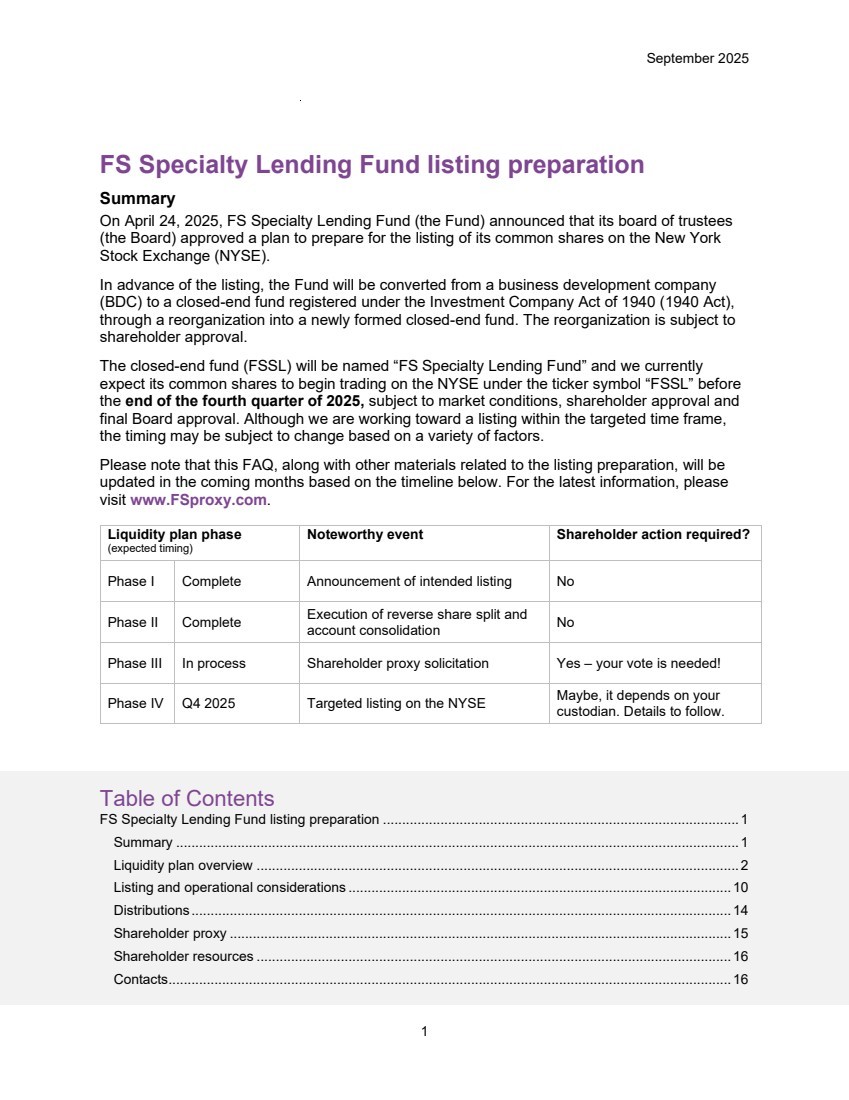

| September 2025 1 FS Specialty Lending Fund listing preparation Summary On April 24, 2025, FS Specialty Lending Fund (the Fund) announced that its board of trustees (the Board) approved a plan to prepare for the listing of its common shares on the New York Stock Exchange (NYSE). In advance of the listing, the Fund will be converted from a business development company (BDC) to a closed-end fund registered under the Investment Company Act of 1940 (1940 Act), through a reorganization into a newly formed closed-end fund. The reorganization is subject to shareholder approval. The closed-end fund (FSSL) will be named “FS Specialty Lending Fund” and we currently expect its common shares to begin trading on the NYSE under the ticker symbol “FSSL” before the end of the fourth quarter of 2025, subject to market conditions, shareholder approval and final Board approval. Although we are working toward a listing within the targeted time frame, the timing may be subject to change based on a variety of factors. Please note that this FAQ, along with other materials related to the listing preparation, will be updated in the coming months based on the timeline below. For the latest information, please visit www.FSproxy.com. Liquidity plan phase (expected timing) Noteworthy event Shareholder action required? Phase I Complete Announcement of intended listing No Phase II Complete Execution of reverse share split and account consolidation No Phase III In process Shareholder proxy solicitation Yes – your vote is needed! Phase IV Q4 2025 Targeted listing on the NYSE Maybe, it depends on your custodian. Details to follow. Table of Contents FS Specialty Lending Fund listing preparation .............................................................................................1 Summary ...................................................................................................................................................1 Liquidity plan overview ..............................................................................................................................2 Listing and operational considerations ....................................................................................................10 Distributions.............................................................................................................................................14 Shareholder proxy ...................................................................................................................................15 Shareholder resources ............................................................................................................................16 Contacts...................................................................................................................................................16 |

| September 2025 2 Liquidity plan overview Timeline and shareholder considerations Ticker symbol Ticker symbol: FSSL Expected timeline • May 15: The Fund conducted a 6-for-1 reverse share split of its common shares and consolidated account types under a new CUSIP. • Late June: Commenced shareholder proxy solicitation. • Q4 2025: Target listing on the NYSE, subject to market conditions, approval of the NYSE, satisfaction of the NYSE’s listing standards, shareholder approval of the proposals related to the Fund’s reorganization to a registered closed-end fund, and final Board approval. Conversion to a registered closed-end fund • The Fund will be converted from a business development company into a closed-end fund registered under the 1940 Act through a reorganization into a newly formed closed-end fund. The reorganization is subject to shareholder approval. • FSSL, the closed-end fund, will maintain the same board, investment objectives and strategy as the Fund* • The closed-end fund will be named “FS Specialty Lending Fund” and intends to pursue a listing of its shares on the NYSE. Reverse share split • On May 15, 2025, the Fund conducted a 6-for-1 reverse split of its common shares. Following the split, shareholders own one share for every six shares held before the split. • The reverse share split is designed to achieve the following objectives: ‒ Comply with NYSE listing requirements which mandate a minimum stock price of $4.00 per share at the time of listing. As of March 31, 2025, the Fund’s net asset value (NAV) was $3.37 per share. Following the share split, the Fund’s NAV was $20.22 per share. As of June 30, 2025, the Fund’s NAV declined to $19.82 per share, largely driven by the payment of the enhanced quarterly distribution attributed to Q1 2025. ‒ Align the share price with the typical trading range of comparable closed-end funds, which have historically traded in the range of approximately $10 to $20 per share. ‒ Meet the minimum share price requirements for certain intermediaries, broker dealers and custodians. Quarterly repurchase offer • We expect the quarterly tender offers to remain suspended until the listing, at which point all shares will become freely tradable on the NYSE. *The investment strategy will remain the same except for certain requirements specific to BDCs under the 1940 Act, which won’t apply once the Fund is converted to a closed-end fund. |

| September 2025 3 Investment and fund management Management team • The Fund’s Adviser is currently jointly operated by an affiliate of Future Standard and EIG Asset Management, LLC. As part of the conversion to a closed-end fund, Future Standard (FS), formerly FS Investments, will acquire EIG’s interest in the Adviser, making the Adviser an indirect, wholly-owned subsidiary of Future Standard. • The Adviser will continue managing the Fund, with FS’s Global Credit Team assuming full investment management responsibilities. This team has played a central role in the Fund’s transition to a diversified credit strategy since May 2023. Fee changes • Upon a listing, the base management fee will be reduced from 1.75% to 1.50% of gross assets. The Adviser has agreed to waive 0.15% of the fee, resulting in an effective base management fee of 1.35% on gross assets, effective upon the listing and continuing for as long as the FSSL remains a registered closed-end fund.1 • The Adviser currently may earn incentive fees consisting of two components: (i) a capital gains incentive fee and (ii) a subordinated income incentive fee. ‒ Following the conversion and reorganization into a closed-end fund, the Adviser will no longer be entitled to a capital gains incentive fee. ‒ Upon listing and continuing for as long as FSSL remains a registered closed-end fund, the Adviser has agreed to waive a portion of the income incentive fee, reducing it from 20% to 10% subject to an annualized hurdle rate of 6.0%.2 Distributions • The Fund paid enhanced quarterly distributions for Q1 and Q2 2025, in April and July respectively, at an annualized distribution rate of 12.5% based on the Fund’s then-current NAV. • The Fund’s quarterly enhanced distributions were designed to offer attractive returns to shareholders during the transition period to a diversified credit strategy, with the understanding that they were intended to conclude once the Fund achieves a long-term liquidity event, and a portion of the distributions may represent a return of capital. • If a listing occurs prior to the end of the third quarter of 2025, we expect FSSL to pay a full quarterly enhanced distribution for the third quarter, payable in October. In the fourth quarter, we expect FSSL to target a monthly or quarterly distribution, representing an annualized distribution rate of approximately 9.0% to 9.5% of FSSL’s NAV.3 • If a listing occurs in the fourth quarter of 2025, FSSL will pay a full quarterly enhanced distribution for the third quarter of 2025. In the fourth quarter, we expect FSSL to target a monthly or quarterly distribution, representing an annualized distribution rate of approximately 9.0-9.5% of the Fund’s NAV.3 We believe this rate is competitive with those of closed-end fund peers and offers a meaningful income premium over risk-free rates. • Beginning in January 2026, we expect FSSL to declare and pay distributions on a monthly basis, subject to a listing occurring in 2025 and board approval. • Following the listing, all cash dividends or distributions declared by the Board will be reinvested on behalf of shareholders who do not elect to receive their distributions in cash. Shareholders who do not elect to “opt out” of FSSL’s distribution reinvestment plan (DRP) will have their shares automatically reinvested in additional shares. Secondary market support FS and/or its affiliates are evaluating potential options for strengthening demand for FSSL’s shares in the secondary market. |

