Current PEO2 | Prior PEO2 | Average of Non-PEO NEOs3 | Value of $100 Initial Investment Based On: | Net Income (Loss)9 ($000) | Adjusted EBITDA10 ($000) | |||||||||||||||||||||||||||

Fiscal Year1 | SCT Total Compensation4 | Compensation Actually Paid5 12 | SCT Total Compensation4 | Compensation Actually Paid | SCT Total Compensation4 | Compensation Actually Paid6 12 | Cumulative TSR7 | Peer Group TSR8 | ||||||||||||||||||||||||

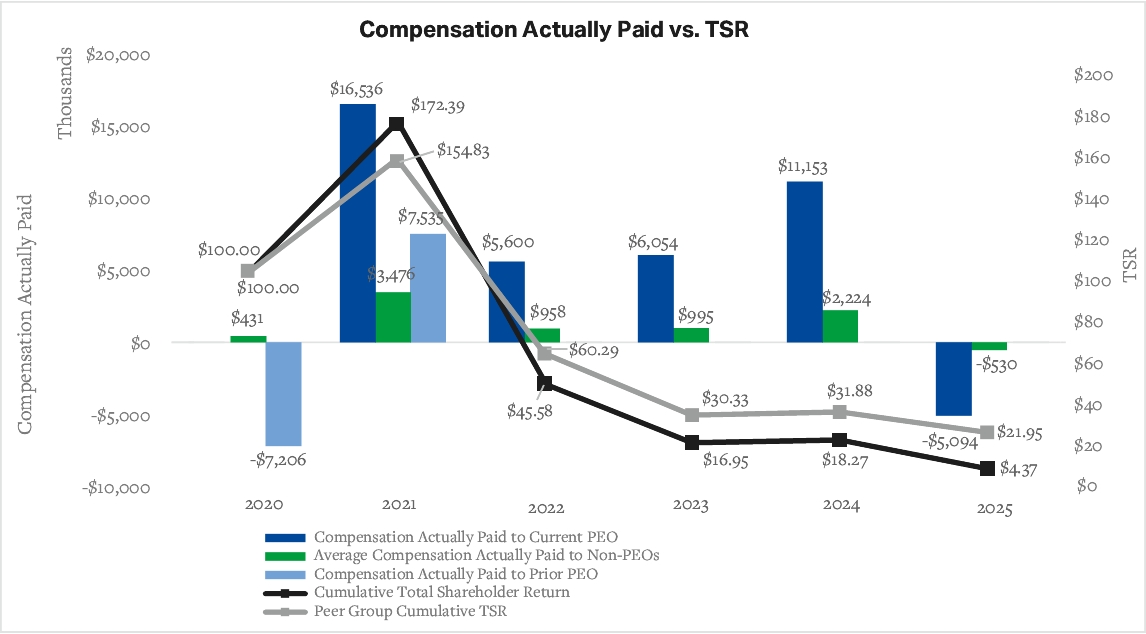

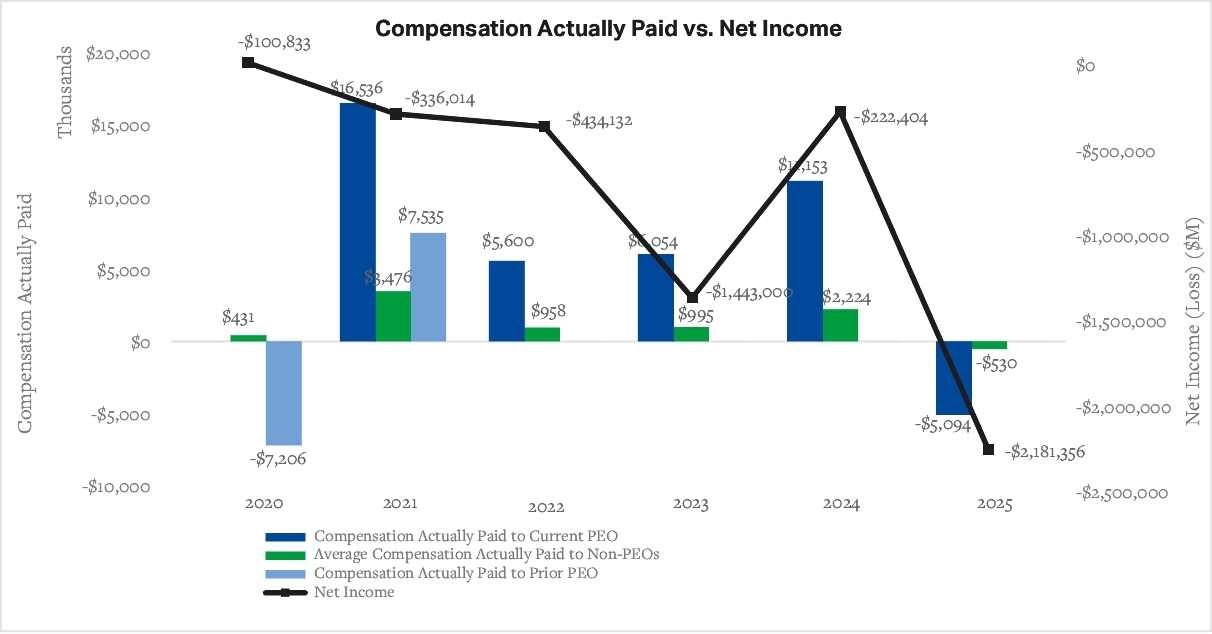

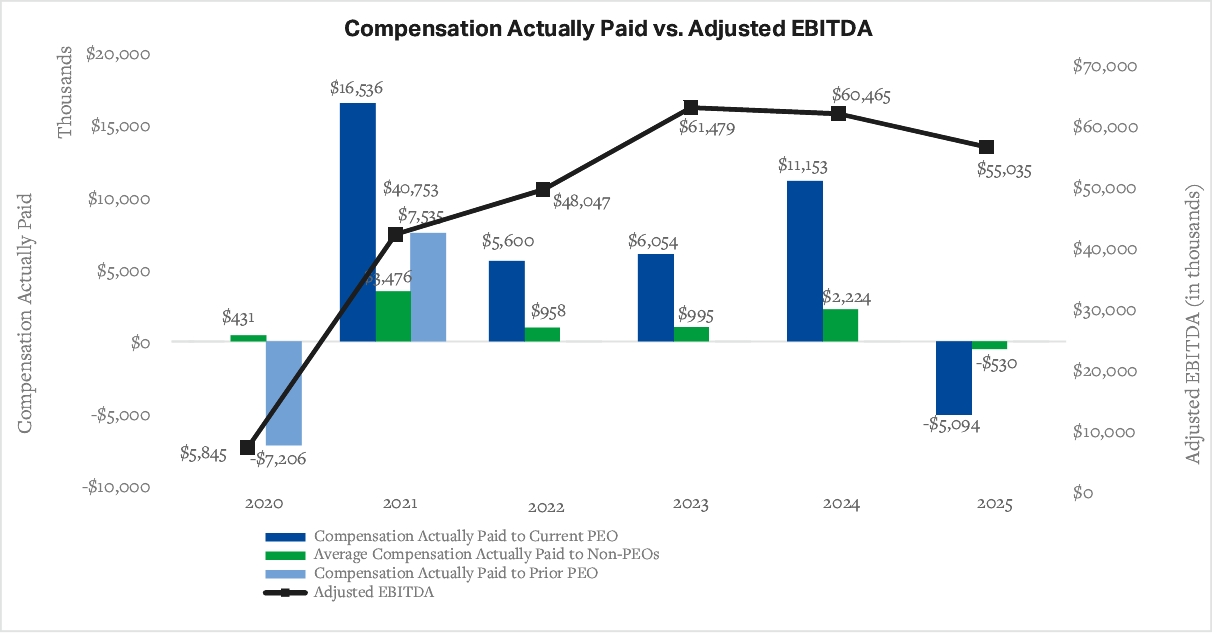

