative measures.

Unit Economics

The Unit Economics, including the net value, PlusAI share of the net value and target gross margin are based on numerous estimates and assumptions, including those set forth below. The actual terms of the definitive long-term contracts and commercial arrangements with our OEM partners are subject to negotiation and there is no assurance PlusAI will achieve the implied revenue terms or share of the net value set forth in the Unit Economics from any given customer or at all. See the section entitled “Risk Factors-Risks Related to PlusAI.” In addition, no assurances can be given that PlusAI or its OEM partners will achieve the savings or implied results described in the Unit Economics on the terms set forth in the Unit Economics or at all. See the section entitled “Risk Factors — Risks Related to PlusAI.”

The key assumptions for SuperDrive Unit Economics include:

EXCEPT TO THE EXTENT REQUIRED BY APPLICABLE FEDERAL SECURITIES LAWS (INCLUDING A REGISTRANT’S RESPONSIBILITY TO MAKE FULL AND PROMPT DISCLOSURE AS REQUIRED BY SUCH FEDERAL SECURITIES LAWS), BY INCLUDING IN THIS PROXY STATEMENT/PROSPECTUS A SUMMARY OF THE UNIT ECONOMICS, NONE OF CCIX, PLUSAI OR ANY OF THEIR RESPECTIVE REPRESENTATIVES OR AFFILIATES UNDERTAKES ANY OBLIGATION TO, AND EACH EXPRESSLY DISCLAIMS ANY RESPONSIBILITY TO, UPDATE OR REVISE, OR PUBLICLY DISCLOSE ANY UPDATE OR REVISION TO, THESE UNIT ECONOMICS TO REFLECT CIRCUMSTANCES OR EVENTS, INCLUDING UNANTICIPATED EVENTS, THAT MAY HAVE OCCURRED OR THAT MAY OCCUR AFTER THE PREPARATION OF THESE UNIT ECONOMICS AND THEIR PRESENTATION TO THE CCIX BOARD AND INCLUSION AS A COMPONENT OF THE FAIRNESS OPINION (AS DEFINED BELOW), EVEN IN THE EVENT THAT ANY OR ALL OF THE ASSUMPTIONS UNDERLYING THE UNIT ECONOMICS ARE SHOWN TO BE IN ERROR OR CHANGE.

Opinion of CCIX’s Financial Advisor

Pursuant to an engagement letter, dated April 25, 2025 (the “OT Engagement Letter”), CCIX retained Ocean Tomo, a part of J.S. Held (“Ocean Tomo”), to advise the CCIX Board regarding the fairness of the Aggregate Consideration (as defined in the Opinion) (the “Purchase Price”) payable by CCIX pursuant to the Merger Agreement and deliver a letter to CCIX outlining its opinion as to whether the Purchase Price is fair, from a financial point of

view, to the shareholders of CCIX (other than the Sponsor), (such opinion and advice, the “Opinion”). Ocean Tomo delivered its written Opinion to CCIX on June 5, 2025 (the “Opinion Date”).

In selecting Ocean Tomo, CCIX considered, among other things, the fact that Ocean Tomo is (1) regularly engaged in the valuation of businesses and their securities and the provision of fairness opinions in connection with various transactions and (2) has undertaken numerous engagements in the artificial intelligence, autonomy, and automotive spaces.

The Opinion was provided for the information of, and directed to, the CCIX Board for its information and assistance in connection with the business combination.

The full text of the Opinion is attached to this proxy statement/prospectus as Annex F and is incorporated into this document by reference. The summary of the Opinion set forth herein is qualified in its entirety by reference to the full text of the Opinion. CCIX’s shareholders are urged to read the Opinion carefully and in its entirety for a discussion of the procedures followed, assumptions made, matters considered, limitations of the review undertaken by Ocean Tomo in connection with the Opinion, as well as other qualifications contained in the Opinion. The full text of the Opinion and a summary of Ocean Tomo’s financial analysis is being included in this proxy statement/prospectus because it was provided to CCIX for their evaluation of the business combination.

