Management’s Discussion & Analysis

For the three and nine months ended July 31, 2025 and 2024

(Stated in thousands of Canadian dollars, except share and per share amounts)

| | | | | |

| High Tide Inc. |

| Management's Discussion and Analysis |

| For the nine months ended July 31, 2025 and 2024 |

| (In thousands of Canadian dollars, except share and per share amounts or otherwise stated) |

Established consumer brands of High Tide Inc.

| | | | | |

| High Tide Inc. |

| Management's Discussion and Analysis |

| For the nine months ended July 31, 2025 and 2024 |

| (In thousands of Canadian dollars, except share and per share amounts or otherwise stated) |

About this MD&A:

This management’s discussion and analysis (this “MD&A”) of High Tide Inc. (“High Tide”, “we”, “our” or the “Company”) for the three and nine months ended July 31, 2025 and 2024 is dated September 15, 2025. This MD&A should be read in conjunction with the unaudited condensed interim consolidated financial statements of the Company for the three and nine months ended July 31, 2025 and 2024 together with the notes thereto and the audited consolidated financial statements of the Company for the years ended October 31, 2024 and 2023 (hereafter the “Financial Statements”). The financial information presented in this MD&A has been derived from the Financial Statements which were prepared in accordance with International Financial Reporting Standards (“IFRS”) as issued by the International Accounting Standards Board (“IASB”). The Company’s continuous disclosure materials, including interim fillings, audited annual consolidated financial statements, annual information form and annual report on Form 40-F can be found on SEDAR+ at www.sedarplus.ca, with the company’s filings with the SEC at www.sec.gov/edgar.

This MD&A refers to the Company’s two reportable operating segments: (i) the “bricks-and-mortar” segment which includes the Company’s Canadian bricks-and-mortar locations, and (ii) the “e-commerce” segment which includes the Company’s USA and international subsidiaries which sell Hemp-derived products and consumption accessories.

High Tide Inc. (the “Company” or “High Tide”) is a retail-focused cannabis company with bricks-and-mortar stores and global e-commerce assets. The Company’s shares are listed on the Nasdaq Capital Market (“Nasdaq”) under the symbol “HITI” (listed as of June 2, 2021), the TSX Venture Exchange (“TSXV”) under the symbol “HITI”, and on the Frankfurt Stock Exchange (“FSE”) under the securities identification code ‘WKN: A2PBPS’ and the ticker symbol “2LYA”. The address of the Company’s corporate and registered office is # 112 – 11127 15 Street NE, Calgary, Alberta Canada T3K 2M4.

High Tide does not engage in any U.S. cannabis-related activities as defined by the Canadian Securities Administrators Staff Notice 51-352.

Corporate overview:

Founded in 2009, High Tide through its subsidiary Canna Cabana is the largest cannabis retail chain in Canada. As of July 31, 2025, the Company operates 203 branded retail cannabis stores across Canada represented by 88 locations in Alberta, 83 locations in Ontario, 12 locations in Saskatchewan, 8 locations in British Columbia, and 12 locations in Manitoba. Included within the 203 stores, the Company has a 50% interest in a partnership that operates a branded retail Canna Cabana location in Sudbury, Ontario and two joint ventures that operate under the Meta Cannabis Supply Co brand with a 49% interest that operate in Manitoba.

Leveraging the brand equity established through its consumer brands, High Tide sells cannabis (only in Canada), Hemp-derived products and consumption accessories through both traditional bricks-and-mortar stores as well as e-commerce platforms. Traditional bricks-and-mortar sales are conducted under the Company’s Canna Cabana. Hemp-derived product and consumption accessory sales are conducted online under the Company’s NuLeaf Naturals, FAB-CBD, Blessed CBD, Grasscity, Smoke Cartel, Daily High Club and DankStop brands.

Under these established brands, High Tide has become one of the most recognized cannabis retail groups globally. The Company sells cannabis and consumption accessories in Canada through its Canna Cabana brand. Hemp-derived products and consumption accessories are available online in Canada, the United States, the United Kingdom, and Europe.

| | | | | |

| High Tide Inc. |

| Management's Discussion and Analysis |

| For the nine months ended July 31, 2025 and 2024 |

| (In thousands of Canadian dollars, except share and per share amounts or otherwise stated) |

Corporate update:

High Tide’s wholly owned subsidiary, Canna Cabana, is the largest cannabis retail brand in Canada with 207 current operating locations. Following the opening of 16 new stores this calendar year, the Company is on track to reach the upper end of its previously stated target of 20–30 new locations in calendar 2025, while advancing toward its long-term goal of surpassing 300 locations nationwide.

The Company’s Cabana Club and ELITE loyalty programs, which remain the largest such cannabis loyalty programs in the world, continue to expand at a rapid pace across Canada. Cabana Club membership has now surpassed 2.15 million members in Canada, which is up 39% in the past year. Over the long term the Company anticipates exceeding 2.5 million Cabana Club members in Canada. Globally, the Company has now surpassed 6.15 million Cabana Club members. ELITE, the paid membership tier, continues to break quarterly and annual growth records and now exceeds 115,000 members in Canada and 123,600 worldwide, with additional members being onboarded daily. ELITE members tend to shop more frequently and in larger quantities than base tier members.

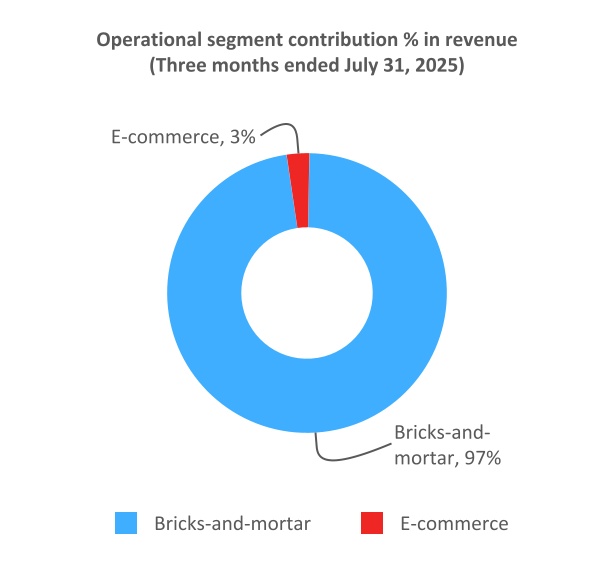

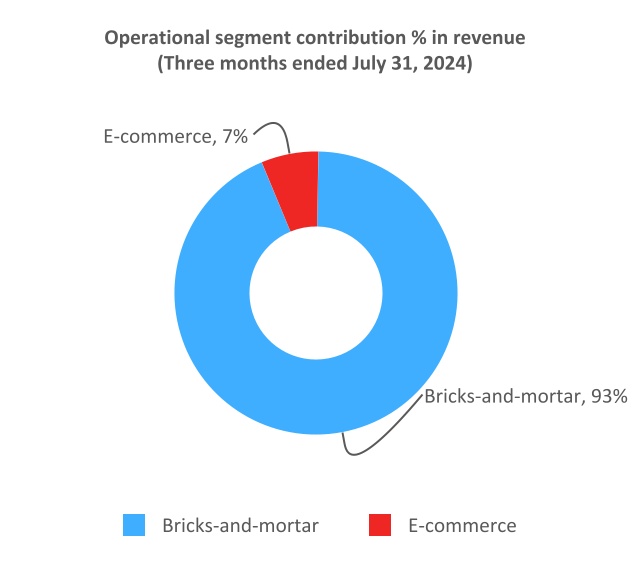

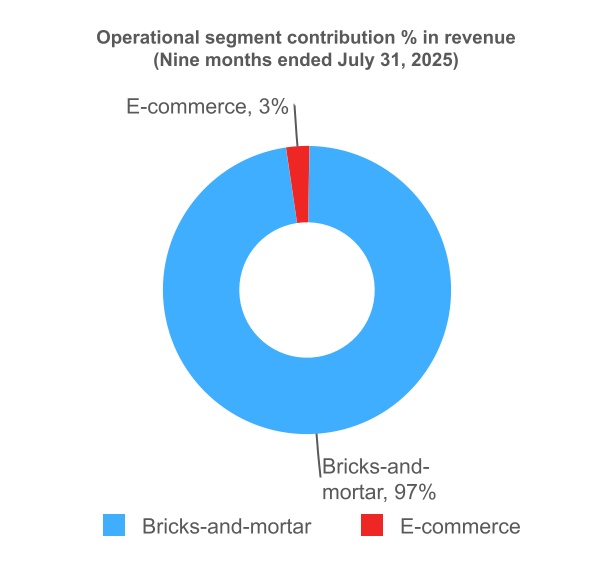

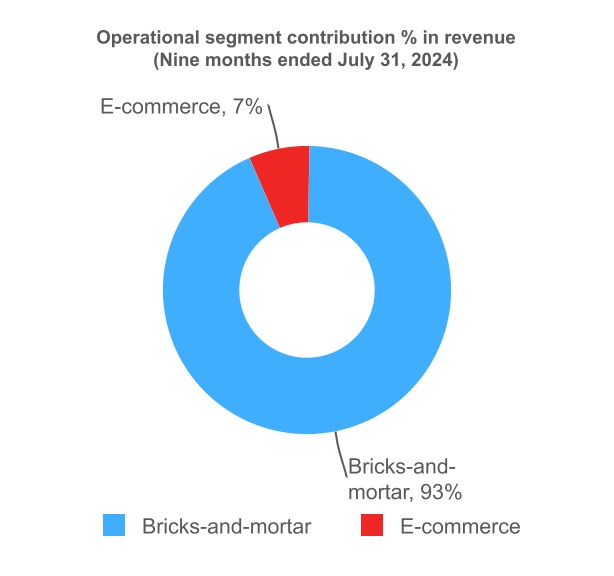

Following the successful launch of its innovative discount club model in its core brick-and-mortar business, in late 2024, the Company expanded Cabana Club across all its global e-commerce businesses, offering disruptive three-tier pricing. While its e-commerce division is currently tracking behind its initial financial forecasts, the Company notes it represents only 3% of consolidated revenue. While the Company has historically focused its e-commerce strategy around consumption accessories and hemp-derived products, it has recently entered the hemp-derived cannabinoids marketplace in the United States, to strengthen and expand its online ecosystem. Management remains focused on executing its original 12-month plan to improve e-commerce performance and is optimistic about a potential turnaround. At the same time, contingency options are under active consideration, including potential partnerships, divestitures, or maintaining pared-down e-commerce platforms primarily as strategic assets in anticipation of further U.S. federal reforms.

The Company has always managed its affairs with a focus on prudent free cash flow generation, having produced more than $38 million over the past two years. With the transformational Remexian acquisition, the Company will need to assess its ongoing cash needs, as Remexian’s anticipated growth will require additional working capital to support further expansion. The Company will assess its impact on consolidated results in due course.

