Shareholder Report

|

6 Months Ended |

|

Jun. 30, 2025

USD ($)

Holding

|

|---|

| Shareholder Report [Line Items] |

|

| Document Type |

N-CSRS

|

| Amendment Flag |

false

|

| Registrant Name |

PENN SERIES FUNDS INC

|

| Entity Central Index Key |

0000702340

|

| Entity Investment Company Type |

N-1A

|

| Document Period End Date |

Jun. 30, 2025

|

| C000018285 [Member] |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

Money Market Fund

|

| Class Name |

Money Market Fund

|

| No Trading Symbol Flag |

true

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the Penn Series Money Market Fund (“Fund”) for the period of January 01, 2025 to June 30, 2025.

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at www.pennmutual.com/FundLiterature. You can also request this information by contacting us at 1-800-523-0650.

|

| Material Fund Change Notice [Text Block] |

This report describes changes to the Fund that occurred during the reporting period.

|

| Additional Information Phone Number |

1-800-523-0650

|

| Additional Information Website |

www.pennmutual.com/FundLiterature

|

| Expenses [Text Block] |

Fund Expenses Based on a hypothetical $10,000 investment

| Fund |

Cost of $10,000 investment |

Costs paid as a percentage

of a $10,000 investment |

| Money Market Fund |

$29 |

0.58% |

|

| Expenses Paid, Amount |

$ 29

|

| Expense Ratio, Percent |

0.58%

|

| Net Assets |

$ 126,925,595

|

| Holdings Count | Holding |

27

|

| Advisory Fees Paid, Amount |

$ 213,096

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics

| Fund net assets |

$126,925,595 |

| Total number of portfolio holdings |

27 |

| Total advisory fee paid |

$213,096 |

|

| Holdings [Text Block] |

Graphical Representation of Holdings The tables below show the investment makeup of the Fund, with each category representing a percentage of the Fund's total investments. Top 10 Holdings

Federal National Mortgage

4.246%, 07/16/25 |

6.3% |

Federal National Mortgage

0.450%, 08/21/25 |

4.7% |

Federal Farm Credit Banks

4.249%, 07/09/25 |

3.9% |

Tennessee Valley Authority

4.215%, 07/09/25 |

3.9% |

Freddie Mac Discount Notes

4.229%, 07/11/25 |

3.9% |

Federal Farm Credit Banks

4.257%, 07/14/25 |

3.9% |

U.S. Treasury Bills

4.248%, 07/31/25 |

3.9% |

Federal Farm Credit Banks

4.265%, 08/07/25 |

3.9% |

U.S. Treasury Bills

4.321%, 08/14/25 |

3.9% |

U.S. Treasury Bills

4.413%, 08/19/25 |

3.9% |

|

| Largest Holdings [Text Block] |

Top 10 Holdings

Federal National Mortgage

4.246%, 07/16/25 |

6.3% |

Federal National Mortgage

0.450%, 08/21/25 |

4.7% |

Federal Farm Credit Banks

4.249%, 07/09/25 |

3.9% |

Tennessee Valley Authority

4.215%, 07/09/25 |

3.9% |

Freddie Mac Discount Notes

4.229%, 07/11/25 |

3.9% |

Federal Farm Credit Banks

4.257%, 07/14/25 |

3.9% |

U.S. Treasury Bills

4.248%, 07/31/25 |

3.9% |

Federal Farm Credit Banks

4.265%, 08/07/25 |

3.9% |

U.S. Treasury Bills

4.321%, 08/14/25 |

3.9% |

U.S. Treasury Bills

4.413%, 08/19/25 |

3.9% |

|

| Material Fund Change [Text Block] |

Material Fund Changes There were no material changes during the reporting period.

|

| Accountant Change Disagreements [Text Block] |

Changes in and Disagreements with Accountants There were no changes in or disagreements with accountants during the reporting period.

|

| C000018286 [Member] |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

Limited Maturity Bond Fund

|

| Class Name |

Limited Maturity Bond Fund

|

| No Trading Symbol Flag |

true

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the Penn Series Limited Maturity Bond Fund (“Fund”) for the period of January 01, 2025 to June 30, 2025.

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at www.pennmutual.com/FundLiterature. You can also request this information by contacting us at 1-800-523-0650.

|

| Material Fund Change Notice [Text Block] |

This report describes changes to the Fund that occurred during the reporting period.

|

| Additional Information Phone Number |

1-800-523-0650

|

| Additional Information Website |

www.pennmutual.com/FundLiterature

|

| Expenses [Text Block] |

Fund Expenses Based on a hypothetical $10,000 investment

| Fund |

Cost of $10,000 investment |

Costs paid as a percentage

of a $10,000 investment |

| Limited Maturity Bond Fund |

$37 |

0.74% |

|

| Expenses Paid, Amount |

$ 37

|

| Expense Ratio, Percent |

0.74%

|

| Net Assets |

$ 70,572,588

|

| Holdings Count | Holding |

54

|

| Advisory Fees Paid, Amount |

$ 147,735

|

| Investment Company Portfolio Turnover |

8.00%

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics

| Fund net assets |

$70,572,588 |

| Total number of portfolio holdings |

54 |

| Total advisory fee paid (net of waivers) |

$147,735 |

| Portfolio turnover rate |

8% |

| Weighted Average Maturity |

5.0 Years |

| Effective Duration |

1.7 Years |

|

| Holdings [Text Block] |

Graphical Representation of Holdings The tables below show the investment makeup of the Fund, with each category representing a percentage of the Fund's total investments. Asset Class Allocation

| Corporate Bonds |

34.7% |

| Residential Mortgage Backed Securities |

28.2% |

| Asset Backed Securities |

27.1% |

| Commercial Mortgage Backed Securities |

5.0% |

| U.S. Treasury Obligations |

2.8% |

| Money Market Funds |

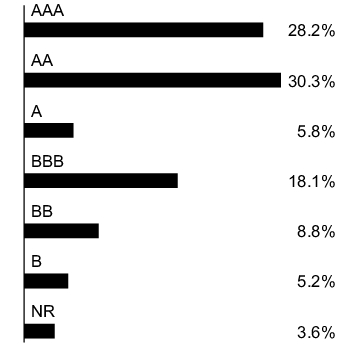

2.2% | Bond Quality Allocation 1 1 Source: Independent Rating Agencies such as Moody’s, S&P and Fitch. Note: When ratings from all three agencies are available, the median rating is used. When ratings are available from two of the agencies, the lower rating is used. When one rating is available, that rating is used. "NR" is used to classify securities for which a rating is not available.

|

| Credit Ratings Selection [Text Block] |

Source: Independent Rating Agencies such as Moody’s, S&P and Fitch.Note: When ratings from all three agencies are available, the median rating is used. When ratings are available from two of the agencies, the lower rating is used. When one rating is available, that rating is used. "NR" is used to classify securities for which a rating is not available.

|

| Material Fund Change [Text Block] |

Material Fund Changes There were no material changes during the reporting period.

|

| Accountant Change Disagreements [Text Block] |

Changes in and Disagreements with Accountants There were no changes in or disagreements with accountants during the reporting period.

|

| C000018287 [Member] |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

Index 500 Fund

|

| Class Name |

Index 500 Fund

|

| No Trading Symbol Flag |

true

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the Penn Series Index 500 Fund (“Fund”) for the period of January 01, 2025 to June 30, 2025.

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at www.pennmutual.com/FundLiterature. You can also request this information by contacting us at 1-800-523-0650.

|

| Material Fund Change Notice [Text Block] |

This report describes changes to the Fund that occurred during the reporting period.

|

| Additional Information Phone Number |

1-800-523-0650

|

| Additional Information Website |

www.pennmutual.com/FundLiterature

|

| Expenses [Text Block] |

Fund Expenses Based on a hypothetical $10,000 investment

| Fund |

Cost of $10,000 investment |

Costs paid as a percentage

of a $10,000 investment |

| Index 500 Fund |

$17 |

0.34% |

|

| Expenses Paid, Amount |

$ 17

|

| Expense Ratio, Percent |

0.34%

|

| Net Assets |

$ 875,446,317

|

| Holdings Count | Holding |

506

|

| Advisory Fees Paid, Amount |

$ 518,924

|

| Investment Company Portfolio Turnover |

2.00%

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics

| Fund net assets |

$875,446,317 |

| Total number of portfolio holdings |

506 |

| Total advisory fee paid |

$518,924 |

| Portfolio turnover rate |

2% |

|

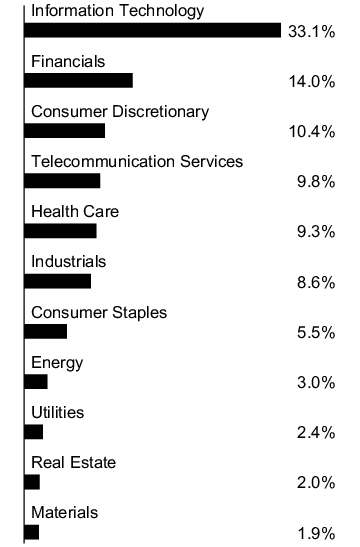

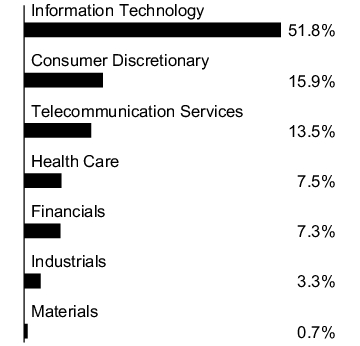

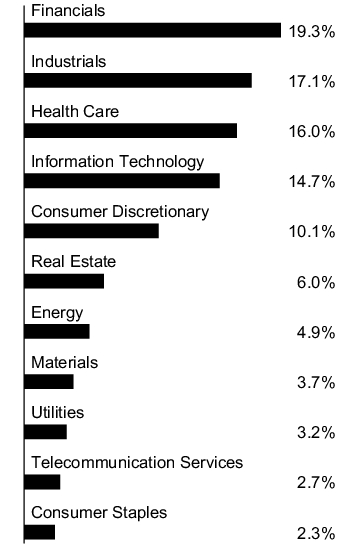

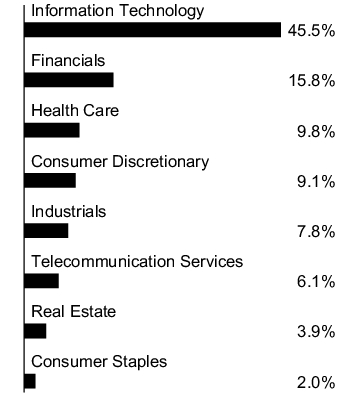

| Holdings [Text Block] |

Graphical Representation of Holdings The tables below show the investment makeup of the Fund, with each category representing a percentage of the Fund's total investments. Top 10 Holdings

