| Baozun Inc. 寶尊電商有限公司* (A company controlled through weighted voting rights and incorporated in the Cayman Islands with limited liability) Stock Code : 9991 *For identification purposes only 2025 INTERIM REPORT |

| Definitions 2 Corporate Information 5 Information about Our Weighted Voting Rights 7 Management Discussion and Analysis 9 Other Information 25 Report on Review of Condensed Consolidated Financial Statements 38 Unaudited Condensed Consolidated Balance Sheet 39 Unaudited Condensed Consolidated Statement of Operations 42 Unaudited Condensed Consolidated Statement of Comprehensive Income 44 Unaudited Condensed Consolidated Statement of Changes in Shareholders’ Equity 45 Unaudited Condensed Consolidated Statement of Cash Flows 46 Notes to Condensed Consolidated Financial Statements 49 CONTENTS Interim Report 2025 1 |

| 2 BAOZUN INC. DEFINITIONS In this interim report, unless the context otherwise requires, the following expressions shall have the following meanings: “2014 Plan” the share incentive plan adopted by the Company in May 2014 and terminated in November 2022 “2015 Plan” the share incentive plan adopted by the Company in May 2015 and terminated in November 2022 “2022 Plan” the share incentive plan adopted by the Company in November 2022, as amended or supplemented from time to time “ADS(s)” American Depositary Shares (each representing three Class A ordinary shares) “associate(s)” has the meaning ascribed thereto under the Listing Rules “Audit Committee” the audit committee of the Board “Board” or “Board of Directors” the board of directors of the Company “CG Code” the Corporate Governance Code as set out in Appendix C1 to the Listing Rules, as amended from time to time “China” or “PRC” the People’s Republic of China “Class A ordinary shares” Class A ordinary shares in the share capital of the Company with a par value of US$0.0001 each, conferring a holder of a Class A ordinary share to one vote per share on any resolution tabled at the Company’s general meeting “Class B ordinary shares” Class B ordinary shares in the share capital of the Company with a par value of US$0.0001 each, conferring weighted voting rights in the Company such that a holder of a Class B ordinary share is entitled to ten votes per share on any resolution tabled at the Company’s general meeting “Company” Baozun Inc., a company incorporated in the Cayman Islands as an exempted company with limited liability on December 17, 2013, the Shares of which are listed on the Main Board of the Stock Exchange and the ADS of which are listed on the NASDAQ “Director(s)” director(s) of the Company |

| Interim Report 2025 3 DEFINITIONS “Group”, “we”, “us” or “our” the Company, consolidated subsidiaries and its affiliated consolidated entities, including its variable interest entity and its subsidiaries, from time to time “Hong Kong” or “HK” the Hong Kong Special Administrative Region of the PRC “Hong Kong dollars”, “HKD” or “HK$” Hong Kong dollars, the lawful currency of Hong Kong “U.S. dollars” United States dollar, the lawful currency of United States “Listing” the listing of the Shares on the Main Board “Listing Date” the date of Listing of the Company, i.e. September 29, 2020 “Listing Rules” the Rules Governing the Listing of Securities on the Stock Exchange of Hong Kong Limited, as amended, supplemented or otherwise modified from time to time “Main Board” the stock exchange (excluding the option market) operated by the Stock Exchange which is independent from and operated in parallel with GEM of the Stock Exchange “Model Code” the Model Code for Securities Transactions by Directors of Listed Issuers set out in Appendix C3 to the Listing Rules “Mr. Qiu” Mr. Vincent Wenbin Qiu, our founder, chairman of the Board and chief executive officer “Mr. Wu” Mr. Junhua Wu, one of our co-founders, our Director and chief strategy officer “NASDAQ” Nasdaq Global Select Market in the United States “Primary Conversion” the Company’s voluntary conversion of its secondary listing status in Hong Kong to primary listing on the Stock Exchange effective from November 1, 2022 “Prospectus” the prospectus of the Company dated September 18, 2020 “Renminbi” or “RMB” the lawful currency of the PRC “Reporting Period” the period from January 1, 2025 to June 30, 2025 “RSU(s)” restricted share unit(s) |

| 4 BAOZUN INC. DEFINITIONS “SEC” the Securities and Exchange Commission of the United States “Service Provider(s)” the consultants, dependent contractors or agents (excluding professional advisors and experts) of the Company or a subsidiary “SFO” the Securities and Futures Ordinance of Hong Kong (Chapter 571 of the Laws of Hong Kong), as amended, supplemented or otherwise modified from time to time “Share(s)” the Class A ordinary shares and Class B ordinary shares in the share capital of the Company, as the context so requires “Share Incentive Plans” the 2014 Plan, the 2015 Plan and the 2022 Plan “Shareholder(s)” holder(s) of the Share(s) “Stock Exchange” or “Hong Kong Stock Exchange” The Stock Exchange of Hong Kong Limited * For identification purposes only This interim report contains translations of certain Renminbi (RMB) amounts into U.S. dollars (US$) at a specified rate solely for the convenience of the reader. Unless otherwise noted, the translation of RMB into US$ has been made at RMB7.1636 to US$1.00 for the financial figures in relation to the Reporting Period, RMB7.2993 to US$1.00 for the financial figures in relation to the year ended December 31, 2024, and RMB7.2672 to US$1.00 for the financial figures in relation to the six months ended June 30, 2024, being the noon buying rate in effect on June 30, 2025, December 31, 2024 and June 28, 2024, respectively, as set forth in the H.10 Statistical Release of the Federal Reserve Board. LANGUAGE If there is any inconsistency between the English version and Chinese version of this interim report, the English version shall prevail, provided that if there is any inconsistency between the Chinese names of the entities or enterprises established in the PRC mentioned in this interim report and their English translations, the Chinese names shall prevail. |

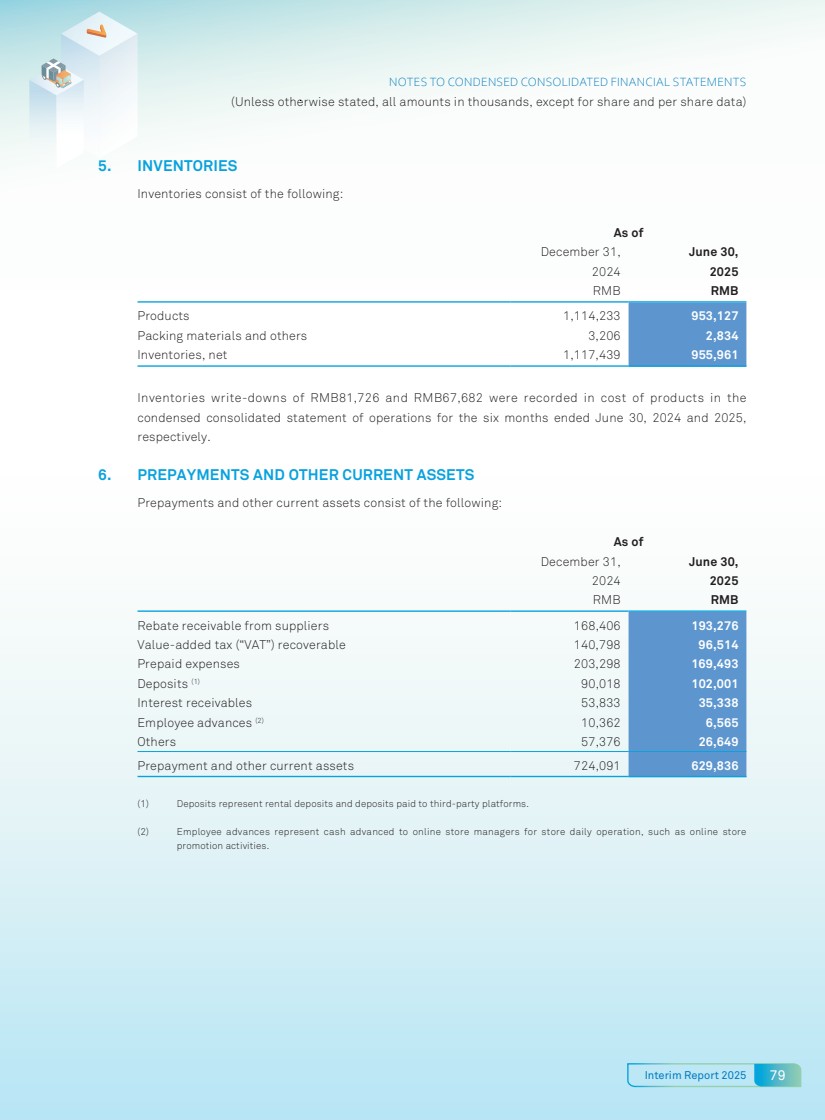

| Interim Report 2025 5 CORPORATE INFORMATION BOARD OF DIRECTORS Directors Mr. Vincent Wenbin Qiu (仇文彬) (Founder, Chairperson and Chief Executive Officer) Mr. Junhua Wu (吳駿華) Mr. Satoshi Okada (岡田聡良) Dr. Jun Wang (王俊) Ms. Bin Yu (余濱) Independent Directors Mr. Yiu Pong Chan Mr. Steve Hsien-Chieng Hsia Mr. Benjamin Changqing Ye (葉長青) AUDIT COMMITTEE Mr. Benjamin Changqing Ye (葉長青) (Chairman) Mr. Yiu Pong Chan Mr. Steve Hsien-Chieng Hsia COMPENSATION COMMITTEE Mr. Yiu Pong Chan (Chairman) Mr. Steve Hsien-Chieng Hsia Mr. Benjamin Changqing Ye (葉長青) NOMINATING AND CORPORATE GOVERNANCE COMMITTEE Mr. Steve Hsien-Chieng Hsia (Chairman) Mr. Yiu Pong Chan Mr. Benjamin Changqing Ye (葉長青) Ms. Bin Yu (余濱) (appointed on May 21, 2025) JOINT COMPANY SECRETARIES Ms. Wendy Shu Sun (孫舒) (appointed on March 20, 2025) Mr. Arthur Yu (resigned on March 20, 2025) Ms. So Ka Man AUTHORISED REPRESENTATIVES Mr. Vincent Wenbin Qiu Ms. So Ka Man REGISTERED OFFICE Vistra (Cayman) Limited P.O. Box 31119 Grand Pavilion, Hibiscus Way 802 West Bay Road Grand Cayman, KY1-1205 Cayman Islands PRINCIPAL EXECUTIVE OFFICES OF MAIN OPERATIONS No. 1-9, Lane 510, West Jiangchang Road Shanghai 200436, China PRINCIPAL PLACE OF BUSINESS IN HONG KONG Room 1928, 19/F, Lee Garden One 33 Hysan Avenue Causeway Bay Hong Kong CAYMAN ISLANDS PRINCIPAL SHARE REGISTRAR AND TRANSFER OFFICE Vistra (Cayman) Limited P.O. Box 31119 Grand Pavilion, Hibiscus Way 802 West Bay Road Grand Cayman, KY1-1205 Cayman Islands HONG KONG BRANCH SHARE REGISTRAR Computershare Hong Kong Investor Services Limited Shops 1712-1716 17th Floor, Hopewell Centre 183 Queen’s Road East Wan Chai, Hong Kong AUDITOR KPMG Public Interest Entity Auditor registered under the Accounting and Financial Reporting Council Ordinance 8th Floor, Prince’s Building, 10 Chater Road Central, Hong Kong |

| 6 BAOZUN INC. CORPORATE INFORMATION LEGAL ADVISOR Davis Polk & Wardwell 10th Floor The Hong Kong Club Building 3A Chater Road Hong Kong PRINCIPAL BANKERS Ping An Bank Co., Ltd. 14/F, No. 5047 Shennan Road East Shenzhen PRC STOCK CODE HKEX: 9991 NASDAQ: BZUN WEBSITE www.baozun.com |

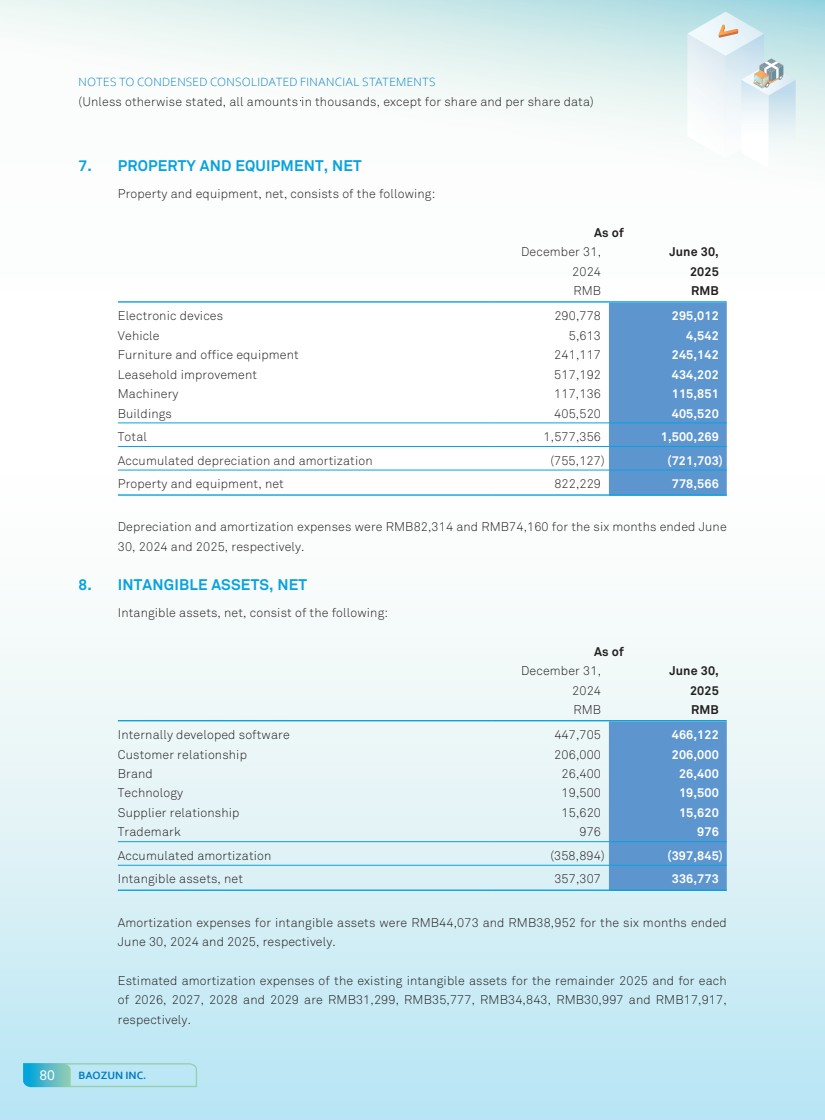

| Interim Report 2025 7 INFORMATION ABOUT OUR WEIGHTED VOTING RIGHTS WEIGHTED VOTING RIGHT STRUCTURE Under our weighted voting rights structure, our share capital comprises Class A ordinary shares and Class B ordinary shares. Each Class A ordinary share entitles the holder to exercise one vote, and each Class B ordinary share entitles the holder to exercise ten votes, respectively, on any resolution tabled at the Company’s general meetings, except as may otherwise required by law or by the Listing Rules or provided for in our Memorandum and Articles of Association. Shareholders and prospective investors should be aware of the potential risks of investing in a company with a weighted voting rights structure. Our American Depositary Shares, each representing three of our Class A ordinary shares, are listed on the Nasdaq Global Select Market in the United States under the symbol BZUN. Each Class B ordinary share is convertible into one Class A ordinary share at any time by the holder thereof. Upon the conversion of all the issued and outstanding Class B ordinary shares into Class A ordinary shares, the Company will issue 13,300,738 Class A ordinary shares, representing approximately 8.31% of the total number of issued and outstanding Class A ordinary shares or 7.67% of the enlarged issued and outstanding shares of the Company (without taking into account any shares to be issued underlying the unexercised options, the unvested RSUs or other awards may be granted from time to time pursuant to the 2014 Plan, the 2015 Plan and the 2022 Plan, and any Shares repurchased but pending cancellation and treasury shares) as of June 30, 2025. WVR BENEFICIARY As of June 30, 2025, the weighted voting rights (“WVR”) beneficiaries are Mr. Vincent Wenbin Qiu, our founder, chairman of the Board and chief executive officer and Mr. Junhua Wu, our co-founder, director and chief strategy officer. Mr. Vincent Wenbin Qiu Mr. Qiu is interested in and controls, through Jesvinco Holdings Limited, a company wholly owned by Mr. Qiu, 10 Class A ordinary shares and 9,410,369 Class B ordinary shares. Mr. Qiu also beneficially owns 4,429,366 Class A ordinary shares, comprising 810,000 Class A ordinary shares underlying unvested restricted share units under the 2022 Plan. As of June 30, 2025, Mr. Qiu controlled 33.35% of the aggregate voting power of our Company (excluding the treasury shares held by the Company and the Shares repurchased by the Company but pending cancellation). Mr. Junhua Wu Mr. Wu is interested in and controls, through Casvendino Holdings Limited, a company wholly owned by Mr. Wu, 2,764,707 Class A ordinary shares (comprising 130,500 Class A ordinary shares underlying unvested restricted share units under the 2015 Plan) and 3,890,369 Class B ordinary shares. Mr. Wu also beneficially owns 46,752 Class A ordinary shares. As of June 30, 2025, Mr. Wu controlled 14.19% of the aggregate voting power of our Company (excluding the treasury shares held by the Company and the Shares repurchased by the Company but pending cancellation). |

| 8 BAOZUN INC. INFORMATION ABOUT OUR WEIGHTED VOTING RIGHTS The Company’s WVR structure enables the WVR beneficiaries to exercise voting control over the Company notwithstanding that the WVR beneficiaries do not hold a majority economic interest in the share capital of the Company. This will enable the Company to benefit from the continuing vision and leadership of the WVR beneficiaries who will control the Company with a view to its long-term prospects and strategy. Prospective investors are advised to be aware of the potential risks of investing in companies with weighted voting rights structures, in particular that interests of the WVR beneficiaries may not necessarily always be aligned with those of our Shareholders as a whole, and that the WVR beneficiaries will be in a position to exert significant influence over the affairs of our Company and the outcome of Shareholders’ resolutions, irrespective of how other Shareholders vote. Prospective investors should make the decision to invest in the Company only after due and careful consideration. Upon any sale, transfer, assignment or disposition of beneficial ownership of any Class B ordinary shares by a holder thereof to any person or entity that is not an Affiliate (as defined in our Articles of Association) of such holder, such Class B ordinary shares will be automatically and immediately converted into an equal number of Class A ordinary shares. As the Company was initially listed as a grandfathered greater China issuer pursuant to Chapter 19C of the Listing Rules with a WVR structure, certain shareholder protection measures and governance safeguards under Chapter 8A of the Listing Rules do not apply to the Company pursuant to Rule 8A.46 of the Listing Rules. The relevant exemptions pursuant to Chapter 8A of the Listing Rules continue to apply after the Primary Conversion. |