| September 2025 4 1. Why list FSSL’s shares on the NYSE now? Background • In May 2023, the Fund announced Board-approved changes to the Fund’s name, investment objectives and investment strategy as part of a plan to transition from investing primarily in private U.S. energy and power companies to a diversified credit strategy spanning private and public credit across a broader range of industries, sectors and subsectors. • The transition to a diversified credit strategy was designed to enhance shareholder returns, maximize the Fund’s long-term liquidity options, accelerate the timeline for a liquidity event and reduce the volatility associated with a single sector-focused strategy. • We also communicated that the Fund would target a liquidity event by the end of Q3 2026 – within three years of the effective date of the changes to the Fund’s name, strategy and investment objectives. Potential liquidity options could include a public listing, merger, sale or another alternative as approved by the Board. • To maximize the liquidity options, we believed the Fund’s strategy, asset mix, distribution, credit quality, and capital structure needed to be positioned to appeal to the broadest possible investor base – whether through the public markets (via a direct listing), a merger with an affiliate or competitor fund, or a sale to institutional asset managers. Key metrics required to maximize long-term liquidity options • Together with the Fund’s Board, we concluded that – regardless of the ultimate liquidity path for shareholders – the Fund must achieve a set of highly interdependent goals to maximize its commercial appeal to the broadest possible audience, including: ‒ Reduce energy holdings to approximately 20% or less of the portfolio’s fair value to create a more broadly diversified portfolio across industries, sectors and subsectors. ‒ Grow the Fund’s net investment income to support an annualized distribution rate that is competitive in the market, based on the Fund’s net asset value at the time of a liquidity event. ‒ Increase income-accruing investments to approximately 90% of the portfolio’s fair value by reducing the Fund’s allocation to common equity and underperforming debt investments. Progress in reaching the key metrics required to maximize long-term liquidity options • As of June 30, 2025, these key portfolio metrics were at or near our target range, and we believe the Fund is well-positioned for a liquidity event through a public listing. ‒ Energy investments represented 8.0% of the portfolio’s fair value as of June 30, 2025, well within our target threshold. The portfolio is broadly diversified across sectors and industries. Senior secured debt comprised 89% of the portfolio’s fair value as of June 30, 2025, reflecting our focus on high-quality, income-generating assets. ‒ Upon listing, we expect FSSL to target an annualized distribution rate of approximately 9.0-9.5% based on NAV, which is competitive with peers in the closed-end fund market.3 Subject to market conditions, fund performance and prevailing yields, we believe this level can be sustained over time by increasing FSSL’s allocation to higher-yielding private credit investments, optimizing borrowings, and further reducing exposure to non-income-producing assets. In November 2024, the Fund received exemptive relief from the U.S. Securities and Exchange Commission (SEC) allowing it to co-invest in privately originated investments alongside certain other FS-managed funds. We believe this added flexibility will help enhance the Fund’s ability to grow net investment income over time. ‒ Income-accruing investments represented 98.5% of the portfolio’s fair value as of June 30, 2025, compared to approximately 60% as of March 31, 2023.4 The increase was driven by our focus on exiting non-income producing equity investments and reducing assets on non-accrual. • We believe a public listing offers a well-balanced liquidity solution–providing current shareholders with near-term access to liquidity, while preserving the opportunity for long-term value appreciation for those who choose to remain invested. |

| 5 2. How will FSSL be differentiated in the public markets? • Fully scaled credit platform with a significant market presence: As of June 30, 2025, the Fund managed approximately $1.9 billion in assets, which would rank as one of the largest public credit-focused registered closed-end funds. A relatively higher market capitalization and float (i.e., the number of shares available for public trading) compared to peers may enhance secondary market liquidity and attract a broader investor base upon listing. • Proven management team: The Adviser will continue to manage FSSL with FS’s Global Credit Team assuming full investment management responsibilities. The team has played a central role in the Fund’s transition to a diversified credit strategy since May 2023. Formed in 2017, FS’s Global Credit Team is led by Andrew Beckman and Nick Heilbut, seasoned credit investors with prior experience at DW Partners, Magnetar and Goldman Sachs’ Special Situations Multi-Strategy Group. Their vision was to bring the investment style they developed at Goldman to a broader investor base and build a global credit platform with diverse market exposure. Team highlights: ‒ Manage over $7 billion in assets for institutional and individual investors across registered closed end funds, private drawdown funds, collateralized loan obligations (CLO) and FSSL. ‒ Long-tenured leadership: Andrew Beckman and several senior team members have worked together for nearly 20 years, beginning in the early 2000s as part of Goldman Sachs’ Special Situations Multi-Strategy Group. ‒ Access to FS’s $86 billion asset management platform: The team benefits from the resources, personnel, and infrastructure of FS’s asset management platform, which provides a continuous flow of market insights to enhance the team’s underwriting, while seeking to generate strong shareholder returns. ‒ Deep middle market expertise: The team has significant experience sourcing, underwriting and managing investments in middle market companies with a specialized focus on lower and core middle market companies. ‒ Robust, multi-channel deal sourcing: The Fund leverages an extensive deal sourcing network spanning the investment management team and the broader firm, including a private sourcing partnership with J.P. Morgan, to originate differentiated investment opportunities. • Dynamic strategy investing across private and public credit: The investment team aims to dynamically allocate capital to the most attractive opportunities across private and public credit in pursuit of return premiums. Unlike banks, insurance companies, or many private traditional credit strategies, the team is not constrained by a specific asset class mandate, allowing for greater adaptability in shifting market environments. • Attractive distribution: Upon listing, we expect FSSL to target an annualized distribution rate of approximately 9.0-9.5% based on its NAV. This rate is competitive with closed-end fund peers and offers a meaningful income premium over risk-free rates. 3 3. What liquidity options were considered? • We previously communicated a liquidity event could include a merger, sale of the portfolio, a listing of the Fund’s common shares on a national securities exchange or other transaction as approved by the Board. • The Board discussed and considered matters relating to a potential liquidity event at a series of several meetings held over a period of months. Throughout the process, the Board requested, received and discussed information from various parties, including presentations from the Adviser and presentations and analysis from Keefe, Bruyette & Woods (KBW), financial adviser to the Board. During the course of the Board’s deliberations, the Independent Trustees were represented by independent counsel and met various times with independent counsel separate from Fund management. • The Board, management and KBW discussed a variety of possible strategic alternatives for the Fund, including listing as a BDC, listing as a closed-end fund, conducting an initial public offering, merging with an affiliated entity, merging with a non-affiliated entity, winding down the Fund and maintaining the Fund as a non-listed BDC. • KBW provided the Board with an analysis of strategic alternatives, including but not limited to, estimated total shareholder value under each scenario, peer performance benchmarks for closed-end funds and BDCs, current market dynamics, historical IPO and listing data, and relevant case studies on listings, IPOs, mergers, and BDC transaction trends. |