| NVIDIA Corp. |

7.3% |

| Microsoft Corp. |

7.0% |

| Apple, Inc. |

5.8% |

| Amazon.com, Inc. |

3.9% |

| Meta Platforms, Inc., Class A |

3.0% |

| Broadcom, Inc. |

2.5% |

| Alphabet, Inc., Class A |

2.0% |

| Berkshire Hathaway, Inc., Class B |

1.7% |

| Tesla, Inc. |

1.7% |

| Alphabet, Inc., Class C |

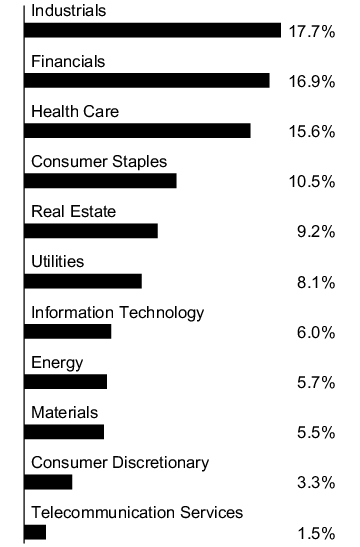

1.6% | Sector Allocation 1 1 Sector allocation is presented as a percentage of total investments before short-term investments.

|

| Largest Holdings [Text Block] |

Top 10 Holdings

| NVIDIA Corp. |

7.3% |

| Microsoft Corp. |

7.0% |

| Apple, Inc. |

5.8% |

| Amazon.com, Inc. |

3.9% |

| Meta Platforms, Inc., Class A |

3.0% |

| Broadcom, Inc. |

2.5% |

| Alphabet, Inc., Class A |

2.0% |

| Berkshire Hathaway, Inc., Class B |

1.7% |

| Tesla, Inc. |

1.7% |

| Alphabet, Inc., Class C |

1.6% |

|

| Material Fund Change [Text Block] |

Material Fund Changes There were no material changes during the reporting period.

|

| Accountant Change Disagreements [Text Block] |

Changes in and Disagreements with Accountants There were no changes in or disagreements with accountants during the reporting period.

|

| C000018288 [Member] |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

Mid Cap Growth Fund

|

| Class Name |

Mid Cap Growth Fund

|

| No Trading Symbol Flag |

true

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the Penn Series Mid Cap Growth Fund (“Fund”) for the period of January 01, 2025 to June 30, 2025.

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at www.pennmutual.com/FundLiterature. You can also request this information by contacting us at 1-800-523-0650.

|

| Material Fund Change Notice [Text Block] |

This report describes changes to the Fund that occurred during the reporting period.

|

| Additional Information Phone Number |

1-800-523-0650

|

| Additional Information Website |

www.pennmutual.com/FundLiterature

|

| Expenses [Text Block] |

Fund Expenses Based on a hypothetical $10,000 investment

| Fund |

Cost of $10,000 investment |

Costs paid as a percentage

of a $10,000 investment |

| Mid Cap Growth Fund |

$49 |

0.97% |

|

| Expenses Paid, Amount |

$ 49

|

| Expense Ratio, Percent |

0.97%

|

| Net Assets |

$ 128,328,520

|

| Holdings Count | Holding |

67

|

| Advisory Fees Paid, Amount |

$ 427,194

|

| Investment Company Portfolio Turnover |

28.00%

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics

| Fund net assets |

$128,328,520 |

| Total number of portfolio holdings |

67 |

| Total advisory fee paid |

$427,194 |

| Portfolio turnover rate |

28% |

|

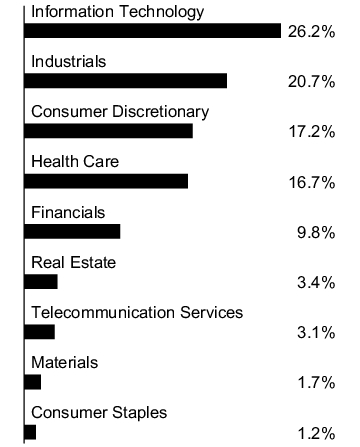

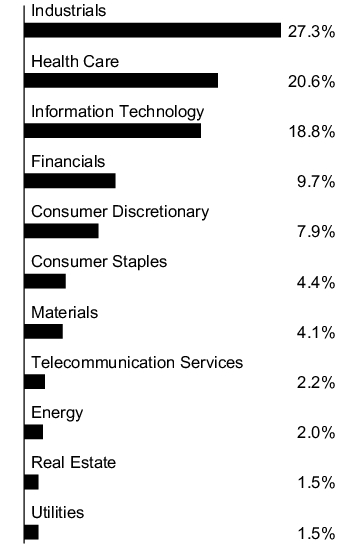

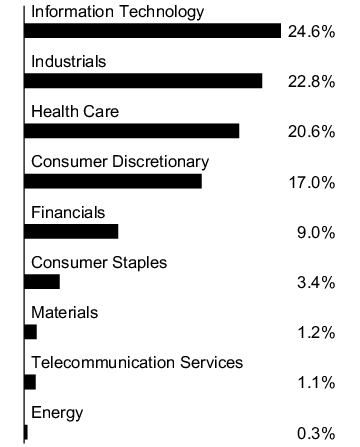

| Holdings [Text Block] |

Graphical Representation of Holdings The tables below show the investment makeup of the Fund, with each category representing a percentage of the Fund's total investments. Top 10 Holdings

| IDEXX Laboratories, Inc. |

3.5% |

| CoStar Group, Inc. |

3.4% |

| Royal Caribbean Cruises Ltd. |

3.1% |

| Insulet Corp. |

2.6% |

| Cloudflare, Inc., Class A |

2.6% |

| Fastenal Co. |

2.5% |

| Datadog, Inc., Class A |

2.4% |

| Howmet Aerospace, Inc. |

2.3% |

| HEICO Corp., Class A |

2.1% |

| LPL Financial Holdings, Inc. |

2.0% | Sector Allocation 1 1 Sector allocation is presented as a percentage of total investments before short-term investments.

|

| Largest Holdings [Text Block] |

Top 10 Holdings

| IDEXX Laboratories, Inc. |

3.5% |

| CoStar Group, Inc. |

3.4% |

| Royal Caribbean Cruises Ltd. |

3.1% |

| Insulet Corp. |

2.6% |

| Cloudflare, Inc., Class A |

2.6% |

| Fastenal Co. |

2.5% |

| Datadog, Inc., Class A |

2.4% |

| Howmet Aerospace, Inc. |

2.3% |

| HEICO Corp., Class A |

2.1% |

| LPL Financial Holdings, Inc. |

2.0% |

|

| Material Fund Change [Text Block] |

Material Fund Changes There were no material changes during the reporting period.

|

| Accountant Change Disagreements [Text Block] |

Changes in and Disagreements with Accountants There were no changes in or disagreements with accountants during the reporting period.

|

| C000018289 [Member] |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

Mid Cap Value Fund

|

| Class Name |

Mid Cap Value Fund

|

| No Trading Symbol Flag |

true

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the Penn Series Mid Cap Value Fund (“Fund”) for the period of January 01, 2025 to June 30, 2025.

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at www.pennmutual.com/FundLiterature. You can also request this information by contacting us at 1-800-523-0650.

|

| Material Fund Change Notice [Text Block] |

This report describes changes to the Fund that occurred during the reporting period.