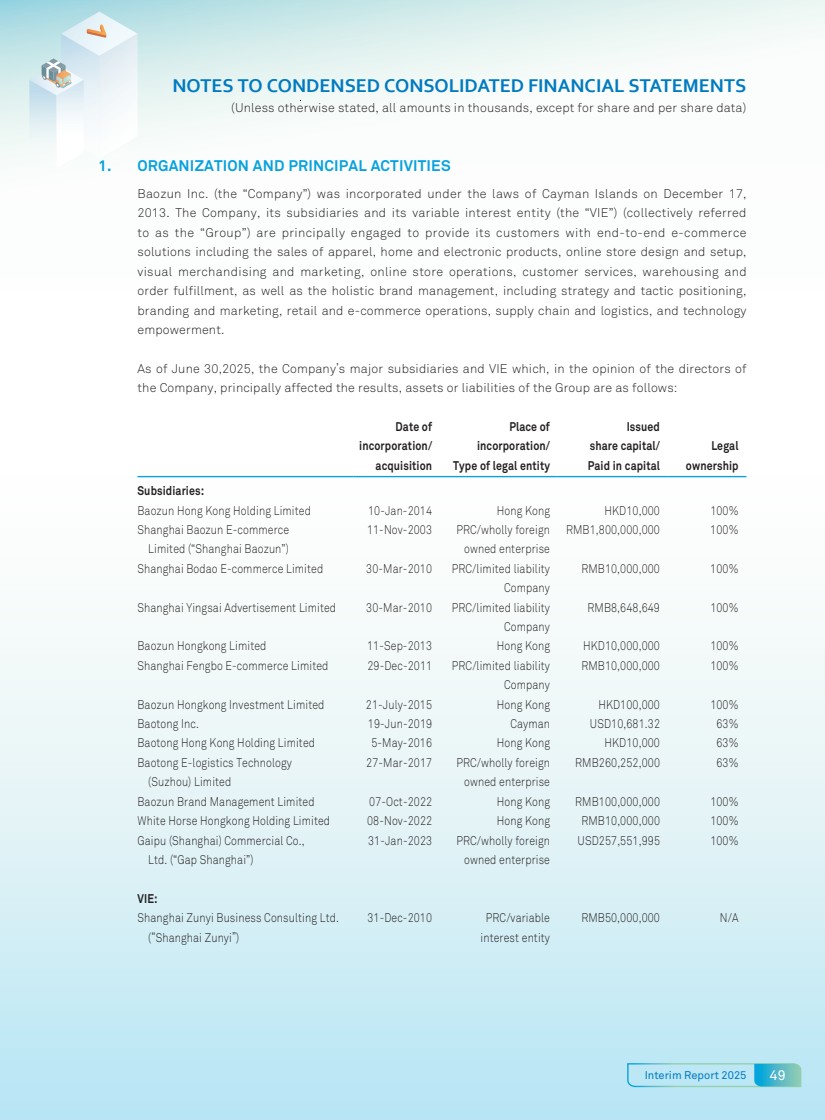

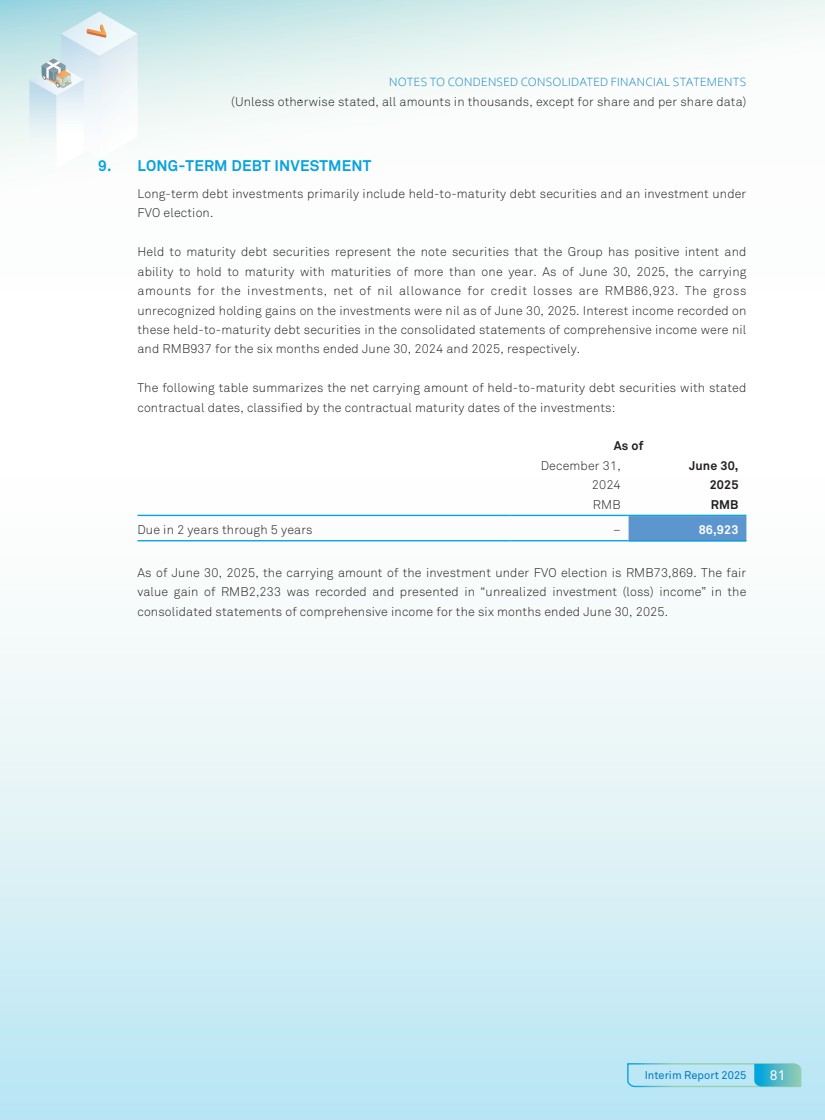

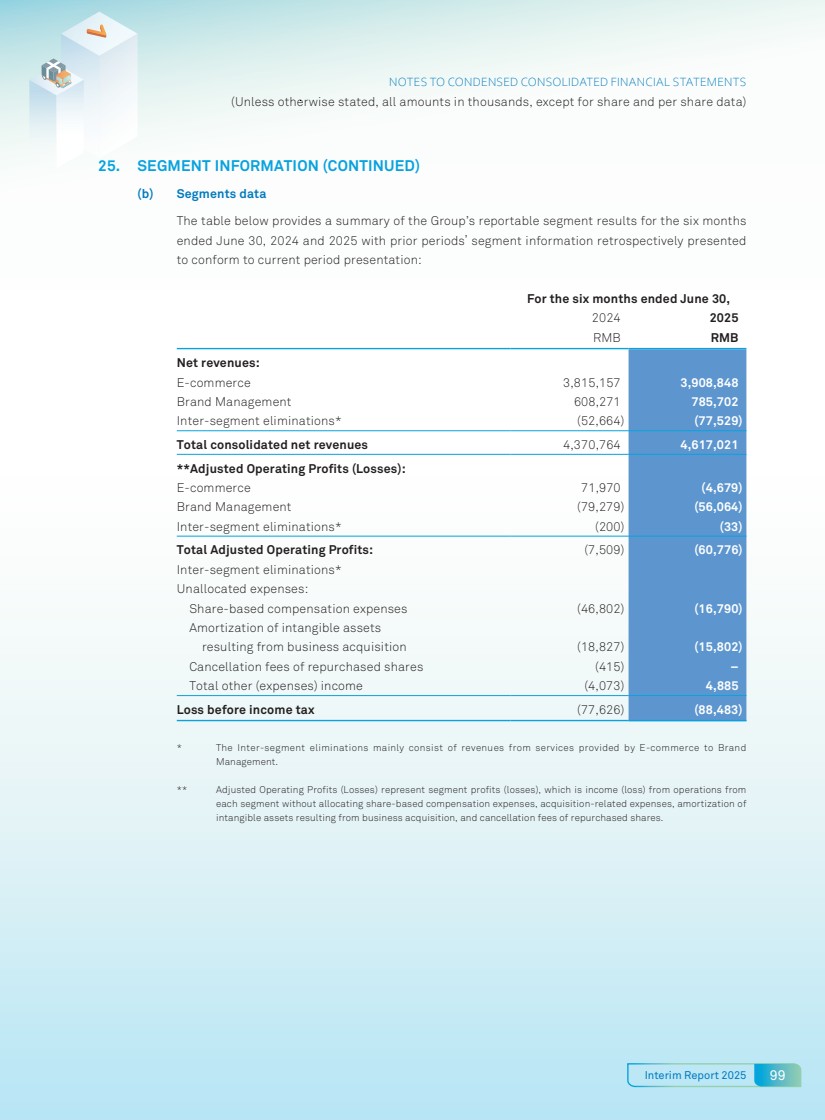

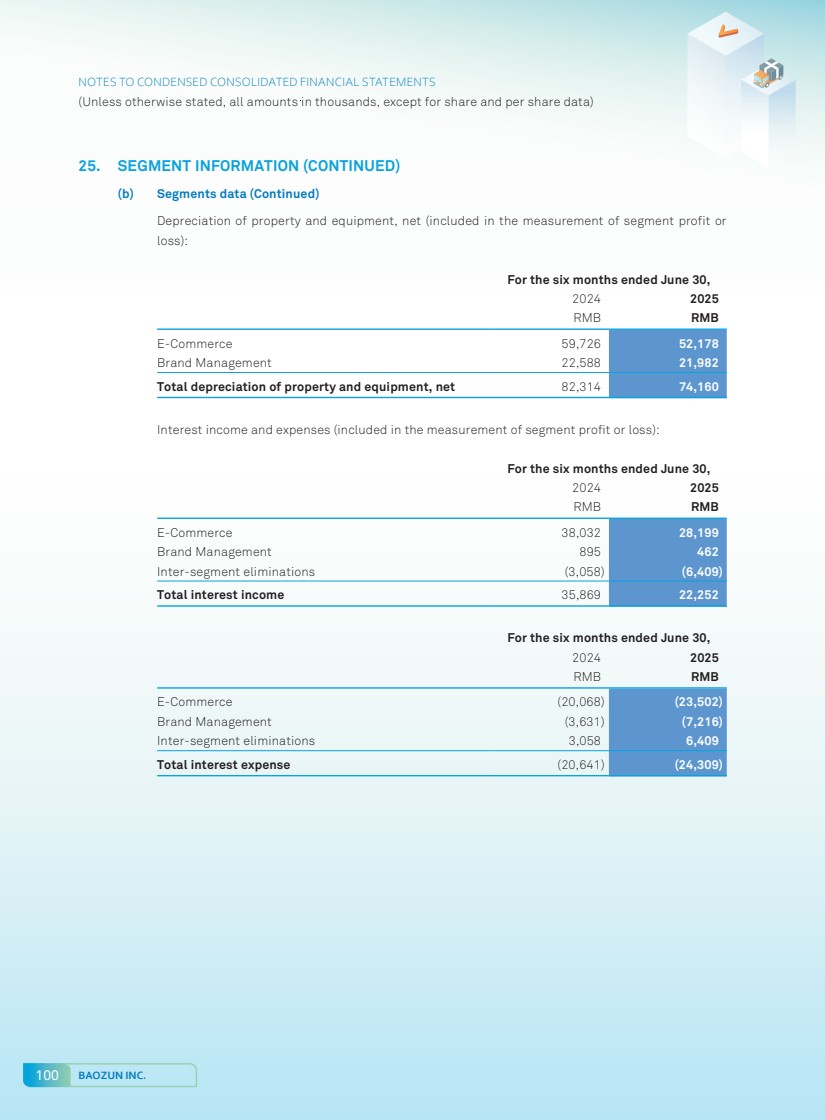

| Interim Report 2025 9 MANAGEMENT DISCUSSION AND ANALYSIS BUSINESS OVERVIEW We are a leading pioneer in the brand e-commerce service industry and a digital commerce enabler in China. We empower a diverse range of brands to grow and succeed by leveraging our end-to-end e-commerce service capabilities, omni-channel expertise, and technology-driven solutions. Recognizing the growing convergence of online and offline commerce, we view this trend as a significant opportunity. Adhering to our vision of “Technology Empowers Future Success”, our advanced technology and operating platforms provide a unified and robust foundation that supports our expanded range of services and markets. In 2023, we expanded our businesses into three business lines – Baozun E-commerce (BEC), Baozun Brand Management (BBM) and Baozun International (BZI). Starting from the first quarter of 2023, we have two operating segments: E-Commerce (encompassing BEC and BZI) and Brand Management (representing BBM). Baozun e-Commerce includes our China e-commerce businesses, such as brands’ store operations, customer services and value-added services in logistics and supply chain management, IT, and digital marketing. Baozun Brand Management engages in holistic brand management, including strategy and tactic positioning, branding and marketing, retail and e-commerce operations, supply chain and logistics, and technology empowerment. We aim to leverage our portfolio of technologies to establish longer and deeper relationships with brands. Baozun International is a long-term opportunity that we will patiently invest in and explore. We have a distinct advantage to replicate our China e-commerce success. Baozun International will empower brands with local market insights and critical e-commerce infrastructure, serving local consumers through a wide product selection and differentiated customer experience. The expansion of Baozun group into three business lines – BEC, BBM and BZI, is aimed at creating a virtuous ecosystem in which each division brings value to the others. Our 18 years of expertise and technological advancements in the e-commerce industry have allowed us to rapidly increase our scale and establish deeper relationships with brand partners. Our strategy capitalizes on virtuous cycles and synergies across our business lines. Our revenue increased by 5.6% from RMB4,370.8 million for the six months end June 30, 2024 to RMB4,617.0 million for the same period in 2025, primarily driven by both of the Group’s two operating segments. Our non-GAAP operating loss increased from RMB7.5 million for the six months ended June 30, 2024 to RMB60.8 million for the same period in 2025, primarily due to write-down of accounts receivable totaling RMB53.3 million. Excluding this write-down, non-GAAP operating loss was flat year-over-year. |

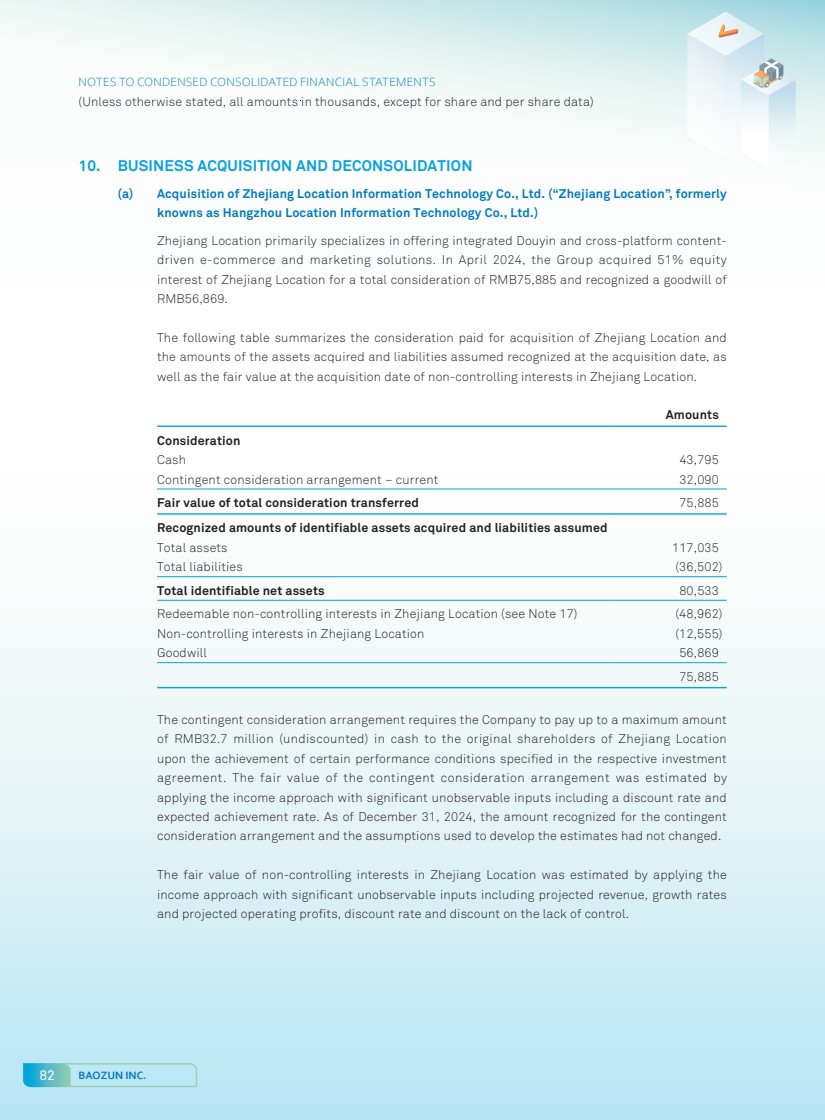

| 10 BAOZUN INC. MANAGEMENT DISCUSSION AND ANALYSIS Baozun E-Commerce (BEC) Baozun e-Commerce includes our China e-commerce businesses, such as brands’ store operations, customer services and value-added services covering warehousing and fulfillment, IT, and digital marketing. We empower a broad and diverse range of brands to grow and succeed by leveraging our end-to-end e-commerce service capabilities, omni-channel expertise, and technology-driven solutions. Our competitive advantages have enabled us to achieve rapid growth in our brand partnerships. We collaborate with global leaders in their respective verticals, including brands like Philips, Nike, and Microsoft. Our ability to help brand partners navigate the challenges arising from the macroeconomy, by leveraging our efficient e-commerce operational capabilities and effective omni-channel solutions, demonstrates the value of our services. With our deep understanding of the needs of various brands, we are able to offer value propositions that set us apart from other market players. • Multi-category, multi-brand capabilities: Our capabilities extend across multiple categories and brands of different types, scales, and stages of development. We possess in-depth industry-specific domain knowledge that spans the entire e-commerce value chain. • Full-scope services: We provide integrated one-stop solutions to address all core aspects of e-commerce operations, including IT solutions, online store operations, digital marketing, customer service, and warehousing and fulfilment. Our ability to provide one-stop e-commerce solutions is backed by our proprietary and robust technology stack, including our Cloud-based System that enables efficient setup of official brand stores and official marketplace stores, ROSS that facilitates smooth and efficient online store operations; big data analytics and AI capabilities that drive our efficient and effective digital marketing solutions; customer relationship management, or CRM, that supports attentive real-time pre-sale and post-sale customer services and engagement; and order management system, or OMS, and warehouse management system, or WMS, that enable integrated and reliable multi-category warehousing and fulfillment services. We remain committed to investing in new technologies and infrastructure to provide innovative and reliable solutions to our brand partners. • Omni-channel coverage: We help brand partners adapt to and thrive in China’s complex e-commerce ecosystem and evolving e-commerce landscape. We enable brands to integrate online and offline operations. We help brand partners formulate and implement coherent e-commerce strategies, which require holistic performance analysis across channels and balanced tactics for different platforms. Based on the different needs of our brand partners, we operate under three business models: the distribution model, the service fee model, and the consignment model. We generate product sales revenues primarily through selling the products that we purchase from our brand partners and/or their authorized distributors to consumers under the distribution model, and derive services revenues primarily through charging brand partners and other customers fees under the service fee model and the consignment model. |

| Interim Report 2025 11 MANAGEMENT DISCUSSION AND ANALYSIS Our Business Models and Solutions Through our integrated brand e-commerce capabilities, we provide end-to-end brand e-commerce solutions that cater to our brand partners’ unique needs. We leverage our brand partners’ resources and seamlessly integrate with their back-end systems to enable data analytics for the entire transaction value chain, making our services a crucial part of our brand partners’ e-commerce functions. Our e-commerce capabilities encompass every aspect of the e-commerce value chain, including online store operations, customer service, IT solutions, digital marketing, warehousing, and fulfillment. Depending on each brand partner’s specific needs and the characteristics of its product category, our brand partners utilize one or a blend of our solutions under one or a combination of our business models: the distribution model, the service fee model, and the consignment model. Operational Highlights of BEC For the Six Months Ended June 30, 2025 During the first six months ended June 30, 2025, service revenue grew by 1.8%, primally driven by strong digital marketing demand from brand partners and strong performance of sportswear and apparel category. Omni-channel expansion remains a key theme for our brand partners. We continued to further enhance our omni-channel capabilities. As of June 30, 2025, approximately 48.5% of our brand partners engaged with us for store operations of at least two channels, compared to 45.8% at the end of same period of last year. |

| 12 BAOZUN INC. MANAGEMENT DISCUSSION AND ANALYSIS Baozun Brand Management (BBM) Baozun Brand Management engages in holistic brand management and serves as an all-rounded partner for global brands to further unlock their business potential in China. BBM offers expertise in strategy and tactic positioning, branding and marketing, retail and e-commerce operations, supply chain and logistics, and technology empowerment. We aim to leverage our portfolio of technologies to establish longer and deeper relationships with brands. BBM targets the mid-end and premium consumer lifestyle brands segment. Our first key acquisition was the Gap China business. On November 8, 2022, we entered into a share purchase agreement with The Gap, Inc. and Gap (UK Holdings) Ltd. for the acquisition of the entire equity interests in two of their operating entities – Gap (Shanghai) Commercial Co., Ltd. and Gap Taiwan Limited – which operate the full business of Gap in Greater China. Concurrently, we and The Gap, Inc. established a series of business arrangements under which The Gap, Inc. granted us the exclusive rights to manufacture, market, distribute, and sell Gap products in Greater China, including the ability to localize the offering. For details, please refer to the announcement made by the Company on November 8, 2022. The acquisition of Gap (Shanghai) Commercial Co., Ltd. was completed on January 31, 2023. As a result, we began operating The Gap, Inc.’s business in Mainland China, Hong Kong, and Macao starting February 1, 2023. For details, please refer to the announcement made by the Company on February 1, 2023. Meanwhile, we, together with The Gap, Inc. and Gap (UK Holdings) Ltd., have been working to complete the acquisition of Gap Taiwan Limited (the “TW Transfer”). However, due to a prolonged delay in obtaining necessary approvals, on August 27, 2025, after due and careful consideration, we reached agreement with The Gap, Inc. and Gap (UK Holdings) Ltd. not to proceed with the TW Transfer. The Company considers that the termination does not have any material adverse impact on the financial position and operations of the Group. Additionally, in 2023, we and ABG Hunter LLC, a subsidiary of Authentic Brands Group, entered into a Hunter Greater China and Southeast Asia Term Sheet for Baozun’s acquisition of 51% equity interest in a special purpose vehicle established by ABG Hunter LLC. This vehicle holds the relevant intellectual property of Hunter brands in Greater China and Southeast Asia. At the same time, an affiliate of Baozun entered into a license agreement with ABG Hunter LLC, under which ABG Hunter LLC grants Baozun’s affiliate the exclusive right to manufacture, market, distribute, and sell Hunter brand products in Greater China. Our technologies and insights enable us to forge a sustainable, symbiotic relationship between physical retail and online commerce. We aim to deliver the best-in-class, seamless omni-channel experience by integrating the digital and the physical at scale, and to excel where few have done so in retail. We are evolving into a leading brand management company of iconic brands through a combination of transformative acquisitions and the consistent growth of our brands in China across all channels. |

| Interim Report 2025 13 MANAGEMENT DISCUSSION AND ANALYSIS GAP overview GAP is one of the world’s most recognized lifestyle brands, uplifting and inspiring consumers since 1969. The brand creates iconic style, which builds on its heritage grounded in denim and khakis and comes alive at the intersection of the classic and the new. GAP is an authority on modern American style. GAP represents a good example for BBM to build its business model and achieve the target of integrating digital technology, retail, and brands. Our current priorities include ensuring a smooth post-acquisition transition, refining products and merchandizing strategies, building supply chain infrastructures, and upgrading back-end systems, including talents and technologies, to pursue our technology-empowered, China-for-China, and digitalized modern new retail model. Our key strategic pillars for 2025 focus on merchandising, channel expansion and marketing initiatives for Gap, aimed at building healthy topline momentum while continuing to improve profitability. As of June 30, 2025, we operated 156 offline stores for GAP in mainland China. While most stores are located in first- and second-tier cities, the brand continues to expand into other high-potential cities across China. We plan to open approximately 40 new stores in 2025 and will continue to optimize our store structure and locations. Product Management China-for-China products remain our core priority. It is essential for us to interpret the GAP’s brand DNA in a way that resonate with the Chinese market. Our designs are guided by data insights and executed through a much shorter supply chain cycle. In the first half of 2025, we also launched several successful IP collaborations, including Forbidden City and Melting Sadness. These collections showcased our ability to blend China’s rich cultural heritage and fashion trends with GAP’s brand DNA – emphasizing comfort, safety, and quality. Retail Management With a consumer-centric and retail-oriented strategy, we have successfully improved our competitiveness, store efficiency, and responsiveness to the ever-changing market. During the Reporting Period, we continued to optimize our retail management capabilities. We aimed to open more “quality” neighborhood stores, such as those in Shanghai POPC, Beijing Tongzhou MixC, Haikou Longfor. These strategically located stores not only drive business but also enhance profitability. Additionally, we co-opened stores in Shenyang, Guiyang, Xi’an and many other cities with our local strategic partners, creating mutual benefits. Strong partnerships facilitate faster store openings, particularly in second- and third-tier cities, and enhance investment efficiency. |

| 14 BAOZUN INC. MANAGEMENT DISCUSSION AND ANALYSIS Supply Chain Management Effective supply chain management is crucial for sustainable growth. We focus on product innovation, quality control, and ensuring our supply chain is responsive and cost-effective. During the Reporting Period, we enhanced our supply chain capabilities to better meet consumer demands. We will continue to develop strategies to enhance the operational efficiency of our supply chain and unlock gross margin opportunities. We believe improving our supply chain efficiencies and managing working capital through the effective use of our infrastructure will enable us to control costs better and provide superior service to our customers. Talent We believe that the talent, commitment, and passion of our teams will always be key to our competitive edge. We offer a unique fashion proposition, defined by creativity, innovation, design, and quality. We successfully filled critical positions in a short timeframe. Our new hires are local industry experts with vast experience in both well-known leading multinational corporations and local apparel companies. We believe this will accelerate our business transformation and enhance organizational efficiency. Baozun International (BZI) Baozun International (BZI) is a long-term opportunity that we will patiently invest in and explore. We have a distinct advantage to replicate our China e-commerce success. BZI will empower brands with local market insights and critical e-commerce infrastructure, in turn serving local consumers through wide product selection and differentiated customer experience. Despite the uncertainties and complexities in the global macro environment, we remain firmly committed to our globalization strategy. We work with brand partners to co-develop “Glocalization”. Glocalization is a term combining “global” and “local” and refers to our philosophy that while we pursue global opportunities, we will rely on local expertise and resources. We plan to build an ecosystem around our technology and businesses, consisting of consumers, brands, retailers, third-party service providers, strategic alliance partners, and other businesses. BZI offers brands across several countries and regions a localized experience within the country in which they operate. In addition, BZI manages localized storefronts in different countries, making cross-border commerce easier for brands. These tailored experiences are designed to increase brand partners’ confidence in new markets and enhance consumer conversion, enabling brand partners to enter these new geographies with ease. Starting with Southeast Asia, we aim to serve brands and consumers around the world through both a localized and an e-commerce experience. As of June 30, 2025, we have set up operational offices in 10 markets, including Hong Kong, Taiwan, Singapore, Malaysia, Philippines, Thailand, Korea, Japan, Vietnam and France. At the same time, we continue to recruit local talent with deep expertise. We aim to empower brand partners with our strong e-commerce operational capabilities, customized vertical-specific solutions, and localized services to better serve the digitalization needs overseas. |

| Interim Report 2025 15 MANAGEMENT DISCUSSION AND ANALYSIS PROSPECTS Looking ahead, we remain cautious about the macro uncertainties but confident that our on-going transformation has strengthened our business fundamentals and value proposition to brand owners. In 2025, our primary focus is to execute our plans diligently, patiently, and sustainably. For BEC, we remain committed to strengthening both the top and bottom lines, with a focus on refined management, value creation and organizational efficiency. Our strategic objective remains clear – delivering “customer-centric, high-quality, and sustainable business growth”. In the first half of 2025, we advanced BEC’s business transition across four key areas: enhancing customer-centric services, growing quality revenue, driving profitability through efficiency, and fostering a sustainable corporate culture. In the second half of 2025, we will further execute our business transition towards a quality- and value-driven, profit-centric framework, positioning BEC well to accelerate profit generation. We will further develop our omni-channel capabilities, with a strong focus on emerging channels, such as Douyin and Rednote. We believe leveraging this established network will extend our success across major e-commerce platforms and drive sustained growth. Amid ever-changing market dynamics, BEC has shown agility in adapting to the evolving needs of our brand partners. Additionally, we aim to grow our product sales business through a high-quality digitalized distribution model. We believe an integrated approach – linking channel management, pricing and inventory control, and marketing – is crucial for building sustainable distribution partnerships in today’s dynamic environment. Our goal is to integrate online and offline channels seamlessly, utilizing our digital capabilities to empower brands across all fronts. We believe this strategy not only elevates our role from distribution partner to comprehensive trade partner but also positions BEC to deliver long-term, value-driven growth. For BBM, our focus is to build on current momentum, strengthen our foundation and reignite growth for the GAP brand in China. We remain on track with merchandising, channel expansion, and marketing initiatives, delivering healthy topline growth alongside improved profitability. Our merchandising strategy, sharply aligned with market timing and segmentation, has driven consistent gains in store traffic and conversion, while reinforcing GAP’s core brand DNA. Hunter also reached a remarkable milestone in unit economics for its first three offline stores, opened in May 2025 and continues to make steady progress in category expansion. These achievements validate the effectiveness of our expansion strategy and our ability to execute with precision. We will continue driving Hunter’s growth by expanding into new categories and diversifying our distribution channels to unlock the brand’s full potential in China. We believe that our expertise in technology, applied to brand operations, is central to Baozun’s identity. Regardless of the business models we deploy, our technology and expertise provide a cohesive and robust foundation for our strategy. With strengthened business fundamentals, we remain focused on executing our plans. Supported by a healthy cash flow and balance sheet, we are well-positioned to seize new opportunities and deliver lasting value to our stakeholders. |