| 6 • The Board considered each strategic alternative, specifically taking into account: (i) feasibility of execution, (ii) attractiveness to shareholders, (iii) potential for shareholder liquidity; (iv) associated costs to the Fund; (v) potential value that shareholders could realize long-term; and (vi) potential risks to the Fund and its shareholders. 4. Why list as a registered closed-end fund instead of a BDC? • After comparing market and financial performance between the Fund and comparable publicly traded BDCs and credit-focused closed-end funds, it became apparent that the Fund would be better aligned with publicly traded registered closed-end funds. Financial metrics evaluated include total assets, borrowings, actual and estimated returns on assets and equity, and expense ratios, among others. Market performance metrics include stock prices, market capitalization, NAV per share and dividend yields, among others. • The Fund would differ from a BDC peer group consisting of publicly traded, externally managed BDCs with market capitalizations over $1 billion in the following notable ways: ‒ Lower allocation to private credit assets: As of June 30, 2025, private credit assets comprised approximately 62% of the Fund’s portfolio, compared to approximately 90% for the BDC peer group. While the Fund intends to increase its allocation to private credit over time, the current underweight allocation may hinder its ability to trade in line with its peers. ‒ Lower leverage: Public BDCs typically use a higher degree of leverage (borrowings) to support their distribution and return targets. While BDCs are permitted to borrow up to a 2:1 debt-to-equity ratio (i.e., $2 of debt for every $1 of equity), the Fund has maintained a more conservative level of borrowings during its transition to a diversified credit strategy. As of June 30, 2025, the Fund’s debt-to-equity ratio was 0.26x, compared to an average of approximately 1.2x for the public BDC peer group. This lower use of leverage results in lower returns on assets and equity, which may limit the Fund’s ability to trade in line with its peers. ‒ Lower divided yield: Upon listing, we expect FSSL to target an annualized distribution rate of approximately 9.0-9.5% based on NAV. By comparison, the average distribution yield for the BDC peer group was 10.3% as of June 30, 2025, also based on NAV. 3 Listing the Fund as a BDC with a less competitive distribution could cause the Fund to trade at a discount to its NAV and relative to the peer group over the long term. • On the other hand, the Fund would benefit from the FS Global Credit Team’s experience managing a publicly traded closed-end fund and would compare favorably to a closed-end fund peer group consisting of publicly traded funds with credit-focused strategies or asset mixes similar to the Fund. ‒ Experienced management team: The Adviser will continue to manage FSSL, with the FS Global Credit Team assuming full investment management responsibilities. This team has played a central role in the Fund’s transition to a diversified credit strategy since May 2023. We believe the Fund is well positioned to benefit from the team’s sourcing capabilities, credit expertise, and track record of performance across the broader FS Global Credit platform. ‒ Strong track record managing publicly traded closed-end fund: The FS Global Credit Team also manages FS Credit Opportunities Corp. (NYSE: FSCO), a publicly traded closed-end fund with a similar strategy that has delivered strong returns since its listing on the NYSE in November 2022. Since the FS Global Credit team assumed management of FSCO in January 2018, the fund has outperformed the high yield bond and leveraged loan benchmark by 329 basis points and 266 basis points, respectively, based on NAV as of June 30, 2025. ‒ Distribution aligned with peers: Upon listing, we expect FSSL to target an annualized distribution rate of approximately 9.0-9.5% based on its NAV, which would make it competitive with closed-end fund peers and offering a significant income premium over risk-free rates.3 ‒ Borrowings aligned with peers: As noted above, the Fund used a modest level of borrowings relative to regulatory limits during the transition to a diversified credit strategy. As of June 30, 2025, the Fund’s debt-to-equity ratio was 0.26x. This level is consistent with closed-end fund peers, within the Fund’s targeted ratio as a listed closed-end fund (0.25x-0.4x) and below the regulatory leverage limit applicable to closed-end funds (0.5x). ‒ Strong market visibility: As of June 30, 2025, the Fund has approximately $1.9 billion in assets, which would rank as one of the largest public credit-focused registered closed-end funds. A relatively higher market capitalization and float (i.e., the number of shares available for public trading) compared to peers may enhance secondary market liquidity and attract a broader investor base upon listing. |

| 7 5. Why not merge the Fund with an affiliated fund? • The FS Global Credit team manages over $7 billion across five strategies, including FS Specialty Lending Fund, private drawdown funds, FS Credit Income Fund, an interval fund, and FS Credit Opportunities Fund (NYSE:FSCO), a publicly traded closed-end fund. • While the Fund and FSCO are not perfect proxies, they share similar investment strategies and investment objectives. Additionally, in November 2024, the Fund received exemptive relief from the U.S. Securities and Exchange Commission (SEC) allowing it to co-invest in privately originated investments alongside FSCO and other funds managed by the FS Global Credit Team. • As a result, a potential merger with FSCO could appear attractive. Potential near- and long-term benefits of an affiliated merger include, but are not limited to, increased scale, enhanced secondary market liquidity, and the potential for reduced operating expenses and lower financing costs. • However, we believe a merger with FSCO would not be the optimal path to maximize shareholder value at this time due to significant execution risks associated with a potential merger: ‒ First, a merger would require approval from both shareholder bases and, because both funds are regulated under the Investment Company Act of 1940, it would need to be completed on a “NAV-for-NAV basis” – meaning the Fund’s shareholders would receive FSCO shares equal in value to their FSSL shares based on each fund’s net asset value. In this case, FSCO shareholders could experience material earnings dilution in the combined entity, primarily driven by the Fund’s lower net investment income compared to FSCO. ‒ In addition, the potential for post-merger selling pressure from FSSL shareholders could negatively affect FSCO’s trading performance. ‒ As of June 30, 2025, the Fund’s portfolio overlap with FSCO was only approximately 52%. Successful affiliated mergers typically involve funds with substantially greater overlap, often comprising the vast majority of their investment portfolios. • Each of these potential risks would likely influence FSCO shareholders to vote against the transaction and/or heighten the execution risk of a successful affiliated merger at this time. 6. Why not merge the Fund with a non-affiliated fund? • A potential merger with a non-affiliated fund could appear attractive. Potential near- and long-term benefits of a non-affiliated merger include, but are not limited to, increased scale, enhanced secondary market liquidity, and the potential for reduced operating expenses and lower financing costs. • However, we believe a merger with a non-affiliated fund would not be the optimal path to maximize shareholder value due to significant execution risks associated with a potential merger. Material risks include, but are not limited to, the following: ‒ Uncertain length and outcome of due diligence by acquirer: The diligence and negotiation process could delay the liquidity event well beyond the target liquidity event date for FSSL. A protracted sale process could result in significant costs to the Fund, which would be borne by shareholders. ‒ Acquirer unlikely to pay fair premium or even fair value for assets: Private credit investments represented 62% of the portfolio’s fair value as of June 30, 2025. These are privately originated transactions between the Fund and a portfolio company where the FS Global Credit Team has direct access to company financials, management, operations and forward-looking growth plans. As a result, the existing manager is often best positioned to assess the fair value of private credit investments, given their ongoing engagement with the borrower and deep understanding of the credit. Because private credit valuations rely on ongoing analysis and judgment – not daily market pricing – a third-party acquirer may be less willing to pay what we believe reflects the true value for the assets. ‒ Post-listing trading performance depends highly on the quality of the acquirer: The stock price and secondary market liquidity of the combined entity are closely tied to both the acquirer’s capabilities and overall market sentiment around the transaction. Differences in management philosophies may limit the potential for operational synergies, reducing the ability to create long-term value for shareholders. 7. Why didn’t the Fund liquidate its assets or wind down the portfolio upon transitioning to a diversified credit strategy? • We did not believe that liquidating the portfolio or allowing it to simply run off would maximize shareholder value. In fact, pursuing that path could have prolonged the timeline before shareholders had the option for full liquidity of |