|

| Additional Information Phone Number |

1-800-523-0650

|

| Additional Information Website |

www.pennmutual.com/FundLiterature

|

| Expenses [Text Block] |

Fund Expenses Based on a hypothetical $10,000 investment

| Fund |

Cost of $10,000 investment |

Costs paid as a percentage

of a $10,000 investment |

| Mid Cap Value Fund |

$41 |

0.83% |

|

| Expenses Paid, Amount |

$ 41

|

| Expense Ratio, Percent |

0.83%

|

| Net Assets |

$ 85,446,139

|

| Holdings Count | Holding |

74

|

| Advisory Fees Paid, Amount |

$ 225,922

|

| Investment Company Portfolio Turnover |

23.00%

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics

| Fund net assets |

$85,446,139 |

| Total number of portfolio holdings |

74 |

| Total advisory fee paid (net of waivers) |

$225,922 |

| Portfolio turnover rate |

23% |

|

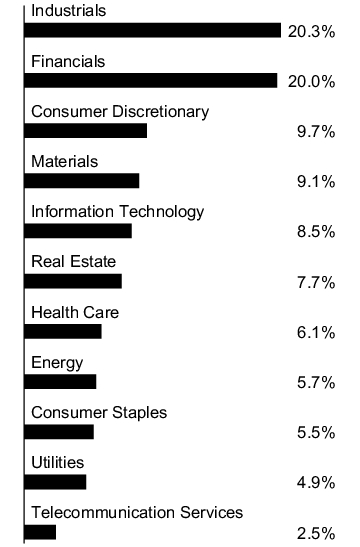

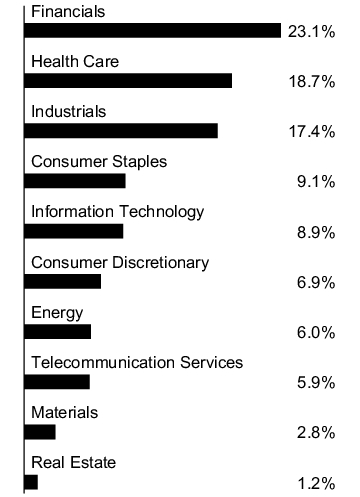

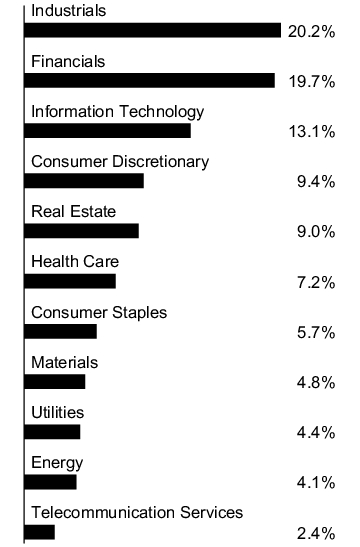

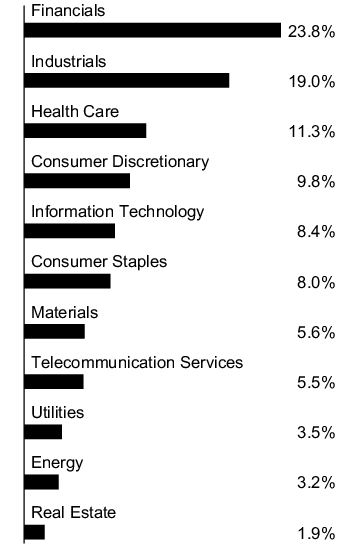

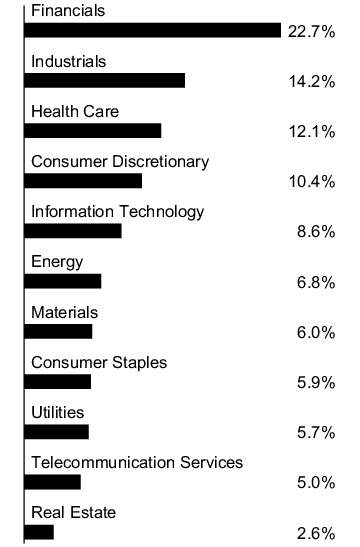

| Holdings [Text Block] |

Graphical Representation of Holdings The tables below show the investment makeup of the Fund, with each category representing a percentage of the Fund's total investments. Top 10 Holdings

| Casey's General Stores, Inc. |

2.7% |

| Expand Energy Corp. |

2.5% |

| Freeport-McMoRan, Inc. |

2.4% |

| Alliant Energy Corp. |

2.4% |

| The Hartford Insurance Group, Inc. |

2.2% |

| BWX Technologies, Inc. |

2.2% |

| Agree Realty Corp. |

2.2% |

| Axis Capital Holdings Ltd. |

2.0% |

| TransUnion |

2.0% |

| Ally Financial, Inc. |

2.0% | Sector Allocation 1 1 Sector allocation is presented as a percentage of total investments before short-term investments.

|

| Largest Holdings [Text Block] |

Top 10 Holdings

| Casey's General Stores, Inc. |

2.7% |

| Expand Energy Corp. |

2.5% |

| Freeport-McMoRan, Inc. |

2.4% |

| Alliant Energy Corp. |

2.4% |

| The Hartford Insurance Group, Inc. |

2.2% |

| BWX Technologies, Inc. |

2.2% |

| Agree Realty Corp. |

2.2% |

| Axis Capital Holdings Ltd. |

2.0% |

| TransUnion |

2.0% |

| Ally Financial, Inc. |

2.0% |

|

| Material Fund Change [Text Block] |

Material Fund Changes There were no material changes during the reporting period.

|

| Accountant Change Disagreements [Text Block] |

Changes in and Disagreements with Accountants There were no changes in or disagreements with accountants during the reporting period.

|

| C000018290 [Member] |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

Large Cap Growth Fund

|

| Class Name |

Large Cap Growth Fund

|

| No Trading Symbol Flag |

true

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the Penn Series Large Cap Growth Fund (“Fund”) for the period of January 01, 2025 to June 30, 2025.

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at www.pennmutual.com/FundLiterature. You can also request this information by contacting us at 1-800-523-0650.

|

| Material Fund Change Notice [Text Block] |

This report describes changes to the Fund that occurred during the reporting period.

|

| Additional Information Phone Number |

1-800-523-0650

|

| Additional Information Website |

www.pennmutual.com/FundLiterature

|

| Expenses [Text Block] |

Fund Expenses Based on a hypothetical $10,000 investment

| Fund |

Cost of $10,000 investment |

Costs paid as a percentage

of a $10,000 investment |

| Large Cap Growth Fund |

$43 |

0.86% |

|

| Expenses Paid, Amount |

$ 43

|

| Expense Ratio, Percent |

0.86%

|

| Net Assets |

$ 71,178,973

|

| Holdings Count | Holding |

57

|

| Advisory Fees Paid, Amount |

$ 180,359

|

| Investment Company Portfolio Turnover |

7.00%

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics

| Fund net assets |

$71,178,973 |

| Total number of portfolio holdings |

57 |

| Total advisory fee paid |

$180,359 |

| Portfolio turnover rate |

7% |

|

| Holdings [Text Block] |

Graphical Representation of Holdings The tables below show the investment makeup of the Fund, with each category representing a percentage of the Fund's total investments. Top 10 Holdings

| Microsoft Corp. |

15.1% |

| NVIDIA Corp. |

6.4% |

| Apple, Inc. |

4.7% |

| Visa, Inc., Class A |

4.0% |

| Accenture PLC, Class A |

2.9% |

| Salesforce, Inc. |

2.3% |

| TransUnion |

2.3% |

| Alphabet, Inc., Class A |

2.3% |

| Eaton Corp. PLC |

2.3% |

| Aon PLC, Class A |

2.3% | Sector Allocation 1 1 Sector allocation is presented as a percentage of total investments before short-term investments.

|

| Largest Holdings [Text Block] |

Top 10 Holdings

| Microsoft Corp. |

15.1% |

| NVIDIA Corp. |

6.4% |

| Apple, Inc. |

4.7% |

| Visa, Inc., Class A |

4.0% |

| Accenture PLC, Class A |

2.9% |

| Salesforce, Inc. |

2.3% |

| TransUnion |

2.3% |

| Alphabet, Inc., Class A |

2.3% |

| Eaton Corp. PLC |

2.3% |

| Aon PLC, Class A |

2.3% |

|

| Material Fund Change [Text Block] |

Material Fund Changes There were no material changes during the reporting period.

|

| Accountant Change Disagreements [Text Block] |

Changes in and Disagreements with Accountants There were no changes in or disagreements with accountants during the reporting period.

|

| C000018291 [Member] |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

Mid Core Value Fund

|

| Class Name |

Mid Core Value Fund

|

| No Trading Symbol Flag |

true

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the Penn Series Mid Core Value Fund (“Fund”) for the period of January 01, 2025 to June 30, 2025.

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at www.pennmutual.com/FundLiterature. You can also request this information by contacting us at 1-800-523-0650.

|

| Material Fund Change Notice [Text Block] |

This report describes changes to the Fund that occurred during the reporting period.

|

| Additional Information Phone Number |

1-800-523-0650

|

| Additional Information Website |

www.pennmutual.com/FundLiterature

|

| Expenses [Text Block] |

Fund Expenses Based on a hypothetical $10,000 investment

| Fund |

Cost of $10,000 investment |

Costs paid as a percentage

of a $10,000 investment |

| Mid Core Value Fund |

$53 |

1.05% |

|

| Expenses Paid, Amount |

$ 53

|

| Expense Ratio, Percent |

1.05%

|

| Net Assets |

$ 73,295,856

|

| Holdings Count | Holding |

116

|

| Advisory Fees Paid, Amount |

$ 248,410

|

| Investment Company Portfolio Turnover |

39.00%

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics

| Fund net assets |

$73,295,856 |

| Total number of portfolio holdings |

116 |

| Total advisory fee paid |

$248,410 |

| Portfolio turnover rate |

39% |

|

| Holdings [Text Block] |

Graphical Representation of Holdings The tables below show the investment makeup of the Fund, with each category representing a percentage of the Fund's total investments. Top 10 Holdings

| Zimmer Biomet Holdings, Inc. |

2.7% |

| Enterprise Products Partners LP |

2.1% |

| Henry Schein, Inc. |

2.1% |

| US Bancorp |

2.0% |

| Truist Financial Corp. |

2.0% |

| Willis Towers Watson PLC |

1.8% |

| Northern Trust Corp. |

1.8% |

| Labcorp Holdings, Inc. |

1.7% |

| Kenvue, Inc. |

1.7% |

| MSC Industrial Direct Co., Inc., Class A |

1.6% | Sector Allocation 1 1 Sector allocation is presented as a percentage of total investments before short-term investments.

|

| Largest Holdings [Text Block] |

Top 10 Holdings

| Zimmer Biomet Holdings, Inc. |

2.7% |

| Enterprise Products Partners LP |

2.1% |

| Henry Schein, Inc. |

2.1% |

| US Bancorp |

2.0% |

| Truist Financial Corp. |

2.0% |

| Willis Towers Watson PLC |

1.8% |

| Northern Trust Corp. |

1.8% |

| Labcorp Holdings, Inc. |

1.7% |

| Kenvue, Inc. |

1.7% |

| MSC Industrial Direct Co., Inc., Class A |

1.6% |

|

| Material Fund Change [Text Block] |

Material Fund Changes There were no material changes during the reporting period.

|

| Accountant Change Disagreements [Text Block] |

Changes in and Disagreements with Accountants There were no changes in or disagreements with accountants during the reporting period.

|

| C000018292 [Member] |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

Real Estate Securities Fund

|

| Class Name |

Real Estate Securities Fund

|

| No Trading Symbol Flag |

true

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the Penn Series Real Estate Securities Fund (“Fund”) for the period of January 01, 2025 to June 30, 2025.