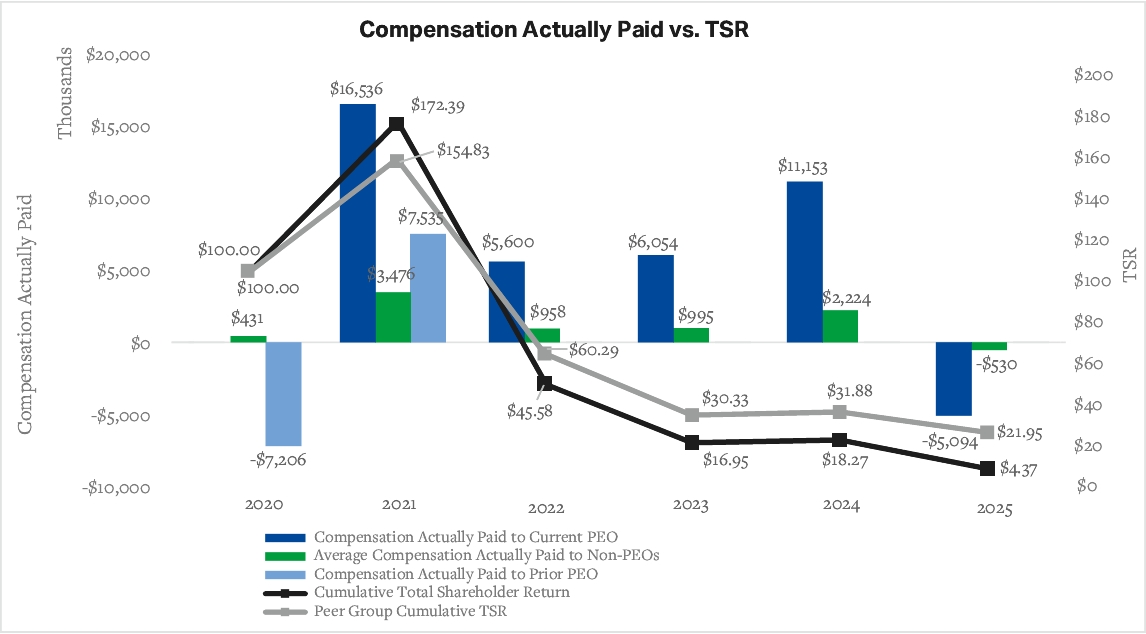

2025 | $10,295,612 | ($5,093,898) | $0 | $0 | $1,989,199 | ($530,210) | $4.37 | $21.95 | ($2,181,356) | $55,035 | ||||||||||||||||||||||

2024 | $10,142,971 | $11,153,152 | $0 | $0 | $2,061,804 | $2,224,106 | $18.27 | $31.88 | ($222,404) | $60,465 | ||||||||||||||||||||||

2023 | $15,656,584 | $6,053,926 | $0 | $0 | $2,371,929 | $994,995 | $16.95 | $30.33 | ($1,443,000) | $61,479 | ||||||||||||||||||||||

2022 | $19,456,767 | $5,599,894 | $0 | $0 | $2,755,870 | $957,950 | $45.58 | $60.29 | ($434,132) | $48,047 | ||||||||||||||||||||||

2021 | $13,683,998 | $16,536,484 | $6,458,729 | $7,535,144 | $2,208,882 | $3,475,621 | $172.39 | $154.83 | ($336,014) | $40,771 | ||||||||||||||||||||||

2020 | $0 | $0 | $1,907,812 | ($7,205,882) | $1,394,132 | $431,435 | $100.00 | $100.00 | ($100,833) | $5,84511 | ||||||||||||||||||||||

(1) | Fiscal year 2021 was a five-month transition period (January 1, 2021 to May 31, 2021) due to the change in the Company’s fiscal year-end. For 2020, the reportable year was January 1, 2020 to December 31, 2020. |

