| FS Specialty Lending Preparing for a shareholder liquidity event September 2025 1 |

| 2 Table of contents Slide number Topics 3 Executive summary 4 Why convert to a closed-end fund? 5 Listing overview 9 Why list now? 16 What is a direct listing? 19 What was the purpose of the reverse share split? 22 What are shareholders asked to vote on? 25 When will distributions be paid? 27 Shareholder resources |

| 3 On April 24, 2025, FS Specialty Lending Fund (the Fund) announced that its board of trustees approved a plan to prepare for the listing of its common shares on the New York Stock Exchange (NYSE). – Prior to listing and subject to shareholder approval, the Fund will be converted from a business development company to a closed-end fund registered under the Investment Company Act of 1940 through a reorganization into a newly formed closed-end fund. – The closed-end fund (FSSL) will be named “FS Specialty Lending Fund” and will maintain the same board, investment objectives and investment strategy.1 – We currently expect FSSL’s common shares to begin trading on the NYSE under the ticker symbol “FSSL” before the end of the fourth quarter of 2025, subject to market conditions, shareholder approval, and final Board approval.2 1. The closed-end fund will maintain the same strategy other than with respect to the portfolio criteria imposed on business development companies (BDC) by the 1940 Act. 2. There can be no assurance that the Fund will be able to complete the listing within the expected time frame or at all. The timing of a listing is subject to many factors, including, but not limited to, Board approval, SEC review, shareholder approval, market conditions and fund performance. FS Specialty Lending Fund announces liquidity plan Visit www.fsproxy.com for a complete list of resources and fund updates |

| 4 Why convert to a registered closed-end fund? All data as of June 30, 2025. 1. The actual dividend yield at listing may be higher or lower based on the then current NAV. The payment of future distributions on the close-end fund’s common shares is subject to the discretion of the closed-end fund’s board of trustees and applicable legal restrictions and, therefore, there can be no assurance as to the amount or timing of any such future distributions. ✓ Experienced management team The FS Global Credit team manages FS Credit Opportunities Corp. (NYSE: FSCO), a listed registered closed-end fund that follows a similar strategy as the Fund. FSCO has delivered strong returns since its listing on the NYSE in November 2022. ✓ Dividend aligned with closed-end fund peers 9.0–9.5% targeted annualized distribution rate is competitive with large, credit-focused closed-end fund peers and offers an attractive premium above risk-free rates. 1 ✓ Borrowings aligned with closed-end fund peers FSSL’s expected level of borrowings (debt-to-equity of 0.25x-0.4x) is consistent with closed-end fund peers and below the regulatory limit applicable to closed-end funds (0.5x debt-to-equity). ✓ Strong market visibility Would rank as one of the largest listed registered credit-focused closed-end funds with approximately $1.9 billion in assets. |

| 5 Listing overview |

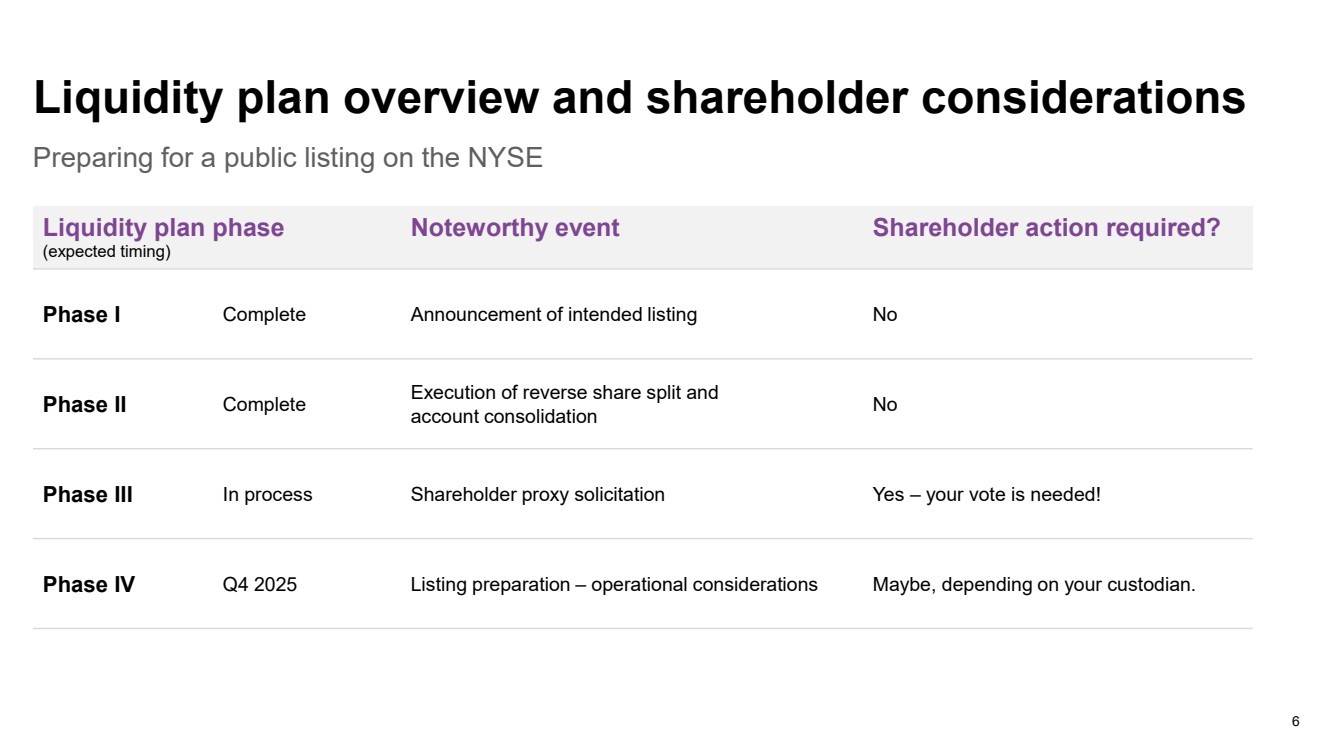

| Preparing for a public listing on the NYSE 6 Liquidity plan phase (expected timing) Noteworthy event Shareholder action required? Phase I Complete Announcement of intended listing No Phase II Complete Execution of reverse share split and account consolidation No Phase III In process Shareholder proxy solicitation Yes – your vote is needed! Phase IV Q4 2025 Listing preparation – operational considerations Maybe, depending on your custodian. Liquidity plan overview and shareholder considerations |