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at www.pennmutual.com/FundLiterature. You can also request this information by contacting us at 1-800-523-0650.

|

| Material Fund Change Notice [Text Block] |

This report describes changes to the Fund that occurred during the reporting period.

|

| Additional Information Phone Number |

1-800-523-0650

|

| Additional Information Website |

www.pennmutual.com/FundLiterature

|

| Expenses [Text Block] |

Fund Expenses Based on a hypothetical $10,000 investment

| Fund |

Cost of $10,000 investment |

Costs paid as a percentage

of a $10,000 investment |

| Real Estate Securities Fund |

$49 |

0.98% |

|

| Expenses Paid, Amount |

$ 49

|

| Expense Ratio, Percent |

0.98%

|

| Net Assets |

$ 99,609,857

|

| Holdings Count | Holding |

39

|

| Advisory Fees Paid, Amount |

$ 347,359

|

| Investment Company Portfolio Turnover |

12.00%

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics

| Fund net assets |

$99,609,857 |

| Total number of portfolio holdings |

39 |

| Total advisory fee paid |

$347,359 |

| Portfolio turnover rate |

12% |

|

| Holdings [Text Block] |

Graphical Representation of Holdings The tables below show the investment makeup of the Fund, with each category representing a percentage of the Fund's total investments. Top 10 Holdings

| Welltower, Inc. |

10.1% |

| Digital Realty Trust, Inc. |

7.4% |

| American Tower Corp. |

6.0% |

| Crown Castle, Inc. |

5.8% |

| SBA Communications Corp. |

5.7% |

| Prologis, Inc. |

5.4% |

| Sun Communities, Inc. |

4.5% |

| Invitation Homes, Inc. |

4.1% |

| Extra Space Storage, Inc. |

3.9% |

| Equinix, Inc. |

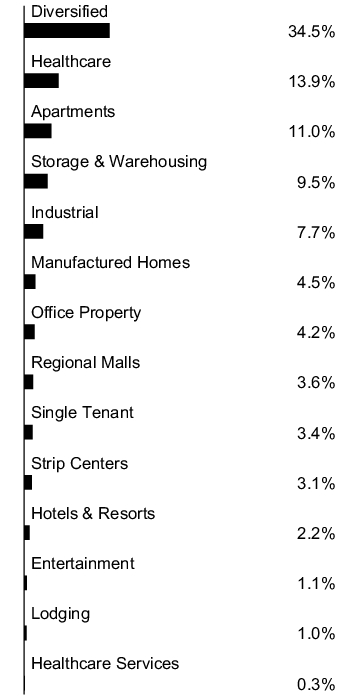

3.8% | Sector Allocation 1 1 Sector allocation is presented as a percentage of total investments before short-term investments.

|

| Largest Holdings [Text Block] |

Top 10 Holdings

| Welltower, Inc. |

10.1% |

| Digital Realty Trust, Inc. |

7.4% |

| American Tower Corp. |

6.0% |

| Crown Castle, Inc. |

5.8% |

| SBA Communications Corp. |

5.7% |

| Prologis, Inc. |

5.4% |

| Sun Communities, Inc. |

4.5% |

| Invitation Homes, Inc. |

4.1% |

| Extra Space Storage, Inc. |

3.9% |

| Equinix, Inc. |

3.8% |

|

| Material Fund Change [Text Block] |

Material Fund Changes There were no material changes during the reporting period.

|

| Accountant Change Disagreements [Text Block] |

Changes in and Disagreements with Accountants There were no changes in or disagreements with accountants during the reporting period.

|

| C000018293 [Member] |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

Quality Bond Fund

|

| Class Name |

Quality Bond Fund

|

| No Trading Symbol Flag |

true

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the Penn Series Quality Bond Fund (“Fund”) for the period of January 01, 2025 to June 30, 2025.

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at www.pennmutual.com/FundLiterature. You can also request this information by contacting us at 1-800-523-0650.

|

| Material Fund Change Notice [Text Block] |

This report describes changes to the Fund that occurred during the reporting period.

|

| Additional Information Phone Number |

1-800-523-0650

|

| Additional Information Website |

www.pennmutual.com/FundLiterature

|

| Expenses [Text Block] |

Fund Expenses Based on a hypothetical $10,000 investment

| Fund |

Cost of $10,000 investment |

Costs paid as a percentage

of a $10,000 investment |

| Quality Bond Fund |

$34 |

0.68% |

|

| Expenses Paid, Amount |

$ 34

|

| Expense Ratio, Percent |

0.68%

|

| Net Assets |

$ 350,310,194

|

| Holdings Count | Holding |

124

|

| Advisory Fees Paid, Amount |

$ 787,888

|

| Investment Company Portfolio Turnover |

16.00%

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics

| Fund net assets |

$350,310,194 |

| Total number of portfolio holdings |

124 |

| Total advisory fee paid |

$787,888 |

| Portfolio turnover rate |

16% |

| Weighted Average Maturity |

9.9 Years |

| Effective Duration |

5.9 Years |

|

| Holdings [Text Block] |

Graphical Representation of Holdings The tables below show the investment makeup of the Fund, with each category representing a percentage of the Fund's total investments. Asset Class Allocation

| Residential Mortgage Backed Securities |

45.0% |

| Corporate Bonds |

24.4% |

| Commercial Mortgage Backed Securities |

12.6% |

| U.S. Treasury Obligations |

7.8% |

| Asset Backed Securities |

7.8% |

| Money Market Funds |

1.6% |

| Municipal Bonds |

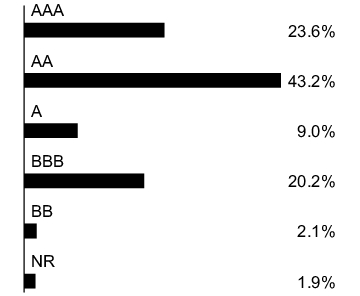

0.8% | Bond Quality Allocation 1 1 Source: Independent Rating Agencies such as Moody’s, S&P and Fitch. Note: When ratings from all three agencies are available, the median rating is used. When ratings are available from two of the agencies, the lower rating is used. When one rating is available, that rating is used. "NR" is used to classify securities for which a rating is not available.

|

| Credit Ratings Selection [Text Block] |

Source: Independent Rating Agencies such as Moody’s, S&P and FitchNote: When ratings from all three agencies are available, the median rating is used. When ratings are available from two of the agencies, the lower rating is used. When one rating is available, that rating is used. "NR" is used to classify securities for which a rating is not available.

|

| Material Fund Change [Text Block] |

Material Fund Changes There were no material changes during the reporting period.

|

| Accountant Change Disagreements [Text Block] |

Changes in and Disagreements with Accountants There were no changes in or disagreements with accountants during the reporting period.

|

| C000018294 [Member] |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

High Yield Bond Fund

|

| Class Name |

High Yield Bond Fund

|

| No Trading Symbol Flag |

true

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the Penn Series High Yield Bond Fund (“Fund”) for the period of January 01, 2025 to June 30, 2025.

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at www.pennmutual.com/FundLiterature. You can also request this information by contacting us at 1-800-523-0650.

|

| Material Fund Change Notice [Text Block] |

This report describes changes to the Fund that occurred during the reporting period.

|

| Additional Information Phone Number |

1-800-523-0650

|

| Additional Information Website |

www.pennmutual.com/FundLiterature

|

| Expenses [Text Block] |

Fund Expenses Based on a hypothetical $10,000 investment

| Fund |

Cost of $10,000 investment |

Costs paid as a percentage

of a $10,000 investment |

| High Yield Bond Fund |

$37 |

0.73% |

|

| Expenses Paid, Amount |

$ 37

|

| Expense Ratio, Percent |

0.73%

|

| Net Assets |

$ 123,125,498

|

| Holdings Count | Holding |

91

|

| Advisory Fees Paid, Amount |

$ 280,000

|

| Investment Company Portfolio Turnover |

81.00%

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics

| Fund net assets |

$123,125,498 |

| Total number of portfolio holdings |

91 |

| Total advisory fee paid |

$280,000 |

| Portfolio turnover rate |

81% |

| Weighted Average Maturity |

2.2 Years |

| Effective Duration |

3.0 Years |

|

| Holdings [Text Block] |

Graphical Representation of Holdings The tables below show the investment makeup of the Fund, with each category representing a percentage of the Fund's total investments. Asset Class Allocation

| Corporate Bonds |

93.2% |

| Loan Agreements |

5.0% |

| Money Market Funds |

1.3% |

| Asset Backed Securities |

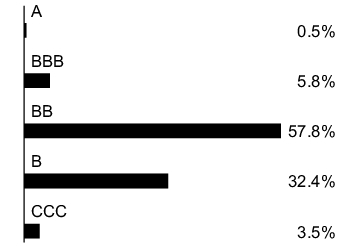

0.5% | Bond Quality Allocation 1 1 Source: Independent Rating Agencies such as Moody’s, S&P and Fitch. Note: When ratings from all three agencies are available, the median rating is used. When ratings are available from two of the agencies, the lower rating is used. When one rating is available, that rating is used. "NR" is used to classify securities for which a rating is not available.

|

| Credit Ratings Selection [Text Block] |

Source: Independent Rating Agencies such as Moody’s, S&P and Fitch.Note: When ratings from all three agencies are available, the median rating is used. When ratings are available from two of the agencies, the lower rating is used. When one rating is available, that rating is used. "NR" is used to classify securities for which a rating is not available.

|

| Material Fund Change [Text Block] |

Material Fund Changes There were no material changes during the reporting period.

|

| Accountant Change Disagreements [Text Block] |

Changes in and Disagreements with Accountants There were no changes in or disagreements with accountants during the reporting period.

|

| C000018295 [Member] |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

Large Growth Stock Fund

|

| Class Name |

Large Growth Stock Fund

|

| No Trading Symbol Flag |

true

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the Penn Series Large Growth Stock Fund (“Fund”) for the period of January 01, 2025 to June 30, 2025.