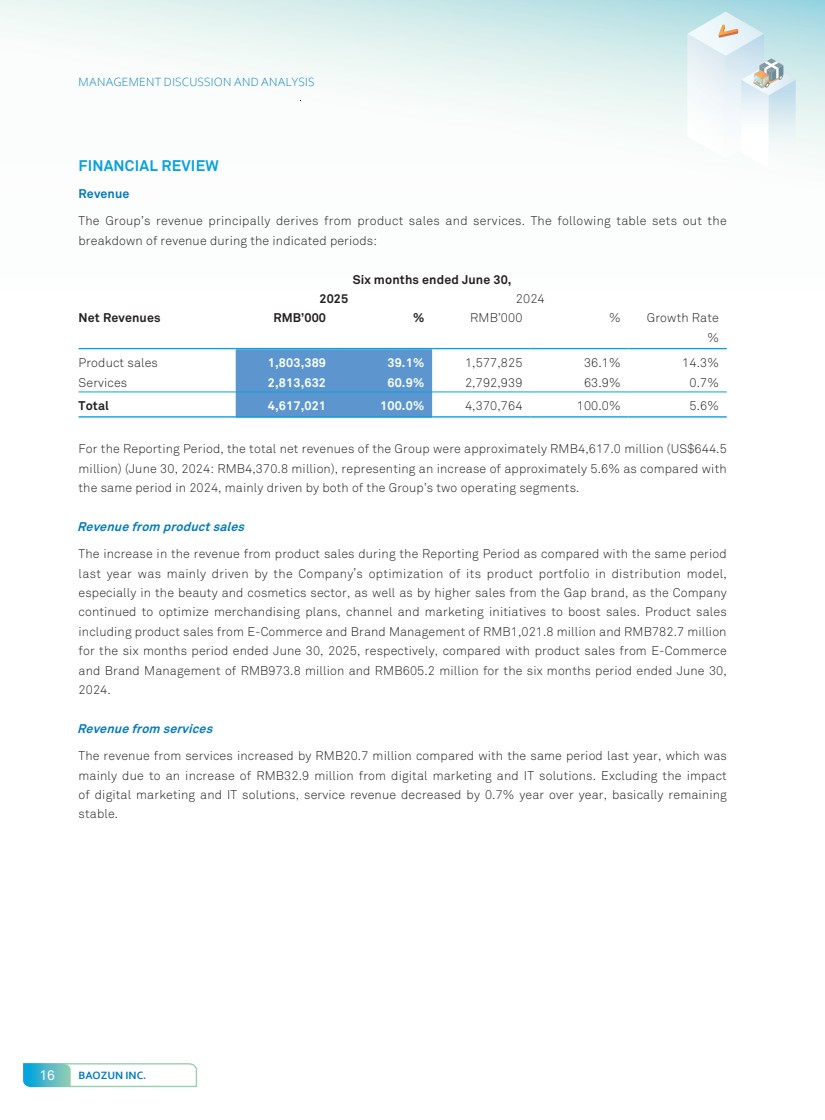

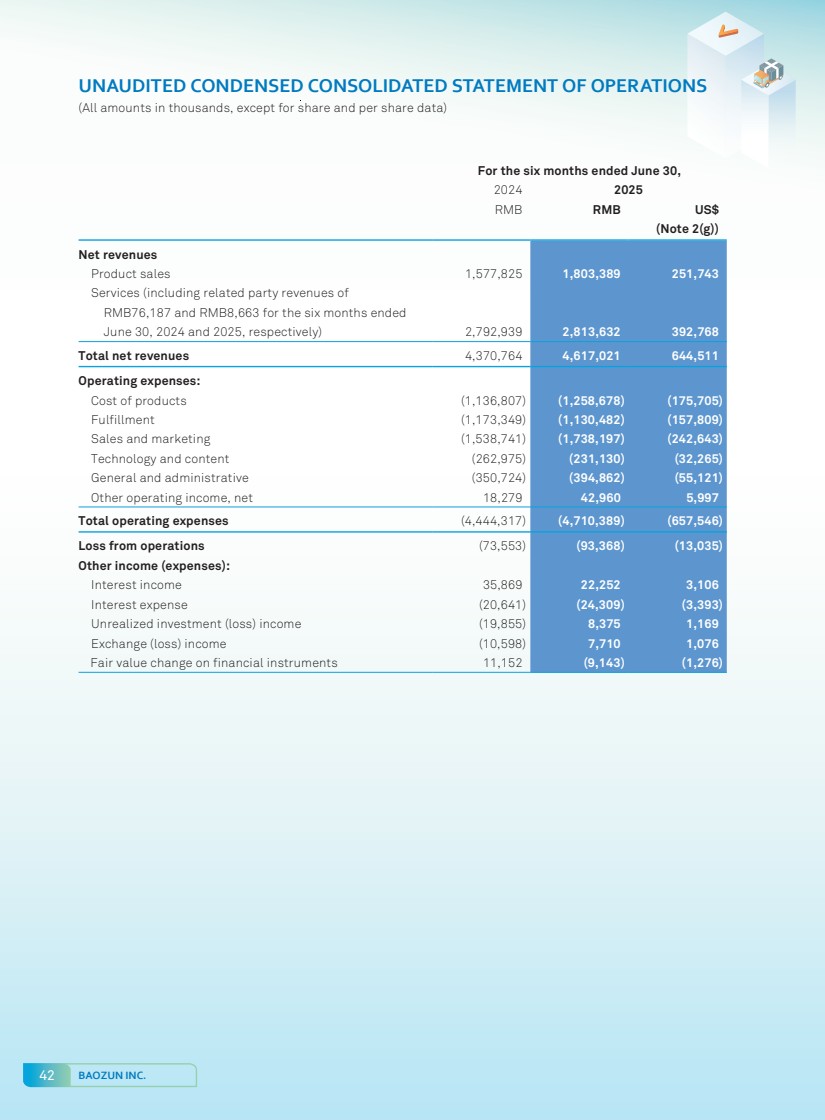

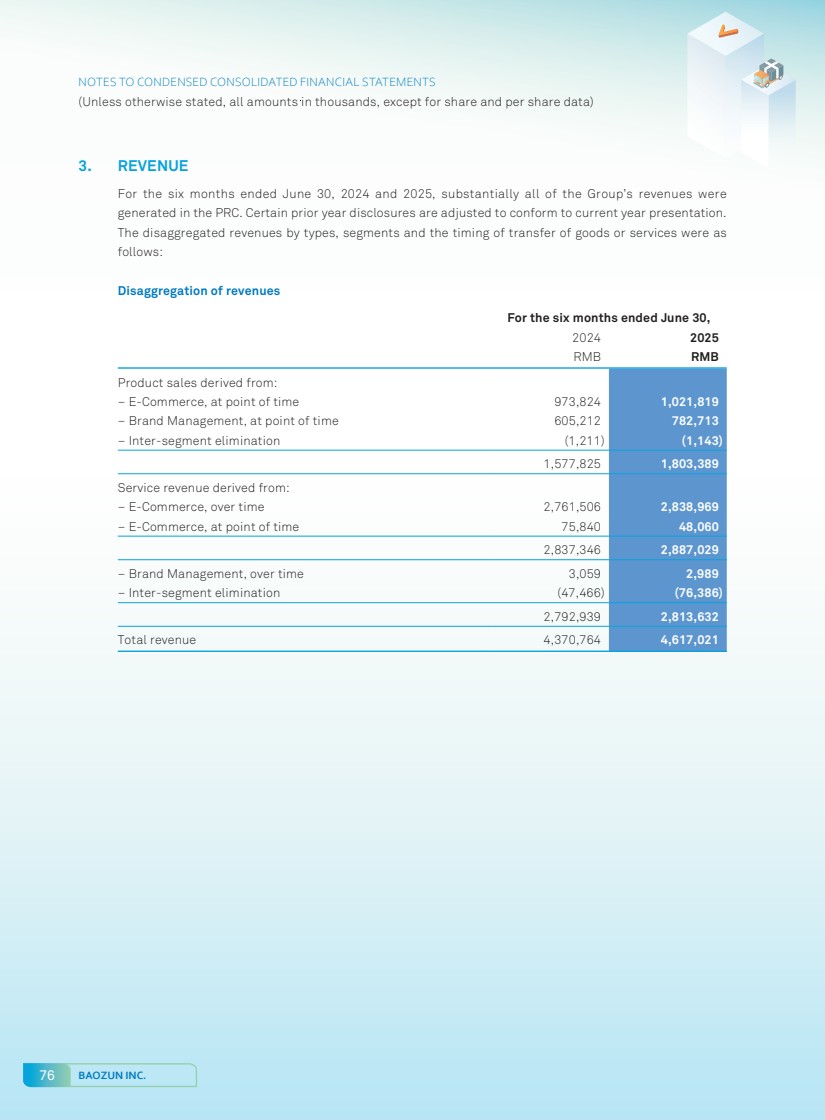

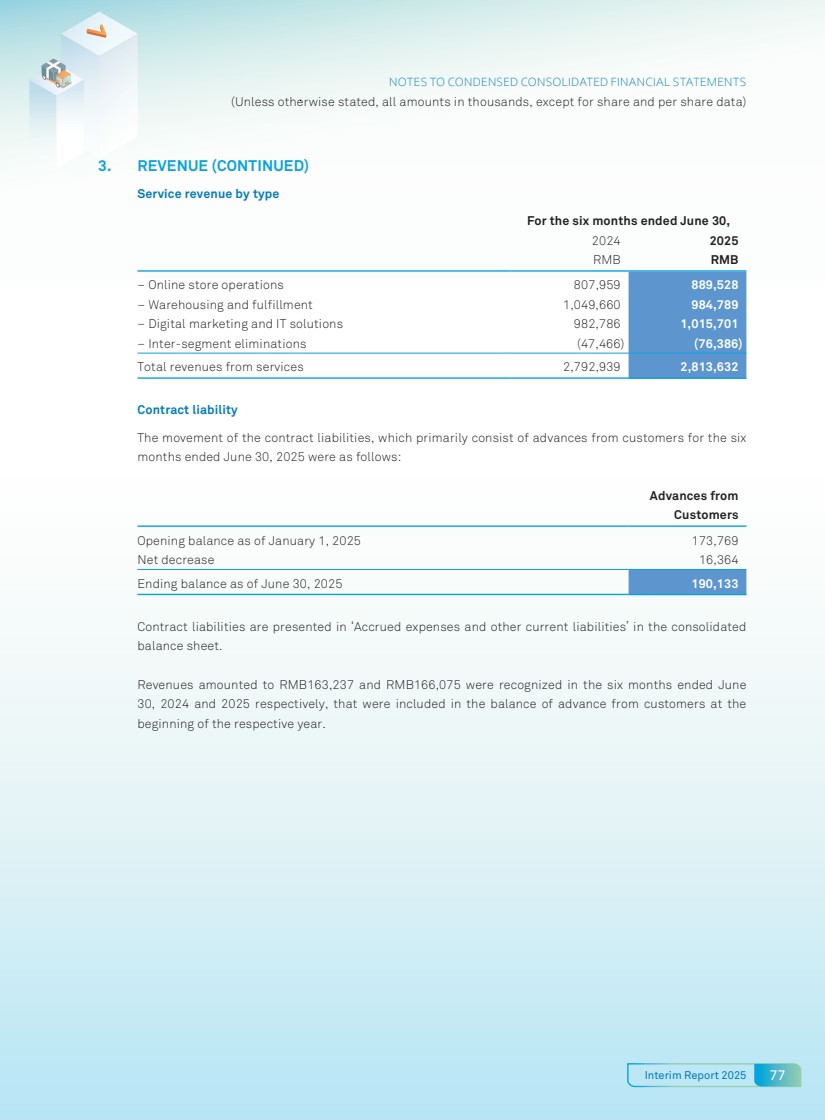

| 16 BAOZUN INC. MANAGEMENT DISCUSSION AND ANALYSIS FINANCIAL REVIEW Revenue The Group’s revenue principally derives from product sales and services. The following table sets out the breakdown of revenue during the indicated periods: Six months ended June 30, 2025 2024 Net Revenues RMB’000 % RMB’000 % Growth Rate % Product sales 1,803,389 39.1% 1,577,825 36.1% 14.3% Services 2,813,632 60.9% 2,792,939 63.9% 0.7% Total 4,617,021 100.0% 4,370,764 100.0% 5.6% For the Reporting Period, the total net revenues of the Group were approximately RMB4,617.0 million (US$644.5 million) (June 30, 2024: RMB4,370.8 million), representing an increase of approximately 5.6% as compared with the same period in 2024, mainly driven by both of the Group’s two operating segments. Revenue from product sales The increase in the revenue from product sales during the Reporting Period as compared with the same period last year was mainly driven by the Company’s optimization of its product portfolio in distribution model, especially in the beauty and cosmetics sector, as well as by higher sales from the Gap brand, as the Company continued to optimize merchandising plans, channel and marketing initiatives to boost sales. Product sales including product sales from E-Commerce and Brand Management of RMB1,021.8 million and RMB782.7 million for the six months period ended June 30, 2025, respectively, compared with product sales from E-Commerce and Brand Management of RMB973.8 million and RMB605.2 million for the six months period ended June 30, 2024. Revenue from services The revenue from services increased by RMB20.7 million compared with the same period last year, which was mainly due to an increase of RMB32.9 million from digital marketing and IT solutions. Excluding the impact of digital marketing and IT solutions, service revenue decreased by 0.7% year over year, basically remaining stable. |

| Interim Report 2025 17 MANAGEMENT DISCUSSION AND ANALYSIS Cost of Products Cost of products is incurred under the distribution model. Cost of products consists of the purchase price of products and inbound shipping charges, as well as inventory write-downs. Our cost of products was RMB1,258.7 million (US$175.7 million) for the Reporting Period (June 30, 2024: RMB1,136.8 million). The increase in cost of products during the Reporting Period as compared to the same period last year was mainly attributable to the growth in product sales of both BEC and BBM. Fulfillment Expenses Our fulfillment expenses primarily consist of (i) expenses charged by third-party couriers for dispatching and delivering products to consumers, (ii) expenses incurred in operating our fulfillment and customer service center, including personnel cost and expenses attributable to buying, receiving, inspecting and warehousing inventories, retrieval, packaging and preparing customer orders for shipment, and store operations, (iii) rental expenses of leased warehouses, and (iv) packaging material costs. The fulfilment expenses decreased by 3.7% from RMB1,173.3 million (US$161.5 million) for the six months ended June 30, 2024 to RMB1,130.5 million (US$157.8 million) for the Reporting Period. The decrease was primarily due to a decline in E-commerce warehouse and logistics revenue, along with savings in Gap logistics expenses. Sales and Marketing Expenses Our sales and marketing expenses primarily consist of payroll, bonus and benefits of sales and marketing staff, advertising costs, service fees paid to marketplaces, agency fees and costs for promotional materials. The sales and marketing expenses increased by 13.0% from RMB1,538.7 million (US$211.7 million) for the six months ended June 30, 2024 to RMB1,738.2 million (US$242.6 million) for the Reporting Period, primarily due to higher revenue contributions from digital marketing services for BEC, as well as increased marketing activities and expenses associated with the expansion of offline stores for BBM during the reporting period. Technology and Content Expenses Our technology and content expenses consist primarily of payroll and related expenses for employees in our technology and system department, technology infrastructure expenses, costs associated with the computers, storage and telecommunications infrastructure for internal use and other costs, such as editorial content costs. The technology and content expenses decreased by 12.1% from RMB263.0 million (US$36.2 million) for the six months ended June 30, 2024 to RMB231.1 million (US$32.3 million) for the Reporting Period, primarily due to the Company’s cost control initiatives and efficiency improvements. |