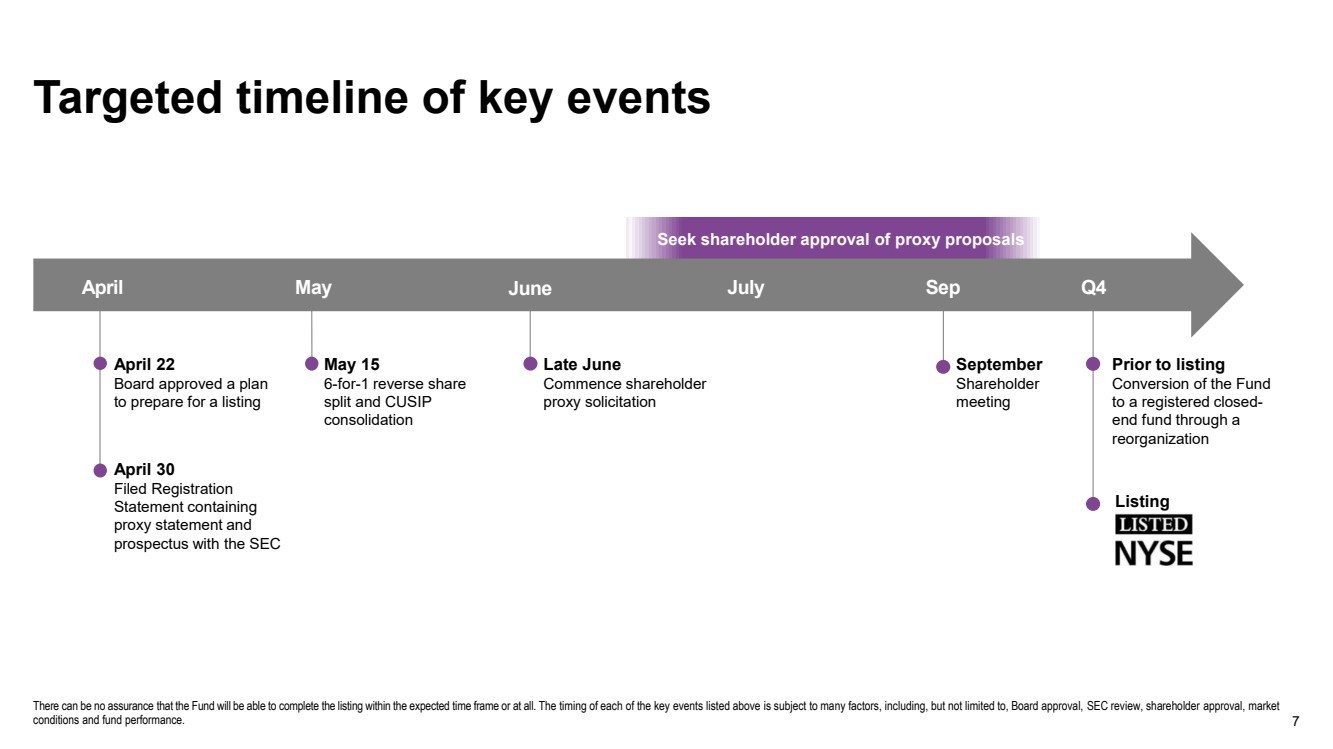

| Late June Commence shareholder proxy solicitation Seek shareholder approval of proxy proposals Targeted timeline of key events 7 April May June July Q4 April 30 Filed Registration Statement containing proxy statement and prospectus with the SEC April 22 Board approved a plan to prepare for a listing May 15 6-for-1 reverse share split and CUSIP consolidation Listing There can be no assurance that the Fund will be able to complete the listing within the expected time frame or at all. The timing of each of the key events listed above is subject to many factors, including, but not limited to, Board approval, SEC review, shareholder approval, market conditions and fund performance. Prior to listing Conversion of the Fund to a registered closed-end fund through a reorganization Sep September Shareholder meeting |

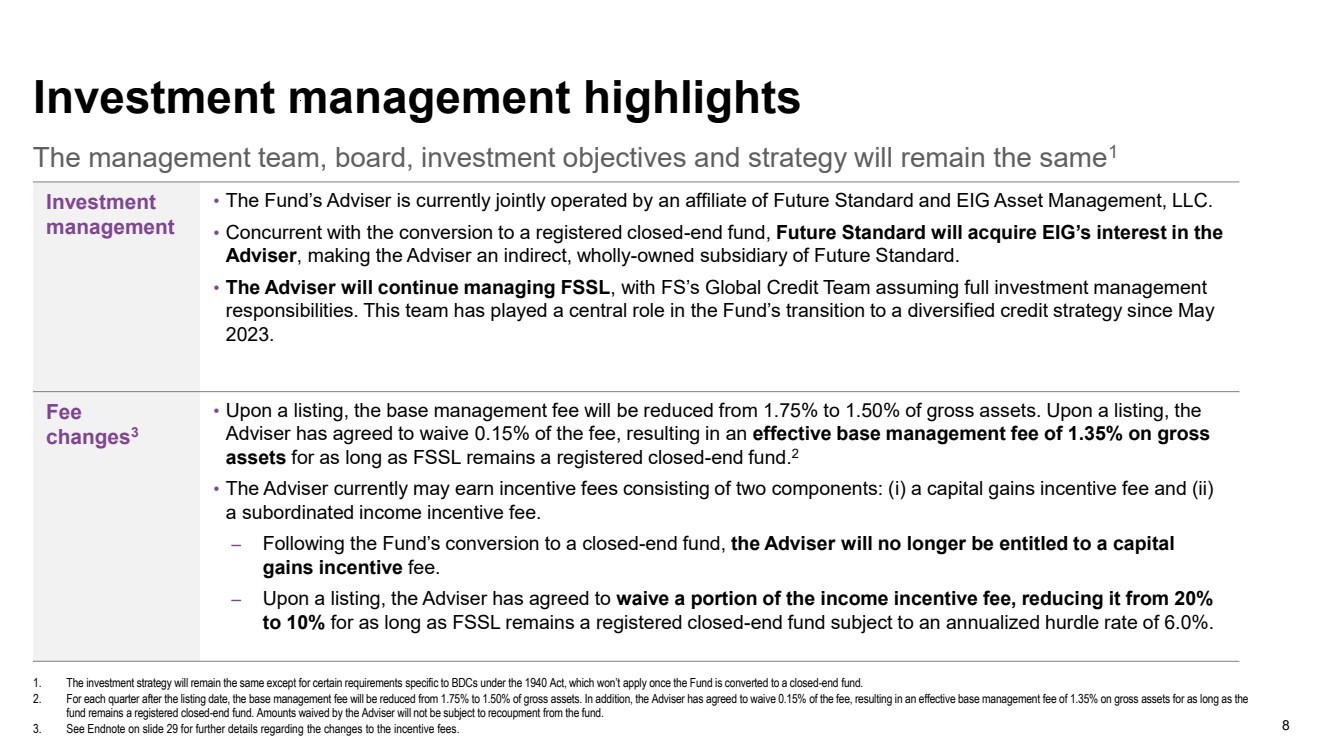

| The management team, board, investment objectives and strategy will remain the same1 1. The investment strategy will remain the same except for certain requirements specific to BDCs under the 1940 Act, which won’t apply once the Fund is converted to a closed-end fund. 2. For each quarter after the listing date, the base management fee will be reduced from 1.75% to 1.50% of gross assets. In addition, the Adviser has agreed to waive 0.15% of the fee, resulting in an effective base management fee of 1.35% on gross assets for as long as the fund remains a registered closed-end fund. Amounts waived by the Adviser will not be subject to recoupment from the fund. 3. See Endnote on slide 29 for further details regarding the changes to the incentive fees. Investment management highlights Investment management • The Fund’s Adviser is currently jointly operated by an affiliate of Future Standard and EIG Asset Management, LLC. • Concurrent with the conversion to a registered closed-end fund, Future Standard will acquire EIG’s interest in the Adviser, making the Adviser an indirect, wholly-owned subsidiary of Future Standard. • The Adviser will continue managing FSSL, with FS’s Global Credit Team assuming full investment management responsibilities. This team has played a central role in the Fund’s transition to a diversified credit strategy since May 2023. Fee changes3 • Upon a listing, the base management fee will be reduced from 1.75% to 1.50% of gross assets. Upon a listing, the Adviser has agreed to waive 0.15% of the fee, resulting in an effective base management fee of 1.35% on gross assets for as long as FSSL remains a registered closed-end fund.2 • The Adviser currently may earn incentive fees consisting of two components: (i) a capital gains incentive fee and (ii) a subordinated income incentive fee. ‒ Following the Fund’s conversion to a closed-end fund, the Adviser will no longer be entitled to a capital gains incentive fee. ‒ Upon a listing, the Adviser has agreed to waive a portion of the income incentive fee, reducing it from 20% to 10% for as long as FSSL remains a registered closed-end fund subject to an annualized hurdle rate of 6.0%. 8 |

