Exhibit 99.1

Developing Anti-Fibrotic Therapeutics for Chronic Organ Diseases H.C.

Wainwright Global Investment Conference September 2025

Forward Looking Statements 2 This presentation contains “forward-looking

statements” within the meaning of the federal securities laws regarding the current plans, expectations and strategies of Gyre Therapeutics, Inc. and its subsidiaries (“Gyre”), which statements are subject to substantial risks and

uncertainties and are based on management’s estimates and assumptions. All statements, other than statements of historical facts included in this presentation, are forward-looking statements, including statements concerning: Gyre’s plans,

objectives, goals, strategies, future events, or intentions relating to Gyre’s products and markets; the safety, efficacy and clinical benefits of Gyre’s product candidates; the anticipated timing and design of any planned or ongoing

preclinical studies and clinical trials; Gyre’s research and development efforts; timing of expected clinical readouts, including timing of the filing of an NDA with the PRC’s NMPA for Hydronidone for the treatment of CHB-related liver

fibrosis, submission of U.S. IND filing for Hydronidone for advanced fibrosis and trial initiation pending regulatory review, timing of completion of Gyre’s Phase 2 clinical trial in the PRC of F573 for ALF/ACLF, IND submission of F528 in

COPD, the expectations regarding commercial revenues from the sales of Etorel and Contiva maleate tablets, management’s plans and objectives for future operations and future results of anticipated product development efforts; potential

addressable market size; and Gyre’s liquidity and capital resources and business trends. In some cases, you can identify forward-looking statements by terms such as “believe,” “can,” “could,” “design,” “estimate,” “expect,” “forecast,”

“intend,” “may,” “might,” “plan,” “potential,” “predict,” “objective,” “should,” “strategy,” “will,” “would,” or the negative of these terms, and similar expressions intended to identify forward-looking statements. These statements involve

known and unknown risks, uncertainties and other factors that could cause Gyre’s actual results to differ materially from the forward-looking statements expressed or implied in this presentation, such as the uncertainties inherent in the

clinical drug development process, the regulatory approval process, the timing of any regulatory filings, the potential for substantial delays, the risk that earlier study results may not be predictive of future study results, manufacturing

risks, and competition from other therapies or products, as well as those described in “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition” in Gyre’s Annual Report on Form 10-K for the year ended December 31, 2024

filed on March 17, 2025 with the Securities and Exchange Commission (the “SEC”) and elsewhere in such filing and in Gyre’s other periodic reports and subsequent disclosure documents filed with the SEC. Gyre cannot assure you that it will

realize the results, benefits or developments that it expects or anticipates or, even if substantially realized, that they will result in the expected consequences or affect Gyre or its business in the ways expected. Forward-looking

statements are not historical facts, and reflect management’s current views with respect to future events. Given the significant uncertainties, you should evaluate all forward-looking statements made in this presentation in the context of

these risks and uncertainties and not place undue reliance on these forward-looking statements as predictions of future events. All forward-looking statements in this presentation apply only as of the date made and are expressly qualified in

their entirety by the cautionary statements included in this presentation. Gyre has no intention to publicly update or revise any forward-looking statements to reflect subsequent events or circumstances, except as required by law. Gyre

obtained the data used throughout this presentation from its own internal estimates and research, as well as from research, surveys and studies conducted by third parties. Internal estimates are derived from publicly available information and

Gyre’s own internal research and experience, and are based on assumptions made by management based on such data and its knowledge, which it believes to be reasonable. In addition, while Gyre believes the data included in this presentation is

reliable and based on reasonable assumptions, Gyre has not independently verified any third-party information, and all such data involve risks and uncertainties and are subject to change based on various factors. This presentation concerns a

discussion of investigational drugs that are under preclinical and/or clinical investigation and which have not yet been approved for marketing by the U.S. Food and Drug Administration. They are currently limited by Federal law to

investigational use, and no representations are made as to their safety or effectiveness for the purposes for which they are being investigated.

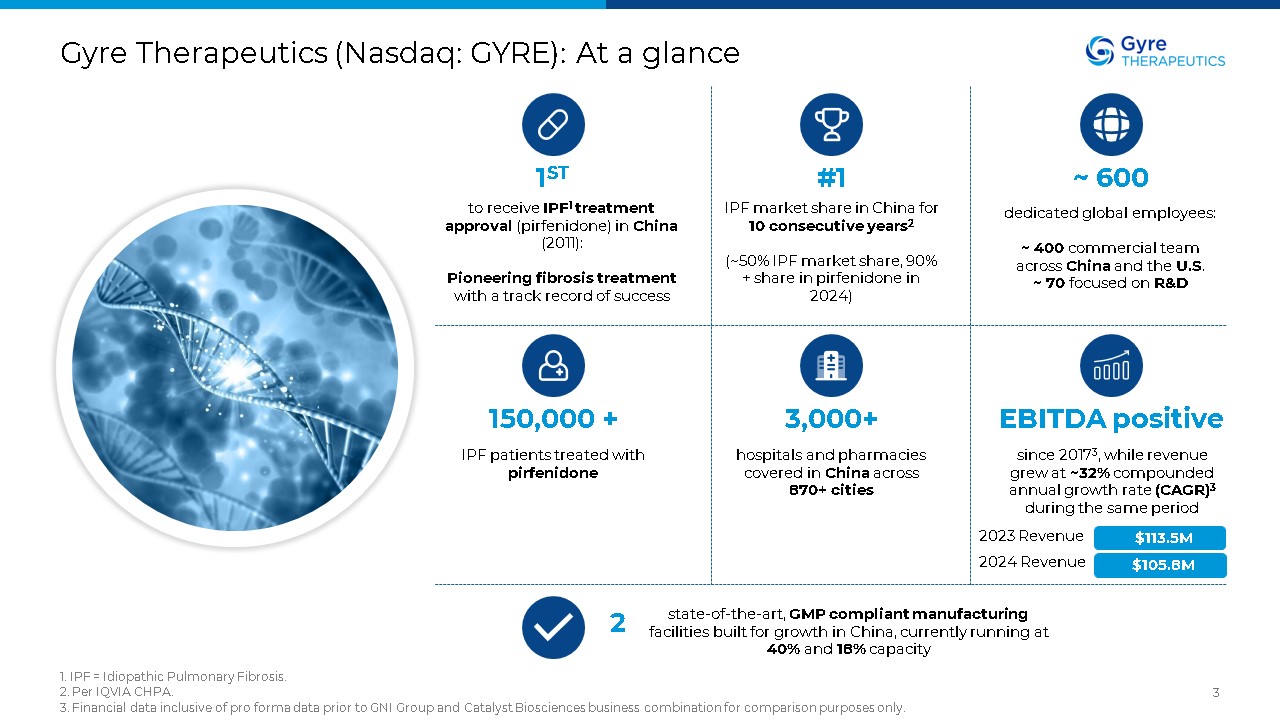

Gyre Therapeutics (Nasdaq: GYRE): At a glance 1. IPF = Idiopathic Pulmonary

Fibrosis. 2. Per IQVIA CHPA. 3. Financial data inclusive of pro forma data prior to GNI Group and Catalyst Biosciences business combination for comparison purposes only. 3 1ST to receive IPF1 treatment approval (pirfenidone) in China

(2011): Pioneering fibrosis treatment with a track record of success #1 IPF market share in China for 10 consecutive years2 (~50% IPF market share, 90% + share in pirfenidone in 2024) ~ 600 dedicated global employees: ~ 400

commercial team across China and the U.S. ~ 70 focused on R&D 150,000 + IPF patients treated with pirfenidone 3,000+ hospitals and pharmacies covered in China across 870+ cities EBITDA positive since 20173, while revenue grew

at ~32% compounded annual growth rate (CAGR)3 during the same period 2 state-of-the-art, GMP compliant manufacturing facilities built for growth in China, currently running at 40% and 18% capacity $113.5M 2023 Revenue 2024 Revenue

