Shareholder Report

|

6 Months Ended |

|

Jun. 30, 2025

USD ($)

Holding

|

|---|

| Shareholder Report [Line Items] |

|

| Document Type |

N-CSRS

|

| Amendment Flag |

false

|

| Registrant Name |

PRAXIS FUNDS

|

| Entity Central Index Key |

0000912900

|

| Entity Investment Company Type |

N-1A

|

| Document Period End Date |

Jun. 30, 2025

|

| C000008547 |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

Praxis Impact Bond Fund

|

| Class Name |

Class A

|

| Trading Symbol |

MIIAX

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about Praxis Impact Bond Fund (the "Fund") for the period of January 1, 2025 to June 30, 2025.

|

| Shareholder Report Annual or Semi-Annual |

Semi-Annual Shareholder Report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at https://www.praxisinvests.com/resources/prospectuses-and-reports. You can also request this information by contacting us at (800) 977-2947.

|

| Additional Information Phone Number |

(800) 977-2947

|

| Additional Information Website |

<span style="font-weight: 700; box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 9.33333px; grid-area: auto; line-height: 14px; margin: 0px; overflow: visible; text-align: left; text-align-last: left; white-space-collapse: preserve-breaks;">https://www.praxisinvests.com/resources/prospectuses-and-reports</span>

|

| Expenses [Text Block] |

What were the Fund’s annualized costs for the last six months?(based on a hypothetical $10,000 investment) Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

Class A | $46 | 0.91% |

|---|

|

| Expenses Paid, Amount |

$ 46

|

| Expense Ratio, Percent |

0.91%

|

| AssetsNet |

$ 1,056,117,947

|

| Holdings Count | Holding |

527

|

| Advisory Fees Paid, Amount |

$ 1,745,804

|

| InvestmentCompanyPortfolioTurnover |

4.00%

|

| Additional Fund Statistics [Text Block] |

- Net Assets$1,056,117,947

- Number of Portfolio Holdings527

- Advisory Fee $1,745,804

- Portfolio Turnover4%

|

| Holdings [Text Block] |

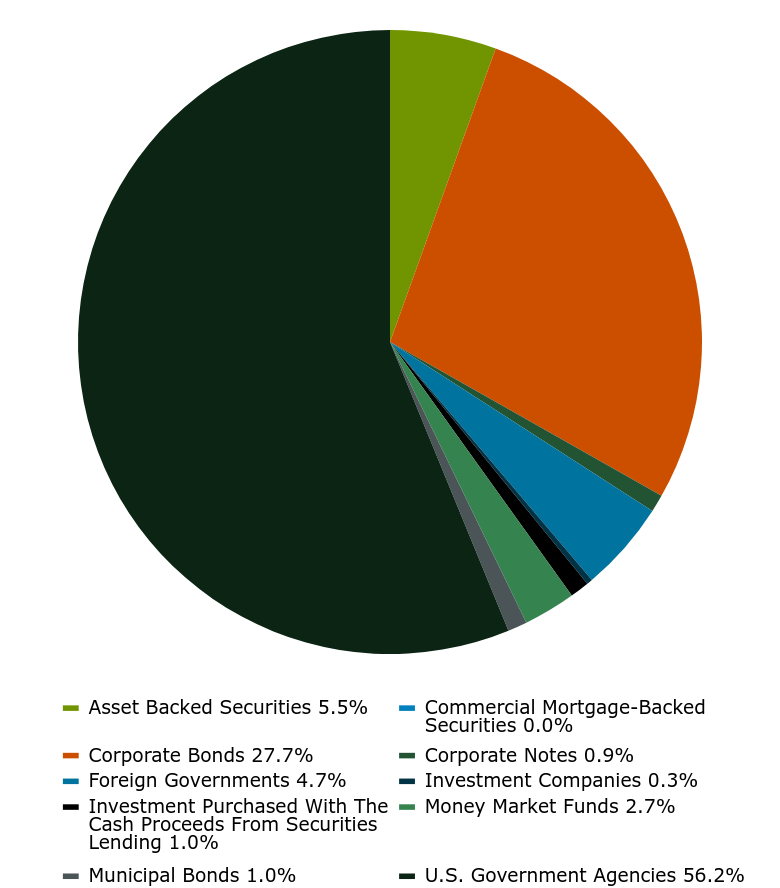

Asset Weighting (% of total investments)Value | Value |

|---|

Asset Backed Securities | 5.5% | Commercial Mortgage-Backed Securities | 0.0% | Corporate Bonds | 27.7% | Corporate Notes | 0.9% | Foreign Governments | 4.7% | Investment Companies | 0.3% | Investment Purchased With The Cash Proceeds From Securities Lending | 1.0% | Money Market Funds | 2.7% | Municipal Bonds | 1.0% | U.S. Government Agencies | 56.2% |

|

| Largest Holdings [Text Block] |

Top 10 Holdings (% of net assets)Holding Name | % of Net Assets |

|---|

FNMA, 0.875%, due 08/5/30 | 2.0% |

|---|

FHLB, 5.500%, due 07/15/36 | 1.9% |

|---|

FNMA, 5.625%, due 07/15/37 | 1.5% |

|---|

FNMA, 6.625%, due 11/15/30 | 1.4% |

|---|

FHLMC, 1.487%, due 11/25/30 | 1.3% |

|---|

FNMA, 1.286%, due 01/25/31 | 1.3% |

|---|

FHLMC, 3.000%, due 07/1/52 | 1.3% |

|---|

FNMA, 3.500%, due 05/1/52 | 1.2% |

|---|

FHLB, 3.250%, due 11/16/28 | 1.2% |

|---|

FNMA, 4.000%, due 09/1/52 | 1.1% |

|---|

|

| Material Fund Change [Text Block] |

No material changes occurred during the period ended June 30, 2025.