(2) | In fiscal year 2021, the PEOs included Irwin Simon (Current PEO) and Brendan Kennedy (Prior PEO). Mr. Simon served as the Company’s PEO for fiscal years 2022-2025. Mr. Kennedy served as the Company’s PEO in fiscal year 2020. |

(3) | The non-PEO NEOs for the applicable fiscal years were as follows: |

(4) | The values in this column reflect the “Total” compensation set forth in the Summary Compensation Table (“SCT”) as stated in the Company’s past proxy filings for the corresponding fiscal year. See the footnotes to the applicable SCT for further detail regarding the amounts in this column. |

(5) | The following table sets forth the adjustments made during each fiscal year presented in the Pay Versus Performance Table to arrive at compensation “actually paid” to our Current PEO during 2025: |

Adjustments to Determine Compensation “Actually Paid” for Current PEO | SCT Total Compensation4 | Deduction for Amounts Reported under the “Stock Awards” and “Option Awards” Column in the SCT | Increase for Fair Value of Awards Granted during the year that Remain Unvested as of Year End | Increase for Fair Value of Awards Granted during the year that Vest during year | Increase/ deduction for Change in Fair Value from prior Year-end to current Year-end of Awards Granted Prior to year that were Outstanding and Unvested as of Year-end | Increase/ deduction for Change in Fair Value from Prior Year-end to Vesting Date of Awards Granted Prior to year that Vested during year | Deduction of Fair Value of Awards Granted Prior to year that were Forfeited or Modified during year | Dollar Value of Dividends or other Earnings Paid on Stock Awards prior to Vesting Date not otherwise included in Total Compensation | Total Adjustments to SCT Total Compensation | ||||||||||||||||||||

2025 | $10,295,612 | $4,729,400 | $1,011,762 | $0 | ($11,837,247 | $165,375 | $0 | $0 | ($10,660,110) | ||||||||||||||||||||

(6) | The following table sets forth the adjustments made during each fiscal year presented in the Pay Versus Performance Table to arrive at the average compensation “actually paid” to our Non-PEO NEOs during each of the reportable years: |

Adjustments to Determine Compensation “Actually Paid” for Current PEO | SCT Total Compensation Of Average of Non-PEO NE | Deduction for Amounts Reported under the “Stock Awards” and “Option Awards” Column in the SCT | Increase for Fair Value of Awards Granted during the year that Remain Unvested as of Year End | Increase for Fair Value of Awards Granted during the year that Vest during year | Increase/ deduction for Change in Fair Value from prior Year-end to current Year-end of Awards Granted Prior to year that were Outstanding and Unvested as of Year-end | Increase/ deduction for Change in Fair Value from Prior Year-end to Vesting Date of Awards Granted Prior to year that Vested during year | Deduction of Fair Value of Awards Granted Prior to year that were Forfeited or Modified during year | Dollar Value of Dividends or other Earnings Paid on Stock Awards prior to Vesting Date not otherwise included in Total Compensation | Total Adjustments to SCT Total Compensation | ||||||||||||||||||||

2025 | $1,989,199 | $904,578 | $193,517 | $0 | ($1,814,303) | $5,955 | $0 | $0 | ($1,614,831) | ||||||||||||||||||||

(7) | Total shareholder return is calculated for each fiscal year based on a fixed investment of $100 from May 31, 2020 through the end of each applicable year, assuming reinvestment of dividends. |

(8) | Horizons Marijuana Life Sciences Index is the peer group index selected by the Company for this purpose and for purposes of the Stock Performance Graph in our Annual Report. |

(9) | The dollar amounts reported represents the amount of net income (loss) reflected in the Company’s audited financial statements for the applicable year or period. |

(10) | The Company has identified Adjusted EBITDA as the Company-selected measure for this pay versus performance disclosure, as it represents the most significant financial performance measure used to link compensation actually paid to the PEOs and Non-PEO NEOs |