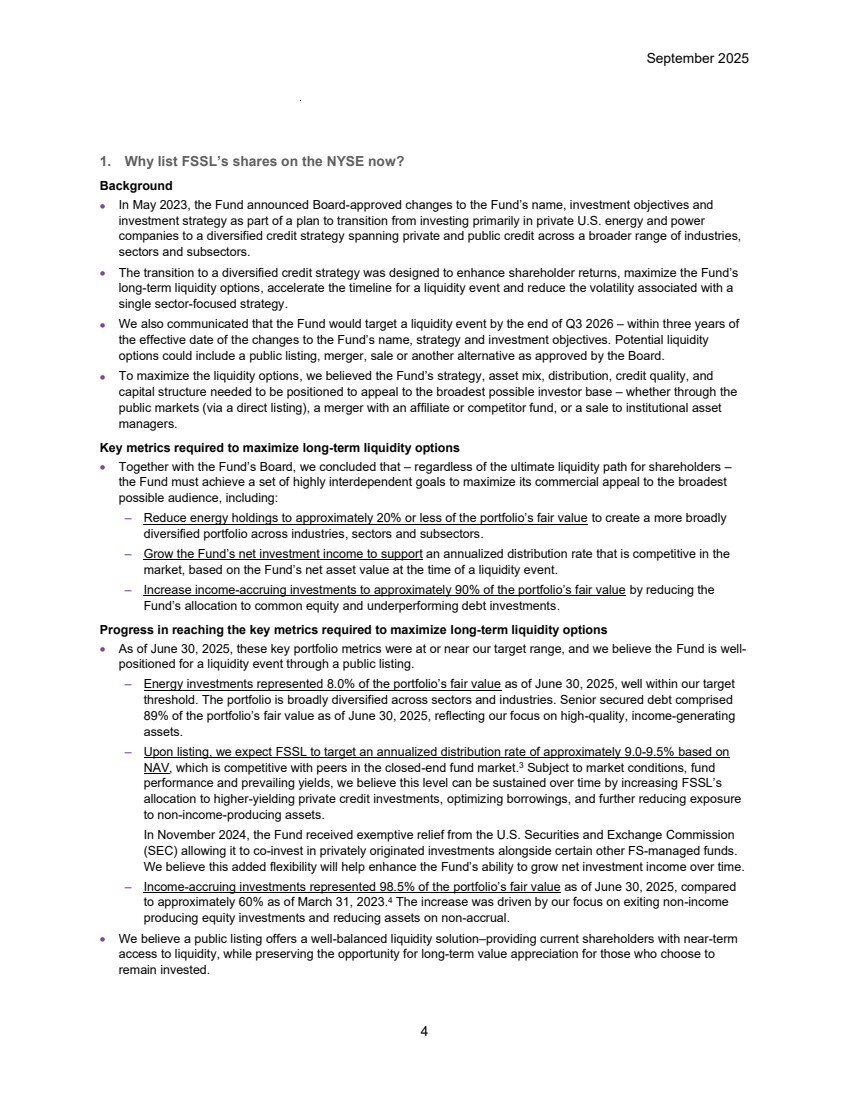

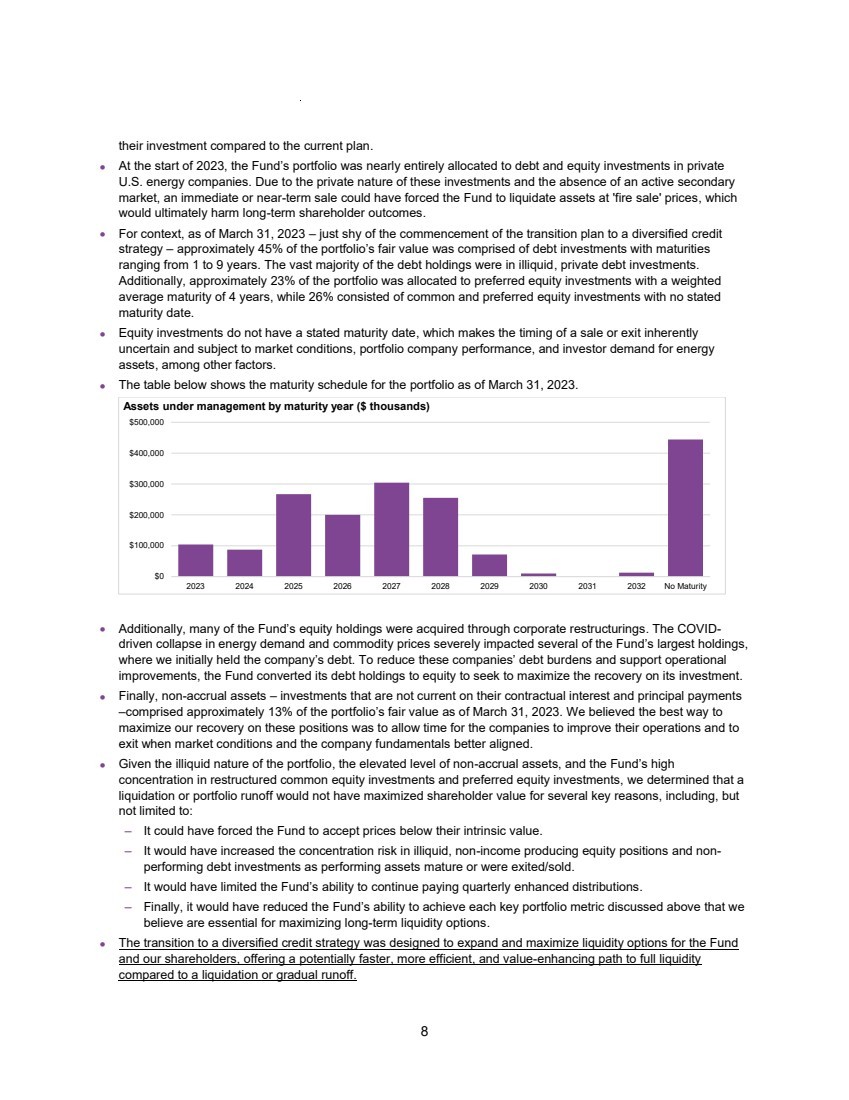

| 8 their investment compared to the current plan. • At the start of 2023, the Fund’s portfolio was nearly entirely allocated to debt and equity investments in private U.S. energy companies. Due to the private nature of these investments and the absence of an active secondary market, an immediate or near-term sale could have forced the Fund to liquidate assets at 'fire sale' prices, which would ultimately harm long-term shareholder outcomes. • For context, as of March 31, 2023 – just shy of the commencement of the transition plan to a diversified credit strategy – approximately 45% of the portfolio’s fair value was comprised of debt investments with maturities ranging from 1 to 9 years. The vast majority of the debt holdings were in illiquid, private debt investments. Additionally, approximately 23% of the portfolio was allocated to preferred equity investments with a weighted average maturity of 4 years, while 26% consisted of common and preferred equity investments with no stated maturity date. • Equity investments do not have a stated maturity date, which makes the timing of a sale or exit inherently uncertain and subject to market conditions, portfolio company performance, and investor demand for energy assets, among other factors. • The table below shows the maturity schedule for the portfolio as of March 31, 2023. • Additionally, many of the Fund’s equity holdings were acquired through corporate restructurings. The COVID-driven collapse in energy demand and commodity prices severely impacted several of the Fund’s largest holdings, where we initially held the company’s debt. To reduce these companies’ debt burdens and support operational improvements, the Fund converted its debt holdings to equity to seek to maximize the recovery on its investment. • Finally, non-accrual assets – investments that are not current on their contractual interest and principal payments –comprised approximately 13% of the portfolio’s fair value as of March 31, 2023. We believed the best way to maximize our recovery on these positions was to allow time for the companies to improve their operations and to exit when market conditions and the company fundamentals better aligned. • Given the illiquid nature of the portfolio, the elevated level of non-accrual assets, and the Fund’s high concentration in restructured common equity investments and preferred equity investments, we determined that a liquidation or portfolio runoff would not have maximized shareholder value for several key reasons, including, but not limited to: ‒ It could have forced the Fund to accept prices below their intrinsic value. ‒ It would have increased the concentration risk in illiquid, non-income producing equity positions and non-performing debt investments as performing assets mature or were exited/sold. ‒ It would have limited the Fund’s ability to continue paying quarterly enhanced distributions. ‒ Finally, it would have reduced the Fund’s ability to achieve each key portfolio metric discussed above that we believe are essential for maximizing long-term liquidity options. • The transition to a diversified credit strategy was designed to expand and maximize liquidity options for the Fund and our shareholders, offering a potentially faster, more efficient, and value-enhancing path to full liquidity compared to a liquidation or gradual runoff. $0 $100,000 $200,000 $300,000 $400,000 $500,000 2023 2024 2025 2026 2027 2028 2029 2030 2031 2032 No Maturity Assets under management by maturity year ($ thousands) |

| 9 8. Why didn’t the Fund return capital to shareholders as the energy investments were exited or sold? • Distributing proceeds from asset sales, exits, or repayments would have conflicted with the Fund’s ability to achieve the key portfolio metrics outlined above, which we believe are essential prerequisites for accelerating the timing of a long-term liquidity event that maximizes shareholder value. • For example, distributing proceeds throughout the transition period would have: ‒ Limited the Fund’s ability to reinvest capital into income-producing assets, which is critical to growing net investment income and supporting an annualized distribution rate that is competitive in the market. ‒ Hindered progress toward reducing energy holdings to 20% or less of the portfolio’s fair value. ‒ Increased the concentration risk in illiquid, non-income producing equity positions and non-performing debt investments as performing assets matured or were exited/sold. |