|

| C000035282 |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

Praxis Impact Bond Fund

|

| Class Name |

Class I

|

| Trading Symbol |

MIIIX

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about Praxis Impact Bond Fund (the "Fund") for the period of January 1, 2025 to June 30, 2025.

|

| Shareholder Report Annual or Semi-Annual |

Semi-Annual Shareholder Report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at https://www.praxisinvests.com/resources/prospectuses-and-reports. You can also request this information by contacting us at (800) 977-2947.

|

| Additional Information Phone Number |

(800) 977-2947

|

| Additional Information Website |

<span style="font-weight: 700; box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 9.33333px; grid-area: auto; line-height: 14px; margin: 0px; overflow: visible; text-align: left; text-align-last: left; white-space-collapse: preserve-breaks;">https://www.praxisinvests.com/resources/prospectuses-and-reports</span>

|

| Expenses [Text Block] |

What were the Fund’s annualized costs for the last six months?(based on a hypothetical $10,000 investment) Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

Class I | $23 | 0.46% |

|---|

|

| Expenses Paid, Amount |

$ 23

|

| Expense Ratio, Percent |

0.46%

|

| AssetsNet |

$ 1,056,117,947

|

| Holdings Count | Holding |

527

|

| Advisory Fees Paid, Amount |

$ 1,745,804

|

| InvestmentCompanyPortfolioTurnover |

4.00%

|

| Additional Fund Statistics [Text Block] |

- Net Assets$1,056,117,947

- Number of Portfolio Holdings527

- Advisory Fee $1,745,804

- Portfolio Turnover4%

|

| Holdings [Text Block] |

Asset Weighting (% of total investments)Value | Value |

|---|

Asset Backed Securities | 5.5% | Commercial Mortgage-Backed Securities | 0.0% | Corporate Bonds | 27.7% | Corporate Notes | 0.9% | Foreign Governments | 4.7% | Investment Companies | 0.3% | Investment Purchased With The Cash Proceeds From Securities Lending | 1.0% | Money Market Funds | 2.7% | Municipal Bonds | 1.0% | U.S. Government Agencies | 56.2% |

|

| Largest Holdings [Text Block] |

Top 10 Holdings (% of net assets)Holding Name | % of Net Assets |

|---|

FNMA, 0.875%, due 08/5/30 | 2.0% |

|---|

FHLB, 5.500%, due 07/15/36 | 1.9% |

|---|

FNMA, 5.625%, due 07/15/37 | 1.5% |

|---|

FNMA, 6.625%, due 11/15/30 | 1.4% |

|---|

FHLMC, 1.487%, due 11/25/30 | 1.3% |

|---|

FNMA, 1.286%, due 01/25/31 | 1.3% |

|---|

FHLMC, 3.000%, due 07/1/52 | 1.3% |

|---|

FNMA, 3.500%, due 05/1/52 | 1.2% |

|---|

FHLB, 3.250%, due 11/16/28 | 1.2% |

|---|

FNMA, 4.000%, due 09/1/52 | 1.1% |

|---|

|

| Material Fund Change [Text Block] |

No material changes occurred during the period ended June 30, 2025.

|

| C000008549 |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

Praxis International Index Fund

|

| Class Name |

Class A

|

| Trading Symbol |

MPLAX

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about Praxis International Index Fund (the "Fund") for the period of January 1, 2025 to June 30, 2025.

|

| Shareholder Report Annual or Semi-Annual |

Semi-Annual Shareholder Report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at https://www.praxisinvests.com/resources/prospectuses-and-reports. You can also request this information by contacting us at (800) 977-2947.

|

| Additional Information Phone Number |

(800) 977-2947

|

| Additional Information Website |

<span style="font-weight: 700; box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 9.33333px; grid-area: auto; line-height: 14px; margin: 0px; overflow: visible; text-align: left; text-align-last: left; white-space-collapse: preserve-breaks;">https://www.praxisinvests.com/resources/prospectuses-and-reports</span>

|

| Expenses [Text Block] |

What were the Fund’s annualized costs for the last six months?(based on a hypothetical $10,000 investment) Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