The Company continues to expand the its white label cannabis product portfolio between its flagship Queen of Bud and Cabana Cannabis Co. brands, with 25 cannabis SKUs now available across the Canna Cabana store network. The Company continues to work on exciting new white label product offerings that are expected to launch in the coming months.

Regarding its balance sheet, the Company continues to have no meaningful debt maturities for the next two years, has significantly more cash on hand than in the past, and continues to generate meaningful free cash flow from its core brick-and-mortar operations. As a result, the Company believes it can continue to fund future store growth internally.

| | | | | |

| High Tide Inc. |

| Management's Discussion and Analysis |

| For the nine months ended July 31, 2025 and 2024 |

| (In thousands of Canadian dollars, except share and per share amounts or otherwise stated) |

Select financial highlights and operating performance: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three months ended July 31 | | Nine Months Ended July 31 |

| | 2025 | | 2024 | | Change | | 2025 | | 2024 | | Change |

| | $ | | $ | | ∆ | | $ | | $ | | ∆ |

Free cash flow(i) | | 7,682 | | 3,092 | | 148% | | 10,678 | | 16,083 | | (34) | % |

| Net cash provided by operating activities | | 10,650 | | 6,213 | | 71% | | 19,588 | | 25,895 | | (24) | % |

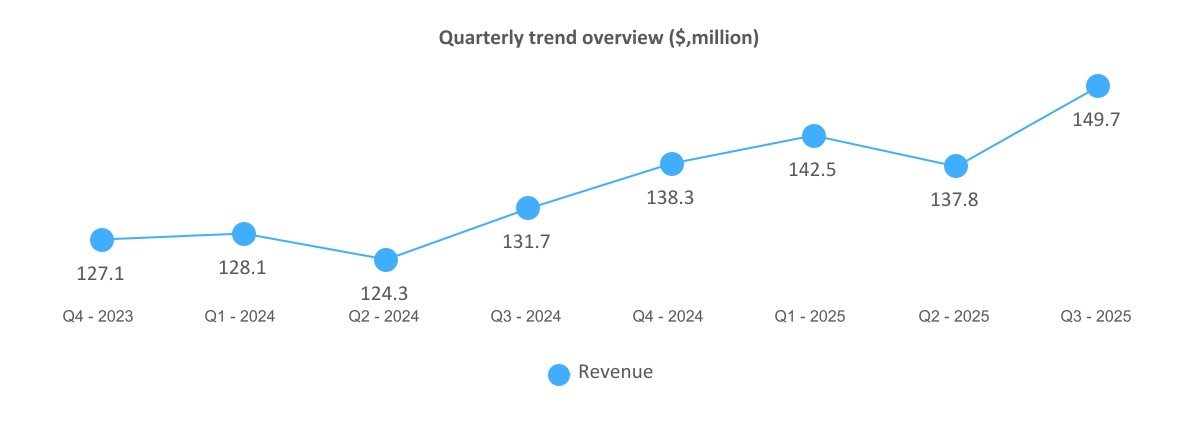

| Revenue | | 149,690 | | 131,685 | | 14% | | 429,955 | | 384,011 | | 12 | % |

| Gross profit | | 40,091 | | 35,454 | | 13% | | 111,002 | | 106,747 | | 4 | % |

Gross profit margin(ii) | | 27% | | 27% | | —% | | 26% | | 28% | | (2) | % |

| Total expenses | | (36,352) | | (32,399) | | 12% | | (106,264) | | (98,913) | | 7 | % |

| Total expenses as a % of revenue | | 24% | | 25% | | (1)% | | 25% | | 26% | | (1) | % |

| Income from operations | | 3,739 | | 3,055 | | 22% | | 4,738 | | 7,834 | | (40) | % |

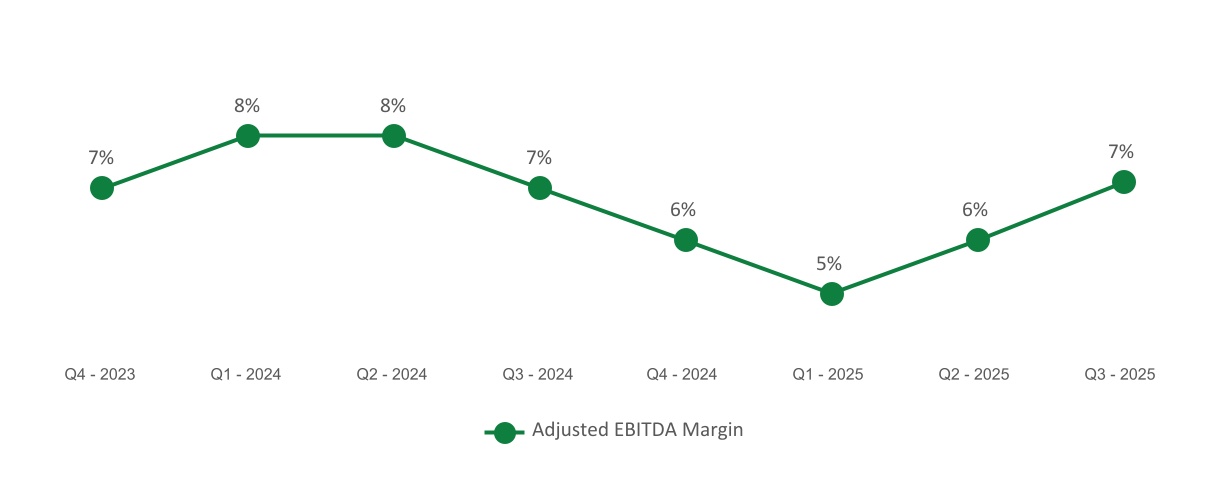

Adjusted EBITDA(iii) | | 10,643 | | 9,614 | | 11% | | 25,794 | | 30,090 | | (14) | % |

Adjusted EBITDA as a percentage of revenue(iv) | | 7% | | 7% | | —% | | 6% | | 8% | | (2) | % |

| Net income (loss) | | 832 | | 825 | | 1% | | (4,693) | | 991 | | |

| | | | | | | | | | | | |

| Basic and diluted income (loss) per share | | 0.01 | | 0.01 | | | | (0.06) | | — | | |

(i)Free cash flow is a non-IFRS financial measure prepared based on the calculation mentioned in “Select financial highlights and operating performance" section on page 8.

(ii)Gross profit margin - a non-IFRS financial measure. Gross profit margin is calculated by dividing gross profit by revenue.

(iii)Adjusted EBITDA - a non-IFRS financial measure. A reconciliation of the Adjusted EBITDA to Net income (loss) is found under “Select financial highlights and operating performance" section on page 8.

(iv)Adjusted EBITDA as a percentage of revenue - a non-IFRS financial measure. This metric is calculated as adjusted EBITDA divided by revenue.

The key factors affecting the results of the three months ended July 31, 2025, were:

•Free cash flow – Free cash flow increased $4,590 year over year, primarily driven by a $4,437 improvement in net cash provided by operating activities.

•Revenue – Revenue increased $18,005 year over year. Contributions included $6,532 from new bricks-and-mortar stores, $12,916 from organic same-store sales1 growth, $3,253 from data analytics, advertising and other revenue, which accounts for 97% of the business and decline of $4,696 in the e-commerce revenue.

•Total expenses – Total expenses were 24% of revenue, down 1% point from 25% in the prior-year period. The improvement reflects company initiatives to reduce expenditure and implement operating efficiencies without impacting revenue.

•Adjusted EBITDA – Adjusted EBITDA margin was 7%, unchanged from the prior-year period, reflecting disciplined cost control alongside revenue growth.

1 Same store sales is calculated based on stores which were open in the previous period being compared. Stores which were opened partially in the period being compared are accounted as new store sales.

| | | | | |

| High Tide Inc. |

| Management's Discussion and Analysis |

| For the nine months ended July 31, 2025 and 2024 |

| (In thousands of Canadian dollars, except share and per share amounts or otherwise stated) |

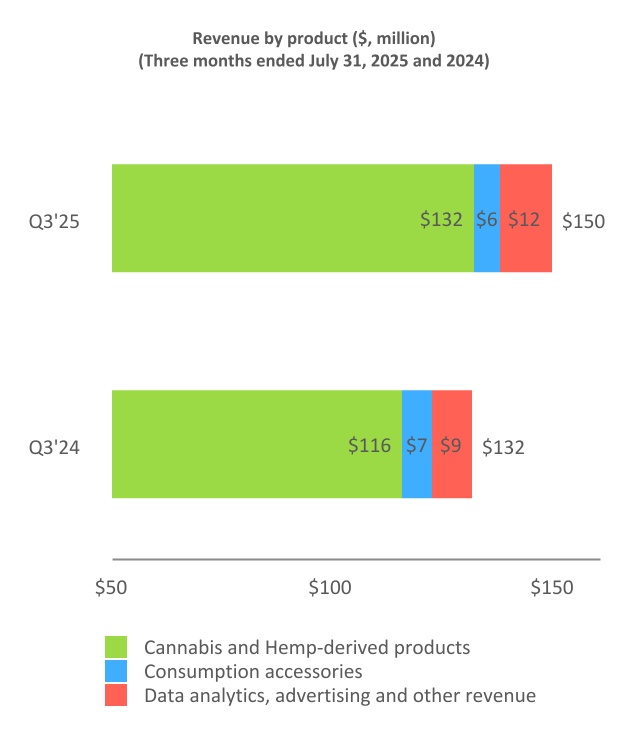

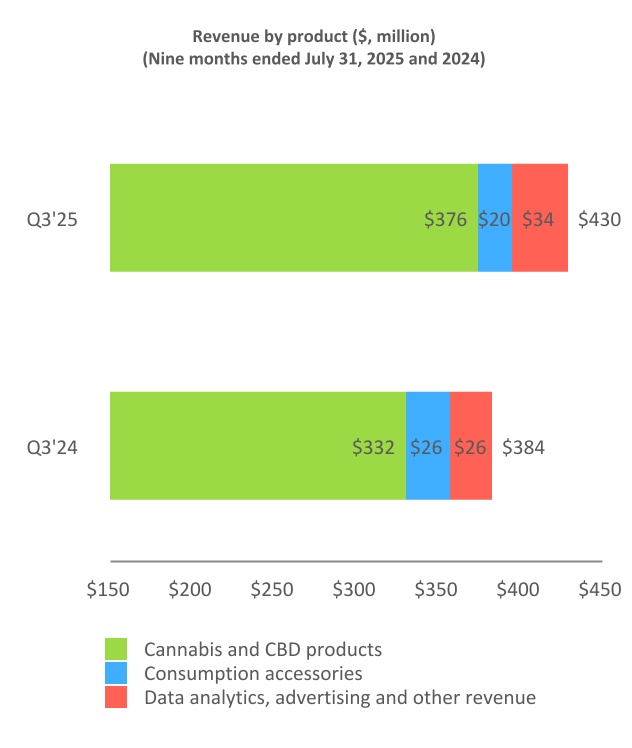

Revenue

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three months ended July 31 | | Nine Months Ended July 31 |

| | 2025 | | 2024 | | Change | | 2025 | | 2024 | | Change |

| | $ | | $ | | ∆ | | $ | | $ | | ∆ |

| Cannabis and Hemp-derived products | | 131,963 | | 115,667 | | 14% | | 375,633 | | 332,533 | | 13% |

| Consumption accessories | | 5,744 | | 6,972 | | (18)% | | 19,703 | | 25,673 | | (23)% |

| Data analytics, advertising and other revenue | | 11,983 | | 9,046 | | 32% | | 34,619 | | 25,805 | | 34% |

| | | | | | | | | | | | |

| Revenue | | 149,690 | | 131,685 | | 14% | | 429,955 | | 384,011 | | 12% |

Revenue increased 14% to $149,690 for three months ended July 31, 2025 (July 31, 2024: 131,685) and increased 12% to 429,955 for the nine months ended July 31, 2025 (July 31, 2024: 384,011). The Company notes that its core brick-and-mortar segment generates 97% of the revenue.