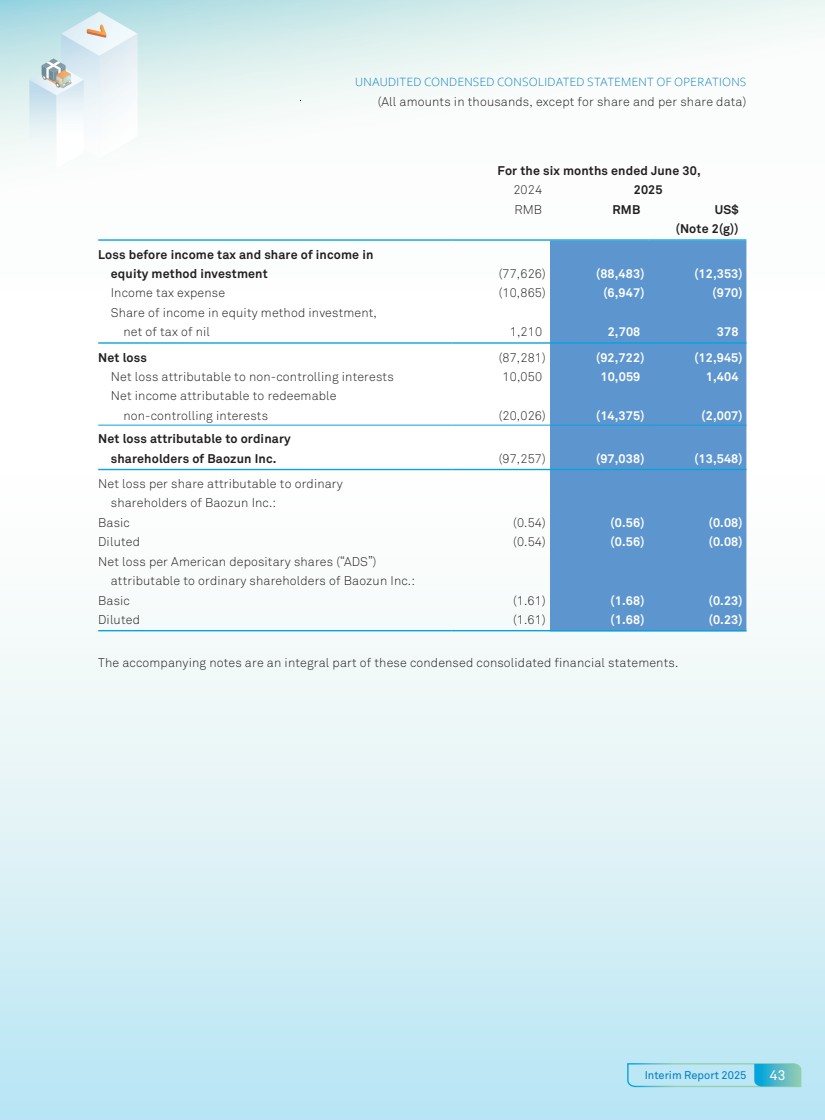

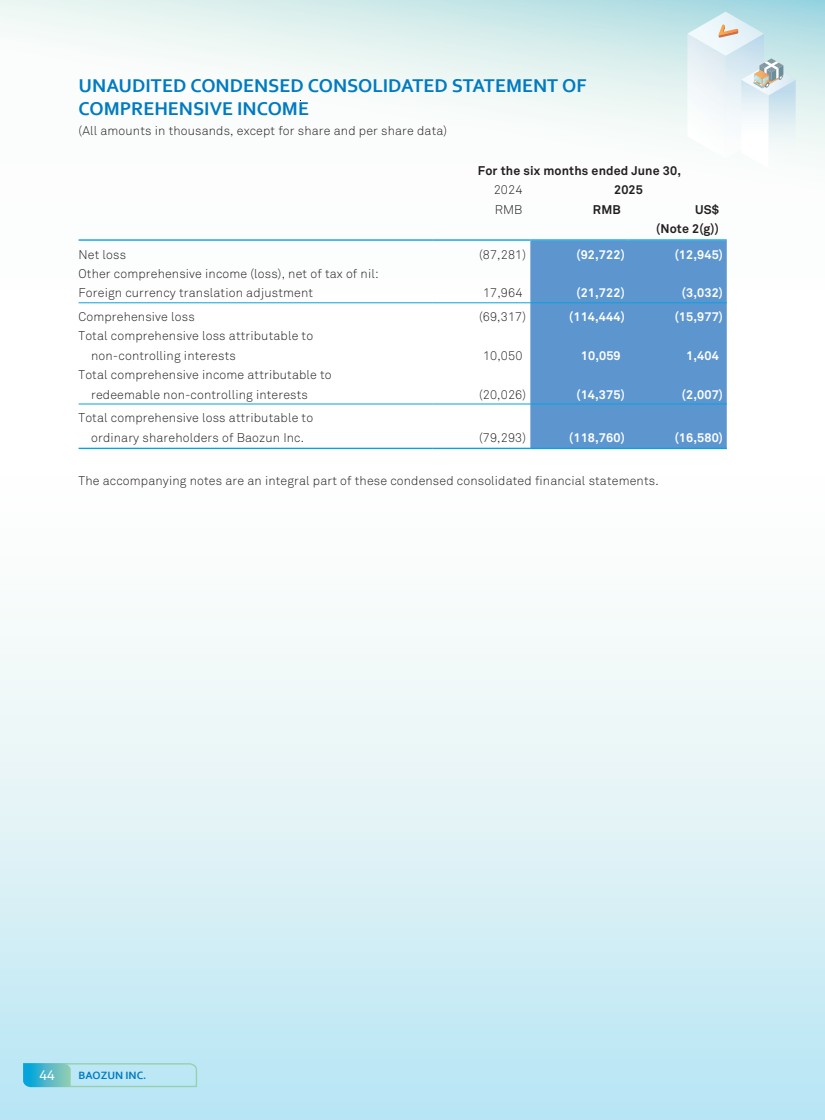

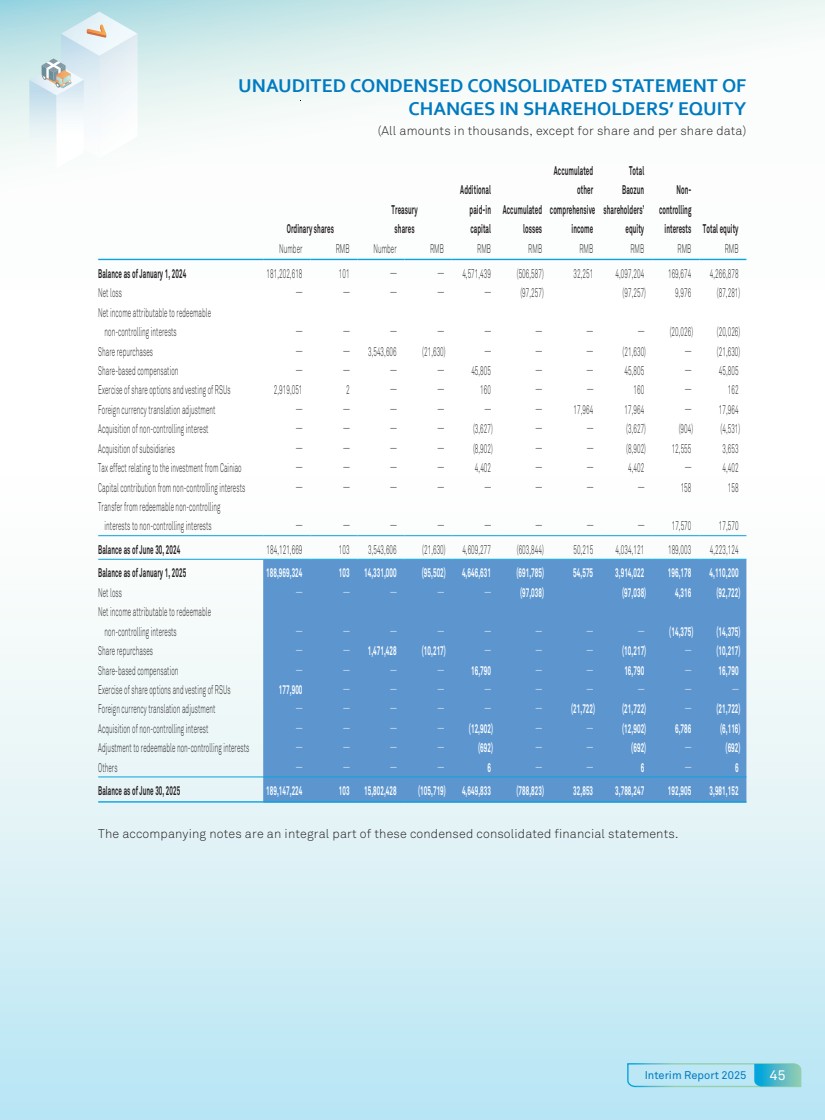

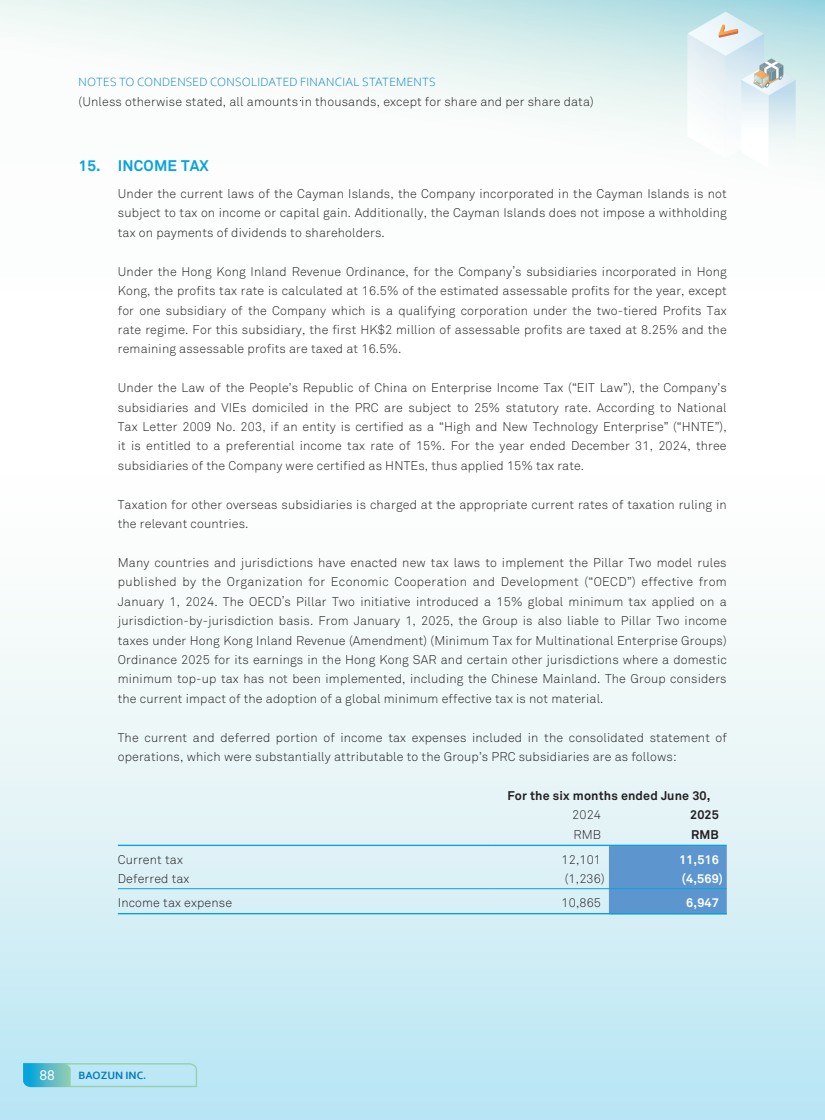

| 18 BAOZUN INC. MANAGEMENT DISCUSSION AND ANALYSIS General and Administrative Expenses Our general and administrative expenses consist primarily of payroll and related expenses for our management and other employees involved in general corporate functions, office rentals, depreciation and amortization expenses relating to property and equipment used in general and administrative functions, provision for allowance for doubtful accounts, professional service and consulting fees and other expenses incurred in connection with general corporate purposes. The general and administrative expenses increased by 12.6% from RMB350.7 million (US$48.3 million) for the six months ended June 30, 2024 to RMB394.9 million (US$55.1 million) for the Reporting Period. The increase was primarily due to an addition allowance of accounts receivable totaling RMB53.3 million, partially offset by the Company’s cost control initiatives and efficiency improvements. As disclosed in the Form 20-F of 2024 and 2024 annual report of the Company, in September 2021, one of our subsidiaries, Baozun Hong Kong Holding Limited, initiated an arbitration proceeding against a distributor in the health care and cosmetics industry for payment default. Management had previously provided an allowance of RMB93.3 million (US$13.1 million) of accounts receivable in connection with the default of this distributor in the past. Based on the latest progress of arbitration proceedings, management assessed the likelihood of recovery as remote and therefore provided additional allowance against the remaining carrying amount due from this distributor. Other Operating Income, Net Our other operating income mainly consists of cash subsidies received by the subsidiaries of the Group in the PRC from local governments as incentives for conducting business in certain local districts. The other operating income increased by 135.0% from RMB18.3 million (US$2.5 million) for the six months ended June 30, 2024 to RMB43.0 million (US$6.0 million) for the Reporting Period, primarily attributable to an increase in government grants received of RMB33.1 million. Other Income (Expense) The other income (expenses), consist of net interest expenses or income, unrealized investment (loss) gain, fair value change on financial instruments and exchange (loss) gain. For the Reporting Period, other income (net) were approximately RMB4.9 million (US$0.7 million), other expense (net) approximately RMB4.1 million (US$0.6 million) for the six months ended June 30, 2024, primarily attributable to an increase in the unrealized investment gain which arising from the change in the trading price of publicly listed companies we invest in. Income Tax Expense For the Reporting Period, our income tax expense was RMB6.9 million (US$1.0 million) as compared to RMB10.9 million (US$1.5 million) for the six months ended June 30, 2024. Net Loss As a result of the above factors, net loss of approximately RMB92.7 million (US$12.9 million) for the Reporting Period was recorded, compared to a net loss of RMB87.3 million (US$12.0 million) for the six months ended June 30, 2024. |

