Pay Versus Performance

The following tables provide additional compensation information regarding our NEOs, prepared in accordance with the SEC's pay versus performance disclosure regulations for fiscal years 2025, 2024, 2023, 2022, and 2021.

Pay Versus Performance (PVP) Table

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Value of Initial Fixed $100 |

|

|

|

|

|

|

|

|

||||||||||||||

Fiscal Year |

|

Summary |

|

Compensation Actually Paid (CAP) to PEO(1) |

|

Average SCT Total for Non-PEO NEOs(2) |

|

Average CAP to Non-PEO NEOs(3) |

|

Neogen TSR |

|

S&P MidCap |

|

Net (Loss) Income |

|

Adjusted EBITDA |

||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

2025 |

|

$ |

6,824,891 |

|

|

|

$ |

(457,682 |

) |

|

|

$ |

2,241,470 |

|

|

|

$ |

90,305 |

|

|

|

|

16.5 |

|

|

|

|

102.8 |

|

|

|

$ |

(1,092.0 |

) |

|

|

$ |

184.2 |

|

|

2024 |

|

|

7,221,352 |

|

|

|

|

4,499,416 |

|

|

|

|

2,991,286 |

|

|

|

|

2,366,175 |

|

|

|

|

36.9 |

|

|

|

|

109.4 |

|

|

|

|

(9.4 |

) |

|

|

|

213.2 |

|

|

2023 |

|

|

5,325,174 |

|

|

|

|

4,853,105 |

|

|

|

|

1,327,952 |

|

|

|

|

1,251,767 |

|

|

|

|

49.1 |

|

|

|

|

105.5 |

|

|

|

|

(20.9 |

) |

|

|

|

205.1 |

|

|

2022 |

|

|

4,315,427 |

|

|

|

|

2,315,621 |

|

|

|

|

1,220,774 |

|

|

|

|

727,779 |

|

|

|

|

74.3 |

|

|

|

|

110.8 |

|

|

|

|

48.3 |

|

|

|

|

115.4 |

|

|

2021 |

|

|

2,507,046 |

|

|

|

|

4,575,029 |

|

|

|

|

714,856 |

|

|

|

|

1,226,880 |

|

|

|

|

129.6 |

|

|

|

|

129.8 |

|

|

|

|

60.9 |

|

|

|

|

104.2 |

|

|

CEO SCT Total to CAP Reconciliation

Fiscal Year |

|

SCT Total |

|

Reported Value of |

|

Equity Award |

|

Compensation |

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

2025 |

|

$ |

6,824,891 |

|

|

|

$ |

6,000,000 |

|

|

|

|

(1,282,573 |

) |

|

|

$ |

(457,682 |

) |

|

2024 |

|

|

7,221,352 |

|

|

|

|

6,000,000 |

|

|

|

|

3,278,064 |

|

|

|

|

4,499,416 |

|

|

2023 |

|

|

5,325,174 |

|

|

|

|

4,000,000 |

|

|

|

|

3,527,931 |

|

|

|

|

4,853,105 |

|

|

2022 |

|

|

4,315,427 |

|

|

|

|

2,925,547 |

|

|

|

|

925,741 |

|

|

|

|

2,315,621 |

|

|

2021 |

|

|

2,507,046 |

|

|

|

|

1,662,618 |

|

|

|

|

3,730,601 |

|

|

|

|

4,575,029 |

|

|

CEO Equity Component of CAP

Fiscal Year |

|

Awards Granted During Current Fiscal Year and Unvested at End of Fiscal Year |

|

Awards Granted in Prior Fiscal Year(s) and Unvested at End of Fiscal Year |

|

Awards Granted in Prior Fiscal Year(s) and Vested During Current Fiscal Year |

|

Equity Adjustment |

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

2025 |

|

$ |

2,305,639 |

|