For the three-month period, revenue rose by $18,005, primarily driven by:

•$12,916 from organic same-store sales growth,

•$6,532 from new stores

•$3,253 from higher data analytics, advertising and other revenue, and the Company notes that its core bricks-and-mortar segment generates 97% of the revenue

•$4,696 decline in the e-commerce revenue

For the nine-month period, revenue rose by $45,944, primarily driven by:

•$39,492 from organic same-store sales growth

•$12,024 from new stores

•$9,159 from higher data analytics, advertising and other revenue, and the Company notes that its core bricks-and-mortar segment generates 97% of the revenue

•$14,731 decline in e-commerce revenue

Gross profit | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three months ended July 31 | | Nine Months Ended July 31 |

| | 2025 | | 2024 | | Change | | 2025 | | 2024 | | Change |

| | $ | | $ | | ∆ | | $ | | $ | | ∆ |

| Revenue | | 149,690 | | 131,685 | | 14% | | 429,955 | | 384,011 | | 12% |

| Cost of sales | | (109,599) | | (96,231) | | 14% | | (318,953) | | (277,264) | | 15% |

| Gross profit | | 40,091 | | 35,454 | | 13% | | 111,002 | | 106,747 | | 4% |

Gross profit margin (i) | | 27% | | 27% | | —% | | 26% | | 28% | | (2)% |

(i) Gross profit margin is a non-IFRS financial measure. Gross profit margin is calculated by dividing gross profit by revenue. For the three months ended July 31, 2025, the gross profit margin was 27%, consistent with the prior-year period. Gross profit was a record $40.1 million for the three months ended July 31, 2025, up 13% year over year.

For the nine months ended July 31, 2025, the gross profit margin was 26%, down 2% points from the prior-year period. Bricks-and-mortar margins were softer in Q1 and Q2 as newer stores required longer ramp-up periods.

| | | | | |

| High Tide Inc. |

| Management's Discussion and Analysis |

| For the nine months ended July 31, 2025 and 2024 |

| (In thousands of Canadian dollars, except share and per share amounts or otherwise stated) |

Total expenses | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three months ended July 31 | | Nine Months Ended July 31 |

| | 2025 | | 2024 | | Change | | 2025 | | 2024 | | Change |

| | $ | | $ | | ∆ | | $ | | $ | | ∆ |

| Salaries, wages and benefits | | 18,288 | | 16,667 | | 10% | | 53,345 | | 47,999 | | 11% |

| Share-based compensation | | 824 | | 881 | | (7)% | | 3,249 | | 2,225 | | 46% |

| General and administration | | 6,623 | | 4,815 | | 38% | | 18,954 | | 15,980 | | 19% |

| Professional fees | | 2,301 | | 1,749 | | 32% | | 5,800 | | 5,815 | | (0.3)% |

| Advertising and promotion | | 592 | | 1,178 | | (50)% | | 2,534 | | 3,154 | | (20)% |

| Depreciation and amortization | | 6,080 | | 5,678 | | 7% | | 17,807 | | 20,031 | | (11)% |

| | | | | | | | | | | | |

| Interest and bank charges | | 1,644 | | 1,431 | | 15% | | 4,575 | | 3,709 | | 23% |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| Total expenses | | 36,352 | | 32,399 | | 12% | | 106,264 | | 98,913 | | 7% |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three months ended July 31 | | Nine Months Ended July 31 |

| As a percentage of revenue | | 2025 | | 2024 | | Change | | 2025 | | 2024 | | Change |

| | $ | | $ | | ∆ | | $ | | $ | | ∆ |

| Salaries, wages and benefits | | 12.2% | | 12.7% | | (0.5)% | | 12.4% | | 12.5% | | (0.1)% |

| Share-based compensation | | 0.6% | | 0.7% | | (0.1)% | | 0.8% | | 0.6% | | 0.2% |

| General and administration | | 4.4% | | 3.7% | | 0.7% | | 4.4% | | 4.2% | | 0.2% |

| Professional fees | | 1.5% | | 1.3% | | 0.2% | | 1.3% | | 1.5% | | (0.2)% |

| Advertising and promotion | | 0.4% | | 0.9% | | (0.5)% | | 0.6% | | 0.8% | | (0.2)% |

| Depreciation and amortization | | 4.1% | | 4.3% | | (0.2)% | | 4.1% | | 5.2% | | (1.1)% |

| | | | | | | | | | | | |

| Interest and bank charges | | 1.1% | | 1.1% | | —% | | 1.1% | | 1.0% | | 0.1% |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| Total expense as a percentage of revenue | | 24.3% | | 24.7% | | (0.4)% | | 24.7% | | 25.8% | | (1.1)% |

Total expense excluding depreciation and amortization as a percentage of revenue(i) | | 20.2% | | 20.4% | | (0.2)% | | 20.6% | | 20.6% | | —% |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

(i)Total expense excluding depreciation and amortization as a percentage of revenue - a non-IFRS financial measure is calculated by dividing total expenses excluding depreciation and amortization by revenue.

For the three months ended July 31, 2025, total expenses were 24.3% of revenue, down from 24.7% in the comparable prior-year period (a decrease of 0.4% point). Salaries, wages and benefits were 12.2% of revenue, also 0.5% point lower than the prior period, reflecting that revenue growth has outpaced the growth in personnel costs.

For the nine months ended July 31, 2025, total expenses were 24.7% of revenue, down from 25.8% in the comparable prior-year period (a decrease of 1.1% point). Depreciation and amortization represented 4.1% of revenue, also 1.1% point lower than the prior period, primarily due to the completion of amortization of business licenses in fiscal 2024.

EBITDA and Adjusted EBITDA

The Company defines EBITDA and Adjusted EBITDA as per the table below. It should be noted that these performance measures are not defined under IFRS and may not be comparable to similar measures used by other entities. The Company believes that these measures are useful financial metrics as they assist in determining the ability to generate cash from operations. Investors should be cautioned that EBITDA and Adjusted EBITDA should not be construed as an alternative to net earnings or cash flows as determined under IFRS. Management defines “Adjusted EBITDA” as the net (loss) income for the period, before income tax (recovery) expense, accretion and interest expense, depreciation and amortization, and adjusted for foreign exchange (gain) losses, transaction and acquisition costs, (gain) loss on revaluation of put option liability, (gain) loss on extinguishment of debenture, impairment loss, share-based compensation, (gain) loss on revaluation of marketable securities and (gain) loss on extinguishment of financial liability and other (gain) loss.

| | | | | |

| High Tide Inc. |

| Management's Discussion and Analysis |

| For the nine months ended July 31, 2025 and 2024 |

| (In thousands of Canadian dollars, except share and per share amounts or otherwise stated) |

The reconciling items between net earnings, EBITDA, and Adjusted EBITDA are as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | 2025 | | 2024 | 2023 | | | |

| Q3 | Q2 | Q1 | Q4 | Q3 | Q2 | Q1 | Q4 | | | | |

| Net (loss) Income | 832 | | (2,836) | | (2,689) | | (4,802) | | 825 | | 171 | | (5) | | (31,805) | | | | | |

| Income/deferred tax recovery (expense) | 69 | | 46 | | 38 | | (153) | | 671 | | (878) | | (233) | | (4,571) | | | | | |

| Accretion and interest | 1,795 | | 1,950 | | 2,101 | | 2,308 | | 1,681 | | 1,712 | | 1,743 | | 1,632 | | | | | |

| Depreciation and amortization | 6,080 | | 5,880 | | 5,847 | | 5,362 | | 5,678 | | 7,505 | | 6,848 | | 8,583 | | | | | |

EBITDA(i) | 8,776 | | 5,040 | | 5,297 | | 2,715 | | 8,855 | | 8,510 | | 8,353 | | (26,161) | | | | | |

| Foreign exchange loss (gain) | 120 | | 114 | | (13) | | 5 | | 19 | | (5) | | 5 | | (152) | | | | | |

| Transaction and acquisition costs | 881 | | 1,616 | | 630 | | 773 | | 12 | | 1,314 | | 515 | | 691 | | | | | |

| Loss (gain) revaluation of put option liability | - | | - | | - | | (88) | | (159) | | (110) | | (300) | | 544 | | | | | |

| Other (gain) loss | (1) | | 42 | | - | | 11 | | (6) | | 337 | | - | | 37 | | | | | |

| Loss (gain) on extinguishment of debenture | - | | - | | - | | (885) | | - | | - | | - | | - | | | | | |

| Impairment loss | - | | - | | - | | 4,964 | | - | | - | | - | | 34,265 | | | | | |

| Share-based compensation | 824 | | 1,250 | | 1,175 | | 750 | | 881 | | 549 | | 795 | | (284) | | | | | |

| Loss (gain) on revaluation of marketable securities | - | | - | | - | | - | | 12 | | - | | 77 | | (13) | | | | | |

| Loss (gain) on revaluation of debenture | 43 | | - | | - | | - | | - | | (240) | | 755 | | (505) | | | | | |

| Loss (gain) on extinguishment of financial liability | - | | - | | - | | - | | - | | (314) | | 235 | | (60) | | | | | |

Adjusted EBITDA(i) | 10,643 | | 8,062 | | 7,089 | | 8,245 | | 9,614 | | 10,041 | | 10,435 | | 8,362 | | | | | |