$105.8M

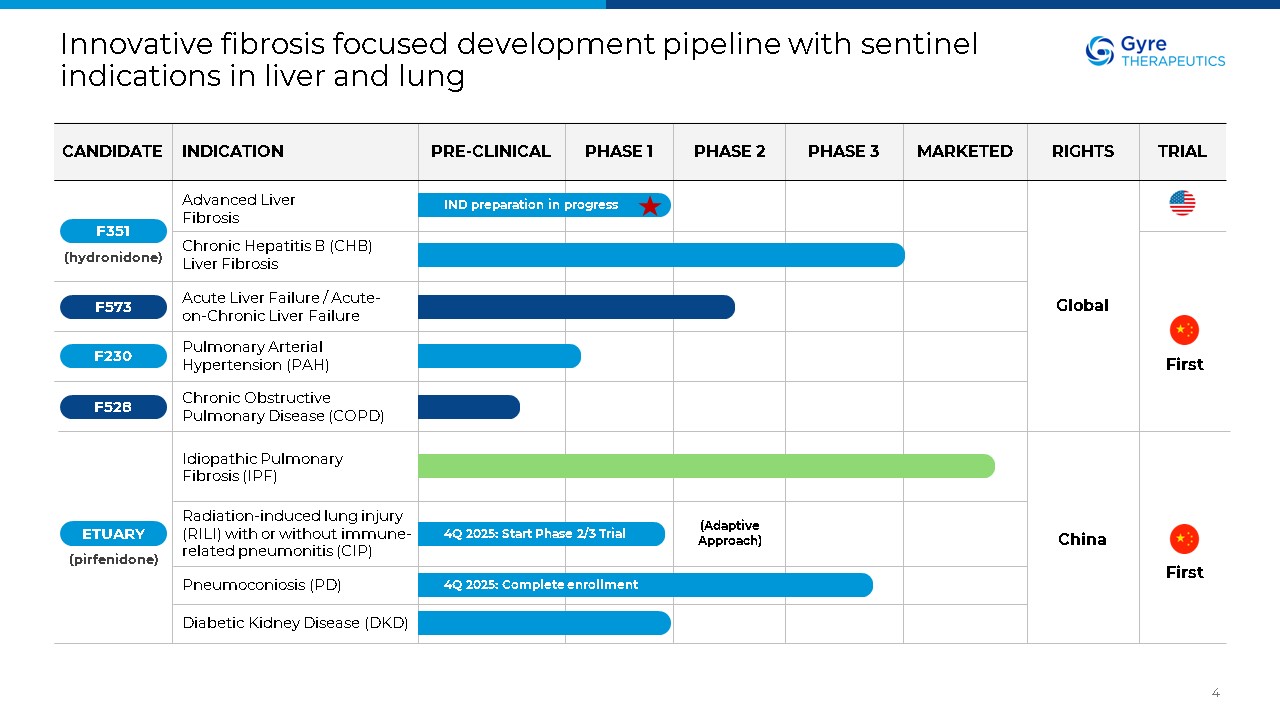

Innovative fibrosis focused development pipeline with sentinel indications in

liver and lung 4 Advanced Liver Fibrosis Chronic Hepatitis B (CHB) Liver Fibrosis (hydronidone) Acute Liver Failure / Acute-on-Chronic Liver Failure Pulmonary Arterial Hypertension (PAH) Chronic Obstructive Pulmonary Disease

(COPD) Idiopathic Pulmonary Fibrosis (IPF) Radiation-induced lung injury (RILI) with or without immune-related pneumonitis (CIP) Pneumoconiosis (PD) Diabetic Kidney Disease (DKD) Global China IND preparation in progress 4Q 2025: Start

Phase 2/3 Trial 4Q 2025: Complete enrollment (Adaptive Approach) F528 F230 F573 F351 ETUARY (pirfenidone) First First CANDIDATE INDICATION PRE-CLINICAL PHASE 1 PHASE 2 PHASE 3 MARKETED RIGHTS TRIAL

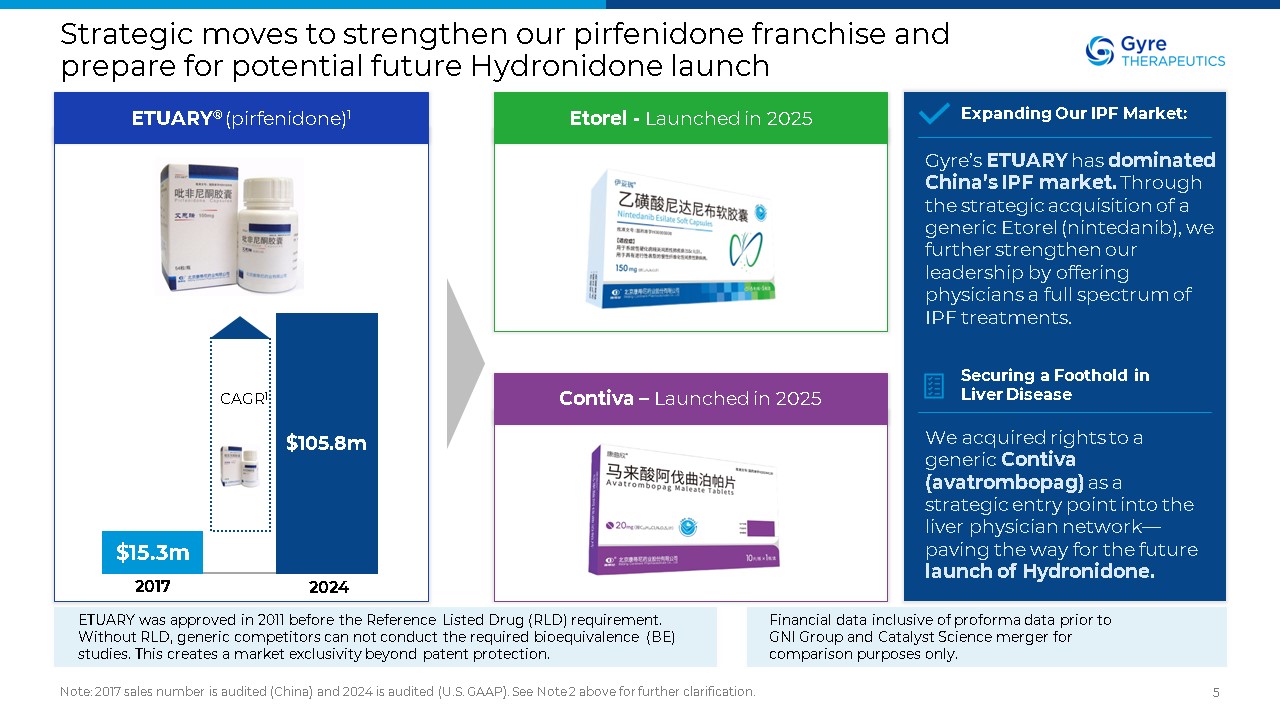

Strategic moves to strengthen our pirfenidone franchise and prepare for

potential future Hydronidone launch Note: 2017 sales number is audited (China) and 2024 is audited (U.S. GAAP). See Note 2 above for further clarification. 5 ETUARY® (pirfenidone)1 Etorel - Launched in 2025 Contiva – Launched in

2025 Gyre’s ETUARY has dominated China’s IPF market. Through the strategic acquisition of a generic Etorel (nintedanib), we further strengthen our leadership by offering physicians a full spectrum of IPF treatments. Expanding Our IPF

Market: We acquired rights to a generic Contiva (avatrombopag) as a strategic entry point into the liver physician network—paving the way for the future launch of Hydronidone. Securing a Foothold in Liver

Disease $15.3m $105.8m 2017 2024 CAGR1 Financial data inclusive of proforma data prior to GNI Group and Catalyst Science merger for comparison purposes only. ETUARY was approved in 2011 before the Reference Listed Drug (RLD)

requirement. Without RLD, generic competitors can not conduct the required bioequivalence (BE) studies. This creates a market exclusivity beyond patent protection.

