|

Class Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment

|

|

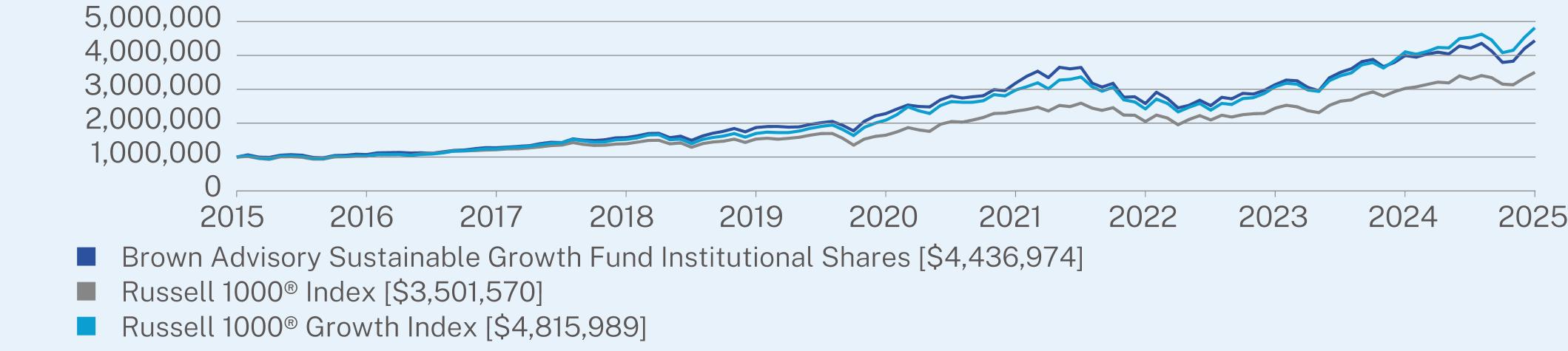

Institutional Shares

|

$76

|

0.71%

|

|

Top Contributors

|

|

|

↑

|

Netflix, Inc.

|

|

↑

|

NVIDIA Corporation

|

|

↑

|

ServiceNow, Inc.

|

|

↑

|

Uber Technologies, Inc.

|

|

↑

|

Progressive Corporation

|

|

Top Detractors

|

|

|

↓

|

Edwards Lifesciences Corporation

|

|

↓

|

Trade Desk, Inc. Class A

|

|

↓

|

Adobe Inc.

|

|

↓

|

Align Technology, Inc.

|

|

↓

|

West Pharmaceutical Services, Inc.

|

|

|

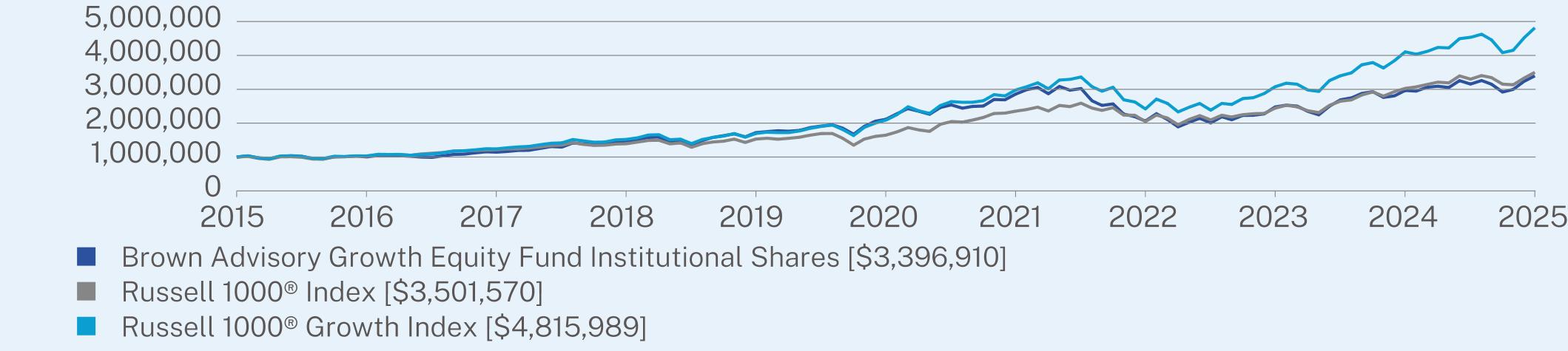

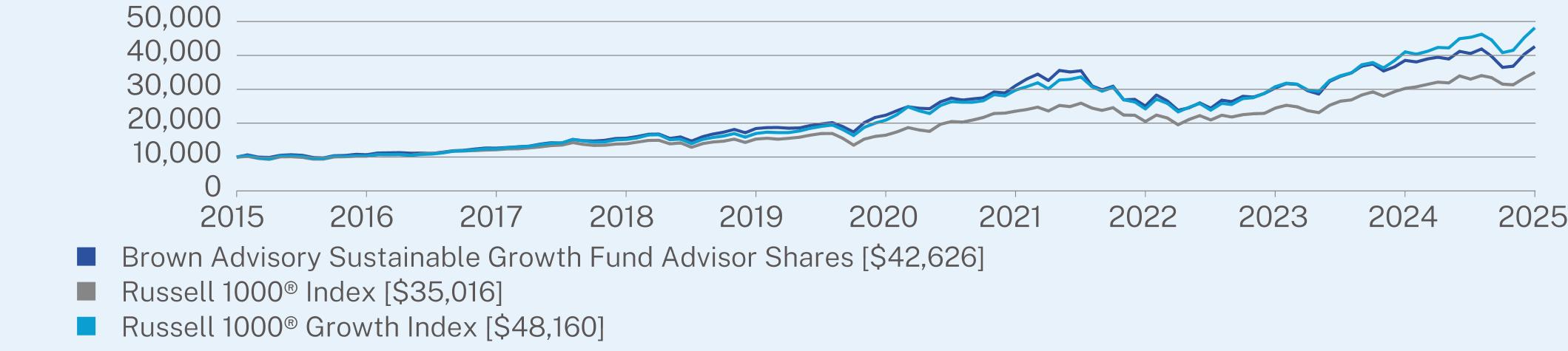

1 Year

|

5 Year

|

10 Year

|

|

Institutional Shares

|

14.50

|

9.93

|

13.01

|

|

Russell 1000® Index

|

15.66

|

16.30

|

13.35

|

|

Russell 1000® Growth Index

|

17.32

|

18.17

|

17.02

|

|

Net Assets

|

$644,860,049

|

|

Number of Holdings

|

34

|

|

Net Advisory Fee

|

$5,213,858

|

|

Portfolio Turnover

|

27%

|

|

Top Sectors*

|

(%)

|

|

Information Technology

|

34.1%

|

|

Industrials

|

16.0%

|

|

Communication Services

|

13.3%

|

|

Consumer Discretionary

|

10.3%

|

|

Health Care

|

9.3%

|

|

Financials

|

8.2%

|

|

Consumer Staples

|

4.1%

|

|

Real Estate

|

2.4%

|

|

Cash & Other

|

2.3%

|

|

Top 10 Issuers

|

(%)

|

|

NVIDIA Corp.

|

5.1%

|

|

Microsoft Corp.

|

4.5%

|

|

Amazon.com, Inc.

|

4.4%

|

|

Netflix, Inc.

|

4.2%

|

|

Meta Platforms, Inc.

|

4.2%

|

|

Costco Wholesale Corp.

|

4.1%

|

|

Uber Technologies, Inc.

|

4.1%

|

|

Hilton Worldwide Holdings, Inc.

|

3.9%

|

|

Mastercard, Inc.

|

3.8%

|

|

Intuit, Inc.

|

3.7%

|

|

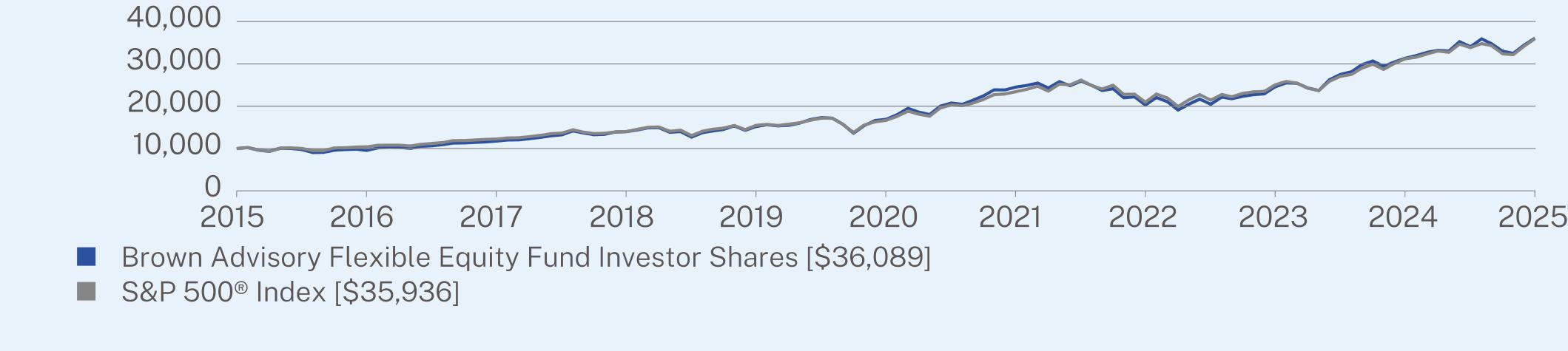

Class Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment

|

|

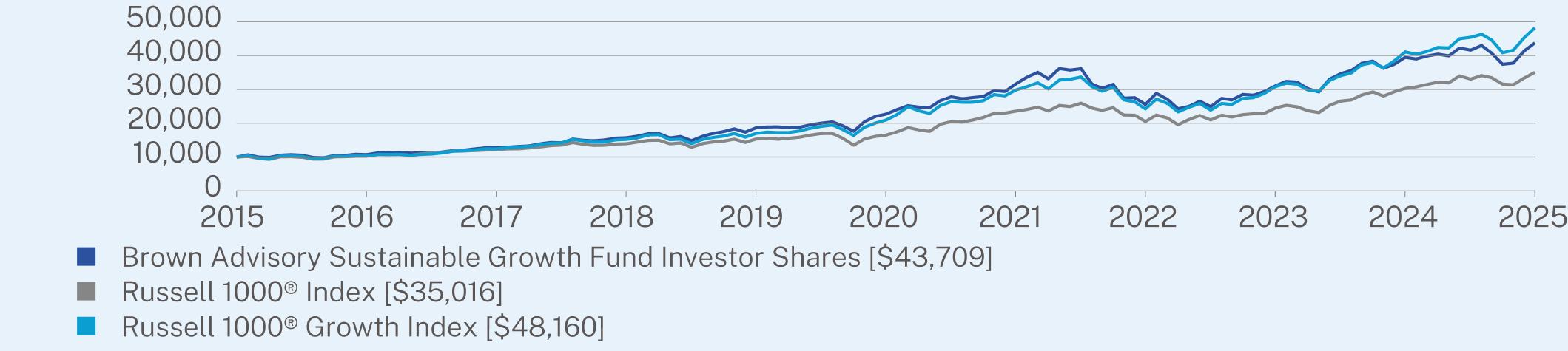

Investor Shares

|

$92

|

0.86%

|

|

Top Contributors

|

|

|

↑

|

Netflix, Inc.

|

|

↑

|

NVIDIA Corporation

|

|

↑

|

ServiceNow, Inc.

|

|

↑

|

Uber Technologies, Inc.

|

|

↑

|

Progressive Corporation

|

|

Top Detractors

|

|

|

↓

|

Edwards Lifesciences Corporation

|

|

↓

|

Trade Desk, Inc. Class A

|

|

↓

|

Adobe Inc.

|

|

↓

|

Align Technology, Inc.

|

|

↓

|

West Pharmaceutical Services, Inc.