| 9 Why list now? |

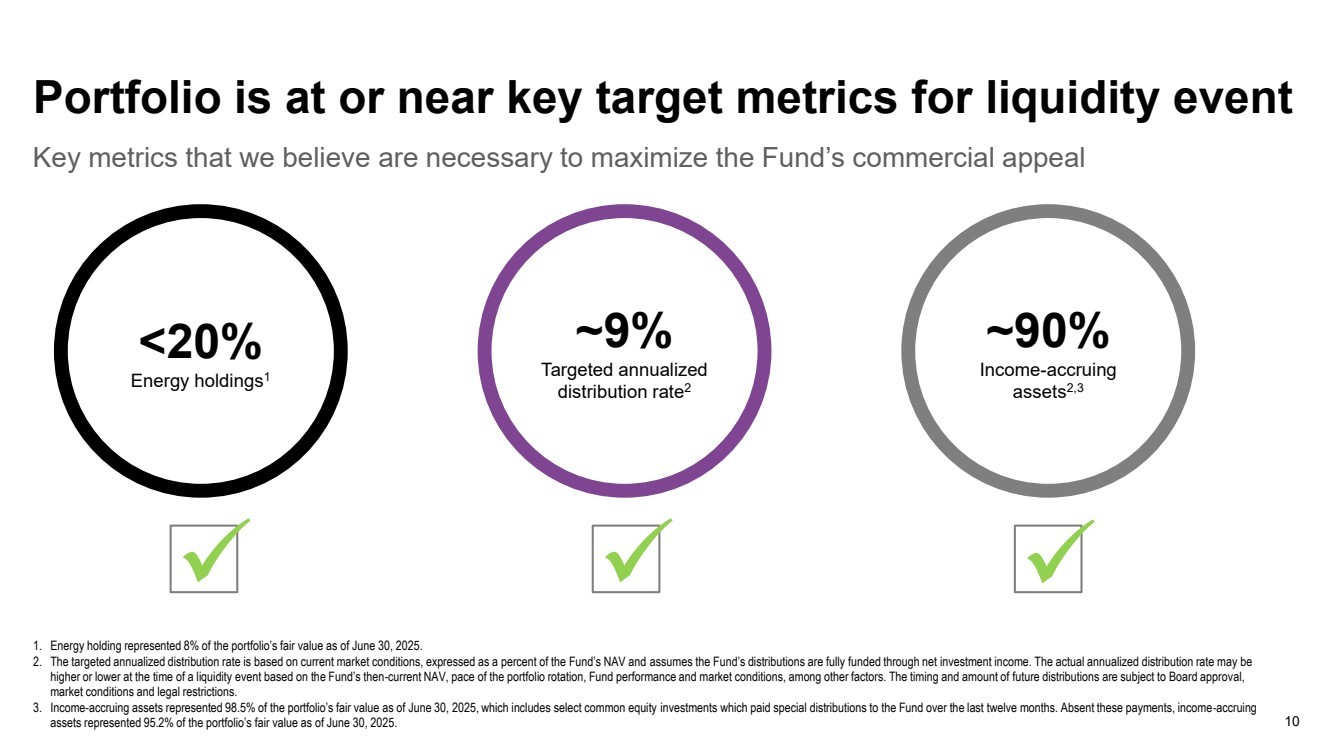

| ✓ ✓ ✓ Key metrics that we believe are necessary to maximize the Fund’s commercial appeal 10 1. Energy holding represented 8% of the portfolio’s fair value as of June 30, 2025. 2. The targeted annualized distribution rate is based on current market conditions, expressed as a percent of the Fund’s NAV and assumes the Fund’s distributions are fully funded through net investment income. The actual annualized distribution rate may be higher or lower at the time of a liquidity event based on the Fund’s then-current NAV, pace of the portfolio rotation, Fund performance and market conditions, among other factors. The timing and amount of future distributions are subject to Board approval, market conditions and legal restrictions. 3. Income-accruing assets represented 98.5% of the portfolio’s fair value as of June 30, 2025, which includes select common equity investments which paid special distributions to the Fund over the last twelve months. Absent these payments, income-accruing assets represented 95.2% of the portfolio’s fair value as of June 30, 2025. Portfolio is at or near key target metrics for liquidity event ~9% Targeted annualized distribution rate2 <20% Energy holdings1 ~90% Income-accruing assets2,3 |

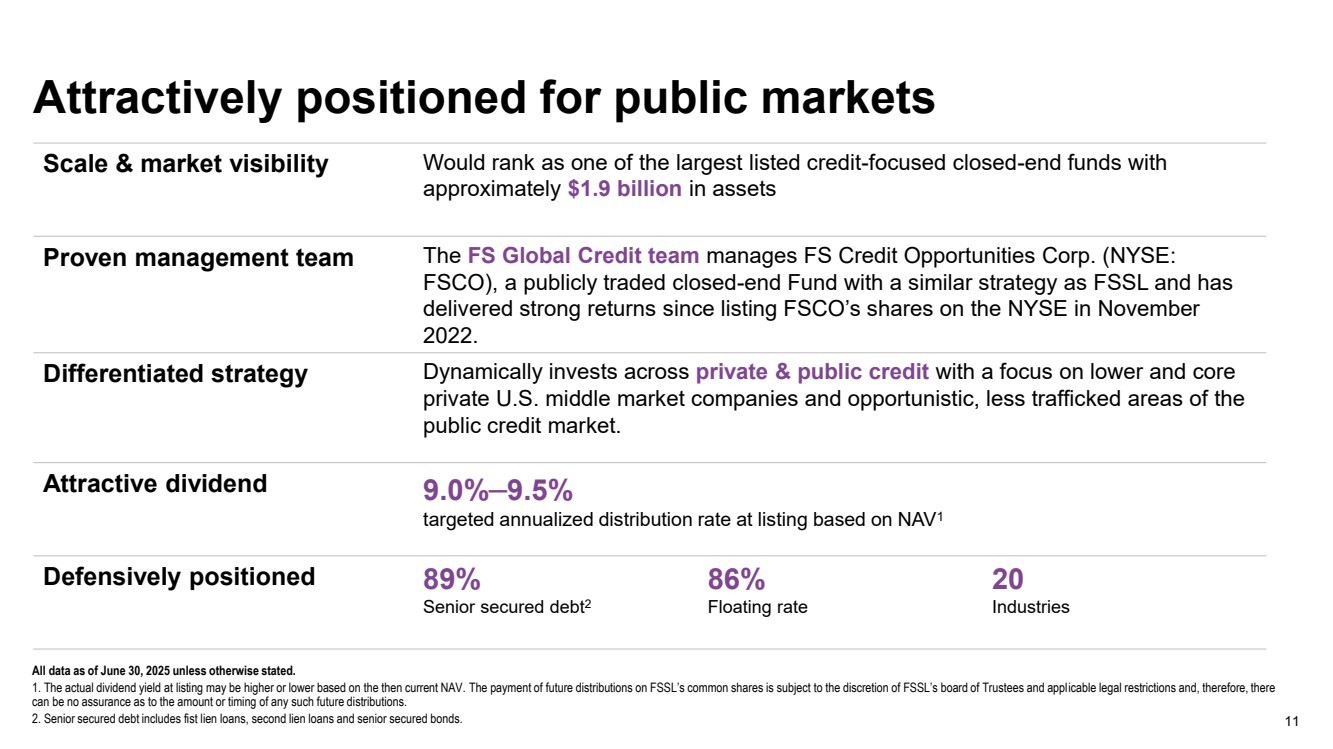

| 11 Attractively positioned for public markets All data as of June 30, 2025 unless otherwise stated. 1. The actual dividend yield at listing may be higher or lower based on the then current NAV. The payment of future distributions on FSSL’s common shares is subject to the discretion of FSSL’s board of Trustees and applicable legal restrictions and, therefore, there can be no assurance as to the amount or timing of any such future distributions. 2. Senior secured debt includes fist lien loans, second lien loans and senior secured bonds. Scale & market visibility Would rank as one of the largest listed credit-focused closed-end funds with approximately $1.9 billion in assets Proven management team The FS Global Credit team manages FS Credit Opportunities Corp. (NYSE: FSCO), a publicly traded closed-end Fund with a similar strategy as FSSL and has delivered strong returns since listing FSCO’s shares on the NYSE in November 2022. Differentiated strategy Dynamically invests across private & public credit with a focus on lower and core private U.S. middle market companies and opportunistic, less trafficked areas of the public credit market. Attractive dividend 9.0%–9.5% targeted annualized distribution rate at listing based on NAV1 Defensively positioned 89% Senior secured debt2 86% Floating rate 20 Industries |