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at www.pennmutual.com/FundLiterature. You can also request this information by contacting us at 1-800-523-0650.

|

| Material Fund Change Notice [Text Block] |

This report describes changes to the Fund that occurred during the reporting period.

|

| Additional Information Phone Number |

1-800-523-0650

|

| Additional Information Website |

www.pennmutual.com/FundLiterature

|

| Expenses [Text Block] |

Fund Expenses Based on a hypothetical $10,000 investment

| Fund |

Cost of $10,000 investment |

Costs paid as a percentage

of a $10,000 investment |

| Large Growth Stock Fund |

$47 |

0.92% |

|

| Expenses Paid, Amount |

$ 47

|

| Expense Ratio, Percent |

0.92%

|

| Net Assets |

$ 369,276,717

|

| Holdings Count | Holding |

64

|

| Advisory Fees Paid, Amount |

$ 1,167,898

|

| Investment Company Portfolio Turnover |

17.00%

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics

| Fund net assets |

$369,276,717 |

| Total number of portfolio holdings |

64 |

| Total advisory fee paid |

$1,167,898 |

| Portfolio turnover rate |

17% |

|

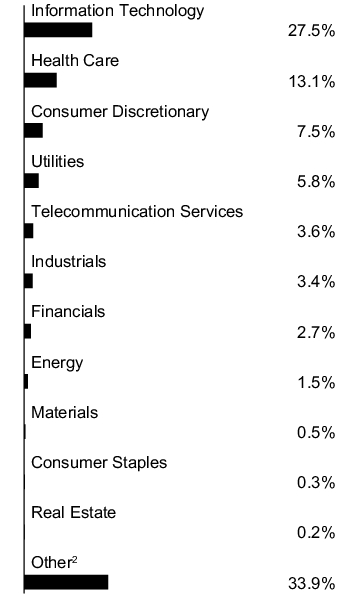

| Holdings [Text Block] |

Graphical Representation of Holdings The tables below show the investment makeup of the Fund, with each category representing a percentage of the Fund's total investments. Top 10 Holdings

| Microsoft Corp. |

13.2% |

| NVIDIA Corp. |

12.5% |

| Apple, Inc. |

7.9% |

| Amazon.com, Inc. |

7.5% |

| Meta Platforms, Inc., Class A |

5.4% |

| Broadcom, Inc. |

4.7% |

| Alphabet, Inc., Class A |

3.3% |

| Netflix, Inc. |

3.3% |

| Visa, Inc., Class A |

2.9% |

| Eli Lilly & Co. |

2.4% | Sector Allocation 1 1 Sector allocation is presented as a percentage of total investments before short-term investments.

|

| Largest Holdings [Text Block] |

Top 10 Holdings

| Microsoft Corp. |

13.2% |

| NVIDIA Corp. |

12.5% |

| Apple, Inc. |

7.9% |

| Amazon.com, Inc. |

7.5% |

| Meta Platforms, Inc., Class A |

5.4% |

| Broadcom, Inc. |

4.7% |

| Alphabet, Inc., Class A |

3.3% |

| Netflix, Inc. |

3.3% |

| Visa, Inc., Class A |

2.9% |

| Eli Lilly & Co. |

2.4% |

|

| Material Fund Change [Text Block] |

Material Fund Changes There were no material changes during the reporting period.

|

| Accountant Change Disagreements [Text Block] |

Changes in and Disagreements with Accountants There were no changes in or disagreements with accountants during the reporting period.

|

| C000018296 [Member] |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

Large Cap Value Fund

|

| Class Name |

Large Cap Value Fund

|

| No Trading Symbol Flag |

true

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the Penn Series Large Cap Value Fund (“Fund”) for the period of January 01, 2025 to June 30, 2025.

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at www.pennmutual.com/FundLiterature. You can also request this information by contacting us at 1-800-523-0650.

|

| Material Fund Change Notice [Text Block] |

This report describes changes to the Fund that occurred during the reporting period.

|

| Additional Information Phone Number |

1-800-523-0650

|

| Additional Information Website |

www.pennmutual.com/FundLiterature

|

| Expenses [Text Block] |

Fund Expenses Based on a hypothetical $10,000 investment

| Fund |

Cost of $10,000 investment |

Costs paid as a percentage

of a $10,000 investment |

| Large Cap Value Fund |

$47 |

0.93% |

|

| Expenses Paid, Amount |

$ 47

|

| Expense Ratio, Percent |

0.93%

|

| Net Assets |

$ 162,003,664

|

| Holdings Count | Holding |

74

|

| Advisory Fees Paid, Amount |

$ 533,446

|

| Investment Company Portfolio Turnover |

30.00%

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics

| Fund net assets |

$162,003,664 |

| Total number of portfolio holdings |

74 |

| Total advisory fee paid |

$533,446 |

| Portfolio turnover rate |

30% |

|

| Holdings [Text Block] |

Graphical Representation of Holdings The tables below show the investment makeup of the Fund, with each category representing a percentage of the Fund's total investments. Top 10 Holdings

| JPMorgan Chase & Co. |

4.2% |

| Berkshire Hathaway, Inc., Class B |

3.9% |

| Philip Morris International, Inc. |

3.7% |

| Johnson & Johnson |

3.6% |

| Walmart, Inc. |

3.2% |

| RTX Corp. |

3.0% |

| EOG Resources, Inc. |

2.5% |

| Texas Instruments, Inc. |

2.5% |

| S&P Global, Inc. |

2.4% |

| Elevance Health, Inc. |

2.2% | Sector Allocation 1 1 Sector allocation is presented as a percentage of total investments before short-term investments.

|

| Largest Holdings [Text Block] |

Top 10 Holdings

| JPMorgan Chase & Co. |

4.2% |

| Berkshire Hathaway, Inc., Class B |

3.9% |

| Philip Morris International, Inc. |

3.7% |

| Johnson & Johnson |

3.6% |

| Walmart, Inc. |

3.2% |

| RTX Corp. |

3.0% |

| EOG Resources, Inc. |

2.5% |

| Texas Instruments, Inc. |

2.5% |

| S&P Global, Inc. |

2.4% |

| Elevance Health, Inc. |

2.2% |

|

| Material Fund Change [Text Block] |

Material Fund Changes There were no material changes during the reporting period.

|

| Accountant Change Disagreements [Text Block] |

Changes in and Disagreements with Accountants There were no changes in or disagreements with accountants during the reporting period.

|

| C000018297 [Member] |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

Flexibly Managed Fund

|

| Class Name |

Flexibly Managed Fund

|

| No Trading Symbol Flag |

true

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the Penn Series Flexibly Managed Fund (“Fund”) for the period of January 01, 2025 to June 30, 2025.

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at www.pennmutual.com/FundLiterature. You can also request this information by contacting us at 1-800-523-0650.

|

| Material Fund Change Notice [Text Block] |

This report describes changes to the Fund that occurred during the reporting period.

|

| Additional Information Phone Number |

1-800-523-0650

|

| Additional Information Website |

www.pennmutual.com/FundLiterature

|

| Expenses [Text Block] |

Fund Expenses Based on a hypothetical $10,000 investment

| Fund |

Cost of $10,000 investment |

Costs paid as a percentage

of a $10,000 investment |

| Flexibly Managed Fund |

$44 |

0.87% |

|

| Expenses Paid, Amount |

$ 44

|

| Expense Ratio, Percent |

0.87%

|

| Net Assets |

$ 5,127,362,114

|

| Holdings Count | Holding |

245

|

| Advisory Fees Paid, Amount |

$ 17,206,136

|

| Investment Company Portfolio Turnover |

59.00%

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics

| Fund net assets |

$5,127,362,114 |

| Total number of portfolio holdings |

245 |

| Total advisory fee paid |

$17,206,136 |

| Portfolio turnover rate |

59% |

|

| Holdings [Text Block] |

Graphical Representation of Holdings The tables below show the investment makeup of the Fund, with each category representing a percentage of the Fund's total investments. Top 10 Holdings

| Microsoft Corp. |

6.6% |

U.S. Treasury Notes

4.000%, 02/28/30 |

4.3% |

| Amazon.com, Inc. |

4.2% |

U.S. Treasury Notes

4.000%, 05/31/30 |

3.7% |

| NVIDIA Corp. |

3.5% |

U.S. Treasury Notes

3.875%, 04/30/30 |

3.3% |

| Becton Dickinson & Co. |

2.7% |

| Roper Technologies, Inc. |

2.7% |

U.S. Treasury Notes

4.000%, 03/31/30 |

2.5% |

| PTC, Inc. |

2.2% | Sector Allocation 1 1 Sector allocation is presented as a percentage of total investments before short-term investments. 2 Includes non-equity investments.

|

| Largest Holdings [Text Block] |

Top 10 Holdings

| Microsoft Corp. |

6.6% |

U.S. Treasury Notes

4.000%, 02/28/30 |

4.3% |

| Amazon.com, Inc. |

4.2% |

U.S. Treasury Notes

4.000%, 05/31/30 |

3.7% |

| NVIDIA Corp. |

3.5% |

U.S. Treasury Notes

3.875%, 04/30/30 |

3.3% |

| Becton Dickinson & Co. |

2.7% |

| Roper Technologies, Inc. |

2.7% |

U.S. Treasury Notes

4.000%, 03/31/30 |

2.5% |

| PTC, Inc. |

2.2% |

|

| Material Fund Change [Text Block] |

Material Fund Changes There were no material changes during the reporting period.

|

| Accountant Change Disagreements [Text Block] |

Changes in and Disagreements with Accountants There were no changes in or disagreements with accountants during the reporting period.

|

| C000018298 [Member] |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

International Equity Fund

|

| Class Name |

International Equity Fund

|

| No Trading Symbol Flag |

true

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the Penn Series International Equity Fund (“Fund”) for the period of January 01, 2025 to June 30, 2025.

