NOTE 1 — ORGANIZATION AND PRINCIPAL ACTIVITIES

Prior to the Business Combination, on April 29, 2021, A SPAC I Acquisition Corp. (“ASCA”), was incorporated as a British Virgin Islands business company, specifically a blank check company formed for the purpose of effecting a merger, share exchange, asset acquisition, share purchase, recapitalization, reorganization or similar business combination with one or more target businesses.

The Business Combination

On February 15, 2023, ASCA entered into the Merger Agreement (as amended on June 12, 2023 and December 6, 2023, the “Merger Agreement,” and the transactions contemplated thereunder, the “Business Combination”) with A SPAC I Mini Acquisition Corp., Merger Sub, NewGenIvf Limited, a Cayman Islands exempted company (“Legacy NewGenIvf”) and certain shareholders of Legacy NewGenIvf. Pursuant to the Merger Agreement, the Business Combination was effected in two steps: (i) ASCA was reincorporated to the British Virgin Islands by merging with and into A SPAC I Mini Acquisition Corp. (such transaction, the “Reincorporation Merger”) and then the listed company was renamed as NewGenIvf Group Limited; and (ii) Merger Sub merged with and into Legacy NewGenIvf, resulting in Legacy NewGenIvf being a wholly-owned subsidiary of the Company (such second step in isolation, the “Acquisition Merger”). The surviving entity of the Business Combination, together with its subsidiaries is referred to in this prospectus as “NewGenIvf,” the “Company,” “we,” “our,” or “us,” unless the context otherwise requires.

On June 12, 2023, the parties to the Merger Agreement entered into the First Amendment to Merger Agreement (the “First Amendment”), pursuant to which Legacy NewGenIvf agreed to provide non-interest bearing loans in an aggregate principal amount of up to $560,000 (the “Loan”) to ASCA to fund any amount that would be required in order to further extend the period of time available for ASCA to consummate a business combination and for ASCA’s working capital, payment of professional, administrative and operational fees and expenses, and other purposes as mutually agreed by ASCA and Legacy NewGenIvf. Such loans were to become repayable upon the closing of the Acquisition Merger. In addition, pursuant to the First Amendment, subject to receipt of at least $140,000 as part of the Loan from Legacy NewGenIvf, ASCA agreed to waive its termination rights and the right to receive any break-up fee due to Legacy NewGenIvf’s failure to deliver audited financial statements by no later than February 28, 2023.

On December 6, 2023, the parties to the Merger Agreement entered into the Second Amendment to the Merger Agreement (the “Second Amendment”) which amended and modified the Merger Agreement to, among other things, (i) reduce the size of NewGenIvf’s board of directors following the consummation of the Business Combination to five (5) directors, two (2) of whom would be executive directors designated by NewGenIvf and three (3) of whom will be designated by NewGenIvf to serve as independent directors in accordance with Nasdaq requirements, (ii) provide for the conversion of NewGenIvf shares issued by NewGenIvf following the original date of the Merger Agreement into Class A Ordinary Shares in connection with the Acquisition Merger, and (iii) remove the condition that ASCA have in excess of $5,000,000 in net tangible assets immediately after the consummation of the Business Combination.

On April 3, 2024, the Business Combination was consummated with the Company as the surviving entity.

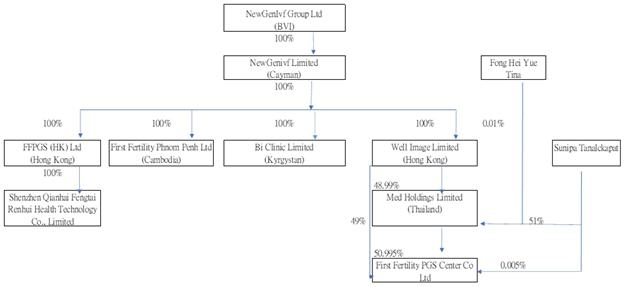

The following is an organization chart of the Company and its subsidiaries as of December 31, 2024:

The Company’s subsidiaries are detailed in the table as follows:

| Name | Background | Ownership % | Principal activity | |||

| NewGenivf Limited | ● A Cayman Islands company ● Incorporated on 16 January, 2019 | 100% | Investment holding | |||

| FFPGS (HK) Limited | ● A Hong Kong company ● Incorporated on December 19, 2019 | 100% | Marketing and administrative services | |||

| Well Image Limited | ● A Hong Kong company ● Incorporated on July 11, 2008 | 100% | Investment holding | |||

| Med Holdings Limited (“Med Holdings”) (Note) | ● A Thailand company ● Incorporated on January 21, 2015 | 49%* | Investment holding | |||

| First Fertility PGS Center Limited (“FFC”) (Note) | ● A Thailand company ● Incorporated on March 6, 2014 | 74% | Provision of IVF treatment | |||

