Shareholder Report

|

6 Months Ended |

|

Jun. 30, 2025

USD ($)

Holding

|

|---|

| Shareholder Report [Line Items] |

|

|

| Document Type |

N-CSRS

|

|

| Amendment Flag |

false

|

|

| Registrant Name |

INVESTMENT MANAGERS SERIES TRUST

|

|

| Entity Central Index Key |

0001318342

|

|

| Entity Investment Company Type |

N-1A

|

|

| Document Period End Date |

Jun. 30, 2025

|

|

| C000248864 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

GramercyEmerging Markets Debt Fund

|

|

| Class Name |

Class A

|

|

| Trading Symbol |

GFEAX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the Gramercy Emerging Markets Debt Fund (“Fund”) for the period of January 01, 2025 through June 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at https://libertystreetfunds.com/gramercy-emerging-markets-debt-fund/. You can also request this information by contacting us at (800) 207-7108.

|

|

| Additional Information Phone Number |

(800) 207-7108

|

|

| Additional Information Website |

https://libertystreetfunds.com/gramercy-emerging-markets-debt-fund/

|

|

| Expenses [Text Block] |

Fund Expenses

(Based on a hypothetical $10,000 investment)

| Fund (Class) |

Costs of a $10,000 investment |

Costs paid as a percentage

of a $10,000 investment |

Gramercy Emerging Markets Debt Fund

(Class A/GFEAX) |

$57 |

1.11%1 |

|

|

| Expenses Paid, Amount |

$ 57

|

|

| Expense Ratio, Percent |

1.11%

|

[1] |

| Net Assets |

$ 58,663,838

|

|

| Holdings Count | Holding |

128

|

|

| Investment Company Portfolio Turnover |

42.00%

|

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics

The following table outlines key fund statistics that you should pay attention to.

| Fund's net assets |

$58,663,838 |

| Total number of portfolio holdings |

128 |

| Portfolio turnover rate as of the end of the reporting period |

42% |

|

|

| Holdings [Text Block] |

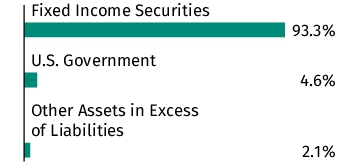

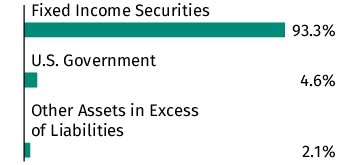

Graphical Representation of Holdings

The tables below show the investment makeup of the Fund, representing percentage of the total net assets of the Fund. The Top Ten Holdings exclude short-term holdings, if any. Interest rates presented in the Top Ten Holdings are as of the reporting period end.

