|

Fund Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment

|

|

Point Bridge America First ETF

|

$77

|

0.72%

|

|

|

1 Year

|

5 Year

|

Since Inception

(09/06/2017) |

|

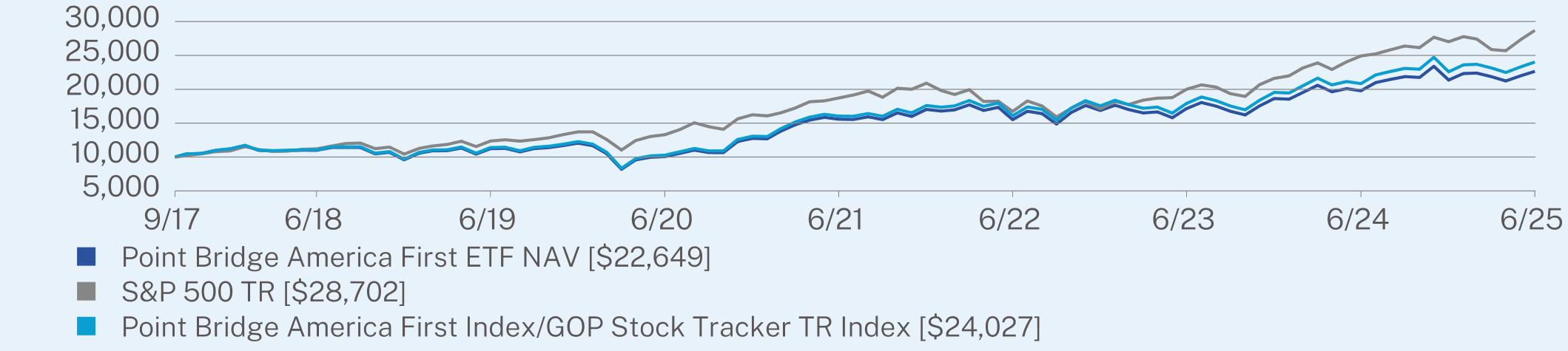

Point Bridge America First ETF NAV

|

14.49

|

17.61

|

11.03

|

|

S&P 500 TR

|

15.16

|

16.64

|

14.45

|

|

Point Bridge America First Index/GOP Stock Tracker TR Index

|

15.33

|

18.52

|

11.87

|

|

Net Assets

|

$31,365,308

|

|

Number of Holdings

|

151

|

|

Net Advisory Fee

|

$192,931

|

|

Portfolio Turnover

|

40%

|

|

30-Day SEC Yield

|

1.43%

|

|

30-Day SEC Yield Unsubsidized

|

1.43%

|

|

Top Sectors

|

(% of Net Assets)

|

|

Financial

|

21.6%

|

|

Industrial

|

16.8%

|

|

Consumer, Non-cyclical

|

14.5%

|

|

Consumer, Cyclical

|

14.0%

|

|

Energy

|

12.2%

|

|

Utilities

|

10.6%

|

|

Basic Materials

|

6.5%

|

|

Technology

|

2.0%

|

|

Communications

|

1.5%

|

|

Cash & Other

|

0.3%

|

|

Top 10 Issuers

|

(% of Net Assets)

|

|

HEICO Corporation

|

1.4%

|

|

Lennar Corporation

|

1.3%

|

|

Robinhood Markets, Inc.

|

0.8%

|

|

Goldman Sachs Group, Inc.

|

0.7%

|

|

EMCOR Group, Inc.

|

0.7%

|

|

United Rentals, Inc.

|

0.7%

|

|

Vistra Corporation

|

0.7%

|

|

Truist Financial Corporation

|

0.7%

|

|

Synchrony Financial

|

0.7%

|

|

Kroger Company

|

0.7%

|