The Fund seeks to match, at the end of the current Outcome Period, the share price returns of the iShares® MSCI EAFE ETF (the “Underlying ETF”), up to a specified upside Cap, while providing a Buffer against the first 5% of Underlying ETF losses. The Cap and the Buffer will be reduced after taking into account management fees and other Fund fees and expenses.

This table describes the fees and expenses that you may pay if you buy, hold and sell shares of the Fund (“Shares”). Investors may pay other fees, such as brokerage commissions and other fees to financial intermediaries, which are not reflected in the table or the example below.

| Management Fees | 0.74% |

| Distribution and/or Service (12b-1) Fees | 0.00% |

| Other Expenses1 | 0.00% |

| Total Annual Fund Operating Expenses | 0.74% |

| 1 | Other Expenses are estimated for the current fiscal year. |

This example is intended to help you compare the cost of investing in the Fund with the cost of investing in other funds.

This example assumes that you invest $10,000 in the Fund for the time periods indicated and then sell all of your Shares at the end of those periods. The example also assumes that your investment has a 5% return each year and that the Fund’s operating expenses remain at current levels. This example does not include the brokerage commissions that investors may pay to buy and sell Shares. Although your actual costs may be higher or lower, your costs, based on these assumptions, would be:

| 1 Year | 3 Years |

| $76 | $237 |

The Fund pays transaction costs, such as commissions, when it purchases and sells securities (or “turns over” its portfolio). A higher portfolio turnover will cause the Fund to incur additional transaction costs and may result in higher taxes when Shares are held in a taxable account. These costs, which are not reflected in Total Annual Fund Operating Expenses or in the example, may affect the Fund’s performance. Because the Fund has not yet commenced investment operations, no portfolio turnover information is available at this time.

The Fund pursues a buffered strategy that seeks to match the share price returns of the iShares® MSCI EAFE ETF (the “Underlying ETF”) (i.e., the market price returns of the Underlying ETF), at the end of a three-month calendar quarter (i.e., from January 1 to March 31, April 1 to June 30, July 1 to September 30, or October 1 to December 31), as described below (the “Outcome Period”), subject to an upside maximum percentage return (the “Cap”) and downside protection with a buffer against the first 5.00% of Underlying ETF losses (the “Buffer”). The Fund’s intended return measured across different market conditions (e.g., rising or declining markets) is referred to as “outcomes” in this prospectus. The Underlying ETF’s share price returns reflect the price at which the Underlying ETF’s shares trade on the secondary market (not the Underlying ETF’s net asset value).

Under normal market conditions, the Fund invests at least 80% of its net assets in instruments with economic characteristics similar to equity securities. Specifically, the Fund intends to invest substantially all of its assets in FLexible EXchange Options (“FLEX Options”) that reference the Underlying ETF. FLEX Options are customized equity or index options contracts that trade on an exchange, but provide investors with the ability to customize key contract terms like exercise

prices, styles and expiration dates. The Fund may purchase and sell a combination of call option contracts and put option contracts. A call option contract is an agreement between a buyer and seller that gives the purchaser of the call option contract the right, but not the obligation, to buy, and the seller of the call option contract (or the “writer”) the obligation to sell, a particular asset at a specified future date at an agreed upon price (commonly known as the “strike price”). A put option contract gives the purchaser of the put option contract the right, but not the obligation, to sell, and the writer of the put option contract the obligation to buy, a particular asset at a specified future date at the strike price.

The Cap is set at or near the close of the market on the business day prior to the first day of the Outcome Period, based on market conditions. Specifically, the Cap is based on the market costs associated with a series of FLEX Options that are purchased and sold in order to seek to obtain the relevant market exposure and to provide downside protection via the Buffer. The market conditions and other factors that influence the Cap can include market volatility, risk free rates, and time to expiration of the FLEX Options. The Cap for the current Outcome Period is [ ]% prior to taking into account any fees or expenses charged to the Fund. When the Fund’s annualized management fee of 0.74% of the Fund’s average daily net assets is taken into account, the Cap is reduced to [ ]%. The Buffer is 5.00% prior to taking into account any fees or expenses charged to the Fund. When the Fund’s annualized management fee of 0.74% of the Fund’s average daily net assets is taken into account, the Buffer is reduced to [ ]%.