Scope of Analysis

In connection with the Opinion, Ocean Tomo made such reviews, analyses, and inquiries as it deemed necessary and appropriate to enable Ocean Tomo to render the Opinion. Ocean Tomo also accounted for its assessment of general economic, market, technical, and financial conditions, as well as its experience in complex securities, technology, and business valuation, in general and with respect to similar transactions. Ocean Tomo’s procedures, investigations, and financial analyses with respect to the preparation of the Opinion included, but were not limited to, the items summarized below:

Assumptions, Qualifications and Limiting Conditions

In performing its analyses and rendering the Opinion with respect to the Purchase Price, Ocean Tomo, with CCIX’s consent:

To the extent that any of the foregoing assumptions or any of the facts on which this Opinion is based prove to be untrue in any material respect, this Opinion cannot and should not be relied upon. Furthermore, in Ocean Tomo’s analysis and in connection with the preparation of this Opinion, Ocean Tomo has made numerous assumptions with respect to industry performance, general business, market and economic conditions and other matters, many of which are beyond the control of any party involved in the business combination.

Ocean Tomo prepared the Opinion effective as of the Opinion Date. The Opinion is based upon market, economic, financial and other conditions as they existed and could be evaluated as of the Opinion Date. Ocean Tomo disclaims any undertaking or obligation to advise any person of any change in any fact or matter affecting the Opinion which may come or be brought to the attention of Ocean Tomo after the Opinion Date.

Ocean Tomo has not been requested to, and did not, (1) initiate any discussions with, or solicit any indications of interest from, third parties with respect to the business combination, or (2) advise CCIX or any other party with respect to alternatives to the business combination.

The Opinion was furnished solely for the use and benefit of CCIX in connection with assessing the fairness of the Purchase Price. The Opinion is not intended to be used by CCIX or others for any other purpose, including, without limitation, compliance under any state statutes governing transfers or distributions. The Opinion is not intended to, and does not, confer any rights or remedies upon any other person, and is not intended to be used, and may not be used, by any other person or for any other purpose, without Ocean Tomo’s express consent which has not been provided except as stated in Annex F to this proxy statement/prospectus. The Opinion is not and should not be construed as a credit rating or a solvency opinion, an analysis of PlusAI’s credit worthiness, as tax advice, or as accounting advice. Ocean Tomo has not made, and assumes no responsibility to make, any representation, or render any opinion, as to any legal matter.

The Opinion (1) does not address the merits of the underlying business decision to enter into the business combination versus any alternative strategy or transaction; (2) does not address any other transaction; and (3) was not a recommendation as to how the CCIX Board should vote or act with respect to any matters relating to the business combination, or whether to proceed with the business combination or any related transaction. The decision as to whether to proceed with the business combination or any related transaction may depend on an assessment of factors unrelated to the financial analysis on which the Opinion was based. The Opinion should not be construed as creating any fiduciary duty on the part of Ocean Tomo to any party.

Summary of Financial Analyses

In preparing the Opinion, Ocean Tomo utilized two valuation approaches to determine the implied value of PlusAI, specifically the Discounted Cash Flow (“DCF”) method of the income approach and the market approach (as described in further detail below). For purposes of its financial analyses, Ocean Tomo assumed that the Purchase Price set forth in the Merger Agreement had a value equal to $1.2 billion. The following is a summary of the financial analyses performed by Ocean Tomo in connection with the preparation of the Opinion presented to CCIX. For each valuation approach, Ocean Tomo considered four possible scenarios. The four scenarios were based on the unit

economics provided by CCIX and PlusAI with sensitivities around (1) the timing of truck deployments in the U.S. and Europe and (2) truck utilization/truck miles driven annually.

The following is a summary of the scenarios considered by Ocean Tomo in connection with the preparation of its Opinion and orally presented to the CCIX Board on June 2, 2025, after which Ocean Tomo delivered its written Opinion on June 5, 2025:

Discounted Cash Flow Analysis

The DCF method of the income approach estimates the value of a company as the present value of expected future cash flows that a business can be expected to generate. The DCF method begins with an estimation of the annual cash flows the subject business is expected to generate over a discrete projection period (e.g., a 16-year period). The estimated cash flows for each of the years in the discrete projection period are then converted to their present value equivalents using a discount rate appropriate for the risk of achieving the projected cash flows. The present value of the estimated discrete period cash flows is then added to the present value equivalent of the residual/terminal value of the business at the end of the discrete projection period to arrive at an estimate of total value. The terminal value is the value of a business beyond the explicit forecast period and represents the future cash flows expected to be generated by the business into perpetuity.