Class A | $61 | 1.14% |

|---|

|

| Expenses Paid, Amount |

$ 61

|

| Expense Ratio, Percent |

1.14%

|

| AssetsNet |

$ 497,484,735

|

| Holdings Count | Holding |

454

|

| Advisory Fees Paid, Amount |

$ 942,176

|

| InvestmentCompanyPortfolioTurnover |

9.00%

|

| Additional Fund Statistics [Text Block] |

- Net Assets$497,484,735

- Number of Portfolio Holdings454

- Advisory Fee $942,176

- Portfolio Turnover9%

|

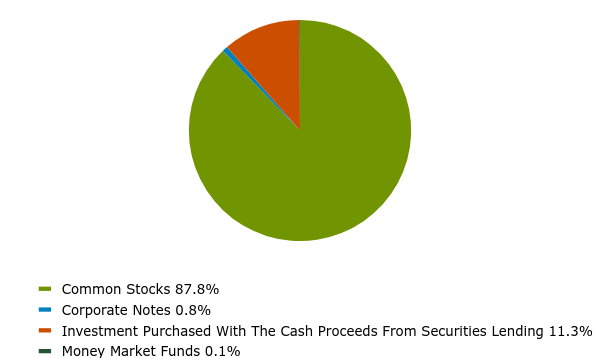

| Holdings [Text Block] |

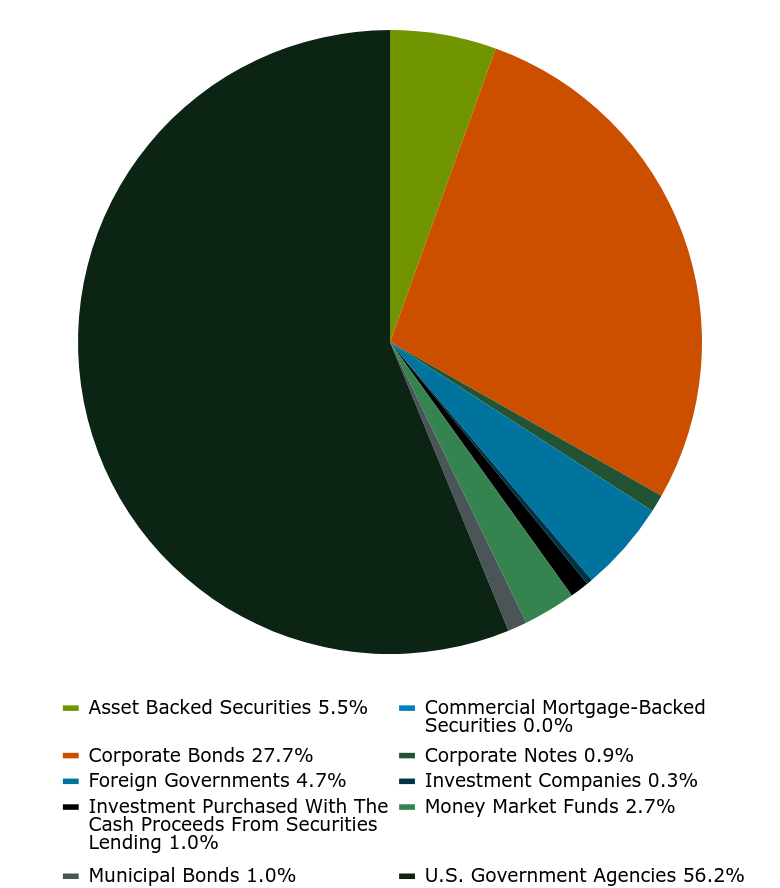

Asset Weighting (% of total investments)Value | Value |

|---|

Common Stocks | 87.8% | Corporate Notes | 0.8% | Investment Purchased With The Cash Proceeds From Securities Lending | 11.3% | Money Market Funds | 0.1% |

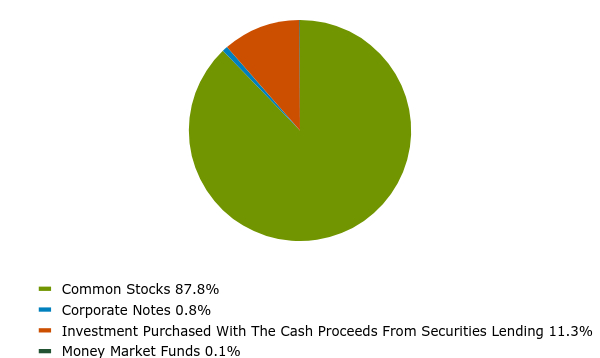

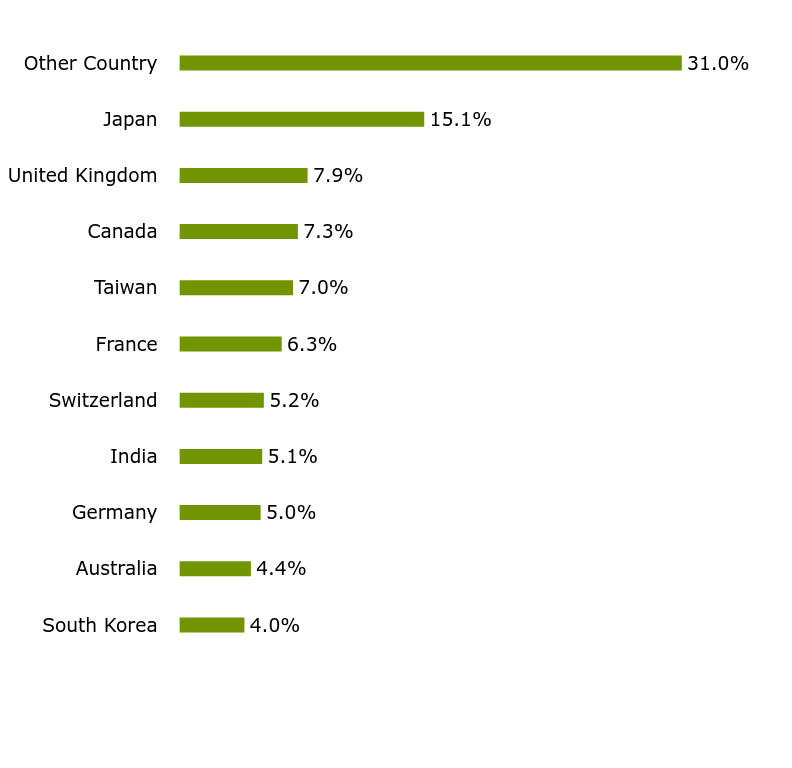

Common Stocks Country Weighting (% of net assets)Value | Value |

|---|

South Korea | 4.0% | Australia | 4.4% | Germany | 5.0% | India | 5.1% | Switzerland | 5.2% | France | 6.3% | Taiwan | 7.0% | Canada | 7.3% | United Kingdom | 7.9% | Japan | 15.1% | Other Country | 31.0% |

|

| Largest Holdings [Text Block] |

Top 10 Holdings (% of net assets)Holding Name | % of Net Assets |

|---|

Taiwan Semiconductor Manufacturing Co. Ltd. - ADR | 5.0% |

|---|

ICICI Bank Ltd. - ADR | 1.7% |

|---|

Samsung Electronics Co. Ltd. | 1.5% |

|---|

Tencent Holdings Ltd. - ADR | 1.5% |

|---|

HDFC Bank Ltd. - ADR | 1.4% |

|---|

Chunghwa Telecom Co. Ltd. - ADR | 1.3% |

|---|

Infosys Ltd. - ADR | 1.1% |

|---|

ASML Holding N.V. | 1.1% |

|---|

Schneider Electric SE | 1.0% |

|---|

Wipro Ltd. - ADR | 0.9% |

|---|

|

| Material Fund Change [Text Block] |

No material changes occurred during the period ended June 30, 2025.