ITT = Intent-To-Treat. 2. NMPA = National Medical Products Administration of

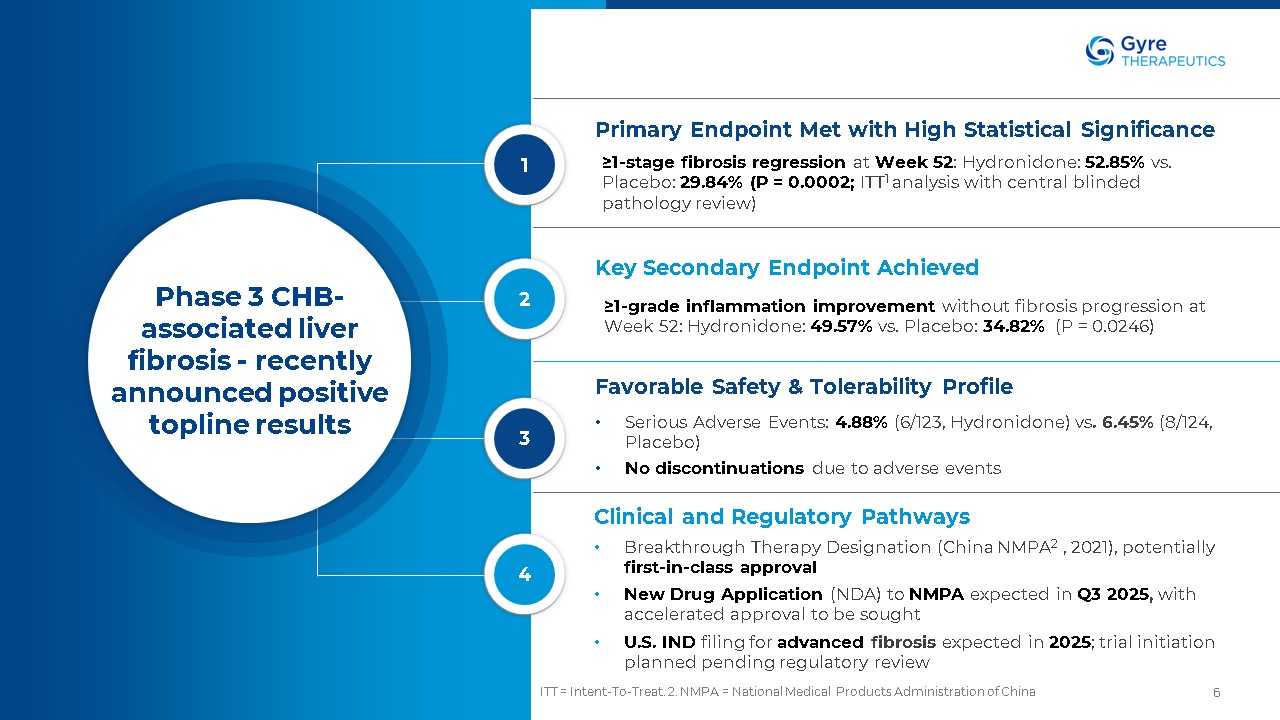

China 6 Co-secreted with insulin from pancreatic beta cells Co-secreted with insulin from pancreatic beta cells Co-secreted with insulin from pancreatic beta cells Phase 3 CHB-associated liver fibrosis - recently announced positive

topline results Primary Endpoint Met with High Statistical Significance ≥1-stage fibrosis regression at Week 52: Hydronidone: 52.85% vs. Placebo: 29.84% (P = 0.0002; ITT1 analysis with central blinded pathology review) Key Secondary

Endpoint Achieved ≥1-grade inflammation improvement without fibrosis progression at Week 52: Hydronidone: 49.57% vs. Placebo: 34.82% (P = 0.0246) Favorable Safety & Tolerability Profile Serious Adverse Events: 4.88% (6/123,

Hydronidone) vs. 6.45% (8/124, Placebo) No discontinuations due to adverse events Clinical and Regulatory Pathways Breakthrough Therapy Designation (China NMPA2 , 2021), potentially first-in-class approval New Drug Application (NDA) to

NMPA expected in Q3 2025, with accelerated approval to be sought U.S. IND filing for advanced fibrosis expected in 2025; trial initiation planned pending regulatory review 1 2 3 4

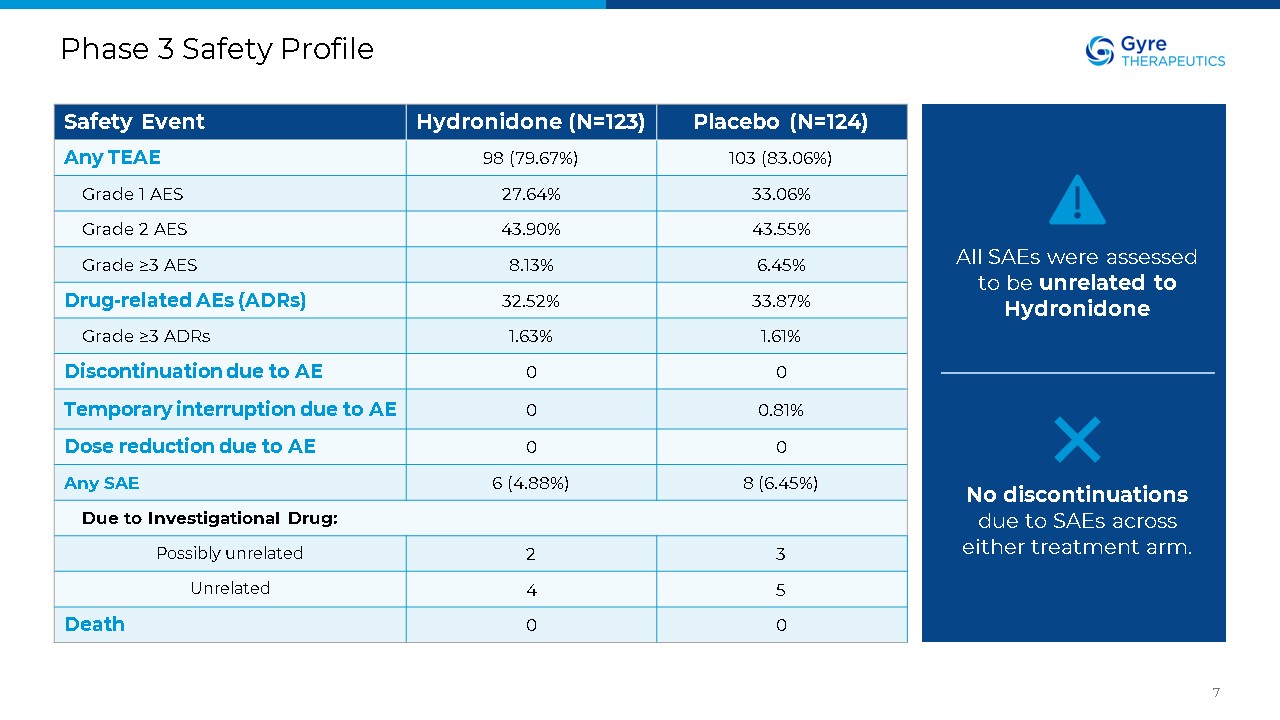

Phase 3 Safety Profile 7 Safety Event Hydronidone (N=123) Placebo

(N=124) Any TEAE 98 (79.67%) 103 (83.06%) Grade 1 AES 27.64% 33.06% Grade 2 AES 43.90% 43.55% Grade ≥3 AES 8.13% 6.45% Drug-related AEs (ADRs) 32.52% 33.87% Grade ≥3 ADRs 1.63% 1.61% Discontinuation due to

AE 0 0 Temporary interruption due to AE 0 0.81% Dose reduction due to AE 0 0 Any SAE 6 (4.88%) 8 (6.45%) Due to Investigational Drug: Possibly unrelated 2 3 Unrelated 4 5 Death 0 0 All SAEs were assessed to be unrelated

to Hydronidone No discontinuations due to SAEs across either treatment arm.