The DCF analyses performed by Ocean Tomo considered both the Gordon Growth Model and Exit Multiples Approach when calculating the terminal value of the business in each scenario. The Gordon Growth Model is a formula used to calculate the terminal value that assumes that the cash flows generated by the subject company will increase at a constant growth rate into perpetuity. The Exit Multiples approach assumes that the value of a business can be determined at the end of a projected period based on the existing public market valuations of comparable companies. Exit multiples are derived from comparable companies by dividing enterprise value (“EV”) by current or expected financial performance indicators such as revenue or earnings before interest, taxes, depreciation, and amortization (“EBITDA”). The selected multiples are then applied to the revenue or EBITDA at the end of the discrete forecast period to arrive at an undiscounted indication of the terminal value.

Ocean Tomo’s DCF analyses of PlusAI considered the forecasted discrete period of estimation from fiscal year ending December 31 (“FYE”), 2025 through FYE 2040 – 2042, depending on the scenario. Ocean Tomo arrived at each indication of value by adding both the present value of the discrete period cash flows and a terminal value. This forecasted unlevered cash flow information was developed by Ocean Tomo based on the unit economicsinformation, interviews with PlusAI management, and tax documentation provided by CCIX, and by Ocean Tomo applying the related assumptions around such unit economic information as described further in the section entitled “Unit Economics” and its industry expertise.Risk in each scenario was determined through Ocean Tomo’s selected discount rate, which was calculated using the Capital Asset Pricing Model (“CAPM”) approach, in addition to identifying qualitative measures of risk and benchmarking against venture capital and private equity rates of return for companies at similar stages of development and commercialization. The selected range of discount rates was calculated using the weighted average cost of capital formula and considered factors such as the results of published studies on discount rates and industry capital costs.

In determining an EV/revenue and EV/EBITDA exit multiple for purposes of calculating a terminal value, Ocean Tomo reviewed certain financial data for 20 selected companies with publicly traded equity securities that were deemed relevant. The selected benchmarks were software-as-a-service (“SaaS”) companies given PlusAI’s SaaS business model. The selected companies and resulting median, mean, and quartile data included the following:

Software as a Service (SaaS) Companies |

|

LTM |

|

LTM |

AppLovin Corporation |

|

25.7x |

|

47.1x |

Autodesk, Inc. |

|

10.2x |

|

43.1x |

Bentley Systems, Incorporated |

|

11.9x |

|

41.9x |

Box, Inc. |

|

4.5x |

|

66.3x |

CSG Systems International, Inc. |

|

1.9x |

|

12.2x |

Datadog, Inc. |

|

13.4x |

|

490.7x |

DocuSign, Inc. |

|

5.6x |

|

58.0x |

Dropbox, Inc. |

|

3.9x |

|

13.6x |

Dun & Bradstreet Holdings, Inc. |

|

3.1x |

|

11.4x |

Nutanix, Inc. |

|

9.0x |

|

132.1x |

Paycom Software, Inc. |

|

7.4x |

|

29.2x |

Paylocity Holding Corporation |

|

6.9x |

|

32.0x |

Pegasystems Inc. |

|

4.8x |

|

27.1x |

Sabre Corporation |

|

1.8x |

|

14.4x |

Teradata Corporation |

|

1.4x |

|

7.4x |

Tyler Technologies, Inc. |

|

11.3x |

|

57.4x |

Unisys Corporation |

|

0.3x |

|

3.1x |

Veeva Systems Inc. |

|

12.3x |

|

45.8x |

Workday, Inc. |

|

6.8x |

|

61.3x |

ZoomInfo Technologies Inc. |

|

3.7x |

|

17.2x |

SaaS GPC Statistical Summary |

|

LTM |

|

LTM |

1st Quartile |

|

3.2x |

|

13.8x |

Average |

|

7.3x |

|

60.6x |

Median |

|

6.2x |

|

37.0x |

3rd Quartile |

|

11.0x |

|

57.9x |

EBITDA: Earnings before interest, taxes, depreciation and amortization.

EV: Enterprise Value = market capitalization plus preferred stock plus outstanding debt minus cash and equivalents.

For the Gordon Growth model, Ocean Tomo calculated the terminal value for each scenario using a 3% terminal growth rate. For the Exit Multiple Approach, Ocean Tomo utilized an EV/revenue exit multiple of 3.2x. The multiple utilized reflects the 1st Quartile EV/revenue multiple of the selected public companies identified above. We selected the first quartile to account for the fact that PlusAI will be at a mature level of growth at the end of the discrete forecast period. For the Gordon Growth Model and Exit Multiple Approach calculations, Ocean Tomo utilized a discount rate of 30%, consistent with the risk identified in the CAPM approach and venture capital and private equity rates of return that were considered. Ocean Tomo’s use of such terminal value calculations assumes normalized growth and risk at the point of exit for each scenario.