(i) EBITDA and Adjusted EBITDA are non-IFRS financial measures. Free cash flow

The Company defines free cash flow as net cash provided by operating activities, minus sustaining capex, minus lease liability payments. Sustaining Capex is defined as leasehold improvements and maintenance expenditure required in the existing business. The most directly comparable financial measure is net cash provided by operating activities, as disclosed in the condensed interim consolidated statements of cash flows. It should not be viewed as a measure of liquidity or a substitute for comparable metrics prepared in accordance with IFRS.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | 2025 | | 2024 | | 2023 |

| | Q3 2025 | | Q2 2025 | | Q1 2025 | | Q4 2024 | | Q3 2024 | | Q2 2024 | | Q1 2024 | | Q4 2023 |

| Cash flow from operating activities | | 8,231 | | | 4,686 | | | 4,644 | | | 6,179 | | | 8,928 | | | 8,032 | | | 9,363 | | | 7,207 | |

| Changes in non-cash working capital | | 2,419 | | | 3,569 | | | (3,961) | | | 3,473 | | | (2,715) | | | 4,777 | | | (2,490) | | | 2,430 | |

| Net cash provided by operating activities | | 10,650 | | | 8,255 | | | 683 | | | 9,652 | | | 6,213 | | | 12,809 | | | 6,873 | | | 9,637 | |

Sustaining capex(i) | | (460) | | | (692) | | | (361) | | | (533) | | | (279) | | | (528) | | | (511) | | | (1,080) | |

| Lease liability payments | | (2,508) | | | (2,667) | | | (2,222) | | | (3,211) | | | (2,842) | | | (2,898) | | | (2,754) | | | (2,870) | |

Free cash flow(ii) | | 7,682 | | | 4,896 | | | (1,900) | | | 5,908 | | | 3,092 | | | 9,383 | | | 3,608 | | | 5,687 | |

| | | | | | | | | | | | | | | | |

(i) Sustaining capex is a non-IFRS measure

(ii) Free cash flow is a non-IFRS measure

(iii) For the three months ended July 31, 2025, interest paid on right-of-use lease liabilities ($940) has been classified as a component of cash flow from operating activities within the condensed interim consolidated financial statements in line with the entity's accounting policy. The three months ended July 31, 2024, include interest paid on right-of-use lease liabilities ($773) in cash used in financing activities. Periods prior to Q1 2025 have not been adjusted as the amounts are not material.

Segmented operations:

The accounting policies used for segment reporting are consistent with the accounting policies used for the preparation of the Company’s annual audited consolidated financial statements. The comparative information has been prepared in accordance with the current reporting segments noted above. There have been no changes to the underlying data used to prepare the comparative reporting segments for the prior year.

| | | | | |

| High Tide Inc. |

| Management's Discussion and Analysis |

| For the nine months ended July 31, 2025 and 2024 |

| (In thousands of Canadian dollars, except share and per share amounts or otherwise stated) |

Performance by operational segment:

| | | | | |

| High Tide Inc. |

| Management's Discussion and Analysis |

| For the nine months ended July 31, 2025 and 2024 |

| (In thousands of Canadian dollars, except share and per share amounts or otherwise stated) |

| | | | | |

| High Tide Inc. |

| Management's Discussion and Analysis |

| For the nine months ended July 31, 2025 and 2024 |

| (In thousands of Canadian dollars, except share and per share amounts or otherwise stated) |

The following is a representation of these operational segments:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Bricks-and-Mortar | | Bricks-and-Mortar | | E-commerce | | E-commerce | | Total | | Total |

| For the three months ended July 31, | | 2025 | | 2024 | | 2025 | | 2024 | | 2025 | | 2024 |

| | $ | | $ | | $ | | $ | | $ | | $ |

| Revenue | | $145,792 | | $123,092 | | $3,898 | | $8,593 | | $149,690 | | $131,685 |

| Gross profit | | $38,889 | | $32,193 | | $1,202 | | $3,261 | | $40,091 | | $35,454 |

Gross profit margin(i) | | 27% | | 26% | | 31% | | 38% | | 27% | | 27% |

| Income (loss) from operations | | $6,636 | | $2,964 | | $(2,897) | | $91 | | $3,739 | | $3,055 |

Adjusted EBITDA(ii) | | $12,692 | | $8,947 | | $(2,049) | | $667 | | $10,643 | | $9,614 |

Adjusted EBITDA margin(iii) | | 9% | | 7% | | (53)% | | 8% | | 7% | | 7% |

| | | | | | | | | | | | |

| | Bricks-and-Mortar | | Bricks-and-Mortar | | E-commerce | | E-commerce | | Total | | Total |

| For the nine months ended July 31, | | 2025 | | 2024 | | 2025 | | 2024 | | 2025 | | 2024 |

| | $ | | $ | | $ | | $ | | $ | | $ |

| Revenue | | $414,597 | | $353,922 | | $15,358 | | $30,089 | | $429,955 | | $384,011 |

| Gross profit | | $106,162 | | $93,342 | | $4,840 | | $13,405 | | $111,002 | | $106,747 |

Gross profit margin(i) | | 26% | | 26% | | 32% | | 45% | | 26% | | 28% |

| Income (loss) from operations | | $12,681 | | $6,734 | | $(7,943) | | $1,100 | | $4,738 | | $7,834 |

Adjusted EBITDA(ii) | | $31,107 | | $26,550 | | $(5,313) | | $3,539 | | $25,794 | | $30,089 |

Adjusted EBITDA margin(iii) | | 8% | | 8% | | (35)% | | 12% | | 6% | | 8% |

| | | | | | | | | | | | |

| | Bricks-and-Mortar | | Bricks-and-Mortar | | E-commerce | | E-commerce | | Total | | Total |

| As at July 31, 2025 and October 31, 2024 | | 2025 | | 2024 | | 2025 | | 2024 | | 2025 | | 2024 |

| | $ | | $ | | $ | | $ | | $ | | $ |

| Current assets | | $95,625 | | $75,161 | | $7,977 | | $10,628 | | $103,602 | | $85,789 |

| Non-current assets | | $128,945 | | $128,719 | | $27,842 | | $31,700 | | $156,787 | | $160,419 |

| Current liabilities | | $51,908 | | $56,741 | | $4,151 | | $4,739 | | $56,059 | | $61,480 |

| Non-current liabilities | | $57,708 | | $35,788 | | $3,131 | | $3,428 | | $60,839 | | $39,216 |

(i)Gross profit margin - a non-IFRS financial measure. Gross profit margin is calculated by dividing gross profit by revenue.

(ii)Adjusted EBITDA - a non-IFRS financial measure. A reconciliation of the Adjusted EBITDA to Net loss is found under “Select financial highlights and operating performance" section on page 8.

(iii)Adjusted EBITDA margin - a non-IFRS financial measure. This metric is calculated as Adjusted EBITDA divided by revenue.

Corporate overhead is allocated to bricks-and-mortar and e-commerce on a percentage of revenue based on the nine months ended July 31, 2025, 97%, bricks-and-mortar and 3% e-commerce (July 31, 2024 - 93% bricks-and-mortar and 7% e-commerce)

| | | | | |

| High Tide Inc. |

| Management's Discussion and Analysis |

| For the nine months ended July 31, 2025 and 2024 |

| (In thousands of Canadian dollars, except share and per share amounts or otherwise stated) |

Bricks-and-Mortar performance | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three months ended July 31 | Nine months ended July 31 |

| | 2025 | | 2024 | | Change | 2025 | | 2024 | | Change |

| | $ | | $ | | ∆ | $ | | $ | | ∆ |

| Cannabis and Hemp-derived products | | 130,662 | | 111,773 | | 17% | 370,069 | | 319,329 | | 16% |

| Consumption accessories | | 3,240 | | 2,682 | | 21% | 10,157 | | 9,381 | | 8% |

| Data analytics, advertising and other revenue | | 11,890 | | 8,637 | | 38% | 34,371 | | 25,212 | | 36% |

| Revenue | | 145,792 | | 123,092 | | 18% | 414,597 | | 353,922 | | 17% |

| Cost of goods sold | | 106,903 | | 90,899 | | 18% | 308,435 | | 260,580 | | 18% |

| Gross profit | | 38,889 | | 32,193 | | 20% | 106,162 | | 93,342 | | 14% |

Gross profit margin(i) | | 27% | | 26% | | 1% | 26% | | 26% | | —% |

| Total expenses | | 32,254 | | 29,229 | | 10% | 93,481 | | 86,608 | | 8% |

| Income from operations | | 6,636 | | 2,964 | | 124% | 12,681 | | 6,734 | | 88% |

| Depreciation and amortization | | 5,249 | | 5,163 | | 2% | 15,293 | | 17,766 | | (14)% |

| Share-based compensation | | 807 | | 820 | | (2)% | 3,133 | | 2,050 | | 53% |

Adjusted EBITDA(i) | | 12,692 | | 8,947 | | 42% | 31,107 | | 26,550 | | 17% |

Adjusted EBITDA margin(i) | | 9% | | 7% | | 2% | 8% | | 8% | | —% |

(i) Gross profit margin, Adjusted EBITDA and Adjusted EBITDA margin are non-IFRS measures

Revenue increased 18% to $145,792 for the three months ended July 31, 2025 (July 31, 2024: $123,092) and increased 17% to $414,597 for the nine months ended July 31, 2025 (July 31, 2024: $353,922).

For the three-month period, revenue rose by $22,700, driven by:

•$11,596 from organic same-store sales growth,

•$7,852 from new stores, and

•$3,253 from higher data analytics, advertising and other revenue

For the nine-month period, revenue rose by $60,675, driven by:

•$37,107 from organic same-store sales growth,

•$14,409 from new stores, and

•$9,159 from higher data analytics, advertising and other revenue

Revenue growth benefited from the dual tailwinds of new store openings and organic same-store sales. The table below summarizes store counts at each quarter-end from the beginning of fiscal 2024 to July 31, 2025.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Oct 2023 | Jan 2024 | Apr 2024 | July 2024 | Oct 2024 | Jan 2025 | Apr 2025 | July 2025 |

| | | | | | | | |

| Stores count | 157 | 163 | 166 | 180 | 186 | 189 | 195 | 203 |

The Cabanalytics Business Data & Insights Platform provides subscribers with monthly, anonymized consumer-purchase insights to support demand forecasting, assortment planning, and targeted marketing.