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at www.pennmutual.com/FundLiterature. You can also request this information by contacting us at 1-800-523-0650.

|

| Material Fund Change Notice [Text Block] |

This report describes changes to the Fund that occurred during the reporting period.

|

| Additional Information Phone Number |

1-800-523-0650

|

| Additional Information Website |

www.pennmutual.com/FundLiterature

|

| Expenses [Text Block] |

Fund Expenses Based on a hypothetical $10,000 investment

| Fund |

Cost of $10,000 investment |

Costs paid as a percentage

of a $10,000 investment |

| International Equity Fund |

$58 |

1.07% |

|

| Expenses Paid, Amount |

$ 58

|

| Expense Ratio, Percent |

1.07%

|

| Net Assets |

$ 243,226,109

|

| Holdings Count | Holding |

46

|

| Advisory Fees Paid, Amount |

$ 918,017

|

| Investment Company Portfolio Turnover |

118.00%

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics

| Fund net assets |

$243,226,109 |

| Total number of portfolio holdings |

46 |

| Total advisory fee paid |

$918,017 |

| Portfolio turnover rate |

118% |

|

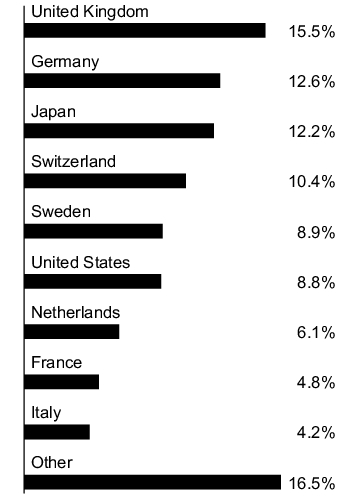

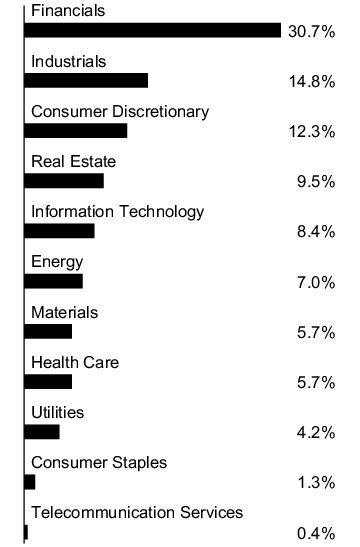

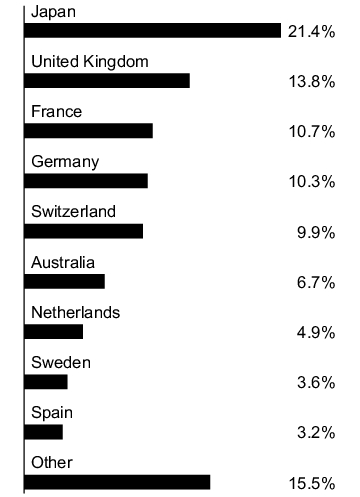

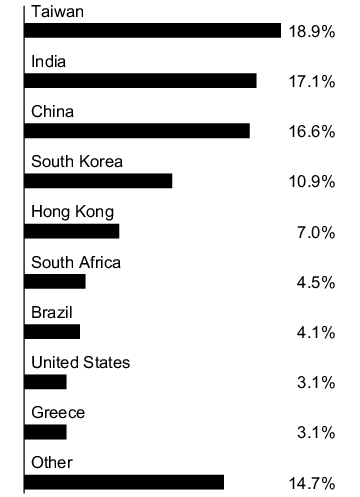

| Holdings [Text Block] |

Graphical Representation of Holdings The tables below show the investment makeup of the Fund, with each category representing a percentage of the Fund's total investments. Top 10 Holdings

| Philip Morris International, Inc. |

4.9% |

| Capcom Co., Ltd. |

4.0% |

| Rheinmetall AG |

3.9% |

| Svenska Handelsbanken AB, Class A |

3.8% |

| Galderma Group AG |

3.8% |

| Tencent Holdings Ltd. |

3.7% |

| Games Workshop Group PLC |

3.5% |

| Universal Music Group N.V. |

3.5% |

| Chocoladefabriken Lindt & Spruengli AG, Participation Certificates |

3.3% |

| SAP S.E. |

3.2% | Sector Allocation 1 Country Allocation 1 Sector allocation is presented as a percentage of total investments before short-term investments.

|

| Largest Holdings [Text Block] |

Top 10 Holdings

| Philip Morris International, Inc. |

4.9% |

| Capcom Co., Ltd. |

4.0% |

| Rheinmetall AG |

3.9% |

| Svenska Handelsbanken AB, Class A |

3.8% |

| Galderma Group AG |

3.8% |

| Tencent Holdings Ltd. |

3.7% |

| Games Workshop Group PLC |

3.5% |

| Universal Music Group N.V. |

3.5% |

| Chocoladefabriken Lindt & Spruengli AG, Participation Certificates |

3.3% |

| SAP S.E. |

3.2% |

|

| Material Fund Change [Text Block] |

Material Fund Changes There were no material changes during the reporting period.

|

| Accountant Change Disagreements [Text Block] |

Changes in and Disagreements with Accountants There were no changes in or disagreements with accountants during the reporting period.

|

| C000018299 [Member] |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

Small Cap Value Fund

|

| Class Name |

Small Cap Value Fund

|

| No Trading Symbol Flag |

true

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the Penn Series Small Cap Value Fund (“Fund”) for the period of January 01, 2025 to June 30, 2025.

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at www.pennmutual.com/FundLiterature. You can also request this information by contacting us at 1-800-523-0650.

|

| Material Fund Change Notice [Text Block] |

This report describes changes to the Fund that occurred during the reporting period.

|

| Additional Information Phone Number |

1-800-523-0650

|

| Additional Information Website |

www.pennmutual.com/FundLiterature

|

| Expenses [Text Block] |

Fund Expenses Based on a hypothetical $10,000 investment

| Fund |

Cost of $10,000 investment |

Costs paid as a percentage

of a $10,000 investment |

| Small Cap Value Fund |

$49 |

0.99% |

|

| Expenses Paid, Amount |

$ 49

|

| Expense Ratio, Percent |

0.99%

|

| Net Assets |

$ 138,593,512

|

| Holdings Count | Holding |

180

|

| Advisory Fees Paid, Amount |

$ 468,647

|

| Investment Company Portfolio Turnover |

45.00%

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics

| Fund net assets |

$138,593,512 |

| Total number of portfolio holdings |

180 |

| Total advisory fee paid |

$468,647 |

| Portfolio turnover rate |

45% |

|

| Holdings [Text Block] |

Graphical Representation of Holdings The tables below show the investment makeup of the Fund, with each category representing a percentage of the Fund's total investments. Top 10 Holdings

| TXNM Energy, Inc. |

1.7% |

| Ameris Bancorp |

1.5% |

| UMB Financial Corp. |

1.5% |

| Glacier Bancorp, Inc. |

1.3% |

| Renasant Corp. |

1.3% |

| Atlantic Union Bankshares Corp. |

1.2% |

| Cadence Bank |

1.2% |

| PennyMac Financial Services, Inc. |

1.2% |

| Gates Industrial Corp. PLC |

1.2% |

| Independence Realty Trust, Inc. |

1.1% | Sector Allocation 1 1 Sector allocation is presented as a percentage of total investments before short-term investments.

|

| Largest Holdings [Text Block] |

Top 10 Holdings

| TXNM Energy, Inc. |

1.7% |

| Ameris Bancorp |

1.5% |

| UMB Financial Corp. |

1.5% |

| Glacier Bancorp, Inc. |

1.3% |

| Renasant Corp. |

1.3% |

| Atlantic Union Bankshares Corp. |

1.2% |

| Cadence Bank |

1.2% |

| PennyMac Financial Services, Inc. |

1.2% |

| Gates Industrial Corp. PLC |

1.2% |

| Independence Realty Trust, Inc. |

1.1% |

|

| Material Fund Change [Text Block] |

Material Fund Changes There were no material changes during the reporting period.

|

| Accountant Change Disagreements [Text Block] |

Changes in and Disagreements with Accountants There were no changes in or disagreements with accountants during the reporting period.

|

| C000018300 [Member] |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

Small Cap Growth Fund

|

| Class Name |

Small Cap Growth Fund

|

| No Trading Symbol Flag |

true

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the Penn Series Small Cap Growth Fund (“Fund”) for the period of January 01, 2025 to June 30, 2025.