Based on these assumptions and methodologies, the DCF analysis indicated an implied range of enterprise values from approximately $1.3 billion to $2.5 billion.

Market Approach

The market approach provides an estimation of EV by applying a valuation multiple derived from public company data to a specific financial metric for the subject company. Valuation multiples are derived from the market prices of actively traded public companies, publicly available historical financial information, and consensus equity analyst research estimates of future financial performance or prices paid in actual mergers, acquisitions, or other transactions.

Ocean Tomo conducted two separate Market Approaches. The first applies stabilized guideline public company valuation multiples to PlusAI’s future revenues and EBITDA (“Mature Market Approach”). Ocean Tomo identified 20 publicly traded companies as benchmarks for the Mature Market Approach (the “Selected Mature Publicly Traded Companies”). Ocean Tomo chose the Selected Mature Publicly Traded Companies based on the comparability of their SaaS business models and stage of maturity. Ocean Tomo also identified Mobileye Global Inc., a mature player in the autonomous vehicle space, that was corroborative of the median of the Selected Mature Publicly Traded Companies. Ocean Tomo does not have access to non-public information on the Selected Mature Publicly Traded Companies. Ocean Tomo developed estimates of value for PlusAI by multiplying LTM valuation multiples of the Selected Mature Publicly Traded Companies by PlusAI’s discounted (to today) future revenues and EBITDA. The selected years of future revenues and EBITDAs were determined based on PlusAI’s deployment schedule maturity and comparable profit magnitudes, respectively. Ocean Tomo noted that none of the Selected Mature Publicly Traded Companies are perfectly comparable to PlusAI. Thus, Ocean Tomo considered the best comparable company (Aurora Innovation) in its second Market Approach discussed below.

Aurora Innovation, Inc. (“Aurora”) is the most comparable company to PlusAI from industry, risk, technology, and stage of development perspectives. Given this comparability and Aurora’s recent closed upsized public offering, Ocean Tomo believes that applying Aurora’s valuation multiple to PlusAI captures current market sentiment and pricing for a comparable company and provides a relevant and realistic benchmark for estimating the value of PlusAI (“Implied Aurora Valuation”). Given the difference in maturity between both companies, Ocean Tomo utilized Aurora’s FY+3 (2027) Enterprise Value/Revenue multiple and discounted PlusAI’s future performance to when it achieves a similar level of revenue and growth.

Both the Mature Market Approach and the Implied Aurora Valuation were quantitatively included in our determination of value for PlusAI.

The tables below summarize certain observed historical and forecasted financial performance and trading multiples of the Selected Mature Publicly Traded Companies and Aurora.

Selected Publicly Traded Companies

Ocean Tomo reviewed certain financial data for 22 selected companies with publicly traded equity securities that were deemed relevant (the 20 Selected Mature Publicly Traded Companies in addition to Mobileye and Aurora). The selected companies and resulting median, mean, and quartile data included the following:

