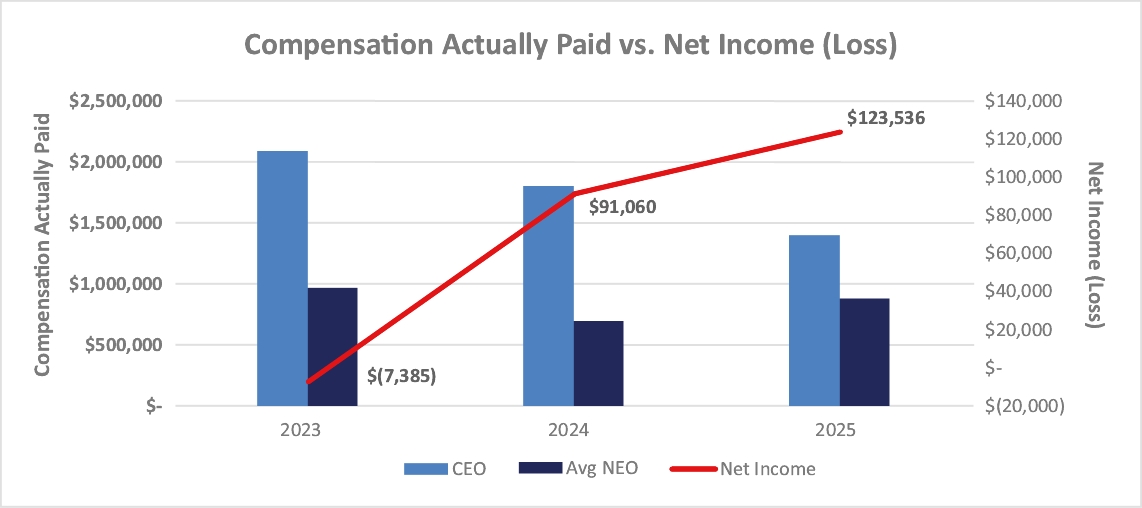

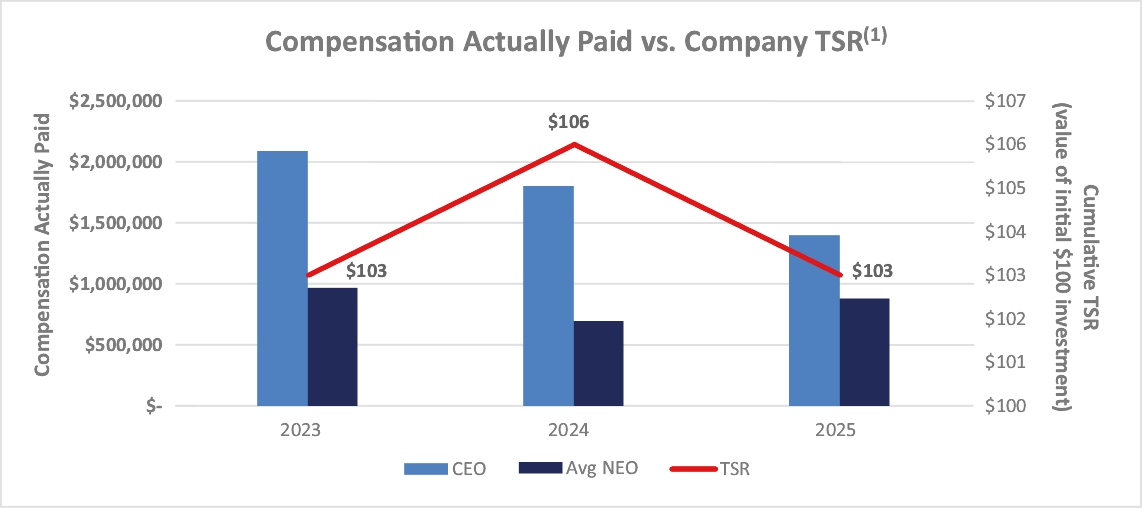

Summary Compensation Table Total for CEO(1) ($) | Compensation Actually Paid to CEO(1)(2) ($) | Average Summary Compensation Table for Other NEOs(1) ($) | Average Compensation Actually Paid to Other NEOs (1)(2) ($) | Value of Initial Fixed $100 Investment Based on: Total Shareholder Return(3) ($) | Net Income (Loss) ($ in thousands) | |||||||||||||||

2025 | 1,586,805 | 1,395,973 | 978,350 | 878,728 | 103 | 123,536 | ||||||||||||||

2024 | 1,842,007 | 1,799,593 | 729,285 | 693,551 | 106 | 91,060 | ||||||||||||||

2023 | 1,938,862 | 2,087,345 | 994,449 | 966,470 | 103 | (7,385) | ||||||||||||||

1 | Our NEOs were: |

Year | CEO | Other NEOs | ||||||

2025 | Matthew Doctor | Kersten D. Zupfer, Jim B. Lain | ||||||

2024 | Matthew Doctor | Kersten D. Zupfer, John C. Davi | ||||||

2023 | Matthew Doctor | Kersten D. Zupfer, John C. Davi | ||||||

2 | None of our NEOs participate in a pension plan; therefore, no adjustment from the Summary Compensation Table total related to pension value was made. A reconciliation of Total Compensation from the Summary Compensation Table (referred to below as “SCT”) to Compensation Actually Paid to our CEO and our Other NEOs (as an average) is shown below: |

2025 | ||||||||

Adjustments | CEO ($) | Average of Other NEOs ($) | ||||||

Total Compensation from SCT | 1,586,805 | 978,350 | ||||||

(Subtraction): SCT amounts for Stock Awards and Option Awards | (371,250) | (121,500) | ||||||