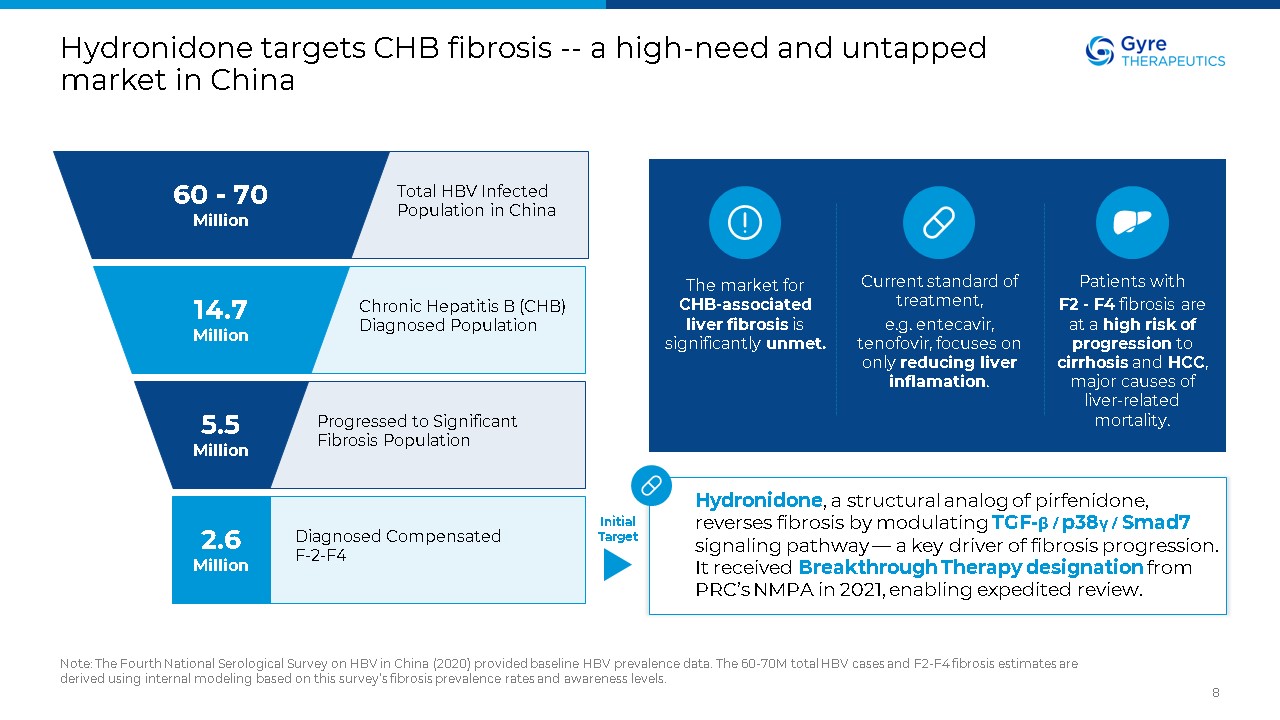

Hydronidone targets CHB fibrosis -- a high-need and untapped market in

China Note: The Fourth National Serological Survey on HBV in China (2020) provided baseline HBV prevalence data. The 60-70M total HBV cases and F2-F4 fibrosis estimates are derived using internal modeling based on this survey’s fibrosis

prevalence rates and awareness levels. 8 60 - 70 Million 14.7 Million 5.5 Million 2.6 Million Total HBV Infected Population in China Chronic Hepatitis B (CHB) Diagnosed Population Progressed to Significant Fibrosis

Population Diagnosed Compensated F-2-F4 Hydronidone, a structural analog of pirfenidone, reverses fibrosis by modulating TGF-β / p38γ / Smad7 signaling pathway — a key driver of fibrosis progression. It received Breakthrough Therapy

designation from PRC’s NMPA in 2021, enabling expedited review. Current standard of treatment, e.g. entecavir, tenofovir, focuses on only reducing liver inflamation. Patients with F2 - F4 fibrosis are at a high risk of progression to

cirrhosis and HCC, major causes of liver-related mortality. The market for CHB-associated liver fibrosis is significantly unmet. Initial Target

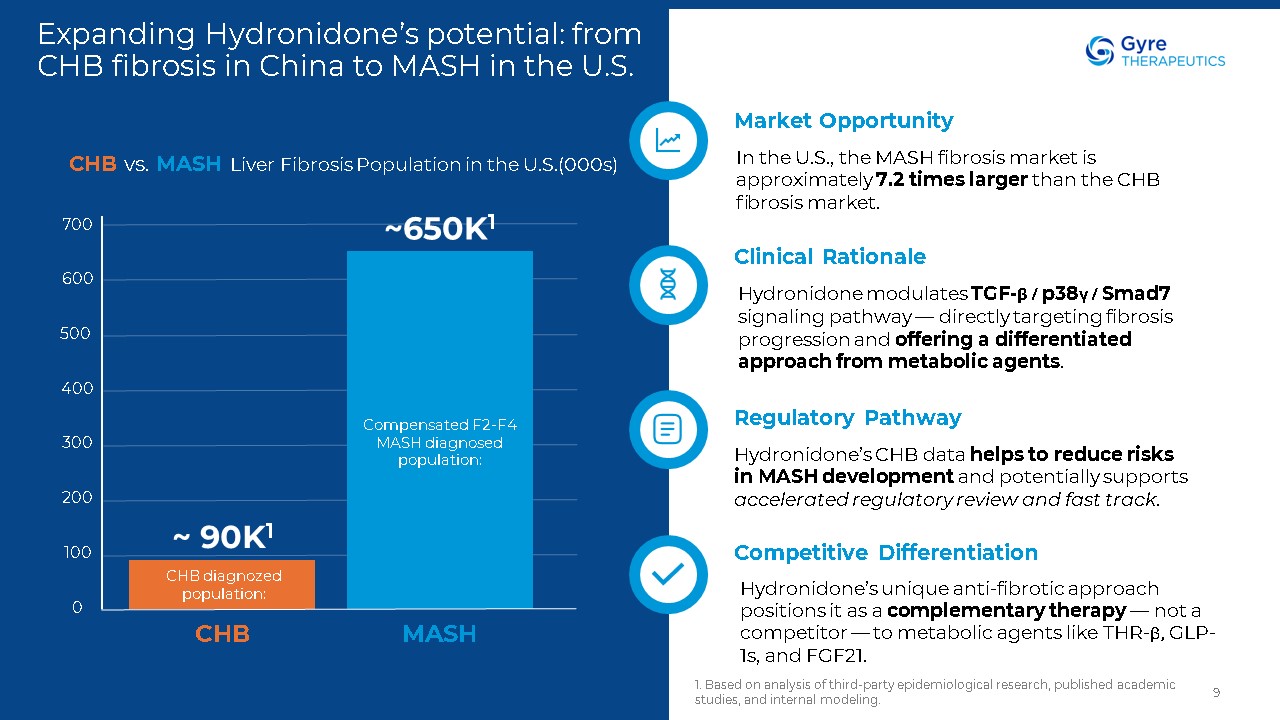

Expanding Hydronidone’s potential: from CHB fibrosis in China to MASH in the

U.S. 1. Based on analysis of third-party epidemiological research, published academic studies, and internal modeling. 9 Market Opportunity In the U.S., the MASH fibrosis market is approximately 7.2 times larger than the CHB fibrosis

market. Clinical Rationale Hydronidone modulates TGF-β / p38γ / Smad7 signaling pathway — directly targeting fibrosis progression and offering a differentiated approach from metabolic agents. Regulatory Pathway Hydronidone’s CHB data

helps to reduce risks in MASH development and potentially supports accelerated regulatory review and fast track. Competitive Differentiation Hydronidone’s unique anti-fibrotic approach positions it as a complementary therapy — not a