(11) | Represents Aphria Inc.’s Adjusted EBITDA for the year ended May 31, 2020, presented in USD and according to US GAAP. |

(12) | The “2024 EBITDA PSU Awards” as described in the Compensation Discussion & Analysis section are not included because there was no change in fair value as of the end of Fiscal Year 2025 based upon the probable outcome of the performance conditions as of the last day of Fiscal Year 2025. There was no grant date fair value for purposes of ASC 718 due to the three-year cumulative performance targets not having been set during Fiscal Year 2025. |

(2) | In fiscal year 2021, the PEOs included Irwin Simon (Current PEO) and Brendan Kennedy (Prior PEO). Mr. Simon served as the Company’s PEO for fiscal years 2022-2025. Mr. Kennedy served as the Company’s PEO in fiscal year 2020. |

(3) | The non-PEO NEOs for the applicable fiscal years were as follows: |

(8) | Horizons Marijuana Life Sciences Index is the peer group index selected by the Company for this purpose and for purposes of the Stock Performance Graph in our Annual Report. |

(5) | The following table sets forth the adjustments made during each fiscal year presented in the Pay Versus Performance Table to arrive at compensation “actually paid” to our Current PEO during 2025: |

Adjustments to Determine Compensation “Actually Paid” for Current PEO | SCT Total Compensation4 | Deduction for Amounts Reported under the “Stock Awards” and “Option Awards” Column in the SCT | Increase for Fair Value of Awards Granted during the year that Remain Unvested as of Year End | Increase for Fair Value of Awards Granted during the year that Vest during year | Increase/ deduction for Change in Fair Value from prior Year-end to current Year-end of Awards Granted Prior to year that were Outstanding and Unvested as of Year-end | Increase/ deduction for Change in Fair Value from Prior Year-end to Vesting Date of Awards Granted Prior to year that Vested during year | Deduction of Fair Value of Awards Granted Prior to year that were Forfeited or Modified during year | Dollar Value of Dividends or other Earnings Paid on Stock Awards prior to Vesting Date not otherwise included in Total Compensation | Total Adjustments to SCT Total Compensation | ||||||||||||||||||||

2025 | $10,295,612 | $4,729,400 | $1,011,762 | $0 | ($11,837,247 | $165,375 | $0 | $0 | ($10,660,110) | ||||||||||||||||||||

(6) | The following table sets forth the adjustments made during each fiscal year presented in the Pay Versus Performance Table to arrive at the average compensation “actually paid” to our Non-PEO NEOs during each of the reportable years: |

Adjustments to Determine Compensation “Actually Paid” for Current PEO | SCT Total Compensation Of Average of Non-PEO NE | Deduction for Amounts Reported under the “Stock Awards” and “Option Awards” Column in the SCT | Increase for Fair Value of Awards Granted during the year that Remain Unvested as of Year End | Increase for Fair Value of Awards Granted during the year that Vest during year | Increase/ deduction for Change in Fair Value from prior Year-end to current Year-end of Awards Granted Prior to year that were Outstanding and Unvested as of Year-end | Increase/ deduction for Change in Fair Value from Prior Year-end to Vesting Date of Awards Granted Prior to year that Vested during year | Deduction of Fair Value of Awards Granted Prior to year that were Forfeited or Modified during year | Dollar Value of Dividends or other Earnings Paid on Stock Awards prior to Vesting Date not otherwise included in Total Compensation | Total Adjustments to SCT Total Compensation | ||||||||||||||||||||

2025 | $1,989,199 | $904,578 | $193,517 | $0 | ($1,814,303) | $5,955 | $0 | $0 | ($1,614,831) | ||||||||||||||||||||

Adjusted EBITDA | ||

Consolidated Net Revenue | ||

(10) | The Company has identified Adjusted EBITDA as the Company-selected measure for this pay versus performance disclosure, as it represents the most significant financial performance measure used to link compensation actually paid to the PEOs and Non-PEO NEOs |