On September 5, 2023, the Company reported the results of the Carangas MRE Technical Report. The effective date of the Carangas MRE Technical Report is August 25, 2023. For more information, please see the Company’s news release dated September 5, 2023 filed under the Company’s profile on SEDAR+ at www.sedarplus.ca, with the SEC on EDGAR at www.sec.gov/edgar, and on the Company’s website at www.newpacificmetals.com.

On August 16, 2023, the Company filed the 2023 Prospectus with the securities regulatory authorities in each of the provinces of Canada and a corresponding shelf registration statement on Form F-10 with the United States Securities and Exchange Commission (the “2023 Registration Statement”). The 2023 Prospectus and the 2023 Registration Statement replaced the Company’s prior base shelf prospectus, which was filed in July 2021 and expired in August 2023. The 2023 Prospectus and 2023 Registration Statement enable the Company to make offerings of up to US$200,000,000 of Shares, preferred shares, debt securities, warrants, units or subscription receipts of the Company, or any combination thereof, from time to time, separately or together, in amounts, at prices and on terms to be determined based on market conditions at the time of the offering and as set out in an accompanying prospectus supplement during the 25-month period that the 2023 Prospectus is effective, which is expected to expire on or about September 16, 2025. Copies of the 2023 Prospectus and Prospectus Supplement are available under the Company’s profile on SEDAR+ at www.sedarplus.ca and a copy of the 2023 Registration Statement was filed with the SEC on EDGAR at www.sec.gov/edgar. The 2023 Prospectus, the Prospectus Supplement and the 2023 Registration Statement can also be located on the Company’s website at www.newpacificmetals.com.

On July 6, 2023, the Company announced the assay results of the last 18 drill holes from its 2023 dill program at its Carangas Project. For more information, please see the Company’s news release dated July 6, 2023 filed under the Company’s profile on SEDAR+ at www.sedarplus.ca, with the SEC on EDGAR at www.sec.gov/edgar, and on the Company’s website at www.newpacificmetals.com. The 2023 drill program was completed with 17,623 m in 39 holes. For details of the 2023 drill program, please refer to the Company’s news releases dated July 6, 2023 and May 30, 2023, filed under the Company’s profile on SEDAR+ at www.sedarplus.ca, with the SEC on EDGAR at www.sec.gov/edgar, and on the Company’s website at www.newpacificmetals.com.

(d)Year ended June 30, 2023

On May 30, 2023, the Company reported assay results of the first 21 drill holes from its 2023 Q1 drill program at its Carangas Project. The 2023 Q1 drilling was a continuation of the 2022 drilling campaign at the Carangas Project. It was originally budgeted as 15,000 metres (“m”) of diamond core drilling, infilling areas drilled in 2021-2022 and stepping out beyond these previously drilled areas. This drilling program started on schedule in January 2023 and was expanded based on encouraging results and is now complete. A total of 17,623 m in 39 holes was drilled up to the end of April 2023. Each of the 39 holes intersected mineralization. For more information, please see the Company’s news release dated May 30, 2023 filed under the Company’s profile on SEDAR+ at www.sedarplus.ca, with the SEC on EDGAR at www.sec.gov/edgar, and on the Company’s website at www.newpacificmetals.com.

On April 6, 2023, the Company announced the assay results of the last 29 drill holes from the 2022 drill program at its Carangas Project. The 2022 drill program was completed with 50,368 m drilled in 115 holes. For details of the 2022 drill program, please refer to the Company’s news releases dated April 6, 2023, February 21, 2023, February 1, 2023, January 24, 2023, November 14, 2022, October 19, 2022, August 8, 2022, and July 13, 2022, filed under the Company’s profile on SEDAR+ at www.sedarplus.ca, with the SEC on EDGAR at www.sec.gov/edgar, and on the Company’s website at www.newpacificmetals.com.

On February 21, 2023, the Company reported assay results from the Carangas Project, including 524 m interval grading 1.24 grams (“g”) per tonne (“t”) of gold (“Au”). . For more information, please see the Company’s news release dated February 21, 2023 filed under the Company’s profile on SEDAR+ at www.sedarplus.ca, with the SEC on EDGAR at www.sec.gov/edgar, and on the Company’s website at www.newpacificmetals.com.

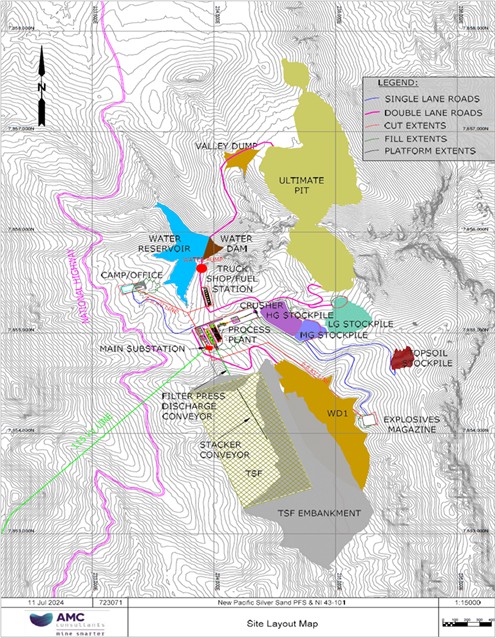

On February 16, 2023, the Company filed an independent preliminary economic assessment and technical report prepared in accordance with NI 43-101 titled “Technical Report – Silver Sand Deposit Preliminary Economic Assessment” dated February 16, 2023, and with an effective date of November 30, 2022 (the “Silver Sand PEA Technical Report”). The Silver Sand PEA Technical Report is based on the Silver Sand MRE Technical Report, which was reported on November 28, 2022. The Silver Sand PEA Technical Report has been superseded by the Silver Sand PFS Technical Report, and should no longer be relied upon.

On February 1, 2023, the Company reported assay results from the Carangas Project, including 230 m interval grading 146 g/t of silver (“Ag”). For more information, please see the Company’s news release dated February 1, 2023 filed under the Company’s profile on SEDAR+ at www.sedarplus.ca, with the SEC on EDGAR at www.sec.gov/edgar, and on the Company’s website at www.newpacificmetals.com.

On January 24, 2023, the Company announced assay results from the Carangas Project, including a 505 m interval grading 1.22 g/t Au. For more information, please see the Company’s news release dated January 24, 2023 filed under the Company’s profile on SEDAR+ at www.sedarplus.ca, with the SEC on EDGAR at www.sec.gov/edgar, and on the Company’s website at www.newpacificmetals.com.