|

Fund Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment*

|

|

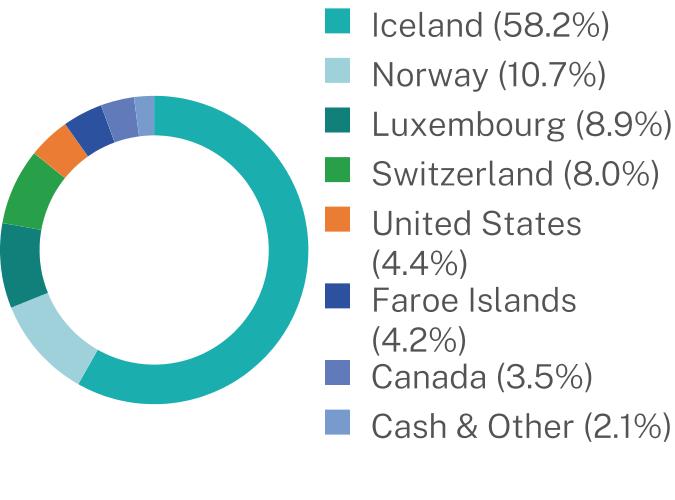

GlacierShares Nasdaq Iceland ETF

|

$25

|

0.95%

|

|

Net Assets

|

$764,199

|

|

Number of Holdings

|

31

|

|

Net Advisory Fee

|

$1,669

|

|

Portfolio Turnover

|

8%

|

|

Top Sectors

|

(%)

|

|

Financials

|

28.7%

|

|

Health Care

|

21.9%

|

|

Consumer Staples

|

20.3%

|

|

Real Estate

|

7.8%

|

|

Industrials

|

7.3%

|

|

Consumer Discretionary

|

6.5%

|

|

Materials

|

3.5%

|

|

Communications

|

1.1%

|

|

Energy

|

0.8%

|

|

Cash & Other

|

2.1%

|

|

Top 10 Issuers

|

(%)

|

|

Islandsbanki HF

|

11.7%

|

|

Arion Banki HF

|

10.5%

|

|

Alvotech SA

|

8.9%

|

|

Oculis Holding AG

|

8.0%

|

|

Embla Medical HF

|

5.0%

|

|

Mowi ASA

|

4.5%

|

|

JBT Marel Corp.

|

4.4%

|

|

Bakkafrost P/F

|

4.2%

|

|

Salmar ASA

|

4.1%

|

|

Kvika banki hf

|

3.6%

|

|

Fund Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment*

|

|

Relative Strength Managed Volatility Strategy ETF

|

$44

|

0.96%

|

|

Net Assets

|

$48,027,491

|

|

Number of Holdings

|

39

|

|

Net Advisory Fee

|

$327,448

|

|

Portfolio Turnover

|

242%

|

|

Top 10 Issuers

|

(%)

|

|

Alphabet, Inc.

|

4.9%

|

|

SPDR Portfolio Short Term Treasury ETF

|

4.5%

|

|

Wells Fargo & Co.

|

2.7%

|

|

Netflix, Inc.

|

2.7%

|

|

NVIDIA Corp.

|

2.7%

|

|

Broadcom, Inc.

|

2.7%

|

|

General Electric Co.

|

2.7%

|

|

JPMorgan Chase & Co.

|

2.6%

|

|

Bank of America Corp.

|

2.6%

|

|

Cisco Systems, Inc.

|

2.6%

|

|

Fund Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment*

|

|

Teucrium 2x Daily Corn ETF

|

$42

|

0.95%

|

|

Net Assets

|

$812,243

|

|

Number of Holdings

|

1

|

|

Net Advisory Fee

|

$7,770

|

|

Portfolio Turnover

|

0%

|

|

Top 10 Issuers

|

(%)

|

|

Corn No. 2 Yellow Futures

|

-8.0%

|

|

Fund Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment*

|

|

Teucrium 2x Daily Wheat ETF

|

$42

|

0.95%

|

|

Net Assets

|

$771,882

|

|

Number of Holdings

|

1

|

|

Net Advisory Fee

|

$6,750

|

|

Portfolio Turnover

|

0%

|

|

Top 10 Issuers

|

(%)

|

|

Wheat Futures

|

-5.8%

|

|

Fund Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment*

|

|

Teucrium 2x Long Daily XRP ETF

|

$125

|

5.01%

|

|

Net Assets

|

$158,666,221

|

|

Number of Holdings

|

4

|

|

Net Advisory Fee

|

$354,165

|

|

Portfolio Turnover

|

0%

|

|

Top 10 Issuers

|

(%)

|

|

XRP Futures

|

7.1%

|

|

CME XRP Futures

|

0.1%

|

|

Fund Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment*

|

|

Teucrium Agricultural Strategy No K-1 ETF

|

$44

|

0.89%

|

|

Net Assets

|

$3,652,554

|

|

Number of Holdings

|

4

|

|

Portfolio Turnover

|

0%

|

|

Top 10 Issuers

|

(%)

|

|

Soybean Futures

|

-0.2%

|

|

Sugar No. 11 Futures

|

-0.6%

|

|

Wheat Futures

|

-0.8%

|

|

Corn No. 2 Yellow Futures

|

-1.3%

|

|

Fund Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment*

|

|

Yields For You Income Strategy A ETF

|

$41

|

1.00%

|

|

Net Assets

|

$24,443,498

|

|

Number of Holdings

|

6

|

|

Net Advisory Fee

|

$104,577

|

|

Portfolio Turnover

|

9%

|

|

Top 10 Issuers

|

(%)

|

|

SPDR Bloomberg 1-3 Month T-Bill ETF

|

35.0%

|

|

Touchstone Ultra Short Income ETF

|

30.0%

|

|

AAM Low Duration Preferred and Income Securities ETF

|

21.5%

|

|

JPMorgan Nasdaq Equity Premium Income ETF

|

5.2%

|

|

JPMorgan Equity Premium Income ETF

|

5.1%

|

|

FolioBeyond Alternative Income and Interest Rate Hedge ETF

|

3.0%

|

| [1] |

|

||

| [2] |

|

||

| [3] |

|

||

| [4] |

|

||

| [5] |

|

||

| [6] |

|

||

| [7] |

|