For the three and nine months ended July 31, 2025, the Company recognized $11,890 and $34,371, respectively, in revenue from its proprietary data analytics service and other revenues — up 38% and 36% from the comparable 2024 periods ($8,637 and $25,212, respectively).

| | | | | |

| High Tide Inc. |

| Management's Discussion and Analysis |

| For the nine months ended July 31, 2025 and 2024 |

| (In thousands of Canadian dollars, except share and per share amounts or otherwise stated) |

E-commerce segment performance

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three months ended July 31 | | Nine Months Ended July 31 |

| | 2025 | | 2024 | | Change | | 2025 | | 2024 | | Change |

| | $ | | $ | | ∆ | | $ | | $ | | ∆ |

| Cannabis and Hemp-derived products | | 1,301 | | 3,894 | | (67)% | | 5,564 | | 13,204 | | (58)% |

| Consumption accessories | | 2,504 | | 4,290 | | (42)% | | 9,546 | | 16,292 | | (41)% |

| Data analytics, advertising and other revenue | | 93 | | 409 | | (77)% | | 248 | | 593 | | (58)% |

| Revenue | | 3,898 | | 8,593 | | (55)% | | 15,358 | | 30,089 | | (49)% |

| Cost of goods sold | | 2,696 | | 5,332 | | (49)% | | 10,518 | | 16,684 | | (37)% |

| Gross profit | | 1,202 | | 3,261 | | (63)% | | 4,840 | | 13,405 | | (64)% |

Gross profit margin(i) | | 31% | | 38% | | (7)% | | 32% | | 45% | | (13)% |

| Total expenses | | 4,098 | | 3,170 | | 29% | | 12,783 | | 12,305 | | 4% |

| (Loss) income from operations | | (2,897) | | 91 | | (3284)% | | (7,943) | | 1,100 | | (822)% |

| Depreciation and amortization | | 831 | | 515 | | 61% | | 2,514 | | 2,265 | | 11% |

| Share-based compensation | | 17 | | 60 | | (72)% | | 116 | | 174 | | (33)% |

| | | | | | | | | | | | |

Adjusted EBITDA(i) | | (2,049) | | 666 | | (408)% | | (5,313) | | 3,539 | | (250)% |

Adjusted EBITDA margin(i) | | (53)% | | 8% | | (60)% | | (35)% | | 12% | | (46)% |

(i) Gross profit margin, Adjusted EBITDA and Adjusted EBITDA margin are non-IFRS measures.

The 55% and 49% decrease in revenue for the three and nine months ended July 31, 2025 is primarily due to decreased search volumes and increased competition within the Hemp-derived products and consumption accessories industries, as well as the Company's international pricing strategy and debut of its Cabana Club loyalty program into existing markets outside Canada.

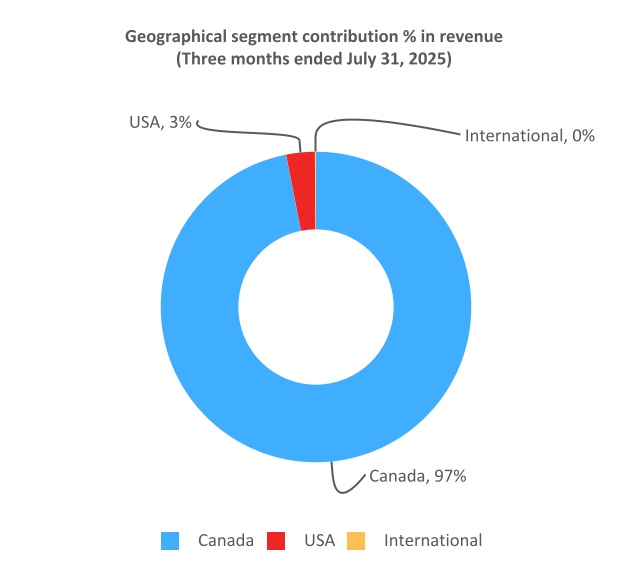

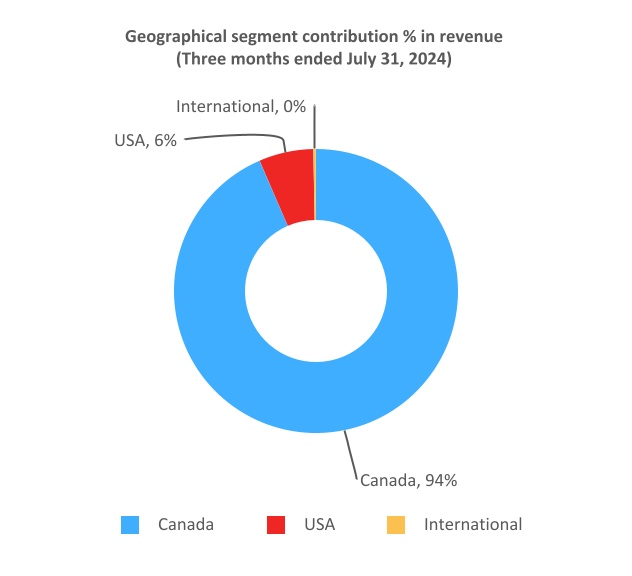

Performance by geographical markets:

Geographical markets represent revenue based on the geographical locations of the customers who have contributed to the revenue. The following is a representation of these geographical markets. The Company's geographic segments are characterized as follows:

Canada: Within Canada, the Company operates 203 (as of July 31, 2025) of its branded retail cannabis stores under the Canna Cabana brand, and 2 branded cannabis stores under Meta Cannabis Supply Co brand in addition to its Canadian warehouse operations which primarily service the retail locations.

USA: Within the USA the Company operates its e-commerce platforms including Smoke Cartel, Grasscity, Daily High Club, DankStop, NuLeaf Naturals and FABCBD, as well as USA sales on the international e-commerce platforms. In addition, the Company operates a warehouse which primarily services the e-commerce consumption accessories operations.

International: Within the International markets the Company operates its e-commerce platform Blessed CBD, as well as international sales on the aforementioned e-commerce platforms.

| | | | | |

| High Tide Inc. |

| Management's Discussion and Analysis |

| For the nine months ended July 31, 2025 and 2024 |

| (In thousands of Canadian dollars, except share and per share amounts or otherwise stated) |

Geographical markets

| | | | | |

| High Tide Inc. |

| Management's Discussion and Analysis |

| For the nine months ended July 31, 2025 and 2024 |

| (In thousands of Canadian dollars, except share and per share amounts or otherwise stated) |

The following presents information related to the Company’s geographical market.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Canada | | Canada | | USA | | USA | | International | | International | | Total | | Total |

| For the three months ended July 31, 2025 and 2024 | | | | 2024 | | 2025 | | 2024 | | 2025 | | 2024 | | 2025 | | 2024 |

| | $ | | $ | | $ | | $ | | $ | | $ | | $ | | $ |

| | | | | | | | | | | | | | | | |

| Revenue | | $145,792 | | $123,092 | | $3,746 | | $8,153 | | $152 | | $440 | | $149,690 | | $131,685 |

| Cost of goods sold | | $106,904 | | $90,899 | | $2,600 | | $5,179 | | $95 | | $153 | | $109,599 | | $96,231 |

Gross profit (i) | | $38,888 | | $32,193 | | $1,146 | | $2,974 | | $57 | | $287 | | $40,091 | | $35,454 |

| Gross profit margin | | 27% | | 26% | | 31% | | 36% | | 38% | | 65% | | 27% | | 27% |

| Operating expenses | | $32,410 | | $29,229 | | $3,709 | | $2,901 | | $233 | | $269 | | $36,352 | | $32,399 |

| Income (loss) from operations | | $6,478 | | $2,964 | | $(2,563) | | $73 | | $(176) | | $18 | | $3,739 | | $3,055 |

| Depreciation and amortization | | $5,256 | | $5,359 | | $822 | | $315 | | $2 | | $4 | | $6,080 | | $5,678 |

| Share-based compensation | | $824 | | $881 | | — | | — | | — | | — | | $824 | | $881 |

Adjusted EBITDA(i) | | $12,558 | | $9,204 | | $(1,741) | | $388 | | $(174) | | $22 | | $10,643 | | $9,614 |

(i) Gross profit margin and Adjusted EBITDA are non-IFRS measures.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Canada | | Canada | | USA | | USA | | International | | International | | Total | | Total |

| For the nine months ended July 31, 2025 and 2024 | | 2025 | | 2024 | | 2025 | | 2024 | | 2025 | | 2024 | | 2025 | | 2024 |

| | $ | | $ | | $ | | $ | | $ | | $ | | $ | | $ |

| | | | | | | | | | | | | | | | |

| Revenue | | 414,597 | | | 353,922 | | | 14,746 | | | 28,684 | | | 612 | | | 1,405 | | | 429,955 | | | 384,011 | |

| Cost of goods sold | | 308,435 | | | 260,580 | | | 10,144 | | | 16,164 | | | 374 | | | 520 | | | 318,953 | | | 277,264 | |

| Gross profit | | 106,162 | | | 93,342 | | | 4,602 | | | 12,520 | | | 238 | | | 885 | | | 111,002 | | | 106,747 | |

Gross profit margin(i) | | 26% | | 26% | | 31% | | 44% | | 39% | | 63% | | 26% | | 28% |

| Total expenses | | 94,209 | | | 86,608 | | | 11,122 | | | 12,161 | | | 933 | | | 144 | | | 106,264 | | | 98,913 | |

| Income (loss) from operations | | 11,953 | | | 6,734 | | | (6,520) | | | 359 | | | (695) | | | 741 | | | 4,738 | | | 7,834 | |

| Depreciation and amortization | | 15,323 | | | 17,987 | | | 2,428 | | | 2,033 | | | 56 | | | 11 | | | 17,807 | | | 20,031 | |

| Share-based compensation | | 3,249 | | | 2,225 | | | — | | — | | — | | — | | 3,249 | | | 2,225 | |

| | | | | | | | | | | | | | | | |

Adjusted EBITDA(i) | | 30,525 | | | 26,946 | | | (4,092) | | | 2,392 | | | (639) | | | 752 | | | 25,794 | | | 30,090 | |

(i) Gross profit margin and Adjusted EBITDA are non-IFRS measures.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Canada | | Canada | | USA | | USA | | International | | International | | Total | | Total |

| As at July 31, 2025 and October 31, 2024 | | 2025 | | 2024 | | 2025 | | 2024 | | 2025 | | 2024 | | 2025 | | 2024 |

| | $ | | $ | | $ | | $ | | $ | | $ | | $ | | $ |

| Current assets | | 96,394 | | | 77,037 | | | 6,862 | | | 7,940 | | | 346 | | | 812 | | | 103,602 | | | 85,789 | |

| Non-current assets | | 129,095 | | | 129,115 | | | 24,481 | | | 27,634 | | | 3,211 | | | 3,670 | | | 156,787 | | | 160,419 | |

| Current liabilities | | 52,678 | | | 57,692 | | | 3,131 | | | 3,580 | | | 250 | | | 208 | | | 56,059 | | | 61,480 | |

| Non-current liabilities | | 58,862 | | | 36,680 | | | 1,687 | | | 2,252 | | | 290 | | | 284 | | | 60,839 | | | 39,216 | |

| | | | | |

| High Tide Inc. |

| Management's Discussion and Analysis |

| For the nine months ended July 31, 2025 and 2024 |

| (In thousands of Canadian dollars, except share and per share amounts or otherwise stated) |

Geographic markets vs. operating segments

The Canada geographic market generally aligns with the Bricks-and-mortar operating segment, while the combined USA and International geographic markets align with the e-commerce operating segment. Differences between geographic market and operating segment results primarily reflect corporate overhead allocation: in the operating segment view, overhead is allocated to each segment based on its share of revenue; in the geographic market view, overhead is recorded in the market where incurred - predominantly Canada.

