Shareholder Report

|

6 Months Ended |

|

Jun. 30, 2025

USD ($)

shares

|

|---|

| Shareholder Report [Line Items] |

|

| Document Type |

N-CSRS

|

| Amendment Flag |

false

|

| Registrant Name |

Trailmark Series Trust

|

| Entity Central Index Key |

0001643838

|

| Entity Investment Company Type |

N-1A

|

| Document Period End Date |

Jun. 30, 2025

|

| IDX Risk-Managed Digital Assets Strategy Fund | Institutional Class |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

IDX Risk-Managed Digital Assets Strategy Fund

|

| Class Name |

Institutional Class

|

| Trading Symbol |

BTIDX

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the IDX Risk-Managed Digital Assets Strategy Fund, for the period of January 1, 2025 to June 30, 2025.

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information at https://idxfunds.com/btidx/ or (216) 329-4271.

|

| Material Fund Change Notice [Text Block] |

This report describes changes to the Fund that occurred during the reporting period

|

| Additional Information Phone Number |

(216) 329-4271

|

| Additional Information Website |

https://idxfunds.com/btidx/

|

| Expenses [Text Block] |

(Based on a hypothetical $10,000 investment)

| Institutional Class |

$131 |

2.63% |

|

| Expenses Paid, Amount |

$ 131

|

| Expense Ratio, Percent |

2.63%

|

| Material Change Date |

Jul. 31, 2025

|

| Net Assets |

$ 16,228,160

|

| Holdings Count | shares |

1

|

| Advisory Fees Paid, Amount |

$ 22,588

|

| Investment Company, Portfolio Turnover |

0.00%

|

| Additional Fund Statistics [Text Block] |

(as of June 30, 2025)

| Net Assets ($) |

$16,228,160 |

| Number of Portfolio Holdings* |

1 |

| Portfolio Turnover Rate (%) |

0% |

| Total Advisory Fees Paid ($) (net of waivers) |

$22,588 |

| | * | Does not include derivatives. |

|

| Holdings [Text Block] |

(as of June 30, 2025)

|

First American Government Obligations Fund, Class X

|

51.90% |

|

Total

|

51.90% |

|

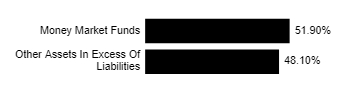

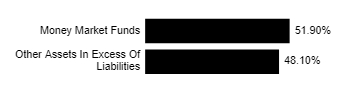

Money Market Funds

|

51.90% |

|

Other Assets In Excess Of Liabilities

|

48.10% |

|

| Largest Holdings [Text Block] |

|

First American Government Obligations Fund, Class X

|

51.90% |

|

Total

|

51.90% |

|

| Material Fund Change [Text Block] |

This is a summary of certain changes to the Fund since January 1, 2025. For more complete information, you may review the Fund's prospectus dated April 30, 2025, which is available at https://idxfunds.com/coidx/ or upon request at (216) 329-4271. Effective July 31, 2025, the Board approved the renaming of IDX Funds (the "Trust") to Trailmark Series Trust. The Fund is a series of the Trust. |

| Material Fund Change Name [Text Block] |

Effective July 31, 2025, the Board approved the renaming of IDX Funds (the "Trust") to Trailmark Series Trust. The Fund is a series of the Trust.

|

| Summary of Change Legend [Text Block] |

This is a summary of certain changes to the Fund since January 1, 2025. For more complete information, you may review the Fund's prospectus dated April 30, 2025, which is available at https://idxfunds.com/coidx/ or upon request at (216) 329-4271.

|

| Updated Prospectus Phone Number |

(216) 329-4271

|

| Updated Prospectus Web Address |

https://idxfunds.com/coidx/

|

| IDX Adaptive Opportunities Fund | Institutional Class |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

IDX Adaptive Opportunities Fund

|

| Class Name |

Institutional Class

|

| Trading Symbol |

COIDX

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the IDX Adaptive Opportunities Fund, for the period of January 1, 2025 to June 30, 2025.