| First Fertility Phnom Penh Limited (“FFPP”) | ● A Cambodia company ● Incorporated on August 10, 2015 | 100% | Provision of IVF treatment | |||

| Bi Clinic Ltd (“FFBi”) | ● A Kyrgyzstan company ● Incorporated on December 16, 2021 ● Acquired on December 17, 2024 | 100% | Provision of IVF treatment, surrogacy and ancillary caring services | |||

| Shenzhen Qianhai Fengtai Renhui Health Technology Co., Ltd. (“SZ QianHai”) | ● A Shenzhen China, PRC company ● Incorporated on October 24, 2024 | 100% | Marketing and administrative services |

| * | Where less than 50% of the equity of an investee is held, the Company (through its subsidiaries) holds significantly more voting rights than any other vote holder or organized company of vote holders. An assessment has been made, taking into account all the factors relevant to the relationship with the investee, to ascertain control has been established and the investee should be consolidated as a subsidiary of the Company. |

Note:

According to Thailand’s Foreign Business Act (the “FBA”), the majority shareholdings of limited company incorporated in Thailand is required to be owned by Thai nationals.

With reference to the capital structure and voting rights structure of ordinary shares and preference shares (the “Share Structure”) of Med Holdings and FFC, all the preference share capital shall be owned by a Thai national. No preference shares, however, have been issued to date. The ordinary shares and preference shares have the same rights and status in all respects except for the distribution of profits by way of dividends with details as follow:

| (a) | Dividends from profits of Med Holdings and FFC shall be allocated to the holders of preference shares at a rate fixed from time to time by the board of directors prior to allocating to the holders of ordinary shares. In any event, such dividends to be allocated to the holders of preference shares shall not exceed 15% of the total amount of dividends declared from time to time; |

| (b) | After allocation of dividends as per (a) above, the rest of the dividends shall be distributed equally amongst the holders of ordinary shares according to their shareholding ratio; |

| (c) | The holders of preferred shares shall be entitled to dividends only in respect of the years for which the Company has declared a dividend payment, and there shall be no cumulative dividends; and |

| (d) | Dividends allocated to the holders of preferred shares in each year shall be limited at the rate as stated in (a) only. No additional dividends shall be paid to the holders of preferred shares. |

Based upon the management’s judgement on the Shares Structure, as the Company is able to exercise majority voting power in any board meeting, the Company accounts for Med Holdings and FFC as subsidiaries on the ground that the Company is able to control Med Holdings and FFC by exercising its majority voting power in any board meetings.

On April 17, 2024, the Company entered into a non-binding term sheet (the “Non-Binding Term Sheet”) with European Wellness Investment Holdings Limited (“EWIHL”) for (i) the potential acquisition of the entire equity interest of EWIHL by the Company for a consideration of US$268,000,000 to be payable by issuing 53,600,000 ordinary shares of the of the Company to the shareholder(s) of EWIHL or its associate and (ii) the fund-raising activity by the Company from public or private shareholders, and in a form mutually acceptable to the parties, including structured equity investment for up to US$30 million. On December 11, 2024, NewGenIvf announced its entry into a binding term sheet with European Wellness Investment Holdings Limited (“EWIHL”) for the above proposed reverse merger, completion of which was subject to, among other conditions, the completion of due diligence, the negotiation of a definitive agreement, and obtaining adequate financing.

On May 24, 2024, the Company received a deficiency letter from the Listing Qualifications Department of The Nasdaq Stock Market LLC (“Nasdaq”) notifying the Company of its non-compliance with two (2) listing requirements for continued listing on Nasdaq pursuant to Nasdaq Listing Rules. On November 21, 2024, a delisting notice was received from the continued non-compliance. The Company had filed to appeal the delisting determination and undertook several strategic actions to regain compliance with Nasdaq’s listing require. On February 27, 2025. received approval for the transfer the Company’s securities from the Nasdaq Global Market to the Nasdaq Capital Market and on March 10, 2025 its compliance with the listing requirements thereof.

On June 3, 2024, the Company announced the execution of a non-binding term sheet (the “Term Sheet”) regarding a proposed reverse merger (the “Proposed Transaction”) with pharmaceutical company COVIRIX Medical Pty Ltd (“COVIRIX”). The consideration was to be settled by way of the issuance of 102,890,000 (pre Reverse Stock Splits) of its ordinary shares to the shareholder(s) of COVIRIX or their respective nominees (the “COVIRIX Shareholders”) in exchange for 100% equity interest of COVIRIX, at a deemed price per share of US$6, representing an aggregate amount of US$617,340,000. Simultaneously, it is proposed that COVIRIX undertakes to introduce investors to raise US$6 million at US$6 per share for NIVF, in a form mutually acceptable to both NewGen and COVIRIX. Following stockholder approval of the Proposed Transaction, COVIRIX Shareholders are expected to hold approximately 85.8% equity interest in NewGen. However, on September 21, 2024, COVIRIX withdrew from the Proposed Transaction, as such the Proposed Transaction was terminated with no cost to the Company.