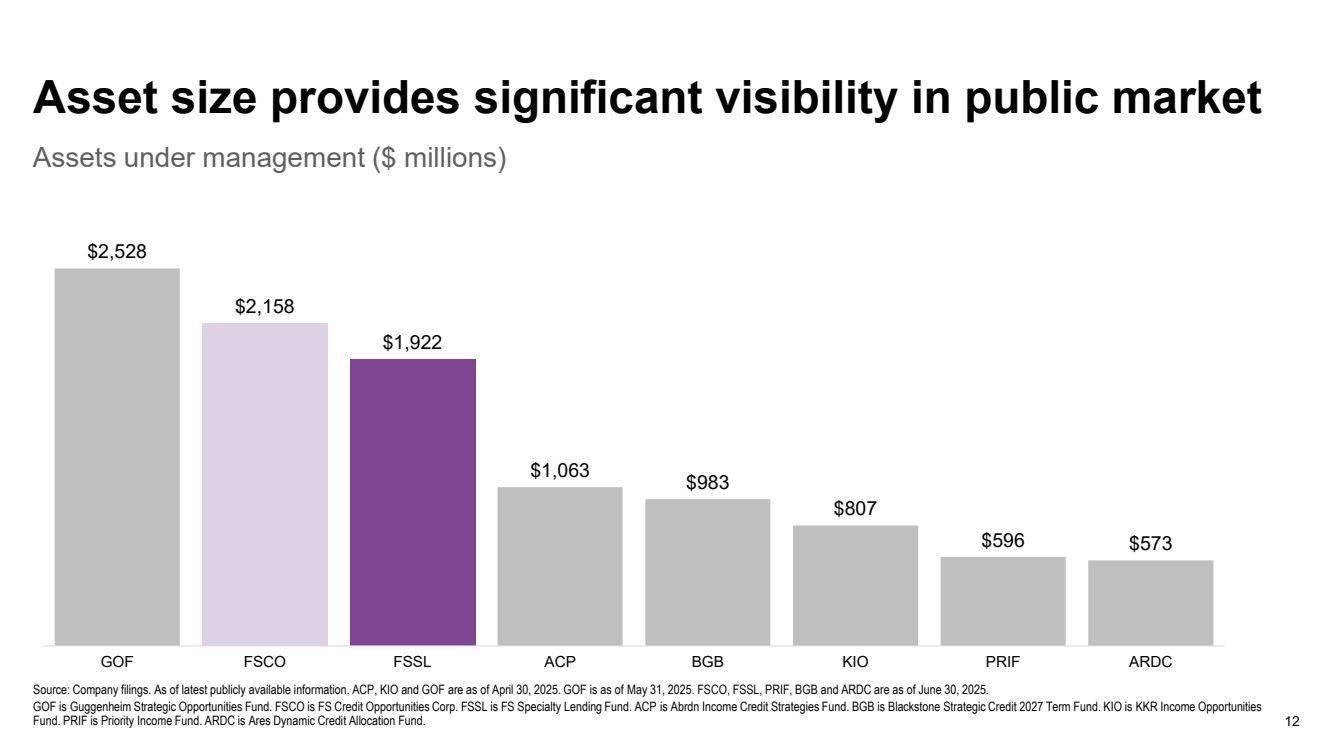

| 12 Assets under management ($ millions) Source: Company filings. As of latest publicly available information. ACP, KIO and GOF are as of April 30, 2025. GOF is as of May 31, 2025. FSCO, FSSL, PRIF, BGB and ARDC are as of June 30, 2025. GOF is Guggenheim Strategic Opportunities Fund. FSCO is FS Credit Opportunities Corp. FSSL is FS Specialty Lending Fund. ACP is Abrdn Income Credit Strategies Fund. BGB is Blackstone Strategic Credit 2027 Term Fund. KIO is KKR Income Opportunities Fund. PRIF is Priority Income Fund. ARDC is Ares Dynamic Credit Allocation Fund. Asset size provides significant visibility in public market $2,528 $2,158 $1,922 $1,063 $983 $807 $596 $573 GOF FSCO FSSL ACP BGB KIO PRIF ARDC |

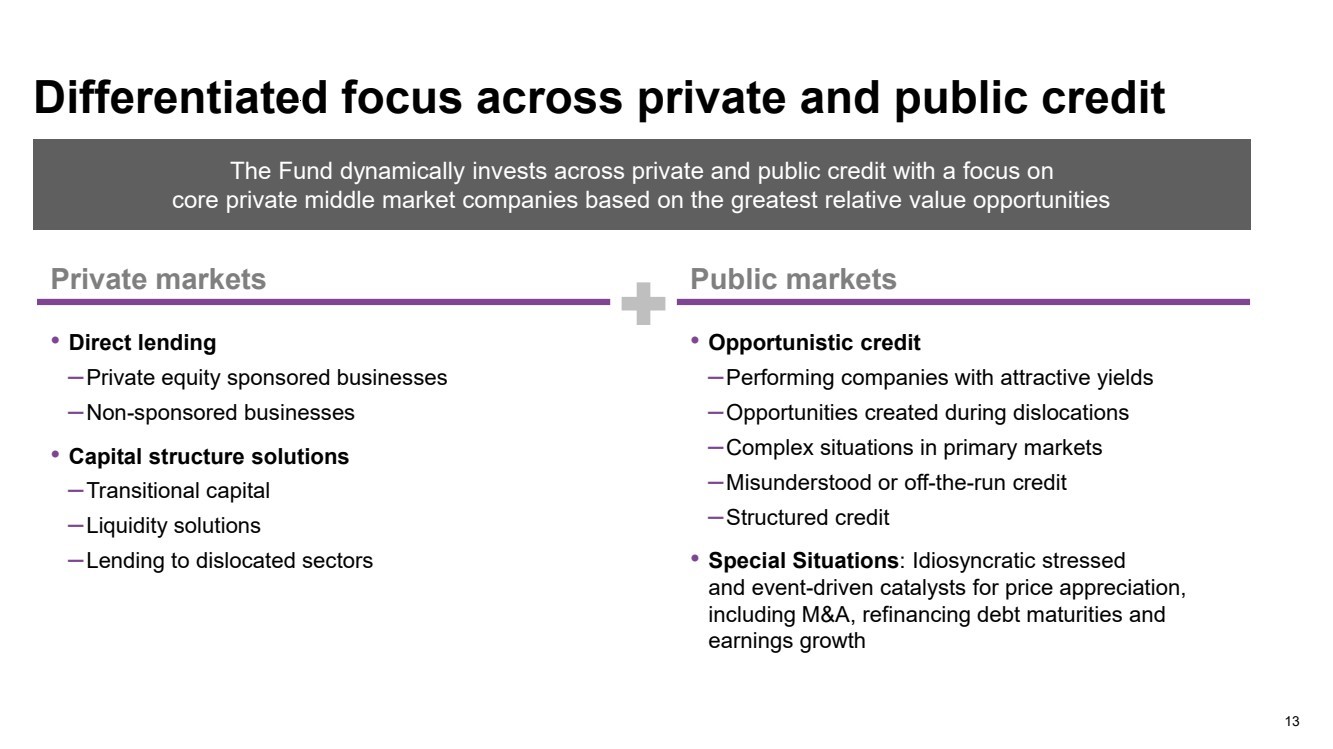

| The Fund dynamically invests across private and public credit with a focus on core private middle market companies based on the greatest relative value opportunities 13 Differentiated focus across private and public credit Private markets Public markets • Direct lending ‒Private equity sponsored businesses ‒Non-sponsored businesses • Capital structure solutions ‒Transitional capital ‒Liquidity solutions ‒Lending to dislocated sectors • Opportunistic credit ‒Performing companies with attractive yields ‒Opportunities created during dislocations ‒Complex situations in primary markets ‒Misunderstood or off-the-run credit ‒Structured credit • Special Situations: Idiosyncratic stressed and event-driven catalysts for price appreciation, including M&A, refinancing debt maturities and earnings growth |

