Exhibit 99.2

OPERATING AND FINANCIAL REVIEW AND PROSPECTS

You should read the following discussion and analysis of results of operations, financial condition and prospects of Freightos Limited (referred to as “Freightos”, “the Company”, “our company”, “we”, “us” and similar terms) together with (i) our interim unaudited consolidated financial statements for the six months ended June 30, 2025, included as Exhibit 99.1 to the Report of Foreign Private Issuer on Form 6-K (the “Report”) to which this Operating and Financial Review and Prospects is attached, and (ii) our audited consolidated financial statements and the related notes for the year ended December 31, 2024 appearing in our Annual Report on Form 20-F for the year ended December 31, 2024, filed with the Securities and Exchange Commission (the “SEC”) on March 24, 2025 (our “Annual Report”) and “Item 5 – Operating and Financial Review and Prospects” of that Annual Report. This discussion contains forward-looking statements that reflect our plans, estimates and beliefs that involve risks and uncertainties. As a result of many factors, such as those set forth under the “Risk Factors” and “Cautionary Note Regarding Forward-Looking Statements” sections of our Annual Report, our actual results may differ materially from those anticipated in these forward-looking statements.

Overview

Our mission is to expand trade among the people of the world, making global trade more efficient and transparent by streamlining air, ocean and land freight pricing and booking across carriers, freight forwarders, importers and exporters on the world’s digital freight platform.

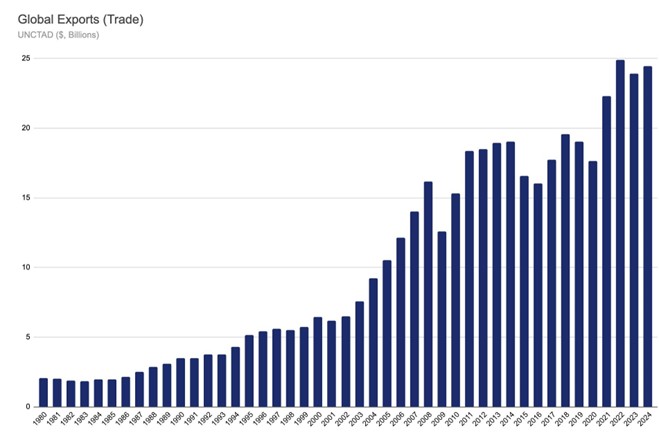

We operate a leading, vendor-neutral booking and payment platform for international freight, spanning air, ocean and ground. Our Platform supports supply chain efficiency and agility by enabling real-time procurement of ocean and air shipping across more than ten thousand importers/exporters, thousands of freight forwarders, and dozens of airlines and ocean carriers. According to the United Nations Conference on Trade and Development (“UNCTAD”), the value of goods traded internationally reached an estimated $24.4 trillion in 2024, representing approximately 22% of global gross domestic product (“GDP”). International trade is facilitated by the third-party logistics market, which, according to logistics research firm Armstrong & Associates, generated 1.22 trillion dollars in revenue in 2024, exceeding pre-pandemic numbers by some 25%.

Despite its size and importance, global freight has not yet undergone a comprehensive digital transformation. Unlike passenger travel, hotels and retail, cross-border freight services remain largely offline, opaque and inefficient. Most international air and ocean shipments involve multiple intermediaries, often with as many as 30 actors and 100 people, communicating across time zones. These manual processes, replicated hundreds of thousands of times each day, typically result in delays, non-binding and inconsistent pricing, and uncertain transit times. Even on major trade lanes, such as Asia to the United States, our research shows that - even in 2024 - it is common for importers/exporters to wait several days for a spot price quote, and prices often vary by tens of percentage points. Actual prices and transit times are usually not guaranteed and are unpredictable.

The consequences of this dysfunction flow through international freight, supply chains and, ultimately, businesses and consumers everywhere. As a result, consumers pay more for goods, businesses experience reduced margins, and goods remain under or overstocked. The environment also suffers from this lack of efficiency; according to the International Air Transport Association (“IATA”), air cargo holds in 2024 were only 46% utilized - more than half empty.

These inefficiencies are amplified by persistent volatility impacting the global trade environment. These impact factors can range from global wars, like the Russia-Ukraine conflict that changed air routes or the shutdown of the Red Sea by Houthi terrorists, “trade wars”, like that experienced in 2025, pandemics and natural disasters. Without fully deployed digitalization - we estimate that even in the air cargo spot market - a relatively advanced market when it comes to digital adoption - less than 10% of bookings are booked through digital platforms and well over half of capacity is booked offline. As a result,supply chains are unable to respond to stressors in an agile and cost-effective manner.

We operate our business in two segments. In our Platform segment, we connect Buyers and Sellers of freight services to provide digitalized price quoting, booking, payments and basic shipment management - the sellers are typically carriers or forwarders while buyers can be carriers, forwarders, or importers and exporters (sometimes referred to as “shippers”). In our Solutions segment, we provide software tools and data to help industry participants automate their pricing, sales and procurement processes. In addition to driving significant value for companies around the world, our SaaS products encourage adoption of our Platform. Other companies that have successfully deployed SaaS-enabled marketplace strategies include OpenTable, Zenefits and Carta.

Given the size, complexity and conservatism of the international freight industry, it took us a decade to achieve direct digital connections with multiple layers of the industry: carriers, freight forwarders (who are analogous to sophisticated travel agents for goods) and importers/exporters. Around 2020, we achieved a critical mass of airlines offering digital connections, and our Platform reached an inflection point. Since then, we have achieved rapid growth of our gross booking value (“GBV”, also referred to by some as “GMV”), which is equal to the total value of freight services and related services purchased on our Platform. In most cases, freight