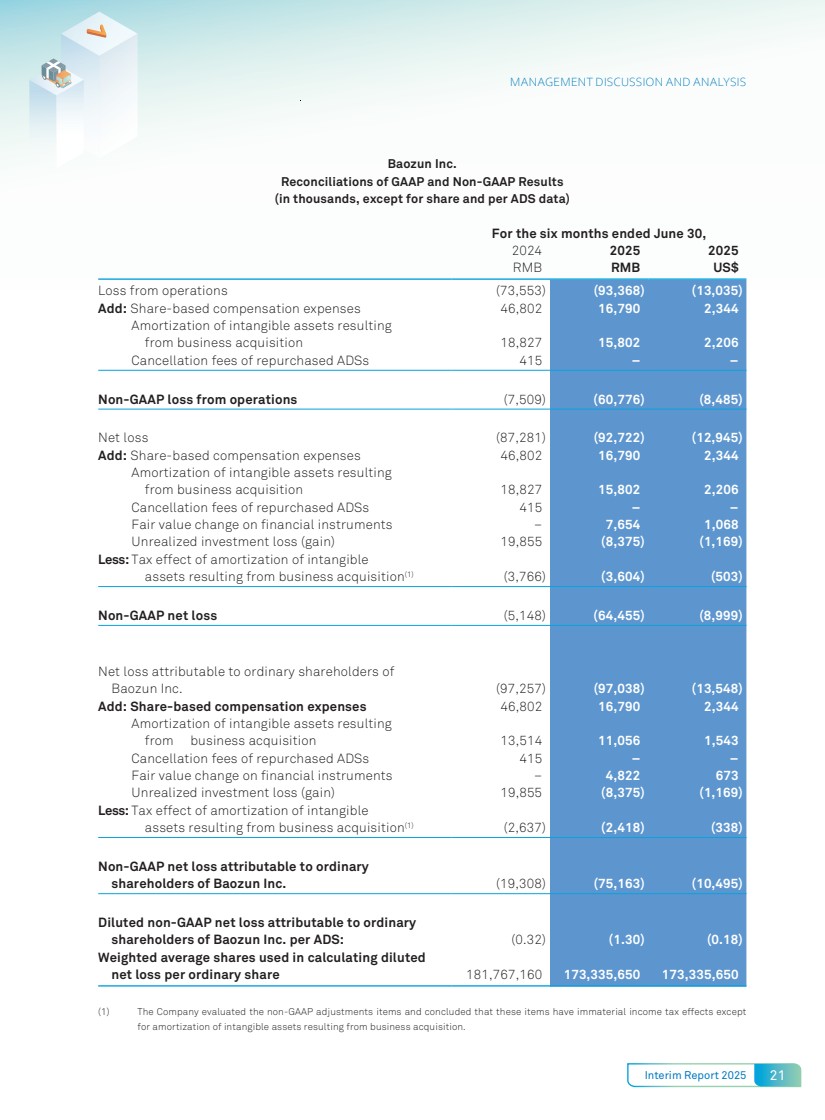

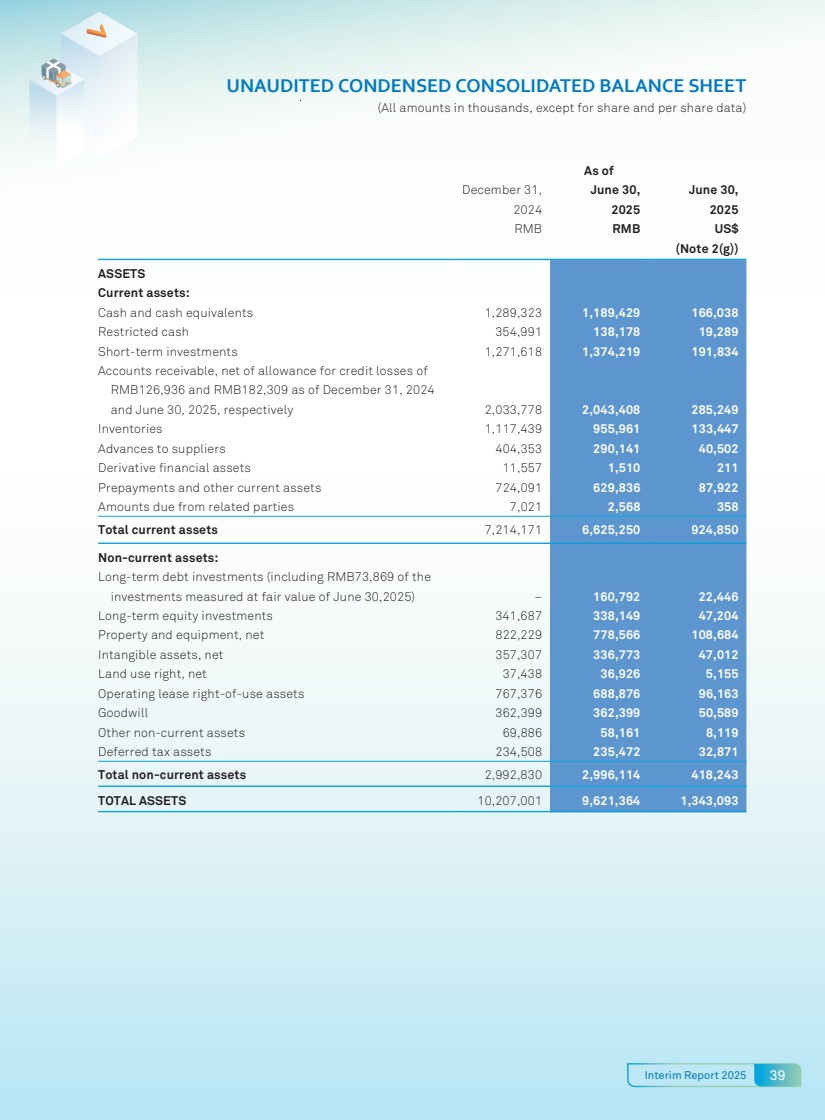

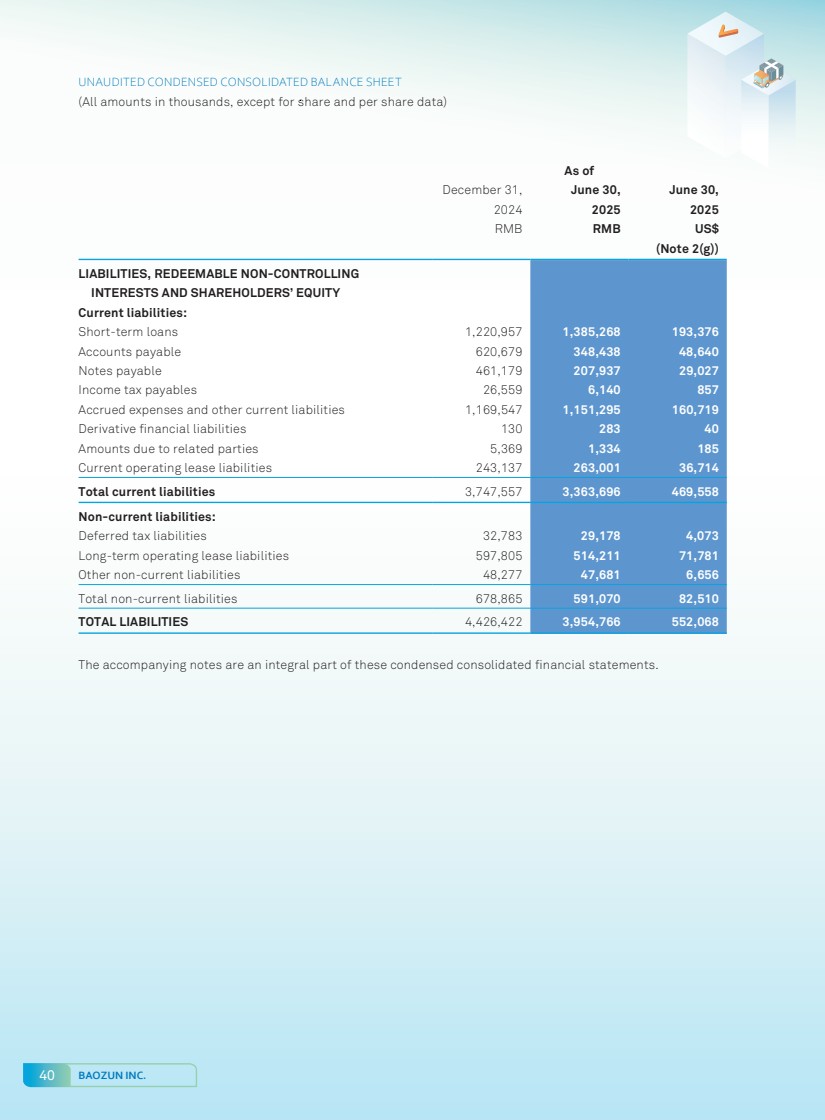

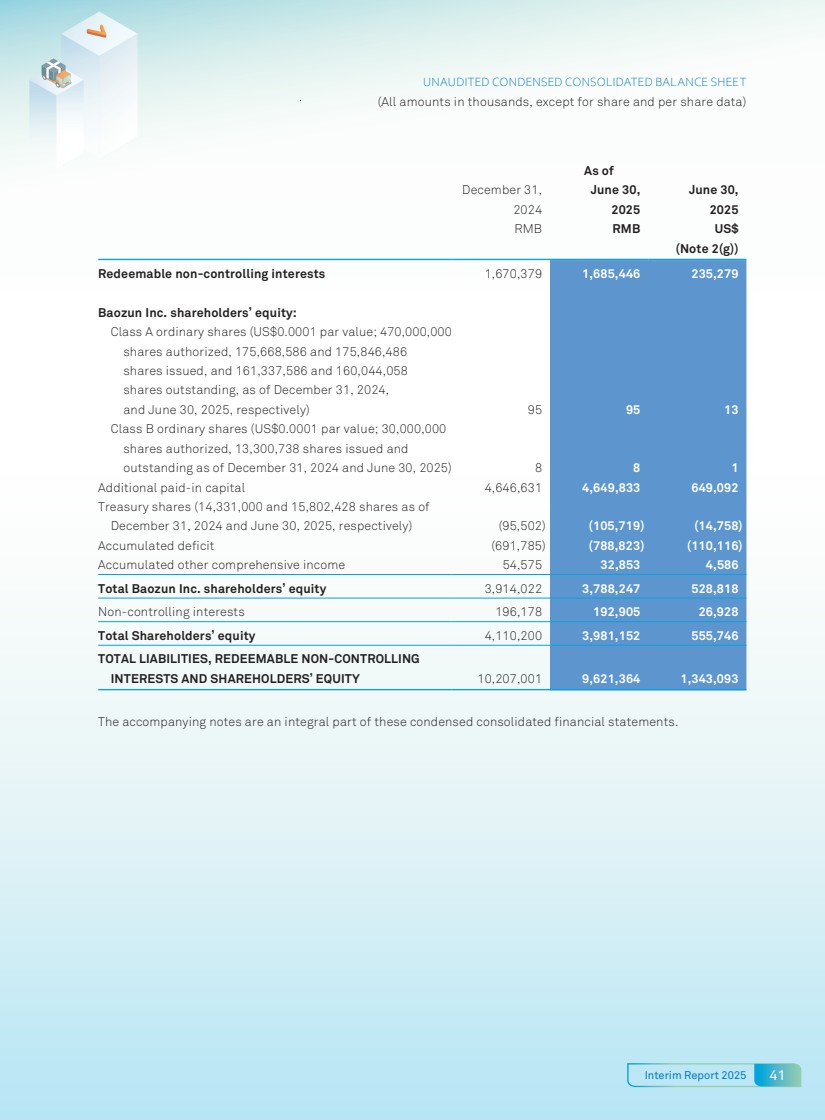

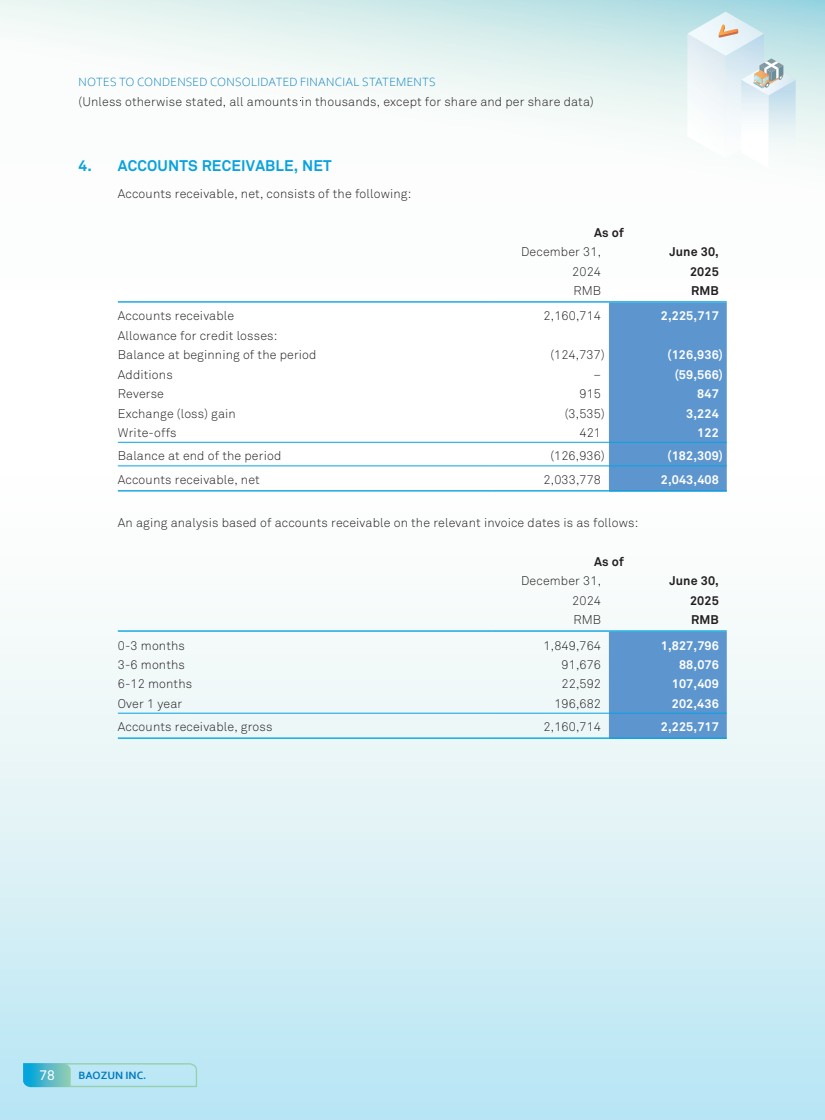

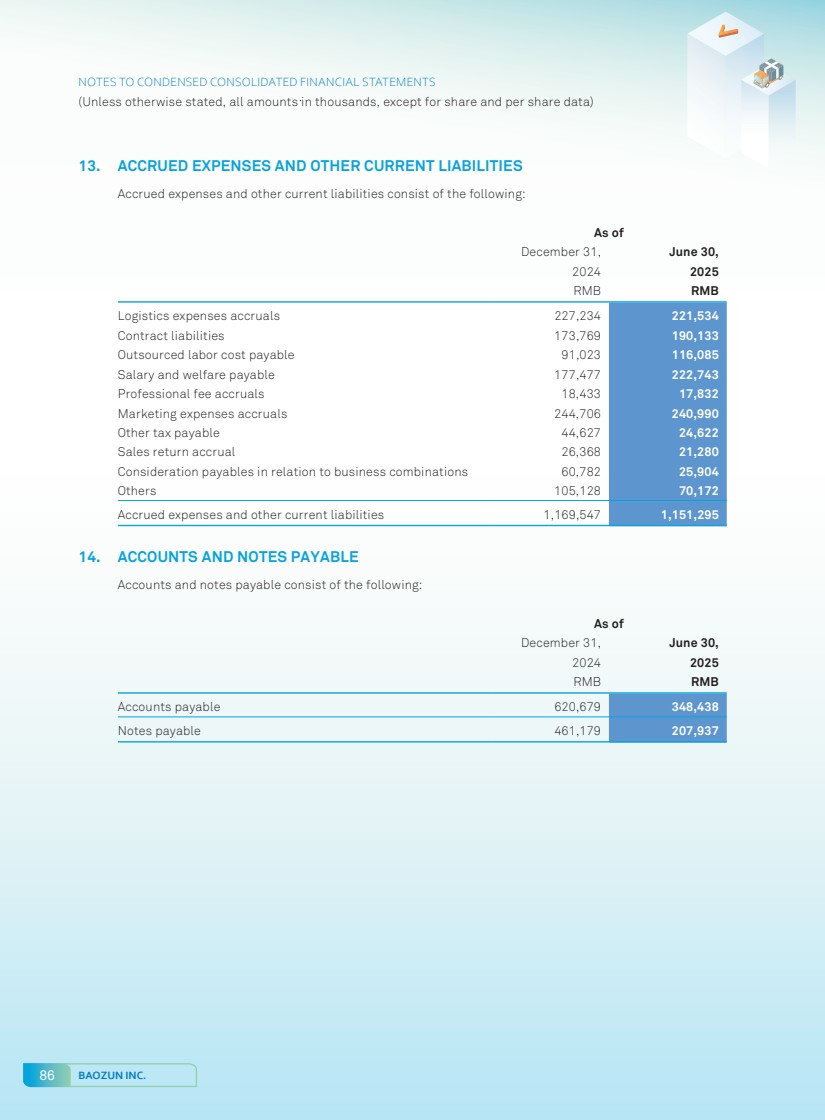

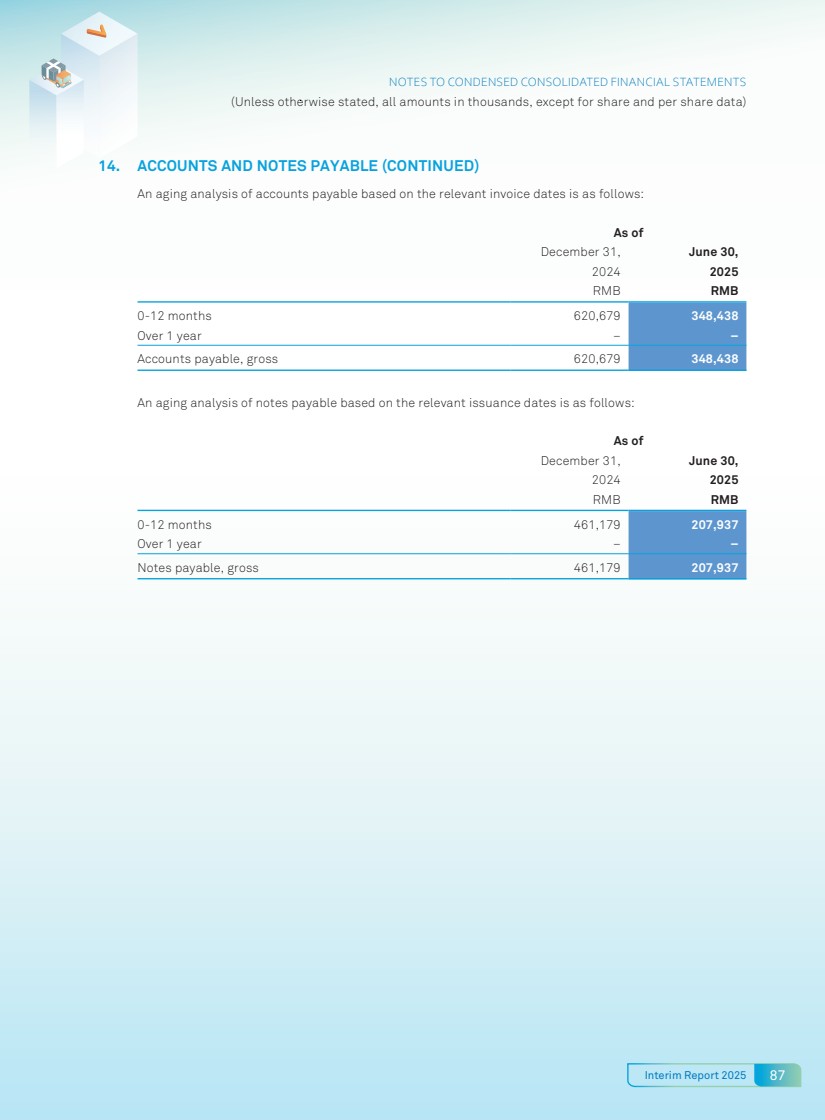

| Interim Report 2025 19 MANAGEMENT DISCUSSION AND ANALYSIS Current Assets As of June 30, 2025, the current assets of the Group were approximately RMB6,625.3 million (US$924.9 million), representing a decrease of 8.2% as compared with approximately RMB7,214.2 million (US$988.3 million) as of December 31, 2024. As of June 30, 2025, the current ratio (current assets divided by current liabilities) of the Group was approximately 2.0 times (December 31, 2024: approximately 1.9 times). Accounts Receivables, net of Allowance for Credit Losses Our accounts receivables represent receivables from customers. The accounts receivables (net of allowance of credit loss) increased by 0.5% from RMB2,033.8 million (US$278.6 million) as of December 31, 2024 to RMB2,043.4 million (US$285.2 million) as of June 30, 2025. Accounts Payable and Notes Payable Our accounts payable and notes payable represent payables to suppliers. As of June 30, 2025, accounts payable and notes payable amounted to approximately RMB556.4 million (US$77.7 million), representing a decrease of approximately 48.6% as compared with approximately RMB1,081.9 million (US$148.2 million) as of December 31, 2024. Accrued Expenses and Other Current Liabilities Other current liabilities primarily consist of logistics expenses accruals, salary and welfare payable as well as marketing expenses accruals. As of June 30, 2025, accrued expenses and other current liabilities amounted to approximately RMB1,151.3 million (US$160.7 million), representing a decrease of approximately 1.6% as compared with approximately RMB1,169.5 million (US$160.2 million) as of December 31, 2024. NON-GAAP FINANCIAL MEASURES In evaluating our business, we consider and use non-GAAP income (loss) from operations, non-GAAP net income (loss), non-GAAP net income (loss) attributable to ordinary shareholders of Baozun, and diluted non-GAAP net income (loss) attributable to ordinary shareholders of Baozun per ADS, as supplemental measures to review and assess our operating performance. The presentation of these non-GAAP financial measures is not intended to be considered in isolation or as a substitute for the financial information prepared and presented in accordance with U.S. GAAP. Non-GAAP income (loss) from operations is income (loss) from operations excluding the impact of share-based compensation expenses, amortization of intangible assets resulting from business acquisition, acquisition-related expenses, impairment of goodwill, and cancellation fees of repurchased ADSs. Non-GAAP net income (loss) is net income (loss) excluding the impact of share-based compensation expenses, amortization of intangible assets resulting from business acquisition, acquisition-related expenses, impairment of goodwill and investments, cancellation fees of repurchased ADSs, fair value change on financial instruments, other-than-temporary impairment of equity method investments, (gain) on disposal/acquisition of subsidiaries, and unrealized investment loss (gain). Non-GAAP net income (loss) attributable to ordinary shareholders of Baozun is net income (loss) attributable to ordinary shareholders of Baozun excluding the impact of share-based compensation expenses, amortization of intangible assets resulting from business acquisition, acquisition-related expenses, impairment of goodwill and investments, cancellation fees of repurchased ADSs, fair value change on financial instruments, other-than-temporary impairment of equity method investments, loss (gain) on disposal/acquisition of subsidiaries, and unrealized investment loss (gain). Diluted non-GAAP net income (loss) attributable to ordinary shareholders of Baozun per ADS is non-GAAP net income (loss) attributable to ordinary shareholders of Baozun divided by weighted average number of shares used in calculating net income (loss) per ordinary share multiplied by three, as each ADS represents three of our Class A ordinary shares. |

| 20 BAOZUN INC. MANAGEMENT DISCUSSION AND ANALYSIS We present the non-GAAP financial measures because they are also used by our management to evaluate our operating performance and formulate business plans. Non-GAAP income (loss) from operations, non-GAAP net income (loss), non-GAAP net income (loss) attributable to ordinary shareholders of Baozun and diluted non-GAAP net income (loss) attributable to ordinary shareholders of Baozun per ADS enable our management to assess our operating results without considering the impact of share-based compensation expenses, amortization of intangible assets resulting from business acquisition and unrealized investment loss. Such items are non-cash expenses that are not directly related to our business operations. Share-based compensation expenses represent non-cash expenses associated with share options and restricted share units we grant under share incentive plans. Amortization of intangible assets resulting from business acquisition represents non-cash expenses associated with intangible assets acquired through one-off business acquisition. Unrealized investment loss represents non-cash expenses associated with the change in fair value of the equity investments. We believe that, by excluding such non-cash items, the non-GAAP financial measures help identify the trends underlying our core operating results that could otherwise be distorted. As such, we believe that the non-GAAP financial measures facilitate investors’ assessment of our operating performance, enhance the overall understanding of our past performance and future prospects and allow for greater visibility with respect to key metrics used by our management in their financial and operational decision-making. The non-GAAP financial measures are not defined under U.S. GAAP and are not presented in accordance with U.S. GAAP. The non-GAAP financial measures have limitations as analytical tools. One of the key limitations of using non-GAAP income (loss) from operations, non-GAAP net income (loss), non-GAAP net income (loss) attributable to ordinary shareholders of Baozun and diluted non-GAAP net income (loss) attributable to ordinary shareholders of Baozun per ADS is that they do not reflect all items of income (loss) and expense that affect our operations. Share-based compensation expenses and amortization of intangible assets resulting from business acquisition and unrealized investment loss have been and may continue to be incurred in our business and are not reflected in the presentation of non-GAAP income (loss) from operations, non-GAAP net income (loss), non-GAAP net income (loss) attributable to ordinary shareholders of Baozun and diluted non-GAAP net income (loss) attributable to ordinary shareholders of Baozun per ADS. Further, the non-GAAP measures may differ from the non-GAAP measures used by other companies, including peer companies, and therefore their comparability may be limited. In light of the foregoing limitations, the non-GAAP income (loss) from operations, non-GAAP net income (loss), non-GAAP net income (loss) attributable to ordinary shareholders of Baozun and diluted non-GAAP net income (loss) attributable to ordinary shareholders of Baozun per ADS for the period should not be considered in isolation from or as an alternative to income (loss) from operations, net income (loss), net income (loss) attributable to ordinary shareholders of Baozun, net income (loss) attributable to ordinary shareholders of Baozun per ADS, or other financial measures prepared in accordance with U.S. GAAP. We compensate for these limitations by reconciling the non-GAAP financial measure to the nearest U.S. GAAP performance measure, which should be considered when evaluating our performance. We encourage you to review our financial information in its entirety and not rely on a single financial measure. A reconciliation of these non-GAAP financial measures to the nearest U.S. GAAP performance measures is provided below: |

| Interim Report 2025 21 MANAGEMENT DISCUSSION AND ANALYSIS Baozun Inc. Reconciliations of GAAP and Non-GAAP Results (in thousands, except for share and per ADS data) For the six months ended June 30, 2024 2025 2025 RMB RMB US$ Loss from operations (73,553) (93,368) (13,035) Add: Share-based compensation expenses 46,802 16,790 2,344 Amortization of intangible assets resulting from business acquisition 18,827 15,802 2,206 Cancellation fees of repurchased ADSs 415 – – Non-GAAP loss from operations (7,509) (60,776) (8,485) Net loss (87,281) (92,722) (12,945) Add: Share-based compensation expenses 46,802 16,790 2,344 Amortization of intangible assets resulting from business acquisition 18,827 15,802 2,206 Cancellation fees of repurchased ADSs 415 – – Fair value change on financial instruments – 7,654 1,068 Unrealized investment loss (gain) 19,855 (8,375) (1,169) Less: Tax effect of amortization of intangible assets resulting from business acquisition(1) (3,766) (3,604) (503) Non-GAAP net loss (5,148) (64,455) (8,999) Net loss attributable to ordinary shareholders of Baozun Inc. (97,257) (97,038) (13,548) Add: Share-based compensation expenses 46,802 16,790 2,344 Amortization of intangible assets resulting from business acquisition 13,514 11,056 1,543 Cancellation fees of repurchased ADSs 415 – – Fair value change on financial instruments – 4,822 673 Unrealized investment loss (gain) 19,855 (8,375) (1,169) Less: Tax effect of amortization of intangible assets resulting from business acquisition(1) (2,637) (2,418) (338) Non-GAAP net loss attributable to ordinary shareholders of Baozun Inc. (19,308) (75,163) (10,495) Diluted non-GAAP net loss attributable to ordinary shareholders of Baozun Inc. per ADS: (0.32) (1.30) (0.18) Weighted average shares used in calculating diluted net loss per ordinary share 181,767,160 173,335,650 173,335,650 (1) The Company evaluated the non-GAAP adjustments items and concluded that these items have immaterial income tax effects except for amortization of intangible assets resulting from business acquisition. |

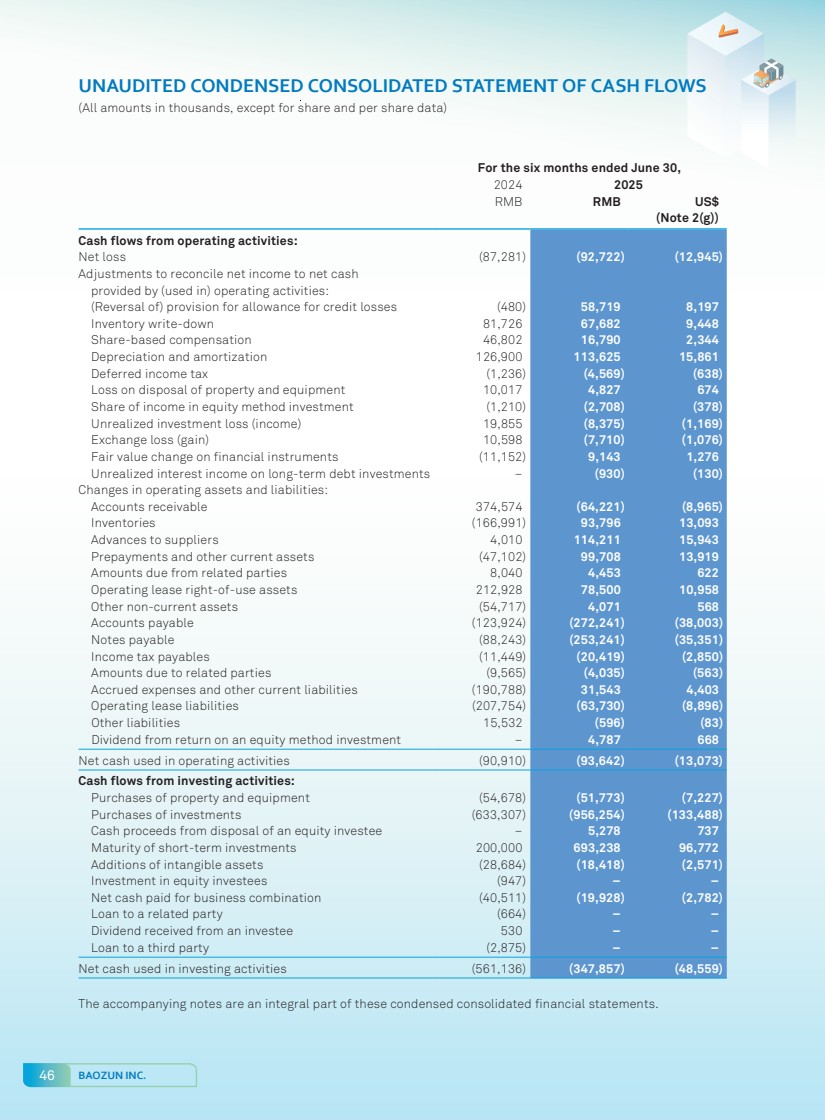

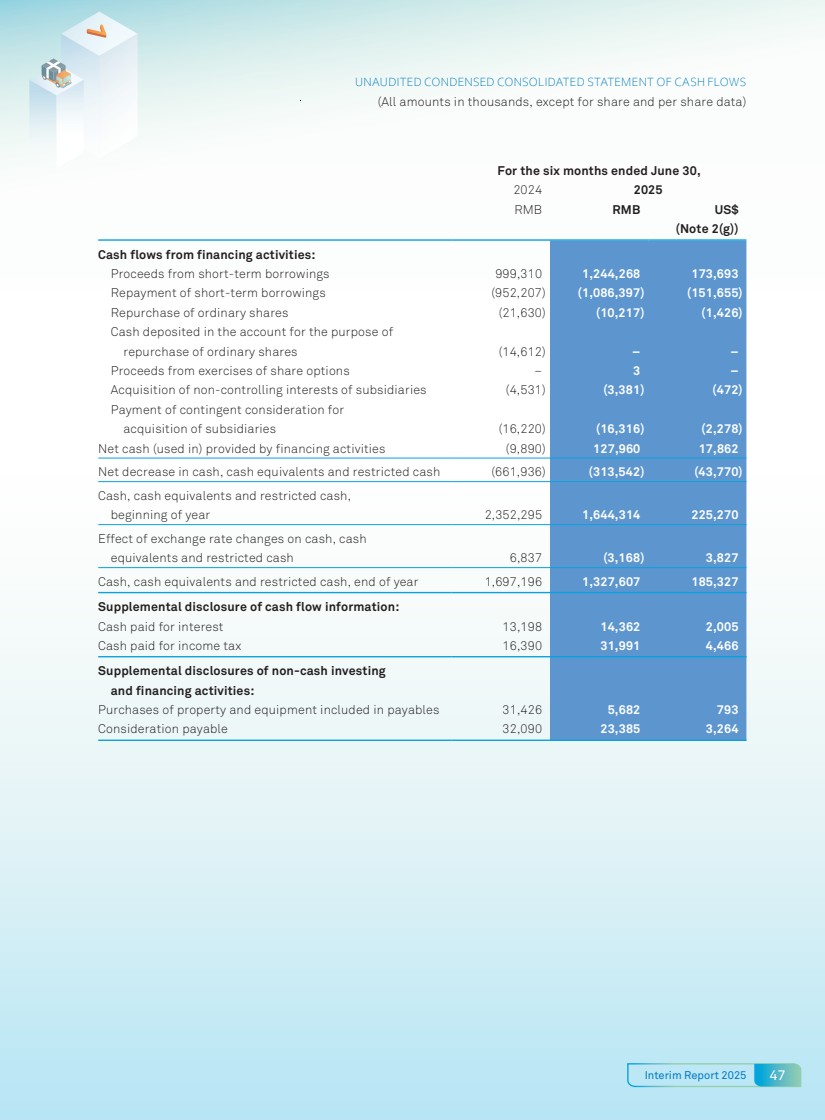

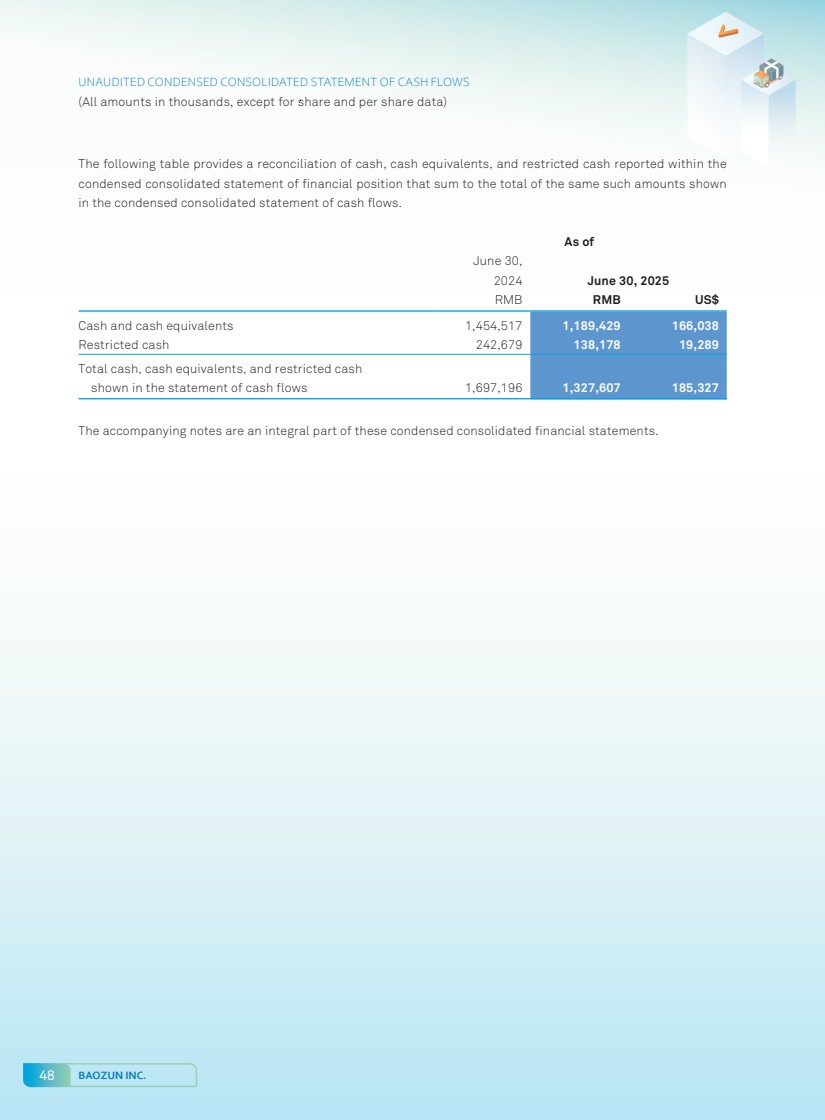

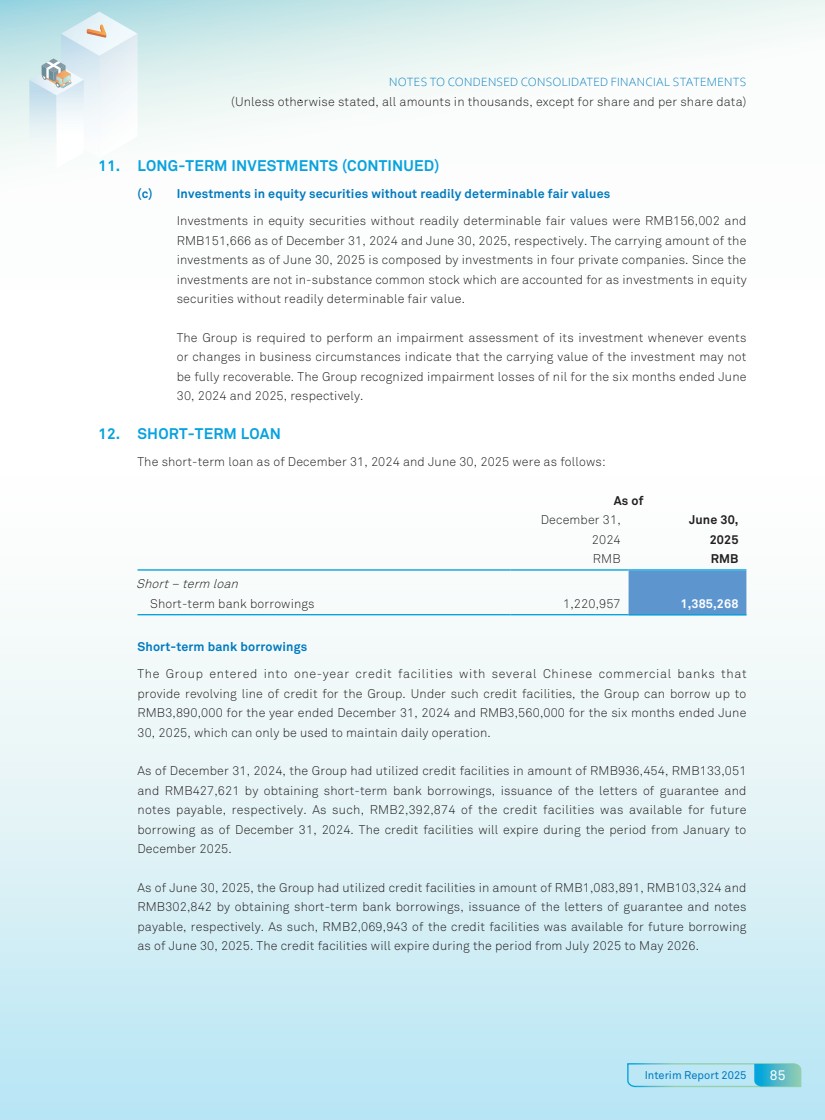

| 22 BAOZUN INC. MANAGEMENT DISCUSSION AND ANALYSIS LIQUIDITY AND CAPITAL RESOURCES We have financed our operations primarily through cash generated from operating activities, proceeds from our public offerings and private placements and short-term bank borrowings. Cash and Cash Equivalents Our cash and cash equivalents generally consist of bank deposits denominated in RMB, USD and HKD. Bank deposits carry interest at market rates which range from 0% to 4.48% per annum. Our cash and cash equivalents, restricted cash and short-term investment amounted to approximately RMB1,189.4 million (US$166.0 million), RMB138.2 million (US$19.3 million), and RMB1,374.2 million (US$191.8 million) as of June 30, 2025, respectively (December 31, 2024: RMB1,289.3 million (US$176.6 million), RMB355.0 million (US$48.6 million), and RMB1,271.6 million (US$174.2 million), respectively). The cash position remains stable for the Reporting Period and the same period last year. Short-term Loan As of June 30, 2025, we had short-term loan of approximately RMB1,385.3 million (US$193.4 million) (December 31, 2024: RMB1,221.0 million (US$167.3 million)). For the Reporting Period, the effective interest rates of the Group’s short-term bank borrowings ranged from 2.0% to 3.0% (December 31, 2024: 2.6% to 3.0%). Pledge of Assets As of June 30, 2025, we had RMB213.9 million bank deposits pledged to secure RMB185.0 million outstanding bank borrowing. Gearing Ratio The calculation of gearing ratio is based on total liabilities at the end of the period divided by total equity for the period and multiplied by 100.0%. The gearing ratio as of December 31, 2024 and June 30, 2025 were 1.08 and 0.99, respectively. Contingent Liabilities and Commitments As of June 30, 2025, the Group did not have any material contingent liabilities or commitments. |

| Interim Report 2025 23 MANAGEMENT DISCUSSION AND ANALYSIS Concentration of Credit Risks Financial instruments that potentially subject the Group to significant concentrations of credit risk primarily consist of cash and cash equivalents, restricted cash, accounts receivable, short-term investments, and amounts due from related parties. All of the Group’s cash and cash equivalents, restricted cash, and short-term investments were held by major financial institutions located in the PRC, Hong Kong, Japan and Taiwan which management believes are of high credit quality. We had accounts receivables, net of allowance for credit losses, of RMB2,043.4 million (US$285.2 million) and RMB2,033.8 million (US$278.6 million) and amounts due from related parties of RMB2.6 million (US$0.4 million) and RMB7.0 million (US$1.0 million) as of June 30, 2025 and December 31, 2024, respectively. Accounts receivable and amounts due from related parties are typically unsecured and are derived from revenues earned from customers in the PRC. The risk with respect to accounts receivable is mitigated by credit evaluations the Group performs on its customers and its ongoing monitoring process of outstanding balances. Foreign Exchange Risk The Group is exposed to foreign exchange risk primarily from purchases of goods or services which give rises to payables that are denominated in a foreign currency. The conversion of Renminbi into foreign currencies, including U.S. dollars, is based on rates set by The People’s Bank of China. Renminbi has fluctuated against the U.S. dollars, at times significantly and unpredictably. During the Reporting Period, the Group had deployed certain financial instruments for mitigating its exposures towards foreign currency risk. The Group will continue to keep track of the foreign exchange risk and take prudent measures to mitigate exchange risk, and take appropriate action where necessary. SIGNIFICANT INVESTMENT HELD, MATERIAL ACQUISITIONS AND DISPOSALS As of June 30, 2025, there were no significant investments (including any investment in an investee company with a value of 5% or more of the Group’s total assets as of June 30, 2025) held by the Group. During the Reporting Period, there were no material acquisitions and disposals of subsidiaries, associates or joint ventures. |

| 24 BAOZUN INC. MANAGEMENT DISCUSSION AND ANALYSIS FUTURE PLANS FOR MATERIAL INVESTMENTS AND CAPITAL ASSETS The Group had not executed any agreement in respect of material investment or capital asset and did not have any other plans relating to material investment or capital asset as of the date of this interim report. However, as China e-commerce and retail market evolves, if any potential investment opportunity arises in the coming future, the Group will perform feasibility studies and prepare implementation plans to consider whether it is beneficial to the Group and our shareholders as a whole. EMPLOYEES AND REMUNERATION POLICY As of June 30, 2025, the Group had 6,887 full-time employees, compared with 7,650 as of December 31, 2024. The decrease in full-time employees was mainly due to the Company’s efficiency enhancement and cost control initiatives. Our success depends on our ability to attract, retain and motivate qualified personnel. Most of our senior management team members possess overseas or top-tier educational backgrounds, strong IT capabilities, deep industry knowledge and extensive experience working with brand partners. In addition, our brand management team is comprised of personnel who connect well culturally with brands. We have fostered a corporate culture that encourages teamwork, effectiveness, self-development and a strong commitment to providing superior services to our brand partners. We typically remunerate our employees with cash compensation and benefits, we may also grant our employees with share options and RSUs under our share incentive plans. We usually enter into standard labor contracts with our employees. We also enter into standard confidentiality and non-compete agreements with our senior management. The non-compete restricted period typically extends for up to two years after the termination of employment, during which we compensate the employee with a certain percentage of his or her pre-departure salary. The employee benefit expenses for the six months ended June 30, 2025 were approximately RMB1,325 million. We have established comprehensive training programs, including orientation programs and on-the-job training, to enhance performance and service quality. Our orientation programs cover such topics as our corporate culture, business ethics, e-commerce workflows and services. Our on-the-job training includes training of business English and business presentation, management training camp for junior managers and customer service agent career development programs. SUBSEQUENT EVENTS Save as disclosed in this interim report, no event has taken place subsequent to June 30, 2025 and up to the date of this interim report that may have a material impact on the Group’s operating and financial performance. |

| Interim Report 2025 25 OTHER INFORMATION CORPORATE GOVERNANCE PRACTICES We aim to achieve high standards of corporate governance which are crucial to our development and safeguard the interests of the Shareholders. The Group has adopted the code provisions in Part 2 of the CG Code as its own code of corporate governance. Save for the deviation for reasons set out below, during the Reporting Period, the Group has complied with the CG Code. Pursuant to code provision C.2.1 of the CG Code, the responsibilities between the chairman and the chief executive officer should be segregated and should not be performed by the same individual. However, we do not have a separate chairman and chief executive officer and Mr. Qiu is performing these two roles. Mr. Qiu is responsible for the overall management, operation and strategic development of the Group and has been instrumental to our growth and business operation as the founder of the Group. Taking into account the continuation of management and the implementation of our business strategies, the Directors (including the independent Directors) consider that vesting the roles of the chairman and the chief executive officer in the same person would allow the Company to be more effective and efficient in developing business strategies and executing business plans. The existing arrangements are beneficial to the business prospect and management of the Group and are in the interests of the Company and the Shareholders as a whole. The balance of power and authority is ensured by the operation of the senior management and the Board, both of which comprises experienced and high-calibre individuals. The Board will regularly review the effectiveness of this structure to ensure that it is appropriate to the Group’s circumstances. The Company will continue to review and enhance its corporate governance practices, and identify and formalize appropriate measures and policies, to ensure compliance with the CG Code. MODEL CODE FOR SECURITIES TRANSACTIONS The Company has adopted the Model Code as a code of conduct for securities transactions by the Directors during the Reporting Period. Having made specific enquiry to all the Directors, all the Directors confirmed that they have strictly complied with the required standards set out in the Model Code during the Reporting Period. The Board has also adopted the Model Code to regulate all dealings by relevant employees, including any employee or a director or employee of a subsidiary or holding company, who, because of his/her office or employment, are likely to be in possession of unpublished inside information of the Company in respect of securities in the Company. No incident of non-compliance with the Model Code by the Company’s relevant employees has been noted during the Reporting Period after making reasonable enquiry. |