The Fund’s return will be reduced by the Fund’s unitary management fee and further reduced by brokerage commissions, trading fees, taxes and non-routine or extraordinary expenses not included in the Fund’s unitary management fee. For the purpose of this prospectus, “non-routine or extraordinary expenses” are non-recurring expenses that may be incurred by the Fund outside of the ordinary course of its business, including, without limitation, costs incurred in connection with any claim, litigation, arbitration, mediation, government investigation or similar proceedings, indemnification expenses and expenses in connection with holding or soliciting proxies for a meeting of Fund shareholders. The returns that the Fund seeks to provide also do not include the costs associated with purchasing Shares of the Fund. The Fund will not receive or benefit from any dividend payments made by the Underlying ETF. It is expected that the Cap will change from one Outcome Period to the next. There is no guarantee, and it is unlikely, that the Cap will remain the same after the end of the Outcome Period. The Cap may increase or decrease, and it may change significantly, depending upon the market conditions at that time.

The Fund is classified as “non-diversified” under the Investment Company Act of 1940, as amended (the “1940 Act”), which means it generally may invest a greater proportion of its assets in the securities of one or more issuers and may invest overall in a smaller number of issuers than a diversified fund. Through its exposure to FLEX Options that reference the Underlying ETF, the Fund will concentrate its investments (i.e., invest 25% or more of the value of its net assets) in securities of issuers in any one industry or group of industries only to the extent that the Underlying ETF reflects a concentration in that industry or group of industries. The Fund will not otherwise concentrate its investments in securities of issuers in any one industry or group of industries.

The Underlying ETF is an exchange-traded fund that seeks to track the investment results of the MSCI EAFE Index (the “Underlying Index”), which is a free float-adjusted, market capitalization-weighted index designed to measure large- and mid-capitalization equity market performance of developed markets outside of the U.S. and Canada. The Underlying Index includes stocks from Europe, Australasia and the Far East and, as of July 31, 2025, consisted of securities from the following 21 developed market countries or regions: Australia, Austria, Belgium, Denmark, Finland, France, Germany, Hong Kong, Ireland, Israel, Italy, Japan, the Netherlands, New Zealand, Norway, Portugal, Singapore, Spain, Sweden, Switzerland and the United Kingdom. As of July 31, 2025, a significant portion of the Underlying Index was represented by securities of companies in the financials and industrials sectors and companies in Japan. Accordingly, through its investments in FLEX Options that reference the Underlying ETF, the Fund had significant exposure to the financials and industrials sectors and to Japan as of July 31, 2025. The components of the Underlying Index are likely to change over time.

The Underlying ETF utilizes a representative sampling indexing strategy to seek to track the Underlying Index. “Representative sampling” is an indexing strategy that involves investing in a representative sample of securities that collectively has an investment profile similar to that of an applicable underlying index. The securities selected are expected to have, in the aggregate, investment characteristics (based on factors such as market capitalization and industry weightings), fundamental characteristics (such as return variability and yield) and liquidity measures similar to those of an applicable underlying index. As a result, the Underlying ETF may or may not hold all of the securities in the Underlying Index.

The Fund seeks to achieve its objective by buying and selling call and put FLEX Options that reference the Underlying ETF. Generally, the Fund will enter into the FLEX Options for an Outcome Period on the business day immediately prior to the

first day of the Outcome Period, and the FLEX Options of an Outcome Period will expire on the last business day of the Outcome Period, at which time the Fund will invest in a new set of FLEX Options for the next Outcome Period.

