Pay vs Performance Disclosure - USD ($)

|

12 Months Ended |

Jun. 30, 2025 |

Jun. 30, 2024 |

Jun. 30, 2023 |

Jun. 30, 2022 |

Jun. 30, 2021 |

| Pay vs Performance Disclosure |

|

|

|

|

|

| Pay vs Performance Disclosure, Table |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Value of Initial Fixed $100 Invested Based On: | | | | Year | Summary Compensation Table Total for PEO (Jack Springer ) ($) (1)(2) | Compensation Actually Paid to PEO (Jack Springer) ($) (1)(3)

| Summary Compensation Table Total for PEO (Michael Hooks) ($) (1)(2) | Compensation Actually Paid to PEO (Michael Hooks) ($) (1)(3)

| Summary Compensation Table Total for PEO (Steven Menneto) ($) (1)(2) | Compensation Actually Paid to PEO (Steven Menneto) ($) (1)(3)

| Average Summary Compensation Table Total for Non-PEO NEOs ($) (4) | Average Compensation Actually Paid to Non-PEO NEOs ($) (5) | Total Shareholder Return ($) (6) | Dow Jones Recreational Products Index Total Shareholder Return ($) (7) | Net Income ($) ($M))(8) | Adjusted EBITDA ($) ($M) (9) | | | | | | | | | | | | | | | 2025 | — | | — | | 67,742 | | 67,742 | | 4,206,701 | | 3,715,353 | | 1,523,561 | | (1,000,830) | | 60.3 | | 82.8 | | 15.2 | | 74.8 | | | 2024 | 2,923,537 | | (3,046,395) | | 490,679 | | 708,011 | | — | | — | | 2,496,279 | | 1,544,238 | | 67.5 | | 102.8 | | -56.4 | | 82.2 | | | 2023 | 4,535,792 | | 5,847,922 | | — | | — | | — | | — | | 1,128,644 | | 591,110 | | 112.9 | | 128.9 | | 107.9 | | 284 | | | 2022 | 4,838,018 | | 2,059,911 | | — | | — | | — | | — | | 1,683,805 | | 557,849 | | 101.5 | | 108.8 | | 163.4 | | 246.5 | | | 2021 | 4,480,177 | | 7,487,216 | | — | | — | | — | | — | | 1,932,208 | | 3,351,361 | | 141.2 | | 150.5 | | 114.3 | | 190 | |

|

|

|

|

|

| Company Selected Measure Name |

Adjusted EBITDA

|

|

|

|

|

| Named Executive Officers, Footnote |

This figure is the average of the total compensation paid to our NEOs other than our PEO in each listed year, as shown in our Summary Compensation Table for such listed year. The names of the non-PEO NEOs in each year are listed in the table below. | | | | | | | | | | | | | | | | | | | | | | | | | 2025 | | 2024 | | 2023 | | 2022 | 2021 | | Ritchie Anderson | | Ritchie Anderson | | Ritchie Anderson | | Ritchie Anderson | Ritchie Anderson | | Bruce Beckman | | Bruce Beckman | | Wayne Wilson | | Wayne Wilson | Wayne Wilson | | | David Black | | David Black | | | |

|

|

|

|

|

| Peer Group Issuers, Footnote |

The peer group used is the Dow Jones U.S. Recreational Products Index, as used in the Company's performance graph found in the Company’s Annual Report on Form 10-K. Total shareholder return is calculated by assuming that a $100 investment was made on the day prior to the start of the first fiscal year reported in the table (June 30, 2020) assuming all dividends paid from the start of the measurement period through end of the measurement period (June 30, 2025) are reinvested.