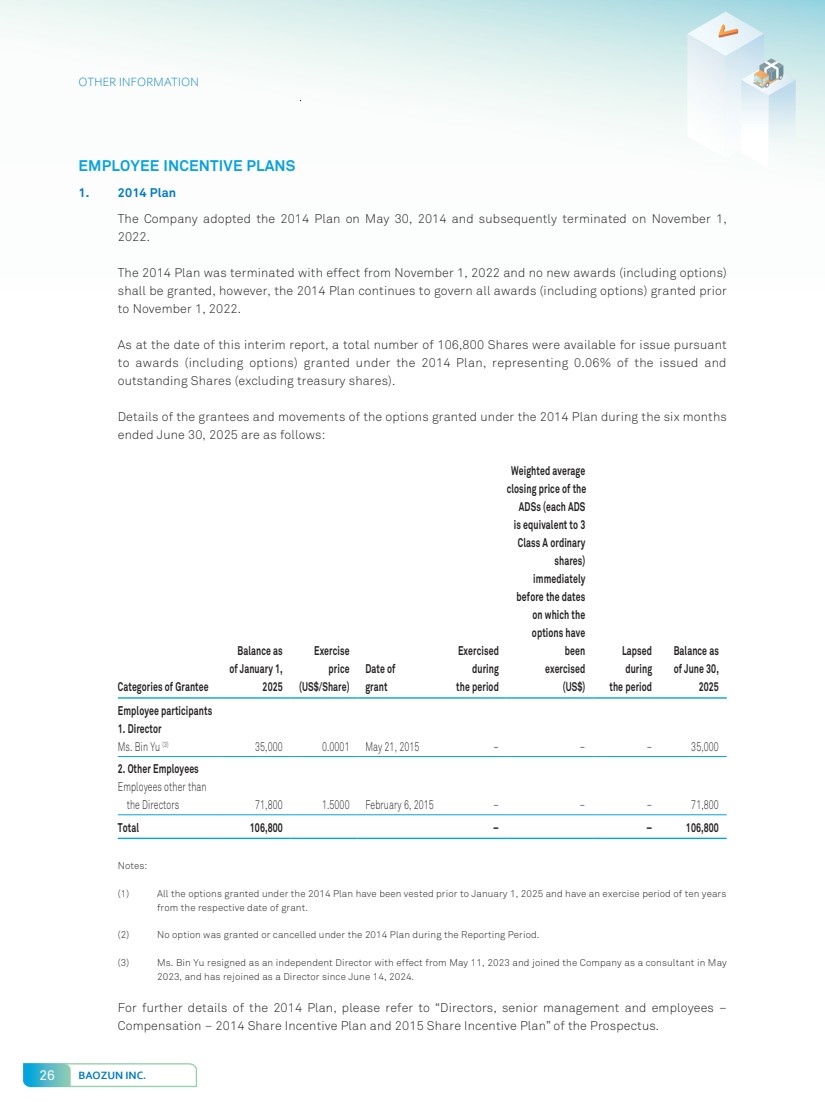

| 26 BAOZUN INC. OTHER INFORMATION EMPLOYEE INCENTIVE PLANS 1. 2014 Plan The Company adopted the 2014 Plan on May 30, 2014 and subsequently terminated on November 1, 2022. The 2014 Plan was terminated with effect from November 1, 2022 and no new awards (including options) shall be granted, however, the 2014 Plan continues to govern all awards (including options) granted prior to November 1, 2022. As at the date of this interim report, a total number of 106,800 Shares were available for issue pursuant to awards (including options) granted under the 2014 Plan, representing 0.06% of the issued and outstanding Shares (excluding treasury shares). Details of the grantees and movements of the options granted under the 2014 Plan during the six months ended June 30, 2025 are as follows: Categories of Grantee Balance as of January 1, 2025 Exercise price (US$/Share) Date of grant Exercised during the period Weighted average closing price of the ADSs (each ADS is equivalent to 3 Class A ordinary shares) immediately before the dates on which the options have been exercised (US$) Lapsed during the period Balance as of June 30, 2025 Employee participants 1. Director Ms. Bin Yu (3) 35,000 0.0001 May 21, 2015 – – – 35,000 2. Other Employees Employees other than the Directors 71,800 1.5000 February 6, 2015 – – – 71,800 Total 106,800 – – 106,800 Notes: (1) All the options granted under the 2014 Plan have been vested prior to January 1, 2025 and have an exercise period of ten years from the respective date of grant. (2) No option was granted or cancelled under the 2014 Plan during the Reporting Period. (3) Ms. Bin Yu resigned as an independent Director with effect from May 11, 2023 and joined the Company as a consultant in May 2023, and has rejoined as a Director since June 14, 2024. For further details of the 2014 Plan, please refer to “Directors, senior management and employees – Compensation – 2014 Share Incentive Plan and 2015 Share Incentive Plan” of the Prospectus. |

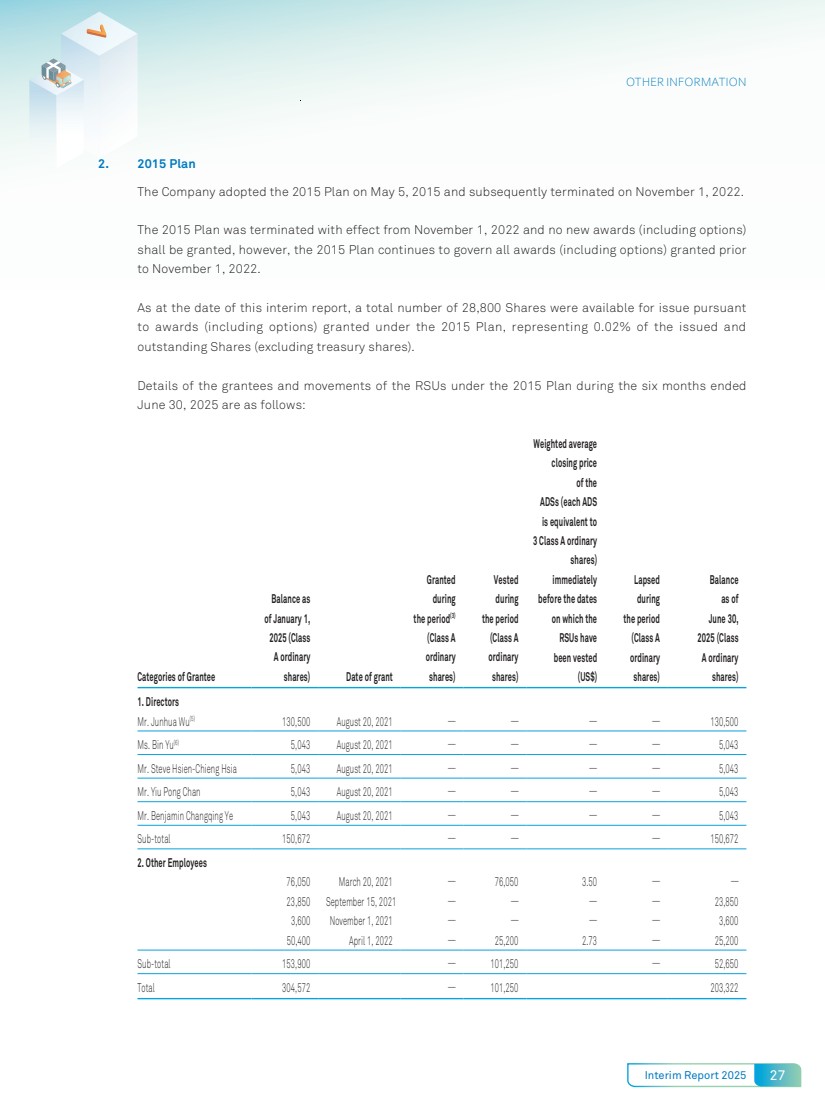

| Interim Report 2025 27 OTHER INFORMATION 2. 2015 Plan The Company adopted the 2015 Plan on May 5, 2015 and subsequently terminated on November 1, 2022. The 2015 Plan was terminated with effect from November 1, 2022 and no new awards (including options) shall be granted, however, the 2015 Plan continues to govern all awards (including options) granted prior to November 1, 2022. As at the date of this interim report, a total number of 28,800 Shares were available for issue pursuant to awards (including options) granted under the 2015 Plan, representing 0.02% of the issued and outstanding Shares (excluding treasury shares). Details of the grantees and movements of the RSUs under the 2015 Plan during the six months ended June 30, 2025 are as follows: Categories of Grantee Balance as of January 1, 2025 (Class A ordinary shares) Date of grant Granted during the period(3) (Class A ordinary shares) Vested during the period (Class A ordinary shares) Weighted average closing price of the ADSs (each ADS is equivalent to 3 Class A ordinary shares) immediately before the dates on which the RSUs have been vested (US$) Lapsed during the period (Class A ordinary shares) Balance as of June 30, 2025 (Class A ordinary shares) 1. Directors Mr. Junhua Wu(5) 130,500 August 20, 2021 — — — — 130,500 Ms. Bin Yu(6) 5,043 August 20, 2021 — — — — 5,043 Mr. Steve Hsien-Chieng Hsia 5,043 August 20, 2021 — — — — 5,043 Mr. Yiu Pong Chan 5,043 August 20, 2021 — — — — 5,043 Mr. Benjamin Changqing Ye 5,043 August 20, 2021 — — — — 5,043 Sub-total 150,672 — — — 150,672 2. Other Employees 76,050 March 20, 2021 — 76,050 3.50 — — 23,850 September 15, 2021 — — — — 23,850 3,600 November 1, 2021 — — — — 3,600 50,400 April 1, 2022 — 25,200 2.73 — 25,200 Sub-total 153,900 — 101,250 — 52,650 Total 304,572 — 101,250 203,322 |

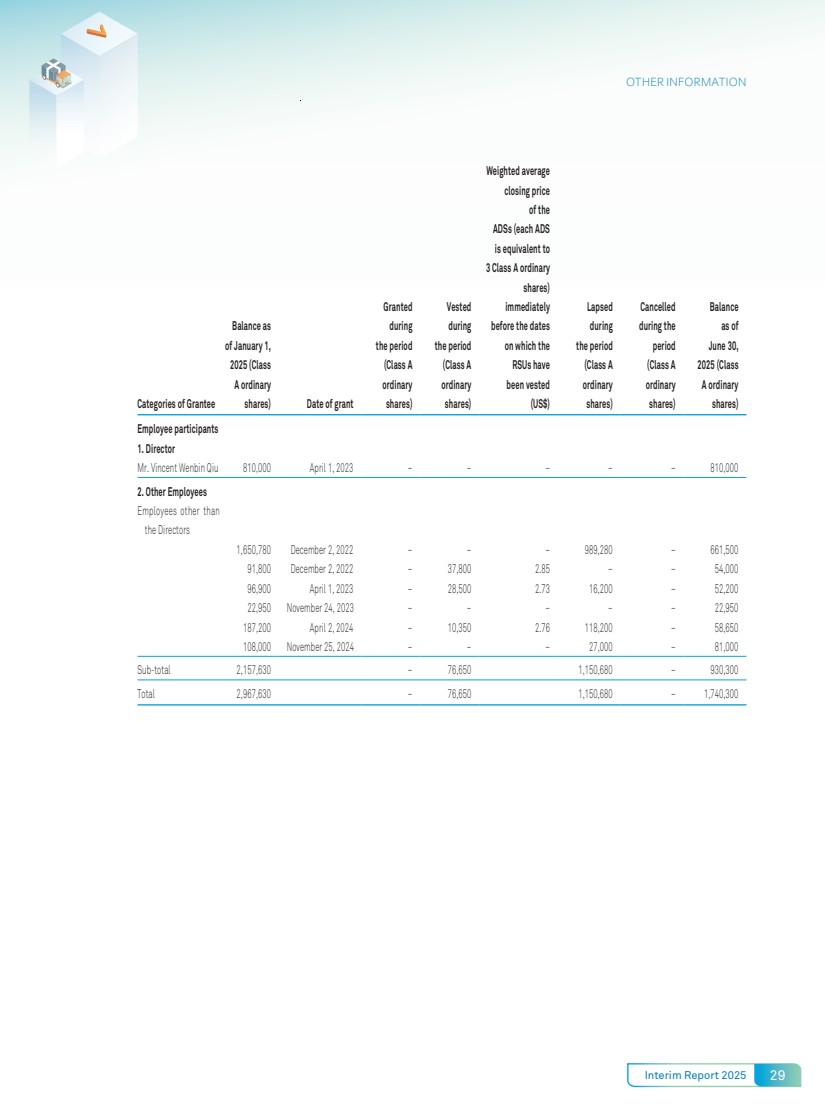

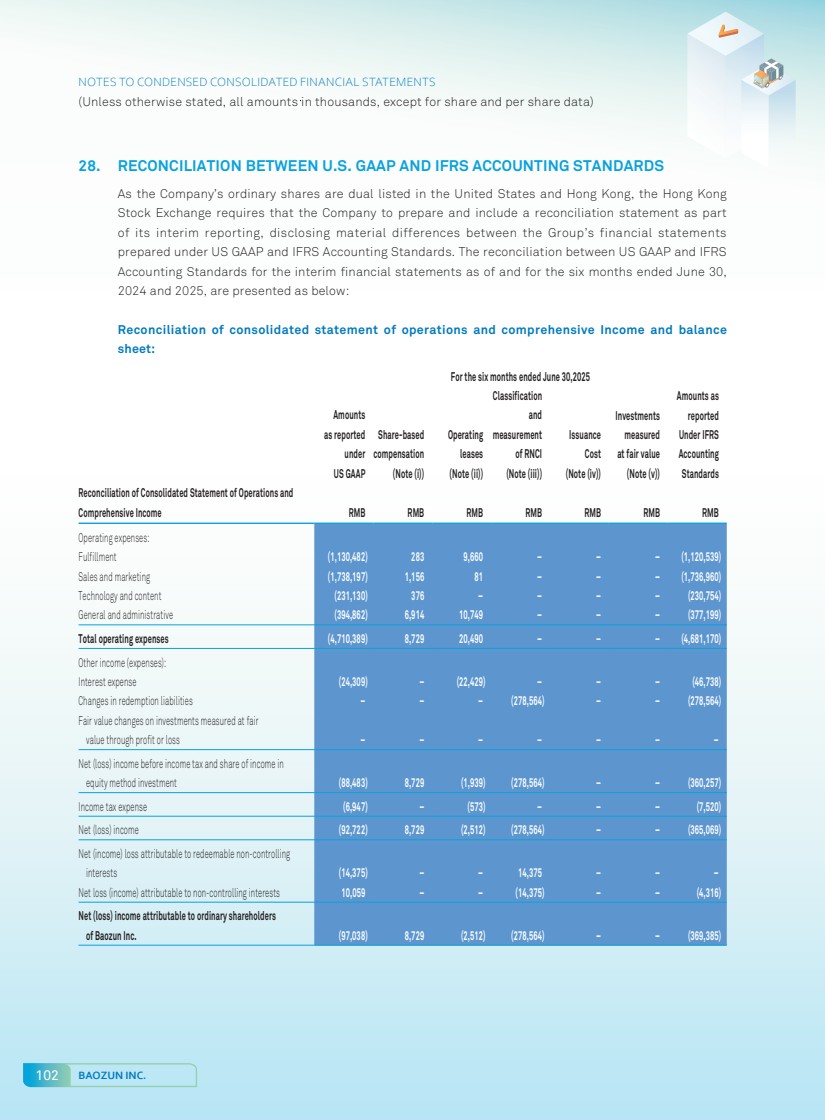

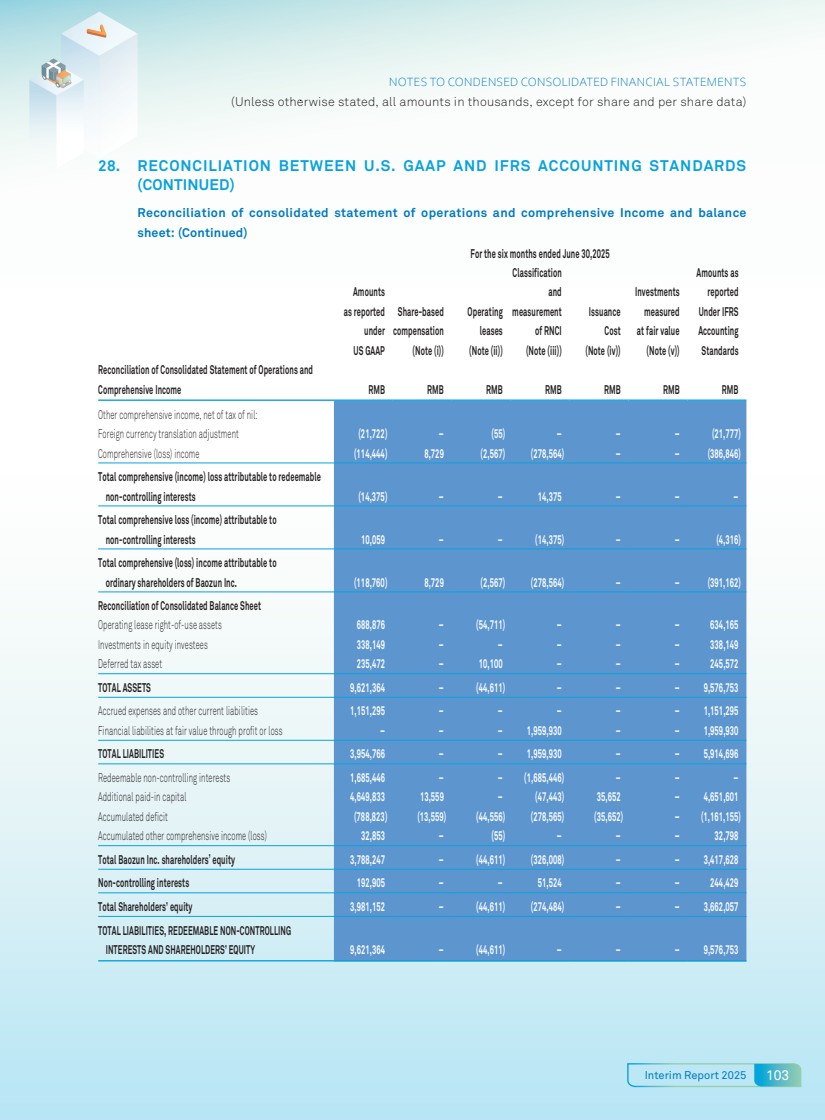

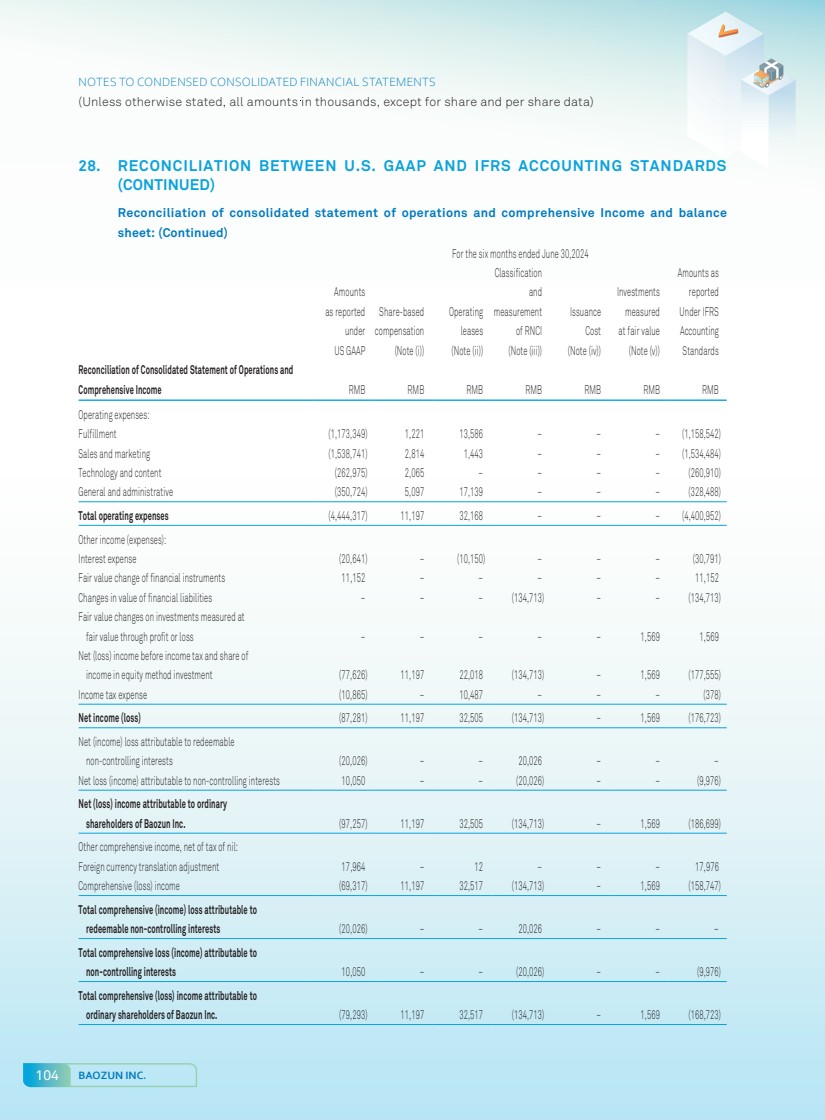

| 28 BAOZUN INC. OTHER INFORMATION Notes: (1) The RSUs were vested as ADSs, thus the weighted average closing prices were calculated with closing prices of the ADSs as of the respective dates. (2) Subject to the satisfaction of the individual performance review and satisfaction of certain milestones or performance targets relating to the Group including but not limited to the growth of revenue and profit of the Group for the relevant period as set out in the award agreements applicable to the respective grantees being met, as of June 30, 2025, out of the balance of 203,322 unvested RSUs, (i) for 150,672 RSUs shall vest on August 20, 2025; (ii) for 23,850 RSUs shall vest on September 15, 2025; (iii) for 3,600 RSUs shall vest on November 1, 2025; and (iv) for 25,200 RSUs shall vest on April 1, 2026. All of the RSUs granted have an exercise period of ten years from the respective date of grant. The grantees are not required to pay any purchase price for the Class A ordinary shares issuable under the RSUs. (3) No RSU was granted or cancelled under the 2015 Plan during the Reporting Period. (4) Save as disclosed above, the RSUs are not subject to any other exercising conditions, purchase price or performance targets. (5) The awards were granted to Casvendino Holdings Limited, a company wholly owned by Mr. Junhua Wu. (6) Ms. Bin Yu resigned as an independent Director with effect from May 11, 2023 and joined the Company as a consultant in May 2023, and has rejoined as a Director since June 14, 2024. For further details of the 2015 Plan, please refer to “Directors, senior management and employees – Compensation – 2014 Share Incentive Plan and 2015 Share Incentive Plan” of the Prospectus. 3. 2022 Plan The Company adopted the 2022 Plan by way of ordinary resolution passed by the Shareholders with effect from November 1, 2022. As of January 1, 2025, awards representing 5,241,446 Class A ordinary shares were available for grant under the 2022 Plan, within which, awards representing 524,652 Class A ordinary shares were available for grant to the Service Providers. As of June 30, 2025, awards representing 6,392,126 Class A ordinary shares were available for grant under the 2022 Plan, within which, awards representing 524,652 Class A ordinary shares were available for grant to the Service Providers. As at the date of this interim report, the total number of Shares available for issue under the 2022 Plan is 8,124,326 Shares, representing approximately 4.68% of the issued and outstanding Shares (excluding treasury shares). Details of the grantees and movements of the RSUs granted under the 2022 Plan during the six months ended June 30, 2025 are as follows: |