|

| C000035283 |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

Praxis International Index Fund

|

| Class Name |

Class I

|

| Trading Symbol |

MPLIX

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about Praxis International Index Fund (the "Fund") for the period of January 1, 2025 to June 30, 2025.

|

| Shareholder Report Annual or Semi-Annual |

Semi-Annual Shareholder Report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at https://www.praxisinvests.com/resources/prospectuses-and-reports. You can also request this information by contacting us at (800) 977-2947.

|

| Additional Information Phone Number |

(800) 977-2947

|

| Additional Information Website |

<span style="font-weight: 700; box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 9.33333px; grid-area: auto; line-height: 14px; margin: 0px; overflow: visible; text-align: left; text-align-last: left; white-space-collapse: preserve-breaks;">https://www.praxisinvests.com/resources/prospectuses-and-reports</span>

|

| Expenses [Text Block] |

What were the Fund’s annualized costs for the last six months?(based on a hypothetical $10,000 investment) Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

Class I | $30 | 0.55% |

|---|

|

| Expenses Paid, Amount |

$ 30

|

| Expense Ratio, Percent |

0.55%

|

| AssetsNet |

$ 497,484,735

|

| Holdings Count | Holding |

454

|

| Advisory Fees Paid, Amount |

$ 942,176

|

| InvestmentCompanyPortfolioTurnover |

9.00%

|

| Additional Fund Statistics [Text Block] |

- Net Assets$497,484,735

- Number of Portfolio Holdings454

- Advisory Fee $942,176

- Portfolio Turnover9%

|

| Holdings [Text Block] |

Asset Weighting (% of total investments)Value | Value |

|---|

Common Stocks | 87.8% | Corporate Notes | 0.8% | Investment Purchased With The Cash Proceeds From Securities Lending | 11.3% | Money Market Funds | 0.1% |

Common Stocks Country Weighting (% of net assets)Value | Value |

|---|

South Korea | 4.0% | Australia | 4.4% | Germany | 5.0% | India | 5.1% | Switzerland | 5.2% | France | 6.3% | Taiwan | 7.0% | Canada | 7.3% | United Kingdom | 7.9% | Japan | 15.1% | Other Country | 31.0% |

|

| Largest Holdings [Text Block] |

Top 10 Holdings (% of net assets)Holding Name | % of Net Assets |

|---|

Taiwan Semiconductor Manufacturing Co. Ltd. - ADR | 5.0% |

|---|

ICICI Bank Ltd. - ADR | 1.7% |

|---|

Samsung Electronics Co. Ltd. | 1.5% |

|---|

Tencent Holdings Ltd. - ADR | 1.5% |

|---|

HDFC Bank Ltd. - ADR | 1.4% |

|---|

Chunghwa Telecom Co. Ltd. - ADR | 1.3% |

|---|

Infosys Ltd. - ADR | 1.1% |

|---|

ASML Holding N.V. | 1.1% |

|---|

Schneider Electric SE | 1.0% |

|---|

Wipro Ltd. - ADR | 0.9% |

|---|

|

| Material Fund Change [Text Block] |

No material changes occurred during the period ended June 30, 2025.

|

| C000008551 |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

Praxis Value Index Fund

|

| Class Name |

Class A

|

| Trading Symbol |

MVIAX

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about Praxis Value Index Fund (the "Fund") for the period of January 1, 2025 to June 30, 2025.

|

| Shareholder Report Annual or Semi-Annual |

Semi-Annual Shareholder Report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at https://www.praxisinvests.com/resources/prospectuses-and-reports. You can also request this information by contacting us at (800) 977-2947.

|

| Additional Information Phone Number |

(800) 977-2947

|

| Additional Information Website |

<span style="font-weight: 700; box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 9.33333px; grid-area: auto; line-height: 14px; margin: 0px; overflow: visible; text-align: left; text-align-last: left; white-space-collapse: preserve-breaks;">https://www.praxisinvests.com/resources/prospectuses-and-reports</span>

|

| Expenses [Text Block] |

What were the Fund’s annualized costs for the last six months?(based on a hypothetical $10,000 investment) Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