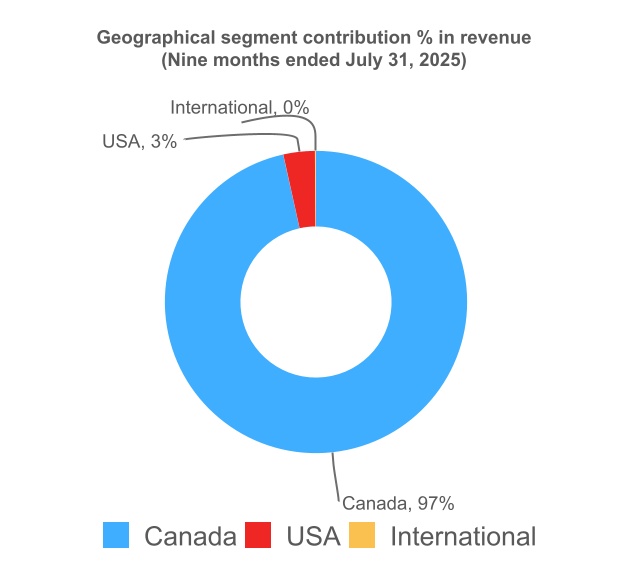

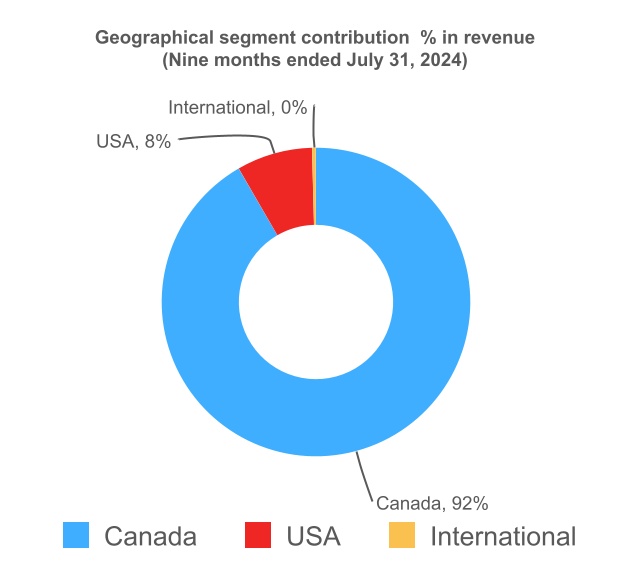

Canada

For the nine months ended July 31, 2025 Canada contributed 97% of total revenue (2024: 92%). The Company continues to operate primarily in Canada and is expanding its footprint across provinces in which it operates. Canadian revenue increased 18% for the three months and 17% for the nine months ended July 31, 2025, compared with the prior-year periods, driven by same-store sales growth and continued expansion. Over the 12 months ended July 31, 2025, the Company opened 23 stores.

USA

For the nine months ended July 31, 2025, the USA contributed 3% of total revenue (2024: 8%). US revenue decreased 54% for the three months and 49% for the nine months ended July 31, 2025, compared with the prior-year periods. The decrease in revenue is primarily due to decreased search volumes and increased competition within the Hemp-derived products and consumption accessories industries, as well as the Company's international pricing strategy and debut of its Cabana Club loyalty program into existing markets outside Canada.

International

For the nine months ended July 31, 2025, the International market contributed <1% of total revenue (2024: <1%). International revenue decreased 65% for the three months and 56% for the nine months ended July 31, 2025, compared with the prior-year periods. The decrease in revenue is primarily due to decreased search volumes and increased competition within the Hemp-derived products and consumption accessories industries, as well as the Company's international pricing strategy and debut of its Cabana Club loyalty program into existing markets outside Canada.

Summary of quarterly results:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| 2025 | 2024 | 2023 | | | |

| Q3 | Q2 | Q1 | Q4 | Q3 | Q2 | Q1 | Q4 | | | | |

Free cash flow(i) | 7,682 | 4,896 | (1,900) | 5,908 | 3,092 | 9,383 | 3,608 | 5,687 | | | | |

| Cash and cash equivalents | 63,809 | 34,692 | 33,341 | 47,267 | 35,254 | 34,540 | 28,685 | 30,121 | | | | |

| Cannabis and Hemp-derived products | 131,963 | 120,051 | 123,619 | 120,259 | 115,667 | 107,959 | 108,908 | 111,846 | | | | |

| Consumption accessories | 5,744 | 6,415 | 7,544 | 7,128 | 6,972 | 7,323 | 11,378 | 7,899 | | | | |

| Data analytics, advertising and other revenue | 11,983 | 11,338 | 11,298 | 10,908 | 9,046 | 8,977 | 7,782 | 7,360 | | | | |

| Revenue | 149,690 | 137,804 | 142,461 | 138,295 | 131,685 | 124,259 | 128,068 | 127,105 | | | | |

Gross profit (i) | 40,091 | 35,471 | 35,440 | 35,755 | 35,454 | 35,299 | 35,994 | 32,984 | | | | |

| Gross profit margin | 27% | 26% | 25% | 26% | 27% | 28% | 28% | 26% | | | | |

Adjusted EBITDA (i) | 10,643 | 8,062 | 7,089 | 8,245 | 9,614 | 10,041 | 10,435 | 8,362 | | | | |

Adjusted EBITDA margin(i) | 7% | 6% | 5% | 6% | 7% | 8% | 8% | 7% | | | | |

| Income (loss) from operations | 3,739 | 932 | 67 | 2,831 | 3,055 | 1,987 | 2,792 | (34,204) | | | | |

| Net income (loss) | 832 | (2,836) | (2,689) | 4,802 | 825 | 171 | (5) | (31,805) | | | | |

| Basic and diluted income (loss) per share | 0.01 | (0.04) | (0.03) | (0.06) | 0.01 | 0.00 | 0.00 | (0.04) | | | | |

| | | | | | | | | | | | |

(i)Free cash flow, Adjusted EBITDA and adjusted EBITDA Margin are non-IFRS financial measures, and accordingly, the Company’s use of such term may not be comparable to similarly defined measures presented by other entities. A reconciliation of the Adjusted EBITDA to Net (Loss) income is found under “EBITDA and Adjusted EBITDA of “Select Financial Highlights and Operating Performance” section on page 8.

| | | | | |

| High Tide Inc. |

| Management's Discussion and Analysis |

| For the nine months ended July 31, 2025 and 2024 |

| (In thousands of Canadian dollars, except share and per share amounts or otherwise stated) |

| | | | | |

| High Tide Inc. |

| Management's Discussion and Analysis |

| For the nine months ended July 31, 2025 and 2024 |

| (In thousands of Canadian dollars, except share and per share amounts or otherwise stated) |

Q3 2025 vs Q3 2024 - Key Highlights:

•Revenue increased 14% year over year, driven by growth in bricks-and-mortar store count and continued organic same-store sales growth, partially offset by lower revenue in the much smaller e-commerce segment.

•Free cash flow increased $4,590 year over year, primarily driven by a $4,437 improvement in net cash provided by operating activities.

•Adjusted EBITDA margin was 7%, unchanged from the prior-year period, reflecting disciplined cost control alongside revenue growth.

Financial position, liquidity and capital resources:

| | | | | | | | | | | |

| Assets | July 31, 2025 | October 31, 2024 | Change |

| Current assets | 103,602 | | 85,789 | | 17,813 | |

| Non-current assets | 156,787 | | 160,419 | | (3,632) | |

| Total assets | 260,389 | | 246,208 | | 14,181 | |

| | | |

| Liabilities | | | |

| Current liabilities | 56,059 | | 61,480 | | (5,421) | |

| Non-current liabilities | 60,839 | | 39,216 | | 21,623 | |

| Total liabilities | 116,898 | | 100,696 | | 16,202 | |

| | | |

| Equity | 143,491 | | 145,512 | | (2,021) | |

| Total liabilities & equity | 260,389 | | 246,208 | | 14,181 | |

| | | |

| Working Capital | 47,543 | | 24,309 | | 23,234 | |

Working capital at July 31, 2025 was $47,543, an increase of $23,234 from $24,309 at October 31, 2024. This indicates that the Company was well-positioned for completing the acquisition of 51% of Remexian Pharma GmbH which was completed on September 1, 2025.

Current Assets at July 31, 2025 were $103,602, an increase of $17,813 from $85,789 at October 31, 2024 primarily due to the following:

•Receipt of net proceeds from new debt ($4,427 from second disbursement of Secured Debentures, $24,790 net proceeds of a subsidiary of Cronos loan

•Repayment of debt ($13,000 OCN note payable)

•$1,920 in inventory investments related to new stores

Non-current Assets at July 31, 2025 were $156,787, a decrease of $3,632 from $160,419 at October 31, 2024 primarily due to $3,487 in finite life intangible asset amortization.

Current Liabilities at July 31, 2025 were $56,059, a decrease of $5,421 from $61,480 at October 31, 2024 primarily due to the following:

•Repayment of debt ($13,000 OCN note payable, $2,804 in principal payments made on interest bearing loans and borrowings)

•Recognition of a $6,863 warrant/derivative liability as part of a subsidiary of Cronos loan

•A $3,945 increase in deferred revenue from prepaid data analytics contract revenue

Non-current Liabilities at July 31, 2025 was $60,839, an increase of $21,623 from $39,216 at October 31, 2024 primarily due to the following:

•Recognition of $17,923 of convertible debt related to a subsidiary of Cronos junior secured convertible loan

•Receipt of net proceeds of $4,427 from the second disbursement of Secured Debentures

Shareholders’ Equity at July 31, 2025 was $143,491, a decrease of $2,021 from $145,512 at October 31, 2024 primarily due to the following:

•A decrease in equity due to Q3 YTD net loss of $5,108

•An increase in equity of $3,324 related to share-based compensation grant, vesting, and exercise activity

Summary of Outstanding Share Data

The Company had the following securities issued and outstanding as at the date of this MD&A:

| | | | | | | | |

Securities (i) | | Units Outstanding |

| Common shares | | 87,111,205 | |

| Warrants | | 8,633,877 | |

| Stock options | | 2,575,582 | |

| RSUs | | 918,688 | |

(i)Refer to the Condensed Interim Consolidated Financial Statements for a detailed description of these securities.

ATM Program

The Company announces that, during the three and nine months ended July 31, 2025, the Company issued an aggregate of nil and 11,600 Common Shares over the Nasdaq or TSXV, for aggregate gross proceeds of $nil and $52. Pursuant to the Equity Distribution Agreement cash commission of $1 on the aggregate gross proceeds raised was paid to the Agents in connection with their services under the Equity Distribution Agreement during nine months ended July 31, 2025.

Pursuant to the Company’s ATM Program that allowed the Company to issue up to $30 million (or the equivalent in U.S. dollars) of Common Shares from the treasury to the public from time to time, at the Company’s discretion and subject to regulatory requirements, as required pursuant to National Instrument 44-102 – Shelf Distributions and the policies of the TSXV.