| Interim Report 2025 29 OTHER INFORMATION Categories of Grantee Balance as of January 1, 2025 (Class A ordinary shares) Date of grant Granted during the period (Class A ordinary shares) Vested during the period (Class A ordinary shares) Weighted average closing price of the ADSs (each ADS is equivalent to 3 Class A ordinary shares) immediately before the dates on which the RSUs have been vested (US$) Lapsed during the period (Class A ordinary shares) Cancelled during the period (Class A ordinary shares) Balance as of June 30, 2025 (Class A ordinary shares) Employee participants 1. Director Mr. Vincent Wenbin Qiu 810,000 April 1, 2023 – – – – – 810,000 2. Other Employees Employees other than the Directors 1,650,780 December 2, 2022 – – – 989,280 – 661,500 91,800 December 2, 2022 – 37,800 2.85 – – 54,000 96,900 April 1, 2023 – 28,500 2.73 16,200 – 52,200 22,950 November 24, 2023 – – – – – 22,950 187,200 April 2, 2024 – 10,350 2.76 118,200 – 58,650 108,000 November 25, 2024 – – – 27,000 – 81,000 Sub-total 2,157,630 – 76,650 1,150,680 – 930,300 Total 2,967,630 – 76,650 1,150,680 – 1,740,300 |

| 30 BAOZUN INC. OTHER INFORMATION Notes: (1) Subject to the satisfaction of the individual performance review and satisfaction of certain milestones or performance targets relating to the Group including but not limited to the growth of revenue and profit of the Group for the relevant period as set out in the award agreements applicable to the respective Grantees being met, out of the 3,966,300 RSUs granted on December 2, 2022, (i) for 3,531,300 RSUs, 15%, 25%, 30% and 30% of the RSUs shall vest on December 2, 2023, 2024, 2025 and 2026, respectively; (ii) for 186,000 RSUs, all RSUs shall vest on February 1, 2023; (iii) for 150,000 RSUs, 15%, 25%, 30% and 30% of the RSUs shall vest on June 1, 2023, 2024, 2025 and 2026, respectively; (iv) for 45,000 RSUs, 15%, 25%, 30% and 30% of the RSUs shall vest on August 1, 2023, 2024, 2025 and 2026, respectively; and (v) for 54,000 RSUs, 15%, 25%, 30% and 30% of the RSUs shall vest on September 1, 2023, 2024, 2025 and 2026, respectively. (2) Subject to the satisfaction of the individual performance review and satisfaction of certain milestones or performance targets relating to the Group including but not limited to the growth of revenue and profit of the Group for the relevant period as set out in the award agreements applicable to the respective Grantees being met, out of the 5,330,463 RSUs granted on April 1, 2023, (i) for 1,350,000 RSUs, 15%, 25%, 30% and 30% of the RSUs shall vest on December 1, 2023, 2024, 2025 and 2026, respectively; (ii) for 402,984 RSUs, 50% each of the RSUs shall vest on October 1, 2023 and April 1, 2024, respectively; (iii) for 114,000 RSUs, 15%, 25%, 30% and 30% of the RSUs shall vest on April 1, 2024, 2025, 2026 and 2027, respectively; (iv) for 2,618,487 RSUs, 50% each of the RSUs shall vest on October 1, 2023 and April 1, 2024, respectively; (v) for 135,000 RSUs, 50% each of the RSUs shall vest on December 1, 2023 and April 1, 2024, respectively; and (vi) for 709,992 RSUs, 100% of the RSUs shall vest on July 1, 2023. (3) Subject to the satisfaction of the individual performance review and satisfaction of certain milestones or performance targets relating to the Group including but not limited to the growth of revenue and profit of the Group for the relevant period as set out in the award agreements applicable to the respective Grantees being met, out of the 77,019 RSUs granted on November 24, 2023, (i) for 54,000 RSUs, 15%, 25%, 30% and 30% of the RSUs shall vest on October 10, 2024, 2025, 2026 and 2027, respectively; (ii) for 23,019 RSUs, 100% of the RSUs shall be vested on October 10, 2024. (4) Subject to the satisfaction of the individual performance review and satisfaction of certain milestones or performance targets relating to the Group including but not limited to the growth of revenue and profit of the Group for the relevant period as set out in the award agreements applicable to the respective Grantees being met, out of the 3,472,806 RSUs granted on April 2, 2024, (i) for 187,200 RSUs, 15%, 25%, 30% and 30% of the RSUs shall vest on April 2, 2025, 2026, 2027 and 2028, respectively; (ii) for 3,285,606 RSUs, 100% of the RSUs shall be vested on October 2, 2024. (5) Subject to the satisfaction of the individual performance review and satisfaction of certain milestones or performance targets relating to the Group including but not limited to the growth of revenue and profit of the Group for the relevant period as set out in the award agreements applicable to the respective Grantees being met, 15%, 25%, 30% and 30% of the 108,000 RSUs granted on November 25, 2024 shall be vested on November 25, 2025, 2026, 2027 and 2028, respectively. (6) All of the RSUs granted have an exercise period of ten years from the respective date of grant. No options have been granted under 2022 Plan since its adoption. (7) The grantees are not required to pay any purchase price for the Class A ordinary shares issuable under the RSUs granted under 2022 Plan. (8) Save as disclosed above, the RSUs are not subject to any other exercising conditions or performance targets. In relation to the accounting standard and policy adopted and the estimated fair value of the RSUs granted under the 2022 Plan, please refer to note 2 and note 22 to the unaudited condensed consolidated financial statements, respectively. For further details of the 2022 Plan, please refer to appendix IV of the circular of the Company dated October 5, 2022. As no awards (including options) were granted by the Company under any Share Incentive Plan during the Reporting Period, the disclosure requirement under Rule 17.07(3) of the Listing Rules is not applicable to the Company for the purpose of this interim report. |

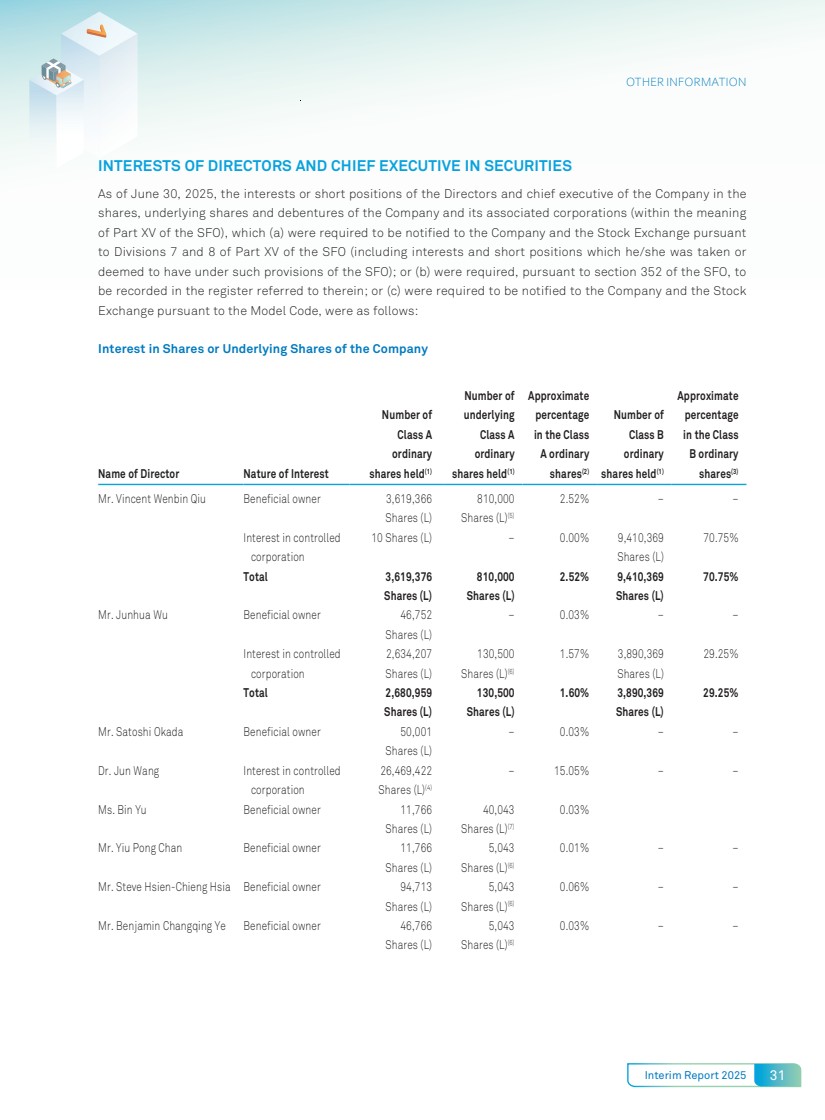

| Interim Report 2025 31 OTHER INFORMATION INTERESTS OF DIRECTORS AND CHIEF EXECUTIVE IN SECURITIES As of June 30, 2025, the interests or short positions of the Directors and chief executive of the Company in the shares, underlying shares and debentures of the Company and its associated corporations (within the meaning of Part XV of the SFO), which (a) were required to be notified to the Company and the Stock Exchange pursuant to Divisions 7 and 8 of Part XV of the SFO (including interests and short positions which he/she was taken or deemed to have under such provisions of the SFO); or (b) were required, pursuant to section 352 of the SFO, to be recorded in the register referred to therein; or (c) were required to be notified to the Company and the Stock Exchange pursuant to the Model Code, were as follows: Interest in Shares or Underlying Shares of the Company Name of Director Nature of Interest Number of Class A ordinary shares held(1) Number of underlying Class A ordinary shares held(1) Approximate percentage in the Class A ordinary shares(2) Number of Class B ordinary shares held(1) Approximate percentage in the Class B ordinary shares(3) Mr. Vincent Wenbin Qiu Beneficial owner 3,619,366 Shares (L) 810,000 Shares (L)(5) 2.52% – – Interest in controlled corporation 10 Shares (L) – 0.00% 9,410,369 Shares (L) 70.75% Total 3,619,376 Shares (L) 810,000 Shares (L) 2.52% 9,410,369 Shares (L) 70.75% Mr. Junhua Wu Beneficial owner 46,752 Shares (L) – 0.03% – – Interest in controlled corporation 2,634,207 Shares (L) 130,500 Shares (L)(6) 1.57% 3,890,369 Shares (L) 29.25% Total 2,680,959 Shares (L) 130,500 Shares (L) 1.60% 3,890,369 Shares (L) 29.25% Mr. Satoshi Okada Beneficial owner 50,001 Shares (L) – 0.03% – – Dr. Jun Wang Interest in controlled corporation 26,469,422 Shares (L)(4) – 15.05% – – Ms. Bin Yu Beneficial owner 11,766 Shares (L) 40,043 Shares (L)(7) 0.03% Mr. Yiu Pong Chan Beneficial owner 11,766 Shares (L) 5,043 Shares (L)(6) 0.01% – – Mr. Steve Hsien-Chieng Hsia Beneficial owner 94,713 Shares (L) 5,043 Shares (L)(6) 0.06% – – Mr. Benjamin Changqing Ye Beneficial owner 46,766 Shares (L) 5,043 Shares (L)(6) 0.03% – – |

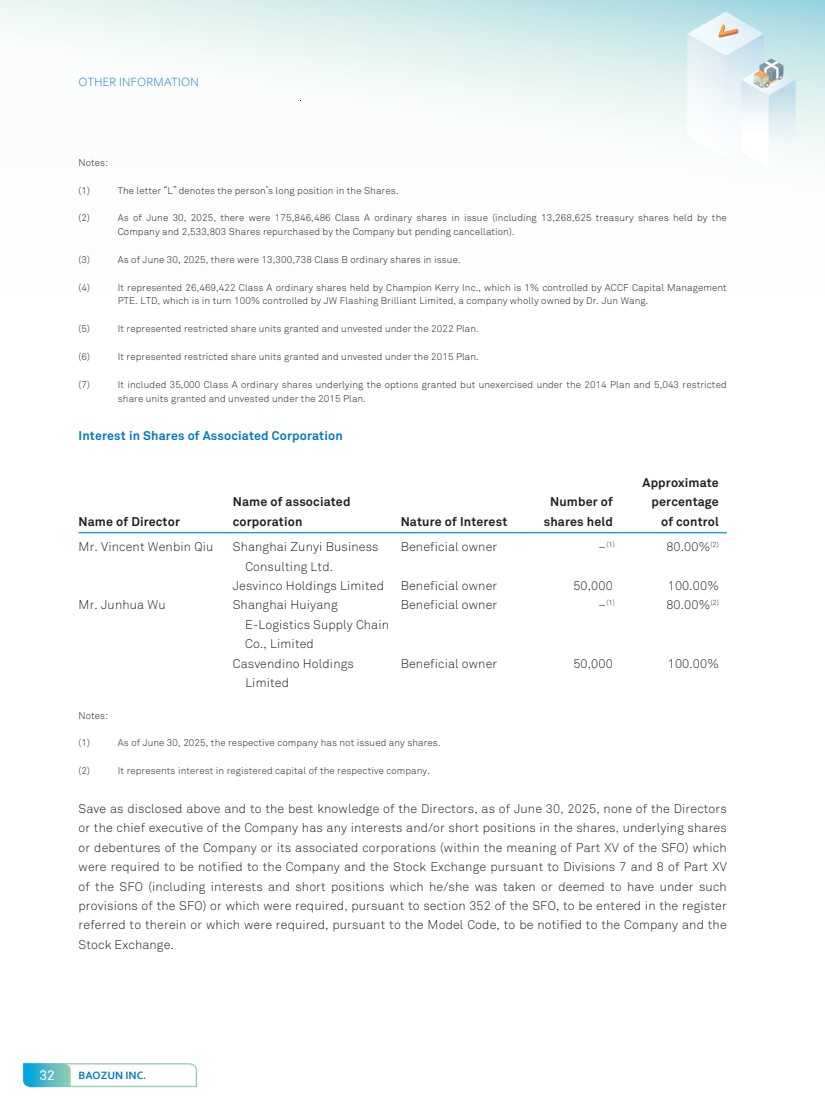

| 32 BAOZUN INC. OTHER INFORMATION Notes: (1) The letter “L” denotes the person’s long position in the Shares. (2) As of June 30, 2025, there were 175,846,486 Class A ordinary shares in issue (including 13,268,625 treasury shares held by the Company and 2,533,803 Shares repurchased by the Company but pending cancellation). (3) As of June 30, 2025, there were 13,300,738 Class B ordinary shares in issue. (4) It represented 26,469,422 Class A ordinary shares held by Champion Kerry Inc., which is 1% controlled by ACCF Capital Management PTE. LTD, which is in turn 100% controlled by JW Flashing Brilliant Limited, a company wholly owned by Dr. Jun Wang. (5) It represented restricted share units granted and unvested under the 2022 Plan. (6) It represented restricted share units granted and unvested under the 2015 Plan. (7) It included 35,000 Class A ordinary shares underlying the options granted but unexercised under the 2014 Plan and 5,043 restricted share units granted and unvested under the 2015 Plan. Interest in Shares of Associated Corporation Name of Director Name of associated corporation Nature of Interest Number of shares held Approximate percentage of control Mr. Vincent Wenbin Qiu Shanghai Zunyi Business Consulting Ltd. Beneficial owner –(1) 80.00%(2) Jesvinco Holdings Limited Beneficial owner 50,000 100.00% Mr. Junhua Wu Shanghai Huiyang E-Logistics Supply Chain Co., Limited Beneficial owner –(1) 80.00%(2) Casvendino Holdings Limited Beneficial owner 50,000 100.00% Notes: (1) As of June 30, 2025, the respective company has not issued any shares. (2) It represents interest in registered capital of the respective company. Save as disclosed above and to the best knowledge of the Directors, as of June 30, 2025, none of the Directors or the chief executive of the Company has any interests and/or short positions in the shares, underlying shares or debentures of the Company or its associated corporations (within the meaning of Part XV of the SFO) which were required to be notified to the Company and the Stock Exchange pursuant to Divisions 7 and 8 of Part XV of the SFO (including interests and short positions which he/she was taken or deemed to have under such provisions of the SFO) or which were required, pursuant to section 352 of the SFO, to be entered in the register referred to therein or which were required, pursuant to the Model Code, to be notified to the Company and the Stock Exchange. |