|

|

|

|

|

| Adjustment To PEO Compensation, Footnote |

| | | | | | | | | | | | | | Michael Hooks | | 2025 | | | | | | Summary Compensation Table Total | | $ | 67,742 | | | | | | | Subtract Grant Date Fair Value of Option Awards and Stock Awards Granted in Fiscal Year | | — | | | | | | | Add Fair Value at Fiscal Year-End of Outstanding and Unvested Option Awards and Stock Awards Granted in Fiscal Year | | — | | | | | | | Adjust for Change in Fair Value of Outstanding and Unvested Option Awards and Stock Awards Granted in Prior Fiscal Years | | — | | | | | | | Adjust for Fair Value at Vesting of Option Awards and Stock Awards Granted in Fiscal Year That Vested During Fiscal Year | | — | | | | | | | Adjust for Change in Fair Value as of Vesting Date of Option Awards and Stock Awards Granted in Prior Fiscal Years For Which Applicable Vesting Conditions Were Satisfied During Fiscal Year | | — | | | | | | | Subtract Fair Value as of Prior Fiscal Year-End of Option Awards and Stock Awards Granted in Prior Fiscal Years That Failed to Meet Applicable Vesting Conditions During Fiscal Year | | — | | | | | | | Add Value of Dividends or other Earnings Paid on Stock or Option Awards not Otherwise Reflected in Fair Value or Total Compensation | | — | | | | | | | Compensation Actually Paid | | $ | 67,742 | | | | | |

| | | | | | | | | | | | | | Steven Menneto | | 2025 | | | | | | Summary Compensation Table Total | | $ | 4,206,701 | | | | | | | Subtract Grant Date Fair Value of Option Awards and Stock Awards Granted in Fiscal Year | | (2,886,855) | | | | | | | Add Fair Value at Fiscal Year-End of Outstanding and Unvested Option Awards and Stock Awards Granted in Fiscal Year | | 2,395,507 | | | | | | | Adjust for Change in Fair Value of Outstanding and Unvested Option Awards and Stock Awards Granted in Prior Fiscal Years | | — | | | | | | | Adjust for Fair Value at Vesting of Option Awards and Stock Awards Granted in Fiscal Year That Vested During Fiscal Year | | — | | | | | | | Adjust for Change in Fair Value as of Vesting Date of Option Awards and Stock Awards Granted in Prior Fiscal Years For Which Applicable Vesting Conditions Were Satisfied During Fiscal Year | | — | | | | | | | Subtract Fair Value as of Prior Fiscal Year-End of Option Awards and Stock Awards Granted in Prior Fiscal Years That Failed to Meet Applicable Vesting Conditions During Fiscal Year | | — | | | | | | | Add Value of Dividends or other Earnings Paid on Stock or Option Awards not Otherwise Reflected in Fair Value or Total Compensation | | — | | | | | | | Compensation Actually Paid | | $ | 3,715,353 | | | | | |

*The assumptions used for determining the fair values shown in this table are materially consistent with those used to determine the fair values disclosed as of the grant date of such awards. **Note that we have not reported any amounts in our Summary Compensation Table with respect to “Change in Pension and Nonqualified Deferred Compensation “and, accordingly, the adjustments with respect to such items prescribed by the pay-versus-performance rules are not relevant to our analysis and no adjustments have been made.

|

|

|

|

|

| Non-PEO NEO Average Total Compensation Amount |

$ 1,523,561

|

$ 2,496,279

|

$ 1,128,644

|

$ 1,683,805

|

$ 1,932,208

|

| Non-PEO NEO Average Compensation Actually Paid Amount |

$ (1,000,830)