competitor — to metabolic agents like THR-β, GLP-1s, and FGF21. CHB MASH 700 500 400 300 200 100 0 600 Compensated F2-F4 MASH diagnosed population: CHB vs. MASH Liver Fibrosis Population in the U.S.(000s) ~650K1 CHB diagnozed

population: ~ 90K1

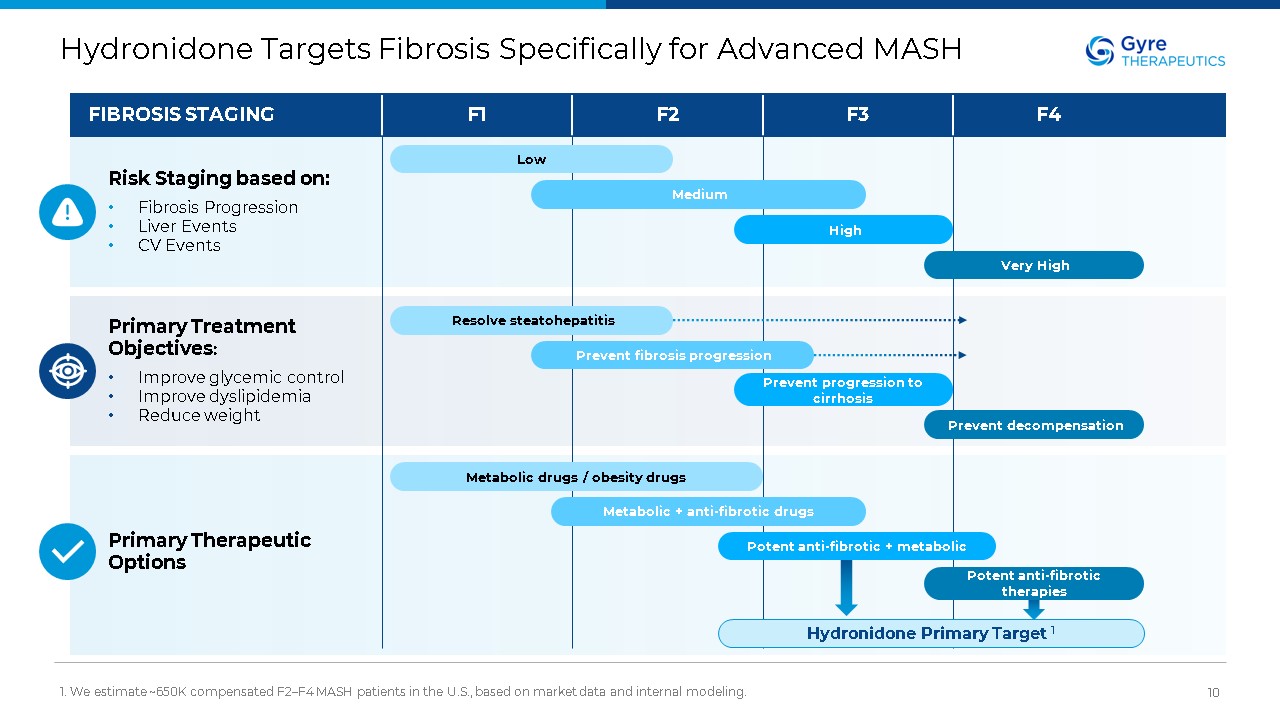

Hydronidone Targets Fibrosis Specifically for Advanced MASH 1. We estimate

~650K compensated F2–F4 MASH patients in the U.S., based on market data and internal modeling. 10 Hydronidone Primary Target 1 FIBROSIS STAGING Risk Staging based on: Fibrosis Progression Liver Events CV Events Primary Treatment

Objectives: Improve glycemic control Improve dyslipidemia Reduce weight F1 F2 F3 F4 Primary Therapeutic Options Low Medium High Very High Resolve steatohepatitis Prevent fibrosis progression Prevent progression to

cirrhosis Prevent decompensation Metabolic drugs / obesity drugs Metabolic + anti-fibrotic drugs Potent anti-fibrotic + metabolic Potent anti-fibrotic therapies

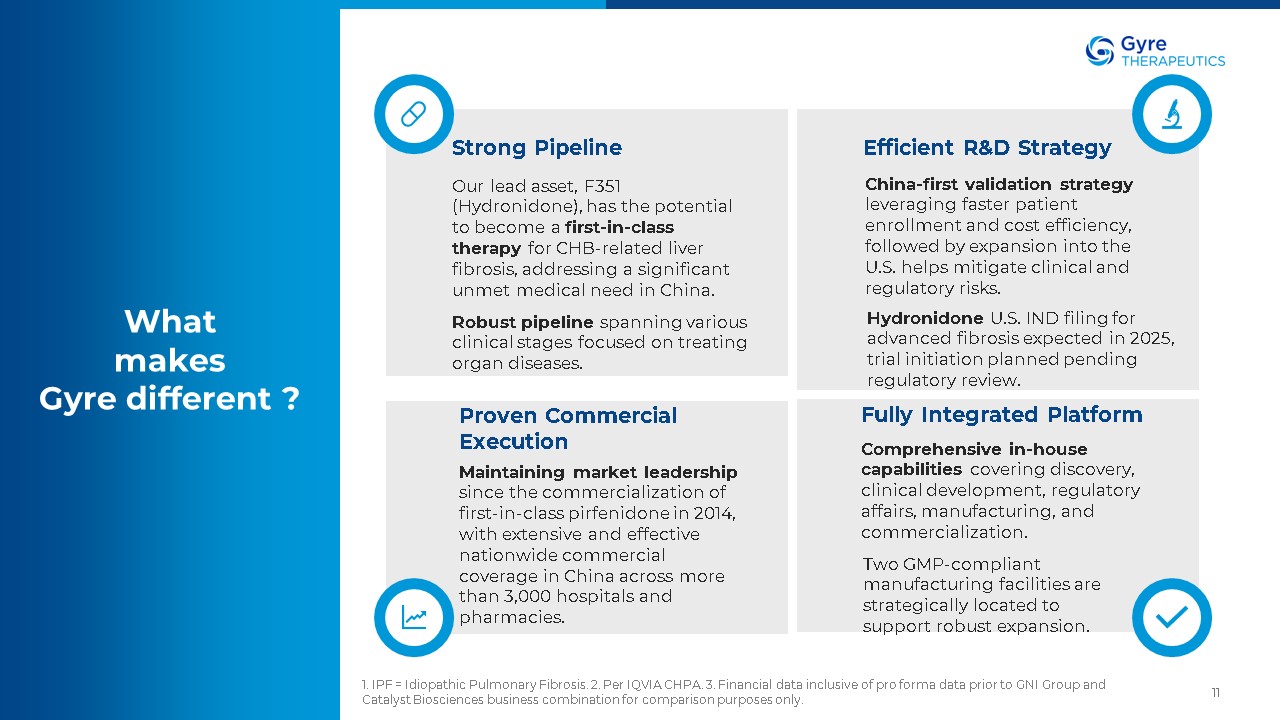

11 What makes Gyre different ? Strong Pipeline Our lead asset, F351

(Hydronidone), has the potential to become a first-in-class therapy for CHB-related liver fibrosis, addressing a significant unmet medical need in China. Robust pipeline spanning various clinical stages focused on treating organ

diseases. Efficient R&D Strategy China-first validation strategy leveraging faster patient enrollment and cost efficiency, followed by expansion into the U.S. helps mitigate clinical and regulatory risks. Hydronidone U.S. IND filing

for advanced fibrosis expected in 2025, trial initiation planned pending regulatory review. Proven Commercial Execution Fully Integrated Platform Comprehensive in-house capabilities covering discovery, clinical development, regulatory

affairs, manufacturing, and commercialization. Two GMP-compliant manufacturing facilities are strategically located to support robust expansion. Maintaining market leadership since the commercialization of first-in-class pirfenidone in

2014, with extensive and effective nationwide commercial coverage in China across more than 3,000 hospitals and pharmacies. 1. IPF = Idiopathic Pulmonary Fibrosis. 2. Per IQVIA CHPA. 3. Financial data inclusive of pro forma data prior to GNI

Group and Catalyst Biosciences business combination for comparison purposes only.