|

|

|

1 Year

|

5 Year

|

10 Year

|

|

Investor Shares

|

14.34

|

9.77

|

12.84

|

|

Russell 1000® Index

|

15.66

|

16.30

|

13.35

|

|

Russell 1000® Growth Index

|

17.32

|

18.17

|

17.02

|

|

Net Assets

|

$644,860,049

|

|

Number of Holdings

|

34

|

|

Net Advisory Fee

|

$5,213,858

|

|

Portfolio Turnover

|

27%

|

|

Top Sectors*

|

(%)

|

|

Information Technology

|

34.1%

|

|

Industrials

|

16.0%

|

|

Communication Services

|

13.3%

|

|

Consumer Discretionary

|

10.3%

|

|

Health Care

|

9.3%

|

|

Financials

|

8.2%

|

|

Consumer Staples

|

4.1%

|

|

Real Estate

|

2.4%

|

|

Cash & Other

|

2.3%

|

|

Top 10 Issuers

|

(%)

|

|

NVIDIA Corp.

|

5.1%

|

|

Microsoft Corp.

|

4.5%

|

|

Amazon.com, Inc.

|

4.4%

|

|

Netflix, Inc.

|

4.2%

|

|

Meta Platforms, Inc.

|

4.2%

|

|

Costco Wholesale Corp.

|

4.1%

|

|

Uber Technologies, Inc.

|

4.1%

|

|

Hilton Worldwide Holdings, Inc.

|

3.9%

|

|

Mastercard, Inc.

|

3.8%

|

|

Intuit, Inc.

|

3.7%

|

|

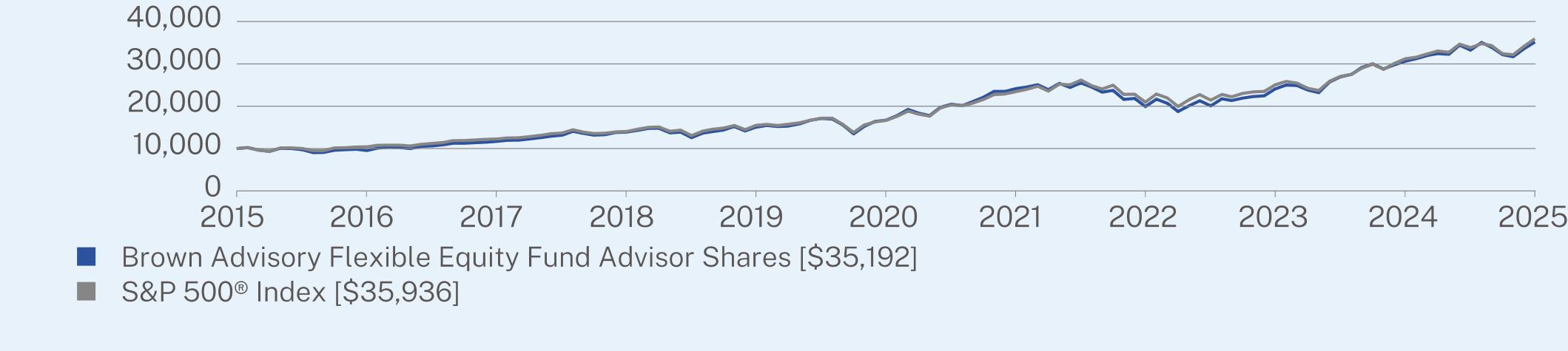

Class Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment

|

|

Advisor Shares

|

$119

|

1.11%

|

|

Top Contributors

|

|

|

↑

|

Netflix, Inc.

|

|

↑

|

NVIDIA Corporation

|

|

↑

|

ServiceNow, Inc.

|

|

↑

|

Uber Technologies, Inc.

|

|

↑

|

Progressive Corporation

|

|

Top Detractors

|

|

|

↓

|

Edwards Lifesciences Corporation

|

|

↓

|

Trade Desk, Inc. Class A

|

|

↓

|

Adobe Inc.

|

|

↓

|

Align Technology, Inc.

|

|

↓

|

West Pharmaceutical Services, Inc.

|

|

|

1 Year

|

5 Year

|

10 Year

|

|

Advisor Shares

|

14.04

|

9.50

|

12.56

|

|

Russell 1000® Index

|

15.66

|

16.30

|

13.35

|

|

Russell 1000® Growth Index

|

17.32

|

18.17

|

17.02

|

|

Net Assets

|

$644,860,049

|

|

Number of Holdings

|

34

|

|

Net Advisory Fee

|

$5,213,858

|

|

Portfolio Turnover

|

27%

|

|

Top Sectors*

|

(%)

|

|

Information Technology

|

34.1%

|

|

Industrials

|

16.0%

|

|

Communication Services

|

13.3%

|

|

Consumer Discretionary

|

10.3%

|

|

Health Care

|

9.3%

|

|

Financials

|

8.2%

|

|

Consumer Staples

|

4.1%

|

|

Real Estate

|

2.4%

|

|

Cash & Other

|

2.3%

|

|

Top 10 Issuers

|

(%)

|

|

NVIDIA Corp.

|

5.1%

|

|

Microsoft Corp.

|

4.5%

|

|

Amazon.com, Inc.

|

4.4%

|

|

Netflix, Inc.

|

4.2%

|

|

Meta Platforms, Inc.

|

4.2%

|

|

Costco Wholesale Corp.

|

4.1%

|

|

Uber Technologies, Inc.

|

4.1%

|

|

Hilton Worldwide Holdings, Inc.

|

3.9%

|

|

Mastercard, Inc.

|

3.8%

|

|

Intuit, Inc.

|

3.7%

|

|

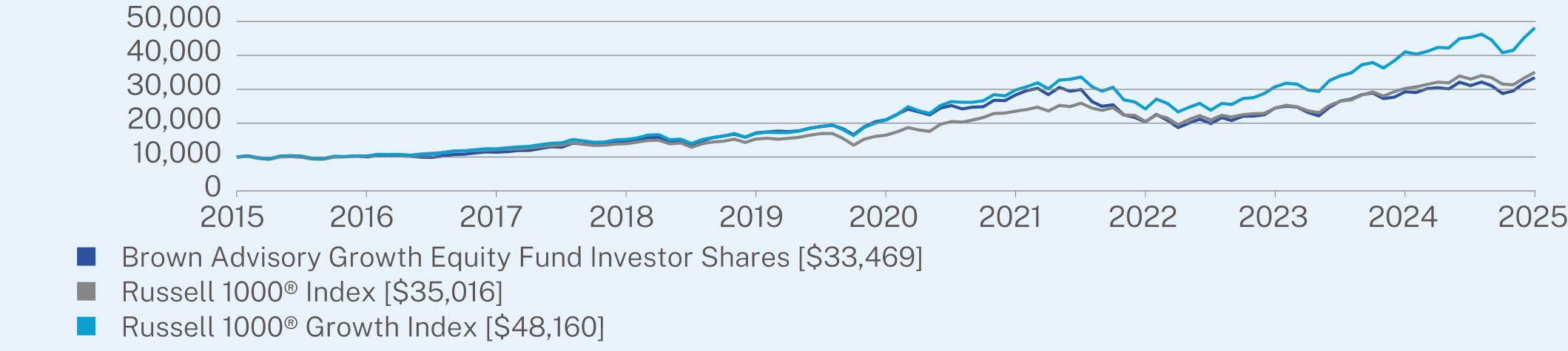

Class Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment

|

|

Institutional Shares

|

$56

|

0.52%

|

|

Top Contributors

|

|

|

↑

|

Meta Platforms Inc Class A

|

|

↑

|

Amer Sports, Inc.

|

|

↑

|

Visa Inc. Class A

|

|

↑

|

KKR & Co Inc

|

|

↑

|

Taiwan Semiconductor Manufacturing Co., Ltd. Sponsored ADR

|

|

Top Detractors

|

|

|

↓

|

UnitedHealth Group Incorporated

|

|

↓

|

Elevance Health, Inc.

|

|

↓

|

Adobe Inc.

|

|

↓

|

Edwards Lifesciences Corporation

|

|

↓

|

Illumina, Inc.

|

|

|

1 Year

|

5 Year

|

10 Year

|

|

Institutional Shares

|

15.41

|

16.56

|

13.87

|

|

S&P 500® Index

|

15.16

|

16.64

|

13.65

|

|

Net Assets

|

$1,031,226,798

|

|

Number of Holdings

|

46

|

|

Net Advisory Fee

|

$4,143,680

|

|

Portfolio Turnover

|

17%

|

|

Top Sectors*

|

(%)

|

|

Financials

|

27.1%

|

|

Information Technology

|

24.0%

|

|

Communication Services

|

12.1%

|

|

Consumer Discretionary

|

11.6%

|

|

Industrials

|

10.4%

|

|

Health Care

|

8.8%

|

|

Consumer Staples

|

2.1%

|

|

Energy

|

1.9%

|

|

Cash & Other

|

2.0%

|

|

Top 10 Issuers

|

(%)

|

|

Microsoft Corp.

|

7.3%

|

|

Meta Platforms, Inc.

|

6.1%

|

|

Alphabet, Inc.

|

4.8%

|

|

Visa, Inc.

|

4.7%

|

|

Mastercard, Inc.

|

4.4%

|

|

Taiwan Semiconductor Manufacturing Co., Ltd.

|

4.3%

|

|

Amazon.com, Inc.

|

4.3%

|

|

KKR & Co., Inc.

|

4.2%

|

|

Berkshire Hathaway, Inc.

|

3.6%

|

|

Intuit, Inc.

|

2.9%

|

|

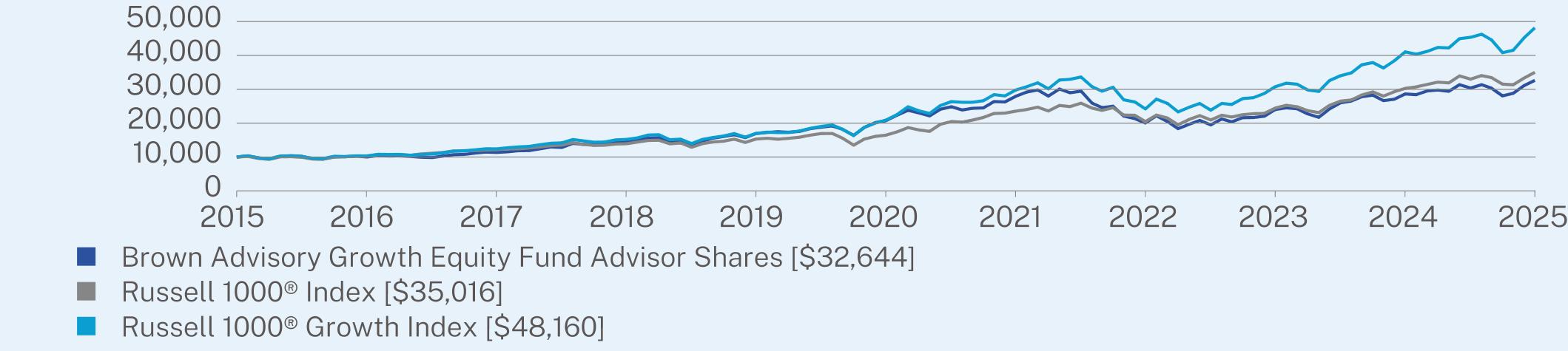

Class Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment

|

|

Investor Shares

|

$72

|

0.67%

|

|

Top Contributors

|

|

|

↑

|

Meta Platforms Inc Class A

|

|

↑

|

Amer Sports, Inc.

|

|

↑

|

Visa Inc. Class A

|

|

↑

|

KKR & Co Inc

|

|

↑

|

Taiwan Semiconductor Manufacturing Co., Ltd. Sponsored ADR

|

|

Top Detractors

|

|

|

↓

|

UnitedHealth Group Incorporated

|

|

↓

|

Elevance Health, Inc.

|

|

↓

|

Adobe Inc.