Top Ten Holdings

| Brazil Notas do Tesouro Nacional Serie F, 10.000%, 1/1/2031 |

3.8% |

| Republic of South Africa Government Bond, 6.500%, 2/28/2041 |

3.1% |

| Mexican Bonos, 5.750%, 3/5/2026 |

2.5% |

| Czech Republic Government Bond, 3.000%, 3/3/2033 |

1.9% |

| Turkiye Garanti Bankasi A.S., 8.125%, 1/8/2036 |

1.7% |

| Banco Davivienda S.A., 8.125%, 7/2/2035 |

1.6% |

| Qatar Government International Bond, 4.750%, 5/29/2034 |

1.5% |

| Colombian TES, 6.000%, 4/28/2028 |

1.4% |

| MDGH GMTN RSC Ltd., 2.500%, 6/3/2031 |

1.3% |

| Indonesia Government International Bond, 3.700%, 10/30/2049 |

1.2% |

Asset Allocation

|

|

| Largest Holdings [Text Block] |

Top Ten Holdings

| Brazil Notas do Tesouro Nacional Serie F, 10.000%, 1/1/2031 |

3.8% |

| Republic of South Africa Government Bond, 6.500%, 2/28/2041 |

3.1% |

| Mexican Bonos, 5.750%, 3/5/2026 |

2.5% |

| Czech Republic Government Bond, 3.000%, 3/3/2033 |

1.9% |

| Turkiye Garanti Bankasi A.S., 8.125%, 1/8/2036 |

1.7% |

| Banco Davivienda S.A., 8.125%, 7/2/2035 |

1.6% |

| Qatar Government International Bond, 4.750%, 5/29/2034 |

1.5% |

| Colombian TES, 6.000%, 4/28/2028 |

1.4% |

| MDGH GMTN RSC Ltd., 2.500%, 6/3/2031 |

1.3% |

| Indonesia Government International Bond, 3.700%, 10/30/2049 |

1.2% |

|

|

| C000248863 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

GramercyEmerging Markets Debt Fund

|

|

| Class Name |

Institutional Class

|

|

| Trading Symbol |

GFEMX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the Gramercy Emerging Markets Debt Fund (“Fund”) for the period of January 01, 2025 through June 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at https://libertystreetfunds.com/gramercy-emerging-markets-debt-fund/. You can also request this information by contacting us at (800) 207-7108.

|

|

| Additional Information Phone Number |

(800) 207-7108

|

|

| Additional Information Website |

https://libertystreetfunds.com/gramercy-emerging-markets-debt-fund/

|

|

| Expenses [Text Block] |

Fund Expenses

(Based on a hypothetical $10,000 investment)

| Fund (Class) |

Costs of a $10,000 investment |

Costs paid as a percentage

of a $10,000 investment |

Gramercy Emerging Markets Debt Fund

(Institutional Class/GFEMX) |

$44 |

0.86%1 |

|

|

| Expenses Paid, Amount |

$ 44

|

|

| Expense Ratio, Percent |

0.86%

|

[2] |

| Net Assets |

$ 58,663,838

|

|

| Holdings Count | Holding |

128

|

|

| Investment Company Portfolio Turnover |

42.00%

|

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics

The following table outlines key fund statistics that you should pay attention to.

| Fund's net assets |

$58,663,838 |

| Total number of portfolio holdings |

128 |

| Portfolio turnover rate as of the end of the reporting period |

42% |

|

|

| Holdings [Text Block] |

Graphical Representation of Holdings

The tables below show the investment makeup of the Fund, representing percentage of the total net assets of the Fund. The Top Ten Holdings exclude short-term holdings, if any. Interest rates presented in the Top Ten Holdings are as of the reporting period end.

Top Ten Holdings

| Brazil Notas do Tesouro Nacional Serie F, 10.000%, 1/1/2031 |

3.8% |

| Republic of South Africa Government Bond, 6.500%, 2/28/2041 |

3.1% |

| Mexican Bonos, 5.750%, 3/5/2026 |

2.5% |

| Czech Republic Government Bond, 3.000%, 3/3/2033 |

1.9% |

| Turkiye Garanti Bankasi A.S., 8.125%, 1/8/2036 |

1.7% |

| Banco Davivienda S.A., 8.125%, 7/2/2035 |

1.6% |

| Qatar Government International Bond, 4.750%, 5/29/2034 |

1.5% |

| Colombian TES, 6.000%, 4/28/2028 |

1.4% |

| MDGH GMTN RSC Ltd., 2.500%, 6/3/2031 |

1.3% |

| Indonesia Government International Bond, 3.700%, 10/30/2049 |

1.2% |

Asset Allocation

|

|

| Largest Holdings [Text Block] |

Top Ten Holdings

| Brazil Notas do Tesouro Nacional Serie F, 10.000%, 1/1/2031 |

3.8% |

| Republic of South Africa Government Bond, 6.500%, 2/28/2041 |

3.1% |

| Mexican Bonos, 5.750%, 3/5/2026 |

2.5% |

| Czech Republic Government Bond, 3.000%, 3/3/2033 |

1.9% |

| Turkiye Garanti Bankasi A.S., 8.125%, 1/8/2036 |

1.7% |

| Banco Davivienda S.A., 8.125%, 7/2/2035 |

1.6% |

| Qatar Government International Bond, 4.750%, 5/29/2034 |

1.5% |

| Colombian TES, 6.000%, 4/28/2028 |

1.4% |

| MDGH GMTN RSC Ltd., 2.500%, 6/3/2031 |

1.3% |

| Indonesia Government International Bond, 3.700%, 10/30/2049 |

1.2% |

|

|

|

|