|

1,544,238

|

591,110

|

557,849

|

3,351,361

|

| Adjustment to Non-PEO NEO Compensation Footnote |

| | | | | | | | | | | | | | | 2025 | | | | | | Summary Compensation Table Total | | $ | 1,523,561 | | | | | | | Subtract Grant Date Fair Value of Option Awards and Stock Awards Granted in Fiscal Year | | (800,228) | | | | | | | Add Fair Value at Fiscal Year-End of Outstanding and Unvested Option Awards and Stock Awards Granted in Fiscal Year | | 185,202 | | | | | | | Adjust for Change in Fair Value of Outstanding and Unvested Option Awards and Stock Awards Granted in Prior Fiscal Years | | (15,209) | | | | | | | Adjust for Fair Value at Vesting of Option Awards and Stock Awards Granted in Fiscal Year That Vested During Fiscal Year | | — | | | | | | | Adjust for Change in Fair Value as of Vesting Date of Option Awards and Stock Awards Granted in Prior Fiscal Years For Which Applicable Vesting Conditions Were Satisfied During Fiscal Year | | 57,160 | | | | | | | Subtract Fair Value as of Prior Fiscal Year-End of Option Awards and Stock Awards Granted in Prior Fiscal Years That Failed to Meet Applicable Vesting Conditions During Fiscal Year | | (1,951,316) | | | | | | | Add Value of Dividends or other Earnings Paid on Stock or Option Awards not Otherwise Reflected in Fair Value or Total Compensation | | — | | | | | | | Compensation Actually Paid | | $ | (1,000,830) | | | | | |

*Note that the fair value assumptions shown with respect to footnote 3 apply to the figures in this table as well. **Note that we have not reported any amounts in our Summary Compensation Table with respect to “Change in Pension and Nonqualified Deferred Compensation “ and, accordingly, the adjustments with respect to such items prescribed by the pay-versus-performance rules are not relevant to our analysis and no adjustments have been made.