|

|

↓

|

Edwards Lifesciences Corporation

|

|

↓

|

Illumina, Inc.

|

|

|

1 Year

|

5 Year

|

10 Year

|

|

Investor Shares

|

15.22

|

16.39

|

13.69

|

|

S&P 500® Index

|

15.16

|

16.64

|

13.65

|

|

Net Assets

|

$1,031,226,798

|

|

Number of Holdings

|

46

|

|

Net Advisory Fee

|

$4,143,680

|

|

Portfolio Turnover

|

17%

|

|

Top Sectors*

|

(%)

|

|

Financials

|

27.1%

|

|

Information Technology

|

24.0%

|

|

Communication Services

|

12.1%

|

|

Consumer Discretionary

|

11.6%

|

|

Industrials

|

10.4%

|

|

Health Care

|

8.8%

|

|

Consumer Staples

|

2.1%

|

|

Energy

|

1.9%

|

|

Cash & Other

|

2.0%

|

|

Top 10 Issuers

|

(%)

|

|

Microsoft Corp.

|

7.3%

|

|

Meta Platforms, Inc.

|

6.1%

|

|

Alphabet, Inc.

|

4.8%

|

|

Visa, Inc.

|

4.7%

|

|

Mastercard, Inc.

|

4.4%

|

|

Taiwan Semiconductor Manufacturing Co., Ltd.

|

4.3%

|

|

Amazon.com, Inc.

|

4.3%

|

|

KKR & Co., Inc.

|

4.2%

|

|

Berkshire Hathaway, Inc.

|

3.6%

|

|

Intuit, Inc.

|

2.9%

|

|

Class Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment

|

|

Advisor Shares

|

$99

|

0.92%

|

|

Top Contributors

|

|

|

↑

|

Meta Platforms Inc Class A

|

|

↑

|

Amer Sports, Inc.

|

|

↑

|

Visa Inc. Class A

|

|

↑

|

KKR & Co Inc

|

|

↑

|

Taiwan Semiconductor Manufacturing Co., Ltd. Sponsored ADR

|

|

Top Detractors

|

|

|

↓

|

UnitedHealth Group Incorporated

|

|

↓

|

Elevance Health, Inc.

|

|

↓

|

Adobe Inc.

|

|

↓

|

Edwards Lifesciences Corporation

|

|

↓

|

Illumina, Inc.

|

|

|

1 Year

|

5 Year

|

10 Year

|

|

Advisor Shares

|

14.93

|

16.09

|

13.41

|

|

S&P 500® Index

|

15.16

|

16.64

|

13.65

|

|

Net Assets

|

$1,031,226,798

|

|

Number of Holdings

|

46

|

|

Net Advisory Fee

|

$4,143,680

|

|

Portfolio Turnover

|

17%

|

|

Top Sectors*

|

(%)

|

|

Financials

|

27.1%

|

|

Information Technology

|

24.0%

|

|

Communication Services

|

12.1%

|

|

Consumer Discretionary

|

11.6%

|

|

Industrials

|

10.4%

|

|

Health Care

|

8.8%

|

|

Consumer Staples

|

2.1%

|

|

Energy

|

1.9%

|

|

Cash & Other

|

2.0%

|

|

Top 10 Issuers

|

(%)

|

|

Microsoft Corp.

|

7.3%

|

|

Meta Platforms, Inc.

|

6.1%

|

|

Alphabet, Inc.

|

4.8%

|

|

Visa, Inc.

|

4.7%

|

|

Mastercard, Inc.

|

4.4%

|

|

Taiwan Semiconductor Manufacturing Co., Ltd.

|

4.3%

|

|

Amazon.com, Inc.

|

4.3%

|

|

KKR & Co., Inc.

|

4.2%

|

|

Berkshire Hathaway, Inc.

|

3.6%

|

|

Intuit, Inc.

|

2.9%

|

|

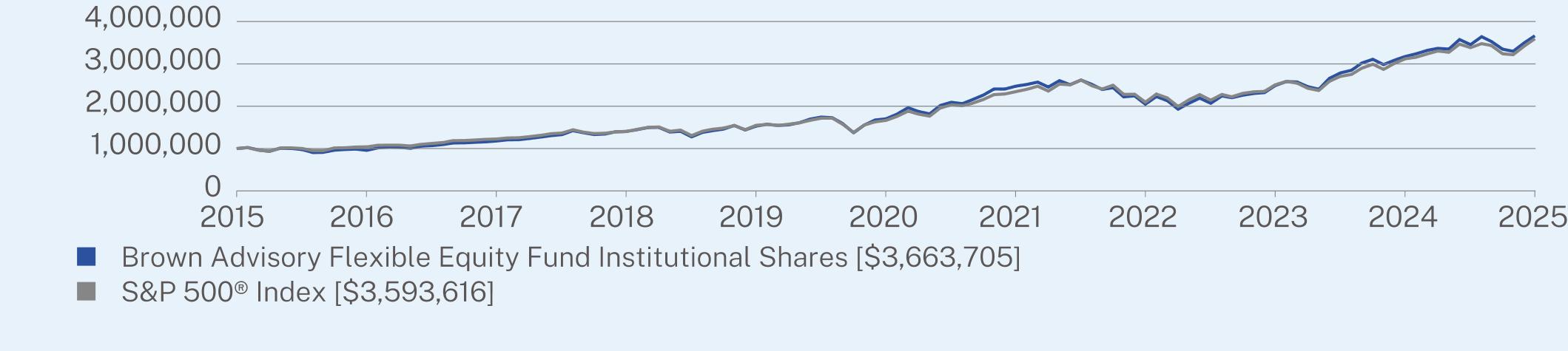

Class Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment

|

|

Institutional Shares

|

$63

|

0.60%

|

|

Top Contributors

|

|

|

↑

|

NVIDIA Corporation

|

|

↑

|

ServiceNow, Inc.

|

|

↑

|

Visa Inc. Class A

|

|

↑

|

Microsoft Corporation

|

|

↑

|

Progressive Corporation

|

|

Top Detractors

|

|

|

↓

|

Edwards Lifesciences Corporation

|

|

↓

|

West Pharmaceutical Services, Inc.

|

|

↓

|

Trade Desk, Inc. Class A

|

|

↓

|

Danaher Corporation

|

|

↓

|

Thermo Fisher Scientific Inc.

|

|

|

1 Year

|

5 Year

|

10 Year

|

|

Institutional Shares

|

11.02

|

14.21

|

16.07

|

|

Russell 1000® Index

|

15.66

|

16.30

|

13.35

|

|

Russell 1000® Growth Index

|

17.32

|

18.17

|

17.02

|

|

Net Assets

|

$9,027,770,024

|

|

Number of Holdings

|

34

|

|

Net Advisory Fee

|

$47,705,230

|

|

Portfolio Turnover

|

32%

|

|

Top Sectors*

|

(%)

|

|

Information Technology

|

45.4%

|

|

Financials

|

19.1%

|

|

Consumer Discretionary

|

11.7%

|

|

Industrials

|

10.9%

|

|

Health Care

|

6.3%

|

|

Communication Services

|

2.9%

|

|

Materials

|

1.7%

|

|

Cash & Other

|

2.0%

|

|

Top 10 Issuers

|

(%)

|

|

NVIDIA Corp.

|

8.8%

|

|

Microsoft Corp.

|

8.6%

|

|

Amazon.com, Inc.

|

7.4%

|

|

Intuit, Inc.

|

4.4%

|

|

Visa, Inc.

|

4.0%

|

|

KKR & Co., Inc.

|

3.9%

|

|

Marvell Technology, Inc.

|

3.5%

|

|

Progressive Corp.

|

3.4%

|

|

ServiceNow, Inc.

|

3.1%

|

|

Arthur J Gallagher & Co.

|

2.9%

|

|

Class Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment

|

|

Investor Shares

|

$79

|

0.75%

|

|

Top Contributors

|

|

|

↑

|

NVIDIA Corporation

|

|

↑

|

ServiceNow, Inc.

|

|

↑

|

Visa Inc. Class A

|

|

↑

|

Microsoft Corporation

|

|

↑

|

Progressive Corporation

|

|

Top Detractors

|

|

|

↓

|

Edwards Lifesciences Corporation

|

|

↓

|

West Pharmaceutical Services, Inc.

|

|

↓

|

Trade Desk, Inc. Class A

|

|

↓

|

Danaher Corporation

|

|

↓

|

Thermo Fisher Scientific Inc.

|

|

|

1 Year

|

5 Year

|

10 Year

|

|

Investor Shares

|

10.84

|

14.05

|

15.89

|

|

Russell 1000® Index

|

15.66

|

16.30

|

13.35

|

|

Russell 1000® Growth Index

|

17.32

|

18.17

|

17.02

|

|

Net Assets

|

$9,027,770,024

|

|

Number of Holdings

|

34

|

|

Net Advisory Fee

|

$47,705,230

|

|

Portfolio Turnover

|

32%

|

|

Top Sectors*

|

(%)

|

|

Information Technology

|

45.4%

|

|

Financials

|

19.1%

|

|

Consumer Discretionary

|

11.7%

|

|

Industrials

|

10.9%

|

|

Health Care

|

6.3%

|

|

Communication Services

|

2.9%

|

|

Materials

|

1.7%

|

|

Cash & Other

|

2.0%

|

|

Top 10 Issuers

|

(%)

|

|

NVIDIA Corp.

|

8.8%

|

|

Microsoft Corp.

|

8.6%

|

|

Amazon.com, Inc.

|

7.4%

|

|

Intuit, Inc.

|

4.4%

|

|

Visa, Inc.

|

4.0%

|

|

KKR & Co., Inc.

|

3.9%

|

|

Marvell Technology, Inc.

|

3.5%

|

|

Progressive Corp.

|

3.4%

|

|

ServiceNow, Inc.

|

3.1%

|

|

Arthur J Gallagher & Co.

|

2.9%

|

|

Class Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment

|

|

Advisor Shares

|

$105

|

1.00%

|

|

Top Contributors

|

|

|

↑

|

NVIDIA Corporation

|

|

↑

|

ServiceNow, Inc.

|

|

↑

|

Visa Inc. Class A

|

|

↑

|

Microsoft Corporation

|

|

↑

|

Progressive Corporation

|

|

Top Detractors

|

|

|

↓

|

Edwards Lifesciences Corporation

|

|

↓

|

West Pharmaceutical Services, Inc.

|

|

↓

|

Trade Desk, Inc. Class A

|

|

↓

|

Danaher Corporation

|

|

↓

|

Thermo Fisher Scientific Inc.

|

|

|

1 Year

|

5 Year

|

10 Year

|

|

Advisor Shares

|

10.59

|

13.76

|

15.60

|

|

Russell 1000® Index

|

15.66

|

16.30

|

13.35

|

|

Russell 1000® Growth Index

|

17.32

|

18.17

|

17.02

|

|

Net Assets

|

$9,027,770,024

|

|

Number of Holdings

|

34

|

|

Net Advisory Fee

|

$47,705,230

|

|

Portfolio Turnover

|

32%

|

|

Top Sectors*

|

(%)

|

|

Information Technology

|

45.4%

|

|

Financials

|

19.1%

|

|

Consumer Discretionary

|

11.7%

|

|

Industrials

|

10.9%

|

|

Health Care

|

6.3%

|

|

Communication Services

|

2.9%

|

|

Materials

|

1.7%

|

|

Cash & Other

|

2.0%

|

|

Top 10 Issuers

|

(%)

|

|

NVIDIA Corp.

|

8.8%

|

|

Microsoft Corp.

|

8.6%

|

|

Amazon.com, Inc.

|

7.4%

|

|

Intuit, Inc.

|

4.4%

|

|

Visa, Inc.

|

4.0%

|

|

KKR & Co., Inc.

|

3.9%

|

|

Marvell Technology, Inc.

|

3.5%

|

|

Progressive Corp.

|

3.4%

|

|

ServiceNow, Inc.