Class A | $39 | 0.76% |

|---|

|

| Expenses Paid, Amount |

$ 39

|

| Expense Ratio, Percent |

0.76%

|

| AssetsNet |

$ 493,491,907

|

| Holdings Count | Holding |

287

|

| Advisory Fees Paid, Amount |

$ 583,506

|

| InvestmentCompanyPortfolioTurnover |

13.00%

|

| Additional Fund Statistics [Text Block] |

- Net Assets$493,491,907

- Number of Portfolio Holdings287

- Advisory Fee $583,506

- Portfolio Turnover13%

|

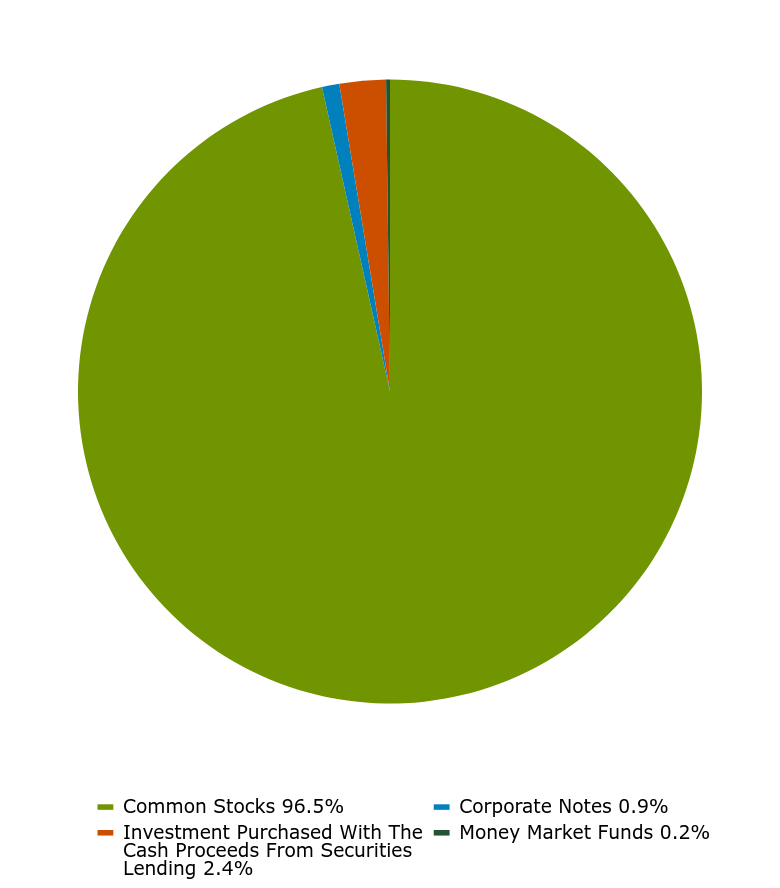

| Holdings [Text Block] |

Asset Weighting (% of total investments)Value | Value |

|---|

Common Stocks | 96.5% | Corporate Notes | 0.9% | Investment Purchased With The Cash Proceeds From Securities Lending | 2.4% | Money Market Funds | 0.2% |

|

| Largest Holdings [Text Block] |

Top 10 Holdings (% of net assets)Holding Name | % of Net Assets |

|---|

JPMorgan Chase & Co. | 4.2% |

|---|

Walmart, Inc. | 2.3% |

|---|

Procter & Gamble Co. (The) | 2.0% |

|---|

AbbVie, Inc. | 1.7% |

|---|

Bank of America Corp. | 1.7% |

|---|

Oracle Corp. | 1.7% |

|---|

Home Depot, Inc. (The) | 1.6% |

|---|

Johnson & Johnson | 1.5% |

|---|

Coca-Cola Co. (The) | 1.4% |

|---|

Cisco Systems, Inc. | 1.4% |

|---|

|

| Material Fund Change [Text Block] |

No material changes occurred during the period ended June 30, 2025.

|

| C000035284 |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

Praxis Value Index Fund

|

| Class Name |

Class I

|

| Trading Symbol |

MVIIX

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about Praxis Value Index Fund (the "Fund") for the period of January 1, 2025 to June 30, 2025.

|

| Shareholder Report Annual or Semi-Annual |

Semi-Annual Shareholder Report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at https://www.praxisinvests.com/resources/prospectuses-and-reports. You can also request this information by contacting us at (800) 977-2947.

|

| Additional Information Phone Number |

(800) 977-2947

|

| Additional Information Website |

<span style="font-weight: 700; box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 9.33333px; grid-area: auto; line-height: 14px; margin: 0px; overflow: visible; text-align: left; text-align-last: left; white-space-collapse: preserve-breaks;">https://www.praxisinvests.com/resources/prospectuses-and-reports</span>

|

| Expenses [Text Block] |

What were the Fund’s annualized costs for the last six months?(based on a hypothetical $10,000 investment) Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

Class I | $18 | 0.36% |

|---|

|

| Expenses Paid, Amount |

$ 18

|

| Expense Ratio, Percent |

0.36%

|

| AssetsNet |

$ 493,491,907

|

| Holdings Count | Holding |

287

|

| Advisory Fees Paid, Amount |

$ 583,506

|

| InvestmentCompanyPortfolioTurnover |

13.00%

|

| Additional Fund Statistics [Text Block] |

- Net Assets$493,491,907

- Number of Portfolio Holdings287

- Advisory Fee $583,506

- Portfolio Turnover13%

|

| Holdings [Text Block] |

Asset Weighting (% of total investments)Value | Value |

|---|

Common Stocks | 96.5% | Corporate Notes | 0.9% | Investment Purchased With The Cash Proceeds From Securities Lending | 2.4% | Money Market Funds | 0.2% |

|

| Largest Holdings [Text Block] |

Top 10 Holdings (% of net assets)Holding Name | % of Net Assets |

|---|

JPMorgan Chase & Co. | 4.2% |

|---|

Walmart, Inc. | 2.3% |

|---|

Procter & Gamble Co. (The) | 2.0% |

|---|

AbbVie, Inc. | 1.7% |

|---|

Bank of America Corp. | 1.7% |

|---|

Oracle Corp. | 1.7% |

|---|

Home Depot, Inc. (The) | 1.6% |

|---|

Johnson & Johnson | 1.5% |

|---|

Coca-Cola Co. (The) | 1.4% |

|---|

Cisco Systems, Inc. | 1.4% |

|---|

|

| Material Fund Change [Text Block] |

No material changes occurred during the period ended June 30, 2025.

|

| C000047793 |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

Praxis Growth Index Fund

|

| Class Name |

Class A

|

| Trading Symbol |

MGNDX

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about Praxis Growth Index Fund (the "Fund") for the period of January 1, 2025 to June 30, 2025.

|

| Shareholder Report Annual or Semi-Annual |

Semi-Annual Shareholder Report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at https://www.praxisinvests.com/resources/prospectuses-and-reports. You can also request this information by contacting us at (800) 977-2947.