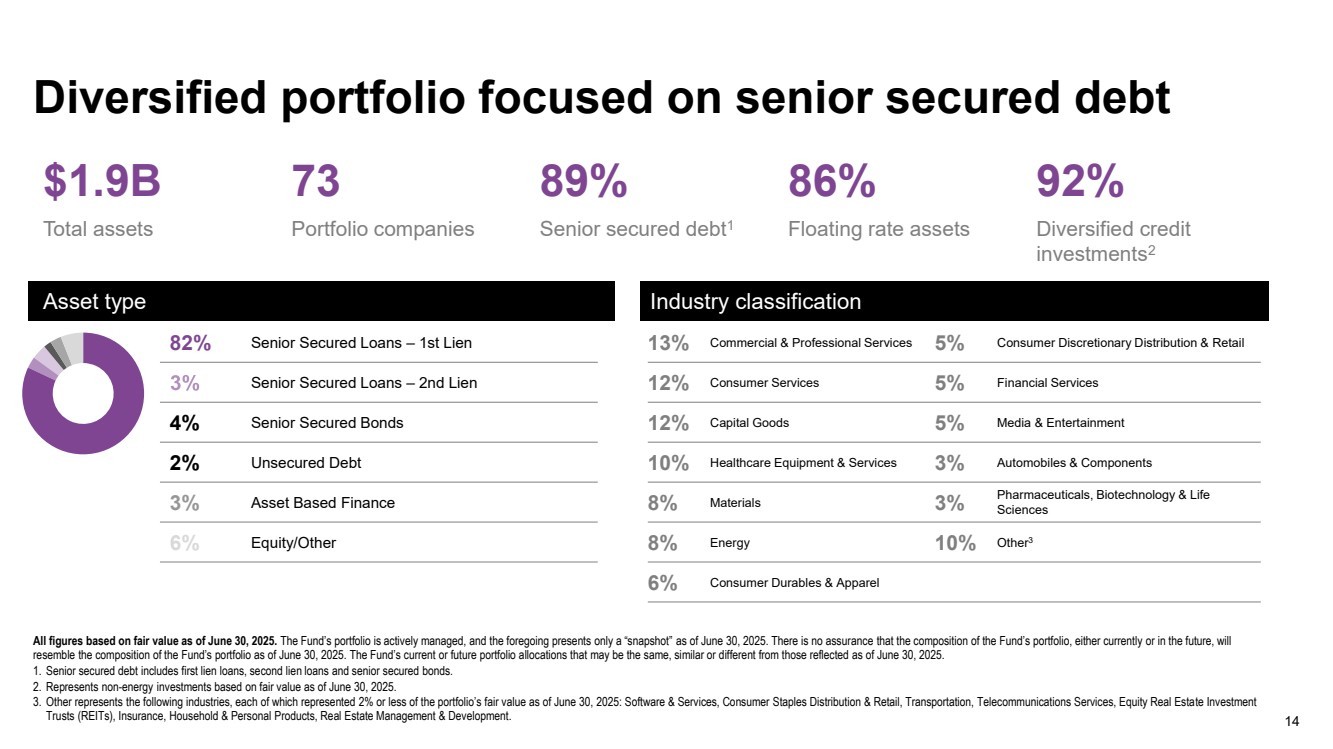

| Diversified portfolio focused on senior secured debt Asset type 82% Senior Secured Loans – 1st Lien Senior Secured Loans – 2nd Lien 4% Senior Secured Bonds 2% Unsecured Debt 3% Asset Based Finance 6% Equity/Other Industry classification 13% Commercial & Professional Services 5% Consumer Discretionary Distribution & Retail 12% Consumer Services 5% Financial Services 12% Capital Goods 5% Media & Entertainment 10% Healthcare Equipment & Services 3% Automobiles & Components 8% Materials 3% Pharmaceuticals, Biotechnology & Life Sciences 8% Energy 10% Other3 6% Consumer Durables & Apparel All figures based on fair value as of June 30, 2025. The Fund’s portfolio is actively managed, and the foregoing presents only a “snapshot” as of June 30, 2025. There is no assurance that the composition of the Fund’s portfolio, either currently or in the future, will resemble the composition of the Fund’s portfolio as of June 30, 2025. The Fund’s current or future portfolio allocations that may be the same, similar or different from those reflected as of June 30, 2025. 1. Senior secured debt includes first lien loans, second lien loans and senior secured bonds. 2. Represents non-energy investments based on fair value as of June 30, 2025. 3. Other represents the following industries, each of which represented 2% or less of the portfolio’s fair value as of June 30, 2025: Software & Services, Consumer Staples Distribution & Retail, Transportation, Telecommunications Services, Equity Real Estate Investment Trusts (REITs), Insurance, Household & Personal Products, Real Estate Management & Development. 14 $1.9B 73 89% 86% 92% Total assets Portfolio companies Senior secured debt1 Floating rate assets Diversified credit investments2 |

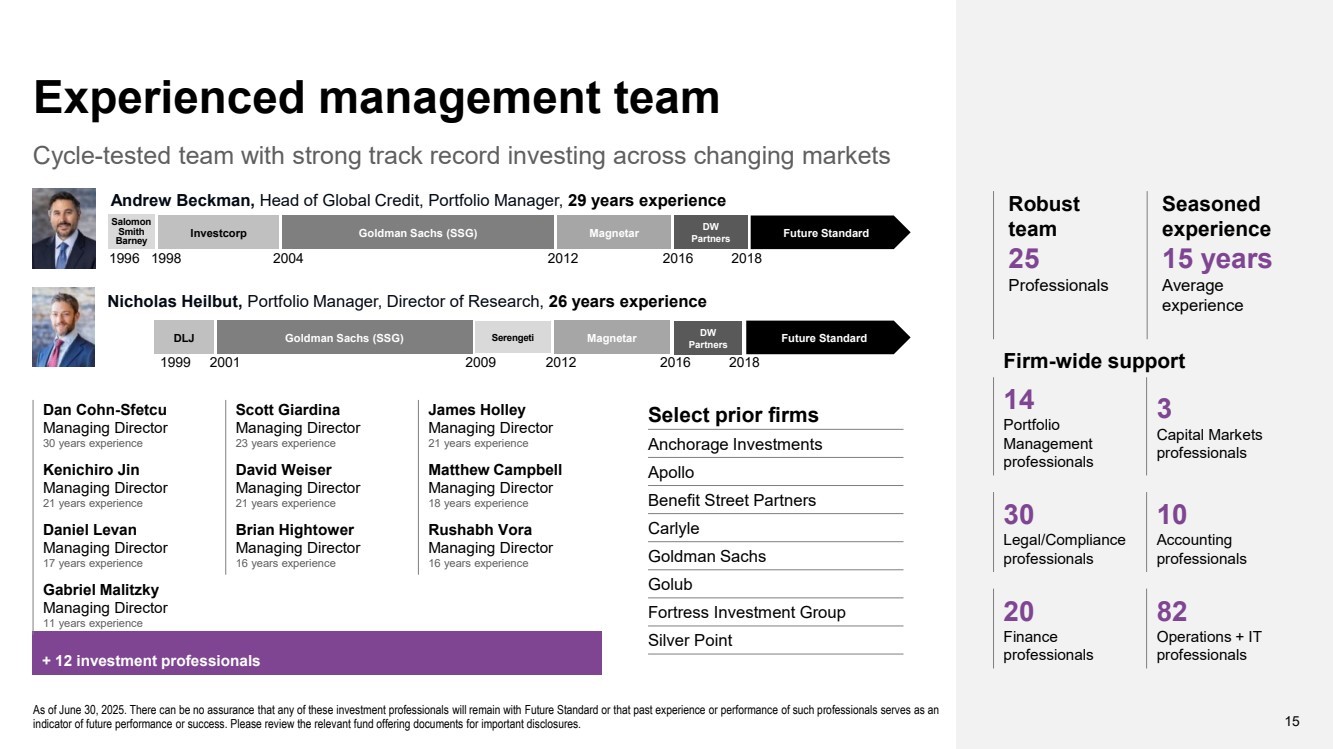

| Cycle-tested team with strong track record investing across changing markets 15 As of June 30, 2025. There can be no assurance that any of these investment professionals will remain with Future Standard or that past experience or performance of such professionals serves as an indicator of future performance or success. Please review the relevant fund offering documents for important disclosures. Experienced management team Robust team 25 Professionals Seasoned experience 15 years Average experience Firm-wide support 14 Portfolio Management professionals 3 Capital Markets professionals 30 Legal/Compliance professionals 10 Accounting professionals 20 Finance professionals 82 Operations + IT professionals + 12 investment professionals Select prior firms Anchorage Investments Apollo Benefit Street Partners Carlyle Goldman Sachs Golub Fortress Investment Group Silver Point Dan Cohn-Sfetcu Managing Director 30 years experience Scott Giardina Managing Director 23 years experience James Holley Managing Director 21 years experience Kenichiro Jin Managing Director 21 years experience David Weiser Managing Director 21 years experience Matthew Campbell Managing Director 18 years experience Daniel Levan Managing Director 17 years experience Brian Hightower Managing Director 16 years experience Rushabh Vora Managing Director 16 years experience Gabriel Malitzky Managing Director 11 years experience Nicholas Heilbut, Portfolio Manager, Director of Research, 26 years experience Andrew Beckman, Head of Global Credit, Portfolio Manager, 29 years experience 1996 1998 2004 2012 2016 2018 Investcorp Goldman Sachs (SSG) Magnetar Future Standard DW Partners Salomon Smith Barney 1999 2001 2009 2012 2016 2018 DLJ Goldman Sachs (SSG) Serengeti Magnetar DW Partners Future Standard |

| 16 What is a direct listing? |

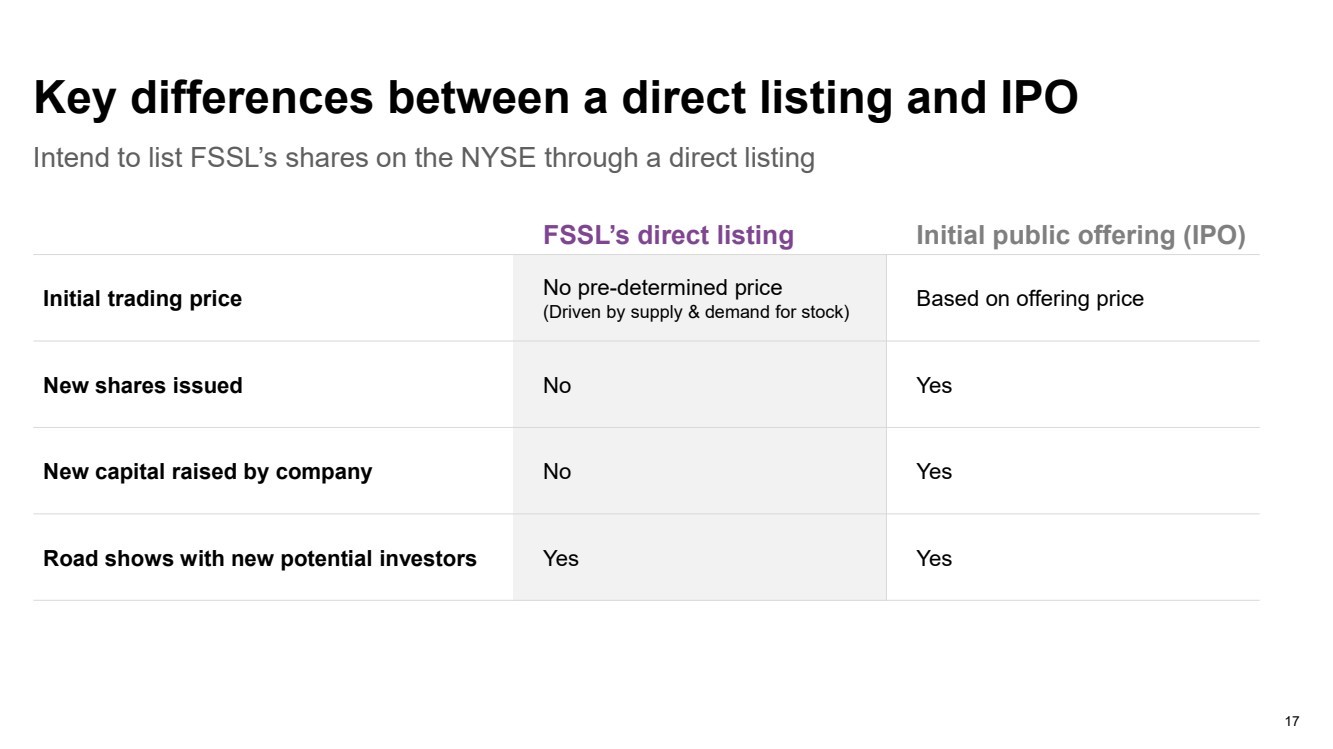

| 17 Intend to list FSSL’s shares on the NYSE through a direct listing Key differences between a direct listing and IPO FSSL’s direct listing Initial public offering (IPO) Initial trading price No pre-determined price (Driven by supply & demand for stock) Based on offering price New shares issued No Yes New capital raised by company No Yes Road shows with new potential investors Yes Yes |