|

|

|

|

|

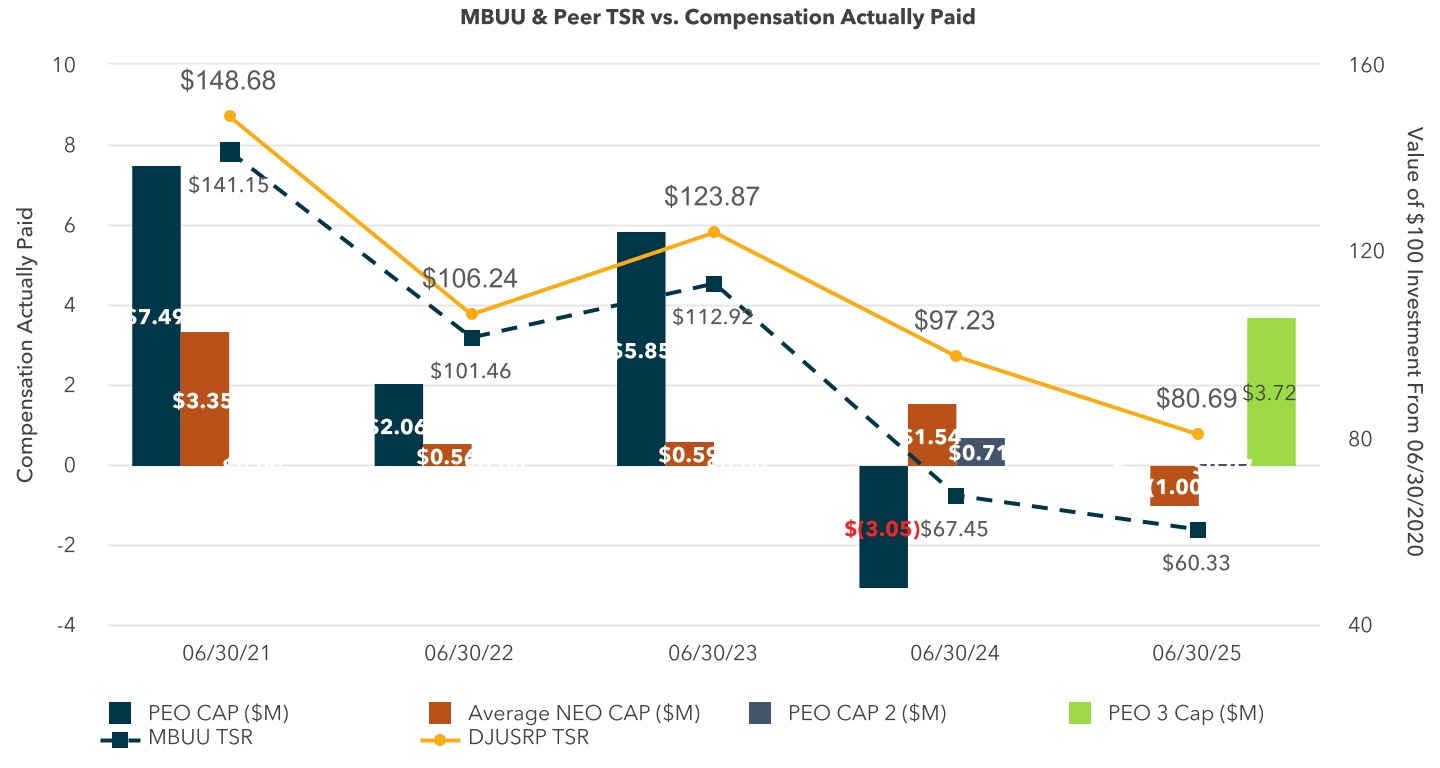

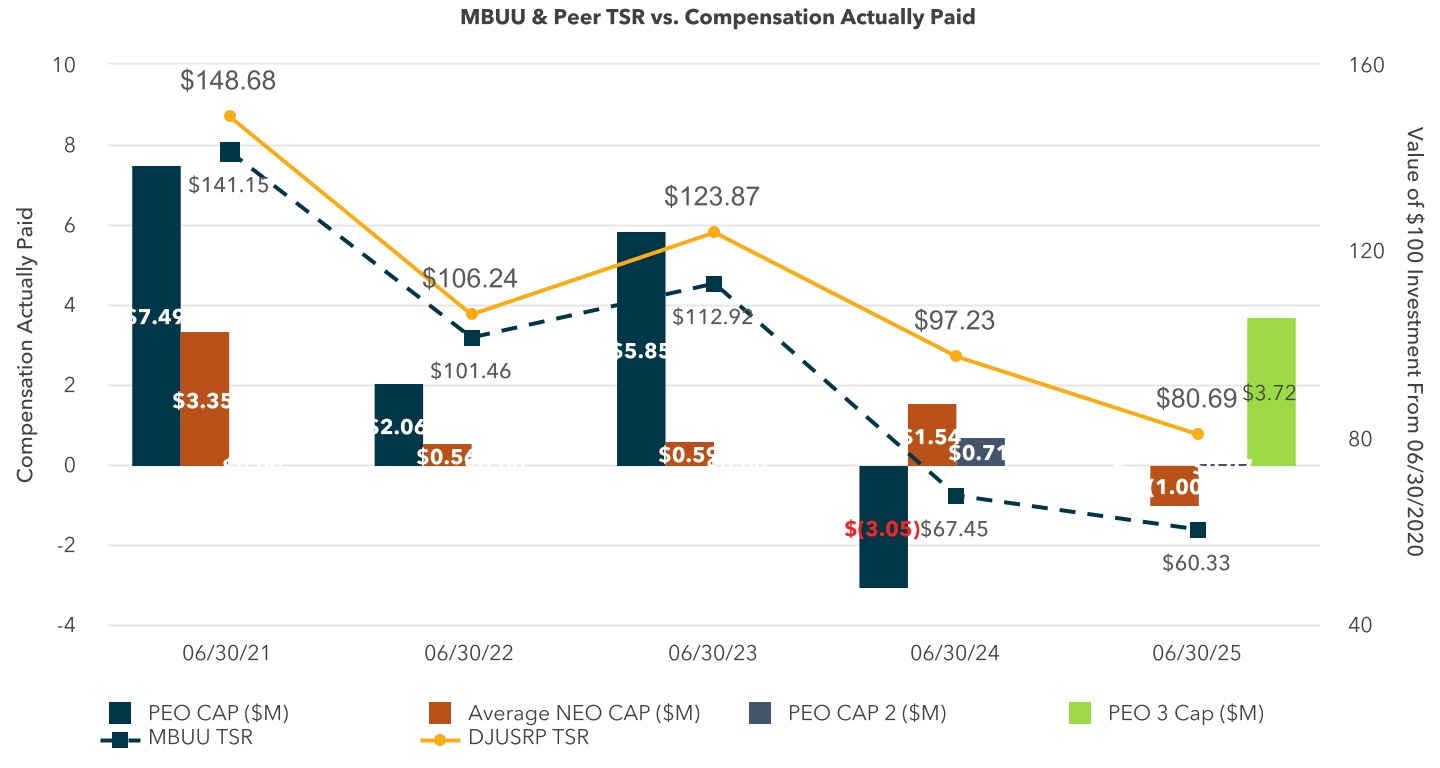

| Compensation Actually Paid vs. Total Shareholder Return |

Compensation Actually Paid Versus TSR

|

|

|

|

|

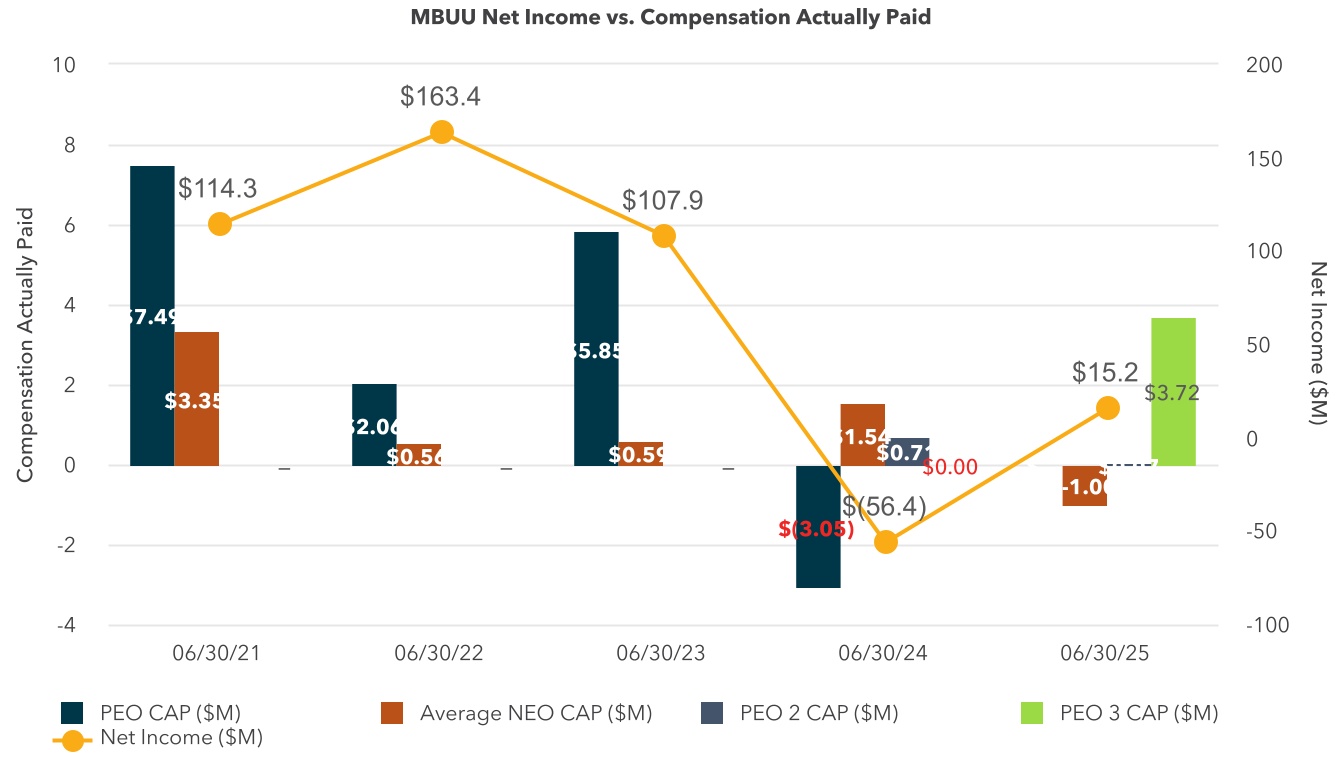

| Compensation Actually Paid vs. Net Income |

Compensation Actually Paid Versus Net Income

|

|

|

|

|

| Compensation Actually Paid vs. Company Selected Measure |

Compensation Actually Paid Versus Adjusted EBITDA

|

|

|

|

|

| Total Shareholder Return Vs Peer Group |

Compensation Actually Paid Versus TSR

|

|

|

|

|

| Tabular List, Table |

| | | | Tabular List | | Adjusted EBITDA | | Relative Total Shareholder Return | | Net Income |