AV and ADAS Technology Company |

|

LTM |

|

LTM |

Mobileye Global Inc. |

|

6.3x |

|

NM |

Software as a Service (SaaS) Companies |

|

LTM |

|

LTM |

AppLovin Corporation |

|

25.7x |

|

47.1x |

Autodesk, Inc. |

|

10.2x |

|

43.1x |

Bentley Systems, Incorporated |

|

11.9x |

|

41.9x |

Boc, Inc. |

|

4.5x |

|

66.3x |

CSG Systems International, Inc, |

|

1.9x |

|

12.2x |

Datadog, Inc. |

|

13.4x |

|

490.7x |

DocuSign, Inc. |

|

5.6x |

|

58.0x |

Dropbox, Inc. |

|

3.9x |

|

13.6x |

Dun & Bradstreet Holdings, Inc. |

|

3.1x |

|

11.4x |

Nutanix, Inc. |

|

9.0x |

|

132.1x |

Paycom Software, Inc. |

|

7.4x |

|

29.2x |

Paylocity Holding Corporation |

|

6.9x |

|

32.0x |

Pegasystems Inc. |

|

4.8x |

|

27.1x |

Sabre Corporation |

|

1.8x |

|

14.4x |

Teradata Corporation |

|

1.4x |

|

7.4x |

Tyler Technologies, Inc. |

|

11.3x |

|

57.4x |

Unisys Corporation |

|

0.3x |

|

3.1x |

Veeva Systems Inc. |

|

12.3x |

|

45.8x |

Workday, Inc. |

|

6.8x |

|

61.3x |

ZoomInfo Technologies Inc. |

|

3.7x |

|

17.2x |

SaaS GPC Statistical Summary |

|

LTM |

|

LTM |

1st Quartile |

|

3.2x |

|

13.8x |

Average |

|

7.3x |

|

60.6x |

Median |

|

6.2x |

|

37.0x |

3rd Quartile |

|

11.0x |

|

57.9x |

Aurora Implied Valuation |

|

FYE 2027 |

|

FYE 2027 |

Aurora Innovation, Inc. |

|

29.7x |

|

NM |

EBITDA: Earnings before interest, taxes, depreciation and amortization.

EV: Enterprise Value = market capitalization plus preferred stock plus outstanding debt minus cash and equivalents.

Based on the results of the Selected Publicly Traded Company analysis, and its experience and professional judgment, Ocean Tomo applied an EV/revenue multiple of 6.20x and an EV/EBITDA multiple of 36.99x for each scenario. The multiples utilized reflected the median EV/revenue and EV/EBITDA multiples of the selected public companies noted above. The Mature Market Approach indicated a range of enterprise values for PlusAI of approximately $1.7 billion to $2.7 billion based on EV/revenue multiples and approximately $2.3 billion to $3.5 billion based on EV/EBITDA multiples, in each case as compared to the $1.2 billion Purchase Price. The Implied Aurora Valuation indicated a range of enterprise values for PlusAI of approximately $2.8 billion to $3.3 billion based on Aurora’s FY+3 EV/revenue multiple.

Implied Value Per Share Calculation

In conjunction with the valuation of PlusAI, Ocean Tomo performed a post-Closing pro forma implied value per share calculation to determine the implied pro forma value per share for the shareholders of CCIX at Closing under various redemption scenarios. For the purposes of its calculation, Ocean Tomo utilized the average of all its DCF and market approach enterprise valuations for each of the four different valuation scenarios described above. The average EV from each scenario was then adjusted for the expected cash in the trust account at Closing (assuming both no redemptions by holders of CCIX public shares, referred to as the No Redemption Scenario and the scenario in which redemptions by holders of CCIX public shares result in $100.0 million in Available Closing SPAC Cash at Closing, referred to as the $100 Million Available Closing SPAC Cash Scenario) and estimated transaction expenses of $35 million as provided by CCIX. The adjusted average EV from each scenario was then divided by two different post-Closing outstanding share counts which were based on the following two redemption scenarios provided by CCIX: (1) redemptions of CCIX public shares resulting in $100.0 million in the trust account at Closing and (2) no redemptions of CCIX public shares. This analysis indicated the ranges of implied pro forma values per share of CCIX Class A Ordinary Shares shown in the table below. Ocean Tomo compared these ranges to the illustrative redemption value for a CCIX public share of $10.41.

|

|

Average PlusAI |

|

|

No Redemption |

|

|

$100 Million |

|

|||

Baseline |

|

$ |

2,781,290,131 |

|

|

$ |

17.35 |

|

|

$ |

18.16 |

|

Scenario 2 |

|

$ |

2,286,657,569 |

|

|

$ |

14.64 |

|

|

$ |

15.17 |

|

Scenario 3 |

|

$ |

2,080,723,270 |

|

|

$ |

13.49 |

|

|

$ |

13.88 |

|

Scenario 4 |

|

$ |

1,917,166,846 |

|

|

$ |

12.56 |

|

|

$ |

12.84 |

|

Conclusion

Fees and Expenses

In connection with providing the Opinion to the CCIX Board, CCIX agreed to pay Ocean Tomo a fee of $435,000 pursuant to the OT Engagement Letter. In addition, CCIX has agreed to indemnify Ocean Tomo for certain liabilities arising from its engagement. No portion of the fee was contingent upon the conclusion within the Opinion.

Disclosure of Prior Relationships

During the two years preceding the date of the Opinion, Ocean Tomo has not had any material relationship with any party to the business combination for which compensation has been received or is intended to be received, nor is any such material relationship or related compensation mutually understood to be contemplated.

Recommendation of the CCIX Board

After careful consideration, the CCIX Board has unanimously determined that the business combination proposal is fair to, and in the best interests of, CCIX and its shareholders and unanimously recommends that you vote or give instruction to vote “FOR” the business combination proposal.