In general, the Fund seeks to achieve the following outcomes for each Outcome Period, although there can be no guarantee these results will be achieved:

| • | If the Underlying ETF’s share price has increased as of the end of the Outcome Period, the combination of FLEX Options held by the Fund is designed to provide positive returns that match the return of the Underlying ETF’s share price, up to the Cap. |

| • | If the Underlying ETF’s share price has decreased as of the end of the Outcome Period, the combination of FLEX Options held by the Fund is designed to compensate for the first 5.00% of losses experienced by the Underlying ETF’s share price. |

| • | If the Underlying ETF’s share price has decreased by more than 5.00% as of the end of the Outcome Period, the Fund is expected to experience all subsequent losses experienced by the Underlying ETF’s share price beyond 5.00% on a one-to-one basis, meaning that the Fund will decrease 1% for every 1% decrease in the Underlying ETF’s share price (i.e., if the Underlying ETF loses 20%, the Fund is designed to lose 15%). |

The outcomes described here are before taking into account Fund fees and expenses, brokerage commissions, trading fees, taxes and non-routine or extraordinary expenses not included in the Fund’s unitary management fee. An investor that purchases Shares after the Outcome Period has begun or sells Shares prior to the end of the Outcome Period may experience results that are very different from the investment objective sought by the Fund for that Outcome Period.

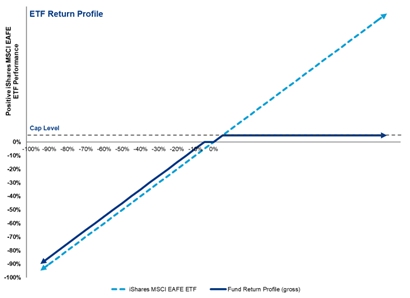

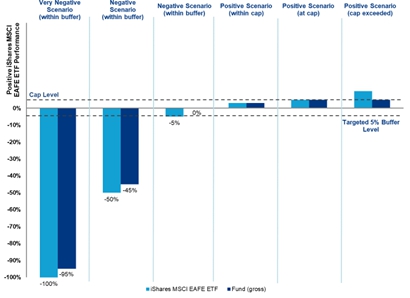

The following charts illustrate the hypothetical returns that the Fund seeks to provide where a shareholder holds Shares for the entire Outcome Period. The Cap Level illustrated in these charts is for illustration only and the actual Cap may be different and will change each Outcome Period.

The returns shown in the charts are based on hypothetical performance of the Underlying ETF’s share price in certain illustrative scenarios and do not take into account payment by the Fund of fees and expenses, brokerage commissions, trading fees, taxes and non-routine or extraordinary expenses not included in the Fund’s unitary management fee. There is no guarantee that the Fund will be successful in providing these investment outcomes for any Outcome Period.

In the first graph below, the dotted line represents the Underlying ETF’s share price performance, and the solid line represents the gross returns that the Fund seeks to provide relative to the Underlying ETF’s share price performance.

Despite the intended Buffer, a shareholder who holds Shares for the entire Outcome Period could lose their entire investment. An investment in the Fund is only appropriate for shareholders willing to bear the loss of their entire investment.

The outcomes may only be achieved if Shares are held over a complete Outcome Period. An investor that purchases or sells Shares during an Outcome Period may experience results that are very different from the outcomes sought by the Fund for that Outcome Period. For example, if an investor purchases Shares during an Outcome Period at a time when the Underlying ETF’s share price has decreased from its price at the beginning of the Outcome Period, that investor’s buffer will essentially be decreased by the amount of the decrease in the Underlying ETF’s share price. Conversely, if an investor purchases Shares during an Outcome Period at a time when the Underlying ETF’s share price has increased from its price at the beginning of the Outcome Period, that investor’s cap will essentially be decreased by the amount of the increase in the Underlying ETF’s share price. The strategy is designed to realize the outcomes only on the final day of the Outcome Period. To achieve the target outcomes sought by the Fund for an Outcome Period, an investor must hold Shares for that entire Outcome Period. This means investors should purchase the Shares immediately prior to the beginning of the Outcome Period and hold the Shares until the end of the Outcome Period to achieve the intended results.