|

3.1%

|

|

Arthur J Gallagher & Co.

|

2.9%

|

|

Class Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment

|

|

Institutional Shares

|

$89

|

0.82%

|

|

Top Contributors

|

|

|

↑

|

Roblox Corp. Class A

|

|

↑

|

DoorDash, Inc. Class A

|

|

↑

|

Vistra Corp.

|

|

↑

|

Cheniere Energy, Inc.

|

|

↑

|

Insulet Corporation

|

|

Top Detractors

|

|

|

↓

|

DexCom, Inc.

|

|

↓

|

West Pharmaceutical Services, Inc.

|

|

↓

|

Edwards Lifesciences Corporation

|

|

↓

|

Bio-Techne Corporation

|

|

↓

|

Entegris, Inc.

|

|

|

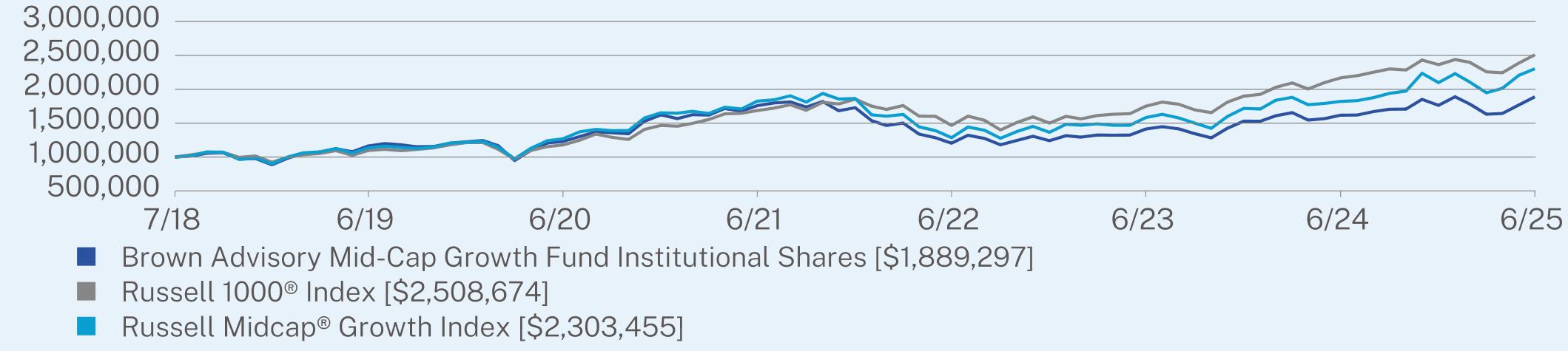

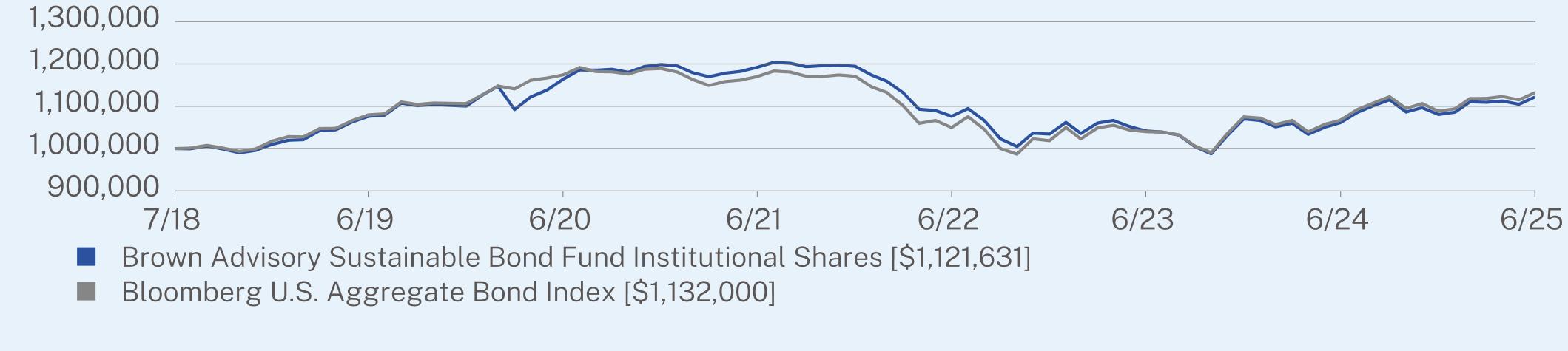

1 Year

|

5 Year

|

Since Inception

(07/02/2018) |

|

Institutional Shares

|

16.77

|

8.97

|

9.52

|

|

Russell 1000® Index

|

15.66

|

16.30

|

14.05

|

|

Russell Midcap® Growth Index

|

26.49

|

12.65

|

12.67

|

|

Net Assets

|

$72,530,892

|

|

Number of Holdings

|

59

|

|

Net Advisory Fee

|

$511,191

|

|

Portfolio Turnover

|

73%

|

|

Top Sectors*

|

(%)

|

|

Information Technology

|

25.0%

|

|

Industrials

|

21.1%

|

|

Health Care

|

15.3%

|

|

Consumer Discretionary

|

11.6%

|

|

Financials

|

5.4%

|

|

Energy

|

4.6%

|

|

Utilities

|

3.7%

|

|

Communication Services

|

3.5%

|

|

Real Estate

|

2.7%

|

|

Cash & Other

|

7.1%

|

|

Top 10 Issuers

|

(%)

|

|

First American Government Obligations Fund

|

4.8%

|

|

Vistra Corp.

|

3.7%

|

|

Marvell Technology, Inc.

|

3.7%

|

|

West Pharmaceutical Services, Inc.

|

3.2%

|

|

Cheniere Energy, Inc.

|

3.2%

|

|

Hilton Worldwide Holdings, Inc.

|

3.0%

|

|

CoStar Group, Inc.

|

2.7%

|

|

HEICO Corp.

|

2.6%

|

|

Datadog, Inc.

|

2.6%

|

|

CCC Intelligent Solutions Holdings, Inc.

|

2.3%

|

|

Class Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment

|

|

Investor Shares

|

$105

|

0.97%

|

|

Top Contributors

|

|

|

↑

|

Roblox Corp. Class A

|

|

↑

|

DoorDash, Inc. Class A

|

|

↑

|

Vistra Corp.

|

|

↑

|

Cheniere Energy, Inc.

|

|

↑

|

Insulet Corporation

|

|

Top Detractors

|

|

|

↓

|

DexCom, Inc.

|

|

↓

|

West Pharmaceutical Services, Inc.

|

|

↓

|

Edwards Lifesciences Corporation

|

|

↓

|

Bio-Techne Corporation

|

|

↓

|

Entegris, Inc.

|

|

|

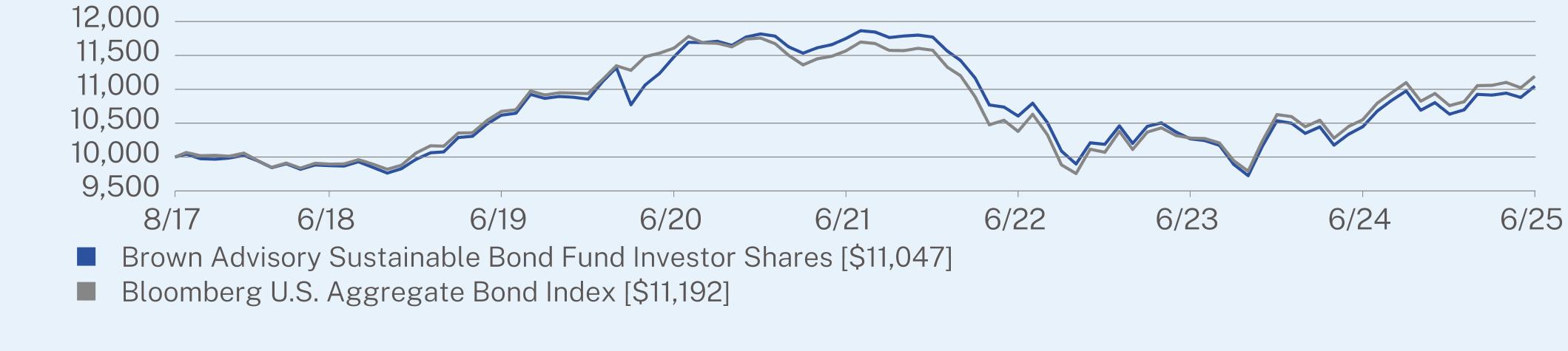

1 Year

|

5 Year

|

Since Inception

(10/02/2017) |

|

Investor Shares

|

16.70

|

8.82

|

10.29

|

|

Russell 1000® Index

|

15.66

|

16.30

|

13.94

|

|

Russell Midcap® Growth Index

|

26.49

|

12.65

|

13.09

|

|

Net Assets

|

$72,530,892

|

|

Number of Holdings

|

59

|

|

Net Advisory Fee

|

$511,191

|

|

Portfolio Turnover

|

73%

|

|

Top Sectors*

|

(%)

|

|

Information Technology

|

25.0%

|

|

Industrials

|

21.1%

|

|

Health Care

|

15.3%

|

|

Consumer Discretionary

|

11.6%

|

|

Financials

|

5.4%

|

|

Energy

|

4.6%

|

|

Utilities

|

3.7%

|

|

Communication Services

|

3.5%

|

|

Real Estate

|

2.7%

|

|

Cash & Other

|

7.1%

|

|

Top 10 Issuers

|

(%)

|

|

First American Government Obligations Fund

|

4.8%

|

|

Vistra Corp.

|

3.7%

|

|

Marvell Technology, Inc.

|

3.7%

|

|

West Pharmaceutical Services, Inc.

|

3.2%

|

|

Cheniere Energy, Inc.

|

3.2%

|

|

Hilton Worldwide Holdings, Inc.

|

3.0%

|

|

CoStar Group, Inc.

|

2.7%

|

|

HEICO Corp.

|

2.6%

|

|

Datadog, Inc.

|

2.6%

|

|

CCC Intelligent Solutions Holdings, Inc.

|

2.3%

|

|

Class Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment

|

|

Institutional Shares

|

$97

|

0.95%

|

|

Top Contributors

|

|

|

↑

|

Curtiss-Wright Corporation

|

|

↑

|

SiTime Corporation

|

|

↑

|

Inari Medical, Inc.

|

|

↑

|

Mirion Technologies, Inc. Class A

|

|

↑

|

Encompass Health Corporation

|

|

Top Detractors

|

|

|

↓

|

KinderCare Learning Companies Inc

|

|

↓

|

Entegris, Inc.