| September 2025 10 Listing and operational considerations 9. Why convert to a registered closed-end fund? • The Fund will be converted from a business development company into a closed-end fund registered under the 1940 Act through a reorganization into a newly formed closed-end fund. The reorganization is subject to shareholder approval. • The closed-end fund will maintain the same board, investment objectives and strategy as the Fund except for certain requirements specific to BDCs under the 1940 Act, which won’t apply once the Fund is converted to a closed-end fund. • The closed-end fund will be named “FS Specialty Lending Fund” and intends to pursue a listing of its shares on the NYSE. • The decision to convert the Fund to a registered closed-end fund was guided by several key factors that we believe are in the best interests of shareholders, including: ‒ Experienced management team: The Adviser will continue to manage FSSL, with FS’s Global Credit Team assuming full investment management responsibilities. This team has played a central role in the Fund’s transition to a diversified credit strategy since May 2023. The FS Global Credit Team also manages FS Credit Opportunities Corp. (NYSE: FSCO), a publicly traded closed-end fund with a strategy similar to the Fund. FSCO was listed on the NYSE in November 2022 and has delivered strong returns since that time. We believe the Fund is well positioned to benefit from the team’s expertise, differentiated sourcing network, and deep investment experience across the combined platform. ‒ Distribution aligned with peers: At the time of listing, we expect FSSL to target an annualized distribution rate of approximately 9.0-9.5% based on its NAV, making it competitive with closed-end fund peers and offering a significant income premium over risk-free rates.3 ‒ Borrowings aligned with peers: As part of the transition to the diversified credit strategy, the Fund has used a modest level of borrowings relative to regulatory limits. While BDCs are permitted to borrow up to 2:1 debt-to-equity (i.e., borrow $2 dollars for every $1 of equity), as of June 30, 2025, the Fund’s debt-to-equity ratio was 0.26x. This level is consistent with closed-end fund peers, within our targeted ratio as a listed closed-end fund (0.25x-0.4x) and below the regulatory leverage limit applicable to closed-end funds (0.5x). ‒ Strong market visibility: As of June 30, 2025 the Fund managed approximately $1.9 billion in assets, which would rank as one of the largest public credit-focused registered closed-end funds. A relatively higher market capitalization and float (i.e., the number of shares available for public trading) compared to peers may enhance secondary market liquidity and attract a broader investor base upon listing. 10. What is the difference between a direct listing and an initial public offering (IPO)? • We intend for FSSL’s common shares to begin trading through a direct listing on the NYSE – not an initial public offering – subject to various factors. • This is an important distinction because, in an IPO, a company issues new shares and raises new capital in the public markets at an offering price and shares typically begin trading in the public markets based on the offering price. • In contrast, FSSL’s direct listing does not involve the issuance of new shares, and the stock price will not be set prior to the listing. • Instead, the public share price will be determined by market dynamics – specifically, the supply from existing shareholders looking to sell and demand from both existing and new investors seeking to purchase shares. • If supply significantly exceeds demand at listing (i.e., more sellers than buyers) FSSL’s share price may decline and trade at a meaningful discount to its net asset value. Conversely, if supply and demand are more balanced, the share price may trade closer to NAV. 5 |

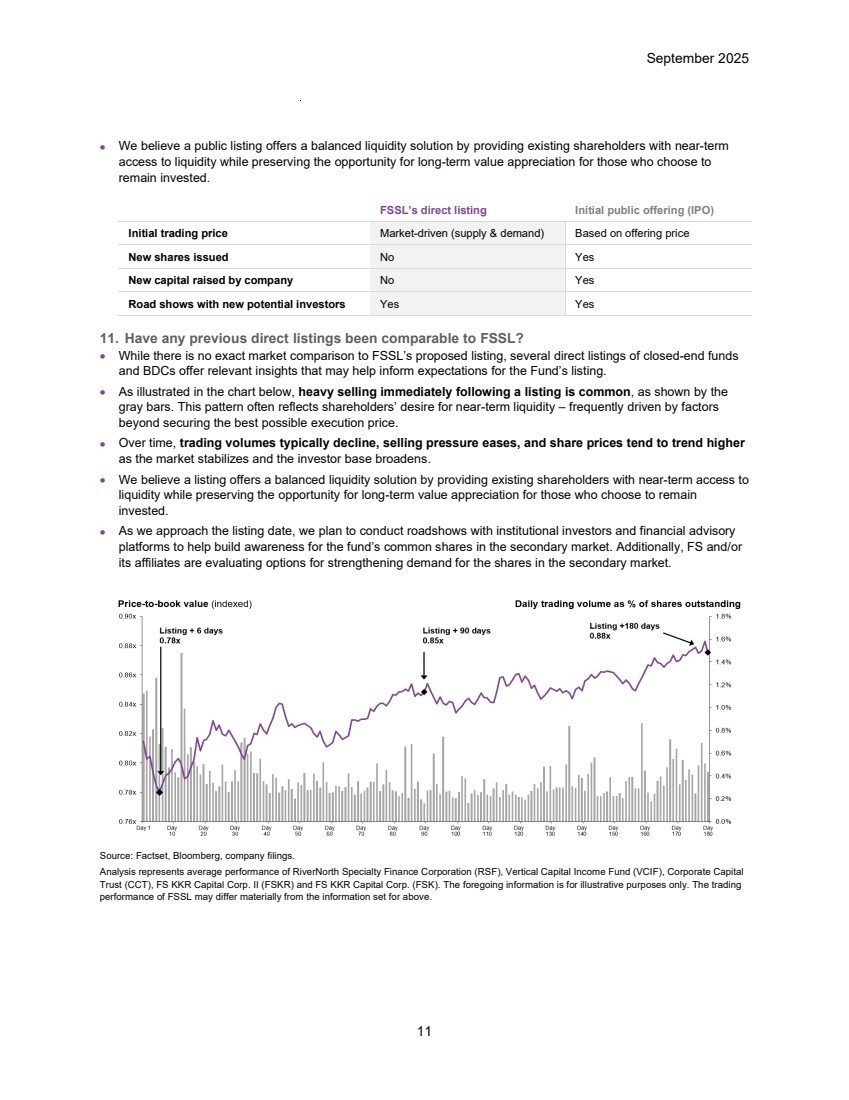

| September 2025 11 • We believe a public listing offers a balanced liquidity solution by providing existing shareholders with near-term access to liquidity while preserving the opportunity for long-term value appreciation for those who choose to remain invested. FSSL’s direct listing Initial public offering (IPO) Initial trading price Market-driven (supply & demand) Based on offering price New shares issued No Yes New capital raised by company No Yes Road shows with new potential investors Yes Yes 11. Have any previous direct listings been comparable to FSSL? • While there is no exact market comparison to FSSL’s proposed listing, several direct listings of closed-end funds and BDCs offer relevant insights that may help inform expectations for the Fund’s listing. • As illustrated in the chart below, heavy selling immediately following a listing is common, as shown by the gray bars. This pattern often reflects shareholders’ desire for near-term liquidity – frequently driven by factors beyond securing the best possible execution price. • Over time, trading volumes typically decline, selling pressure eases, and share prices tend to trend higher as the market stabilizes and the investor base broadens. • We believe a listing offers a balanced liquidity solution by providing existing shareholders with near-term access to liquidity while preserving the opportunity for long-term value appreciation for those who choose to remain invested. • As we approach the listing date, we plan to conduct roadshows with institutional investors and financial advisory platforms to help build awareness for the fund’s common shares in the secondary market. Additionally, FS and/or its affiliates are evaluating options for strengthening demand for the shares in the secondary market. Source: Factset, Bloomberg, company filings. Analysis represents average performance of RiverNorth Specialty Finance Corporation (RSF), Vertical Capital Income Fund (VCIF), Corporate Capital Trust (CCT), FS KKR Capital Corp. II (FSKR) and FS KKR Capital Corp. (FSK). The foregoing information is for illustrative purposes only. The trading performance of FSSL may differ materially from the information set for above. |