|

|

$ |

(3,335,247 |

) |

|

|

$ |

(252,965 |

) |

|

|

|

(1,282,573 |

) |

|

2024 |

|

|

4,787,158 |

|

|

|

|

(1,363,377 |

) |

|

|

|

(145,717 |

) |

|

|

|

3,278,064 |

|

|

2023 |

|

|

5,647,124 |

|

|

|

|

(1,100,298 |

) |

|

|

|

(1,018,895 |

) |

|

|

|

3,527,931 |

|

|

2022 |

|

|

2,731,035 |

|

|

|

|

(1,731,231 |

) |

|

|

|

(74,063 |

) |

|

|

|

925,741 |

|

|

2021 |

|

|

2,658,177 |

|

|

|

|

1,029,084 |

|

|

|

|

43,340 |

|

|

|

|

3,730,601 |

|

|

Average Other NEOs SCT Total to CAP Reconciliation

Fiscal Year |

|

SCT Total |

|

Reported Value of |

|

Equity Award |

|

Compensation |

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

2025 |

|

$ |

2,241,470 |

|

|

|

$ |

1,730,333 |

|

|

|

$ |

(420,831 |

) |

|

|

$ |

90,305 |

|

|

2024 |

|

|

2,991,286 |

|

|

|

|

2,300,000 |

|

|

|

|

1,674,889 |

|

|

|

|

2,366,175 |

|

|

2023 |

|

|

1,327,952 |

|

|

|

|

776,244 |

|

|

|

|

725,576 |

|

|

|

|

1,251,767 |

|

|

2022 |

|

|

1,220,774 |

|

|

|

|

673,894 |

|

|

|

|

180,899 |

|

|

|

|

727,779 |

|

|

2021 |

|

|

714,856 |

|

|

|

|

342,362 |

|

|

|

|

854,386 |

|

|

|

|

1,226,880 |

|

|

Average Other NEOs Equity Component of CAP

Fiscal Year |

|

Awards Granted During Current Fiscal Year and Unvested at End of Fiscal Year |

|

Awards Granted in Prior Fiscal Year(s) and Unvested at End of Fiscal Year |

|

Awards Granted in Prior Fiscal Year(s) and Vested During Current Fiscal Year |

|

Equity Adjustment |

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

2025 |

|

$ |

671,195 |

|

|

|

$ |

(1,015,084 |

) |

|

|

$ |

(76,942 |

) |

|

|

|

(420,831 |

) |

|

2024 |

|

|

1,830,083 |

|

|

|

|

(128,113 |

) |

|

|

|

(27,081 |

) |

|

|

|

1,674,889 |

|

|

2023 |

|

|

1,060,429 |

|

|

|

|

(224,528 |

) |

|

|

|

(110,326 |

) |

|

|

|

725,576 |

|

|

2022 |

|

|

617,287 |

|

|

|

|

(408,559 |

) |

|

|

|

(27,828 |

) |

|

|

|

180,899 |

|

|

2021 |

|

|

530,239 |

|

|

|

|

296,954 |

|

|

|

|

27,193 |

|

|

|

|

854,386 |

|

|

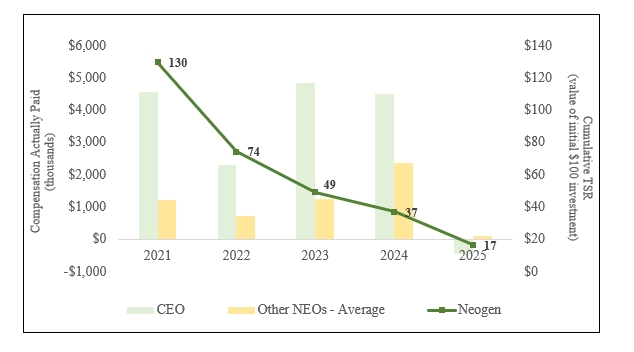

2. Compensation Actually Paid (CAP) versus Neogen TSR

The graph below compares Neogen’s Total Shareholder Return (TSR) to the CEO’s and Other NEOs’ Compensation Actually Paid (CAP) for the five fiscal years beginning with 2021. As shown in the graph, the CAP to the CEO declined in 2022 and increased in 2023 before declining again in 2024 and 2025. CAP to Other NEOs increased in 2023 and 2024, primarily reflecting the completion of the merger with the former 3M Food Safety Division and the resulting increase in size and complexity of the Company, before declining in 2025.