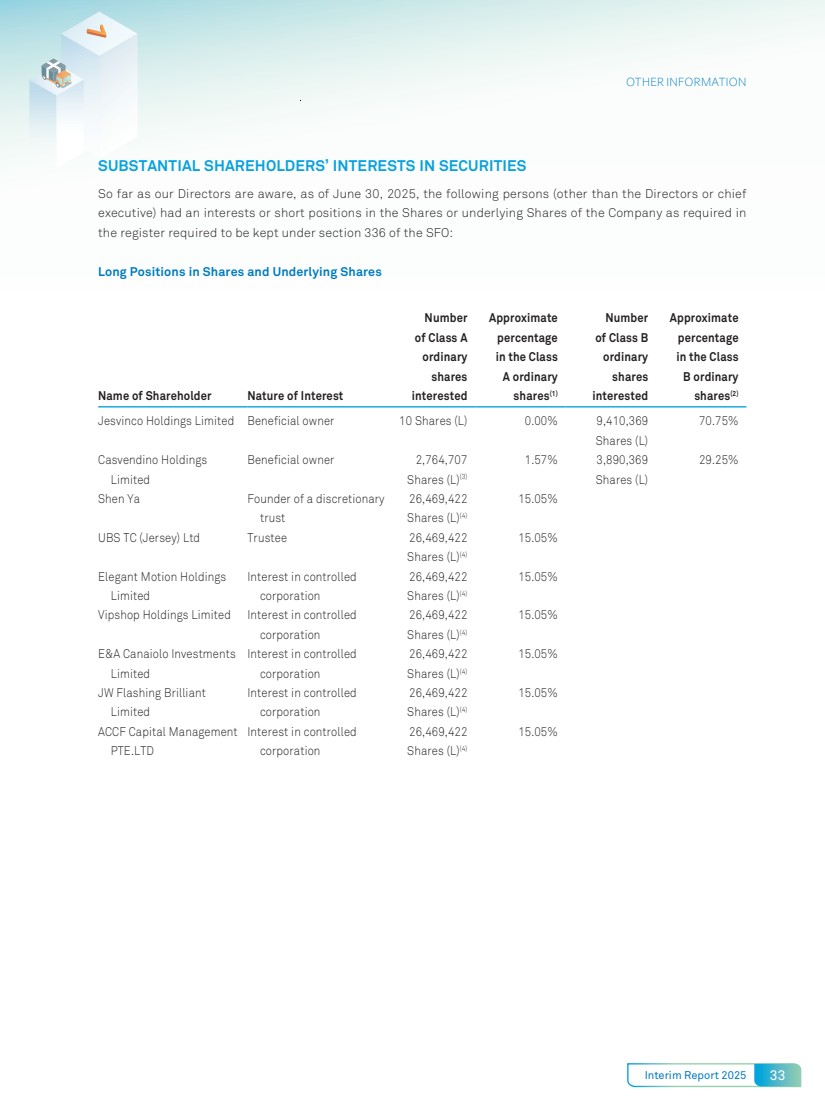

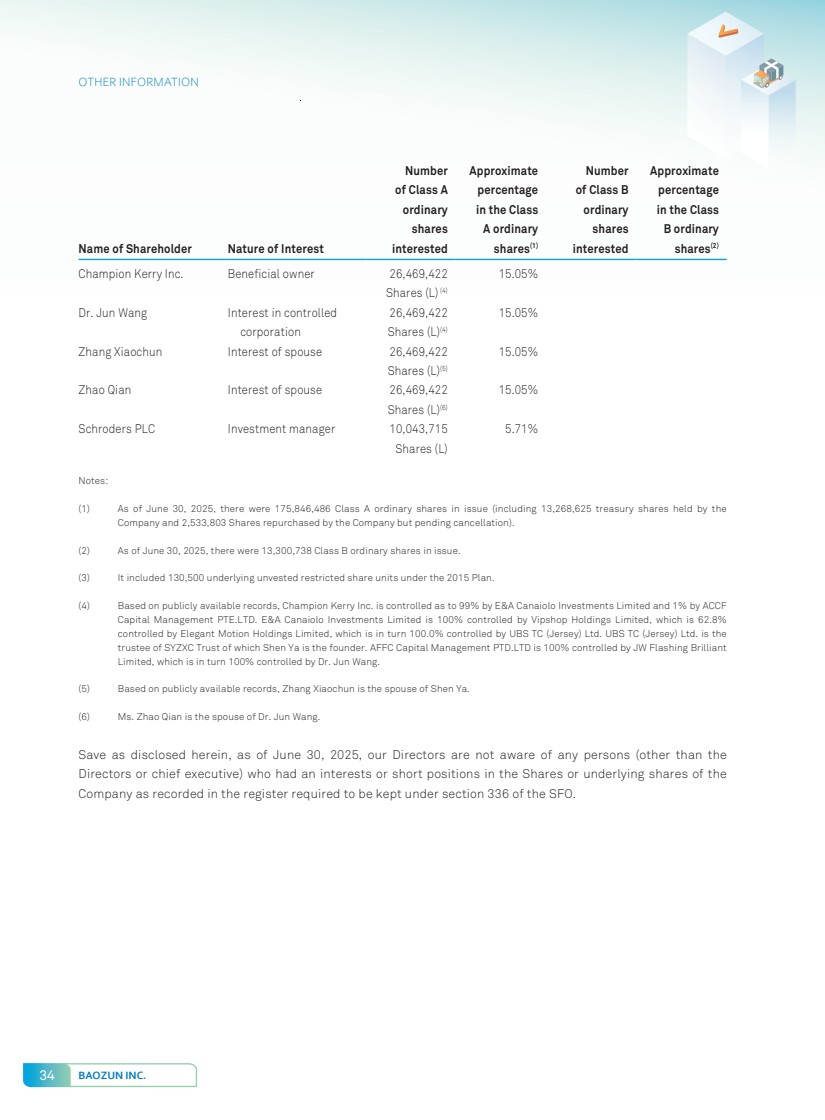

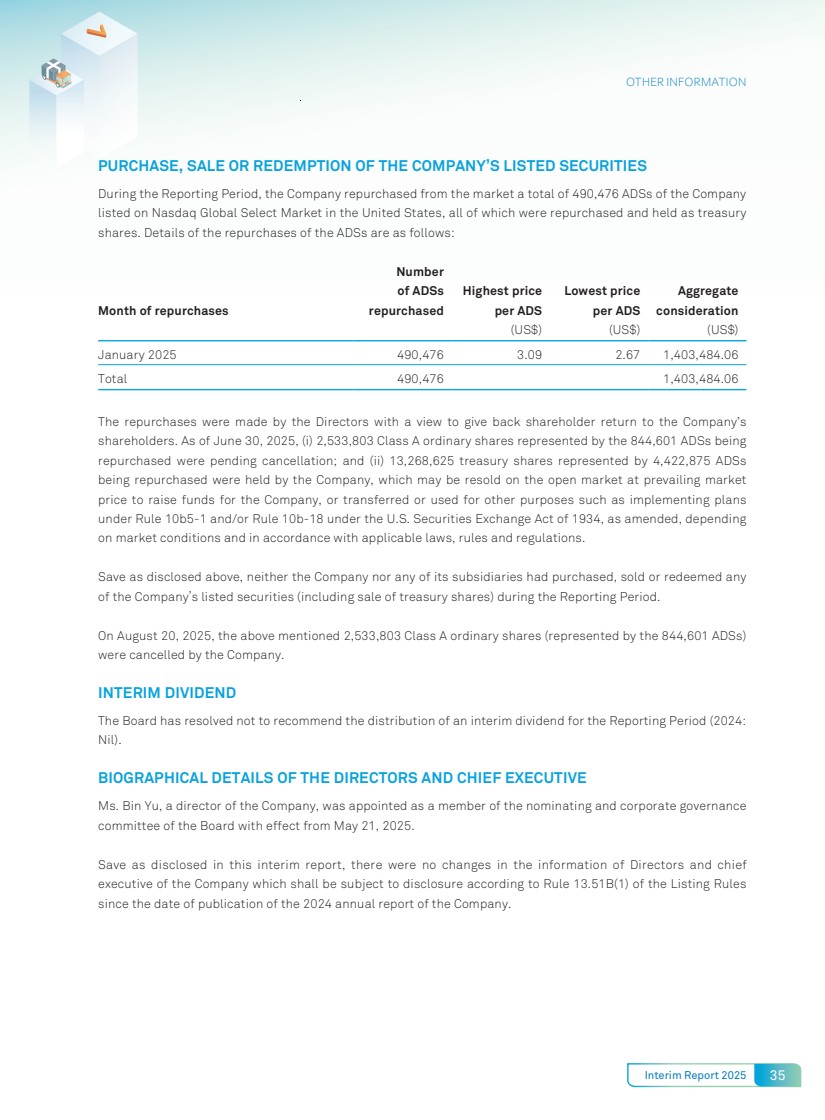

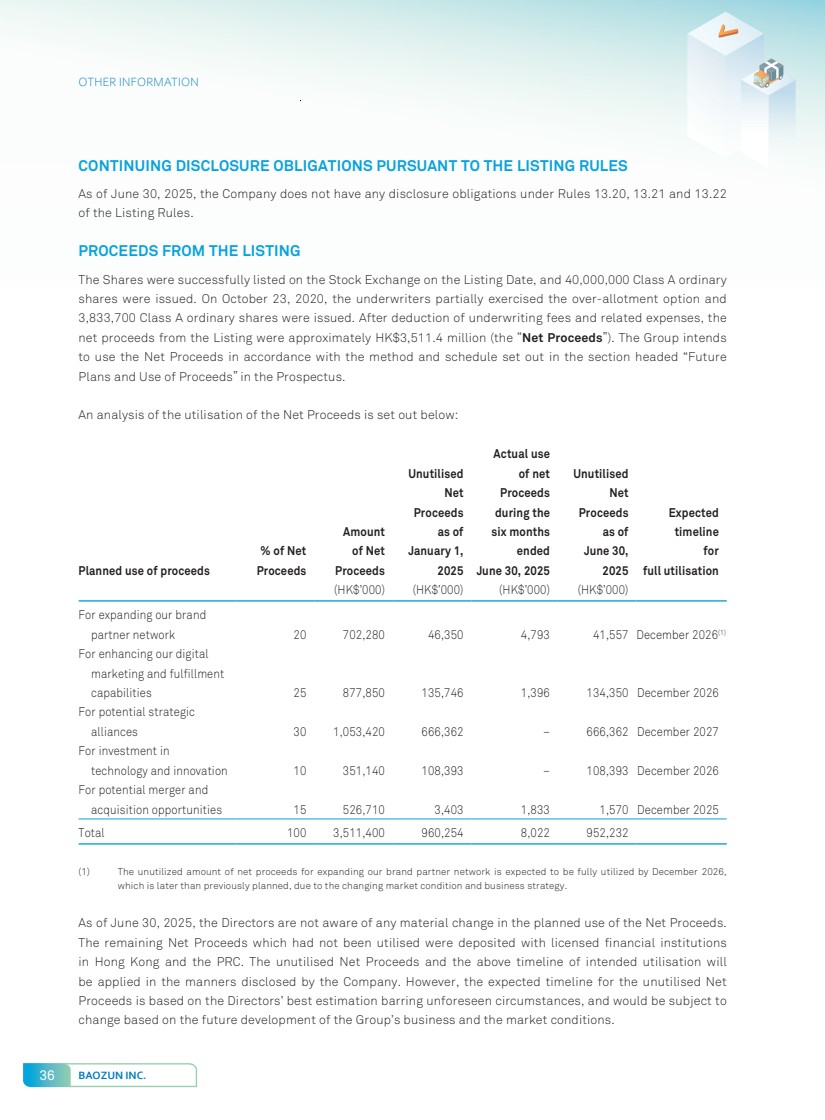

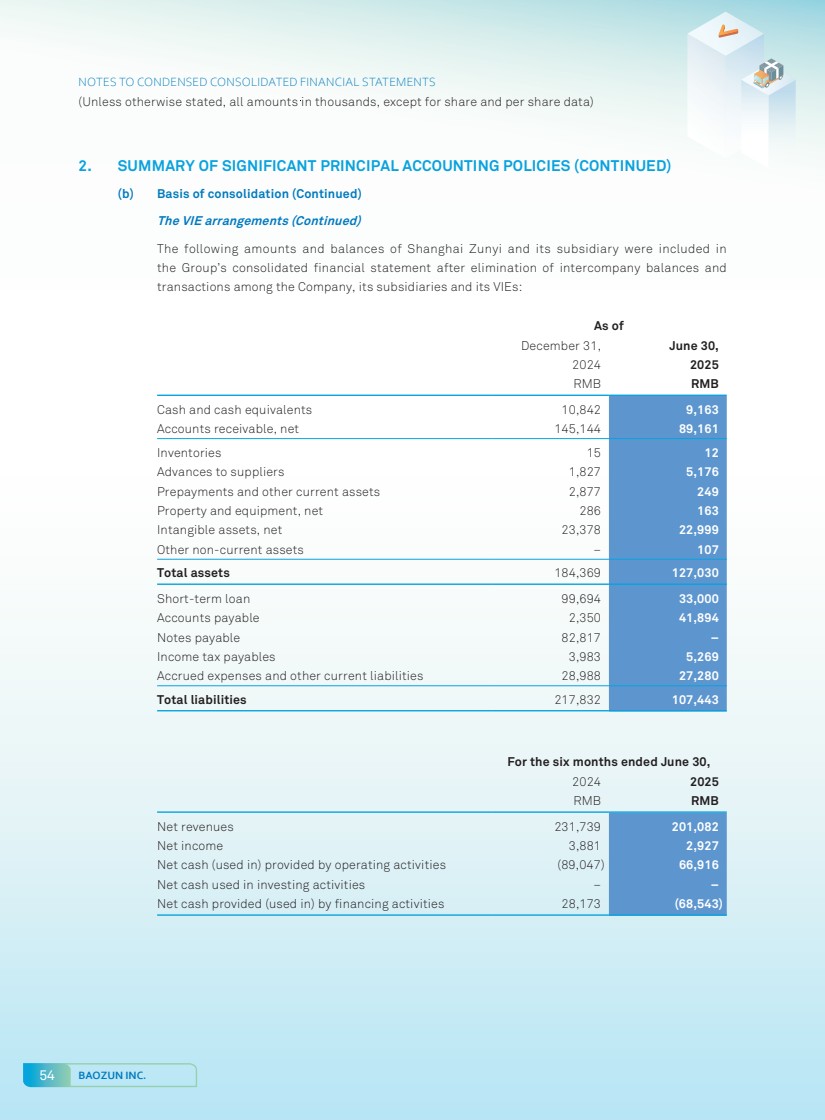

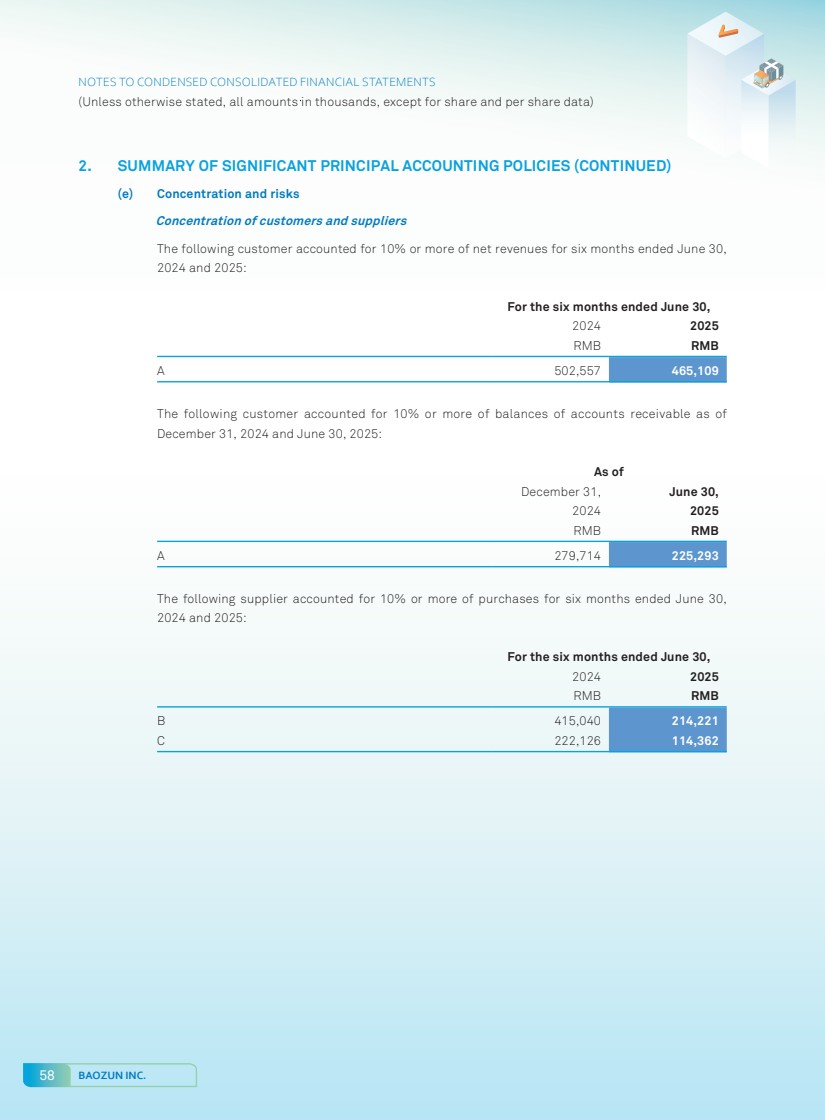

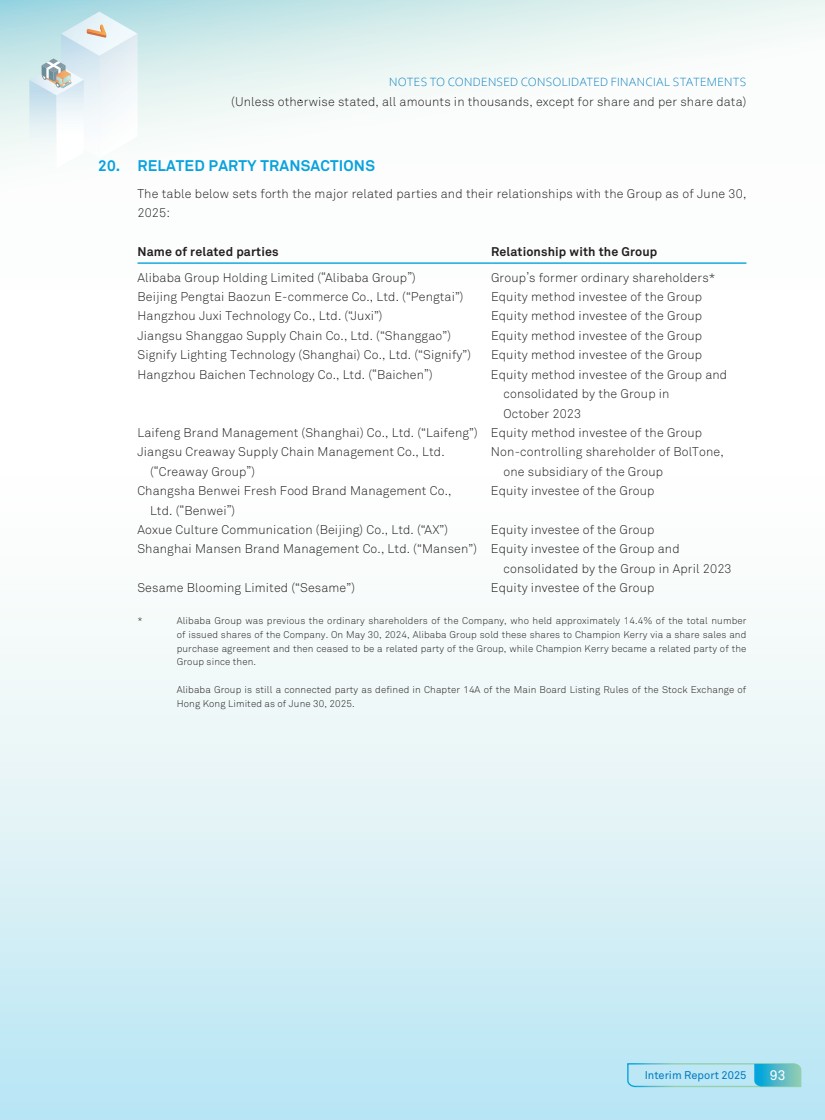

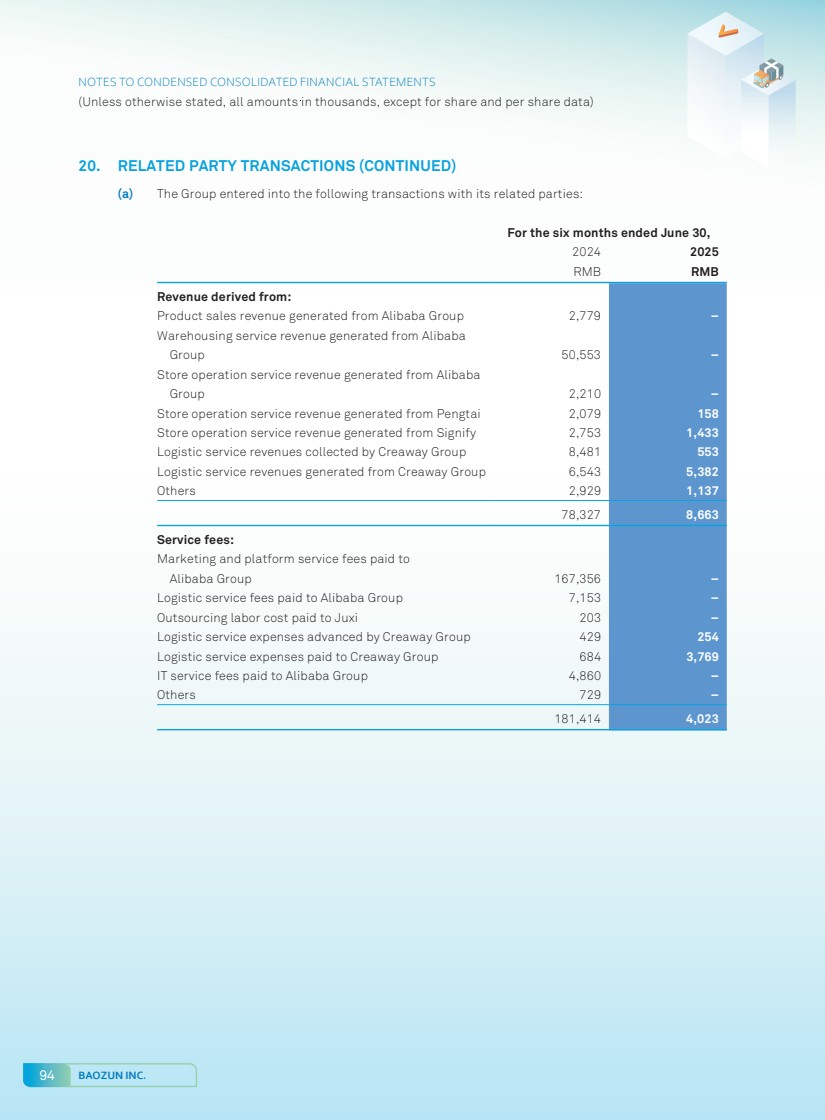

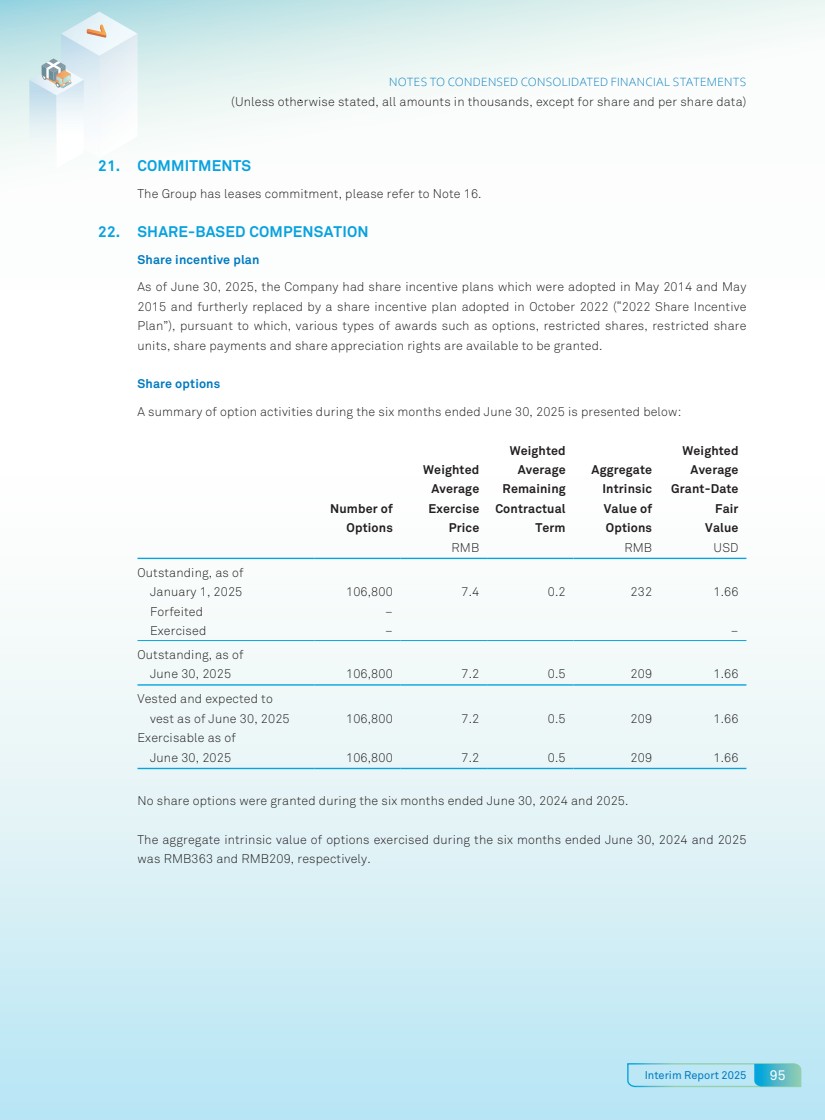

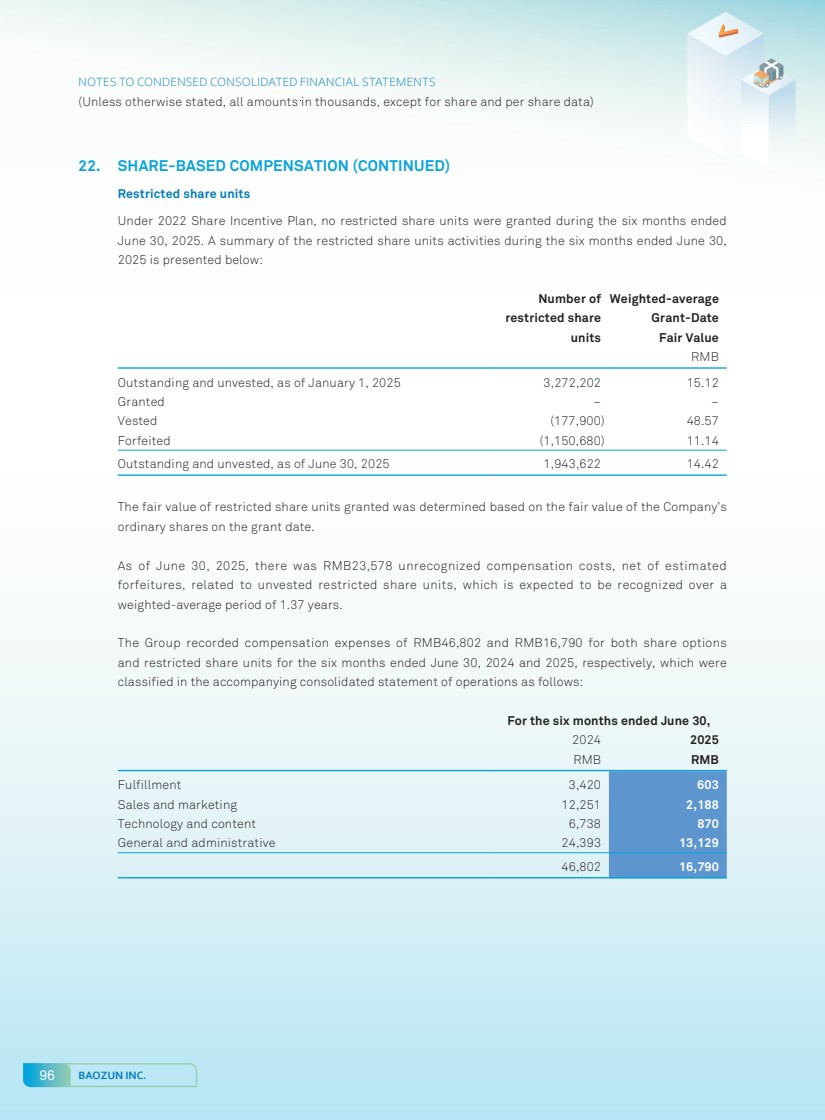

| Interim Report 2025 33 OTHER INFORMATION SUBSTANTIAL SHAREHOLDERS’ INTERESTS IN SECURITIES So far as our Directors are aware, as of June 30, 2025, the following persons (other than the Directors or chief executive) had an interests or short positions in the Shares or underlying Shares of the Company as required in the register required to be kept under section 336 of the SFO: Long Positions in Shares and Underlying Shares Name of Shareholder Nature of Interest Number of Class A ordinary shares interested Approximate percentage in the Class A ordinary shares(1) Number of Class B ordinary shares interested Approximate percentage in the Class B ordinary shares(2) Jesvinco Holdings Limited Beneficial owner 10 Shares (L) 0.00% 9,410,369 Shares (L) 70.75% Casvendino Holdings Limited Beneficial owner 2,764,707 Shares (L)(3) 1.57% 3,890,369 Shares (L) 29.25% Shen Ya Founder of a discretionary trust 26,469,422 Shares (L)(4) 15.05% UBS TC (Jersey) Ltd Trustee 26,469,422 Shares (L)(4) 15.05% Elegant Motion Holdings Limited Interest in controlled corporation 26,469,422 Shares (L)(4) 15.05% Vipshop Holdings Limited Interest in controlled corporation 26,469,422 Shares (L)(4) 15.05% E&A Canaiolo Investments Limited Interest in controlled corporation 26,469,422 Shares (L)(4) 15.05% JW Flashing Brilliant Limited Interest in controlled corporation 26,469,422 Shares (L)(4) 15.05% ACCF Capital Management PTE.LTD Interest in controlled corporation 26,469,422 Shares (L)(4) 15.05% |