Thank you Contact: David Zhang David.Zhang@Gyretx.com

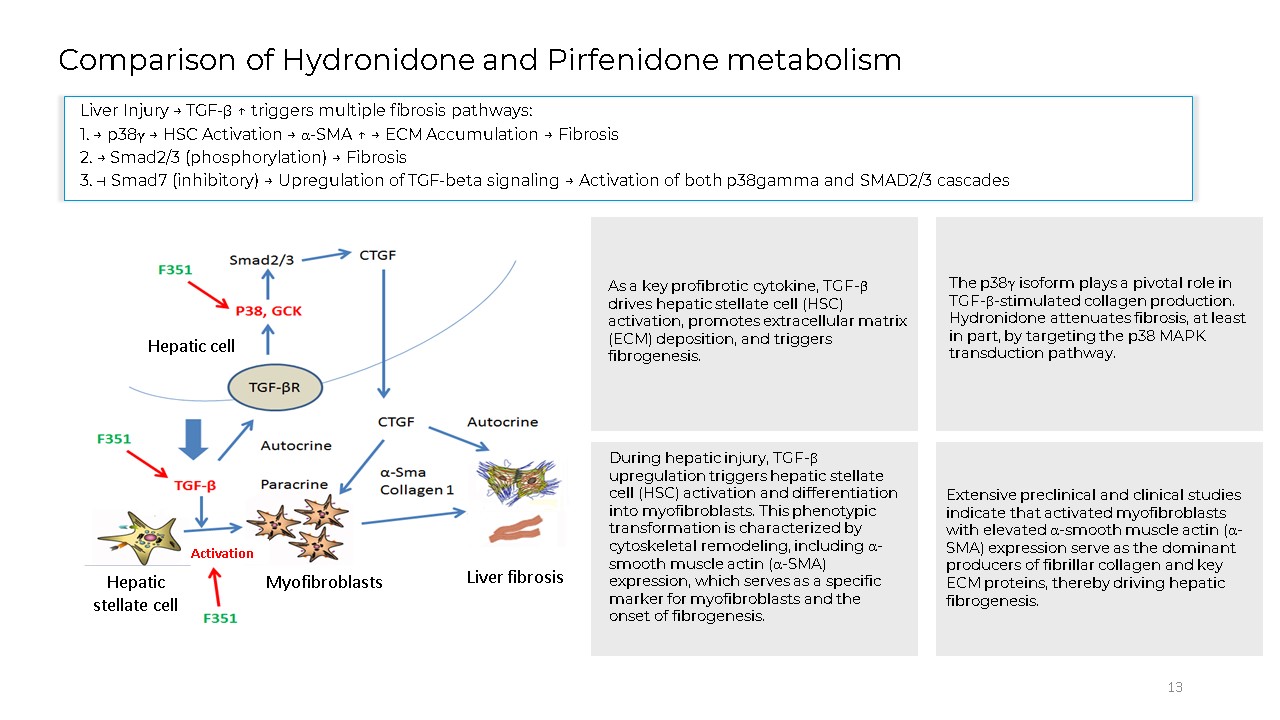

13 Comparison of Hydronidone and Pirfenidone metabolism Hepatic cell Hepatic

stellate cell Myofibroblasts Liver fibrosis Activation Liver Injury → TGF-β ↑ triggers multiple fibrosis pathways: 1. → p38γ → HSC Activation → α-SMA ↑ → ECM Accumulation → Fibrosis 2. → Smad2/3 (phosphorylation) → Fibrosis 3. ⊣ Smad7

(inhibitory) → Upregulation of TGF-beta signaling → Activation of both p38gamma and SMAD2/3 cascades As a key profibrotic cytokine, TGF-β drives hepatic stellate cell (HSC) activation, promotes extracellular matrix (ECM) deposition, and

triggers fibrogenesis. The p38γ isoform plays a pivotal role in TGF-β-stimulated collagen production. Hydronidone attenuates fibrosis, at least in part, by targeting the p38 MAPK transduction pathway. During hepatic injury, TGF-β

upregulation triggers hepatic stellate cell (HSC) activation and differentiation into myofibroblasts. This phenotypic transformation is characterized by cytoskeletal remodeling, including α-smooth muscle actin (α-SMA) expression, which serves

as a specific marker for myofibroblasts and the onset of fibrogenesis. Extensive preclinical and clinical studies indicate that activated myofibroblasts with elevated α-smooth muscle actin (α-SMA) expression serve as the dominant producers

of fibrillar collagen and key ECM proteins, thereby driving hepatic fibrogenesis.

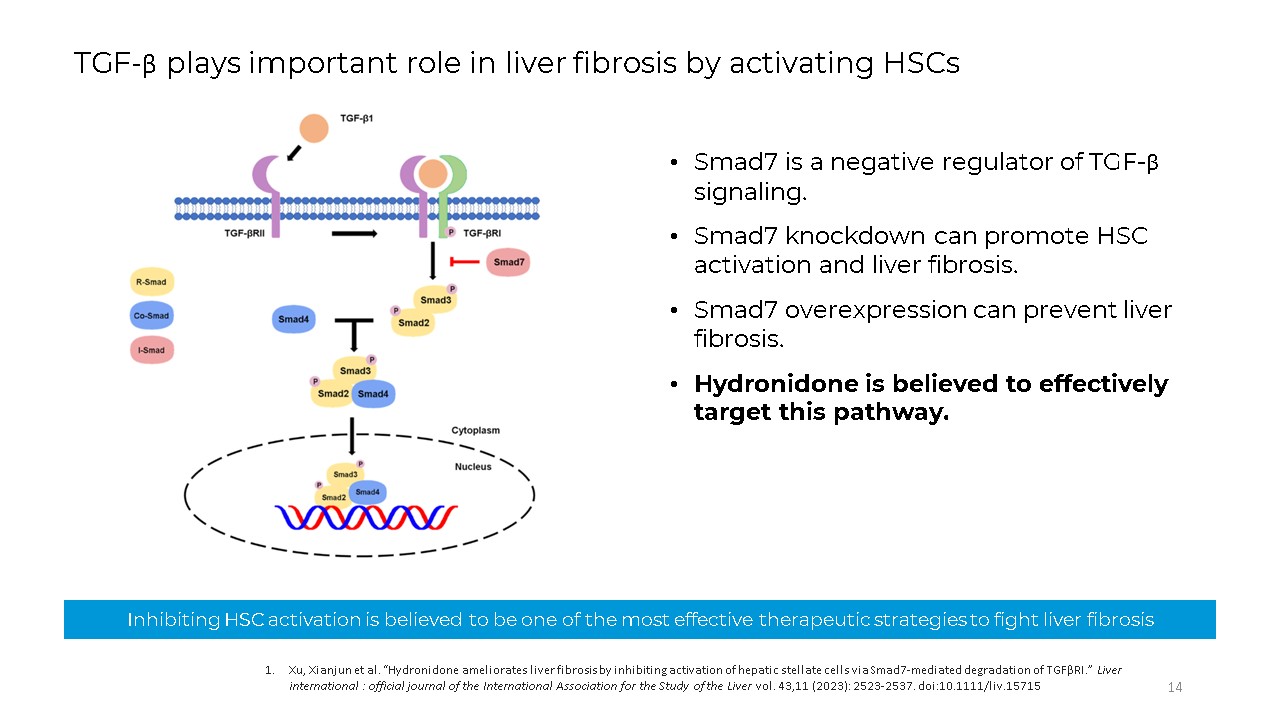

Smad7 is a negative regulator of TGF-β signaling. Smad7 knockdown can promote

HSC activation and liver fibrosis. Smad7 overexpression can prevent liver fibrosis. Hydronidone is believed to effectively target this pathway. Inhibiting HSC activation is believed to be one of the most effective therapeutic strategies to

fight liver fibrosis 14 Xu, Xianjun et al. “Hydronidone ameliorates liver fibrosis by inhibiting activation of hepatic stellate cells via Smad7-mediated degradation of TGFβRI.” Liver international : official journal of the International