|

| Additional Information Phone Number |

(800) 977-2947

|

| Additional Information Website |

<span style="font-weight: 700; box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 9.33333px; grid-area: auto; line-height: 14px; margin: 0px; overflow: visible; text-align: left; text-align-last: left; white-space-collapse: preserve-breaks;">https://www.praxisinvests.com/resources/prospectuses-and-reports</span>

|

| Expenses [Text Block] |

What were the Fund’s annualized costs for the last six months?(based on a hypothetical $10,000 investment) Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

Class A | $33 | 0.65% |

|---|

|

| Expenses Paid, Amount |

$ 33

|

| Expense Ratio, Percent |

0.65%

|

| AssetsNet |

$ 672,189,137

|

| Holdings Count | Holding |

168

|

| Advisory Fees Paid, Amount |

$ 733,054

|

| InvestmentCompanyPortfolioTurnover |

10.00%

|

| Additional Fund Statistics [Text Block] |

- Net Assets$672,189,137

- Number of Portfolio Holdings168

- Advisory Fee $733,054

- Portfolio Turnover10%

|

| Holdings [Text Block] |

Asset Weighting (% of total investments)Value | Value |

|---|

Common Stocks | 98.3% | Corporate Notes | 0.9% | Investment Purchased With The Cash Proceeds From Securities Lending | 0.7% | Money Market Funds | 0.1% |

|

| Largest Holdings [Text Block] |

Top 10 Holdings (% of net assets)Holding Name | % of Net Assets |

|---|

NVIDIA Corp. | 12.1% |

|---|

Apple, Inc. | 10.6% |

|---|

Microsoft Corp. | 9.5% |

|---|

Amazon.com, Inc. | 5.7% |

|---|

Meta Platforms, Inc. - Class A | 5.0% |

|---|

Broadcom, Inc. | 4.4% |

|---|

Alphabet, Inc. - Class A | 3.3% |

|---|

Tesla, Inc. | 2.8% |

|---|

Alphabet, Inc. - Class C | 2.6% |

|---|

Eli Lilly & Co. | 2.4% |

|---|

|

| Material Fund Change [Text Block] |

No material changes occurred during the period ended June 30, 2025.

|

| C000047795 |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

Praxis Growth Index Fund

|

| Class Name |

Class I

|

| Trading Symbol |

MMDEX

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about Praxis Growth Index Fund (the "Fund") for the period of January 1, 2025 to June 30, 2025.

|

| Shareholder Report Annual or Semi-Annual |

Semi-Annual Shareholder Report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at https://www.praxisinvests.com/resources/prospectuses-and-reports. You can also request this information by contacting us at (800) 977-2947.

|

| Additional Information Phone Number |

(800) 977-2947

|

| Additional Information Website |

<span style="font-weight: 700; box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 9.33333px; grid-area: auto; line-height: 14px; margin: 0px; overflow: visible; text-align: left; text-align-last: left; white-space-collapse: preserve-breaks;">https://www.praxisinvests.com/resources/prospectuses-and-reports</span>

|

| Expenses [Text Block] |

What were the Fund’s annualized costs for the last six months?(based on a hypothetical $10,000 investment) Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

Class I | $17 | 0.34% |

|---|

|

| Expenses Paid, Amount |

$ 17

|

| Expense Ratio, Percent |

0.34%

|

| AssetsNet |

$ 672,189,137

|

| Holdings Count | Holding |

168

|

| Advisory Fees Paid, Amount |

$ 733,054

|

| InvestmentCompanyPortfolioTurnover |

10.00%

|

| Additional Fund Statistics [Text Block] |

- Net Assets$672,189,137

- Number of Portfolio Holdings168

- Advisory Fee $733,054

- Portfolio Turnover10%

|

| Holdings [Text Block] |

Asset Weighting (% of total investments)Value | Value |

|---|

Common Stocks | 98.3% | Corporate Notes | 0.9% | Investment Purchased With The Cash Proceeds From Securities Lending | 0.7% | Money Market Funds | 0.1% |

|

| Largest Holdings [Text Block] |

Top 10 Holdings (% of net assets)Holding Name | % of Net Assets |

|---|

NVIDIA Corp. | 12.1% |

|---|

Apple, Inc. | 10.6% |

|---|

Microsoft Corp. | 9.5% |

|---|

Amazon.com, Inc. | 5.7% |

|---|

Meta Platforms, Inc. - Class A | 5.0% |

|---|

Broadcom, Inc. | 4.4% |

|---|

Alphabet, Inc. - Class A | 3.3% |

|---|

Tesla, Inc. | 2.8% |

|---|

Alphabet, Inc. - Class C | 2.6% |

|---|

Eli Lilly & Co. | 2.4% |

|---|

|

| Material Fund Change [Text Block] |

No material changes occurred during the period ended June 30, 2025.

|

| C000047796 |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

Praxis Small Cap Index Fund

|

| Class Name |

Class A

|

| Trading Symbol |

MMSCX

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about Praxis Small Cap Index Fund (the "Fund") for the period of January 1, 2025 to June 30, 2025.

|

| Shareholder Report Annual or Semi-Annual |

Semi-Annual Shareholder Report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at https://www.praxisinvests.com/resources/prospectuses-and-reports. You can also request this information by contacting us at (800) 977-2947.

|

| Additional Information Phone Number |

(800) 977-2947

|

| Additional Information Website |

<span style="font-weight: 700; box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 9.33333px; grid-area: auto; line-height: 14px; margin: 0px; overflow: visible; text-align: left; text-align-last: left; white-space-collapse: preserve-breaks;">https://www.praxisinvests.com/resources/prospectuses-and-reports</span>

|

| Expenses [Text Block] |

What were the Fund’s annualized costs for the last six months?(based on a hypothetical $10,000 investment) Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