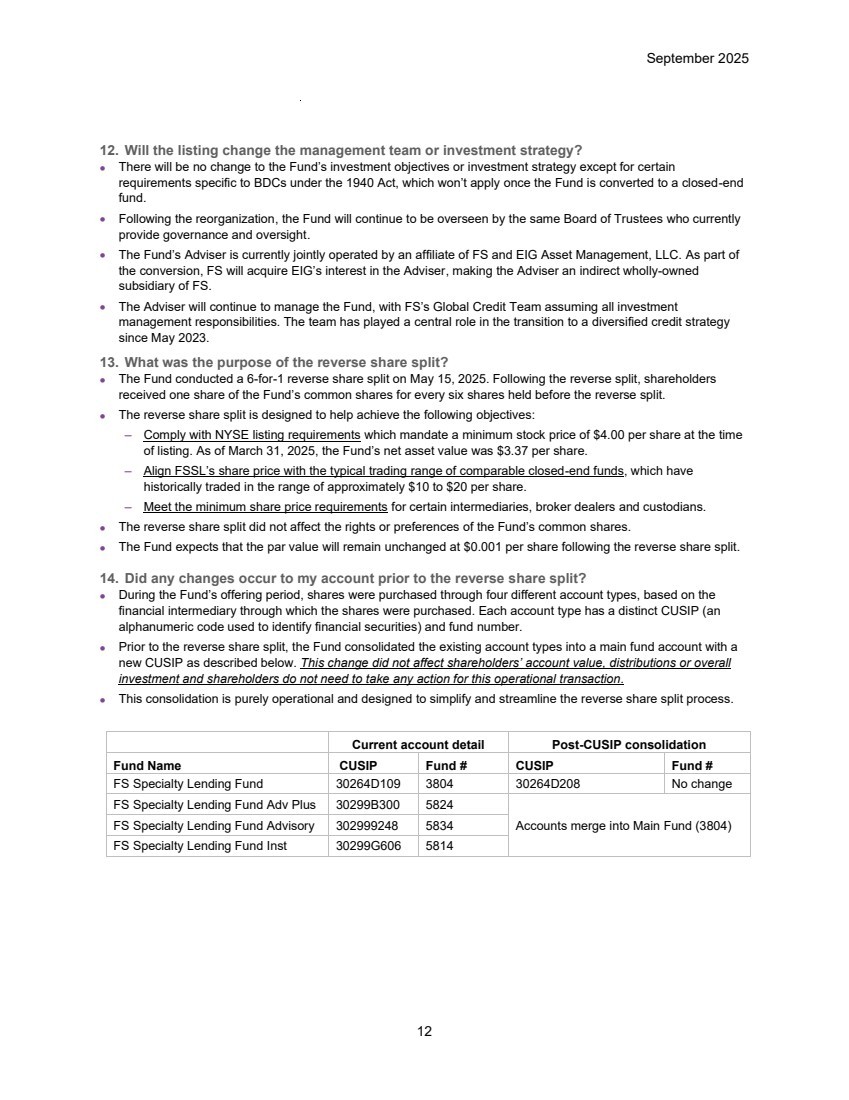

| September 2025 12 12. Will the listing change the management team or investment strategy? • There will be no change to the Fund’s investment objectives or investment strategy except for certain requirements specific to BDCs under the 1940 Act, which won’t apply once the Fund is converted to a closed-end fund. • Following the reorganization, the Fund will continue to be overseen by the same Board of Trustees who currently provide governance and oversight. • The Fund’s Adviser is currently jointly operated by an affiliate of FS and EIG Asset Management, LLC. As part of the conversion, FS will acquire EIG’s interest in the Adviser, making the Adviser an indirect wholly-owned subsidiary of FS. • The Adviser will continue to manage the Fund, with FS’s Global Credit Team assuming all investment management responsibilities. The team has played a central role in the transition to a diversified credit strategy since May 2023. 13. What was the purpose of the reverse share split? • The Fund conducted a 6-for-1 reverse share split on May 15, 2025. Following the reverse split, shareholders received one share of the Fund’s common shares for every six shares held before the reverse split. • The reverse share split is designed to help achieve the following objectives: ‒ Comply with NYSE listing requirements which mandate a minimum stock price of $4.00 per share at the time of listing. As of March 31, 2025, the Fund’s net asset value was $3.37 per share. ‒ Align FSSL’s share price with the typical trading range of comparable closed-end funds, which have historically traded in the range of approximately $10 to $20 per share. ‒ Meet the minimum share price requirements for certain intermediaries, broker dealers and custodians. • The reverse share split did not affect the rights or preferences of the Fund’s common shares. • The Fund expects that the par value will remain unchanged at $0.001 per share following the reverse share split. 14. Did any changes occur to my account prior to the reverse share split? • During the Fund’s offering period, shares were purchased through four different account types, based on the financial intermediary through which the shares were purchased. Each account type has a distinct CUSIP (an alphanumeric code used to identify financial securities) and fund number. • Prior to the reverse share split, the Fund consolidated the existing account types into a main fund account with a new CUSIP as described below. This change did not affect shareholders’ account value, distributions or overall investment and shareholders do not need to take any action for this operational transaction. • This consolidation is purely operational and designed to simplify and streamline the reverse share split process. Current account detail Post-CUSIP consolidation Fund Name CUSIP Fund # CUSIP Fund # FS Specialty Lending Fund 30264D109 3804 30264D208 No change FS Specialty Lending Fund Adv Plus 30299B300 5824 FS Specialty Lending Fund Advisory 302999248 5834 Accounts merge into Main Fund (3804) FS Specialty Lending Fund Inst 30299G606 5814 |

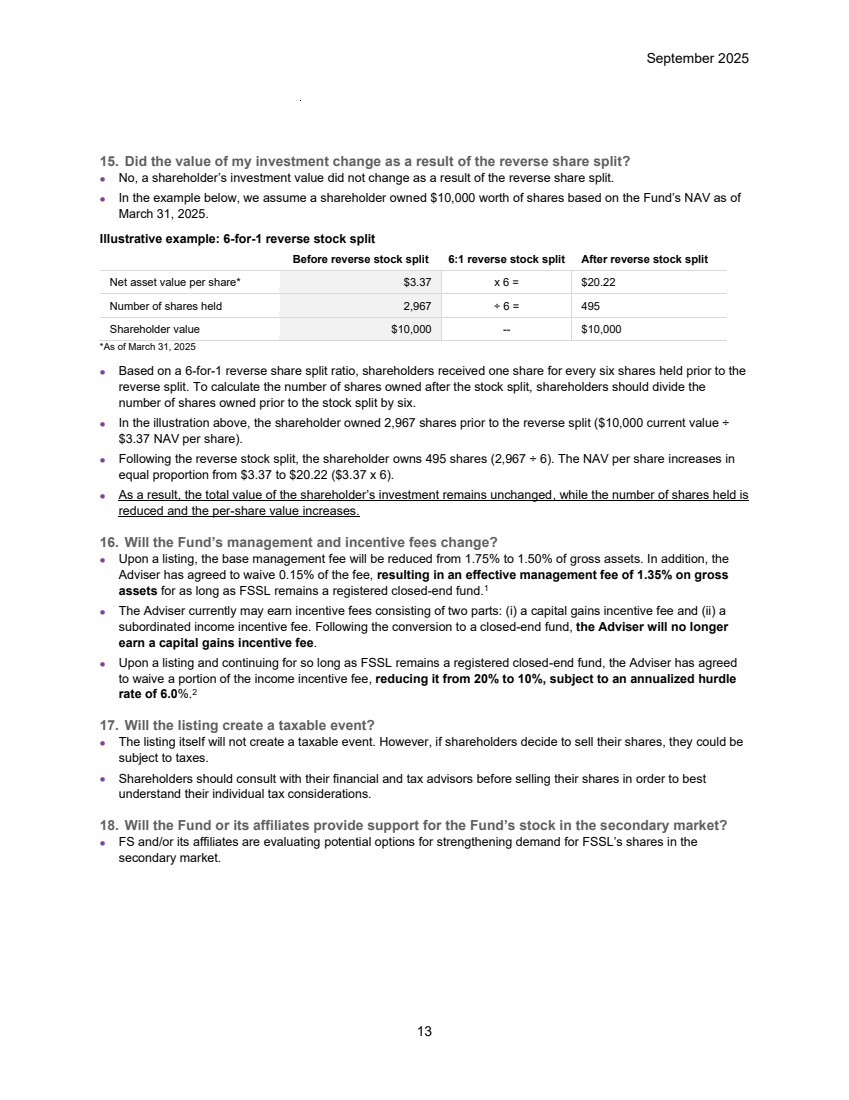

| September 2025 13 15. Did the value of my investment change as a result of the reverse share split? • No, a shareholder’s investment value did not change as a result of the reverse share split. • In the example below, we assume a shareholder owned $10,000 worth of shares based on the Fund’s NAV as of March 31, 2025. Illustrative example: 6-for-1 reverse stock split Before reverse stock split 6:1 reverse stock split After reverse stock split Net asset value per share* $3.37 x 6 = $20.22 Number of shares held 2,967 ÷ 6 = 495 Shareholder value $10,000 -- $10,000 *As of March 31, 2025 • Based on a 6-for-1 reverse share split ratio, shareholders received one share for every six shares held prior to the reverse split. To calculate the number of shares owned after the stock split, shareholders should divide the number of shares owned prior to the stock split by six. • In the illustration above, the shareholder owned 2,967 shares prior to the reverse split ($10,000 current value ÷ $3.37 NAV per share). • Following the reverse stock split, the shareholder owns 495 shares (2,967 ÷ 6). The NAV per share increases in equal proportion from $3.37 to $20.22 ($3.37 x 6). • As a result, the total value of the shareholder’s investment remains unchanged, while the number of shares held is reduced and the per-share value increases. 16. Will the Fund’s management and incentive fees change? • Upon a listing, the base management fee will be reduced from 1.75% to 1.50% of gross assets. In addition, the Adviser has agreed to waive 0.15% of the fee, resulting in an effective management fee of 1.35% on gross assets for as long as FSSL remains a registered closed-end fund.1 • The Adviser currently may earn incentive fees consisting of two parts: (i) a capital gains incentive fee and (ii) a subordinated income incentive fee. Following the conversion to a closed-end fund, the Adviser will no longer earn a capital gains incentive fee. • Upon a listing and continuing for so long as FSSL remains a registered closed-end fund, the Adviser has agreed to waive a portion of the income incentive fee, reducing it from 20% to 10%, subject to an annualized hurdle rate of 6.0%. 2 17. Will the listing create a taxable event? • The listing itself will not create a taxable event. However, if shareholders decide to sell their shares, they could be subject to taxes. • Shareholders should consult with their financial and tax advisors before selling their shares in order to best understand their individual tax considerations. 18. Will the Fund or its affiliates provide support for the Fund’s stock in the secondary market? • FS and/or its affiliates are evaluating potential options for strengthening demand for FSSL’s shares in the secondary market. |