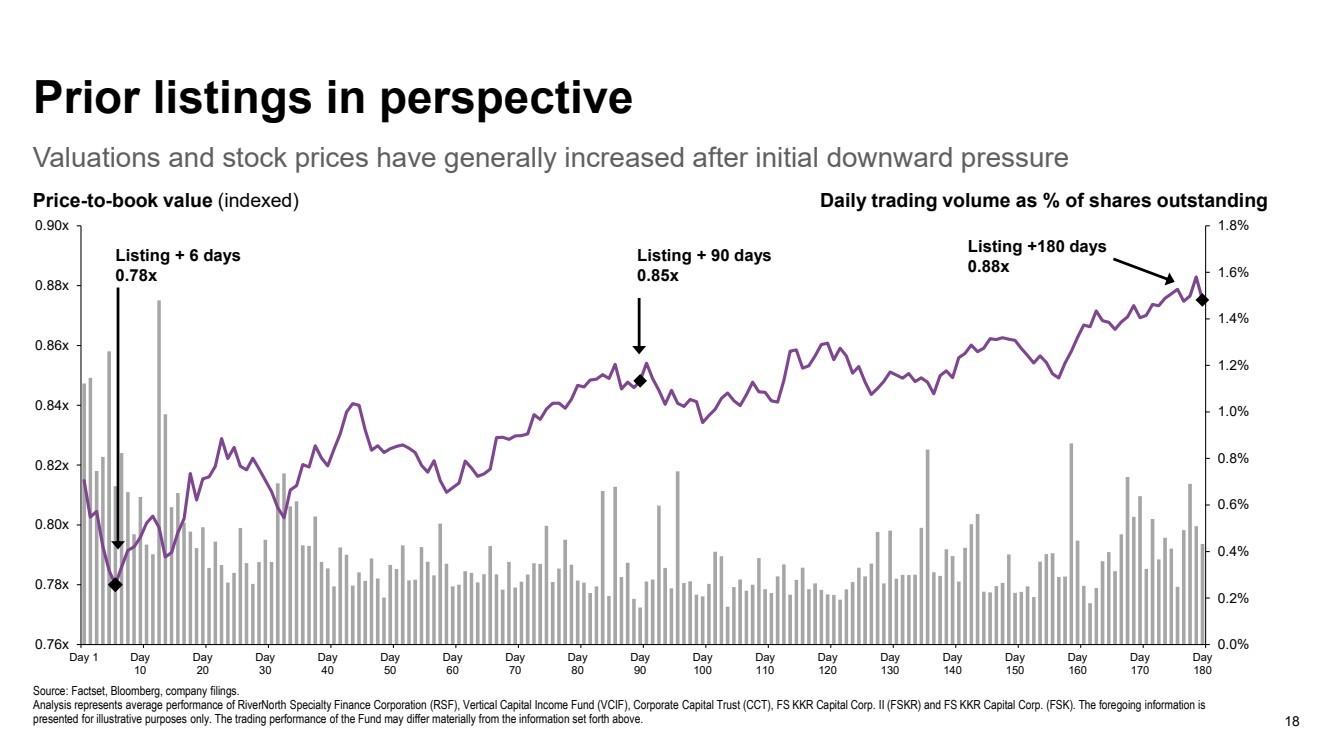

| Valuations and stock prices have generally increased after initial downward pressure 18 Price-to-book value (indexed) Daily trading volume as % of shares outstanding Source: Factset, Bloomberg, company filings. Analysis represents average performance of RiverNorth Specialty Finance Corporation (RSF), Vertical Capital Income Fund (VCIF), Corporate Capital Trust (CCT), FS KKR Capital Corp. II (FSKR) and FS KKR Capital Corp. (FSK). The foregoing information is presented for illustrative purposes only. The trading performance of the Fund may differ materially from the information set forth above. Prior listings in perspective 0.0% 0.2% 0.4% 0.6% 0.8% 1.0% 1.2% 1.4% 1.6% 1.8% 0.76x 0.78x 0.80x 0.82x 0.84x 0.86x 0.88x 0.90x Day 1 Day 10 Day 20 Day 30 Day 40 Day 50 Day 60 Day 70 Day 80 Day 90 Day 100 Day 110 Day 120 Day 130 Day 140 Day 150 Day 160 Day 170 Day 180 Listing + 6 days 0.78x Listing + 90 days 0.85x Listing +180 days 0.88x |

| 19 What was the purpose of the reverse share split? |

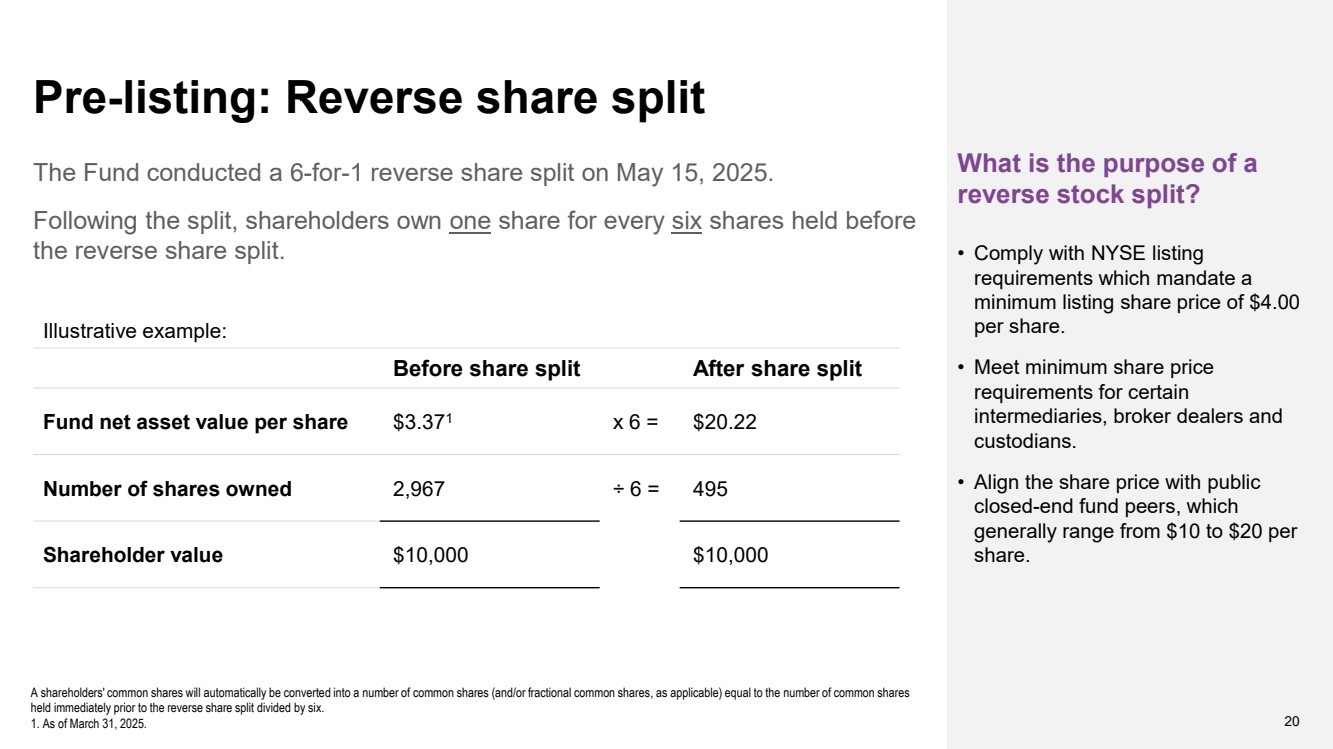

| What is the purpose of a reverse stock split? • Comply with NYSE listing requirements which mandate a minimum listing share price of $4.00 per share. • Meet minimum share price requirements for certain intermediaries, broker dealers and custodians. • Align the share price with public closed-end fund peers, which generally range from $10 to $20 per share. 20 A shareholders' common shares will automatically be converted into a number of common shares (and/or fractional common shares, as applicable) equal to the number of common shares held immediately prior to the reverse share split divided by six. 1. As of March 31, 2025. Pre-listing: Reverse share split Illustrative example: Before share split After share split Fund net asset value per share $3.371 x 6 = $20.22 Number of shares owned 2,967 ÷ 6 = 495 Shareholder value $10,000 $10,000 The Fund conducted a 6-for-1 reverse share split on May 15, 2025. Following the split, shareholders own one share for every six shares held before the reverse share split. |