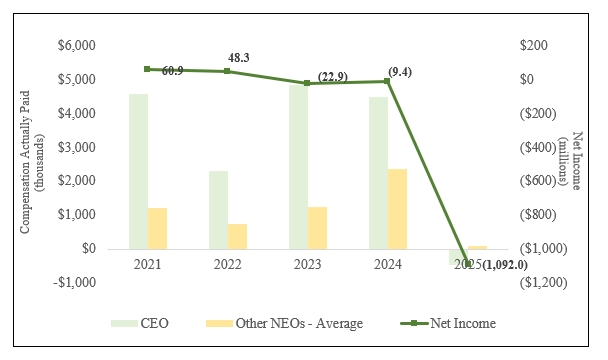

3. CAP versus Net Income

The graph below compares Neogen’s net income to the CEO’s and Other NEOs’ Compensation Actually Paid (CAP) for the five fiscal years beginning with 2021. Net income declined in 2023, primarily as a result of transaction costs, the amortization of acquired intangibles and interest expense incurred on debt related to the merger with the former 3M Food Safety Division. The decline in net income in 2025 was due primarily to a non-cash goodwill impairment charge. CAP to the CEO increased in 2023 before declining in 2024 and 2025, while CAP to Other NEOs increased in 2023 and 2024 before declining in 2025. Neogen does not use net income as a metric in the determination of executive compensation.

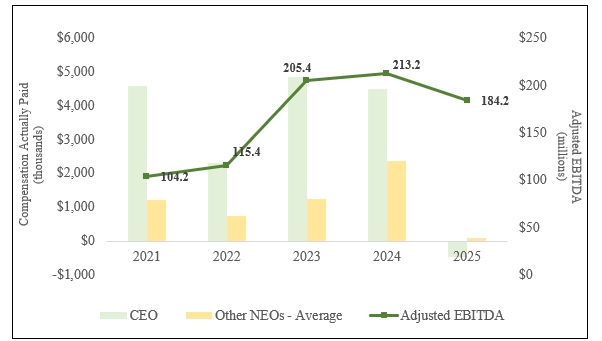

4. CAP versus Adjusted EBITDA (Company Selected Measure)

The graph below compares Neogen’s Adjusted EBITDA to the CEO’s and Other NEOs’ Compensation Actually Paid (CAP) for the five fiscal years beginning with 2021. Management defines Adjusted EBITDA as EBITDA, adjusted for share-based compensation, certain transaction and integration costs and other non-recurring charges. Adjusted EBITDA increased from 2022 to 2024, due primarily to the merger with the former 3M Food Safety Division. In 2025, the decline in Adjusted EBITDA was driven by a combination of end-market weakness, foreign currency headwinds and challenges related to the integration of the former 3M Food Safety Division. CAP to the CEO increased in 2023 before declining in 2024 and 2025, while CAP to Other NEOs increased in 2023 and 2024 before declining in 2025. While the Company uses other financial and non-financial performance measures in its compensation programs, Neogen has determined that Adjusted EBITDA is the most important performance measure used to link CAP to the CEO and Other NEOs in 2025 to the performance of the Company.

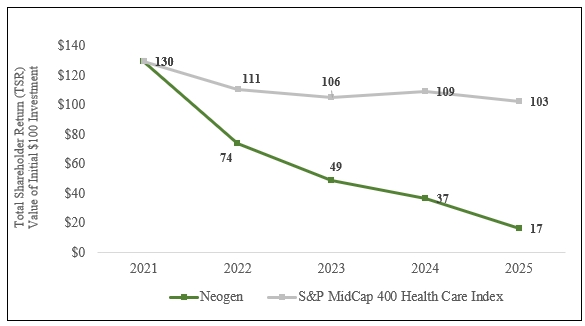

1. Total Shareholder Return (TSR): Neogen versus S&P Midcap 400 Health Care Index

The graph below assumes an initial investment of $100 on May 31, 2020, in Neogen common stock and the S&P MidCap 400 Health Care Index, and assumes dividends, if any, were reinvested. As shown in the graph, Neogen’s TSR has been below the S&P MidCap 400 Health Care Index. The companies included in the S&P MidCap 400 Health Care Index are not the same as those used in our compensation benchmarking.

List of Most Important Measures

The items listed below represent the most important metrics used to determine CAP for fiscal year 2025 as further described in our Compensation Discussion & Analysis (CD&A) within the sections titled “Incentive Compensation Plan (ICP)” and “Long-Term Incentive (LTI) Compensation:”

Performance Measure |

|

|

Revenue |

|

|

Adjusted EBITDA |

|

|

Free Cash Flow |

|

|