Both the Cap and Buffer are fixed at levels calculated in relation to the Outcome NAV and the Underlying ETF’s share price. The Outcome NAV is the Fund’s net asset value (or “NAV”, which is the per share value of the Fund’s assets) calculated at the close of the market on the business day prior to the first day of the Outcome Period. An investor purchasing Shares on the secondary market on the first day of the Outcome Period may pay a price that is different from the Fund’s Outcome NAV. As a result, the investor may not experience the same investment results as the Fund, even if the Fund is successful in achieving the outcomes. Furthermore, an investor cannot expect to purchase Shares precisely at the beginning of the Outcome Period or precisely at the price of the Outcome NAV, or sell Shares precisely at the end of the Outcome Period or precisely at the price of the last calculated NAV of the Outcome Period, and thereby experience precisely the investment returns sought by the Fund for the Outcome Period.

The Outcome Period will be a three-month calendar quarter from January 1 to March 31, April 1 to June 30, July 1 to September 30, or October 1 to December 31. The Fund is designed to seek to achieve the outcomes at the end of each successive calendar quarter Outcome Period. The outcomes that the Fund achieves over multiple calendar quarter Outcome Periods likely will be different than the outcomes achieved by a comparable fund with a longer outcome period, and an investor holding Shares over multiple calendar quarter Outcome Periods likely will experience different investment results than if the investor held shares in a comparable fund with a longer outcome period. For example, during a single twelve-month period, the outcomes achieved by the Fund over four successive three-month Outcome Periods likely would be different than the outcomes achieved by a comparable fund over a one-year outcome period. The Fund resets at the beginning

of each Outcome Period by investing in a new set of FLEX Options that will provide a new Cap for the new Outcome Period. This means that the Cap is expected to change for each Outcome Period and is determined by market conditions on the business day immediately prior to the first day of each Outcome Period. The Cap may increase or decrease for each Outcome Period. The Buffer is not expected to change for each Outcome Period. The Cap and Buffer, and the Fund’s position relative to each, should be considered before investing in the Fund. The Fund will be indefinitely offered with a new Outcome Period tied to the same Underlying ETF beginning after the end of each Outcome Period; the Fund is not intended to terminate after the current or any subsequent Outcome Period.

Approximately one week prior to the end of each Outcome Period, the Fund will file a prospectus supplement that discloses the anticipated ranges for the Cap for the next Outcome Period. Following the close of business on the last day of the Outcome Period, the Fund will file a prospectus supplement that discloses the Fund’s final Cap (both before and after taking into account the Fund’s annualized management fee) for the next Outcome Period. There is no guarantee the final Cap will be within the anticipated range. This information also will be available on the Fund’s website, www.AllianzIMetfs.com/QBIV.

An investor that purchases Shares after the Outcome Period has begun or sells Shares prior to the end of the Outcome Period may experience investment returns very different from those sought by the Fund for that Outcome Period. The Fund’s website, www.AllianzIMetfs.com/QBIV, provides, on a daily basis, important Fund information, including the Fund’s position relative to the Cap and Buffer, as well as information relating to the potential return scenarios as a result of an investment in the Fund. Before purchasing Shares, an investor should visit the website to review this information and understand the possible outcomes of an investment in Shares on a particular day and held through the end of the Outcome Period.

As of the date of this prospectus, the Fund has not commenced operations and therefore does not have a performance history. Once available, the Fund’s performance information will be available on the Fund’s website at www.allianzIMetfs.com and will provide some indication of the risks of investing in the Fund. The Fund’s past performance (before and after taxes) is not necessarily an indication of how the Fund will perform in the future.