| September 2025 14 Distributions 19. Will the Fund continue to pay quarterly enhanced distributions? • The Fund paid enhanced quarterly distributions for Q1 and Q2 2025 in April and July, respectively, at an annualized distribution rate of 12.5% based on the Fund’s then-current NAV. • The Fund’s quarterly enhanced distributions were designed to offer attractive returns to shareholders during the transition period to a diversified credit strategy, with the understanding that they were intended to conclude once the Fund achieves a long-term liquidity event, and a portion of the distributions may represent a return of capital. • Given our expectation for a listing by the end of Q4 2025, we expect the quarterly enhanced distribution for Q3 will be the final quarterly enhanced distribution. ‒ If a listing occurs prior to the end of the third quarter of 2025, we expect FSSL to pay a full quarterly enhanced distribution for the third quarter, payable in October. In the fourth quarter we expect the closed-end fund to target a monthly or quarterly distribution representing an annualized distribution rate of approximately 9.0% to 9.5% of FSSL’s NAV.3 We believe this rate is competitive with those of closed-end fund peers and offers a meaningful income premium over risk-free rates. ‒ If a listing occurs in the fourth quarter of 2025, FSSL will pay a full quarterly enhanced distribution for the third quarter of 2025. In the fourth quarter, we expect FSSL to target a monthly or quarterly distribution representing an annualized distribution rate of approximately 9.0-9.5% of the Fund’s NAV.3 ‒ Beginning in January 2026, we expect FSSL to declare and pay distributions on a monthly basis, subject to a listing occurring in 2025 and board approval. • As previously communicated, we believe a portion of the enhanced quarterly distributions may represent a return of capital to investors on a tax basis. Tax characteristics for the Fund’s distributions are reported annually on shareholders’ Form 1099-DIV. In 2023 and 2024, 100% of the Fund’s distributions were funded through ordinary income on a tax basis. This was supported by the Fund’s undistributed taxable income from prior periods as well as one-time distributions from certain holdings, all which contributed to covering distributions through the Fund’s net investment income. 20. Will the Fund have a distribution reinvestment plan upon a listing? • Yes. Following the listing, FSSL will reinvest all cash dividends or distributions declared by the board on behalf of shareholders who do not elect to receive their distributions in cash. As a result, shareholders who have not elected to “opt out” of the Fund’s distribution reinvestment plan (DRP) will have their shares automatically reinvested in additional shares. • If the per share market price is equal to or greater than the estimated NAV per share on the payment date for a distribution, then FSSL will issue shares at the greater of (i) NAV per share or (ii) 95% of the market price. If the per share market price is less than NAV per share, then FSSL, at its discretion, will (i) purchase shares in the open market for accounts of participants where practicable, or (ii) issue shares at NAV per share. |

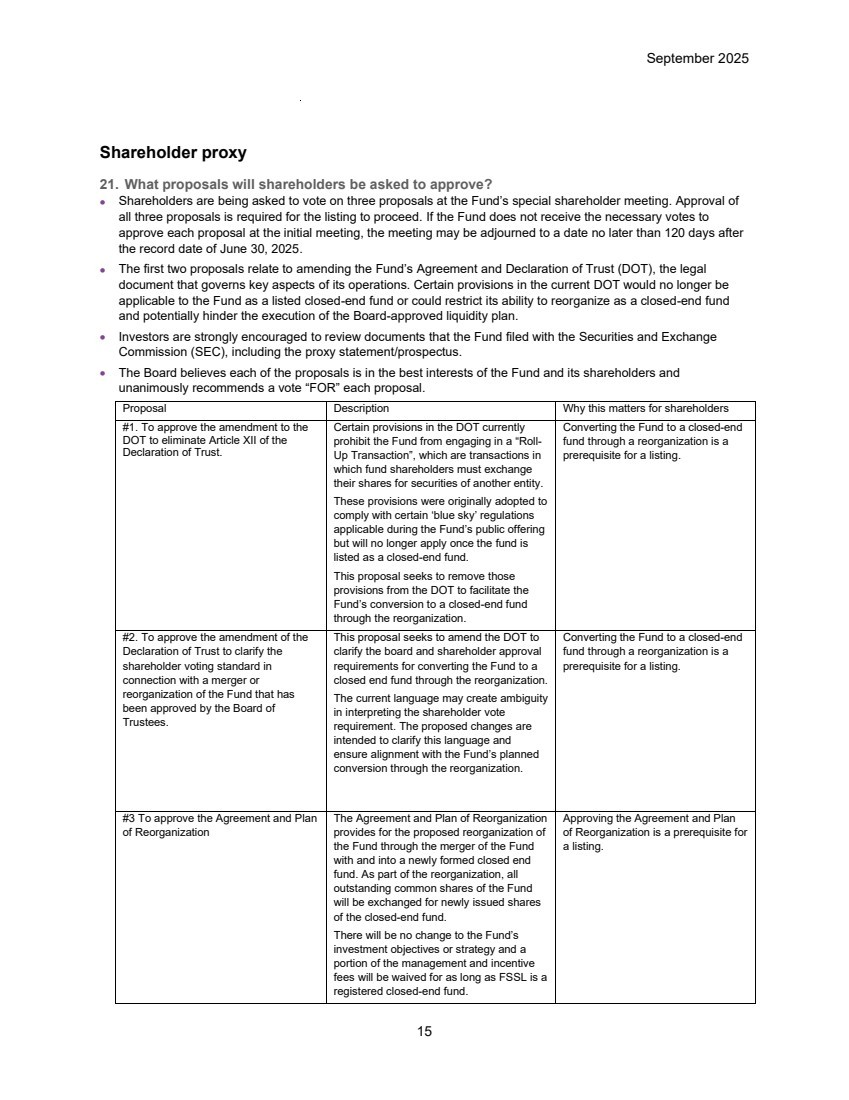

| September 2025 15 Shareholder proxy 21. What proposals will shareholders be asked to approve? • Shareholders are being asked to vote on three proposals at the Fund’s special shareholder meeting. Approval of all three proposals is required for the listing to proceed. If the Fund does not receive the necessary votes to approve each proposal at the initial meeting, the meeting may be adjourned to a date no later than 120 days after the record date of June 30, 2025. • The first two proposals relate to amending the Fund’s Agreement and Declaration of Trust (DOT), the legal document that governs key aspects of its operations. Certain provisions in the current DOT would no longer be applicable to the Fund as a listed closed-end fund or could restrict its ability to reorganize as a closed-end fund and potentially hinder the execution of the Board-approved liquidity plan. • Investors are strongly encouraged to review documents that the Fund filed with the Securities and Exchange Commission (SEC), including the proxy statement/prospectus. • The Board believes each of the proposals is in the best interests of the Fund and its shareholders and unanimously recommends a vote “FOR” each proposal. Proposal Description Why this matters for shareholders #1. To approve the amendment to the DOT to eliminate Article XII of the Declaration of Trust. Certain provisions in the DOT currently prohibit the Fund from engaging in a “Roll-Up Transaction”, which are transactions in which fund shareholders must exchange their shares for securities of another entity. These provisions were originally adopted to comply with certain ‘blue sky’ regulations applicable during the Fund’s public offering but will no longer apply once the fund is listed as a closed-end fund. This proposal seeks to remove those provisions from the DOT to facilitate the Fund’s conversion to a closed-end fund through the reorganization. Converting the Fund to a closed-end fund through a reorganization is a prerequisite for a listing. #2. To approve the amendment of the Declaration of Trust to clarify the shareholder voting standard in connection with a merger or reorganization of the Fund that has been approved by the Board of Trustees. This proposal seeks to amend the DOT to clarify the board and shareholder approval requirements for converting the Fund to a closed end fund through the reorganization. The current language may create ambiguity in interpreting the shareholder vote requirement. The proposed changes are intended to clarify this language and ensure alignment with the Fund’s planned conversion through the reorganization. Converting the Fund to a closed-end fund through a reorganization is a prerequisite for a listing. #3 To approve the Agreement and Plan of Reorganization The Agreement and Plan of Reorganization provides for the proposed reorganization of the Fund through the merger of the Fund with and into a newly formed closed end fund. As part of the reorganization, all outstanding common shares of the Fund will be exchanged for newly issued shares of the closed-end fund. There will be no change to the Fund’s investment objectives or strategy and a portion of the management and incentive fees will be waived for as long as FSSL is a registered closed-end fund. Approving the Agreement and Plan of Reorganization is a prerequisite for a listing. |