Association for the Study of the Liver vol. 43,11 (2023): 2523-2537. doi:10.1111/liv.15715 TGF-β plays important role in liver fibrosis by activating HSCs

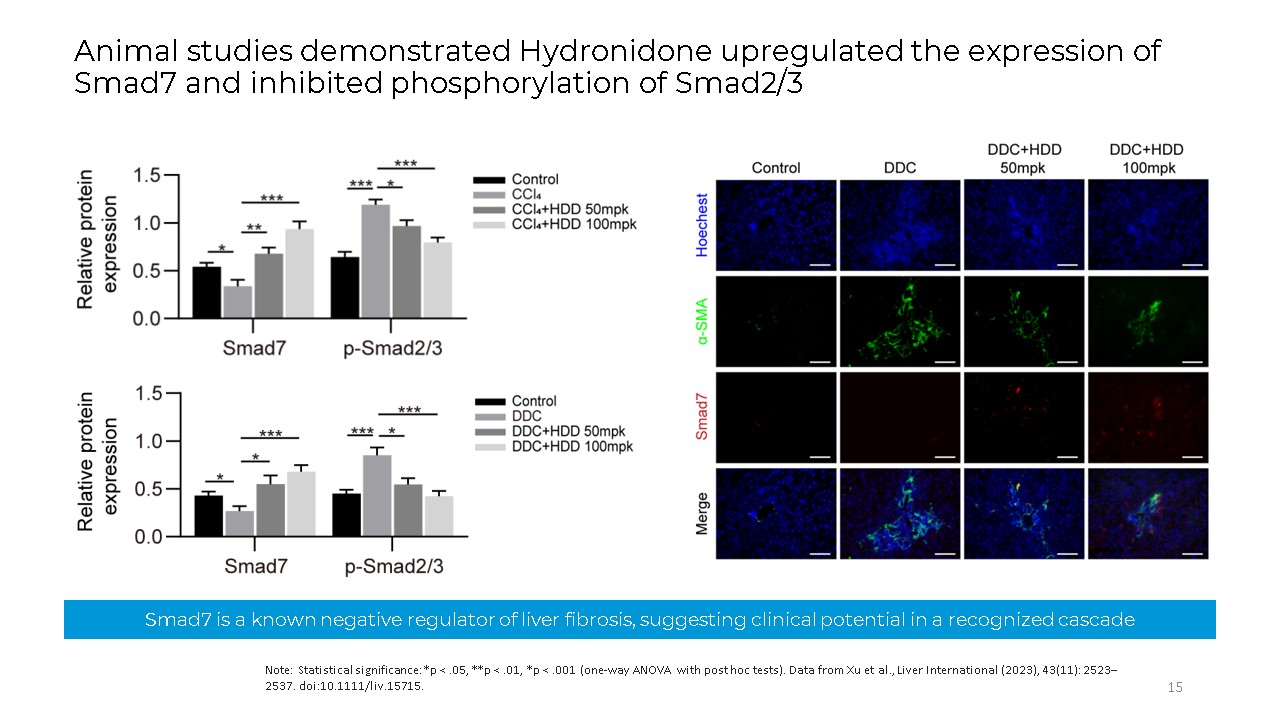

Smad7 is a known negative regulator of liver fibrosis, suggesting clinical

potential in a recognized cascade Note: Statistical significance: *p < .05, **p < .01, *p < .001 (one-way ANOVA with post hoc tests). Data from Xu et al., Liver International (2023), 43(11): 2523–2537.

doi:10.1111/liv.15715. 15 Animal studies demonstrated Hydronidone upregulated the expression of Smad7 and inhibited phosphorylation of Smad2/3

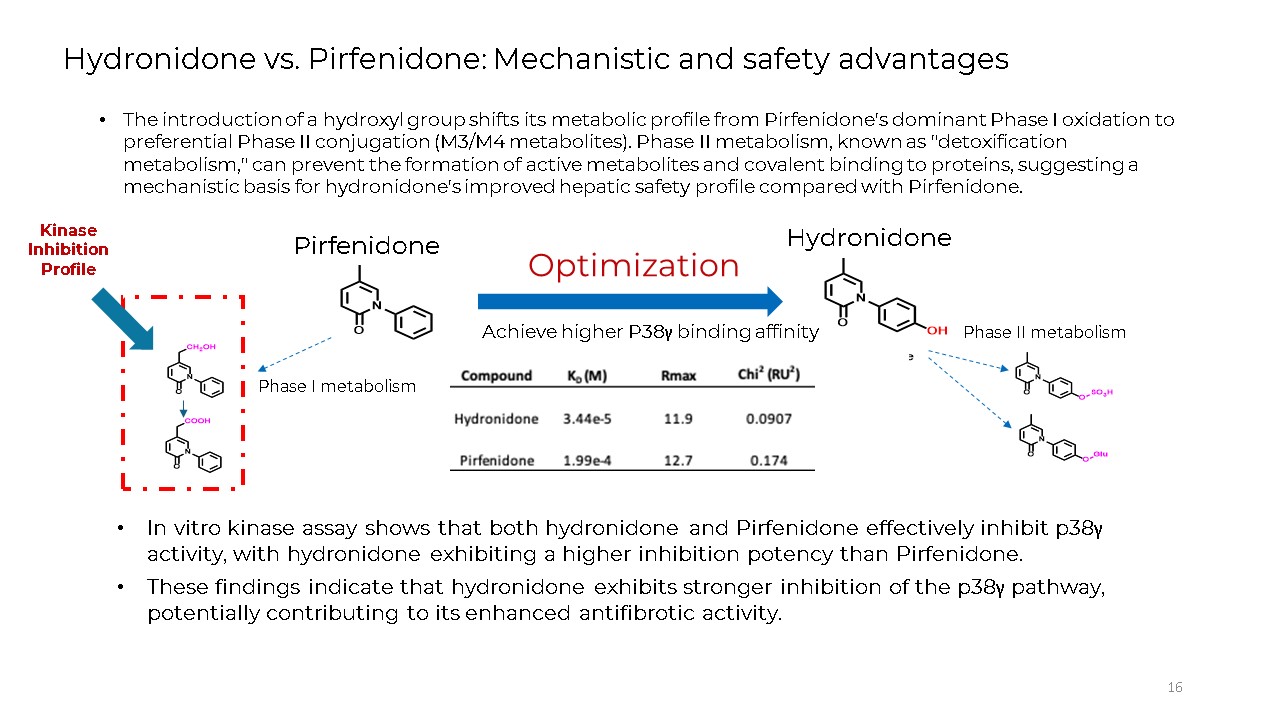

16 Hydronidone vs. Pirfenidone: Mechanistic and safety advantages The

introduction of a hydroxyl group shifts its metabolic profile from Pirfenidone's dominant Phase I oxidation to preferential Phase II conjugation (M3/M4 metabolites). Phase II metabolism, known as "detoxification metabolism," can prevent the

formation of active metabolites and covalent binding to proteins, suggesting a mechanistic basis for hydronidone's improved hepatic safety profile compared with Pirfenidone. Phase II metabolism Phase I metabolism Optimization Achieve

higher P38γ binding affinity Pirfenidone Hydronidone Kinase Inhibition Profile In vitro kinase assay shows that both hydronidone and Pirfenidone effectively inhibit p38γ activity, with hydronidone exhibiting a higher inhibition potency

than Pirfenidone. These findings indicate that hydronidone exhibits stronger inhibition of the p38γ pathway, potentially contributing to its enhanced antifibrotic activity.