On August 7, 2024, the Company entered into a Securities Purchase Agreement with certain investors named therein (collectively, the “Buyers”), pursuant to which, amongst other things: (i) the Company agreed to sell, at an initial closing with JAK Opportunities VI LLC (“JAK” and such initial closing, the “Initial Closing”), pursuant to which the Company agreed to sell to JAK (a) a senior convertible note (the “Initial Note”) in the aggregate original principal amount of $1,100,000, and which terms are further set forth below under the subheading “(ii) Initial Closing with JAK”, (b) a warrant to purchase 1,325,301 Class A Ordinary Shares of the Company (subject to Reverse Stock Split adjustments), no par value (“Class A Shares” and such warrant, the Series A Warrant), and (c) a warrant to purchase 180,722 Class B Ordinary Shares (subject to Reverse Stock Split adjustments) of the Company, no par value (“Class B Shares” and such warrant, the Series B Warrant, and the Series B Warrants, together with the Series A Warrants, the “Warrants”); and (ii) the Company may require each Buyer (or each Buyer may require the Company, as applicable) to participate in the sale of (a) one or more additional convertible notes (which aggregate original principal amount for all additional convertible notes shall not exceed $9,500,000) (the “Additional Notes,” and, together with the Initial Note, the “Notes”).

On August 12, 2024, the Company and JAK consummated the Initial Closing. The Initial Note sold to JAK in connection with the Securities Purchase Agreement bears an interest rate of 14.75% per annum and is convertible into the Company’s Class A Shares as follows: the Conversion Amount (as defined below) into validly issued, fully paid and non-assessable Class A at the Conversion Rate determined by dividing the aggregate of the principal sum plus the interest rates (including late interest charges, if any) and the Make-Whole Amount, if any, by conversion price of $0.83.

At the Initial Closing, the Company also sold to JAK a Series A Warrant to purchase 1,325,301 Class A Shares and a Series B Warrant to purchase 180,722 Class B Shares subject to Reverse Stock Split adjustments.

Additionally, in connection with the Securities Purchase Agreement, the Company entered into amendment and exchange agreements with certain holders of its convertible promissory notes (the “Existing Notes” and each of such amendment and exchange agreements, “Amendment and Exchange Agreement”), pursuant to which the Company will exchange the Existing Notes by issuing, among other things, (i) senior convertible notes in the aggregate principal amount of $2,700,000 (the “Exchange Notes”) and (b) a series of warrants to initially acquire up to a certain number of ordinary shares to the holders of the Existing Notes set forth therein or in the Amendment and Exchange Agreement (the “Exchange Warrants”)

On August 28, 2024, the Company consummated the second tranche of its debt financing under the terms of the Securities Purchase Agreement. At the closing of the second tranche, the Company sold to JAK Opportunities VI LLC (“JAK”) a senior convertible note (the “Note”) in the principal amount of $500,000.

On November 11, 2024, the Company consummated the third tranche of its debt financing under the terms of the Securities Purchase Agreement (“SPA”) referenced in the current report on Form 6-K filed with the United States Securities and Exchange Commission (the “SEC”) on August 16, 2024. The Form 6-K filed with the SEC on August 16, 2024 is incorporated by reference herein. Pursuant to the terms of the SPA, the Company may elect at the second additional mandatory closing to sell and the institutional investor party to the SPA shall be required to purchases, subject to certain conditions, an additional note (“Second Additional Mandatory Note”) in the principal amount of $1,500,000, after the effective date of the Registration Statement (as defined in the SPA). The sale of the Second Additional Mandatory Note resulted in $1,395,000 of gross proceeds to the company before fees and expenses. The Notes bears an interest rate of 14.75% per annum and may be adjustable from time to time pursuant to its terms, with maturity at the 4.5 years anniversary of the date of issuance, subject to extension at the option of the holders in certain circumstances. The Second Additional Note are convertible at any time, at an initial conversion price of $0.658.

On November. 18, 2024, the Company entered into a binding term sheet (the “Term Sheet”) with White Lion Capital, LLC, (“White Lion”) a California-based institutional investor focused on high-growth, early-stage public companies, setting out the principal terms and conditions for a $100 million equity line of credit, expandable to $500 million. Pursuant to the Term Sheet, NewGen will have the option, but not the obligation, to sell to White Lion up to $100.0 million in shares of common stock over an initial 36-month period, with the potential to increase to $300.0 million upon substantial M&A or merger activity, and further to $500.0 million after $250.0 million has been drawn.

On November 29, 2024, the Company appointed Tam, Chun Wa to the Company’s Board of Directors (the “Board”). Mr. Tam will serve as an independent director. In addition, Mr. Tam has been named to the Audit Committee of the Board. Following the appointment of Mr. Tam, the Board consists of five members.