Class A | $52 | 1.06% |

|---|

|

| Expenses Paid, Amount |

$ 52

|

| Expense Ratio, Percent |

1.06%

|

| AssetsNet |

$ 186,674,704

|

| Holdings Count | Holding |

661

|

| Advisory Fees Paid, Amount |

$ 266,120

|

| InvestmentCompanyPortfolioTurnover |

21.00%

|

| Additional Fund Statistics [Text Block] |

- Net Assets$186,674,704

- Number of Portfolio Holdings661

- Advisory Fee $266,120

- Portfolio Turnover21%

|

| Holdings [Text Block] |

Asset Weighting (% of total investments)Value | Value |

|---|

Common Stocks | 83.4% | Corporate Notes | 0.7% | Investment Purchased With The Cash Proceeds From Securities Lending | 15.2% | Money Market Funds | 0.7% | Rights | 0.0% |

|

| Largest Holdings [Text Block] |

Top 10 Holdings (% of net assets)Holding Name | % of Net Assets |

|---|

Liberty Media Corp. - Liberty Formula One - Series C | 0.7% |

|---|

Expand Energy Corp. | 0.6% |

|---|

SPX Technologies, Inc. | 0.6% |

|---|

Franklin Resources, Inc. | 0.5% |

|---|

NRG Energy, Inc. | 0.5% |

|---|

Sanmina Corp. | 0.4% |

|---|

Balchem Corp. | 0.4% |

|---|

Smurfit WestRock plc | 0.4% |

|---|

UGI Corp. | 0.4% |

|---|

Rexford Industrial Realty, Inc. | 0.4% |

|---|

|

| Material Fund Change [Text Block] |

No material changes occurred during the period ended June 30, 2025.

|

| C000047798 |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

Praxis Small Cap Index Fund

|

| Class Name |

Class I

|

| Trading Symbol |

MMSIX

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about Praxis Small Cap Index Fund (the "Fund") for the period of January 1, 2025 to June 30, 2025.

|

| Shareholder Report Annual or Semi-Annual |

Semi-Annual Shareholder Report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at https://www.praxisinvests.com/resources/prospectuses-and-reports. You can also request this information by contacting us at (800) 977-2947.

|

| Additional Information Phone Number |

(800) 977-2947

|

| Additional Information Website |

<span style="font-weight: 700; box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 9.33333px; grid-area: auto; line-height: 14px; margin: 0px; overflow: visible; text-align: left; text-align-last: left; white-space-collapse: preserve-breaks;">https://www.praxisinvests.com/resources/prospectuses-and-reports</span>

|

| Expenses [Text Block] |

What were the Fund’s annualized costs for the last six months?(based on a hypothetical $10,000 investment) Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

Class I | $21 | 0.42% |

|---|

|

| Expenses Paid, Amount |

$ 21

|

| Expense Ratio, Percent |

0.42%

|

| AssetsNet |

$ 186,674,704

|

| Holdings Count | Holding |

661

|

| Advisory Fees Paid, Amount |

$ 266,120

|

| InvestmentCompanyPortfolioTurnover |

21.00%

|

| Additional Fund Statistics [Text Block] |

- Net Assets$186,674,704

- Number of Portfolio Holdings661

- Advisory Fee $266,120

- Portfolio Turnover21%

|

| Holdings [Text Block] |

Asset Weighting (% of total investments)Value | Value |

|---|

Common Stocks | 83.4% | Corporate Notes | 0.7% | Investment Purchased With The Cash Proceeds From Securities Lending | 15.2% | Money Market Funds | 0.7% | Rights | 0.0% |

|

| Largest Holdings [Text Block] |

Top 10 Holdings (% of net assets)Holding Name | % of Net Assets |

|---|

Liberty Media Corp. - Liberty Formula One - Series C | 0.7% |

|---|

Expand Energy Corp. | 0.6% |

|---|

SPX Technologies, Inc. | 0.6% |

|---|

Franklin Resources, Inc. | 0.5% |

|---|

NRG Energy, Inc. | 0.5% |

|---|

Sanmina Corp. | 0.4% |

|---|

Balchem Corp. | 0.4% |

|---|

Smurfit WestRock plc | 0.4% |

|---|

UGI Corp. | 0.4% |

|---|

Rexford Industrial Realty, Inc. | 0.4% |

|---|

|

| Material Fund Change [Text Block] |

No material changes occurred during the period ended June 30, 2025.

|

| C000080567 |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

Praxis Genesis Conservative Portfolio

|

| Class Name |

Class A

|

| Trading Symbol |

MCONX

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about Praxis Genesis Conservative Portfolio (the "Fund") for the period of January 1, 2025 to June 30, 2025.

|

| Shareholder Report Annual or Semi-Annual |

Semi-Annual Shareholder Report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at https://www.praxisinvests.com/resources/prospectuses-and-reports. You can also request this information by contacting us at (800) 977-2947.

|

| Additional Information Phone Number |

(800) 977-2947

|

| Additional Information Website |

<span style="font-weight: 700; box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 9.33333px; grid-area: auto; line-height: 14px; margin: 0px; overflow: visible; text-align: left; text-align-last: left; white-space-collapse: preserve-breaks;">https://www.praxisinvests.com/resources/prospectuses-and-reports</span>

|

| Expenses [Text Block] |

What were the Fund’s annualized costs for the last six months?(based on a hypothetical $10,000 investment) Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