|

|

|

|

|

| Total Shareholder Return Amount |

$ 60.3

|

67.5

|

112.9

|

101.5

|

141.2

|

| Peer Group Total Shareholder Return Amount |

82.8

|

102.8

|

128.9

|

108.8

|

150.5

|

| Net Income (Loss) |

$ 15,200,000

|

$ (56,400,000)

|

$ 107,900,000

|

$ 163,400,000

|

$ 114,300,000

|

| Company Selected Measure Amount |

74,800,000

|

82,200,000

|

284,000,000

|

246,500,000

|

190,000,000

|

| Additional 402(v) Disclosure |

Represents the total compensation paid to our PEO in each listed year, as shown in our Summary Compensation Table for such listed year.Compensation actually paid does not mean that our PEO was actually paid those amounts in the listed year, but this is a dollar amount derived from the starting point of summary compensation table total compensation under the methodology prescribed under the relevant rules as shown in the adjustment table below.Total shareholder return is calculated by assuming that a $100 investment was made on the day prior to the start of the first fiscal year reported in the table (June 30, 2020) assuming all dividends paid from the start of the measurement period through end of the measurement period (June 30, 2025) are reinvested.The dollar amounts reported are the Company's net income reflected in the Company’s audited financial statements.

|

|

|

|

|

| Measure:: 1 |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Non-GAAP Measure Description |

In the Company's assessment Adjusted EBITDA is the financial performance measure that is the most important financial performance measure (other than total shareholder return and net income) used by the Company in 2025 to link compensation actually paid to performance. The Company defines adjusted EBITDA as net income before interest expense, income taxes, depreciation, amortization, goodwill and other intangible asset impairment expense and non-cash, non-recurring or non-operating expenses, including abandonment of construction in process, litigation settlements, certain professional fees, non-cash compensation expense and adjustments to our tax receivable agreement liability.

|

|

|

|

|

| Jack D. Springer [Member] |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| PEO Total Compensation Amount |

$ 0

|

$ 2,923,537

|

$ 4,535,792

|

$ 4,838,018

|

$ 4,480,177

|

| PEO Actually Paid Compensation Amount |

0

|

(3,046,395)

|

5,847,922

|

2,059,911

|

7,487,216

|

| Michael K. Hooks [Member] |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| PEO Total Compensation Amount |

67,742

|

490,679

|

0

|

0

|

0

|

| PEO Actually Paid Compensation Amount |

67,742

|

708,011

|

0

|

0

|

0

|

| Steven D. Menneto [Member] |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| PEO Total Compensation Amount |

4,206,701

|

0

|

0

|

0

|

0

|

| PEO Actually Paid Compensation Amount |

$ 3,715,353

|

$ 0

|

$ 0

|

$ 0

|

$ 0

|

| PEO | Measure:: 1 |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Name |

Adjusted EBITDA

|

|

|

|

|

| PEO | Measure:: 2 |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Name |

Relative Total Shareholder Return

|

|

|

|

|

| PEO | Measure:: 3 |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Name |

Net Income

|

|

|

|

|

| PEO | Michael K. Hooks [Member] | Equity Awards, Grant Date Fair Value Granted In Fiscal Year [Member] |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Adjustment to Compensation, Amount |

$ 0

|

|

|

|

|

| PEO | Michael K. Hooks [Member] | Equity Awards, Fair Value Of Outstanding And Unvested Awards Granted In Fiscal Year [Member] |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Adjustment to Compensation, Amount |