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at www.pennmutual.com/FundLiterature. You can also request this information by contacting us at 1-800-523-0650.

|

| Material Fund Change Notice [Text Block] |

This report describes changes to the Fund that occurred during the reporting period.

|

| Additional Information Phone Number |

1-800-523-0650

|

| Additional Information Website |

www.pennmutual.com/FundLiterature

|

| Expenses [Text Block] |

Fund Expenses Based on a hypothetical $10,000 investment

| Fund |

Cost of $10,000 investment |

Costs paid as a percentage

of a $10,000 investment |

| Small Cap Growth Fund |

$50 |

1.00% |

|

| Expenses Paid, Amount |

$ 50

|

| Expense Ratio, Percent |

1.00%

|

| Net Assets |

$ 93,980,888

|

| Holdings Count | Holding |

126

|

| Advisory Fees Paid, Amount |

$ 321,828

|

| Investment Company Portfolio Turnover |

13.00%

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics

| Fund net assets |

$93,980,888 |

| Total number of portfolio holdings |

126 |

| Total advisory fee paid |

$321,828 |

| Portfolio turnover rate |

13% |

|

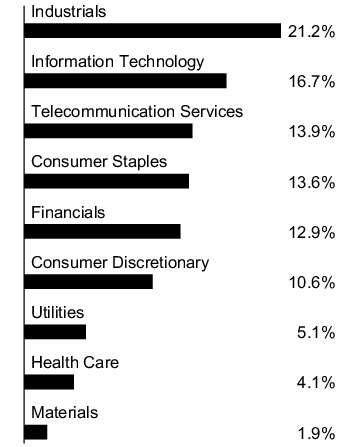

| Holdings [Text Block] |

Graphical Representation of Holdings The tables below show the investment makeup of the Fund, with each category representing a percentage of the Fund's total investments. Top 10 Holdings

| SS&C Technologies Holdings, Inc. |

2.5% |

| Stride, Inc. |

2.5% |

| Mirion Technologies, Inc. |

2.3% |

| OSI Systems, Inc. |

2.2% |

| Crown Holdings, Inc. |

2.1% |

| Sensient Technologies Corp. |

2.0% |

| LPL Financial Holdings, Inc. |

2.0% |

| The Descartes Systems Group, Inc. |

1.8% |

| Shift4 Payments, Inc., Class A |

1.7% |

| Casey's General Stores, Inc. |

1.6% | Sector Allocation 1 1 Sector allocation is presented as a percentage of total investments before short-term investments.

|

| Largest Holdings [Text Block] |

Top 10 Holdings

| SS&C Technologies Holdings, Inc. |

2.5% |

| Stride, Inc. |

2.5% |

| Mirion Technologies, Inc. |

2.3% |

| OSI Systems, Inc. |

2.2% |

| Crown Holdings, Inc. |

2.1% |

| Sensient Technologies Corp. |

2.0% |

| LPL Financial Holdings, Inc. |

2.0% |

| The Descartes Systems Group, Inc. |

1.8% |

| Shift4 Payments, Inc., Class A |

1.7% |

| Casey's General Stores, Inc. |

1.6% |

|

| Material Fund Change [Text Block] |

Material Fund Changes There were no material changes during the reporting period.

|

| Accountant Change Disagreements [Text Block] |

Changes in and Disagreements with Accountants There were no changes in or disagreements with accountants during the reporting period.

|

| C000063367 [Member] |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

Aggressive Allocation Fund

|

| Class Name |

Aggressive Allocation Fund

|

| No Trading Symbol Flag |

true

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the Penn Series Aggressive Allocation Fund (“Fund”) for the period of January 01, 2025 to June 30, 2025.

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at www.pennmutual.com/FundLiterature. You can also request this information by contacting us at 1-800-523-0650.

|

| Material Fund Change Notice [Text Block] |

This report describes changes to the Fund that occurred during the reporting period.

|

| Additional Information Phone Number |

1-800-523-0650

|

| Additional Information Website |

www.pennmutual.com/FundLiterature

|

| Expenses [Text Block] |

Fund Expenses Based on a hypothetical $10,000 investment

| Fund |

Cost of $10,000 investment |

Costs paid as a percentage

of a $10,000 investment |

| Aggressive Allocation Fund |

$17 |

0.33% |

|

| Expenses Paid, Amount |

$ 17

|

| Expense Ratio, Percent |

0.33%

|

| Net Assets |

$ 57,188,973

|

| Holdings Count | Holding |

20

|

| Advisory Fees Paid, Amount |

$ 33,692

|

| Investment Company Portfolio Turnover |

10.00%

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics

| Fund net assets |

$57,188,973 |

| Total number of portfolio holdings |

20 |

| Total advisory fee paid |

$33,692 |

| Portfolio turnover rate |

10% |

|

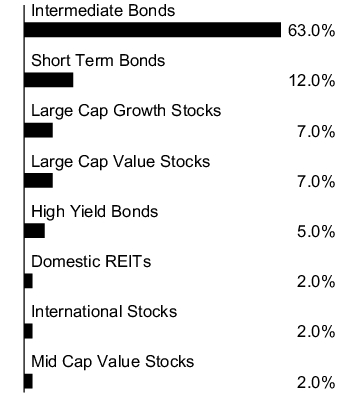

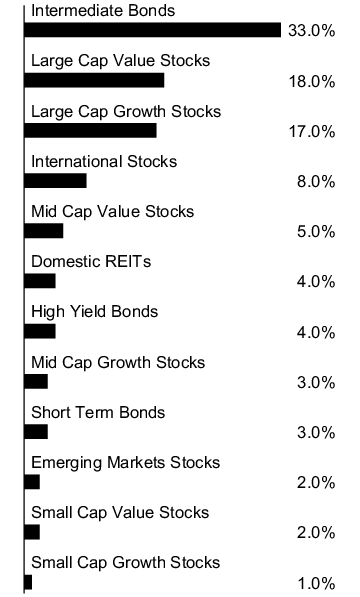

| Holdings [Text Block] |

Graphical Representation of Holdings The tables below show the investment makeup of the Fund, with each category representing a percentage of the Fund's total investments. Top 10 Holdings

| Penn Series Index 500 Fund |

27.2% |

| Penn Series Flexibly Managed Fund |

8.9% |

| Penn Series International Equity Fund |

8.9% |

| Penn Series Large Cap Value Fund |

5.9% |

| Penn Series Quality Bond Fund |

5.9% |

| Penn Series Large Growth Stock Fund |

5.1% |

| Penn Series Developed International Index Fund |

4.9% |

| Penn Series Mid Core Value Fund |

4.9% |

| Penn Series Real Estate Securities Fund |

4.9% |

| Penn Series Large Core Growth Fund |

4.0% | Asset Allocation Target

|

| Largest Holdings [Text Block] |

Top 10 Holdings

| Penn Series Index 500 Fund |

27.2% |

| Penn Series Flexibly Managed Fund |

8.9% |

| Penn Series International Equity Fund |

8.9% |

| Penn Series Large Cap Value Fund |

5.9% |

| Penn Series Quality Bond Fund |

5.9% |

| Penn Series Large Growth Stock Fund |

5.1% |

| Penn Series Developed International Index Fund |

4.9% |

| Penn Series Mid Core Value Fund |

4.9% |

| Penn Series Real Estate Securities Fund |

4.9% |

| Penn Series Large Core Growth Fund |

4.0% |

|

| Material Fund Change [Text Block] |

Material Fund Changes There were no material changes during the reporting period.

|

| Accountant Change Disagreements [Text Block] |

Changes in and Disagreements with Accountants There were no changes in or disagreements with accountants during the reporting period.

|

| C000063368 [Member] |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

Moderately Conservative Allocation Fund

|

| Class Name |

Moderately Conservative Allocation Fund

|

| No Trading Symbol Flag |

true

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the Penn Series Moderately Conservative Allocation Fund (“Fund”) for the period of January 01, 2025 to June 30, 2025.

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at www.pennmutual.com/FundLiterature. You can also request this information by contacting us at 1-800-523-0650.

|

| Material Fund Change Notice [Text Block] |

This report describes changes to the Fund that occurred during the reporting period.

|

| Additional Information Phone Number |

1-800-523-0650

|

| Additional Information Website |

www.pennmutual.com/FundLiterature

|

| Expenses [Text Block] |

Fund Expenses Based on a hypothetical $10,000 investment

| Fund |

Cost of $10,000 investment |

Costs paid as a percentage

of a $10,000 investment |

| Moderately Conservative Allocation Fund |

$16 |

0.32% |

|

| Expenses Paid, Amount |

$ 16

|

| Expense Ratio, Percent |

0.32%

|

| Net Assets |

$ 72,150,304

|

| Holdings Count | Holding |

15

|

| Advisory Fees Paid, Amount |

$ 43,348

|

| Investment Company Portfolio Turnover |

4.00%

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics

| Fund net assets |

$72,150,304 |

| Total number of portfolio holdings |

15 |

| Total advisory fee paid |

$43,348 |

| Portfolio turnover rate |

4% |

|

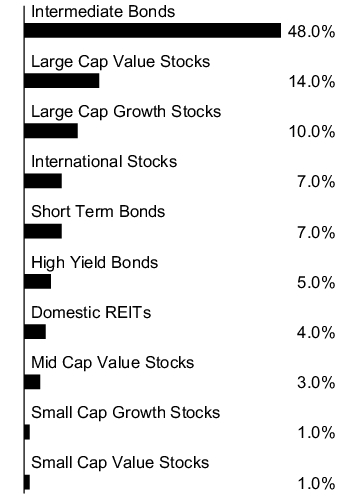

| Holdings [Text Block] |

Graphical Representation of Holdings The tables below show the investment makeup of the Fund, with each category representing a percentage of the Fund's total investments. Top 10 Holdings

| Penn Series Quality Bond Fund |

44.3% |

| Penn Series Index 500 Fund |

13.1% |

| Penn Series Flexibly Managed Fund |

7.9% |

| Penn Series Limited Maturity Bond Fund |

6.9% |

| Penn Series High Yield Bond Fund |

4.9% |

| Penn Series International Equity Fund |

3.9% |

| Penn Series Real Estate Securities Fund |

3.9% |

| Penn Series Large Cap Value Fund |

3.0% |

| Penn Series Developed International Index Fund |

3.0% |

| Penn Series Mid Core Value Fund |

3.0% | Asset Allocation Target

|

| Largest Holdings [Text Block] |

Top 10 Holdings

| Penn Series Quality Bond Fund |

44.3% |

| Penn Series Index 500 Fund |

13.1% |

| Penn Series Flexibly Managed Fund |

7.9% |

| Penn Series Limited Maturity Bond Fund |

6.9% |

| Penn Series High Yield Bond Fund |

4.9% |

| Penn Series International Equity Fund |

3.9% |

| Penn Series Real Estate Securities Fund |

3.9% |

| Penn Series Large Cap Value Fund |

3.0% |

| Penn Series Developed International Index Fund |

3.0% |

| Penn Series Mid Core Value Fund |

3.0% |

|

| Material Fund Change [Text Block] |

Material Fund Changes There were no material changes during the reporting period.

|

| Accountant Change Disagreements [Text Block] |

Changes in and Disagreements with Accountants There were no changes in or disagreements with accountants during the reporting period.

|

| C000063369 [Member] |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

Small Cap Index Fund

|

| Class Name |

Small Cap Index Fund

|

| No Trading Symbol Flag |

true

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the Penn Series Small Cap Index Fund (“Fund”) for the period of January 01, 2025 to June 30, 2025.