Addition: Fair value at end of fiscal 2025 of awards granted during fiscal 2025 that are outstanding and unvested at the end of fiscal 2025 | 367,950 | 120,420 | ||||||

Addition (Subtraction): The difference between the fair value of awards from the end of fiscal 2024 to the end of fiscal 2025 which were granted in any fiscal year prior to fiscal 2025 that are outstanding and unvested at the end of fiscal 2025 | 0 | (11,769) | ||||||

Addition: Vesting date fair value of awards granted and vesting during fiscal 2025 | — | — | ||||||

Addition (Subtraction): The difference between the fair value of awards from the end of fiscal 2024 to the vesting date for awards granted in any fiscal year prior to fiscal 2025 for which vesting conditions were satisfied as of the end of fiscal 2025 | (187,532) | (86,773) | ||||||

(Subtraction): Fair value at end of fiscal 2024 of awards granted in any fiscal year prior to fiscal 2025 that fail to meet the applicable vesting conditions in fiscal 2025 | — | — | ||||||

Addition: Dividends or other earnings paid on stock or option awards in fiscal 2025 prior to vesting if not otherwise included in the SCT amount for fiscal 2025 | — | — | ||||||

Compensation Actually Paid (as calculated) | 1,395,973 | 878,728 | ||||||

3 | Total shareholder return as calculated based on a fixed investment of one hundred dollars in Company stock measured from the market close on June 30, 2022 (the last trading day of fiscal 2022) through and including the end of the fiscal year for each year reported in the table. |

1 | Our NEOs were: |

Year | CEO | Other NEOs | ||||||

2025 | Matthew Doctor | Kersten D. Zupfer, Jim B. Lain | ||||||

2024 | Matthew Doctor | Kersten D. Zupfer, John C. Davi | ||||||

2023 | Matthew Doctor | Kersten D. Zupfer, John C. Davi | ||||||

2 | None of our NEOs participate in a pension plan; therefore, no adjustment from the Summary Compensation Table total related to pension value was made. A reconciliation of Total Compensation from the Summary Compensation Table (referred to below as “SCT”) to Compensation Actually Paid to our CEO and our Other NEOs (as an average) is shown below: |

2025 | ||||||||

Adjustments | CEO ($) | Average of Other NEOs ($) | ||||||

Total Compensation from SCT | 1,586,805 | 978,350 | ||||||

(Subtraction): SCT amounts for Stock Awards and Option Awards | (371,250) | (121,500) | ||||||

Addition: Fair value at end of fiscal 2025 of awards granted during fiscal 2025 that are outstanding and unvested at the end of fiscal 2025 | 367,950 | 120,420 | ||||||

Addition (Subtraction): The difference between the fair value of awards from the end of fiscal 2024 to the end of fiscal 2025 which were granted in any fiscal year prior to fiscal 2025 that are outstanding and unvested at the end of fiscal 2025 | 0 | (11,769) | ||||||

Addition: Vesting date fair value of awards granted and vesting during fiscal 2025 | — | — | ||||||

Addition (Subtraction): The difference between the fair value of awards from the end of fiscal 2024 to the vesting date for awards granted in any fiscal year prior to fiscal 2025 for which vesting conditions were satisfied as of the end of fiscal 2025 | (187,532) | (86,773) | ||||||

(Subtraction): Fair value at end of fiscal 2024 of awards granted in any fiscal year prior to fiscal 2025 that fail to meet the applicable vesting conditions in fiscal 2025 | — | — | ||||||

Addition: Dividends or other earnings paid on stock or option awards in fiscal 2025 prior to vesting if not otherwise included in the SCT amount for fiscal 2025 | — | — | ||||||

Compensation Actually Paid (as calculated) | 1,395,973 | 878,728 | ||||||

2 | None of our NEOs participate in a pension plan; therefore, no adjustment from the Summary Compensation Table total related to pension value was made. A reconciliation of Total Compensation from the Summary Compensation Table (referred to below as “SCT”) to Compensation Actually Paid to our CEO and our Other NEOs (as an average) is shown below: |

2025 | ||||||||

Adjustments | CEO ($) | Average of Other NEOs ($) | ||||||

Total Compensation from SCT | 1,586,805 | 978,350 | ||||||

(Subtraction): SCT amounts for Stock Awards and Option Awards | (371,250) | (121,500) | ||||||

Addition: Fair value at end of fiscal 2025 of awards granted during fiscal 2025 that are outstanding and unvested at the end of fiscal 2025 | 367,950 | 120,420 | ||||||

Addition (Subtraction): The difference between the fair value of awards from the end of fiscal 2024 to the end of fiscal 2025 which were granted in any fiscal year prior to fiscal 2025 that are outstanding and unvested at the end of fiscal 2025 | 0 | (11,769) | ||||||

Addition: Vesting date fair value of awards granted and vesting during fiscal 2025 | — | — | ||||||

Addition (Subtraction): The difference between the fair value of awards from the end of fiscal 2024 to the vesting date for awards granted in any fiscal year prior to fiscal 2025 for which vesting conditions were satisfied as of the end of fiscal 2025 | (187,532) | (86,773) | ||||||

(Subtraction): Fair value at end of fiscal 2024 of awards granted in any fiscal year prior to fiscal 2025 that fail to meet the applicable vesting conditions in fiscal 2025 | — | — | ||||||

Addition: Dividends or other earnings paid on stock or option awards in fiscal 2025 prior to vesting if not otherwise included in the SCT amount for fiscal 2025 | — | — | ||||||

Compensation Actually Paid (as calculated) | 1,395,973 | 878,728 | ||||||

(1) | Total shareholder return in the above chart reflects the cumulative return of $100 as if invested in our Company stock on June 30, 2022, including reinvestment of any dividends. |