0

|

|

|

|

|

| PEO | Michael K. Hooks [Member] | Equity Awards, Change In Fair Value Of Awards Granted In Fiscal Year That Vested During Fiscal Year [Member] |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Adjustment to Compensation, Amount |

0

|

|

|

|

|

| PEO | Michael K. Hooks [Member] | Equity Awards, Fair Value At Vesting Of Awards Granted And Vested During Fiscal Year [Member] |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Adjustment to Compensation, Amount |

0

|

|

|

|

|

| PEO | Michael K. Hooks [Member] | Equity Awards Granted in Prior Years, Vested [Member] |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Adjustment to Compensation, Amount |

0

|

|

|

|

|

| PEO | Michael K. Hooks [Member] | Equity Awards that Failed to Meet Vesting Conditions [Member] |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Adjustment to Compensation, Amount |

0

|

|

|

|

|

| PEO | Michael K. Hooks [Member] | Equity Awards, Value Of Dividends And Other Earnings Paid Adjustment [Member] |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Adjustment to Compensation, Amount |

0

|

|

|

|

|

| PEO | Steven D. Menneto [Member] | Equity Awards, Grant Date Fair Value Granted In Fiscal Year [Member] |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Adjustment to Compensation, Amount |

(2,886,855)

|

|

|

|

|

| PEO | Steven D. Menneto [Member] | Equity Awards, Fair Value Of Outstanding And Unvested Awards Granted In Fiscal Year [Member] |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Adjustment to Compensation, Amount |

2,395,507

|

|

|

|

|

| PEO | Steven D. Menneto [Member] | Equity Awards, Change In Fair Value Of Awards Granted In Fiscal Year That Vested During Fiscal Year [Member] |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Adjustment to Compensation, Amount |

0

|

|

|

|

|

| PEO | Steven D. Menneto [Member] | Equity Awards, Fair Value At Vesting Of Awards Granted And Vested During Fiscal Year [Member] |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Adjustment to Compensation, Amount |

0

|

|

|

|

|

| PEO | Steven D. Menneto [Member] | Equity Awards Granted in Prior Years, Vested [Member] |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Adjustment to Compensation, Amount |

0

|

|

|

|

|

| PEO | Steven D. Menneto [Member] | Equity Awards that Failed to Meet Vesting Conditions [Member] |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Adjustment to Compensation, Amount |

0

|

|

|

|

|

| PEO | Steven D. Menneto [Member] | Equity Awards, Value Of Dividends And Other Earnings Paid Adjustment [Member] |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Adjustment to Compensation, Amount |

0

|

|

|

|

|

| Non-PEO NEO | Equity Awards, Grant Date Fair Value Granted In Fiscal Year [Member] |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Adjustment to Compensation, Amount |

(800,228)

|

|

|

|

|

| Non-PEO NEO | Equity Awards, Fair Value Of Outstanding And Unvested Awards Granted In Fiscal Year [Member] |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Adjustment to Compensation, Amount |

185,202

|

|

|

|

|

| Non-PEO NEO | Equity Awards, Change In Fair Value Of Awards Granted In Fiscal Year That Vested During Fiscal Year [Member] |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Adjustment to Compensation, Amount |

(15,209)

|

|

|

|

|

| Non-PEO NEO | Equity Awards, Fair Value At Vesting Of Awards Granted And Vested During Fiscal Year [Member] |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Adjustment to Compensation, Amount |

0

|

|

|

|

|

| Non-PEO NEO | Equity Awards Granted in Prior Years, Vested [Member] |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Adjustment to Compensation, Amount |

57,160

|

|

|

|

|

| Non-PEO NEO | Equity Awards that Failed to Meet Vesting Conditions [Member] |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Adjustment to Compensation, Amount |

(1,951,316)

|

|

|

|

|

| Non-PEO NEO | Equity Awards, Value Of Dividends And Other Earnings Paid Adjustment [Member] |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Adjustment to Compensation, Amount |

$ 0

|

|

|

|

|