|

|

↓

|

Bruker Corporation

|

|

↓

|

Bio-Techne Corporation

|

|

↓

|

ChampionX Corporation

|

|

|

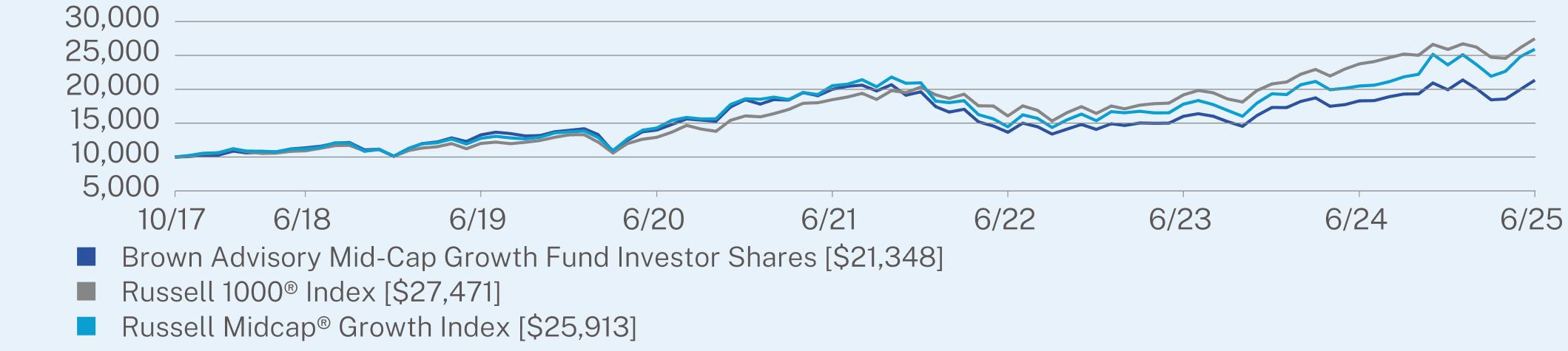

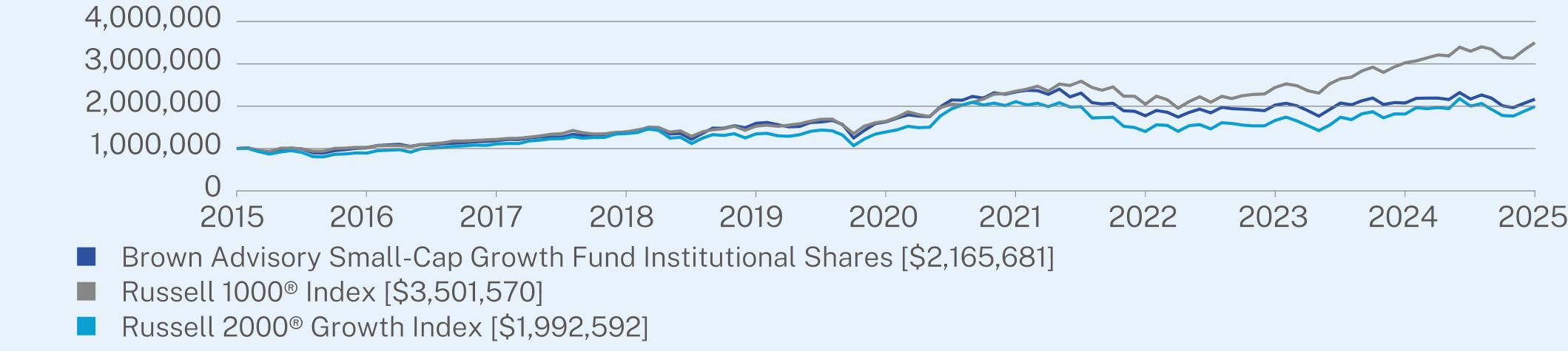

1 Year

|

5 Year

|

10 Year

|

|

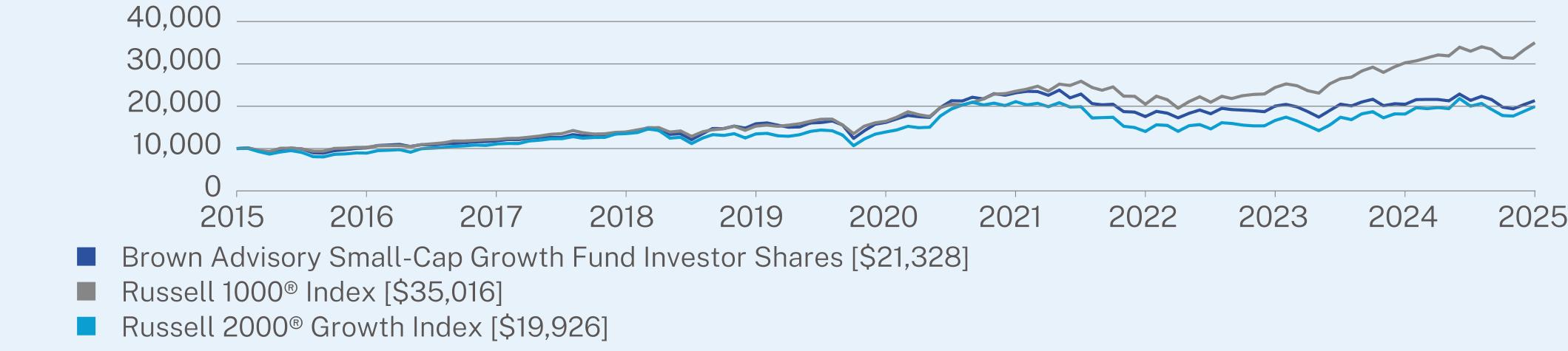

Institutional Shares

|

4.37

|

5.83

|

8.03

|

|

Russell 1000® Index

|

15.66

|

16.30

|

13.35

|

|

Russell 2000® Growth Index

|

9.73

|

7.42

|

7.14

|

|

Net Assets

|

$932,266,930

|

|

Number of Holdings

|

75

|

|

Net Advisory Fee

|

$11,838,825

|

|

Portfolio Turnover

|

28%

|

|

Top Sectors*

|

(%)

|

|

Industrials

|

30.1%

|

|

Information Technology

|

24.6%

|

|

Health Care

|

20.6%

|

|

Consumer Discretionary

|

6.4%

|

|

Energy

|

4.7%

|

|

Financials

|

4.4%

|

|

Communication Services

|

2.4%

|

|

Consumer Staples

|

2.1%

|

|

Real Estate

|

1.9%

|

|

Cash & Other

|

2.8%

|

|

Top 10 Issuers

|

(%)

|

|

CCC Intelligent Solutions Holdings, Inc.

|

4.0%

|

|

HealthEquity, Inc.

|

3.2%

|

|

Dynatrace, Inc.

|

3.2%

|

|

Bright Horizons Family Solutions, Inc.

|

3.2%

|

|

Waste Connections, Inc.

|

3.0%

|

|

Prosperity Bancshares, Inc.

|

2.9%

|

|

Curtiss-Wright Corp.

|

2.5%

|

|

StandardAero, Inc.

|

2.5%

|

|

Mirion Technologies, Inc.

|

2.5%

|

|

Encompass Health Corp.

|

2.5%

|

|

Class Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment

|

|

Investor Shares

|

$112

|

1.10%

|

|

Top Contributors

|

|

|

↑

|

Curtiss-Wright Corporation

|

|

↑

|

SiTime Corporation

|

|

↑

|

Inari Medical, Inc.

|

|

↑

|

Mirion Technologies, Inc. Class A

|

|

↑

|

Encompass Health Corporation

|

|

Top Detractors

|

|

|

↓

|

KinderCare Learning Companies Inc

|

|

↓

|

Entegris, Inc.

|

|

↓

|

Bruker Corporation

|

|

↓

|

Bio-Techne Corporation

|

|

↓

|

ChampionX Corporation

|

|

|

1 Year

|

5 Year

|

10 Year

|

|

Investor Shares

|

4.24

|

5.68

|

7.87

|

|

Russell 1000® Index

|

15.66

|

16.30

|

13.35

|

|

Russell 2000® Growth Index

|

9.73

|

7.42

|

7.14

|

|

Net Assets

|

$932,266,930

|

|

Number of Holdings

|

75

|

|

Net Advisory Fee

|

$11,838,825

|

|

Portfolio Turnover

|

28%

|

|

Top Sectors*

|

(%)

|

|

Industrials

|

30.1%

|

|

Information Technology

|

24.6%

|

|

Health Care

|

20.6%

|

|

Consumer Discretionary

|

6.4%

|

|

Energy

|

4.7%

|

|

Financials

|

4.4%

|

|

Communication Services

|

2.4%

|

|

Consumer Staples

|

2.1%

|

|

Real Estate

|

1.9%

|

|

Cash & Other

|

2.8%

|

|

Top 10 Issuers

|

(%)

|

|

CCC Intelligent Solutions Holdings, Inc.

|

4.0%

|

|

HealthEquity, Inc.

|

3.2%

|

|

Dynatrace, Inc.

|

3.2%

|

|

Bright Horizons Family Solutions, Inc.

|

3.2%

|

|

Waste Connections, Inc.

|

3.0%

|

|

Prosperity Bancshares, Inc.

|

2.9%

|

|

Curtiss-Wright Corp.

|

2.5%

|

|

StandardAero, Inc.

|

2.5%

|

|

Mirion Technologies, Inc.

|

2.5%

|

|

Encompass Health Corp.

|

2.5%

|

|

Class Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment

|

|

Advisor Shares

|

$138

|

1.35%

|

|

Top Contributors

|

|

|

↑

|

Curtiss-Wright Corporation

|

|

↑

|

SiTime Corporation

|

|

↑

|

Inari Medical, Inc.

|

|

↑

|

Mirion Technologies, Inc. Class A

|

|

↑

|

Encompass Health Corporation

|

|

Top Detractors

|

|

|

↓

|

KinderCare Learning Companies Inc

|

|

↓

|

Entegris, Inc.

|

|

↓

|

Bruker Corporation

|

|

↓

|

Bio-Techne Corporation

|

|

↓

|

ChampionX Corporation

|

|

|

1 Year

|

5 Year

|

10 Year

|

|

Advisor Shares

|

3.97

|

5.41

|

7.60

|

|

Russell 1000® Index

|

15.66

|

16.30

|

13.35

|

|

Russell 2000® Growth Index

|

9.73

|

7.42

|

7.14

|

|

Net Assets

|

$932,266,930

|

|

Number of Holdings

|

75

|

|

Net Advisory Fee

|

$11,838,825

|

|

Portfolio Turnover

|

28%

|

|

Top Sectors*

|

(%)

|

|

Industrials

|

30.1%

|

|

Information Technology

|

24.6%

|

|

Health Care

|

20.6%

|

|

Consumer Discretionary

|

6.4%

|

|

Energy

|

4.7%

|

|

Financials

|

4.4%

|

|

Communication Services

|

2.4%

|

|

Consumer Staples

|

2.1%

|

|

Real Estate

|

1.9%

|

|

Cash & Other

|

2.8%

|

|

Top 10 Issuers

|

(%)

|

|

CCC Intelligent Solutions Holdings, Inc.

|

4.0%

|

|

HealthEquity, Inc.

|

3.2%

|

|

Dynatrace, Inc.

|

3.2%

|

|

Bright Horizons Family Solutions, Inc.

|

3.2%

|

|

Waste Connections, Inc.

|

3.0%

|

|

Prosperity Bancshares, Inc.

|

2.9%

|

|

Curtiss-Wright Corp.

|

2.5%

|

|

StandardAero, Inc.

|

2.5%

|

|

Mirion Technologies, Inc.

|

2.5%

|

|

Encompass Health Corp.

|

2.5%

|

|

Class Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment

|

|

Institutional Shares

|

$97

|

0.95%

|

|

Top Contributors

|

|

|

↑

|

Talen Energy Corp

|

|

↑

|

Bancorp Inc

|

|

↑

|

OSI Systems, Inc.

|

|

↑

|

Hanover Insurance Group, Inc.

|

|

↑

|

Curtiss-Wright Corporation

|

|

Top Detractors

|

|

|

↓

|

Cable One, Inc.

|

|

↓

|

Orion S.A.

|

|

↓

|

Acadia Healthcare Company, Inc.

|

|

↓

|

Avanos Medical, Inc.

|

|

↓

|

Expro Group Holdings N.V.