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information at https://idxfunds.com/coidx/ or (216) 329-4271.

|

| Material Fund Change Notice [Text Block] |

This report describes changes to the Fund that occurred during the reporting period

|

| Additional Information Phone Number |

(216) 329-4271

|

| Additional Information Website |

https://idxfunds.com/coidx/

|

| Expenses [Text Block] |

(Based on a hypothetical $10,000 investment)

| Institutional Class |

$97 |

1.93% |

|

| Expenses Paid, Amount |

$ 97

|

| Expense Ratio, Percent |

1.93%

|

| Material Change Date |

Jan. 01, 2025

|

| Net Assets |

$ 20,878,353

|

| Holdings Count | shares |

12

|

| Advisory Fees Paid, Amount |

$ 62,914

|

| Investment Company, Portfolio Turnover |

0.00%

|

| Additional Fund Statistics [Text Block] |

(as of June 30, 2025)

| Net Assets ($) |

$20,878,353 |

| Number of Portfolio Holdings* |

12 |

| Portfolio Turnover Rate (%) |

0% |

| Total Advisory Fees Paid ($) (net of waivers) |

$62,914 |

| | * | Does not include derivatives, except purchased options. |

|

| Holdings [Text Block] |

(as of June 30, 2025)

|

First American Government Obligations Fund, Class X

|

57.26% |

|

iShares Core MSCI EAFE ETF

|

2.60% |

|

First Trust Long/Short Equity ETF

|

2.38% |

|

SPDR S&P Emerging Markets Dividend ETF

|

2.28% |

|

Simplify Managed Futures Strategy ETF

|

1.92% |

|

AGF U.S. Market Neutral Anti-Beta Fund

|

1.91% |

|

Convergence Long/Short Equity ETF

|

0.56% |

|

Total

|

68.91% |

|

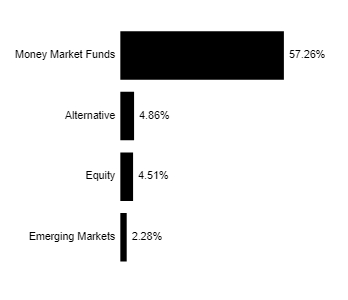

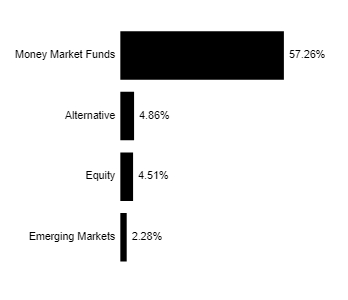

Money Market Funds

|

57.26% |

|

Alternative

|

4.86% |

|

Equity

|

4.51% |

|

Emerging Markets

|

2.28% |

|

| Largest Holdings [Text Block] |

|

First American Government Obligations Fund, Class X

|

57.26% |

|

iShares Core MSCI EAFE ETF

|

2.60% |

|

First Trust Long/Short Equity ETF

|

2.38% |

|

SPDR S&P Emerging Markets Dividend ETF

|

2.28% |

|

Simplify Managed Futures Strategy ETF

|

1.92% |

|

AGF U.S. Market Neutral Anti-Beta Fund

|

1.91% |

|

Convergence Long/Short Equity ETF

|

0.56% |

|

Total

|

68.91% |

|

| Material Fund Change [Text Block] |

This is a summary of certain changes to the Fund since January 1, 2025. For more complete information, you may review the Fund's prospectus dated April 30, 2025, which is available at https://idxfunds.com/coidx/ or upon request at (216) 329-4271. (1) The Fund was renamed from "IDX Commodity Opportunities Fund" to its current name. (2) Effective April 30, 2025, the Fund amended its principal investment strategy to remove the 80% policy related to investing in commodities, allowing it to invest in more sectors, including the ability to indirectly invest in digital assets. Effective July 31, 2025, the Board approved the renaming of IDX Funds (the "Trust") to Trailmark Series Trust. The Fund is a series of the Trust. |

| Material Fund Change Name [Text Block] |

(1) The Fund was renamed from "IDX Commodity Opportunities Fund" to its current name.

|

| Material Fund Change Strategies [Text Block] |

(2) Effective April 30, 2025, the Fund amended its principal investment strategy to remove the 80% policy related to investing in commodities, allowing it to invest in more sectors, including the ability to indirectly invest in digital assets.

|

| Summary of Change Legend [Text Block] |

This is a summary of certain changes to the Fund since January 1, 2025. For more complete information, you may review the Fund's prospectus dated April 30, 2025, which is available at https://idxfunds.com/coidx/ or upon request at (216) 329-4271.

|

| Updated Prospectus Phone Number |

(216) 329-4271

|

| Updated Prospectus Web Address |

https://idxfunds.com/coidx/

|