The Company intends to use the net proceeds of the ATM Program at the discretion of the Company, to fund strategic initiatives it is currently developing, to support the growth and development of the Company’s existing operations, funding future acquisitions as well as working capital and general corporate purposes.

Common Shares issued pursuant to the ATM Program we are issued pursuant to a prospectus supplement dated August 31, 2023 (the “Canadian Prospectus Supplement”) to the Company’s final base shelf prospectus dated August 3, 2023, filed with the securities commissions or similar regulatory authorities in each of the provinces and territories of Canada (the “Canadian Shelf Prospectus”) and pursuant to a prospectus supplement dated August 31, 2023 (the “U.S. Prospectus Supplement”) to the Company’s U.S. base prospectus dated August 3, 2023 (the “U.S. Base Prospectus”) included in its registration statement on Form F-10 (the “Registration Statement”) and filed with the U.S. Securities and Exchange Commission (the “SEC”). The Canadian Prospectus Supplement and Canadian Shelf Prospectus are available for download from SEDAR+ at www.sedarplus.ca, and the U.S. Prospectus Supplement, the U.S. Base Prospectus and Registration Statement are accessible via EDGAR on the SEC’s website at www.sec.gov.

The ATM Program was effective until until July 24, 2025, when the Canadian Shelf Prospectus was withdrawn in order to file a new base shelf prospectus.

Subsequent to period end on August 11, 2025, the Company filed a final short form base shelf prospectus in all Canadian provinces and territories and a corresponding shelf registration statement with the U.S. Securities and Exchange Commission under the Multijurisdictional Disclosure System.

These filings allow the Company to offer, during the 25-month effective period, up to an aggregate of C$100,000,000 in one or more offerings of equity, debt, warrants, subscription receipts, units, convertible securities, or combinations thereof. As at the date the financial statements were authorized for issue, no securities had been issued under the shelf and no at-the-market distribution

| | | | | |

| High Tide Inc. |

| Management's Discussion and Analysis |

| For the nine months ended July 31, 2025 and 2024 |

| (In thousands of Canadian dollars, except share and per share amounts or otherwise stated) |

agreement or prospectus supplement had been entered into. This event is a non-adjusting subsequent event and does not affect the amounts recognized at July 31, 2025.

Cash Flows

During the nine months ended July 31, 2025, the Company’s cash and cash equivalents increased by $16,542 to $63,809 (October 31, 2024:$47,267).

Operating activities: Net cash provided by operating activities was $19,588 (2024: $25,895), with the decrease primarily reflecting lower EBITDA.

Investing activities: Net cash used was $6,877 (2024: $7,611). Lower outflows were driven by maturities of marketable securities and reduced spending on capitalized software and lease acquisition costs, partially offset by higher capital expenditures related to a higher store count.

Financing activities: Net cash provided was $4,270 (2024: net cash used of $11,942), driven by the issuance of new convertible debt and secured debentures, partially offset by the settlement of notes payable.

Liquidity

ConnectFirst Credit Facility

On August 15, 2022, the Company entered into a $19,000 demand term loan with Connect First credit union (the "Credit Facility") with Tranche 1 - $12,100 available in a single advance, and Tranche 2 - $6,900 available in multiple draws subject to pre-disbursement conditions set. The demand loan bears interest at the Credit Union’s prime lending rate plus 2.5% per annum and is set to mature on September 5, 2027.

Tranche 1, is repayable on demand, but until demand is made this Credit Facility shall be repaid in monthly blended payments of principal and interest of $241. Blended payments may be adjusted from time to time, if necessary, on the basis of the Credit Union’s Prime Lending Rate and the principal outstanding. The Company received the inflow on October 7, 2022. The balance at the end of July 31, 2025 is $6,513 (October 31, 2024 : $8,238).

Tranche 2, is repayable on demand, but until demand is made this Credit Facility shall be repaid in monthly blended payments of principal and interest of $147. Blended payments may be adjusted from time to time, if necessary, on the basis of Credit Union's Prime Lending Rate and the principal outstanding. The Company received the inflow on October 25, 2022. The Company received the remaining $2,673 on March 8, 2023. The balance at the end of the period ended July 31, 2025 is $3,574 (October 31, 2024 : $4,653).

As of July 31, 2025, the Company has met all the covenants attached to the ConnectFirst Credit Facility.

Secured Debentures

On July 31, 2024, the Company established a secured debenture facility with a 12% coupon rate and 5-year maturity. On August 7, 2024, the Company issued $10,000 of debentures at a 10% discount and received net cash proceeds of $8,700. On November 30, 2024, the Company issued an additional $5,000 of debentures at a 10% discount and received net cash proceeds of $4,449.

On July 31, 2024, the Company issued 230,760 shares for consideration of $800.

For the nine months ended July 31, 2025, the Company incurred interest in the amount of $1,333 (July 31, 2024: $nil) and accretion expense of $213 (July 31, 2024: $nil) In addition, the Company recorded amortization expense of issuance fees of $271 (July 31, 2024 - $nil

This secured debenture is subject to the same covenants as the Connect First loan, with which the Company remains in full compliance.

| | | | | |

| High Tide Inc. |

| Management's Discussion and Analysis |

| For the nine months ended July 31, 2025 and 2024 |

| (In thousands of Canadian dollars, except share and per share amounts or otherwise stated) |

Junior secured convertible loan and detachable warrants

On July 16, 2025, the Company entered into a non-revolving $30,000 junior secured term loan with a wholly owned subsidiary of Cronos Group Inc. (the “Lender”). An original issue discount (“OID”) of 16% ($4,800) was retained by the Lender; the Funded Amount received by the Company was $25,200. Interest accrues at 4% per annum on the full $30,000 principal (inclusive of OID), payable quarterly in arrears on the last day of each quarter. The loan matures five years from closing and is prepayable at the Company’s option without penalty.

For the nine months ended July 31, 2025, the Company incurred interest in the amount of $49 (July 31, 2024: $nil) and accretion expense of $77 (July 31, 2024: $nil).

Capital Management

The Company’s objectives when managing capital resources are to:

(i)Explore profitable growth opportunities;

(ii)Deploy capital to provide an appropriate return on investment for shareholders;

(iii)Maintain financial flexibility to preserve the ability to meet financial obligations; and

(iv)Maintain a capital structure that provides financial flexibility to execute on strategic opportunities.

The Company’s strategy is formulated to maintain a flexible capital structure consistent with the objectives stated above as well as to respond to changes in economic conditions and to the risks inherent in its underlying assets. The Board of Directors does not establish quantitative return on capital criteria for management, but rather promotes year‐over‐year sustainable profitable growth. The Company’s capital structure consists of equity and working capital. To maintain or alter the capital structure, the Company may adjust capital spending, take on new debt or issue share capital. The Company anticipates that it will have adequate liquidity to fund future working capital, commitments, and forecasted capital expenditures through a combination of cash flow, cash‐on‐hand and financings, as required.

Off Balance Sheet Transactions

The Company does not have any financial arrangements that are excluded from the condensed interim consolidated financial statements as of July 31, 2025, nor are any such arrangements outstanding as of the date of this MD&A.

Transactions between related parties:

As of July 31, 2025, the Company had the following transactions with related parties as defined in IAS 24 – Related Party Disclosures, except those pertaining to transactions with key management personnel in the ordinary course of their employment and/or directorship arrangements and transactions with the Company’s shareholders in the form of various financing.

Operational transactions

An office and warehouse unit (27,000 sq ft) has been developed by Grover Properties Inc., a company that is related through a common controlling shareholder and the President & CEO of the Company. The office and warehouse space were leased to High Tide to accommodate the Company’s operational expansion. The lease was established by an independent real estate valuations services company at prevailing market rates and has annual lease payments totaling $386 per annum. The current lease term is 5 years that ends on December 31, 2028 with one additional 5-year term extension exercisable remaining at the option of the Company.

Financing transactions

On August 15, 2022, the Company entered into a $19,000 demand term loan with Connect First credit union (the "Credit Facility") with Tranche 1 - $12,100 available in a single advance, and Tranche 2 - $6,900 available in multiple draws subject to pre-disbursement conditions set. To facilitate the credit facility, the president and CEO of the Company provided limited Recourse Guarantee against $5,000 worth of High Tide Inc. shares held by the CEO, and affiliates, to be pledged in favor of the Credit Union.

The parties agree that this personal guarantee will only be available after all collection efforts against High Tide Inc. have been exhausted, including the sale of High Tide Inc.

| | | | | |

| High Tide Inc. |

| Management's Discussion and Analysis |

| For the nine months ended July 31, 2025 and 2024 |

| (In thousands of Canadian dollars, except share and per share amounts or otherwise stated) |

Financial instruments:

Please refer to Note 23 of the condensed interim consolidated financial statements for the three and nine months ended 2025 and 2024 for details on measurement, carrying value, fair value and related risks of financial instruments, which is hereby incorporated by reference into this MD&A. For the three and nine months ended July 31, 2025, the Company had a derivative liability of $6,863, and the Company did not engage in hedging activities.

Disclosure controls and procedures and internal controls over financial reporting:

The Chief Executive Officer and Chief Financial Officer of the Company have designed or caused to be designed under their supervision, disclosure controls and procedures which provide reasonable assurance that material information regarding the Company is accumulated and communicated to Management, including its Chief Executive Officer and Chief Financial Officer, in a timely manner. Under the supervision and with the participation of Management, including our Chief Executive Officer and Chief Financial Officer, we carried out an evaluation of the effectiveness of our disclosure controls and procedures (as defined in Canada by NI 52-109 and in the United States by the rules adopted by the SEC). In addition, the Chief Executive Officer and Chief Financial Officer of the Company are responsible for designing internal controls over financial reporting or causing them to be designed under their supervision in order to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with IFRS. Based on this evaluation, our Chief Executive Officer and Chief Financial Officer concluded that the design and operation of our disclosure controls and procedures were ineffective due to the material weakness identified in our internal control over financial reporting, as further described below.

Due to its inherent limitations, internal control over financial reporting may not prevent or detect misstatements on a timely basis. Also, projections of any evaluation of the effectiveness of internal control over financial reporting to future periods are subject to the risk that the controls may become inadequate because of changes in conditions, or that the degree of compliance with the policies or procedures may deteriorate.

Management assessed the effectiveness of the Company’s internal control over financial reporting as of July 31, 2025, based on the criteria set forth in Internal Control – Integrated Framework (2013 Framework) issued by the Committee of Sponsoring Organizations of the Treadway Commission. Based on that assessment, Management has concluded that our internal control over financial reporting (ICFR) was not effective as of July 31, 2025, due to a material weaknesses in our internal controls over financial reporting. A material weakness is a deficiency, or combination of deficiencies, in internal control over financial reporting, such that there is a reasonable possibility that a material misstatement of the Company’s annual or interim financial statements will not be prevented or detected on a timely basis. Management identified the following internal control deficiency that constitutes a material weakness in the Company’s ICFR as of July 31, 2025.