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at www.pennmutual.com/FundLiterature. You can also request this information by contacting us at 1-800-523-0650.

|

| Material Fund Change Notice [Text Block] |

This report describes changes to the Fund that occurred during the reporting period.

|

| Additional Information Phone Number |

1-800-523-0650

|

| Additional Information Website |

www.pennmutual.com/FundLiterature

|

| Expenses [Text Block] |

Fund Expenses Based on a hypothetical $10,000 investment

| Fund |

Cost of $10,000 investment |

Costs paid as a percentage

of a $10,000 investment |

| Small Cap Index Fund |

$35 |

0.72% |

|

| Expenses Paid, Amount |

$ 35

|

| Expense Ratio, Percent |

0.72%

|

| Net Assets |

$ 76,273,571

|

| Holdings Count | Holding |

1,991

|

| Advisory Fees Paid, Amount |

$ 115,078

|

| Investment Company Portfolio Turnover |

10.00%

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics

| Fund net assets |

$76,273,571 |

| Total number of portfolio holdings |

1,991 |

| Total advisory fee paid |

$115,078 |

| Portfolio turnover rate |

10% |

|

| Holdings [Text Block] |

Graphical Representation of Holdings The tables below show the investment makeup of the Fund, with each category representing a percentage of the Fund's total investments. Top 10 Holdings

| Credo Technology Group Holding Ltd. |

0.5% |

| Fabrinet |

0.4% |

| IonQ, Inc. |

0.4% |

| Hims & Hers Health, Inc. |

0.4% |

| HealthEquity, Inc. |

0.4% |

| The Ensign Group, Inc. |

0.3% |

| Fluor Corp. |

0.3% |

| Blueprint Medicines Corp. |

0.3% |

| AeroVironment, Inc. |

0.3% |

| Brinker International, Inc. |

0.3% | Sector Allocation 1 1 Sector allocation is presented as a percentage of total investments before short-term investments.

|

| Largest Holdings [Text Block] |

Top 10 Holdings

| Credo Technology Group Holding Ltd. |

0.5% |

| Fabrinet |

0.4% |

| IonQ, Inc. |

0.4% |

| Hims & Hers Health, Inc. |

0.4% |

| HealthEquity, Inc. |

0.4% |

| The Ensign Group, Inc. |

0.3% |

| Fluor Corp. |

0.3% |

| Blueprint Medicines Corp. |

0.3% |

| AeroVironment, Inc. |

0.3% |

| Brinker International, Inc. |

0.3% |

|

| Material Fund Change [Text Block] |

Material Fund Changes There were no material changes during the reporting period.

|

| Accountant Change Disagreements [Text Block] |

Changes in and Disagreements with Accountants There were no changes in or disagreements with accountants during the reporting period.

|

| C000063370 [Member] |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

SMID Cap Growth Fund

|

| Class Name |

SMID Cap Growth Fund

|

| No Trading Symbol Flag |

true

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the Penn Series SMID Cap Growth Fund (“Fund”) for the period of January 01, 2025 to June 30, 2025.

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at www.pennmutual.com/FundLiterature. You can also request this information by contacting us at 1-800-523-0650.

|

| Material Fund Change Notice [Text Block] |

This report describes changes to the Fund that occurred during the reporting period.

|

| Additional Information Phone Number |

1-800-523-0650

|

| Additional Information Website |

www.pennmutual.com/FundLiterature

|

| Expenses [Text Block] |

Fund Expenses Based on a hypothetical $10,000 investment

| Fund |

Cost of $10,000 investment |

Costs paid as a percentage

of a $10,000 investment |

| SMID Cap Growth Fund |

$51 |

1.05% |

|

| Expenses Paid, Amount |

$ 51

|

| Expense Ratio, Percent |

1.05%

|

| Net Assets |

$ 69,643,719

|

| Holdings Count | Holding |

84

|

| Advisory Fees Paid, Amount |

$ 250,441

|

| Investment Company Portfolio Turnover |

66.00%

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics

| Fund net assets |

$69,643,719 |

| Total number of portfolio holdings |

84 |

| Total advisory fee paid |

$250,441 |

| Portfolio turnover rate |

66% |

|

| Holdings [Text Block] |

Graphical Representation of Holdings The tables below show the investment makeup of the Fund, with each category representing a percentage of the Fund's total investments. Top 10 Holdings

| Toast, Inc., Class A |

2.4% |

| Natera, Inc. |

2.1% |

| Loar Holdings, Inc. |

2.0% |

| Texas Roadhouse, Inc. |

2.0% |

| Credo Technology Group Holding Ltd. |

2.0% |

| Guidewire Software, Inc. |

2.0% |

| Applied Industrial Technologies, Inc. |

1.9% |

| SharkNinja, Inc. |

1.9% |

| Shake Shack, Inc., Class A |

1.9% |

| Kinsale Capital Group, Inc. |

1.8% | Sector Allocation 1 1 Sector allocation is presented as a percentage of total investments before short-term investments.

|

| Largest Holdings [Text Block] |

Top 10 Holdings

| Toast, Inc., Class A |

2.4% |

| Natera, Inc. |

2.1% |

| Loar Holdings, Inc. |

2.0% |

| Texas Roadhouse, Inc. |

2.0% |

| Credo Technology Group Holding Ltd. |

2.0% |

| Guidewire Software, Inc. |

2.0% |

| Applied Industrial Technologies, Inc. |

1.9% |

| SharkNinja, Inc. |

1.9% |

| Shake Shack, Inc., Class A |

1.9% |

| Kinsale Capital Group, Inc. |

1.8% |

|

| Material Fund Change [Text Block] |

Material Fund Changes There were no material changes during the reporting period.

|

| Accountant Change Disagreements [Text Block] |

Changes in and Disagreements with Accountants There were no changes in or disagreements with accountants during the reporting period.

|

| C000063371 [Member] |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

SMID Cap Value Fund

|

| Class Name |

SMID Cap Value Fund

|

| No Trading Symbol Flag |

true

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the Penn Series SMID Cap Value Fund (“Fund”) for the period of January 01, 2025 to June 30, 2025.

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at www.pennmutual.com/FundLiterature. You can also request this information by contacting us at 1-800-523-0650.

|

| Material Fund Change Notice [Text Block] |

This report describes changes to the Fund that occurred during the reporting period.

|

| Additional Information Phone Number |

1-800-523-0650

|

| Additional Information Website |

www.pennmutual.com/FundLiterature

|

| Expenses [Text Block] |

Fund Expenses Based on a hypothetical $10,000 investment

| Fund |

Cost of $10,000 investment |

Costs paid as a percentage

of a $10,000 investment |

| SMID Cap Value Fund |

$57 |

1.17% |

|

| Expenses Paid, Amount |

$ 57

|

| Expense Ratio, Percent |

1.17%

|

| Net Assets |

$ 47,674,027

|

| Holdings Count | Holding |

93

|

| Advisory Fees Paid, Amount |

$ 188,598

|

| Investment Company Portfolio Turnover |

37.00%

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics

| Fund net assets |

$47,674,027 |

| Total number of portfolio holdings |

93 |

| Total advisory fee paid |

$188,598 |

| Portfolio turnover rate |

37% |

|

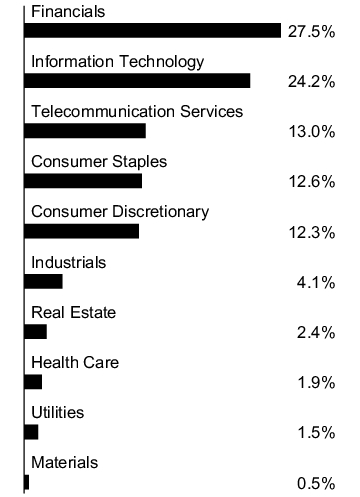

| Holdings [Text Block] |

Graphical Representation of Holdings The tables below show the investment makeup of the Fund, with each category representing a percentage of the Fund's total investments. Top 10 Holdings

| BJ's Wholesale Club Holdings, Inc. |

2.0% |

| Encompass Health Corp. |

1.8% |

| TXNM Energy, Inc. |

1.8% |

| Jones Lang LaSalle, Inc. |

1.7% |

| IDACORP, Inc. |

1.6% |

| Nexstar Media Group, Inc. |

1.6% |

| The Hanover Insurance Group, Inc. |

1.6% |

| Tenet Healthcare Corp. |

1.6% |

| Pentair PLC |

1.5% |

| RPM International, Inc. |

1.4% | Sector Allocation 1 1 Sector allocation is presented as a percentage of total investments before short-term investments.

|

| Largest Holdings [Text Block] |

Top 10 Holdings

| BJ's Wholesale Club Holdings, Inc. |

2.0% |

| Encompass Health Corp. |

1.8% |

| TXNM Energy, Inc. |

1.8% |

| Jones Lang LaSalle, Inc. |

1.7% |

| IDACORP, Inc. |

1.6% |