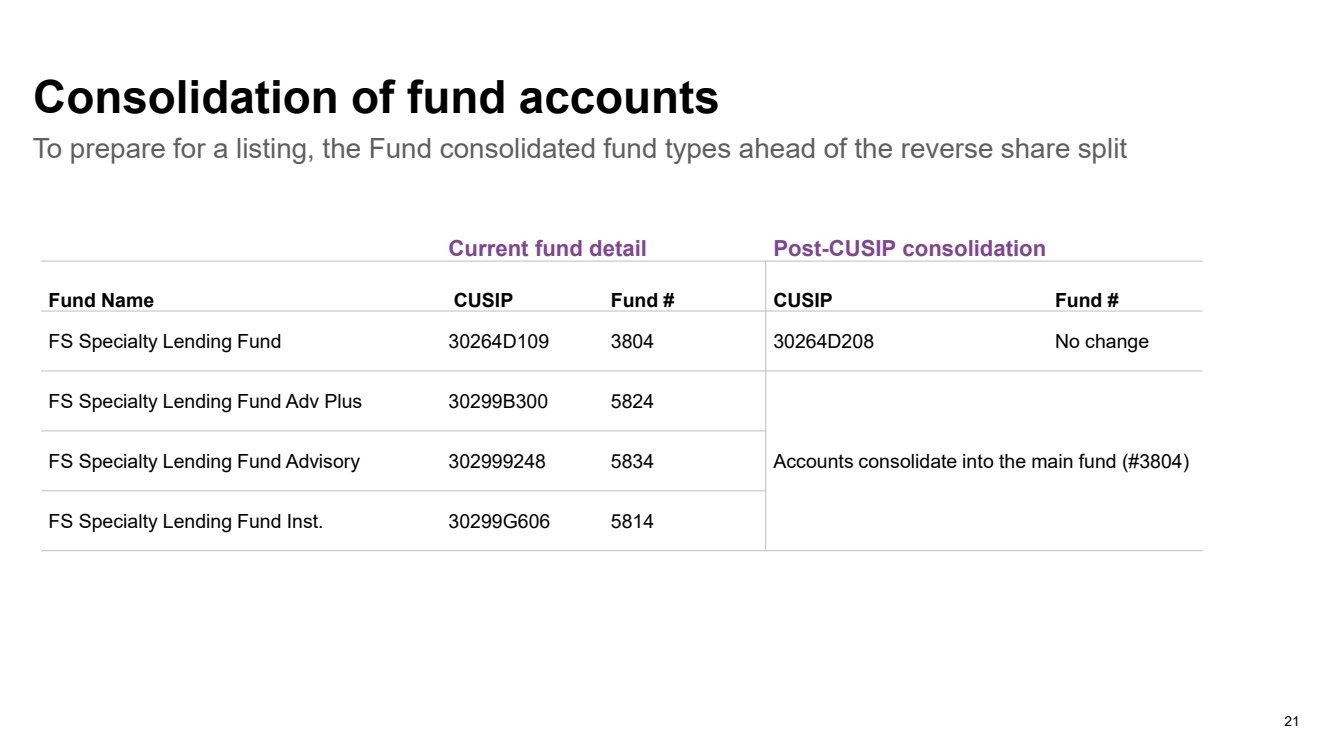

| 21 To prepare for a listing, the Fund consolidated fund types ahead of the reverse share split Consolidation of fund accounts Current fund detail Post-CUSIP consolidation Fund Name CUSIP Fund # CUSIP Fund # FS Specialty Lending Fund 30264D109 3804 30264D208 No change FS Specialty Lending Fund Adv Plus 30299B300 5824 FS Specialty Lending Fund Advisory 302999248 5834 Accounts consolidate into the main fund (#3804) FS Specialty Lending Fund Inst. 30299G606 5814 |

| 22 What are shareholders asked to vote on? |

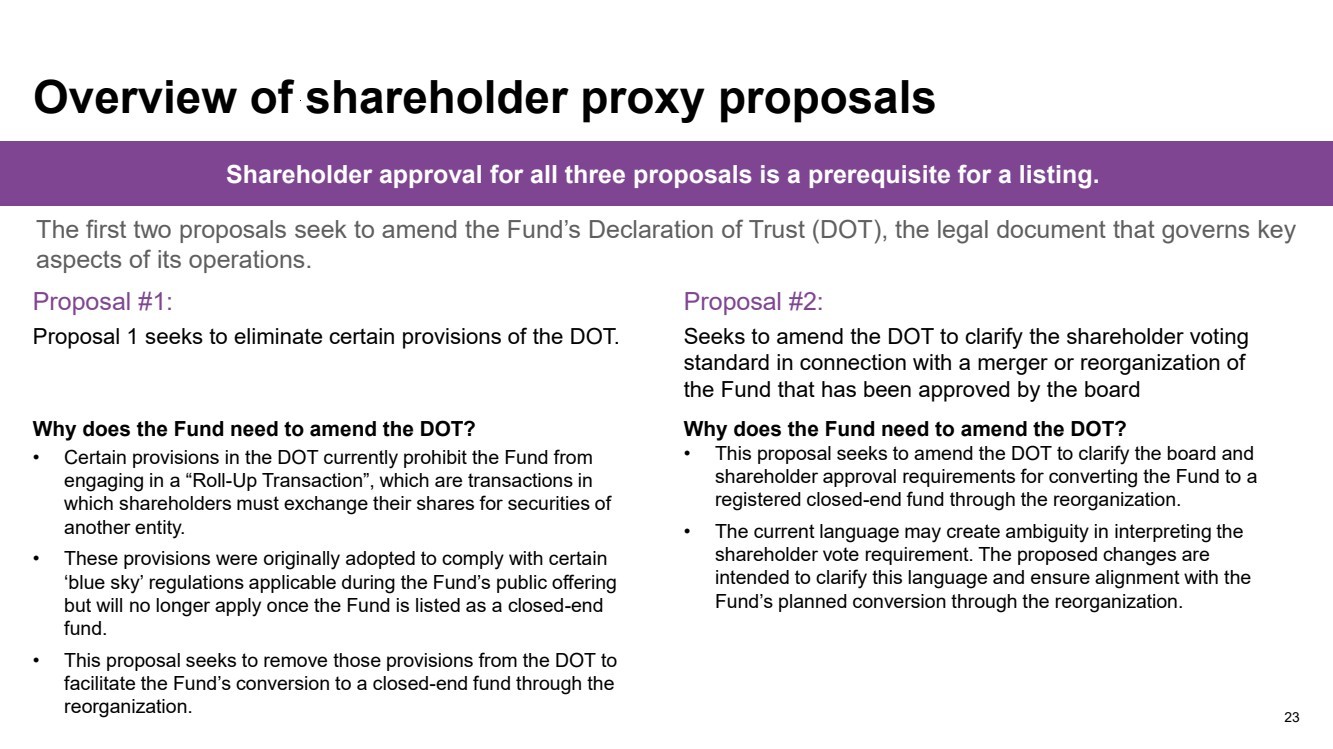

| 23 Overview of shareholder proxy proposals Proposal #1: Proposal 1 seeks to eliminate certain provisions of the DOT. Proposal #2: Seeks to amend the DOT to clarify the shareholder voting standard in connection with a merger or reorganization of the Fund that has been approved by the board Shareholder approval for all three proposals is a prerequisite for a listing. Why does the Fund need to amend the DOT? • Certain provisions in the DOT currently prohibit the Fund from engaging in a “Roll-Up Transaction”, which are transactions in which shareholders must exchange their shares for securities of another entity. • These provisions were originally adopted to comply with certain ‘blue sky’ regulations applicable during the Fund’s public offering but will no longer apply once the Fund is listed as a closed-end fund. • This proposal seeks to remove those provisions from the DOT to facilitate the Fund’s conversion to a closed-end fund through the reorganization. Why does the Fund need to amend the DOT? • This proposal seeks to amend the DOT to clarify the board and shareholder approval requirements for converting the Fund to a registered closed-end fund through the reorganization. • The current language may create ambiguity in interpreting the shareholder vote requirement. The proposed changes are intended to clarify this language and ensure alignment with the Fund’s planned conversion through the reorganization. The first two proposals seek to amend the Fund’s Declaration of Trust (DOT), the legal document that governs key aspects of its operations. |