Consistent with previous periods the Company did not effectively design, implement, and operate effective process-level control activities related to various processes or engage an adequate number of accounting personnel to allow for a detailed review of significant and non-routine accounting transactions that would identify errors in a timely manner, including business combinations, impairment testing and financing arrangements. As of July 31, 2025, a material weakness continues to exist in the operating effectiveness of controls over significant and non-routine accounting transactions as a result of insufficient capacity in its financial reporting function to identify and detect material misstatements. Management continues to hire qualified resources to increase capacity. Further remediation efforts are required for the Company to fully remediate this material weakness.

| | | | | |

| High Tide Inc. |

| Management's Discussion and Analysis |

| For the nine months ended July 31, 2025 and 2024 |

| (In thousands of Canadian dollars, except share and per share amounts or otherwise stated) |

Cautionary note regarding forward-looking information:

Certain statements contained in this MD&A, and in the documents incorporated by reference in this MD&A, constitute “forward-looking information” and “forward-looking statements” (together “forward-looking statements”) within the meaning of Applicable Securities Laws and are based on assumptions, expectations, estimates and projections as at the date of this MD&A. Forward-looking statements relate to future events or future performance and reflect Management’s expectations or beliefs regarding future events. In certain cases, forward-looking statements can be identified by the use of words such as “plans”, “expects” or “does not expect”, “is expected”, “budget”, “scheduled”, “estimates”, “forecasts”, “intends”, “anticipates” or “does not anticipate”, or “believes”, or variations of such words and phrases or statements that certain actions, events or results “may”, “could”, “would”, “might” or “will be taken”, “occur” or “be achieved” or the negative of these terms or comparable terminology.

Forward-looking statements in this MD&A herein include, but are not limited to, statements with respect to:

•the Business objectives and milestones and the anticipated timing of, and costs in connection with, the execution or achievement of such objectives and milestones (including, without limitation proposed M&A);

•the Company’s future growth prospects and intentions to pursue one or more viable Business opportunities;

•the development of the Business and future activities following the date of this MD&A;

•the closing of announced acquisitions;

•expectations relating to market size and anticipated growth in the jurisdictions within which the Company may from time to time operate or contemplate future operations;

•the ability of the Company to enter into new markets following cannabis legalization, including the United States and Germany;

•expectations with respect to economic, Business, regulatory, or competitive factors related to the Company or the cannabis industry generally;

•the market for the Company’s current and proposed product offerings, as well as the Company’s ability to capture market share;

•the Company’s strategic investments and capital expenditures, and related benefits;

•the distribution methods expected to be used by the Company to deliver its product offerings;

•same-store sales and consolidated gross margins continuing to increase;

•the competitive landscape within which the Company operates and the Company’s market share or reach;

•the performance of Business operations and activities of the Company;

•the number of additional cannabis retail store locations the Company proposes to add to its Business, with Ontario representing the majority share of the increase;

•the Company’s ability to obtain, maintain, and renew or extend, applicable Authorizations, including the timing and impact of the receipt thereof;

•the realization of cost savings, synergies or benefits from the Company’s recent and proposed acquisitions, and the Company’s ability to successfully integrate the operations of any business acquired within the Business;

•the Company’s intention to devote resources to the protection of its intellectual property rights, including by seeking and obtaining registered protections and developing and implementing standard operating procedures;

•the anticipated sales from continuing operations;

•the intention of the Company to complete the ATM Program and any additional offering of securities of the Company and the aggregate amount of the total proceeds that the Company will receive pursuant to the ATM Program, Credit Facility, or any future offering;

•the Company’s expected use of the net proceeds from the ATM Program, Credit Facility, or any future offering;

•the anticipated effects of the ATM Program and Credit Facility and/or any future offering on the Business and operations of the Company;

•the listing of Common Shares offered in the ATM Program and/or any future offering;

•the Company’s ability to generate cash flow from operations and from financing activities and remain free cash flow positive;

•future initiatives to strengthen the performance of our e-commerce platforms;

•the Company continuing to increase its revenue;

| | | | | |

| High Tide Inc. |

| Management's Discussion and Analysis |

| For the nine months ended July 31, 2025 and 2024 |

| (In thousands of Canadian dollars, except share and per share amounts or otherwise stated) |

•the Company continuing to integrate and expand its hemp-derived product brands;

•the success of the Remexian acquisition;

•Whether the company will need additional working capital for the expansion of Remexian;

•Cabana Club and Cabana ELITE loyalty programs membership continuing to increase;

•the Company continuing to increase its ELITE product offerings;

•the effects of the ELITE program on the business and operations of the Company;

•the ability of the Company to reach its goals of 300 stores nationwide and 2.5 million Cabana Club members;

•the timelines for its international launch to become revenue and EBITDA neutral;

•the ability of the company to turn around its e-commerce brands;

•new white label products launching in the coming months;

•the ability of the Company to use cash generated from existing operations to fund future locations;

•the Company hitting its forecasted revenue and sales projections;

•changes in general and administrative expenses;

•future Business operations and activities and the timing thereof;

•the future tax liability of the Company;

•the estimated future contractual obligations of the Company; and

•the future liquidity and financial capacity of the Company; and its ability to fund its working capital requirements and forecasted capital expenditures.

Forward-looking statements are subject to certain risks and uncertainties. Although Management believes that the expectations reflected in these forward-looking statements are reasonable in light of, among other things, its perception of trends, current conditions and expected developments, as well as other factors that Management believes to be relevant and reasonable in the circumstances at the date that such statements are made, readers are cautioned not to place undue reliance on forward-looking statements, as forward-looking statements may prove to be incorrect. A number of factors could cause actual results to differ materially from a conclusion, forecast or projection contained in the forward-looking statements. Importantly, forward-looking statements contained in this MD&A and in documents incorporated by reference are based upon certain assumptions that Management believes to be reasonable based on the information currently available to Management.

By their very nature forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Company to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. Although Management believes that the expectations reflected in, and assumptions underlying, such forward-looking statements are reasonable, it can give no assurance that such expectations will prove to have been correct. New factors emerge from time to time, and it is not possible for Management to predict all of those factors or to assess in advance the impact of each such factor on the Business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statement.

Readers are cautioned that the foregoing is not exhaustive. The forward-looking statements contained in this MD&A and the documents incorporated by reference herein are expressly qualified by this cautionary statement. The forward-looking statements contained in this document speak only as of that date of this document and the Company does not assume any obligation to publicly update or revise them to reflect new events or circumstances, except as may be required pursuant to Applicable Securities Laws.

These forward-looking statements speak only as of the date of this MD&A or as of the date specified in the documents incorporated by reference into this MD&A. The actual results could differ materially from those anticipated in these forward-looking statements as a result of the risk factors set forth below and elsewhere in this MD&A: counterparty credit risk; access to capital; limitations on insurance; changes in environmental or legislation applicable to our operations, and our ability to comply with current and future environmental and other laws; changes in income tax laws or changes in tax laws and incentive programs relating to the cannabis industry; and the other factors discussed under “Financial Instruments” in this MD&A.

Additional risk factors that can cause results to differ materially from those expressed in forward-looking statements in this MD&A are discussed in greater detail in the “Non-Exhaustive List of Risk Factors” section in Schedule A to our current annual information form, and elsewhere in this MD&A, as such factors may be further updated from time to time in our periodic filings, available at www.sedarplus.com and www.sec.gov, which risk factors are incorporated herein by reference.

| | | | | |

| High Tide Inc. |

| Management's Discussion and Analysis |

| For the nine months ended July 31, 2025 and 2024 |

| (In thousands of Canadian dollars, except share and per share amounts or otherwise stated) |

Cautionary note regarding FOFI:

This MD&A, and documents incorporated by reference herein, may contain FOFI within the meaning of Applicable Securities Laws and analogous U.S. securities Laws, about prospective results of operations, financial position or cash flows, based on assumptions about future economic conditions and courses of action, which FOFI is not presented in the format of a historical balance sheet, income statement or cash flow statement. The FOFI has been prepared by Management to provide an outlook of the Company’s activities and results and has been prepared based on a number of assumptions including the assumptions discussed under the heading “Cautionary Note Regarding Forward-Looking Information” and assumptions with respect to the costs and expenditures to be incurred by the Company, capital expenditures and operating costs, taxation rates for the Company and general and administrative expenses. Management does not have, or may not have had at the relevant date, firm commitments for all of the costs, expenditures, prices or other financial assumptions which may have been used to prepare the FOFI or assurance that such operating results will be achieved and, accordingly, the complete financial effects of all of those costs, expenditures, prices and operating results are not, or may not have been at the relevant date of the FOFI, objectively determinable.

Importantly, the FOFI contained in this MD&A, and in documents incorporated by reference herein are, or may be, based upon certain additional assumptions that Management believes to be reasonable based on the information currently available to Management, including, but not limited to, assumptions about: (i) the future pricing for the Company’s products, (ii) the future market demand and trends within the jurisdictions in which the Company may from time to time conduct the Business, (iii) the Company’s ongoing inventory levels, and operating cost estimates, and (iv) the Company’s net proceeds from the ATM Program and Credit Facility. The FOFI or financial outlook contained in MD&A, and in documents incorporated by reference herein do not purport to present the Company’s financial condition in accordance with IFRS as issued by the International Accounting Standards Board, and there can be no assurance that the assumptions made in preparing the FOFI will prove accurate. The actual results of operations of the Company and the resulting financial results will likely vary from the amounts set forth in the analysis presented in any such document, and such variation may be material (including due to the occurrence of unforeseen events occurring subsequent to the preparation of the FOFI). The Company and Management believe that the FOFI has been prepared on a reasonable basis, reflecting Management’s best estimates and judgments as at the applicable date. However, because this information is highly subjective and subject to numerous risks including the risks discussed under the heading “Risk Assessment”, FOFI or financial outlook within this MD&A, and in documents incorporated by reference herein, should not be relied on as necessarily indicative of future results.

Readers are cautioned not to place undue reliance on the FOFI, or financial outlook contained in this MD&A, and in documents incorporated by reference herein. Except as required by Applicable Securities Laws, the Company does not intend, and does not assume any obligation, to update such FOFI.

Non-IFRS Financial Measures

Throughout this MD&A, references are made to non-IFRS financial measures, including free cash flow, gross profit margin, sustaining capex, EBITDA and Adjusted EBITDA. These measures do not have a standardized meaning prescribed by IFRS and are therefore unlikely to be comparable to similar measures presented by other issuers. Non-IFRS measures provide investors with a supplemental measure of the Company’s operating performance and therefore highlight trends in Company’s core Business that may not otherwise be apparent when relying solely on IFRS measures. Management uses non-IFRS measures in measuring the financial performance of the Company.

Risk Assessment