| 16 22. What vote is required for each proposal to pass? • Proposals 1 and 2 require approval by a majority of votes cast. • Proposal 3 requires the affirmative vote of the lesser of (i) a majority of the Fund’s outstanding shares, or (ii) 67% or more of the shares present at the shareholder meeting, provided that a majority of the Fund’s outstanding shares are present at the meeting. 23. Will the Fund incur expenses in soliciting proxies? • The expenses of the solicitation of proxies for the shareholder meetings, including the cost of preparing, printing and mailing the proxy statement, the applicable accompanying notice of the special shareholder meeting of shareholders and the proxy card, will be borne by the Fund. • Broadridge Investor Communication Solutions, Inc. has been retained by the Fund to assist in the solicitation of proxies. Shareholder resources 24. Where can I find additional resources? • Please note that this FAQ, along with other materials related to the listing preparation, will be updated in the coming months based on the timeline above. For the latest information, please visit www.FSproxy.com. Contacts ADVISORS AND SHAREHOLDERS 877-628-8575 MEDIA (FUTURE STANDARD) Melanie Hemmert, media@fsinvestments.com, 215-309-6843 FOOTNOTES 1. For each quarter after the listing date, the base management fee will be reduced from 1.75% to 1.50% of gross assets. In addition, the Adviser has agreed to waive 0.15% of the fee, resulting in an effective base management fee of 1.35% on gross assets commencing upon the listing and continuing for as long as FSSL remains a registered closed-end fund. Amounts waived by the Adviser will not be subject to recoupment from FSSL. 2. Pursuant to the terms of FSSL’s Investment Advisory Agreement, for any quarter ending after the listing, the incentive fee on income is calculated and payable quarterly in arrears and equals 20.0% of FSSL’s “pre-incentive fee net investment income” for the immediately preceding quarter subject to a hurdle rate, expressed as a rate of return on net assets, equal to 1.5% per quarter, or an annualized hurdle rate of 6.0% compared to the current hurdle rate of 6.5%. As a result, the Adviser will not earn this incentive fee for any quarter until FSSL’s pre-incentive fee net investment income for such quarter exceeds the hurdle rate of 1.5%. Once FSSL’s pre-incentive fee net investment income in any quarter exceeds the hurdle rate, the Adviser will be entitled to a “catch-up” fee equal to the amount of FSSL’s pre-incentive fee net investment income in excess of the hurdle rate, until FSSL’s pre-incentive fee net investment income for such quarter equals 1.875%, or 7.5% annually, of net assets. This “catch-up” feature will allow the Adviser to recoup the fees foregone as a result of the existence of the hurdle rate. Thereafter, the Adviser will be entitled to receive 20.0% of FSSL’s pre-incentive fee net investment income. While the incentive fee on income of the Fund and FSSL prior to the listing will be subject to a hurdle rate equal to a percentage of “adjusted capital” (as defined the Fund’s and FSSL’s Investment Advisory Agreement), the incentive fee on income of FSSL after the listing will be subject to a hurdle rate expressed as a rate of return on net assets, which will have the effect of making it more likely that the fund’s pre-incentive fee net investment income will exceed the hurdle rate and therefore more likely that FSSL will pay an incentive fee on income. Effective on the listing and for so long as FSSL is a registered closed-end fund, the Adviser has contractually agreed to waive a portion of FSSL’s incentive fee. After giving effect to such fee waiver, the incentive fee on income will be calculated and payable quarterly in arrears and equals 10.00% of the closed-end fund’s “pre-incentive fee net investment income” for the immediately preceding quarter subject to a hurdle rate, expressed as a rate of return on net assets, equal to 1.5% per quarter, or an annualized hurdle rate of 6.0%. As a result, the Adviser will not earn this incentive fee for any quarter until FSSL’s pre-incentive fee net investment income for such quarter exceeds the hurdle rate of 1.5%. Once FSSL’s pre-incentive fee net investment income in any quarter exceeds the hurdle rate, the Adviser will be entitled to a “catch-up” fee equal to the amount of FSSL’s pre-incentive fee net investment income in excess of the hurdle rate, until the closed-end fund’s pre-incentive fee net investment income for such quarter equals 1.667%, or 6.667% annually, of net assets. This “catch-up” feature will allow the Adviser to recoup the fees foregone as a result of the existence of the hurdle rate. Thereafter, the Adviser will be entitled to receive 10.00% of the closed-end fund’s pre-incentive fee net investment income. Amounts waived by the Adviser will not be subject to recoupment from the closed-end fund. 3. The actual annualized distribution rate at listing may be higher or lower based on the then current NAV. The payment of future distributions on the fund’s common shares is subject to the discretion of the fund’s board of trustees and applicable legal restrictions and, therefore, there can be no assurance as to the amount or timing of any such future distributions 4. Income-producing investments represented 98.5% of the portfolio as of June 30, 2025, inclusive of certain common equity investments which paid special distributions to the Fund over the last twelve months. Absent these payments, however, income-accruing assets represented 95.2% off the portfolio’s fair value as of June 30, 2025. |

| 17 5. There can be no assurance the Fund will successfully complete the proposed listing. If the Fund completes a listing of its common shares, shares of closed-end funds frequently trade at a price lower than their net asset value. This is commonly referred to as “trading at a discount.” This characteristic of shares of closed-end funds is a risk separate and distinct from the risk that a fund’s net asset value may decrease. Because the shares of the Fund have been illiquid, this risk may be more pronounced during the period shortly after the listing, during which the shares may experience greater volatility and may trade at significant discounts to net asset value. The fund is designed primarily for long-term investors and should not be considered a vehicle for trading purposes. Whether investors will realize a gain or loss upon the sale of the Fund’s common shares will depend upon whether the market value of the shares at the time of sale is above or below the price the investor paid, taking into account transaction costs, for the common shares and is not directly dependent upon the Fund’s net asset value. Because the market value of the Fund’s common shares will be determined by factors such as the relative demand for and supply of the common shares in the market, general market conditions and other factors beyond the control of the Fund, the Fund cannot predict whether its common stock will trade at, below or above NAV, or below or above the initial listing price for the common shares. As a result, even if the Fund does complete a listing, shareholders may not receive a return of all of their invested capital upon a sale of their shares on the exchange. CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS Statements included herein may constitute “forward-looking” statements as that term is defined in Section 27A of the Securities Act, and Section 21E of the Securities Exchange Act of 1934, as amended by the Private Securities Litigation Reform Act of 1995, including statements with regard to future events or the future performance or operations of the Fund, including but not limited to, anticipated distribution rates and liquidity events. Words such as “intends,” “will,” “believes,” “expects,” “projects,” “future” and “may” or similar expressions are intended to identify forward-looking statements. These forward-looking statements are subject to the inherent uncertainties in predicting future results and conditions. Certain factors could cause actual results to differ materially from those projected in these forward-looking statements. Factors that could cause actual results to differ materially include changes in the economy due to geo-political risks, risks associated with possible disruption to the Fund’s operations or the economy generally due to hostilities, terrorism, natural disasters or pandemics, future changes in laws or regulations and conditions in the Fund’s operating area, unexpected costs, the ability of the Fund to complete the reorganization, complete the listing of the common shares on a national securities exchange, the price at which the common shares may trade on a national securities exchange, and failure to list the common shares on a national securities exchange, and such other factors that are disclosed in the Fund’s filings with the Securities and Exchange Commission (the “SEC”). The inclusion of forward-looking statements should not be regarded as a representation that any plans, estimates or expectations will be achieved. Any forward-looking statements speak only as of the date of this communication. Except as required by federal securities laws, the Fund undertakes no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. Readers are cautioned not to place undue reliance on any of these forward-looking statements. ADDITIONAL INFORMATION AND WHERE TO FIND IT In connection with the Reorganization and Declaration of Trust amendments discussed herein, the Successor Fund has filed with the SEC solicitation materials in the form of a joint proxy statement/prospectus included in an effective registration statement on Form N-14 (File No. 333-286859). The definitive joint proxy statement/prospectus has been mailed to shareholders of the Fund. This document is not a substitute for the definitive joint proxy statement/prospectus or registration statement or any other document that the Fund or the Successor Fund may file with the SEC. Investors are urged to read the proxy statement/prospectus and any other relevant documents filed or to be filed with the SEC carefully because they contain and will contain important information about the Reorganization, the Declaration of Trust amendment proposals, the Fund and the Successor Fund. Free copies of the joint proxy statement/prospectus and other documents are available, and any other documents filed by the Fund and the Successor Fund in connection with the Reorganization and the Declaration of Trust amendment proposals will be available, on the SEC’s web site at www.sec.gov or at www.fsproxy.com. IMPORTANT INFORMATION The Fund, its trustees and certain of its officers may be considered to be participants in the solicitation of proxies from shareholders in connection with the matters described herein. Information regarding the identity of potential participants, and their direct or indirect interests in the Fund, by security holdings or otherwise, are set forth in the definitive joint proxy statement/prospectus. and the proxy statement and any other materials filed with the SEC in connection with the Fund’s 2024 annual meeting of shareholders. Shareholders are able to obtain any such documents for no charge at the SEC’s website at www.sec.gov. Copies are available at no charge at the Fund’s website at www.fsproxy.com. Investors should consider a fund’s investment objective, risks, and charges and expenses before investing. The joint proxy statement/prospectus, contains this and other information about the Fund and the Successor Fund, including risk factors that should be carefully considered. |

| 18 This communication does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended. |