Class A | $31 | 0.61% |

|---|

|

| Expenses Paid, Amount |

$ 31

|

| Expense Ratio, Percent |

0.61%

|

| AssetsNet |

$ 24,393,370

|

| Holdings Count | Holding |

6

|

| Advisory Fees Paid, Amount |

$ 5,962

|

| InvestmentCompanyPortfolioTurnover |

5.00%

|

| Additional Fund Statistics [Text Block] |

- Net Assets$24,393,370

- Number of Portfolio Holdings6

- Advisory Fee $5,962

- Portfolio Turnover5%

|

| Holdings [Text Block] |

Asset Weighting (% of total investments)Value | Value |

|---|

Affiliated Mutual Funds | 100.0% | Money Market Funds | 0.0% |

|

| Largest Holdings [Text Block] |

Top Holdings (% of net assets)Holding Name | % of Net Assets |

|---|

Praxis Impact Bond Fund - Class I | 69.5% |

|---|

Praxis Growth Index Fund - Class I | 9.4% |

|---|

Praxis Value Index Fund - Class I | 9.3% |

|---|

Praxis International Index Fund - Class I | 9.1% |

|---|

Praxis Small Cap Index Fund - Class I | 2.5% |

|---|

|

| Material Fund Change [Text Block] |

No material changes occurred during the period ended June 30, 2025.

|

| C000080568 |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

Praxis Genesis Balanced Portfolio

|

| Class Name |

Class A

|

| Trading Symbol |

MBAPX

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about Praxis Genesis Balanced Portfolio (the "Fund") for the period of January 1, 2025 to June 30, 2025.

|

| Shareholder Report Annual or Semi-Annual |

Semi-Annual Shareholder Report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at https://www.praxisinvests.com/resources/prospectuses-and-reports. You can also request this information by contacting us at (800) 977-2947.

|

| Additional Information Phone Number |

(800) 977-2947

|

| Additional Information Website |

<span style="font-weight: 700; box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 9.33333px; grid-area: auto; line-height: 14px; margin: 0px; overflow: visible; text-align: left; text-align-last: left; white-space-collapse: preserve-breaks;">https://www.praxisinvests.com/resources/prospectuses-and-reports</span>

|

| Expenses [Text Block] |

What were the Fund’s annualized costs for the last six months?(based on a hypothetical $10,000 investment) Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

Class A | $24 | 0.47% |

|---|

|

| Expenses Paid, Amount |

$ 24

|

| Expense Ratio, Percent |

0.47%

|

| AssetsNet |

$ 99,299,435

|

| Holdings Count | Holding |

6

|

| Advisory Fees Paid, Amount |

$ 23,517

|

| InvestmentCompanyPortfolioTurnover |

7.00%

|

| Additional Fund Statistics [Text Block] |

- Net Assets$99,299,435

- Number of Portfolio Holdings6

- Advisory Fee $23,517

- Portfolio Turnover7%

|

| Holdings [Text Block] |

Asset Weighting (% of total investments)Value | Value |

|---|

Affiliated Mutual Funds | 100.0% | Money Market Funds | 0.0% |

|

| Largest Holdings [Text Block] |

Top Holdings (% of net assets)Holding Name | % of Net Assets |

|---|

Praxis Impact Bond Fund - Class I | 39.6% |

|---|

Praxis International Index Fund - Class I | 18.1% |

|---|

Praxis Growth Index Fund - Class I | 16.2% |

|---|

Praxis Value Index Fund - Class I | 16.0% |

|---|

Praxis Small Cap Index Fund - Class I | 10.0% |

|---|

|

| Material Fund Change [Text Block] |

No material changes occurred during the period ended June 30, 2025.

|

| C000080569 |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

Praxis Genesis Growth Portfolio

|

| Class Name |

Class A

|

| Trading Symbol |

MGAFX

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about Praxis Genesis Growth Portfolio (the "Fund") for the period of January 1, 2025 to June 30, 2025.

|

| Shareholder Report Annual or Semi-Annual |

Semi-Annual Shareholder Report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at https://www.praxisinvests.com/resources/prospectuses-and-reports. You can also request this information by contacting us at (800) 977-2947.

|

| Additional Information Phone Number |

(800) 977-2947

|

| Additional Information Website |

<span style="font-weight: 700; box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 9.33333px; grid-area: auto; line-height: 14px; margin: 0px; overflow: visible; text-align: left; text-align-last: left; white-space-collapse: preserve-breaks;">https://www.praxisinvests.com/resources/prospectuses-and-reports</span>

|

| Expenses [Text Block] |

What were the Fund’s annualized costs for the last six months?(based on a hypothetical $10,000 investment) Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

Class A | $25 | 0.49% |

|---|

|

| Expenses Paid, Amount |

$ 25

|

| Expense Ratio, Percent |

0.49%

|

| AssetsNet |

$ 118,072,462

|

| Holdings Count | Holding |

6

|

| Advisory Fees Paid, Amount |

$ 27,929

|

| InvestmentCompanyPortfolioTurnover |

6.00%

|

| Additional Fund Statistics [Text Block] |

- Net Assets$118,072,462

- Number of Portfolio Holdings6

- Advisory Fee $27,929

- Portfolio Turnover6%

|

| Holdings [Text Block] |

Asset Weighting (% of total investments)Value | Value |

|---|

Affiliated Mutual Funds | 100.0% | Money Market Funds | 0.0% |

|

| Largest Holdings [Text Block] |

Top Holdings (% of net assets)Holding Name | % of Net Assets |

|---|

Praxis International Index Fund - Class I | 24.0% |

|---|

Praxis Growth Index Fund - Class I | 20.7% |

|---|

Praxis Value Index Fund - Class I | 20.5% |

|---|

Praxis Impact Bond Fund - Class I | 19.7% |

|---|

Praxis Small Cap Index Fund - Class I | 15.0% |

|---|

|

| Material Fund Change [Text Block] |

No material changes occurred during the period ended June 30, 2025.

|