|

|

|

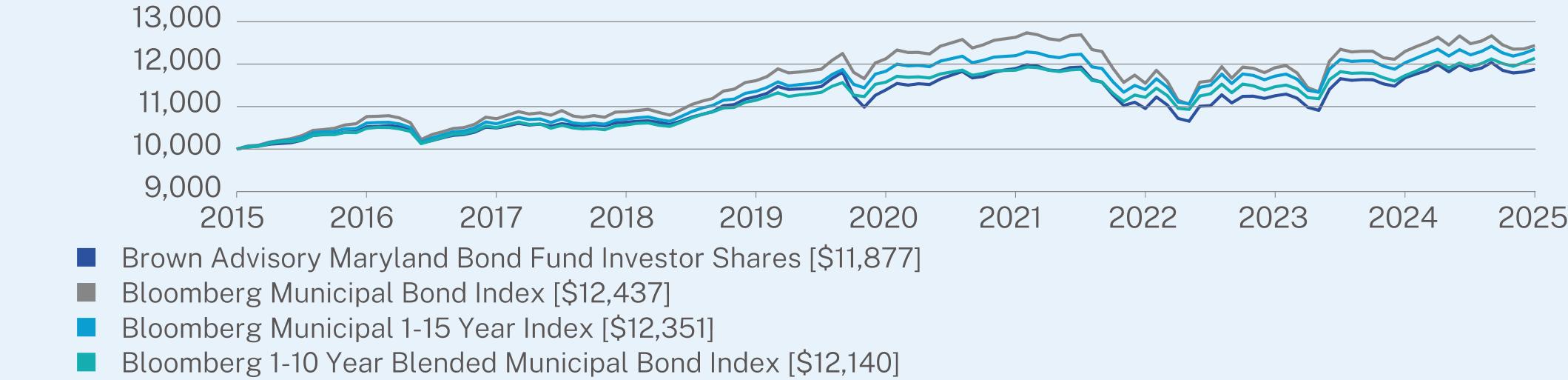

1 Year

|

5 Year

|

10 Year

|

|

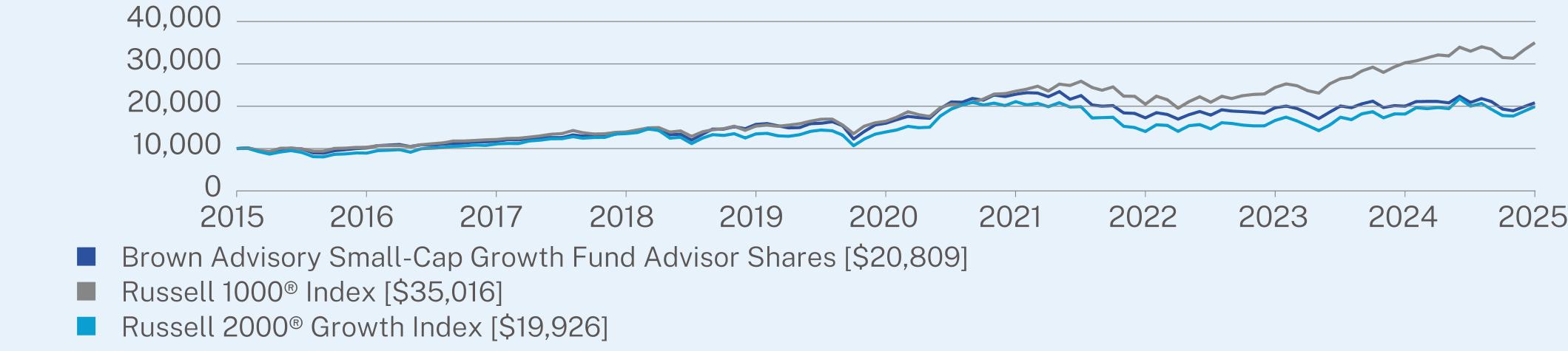

Institutional Shares

|

3.93

|

13.33

|

6.99

|

|

Russell 1000® Index

|

15.66

|

16.30

|

13.35

|

|

Russell 2000® Value Index

|

5.54

|

12.47

|

6.72

|

|

Net Assets

|

$1,177,998,140

|

|

Number of Holdings

|

65

|

|

Net Advisory Fee

|

$11,566,211

|

|

Portfolio Turnover

|

39%

|

|

Top Sectors*

|

(%)

|

|

Financials

|

30.6%

|

|

Consumer Discretionary

|

11.8%

|

|

Industrials

|

9.5%

|

|

Information Technology

|

8.3%

|

|

Communication Services

|

7.2%

|

|

Materials

|

7.0%

|

|

Utilities

|

6.2%

|

|

Energy

|

5.6%

|

|

Real Estate

|

4.7%

|

|

Cash & Other

|

9.1%

|

|

Top 10 Issuers

|

(%)

|

|

Talen Energy Corp.

|

4.1%

|

|

First American Government Obligations Fund

|

3.8%

|

|

Signet Jewelers Ltd.

|

3.0%

|

|

Bancorp, Inc.

|

2.9%

|

|

NCR Atleos Corp.

|

2.9%

|

|

Eastern Bankshares, Inc.

|

2.4%

|

|

Eagle Materials, Inc.

|

2.4%

|

|

John Wiley & Sons, Inc.

|

2.3%

|

|

Old National Bancorp

|

2.3%

|

|

Nomad Foods Ltd.

|

2.2%

|

|

Class Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment

|

|

Investor Shares

|

$112

|

1.10%

|

|

Top Contributors

|

|

|

↑

|

Talen Energy Corp

|

|

↑

|

Bancorp Inc

|

|

↑

|

OSI Systems, Inc.

|

|

↑

|

Hanover Insurance Group, Inc.

|

|

↑

|

Curtiss-Wright Corporation

|

|

Top Detractors

|

|

|

↓

|

Cable One, Inc.

|

|

↓

|

Orion S.A.

|

|

↓

|

Acadia Healthcare Company, Inc.

|

|

↓

|

Avanos Medical, Inc.

|

|

↓

|

Expro Group Holdings N.V.

|

|

|

1 Year

|

5 Year

|

10 Year

|

|

Investor Shares

|

3.78

|

13.16

|

6.83

|

|

Russell 1000® Index

|

15.66

|

16.30

|

13.35

|

|

Russell 2000® Value Index

|

5.54

|

12.47

|

6.72

|

|

Net Assets

|

$1,177,998,140

|

|

Number of Holdings

|

65

|

|

Net Advisory Fee

|

$11,566,211

|

|

Portfolio Turnover

|

39%

|

|

Top Sectors*

|

(%)

|

|

Financials

|

30.6%

|

|

Consumer Discretionary

|

11.8%

|

|

Industrials

|

9.5%

|

|

Information Technology

|

8.3%

|

|

Communication Services

|

7.2%

|

|

Materials

|

7.0%

|

|

Utilities

|

6.2%

|

|

Energy

|

5.6%

|

|

Real Estate

|

4.7%

|

|

Cash & Other

|

9.1%

|

|

Top 10 Issuers

|

(%)

|

|

Talen Energy Corp.

|

4.1%

|

|

First American Government Obligations Fund

|

3.8%

|

|

Signet Jewelers Ltd.

|

3.0%

|

|

Bancorp, Inc.

|

2.9%

|

|

NCR Atleos Corp.

|

2.9%

|

|

Eastern Bankshares, Inc.

|

2.4%

|

|

Eagle Materials, Inc.

|

2.4%

|

|

John Wiley & Sons, Inc.

|

2.3%

|

|

Old National Bancorp

|

2.3%

|

|

Nomad Foods Ltd.

|

2.2%

|

|

Class Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment

|

|

Advisor Shares

|

$137

|

1.35%

|

|

Top Contributors

|

|

|

↑

|

Talen Energy Corp

|

|

↑

|

Bancorp Inc

|

|

↑

|

OSI Systems, Inc.

|

|

↑

|

Hanover Insurance Group, Inc.

|

|

↑

|

Curtiss-Wright Corporation

|

|

Top Detractors

|

|

|

↓

|

Cable One, Inc.

|

|

↓

|

Orion S.A.

|

|

↓

|

Acadia Healthcare Company, Inc.

|

|

↓

|

Avanos Medical, Inc.

|

|

↓

|

Expro Group Holdings N.V.

|

|

|

1 Year

|

5 Year

|

10 Year

|

|

Advisor Shares

|

3.50

|

12.87

|

6.56

|

|

Russell 1000® Index

|

15.66

|

16.30

|

13.35

|

|

Russell 2000® Value Index

|

5.54

|

12.47

|

6.72

|

|

Net Assets

|

$1,177,998,140

|

|

Number of Holdings

|

65

|

|

Net Advisory Fee

|

$11,566,211

|

|

Portfolio Turnover

|

39%

|

|

Top Sectors*

|

(%)

|

|

Financials

|

30.6%

|

|

Consumer Discretionary

|

11.8%

|

|

Industrials

|

9.5%

|

|

Information Technology

|

8.3%

|

|

Communication Services

|

7.2%

|

|

Materials

|

7.0%

|

|

Utilities

|

6.2%

|

|

Energy

|

5.6%

|

|

Real Estate

|

4.7%

|

|

Cash & Other

|

9.1%

|

|

Top 10 Issuers

|

(%)

|

|

Talen Energy Corp.

|

4.1%

|

|

First American Government Obligations Fund

|

3.8%

|

|

Signet Jewelers Ltd.

|

3.0%

|

|

Bancorp, Inc.

|

2.9%

|

|

NCR Atleos Corp.

|

2.9%

|

|

Eastern Bankshares, Inc.

|

2.4%

|

|

Eagle Materials, Inc.

|

2.4%

|

|

John Wiley & Sons, Inc.

|

2.3%

|

|

Old National Bancorp

|

2.3%

|

|

Nomad Foods Ltd.

|

2.2%

|

|

Class Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment

|

|

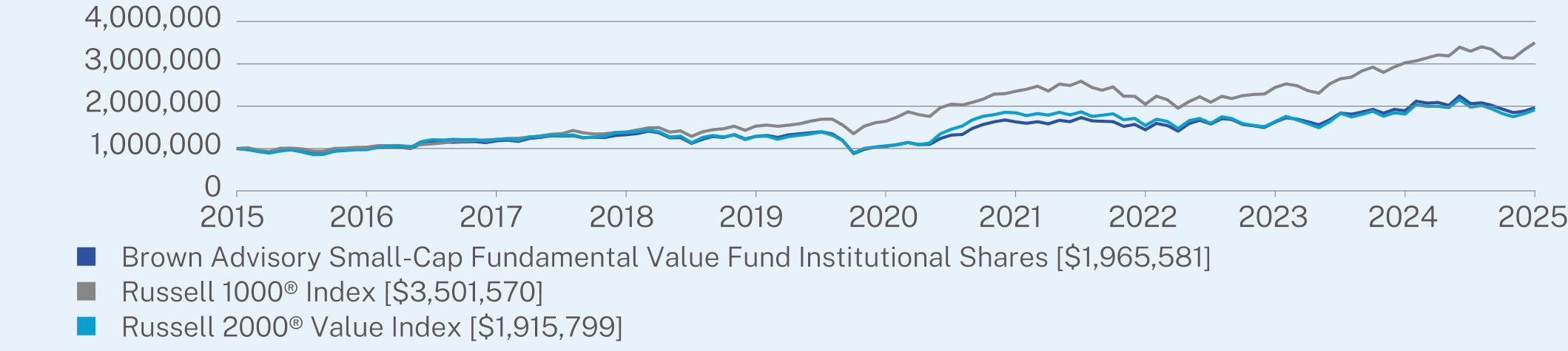

Institutional Shares

|

$96

|

0.93%

|

|

Top Contributors

|

|

|

↑

|

Talen Energy Corp

|

|

↑

|

Bancorp Inc

|

|

↑

|

Encompass Health Corporation

|

|

↑

|

Inari Medical, Inc.

|

|

↑

|

Mirion Technologies, Inc. Class A

|

|

Top Detractors

|

|

|

↓

|

KinderCare Learning Companies Inc

|

|

↓

|

Onto Innovation, Inc.

|

|

↓

|

Vaxcyte, Inc.

|

|

↓

|

Biohaven Ltd.

|

|

↓

|

Cable One, Inc.