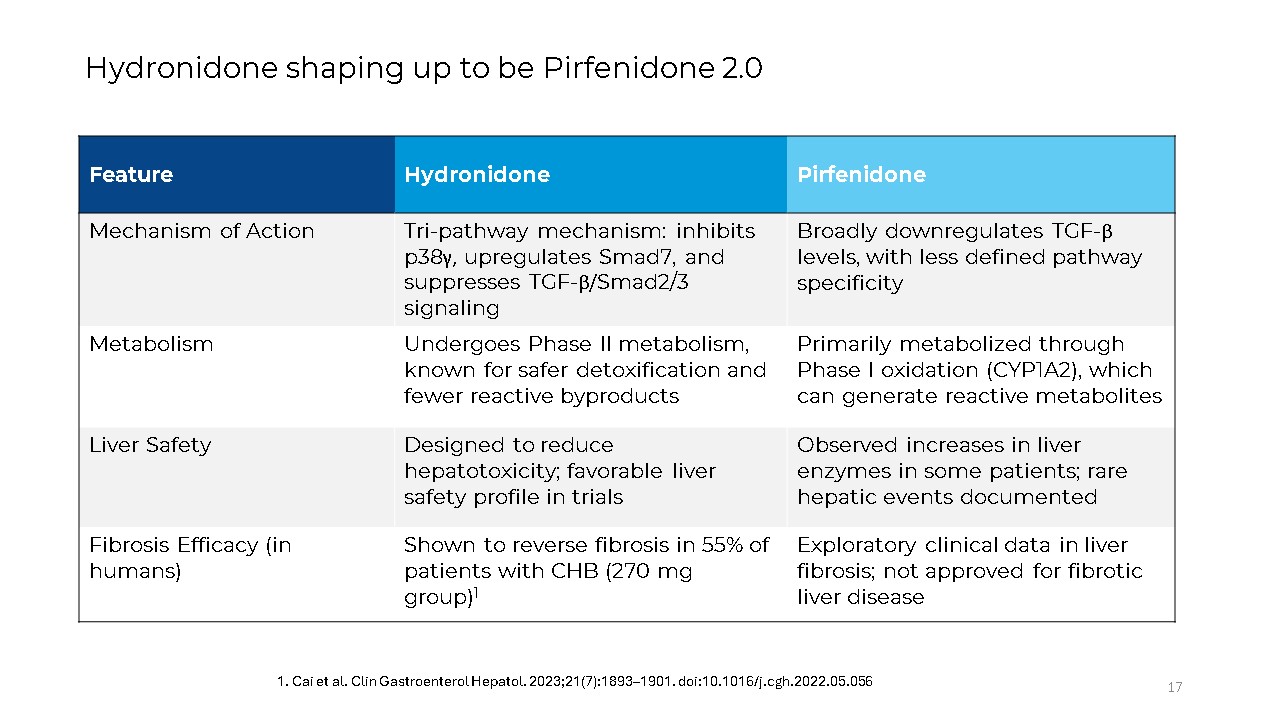

17 Hydronidone shaping up to be Pirfenidone

2.0 Feature Hydronidone Pirfenidone Mechanism of Action Tri-pathway mechanism: inhibits p38γ, upregulates Smad7, and suppresses TGF-β/Smad2/3 signaling Broadly downregulates TGF-β levels, with less defined pathway

specificity Metabolism Undergoes Phase II metabolism, known for safer detoxification and fewer reactive byproducts Primarily metabolized through Phase I oxidation (CYP1A2), which can generate reactive metabolites Liver Safety Designed to

reduce hepatotoxicity; favorable liver safety profile in trials Observed increases in liver enzymes in some patients; rare hepatic events documented Fibrosis Efficacy (in humans) Shown to reverse fibrosis in 55% of patients with CHB (270

mg group)1 Exploratory clinical data in liver fibrosis; not approved for fibrotic liver disease 1. Cai et al. Clin Gastroenterol Hepatol. 2023;21(7):1893–1901. doi:10.1016/j.cgh.2022.05.056

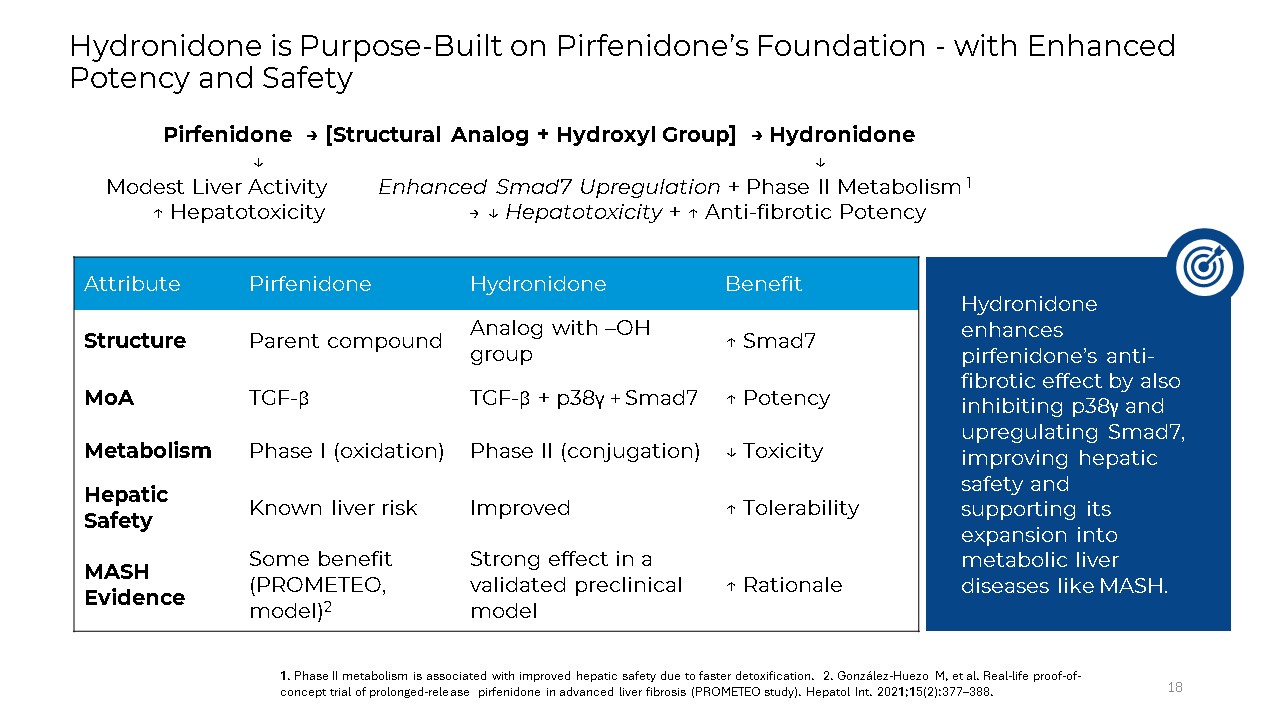

Hydronidone is Purpose-Built on Pirfenidone’s Foundation - with Enhanced Potency

and Safety 18 Pirfenidone → [Structural Analog + Hydroxyl Group] → Hydronidone ↓ ↓ Modest Liver Activity Enhanced Smad7 Upregulation + Phase II Metabolism 1 ↑ Hepatotoxicity → ↓ Hepatotoxicity + ↑ Anti-fibrotic

Potency Attribute Pirfenidone Hydronidone Benefit Structure Parent compound Analog with –OH group ↑ Smad7 MoA TGF-β TGF-β + p38γ + Smad7 ↑ Potency Metabolism Phase I (oxidation) Phase II (conjugation) ↓ Toxicity Hepatic

Safety Known liver risk Improved ↑ Tolerability MASH Evidence Some benefit (PROMETEO, model)2 Strong effect in a validated preclinical model ↑ Rationale 1. Phase II metabolism is associated with improved hepatic safety due to faster

detoxification. 2. González-Huezo M, et al. Real-life proof-of-concept trial of prolonged-release pirfenidone in advanced liver fibrosis (PROMETEO study). Hepatol Int. 2021;15(2):377–388. Hydronidone enhances pirfenidone’s anti-fibrotic

effect by also inhibiting p38γ and upregulating Smad7, improving hepatic safety and supporting its expansion into metabolic liver diseases like MASH.