| 24 1. The investment strategy will remain the same except for certain requirements specific to BDCs under the 1940 Act, which won’t apply once the Fund is converted to a closed-end fund. The Fund’s Adviser is currently jointly operated by an affiliate of Future Standard and EIG Asset Management, LLC. Concurrent with the conversion to a closed-end fund, Future Standard will acquire EIG’s interest in the Adviser, making the Adviser an indirect, wholly-owned subsidiary of Future Standard. Overview of shareholder proxy proposals Proposal #3: Seeks shareholder approval for the Agreement and Plan of Reorganization Shareholder approval for all three proposals is a prerequisite for a listing. • The Agreement and Plan of Reorganization provides for the proposed reorganization of the Fund through the merger of the Fund with and into a newly formed closed-end fund. • As part of the reorganization, all outstanding common shares of the Fund will be exchanged for newly issued shares of the new closed-end fund. • There will be no change to the Fund’s investment objectives or strategy.1 • The Adviser will no longer earn a capital gains incentive fee and a portion of the base management and incentive fee on income will be waived commencing upon the listing and continuing for as long as FSSL is a registered closed-end fund. |

| 25 When will distributions be paid? |

| 26 1. The actual annualized distribution rate at listing may be higher or lower based on the then current NAV. The payment of future distributions on the fund’s common shares is subject to the discretion of the fund’s board of trustees and applicable legal restrictions and, therefore, there can be no assurance as to the amount or timing of any such future distributions Targeted 2025 distribution schedule • Q1 and Q2 2025 enhanced quarterly distributions were paid in April and July, respectively, based on an annualized rate of 12.5% based on the Fund’s then-current NAV. • If a listing occurs prior to the end of Q3 2025, we expect FSSL to pay a full quarterly enhanced distribution for the third quarter, payable in October. In the fourth quarter we expect FSSL to target a monthly or quarterly distribution representing an annualized distribution rate of 9.0%‒9.5% of the FSSL’s NAV.1 • If a listing occurs in Q4 2025, the Fund will pay a full quarterly enhanced distribution for the third quarter of 2025. In the fourth quarter, we expect FSSL to target a monthly or quarterly distribution representing an annualized distribution rate of 9.0%‒9.5% of the FSSL’s NAV.1 • Beginning in January 2026, FSSL expects to declare and pay distributions monthly, subject to a listing and board approval. |

| 27 Resources |

| 28 Visit www.FSproxy.com • Summary overview of listing process ‒ Timeline ‒ Distributions ‒ Operational considerations • FAQ • On-demand presentation • Slide presentation Shareholder resources |

| 29 Pursuant to the terms of FSSL’s Investment Advisory Agreement, for any quarter ending after the listing, the incentive fee on income is calculated and payable quarterly in arrears and equals 20.0% of FSSL’s “pre-incentive fee net investment income” for the immediately preceding quarter subject to a hurdle rate, expressed as a rate of return on net assets, equal to 1.5% per quarter, or an annualized hurdle rate of 6.0%. As a result, the Adviser will not earn this incentive fee for any quarter until FSSL’s pre-incentive fee net investment income for such quarter exceeds the hurdle rate of 1.5%. Once FSSL’s pre-incentive fee net investment income in any quarter exceeds the hurdle rate, the Adviser will be entitled to a “catch-up” fee equal to the amount of the closed-end fund’s pre-incentive fee net investment income in excess of the hurdle rate, until FSSL’s pre-incentive fee net investment income for such quarter equals 1.875%, or 7.5% annually, of net assets. This “catch-up” feature will allow the Adviser to recoup the fees foregone as a result of the existence of the hurdle rate. Thereafter, the Adviser will be entitled to receive 20.0% of FSSL’s pre-incentive fee net investment income. While the incentive fee on income of the Fund and FSSL prior to the listing will be subject to a hurdle rate equal to a percentage of “adjusted capital” (as defined in the Fund’s and the closed-end fund’s Investment Advisory Agreement) the incentive fee on income of FSSL after the listing will be subject to a hurdle rate expressed as a rate of return on net assets, which will have the effect of making it more likely that the fund’s pre-incentive fee net investment income will exceed the hurdle rate and therefore more likely that FSSL will pay an incentive fee on income. Effective on the listing and for so long as FSSL is a registered closed-end fund, the Adviser has contractually agreed to waive a portion of the FSSL’s incentive fee. After giving effect to such fee waiver, the incentive fee on income will be calculated and payable quarterly in arrears and equals 10.00% of FSSL’s “pre-incentive fee net investment income” for the immediately preceding quarter subject to a hurdle rate, expressed as a rate of return on net assets, equal to 1.5% per quarter, or an annualized hurdle rate of 6.0% compared to the current hurdle rate of 6.5%. As a result, the Adviser will not earn this incentive fee for any quarter until FSSL’s pre-incentive fee net investment income for such quarter exceeds the hurdle rate of 1.5%. Once FSSL’s pre-incentive fee net investment income in any quarter exceeds the hurdle rate, the Adviser will be entitled to a “catch-up” fee equal to the amount of FSSL’s pre-incentive fee net investment income in excess of the hurdle rate, until FSSL’s pre-incentive fee net investment income for such quarter equals 1.667%, or 6.667% annually, of net assets. This “catch-up” feature will allow the Adviser to recoup the fees foregone as a result of the existence of the hurdle rate. Thereafter, the Adviser will be entitled to receive 10.00% of FSSL’s pre-incentive fee net investment income. Amounts waived by the Adviser will not be subject to recoupment from FSSL. Endnotes |

| 30 CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS Statements included herein may constitute “forward-looking” statements as that term is defined in Section 27A of the Securities Act, and Section 21E of the Securities Exchange Act of 1934, as amended by the Private Securities Litigation Reform Act of 1995, including statements with regard to future events or the future performance or operations of the Fund, including but not limited to, anticipated distribution rates and liquidity events. Words such as “intends,” “will,” “believes,” “expects,” “projects,” “future” and “may” or similar expressions are intended to identify forward-looking statements. These forward-looking statements are subject to the inherent uncertainties in predicting future results and conditions. Certain factors could cause actual results to differ materially from those projected in these forward-looking statements. Factors that could cause actual results to differ materially include changes in the economy due to geo-political risks, risks associated with possible disruption to the Fund’s operations or the economy generally due to hostilities, terrorism, natural disasters or pandemics, future changes in laws or regulations and conditions in the Fund’s operating area, unexpected costs, the ability of the Fund to complete the reorganization, complete the listing of the common shares on a national securities exchange, the price at which the common shares may trade on a national securities exchange, and failure to list the common shares on a national securities exchange, and such other factors that are disclosed in the Fund’s filings with the Securities and Exchange Commission (the “SEC”). The inclusion of forward-looking statements should not be regarded as a representation that any plans, estimates or expectations will be achieved. Any forward-looking statements speak only as of the date of this communication. Except as required by federal securities laws, the Fund undertakes no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. Readers are cautioned not to place undue reliance on any of these forward-looking statements. Disclosures |

| 31 ADDITIONAL INFORMATION AND WHERE TO FIND IT In connection with the Reorganization and Declaration of Trust amendments discussed herein, the Successor Fund has filed with the SEC solicitation materials in the form of a joint proxy statement/prospectus included in an effective registration statement on Form N-14 (File No. 333-286859). The definitive joint proxy statement/prospectus has been mailed to shareholders of the Fund. This document is not a substitute for the definitive joint proxy statement/prospectus or registration statement or any other document that the Fund or the Successor Fund may file with the SEC. Investors are urged to read the proxy statement/prospectus and any other relevant documents filed or to be filed with the SEC carefully because they contain and will contain important information about the Reorganization, the Declaration of Trust amendment proposals, the Fund and the Successor Fund. Free copies of the joint proxy statement/prospectus and other documents are available, and any other documents filed by the Fund and the Successor Fund in connection with the Reorganization and the Declaration of Trust amendment proposals will be available, on the SEC’s web site at www.sec.gov or at www.fsproxy.com. IMPORTANT INFORMATION The Fund, its trustees and certain of its officers may be considered to be participants in the solicitation of proxies from shareholders in connection with the matters described herein. Information regarding the identity of potential participants, and their direct or indirect interests in the Fund, by security holdings or otherwise, are set forth in the definitive joint proxy statement/prospectus. and the proxy statement and any other materials filed with the SEC in connection with the Fund’s 2024 annual meeting of shareholders. Shareholders are able to obtain any such documents for no charge at the SEC’s website at www.sec.gov. Copies are available at no charge at the Fund’s website at www.fsproxy.com. Investors should consider a fund’s investment objective, risks, and charges and expenses before investing. The joint proxy statement/prospectus, contains this and other information about the Fund and the Successor Fund, including risk factors that should be carefully considered. This communication does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended. Disclosures |