|

|

|

1 Year

|

Since Inception

(09/30/2021) |

|

Institutional Shares

|

6.96

|

1.09

|

|

Russell 1000® Index

|

15.66

|

11.11

|

|

Russell 2000® Index

|

7.68

|

1.08

|

|

Net Assets

|

$99,422,927

|

|

Number of Holdings

|

74

|

|

Net Advisory Fee

|

$664,803

|

|

Portfolio Turnover

|

43%

|

|

Top Sectors*

|

(%)

|

|

Industrials

|

19.8%

|

|

Financials

|

19.0%

|

|

Health Care

|

15.8%

|

|

Information Technology

|

14.5%

|

|

Consumer Discretionary

|

9.3%

|

|

Real Estate

|

5.0%

|

|

Consumer Staples

|

3.2%

|

|

Utilities

|

3.2%

|

|

Communication Services

|

3.0%

|

|

Cash & Other

|

7.2%

|

|

Top 10 Issuers

|

(%)

|

|

First American Government Obligations Fund

|

4.5%

|

|

Talen Energy Corp.

|

3.2%

|

|

Bancorp, Inc.

|

2.9%

|

|

Encompass Health Corp.

|

2.4%

|

|

SPX Technologies, Inc.

|

2.3%

|

|

Eastern Bankshares, Inc.

|

2.2%

|

|

Old National Bancorp

|

2.0%

|

|

Valmont Industries, Inc.

|

2.0%

|

|

EnPro, Inc.

|

1.9%

|

|

Bright Horizons Family Solutions, Inc.

|

1.9%

|

|

Class Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment

|

|

Investor Shares

|

$112

|

1.08%

|

|

Top Contributors

|

|

|

↑

|

Talen Energy Corp

|

|

↑

|

Bancorp Inc

|

|

↑

|

Encompass Health Corporation

|

|

↑

|

Inari Medical, Inc.

|

|

↑

|

Mirion Technologies, Inc. Class A

|

|

Top Detractors

|

|

|

↓

|

KinderCare Learning Companies Inc

|

|

↓

|

Onto Innovation, Inc.

|

|

↓

|

Vaxcyte, Inc.

|

|

↓

|

Biohaven Ltd.

|

|

↓

|

Cable One, Inc.

|

|

|

1 Year

|

Since Inception

(09/30/2021) |

|

Investor Shares

|

6.74

|

0.91

|

|

Russell 1000® Index

|

15.66

|

11.11

|

|

Russell 2000® Index

|

7.68

|

1.08

|

|

Net Assets

|

$99,422,927

|

|

Number of Holdings

|

74

|

|

Net Advisory Fee

|

$664,803

|

|

Portfolio Turnover

|

43%

|

|

Top Sectors*

|

(%)

|

|

Industrials

|

19.8%

|

|

Financials

|

19.0%

|

|

Health Care

|

15.8%

|

|

Information Technology

|

14.5%

|

|

Consumer Discretionary

|

9.3%

|

|

Real Estate

|

5.0%

|

|

Consumer Staples

|

3.2%

|

|

Utilities

|

3.2%

|

|

Communication Services

|

3.0%

|

|

Cash & Other

|

7.2%

|

|

Top 10 Issuers

|

(%)

|

|

First American Government Obligations Fund

|

4.5%

|

|

Talen Energy Corp.

|

3.2%

|

|

Bancorp, Inc.

|

2.9%

|

|

Encompass Health Corp.

|

2.4%

|

|

SPX Technologies, Inc.

|

2.3%

|

|

Eastern Bankshares, Inc.

|

2.2%

|

|

Old National Bancorp

|

2.0%

|

|

Valmont Industries, Inc.

|

2.0%

|

|

EnPro, Inc.

|

1.9%

|

|

Bright Horizons Family Solutions, Inc.

|

1.9%

|

|

Class Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment

|

|

Institutional Shares

|

$75

|

0.70%

|

|

Top Contributors

|

|

|

↑

|

Constellation Energy Corporation

|

|

↑

|

Cardinal Health, Inc.

|

|

↑

|

T-Mobile US, Inc.

|

|

↑

|

CRH public limited company

|

|

↑

|

Trane Technologies plc

|

|

Top Detractors

|

|

|

↓

|

Weatherford International plc

|

|

↓

|

Schlumberger Limited

|

|

↓

|

Elevance Health, Inc.

|

|

↓

|

ChampionX Corporation

|

|

↓

|

Merck & Co., Inc.

|

|

|

1 Year

|

Since Inception

(02/28/2023) |

|

Institutional Shares

|

13.76

|

15.85

|

|

Russell 1000® Index

|

15.66

|

22.47

|

|

Russell 1000® Value Index

|

13.70

|

13.06

|

|

Net Assets

|

$158,641,914

|

|

Number of Holdings

|

42

|

|

Net Advisory Fee

|

$717,079

|

|

Portfolio Turnover

|

29%

|

|

Top Sectors*

|

(%)

|

|

Financials

|

22.1%

|

|

Health Care

|

17.5%

|

|

Information Technology

|

12.3%

|

|

Industrials

|

11.5%

|

|

Communication Services

|

7.9%

|

|

Energy

|

4.9%

|

|

Consumer Staples

|

4.7%

|

|

Materials

|

4.5%

|

|

Consumer Discretionary

|

4.3%

|

|

Cash & Other

|

10.3%

|

|

Top 10 Issuers

|

(%)

|

|

First American Government Obligations Fund

|

5.3%

|

|

CRH PLC

|

4.5%

|

|

Ferguson Enterprises, Inc.

|

4.2%

|

|

Sanofi SA

|

4.1%

|

|

Cardinal Health, Inc.

|

4.1%

|

|

American International Group, Inc.

|

3.8%

|

|

Unilever PLC

|

3.8%

|

|

Bank of America Corp.

|

3.7%

|

|

Constellation Energy Corp.

|

3.5%

|

|

Willis Towers Watson PLC

|

3.5%

|

|

Class Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment

|

|

Investor Shares

|

$91

|

0.85%

|

|

Top Contributors

|

|

|

↑

|

Constellation Energy Corporation

|

|

↑

|

Cardinal Health, Inc.

|

|

↑

|

T-Mobile US, Inc.

|

|

↑

|

CRH public limited company

|

|

↑

|

Trane Technologies plc

|

|

Top Detractors

|

|

|

↓

|

Weatherford International plc

|

|

↓

|

Schlumberger Limited

|

|

↓

|

Elevance Health, Inc.

|

|

↓

|

ChampionX Corporation

|

|

↓

|

Merck & Co., Inc.

|

|

|

1 Year

|

Since Inception

(02/28/2023) |

|

Investor Shares

|

13.60

|

15.61

|

|

Russell 1000® Index

|

15.66

|

22.47

|

|

Russell 1000® Value Index

|

13.70

|

13.06

|

|

Net Assets

|

$158,641,914

|

|

Number of Holdings

|

42

|

|

Net Advisory Fee

|

$717,079

|

|

Portfolio Turnover

|

29%

|

|

Top Sectors*

|

(%)

|

|

Financials

|

22.1%

|

|

Health Care

|

17.5%

|

|

Information Technology

|

12.3%

|

|

Industrials

|

11.5%

|

|

Communication Services

|

7.9%

|

|

Energy

|

4.9%

|

|

Consumer Staples

|

4.7%

|

|

Materials

|

4.5%

|

|

Consumer Discretionary

|

4.3%

|

|

Cash & Other

|

10.3%

|

|

Top 10 Issuers

|

(%)

|

|

First American Government Obligations Fund

|

5.3%

|

|

CRH PLC

|

4.5%

|

|

Ferguson Enterprises, Inc.

|

4.2%

|

|

Sanofi SA

|

4.1%

|

|

Cardinal Health, Inc.

|

4.1%

|

|

American International Group, Inc.

|

3.8%

|

|

Unilever PLC

|

3.8%

|

|

Bank of America Corp.

|

3.7%

|

|

Constellation Energy Corp.

|

3.5%

|

|

Willis Towers Watson PLC

|

3.5%

|

|

Class Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment

|

|

Institutional Shares

|

$81

|

0.75%

|

|

Top Contributors

|

|

|

↑

|

Deutsche Boerse AG

|

|

↑

|

GE Aerospace

|

|

↑

|

Safran SA

|

|

↑

|

Mastercard Incorporated Class A

|

|

↑

|

London Stock Exchange Group plc

|

|

Top Detractors

|

|

|

↓

|

Illumina, Inc.

|

|

↓

|

Adobe Inc.

|

|

↓

|

Alphabet Inc. Class C

|

|

↓

|

Edwards Lifesciences Corporation

|

|

↓

|

Zoetis, Inc. Class A

|

|

|

1 Year

|

5 Year

|

Since Inception

(10/31/2018) |

|

Institutional Shares

|

16.95

|

13.64

|

13.88

|

|

MSCI All Country World Index (ACWI)

|

16.17

|

13.65

|

11.96

|

|

Net Assets

|

$2,417,663,440

|

|

Number of Holdings

|

34

|

|

Net Advisory Fee

|

$13,850,998

|

|

Portfolio Turnover

|

22%

|

|

Top Sectors*

|

(%)

|

|

Financials

|

32.8%

|

|

Information Technology

|

22.7%

|

|

Industrials

|

18.9%

|

|

Health Care

|

8.1%

|

|

Communication Services

|

5.4%

|

|

Consumer Discretionary

|

4.5%

|

|

Consumer Staples

|

3.9%

|

|

Materials

|

1.5%

|

|

Cash & Other

|

2.2%

|

|

Top 10 Issuers

|

(%)

|

|

Microsoft Corp.

|

9.4%

|

|

London Stock Exchange Group PLC

|

4.9%

|

|

Deutsche Boerse AG

|

4.6%

|

|

Visa, Inc.

|

4.3%

|

|

Unilever PLC

|

3.9%

|

|

Mastercard, Inc.

|

3.8%

|

|

Intuit, Inc.

|

3.8%

|

|

Safran SA

|

3.3%

|

|

Alphabet, Inc.

|

3.3%

|

|

HDFC Bank Ltd.

|

3.2%

|

|

Top 10 Countries

|

(%)

|

|

United States

|

54.2%

|

|

United Kingdom

|

12.9%

|

|

Germany

|

6.7%

|

|

Netherlands

|

4.6%

|

|

France

|

3.3%

|

|

India

|

3.2%

|

|

Switzerland

|

3.0%

|

|

China

|

2.8%

|

|

Brazil

|

2.8%

|

|

Taiwan

|

2.5%

|

|

Class Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment

|

|

Investor Shares

|

$98

|

0.90%

|

|

Top Contributors

|

|

|

↑

|

Deutsche Boerse AG

|

|

↑

|

GE Aerospace

|

|

↑

|

Safran SA

|

|

↑

|

Mastercard Incorporated Class A

|

|

↑

|

London Stock Exchange Group plc

|

|

Top Detractors

|

|

|

↓

|

Illumina, Inc.

|

|

↓

|

Adobe Inc.

|

|

↓

|

Alphabet Inc. Class C

|

|

↓

|

Edwards Lifesciences Corporation

|

|

↓

|

Zoetis, Inc. Class A

|

|

|

1 Year

|

5 Year

|

Since Inception

(07/01/2015) |

|

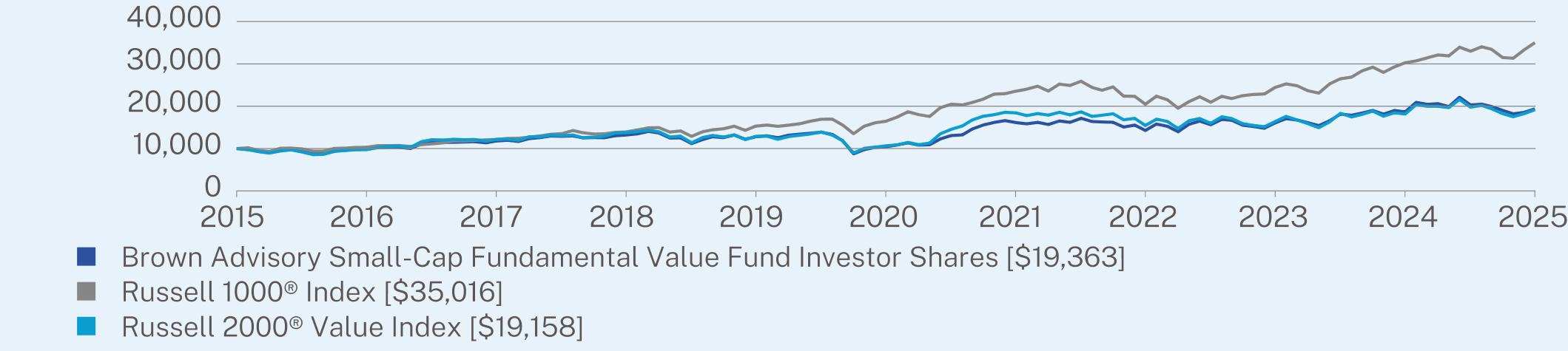

Investor Shares

|

16.78

|

13.45

|

11.98

|

|

MSCI All Country World Index (ACWI)

|

16.17

|

13.65

|

9.93

|

|

Net Assets

|

$2,417,663,440

|

|

Number of Holdings

|

34

|

|

Net Advisory Fee

|

$13,850,998

|

|

Portfolio Turnover

|

22%

|

|

Top Sectors*

|

(%)

|

|

Financials

|

32.8%

|

|

Information Technology

|

22.7%

|

|

Industrials

|

18.9%

|

|

Health Care

|

8.1%

|

|

Communication Services

|

5.4%

|

|

Consumer Discretionary

|

4.5%

|

|

Consumer Staples

|

3.9%

|

|

Materials

|

1.5%

|

|

Cash & Other

|

2.2%

|

|

Top 10 Issuers

|

(%)

|

|

Microsoft Corp.

|

9.4%

|

|

London Stock Exchange Group PLC

|

4.9%

|

|

Deutsche Boerse AG

|

4.6%

|

|

Visa, Inc.

|

4.3%

|

|

Unilever PLC

|

3.9%

|

|

Mastercard, Inc.

|

3.8%

|

|

Intuit, Inc.

|

3.8%

|

|

Safran SA

|

3.3%

|

|

Alphabet, Inc.

|

3.3%

|

|

HDFC Bank Ltd.

|

3.2%

|

|

Top 10 Countries

|

(%)

|

|

United States

|

54.2%

|

|

United Kingdom

|

12.9%

|

|

Germany

|

6.7%

|

|

Netherlands

|

4.6%

|

|

France

|

3.3%

|

|

India

|

3.2%

|

|

Switzerland

|

3.0%

|

|

China

|

2.8%

|

|

Brazil

|

2.8%

|

|

Taiwan

|

2.5%

|

|

Class Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment

|

|

Institutional Shares

|

$92

|

0.85%

|

|

Top Contributors

|

|

|

↑

|

Deutsche Boerse AG

|

|

↑

|

Safran SA

|

|

↑

|

Airbus SE

|

|

↑

|

B3 SA - Brasil, Bolsa, Balcao

|

|

↑

|

CTS Eventim AG & Co. KGaA

|

|

Top Detractors

|

|

|

↓

|

LVMH Moet Hennessy Louis Vuitton SE

|

|

↓

|

Rentokil Initial plc

|

|

↓

|

NXP Semiconductors NV

|

|

↓

|

Diageo plc

|

|

↓

|

ASML Holding NV

|

|

|

1 Year

|

Since Inception

(02/28/2022) |

|

Institutional Shares

|

15.64

|

6.92

|

|

MSCI ACWI ex USA Index

|

17.72

|

7.68

|

|

Net Assets

|

$42,021,685

|

|

Number of Holdings

|

35

|

|

Net Advisory Fee

|

$163,359

|

|

Portfolio Turnover

|

47%

|

|

Top Sectors*

|

(%)

|

|

Industrials

|

31.2%

|

|

Financials

|

24.7%

|

|

Consumer Discretionary

|

16.1%

|

|

Information Technology

|

13.2%

|

|

Health Care

|

6.5%

|

|

Communication Services

|

2.9%

|

|

Consumer Staples

|

2.6%

|

|

Cash & Other

|

2.8%

|

|

Top 10 Issuers

|

(%)

|

|

Deutsche Boerse AG

|

6.4%

|

|

London Stock Exchange Group PLC

|

5.2%

|

|

Howden Joinery Group PLC

|

4.7%

|

|

Experian PLC

|

4.3%

|

|

Airbus SE

|

4.1%

|

|

HDFC Bank Ltd.

|

3.8%

|

|

AIA Group Ltd.

|

3.8%

|

|

Wolters Kluwer NV

|

3.7%

|

|

Rentokil Initial PLC

|

3.5%

|

|

Taiwan Semiconductor Manufacturing Co., Ltd.

|

3.4%

|

|

Top 10 Countries

|

(%)

|

|

United Kingdom

|

27.4%

|

|

Germany

|

10.3%

|

|

France

|

10.2%

|

|

United States

|

8.2%

|

|

Netherlands

|

6.7%

|

|

China

|

5.1%

|

|

India

|

5.1%

|

|

Switzerland

|

3.9%

|

|

Japan

|

3.5%

|

|

Taiwan

|

3.4%

|

|

Class Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment

|

|

Investor Shares

|

$108

|

1.00%

|

|

Top Contributors

|

|

|

↑

|

Deutsche Boerse AG

|

|

↑

|

Safran SA

|

|

↑

|

Airbus SE

|

|

↑

|

B3 SA - Brasil, Bolsa, Balcao

|

|

↑

|

CTS Eventim AG & Co. KGaA

|

|

Top Detractors

|

|

|

↓

|

LVMH Moet Hennessy Louis Vuitton SE

|

|

↓

|

Rentokil Initial plc

|

|

↓

|

NXP Semiconductors NV

|

|

↓

|

Diageo plc

|

|

↓

|

ASML Holding NV

|

|

|

1 Year

|

Since Inception

(02/28/2022) |

|

Investor Shares

|

15.49

|

6.71

|

|

MSCI ACWI ex USA Index

|

17.72

|

7.68

|

|

Net Assets

|

$42,021,685

|

|

Number of Holdings

|

35

|

|

Net Advisory Fee

|

$163,359

|

|

Portfolio Turnover

|

47%

|

|

Top Sectors*

|

(%)

|

|

Industrials

|

31.2%

|

|

Financials

|

24.7%

|

|

Consumer Discretionary

|

16.1%

|

|

Information Technology

|

13.2%

|

|

Health Care

|

6.5%

|

|

Communication Services

|

2.9%

|

|

Consumer Staples

|

2.6%

|

|

Cash & Other

|

2.8%

|

|

Top 10 Issuers

|

(%)

|

|

Deutsche Boerse AG

|

6.4%

|

|

London Stock Exchange Group PLC

|

5.2%

|

|

Howden Joinery Group PLC

|

4.7%

|

|

Experian PLC

|

4.3%

|

|

Airbus SE

|

4.1%

|

|

HDFC Bank Ltd.

|

3.8%

|

|

AIA Group Ltd.

|

3.8%

|

|

Wolters Kluwer NV

|

3.7%

|

|

Rentokil Initial PLC

|

3.5%

|

|

Taiwan Semiconductor Manufacturing Co., Ltd.

|

3.4%

|

|

Top 10 Countries

|

(%)

|

|

United Kingdom

|

27.4%

|

|

Germany

|

10.3%

|

|

France

|

10.2%

|

|

United States

|

8.2%

|

|

Netherlands

|

6.7%

|

|

China

|

5.1%

|

|

India

|

5.1%

|

|

Switzerland

|

3.9%

|

|

Japan

|

3.5%

|

|

Taiwan

|

3.4%

|

|

Class Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment

|

|

Investor Shares

|

$55

|

0.53%

|

|

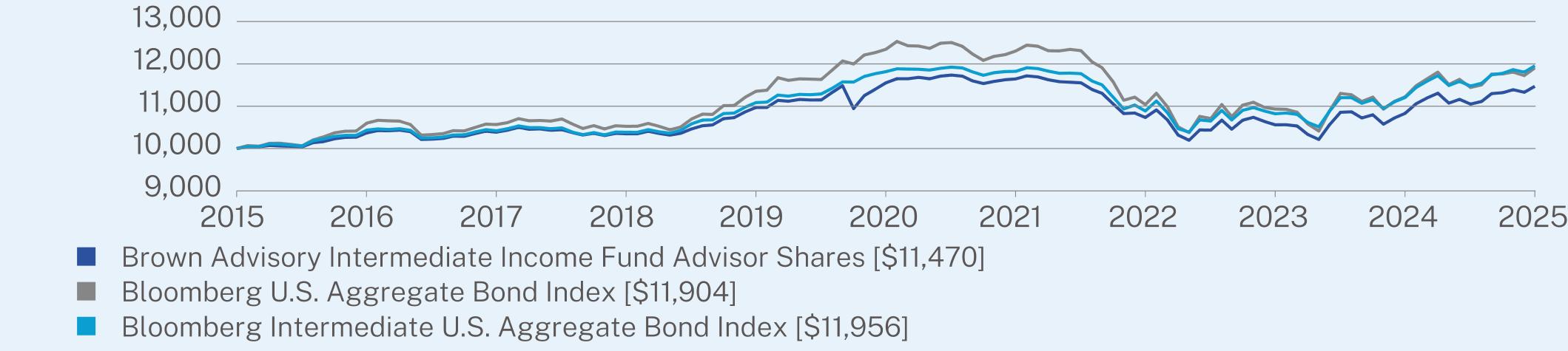

|

1 Year

|

5 Year

|

10 Year

|

|

Investor Shares

|

6.24

|

0.13

|

1.64

|

|

Bloomberg U.S. Aggregate Bond Index

|

6.08

|

-0.73

|

1.76

|

|

Bloomberg Intermediate U.S. Aggregate Bond Index

|

6.69

|

0.23

|

1.80

|

|

Net Assets

|

$128,582,672

|

|

Number of Holdings

|

119

|

|

Net Advisory Fee

|

$370,608

|

|

Portfolio Turnover

|

50%

|

|

Security Type

|

(%)

|

|

Agency Residential Mortgage-Backed Securities

|

32.6%

|

|

U.S. Treasury Securities

|

30.8%

|

|

Corporate Bonds

|

27.5%

|

|

Asset-Backed Securities

|

4.4%

|

|

Agency Commercial Mortgage-Backed Securities

|

1.8%

|

|

Money Market Funds

|

0.9%

|

|

Non-Agency Residential Mortgage-Backed Securities

|

0.5%

|

|

Non-Agency Commercial Mortgage-Backed Securities

|

0.5%

|

|

Futures Contracts

|

0.0%

|

|

Cash & Other

|

1.0%

|

|

Top 10 Issuers

|

(%)

|

|

United States Treasury Note

|

30.8%

|

|

Federal National Mortgage Association

|

17.8%

|

|

Federal Home Loan Mortgage Corp.

|

11.4%

|

|

Ginnie Mae II Pool

|

5.1%

|

|

Waste Connections, Inc.

|

1.5%

|

|

Verizon Master Trust

|

1.0%

|

|

AerCap Ireland Capital DAC / AerCap Global Aviation Trust

|

1.0%

|

|

Prologis LP

|

1.0%

|

|

Analog Devices, Inc.

|

1.0%

|

|

Kroger Co.

|

1.0%

|

|

Class Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment

|

|

Advisor Shares

|

$80

|

0.78%

|

|

|

1 Year

|

5 Year

|

10 Year

|

|

Advisor Shares

|

5.89

|

-0.14

|

1.38

|

|

Bloomberg U.S. Aggregate Bond Index

|

6.08

|

-0.73

|

1.76

|

|

Bloomberg Intermediate U.S. Aggregate Bond Index

|

6.69

|

0.23

|

1.80

|

|

Net Assets

|

$128,582,672

|

|

Number of Holdings

|

119

|

|

Net Advisory Fee

|

$370,608

|

|

Portfolio Turnover

|

50%

|

|

Security Type

|

(%)

|

|

Agency Residential Mortgage-Backed Securities

|

32.6%

|

|

U.S. Treasury Securities

|